Exhibit 99.2

Cautionary Statements Regarding Forward - Looking Information This Document by theMaven , Inc. (“Parent”), which includes information for its wholly owned subsidiaries Maven Coalition, Inc., HubPages , Inc. and SM Acquisition Co., Inc. (collectively “ theMaven ,” “Company” or “we”) contains “forward - looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward - looking statements relate to future events or future performance and include, without limitation, statements concerning the Company’s business strategy, future revenues, market growth, capital requirements, product introductions and expansion plans and the adequacy of the Company’s funding. Other statements contained in this Document that are not historical facts are also forward - looking statements. The Company has tried, wherever possible, to identify forward - looking statements by terminology such as “may,” “will,” “could,” “should,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and other comparable terminology. The Company cautions investors that any forward - looking statements presented in this Document, or that the Company may make orally or in writing from time to time, are based on the beliefs of, assumptions made by, and information currently available to, the Company. Such statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond the Company’s control or ability to predict. Although the Company believes that its assumptions are reasonable, they are not guarantees of future performance, and some will inevitably prove to be incorrect. As a result, the Company’s actual future results can be expected to differ from its expectations, and those differences may be material. Accordingly, investors should use caution in relying on forward - looking statements, which are based only on known results and trends at the time they are made, to anticipate future results or trends. More detailed information about the Company and the risk factors that may affect the realization of forward - looking statements is set forth in the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10 - K. This Document and all subsequent written and oral forward - looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. The Company does not undertake any obligation to release publicly any revisions to its forward - looking statements to reflect events or circumstances after the date of this Document. This Document shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state. Regarding Financial Projections Projections of future financial performance have been prepared by the Company to assist in the evaluation of the Company and are not to be relied upon as an accurate representation of future results. Furthermore, because the pro forma financial information is based upon estimates and assumptions about circumstances and events that have not been audited and are subject to variation, there can be no assurance that the unaudited proforma data will be attained. Predictions and projections as to future events are subject to a high degree of risk and uncertainty. The pro forma financial information should not be regarded as a representation, expressed or implied, by the Company or any person that the results set forth therein will be achieved. Changes in facts underlying the assumptions, among others, may have a material adverse effect upon the Company’s business, results of operation and financial condition. The Company does not intend to update or otherwise revise the projections or proforma data to reflect circumstances existing after the date of this document or to reflect the occurrence of unanticipated events even if any or all of the underlying assumptions do not come to fruition. Further, the Company does not intend to update or revise the projections or proforma data to reflect changes in general economic conditions. The projections were not prepared under the guidelines established by the American Institute of Certified Public Accountants or any other rules or regulations of any governing authority. There can be no assurance that the projections will be realized. It can be expected that actual results will vary from those set forth in the projections, and the variations may be material and adverse. Prospective investors are cautioned not to place reliance on the projections or proforma data. 1

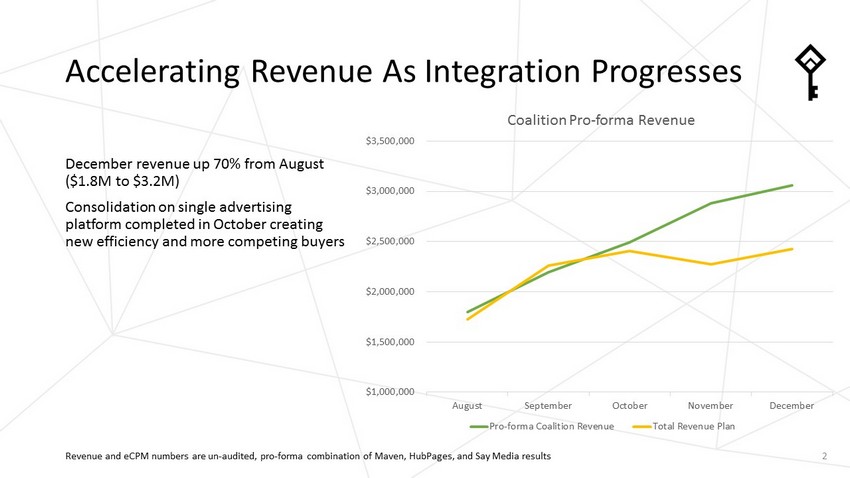

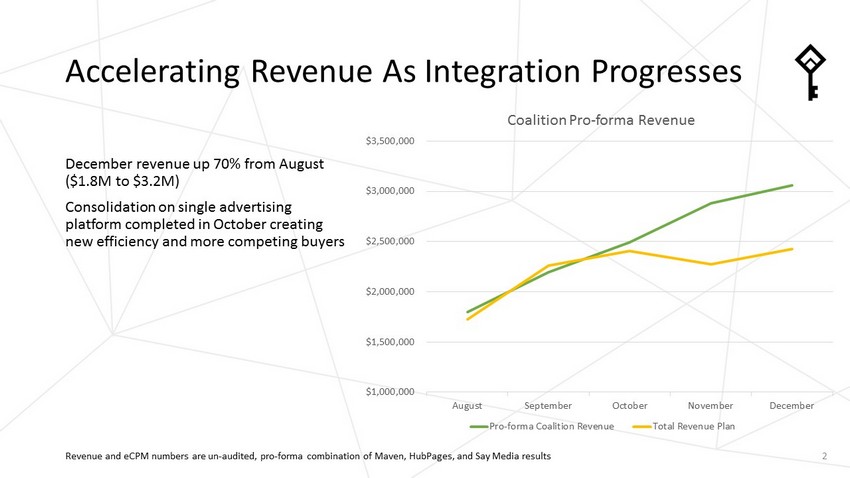

Accelerating Revenue As Integration Progresses December revenue up 70% from August ($1.8M to $3.2M) Consolidation on single advertising platform completed in October creating new efficiency and more competing buyers 2 Revenue and eCPM numbers are un - audited, pro - forma combination of Maven, HubPages , and Say Media results $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 August September October November December Coalition Pro - forma Revenue Pro-forma Coalition Revenue Total Revenue Plan

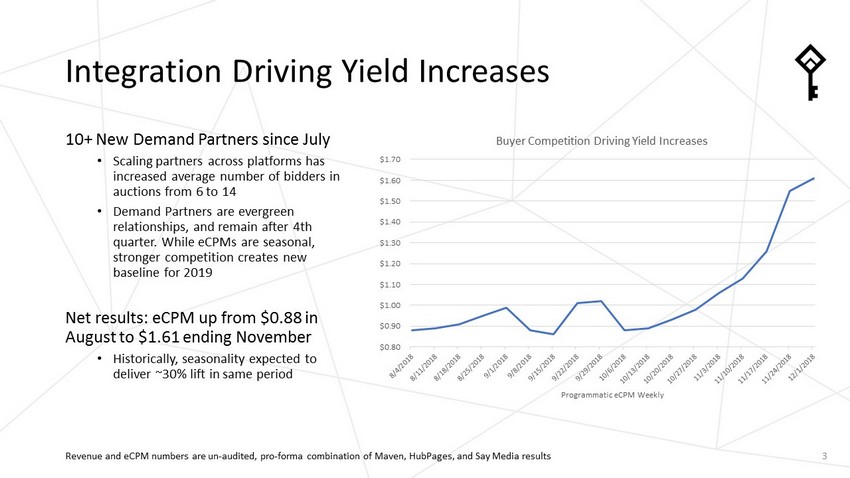

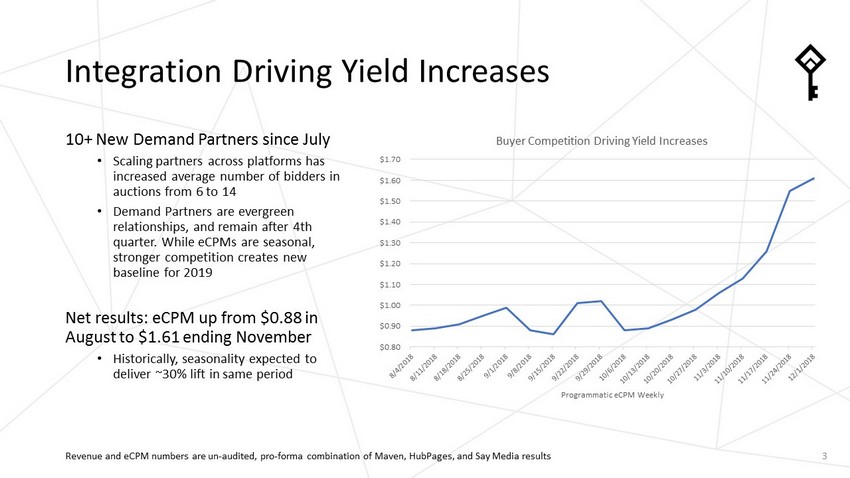

Integration Driving Yield Increases 10+ New Demand Partners since July • Scaling partners across platforms has increased average number of bidders in auctions from 6 to 14 • Demand Partners are evergreen relationships, and remain after 4th quarter. While eCPMs are seasonal, stronger competition creates new baseline for 2019 Net results: eCPM up from $0.88 in August to $1.61 ending November • Historically, seasonality expected to deliver ~30% lift in same period 3 Revenue and eCPM numbers are un - audited, pro - forma combination of Maven, HubPages , and Say Media results $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 $1.40 $1.50 $1.60 $1.70 Programmatic eCPM Weekly Buyer Competition Driving Yield Increases

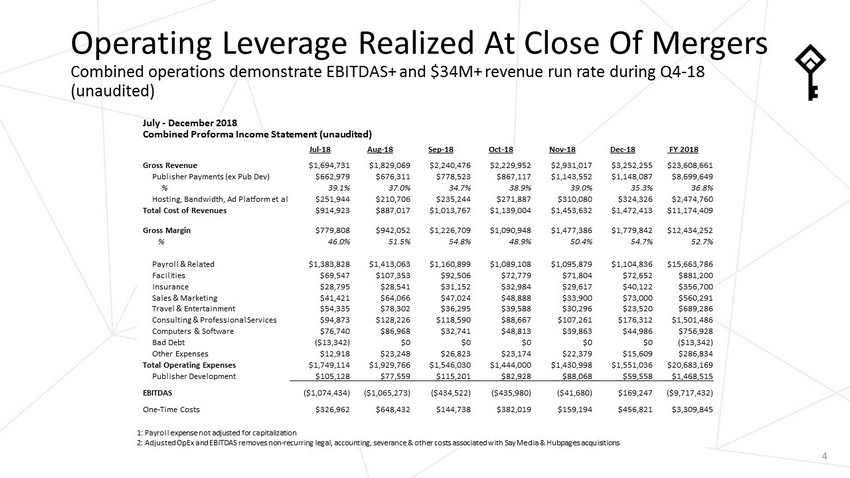

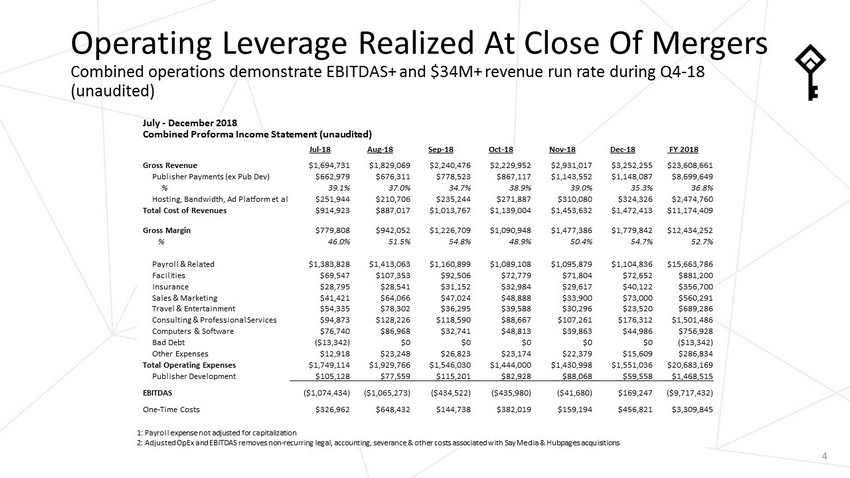

July - December 2018 Combined Proforma Income Statement (unaudited) 4 Jul - 18 Aug - 18 Sep - 18 Oct - 18 Nov - 18 Dec - 18 FY 2018 Gross Revenue $1,694,731 $1,829,069 $2,240,476 $2,229,952 $2,931,017 $3,252,255 $23,608,661 Publisher Payments (ex Pub Dev) $662,979 $676,311 $778,523 $867,117 $1,143,552 $1,148,087 $8,699,649 % 39.1% 37.0% 34.7% 38.9% 39.0% 35.3% 36.8% Hosting, Bandwidth, Ad Platform et al $251,944 $210,706 $235,244 $271,887 $310,080 $324,326 $2,474,760 Total Cost of Revenues $914,923 $887,017 $1,013,767 $1,139,004 $1,453,632 $1,472,413 $11,174,409 Gross Margin $779,808 $942,052 $1,226,709 $1,090,948 $1,477,386 $1,779,842 $12,434,252 % 46.0% 51.5% 54.8% 48.9% 50.4% 54.7% 52.7% Payroll & Related $1,383,828 $1,413,063 $1,160,899 $1,089,108 $1,095,879 $1,104,836 $15,663,786 Facilities $69,547 $107,353 $92,506 $72,779 $71,804 $72,652 $881,200 Insurance $28,795 $28,541 $31,152 $32,984 $29,617 $40,122 $356,700 Sales & Marketing $41,421 $64,066 $47,024 $48,888 $33,900 $73,000 $560,291 Travel & Entertainment $54,335 $78,302 $36,295 $39,588 $30,296 $23,520 $689,286 Consulting & Professional Services $94,873 $128,226 $118,590 $88,667 $107,261 $176,312 $1,501,486 Computers & Software $76,740 $86,968 $32,741 $48,813 $39,863 $44,986 $756,928 Bad Debt ($13,342) $0 $0 $0 $0 $0 ($13,342) Other Expenses $12,918 $23,248 $26,823 $23,174 $22,379 $15,609 $286,834 Total Operating Expenses $1,749,114 $1,929,766 $1,546,030 $1,444,000 $1,430,998 $1,551,036 $20,683,169 Publisher Development $105,128 $77,559 $115,201 $82,928 $88,068 $59,558 $1,468,515 EBITDAS ($1,074,434) ($1,065,273) ($434,522) ($435,980) ($41,680) $169,247 ($9,717,432) One - Time Costs $326,962 $648,432 $144,738 $382,019 $159,194 $456,821 $3,309,845 1: Payroll expense not adjusted for capitalization 2: Adjusted OpEx and EBITDAS removes non - recurring legal, accounting, severance & other costs associated with Say Media & Hubpages acquisitions Operating Leverage Realized At Close Of Mergers Combined operations demonstrate EBITDAS+ and $34M+ revenue run rate during Q4 - 18 (unaudited)

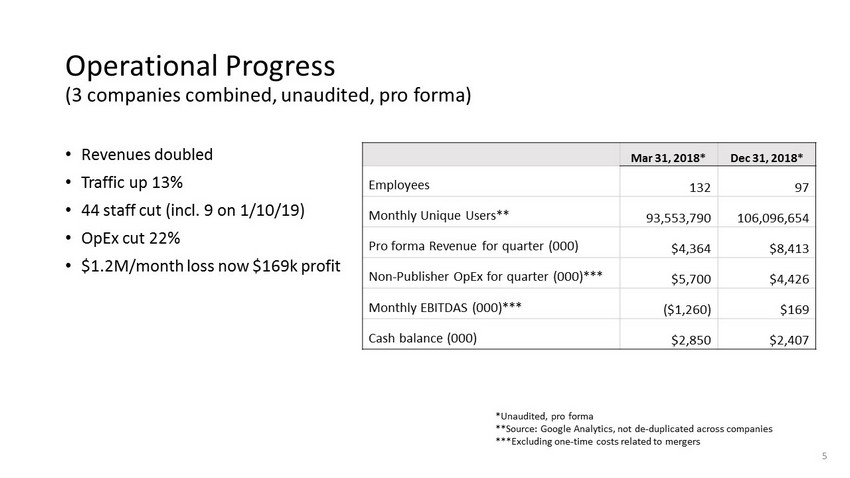

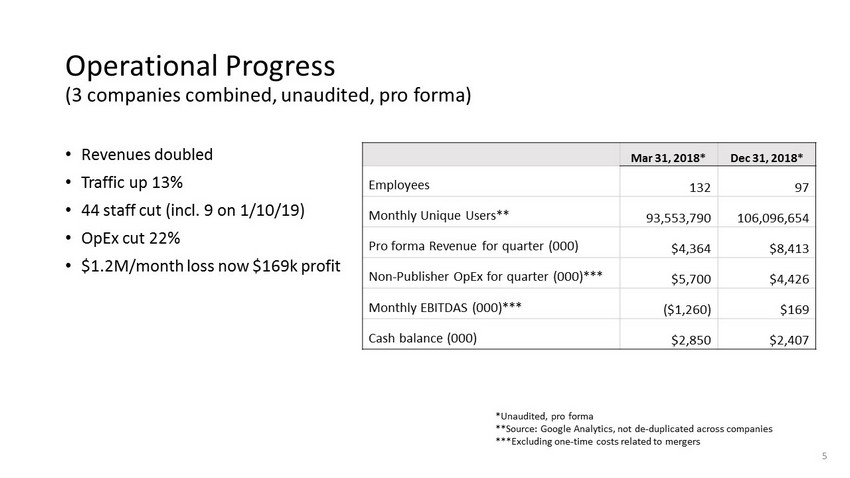

Operational Progress (3 companies combined, unaudited, pro forma) 5 Mar 31, 2018* Dec 31, 2018* Employees 132 97 Monthly Unique Users** 93,553,790 106,096,654 Pro forma Revenue for quarter (000) $4,364 $8,413 Non - Publisher OpEx for quarter (000)*** $5,700 $4,426 Monthly EBITDAS (000)*** ($1,260) $169 Cash balance (000) $2,850 $2,407 *Unaudited, pro forma **Source: Google Analytics, not de - duplicated across companies ***Excluding one - time costs related to mergers • Revenues doubled • Traffic up 13% • 44 staff cut (incl. 9 on 1/10/19) • OpEx cut 22% • $1.2M/month loss now $169k profit

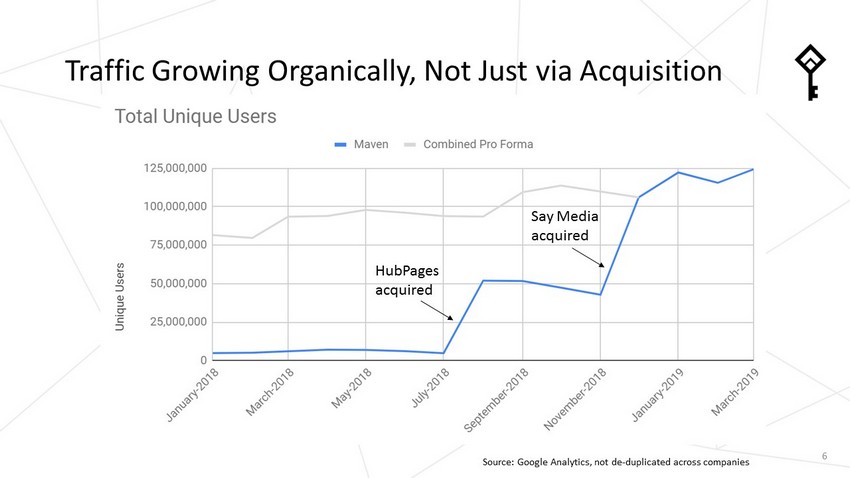

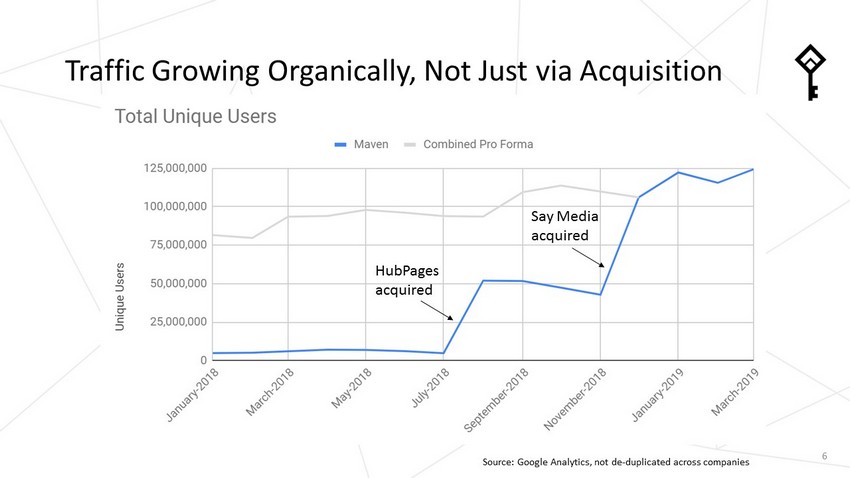

Traffic Growing Organically, Not Just via Acquisition 6 HubPages acquired Say Media acquired Source: Google Analytics, not de - duplicated across companies

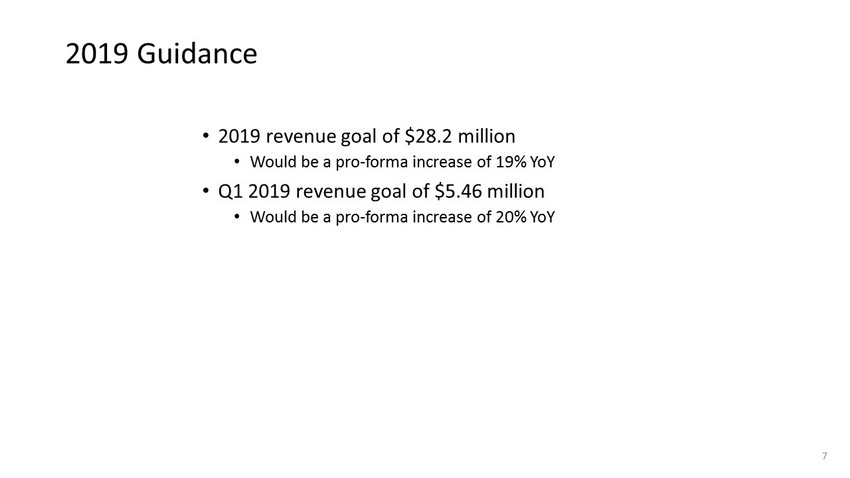

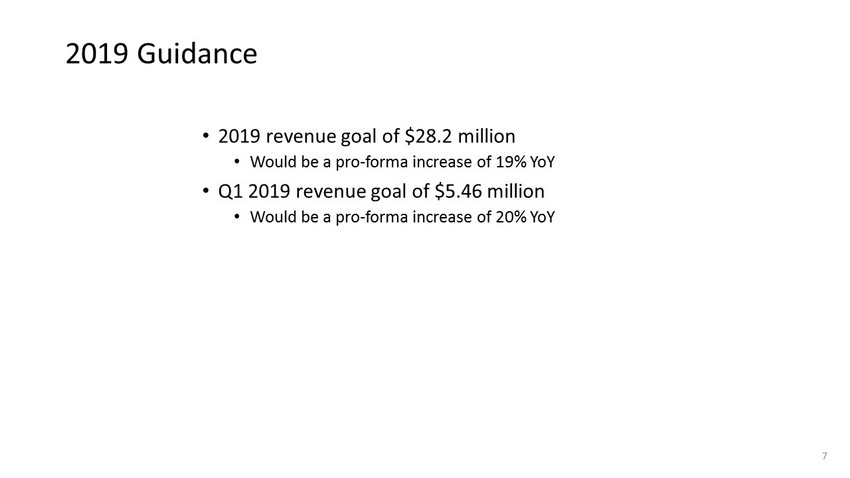

2019 Guidance 7 • 2019 revenue goal of $28.2 million • Would be a pro - forma increase of 19% YoY • Q1 2019 revenue goal of $5.46 million • Would be a pro - forma increase of 20% YoY