UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07358

Duff & Phelps Utility and Corporate Bond Trust Inc.

(Exact name of registrant as specified in charter)

200 South Wacker Drive, Suite 500, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Alan M. Meder | Lawrence R. Hamilton, Esq. | |

| Duff & Phelps Utility and Corporate Bond Trust Inc. | Mayer Brown LLP | |

| 200 South Wacker Drive, Suite 500 | 71 South Wacker Drive | |

| Chicago, Illinois 60606 | Chicago, Illinois 60606 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (800) 338-8214

Date of fiscal year end: October 31

Date of reporting period: April 30, 2016

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders follows.

Board of Directors

David J. Vitale, Chairman

Donald C. Burke

Robert J. Genetski

Clifford W. Hoffman

Philip R. McLoughlin

Geraldine M. McNamara

Eileen A. Moran

Nathan I. Partain, CFA

Christian H. Poindexter

Carl F. Pollard

Officers

Nathan I. Partain, CFA

President & Chief Executive Officer

Daniel J. Petrisko, CFA

Vice President, Chief Investment Officer & Assistant Secretary

William J. Renahan

Vice President & Secretary

Dianna P. Wengler

Vice President & Assistant Secretary

Alan M. Meder, CFA, CPA

Treasurer & Assistant Secretary

Joyce B. Riegel

Chief Compliance Officer

Investment Adviser

Duff & Phelps Investment Management Co.

200 South Wacker Drive, Suite 500

Chicago, IL 60606

Call toll-free (800) 338-8214

www.dpimc.com

Administrator

J.J.B. Hilliard, W.L. Lyons, LLC

500 West Jefferson Street

Louisville, KY 40202

Call toll-free (888) 878-7845

Transfer Agent

Computershare

P.O. Box 43078

Providence, RI 02940

Call toll-free (866) 221-1681

Custodian

The Bank of New York Mellon

Legal Counsel

Mayer Brown LLP

Independent Registered Public Accounting Firm

Ernst & Young LLP

Duff & Phelps Utility and Corporate Bond Trust Inc.

[LOGO]

SEMI-ANNUAL REPORT

APRIL 30, 2016

June 16, 2016

Dear Fellow Shareholders:

YOUR FUND’S PERFORMANCE

Over the last six months, the performance of leveraged bond funds, including Duff & Phelps Utility and Corporate Bond Trust Inc. (the “DUC Fund” or the “Fund”), was influenced by continued questions about the resiliency of the U.S. economic recovery in light of a shift to a less accommodative monetary policy and the potential consequences of a global slowdown. The belief that the recovery may have reached a point where it is self-sustaining led the Federal Reserve in December to begin paring back the extraordinary monetary stimulus that had been in place over the previous seven years. However, a much anticipated rise in U.S. interest rates failed to materialize as relatively low global rates and mounting concerns in the global economy seemed to temper any upward pressure on U.S. rates. As a result, the DUC Fund, along with the broader fixed income market, posted solid returns.

The following table compares the performance of the DUC Fund to a broad-based investment grade bond market benchmark. It is important to note that the index returns stated below include no fees or expenses, whereas the DUC Fund’s net asset value (“NAV”) returns are net of fees and expenses.

Total Return1 For the period indicated through April 30, 2016 | ||||||||||||||||

Six Months | One Year | Three Years (annualized) | Five Years (annualized) | |||||||||||||

Duff & Phelps Utility and Corporate Bond Trust Inc. | ||||||||||||||||

Market Value2 | 5.54% | 5.01 | % | -1.52 | % | 4.62% | ||||||||||

Net Asset Value3 | 2.60% | 1.73 | % | 1.67 | % | 4.19% | ||||||||||

Barclays U.S. Aggregate Bond Index4 | 2.82% | 2.72 | % | 2.29 | % | 3.60% | ||||||||||

| 1 | Past performance is not indicative of future results. Current performance may be lower or higher than performance in historical periods. |

| 2 | Total return on market value assumes a purchase of common stock at the opening market price on the first business day and a sale at the closing market price on the last business day of the period shown in the table and assumes reinvestment of dividends at the actual reinvestment prices obtained under the terms of the DUC Fund’s dividend reinvestment plan. In addition, when buying or selling stock, you would ordinarily pay brokerage expenses. Because brokerage expenses are not reflected in the above calculations, your total return net of brokerage expenses would be lower than the total returns on market value shown in the table. Source: Administrator of the DUC Fund. |

| 3 | Total return on NAV uses the same methodology as is described in note 2, but with use of NAV for beginning, ending and reinvestment values. Because the DUC Fund’s expenses (ratios detailed on page 13 of this report) reduce the DUC Fund’s NAV, they are already reflected in the DUC Fund’s total return on NAV shown in the table. NAV represents the underlying value of the DUC Fund’s net assets, but the market price per share may be higher or lower than the NAV. Source: Administrator of the DUC Fund. |

| 4 | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The index is calculated on a total return basis and rebalanced monthly. Income generated during the month is held in the index without a reinvestment return until month-end when it is removed from the index. The index is unmanaged; its returns do not reflect any fees, expenses, or sales charges and it is not available for direct investment. Source: Bloomberg L.P. |

Based on the April 30, 2016 closing price of $9.60 and a monthly distribution of $0.05 per share, the DUC Fund common stock had an annualized distribution rate of 6.25%. Please refer to the portion of this letter captioned “ABOUT YOUR FUND” for important information about the sources and characterizations of the DUC Fund’s distributions.

1

MARKET OVERVIEWAND OUTLOOK

During the first quarter of 2016, the U.S. economy grew at its slowest pace in the last two years. Although sluggish starts to the year are not unusual, the anemic growth raised questions about the durability of the multi-year expansion amidst a backdrop of less accommodative monetary policy and slowing global growth. On the consumer side, household finances continued to improve, due in part to a robust job market, low gasoline prices and the recovering housing sector. Despite improving household finances, consumer spending was restrained by stagnant wages, tight credit conditions and an increased focus on savings. On the corporate side, a strong dollar and the global slow-down posed challenges for corporations that are dependent on overseas sales. In spite of these headwinds, companies continued to issue debt at a record pace in order to take advantage of low borrowing costs. Record issuance, in many instances, may arguably have benefited shareholders as the proceeds were often used for stock buybacks, dividends and M&A activity. Nationally, election year rhetoric ran high and added to fiscal uncertainty. Locally, although the financial condition of many municipalities continued to improve, some state and city governments remained burdened with staggering pension obligations and shrinking reserves. Globally, growth was challenged and outside of the U.S. many key central banks renewed their commitment to stimulative monetary policies.

Late last year, the Federal Open Market Committee (“FOMC”), the committee within the Federal Reserve that sets domestic monetary policy, began to reverse the highly accommodative policy of the last seven years. On December 16, 2015, the FOMC raised the target range for the federal funds rate to 0.25% to 0.50%. As a result, some investors began to speculate that the era of unprecedented U.S. monetary stimulus would soon come to an end. However, policy makers were quick to counter such speculation and indicated that additional moves toward a more normalized monetary policy would be data dependent and would likely occur at a gradual pace. Accordingly, short term interest rates rose only modestly. Upward pressure on long term U.S. interest rates was mitigated by extremely low global rates and renewed geopolitical tension, which caused many investors to remain committed to the relative safety of the U.S. bond market. Over the six month period ended April 30, 2016, the U.S. Treasury yield curve flattened, as yields increased by 6 basis points on 2-year maturities, while yields decreased by 31 basis points on 10-year maturities and by 24 basis points on 30-year maturities. Consequently, many sectors of the broader fixed income markets posted solid returns.

We continue to believe that the U.S. economy remains on track to experience positive albeit moderate growth over the next few quarters. Although we expect a strenghtening job market, improving housing sector and low energy prices to provide support for consumers, we also believe that meager global growth, weaker exports (due in part to the strong dollar) and further fiscal drag are likely to limit U.S. growth and keep the recovery slow and uneven. The FOMC recently commented that economic activity is expected to expand at a moderate pace and reiterated that it intends to closely monitor global economic and financial developments. The committee added that inflation is expected to remain low in the near term, but to ultimately rise as the effect of declines in energy prices dissipates and the labor market strengthens further. While policy makers are likely to remain divided between those who fear the potential for a pick-up in inflation and those who worry about the risk of raising rates too early, we believe that choppy economic growth and low inflation increase the likelihood that the FOMC will move cautiously as it endeavors to normalize monetary policy.

If the U.S. economy continues to post sub-par growth, the debate over the FOMC’s willingness to significantly raise the federal funds target rate against a backdrop of low inflation and modest global growth is likely to continue. Given ongoing geopolitical tensions, growing uncertainties in the global economy and mixed economic indicators at home, the fixed income market is likely to remain highly volatile and reactive to the tone of economic data. In the near term, a fragile U.S. economic recovery and relatively low global interest rates should limit upward pressure on U.S. Treasury yields. Over the longer term, a self-sustaining economic recovery and growing inflation expectations could set the stage for a sustained and meaningful rise in interest rates. If that happens, the total return of leveraged bond funds, including the DUC Fund, would likely be restrained.

ABOUT YOUR FUND

The DUC Fund seeks to provide investors with a stable monthly distribution that is primarily derived from current fiscal year net investment income. At times a portion of the monthly distribution could be derived from realized capital gains, and to the extent necessary, a return of capital, in which case the DUC Fund is required to inform shareholders of

2

the sources of the distribution based on U.S. generally accepted accounting principles (“GAAP”). A return of capital distribution does not necessarily reflect the DUC Fund’s investment performance and should not be confused with “yield” or “income.” A return of capital may occur, for example, when some of the money that is invested in the Fund is paid back to the investor. Based on GAAP, for the six month period ended April 30, 2016, 66% of the total distributions were attributable to current year net investment income and 34% were in excess of current year net investment income and were therefore attributable to a return of capital. The characterization of the distributions for GAAP purposes and federal income tax purposes differs, primarily because of a difference in the tax and GAAP accounting treatment of amortization for premiums on fixed income securities. As of the date of this letter, for federal income tax purposes, the DUC Fund estimates that its current year distributions will be derived entirely from net investment income. In early 2017, a Form 1099-DIV will be sent to shareholders which will state the amount and tax characterization of the DUC Fund’s 2016 distributions.

The use of leverage enables the DUC Fund to borrow at short-term rates and invest at long-term rates. As of April 30, 2016, the DUC Fund’s leverage consisted of floating rate senior debt in the amount of $125 million. On that date, the amount of leverage represented by the senior debt constituted approximately 31% of the DUC Fund’s total assets. The amount and type of leverage is reviewed periodically by the Board of Directors based on the DUC Fund’s expected earnings relative to the anticipated costs (including fees and expenses) associated with the leverage. In addition, the long-term expected benefits of leverage are weighed against the potential effect of increasing the volatility of both the DUC Fund’s NAV and the market value of its common stock. Historically, the tendency of the U.S. yield curve to exhibit a positive slope (i.e., long-term rates higher than short-term rates) has fostered an environment in which leverage can make a positive contribution to the earnings of the DUC Fund. However, there is no assurance that this will continue to be the case in the future. A rise in short-term interest rates relative to long-term interest rates could have an adverse effect on the income provided from leverage. If the DUC Fund were to conclude that the use of leverage was likely to cease being beneficial, it could modify the amount and type of leverage it uses or eliminate the use of leverage entirely.

The DUC Fund does not currently use derivatives and has no investments in complex securities or structured investment vehicles. However, due to the inherent interconnectivity of today’s financial markets, corporate bond investors are faced with the task of identifying and quantifying counterparty risk among both financial and non-financial companies. As a result of the DUC Fund’s mandate to invest in the credit markets, any disruptions in the broader credit markets could materially and adversely impact the valuation of the investments held in the DUC Fund.

In addition to the risk of disruptions in the broader credit market, the level of interest rates can be a primary driver of bond fund total returns, including the DUC Fund’s returns. For example, an extended environment of historically low interest rates adds an element of reinvestment risk, since the proceeds of maturing bonds may need to be reinvested in lower yielding securities. Alternatively, a sudden or unexpected rise in interest rates would likely reduce the total return of bond funds, since higher interest rates could be expected to depress the valuations of fixed rate bonds held in a portfolio.

Maturity and duration are measures of the sensitivity of a fund’s portfolio of investments to changes in interest rates. More specifically, duration refers to the percentage change in a bond’s price for a given change in rates (typically +/- 100 basis points). In general, the greater the average maturity and duration of a portfolio, the greater is the potential percentage price volatility for a given change in interest rates. As of April 30, 2016, the DUC Fund’s portfolio of investments had an average maturity of 4.0 years and a duration of 3.3 years, while the Barclays U.S. Aggregate Bond Index had an average maturity of 7.8 years and a duration of 5.5 years.

As a practical matter, it is not possible for the DUC Fund to be completely insulated from disruptions in the broader credit market or unexpected moves in interest rates. However, management believes that over the long term the diversification of the portfolio across industries and issuers, in addition to the conservative distribution of assets along the yield curve, positions the DUC Fund to take advantage of future opportunities while limiting volatility to some degree.

3

ANNUAL SHAREHOLDER MEETING

The annual meeting of the Fund’s shareholders was held on March 15, 2016. At that meeting, holders of the Fund’s common stock reelected Robert J. Genetski, Philip R. McLoughlin and Nathan I. Partain as directors of the DUC Fund.

BOARDOF DIRECTORS MEETING

At the regular March 2016 Board of Directors’ meeting, the Board declared the following monthly dividends:

Cents Per Share | Record Date | Payable Date | ||

5.0 | April 15 | April 29 | ||

5.0 | May 16 | May 31 | ||

5.0 | June 15 | June 30 |

At the regular June 2016 Board of Directors’ meeting, the Board declared the following monthly dividends:

Cents Per Share | Record Date | Payable Date | ||

5.0 | July 15 | July 29 | ||

5.0 | August 15 | August 31 | ||

5.0 | September 15 | September 30 |

Also at the June 2016 Board of Directors meeting, the Board elected Clifford W. Hoffman as a director of the Fund for a term ending in 2018, to fill the vacancy created by the resignation of Stewart E. Conner. Mr. Hoffman is a retired partner from Deloitte & Touche LLP.

DIVIDEND REINVESTMENTAND CASH PURCHASE PLANAND DIRECT DEPOSIT

For those of you receiving dividends in cash, you may want to consider taking advantage of the dividend reinvestment and cash purchase plan (the “Plan”) available to all registered shareholders of the DUC Fund. Under the Plan, the DUC Fund absorbs all administrative costs (except brokerage commissions, if any) so that the total amount of your dividends and other distributions may be reinvested in additional shares of the DUC Fund. The cash purchase option permits Plan participants to make voluntary additional share purchases in the open market through the Plan’s Agent, Computershare. For those shareholders who wish to continue receiving their dividends in cash, you may want to consider having your monthly dividends deposited, free of charge, directly into your bank account through electronic funds transfer. Direct deposit provides the convenience of automatic and immediate access to your funds, while eliminating the possibility of mail delays and lost, stolen or destroyed checks. Further information about the Plan and direct deposit is available from Computershare, at 1-866-221-1681 or www.computershare.com/investor.

For more information about the DUC Fund, shareholders can access www.ducfund.com.

We appreciate your investment in Duff & Phelps Utility and Corporate Bond Trust Inc. and look forward to continuing our service to you.

Sincerely,

| Daniel J. Petrisko, CFA | Nathan I. Partain, CFA | |

| Vice President, | Director, President and | |

| Chief Investment Officer | Chief Executive Officer | |

| and Assistant Secretary |

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein, are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The DUC Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

4

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

SCHEDULE OF INVESTMENTS

April 30, 2016

(Unaudited)

| Principal Amount (000) | Description | Value (Note 2) | ||||||

LONG-TERM INVESTMENTS—137.3% |

| |||||||

| Corporate Bonds—136.7% | ||||||||

| Electric, Gas and Water—56.2% | ||||||||

| $ | 4,000 | CMS Energy Corporation, | $4,518,420 | |||||

| 10,000 | CalEnergy Company, Inc., | 14,973,040 | ||||||

| 5,000 | CenterPoint Energy Resources Corp., | 5,360,085 | ||||||

| 10,713 | The Cleveland Electric Illuminating Company, | 12,608,601 | ||||||

| 5,000 | Commonwealth Edison Company, | 5,523,250 | ||||||

| 5,000 | Consolidated Edison Company of New York Inc., | 5,412,030 | ||||||

| 4,000 | The Detroit Edison Company, | 4,273,392 | ||||||

| 4,000 | Dominion Resources, Inc., | 4,411,996 | ||||||

| 10,000 | Entergy Texas, Inc., | 11,335,150 | ||||||

| 5,475 | Exelon Generation Company, LLC, | 5,816,656 | ||||||

| 8,115 | Indiana Michigan Power Company, | 9,178,739 | ||||||

| 2,000 | Integrys Energy Group, Inc., | 2,155,088 | ||||||

| 7,000 | National Fuel Gas Company, | 7,454,538 | ||||||

| 4,000 | Nevada Power Company, | 4,614,448 | ||||||

| 5,000 | Oncor Electric Delivery Company, LLC, | 6,265,590 | ||||||

| 5,000 | PSEG Power LLC, | 5,076,200 | ||||||

| 10,000 | Progress Energy, Inc., | 11,378,400 | ||||||

| 8,000 | Sempra Energy, | 8,714,336 | ||||||

| 7,785 | South Carolina Electric & Gas Company, | 8,718,694 | ||||||

| Principal Amount (000) | Description | Value (Note 2) | ||||||

| $ | 5,000 | Southern California Edison Company, | $5,479,500 | |||||

| 5,230 | Talen Energy Supply, LLC, | 5,386,900 | ||||||

| 4,400 | Western Massachusetts Electric Company, | 4,587,788 | ||||||

| 5,000 | Xcel Energy, Inc., | 5,195,500 | ||||||

| 158,438,341 | ||||||||

| Financial—31.4% | ||||||||

| 5,000 | American Express Company, | 5,308,570 | ||||||

| 3,000 | AvalonBay Communities, Inc., | 3,227,712 | ||||||

| 3,000 | Citigroup Inc., | 3,280,185 | ||||||

| 4,000 | Duke Realty Limited Partnership, | 4,158,284 | ||||||

| 2,000 | Fifth Third Bancorp, | 2,087,910 | ||||||

| 5,000 | General Electric Capital Corporation, | 5,570,890 | ||||||

| 4,000 | The Goldman Sachs Group, Inc., | 4,527,432 | ||||||

| 5,000 | Health Care Property Investors, Inc., | 5,156,315 | ||||||

| 5,000 | JPMorgan Chase & Co., | 5,373,270 | ||||||

| 4,000 | KeyCorp., | 4,461,116 | ||||||

| 4,000 | Kimco Realty Corporation, | 4,115,548 | ||||||

| 2,250 | Liberty Property Limited Partnership, | 2,370,699 | ||||||

| 5,000 | National City Corporation, | 5,658,740 | ||||||

| 3,000 | Prologis, L.P., | 3,491,061 | ||||||

| 6,000 | Realty Income Corporation, | 6,865,008 | ||||||

| 4,000 | Regency Centers, L.P., | 4,367,708 | ||||||

| 4,000 | Simon Property Group, L.P., | 4,423,836 | ||||||

The accompanying notes are an integral part of these financial statements.

| 5 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2016

(Unaudited)

| Principal Amount (000) | Description | Value (Note 2) | ||||||

| $ | 3,000 | UDR, Inc., | $3,279,387 | |||||

| 6,000 | Wachovia Bank NA, | 6,418,536 | ||||||

| 4,000 | Welltower, Inc., | 4,537,372 | ||||||

| 88,679,579 | ||||||||

| Oil & Gas Storage, Transportation and Production—27.2% | ||||||||

| 4,000 | Conoco Inc., | 4,824,548 | ||||||

| 8,000 | EQT Corporation, | 8,780,184 | ||||||

| 5,000 | Enterprise Products Operating LLC, | 5,582,140 | ||||||

| 5,000 | Kinder Morgan Energy Partners, L.P., | 5,404,760 | ||||||

| 3,500 | Magellan Midstream Energy Partners, L.P., | 3,809,788 | ||||||

| 5,000 | Magellan Midstream Energy Partners, L.P., | 5,602,410 | ||||||

| 9,441 | ONEOK Partners, L.P., | 9,579,584 | ||||||

| 4,000 | Plains All American Pipeline, L.P., 5.00%, 2/01/21 | 4,116,768 | ||||||

| 7,000 | Spectra Energy Capital LLC, | 7,401,744 | ||||||

| 10,000 | Trans-Canada PipeLines Limited, | 12,758,530 | ||||||

| 8,571 | Williams Partners L.P., | 8,836,050 | ||||||

| 76,696,506 | ||||||||

| Industrial—19.2% | ||||||||

| 3,000 | CSX Corporation, | 3,303,747 | ||||||

| 3,000 | CVS Health Corporation, | 3,293,193 | ||||||

| 4,000 | Caterpillar Inc., | 4,401,640 | ||||||

| 6,000 | The Dow Chemical Company, | 7,813,944 | ||||||

| 5,000 | Sun Company, Inc., | 5,549,550 | ||||||

| Principal Amount (000) | Description | Value (Note 2) | ||||||

| $ | 5,275 | Tele-Communications, Inc., | $6,999,371 | |||||

| 3,200 | Tele-Communications, Inc., | 4,208,502 | ||||||

| 5,000 | Time Warner, Inc., | 6,650,260 | ||||||

| 5,000 | Wal-Mart Stores, Inc., | 6,525,660 | ||||||

| 5,000 | Xerox Corporation, | 5,377,335 | ||||||

| 54,123,202 | ||||||||

| Telecommunications—2.7% | ||||||||

| 3,000 | AT&T Inc., | 3,289,497 | ||||||

| 4,000 | Verizon Communications Inc., | 4,255,756 | ||||||

| 7,545,253 | ||||||||

Total Corporate Bonds | 385,482,881 | |||||||

Shares | ||||||||

| Non-Convertible Preferred Stock—0.4% | ||||||||

| Financial—0.4% | ||||||||

| 50,000 | Vornado Realty Trust, | 1,294,000 | ||||||

Total Non-Convertible Preferred Stock | 1,294,000 | |||||||

Principal | ||||||||

| U.S. Government and Agency Mortgage-Backed Securities—0.2% | ||||||||

Federal National Mortgage Association, Pass-Through Certificates, | ||||||||

| $77 | 8.00%, 10/01/30 | 98,193 | ||||||

| 265 | 7.00%, 12/01/31 | 316,389 | ||||||

The accompanying notes are an integral part of these financial statements.

| 6 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2016

(Unaudited)

| Principal Amount (000) | Description | Value (Note 2) | ||||||

Government National Mortgage Association, Pass-Through Certificates, | ||||||||

| $ | 5 | 7.00%, 3/15/26 | $5,143 | |||||

| 31 | 8.00%, 11/15/30 | 34,119 | ||||||

Total U.S. Government and Agency Mortgage-Backed Securities | 453,844 | |||||||

| TOTAL INVESTMENTS—137.3% | ||||||||

(Cost $366,471,579) | $387,230,725 | |||||||

Other assets in excess of | 19,656,480 | |||||||

Borrowings—(44.3)% | (125,000,000 | ) | ||||||

| NET ASSETS APPLICABLE TO COMMON STOCK—100.0% | $281,887,205 | |||||||

| (a) | All or a portion of this security has been pledged as collateral for borrowings and made available for loan. |

| (b) | All or a portion of this security has been loaned. |

The percentage shown for each investment category is the total value of that category as a percentage of the net assets applicable to common stock of the Fund.

The Fund’s investments are carried at fair value which is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. The three-tier hierarchy of inputs established to classify fair value measurements for disclosure purposes is summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. The following is a summary of the inputs used to value each of the Fund’s investments at April 30, 2016:

| Level 1 | Level 2 | |||||||

Corporate bonds | — | $ | 385,482,881 | |||||

Non-convertible preferred stock | $ | 1,294,000 | — | |||||

U.S. Government and Agency mortgage-backed securities | — | 453,844 | ||||||

Total | $ | 1,294,000 | $ | 385,936,725 | ||||

There were no Level 3 priced securities held and there were no transfers between Level 1 and Level 2 related to securities held at April 30, 2016.

Summary of Ratings as a Percentage of Long-Term Investments

At April 30, 2016

Rating * | % | |||

AA | 1.8 | % | ||

A | 25.4 | % | ||

BBB | 71.4 | % | ||

BB | 0.0 | % | ||

B | 1.4 | % | ||

| 100.0 | % | |||

| * | Individual ratings are grouped based on the lower rating of Standard & Poor’s Financial Services LLC (“S&P”) or Moody’s Investors Service Inc. (“Moody’s”) and are expressed using the S&P ratings scale. If a particular security is rated by either S&P or Moody’s, but not both, then the single rating is used. If a particular security is not rated by either S&P or Moody’s, then a rating from Fitch Ratings, Inc. (“Fitch”) is used, if available. The Fund does not evaluate these ratings but simply assignes them to the appropriate credit quality category as determined by the rating agencies, as applicable. Securities that have not been rated by S&P, Moody’s or Fitch totaled 0% of the portfolio at the end of the reporting period. |

The accompanying notes are an integral part of these financial statements.

| 7 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

SCHEDULE OF INVESTMENTS—(Continued)

April 30, 2016

(Unaudited)

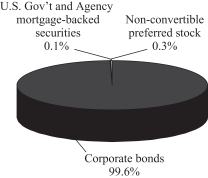

Sector Allocation as a Percentage of

Total Investments at April 30, 2016**

| ** | Percentages are based on total investments rather than total net assets applicable to common stock and include securities pledged as collateral for the Fund’s credit facility. |

The accompanying notes are an integral part of these financial statements.

| 8 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2016

(Unaudited)

ASSETS: | ||||

Investments at value (cost $366,471,579) including $113,548,115 of securities loaned | $ | 387,230,725 | ||

Cash | 14,586,242 | |||

Receivables: | ||||

Interest | 5,317,813 | |||

Securities lending income | 506 | |||

Prepaid expenses | 20,557 | |||

Total assets | 407,155,843 | |||

LIABILITIES: | ||||

Borrowings (Note 6) | 125,000,000 | |||

Investment advisory fee (Note 3) | 165,902 | |||

Administrative fee (Note 3) | 32,108 | |||

Interest on borrowings (Note 6) | 15,485 | |||

Accrued expenses | 55,143 | |||

Total liabilities | 125,268,638 | |||

NET ASSETS APPLICABLE TO COMMON STOCK | $ | 281,887,205 | ||

CAPITAL: | ||||

Common stock ($0.01 par value, 599,992,400 shares authorized, 27,494,683 shares issued and outstanding) | $274,947 | |||

Additional paid-in capital | 336,791,909 | |||

Distributions in excess of net investment income | (25,931,995 | ) | ||

Accumulated net realized loss on investments | (50,006,802 | ) | ||

Net unrealized appreciation on investments | 20,759,146 | |||

Net assets applicable to common stock | $ | 281,887,205 | ||

NET ASSET VALUE PER SHARE OF COMMON STOCK | $10.25 | |||

The accompanying notes are an integral part of these financial statements.

| 9 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

STATEMENT OF OPERATIONS

For the six months ended April 30, 2016

(Unaudited)

INVESTMENT INCOME: | ||||

Interest | $7,688,151 | |||

Dividends | 41,406 | |||

Securities lending income, net | 30,643 | |||

Total investment income | 7,760,200 | |||

EXPENSES: | ||||

Investment advisory fees (Note 3) | 1,001,940 | |||

Interest expense and fees (Note 6) | 942,519 | |||

Administrative fees (Note 3) | 193,521 | |||

Directors’ fees (Note 3) | 59,574 | |||

Professional fees | 48,040 | |||

Reports to shareholders | 36,400 | |||

Custodian fees | 18,200 | |||

Transfer agent fees | 18,200 | |||

Other expenses | 23,782 | |||

Total expenses | 2,342,176 | |||

Net investment income | 5,418,024 | |||

REALIZED AND UNREALIZED GAIN: | ||||

Net realized gain on investments | 143,385 | |||

Net change in unrealized appreciation (depreciation) on investments | 1,674,565 | |||

Net realized and unrealized gain on investments | 1,817,950 | |||

NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCK RESULTING FROM OPERATIONS | $7,235,974 | |||

The accompanying notes are an integral part of these financial statements.

| 10 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

STATEMENTS OF CHANGES IN NET ASSETS

| For the six months ended April 30, 2016 (Unaudited) | For the year ended October 31, 2015 | |||||||

OPERATIONS: | ||||||||

Net investment income | $5,418,024 | $11,311,709 | ||||||

Net realized gain | 143,385 | 584,832 | ||||||

Net change in unrealized appreciation (depreciation) | 1,674,565 | (9,431,647 | ) | |||||

Net increase in net assets applicable to common stock resulting from operations | 7,235,974 | 2,464,894 | ||||||

DISTRIBUTIONS TO COMMON STOCKHOLDERS: | ||||||||

Net investment income | (8,248,405 | ) | (16,496,810 | ) | ||||

Total decrease in net assets | (1,012,431 | ) | (14,031,916 | ) | ||||

TOTAL NET ASSETS APPLICABLE TO COMMON STOCK: | ||||||||

Beginning of period | 282,899,636 | 296,931,552 | ||||||

End of period (including distributions in excess of net investment income of $25,931,995 and $23,101,614, respectively) | $ | 281,887,205 | $ | 282,899,636 | ||||

The accompanying notes are an integral part of these financial statements.

| 11 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

STATEMENT OF CASH FLOWS

For the six months ended April 30, 2016

(Unaudited)

INCREASE (DECREASE) IN CASH— | ||||||||

Cash flows provided by (used in) operating activities: | ||||||||

Interest received | $11,451,134 | |||||||

Income dividends received | 41,406 | |||||||

Securities lending income, net | 30,646 | |||||||

Expenses paid | (1,478,989 | ) | ||||||

Interest paid on borrowings | (893,851 | ) | ||||||

Purchase of investment securities | (28,880,841 | ) | ||||||

Proceeds from sales and maturities of investment securities | 26,644,832 | |||||||

Net cash provided by operating activities | $6,914,337 | |||||||

Cash flows provided by (used in) financing activities: | ||||||||

Distributions paid | (8,248,405 | ) | ||||||

Net cash used in financing activities | (8,248,405 | ) | ||||||

Net decrease in cash | (1,334,068 | ) | ||||||

Cash—beginning of period | 15,920,310 | |||||||

Cash—end of period | $ | 14,586,242 | ||||||

Reconciliation of net increase in net assets resulting from operations to | ||||||||

Net increase in net assets resulting from operations | $7,235,974 | |||||||

Purchase of investment securities | (28,880,841 | ) | ||||||

Proceeds from sales and maturities of investment securities | 26,644,832 | |||||||

Net realized gain on investments | (143,385 | ) | ||||||

Net change in unrealized (appreciation) depreciation on investments | (1,674,565 | ) | ||||||

Amortization of premiums and discounts on debt securities, net | 3,566,892 | |||||||

Decrease in interest receivable | 196,091 | |||||||

Increase in interest payable on borrowings | 3,168 | |||||||

Decrease in other receivable | 3 | |||||||

Decrease in accrued expenses | (33,832 | ) | ||||||

Total adjustments | (321,637 | ) | ||||||

Net cash provided by operating activities | $6,914,337 | |||||||

The accompanying notes are an integral part of these financial statements.

| 12 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

FINANCIAL HIGHLIGHTS—SELECTED PER SHARE DATA AND RATIOS

The table below provides information about income and capital changes for a share of common stock outstanding throughout the periods indicated (excluding supplemental data provided below):

| For the six months ended April 30, 2016 (Unaudited) | For the year ended October 31, 2015 | For the ten months ended October 31, 2014 | For the year ended December 31, | |||||||||||||||||||||||||

| PER SHARE DATA: | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||

Net asset value, beginning of period | $10.29 | $10.80 | $10.92 | $11.93 | $11.74 | $11.71 | $11.70 | |||||||||||||||||||||

Net investment income | 0.19 | 0.41 | 0.35 | 0.45 | 0.49 | 0.53 | 0.66 | |||||||||||||||||||||

Net realized and unrealized gain (loss) | 0.07 | (0.32 | ) | 0.21 | (0.60 | ) | 0.58 | 0.39 | 0.24 | |||||||||||||||||||

Distributions on auction market preferred shares:(1) | ||||||||||||||||||||||||||||

Net investment income | — | — | — | (0.02 | ) | (0.05 | ) | (0.05 | ) | (0.05 | ) | |||||||||||||||||

Benefit to common shareholders from tender offer for auction market preferred shares | — | — | — | — | 0.01 | — | — | |||||||||||||||||||||

Net increase (decrease) from investment operations applicable to common stock | 0.26 | 0.09 | 0.56 | (0.17 | ) | 1.03 | 0.87 | 0.85 | ||||||||||||||||||||

Distributions on common stock: | ||||||||||||||||||||||||||||

Net investment income | (0.30 | ) | (0.60 | ) | (0.68 | ) | (0.84 | ) | (0.84 | ) | (0.84 | ) | (0.84 | ) | ||||||||||||||

Net asset value, end of period | $10.25 | $10.29 | $10.80 | $10.92 | $11.93 | $11.74 | $11.71 | |||||||||||||||||||||

Per share market value, end of period | $9.60 | $9.39 | $9.92 | $10.03 | $12.26 | $12.04 | $11.39 | |||||||||||||||||||||

| RATIOS TO AVERAGE NET ASSETS APPLICABLE TO COMMON STOCK: | ||||||||||||||||||||||||||||

Operating expenses | 1.69 | %* | 1.52 | % | 1.48 | %* | 1.69 | % | 1.79 | % | 1.86 | % | 1.89 | % | ||||||||||||||

Operating expenses, without leverage | 1.01 | %* | 0.99 | % | 0.99 | %* | 1.05 | % | 1.11 | % | 1.08 | % | 1.11 | % | ||||||||||||||

Net investment income | 3.90 | %* | 3.88 | % | 3.90 | %* | 3.95 | % | 4.15 | % | 4.51 | % | 5.53 | % | ||||||||||||||

| SUPPLEMENTAL DATA: | ||||||||||||||||||||||||||||

Total return on market value(2) | 5.54 | % | 0.71 | % | 5.61 | % | (11.68 | )% | 9.23 | % | 13.79 | % | (0.61 | )% | ||||||||||||||

Total return on net asset value(2) | 2.60 | % | 0.82 | % | 5.21 | % | (1.48 | )% | 9.01 | % | 7.66 | % | 7.34 | % | ||||||||||||||

Portfolio turnover rate | 7 | % | 14 | % | 8 | % | 4 | % | 14 | % | 36 | % | 37 | % | ||||||||||||||

Asset coverage ratio on borrowings, end of period | 326 | % | 326 | % | 338 | % | 340 | % | 363 | % | 538 | % | 537 | % | ||||||||||||||

Asset coverage ratio on preferred stock, end of period | — | — | — | — | 790 | % | 438 | % | 437 | % | ||||||||||||||||||

Net assets applicable to common stock, end of period (000’s omitted) | $ | 281,887 | $ | 282,900 | $ | 296,932 | $ | 300,121 | $ | 327,589 | $ | 321,000 | $ | 319,922 | ||||||||||||||

| * | Annualized |

| (1) | The auction market preferred shares were fully redeemed in 2013. |

| (2) | Total return on market value assumes a purchase of common stock at the opening market price on the first business day and a sale at the closing market price on the the last business day of each period shown in the table and assumes reinvestment of dividends at the actual reinvestment prices obtained under the terms of the Fund’s dividend reinvestment plan. Total return on net asset value uses the same methodology, but with use of net asset value for beginning, ending and reinvestment values. |

The accompanying notes are an integral part of these financial statements.

| 13 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

NOTES TO FINANCIAL STATEMENTS

April 30, 2016

(Unaudited)

Note 1. Organization

Duff & Phelps Utility and Corporate Bond Trust Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on November 23, 1992. The Fund commenced operations on January 29, 1993 as a diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to seek high current income consistent with investing in securities of investment grade quality. In 2014, the Fund changed its fiscal year end to October 31 from December 31.

Note 2. Significant Accounting Policies

The following are the significant accounting policies of the Fund:

A. Investment Valuation: Preferred equity securities traded on a national or foreign securities exchange or traded over-the-counter and quoted on the NASDAQ Stock Market are valued at the last reported sale price or, if there was no sale on the valuation date, then the security is valued at the closing bid price, in each case using valuation data provided by an independent pricing service, and are generally classified as Level 1. Preferred equity securities traded on more than one securities exchange shall be valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities and are classified as Level 1. If there was no sale on the valuation date, then the security is valued at the closing bid price of the exchange representing the principal market for such securities. Debt securities are valued at the mean of bid and ask prices provided by an independent pricing service when such prices are believed to reflect the fair value of such securities and are generally classified as Level 2. Any securities for which it is determined that market prices are unavailable or inappropriate are valued at a fair value using a procedure determined in good faith by the Board of Directors and are classified as Level 2 or 3 based on the valuation inputs.

B. Investment Transactions and Investment Income: Securities transactions are recorded on the trade date. Realized gains and losses on sales of securities are calculated on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income is recognized on the accrual basis. The Fund amortizes premiums and accretes discounts on securities using the effective interest method.

C. Federal Income Taxes: It is the Fund’s intention to comply with requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income and capital gains to its shareholders. Therefore, no provision for Federal income or excise taxes is required. Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund’s tax returns filed for the tax years 2012 to 2015 are subject to review.

D. Dividends and Distributions: The Fund declares and pays dividends on its common stock monthly from net investment income. Net long-term capital gains, if any, in excess of capital loss carryforwards are expected to be distributed annually. The Fund will make a determination at the end of its fiscal year as to whether to retain or distribute such gains. Dividends and distributions are recorded on the ex-dividend date. The amount and timing of distributions are generally determined in accordance with federal tax regulations, which may differ from U.S. generally accepted accounting principles.

E. Use of Estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

| 14 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2016

(Unaudited)

Note 3. Agreements and Management Arrangements

A. Adviser: The Fund has an Advisory Agreement with Duff & Phelps Investment Management Co. (the “Adviser”), an indirect, wholly owned subsidiary of Virtus Investment Partners, Inc. (“Virtus”). The investment advisory fee is payable monthly at an annual rate of 0.50% of the Fund’s average weekly managed assets, which is defined as the average weekly value of the total assets of the Fund minus the sum of all accrued liabilities of the Fund (other than the aggregate amount of any outstanding borrowings or other indebtedness constituting financial leverage).

B. Administrator: The Fund has an Administration Agreement with J.J.B. Hilliard, W.L. Lyons, LLC (“Hilliard”). The administration fee is payable monthly at an annual rate of 0.14% of the Fund’s average weekly net assets, which is defined as the average weekly value of the total assets of the Fund minus the sum of all accrued liabilities of the Fund (including the aggregate amount of any outstanding borrowings or other indebtedness constituting financial leverage).

C. Directors: The Fund pays each director not affiliated with the Adviser an annual fee plus a fee for certain meetings of the board or committees of the board attended. Total fees paid to directors for the six months ended April 30, 2016 were $59,574.

D. Affiliated Shareholder: At April 30, 2016, Virtus Partners, Inc. (a wholly owned subsidiary of Virtus) held 47,569 shares of the Fund, which represents 0.17% of the shares of common stock outstanding. These shares may be sold at any time.

Note 4. Investment Transactions

Purchases and sales of investment securities (excluding U.S. Government and agency mortgage-backed securities and short-term investments) for the six months ended April 30, 2016 were $28,880,841 and $26,606,688 respectively. Purchases and sales of U.S. Government and agency mortgage-backed securities for the six months ended April 30, 2016 were $-0- and $38,144, respectively.

Note 5. Distributions and Tax Information

At October 31, 2015, the federal tax cost of investments and aggregate gross unrealized appreciation (depreciation) were as follows:

Federal Tax | Unrealized Appreciation | Unrealized Depreciation | Net Unrealized Depreciation | |||||||||

| $396,457,516 | $ | 9,501,581 | $ | (19,215,439 | ) | $ | (9,713,858 | ) | ||||

The difference between the book basis and tax basis unrealized appreciation (depreciation) is primarily attributable to the difference between book and tax amortization methods for premiums and discounts on fixed income securities.

| 15 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2016

(Unaudited)

The tax character of distributions paid during the year ended October 31, 2015, ten months ended October 31, 2014 and year ended December 31, 2013 was as follows:

| 10/31/2015 | 10/31/2014 | 12/31/2013 | ||||||||||

Distributions paid from ordinary income. . . . . . . . . . . . . . . . . . . . . . . . . | $ | 16,496,810 | $ | 18,696,384 | $ | 23,670,312 | ||||||

The tax character of distributions paid in 2016 will be determined at the Fund’s fiscal year end, October 31, 2016.

At October 31, 2015, the Fund had a net capital loss carryforward of $50,150,186 which may be used to offset future capital gains. This net capital loss carryforward will be reduced by future realized capital gains.

Under current law, the Fund may carry forward net capital losses indefinitely to use to offset capital gains realized in future years. Previous law limited the carry forward of capital losses to the eight tax years following the year the capital loss was realized. If the Fund has capital losses that are subject to current law and also has capital losses subject to prior law, the losses realized under current law will be utilized to offset capital gains before any of the losses governed by prior law can be used. As a result of these ordering rules, capital losses realized under previous law may be more likely to expire unused. Capital losses realized under current law will carry forward retaining their classification as long-term or short-term losses; as compared to under prior law in which all capital losses were carried forward as short term capital losses.

At October 31, 2015, the Fund had net capital losses as follows:

| Not Subject to Expiration | ||||||||||||||||

| Subject to Expiration | Short Term | Long Term | Total | |||||||||||||

Carryover loss: | $ | 29,570,215 | $ | 21,141 | $ | 20,558,830 | $ | 50,150,186 | ||||||||

Expiration dates: | ||||||||||||||||

2017 | 18,907,565 | |||||||||||||||

2018 | 10,662,650 | |||||||||||||||

Note 6. Borrowings

The Fund has a Committed Facility Agreement (the “Facility”) with a commercial bank (the “Bank”) that allows the Fund to borrow cash, up to a limit of $140,000,000. Borrowings under the Facility are collateralized by certain assets of the Fund (the “Hypothecated Securities”). The Fund expressly grants the Bank the right to re-register the Hypothecated Securities in its own name or in another name other than the Fund’s and to pledge, repledge, hypothecate, rehypothecate, sell, lend or otherwise transfer or use the Hypothecated Securities. Interest is charged at 3 month LIBOR (London Interbank Offered Rate) plus an additional percentage rate of 0.85% on the amount borrowed. A commitment fee of 0.60% on the undrawn balance is also paid and is included in interest expense and fees on the Statement of Operations. The Bank has the ability to require repayment of outstanding borrowings under the Facility upon six months’ notice or following an event of default. In addition, the Bank has the ability to require repayment of the Facility upon 29 days’ notice conditioned on a three-notch or greater decline in the Bank’s long-term credit rating. For the six months ended April 30, 2016, the average daily borrowings under the Facility and the weighted daily average interest rate were $125,000,000 and 1.42%, respectively. As of April 30, 2016, the amount of such outstanding borrowings was $125,000,000. The interest rate applicable to the borrowing at April 30, 2016 was 1.49%.

| 16 |

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

April 30, 2016

(Unaudited)

Effective June 15, 2016, certain terms of the Facility have been amended. From and after that date, the commitment fee on any undrawn balance is 0.90%, interest is charged at 3 month LIBOR plus an additional percentage rate of 1.15% and the time period for notice to require repayment of the Facility is 179 days. In addition, the Bank will no longer have the ability to require repayment of the Facility upon 29 days’ notice following a three-notch decline in the Bank’s credit rating.

The Bank has the ability to borrow the Hypothecated Securities (“Rehypothecated Securities”). The Fund is entitled to receive a fee from the Bank in connection with any borrowing of Rehypothecated Securities. The fee is computed daily based on a percentage of the difference between the fair market rate as determined by the Bank and the Federal Funds Open rate and is paid monthly. The Fund can designate any Hypothecated Security as ineligible for rehypothecation and can recall any Rehypothecated Security at any time and if the Bank fails to return it (or an equivalent security) in a timely fashion, the Bank will be liable to the Fund for the ultimate delivery of such security and certain costs associated with delayed delivery. In the event the Bank does not return the Rehypothecated Security or an equivalent security, the Fund will have the right to, among other things, apply and set off an amount equal to 100% of the then-current fair market value of such Rehypothecated Securities against any amounts owed to the Bank under the Facility. The Fund is entitled to receive an amount equal to any and all interest, dividends, or distributions paid or distributed with respect to any Hypothecated Security on the payment date. At April 30, 2016, Hypothecated Securities under the Facility had a market value of $289,096,747 and Rehypothecated Securities had a market value of $113,548,115. If at the close of any business day, the value of all outstanding Rehypothecated Securities exceeds the value of the borrowings, the Bank shall promptly, at its option, either reduce the amount of the outstanding securities or deliver an amount of cash at least equal to the excess amount.

Note 7. Indemnifications

Under the Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not occurred. However, the Fund has not had prior claims or losses pursuant to these arrangements and expects the risk of loss to be remote.

Note 8. Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were available for issuance, and has determined that there were no subsequent events requiring recognition or disclosure in these financial statements.

| 17 |

RENEWAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

Under Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”), the terms of the Fund’s investment advisory agreement must be reviewed and approved at least annually by the Board of Directors of the Fund (the “Board”), including a majority of the directors who are not “interested persons” of the Fund, as defined in section 2(a)(19) of the 1940 Act (the “Independent Directors”). Section 15(c) of the 1940 Act also requires the Fund’s directors to request and evaluate, and the Fund’s investment adviser to furnish, such information as may reasonably be necessary to evaluate the terms of the investment advisory agreement. To assist the Board with this responsibility, the Board has appointed a Contracts Committee, which is composed of three Independent Directors (since expanded to include all of the Independent Directors) and acts under a written charter that was most recently amended on May 11, 2011. A copy of the charter is available on the Fund’s website at www.ducfund.com and in print to any shareholder, upon request.

The Contracts Committee, assisted by the advice of independent legal counsel, conducted an annual review of the terms of the Fund’s contractual arrangements, including the investment advisory agreement with Duff & Phelps Investment Management Co. (the “Adviser”). Set forth below is a description of the Contracts Committee’s annual review of the Fund’s investment advisory agreement, which provided the material basis for the Board’s decision to continue the investment advisory agreement.

In the course of the Contracts Committee’s review, the members of the Contracts Committee considered all of the information they deemed appropriate, including informational materials furnished by the Adviser in response to a request made by the Contracts Committee. In arriving at its recommendation that continuation of the investment advisory agreement was in the best interests of the Fund and its shareholders, the Contracts Committee took into account all factors that it deemed relevant, without identifying any single factor or group of factors as all-important or controlling. Among the factors considered by the Contracts Committee, and the conclusion reached with respect to each, were the following:

Nature, extent, and quality of services. The Contracts Committee considered the nature, extent and quality of the services provided to the Fund by the Adviser. Among other materials, the Adviser furnished the Contracts Committee with a copy of its most recent investment adviser registration form (Form ADV). In evaluating the quality of the Adviser’s services, the Contracts Committee noted the various complexities involved in the operations of the Fund, such as the use of leverage in the form of borrowings under a credit facility and the rehypothecation of portfolio securities pledged under the credit facility, and concluded that the Adviser is consistently providing high-quality services to the Fund in an increasingly complex environment. The Contracts Committee also considered the length of service of the individual professional employees of the Adviser who provide services to the Fund. In the Contracts Committee’s view, the long-term service of capable and conscientious professionals provides a significant benefit to the Fund and its shareholders. The Contracts Committee also considered the Fund’s investment performance as discussed below. The Contracts Committee also took into account its evaluation of the quality of the Adviser’s code of ethics and compliance program. In light of the foregoing, the Contracts Committee concluded that it was generally satisfied with the nature, extent and quality of the services provided to the Fund by the Adviser.

Investment performance of the Fund and the Adviser. The Adviser provided the Contracts Committee with performance information for the Fund for various periods, measured against two benchmarks: the Broadridge General Bond Funds Average (the Fund’s category as determined by Broadridge Financial Services Inc. (“Broadridge”)) and the Barclays U.S. Aggregate Index and the Barclays U.S. Credit Index (which is a subset of the U.S. Aggregate Index). The Contracts Committee noted that the Fund’s performance generally compared favorably with the Barclays U.S. Aggregate Index on a net asset value (NAV) basis over 3- and 5- year periods ended June 30, 2015, although it trailed the index on an NAV basis over the last 1-year period, and trailed the index on a market value basis over 1-, 3- and 5-year periods. The Fund also trailed the U.S. Credit Index and the Broadridge General Bond Funds Average, on an NAV basis and market value basis over 1-, 3-, and 5-year periods ended June 30, 2015. In evaluating the Fund’s performance, the Contracts Committee took into consideration the Adviser’s explanation that the fixed-income investments comprising the benchmarks include certain higher yielding, lower-quality bonds in which the Fund is not permitted to invest. The

18

Contracts Committee also considered that since current income is a component of the Fund’s investment objective, it would be relevant to consider the Fund’s annualized distribution rate. The Contracts Committee noted that as of June 30, 2015, the Fund had an annualized distribution rate of 6.40%, which compared favorably with the 2.35% yield of the Barclays U.S. Aggregate Index as of the same date. The Contracts Committee also considered the Adviser’s reporting that the Fund has changed its dividend policy less frequently than many other funds in its peer group, providing shareholders with greater income stability.

Costs of services and profits realized. The Contracts Committee considered the reasonableness of the compensation paid to the Adviser, in both absolute and comparative terms, and also the profits realized by the Adviser and its affiliates from its relationship with the Fund. To facilitate this analysis, the Contracts Committee retained Broadridge, an independent provider of investment company data, to furnish a report comparing the Fund’s management fee (defined as the sum of the advisory fee and administration fee) and other expenses to the similar expenses of other bond funds selected by Broadridge (the “Broadridge expense group”). The Contracts Committee reviewed, among other things, information provided by Broadridge comparing the Fund’s contractual management fee rate (at common asset levels) and actual management fee rate (reflecting fee waivers, if any) as a percentage of total assets and as a percentage of assets attributable to common stock to other funds in its Broadridge expense group. Based on the data provided on management fee rates, the Contracts Committee noted that: (i) the Fund’s contractual management fee rate at a common asset level was lower than the median of its Broadridge expense group; and (ii) the actual management fee rate was lower than the median of its Broadridge expense group on the basis of assets attributable to common stock and on a total asset basis. The Contracts Committee further noted that the Fund’s total expense ratio, as reported by Broadridge, was below the median both on the basis of assets attributable to common stock and on a total asset basis.

The Adviser also furnished the Contracts Committee with copies of its financial statements, and the financial statements of its parent company, Virtus Investment Partners, Inc. The Adviser also provided information regarding the revenue and expenses related to its management of the Fund. In reviewing those financial statements and other materials, the Contracts Committee examined the profitability of the investment advisory agreement to the Adviser and determined that the profitability of that contract was within the range that courts had found reasonable. The Contracts Committee considered that the Adviser must be able to compensate its employees at competitive levels in order to attract and retain high-quality personnel to provide high-quality service to the Fund. The Contracts Committee concluded that the investment advisory fee was the product of arm’s length bargaining and that it was fair and reasonable to the Fund.

Economies of scale. The Contracts Committee considered whether the Fund has appropriately benefited from any economies of scale. The Contracts Committee concluded that currently the Fund is not sufficiently large to realize benefits from economies of scale with fee breakpoints. The Contracts Committee encouraged the Adviser to continue to work towards reducing costs by leveraging relationships with service providers across the complex of funds advised by the Adviser.

Comparison with other advisory contracts. The Contracts Committee also received comparative information from the Adviser with respect to its standard fee schedule for investment advisory clients other than the Fund. The Contracts Committee noted that, among all accounts managed by the Adviser, the Fund’s advisory fee is slightly higher than the Adviser’s standard fee schedule. However, the Contracts Committee noted that the services provided by the Adviser to the Fund are significantly more extensive and demanding than the services provided by the Adviser to its non-investment company, institutional accounts. Specifically, in providing services to the Fund, the Contracts Committee considered that the Adviser needs to: (1) comply with the 1940 Act, the Sarbanes-Oxley Act and other federal securities laws and New York Stock Exchange requirements, (2) provide for external reporting (including quarterly and semi-annual reports to shareholders, annual audited financial statements and disclosure of proxy voting), tax compliance and reporting (which are particularly complex for investment companies), requirements of Section 19 of the 1940 Act relating to the source of distributions, (3) prepare for and attend meetings of the Board and its committees, (4) communicate with Board and committee members between meetings, (5) communicate with a retail shareholder base consisting of thousands of investors, (6) manage the use of financial leverage and respond to changes in the financial markets and regulatory environment that could affect the amount and type of the Fund’s leverage and (7) respond to unanticipated issues in the financial markets or regulatory environment that can impact the Fund. Based on the fact that the Adviser

19

only provides the foregoing services to its investment company clients and not to its institutional account clients, the Contracts Committee concluded that the management fees charged to the Fund are reasonable compared to those charged to other clients of the Adviser, when the nature and scope of the services provided to the Funds are taken into account. Furthermore, the Contracts Committee noted that many of the Adviser’s other clients would not be considered “like accounts” of the Fund because these accounts are not of similar size and do not have the same investment objectives as, or possess other characteristics similar to, the Fund.

Indirect benefits. The Contracts Committee considered possible sources of indirect benefits to the Adviser from its relationship to the Fund. As a fixed-income fund, the Contracts Committee noted that the Fund does not utilize affiliates of the Adviser for brokerage purposes.

Conclusion. Based upon its evaluation of all material factors, including the foregoing, and assisted by the advice of independent legal counsel, the Contracts Committee concluded that the continued retention of the Adviser as investment adviser to the Fund was in the best interests of the Fund and its shareholders. Accordingly, the Contracts Committee recommended to the full Board that the investment advisory agreement with the Adviser be continued for a one-year term ending March 1, 2017. On December 18, 2015, the Contracts Committee presented its recommendations, and the criteria on which they were based, to the full Board, whereupon the Board, including all of the Independent Directors voting separately, accepted the Contracts Committee’s recommendations and unanimously approved the continuation of the current investment advisory agreement with the Adviser for a one-year term ending March 1, 2017.

INFORMATION ABOUT PROXY VOTING BY THE FUND (Unaudited)

Although the Fund does not typically hold voting securities, a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling the Administrator toll-free at (888) 878-7845 or is available on the Fund’s website at www.ducfund.com or on the SEC’s website at www.sec.gov.

INFORMATION ABOUT THE FUND’S PORTFOLIO HOLDINGS (Unaudited)

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third fiscal quarters of each fiscal year (quarters ended January 31 and July 31) on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling (800) 732-0330. In addition, the Fund’s Form N-Q is available without charge, upon request, by calling the Administrator toll-free at (888) 878-7845 or is available on the Fund’s website at www.ducfund.com.

ADDITIONAL INFORMATION (Unaudited)

Notice is hereby given in accordance with Section 23(c) of the 1940 Act that the Fund may from time to time purchase its shares of common stock in the open market.

20

ANNUAL MEETING OF SHAREHOLDERS (Unaudited)

The Annual Meeting of Shareholders of the Fund was held on March 15, 2016. The following is a description of the matter voted upon at the meeting and the number of votes cast on the matter:

| Shares Voted For | Shares Withheld | |||||||

| To elect three directors to serve until the Annual Meeting in the year 2019 or until their successors are duly elected and qualified: | ||||||||

Robert J. Genetski | 20,170,950 | 3,035,490 | ||||||

Philip R. McLoughlin | 20,228,709 | 2,977,731 | ||||||

Nathan I. Partain | 20,238,230 | 2,968,210 | ||||||

Directors whose term of office continued beyond this meeting are as follows: Donald C. Burke, Geraldine M. McNamara, Eileen A. Moran, Christian H. Poindexter, Carl F. Pollard and David J. Vitale.

21

| ITEM 2. | CODE OF ETHICS. |

Not applicable.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | INVESTMENTS. |

Included as part of the report to stockholders filed under Item 1 of this report.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

During the period covered by this report, no purchases were made by or on behalf of the registrant or any “affiliated purchaser” (as defined in Rule 10b-18(a)(3) under the Securities Exchange Act of 1934 (the “Exchange Act”)) of shares or other units of any class of the registrant’s equity securities that is registered by the registrant pursuant to Section 12 of the Exchange Act.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

No changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors have been implemented after the registrant last provided disclosure in response to the requirements of Item 22(b)(15) of Schedule 14A (i.e., in the registrant’s Proxy Statement dated February 4, 2016) or this Item.

| ITEM 11. | CONTROLS AND PROCEDURES. |

(a) The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “1940 Act”)) are effective, based on an evaluation of those controls and procedures made as of a date within 90 days of the filing date of this report as required by Rule 30a-3(b) under the 1940 Act and Rule 13a-15(b) under the Exchange Act.

(b) There has been no change in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

| ITEM 12. | EXHIBITS. |

| (a) Exhibit 99.CERT | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| (b) Exhibit 99.906CERT | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC. | |

| By (Signature and Title) | /s/ NATHAN I. PARTAIN | |

| Nathan I. Partain | ||

| President and Chief Executive Officer | ||

| (Principal Executive Officer) | ||

| Date | June 29, 2016 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) | /s/ NATHAN I. PARTAIN | |

| Nathan I. Partain | ||

| President and Chief Executive Officer | ||

| (Principal Executive Officer) | ||

| Date | June 29, 2016 | |

| By (Signature and Title) | /s/ ALAN M. MEDER | |

| Alan M. Meder | ||

| Treasurer and Assistant Secretary | ||

| (Principal Financial and Accounting Officer) | ||

| Date | June 29, 2016 | |