As filed with the Securities and Exchange Commission on November 10, 2021

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SF-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

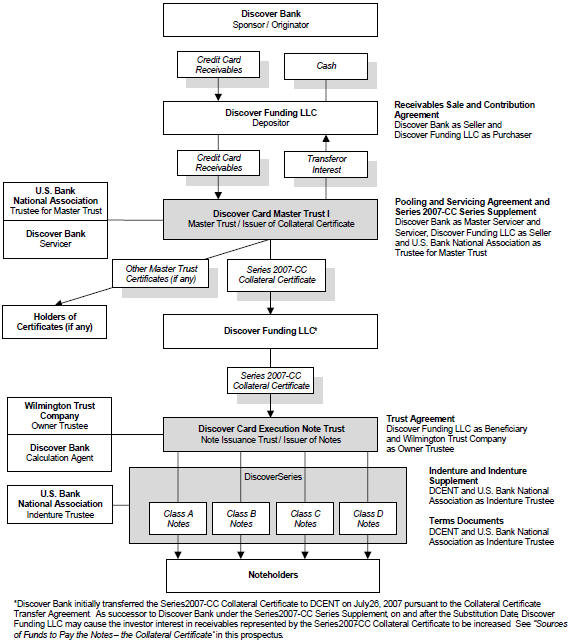

DISCOVER CARD EXECUTION NOTE TRUST

(Issuing entity in respect of the Notes)

DISCOVER CARD MASTER TRUST I

(Issuing entity in respect of the Series 2007-CC Collateral Certificate)

DISCOVER FUNDING LLC

as depositor to the issuing entities described herein

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 51-0020270 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

Commission File Number of depositor: 333-205455

Central Index Key Number of depositor: 0001645731

Central Index Key Number of sponsor: 0000894327

Discover Bank

(Exact name of sponsor as specified in its charter)

12 Read’s Way

New Castle, Delaware 19720

(302) 323-7474

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Patricia S. Hall

Vice President, Chief Financial Officer and Treasurer

Discover Funding LLC

12 Read’s Way

New Castle, Delaware 19720

(302) 323-7474

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

| | | | |

Stuart M. Litwin, Esq. Mayer Brown LLP 71 S. Wacker Drive Chicago, IL 60606 (312) 701-7373 | | Jan C. Stewart, Esq. Mayer Brown LLP 71 S. Wacker Drive Chicago, IL 60606 (312) 701-8859 | | Michael H. Mitchell Orrick Herrington & Sutcliffe LLP Columbia Center 1152 15th Street, N.W. Washington, D.C. 20005 (202) 339-8456 |

| (Counsel to Sponsor and Depositor) | | (Counsel to Sponsor and Depositor) | | (Counsel to Underwriters) |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective, as determined by market conditions.

If any of the securities being registered on this Form SF-3 are to be offered pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form SF-3 is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form SF-3 is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of each class of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit (1) | | Proposed maximum aggregate offering price | | Amount of

registration fee(2) |

Asset-Backed Notes | | $16,750,000,000(3) | | 100% | | $16,750,000,000 | | $1,552,725 |

Discover Card Master Trust I, Series 2007-CC Collateral Certificate(4) | | $16,750,000,000 | | — | | — | | — |

|

| (1) | Estimated for purposes of calculating the registration fee. |

| (2) | Pursuant to Rule 457(p) under the Securities Act of 1933, Discover Funding LLC (the “Registrant”) is offsetting a portion of the filing fee due under this registration statement with the filing fees paid in connection with unsold securities with an aggregate principal amount of $11,950,000,000 (“Terminated Securities”) on the Registrant’s registration statement on Form SF-3 (File no. 333-228025) with an initial effective date of November 15, 2018 (the “Prior Registration Statement”). A registration fee in the amount of $1,448,340 that was paid in connection with the registration of the Terminated Securities on the Prior Registration Statement will be used to offset a portion of the filing fee due under this registration statement pursuant to Rule 457(p). The offering of the Terminated Securities under the Prior Registration Statement will be terminated and will be withdrawn upon the effectiveness of this Registration Statement. After subtracting the amount offset pursuant to Rule 457(p), the total registration fee for this offering is $104,385, which has been paid in connection with filing this Form SF-3. In addition to the amounts noted in the fee table above, pursuant to Rule 415(a)(6) under the Securities Act of 1933, this Registration Statement and the prospectus included herein include $3,250,000,000 aggregate principal amount of Notes that were previously |

registered on the Prior Registration Statement, but which were unsold, (the “Unsold Securities”). A filing fee of $327,275 was paid in connection with the Unsold Securities. The amount of Notes with respect to the fee paid pursuant to this Registration Statement, together with the amount of Unsold Securities, results in a total of $20,000,000,000 of Notes that may be issued under this Registration Statement.

| (3) | With respect to any securities denominated in any foreign currency, the amount to be registered shall be the U.S. dollar equivalent thereof based on the prevailing exchange rate at the time such security is first offered. |

| (4) | No additional consideration will be paid by the purchasers of the Asset-Backed Notes for the Series 2007-CC Collateral Certificate, which is pledged as security for the Notes. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.