UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07358

Duff & Phelps Utility and Corporate Bond

Trust Inc.

(Exact name of registrant as specified in charter)

200 South Wacker Drive, Suite 500, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

| Alan M. Meder | | Lawrence R. Hamilton |

| Duff & Phelps Utility and Corporate Bond Trust Inc. | | Mayer Brown LLP |

| 200 South Wacker Drive, Suite 500 | | 71 South Wacker Drive |

| Chicago, Illinois 60606 | | Chicago, Illinois 60606 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (800) 338-8214

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Stockholders follows.

February 21, 2012

Dear Fellow Shareholders:

YOUR FUND’S PERFORMANCE

During the second half of 2011 the performance of leveraged bond funds, including Duff & Phelps Utility and Corporate Bond Trust Inc. (the “DUC Fund”), was affected by questions about the resiliency of the U.S. economic recovery and the extent to which the turmoil in overseas debt markets could potentially spread to the U.S. markets. Bond investors bounced between risk on/risk off modes, as a handful of modestly positive economic indicators were offset by fear that the European debt crisis was far from being resolved. However, many investors remained committed to the relative safety of high quality fixed income investments. As a result, the DUC Fund along with the broader fixed income markets, posted strong positive returns.

The following table compares the performance of the DUC Fund to a broad based investment grade bond market benchmark. It is important to note that the index returns stated below include no fees or expenses, whereas the DUC Fund’s NAV returns are net of fees and expenses.

| | | | | | | | | | | | |

For the period indicated through December 31, 2011

| | DUC Fund

(Per share

performance

with dividends

reinvested in

Fund plan)

| | | DUC Fund

(NAV based

performance)

| | | Barclays

Capital U.S.

Aggregate Bond

Index

| |

Six Months | | | 10.18 | % | | | 4.04 | % | | | 4.98 | % |

One Year | | | 13.79 | % | | | 7.92 | % | | | 7.84 | % |

Three Years (annualized) | | | 13.91 | % | | | 11.15 | % | | | 6.77 | % |

Five Years (annualized) | | | 8.20 | % | | | 7.02 | % | | | 6.50 | % |

DUC Fund per share based returns and DUC Fund NAV based returns were obtained from the Administrator of the DUC Fund. Performance returns for the Barclays Capital U.S. Aggregate Bond Index were obtained from Bloomberg L.P. Past performance is not indicative of future results.

Based on the December 31, 2011 closing price of $12.04 and a monthly distribution of $0.07 per share the DUC Fund common stock had an annualized distribution rate of 6.98%. Please refer to the portion of this letter captioned “ABOUT YOUR FUND” for important information about the sources and characterizations of the DUC Fund’s distributions.

MARKET OVERVIEW AND OUTLOOK

U.S. Gross Domestic Product (“GDP”) grew modestly during the second half of 2011. Ongoing concerns about high U.S. unemployment and stagnant wages weighed on consumer sentiment. Falling home prices and stricter mortgage lending standards prevented many households from refinancing and taking advantage of low mortgage rates. State and local governments remained under pressure due to weak local economies and diminished federal support, while partisan politics on the national level further eroded consumer confidence. Despite the fact that many corporations enjoyed sound balance sheets and relatively easy access to credit, the business sector remained reluctant to use its healthy cash reserves to meaningfully increase production or hiring. Concerns arose that potential austerity measures intended to address the sovereign debt crisis might be a drag on economic activity and impede the prospects for global growth.

The Federal Open Market Committee (“FOMC”), the committee within the Federal Reserve that sets monetary policy, reaffirmed its accommodative stance by holding the federal funds rate to a “target range” of zero to 0.25%. While the FOMC held its target for the federal funds rate steady, investors grew concerned that Europe’s sovereign debt crisis could spread to the U.S. credit markets and move the economy closer to a double dip recession. The U.S. Treasury yield curve shifted downward and became less positively sloped (i.e., long-term rates higher than short-term rates). Yields decreased by 22 basis points on two-year maturities, by 128 basis points on ten-year maturities and by 148 basis points on thirty-year maturities. Putting downward pressure on the U.S. Treasury yield curve was a recurrence of the “flight to quality” as many investors sought refuge from market volatility in the relative safety of the U.S. Treasury market. As a result, the higher quality sectors of the broader fixed income markets posted strong positive returns for the second half of 2011.

1

Looking forward to 2012, we believe that the U.S. economy is on track to have positive albeit moderate growth. While talk of a double dip recession has abated, a struggling housing market and only modest gains in employment are expected to impede the U.S. economic rebound and keep the recovery slow and uneven. The FOMC recently stated that “the economy has been expanding moderately”, while acknowledging that “strains in the global financial markets continue to pose significant risks to the economic outlook”. The FOMC also indicated that inflation had moderated since early last year. In an effort to support a stronger economic recovery and keep downward pressure on longer term interest rates, the FOMC is extending the average maturity of its security holdings (‘operation twist’). Monetary policy is expected to remain accommodative and the need for additional quantitative easing is likely to continue to be a topic of debate.

In part due to lackluster U.S. economic growth and the evolving European sovereign debt crisis, we expect the fixed income market to stay volatile and highly reactive to the release of economic data. In the near term, we think the recurring flight to quality by nervous investors and the implementation of operation twist will keep U.S. Treasury yields at modest levels. Longer term, an improving economy and record U.S. borrowing to finance expanding budget deficits could set the stage for rising inflation expectations and upward pressure on long-term interest rates. If that happens, the returns of leveraged bond funds, like the DUC Fund, could be reduced.

ABOUT YOUR FUND

The DUC Fund seeks to provide investors with a stable monthly distribution that is primarily derived from current fiscal year net investment income. At times a portion of the monthly distribution could be derived from realized capital gains, and to the extent necessary, paid-in-capital, in which case the DUC Fund is required to inform shareholders of the sources of the distribution based on U.S. generally accepted accounting principles (“GAAP”). A return of capital distribution does not necessarily reflect the DUC Fund’s investment performance and should not be confused with “yield” or “income”. A return of capital may occur, for example, when some or all of the money that is invested in the Fund is paid back to the investor. Based on GAAP, for the twelve month period ended December 31, 2011, 60% of the total distributions were attributable to current year net investment income and 40% were in excess of current year net investment income and were therefore attributable to paid-in-capital. The characterization of the distributions for GAAP purposes and federal income tax purposes may differ, primarily because of a difference in the tax and GAAP accounting treatment of amortization for premiums on fixed income securities. For federal income tax purposes, 100% of the distributions in 2011 were derived from net investment income. A form 1099-DIV has been sent to shareholders which stated the amount and tax characterization of the DUC Fund’s 2011 distributions.

The use of leverage enables the DUC Fund to borrow at short-term rates and invest at long-term rates. As of December 31, 2011, the DUC Fund’s leverage consisted of Auction Market Preferred Shares (“AMPS”) in the amount of $95 million and senior debt in the amount of $95 million. On that date, the total amount of leverage represented by the AMPS and senior debt constituted approximately 37% of the DUC Fund’s total assets. The amount and type of leverage used is reviewed by the Board of Directors based on the DUC Fund’s expected earnings relative to the anticipated costs (including fees and expenses) associated with the leverage. In addition, the long-term expected benefits of leverage are weighed against the potential effect of increasing the volatility of both the DUC Fund’s net asset value and the market value of its common stock. Historically, the tendency of the U.S. yield curve to exhibit a positive slope has fostered an environment in which leverage can make a positive contribution to the earnings of the DUC Fund. However, there is no assurance that this will continue to be the case in the future. If the use of leverage were to cease being beneficial, the amount and type of leverage employed by the DUC Fund could potentially be modified or eliminated.

Early in 2008, disruptions in the short-term fixed income markets resulted in failures in the periodic auctions and remarketings of many closed-end fund’s preferred shares, including the preferred shares of the DUC Fund. After reviewing options for resolving preferred share illiquidity, in March 2009 management arranged a $190 million credit facility with a commercial bank. Subsequent to the implementation of the credit facility, the DUC Fund redeemed $95 million of AMPS.

There are a number of factors that have constrained the DUC Fund from refinancing additional preferred shares with debt. The DUC Fund is limited in its ability to use debt to refinance all of its outstanding AMPS because of the asset coverage requirements of the Investment Company Act of 1940 and related SEC rules. In addition, the DUC Fund cannot incur indebtedness or enter into reverse repurchase agreements without departing from the guidelines established by

2

the two principal rating agencies. While the DUC Funds’ goal is to provide additional liquidity to preferred shareholders, the Board of Directors and the Adviser continue to believe that any action taken to provide such liquidity should not materially disadvantage common shareholders and their ability to benefit from leverage, should be long-term in nature and should not encumber the investment process or reduce the pool of available investment alternatives. Because of all the foregoing considerations, the amount and timing of any future preferred share redemptions are uncertain. The DUC Fund will announce any redemption through press releases and postings to its website.

The DUC Fund does not currently use derivatives and has no investments in complex securities or structured investment vehicles (“SIVs”). Additionally, the portfolio has no direct exposure to financial intermediaries that focus exclusively on derivatives or SIVs. The DUC Fund’s exposure is indirect and is limited to financial institutions with diversified revenue streams. However, due to the inherent interconnectivity of today’s financial intermediaries, corporate bond investors are faced with the task of identifying and quantifying counterparty risk that is often the result of derivatives positions among both financial and non-financial companies. Government intervention and the potential for additional regulation have also introduced additional uncertainty into the capital structure of various financial intermediaries. In normal market conditions, at least 80% of the DUC Fund’s total assets must be invested in Utility and Corporate Bonds, and at least 25% of the DUC Fund’s total assets must be invested in Utility Income Securities. Due to this mandated exposure, any disruptions in the broader credit market could materially and adversely impact the valuation of the investments held in the DUC Fund.

In addition to the risk of disruptions in the broader credit market, an environment of relatively low interest rates can add an element of reinvestment risk to bond funds including the DUC Fund. If bonds held in a portfolio mature during a period of low interest rates, the proceeds may necessarily be reinvested in lower yielding securities. Therefore, a prolonged period of low interest rates and the resultant modest reinvestment opportunities can be expected to adversely impact the earnings of the DUC Fund going forward.

It is impossible for the DUC Fund to be completely insulated from turmoil in the financial markets or adverse levels of interest rates. However, management believes that over the long term the diversification of the portfolio across sectors and issuers, in addition to the conservative distribution of the DUC Fund’s assets along the yield curve, should help limit volatility and reinvestment risk to some degree.

DIVIDEND REINVESTMENTAND CASH PURCHASE PLANAND DIRECT DEPOSIT

For those of you receiving dividends in cash, you may want to consider taking advantage of the dividend reinvestment and cash purchase plan (the “Plan”) available to all registered shareholders of the DUC Fund. Under the Plan, the DUC Fund absorbs all administrative costs (except brokerage commissions, if any) so that the total amount of your dividends and other distributions may be reinvested in additional shares of the DUC Fund. Also, the cash purchase option permits participants to purchase shares in the open market through the Plan Agent. Additional information about the Plan is available from the Plan Agent, Computershare Shareowner Services LLC, at 1-866-221-1681, or for more details, please refer to page 21.

For those shareholders receiving dividend checks, you may want to consider having your monthly dividends deposited, free of charge, directly into your bank account through electronic funds transfer. Direct deposit provides the convenience of automatic and immediate access to your funds, while eliminating the possibility of mail delays and lost, stolen or destroyed checks. Additional information about direct deposit is available from Computershare Shareowner Services LLC, at 1-866-221-1681.

For more information about the DUC Fund, shareholders can access www.ducfund.com.

We appreciate your investment in Duff & Phelps Utility and Corporate Bond Trust Inc. and look forward to continuing our service to you.

Sincerely,

| | |

| Daniel J. Petrisko, CFA | | Nathan I. Partain, CFA |

| Chief Investment Officer | | Director, President & CEO |

3

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Schedule of Investments

December 31, 2011

| | | | | | | | |

Principal

Amount

(000) | | | Description | | Value

(Note 2) | |

| | | | | LONG-TERM INVESTMENTS—151.8% | |

| | | | | U.S. Government and Agency Obligations—0.3% | | | | |

| | | | | Federal National Mortgage Association, Pass-Through Certificates, | | | | |

| $ | 170 | | | 8.00%, 10/01/30 | | $ | 205,965 | |

| | 600 | | | 7.00%, 12/01/31 | | | 698,268 | |

| | | | | Government National Mortgage Association Pass-Through Certificates, | | | | |

| | 12 | | | 7.00%, 3/15/26 | | | 14,122 | |

| | 62 | | | 8.00%, 11/15/30 | | | 74,635 | |

| | 32 | | | 8.00%, 2/15/31 | | | 33,100 | |

| | | | | | |

|

|

|

| | | | | Total U.S. Government and Agency Obligations

(Cost $894,847) | | | 1,026,090 | |

| | | | | | |

|

|

|

| | | | | Corporate Bonds—146.1% | | | | |

| | | | | Financial—38.6% | | | | |

| | 5,000 | | | American Express Co., | | | | |

| | | | | 6.15%, 8/28/17 | | | 5,725,195 | |

| | 7,000 | | | Boeing Capital Corp., | | | | |

| | | | | 6.50%, 2/15/12 (a)(b) | | | 7,052,892 | |

| | 6,000 | | | Caterpillar Financial Services Corp., | | | | |

| | | | | 6.125%, 2/17/14 | | | 6,646,416 | |

| | 5,000 | | | DaimlerChrysler North America Holding Corp., | | | | |

| | | | | 6.50%, 11/15/13 | | | 5,448,405 | |

| | 5,000 | | | Duke Realty Limited Partnership, | | | | |

| | | | | 6.25%, 5/15/13 | | | 5,230,695 | |

| | 5,000 | | | ERP Operating Limited Partnership, | | | | |

| | | | | 6.625%, 3/15/12 | | | 5,051,135 | |

| | 6,000 | | | General Electric Capital Corp., | | | | |

| | | | | 4.80%, 5/01/13 (a)(b) | | | 6,283,320 | |

| | 5,000 | | | The Goldman Sachs Group, Inc., | | | | |

| | | | | 5.50%, 11/15/14 | | | 5,154,745 | |

| | 5,000 | | | JPMorgan Chase & Co., | | | | |

| | | | | 5.375%, 10/01/12 | | | 5,170,300 | |

| | 5,000 | | | JPMorgan Chase & Co., | | | | |

| | | | | 4.75%, 5/01/13 | | | 5,228,765 | |

| | 5,000 | | | Kimco Realty Corp., | | | | |

| | | | | 5.584%, 11/23/15 | | | 5,382,425 | |

| | 5,000 | | | Mack-Cali Realty L.P., | | | | |

| | | | | 5.125%, 1/15/15 | | | 5,248,825 | |

| | 5,000 | | | MetLife, Inc., | | | | |

| | | | | 5.50%, 6/15/14 (a) | | | 5,458,030 | |

| | 6,000 | | | Morgan Stanley, | | | | |

| | | | | 6.00%, 4/28/15 | | | 6,014,904 | |

| | 10,000 | | | NationsBank Capital Trust IV, | | | | |

| | | | | 8.25%, 4/15/27 | | | 9,275,000 | |

| | | | | | | | |

Principal

Amount

(000) | | | Description | | Value (Note 2) | |

| $ | 5,000 | | | National City Corp., | | | | |

| | | | | 6.875%, 5/15/19 | | $ | 5,627,580 | |

| | 5,000 | | | Northern Trust Corp., | | | | |

| | | | | 5.50%, 8/15/13 (a) | | | 5,319,630 | |

| | 5,000 | | | Realty Income Corp., | | | | |

| | | | | 6.75%, 8/15/19 | | | 5,708,465 | |

| | 5,000 | | | Simon Property Group, L.P., | | | | |

| | | | | 5.25%, 12/01/16 | | | 5,547,595 | |

| | 6,000 | | | US Bank, N.A., | | | | |

| | | | | 4.95%, 10/30/14 | | | 6,525,102 | |

| | 6,000 | | | Wachovia Bank NA, | | | | |

| | | | | 6.00%, 11/15/17 | | | 6,633,594 | |

| | | | | | |

|

|

|

| | | | | | | | 123,733,018 | |

| | | | | | |

|

|

|

| | | | | Industrial—29.1% | | | | |

| | 4,000 | | | Archer-Daniels-Midland Company, | | | | |

| | | | | 7.125%, 3/01/13 (a)(b) | | | 4,281,572 | |

| | 6,000 | | | Coca-Cola Enterprises, Inc., | | | | |

| | | | | 8.50%, 2/01/12 (a)(b) | | | 6,035,334 | |

| | 5,000 | | | ConocoPhillips | | | | |

| | | | | 4.75%, 2/01/14 | | | 5,402,790 | |

| | 6,000 | | | Dow Chemical Company, | | | | |

| | | | | 9.00%, 4/01/21 | | | 7,837,248 | |

| | 7,000 | | | Hewlett-Packard Co., | | | | |

| | | | | 6.125%, 3/01/14 (a)(b) | | | 7,551,607 | |

| | 1,827 | | | Kraft Foods, Inc., | | | | |

| | | | | 6.25%, 6/01/12 | | | 1,866,988 | |

| | 5,000 | | | Sun Company, Inc., | | | | |

| | | | | 9.00%, 11/01/24 | | | 6,678,490 | |

| | 5,000 | | | Target Corp., | | | | |

| | | | | 6.00%, 1/15/18 | | | 6,099,725 | |

| | 5,275 | | | Tele-Communications, Inc., | | | | |

| | | | | 10.125%, 4/15/22 (a) | | | 7,652,400 | |

| | 3,200 | | | Tele-Communications, Inc., | | | | |

| | | | | 9.875%, 6/15/22 (a)(b) | | | 4,594,950 | |

| | 5,000 | | | Time Warner Cable, Inc., | | | | |

| | | | | 7.50%, 4/01/14 | | | 5,601,210 | |

| | 5,000 | | | Time Warner Entertainment Company, L.P., | | | | |

| | | | | 8.875%, 10/01/12 (a)(b) | | | 5,271,680 | |

| | 5,000 | | | Time Warner, Inc., | | | | |

| | | | | 9.15%, 2/01/23 | | | 6,852,320 | |

| | 5,000 | | | Wal-Mart Stores, Inc., | | | | |

| | | | | 6.75%, 10/15/23 | | | 6,850,075 | |

| | 5,000 | | | Wellpoint, Inc., | | | | |

| | | | | 6.80%, 8/01/12 | | | 5,170,955 | |

| | 5,000 | | | Xerox Corp., | | | | |

| | | | | 6.35%, 5/15/18 | | | 5,639,765 | |

| | | | | | |

|

|

|

| | | | | | | | 93,387,109 | |

| | | | | | |

|

|

|

The accompanying notes are an integral part of these financial statements.

| | | | | | | | |

Principal

Amount

(000) | | | Description | | Value (Note 2) | |

| | | | | Telephone—6.9% | | | | |

| $ | 5,000 | | | Deutsche Telekom International Finance, | | | | |

| | | | | 5.25%, 7/22/13 | | $ | 5,256,480 | |

| | 6,000 | | | Rogers Communications, Inc., | | | | |

| | | | | 7.50%, 3/15/15 (a) | | | 7,030,524 | |

| | 5,000 | | | Telecom Italia Capital SA, | | | | |

| | | | | 5.25%, 10/01/15 | | | 4,590,440 | |

| | 5,000 | | | Vodafone Group PLC, | | | | |

| | | | | 5.000%, 12/16/13 | | | 5,367,495 | |

| | | | | | |

|

|

|

| | | | | | | | 22,244,939 | |

| | | | | | |

|

|

|

| | | | | Utilities—71.5% | | | | |

| | 5,000 | | | American Water Capital Corp., | | | | |

| | | | | 6.085%, 10/15/17 | | | 5,823,440 | |

| | 5,000 | | | American Water Capital Corp., | | | | |

| | | | | 6.593%, 10/15/37 | | | 6,181,025 | |

| | 5,000 | | | Arizona Public Service Co., | | | | |

| | | | | 6.875%, 8/01/36 | | | 6,584,510 | |

| | 10,000 | | | CalEnergy Company, Inc., | | | | |

| | | | | 8.48%, 9/15/28 (a) | | | 14,502,870 | |

| | 5,000 | | | CenterPoint Energy Resources Corp., | | | | |

| | | | | 6.00%, 5/15/18 | | | 5,816,345 | |

| | 10,713 | | | Cleveland Electric Illumination Co., | | | | |

| | | | | 8.875%, 11/15/18 (a)(b) | | | 14,394,533 | |

| | 5,000 | | | Commonwealth Edison Co., | | | | |

| | | | | 6.95%, 7/15/18 (a) | | | 5,999,850 | |

| | 5,000 | | | Dominion Resources, Inc. | | | | |

| | | | | 5.15%, 7/15/15 | | | 5,577,175 | |

| | 8,000 | | | EQT Corporation, | | | | |

| | | | | 8.125%, 6/01/19 (a) | | | 9,397,152 | |

| | 10,000 | | | Entergy Texas, Inc., | | | | |

| | | | | 7.125%, 2/01/19 (a) | | | 12,220,400 | |

| | 5,475 | | | Exelon Generation Co. LLC, | | | | |

| | | | | 6.20%, 10/01/17 (a) | | | 6,294,953 | |

| | 7,750 | | | FPL Group Capital Inc., | | | | |

| | | | | 7.875%, 12/15/15 (a) | | | 9,253,802 | |

| | 10,000 | | | Hydro-Quebec, | | | | |

| | | | | 7.50%, 4/01/16 (a)(b) | | | 12,311,330 | |

| | 5,000 | | | Indiana Michigan Power Co., | | | | |

| | | | | 7.00%, 3/15/19 | | | 6,158,955 | |

| | 5,000 | | | Kinder Morgan Energy Partners, | | | | |

| | | | | 7.75%, 3/15/32 (a) | | | 6,213,420 | |

| | 6,000 | | | National Grid PLC | | | | |

| | | | | 6.30%, 8/01/16 | | | 6,892,116 | |

| | 6,500 | | | National Rural Utilities Cooperative Finance Corp., | | | | |

| | | | | 5.50%, 7/01/13 (a) | | | 6,954,506 | |

| | 7,167 | | | Oncor Electric Delivery Co., LLC, | | | | |

| | | | | 6.375%, 5/01/12 (a) | | | 7,284,947 | |

| | 9,441 | | | ONEOK Partners, L.P., | | | | |

| | | | | 6.15%, 10/01/16 (a)(b) | | | 10,852,496 | |

| | 3,690 | | | PPL Energy Supply LLC, | | | | |

| | | | | 6.50%, 5/01/18 (a) | | | 4,201,216 | |

| | 5,000 | | | PSEG Power LLC, | | | | |

| | | | | 5.32%, 9/15/16 (a)(b) | | | 5,582,730 | |

| | | | | | | | |

Principal

Amount

(000) | | | Description | | Value (Note 2) | |

| $ | 10,000 | | | Progress Energy, Inc., | | | | |

| | | | | 7.05%, 3/15/19 (a)(b) | | $ | 12,385,750 | |

| | 8,000 | | | Sempra Energy | | | | |

| | | | | 6.15%, 6/15/18 | | | 9,442,448 | |

| | 7,785 | | | South Carolina Electric & Gas Co., | | | | |

| | | | | 6.50%, 11/01/18 | | | 9,673,267 | |

| | 5,000 | | | Spectra Energy Capital LLC, | | | | |

| | | | | 6.20%, 4/15/18 | | | 5,677,095 | |

| | 10,000 | | | Trans-Canada Pipelines Limited, | | | | |

| | | | | 9.875%, 1/01/21 | | | 14,592,390 | |

| | 7,821 | | | Williams Partners L.P., | | | | |

| | | | | 7.25%, 2/01/17 (a) | | | 9,288,415 | |

| | | | | | |

|

|

|

| | | | | | | | 229,557,136 | |

| | | | | | |

|

|

|

| | | | | Total Corporate Bonds

(Cost $441,567,465) | | | 468,922,202 | |

| | | | | | |

|

|

|

| | | | | Asset-Backed Securities—1.8% | | | | |

| | 5,000 | | | Detroit Edison Securitization Funding LLC 2001-1 A6, | | | | |

| | | | | 6.62%, 3/01/16 | | | 5,689,439 | |

| | | | | | |

|

|

|

| | | | | Total Asset-Backed Securities

(Cost $5,331,827) | | | 5,689,439 | |

| | | | | | |

|

|

|

| | | |

| Shares | | | | | | |

| | | | | Non-Convertible Preferred Stock—3.6% | |

| | | | | Financial—3.6% | | | | |

| | 100,000 | | | Duke Realty Corp., Series M, | | | | |

| | | | | 6.95% | | | 2,510,000 | |

| | 100,000 | | | Kimco Realty Corp., Series G, | | | | |

| | | | | 7.75% | | | 2,575,000 | |

| | 100,000 | | | Realty Income Corp., Series D, | | | | |

| | | | | 7.375% | | | 2,684,000 | |

| | 100,000 | | | UDR, Inc., Series G, | | | | |

| | | | | 6.75% | | | 2,550,000 | |

| | 50,000 | | | Vornado Realty Trust, Series I, | | | | |

| | | | | 6.625% | | | 1,259,500 | |

| | | | | | |

|

|

|

| | | | | Total Non-Convertible Preferred Stock

(Cost $11,158,000) | | | 11,578,500 | |

| | | | | | |

|

|

|

| | | | | Total Investments—151.8% | | | | |

| | | | | (Cost $458,952,139) | | | 487,216,231 | |

| | | | | | |

|

|

|

| | | | | Other Assets in Excess of Liabilities—7.4% | | | 23,784,224 | |

| | | | | Borrowings—(29.6)% | | | (95,000,000 | ) |

| | | | | Liquidation Value of Preferred Shares—(29.6)% | | | (95,000,000 | ) |

| | | | | | |

|

|

|

| | | | | Net Assets Applicable to Common Stock—100% | | $ | 321,000,455 | |

| | | | | | |

|

|

|

The accompanying notes are an integral part of these financial statements.

| (a) | All or a portion of this security has been segregated and made available for loan. |

| (b) | All or a portion of this security has been loaned. |

The percentage shown for each investment category is the total value of that category as a percentage of the net assets applicable to common stock of the Fund.

The Fund’s investments are carried at fair value which is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. The three-tier hierarchy of inputs established to classify fair value measurements for disclosure purposes is summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. The following is a summary of inputs used to value each of the Fund’s investments at December 31, 2011:

| | | | | | | | |

| | | Level 1

| | | Level 2

| |

Asset-backed securities | | $ | — | | | $ | 5,689,439 | |

Corporate bonds | | | — | | | | 468,922,202 | |

Non-convertible preferred stock | | | 11,578,500 | | | | — | |

U.S. Government and Agency obligations | | | — | | | | 1,026,090 | |

| | |

|

|

| |

|

|

|

Total | | $ | 11,578,500 | | | $ | 475,637,731 | |

| | |

|

|

| |

|

|

|

There were no Level 3 priced securities held and there were no significant transfers between Level 1 and Level 2 during the year ended December 31, 2011.

Summary of Ratings as a Percentage of Long-Term Investments at December 31, 2011

| | | | |

Rating *

| | %

| |

AAA | | | 1.3 | % |

AA | | | 2.7 | % |

A | | | 27.8 | % |

BBB | | | 63.3 | % |

BB | | | 4.9 | % |

| | |

|

|

|

| | | | 100.0 | % |

| | |

|

|

|

| * | Individual ratings are grouped based on the lower rating of Standard & Poor’s Financial Services LLC (“S&P”) or Moody’s Investors Service Inc. (“Moody’s”) and are expressed using the S&P ratings scale. If a particular security is rated by either S&P or Moody’s, but not both, then the single rating is used. If a particular security is not rated by either S&P or Moody’s, then a rating from Fitch Ratings Ltd. is used, if available. |

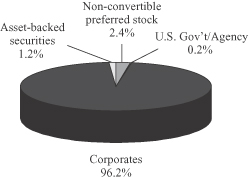

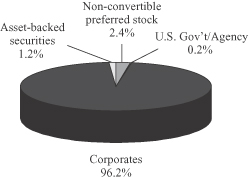

Sector Allocation as a Percentage

of Total Investments at December 31, 2011*

| * | Percentages are based on total investments rather than total net assets applicable to common stock and include securities pledged as collateral for the Fund’s credit facility. |

The accompanying notes are an integral part of these financial statements.

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Statement of Assets and Liabilities

December 31, 2011

| | | | |

| |

| Assets | | | | |

| |

Investments, at value (cost $458,952,139) including $89,629,753 of securities loaned | | $ | 487,216,231 | |

| |

Cash | | | 16,643,194 | |

| |

Interest receivable | | | 7,354,935 | |

| |

Dividends receivable | | | 127,943 | |

| |

Other assets | | | 15,684 | |

| | |

|

|

|

| |

Total assets | | | 511,357,987 | |

| | |

|

|

|

| |

| Liabilities | | | | |

| |

Borrowings (Note 8) | | | 95,000,000 | |

| |

Investment advisory fee (Note 3) | | | 216,575 | |

| |

Administrative fee (Note 3) | | | 38,049 | |

| |

Interest on borrowings (Note 8) | | | 13,308 | |

| |

Dividends on auction market preferred shares | | | 7,578 | |

| |

Accrued expenses | | | 82,022 | |

| | |

|

|

|

| |

Total liabilities | | | 95,357,532 | |

| | |

|

|

|

| |

Auction Market Preferred Shares (3,800 shares issued and outstanding, liquidation preference $25,000 per share) | | | 95,000,000 | |

| | |

|

|

|

| |

| Net Assets Applicable to Common Stock | | $ | 321,000,455 | |

| | |

|

|

|

| |

| Capital | | | | |

| |

Common stock, $.01 par value, 599,992,400 shares authorized, 27,336,527 shares issued and outstanding | | $ | 273,365 | |

| |

Additional paid-in capital | | | 359,036,941 | |

| |

Accumulated distributions in excess of net investment income | | | (5,718,920 | ) |

| |

Accumulated net realized loss on investments | | | (60,855,023 | ) |

| |

Net unrealized appreciation on investments | | | 28,264,092 | |

| | |

|

|

|

| |

| Net Assets Applicable to Common Stock | | $ | 321,000,455 | |

| | |

|

|

|

| |

Net asset value per share of common stock | | $ | 11.74 | |

| | |

|

|

|

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Statement of Operations

For the Year Ended December 31, 2011

| | | | |

| |

| Investment Income | | | | |

| |

Interest income | | $ | 19,538,682 | |

| |

Dividend income | | | 921,660 | |

| | |

|

|

|

| |

Total investment income | | | 20,460,342 | |

| | |

|

|

|

| |

Expenses | | | | |

| |

Investment advisory fees (Note 3) | | | 2,555,011 | |

| |

Borrowing fees and expenses (Note 8) | | | 963,195 | |

| |

Administrative fees (Note 3) | | | 449,399 | |

| |

Directors’ fees | | | 145,454 | |

| |

Broker-dealer commissions—auction market preferred shares | | | 144,479 | |

| |

Professional fees | | | 99,073 | |

| |

Reports to shareholders | | | 71,039 | |

| |

Custodian fees | | | 52,488 | |

| |

Transfer agent fees | | | 40,236 | |

| |

Registration fees | | | 24,601 | |

| |

Leverage fees | | | 15,407 | |

| |

Other expenses | | | 32,646 | |

| | �� |

|

|

|

| |

Total operating expenses | | | 4,593,028 | |

| | |

|

|

|

| |

Interest expense (Note 8) | | | 1,384,407 | |

| |

Total expenses | | | 5,977,435 | |

| | |

|

|

|

| |

Net investment income | | | 14,482,907 | |

| | |

|

|

|

| |

| Realized and Unrealized Gain | | | | |

| |

Net realized gain on investments | | | 2,628,478 | |

| |

Net change in unrealized appreciation on investments | | | 8,081,702 | |

| | |

|

|

|

| |

Net realized and unrealized gain on investments | | | 10,710,180 | |

| | |

|

|

|

| |

| Dividends and Distributions on Auction Market Preferred Shares from Net Investment Income | | | (1,395,284 | ) |

| | |

|

|

|

| |

| Net Increase in Net Assets Applicable to Common Stock Resulting from Operations | | $ | 23,797,803 | |

| | |

|

|

|

The accompanying notes are an integral part of these financial statements.

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Statements of Changes in Net Assets

| | | | | | | | |

| | |

| | | For the

Year Ended

December 31,

2011

| | | For the

Year Ended

December 31,

2010

| |

Operations | | | | | | | | |

| | |

Net investment income | | $ | 14,482,907 | | | $ | 17,996,505 | |

| | |

Net realized gain | | | 2,628,478 | | | | 3,692,989 | |

| | |

Net change in unrealized appreciation | | | 8,081,702 | | | | 2,873,603 | |

| | |

Dividends and distributions on auction market preferred shares from net investment income | | | (1,395,284 | ) | | | (1,453,429 | ) |

| | |

|

|

| |

|

|

|

| | |

Net increase in net assets applicable to common stock resulting from operations | | | 23,797,803 | | | | 23,109,668 | |

| | |

|

|

| |

|

|

|

| | |

Dividends and Distributions on Common Stock

from and in excess of net investment income | | | (22,947,029 | ) | | | (22,900,781 | ) |

| | |

|

|

| |

|

|

|

| | |

Capital Stock Transactions | | | | | | | | |

| | |

Reinvestment of dividends resulting in the issuance of 19,449 shares and 109,933 shares of common stock, respectively | | | 227,561 | | | | 1,320,167 | |

| | |

|

|

| |

|

|

|

| | |

Total increase in net assets | | | 1,078,335 | | | | 1,529,054 | |

| | |

| Net Assets Applicable to Common Stock | | | | | | | | |

| | |

Beginning of year | | | 319,922,120 | | | | 318,393,066 | |

| | |

|

|

| |

|

|

|

| | |

End of year | | $ | 321,000,455 | | | $ | 319,922,120 | |

| | |

|

|

| |

|

|

|

| | |

Distributions in excess of net investment income at end of year | | $ | (5,718,920 | ) | | $ | (5,465,980 | ) |

| | |

|

|

| |

|

|

|

The accompanying notes are an integral part of these financial statements.

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Statement of Cash Flows

For the Year Ended December 31, 2011

| | | | |

| |

Increase (Decrease) in Cash | | | | |

| |

Cash flows provided from (used for) operating activities: | | | | |

| |

Interest and dividends received (excluding discount and premium amortization of ($9,172,440)) | | $ | 30,627,404 | |

| |

Long-term capital gains dividends received | | | 66,819 | |

| |

Operating expenses paid | | | (4,614,983 | ) |

| |

Interest expense paid | | | (1,378,503 | ) |

| |

Dividends paid on preferred stock | | | (1,391,674 | ) |

| |

Purchase of long-term portfolio investments | | | (176,439,515 | ) |

| |

Proceeds from sales and maturities of long-term portfolio investments | | | 179,071,489 | |

| | |

|

|

|

| |

Net cash provided from operating activities | | | 25,941,037 | |

| | |

|

|

|

| |

Cash flows provided from (used for) financing activities: | | | | |

| |

Dividends paid on common stock | | | (23,065,179 | ) |

| |

Proceeds from issuance of common stock under dividend reinvestment plan | | | 227,561 | |

| | |

|

|

|

| |

Net cash used for financing activities | | | (22,837,618 | ) |

| | |

|

|

|

| |

Net increase in cash | | | 3,103,419 | |

| |

Cash at beginning of period | | | 13,539,775 | |

| | |

|

|

|

| |

Cash at end of period | | $ | 16,643,194 | |

| | |

|

|

|

| |

Reconciliation of Net Increase in Net Assets Resulting from Operations to Net Cash Provided from Operating Activities | | | | |

| |

Net increase in net assets resulting from operations | | $ | 23,797,803 | |

| | |

|

|

|

| |

Decrease in investments | | | 11,804,414 | |

| |

Net realized gain on investments | | | (2,628,478 | ) |

| |

Net realized long-term capital gains dividends received | | | 66,819 | |

| |

Net change in unrealized appreciation on investments | | | (8,081,702 | ) |

| |

Decrease in interest receivable | | | 994,622 | |

| |

Decrease in prepaid expenses and other assets | | | 784 | |

| |

Increase in interest payable on borrowings | | | 5,904 | |

| |

Decrease in accrued expenses and other liabilities | | | (19,129 | ) |

| | |

|

|

|

| |

Total adjustments | | | 2,143,234 | |

| | |

|

|

|

| |

Net cash provided from operating activities | | $ | 25,941,037 | |

| | |

|

|

|

The accompanying notes are an integral part of these financial statements.

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Financial Highlights

The table below provides information about income and capital changes for a share of common stock outstanding throughout the years indicated (excluding supplemental data provided below):

| | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended December 31,

| |

| PER SHARE DATA | | 2011

| | | 2010

| | | 2009

| | | 2008

| | | 2007

| |

Net asset value, beginning of year | | $ | 11.71 | | | $ | 11.70 | | | $ | 10.61 | | | $ | 11.65 | | | $ | 11.97 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net investment income(1) | | | 0.53 | | | | 0.66 | | | | 0.77 | | | | 0.84 | | | | 0.93 | |

Net realized and unrealized gain (loss) | | | 0.39 | | | | 0.24 | | | | 1.22 | | | | (0.83 | ) | | | (0.09 | ) |

Dividends and distributions on auction market preferred shares from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | | (0.05 | ) | | | (0.07 | ) | | | (0.27 | ) | | | (0.38 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net increase (decrease) from investment operations | | | 0.87 | | | | 0.85 | | | | 1.92 | | | | (0.26 | ) | | | 0.46 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dividends and distributions on common stock from and in excess of: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.84 | ) | | | (0.84 | ) | | | (0.83 | ) | | | (0.78 | ) | | | (0.78 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net asset value, end of year | | $ | 11.74 | | | $ | 11.71 | | | $ | 11.70 | | | $ | 10.61 | | | $ | 11.65 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Per share market value, end of year | | $ | 12.04 | | | $ | 11.39 | | | $ | 12.29 | | | $ | 10.11 | | | $ | 10.32 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| TOTAL INVESTMENT RETURN ON COMMON STOCK(2) | | | 13.79 | % | | | (0.61 | )% | | | 30.69 | % | | | 5.30 | % | | | (4.71 | )% |

| RATIOS TO AVERAGE NET ASSETS APPLICABLE TO COMMON STOCK:(3) | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.86 | % | | | 1.89 | % | | | 2.12 | % | | | 1.37 | % | | | 1.34 | % |

Net investment income | | | 4.53 | % | | | 5.53 | % | | | 6.82 | % | | | 7.42 | % | | | 7.88 | % |

| SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 36 | % | | | 37 | % | | | 23 | % | | | 12 | % | | | 19 | % |

Net assets applicable to common stock, end of year (000) | | $ | 321,000 | | | $ | 319,922 | | | $ | 318,393 | | | $ | 287,426 | | | $ | 315,439 | |

Preferred stock outstanding (000) | | $ | 95,000 | | | $ | 95,000 | | | $ | 95,000 | | | $ | 190,000 | | | $ | 190,000 | |

Asset coverage per share of preferred stock, end of year | | $ | 109,474 | | | $ | 109,190 | | | $ | 108,788 | | | $ | 62,819 | | | $ | 66,505 | |

Borrowings outstanding (000) | | $ | 95,000 | | | $ | 95,000 | | | $ | 95,000 | | | $ | — | | | $ | — | |

Asset coverage per $1,000 on borrowings, end of year | | $ | 5,379 | | | $ | 5,368 | | | $ | 5,352 | | | $ | — | | | $ | — | |

| (1) | Based on average number of shares of common stock outstanding. |

| (2) | Total investment return is calculated assuming a purchase of common stock at market value on the opening of the first day and a sale at market value on the closing of the last day of each year reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Brokerage commissions are not reflected. |

| (3) | Ratios calculated on the basis of income and expenses applicable to both the common and preferred stock relative to the average net assets applicable to common stock. Ratios do not reflect the effect of dividends paid on auction market preferred shares. |

The accompanying notes are an integral part of these financial statements.

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Notes to Financial Statements

December 31, 2011

Note 1. Organization Duff & Phelps Utility and Corporate Bond Trust Inc. (the “Fund”) was incorporated in Maryland on November 23, 1992 as a diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to seek high current income consistent with investing in securities of investment-grade quality. |

Note 2. Significant Accounting Policies The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. |

A. Securities Valuation: Equity securities traded on a national or foreign securities exchange or traded over-the-counter and quoted on the NASDAQ National List are valued at the last reported sale price or, if there was no sale on the pricing date, then the security is valued at the mean of the bid and ask prices as obtained on that day from one or more dealers regularly making a market in that security and are generally classified as Level 1. Equity securities traded on more than one securities exchange shall be valued at the last sale price on the pricing date at the close of the exchange representing the principal market for such securities and are classified as Level 1. Fixed income securities are valued at the mean of bid and ask prices provided by an independent pricing service when such prices are believed to reflect the fair value of such securities and are generally classified as Level 2. Such bid and ask prices are determined taking into account securities prices, yields, maturities, call features, ratings, and institutional size trading in similar securities and developments related to specific securities. Short-term investments having a maturity of 60 days or less at time of purchase are valued on an amortized cost basis, which approximates fair value and are classified as Level 2. Any securities for which it is determined that market prices are unavailable or inappropriate are valued at a fair value using a procedure determined in good faith by the Board of Directors and are generally classified as Level 2 or 3.

B. Securities Transactions and Investment Income: Securities transactions are recorded on the trade date. Realized gains and losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. The Fund amortizes premiums and accretes discounts on securities using the effective interest method.

C. Federal Income Taxes: It is the Fund’s intention to comply with requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its net taxable income and capital gains to its shareholders. Therefore, no provision for Federal income or excise tax is required. Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund’s tax returns for each of the four years in the period ended December 31, 2011 are subject to such review.

D. Dividends and Distributions: The Fund will declare and pay dividends on its common stock monthly from net investment income. Net long-term capital gains, if any, in excess of loss carryforwards are expected to be distributed annually. The Fund will make a determination at the end of its fiscal year as to whether to retain or distribute such gains. Dividends and distributions are recorded on the ex-dividend date. Dividends and distributions on the Fund’s preferred shares are accrued on a daily basis and are determined as described in Note 7.

The amount and timing of distributions are generally determined in accordance with federal tax regulations, which may differ from U.S. generally accepted accounting principles.

E. Use of Estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

11

Note 3. Agreements and Management Arrangements A. Advisor: The Fund has an Advisory Agreement with Duff & Phelps Investment Management Co. (the “Adviser”), a subsidiary of Virtus Investment Partners, Inc. (“Virtus”). |

The investment advisory fee is payable monthly at an annual rate of 0.50% of the Fund’s average weekly managed assets, which is defined as the average weekly value of the total assets of the Fund minus the sum of all accrued liabilities of the Fund (other than the aggregate amount of any outstanding borrowings or other indebtedness constituting financial leverage).

B. Administrator: The Fund has an Administration Agreement with J.J.B. Hilliard, W.L. Lyons, LLC (“Hilliard”). The administration fee is payable monthly at an annual rate of 0.14% of the Fund’s average weekly net assets, which is defined as the average weekly value of the total assets of the Fund minus the sum of all accrued liabilities of the Fund (including the aggregate amount of any outstanding borrowings or other indebtedness constituting financial leverage).

C. Directors: The Fund pays each director not affiliated with the Adviser an annual fee plus a fee for certain meetings of the board or committees of the board attended. Total fees paid to directors for the year ended December 31, 2011 were $145,454.

D. Affiliated Shareholders: At December 31, 2011, Virtus Partners Inc. held 34,865 shares of the Fund. This represents 0.13% of the Fund’s outstanding shares on this date. These shares may be sold at any time.

Note 4. Investment Transactions Purchases and sales of investment securities (excluding U.S. Government securities and short-term investments) for the year ended December 31, 2011 aggregated $166,398,305 and $149,052,153, respectively. For the year ended December 31, 2011, the Fund had purchases and sales of $10,041,211 and $30,019,336 respectively, of U.S. Government securities. |

Note 5. Distributions and Tax Information | The federal income tax basis of the Fund’s investments and the aggregate gross unrealized appreciation (depreciation) at December 31, 2011 were as follows: |

| | | | | | | | | | | | |

Federal Tax

Cost

| | Unrealized

Appreciation

| | | Unrealized

Depreciation

| | | Net

Unrealized

Appreciation

| |

| $474,936,869 | | $ | 23,058,183 | | | $ | 10,778,821 | | | $ | 12,279,362 | |

The tax character of distributions paid during the fiscal years ended December 31, 2011 and 2010 was as follows:

| | | | | | | | |

| | | 12/31/2011

| | | 12/31/2010

| |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 24,342,313 | | | $ | 24,354,210 | |

| | |

|

|

| |

|

|

|

Total distributions | | $ | 24,342,313 | | | $ | 24,354,210 | |

| | |

|

|

| |

|

|

|

At December 31, 2011, the components of distributable earnings on a tax basis were as follows:

| | | | |

Undistributed net ordinary income | | $ | 10,265,810 | |

Capital loss carryforward | | | (60,855,023 | ) |

Unrealized net appreciation (depreciation) | | | 12,279,362 | |

| | |

|

|

|

| | | $ | (38,309,851 | ) |

| | |

|

|

|

The difference between book basis and tax basis unrealized appreciation (depreciation) is attributable primarily to the difference between book and tax amortization methods for premiums and discounts on fixed income securities.

At December 31, 2011, the Fund had a net capital loss carryforward of $60,855,023 which may be used to offset future capital gains. This net capital loss carryforward will be reduced by future realized gains whether or not distributed.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized for tax years beginning after December 22, 2010 may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

12

At December 31, 2011, the Fund had post-enactment and pre-enactment net capital losses as follows:

| | | | | | | | | | | | | | | | |

| | | | | | Not Subject

to Expiration

| | | | |

| | | Subject

to

Expiration

| | | Short

Term

| | | Long

Term

| | | Total

| |

Carryover loss: | | $ | 53,877,035 | | | $ | 155,708 | | | $ | 6,822,280 | | | $ | 60,855,023 | |

Expiration dates: | | | | | | | | | | | | | | | | |

2012 | | | 3,731,126 | | | | | | | | | | | | | |

2013 | | | 3,265,594 | | | | | | | | | | | | | |

2014 | | | 4,213,979 | | | | | | | | | | | | | |

2015 | | | 13,096,121 | | | | | | | | | | | | | |

2017 | | | 18,907,565 | | | | | | | | | | | | | |

2018 | | | 10,662,650 | | | | | | | | | | | | | |

Note 6. Reclassification of Capital Accounts Due to inherent differences in the recognition and distribution of income and realized gains (losses) under U.S. generally accepted accounting principles and for federal income tax purposes, permanent differences between book and tax basis reporting have been identified and appropriately reclassified on the Statement of Assets and Liabilities. At December 31, 2011, the following reclassifications were recorded: |

| | | | | | | | |

Paid-in Capital

| | Accumulated net realized

loss on investments

| | | Distributions in excess of

net investment income

| |

| $(11,512,356) | | $ | 1,905,890 | | | $ | 9,606,466 | |

The reclassifications primarily relate to permanent differences attributable to amortization methods on fixed income securities, accounting for prepayments on mortgage-backed securities, and the expiration of a net capital loss carryforward. These reclassifications had no effect on net assets or net asset value per share.

Note 7. Auction Market Preferred Shares The Fund’s Charter grants the authority to the Board of Directors to authorize the creation and issuance of one or more series of preferred stock out of the authorized and unissued stock of the Fund. Accordingly, on October 25, 2006, the Fund issued 7,600 shares of Auction Market Preferred Shares (“AMPS”) in two series of 3,800 shares each at a public offering price of $25,000 per share. The underwriting discount and other offering costs incurred in connection with the issuance of the AMPS were recorded as a reduction of paid-in capital on common stock. Dividends on shares of AMPS are cumulative from their date |

of original issue and payable on each dividend payment date. On March 24, 2009, the Fund redeemed 3,800 shares of its T7 series of AMPS at liquidation value. As of December 31, 2011, there were 3,800 shares of AMPS outstanding.

Under the 1940 Act, the Fund may not declare dividends or make other distributions on shares of common stock or purchase any such shares if, at the time of the declaration, distribution or purchase, asset coverage with respect to the outstanding preferred stock would be less than 200%.

The AMPS are redeemable at the option of the Fund, in whole or in part, on any dividend payment date at $25,000 per share plus any accumulated or unpaid dividends, whether or not declared. The AMPS are also subject to a mandatory redemption at $25,000 per share plus any accumulated or unpaid dividends, whether or not declared, if certain requirements relating to the composition of the assets and liabilities of the Fund as set forth in the Fund’s Charter are not satisfied.

The holders of AMPS have voting rights equal to the holders of common stock (one vote per share) and will vote together with holders of common stock as a single class. However, holders of AMPS, voting separately as a class, are also entitled to elect two of the Fund’s directors. In addition, the 1940 Act requires that along with any approval by shareholders that might otherwise be required, the approval of the holders of a majority of any outstanding shares of preferred stock, voting separately as a class, would be required to (a) adopt any plan of reorganization that would adversely affect the preferred stock, and (b) take certain actions requiring a vote of security holders, including, among other things, changes in the Fund’s subclassification as a closed-end investment company or changes in its fundamental investment restrictions. Since February 2008, the AMPS market has been ineffective at matching buyers with sellers. This has impacted the Fund’s AMPS. The AMPS dividend rate was reset to the maximum applicable rate. These maximum dividend rates ranged from 1.41% to 1.50% for the year ended December 31, 2011. A failed auction is not an event of default for the Fund, but it is a liquidity problem for the holders of its AMPS. Dislocations in the auction rate securities markets have triggered numerous failed auctions for many closed-end funds. A failed auction occurs when there are more sellers of AMPS than buyers. It is impossible to predict how long this imbalance will last. A successful auction of the Fund’s AMPS may not occur for a long period of time, if ever. Even if the AMPS

13

market becomes more liquid, the holders of the Fund’s AMPS may not have the amount of liquidity they desire or the ability to sell the AMPS at par.

Note 8. Borrowings On March 12, 2009, the Fund entered into a Committed Facility Agreement (the “Facility”) with a commercial bank (the “Bank”) that allows the Fund to borrow cash from the Bank, up to a limit of $190,000,000 for the purpose of redeeming shares of preferred stock. Borrowings under the Facility are collateralized by certain assets of the Fund (the “Hypothecated Securities”). Interest is charged at 3 month LIBOR (London Inter-bank Offered Rate) plus an additional percentage rate on the amount borrowed and a percentage rate on the undrawn balance (the commitment fee). The Fund also paid a one time arrangement fee based on a percentage of the total borrowing limit. Total commitment fees paid for the year ended December 31, 2011 were $963,195 and are included in Borrowing fees and expenses on the Statement of Operations. The Bank has the ability to require repayment of outstanding borrowings under the Facility upon six months notice or following an event of default. For the year ended December 31, 2011, the average daily borrowings under the Facility and the weighted daily average interest rate were $95,000,000 and 1.44%, respectively. As of December 31, 2011, the amount of such outstanding borrowings was $95,000,000. The interest rate applicable to the borrowing on December 31, 2011 was 1.68%. The Bank has the ability to borrow the Hypothecated Securities (“Rehypothecated Securities”). The Fund is entitled to receive a fee from the Bank in connection with the borrowing of Rehypothecated Securities. The Fund can recall any Rehypothecated Security at any time and if the Bank fails to return it (or an equivalent security) in a timely fashion, the Bank will be liable to the Fund for the ultimate delivery of such security and certain costs associated with delayed delivery. In the event the Bank does not return the Rehypothecated Security or an equivalent security, the Fund will have the right to, among other things, apply and set off an amount equal to one hundred percent (100%) of the then-current fair market value of such Rehypothecated Securities against any amounts owed to the Bank under the Facility. At December 31, 2011, Hypothecated Securities under the Facility had a market value of $213,670,310 and Rehypothecated Securities had a market value of $89,629,753. |

Note 9. Indemnifications Under the Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these arrangements and expects the risk of loss to be remote. |

Note 10. Recent Accounting Pronouncement In May 2011, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (“IFRS”)”. ASU No. 2011-04 includes common requirements for measurement of disclosure about fair value between U.S. GAAP and IFRS. ASU No. 2011-04 will require reporting entities to disclose quantitative information about the unobservable inputs used in the fair value measurements and the valuation processes used by the reporting entity categorized within Level 3 of the fair level hierarchy. In addition, ASU No. 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. Management will add the required disclosure when ASU No. 2011-04 is adopted. |

Note 11. Subsequent Events Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were available for issuance, and has determined that there were no subsequent events requiring recognition or disclosure in these financial statements. |

14

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Directors of Duff & Phelps Utility and Corporate Bond Trust Inc.:

We have audited the accompanying statement of assets and liabilities of Duff & Phelps Utility and Corporate Trust Inc. (the “Fund”), including the schedule of investments, as of December 31, 2011, and the related statement of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Duff & Phelps Utility and Corporate Trust Inc. at December 31, 2011, the results of its operations and cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

February 21, 2012

15

FEDERAL INCOME TAX INFORMATION (Unaudited)

The following information is provided with respect to the ordinary income distributions paid by the Fund during the year ended December 31, 2011 by:

| | | | |

Interest-Related Dividends for Non-U.S. Residents | | | 83.72 | %* |

Federal Obligation Interest | | | 0.59 | %** |

| * | Represents the portion of the taxable ordinary income dividends eligible for exemption from U.S. withholding tax for nonresident aliens and foreign corporations under 871(k)(1) of the Internal Revenue Code. |

| ** | The law varies in each state as to whether and what percentage of dividend income attributable to federal obligations is exempt from state income tax. We recommend that you consult your tax advisor to determine if any portion of the dividends you received is exempt from state income tax. |

INFORMATION ABOUT PROXY VOTING BY THE FUND (Unaudited)

Although the Fund does not typically hold voting securities, the Fund’s Board of Directors has adopted proxy voting policies and procedures whereby Duff & Phelps Investment Management Co., the Fund’s investment adviser (the “Adviser”), would review any proxy solicitation materials on a case-by-case basis and would vote any such securities in accordance with the Adviser’s good faith belief as to the best interests of the Fund and its shareholders. These proxy voting policies and procedures may be changed at any time or from time to time by the Fund’s Board of Directors. A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling the Administrator toll-free at (888) 878-7845 or is available on the Fund’s website at www.ducfund.com or on the SEC’s website at www.sec.gov.

INFORMATION ABOUT THE FUND’S PORTFOLIO HOLDINGS (Unaudited)

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third fiscal quarters of each fiscal year (quarters ended March 31 and September 30) on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) 732-0330. In addition, the Fund’s Form N-Q is available without charge, upon request, by calling the Administrator toll-free at (888) 878-7845 or is available on the Fund’s website at www.ducfund.com.

ADDITIONAL INFORMATION (Unaudited)

Since January 1, 2011: (i) there have been no material changes in the Fund’s investment objectives or policies that have not been approved by the shareholders; (ii) there have been no changes in the Fund’s charter or by-laws that would delay or prevent a change in control of the Fund which have not been approved by the shareholders; (iii) there have been no material changes in the principal risk factors associated with an investment in the Fund; and (iv) there have been no changes in the persons who are primarily responsible for the day-to-day management of the Fund’s portfolio.

Additional information, if any, relating to the Fund’s directors and officers, in addition to such information as is found elsewhere in the Annual Report, may be requested by contacting the Fund at the address provided in this report.

Notice is hereby given in accordance with Section 23(c) of the 1940 Act that the Fund may from time to time purchase its shares of common stock in the open market.

16

DIRECTORS OF THE FUND (Unaudited)

Set forth below are the names and certain biographical information about the directors of the Fund. Directors are divided into three classes and are elected to serve staggered three-year terms. All of the directors are elected by the holders of the Fund’s common stock, except for Mr. Pollard and Ms. Lampton, who are elected by the holders of the Fund’s preferred stock. All of the current directors of the Fund, with the exception of Mr. Partain, are classified as independent directors because none of them are “interested persons” of the Fund, as defined in the 1940 Act. Mr. Partain is an “interested person” of the Fund by reason of his position as President and Chief Executive Officer of the Fund and President, Chief Investment Officer and employee of the Adviser. The term “Fund Complex” refers to the Fund and all the other investment companies advised by affiliates of Virtus.

The address for all directors is c/o Duff & Phelps Investment Management Co., 200 South Wacker Drive, Suite 500, Chicago, Illinois 60606. All of the Fund’s directors currently serve on the Board of Directors of three other registered closed-end investment companies that are advised by Duff & Phelps Investment Management Co.: DNP Select Income Fund Inc. (“DNP”), Duff & Phelps Global Utility Income Fund Inc. (“DPG”) and DTF Tax-Free Income Inc. (“DTF”).

| | | | | | | | | | |

Independent Directors

| | | | | | | | |

| Name and Age | | Positions

Held

with Fund | | Term of

Office and

Length of

Time

Served | | Principal Occupation(s)

During Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other

Directorships Held

by the Director During Past

5 Years |

Stewart E. Conner Age: 70 | | Director | | Term expires 2012; Director since 2009 | | Attorney, Wyatt Tarrant & Combs LLP since 1966 (Chairman, Executive Committee 2000-2004, Managing Partner 1988-2000) | | 4 | | |

| | | | | |

Robert J. Genetski Age: 69 | | Director | | Term expires 2013; Director since 2009 | | President, Robert Genetski & Associates, Inc. (economic and financial consulting firm) since 1991; Senior Managing Director, Chicago Capital Inc. (financial services firm) 1995-2001; former Senior Vice President and Chief Economist, Harris Trust & Savings Bank, author of several books; regular contributor to the Nikkei Financial Daily | | 4 | | Director, Midwest Banc Holdings, Inc. 2005-2010 |

| | | | | |

Nancy Lampton Age: 69 | | Director and Vice Chairperson of the Board | | Term expires 2012; Director since 2005 | | Vice Chairperson of the Board of the Fund and DTF since May 2007, DNP since February 2006 and DPG since May 2011; Chairman and Chief Executive Officer, Hardscuffle Inc. (insurance holding company) since January 2000; Chairman and Chief Executive Officer, American Life and Accident Insurance Company of Kentucky since 1971 | | 4 | | Director, Constellation Energy Group, Inc. (public utility holding company); Advisory Board Member, CanAlaska Uranium Ltd. |

17

| | | | | | | | | | |

Independent Directors

| | | | | | | | |

| Name and Age | | Positions

Held

with Fund | | Term of

Office and

Length of

Time

Served | | Principal Occupation(s)

During Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other

Directorships Held

by the Director During Past

5 Years |

Philip R. McLoughlin Age: 65 | | Director | | Term expires 2013; Director since 1996 | | Partner, CrossPond Partners, LLC (investment management consultant), since 2006; Managing Director, SeaCap Partners LLC (strategic advisory firm) 2009-2010; Private investor 2004-2006; Consultant to Phoenix Investment Partners, Ltd. (“PXP”), 2002-2004; Chief Executive Officer of PXP, 1995-2002 (Chairman 1997-2002, Director 1995-2002); Executive Vice President and Chief Investment Officer, The Phoenix Companies, Inc. 2000-2002 | | 58 | | Chairman of the Board, The World Trust Fund (closed-end fund); Director, Argo Group International Holdings, Ltd. (insurance holding company, formerly known as PXRE Group Ltd.) 1999-2009 |

| | | | | |

Geraldine M. McNamara Age: 60 | | Director | | Term expires 2014; Director since 2003 | | Private investor since July 2006; Managing Director, U.S. Trust Company of New York 1982-July 2006 | | 49 | | |

| | | | | |

Eileen A. Moran Age: 57 | | Director | | Term expires 2012; Director since 1996 | | Private investor since April 2011; President and Chief Executive Officer, PSEG Resources L.L.C. (investment company) 1990-April 2011 | | 4 | | |

| | | | | |

Christian H. Poindexter Age 73 | | Director | | Term expires 2014; Director since 2008 | | Retired Executive Committee Chairman, Constellation Energy Group, Inc. (public utility holding company) since March 2003 (Executive Committee Chairman, July 2002-March 2003; Chairman of the Board, April 1999-July 2002; Chief Executive Officer, April 1999-October 2001; President, April 1999-October 2000); Chairman, Baltimore Gas and Electric Company, January 1993-July 2002 (Chief Executive Officer, January 1993-July 2000; President, March 1998-October 2000; Director, 1988-2003) | | 4 | | Director, The Baltimore Life Insurance Company (1998-November 2011) |

18

| | | | | | | | | | |

Independent Directors

| | | | | | | | |

| Name and Age | | Positions

Held

with Fund | | Term of

Office and

Length of

Time

Served | | Principal Occupation(s)

During Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other

Directorships Held

by the Director During Past

5 Years |

Carl F. Pollard Age: 73 | | Director | | Term expires 2014; Director since 2006 | | Owner, Hermitage Farm LLC (thoroughbred breeding) since January 1995; Chairman, Columbia Healthcare Corporation 1993-1994; Chairman and Chief Executive Officer, Galen Health Care, Inc. March-August 1993; President and Chief Operating Officer, Humana Inc. 1991-1993 (previously Senior Executive Vice President, Executive Vice President and Chief Financial Officer) | | 4 | | Chairman of the Board and Director, Churchill Downs Incorporated 2001-June 2011 (Director 1985-June 2011) |

| | | | | |

David J. Vitale Age: 65 | | Director and Chairman of the Board | | Term expires 2012; Director since 2005 | | Chairman of the Board of the Fund, DNP and DTF since May 2009 and DPG since May 2011; Chairman, Urban Partnership Bank since August 2010; Private investor, January 2009-August 2010; Senior Advisor to the CEO, Chicago Public Schools April 2007-December 2008; Chief Administrative Officer, Chicago Public Schools April 2003-April 2007; President and Chief Executive Officer, Board of Trade of the City of Chicago, Inc. March 2001-November 2002; Vice Chairman and Director, Bank One Corporation, 1998-1999; Vice Chairman and Director, First Chicago NBD Corporation, and President, The First National Bank of Chicago, 1995-1998; Vice Chairman, First Chicago Corporation and The First National Bank of Chicago, 1993-1998 (Director, 1992-1998; Executive Vice President, 1986-1993) | | 4 | | Director, UAL Corporation (airline holding company), Urban Partnership Bank, Alion Science and Technology Corporation, ISO New England Inc. (not for profit independent system operator of New England’s electricity supply), Ariel Capital Management, LLC and Wheels, Inc. (automobile fleet management) |

19

| | | | | | | | | | |

Interested Director

| | | | | | | | | | |

| Name and Age | | Positions

Held

with Fund | | Term of

Office and

Length of

Time

Served | | Principal Occupation(s)

During Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other

Directorships Held

by the Director During Past

5 Years |

Nathan I. Partain, CFA Age: 55 | | Director | | Term expires 2013; Director since 2007 | | President and Chief Executive Officer of the Fund and DTF since 2004; President and Chief Executive Officer of DNP since February 2001 (Chief Investment Officer since April 1998; Executive Vice President, April 1998-February 2001; Senior Vice President, January 1997-April 1998); President and Chief Executive Officer of DPG since March 2011; President and Chief Investment Officer of the Adviser since April 2005 (Executive Vice President 1997-2005); Director of Utility Research, Duff & Phelps Investment Research Co. 1989-1996 (Director of Equity Research, 1993-1996 and Director of Fixed Income Research, 1993) | | 4 | | Chairman of the Board and Director, Otter Tail Corporation (manages diversified operations in the electric, plastics, manufacturing, health services, and other business operations sectors) |

MANAGEMENT OF THE FUND (Unaudited)

The officers serve until their respective successors are chosen and qualified. The Fund’s officers receive no compensation from the Fund, but are also officers of the Adviser or Virtus and receive compensation in such capacities. Information pertaining to Nathan I. Partain, the President and Chief Executive Officer of the Fund, is provided under the caption “Interested Director”. Information pertaining to the other officers of the Fund is set forth below. The address for all officers noted below is c/o Duff & Phelps Investment Management Co., 200 South Wacker Drive, Suite 500, Chicago, Illinois 60606.

| | | | |

| Name and Age | | Position(s) Held with Fund and

Length of Time Served | | Principal Occupation(s) During Past 5 Years |

T. Brooks Beittel, CFA Age: 61 | | Secretary since 2005 | | Executive Vice President and Assistant Chief Investment Officer of the Adviser since 2008 (Senior Vice President 1993-2008; Vice President 1987-1993) |

| | |

Alan M. Meder, CFA, CPA Age: 52 | | Treasurer since 2000; Principal Financial and Accounting Officer and Assistant Secretary since 2002 | | Senior Vice President of the Adviser since 1994; Chief Risk Officer since 2001; Member of Board of Governors of CFA Institute since 2008 (currently serves as Vice Chairman of the Board); Financial Accounting Standards Advisory Council Member since 2011. |

| | |