SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)of the Securities Exchange Act of 1934

| Filed by the Registrant | [X] | | | | |

| Filed by a Party other than the Registrant | [ ] | | | | | |

| | | | | | | | |

| Check the appropriate box: | | | | | | |

| [ | ] Preliminary Proxy Statement | | | | | | |

| | | [ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| |

| | | | | | | | |

| [X ] Definitive Proxy Statement | | | | | | |

| [ | ] Definitive Additional Materials | | | | | | |

| [ | ] Soliciting Material Pursuant to Rule | | | | | | |

| | 14a-11(c) or Rule 14a-12 | | | | | | |

Cowlitz Bancorporation

(Name of Registrant as Specified in Its Charter)

_______________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

[X ] No fee required.

[ ] $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| 1) Title of each class of securities to which transaction applies: |

| |

| 2) Aggregate number of securities to which transaction applies: |

| |

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was |

| determined): |

| |

| 4) Proposed maximum aggregate value of transaction: |

| |

| 5) Total fee paid: |

[ ] Fee paid previously with preliminary materials

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) Amount Previously Paid: |

| |

| |

| 2) Form, Schedule or Registration No.: |

| |

| |

| 3) Filing Party: |

| |

| |

| | 4) Date Filed: |

| |

NOTICE OF THE ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 21, 2004

To the Shareholders of Cowlitz Bancorporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of the shareholders of Cowlitz Bancorporation will be held at the Monticello Hotel, 1405 17th Avenue, Longview Washington on Friday, May 21, 2004 at 10:00 a.m. local time for the purpose of considering and voting upon the following matters:

1. Election of Directors. To elect five directors to serve until the next annual meeting;

2. Any other business properly brought before the Annual Meeting or any adjournments or postponements thereof.

Only those shareholders of record at the close of business on March 15, 2004 are entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

All shareholders are urged to attend the Annual Meeting. Please vote your shares promptly to ensure they are represented at the meeting, by signing the enclosed proxy card and returning it in the envelope provided. If you attend the meeting and wish to change your proxy vote, you may do so by voting in person at the meeting.

We look forward to seeing you at our 2004 Annual Meeting.

Sincerely, on behalf of the Board of Directors,

Lynda Altman

Secretary

Longview, Washington

April 14, 2004

Cowlitz Financial Center

PO Box 1518 / 927 Commerce Avenue

Longview, WA 98632

(360) 423-9800

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

MAY 21, 2004 |

This Proxy Statement and the accompanying Proxy are being sent to shareholders on or about April 15, 2004 in connection with the solicitation of proxies by the Board of Directors for the Annual Meeting of Shareholders (the "Meeting") of Cowlitz Bancorporation (the "Company") to be held on Friday, May 21, 2004 at the Monticello Hotel, 1405 17th Avenue, Longview, Washington, at 10:00 a.m. local time.

VOTING AND PROXY PROCEDURE |

Shareholders Entitled to Vote.Shareholders of record as of the close of business on March 15, 2004 are entitled to vote at the Annual Meeting. As of March 15, 2004, the Company had 3,911,652 shares of Common Stock issued and outstanding and 260 shareholders of record.

Quorum.The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted as shares present at the Annual Meeting for purposes of determining the existence of a quorum.

Voting by Proxy.When a proxy card is returned properly signed and dated, the shares represented thereby will be voted in accordance with the instructions on the proxy card. Where no instructions are indicated, proxies will be voted FOR the election of the nominees for director.

Please mark, sign and date the enclosed proxy and return it in the postage-paid envelope provided. If your shares are held by a broker, bank or other nominee, follow the instructions on the card ADP Proxy Services sent to you.

You are welcome to attend the meeting even if you vote by proxy.

How Votes are Counted.Each share of Common Stock is entitled to one vote on each matter properly presented at the Annual Meeting. The five nominees receiving the largest number of affirmative votes cast at the Annual Meeting will be elected as directors. Shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from each nominee.

Revocation of a Proxy; Voting at the Meeting.Shareholders who execute and submit proxies retain the right to revoke them at any time before they are voted. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company, at the address above, by submitting a proxy bearing a later date, or by casting a ballot at the Annual Meeting. Attendance at the Annual Meeting will not automatically revoke a proxy. You must request a ballot and vote in person to revoke a prior granted proxy.

If your shares are held by a broker, bank or other nominee, you will need to contact the nominee to revoke a proxy or change your vote. You will not be able to vote or revoke a proxy at the meeting if your shares are held by a nominee.

1

Costs of Solicitation. In addition to mailing this material to shareholders of record, the Company has asked banks and brokers to forward copies to persons for whom they hold shares of Common Stock and request authority to execute the proxies. The Company will reimburse the banks and brokers for their reasonable out-of-pocket expenses in doing so. Officers and regular employees of the Company may, without being additionally compensated, solicit proxies by mail, telephone, telegram, facsimile or personal contact.

Shares Owned by Directors, Executive Officers, and other Key Personnel.As of March 15, 2004, directors, executive officers, and other key personnel beneficially owned 322,580 shares, of which 147,280 shares are entitled to vote. Those shares represent approximately 3.77% of the shares entitled to vote at the meeting.

SECURITY OWNERSHIP OF MANAGEMENT AND OTHERS |

The following table sets forth information regarding the beneficial ownership of the Common Stock of the Company with respect to each person known to the Company to own more than 5% of the outstanding Common Stock, directors, and key personnel of the Company as identified herein and by all directors and executive officers as a group as of March 15, 2004. The total number of shares issued and outstanding as of March 15, 2004 was 3,911,652. Each beneficial owner has the sole power to vote and to dispose of all shares of Common Stock owned by such beneficial owner.

| Name & Position of Beneficial Owner | Shares | | Percentage |

|

| |

|

| Nominated Directors, Executive Officers, and Key Personnel | | | |

| Mark F. Andrews, Jr. - Director (1) | 97,915 | | 2.50 |

| Ernie Ballou - VP & Director (2) | 18,115 | | * |

| Richard J. Fitzpatrick - President, CEO & Director (3) | 41,870 | | 1.07 |

| John S. Maring - Director (4) | 71,394 | | 1.83 |

| Phillip S. Rowley - Chairman (5) | 5,000 | | * |

| Lynda Altman - VP, Administrative Officer & Secretary (6) | 8,290 | | * |

| Gerald Caruthers - EVP Cowlitz Bank/Mortgage Division President (7) | 5,000 | | * |

| Donna P. Gardner - VP & CFO (8) | 61,840 | | 1.56 |

| Joey Ingman - VP (9) | 3,300 | | * |

| Sue Rodgers - VP Cowlitz Bank/Information Technology (10) | 5,815 | | * |

| Loree Vandenberg - SVP Cowlitz Bank/General Auditor (11) | 4,000 | | * |

| |

| |

|

| All directors and executive officers as a group (11 persons) | 322,539 | | 7.89 |

| | | | |

| 5% Shareholders | | | |

| Benjamin Namatinia - (12) | 804,582 | | 20.64 |

*Less than 1%

(1) Includes presently exercisable options to purchase 44,000 shares of Common Stock.

(2) Includes presently exercisable options to purchase 18,000 shares of Common Stock.

(3) Includes presently exercisable options to purchase 30,000 shares of Common Stock.

(4) Includes presently exercisable options to purchase 42,500 shares of Common Stock.

(5) Appointed Chairman on March 5, 2004, by the Board of Directors.

Includes presently exercisable options to purchase 5,000 shares of Common Stock.

(6) Includes presently exercisable options to purchase 6,800 shares of Common Stock.

(7) Includes presently exercisable options to purchase 5,000 shares of Common Stock.

(8) Includes presently exercisable options to purchase 14,200 shares of Common Stock

(9) Includes presently exercisable options to purchase 3,300 shares of Common Stock.

(10)Includes presently exercisable options to purchase 2,500 shares of Common Stock.

(11)Includes presently exercisable options to purchase 4,000 shares of Common Stock.

(12)Retired as Chairman on March 5, 2004.

Includes presently exercisable options to purchase 247,500 shares of Common Stock

2

AGENDA ITEM 1 - ELECTION OF DIRECTORS |

The Company's Articles of Incorporation and Bylaws provide that directors are elected to serve one-year terms of office. The Articles of Incorporation establish the number of directors between five and ten, with the exact number to be fixed from time to time by resolution of the Board of Directors. The number of directors is currently set at five.

Five directors have been nominated for election at the Annual Meeting to serve until the 2005 Annual Meeting of shareholders and until the director's successor is elected and qualified, or until there is a decrease in the number of directors.

Unless authority to vote is withheld on a proxy, properly executed proxies will be voted FOR the nominees identified below. Each of the nominees has indicated that he is willing and able to serve as a director. If any nominee is not available for election, the individuals named in the proxy intend to vote for such substitute nominee as the Board of Directors may designate. We have no reason to believe any nominee will be unavailable. All nominees are currently Directors.

The Board of Directors has nominated:

Mark F. Andrews, Jr.

Ernie Ballou

Richard J. Fitzpatrick

John S. Maring

Phillip S. Rowley

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE NOMINEES.

INFORMATION REGARDING THE BOARD OF DIRECTORS

AND ITS COMMITTEES |

The following table states certain information regarding the nominees for election at the Annual Meeting.

| Name | Age | Position |

|

|

|

| | | |

| Mark F. Andrews, Jr. | 71 | Director, Cowlitz Bancorporation and Cowlitz Bank |

| | | |

| Ernie Ballou | 55 | VP and Director - Cowlitz Bancorporation |

| | | EVP, Chief Credit Administrator and Director - Cowlitz Bank |

| | | |

| Richard J. Fitzpatrick | 54 | President, CEO and Director, Cowlitz Bancorporation and Cowlitz Bank |

| | | |

| John S. Maring | 68 | Vice Chairman-Cowlitz Bancorporation |

| | | Chairman-Cowlitz Bank |

| | | |

| Phillip S. Rowley | 57 | Chairman - Cowlitz Bancorporation |

| | | Director - Cowlitz Bank |

Mark F. Andrews, Jr. has served on the Board of Directors since its incorporation in 1991. He has served as a director of Cowlitz Bank since 1988. Mr. Andrews' principal occupation is the management and operation of tree farms. Mr. Andrews is a retired attorney and court commissioner. Mr. Andrews serves as Chairman of the Compensation Committee. He also serves on the Audit Committee and the Corporate Governance Committee.

Ernie Ballou has served on the Board of Directors since May 2003. He was hired as EVP & Chief Credit Administrator of Cowlitz Bank in January 2003 and has served on the Cowlitz Bank Board of Directors since February 2003. Mr. Ballou has over thirty years of lending experience, including over twenty years with First Interstate Bank. He was Chief Credit Officer for First Interstate Bank of Washington, and most recently Manager for the Credit Administration Division in Washington, Idaho, Montana, and Alaska. Hehas also managed large commercial branches and specialized commercial lending departments, including both business and commercial real estate lending.

3

Richard J. Fitzpatrickwas hired as President/CEO of Cowlitz Bancorporation and Cowlitz Bank in March 2003. He has served on the Board of Directors of Cowlitz Bancorporation and Cowlitz Bank since March 2003, as well. Prior to joining Cowlitz, Mr. Fitzpatrick spent nine years with Banknorth Group Inc., most recently as Regional President, responsible for operations in Vermont and New York. Other positions he held include, Chief Banking Officer responsible for Banknorth Group Inc.'s seven banks, and President and Chief Executive Officer of Howard Bank, a subsidiary of Banknorth Group, Inc.

John S. Maring has served on the Board of Directors since July 2000, currently serving as Vice Chairman. Mr. Maring is President, CEO and Chairman of Maring & Assoc., a real estate brokerage and development company. In serving as Chairman of Workplace Health, Mr. Maring has been involved with the development of its e-commerce system and processes for drug testing products. He has been the director and founder of Kazak-American College in Ust-Kamegogorsk, Kazakstan from 1996 to present, and was awarded a doctorate from the Kazak American University. Mr. Maring is Chairman of the Audit Committee. He also serves on the Compensation Committee and the Corporate Governance Committee.

Phillip S. Rowleywas appointed to the Cowlitz Bancorporation and Cowlitz Bank Board of Directors in August 2003. Mr. Rowley was recently appointed by the Board of Directors to serve as Chairman of the Cowlitz Bancorporation Board. Mr. Rowley is currently the President and CEO of Treasury Management Services, Inc., providing consulting in asset/liability management, investment portfolio management, and corporate funding strategies, as well as board and executive management training in these associated areas of banking. He serves on the faculties of several premier banking schools. Mr. Rowley has held several positions for various banks during his 34-year banking career. Mr. Rowley serves on the Compensation Committee, Audit Committee, and Corporate Governance Committee.

The Board of Directors conducts its business through meetings of the Board and through the Audit Committee, the Compensation Committee, and the Corporate Governance Committee. During 2004, the Company held twelve regular meetings and eleven special meetings of the Board as well as committee meetings. Each director serving in 2003 attended at least 75% of the regular and special meetings, as well as meetings of committees on which he served.

The Audit Committee operates pursuant to a charter adopted by the Board of Directors on February 27, 2004, which is attached to this document as Appendix A. The primary responsibilities of the Audit Committee are to recommend the selection of the Company's independent auditors, review with the independent auditors the Company's financial statements to determine if the Company is applying the appropriate accounting policies, and consult with the independent auditors on the Company's internal accounting controls. Each member of the Audit Committee is an independent director as defined under Rule 4200(a)(15) of the listing standards of the National Association of Stock Dealers. The Board believes that each of the current members of the committee has employment experience that provides them with appropriate financial sophistication to serve on the committee. In addition, the Board has reviewed the qualifications of the members of the committee and had determined that Phillip S. Rowley meets the standards of an Audit Committee Financial Expert.

The Compensation Committee operates pursuant to a charter adopted by the Board of Directors on February 27, 2004. The Compensation Committee reviews and approves compensation for Company executives, including salaries and bonus plans, equity incentive grants and other benefits. The committee also oversees the Company's Stock Incentive Plan and Employee Stock Purchase Plan.

The Corporate Governance Committee meets at least twice annually to assist the Board of Directors in identifying qualified individuals to become board members, determining the composition of the Board and its committees, developing and implementing effective corporate governance policies and procedures, developing and enforcing a Code of Business Conduct, monitoring a process to assess the effectiveness of the Board, its members, and its committees, and ensuring the Company is in compliance with NASDAQ listing standards.

4

The Company does not have a separate nomination committee of our board of directors. The Corporate Governance Committee, which has a charter and consists entirely of independent directors, performs the functions of a nominating committee. The Corporate Governance Committee Charter includes factors that the committee will consider in potential board candidates including business experience, other directorships, personal skills and expertise in technology, finance, marketing, financial reporting and areas unique to the Company.

A shareholder may recommend a candidate for consideration and that recommendation will be reviewed and evaluated by the Corporate Governance Committee. The committee will use the same procedures and criteria for evaluating potential nominees recommended by shareholders as it does for potential nominees selected by the Company. Shareholder recommendations for Board candidates should be submitted to the Company's corporate Secretary, Lynda Altman, at Cowlitz Bancorporation, 927 Commerce Avenue, Longview, Washington 98632. In 2003, the Company received no recommendations for Board candidates from shareholders. In 2003 the Company did not hire any third parties to recommend potential Board candidates. When there is a vacancy on the Board, or the Corporate Governance Committee recommends expanding the Board, the committee generally consults with business associates, community leaders, legal counsel and other professionals to identify potential candidates.

In 2003, Phillip S. Rowley joined the Board of Directors. Mr. Rowley was introduced to the Board of Directors by Company management as a result of consulting work he had done for the Company. Through subsequent interviews with the Directors, it was determined that Mr. Rowley's banking experience and personal skills would be a compliment to the existing Board membership.

INFORMATION REGARDING OTHER KEY PERSONNEL |

The age, position, and experience of the Company's other key personnel, about whom information is provided above, are as follows:

Lynda Altman,41, joined the Company in 1997. Ms. Altman has over twelve years banking experience. She currently holds the position of Secretary of the Board and Vice President/Administrative Officer of the Company.

Gerald Carruthers,61, joined the Company in 2002. Mr. Carruthers has over thirty years of banking experience, primarily in the mortgage banking sector. He currently holds the position of Vice President of the Company, Executive Vice President of Cowlitz Bank and Bay Mortgage Division President. Mr. Carruthers' will be leaving the company on April 30, 2004, due to the restructuring of the mortgage division.

Donna Gardner,55, joined the Company in 1981. She has over thirty-seven years of banking experience and currently holds the position of Vice President and Chief Financial Officer of the Company. Ms. Gardner also holds the position of Executive Vice President/Operations of Cowlitz Bank.

Joey Ingman,34, joined the Company in 2000. Mr. Ingman has been in the accounting field for seven years and currently holds the position of Vice President/Controller of the Company. Mr. Ingman is also Vice President and Chief Financial Officer of Cowlitz Bank.

Sue Rodgers,45, joined the Company in 1981. Ms. Rodgers has supervised the Information Technology department since 1985. She is currently Vice President/Information Technology of Cowlitz Bank.

Loree Vandenberg, 39, joined the Company in 2003. Ms. Vandenberg has over thirteen years of experience in the Audit, Risk Management, and Information Technology fields. Ms. Vandenberg currently holds the position of Senior Vice President /General Auditor of Cowlitz Bank.

5

The Audit Committee of Cowlitz Bancorporation has reviewed and discussed with management the Company's audited consolidated financial statements as of and for the fiscal year ended December 31, 2003. The Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. The Committee has received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1, Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and has discussed with the auditors the auditors' independence. The Committee has considered whether the provision of non-audit services is compatible with maintaining the principal accountant's independence.

Based on the reviews and discussions referred to above, the Committee recommends to the Board of Directors that the consolidated financial statements referred to above be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2003.

Submitted by the Audit Committee:

John Maring, Chairman

Mark F. Andrews, Jr.

Phillip S. Rowley

COMPENSATION COMMITTEE REPORT |

The Company's executive compensation program is designed to attract, motivate and retain key executive officers and to align their compensation with the Company's business objectives, long-term objectives of shareholders, and the executive's individual performance.

The Compensation Committee administers the Company's executive compensation program. The Compensation Committee works with management to develop compensation plans for the Company and is responsible for determining the compensation of the executives, as well as the compensation for the Board of Directors.

Executive salaries are reviewed annually. The Compensation Committee utilizes various industry compensation surveys, including the Northwest Financial Industry Salary Survey and public information, to determine the compensation levels of executive officers employed by similar financial institutions that are comparable in size, region, and performance.

Using the information provided by this research, along with other factors such as meeting organizational goals, implementation of strategies, specific and overall performance, and stock value, the Compensation Committee considers the appropriate combination of salary levels, bonuses, and retention incentives based on long-term equity compensation.

Submitted by the Compensation Committee:

Mark F. Andrews, Jr., Chairman

John S. Maring

Phillip S. Rowley

6

Directors are paid the following fees for meetings attended:

| | | Personal Attendance | | Call-In Attendance |

| | |

| |

|

| Cowlitz Bank Board of Directors: | | $ | 500.00 | | | |

| Cowlitz Bancorporation Board of Directors: | | $ | 500.00 | | | |

| Special Board of Directors: | | $ | 600.00 | | $ | 300.00 |

| | | | | | |

| Audit Committee: | | | | | |

| | | | | |

| Chairman | | $ | 500.00 | | | |

| Members | | $ | 300.00 | | $ | 200.00 |

| | | | | | |

| Compensation Committee: | | | | | |

| | | | | |

| Chairman | | $ | 200.00 | | | |

| Members | | $ | 200.00 | | $ | 100.00 |

| | | | | | |

| Corporate Governance Committee: | | | | | |

| | | | | |

| Chairman | | $ | 200.00 | | $ | 100.00 |

| Members | | $ | 200.00 | | | |

As Chairman of the Board, Mr. Namatinia received a monthly salary of $4,000, and other compensation with a value of $16,345 in 2003, including car allowance and 401K contributions, in lieu of board meeting fees.

Stock Options.On January 30, 2003, each director, except the Chairman, received an award of 20,000 stock options, 100% vested upon grant, exercisable at fair market value on the date of the grant. On December 31, 2003, the outside directors were awarded the following stock options, which were vested 20% on grant and 20% on the annual grant anniversary: John Maring - 60,000; Mark Andrews - 30,000; Phillip Rowley - 25,000. All vested options are reflected in the table on page 2.

Summary Compensation Table.The following table sets forth the annual compensation earned during 2001, 2002, and 2003, by the Company's Chief Executive Officer and each of the Company's other executive officers who earned in excess of $100,000 in salary, bonus, and other compensation during the last fiscal year (the "Named Executive Officers").

| | | | | | | | | | | | | | | | | | Stock |

| | | | | | | | | | | | | | | | | |

|

| | | | | | | Other Annual | | | | | | | All Other | | Option |

| | | | | | |

| | | | | | |

| |

|

| Name and Position | Year | | Salary | | Compensation* | | Bonus | | Compensation** | | Grants |

|

| |

| |

| |

| |

| |

|

| | | | | | | | | | | | | | | | | | |

| Richard J. Fitzpatrick | 2003 | | $ | 197,916 | | $ | 11,288 | | | $ | | 104,500 | | $ | 61,796 | | 100,000 |

| President & CEO (1) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Ernie Ballou | 2003 | | $ | 155,898 | | $ | 16,068 | | | $ | | 52,800 | | $ | 11,085 | | 60,000 |

| Vice President (1) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Gerald Carruthers | 2003 | | $ | 143,400 | | $ | 9,403 | | | $ | | 6,888 | | | - | | 5,000 |

| Vice President (2) | 2002 | | | 23,438 | | | - | | | $ | | 22,000 | | | - | | 5,000 |

| | | | | | | | | | | | | | | | | | |

| Donna P. Gardner | 2003 | | $ | 85,000 | | $ | 6,000 | | | $ | | 14,025 | | | - | | 30,000 |

| Vice President & CFO | 2002 | | $ | 81,250 | | $ | 4,995 | | | $ | | 4,000 | | | - | | - |

| | 2001 | | $ | 95,000 | | $ | 5,700 | | | $ | | 2,000 | | | - | | - |

*Includes auto expense, and Company contribution to 401(K) Plan.

** Includes one time moving expenses for Mr. Fitzpatrick and Mr. Ballou. Mr. Fitzpatrick's compensation includes $16,368 for consulting with the Company prior to being hired.

(1) Richard Fitzpatrick and Ernie Ballou joined the Company in 2003.

(2) Gerald Carruthers joined the Company in 2002.

7

Stock Options.The following table sets forth information concerning the award of stock options to the Named Executive Officers during 2003:

| | | | | | | | | | Potential Realizable |

| | Number of | | % of Total | | | | | | Value at Assumed |

| | Securities | | Options/SAR | | Exercise | | | Annual Rates of Stock |

| | Underlying | | s Granted to | | or Base | | | Price Appreciation for |

| | Options/SARs | | Employees | | Price | | Expiration | Option Term (1) |

| Name | Granted (#) | | Fiscal Year | | ($/Share) | | Date | 5% ($) | | 10% ($) |

|

| |

| |

| |

|

| |

|

| | | | | | | | | | | | |

| Richard J. Fitzpatrick (2) | 50,000 | | 35.0% | | | 6.87 | | 2-10-13 | 216,000 | | 547,500 |

| | 50,000 | | | | 10.73 | | 12-31-13 | 337,500 | | 855,000 |

| | | | | | | | | | | | |

| Ernie Ballou (2) | 30,000 | | 21.0% | | | 6.86 | | 1-13-13 | 129,300 | | 327,900 |

| | 30,000 | | | | 10.73 | | 12-31-13 | 202,500 | | 513,000 |

| | | | | | | | | | | | |

| Gerald Carruthers (3) | 5,000 | | 1.8% | | $ | 8.75 | | 10-18-13 | 27,500 | | 69,750 |

| | | | | | | | | | | | |

| Donna P. Gardner | 30,000 | | 10.5% | | 10.73 | | 12-31-13 | 202,500 | | 513,000 |

- These assumed rates of appreciation are provided in order to comply with the requirements of the Securities and Exchange Commission (the "SEC") and do not represent the Company's expectation or projections as to the actual rate of appreciation of the Common Stock. These gains are based on assumed rates of annual compound stock price appreciation of 5% and 10% from the date options were granted over the full option term. The actual value of the options will depend on the performance of the Common Stock and may be greater or less than the amounts shown.

- Options vest 20% upon award and an additional 20% on each anniversary of the award date.

- Options were awarded as part of Mr. Carruthers' employment agreement and fully vest one year from the award date.

The table below provides information on exercises of options during 2003 by the Named Executive Officers and information with respect to unexercised options held by the Named Executive Officers at December 31, 2003:

| Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values |

|

| | | | | | | | | |

| Name | Shares

Acquired on

Exercise (#) | Value

Realized | Number of Securities

Underlying Unexercised

Options/SARs at Fiscal

Year-End (#)

Exercisable/Unexercisable | | Value of Unexercised in-

the-Money Options/SARs at

Fiscal Year-End ($)

Exercisable/Unexercisable |

|

|

|

| |

|

| | | | | | | | | |

| Richard J. Fitzpatrick | - | - | 30,000 / 70,000 | | | $43,500 / $101,500 |

| Ernie Ballou | - | - | 18,000 / 42,000 | | | $26,280 / $61,320 |

| Gerald Carruthers | - | - | 5,000 / 5,000 | | $18,750 / $12,500 |

| Donna P. Gardner | - | - | 14,200 / 25,300 | | $33,942 / $15,043 |

Employment Agreements. Richard J. Fitzpatrick entered into an employment agreement with the Company on February 21, 2003, which has a five-year term, with the agreement that on the third anniversary and each anniversary thereafter the term shall be extended for an additional one year period unless either party delivers written notice of its intent not to extend the term. The term will end, however, no later than the anniversary following Mr. Fitzpatrick's sixty-fifth birthday. Under the employment agreement, Mr. Fitzpatrick receives an annual base salary of $237,500. Under the agreement, Mr. Fitzpatrick is entitled to receive at least 30% annual bonus and additional stock options, provided specific performance goals are met.

8

If Mr. Fitzpatrick's employment is terminated without cause by the Company, or for good reason, he will receive his monthly base salary for the balance of the term, become fully vested in all retirement benefits and stock, and receive all benefits for the balance of the term. If employment is terminated within two years of a change in control, Mr. Fitzpatrick is entitled to receive a lump sum amount equal to three times the sum of his highest annual base salary and highest annual bonus plus the value of payments the Company would have made under certain benefit plans. The lump sum payment is payable within 60 days of termination. The agreement contains a covenant not to compete during the employment period and for a period following termination equal to the number of months for which Mr. Fitzpatrick is entitled to severance payment of employment or twelve months, whichever is greater.

Ernie Ballou entered into an employment agreement with the Company on January 13, 2003. Mr. Ballou's initial base salary is $160,000 per year, subject to annual review and appropriate upward adjustments. Mr. Ballou is entitled to receive up to 25% of his base salary as annual bonus and additional stock options, provided specific performance goals are met.

If Mr. Ballou's employment is terminated without cause by the Company, or for good reason, after the first year anniversary of the contract, he will receive six months base salary. If employment is terminated within two years of a change in control, Mr. Ballou is entitled to receive 24 months of base salary, two times the amount of his highest bonus paid in the two years preceding termination, and continuing insurance benefits for the shorter of 24 months or the full COBRA period. The lump sum payment is payable within 60 days of termination. The agreement contains a covenant not to compete during the employment period and for a six month period following termination.

Gerald Carruthers entered into an employment agreement with the Company on September 1, 2002. Mr. Carruthers' initial base salary is $143,000 per year. Mr. Carruthers is entitled to receive 25% of the non-commissioned employee bonus pool created for the mortgage division. The agreement was amended on October 18, 2002, to extend the term through April 30, 2004. Mr. Carruthers will be leaving the Company at the end of his contracted term due to the recent restructuring of the mortgage division.

Donna Gardner negotiated an "executive severance agreement" with the Company on October 20, 1994, which provide that upon involuntary termination within three years after a change of control, Ms. Gardner shall be entitled to receive 12 months base salary.

EQUITY COMPENSATION PLAN INFORMATION |

The following table sets forth information about equity compensation plans in effect as of the end of the last completed fiscal year that provide for the award of securities or the grant of options to purchase securities to employees of the Company and its subsidiaries.

| | (a) | (b) | (c) |

| Plan category | Number ofsecurities to beissued uponexercise ofoutstandingoptions, warrantsand rights | Weighted-averageexercise priceof outstandingoptions,warrants andrights | Number of securitiesremaining available forfuture issuance underequity compensationplans (excludingsecurities reflected incolumn (a)) |

Equity compensation plansapproved by security holders

| 765,990 | $7.70 | 206,230 |

Equity compensation plans notapproved by security holders (1)

| 296,466 | $10.68 | 0 |

| Total | 1,062,456 | $8.53 | 206,230 |

(1) 231,466 shares with a weighted average exercise price of $11.68 were issued as part of the acquisition of Northern Bank of Commerce, to their directors, and President/CEO. The balance have been issued as a hiring incentive to senior management level employees.

9

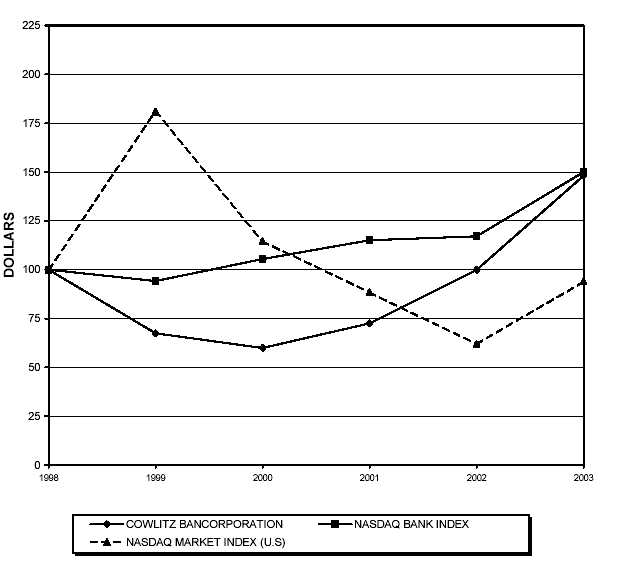

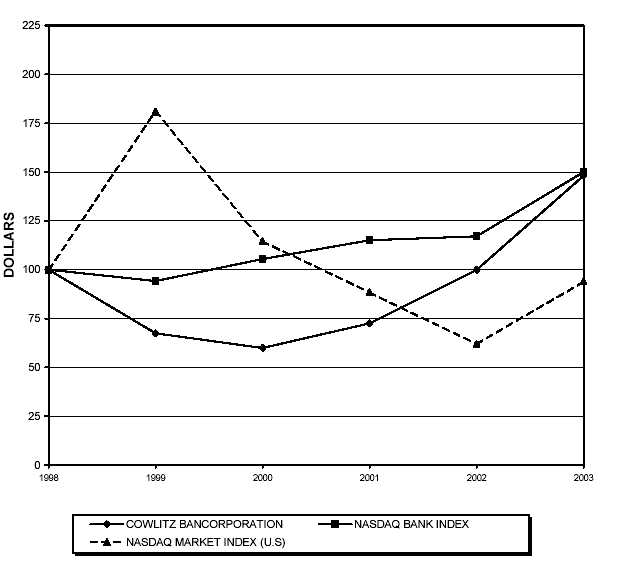

STOCK PRICE PERFORMANCE GRAPH |

The following chart compares the annual percentage change in the cumulative total return of Cowlitz Bancorporation common stock during the period commencing December 31, 1998 and through the fiscal years ended December 31, 2003, with the total return index for the Nasdaq Stock Market (US Companies) and the total return index for Nasdaq Bank stocks. This comparison assumes $100.00 was invested on March 31, 1998, in Cowlitz common stock and in the comparison indices, and assumes reinvestment of all cash dividends prior to any tax effect and retention of all stock dividends. Price information for the chart was obtained using the Nasdaq closing price as of that date.

10

AGENDA ITEM 2 - OTHER MATTERS |

The Board of Directors is not aware of any business to come before the Annual Meeting other than those matters described in this Proxy Statement. However, if any other matters should properly come before the Annual Meeting, it is intended that proxies in the accompanying form will be voted in accordance with the best judgment of the person or persons voting the proxies.

RELATED PARTY TRANSACTIONS |

From time to time, the Company has outstanding loans to directors, their spouses, associates, and related organizations. All such loans are made in the ordinary course of business and on substantially the same terms and conditions, including interest rate and collateral required, as comparable transactions with unaffiliated parties. Such loans do not involve more than the normal risk of collectibility or present other unfavorable features. Currently there is one such outstanding credit line, with a zero balance.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT |

Section 16(a) of the Securities Exchange Act of 1934 requires the executive officers and directors of the Company and all persons who own more than ten percent of the outstanding shares of the Common Stock of the Company (referred to as the "ten percent shareholders") to file with the Securities and Exchange Commission initial reports of beneficial ownership and all subsequent changes in beneficial ownership of the Common Stock and other equity securities of the Company.

During the majority of 2003, and for prior years, the Company assisted its officers and directors in meeting their Section 16 reporting requirements. However, staff was not aware that stock option grants had to be reported at least annually. Although all stock options granted to officers and directors have been properly disclosed annually in the Company's proxy statements, the Company inadvertently failed to report such stock option grants on Form 4 or Form 5 on behalf of the officers and directors. The Company has retained third party administration of the reporting responsibilities to ensure timely reporting of all reportable transactions in the future.

Based solely on review of copies of the forms provided to the Company and the representations by the executive officers, directors and ten percent shareholders, the Company believes, to the best of its knowledge, that all Section 16(a) filing requirements were satisfied for the fiscal year ending December 2003, except the following: Ernest D. Ballou, Mark F. Andrews and John S. Maring, each were late in reporting the annual stock option grant on Form 4. Additionally, for the years 1998 through 2002, Benjamin Namatinia failed to report four annual stock option grants, Mark F. Andrews failed to report four annual stock option grants, John S. Maring failed to report three annual stock option grants and Donna Gardner failed to report two annual stock option grants, which were reported late on a Form 4 in 2003.

11

Moss Adams LLP serves as our independent public accountant. Representatives of Moss Adams LLP are expected to be present at the annual meeting and will have the opportunity to make a statement if they desire to do so. It is expected that such representatives will be available to respond to appropriate questions.

Audit Fees. The aggregate fees billed by Moss Adams LLP for the audit of the Company's annual consolidated financial statements for the fiscal year ended December 31, 2003 and the review of the consolidated financial statements included in the Company's filings on Form 10-Q for fiscal 2003 were $97,400 and for fiscal 2002 were $78,900.

Audit-Related Fees.In 2003,audit-related fees were $19,000, including the audit of the Company's Retirement Savings Plan for 2002 and 2001. In 2002 Moss Adams did not perform any audit-related services.

Financial Information Systems Design and Implementation Fees.There were no fees billed by Moss Adams LLP to the Corporation for financial information systems design and implementation fees for the fiscal year ended December 31, 2003.

Tax Fees. Tax fees for the year 2003 were $8,500 and $6,000 for the year 2002, relating to filing of Federal and Local Tax Returns.

All Other Fees.The aggregate fees billed to the Company for all other services rendered by Moss Adams LLP for the fiscal year ended December 31, 2003 were $4,700, which related to information systems review procedures and items relating to the mortgage division restructuring. For the year ended December 31, 2002, other fees were $50,100, primarily relating to consultation with regard to disposal of a business segment, accounting for goodwill, and accounting for the mortgage operations.

The Audit Committee has determined that the provision of services rendered above is compatible with maintaining Moss Adams LLP's independence.

Pre-Approval Policies. The services performed by Moss Adams LLP in 2003 were pre-approved by the Audit Committee, prior to commencement of service, in accordance with the committee's pre-approval policy and procedures. Moss Adams LLP may not perform any prohibited services as defined by the Sarbanes-Oxley Act of 2002.

The Company has adopted a Code of Business Conduct. The Code requires all employees to avoid conflicts of interest, comply with all laws and regulations, conduct business in an ethical manner and act in the Company's best interest. The Code applies to our chief executive officer, our chief financial officer, our controller and all other officers serving in a finance, accounting, tax or investor relations role. A copy of our Code of Business Conduct is available on our website.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD |

Comments and questions directed to the Company's Board of Directors should be submitted to the Company's corporate secretary, Lynda Altman, at Cowlitz Bancorporation, PO Box 1518, Longview, Washington. These comments will be communicated to the board at its next regular meeting. No communications of this type were received in 2003. The Company does not have a formal policy regarding attendance of directors at the annual meeting of shareholders, but strongly encourages attendance by all directors. All directors attended the 2003 annual meeting.

12

SHAREHOLDER PROPOSALS FOR THE 2005 ANNUAL MEETING |

The Company must receive a shareholder proposal on or before December 20, 2004 to consider it for inclusion in the Company's proxy statement and form of proxy relating to the Company's Annual Meeting of Shareholders in 2005. If a proposal is submitted by March 1, 2005, the proposal may be presented at the annual meeting, but may not be included in the proxy. A proposal submitted after March 1, 2005, will be considered untimely. The Company's address for submitting proposals is P.O. Box 1518, Longview, Washington 98632.

The Company's 2003 Annual Report to Shareholders, including financial statements prepared in conformity with generally accepted accounting principles, is being mailed to shareholders with these proxy materials. Any shareholder that has not received a copy of such Annual Report may obtain a copy by writing the Company or by requesting a copy at www.cowlitzbancorporation.com or by calling 1-800-340-8865 and asking for Lynda Altman, Corporate Secretary.

Lynda Altman Secretary

Longview, Washington April 15, 2004

13

APPENDIX A

COWLITZ BANCORPORATION AUDIT COMMITTEE CHARTER |

Purpose

The Audit Committee is a committee of the Board of Directors organized for the primary purpose of assisting the Board in fulfilling its oversight responsibilities relating to (a) the preparation and integrity of the Company financial statements; (b) the engagement of independent auditors and the evaluation of their performance, qualifications and independence; (c) the implementation and evaluation of the Company internal controls, procedures and policies; and (d) the compliance with certain legal and regulatory requirements, including programs and policies established by management or the Board.

The Audit Committee serves as a conduit to promote open communication between the external auditors, the internal auditors, management and the Board of Directors. The Audit Committee should take appropriate actions to set the overall corporate "tone" for quality financial reporting, sound business risk practices, sound corporate governance, and ethical behavior.

Committee Membership

The Board of Directors, based upon recommendation by the Corporate Governance Committee, will appoint Committee members and a Chair annually. Such appointments to occur after the annual Board of Directors' meeting. If the Board does not appoint a Chair of the Audit Committee, then the Audit Committee members may elect one member to serve as the Chair. The Chair will serve as the primary contact person for communications between the Audit Committee and management, the Audit Committee and the General Auditor, and the Board and the external auditors, outside of regular Audit Committee meetings.

Each committee member, as determined in the business judgment of the Board, will be (a) "independent", as that term is defined by the applicable securities regulations and listing standards; and (b) be financially literate and have the ability to read and understand the Company's basic financial statements. It is the goal of the Company that at least one member, as determined in the business judgment of the Board, will have adequate accounting or related financial expertise and sophistication to understand generally accepted accounting principles and assess the application of such accounting principles in the preparation of the Company financial statements to the degree necessary to satisfy the criteria for being considered an "audit committee financial expert."

If an Audit Committee member serves on the audit committee of more than three public companies, the Board will be required to determine that such simultaneous service will not adversely affect such member's ability to effectively serve on the Company Audit Committee.

Meetings

The Audit Committee may meet as often as it deems necessary and appropriate to fulfill its purpose and responsibilities, but no less regular than necessary to review the financial results of the Company for any period for which financial statements or information are prepared and disseminated to the shareholders. Meetings may be called by the Chair of the Audit Committee or the Chair of the Board and will be conducted in accordance with the Company bylaws. The Audit Committee may take action by written consent of all its members.

As part of its regular meetings, the Audit Committee will meet in executive session and jointly and separately with management, the Company's internal and external auditors. Reports of meetings and actions taken at meetings or by consent action shall be reported to the Board by the Audit Committee Chair at the next regularly scheduled Board meeting and shall include any recommendations of the Audit Committee for consideration by the Board. The Audit Committee Chair shall be available to answer questions of other directors and discuss actions taken or matters considered by the Audit Committee.

14

Committee Authority and Responsibilities

In carrying out its duties and responsibilities, the Audit Committee should design its policies and procedures to be flexible, in order to best react to changing conditions and circumstances and ensure the Company accounting, financial reporting, internal controls, and auditing practices are appropriately tailored to address the Company's specific financial and business risks.

The following shall be the principal recurring processes of the Audit Committee in carrying out its oversight responsibilities. The processes are set forth as a guide with the understanding that the Audit Committee may alter or supplement them as appropriate.

- The Audit Committee is responsible for the supervision of the independent audit function. Management may consult with the independent auditor whenever necessary.

- The Audit Committee will review Audit Policy as necessary, at least annually.

- The Audit Committee will have the sole authority to select, hire and fire the external auditor, to approve all fees and other terms of the audit engagement and to pre-approve any non-audit relationships and engagements with the independent auditors.

- The Audit Committee will annually review and evaluate the performance of the external auditors and their independence from management and the Company. The Audit Committee also will be responsible for assuring the regular rotation of the audit partner as may be required by the securities regulations or listing standards.

- The Audit Committee shall discuss with the external auditors the overall scope and plans for audits, including the adequacy of staffing and compensation; the results of their audit, including material issues regarding accounting and auditing principles and practices; and any significant audit problems or disagreements with management regarding proposed accounting adjustments or financial reporting recommendations and any other matters required to be discussed by Statement on Auditing Standards No. 61 relating to conducting the Company audit.

- The Audit Committee will be responsible for resolving disagreements between management and the independent auditors regarding accounting and financial reporting matters for purposes of preparing and issuing audited financial statements.

- The Audit Committee shall discuss with any internal auditors, the overall scope and plans for their audits, including the adequacy of staffing and compensation; the results of their audits, including major issues regarding accounting and auditing principles and practices; compliance with laws and regulations; the adequacy of the Company's internal controls; and compliance with the Company's policies, procedures and programs.

- The Audit Committee shall discuss with the external auditors the adequacy and effectiveness of the internal accounting and financial controls, including the Company's system to monitor and manage business risk.

- The Audit Committee shall meet periodically with management to review risk assessment, risk management guidelines and policies, the Company's financial risk exposure and the Company's system to monitor and control such exposure. Management, however, will remain ultimately responsible for risk management.

- The Audit Committee shall meet separately with the external and internal auditors, without management present, to discuss the results of their examinations and will provide sufficient opportunity for any internal auditors and the independent auditors to meet privately with the Audit Committee Chair.

- The Audit Committee shall meet with management and the independent auditors to discuss the annual and quarterly financial statements, including Management's Discussion and Analysis of Financial Condition and Results of Operations, and any other Exchange Act filings the AuditCommittee and internal auditors deem necessary to determine that the independent auditors are satisfied with the disclosures and content of the financial statements to be presented to the shareholders.

15

- The Audit Committee shall review and discuss the types of information to be disclosed and the presentation of such information with regard to earnings press releases and financial information and earnings guidance given to analysts and rating agencies.

- The Audit Committee shall review with the CEO and CFO the Company internal controls, which include disclosure controls and procedures and internal controls over financial reporting and will periodically, but not less than quarterly, discuss with management its conclusions about the efficacy of the Company disclosure controls and procedures, and, not less than annually, discuss management's conclusions about the efficacy of Company internal controls over financial reporting, including any material deficiencies in such controls and procedures and the appropriate action to correct any such deficiencies.

- The Audit Committee will meet on a quarterly basis with the Chair of the Disclosure Committee, the General Auditor, and management to discuss (a) any significant deficiencies in the design and operation of the Company disclosure controls and procedures that could adversely affect the Company's ability to record, process, summarize and report financial data, and any material weakness in internal controls over financial reporting; and (b) any fraud, regardless of whether it is material, that involves management or Company personnel who have a significant role in the Company's internal controls.

- The Audit Committee shall review with management and the independent auditors any changes in accounting principles and other significant financial reporting issues, including the use of "pro-forma" or "adjusted" non-GAAP information.

- The Audit Committee shall periodically review the accounting and financial personnel of the Company and address succession planning.

- The Audit Committee shall submit the minutes of all meetings of the Audit Committee to, or discuss the matters discussed at each committee meeting with, the full Board.

- At least annually, the Audit Committee shall review and evaluate its performance to improve its effectiveness and responsiveness to the Board and management, and reassess the adequacy of its Charter and recommend proposed changes to the Board for its approval.

- The Audit Committee shall establish and maintain procedures for (a) receipt, retention and treatment of complaints received by the Company regarding accounting, internal controls or auditing matters, and (b) the confidential, anonymous complaints or allegations by employees of concerns regarding questionable accounting, internal controls or auditing matters.

- The Audit Committee shall serve as the Qualified Legal Compliance Committee to receive, evaluate and appropriately address all reports of potential wrongdoing received from legal counsel pursuant to the Sarbanes-Oxley Act of 2002 and Rule 205 of the Securities Exchange Commission.

- The Audit Committee shall meet periodically with the Company's external counsel and other appropriate Company personnel to review material legal affairs of the Company and any material reports or inquiries received from regulatory or governmental agencies.

- The Audit Committee will discuss with management, the General Auditor, and the external auditor any correspondence with regulators or governmental agencies and any published reports that raise material issues regarding the Company's financial statements and accounting policies; or compliance with other rules, regulations or laws.

- The Audit Committee shall have the authority, to the extent it deems necessary, to retain independent legal, accounting or other advisors without need for Board approval, and the Company shall providefor appropriate funding, as determined by the Audit Committee, for payment of compensation to such advisors retained by the Audit Committee.

16

- The Audit Committee will have access to all Company personnel and records it deems necessary to fulfill its duties and responsibilities under this Charter.

- The Audit Committee shall review and approve all related party transactions that must be disclosed pursuant to Item 404 of Regulation S-K of the SEC rules and regulations.

- The Audit Committee has the authority to designate subcommittees, as it deems necessary and appropriate, consisting of at least one member of the Audit Committee to address specific issues on behalf of the Audit Committee.

- The Audit Committee may appoint a Secretary, who need not be member of the Audit Committee, to keep minutes of all Audit Committee meetings and such other records the Audit Committee deems necessary and appropriate.

- The Audit Committee shall prepare a report for inclusion in the Company's annual proxy statement in accordance with the applicable securities regulation and listing requirements.

Limitations

The primary responsibility of the Audit Committee is to oversee the Company's financial reporting process and system of internal controls on behalf of the Board and report the results of their activities to the Board. While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for preparing the Company's financial statements and maintaining an adequate control environment, and the external auditors are responsible for auditing those financial statements and attesting to the adequacy of the internal controls of financial reporting.

17