Precoat Acquisition Value Creation June 16, 2022 Confidential

Board Considerations 2 Background: AZZ management had been evaluating Precoat Metals as a potential acquisition target since 2019, which made it well positioned to respond quickly when Carlyle/Sequa commenced an auction process in November 2021. AZZ engaged with the board of directors, and various external subject matter experts during the due diligence process, evaluating several acquisition structure alternatives and financing options. Process: To assist with the proposed debt financing, AZZ engaged Citi and Wells Fargo as joint lead book runners and engaged its larger bank group for potential financing structures. AZZ also engaged EY Capital Markets as an independent financial advisor. AZZ and its advisors evaluated several financing alternatives during a tightening credit market, including 100% debt financing for the purchase price or various combinations of debt and equity to reduce potential leverage, including a private offering of an equity-linked security that could eventually be converted into common stock and a public or private offering of common stock. To reduce the potential leverage incurred with 100% debt financing and the desire to lower the equity cost of capital compared to a pure common stock offering, the AZZ board decided to pursue a private offering of equity-linked securities. Private Offering with Blackstone: After consideration of several equity-linked financing partners and, after extensive consultation with the Board, AZZ selected Blackstone based on the favorable terms and conditions offered and Blackstone’s reputation for rapid and efficient deal completion and value-added advisory services.

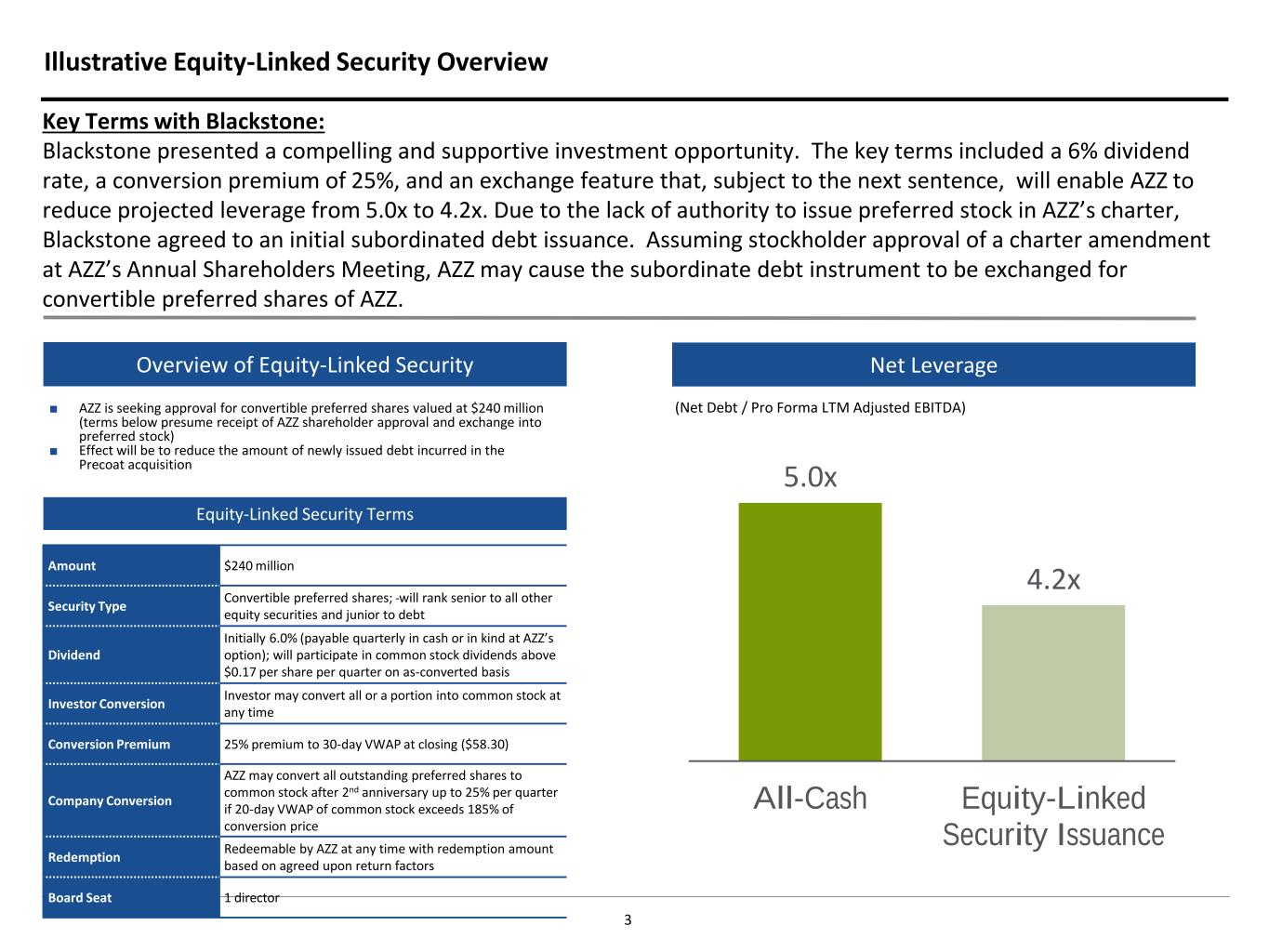

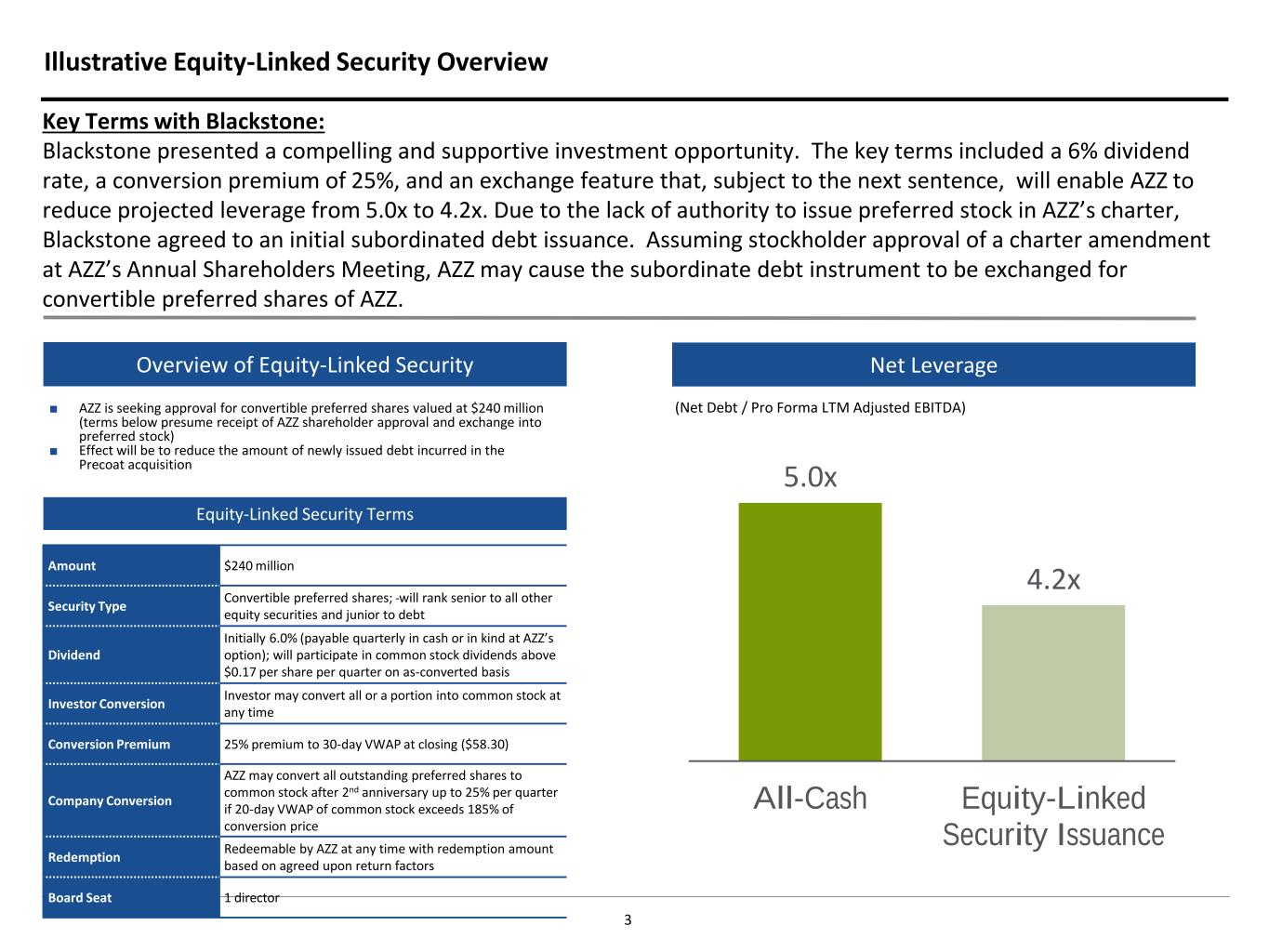

Illustrative Equity-Linked Security Overview Overview of Equity-Linked Security Net Leverage ■ AZZ is seeking approval for convertible preferred shares valued at $240 million (terms below presume receipt of AZZ shareholder approval and exchange into preferred stock) ■ Effect will be to reduce the amount of newly issued debt incurred in the Precoat acquisition (Net Debt / Pro Forma LTM Adjusted EBITDA) Amount $240 million Security Type Convertible preferred shares; will rank senior to all other equity securities and junior to debt Dividend Initially 6.0% (payable quarterly in cash or in kind at AZZ’s option); will participate in common stock dividends above $0.17 per share per quarter on as-converted basis Investor Conversion Investor may convert all or a portion into common stock at any time Conversion Premium 25% premium to 30-day VWAP at closing ($58.30) Company Conversion AZZ may convert all outstanding preferred shares to common stock after 2nd anniversary up to 25% per quarter if 20-day VWAP of common stock exceeds 185% of conversion price Redemption Redeemable by AZZ at any time with redemption amount based on agreed upon return factors Board Seat 1 director Equity-Linked Security Terms 5.0x 4.2x All-Cash Equity-Linked Security Issuance 3 Key Terms with Blackstone: Blackstone presented a compelling and supportive investment opportunity. The key terms included a 6% dividend rate, a conversion premium of 25%, and an exchange feature that, subject to the next sentence, will enable AZZ to reduce projected leverage from 5.0x to 4.2x. Due to the lack of authority to issue preferred stock in AZZ’s charter, Blackstone agreed to an initial subordinated debt issuance. Assuming stockholder approval of a charter amendment at AZZ’s Annual Shareholders Meeting, AZZ may cause the subordinate debt instrument to be exchanged for convertible preferred shares of AZZ.

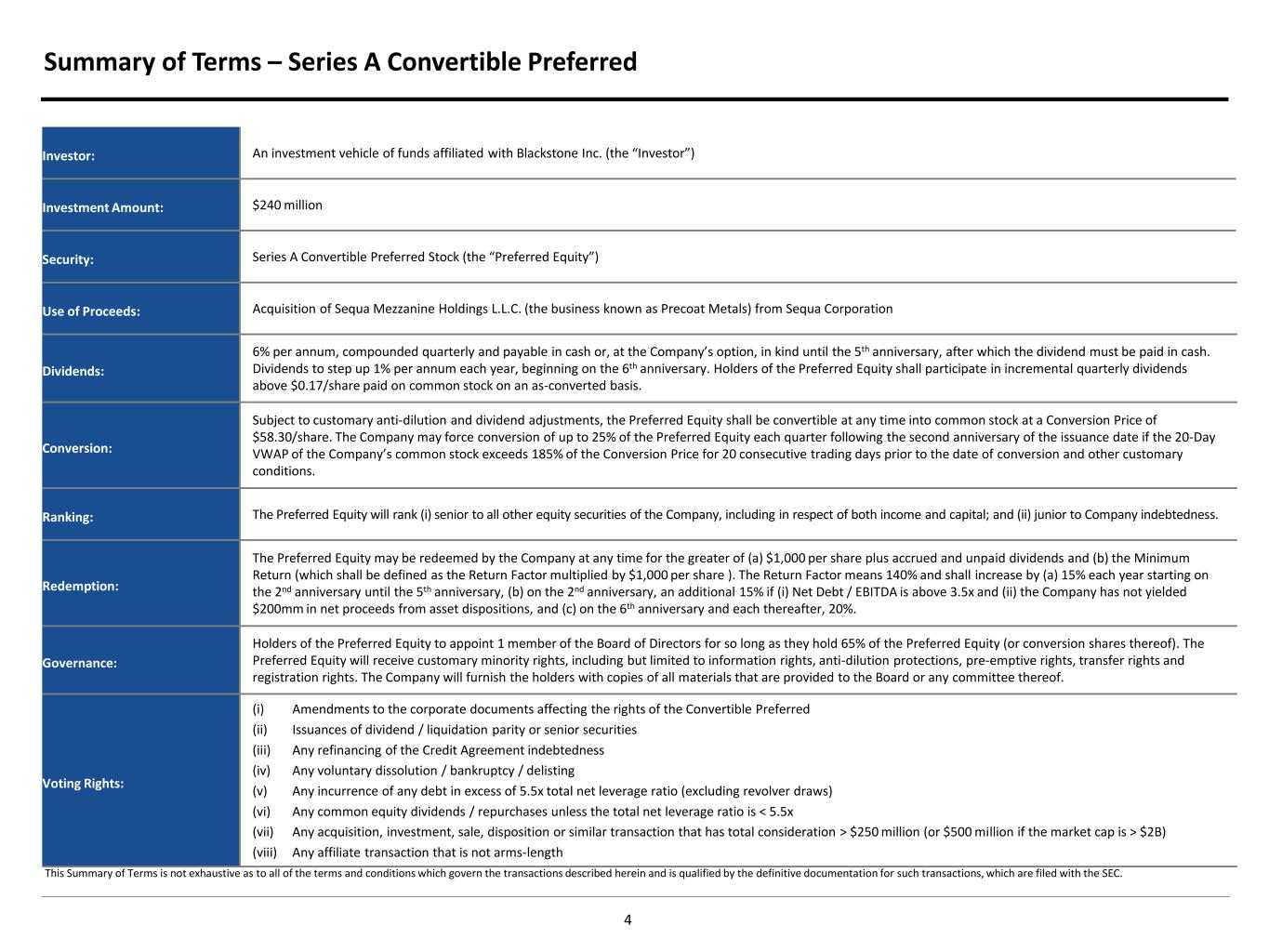

Summary of Terms – Series A Convertible Preferred 4 Investor: An investment vehicle of funds affiliated with Blackstone Inc. (the “Investor”) Investment Amount: $240 million Security: Series A Convertible Preferred Stock (the “Preferred Equity”) Use of Proceeds: Acquisition of Sequa Mezzanine Holdings L.L.C. (the business known as Precoat Metals) from Sequa Corporation Dividends: 6% per annum, compounded quarterly and payable in cash or, at the Company’s option, in kind until the 5th anniversary, after which the dividend must be paid in cash. Dividends to step up 1% per annum each year, beginning on the 6th anniversary. Holders of the Preferred Equity shall participate in incremental quarterly dividends above $0.17/share paid on common stock on an as-converted basis. Conversion: Subject to customary anti-dilution and dividend adjustments, the Preferred Equity shall be convertible at any time into common stock at a Conversion Price of $58.30/share. The Company may force conversion of up to 25% of the Preferred Equity each quarter following the second anniversary of the issuance date if the 20-Day VWAP of the Company’s common stock exceeds 185% of the Conversion Price for 20 consecutive trading days prior to the date of conversion and other customary conditions. Ranking: The Preferred Equity will rank (i) senior to all other equity securities of the Company, including in respect of both income and capital; and (ii) junior to Company indebtedness. Redemption: The Preferred Equity may be redeemed by the Company at any time for the greater of (a) $1,000 per share plus accrued and unpaid dividends and (b) the Minimum Return (which shall be defined as the Return Factor multiplied by $1,000 per share ). The Return Factor means 140% and shall increase by (a) 15% each year starting on the 2nd anniversary until the 5th anniversary, (b) on the 2nd anniversary, an additional 15% if (i) Net Debt / EBITDA is above 3.5x and (ii) the Company has not yielded $200mm in net proceeds from asset dispositions, and (c) on the 6th anniversary and each thereafter, 20%. Governance: Holders of the Preferred Equity to appoint 1 member of the Board of Directors for so long as they hold 65% of the Preferred Equity (or conversion shares thereof). The Preferred Equity will receive customary minority rights, including but limited to information rights, anti-dilution protections, pre-emptive rights, transfer rights and registration rights. The Company will furnish the holders with copies of all materials that are provided to the Board or any committee thereof. Voting Rights: (i) Amendments to the corporate documents affecting the rights of the Convertible Preferred (ii) Issuances of dividend / liquidation parity or senior securities (iii) Any refinancing of the Credit Agreement indebtedness (iv) Any voluntary dissolution / bankruptcy / delisting (v) Any incurrence of any debt in excess of 5.5x total net leverage ratio (excluding revolver draws) (vi) Any common equity dividends / repurchases unless the total net leverage ratio is < 5.5x (vii) Any acquisition, investment, sale, disposition or similar transaction that has total consideration > $250 million (or $500 million if the market cap is > $2B) (viii) Any affiliate transaction that is not arms-length This Summary of Terms is not exhaustive as to all of the terms and conditions which govern the transactions described herein and is qualified by the definitive documentation for such transactions, which are filed with the SEC.

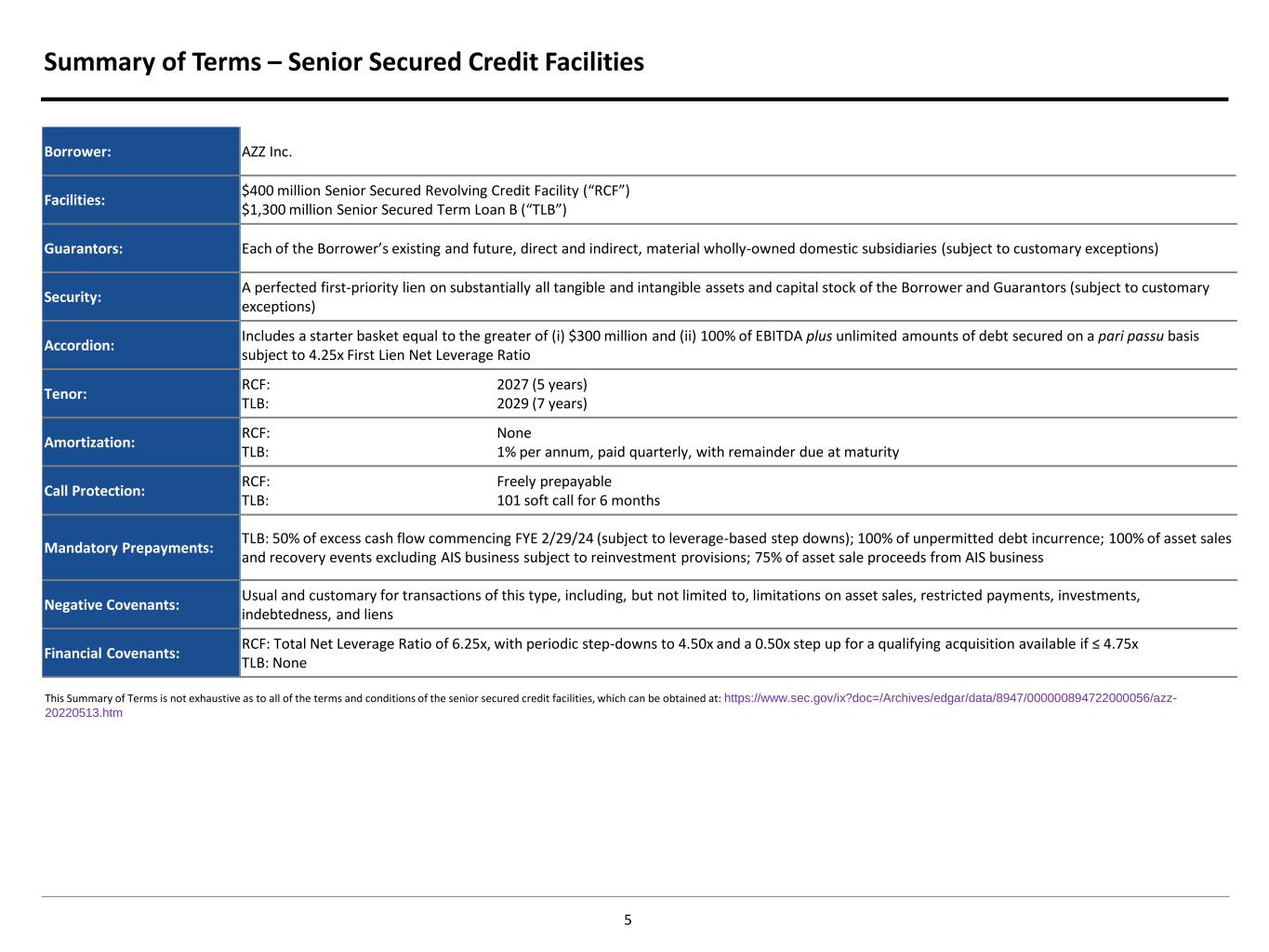

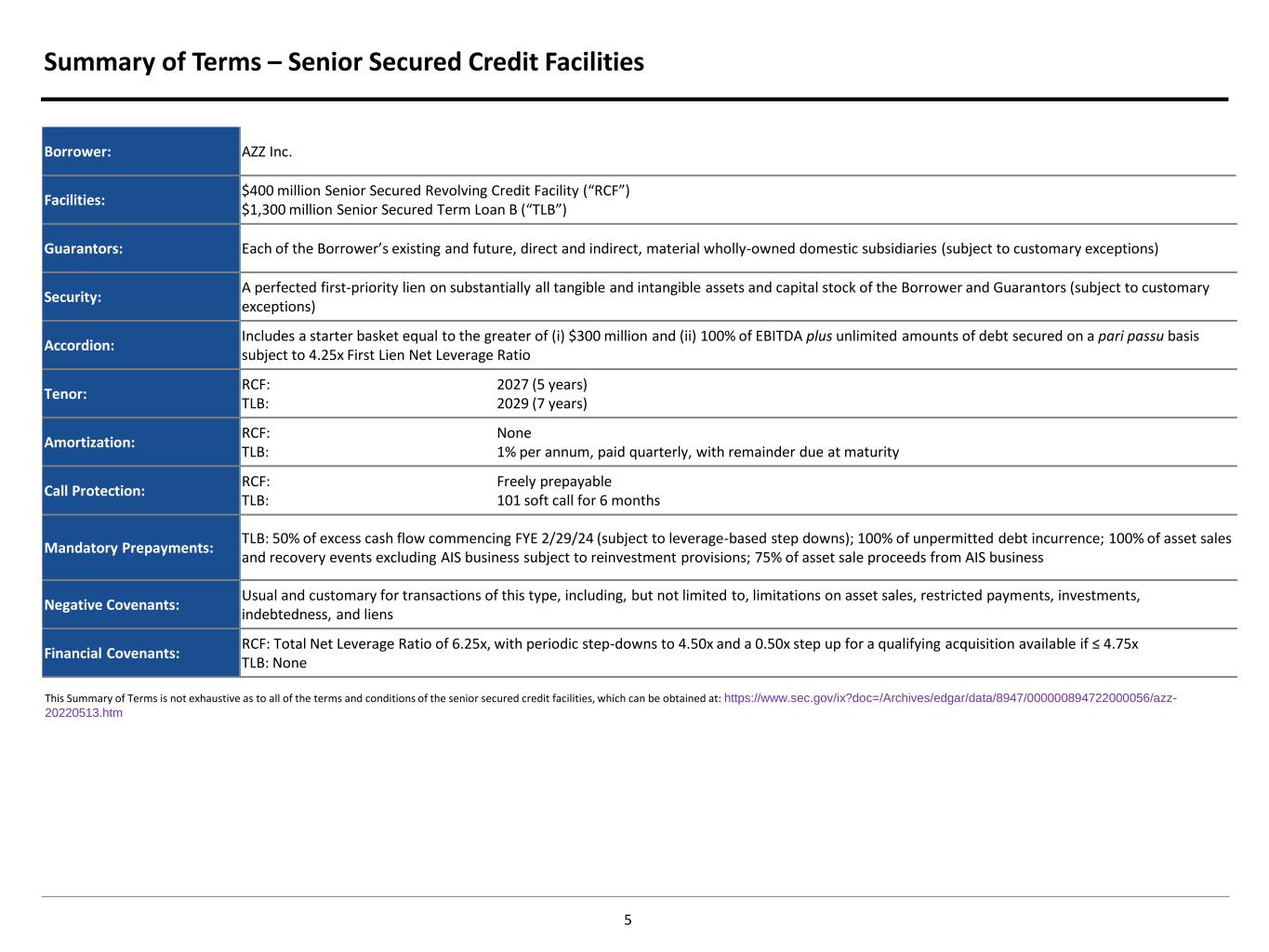

Summary of Terms – Senior Secured Credit Facilities 5 Borrower: AZZ Inc. Facilities: $400 million Senior Secured Revolving Credit Facility (“RCF”) $1,300 million Senior Secured Term Loan B (“TLB”) Guarantors: Each of the Borrower’s existing and future, direct and indirect, material wholly-owned domestic subsidiaries (subject to customary exceptions) Security: A perfected first-priority lien on substantially all tangible and intangible assets and capital stock of the Borrower and Guarantors (subject to customary exceptions) Accordion: Includes a starter basket equal to the greater of (i) $300 million and (ii) 100% of EBITDA plus unlimited amounts of debt secured on a pari passu basis subject to 4.25x First Lien Net Leverage Ratio Tenor: RCF: 2027 (5 years) TLB: 2029 (7 years) Amortization: RCF: None TLB: 1% per annum, paid quarterly, with remainder due at maturity Call Protection: RCF: Freely prepayable TLB: 101 soft call for 6 months Mandatory Prepayments: TLB: 50% of excess cash flow commencing FYE 2/29/24 (subject to leverage-based step downs); 100% of unpermitted debt incurrence; 100% of asset sales and recovery events excluding AIS business subject to reinvestment provisions; 75% of asset sale proceeds from AIS business Negative Covenants: Usual and customary for transactions of this type, including, but not limited to, limitations on asset sales, restricted payments, investments, indebtedness, and liens Financial Covenants: RCF: Total Net Leverage Ratio of 6.25x, with periodic step-downs to 4.50x and a 0.50x step up for a qualifying acquisition available if ≤ 4.75x TLB: None This Summary of Terms is not exhaustive as to all of the terms and conditions of the senior secured credit facilities, which can be obtained at: https://www.sec.gov/ix?doc=/Archives/edgar/data/8947/000000894722000056/azz- 20220513.htm

Blackstone Benefits 6 Engaging with Blackstone provides the Company significant potential forward-looking benefits: • Capital markets and Merger & Acquisition expertise • Employee benefits and healthcare program advantages • Procurement savings • Support for ESG strategy • Identification and execution of new revenue opportunities • Access to data science and data analytics capabilities • Leadership and talent support Note: No assurance can be made that Blackstone will find opportunities relating to the above themes, or that they will achieve their objectives or avoid substantial losses. Independent full-time operating advisors, senior advisors and consultants are not Blackstone employees. The level of involvement and role of the advisors and consultants with Blackstone portfolio companies may vary, including having no involvement at all. These are just selected examples, and savings will vary through various portfolio companies. A Blackstone investment in any portfolio company is no guarantee of future commercial opportunities for such company, and none of Blackstone or their affiliates makes any representation or warranty regarding such opportunities for any portfolio company.