Fiscal Year 2019 Second Quarter Earnings Release Conference Call October 9, 2018

Safe Harbor Statement Certain statements herein about our expectations of future events or results constitute forward- looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as, “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. This presentation may contain forward- looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand and response to products and services offered by AZZ, including demand by the power generation markets, electrical transmission and distribution markets, the industrial markets, and the metal coatings markets; prices and raw material cost, including zinc and natural gas which are used in the hot dip galvanizing process; changes in the political stability and economic conditions of the various markets that AZZ serves, foreign and domestic, customer requested delays of shipments, acquisition opportunities, currency exchange rates, adequacy of financing, and availability of experienced management and employees to implement AZZ’s growth strategy. AZZ has provided additional information regarding risks associated with the business in AZZ’s Annual Report on Form 10-K for the fiscal year ended February 28, 2018 and other filings with the SEC, available for viewing on AZZ’s website at www.azz.com and on the SEC’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward- looking statements, whether as a result of new information, future events, or otherwise. 2

Q2 Fiscal 2019 Upturn • Focus on revenue growth is paying off • Regaining lost market share in Metal Coatings • Utilizing newly acquired facilities in Electrical Group • Normal weak season for the Industrial Group due to low turnaround and outage activity • Solid Metal Coatings quarter, but margins fell on costs • Record quarterly sales of $116.3 million, the second consecutive record • Realized selling price increases partially offsetting higher costs • Operating margins fell on higher realized zinc costs, continued labor pressures, and cost of consolidating plants • Value-added selling processes continuing to take hold • Energy segment gaining traction, but continues focus on operational efficiency and alignment • Solid revenue growth • Strong bookings driving positive outlook • Continuing to gain international traction • Steel prices have increased for our Electrical businesses and we have seen shortages of skilled labor in certain markets 3

Fiscal 2019 Markets • Solid demand in Metal Coatings segment • Infrastructure spend increasing • Increasing demand for Galvabar, scouting for second site • Powder Coating demand growing • Energy segment full year outlook good • Q2 seasonally weaker than Q1 –limited turnarounds and outages during the Summer months • Refinery turnaround activity for Fall is robust • Nuclear market challenges continuing 4

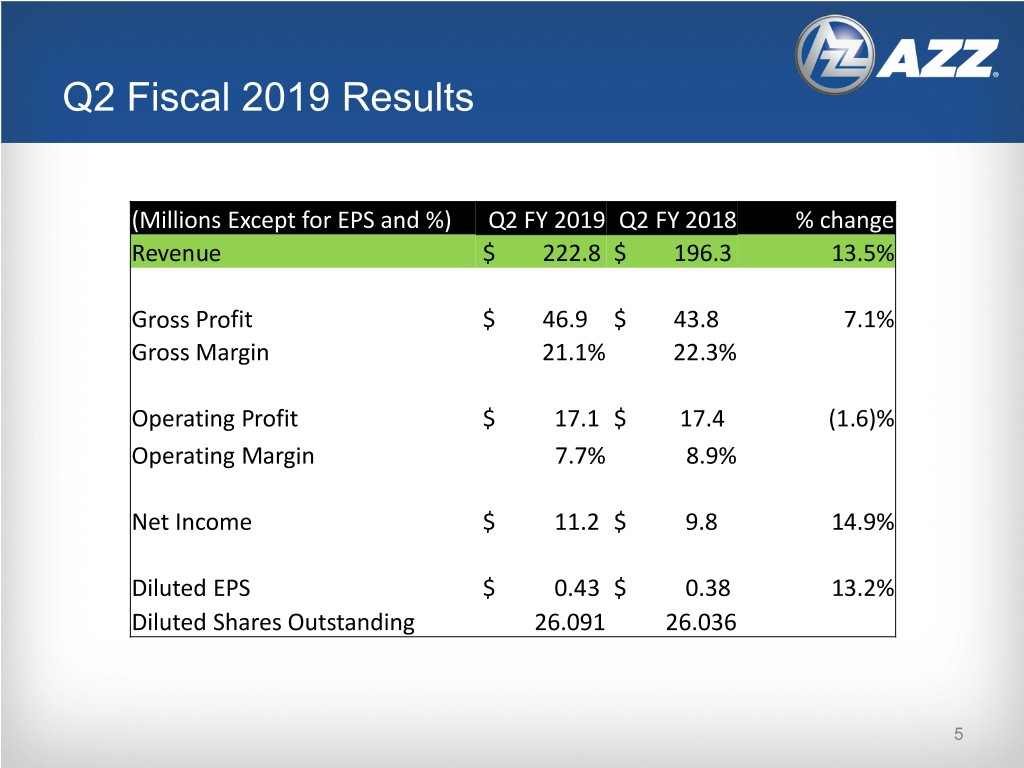

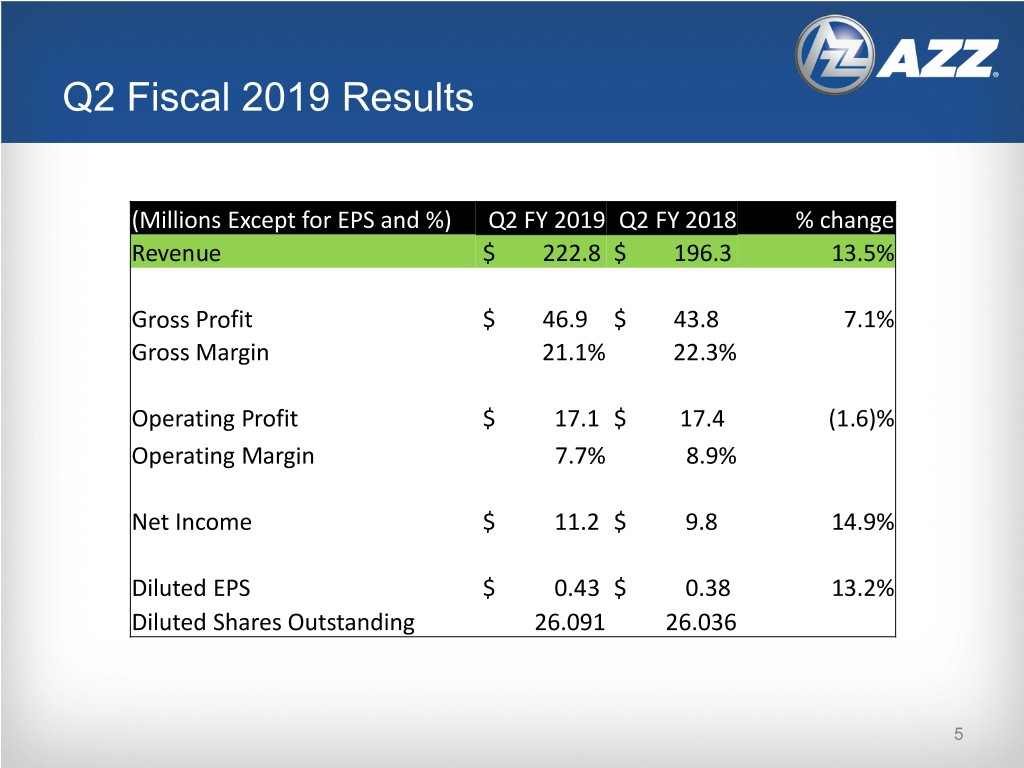

Q2 Fiscal 2019 Results (Millions Except for EPS and %) Q2 FY 2019 Q2 FY 2018 % change Revenue $ 222.8 $ 196.3 13.5% Gross Profit $ 46.9 $ 43.8 7.1% Gross Margin 21.1% 22.3% Operating Profit $ 17.1 $ 17.4 (1.6)% Operating Margin 7.7% 8.9% Net Income $ 11.2 $ 9.8 14.9% Diluted EPS $ 0.43 $ 0.38 13.2% Diluted Shares Outstanding 26.091 26.036 5

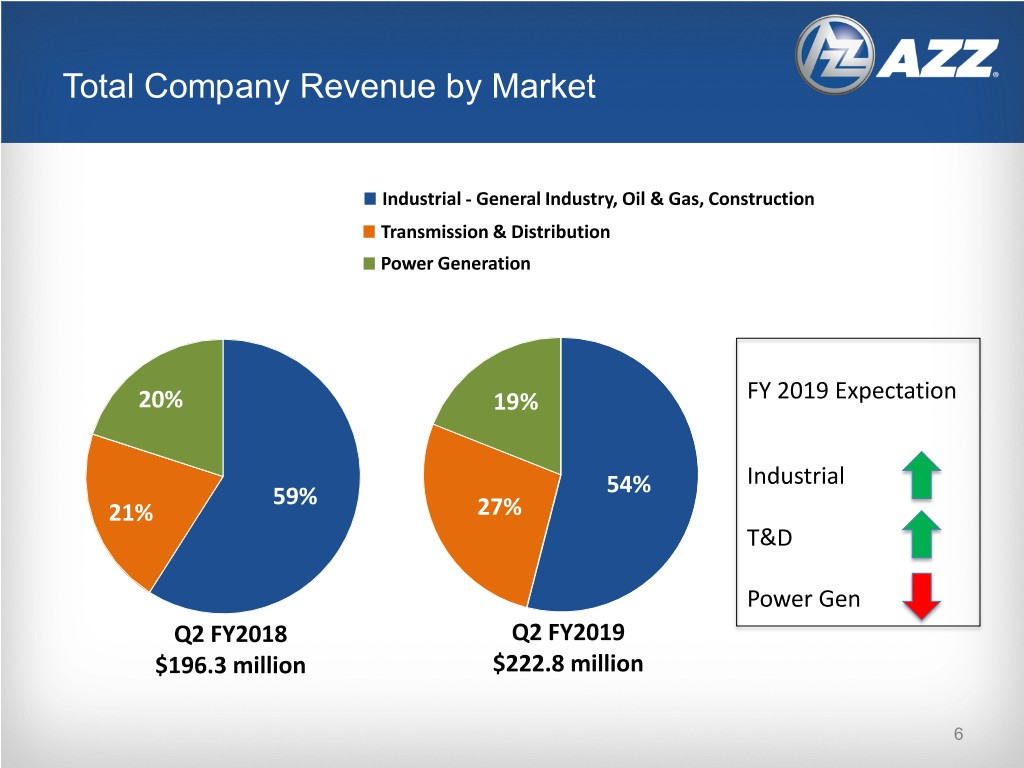

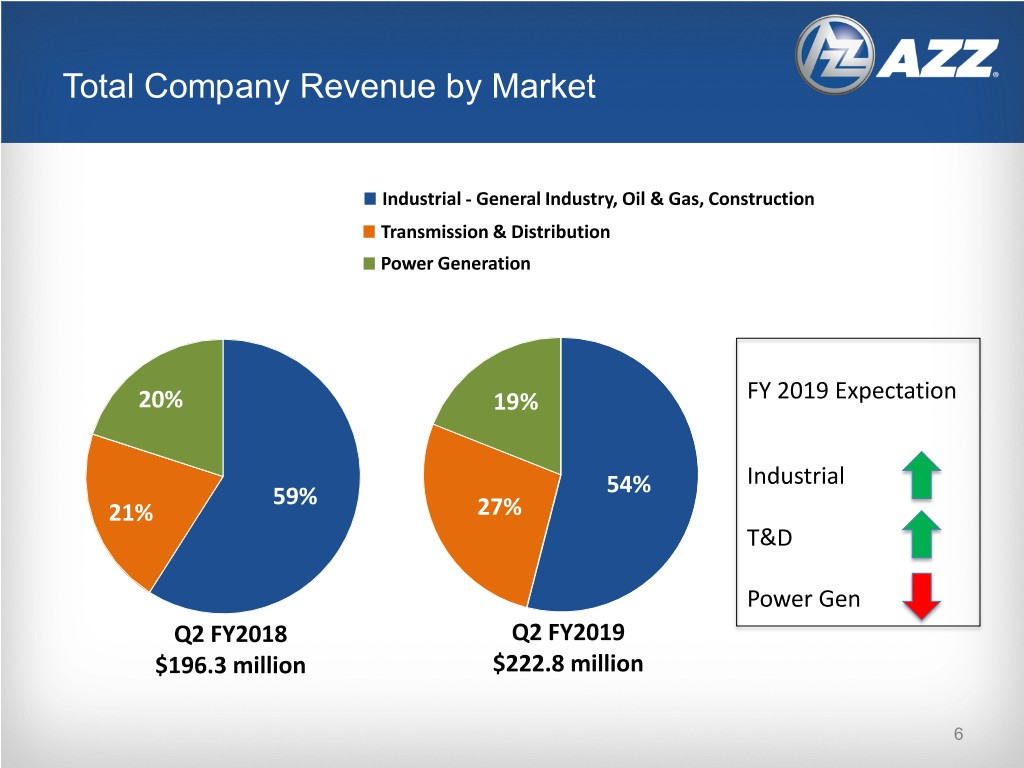

Total Company Revenue by Market Industrial - General Industry, Oil & Gas, Construction Transmission & Distribution Power Generation 20% 19% FY 2019 Expectation Industrial 59% 54% 21% 27% T&D Power Gen Q2 FY2018 Q2 FY2019 $196.3 million $222.8 million 6

First Half FY 2019 Cash Flow Highlights (Millions except for %) H1 FY 2019 H1 FY 2018 Cash flows provided by operating activities $17.5 $2.8 Less: Capital Expenditures $(7.2) $(16.6) Free Cash Flow $10.3 $(13.8) Net Income $27.0 $21.8 Free Cash Flow/Net Income 38.1% (63.3)% Acquisition of subsidiaries, net of cash acquired $8.0 $10.3 Dividends $8.8 $8.8 Share repurchases $0.0 $5.2 7

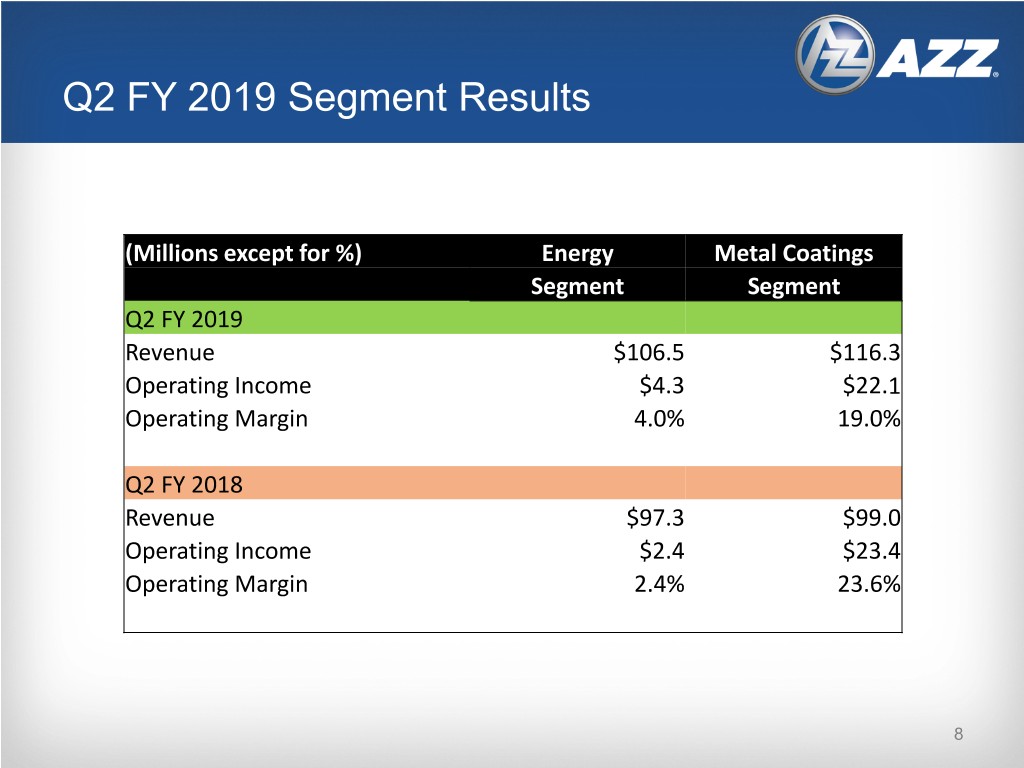

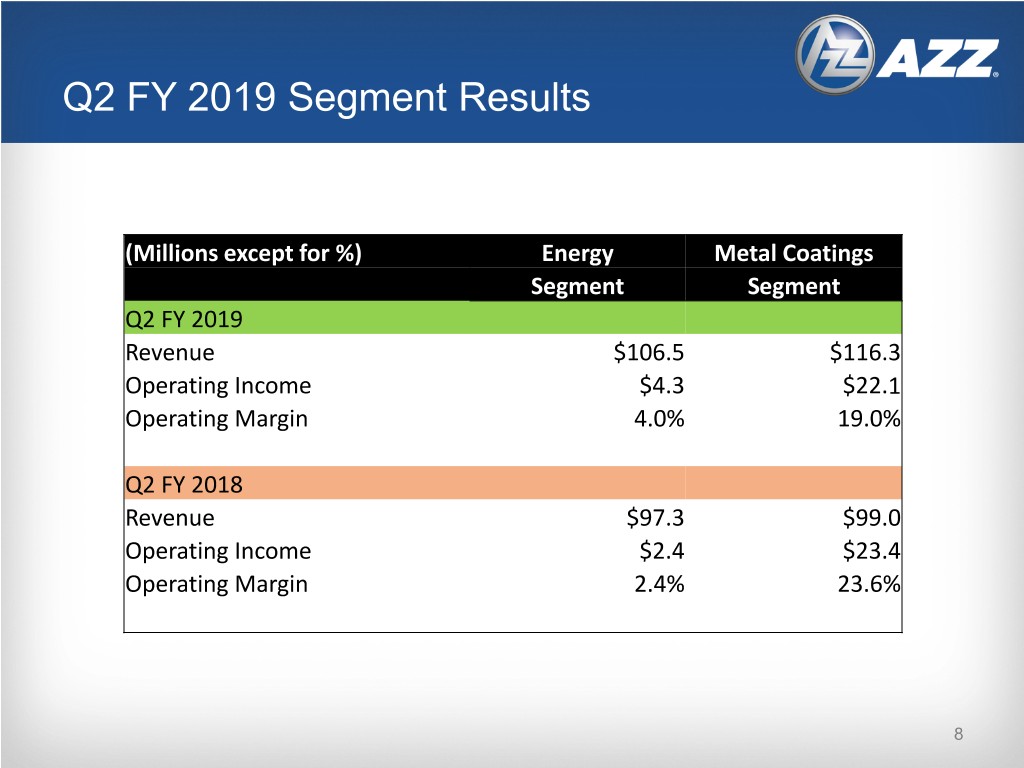

Q2 FY 2019 Segment Results (Millions except for %) Energy Metal Coatings Segment Segment Q2 FY 2019 Revenue $106.5 $116.3 Operating Income $4.3 $22.1 Operating Margin 4.0% 19.0% Q2 FY 2018 Revenue $97.3 $99.0 Operating Income $2.4 $23.4 Operating Margin 2.4% 23.6% 8

Updated FY2019 Guidance FY 2019 Revenue $930 - $970 million Earnings per share $1.90 - $2.25 Updated from previous guidance of Revenue of $900-$960 million and EPS of $1.75-$2.25 per annum driven by: • Metal Coatings experiencing stronger market demand, and will benefit from a stronger selling effort emphasizing value pricing and improved traction on operational improvement initiatives, including Digitization initiative • Metal Coatings income will benefit from the recent reductions in the cost of zinc for the second half, the impact of operational excellence initiatives, lower overhead expense due to site consolidation, and improved execution • Industrial is seeing stronger turnaround activity and highly active international markets in second half that will counter the weak nuclear market • Electrical enclosure market has improved and we will benefit from our acquisitions to serve this market; new management is quickly gaining traction resulting in improved operational execution 9

FY2019 Risks • Metal Coatings cannot offset zinc and direct labor cost increases with price, and operational execution efforts falter • AZZ’s ongoing recruiting and retention efforts fail to provide enough skilled and semi-skilled craft to satisfy demand • Electrical Group’s operational improvement initiatives do not provide the expected margin improvement AZZ believes it has taken steps to effectively mitigate the risks within our control 10

Q&A