UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

| Filed by the Registrant [x] |

| Filed by a Party other than the Registrant [ ] |

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [x] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| VISION-SCIENCES, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| Not Applicable |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| [x] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | |

Dear Stockholder:

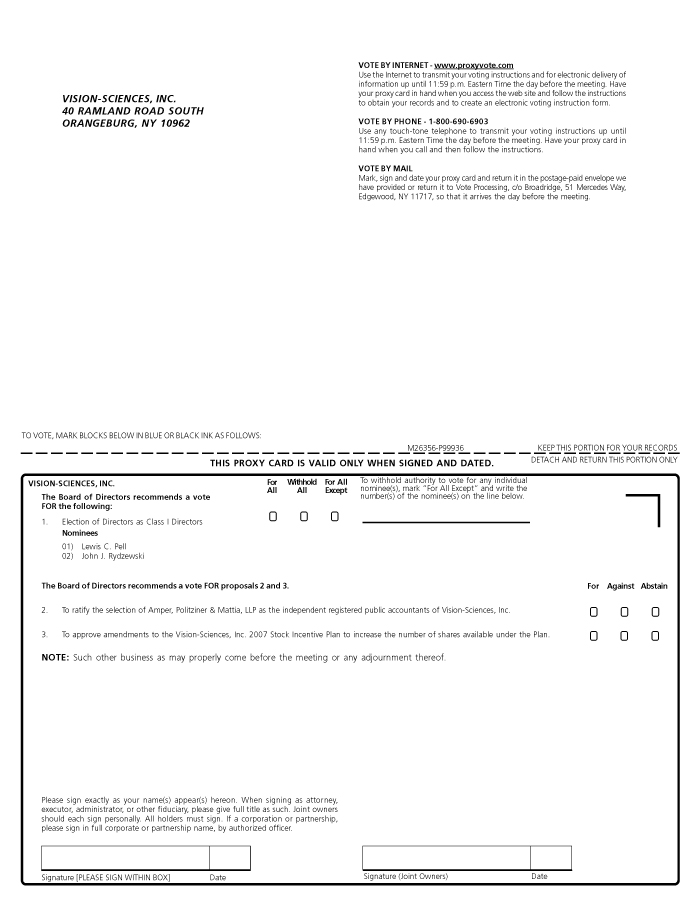

I would like to extend a personal invitation for you to join us at our Annual Meeting of Stockholders at our offices at 40 Ramland Road South, Orangeburg, New York 10962 on September 2, 2010 at 10:00 a.m., local time, to consider and act upon the following matters:

| | (1) | To elect Lewis C. Pell and John J. Rydzewski as Class I Directors, each to serve for a three-year term; |

| | (2) | To ratify the selection of Amper, Politziner & Mattia, LLP as our independent registered public accountants for the fiscal year ending March 31, 2011; |

| | (3) | To amend the Company's 2007 Stock Incentive Plan; and |

| | (4) | To transact such other business as may properly come before the meeting or any adjournment. |

We have provided you notice that the meeting notice and proxy materials are available to you via the Internet in accordance with the rules established by the Securities and Exchange Commission. We believe that this should provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or prior to July 23, 2010, we will mail to our stockholders of record on July 9, 2010 a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and our Annual Report on Form 10-K, and vote their shares. The Notice also contains instructions on how to receive a paper copy of your proxy materials.

Please use this opportunity to take part in our corporate affairs by voting on the business to come before this meeting. Whether or not you plan to attend the meeting, please vote electronically via the Internet or by telephone, or please complete, sign, date and return the accompanying proxy in the enclosed postage-paid envelope. Voting electronically or returning your proxy does NOT deprive you of your right to attend the meeting and to vote your shares in person for the matters acted upon at the meeting.

I hope to see you at the meeting.

| | /s/ Lewis C. Pell |

| | Lewis C. Pell, Chairman |

The Notice of Annual Meeting, Proxy Statement, and Annual Report on Form 10-K for the fiscal year ended March 31, 2010 are available at www.proxyvote.com.

VISION-SCIENCES, INC.

40 Ramland Road South,

Orangeburg, New York 10962

Notice of Annual Meeting of Stockholders

to be Held on September 2, 2010

The Annual Meeting of Stockholders of Vision-Sciences, Inc. will be held at its offices at 40 Ramland Road South, Orangeburg, New York 10962 on September 2, 2010 at 10:00 a.m., local time, to consider and act upon the following matters:

(1) To elect Lewis C. Pell and John J. Rydzewski as Class I Directors, each to serve for a three-year term;

(2) To ratify the selection of Amper, Politziner & Mattia, LLP as our independent registered public accountants for the fiscal year ending March 31, 2011;

(3) To amend the Company's 2007 Stock Incentive Plan; and

(4) To transact such other business as may properly come before the meeting or any adjournment thereof.

All stockholders are cordially invited to attend the Annual Meeting. Only those stockholders of record at the close of business on July 9, 2010 are entitled to notice of and to vote at the Annual Meeting and any adjournments thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the meeting for any purpose germane to the meeting, between the hours of 9:00 a.m. and 4:30 p.m. at our principal executive offices at 40 Ramland Road South, Orangeburg, New York 10962 by contacting our Corporate Secretary.

| | By Order of the Board of Directors, |

| | |

| | |

| | /s/ Lewis C. Pell |

| | Lewis C. Pell, Chairman |

| Orangeburg, New York | |

| July 20, 2010 | |

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE SUBMIT YOUR PROXY BY TELEPHONE OR INTERNET OR COMPLETE, DATE AND SIGN YOUR PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEEDS TO BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

40 Ramland Road South

Orangeburg, New York 10962

For the Annual Meeting of Stockholders

To Be Held on September 2, 2010 at 10:00 a.m. Local Time

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Vision-Sciences, Inc. for use at its Annual Meeting of Stockholders (“Annual Meeting”) to be held on September 2, 2010 at 10:00 a.m. at its offices at 40 Ramland Road South, Orangeburg, New York 10962, and at any adjournment of that meeting. All proxies will be voted in accordance with the stockholders’ instructions, and if no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before its exercise by delivery of written revocation or a subsequently dated proxy to our Corporate Secretary or by voting in person at the Annual Meetin g or by voting again on a later date by Internet or telephone.

This Proxy Statement and the form of Proxy were first furnished or made available to stockholders on or about July 23, 2010.

Voting Securities and Votes Required

At the close of business on July 9, 2010, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 37,593,056 shares of our Common Stock, $0.01 par value per share (“Common Stock”), constituting all of our voting stock. Holders of Common Stock are entitled to one (1) vote per share.

The holders of a majority of the shares of Common Stock outstanding and entitled to vote at the Annual Meeting constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy will be counted for purposes of determining whether a quorum exists at the Annual Meeting and will be voted in accordance with the voting specifications or, if none, in the manner specified in the proxy.

Shares held by stockholders who abstain from voting as to a particular matter and shares held in “street name” by brokers or nominees who do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes for or against any such matter, but will be counted for purposes of establishing a quorum. We encourage you to provide specific voting instructions to any organization that holds your shares of Common Stock in street name.

The affirmative vote of the holders of a plurality of the shares of Common Stock voting on the matter is required for the election of directors. Ratification of the appointment of the independent registered public accountants and the amendment to the 2007 Stock Incentive Plan each require the affirmative vote of a majority of shares of Common Stock voting on the matter.

ALL PROXIES TIMELY RECEIVED WILL BE VOTED IN ACCORDANCE WITH THE CHOICES SPECIFIED ON SUCH PROXIES. PROXIES WILL BE VOTED IN FAVOR OF A PROPOSAL IF NO CONTRARY SPECIFICATION IS MADE. ALL VALID PROXIES OBTAINED WILL BE VOTED AT THE DISCRETION OF THE PERSONS NAMED IN THE PROXY WITH RESPECT TO ANY OTHER BUSINESS THAT MAY COME BEFORE THE ANNUAL MEETING.

None of the matters to be acted on at the Annual Meeting give rise to any statutory right of a stockholder to dissent and obtain the appraisal of or payment for such stockholder’s shares.

TABLE OF CONTENTS

| | Page |

| MATTERS TO BE CONSIDERED AT ANNUAL MEETING | 1 |

| | |

| PROPOSAL 1: ELECTION OF DIRECTORS | 1 |

| | |

| PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS | 3 |

| | |

| PROPOSAL 3: APPROVAL OF AN AMENDMENT TO THE COMPANY’S 2007 STOCK INCENTIVE PLAN | 4 |

| | |

| OTHER MATTERS BEFORE THE ANNUAL MEETING | 7 |

| | |

| BOARD STRUCTURE AND GOVERNANCE | 8 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 11 |

| | |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 12 |

| | |

| DIRECTOR COMPENSATION | 13 |

| | |

| EXECUTIVE COMPENSATION AND OTHER INFORMATION | 14 |

| | |

| NAMED EXECUTIVE OFFICER COMPENSATION | 17 |

| | |

| AGREEMENTS AND OTHER RELATED PARTY TRANSACTIONS | 19 |

| | |

| OTHER MATTERS RELATED TO THIS PROXY STATEMENT | 20 |

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes, with members of each class holding office for staggered three-year terms.

There are currently two Class I Directors, whose terms expire at the 2010 Annual Meeting of Stockholders, one Class II Director, whose term expires at the 2011 Annual Meeting of Stockholders and three Class III Directors, whose terms expire at the 2012 Annual Meeting of Stockholders (in all cases subject to the election of their successors and to their earlier death, resignation or removal). Once elected at the 2010 Annual Meeting, the term for the Class I Directors will expire at the 2013 Annual Meeting of Stockholders (subject to the election of their successors and to their earlier death, resignation or removal).

The persons named in the proxy will vote for Lewis C. Pell and John J. Rydzewski as Class I Directors, unless authority to vote for the election of either of them is withheld by marking the proxy to that effect. Both directors have indicated their willingness to serve, if elected, but if either of them is unable or unwilling to stand for election, proxies may be voted for a substitute nominee or nominees designated by the Board of Directors.

Listed below are the names and certain information with respect to each of our directors, including the nominees for Class I Directors:

| | | | | | | | | First | | | | | | | | | | | | Governance and | |

| | | Class of | | | | | | Became a | | | | | | Audit | | | Compensation | | | Nominating | |

| Name | | Director | | | Age | | | Director | | | Independent (1) | | | Committee (2) | | | Committee | | | Committee | |

| Lewis C. Pell | | I | | | 67 | | | 1987 | | | | | | | | | | | | | |

| John J. Rydzewski | | I | | | 57 | | | 2009 | | | | x | | | | x | | | | x | | | | x | |

| Katsumi Oneda | | II | | | 72 | | | 1987 | | | | x | | | | | | | | | | | | | |

David W. Anderson (3) | | III | | | 57 | | | 2005 | | | | x | | | | x | | | | x | | | | x | |

Warren Bielke (4) | | III | | | 63 | | | 2005 | | | | | | | | | | | | | | | | | |

| Lothar Koob | | III | | | 61 | | | 2009 | | | | x | | | | x | | | | x | | | | x | |

| (1) | All independent directors satisfy the definition of the listing standards of The NASDAQ Stock Market. |

| (2) | All Audit Committee members satisfy the SEC’s requirements for independence for Audit Committee members. |

| (3) | Mr. Anderson was appointed to the Audit Committee on April 7, 2009 replacing Mr. Bielke, and to the Governance and Nominating Committee (formerly known as the Nominating Committee) on June 24, 2009, replacing Mr. Wallace. |

| (4) | Mr. Bielke was a member of the Audit Committee until April 7, 2009 and the Governance and Nominating Committee until November 9, 2009. |

Nominees for Class I Directors: Three Year Terms Ending in 2013

Lewis C. Pell is a co-founder of Vision-Sciences and has been Chairman since 2005. Prior to that, Mr. Pell served as Vice-Chairman of our Board of Directors since 1992. Mr. Pell is a founder or co-founder and chairman and director of several other privately held medical device companies. We believe Mr. Pell’s extensive experience with Vision-Sciences and other companies in the medical device industry, particularly his experience serving as a founder and a member of the board of directors of numerous medical device companies, makes him exceptionally well-suited to continue to serve as a member of our Board.

John J. Rydzewski is a managing director of Christofferson, Robb & Company where he has been responsible for biotechnology and pharmaceutical investments since 2006. Mr. Rydzewski previously served as a healthcare investment banker at Benedetto, Gartland & Co. and Kidder, Peabody & Co. Incorporated. Prior to investment banking, he was a manager at Price, Waterhouse & Co. He is currently Vice Chairman of RAND Health, the healthcare policy research unit of the RAND Corporation. He has served as a director and lead director of several public and privately held companies. He received both an MBA and a BS degree from The Wharton School and he is a C.PA. Mr. Rydzewski serves on our Audit, Go vernance and Nominating, and Compensation Committees. We believe Mr. Rydzewski’s broad healthcare industry experience, professional training and educational background make him well-suited to continue to serve as a member of our Board and our committees.

THE BOARD RECOMMENDS A VOTE FOR THE DIRECTOR NOMINEES.

Other Directors

Class II Director: Continuing in Office until 2011

Katsumi Oneda is a co-founder of Vision-Sciences and was the Chairman of our Board of Directors from 1993 to 2005. From 1993 through 2003 he also served as our President and Chief Executive Officer. He served as Vice-Chairman of our Board from 1992 to 1993, as Honorary Chairman of our Board of Directors from 1991 to 1993 and as Chairman of our Board from 1990 to 1991. Mr. Oneda is a director of a private company. Mr. Oneda’s decades-long experience in the field of endoscopy and device engineering, and his pivotal role in creating and furthering our technology make him well suited to serve on our Board.

Class III Directors: Continuing in Office until 2012

David W. Anderson has served as President, Chief Executive Officer and director of Gentis, Inc. since 2004. Prior to that, Mr. Anderson was the President, Chief Executive Officer and director of Sterilox Technologies, Inc. from 2000 to 2004. Mr. Anderson is a director of Photomedex Inc., Inion Ltd. and several private companies. Mr. Anderson’s experience as a senior executive and a board member in the health care fields, and his service as a director and on the audit and governance and nominating committees of public and private companies, makes him a valuable resource and well-suited to serve on our board and our committees.

Warren Bielke currently serves as our Interim Chief Executive Officer. From April 2009 to November 9, 2009 when he was appointed as Interim Chief Executive Officer, he provided consulting services to Vision-Sciences. Prior to that, he served as a business consultant and an investor. He has served as President and Chief Executive Officer of Vertebral Technologies, Inc., a developer of spinal implants from 2005 to 2006. Prior to that, Mr. Bielke was self-employed as a consultant and investor with start-up businesses from 1999 to 2005. Mr. Bielke is a director of two other private companies. See “Agreements with Directors and Names Officers” below. With a degree in business administration, his long history in the medical device field, and his in-depth expertise in sales, marketing and management, Mr. Bielke is well-suited to serve on our board.

Lothar Koob has been a General Partner of Extera Partners LLC of Cambridge, MA, since 2007. Between 2001 and 2006, Mr. Koob was an Executive Vice President of Analogic Corporation (Analogic) of Peabody, MA. Prior to that, he was with Zeiss/Humphrey as its President of Worldwide Ophthalmic Systems Business and prior to that he spent 24 years in various positions at Siemens Medical where he also served as the General Manager of the MRI and Ultrasound worldwide business units. Mr. Koob is currently a director of XCounter AB, Nexstim Oy, Ultrasonix Medical and Helix Medical. In the past five years he has also been a director of BK Medical and Sky Computers, which a re both subsidiaries of Analogic. With a degree in electrical engineering, a background in medical device manufacturing and his membership on the boards and compensation and audit committees of a number of private companies, Mr. Koob is a valuable asset to our board and our committees.

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has selected and recommends the firm of Amper, Politziner & Mattia, LLP (“Amper”) as our independent registered public accountants for the current fiscal year. Amper has served as our independent registered public accountants effective March 25, 2010 and for the audit of our financial statements for the fiscal year ended March 31, 2010. Although stockholder approval of the Board selection of Amper is not required by law, our Board believes that it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Board may reconsider its selection.

Representatives of Amper are expected to be present at the Annual Meeting, to have the opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions from stockholders.

Change in Auditors

We dismissed BDO Seidman, LLP (our “Former Auditor” or “BDO”) as our independent registered public accounting firm, effective as of March 25, 2010, and engaged Amper, Politziner & Mattia, LLP (the “New Auditor” or “Amper”) as our new independent registered public accounting firm as of and for the year ended March 31, 2010. The change in independent registered public accounting firm was not the result of any disagreement with the Former Auditor.

The report of the Former Auditor on the Company's consolidated financial statements as of and for the years ended March 31, 2009 or March 31, 2008, did not contain an adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope, or accounting principles.

The Audit Committee made the decision to change independent accountants, acting under authority delegated to it by the Board and in accordance with its Audit Committee Charter, and also recommended that the Board approve the change. The Board approved the change of independent accountants at its meeting on March 25, 2010.

During the two most recent fiscal years and through March 25, 2010, there (i) have been no disagreements with the Former Auditor on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of the Former Auditor, would have caused the Former Auditor to make reference to the subject matter of such disagreements in its reports on the financial statements for such years and (ii) were no reportable events of the kind in Item 304(a)(1)(v) of Regulation S-K.

Auditor Fees and Services

The following table shows the aggregate fees for professional services rendered by Amper for the fiscal year ended March 31, 2010 and by BDO for the fiscal year ended March 31, 2009, except as expressly noted:

| | | Fiscal Year Ended March 31, | |

| | | 2010 | | | 2009 | |

Audit Fees (1) | | $ | 181,336 | | | $ | 230,550 | |

Audit-Related Fees (2) | | | 10,903 | | | | 20,000 | |

Tax Fees (3) | | | 32,399 | | | | 32,582 | |

| All Other Fees | | | - | | | | - | |

| Total | | $ | 224,638 | | | $ | 283,132 | |

| (1) | Audit Fees for both years consist of fees for professional services associated with the annual consolidated financial statements audit, review of the interim consolidated financial statements, and services that are normally provided in connection with statutory audits required in regulatory filings. Audit Fees for fiscal 2010 include $40,000 of fees for transition services and audit opinion consent by BDO Seidman in connection with the change in our auditors. |

| (2) | Audit-Related Fees are for auditing our 401(k) plan. |

| (3) | Tax Fees consist of fees for professional services rendered for assistance with federal and state tax compliance and sales tax advisory fees. |

The Audit Committee of our Board chooses and engages our independent registered public accountants to audit our financial statements. In April 2004, our Audit Committee adopted a policy requiring management to obtain the Audit Committee’s approval before engaging our independent registered public accountants to provide any audit or permitted non-audit services to us or our subsidiaries. This policy, which is designed to assure that such engagements do not impair the independence of our independent registered public accountants requires the Audit Committee to pre-approve annually various audit and non-audit services that may be performed by our independent registered public accountants.

Our Chief Financial Officer, Executive Vice President Corporate Development reviews all management requests to engage our independent registered public accountants to provide services and approves the request if the requested services are of the type pre-approved by the Audit Committee. We inform the Audit Committee of these approvals at least quarterly. Services of the type not pre-approved by the Audit Committee require pre-approval by the Audit Committee on a case-by-case basis, subject to exceptions permitted by law. The Audit Committee is not permitted to approve the engagement of our independent registered public accountants for any services that fall into a category of services that is not permitted by applicable law or if the services would be inconsistent with maintaining the registered public accountant� 217;s independence. All of the services performed by the independent registered public accountants in fiscal 2010 were pre-approved by the Audit Committee and, thus, we did not rely on any such exception to the pre-approved requirements.

THE BOARD RECOMMENDS A VOTE FOR THE RATIFICATION OF THE SELECTION OF AMPER.

PROPOSAL 3:

APPROVAL OF AN AMENDMENT TO THE COMPANY’S 2007 STOCK INCENTIVE PLAN

Our current 2007 Stock Incentive Plan (the “2007 Plan”) was adopted by our Board, and approved by our stockholders, at our annual meeting held on August 21, 2008. Up to 4,000,000 shares of Common Stock (subject to adjustment in the event of stock splits and other similar events) were authorized to be issued pursuant to options granted under the 2007 Plan, of which 141,637 remain available as of July 20, 2010.

The Company’s ability to grant equity awards is a necessary and powerful tool for recruiting and retention of valuable employees. We believe there will not be sufficient shares available under our 2007 Plan to meet the Company’s current and projected needs. Accordingly, on July 12, 2010, our Board approved, subject to stockholder approval, an amendment to the 2007 Plan to increase the maximum aggregate number of shares of Common Stock authorized under the 2007 Plan from 4,000,000 to 5,000,000, resulting in 1,141,637 shares available as of July 20, 2010.

Summary of the 2007 Plan

A brief summary of our 2007 Plan is below. A more complete summary and the full text of the 2007 Plan, as proposed to be amended, is attached hereto as Appendix A. and was initially included in our Schedule 14A filed with the SEC on July 27, 2007. Our SEC filings may be found online at the SEC's EDGAR website at http://www.sec.gov.

The purpose of the 2007 Plan is to enhance our ability to attract, retain and motivate persons who make important contributions to the Company, by providing equity ownership opportunities and performance-based incentives. The Board believes that the amendment to the 2007 Plan will continue advance the interests of the Company’s stockholders by better aligning the interests of the participants in the 2007 Plan with those of the Company’s stockholders.

All the Company’s employees, officers, directors, consultants and advisors are eligible to be granted options, restricted stock awards or other stock-based awards under the 2007 Plan. The Board, through its Compensation Committee, will determine who will participate in the 2007 Plan based upon an employee’s achievement of corporate goals, management’s recommendations and the desire to incentivize the applicable employee, officer, director or consultant.

The 2007 Plan provides that the Board will administer the Plan and will have the authority to grant awards and the terms of the awards, including the effect on the award of the disability, death, retirement or other change in employment or status of the participant. The Board may delegate any or all of its powers under the 2007 Plan to one or more committees or subcommittees of the Board. Pursuant to this authority, the Board has delegated the administration of the 2007 Plan to the Compensation Committee. When referring to the Board with respect to the 2007 Plan, we are referring to the Board or any committee or subcommittee appointed by the Board under the 2007 Plan.

Stock Available for Awards

The 2007 Plan, as amended, provides for up to 5,000,000 shares of Common Stock to be awarded under the Plan, subject to adjustments. If any award expires or is terminated without being exercised or Common Stock is not issued, the unused Common Stock covered by the award will be available for grant under the 2007 Plan, subject to tax limitations. The maximum number of shares of Common Stock to be granted to any participant under the 2007 Plan is 2,000,000 per calendar year, subject to adjustments and subject to Section 162(m) of the Code. As of July 16, 2010, the closing price of the Company’s Common Stock as reported on the Nasdaq Capital Market was $0.96 per share.

The Board may grant options to purchase Common Stock under the 2007 Plan. The Board will determine at the time of the grant all terms of the options, including, the number of shares covered by each option, the exercise price, the conditions and limitations applicable to the exercise of each option and the duration of each option, which shall not be granted for a term of more than ten years. The payment for the Common Stock upon exercise of an option, may be in cash, check, an irrevocable and unconditional undertaking by a broker to pay the Company, delivery of registered Common Stock owned by the participant valued at their fair market value, delivery of a promissory note or any other payment of lawful consideration as the Board may determine.

The Board may grant awards entitling recipients to acquire shares of Common Stock, subject to the Company’s right to repurchase all or part of the shares at their issue price or other stated or formula price, subject to the conditions determined and specified by the Board in the award.

The 2007 Plan provides that the Board may grant other awards based upon the Common Stock of the Company, including shares based on certain conditions, convertible securities and stock appreciation rights.

In the event of specified transactions involving the Company’s Common Stock, including stock splits, stock dividends, recapitalizations, spin-offs or other similar changes in capitalization other than a normal capital dividends, (1) the number of shares available under the 2007 Plan, (2) the per-participant limit, (3) the number and class of securities exercisable under each option and the exercise price per share of each option, (3) the repurchase price per restricted stock award and (4) the terms of each other outstanding award, will each be appropriately adjusted by the Company to the extent that the Board determines that an adjustment is necessary and appropriate.

Significant Corporate Events

Upon a proposed liquidation or dissolution of the Company, all options will be exercisable in full and will terminate upon the liquidation or dissolution. The effect of a liquidation or dissolution on restricted stock awards will be established at the time of the grant of the award.

Upon a reorganization event or the execution of an agreement with respect to a reorganization event, the Board will provide that all outstanding options be assumed or equivalent options substituted by the acquiring or succeeding entity and, if that reorganization event constitutes a change of control under the 2007 Plan, the options will be immediately exercisable upon the reorganization event. If the acquiring or succeeding entity does not agree to assume or substitute the options, all unexercised options will become exercisable in full as of a specified time prior to the reorganization event and terminate prior to the reorganization event. If the consideration for the Common Stock in the reorganization event is cash, the Board may instead provide that the options will terminate upon the reorganization event and each participant will receive the equivalent of the consideration in the reorganization event for each share of the Common Stock subject to the option less the exercise price.

Upon a change of control event that is not also a reorganization event, all options will automatically become immediately exercisable in full.

A “reorganization event” is specified mergers or exchange of shares or such time when the directors at the time the 2007 Plan is initially adopted (together with directors appointed by a majority of those directors) do not constitute the majority of the Board, subject to specified exceptions.

A “change of control” is the (1) consummation of a merger, consolidation, reorganization, share exchange or sale of all or substantially all of the assets of the Company unless following that business combination (a) substantially all of the stockholders entitled to elect directors prior to the event own more than 50% of the Common Stock and voting power entitled to elect directors of the resulting company in substantially the same proportions as they did in the Company prior to the transaction and (b) no person, other than Katsumi Oneda or Lewis C. Pell, owns 20% or more of the Common Stock or voting power to elect directors of the resulting company or (2) the acquisition by a person, group or entity of 50% or more of the outstanding Common Stock or the voting power entitled to elect di rectors, except acquisitions by Katsumi Oneda or Lewis C. Pell or any of their affiliates so long as after their acquisition neither person or their affiliates owns more than 40% of the Company’s Common Stock or outstanding voting securities to elect directors and subject to other exceptions in the 2007 Plan.

These adjustments under the 2007 Plan to the terms of the awards for significant corporate events may be viewed as anti-takeover provisions, which may have the effect of discouraging a proposal to acquire or otherwise control the Company.

Except as the Board may otherwise provide in an award, the participant may not transfer, involuntarily or voluntarily, any award under the 2007 Plan, except by will or by the laws of descent and distribution and during the life of the participant the award may only be exercisable by the participant.

Amendments to Granted Awards

The Board may amend, modify or terminate any award. The amendment is subject to the consent of the participant unless the Board determines that the modification would not materially and adversely affect the participant. The Board may, at any time, provide that options will be immediately exercisable in full or in part, that any restricted stock award may be free of restrictions or any other awards become exercisable.

Amendments to the 2007 Plan

The Board may amend, suspend or terminate the 2007 Plan provided that to the extent required by Section 162(m) of the Code, no award granted to a participant that is intended to comply with Section 162(m) after the date of the amendment shall be exercisable, realizable or vested until the amendment is approved the shareholders as required by Section 162(m). As a result, the 2007 Plan may be amended to increase the cost of the 2007 Plan to the Company or to alter the benefits under the plan, without the approval of the shareholders.

The principal federal tax consequences to participants and to the Company of grants and awards under the 2007 Plan are summarized below.

Nonqualified Stock Options. Nonqualified stock options granted under the 2007 Plan are not taxable to an optionee at grant but result in taxation at exercise, at which time the individual will recognize ordinary income in an amount equal to the difference between the option exercise price and the fair market value of the Common Stock on the exercise date. The Company will be entitled to deduct a corresponding amount as a business expense in the year the optionee recognizes this income.

Incentive Stock Options. An employee will generally not recognize income on grant or exercise of an incentive stock option; however, the amount by which the fair market value of the Common Stock at the time of exercise exceeds the option price is a required adjustment for purposes of the alternative minimum tax applicable to the employee. If the employee holds the Common Stock received upon exercise of the option for one year after exercise (and for two years from the date of grant of the option), any difference between the amount realized upon the disposition of the stock and the amount paid for the stock will be treated as long-term capital gain (or loss, if applicable) to the employee. If the employee exercises an incentive stock option and satisf ies these holding period requirements, The Company may not deduct any amount in connection with the incentive stock option.

Stock Appreciation Rights. There are no immediate federal income tax consequences to a participant when a stock appreciation right is granted. Instead, the participant realizes ordinary income upon exercise of a stock appreciation right in an amount equal to the cash and/or fair market value (on the date of exercise) of the shares of Common Stock received. The Company will be entitled to deduct the same amount as a business expense at the time.

Restricted Stock. Generally, an employee will only recognize income on the restricted stock once it vests (when the restrictions lapse). Once vested, the employee will recognize compensation income on the difference between the fair market value of the restricted stock and the amount the employee paid for the stock, if any. The Company would receive a corresponding deduction in the same amount.

Under Section 83(b) of the Internal Revenue Code, the employee may elect to report compensation income for the tax year in which he or she receives a grant of restricted stock. Again, The Company will be entitled to take a corresponding deduction for federal income tax purposes. If the employee makes such an election, the amount of compensation income is the value of the restricted stock at the time of grant. Any later appreciation in the value of the restricted stock is treated as capital gain and recognized only upon a sale of the restricted stock.

Anticipated Awards under the 2007 Plan

The grant of awards to be allocated under the 2007 Plan for each executive officer (including those named in the Summary Compensation Table above, executives as a group, non-executives directors as a group and non-executive officer employees as a group) will be determined by, and is subject to the discretion of, the Board. While awards may be granted in accordance with the Performance Plan, as stock options or otherwise under the 2007 Plan, as of the date of this proxy statement, there has been no determination as to future awards under the 2007 Plan. Accordingly, future amounts or benefits under the 2007 Plan are not determinable at this time hose grants seem to have been earned in 2010.

| | | (A) | | | (B) | | | (C) | |

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants, and rights | | Weighted average exercise price of outstanding options, warrants, and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding column (A)) | |

| Equity compensation plans approved by security holders | | | 6,916,200 | | | $ | 1.88 | | | | 2,648,218 | |

| Equity compensation plans not approved by security holders | | | — | | | | — | | | | — | |

| Total | | | 6,916,200 | | | $ | 1.88 | | | | 2,648,218 | |

Text of Proposed Amendment:

To delete Section 4(a) of the 2007 Plan and replace it with the following:

“4. Stock Available for Awards

(a) Number of Shares. Subject to adjustment under Section 8, Awards may be made under the Plan for up to 5,000,000 shares of common stock, $.01 par value per share, of the Company (the “Common Stock”). If any Award expires or is terminated, surrendered or canceled without having been fully exercised or is forfeited in whole or in part or results in any Common Stock not being issued, the unused Common Stock covered by such Award shall again be available for the grant of Awards under the Plan, subject, however, in the case of Incentive Stock Options (as hereinafter defined), to any limitation required under the Code. Shares issued under the Plan may consist in whole or in part of authorized but unissued shares or treasury shares.

THE BOARD FAVORS A VOTE FOR THE APPROVAL OF THE AMENDMENT TO THE 2007 PLAN.

OTHER MATTERS BEFORE THE ANNUAL MEETING

The Board of Directors does not know of any other matters that may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

BOARD STRUCTURE AND GOVERNANCE

Leadership Structure

Since 2005, we have had separate individuals serving as Chairman of the Board and as Chief Executive Officer (“CEO”) and currently, Interim CEO. The Interim CEO is responsible for managing the day-to-day leadership and performance of the Company, while the Chairman and the Board provides guidance to the Interim CEO and the Chairman leads and manages the Board and presides over meetings of the full Board. We believe this structure strengthens the role of the board in fulfilling its oversight responsibility and fiduciary duties to our shareholders while recognizing the day-to-day management direction of the Company by our Interim CEO.

Our Board selects our executive officers generally on an annual basis or at such other times as the Board may determine, and serve at the Board’s discretion. No family relationship exists among any of our executive officers or directors.

The Board of Directors met eleven times during fiscal 2010. All members of the Board of Directors who then served attended the last Annual Meeting on September 3, 2009 in person and all are expected to attend the 2010 Annual Meeting in person. No incumbent member of the Board attended fewer than 75% of the aggregate meetings of the Board and committees of the Board for which he serves.

Audit Committee

We have a standing Audit Committee of the Board of Directors in accordance with the Securities Exchange Act. The purpose of the Audit Committee is to review our audited financial statements with management, review our independent registered public accountants’ performance in the annual audit, review audit fees, review fees for the preparation of our tax returns, discuss our internal accounting control policies and procedures and consider and appoint our independent registered public accountants.

The current members of the Audit Committee are Messrs. Anderson, Koob and Rydzewski, and each such member is “independent” under the listing standards of The NASDAQ Stock Market and the SEC’s requirements for Audit Committee members. Mr. Anderson is chairman of the Audit Committee.

On April 7, 2009, Mr. Anderson was appointed to the Audit Committee, replacing Mr. Bielke, who resigned from the Audit Committee in connection with his entering into a consulting services agreement with us, as described in “Agreements with Directors and Named Executive Officers”. On June 26, 2009, Mr. Rydzewski was elected to the Board, effective immediately, and was appointed to the Audit Committee, and based on his background and experience, has been recognized by the Board and designated as its “audit committee financial expert,” replacing Mr. Anderson in this role. On July 14, 2009, Mr. Koob was elected to the Board effective immediately, and was appointed as a member of the Audit Committee.

The Audit Committee met eight times during fiscal 2010. The Audit Committee Charter is available on our website at www.visionsciences.com/investors.

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed and discussed with our management our audited consolidated financial statements for fiscal 2010. The Audit Committee has discussed with Amper, Politziner & Mattia, LLP (“Amper”), our independent registered public accounting firm, the matters required to be discussed by Statement on Auditing Standards No. 61 “Communication with Audit Committees” as amended as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T. Management represented to the Audit Committee that our financial statements had been prepared in accordance with generally accepted accounting principles.

The Audit Committee has also received the written disclosures and the letter from Amper as required by the PCAOB in Rule 3526 regarding Amper’s communications with the Audit Committee concerning its independence and has discussed with Amper its independence. Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to our Board that our audited consolidated financial statements be included in our Annual Report on Form 10-K, for fiscal 2010, for filing with the SEC.

| | AUDIT COMMITTEE |

| | David W. Anderson, Chairman |

| | John J. Rydzewski |

| | Lothar Koob |

Compensation Committee

We have a standing Compensation Committee of the Board of Directors. The Compensation Committee, in its capacity as a committee of the Board, has overall responsibility for approving and evaluating officer compensation plans, policies and programs and employee-benefit programs of the Company. The Compensation Committee administers our 2000 and 2007 Stock Incentive Plans and our 2003 Director Plan (the “Plans”) and authorizes option grants under the Plans to our employees.

In October 2009, the Board approved the Compensation Committee Charter which is available on our website at www.visionsciences.com/investors. The authority delegated to the Compensation Committee pursuant to its Charter includes:

| | · | Determining the amount and form of compensation to be paid to the Company’s Interim CEO; |

| | · | Reviewing the amount and form of compensation paid to the Company’s executive officers, officers, employees, consultants and advisors and establishing the Company’s general compensation policies and practices and reviewing the administration of plans and arrangements established pursuant to such policies and practices; |

| | · | Administering the Company’s equity-based compensation plans, including our 2000 and 2007 Stock Option Plans and our 2003 Director Plan and authorizing option grants under these plans; |

| | · | Engaging compensation consultants, legal counsel and such other advisors as it deems necessary and advisable to assist it in carrying out its responsibilities and functions; and |

| | · | When required, preparing reports to on executive compensation and reviewing the compensation discussion in the proxy. |

The Compensation Committee meets in executive session. The Compensation Committee, on occasion, invites members of management and outside advisors to participate in Compensation Committee meetings in order to provide financial or other information useful to the performance of its responsibilities. The Committee did not utilize the services of any advisors during the preceding two fiscal years.

The CEO may not participate in, or be present during, any deliberations of the Compensation Committee regarding his compensation or individual performance objectives. The CEO recommends salaries, bonuses and stock option grants for the Company’s executive officers. The Compensation Committee reviews these recommendations and independently determines the compensation for such officers. The Compensation Committee also approves company-wide pay increases and discretionary compensation that may be allocated to non-executive employees by management.

A description of the Compensation Committee’s determination of executive compensation is included in the Executive Compensation and Other Information section of this Proxy Statement.

Until the resignation of our former director, Mr. Ken Anstey, in July 2010, the members of the Compensation Committee were Messrs. Anderson and Anstey. On July 14, 2009, the Board elected Messrs Koob and Rydzewski to the Compensation Committee, which now consists of Messrs. Anderson, Koob and Rydzewski. Mr. Rydzewski is chairman of the Compensation Committee. Each member of the Compensation Committee is “independent” under the listing standards of The NASDAQ Stock Market.

The Compensation Committee met ten times during fiscal 2010.

Compensation Committee Review

The Compensation Committee has reviewed and discussed the executive compensation information contained in this proxy statement and recommended to the Board of Directors that such information be included in this proxy statement and incorporated into the annual report on Form 10-K for the fiscal year end March 31, 2010.

COMPENSATION COMMITTEE

John J. Rydzewski, Chairman

David W. Anderson

Lothar Koob

Governance and Nominating Committee

We have a standing Governance and Nominating Committee of the Board of Directors. The purpose of the Governance and Nominating Committee is to oversee all aspects of the corporate governance functions, including acting as an independent committee evaluating transactions between the Company and its Board members and officers; assist the Board by identifying individuals qualified to become Board members, and to recommend for selection by the Board the Director nominees to stand for election at the next annual meeting of the Company’s shareholders and recommend to the Board Director nominees for each committee of the Board (other than this Committee).

When reviewing related party transactions the Governance and Nominating Committee has a policy of considering all relevant facts and circumstances, including (1) the commercial reasonableness of the terms, (2) the benefit and perceived benefits, or lack thereof, to us, (3) opportunity costs of alternate transactions, and (4) the materiality and character of the related person’s interest, and the actual or apparent conflict of interest of the related person. It only approves or ratifies a related person transaction when it determines that, upon consideration of all relevant information, the transaction is in, or is not inconsistent with, the best interests of our company and stockholders. No related person transactions will be consummated without the approval or ratification of our Governance and Nominating Com mittee and the disinterested members of the Board. It is our policy that directors interested in a related person transaction will recuse themselves from any vote relating to a related person transaction in which they have an interest.

The Governance and Nominating Committee, by its policy, strives to select individuals as director nominees who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who will be the most effective, in conjunction with the other directors, in collectively serving the long-term interests of the stockholders. To this end, the Governance and Nominating Committee seeks director nominees with the highest professional and personal ethics and values, an understanding of our business and industry, diversity of business experience and expertise, a high level of education and broad-based business acumen. The Governance and Nominating Committee also will consider any other factor that it deems relevant in selecting individuals as director nominees. The Go vernance and Nominating Committee will consider candidates recommended by our stockholders and does not use different standards to evaluate nominees depending on whether they are proposed by the our directors and management or by our stockholders.

The Governance and Nominating Committee met on June 25, 2009 and on July 9, 2009, and recommended to the Board that it elect Mr. Rydzewski to the Board as a Class I director and Mr. Koob as an additional director. The Board accepted both recommendations. The Committee met again on July 14, 2009 and recommended that Mr. Koob, together with Warren Bielke and David Anderson be nominated as Class III directors, to be elected to the Board by the stockholders of the Company at the Company’s meeting of stockholders on September 3, 2009. The Committee met on May 29, 2010 and recommended that Mr. Pell and Mr. Rydzewski be nominated as Class I directors, to be elected to the Board by the stockholders of the Company at the Company’s meeting of stockholders on September 2, 2010. Mr. Rydzew ski abstained from voting on his own nomination.

The Committee met on October 23, 2009, October 28, 2009 and October 29, 2009 to review a revolving loan agreement with Mr. Pell, and recommended approval to the Board. The Board accepted this recommendation. See discussion below under “Agreements with Directors and Named Executive Officers.”

The Governance and Nominating Committee is composed of our three independent directors, Messrs. Anderson, Koob and Rydzewski. Previously, Mr. Anstey and Bielke had served on this committee. Mr. Anderson was appointed as a third member to the Nominating Committee on June 24, 2009, and upon Mr. Anstey’s resignation, Messrs. Koob and Rydzewski were appointed. Mr. Bielke stepped down upon his appointment as Interim CEO. Mr. Koob is chairman of this committee. Each member of the Governance and Nominating Committee is “independent” under the listing standards of The NASDAQ Stock Market.

The Governance and Nominating Committee met six times during fiscal 2010. On July 12, 2010, the Board approved amendments to the Governance and Nominating Committee Charter, which is available on our website at www.visionsciences.com/investors.

Code of Ethics

We have adopted a Code of Ethics applicable to our directors, officers and employees and those of our subsidiaries, including our principal executive officer, the principal financial officer, principal accounting officer, the controller, and other officers of the Company or our subsidiaries. We require all employees, including our senior officers, to read and to adhere to the Code of Ethics in discharging their work-related responsibilities. Our compliance and ethics program involves the administration of, training regarding and enforcement of the Code of Ethics and is under the direction of our Chief Financial Officer, Executive Vice President Corporate Development. Employees are expected to report any conduct th at they believe in good faith to be an actual or apparent violation of the Code of Ethics. Our Code of Ethics, as amended, is posted on our website under Corporate Governance in the Investors tab, at http://ir.visionsciences.com/governance.cfm, and we intend to disclose any future amendments to, or waivers granted to our executive officers from a provision to the Code of Ethics, on our website. Our Code of Ethics was last amended on July 14, 2009 to reflect the new members of our Audit Committee and specify the code’s compliance with certain rules

Stockholder Recommendations and Communications

We have an unwritten policy with regard to stockholder recommendations. Stockholders may recommend candidates for the Board by writing Vision-Sciences, Inc., Attn: Corporate Secretary, 40 Ramland Road South, Orangeburg, New York 10962. All stockholder recommendations that are received will be submitted to the Governance and Nominating Committee for review and consideration. Nominations of directors by stockholders will be considered and reviewed by the Governance and Nominating Committee, which will determine whether these nominations should be presented to the Board. Candidates are required to have the minimum qualifications described above that the Governance and Nominating Committee uses in its director recommendations.

Stockholders may send communications to the Board or to one or more individual directors at any time. Stockholders should direct their communication to the Board or to the individual director(s), in care of our Corporate Secretary at our principal offices, 40 Ramland Road South, Orangeburg, New York 10962. Any stockholder communications that are addressed to the Board or specified individual directors will be delivered by our Corporate Secretary to the Board or such specified individual directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Stock Ownership of Directors and Executive Officers

The following table sets forth certain information, as of July 9, 2010 (unless otherwise indicated below), with respect to the beneficial ownership of our common stock by: (i) each current director, each person serving as director during our fiscal year ended March 31, 2010 (“Fiscal 2010”) (whether or not a current director) and each director nominee; (ii) each current executive officer and former executive officer named in the Summary Compensation Table of this proxy statement; and (iii) all current executive officers and directors as a group.

| | | Amount and | | | | | | Current | |

| | | Nature of | | | Percent of | | | Options and | |

Name of Beneficial Owner (1) | | Beneficial Owner (2) | | | Class (3) | | | Warrants | |

David W. Anderson (4) | | | 32,000 | | | | * | | | | 32,000 | |

Warren Bielke (5)(6) | | | 644,895 | | | | 1.7 | % | | | 432,000 | |

Gideon Hirschmann (6) | | | 237,254 | | | | * | | | | 147,254 | |

Lothar Koob (4) | | | 20,000 | | | | * | | | | 20,000 | |

Mark S. Landman (5)(6) | | | 294,521 | | | | * | | | | 212,321 | |

Katsumi Oneda (7) | | | 8,301,597 | | | | 22.1 | % | | | 24,000 | |

Jitendra Patel (5)(6) | | | 140,971 | | | | * | | | | 71,573 | |

Lewis C. Pell (8) | | | 8,819,159 | | | | 23.5 | % | | | 613,636 | |

John J. Rydzewski (5) | | | 42,500 | | | | * | | | | 20,000 | |

Katherine L. Wolf (6) | | | 277,208 | | | | * | | | | 162,458 | |

Kenneth Anstey (9) | | | - | | | | * | | | | - | |

Ron Hadani (4)(10) | | | 2,008,967 | | | | 5.3 | % | | | 2,008,967 | |

John Wallace (9) | | | - | | | | * | | | | - | |

| All current directors and executive officers, | | | | | | | | | | | | |

as a group 10 persons (11) | | | 18,810,105 | | | | 50.0 | % | | | 3,744,209 | |

| * | Less than 1% of the shares of Common Stock outstanding |

| (1) | Unless otherwise indicated below, each stockholder listed had sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws, if applicable. |

| (2) | The number of shares of Common Stock beneficially owned by each director, nominee for director or executive officer is determined under the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. The inclusion herein of any shares as beneficially owned does not constitute an admission of beneficial ownership. |

| (3) | The number of shares deemed outstanding includes 37,593,056 shares outstanding as of July 9, 2010, and any shares subject to stock options and warrants held by the person or entity in question that are currently exercisable or exercisable within 60 days thereafter. |

| (4) | All shares are subject to stock options currently exercisable or exercisable within 60 days after July 9, 2010. |

| (5) | Includes shares held of record and beneficially owned by the respective individual as of July 9, 2010. |

| (6) | Includes restricted stock awards granted under the performance plan (as described in the Executive Compensation and Other Information section below) to Mr. Bielke (191,250 shares), Mr. Hirschmann (90,000 shares), Mr. Landman (70,200 shares), Mr. Patel (60,648 shares), and Ms. Wolf (114,750 shares). The restricted stock awards are subject to certain performance and time restrictions. |

| (7) | Includes 37,500 shares and 47,500 shares held of record and beneficially owned by Mr. Oneda’s son and daughter, respectively; Mr. Oneda disclaims beneficial ownership of these shares. |

| (8) | Includes 50,000 shares and 37,500 shares held of record and beneficially owned by Mr. Pell’s wife and child, respectively, and 2,400 shares held by Mr. Pell’s bother’s family; Mr. Pell disclaims beneficial ownership of these shares. Also includes exercisable warrants to purchase 272,727 shares of our common stock at $1.375 per share and 340,909 shares at $1.65 per share. |

| (9) | Mr. Anstey resigned from our Board effective July 7, 2009 and Mr. Wallace resigned from our Board May 15, 2009. Any Directors options held by them expired 90 days after their last day as a Board member. |

| (10) | Mr. Hadani resigned as Chief Executive Officer and as a Director effective November 9, 2010. Pursuant to the terms of the separation agreement with Mr. Hadani, he has until November 9, 2012 to exercise his options. |

| (11) | Includes, as to all current directors and executive officers as a group, 3,644,209 shares subject to stock options and warrants that are currently exercisable or exercisable within 60 days after July 9, 2010, and 174,900 shares for which certain individuals have disclaimed beneficial ownership, as set forth in the above footnotes. |

Stock Ownership of Certain Stockholders

The following table sets forth the beneficial ownership of our Common Stock as of July 9, 2010 by each person who is known by us to beneficially own more than 5% of the outstanding shares of Common Stock, other than as reflected on the Stock Ownership of Directors and Officers above:

| | | Amount | | | | |

| | | and Nature | | | Percent of | |

| Name of Beneficial Owner | | of Beneficial Owner | | | Class | |

Asahi Kogaku Kogyo Kabushiki Kaisha (1) | | | 2,000,000 | | | | 5.3 | % |

| (1) | Based on information provided by Pentax Corporation. Shares are held by in the name of Ashi Kogaku Kogyo Kabushiki Kaisha. The address for the beneficial owner is 2-36-9, Maeno-cho, Itabashi-Ku Tokyo 174-8639 Japan. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our directors and executive officers, and persons who own more than ten percent (10%) of our Common Stock, file with the Securities and Exchange Commission reports of initial ownership of our Common Stock and subsequent changes in that ownership and furnish to us copies of all forms they file pursuant to Section 16(a). Based solely on a review of Forms 3, 4 and 5 furnished to us in fiscal 2010, any written representations from reporting persons or copies of the reports that they have filed with the SEC, we believe all Section 16(a) filing requirements were timely made in the fiscal year ended March 31, 2010, except a Form 4, for a single transaction covering the grant of stock options, was not timely filed for Warren Bielk e. This report has now been filed.

The following table sets forth certain information concerning the compensation of our Directors for the fiscal year ended March 31, 2010, including Directors who no longer serve:

| | | Fees Earned | | | | | | | | | Outstanding | |

| | | or Paid | | | Option | | | | | | Options as of | |

| Name | | in Cash | | | Awards (1) | | | Total | | | March 31, 2010 | |

David Anderson (2) | | $ | 21,750 | | | $ | 10,210 | | | $ | 31,960 | | | | 32,000 | |

Warren Bielke (2)(3) | | | 8,500 | | | | 10,210 | | | | 18,710 | | | | 232,000 | |

Lothar Koob (2) | | | 17,000 | | | | 16,597 | | | | 33,597 | | | | 20,000 | |

Katsumi Oneda (2) | | | 7,000 | | | | 10,210 | | | | 17,210 | | | | 24,000 | |

Lewis C. Pell (4) | | | - | | | | - | | | | - | | | | - | |

John J. Rydzewski (2) | | | 21,750 | | | | 16,597 | | | | 38,347 | | | | 20,000 | |

Kenneth W. Anstey (2)(5) | | | - | | | | - | | | | - | | | | - | |

Ron Hadani (6) | | | - | | | | - | | | | - | | | | 2,008,967 | |

John J. Wallace (2)(7) | | | 1,750 | | | | - | | | | 1,750 | | | | - | |

| Total | | $ | 77,750 | | | $ | 63,824 | | | $ | 141,574 | | | | 2,336,967 | |

| (1) | Based on the grant date fair value of the option awards granted in accordance with Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification (“ASC”) 718 (Topic 718, Compensation – Stock Compensation), excluding the impact of forfeitures. The assumptions we used for calculating the grant date fair values are set forth in note 5 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended March 31, 2010. |

| (2) | Messrs. Anderson, Anstey, Oneda, Wallace, Koob, and Rydzewski received director’s fees payable in connection with their attendance at telephonic and in-person meetings of the board and various committees. The amounts in the table do not include reimbursements for certain company-related travel expenses. Mr. Bielke for such period prior to and during the term of his consulting arrangement with Vision-Sciences, but no longer receives these fees. |

| (3) | On April 7, 2009, the Board approved Mr. Warren L. Bielke’s entering into a consulting agreement with us to provide sales and marketing services. In connection with this arrangement, Mr. Bielke resigned from the Audit Committee effective April 7, 2009. Under this Agreement, Mr. Bielke earned $8,000 per month, commencing April 7, 2009, and which was increased to $9,000 per month in October 2009. Effective November 9, 2009, upon the resignation of Mr. Hadani, Mr. Bielke was appointed Interim CEO. For Mr. Bielke, please refer to the “Summary Compensation Table” below for disclosure of his compensation as our Interim CEO. Since Mr. Bielke was appointed as Interim CEO, he does not receive separate compensation in his capacity as a member of our Board. |

| (4) | Mr. Pell is an employee of Vision-Sciences and received $43,770 in salary. He does not receive separate compensation in his capacity as a member of our Board, with the exception of reimbursement of company-related travel expenses. |

| (5) | Mr. Anstey resigned as a member of the Board and each committee he then served effective July 7, 2009. All Directors’ options held by him expired 90 days after his last day as a Director. |

| (6) | Mr. Hadani resigned as a member of our Board and as President and CEO effective November 9, 2009. Pursuant to the terms of separation agreement, his time to exercise his vested options was extended to November 9, 2012. For Mr. Hadani, please refer to the “Summary Compensation Table” below for disclosure of his compensation as our President and CEO. |

| (7) | Mr. Wallace resigned as a member of the Board and each committee he then served effective May 15, 2009. All Directors’ options held by him expired 90 days after his last day as a Director. |

The 2003 Director Stock Option Plan (as amended, the “2003 Director Plan”) provides for the grant of non-statutory stock options (collectively “Director Options”) to our directors who are not our employees or any of our subsidiaries (collectively “Outside Directors”). No discretionary options or other awards can be granted under the 2003 Director Plan; rather, Director Options to purchase 10,000 shares of Common Stock (subject to adjustment for stock splits, reverse stock splits, stock dividends, recapitalizations or other similar changes in capitalization) are granted automatically (i) to each person who becomes an Outside Director after the date the 2003 Director Plan was approved by our stockholders and (ii) to each Outside Director on each date on which ou r annual meeting of the stockholders held, provided that such Outside Director does not then hold any options under the 1993 Director Option Plan that have not vested as of such date.

The exercise price per share of any Director Option is the fair market value of one share of Common Stock on the date of grant. While our stock is listed on a national securities exchange or other nationally recognized trading system such as the NASDAQ Stock Market, this will be the closing price per share of the our Common Stock on the trading day of the Annual Stockholders Meeting. Each Director Option is fully vested and exercisable in full on the date of grant. Director Options are exercisable until the tenth anniversary of the date of grant.

During our fiscal year 2010, each Outside Director received the following fees for attendance at meetings:

| | · | $2,000 for attendance at each in-person meeting of the Board; |

| | · | $1,000 for attendance at telephonic meetings of the Board; |

| | · | $750 for attendance at each Audit Committee meeting; and |

| | · | $500 for attendance at each Governance and Nominating Committee meeting and each Compensation Committee meeting. |

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Overview – Compensation Objectives and Philosophy

The Compensation Committee is responsible for establishing and administering compensation for the Company’s executive officers, including our Interim CEO, and exercising oversight of compensation practices for all employees including strategies for attracting, developing and motivating employees.

The Compensation Committee considers its primary goal to be designing and implementing equitable and cost-effective compensation programs that link corporate strategy and goals to compensation plans. In this regard, there are four primary considerations impacting compensation decisions: (i) driving sustainable Company growth; (ii) progressively improving our operating and financial performance; (iii) fostering an innovative and entrepreneurial corporate culture; and (iv) delivering superior investment returns to our stockholders.

Key factors that the Compensation Committee examines when designing compensation programs include the compensation practices at peer companies and the competitiveness of our programs in the market. We have determined that our Company’s executive compensation practices should place a greater emphasis on corporate performance rather than individual performance. Accordingly, our executive compensation is designed to motivate executives by aligning a substantial portion of their compensation with the achievement of corporate goals.

We design, develop, manufacture and market technologically advanced endoscopic products. In recent years we have incurred substantial net losses resulting from significant investment in new product technologies and systems that have enabled us to remain a technology leader. In the future, we expect our net losses to reduce as market introductions of newly developed products accelerate. Accordingly, in the current fiscal year, the Compensation Committee formalized an incentive bonus program reflecting the Company’s product commercialization targets as described more fully below.

Review of Relevant Compensation Data

We consider market pressures and compensation practices at a peer group of companies when administering executive compensation. In order to assess the competitiveness of our executive compensation practices, the Compensation Committee compared our 2010 executive officer compensation against the compensation provided to executives in comparable positions at peer companies.

The peer group examined by the Compensation Committee includes medical technology companies that are comparable to us in size or business life-cycle stage and with whom we believe we compete for investor capital. These companies are: Atricure; ATS Medical; Cutera; Hansen Medical; LeMaitre Vascular; MELA Sciences, Inc.; Micrus Endovascular; Osteotech; Spectranetics; STARR Surgical; and Stereotaxis.

We reviewed compensation data for executives at the peer companies with positions comparable to those held by our executive officers. This data consisted of salary, bonus and equity award information as well as total direct compensation paid by each of the peer companies as reflected in their proxy statements.

Although the Compensation Committee reviewed peer compensation data to help inform its decision-making process, this data is only one point of information taken into account by the Compensation Committee in making compensation decisions that we feel will best help us achieve our corporate objectives.

Elements of Compensation

The success of a medical technology company is significantly influenced by the quality of its work force. With this in mind, we strive to provide what we believe is a competitive total compensation package to our executive officers through a combination of three different elements of compensation.

First, we set base salaries at a level designed to attract and retain executives based on experience and an internal determination as to how critical the position is to our success and financial performance. Second, we award performance bonuses for achieving pre-determined corporate and individual objectives and to support an environment in which executives are accountable for performance. Finally, we provide equity incentives to encourage sustained long-term performance and create a culture of ownership and entrepreneurship.

In addition to these three elements of compensation, we provide other benefits, such as health and life insurance, to our employees, including our executive officers, to promote their safety and security. The following discussion further describes the mix of compensation elements we pay to our executive officers.

Base Salary

We pay salaries to our executive officers to provide a base-level of compensation to them in consideration of the services they perform for us. We recognize that our financial success and the achievement of our long-term objectives is largely dependent upon the experience, skills and efforts of our executive management and that the executive compensation we pay must be competitive with the compensation paid by other similarly-situated companies in order to recruit and retain our executive management team.

The base salaries of our executive officers are primarily established based on the scope of their responsibilities, taking into account competitive market compensation paid by other small-cap, medical device public companies for similar positions and adjusted as necessary to recruit or retain specific individuals. Other factors affecting executive base salary are the executive’s level of experience and an evaluation of the individual's contribution to our success.

The amount of salary paid during 2010 to each of our named executive officers is shown in the Summary Compensation Table below. The Compensation Committee set the annual base salaries for other named executives after reviewing the individual's level of responsibility, experience and performance.

Performance Bonus

A competitive environment characterized by significant changes in the evolution of our core endoscopic technologies led the Compensation Committee in recent years to conclude that a bonus program with predetermined performance objectives would be unduly rigid. Instead, the Compensation Committee operated on the basis of offering discretionary bonuses to achieve the goals outlined above for our compensation program.

However, our current efforts to significantly accelerate commercialization of several products motivated the Compensation Committee to adopt a Performance Incentive Plan (the “Performance Plan”) at the conclusion of the current fiscal year that will become effective for fiscal 2011. The Plan provides for the payment of bonuses to the Company’s executive officers and other senior managers based on the attainment of specified Company performance and individual executive objectives.

Any payments which may be due under the Performance Plan on account of fiscal 2011 performance will be paid in shares of restricted stock awarded under our current 2007 Stock Incentive Plan and will vest over three years. Thus, the Performance Plan is designed both to motivate executives to maximize the Company’s performance in the year in which they are granted restricted shares and to provide long-term retention incentive for the vesting period with respect to those shares that become eligible to vest based on the Company’s performance.

Our goal in creating the Performance Plan is to more closely align executive compensation with the achievement of key corporate objectives, thereby motivating participants to perform to the best of their ability in making the Company successful and thereby increase shareholder value. The program is designed to focus management’s attention on key Company priorities and goals and to attract, retain and reward results-oriented executives.

Each participant has a target incentive opportunity equal to a percentage of their respective annual base salary. On an annual basis, the Compensation Committee determines the target incentive opportunity to be applied. The target incentive opportunity is the amount that will be paid if the Company meets all of its performance objectives. The actual payout to participants may lower or equal to the target incentive opportunity.

Each year, with guidance from the Board of Directors, the Compensation Committee will determine the performance measures that support the Company’s business plan for the coming year and the appropriate weighting for each performance measure. Revenue growth (“Revenue”) and Earnings (Loss) before Interest and Taxes (“EBIT”) will be used as performance measures each year. The Compensation Committee may establish additional performance measures in future years.

A “minimum,” “target” and “maximum” performance level for each of the annual performance measures will be set each year. Performance below the minimum will result in no payment for that performance measure. Performance exceeding expectations will result in additional payouts up to the allowed maximum. At the target performance level, participants will receive 100% of their target incentive opportunity.

In May 2010, the Compensation Committee set the following performance measures under the Performance Plan for 2011: (1) Company Revenue and EBIT performance and (2) individual executive performance milestones, with each performance measure accounting for 75% and 25%, respectively, of the target incentive opportunity. The target incentive opportunity for 2011 for the Interim CEO is 75% of his annual base salary; for certain other executive officers it is 45% of the executive officer’s annual base salary; and for certain director level management employees it is 15% of the manager’s base salary.

Under the Performance Plan no bonuses are payable to any individual unless we achieve our Revenue and EBIT targets, regardless of whether the individual meets his or her executive performance milestones. Specifically, upon achieving 80% of our target Revenue budget and meeting a specified EBIT level, management will receive 30% of their bonuses; upon achieving of 90% of our target Revenue budget (and meeting a specified EBIT level), management will receive an additional 22.5% of their eligible bonus, and upon achieving 100% of our target Revenue budget (and meeting a specified EBIT level), management will receive the balance of their bonus (an additional 22.5%). If the Company’s Revenue and EBIT targets are met, individual managers will receive 25% of their eligible bonus if their individ ual performance goals are also met.

These levels at which the Compensation Committee set the performance measures for 2011 are intended to be challenging in order to encourage our executive management to aggressively pursue the Company’s financial goals. However, these performance measures were also intended to be attainable, with the Compensation Committee’s expectation that the participants will achieve at least 80% of the target if they successfully execute the strategies and tactics developed under the Company’s strategic plan and meet their individual performance goals.