UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

CASI Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

CASI PHARMACEUTICALS, INC.

Notice of Annual Meeting of Stockholders

| Date: | Tuesday, June 15, 2021 | |

| Time: | 10:00 a.m., local time | |

| Place: | Hilton Garden Inn 14975 Shady Grove Road | |

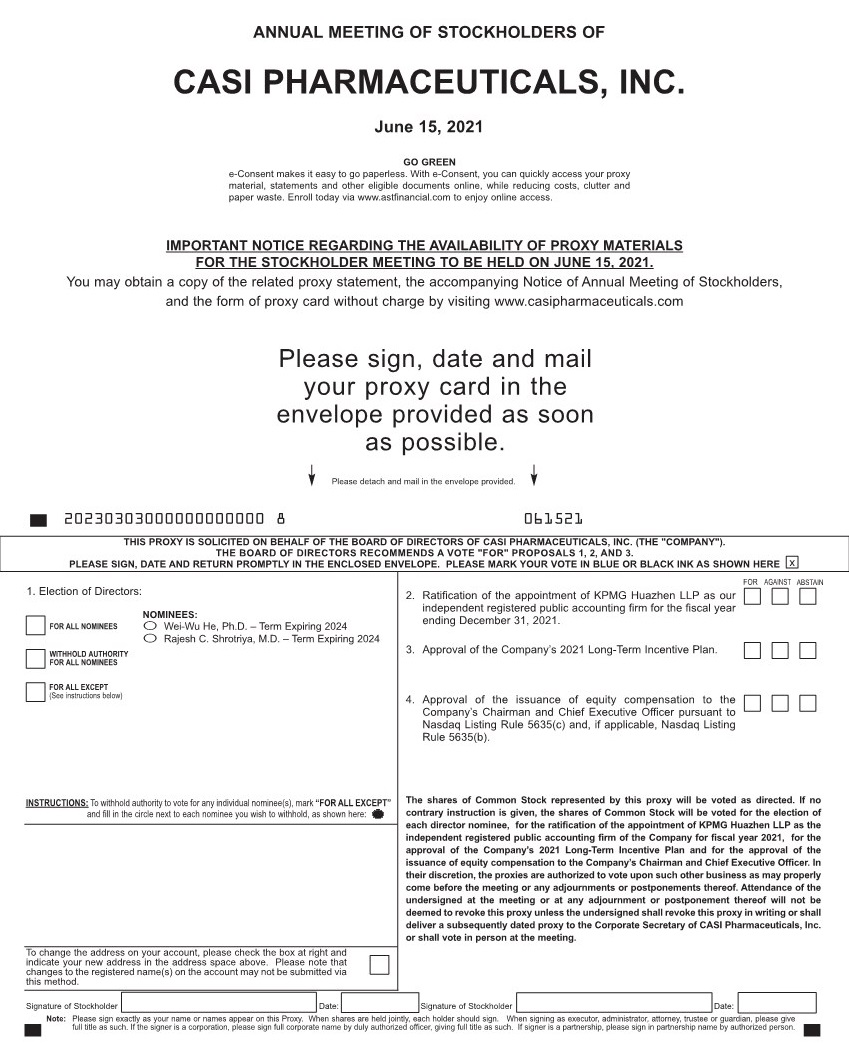

| Purposes: | 1. | To elect two directors;

|

| 2. | To ratify the appointment of KPMG Huazhen LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021;

| |

| 3. | To approve the Company’s 2021 Long-Term Incentive Plan;

| |

| 4. | To approve the issuance of equity compensation to the Company’s Chairman and Chief Executive Officer pursuant to Nasdaq Listing Rule 5635(c) and, if applicable, Nasdaq Listing Rule 5635(b); and

| |

| 5. | To consider and take action upon such other matters as may properly come before the Annual Meeting or any postponement or adjournment thereof.

| |

| Who Can Vote: | Stockholders at the close of business on April 20, 2021. | |

Our Board of Directors has fixed April 20, 2021 as the record date for the determination of stockholders entitled to notice of, and to vote at, the 2021 annual meeting of stockholders (the “Annual Meeting”). Only stockholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting.

We intend to hold our Annual Meeting in person at the location specified above. We will continue to monitor the coronavirus (“COVID-19”) situation and will follow all national and local government protocols. If you are planning to attend the Annual Meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

Details regarding the matters to be acted upon at the Annual Meeting appear in the accompanying Proxy Statement. Please give this material your careful attention.

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend, you are respectfully requested by the Board of Directors to sign, date and return the enclosed proxy promptly. Stockholders who execute proxies retain the right to revoke them at any time prior to the voting thereof. A return envelope, which requires no postage if mailed in the United States, is enclosed for your convenience.

| By Order of the Board of Directors, | |

| Dr. Wei-Wu He | |

| May , 2021 | Chairman and CEO |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

This Proxy Statement relating to the 2021 Annual Meeting of Stockholders and the Annual Report to Stockholders on Form 10-K for the year ended December 31, 2020 are also available for viewing, printing and downloading at www.casipharmaceuticals.com. |

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held on June 15, 2021

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of CASI Pharmaceuticals, Inc., a Delaware corporation (the “Company”), the principal executive offices of which are located at 9620 Medical Center Drive, Suite 300, Rockville, Maryland 20850, for the Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held at the Hilton Garden Inn, 14975 Shady Grove Road, Rockville, MD 20850 on June 15, 2021, at 10:00 a.m. (local time) and for any postponement, or adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. Any stockholder giving a proxy has the power to revoke it at any time before it is voted. Written notice of such revocation should be forwarded directly to the Secretary of the Company at the Company’s executive offices. Attendance at the Annual Meeting will not have the effect of revoking the proxy unless written notice is given or the stockholder votes by ballot at the Annual Meeting.

We intend to hold our Annual Meeting in person at the location specified above. We will continue to monitor the coronavirus (“COVID-19”) situation and will follow all national and local government protocols. If it is not possible or advisable to hold the Annual Meeting at the location specified above in person, we will announce on our website (www.casipharmaceuticals.com) and other sites, as required, appropriate alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting at an alternative location or by means of remote communication.

If the enclosed proxy is properly executed and returned, the shares represented thereby will be voted in accordance with the specified directions and otherwise in accordance with the judgment of the persons designated as proxies. Any proxy returned on which no direction is specified will be voted in favor of the actions described in this Proxy Statement, including the election of the director nominees set forth under the caption “Election of Directors,” the ratification of the appointment of KPMG Huazhen LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021, the approval of the Company’s 2021 Long-Term Incentive Plan and the approval of the issuance of equity compensation to the Company’s Chairman and Chief Executive Officer (“CEO Award”).

The approximate date on which this Proxy Statement and the accompanying form of proxy will first be mailed or given to the Company’s stockholders is May 10, 2021. Pursuant to rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by posting our proxy materials on the Internet. This Proxy Statement and our 2020 Annual Report to Stockholders on Form 10-K are available at www.casipharmaceuticals.com.

All references in this Proxy Statement to “the Company,” “we,” “our,” and “us” mean CASI Pharmaceuticals, Inc. Please note that the Company qualifies as a “smaller reporting company” for the fiscal year ended December 31, 2020 under the applicable rules of the SEC. Accordingly, this Proxy Statement reflects the scaled disclosure requirements available to smaller reporting companies.

Your vote is important.

Whether or not you plan to attend the Annual Meeting, please sign and return the accompanying proxy card so that we can be assured of having a quorum present at the meeting and so that your shares may be voted in accordance with your wishes.

2

Frequently Asked Questions

| Q: | Why am I receiving this Proxy Statement and proxy card? |

| A: | You are receiving a Proxy Statement and proxy card from us because you own shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) as of the record date. This Proxy Statement describes issues on which we would like you, as a stockholder, to vote. It also gives you information on these issues so that you can make an informed decision.

Cynthia W. Hu, the Company’s COO (U.S.), General Counsel & Secretary, Amanda Cui (VP, Global Controller), and Sara B. Capitelli, the Company’s VP, Finance, were named by the Board of Directors as proxy holders. Ms. Hu, Ms. Cui and Ms. Capitelli will vote all proxies, or record an abstention or withheld vote, in accordance with the directions on the proxy. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the meeting, please complete, sign and return your proxy card in advance of the meeting just in case you are unable to attend. You can always decide to vote in person. If no contrary direction is given, the shares will be voted as recommended by the Board of Directors. |

| Q: | What is the record date? |

| A: | The record date is April 20, 2021. Only holders of record of Common Stock as of the close of business on this date will be entitled to vote at the Annual Meeting. |

| Q: | How many shares are outstanding? |

| A: | As of the record date, the Company had 139,797,487 shares of Common Stock outstanding. |

| Q: | What am I voting on? |

| A: | You are being asked to vote on the election of two directors to the terms described in the Proxy Statement, the ratification of KPMG Huazhen LLP as the independent registered public accounting firm of the Company, the approval of the Company’s 2021 Long-Term Incentive Plan, the approval of the CEO Award, and such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

| Q: | How does the Board of Directors recommend I vote? |

| A: | Please see the information included in the proxy statement relating to the proposals to be voted on. Our Board of Directors unanimously recommends that you vote:

1. “FOR” the nominees to the Board of Directors;

2. “FOR” ratification of KPMG Huazhen LLP as our independent registered public accounting firm;

3. “FOR” the approval of the Company’s 2021 Long-Term Incentive Plan; and

4. “FOR” the approval of the CEO Award. |

| Q: | What happens if additional matters are presented at the Annual Meeting? |

| A: | Other than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting in accordance with Delaware law and our Bylaws. |

| Q: | How do I vote? |

| A: | You may either vote by mail or in person at the Annual Meeting. To vote by mail, please sign your proxy card and mail it in the enclosed, prepaid and addressed envelope. If you mark your voting instructions on the proxy card, your shares will be voted in accordance with your instructions. If you return a signed card but do not provide voting instructions, your shares will be voted based on the recommendations of the Board of Directors. We will pass out written ballots to anyone who wants to vote at the Annual Meeting. If you hold your shares through a brokerage account and do not have a physical share certificate, you must request a legal proxy from your stockbroker in order to vote at the Annual Meeting. |

3

| Q: | What does it mean if I receive more than one proxy card? |

| A: | It means that you have multiple accounts at the transfer agent and/or with stockbrokers. Please sign and return all proxy cards to ensure that all your shares are voted. |

| Q: | How many votes do you need to hold the Annual Meeting? |

| A: | A majority of the Company’s outstanding shares of Common Stock as of the record date must be present at the Annual Meeting, in person or in proxy, in order to hold the Annual Meeting and conduct business. This is called a quorum. Proxies received but marked as abstentions and broker non-votes, if any, will be included in the calculation of the number of shares considered to be present at the meeting for quorum purposes. |

| Q: | What is the voting requirement to approve the proposals? |

| A: | In order for a director to be elected, he must receive the affirmative vote of a plurality of the shares voted. In other words, the two nominees receiving the greatest number of affirmative votes cast will be elected. Abstentions and broker non-votes will not have an effect on the outcome of the election of directors.

Ratification of the appointment of KPMG Huazhen LLP as our independent registered public accounting firm also requires the affirmative vote of the majority of shares present or represented and entitled to vote. Abstentions are counted as votes present and entitled to vote and have the same effect as votes “against” the proposal.

Approval of the Company’s 2021 Long-Term Incentive Plan requires the affirmative vote of the majority of shares present or represented and entitled to vote. Abstentions are counted as votes present and entitled to vote and have the same effect as votes “against” the proposal.

Approval of the CEO Award requires the affirmative vote of the majority of shares present or represented and entitled to vote. Abstentions are counted as votes present and entitled to vote and have the same effect as votes “against” the proposal. |

| Q: | Do any of the Company’s officers and directors have an interest in the proposals? |

| A: | Yes. The Company’s Chairman and Executive Chairman, Wei-Wu He, Ph.D. will receive stock options covering eight million shares of the Company’s Common Stock, if the CEO Award is approved. |

| Q: | What are broker non-votes? If my shares are held in street name by my broker, will my broker vote my shares for me? |

| A: | In the United States, the majority of public company stockholders hold their shares through a bank, broker, trustee or other nominee, rather than directly in their own name. When shares are so held, the stockholder is considered the “beneficial owner” of shares held in “street name” and the broker will request voting instructions from the beneficial owner. Generally, broker non-votes occur when shares held by a broker, bank, or other nominee in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker, bank, or other nominee (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares with respect to that particular proposal.

· Non-Discretionary Items. The election of directors (Proposal 1), approval of the 2021 Long-term Incentive Plan (Proposal 3), and approval of the CEO Award (Proposal 4) are non-discretionary items and may not be voted by banks, brokers or other nominees that have not received specific voting instructions from beneficial owners. If you have not specifically instructed your bank, broker or other nominee how to vote your shares on any of these proposals, your shares will not be voted on that matter.

· Discretionary Items. The ratification of the appointment of KPMG Huazhen LLP as our independent registered public accounting firm (Proposal 2) is a discretionary item. Generally, banks, brokers or other nominees that do not receive specific voting instructions from beneficial owners may vote on this proposal at their discretion. |

4

| Q: | Can I change my vote after I have delivered my proxy? |

| A: | Yes. You may revoke your proxy at any time before its exercise. You may also revoke your proxy by voting in person at the Annual Meeting. If your shares are held in street name, you must contact your brokerage firm or bank to change your vote or obtain a proxy to vote your shares if you wish to cast your vote in person at the Annual Meeting. |

| Q: | How are votes counted? |

| A: | Voting results will be tabulated and certified by our transfer agent, American Stock Transfer & Trust Company. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | Preliminary voting results will be announced at the Annual Meeting. We will report final voting results in a Current Report on Form 8-K, which we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

You can obtain a copy, at no charge, of such Current Report on Form 8-K or any of our SEC reports:

• by contacting our corporate offices via phone at (240) 864-2643 or by email at ir@casipharmaceuticals.com; or

• through the SEC via their website: www.sec.gov. |

5

VOTING SECURITIES

Holders of record of shares of the Company’s Common Stock as of the close of business on April 20, 2021 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting on all matters. On the Record Date, the Company had outstanding 139,797,487 shares of Common Stock. Each outstanding share is entitled to one vote upon all matters to be acted upon at the Annual Meeting. A majority of the outstanding shares of Common Stock entitled to vote on any matter and represented at the Annual Meeting, in person or by proxy, shall constitute a quorum.

Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

For the election of directors, you have the option to vote “For” or “Withhold” authority to vote for any of the director nominees. Assuming a quorum is present, the affirmative vote of a plurality of the shares of Common Stock cast in person or represented by proxy at the Annual Meeting and entitled to vote is required to elect director nominees. That means that the two director nominees with the most votes will be elected. If you “Withhold” authority to vote on any or all nominees, your vote will have no effect on the outcome of the election. If you hold your shares in “street name” and do not provide instructions to your broker, your broker will not have discretionary authority with respect to the proposal to elect directors and will therefore provide a “broker non-vote.” Because broker non-votes are not deemed votes cast, they will not affect the outcome of the election of director nominees.

For the ratification of the appointment of KPMG Huazhen LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2021, you have the option to vote “For,” “Against” or “Abstain” from voting. Assuming a quorum is present, the affirmative vote of a majority of the shares of Common Stock cast in person or represented by proxy at the Annual Meeting and entitled to vote is necessary to approve this proposal. If you “Abstain” from voting on this proposal, your shares will be counted as present and entitled to vote and your vote will have the same legal effect as a vote “against” the proposal. If you hold your shares in “street name” and do not provide instructions to your broker, your broker will have discretionary authority to vote your shares with respect to this proposal.

For the approval of the Company’s 2021 Long-Term Incentive Plan, you have the option to vote “For,” “Against” or “Abstain” from voting. Assuming a quorum is present, the affirmative vote of a majority of the shares of Common Stock cast in person or represented by proxy at the Annual Meeting and entitled to vote is necessary to approve this proposal. If you “Abstain” from voting on this proposal, your shares will be counted as present and entitled to vote and your vote will have the same legal effect as a vote “against” the proposal. If you hold your shares in “street name” and do not provide instructions to your broker, your broker will not have discretionary authority with respect to these proposals and will therefore provide a “broker non-vote.” Because broker non-votes are not deemed votes cast, they will not affect the outcome of this proposal.

For the approval of the CEO Award, you have the option to vote “For,” “Against” or “Abstain” from voting. Assuming a quorum is present, the affirmative vote of a majority of the shares of Common Stock cast in person or represented by proxy at the Annual Meeting and entitled to vote is necessary to approve this proposal. If you “Abstain” from voting on this proposal, your shares will be counted as present and entitled to vote and your vote will have the same legal effect as a vote “against” the proposal. If you hold your shares in “street name” and do not provide instructions to your broker, your broker will not have discretionary authority with respect to these proposals and will therefore provide a “broker non-vote.” Because broker non-votes are not deemed votes cast, they will not affect the outcome of this proposal.

The Company is not currently aware of any matters that will be brought before the Annual Meeting (other than procedural matters) that are not referred to in the enclosed Notice of Annual Meeting.

6

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL HOLDERS

The following table sets forth the beneficial ownership of the Company’s Common Stock as of April 19, 2021 for (i) each director (including nominees), (ii) each named executive officer named in the Summary Compensation Table, (iii) all directors (including nominees) and executive officers of the Company as a group, and (iv) each person or group known by us to beneficially own more than 5% of our outstanding stock.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percentage of Common Stock Outstanding | ||||||

| Directors: | ||||||||

| Quan Zhou, Ph.D. | 10,047,530 | (2)(3) | 7.11 | % | ||||

| James Huang | 604,822 | (2) | * | |||||

| Y. Alexander Wu, Ph.D. | 341,685 | (2) | * | |||||

| Rajesh C. Shrotriya, MD | 302,795 | (2) | * | |||||

| Franklin C. Salisbury, Jr. | 316,685 | (2) | * | |||||

| Named Executive Officers: | ||||||||

| Wei-Wu He, Ph.D., Chairman and CEO | 24,601,994 | (2)(4) | 16.54 | % | ||||

| Wei (Larry) Zhang, President | 570,153 | (2) | * | |||||

| Alexander A. Zukiwski, MD, Chief Medical Officer | 350,000 | (2) | * | |||||

| Weihao Xu, Former Chief Financial Officer(5) | 10,000 | * | ||||||

| All executive officers and directors as a group (9 persons)(2) | 37,145,664 | (2) | 24.32 | % | ||||

| More than 5% Beneficial Owners: | ||||||||

| IDG-Accel China and affiliated entities(6) Unit 1509, The Center 99 Queen’s Road, Central, Hong Kong | 9,773,370 | 6.93 | % | |||||

| Spectrum Pharmaceuticals, Inc. and affiliated entities(7) 11500 S. Eastern Ave., Suite 240 Henderson, NV 89052 | 7,556,477 | 5.41 | % | |||||

| Sparkle Byte Limited(8) 6/F, Tower A, COFCO Plaza 8 Jianguomennei Avenue Beijing, 100005, China | 10,198,518 | 7.30 | % | |||||

| Wealth Strategy Holdings Limited(9) Level 12, International Commerce Centre 1 Austin Road West, Kowloon, Hong Kong | 10,017,959 | 7.12 | % | |||||

| Emerging Technology Partners LLC(10) 4919 Rebel Ridge Drive Sugar Land, TX 77478 | 12,207,986 | 8.66 | % | |||||

Consonance Capman GP LLC(11) 1370 Avenue of the Americas, Floor 33 New York, NY 10019 | 7,576,431 | 5.42 | % | |||||

Federated Hermes, Inc.(12) 1001 Liberty Avenue Pittsburgh, PA 15222 | 7,000,000 | 5.01 | % | |||||

7

| (1) | Beneficial ownership is defined in accordance with the rules of the SEC and the information does not necessarily indicate beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares over which the person or entity has sole or shared voting power or investment power and also any shares that the person or entity can acquire within 60 days of April 19, 2021 through the exercise of any stock option or other right. For purpose of computing the percentage of outstanding shares of common stock held by each person or entity, any shares that the person or entity has the right to acquire within 60 days after April 19, 2021, are deemed to be outstanding with respect to such person or entity but are not deemed to be outstanding for the purpose of computing the percentage of ownership of any other person or entity. Unless otherwise noted, each individual has sole voting and investment power with respect to the shares shown in the table above. The address for each person set forth above, unless otherwise noted, is c/o CASI Pharmaceuticals, Inc., 9620 Medical Center Drive, Suite 300, Rockville, Maryland 20850. |

| (2) | Includes shares issuable upon exercise of options and warrants which are exercisable within 60 days of April 19, 2021, in the following amounts: Wei-Wu He, 8,944,581 (including 1,234,567 shares underlying warrants through ETP Global Fund L.P.); James Huang, 604,631; Y. Alexander Wu, 341,685; Franklin C. Salisbury, 316,685; Rajesh Shrotriya, 302,795; Quan Zhou, 1,508,727 (including 1,234,567 shares underlying warrants through IDG-Accel China and affiliated entities); Wei (Larry) Zhang, 550,000; Alexander Zukiwski, 350,000; and all executive officers and directors as a group, 12,919,104. |

| (3) | Includes 9,773,370 shares beneficially held by IDG-Accel China and affiliated entities as to which Dr. Zhou disclaims beneficial ownership. |

| (4) | Includes 441,072 shares beneficially held by Emerging Technology Partners, LLC, 8,766,914 shares beneficially held by ETP Global Fund. L.P., and 3,000,000 shares beneficially held by ETP BioHealth III Fund, L.P. |

| (5) | Includes 10,000 shares held by Mr. Xu’s spouse for which Mr. Xu shares voting and investment power. Effective as of March 29, 2021, Weihao Xu resigned as Chief Financial Officer. |

| (6) | Number of shares and percentage of common stock outstanding are based on the books and records of the Company. According to information provided by IDG in a Schedule 13D Amendment filed on March 20, 2018, the following persons have sole voting and dispositive power and shared voting and dispositive power over the shares indicated in the table below: (i) IDG-Accel Growth, (ii) IDG-Accel Investors, (iii) IDG-Accel China Growth Fund III Associates L.P., an exempted Cayman Islands limited partnership and the sole general partner of IDG-Accel Growth (“IDG-Accel Associates”), (iv) IDG-Accel China Growth Fund GP III Associates, Ltd., an exempted Cayman Islands limited company (“IDG-Accel GP,” and collectively with IDG-Accel Growth, IDG-Accel Investors and IDG-Accel Associates, “IDG-Accel”), and the sole general partner of each of IDG-Accel Investors and IDG-Accel Associates, (v) Chi Sing Ho, an individual, and director and shareholder of IDG- Accel GP, and (vi) Quan Zhou, an individual, director and shareholder of IDG-Accel GP: |

| Sole Power to | Shared Power to | Sole Power to | Shared Power to | |||||||||||||

| Vote/Direct Vote | Vote/Direct Vote | Dispose/Direct Disposition | Dispose/Direct Disposition | |||||||||||||

| IDG-Accel Growth | 9,126,375 | 646,995 | 9,126,375 | 646,995 | ||||||||||||

| IDG-Accel Investors | 646,995 | 9,126,375 | 646,995 | 9,126,375 | ||||||||||||

| IDG-Accel Associates | 9,126,375 | 646,995 | 9,126,375 | 646,995 | ||||||||||||

| IDG-Accel GP | 9,773,370 | 0 | 9,773,370 | 0 | ||||||||||||

| Chi Sing Ho | 0 | 9,773,370 | 0 | 9,773,370 | ||||||||||||

| Quan Zhou | 75,000 | 9,773,370 | 75,000 | 9,773,370 | ||||||||||||

8

| (7) | Number of shares and percentage of common stock outstanding are based on the books and records of the Company. Based in part on a Schedule 13D Amendment filed jointly by Spectrum Pharmaceuticals, Inc. (“Spectrum”) and Spectrum Pharmaceuticals Cayman, L.P. (“Spectrum Cayman”) on August 18, 2020, according to which, Spectrum has sole voting and dispositive power over 4,584,053 shares that are held directly by Spectrum and shared voting and dispositive power over the 4,650,262 shares held by Spectrum Cayman, and Spectrum Cayman has shared voting and dispositive power over the 4,650,262 shares held directly by Spectrum Cayman. | |

| (8) | According to a Schedule 13D Amendment filed with the SEC on November 14, 2018, the record owner of these shares is Sparkle Byte Limited. By virtue of holding 100% of the equity interest of Sparkle Byte Limited, Snow Moon Limited may be deemed to have sole voting and dispositive power with respect to these shares. By virtue of holding 100% of the equity interest of Snow Moon Limited, Tianjin Jingran Management Center (Limited Partnership) may be deemed to have sole voting and dispositive power with respect to these shares. By virtue of being the general partner of Tianjin Jingran Management Center (Limited Partnership), He Xie Ai Qi Investment Management (Beijing) Co., Ltd. may be deemed to have sole voting and dispositive power with respect to these shares. By virtue of being the shareholders and/or directors of He Xie Ai Qi Investment Management (Beijing) Co., Ltd., Jianguang Li, Dongliang Lin, Fei Yang and Hugo Shong may be deemed to have shared voting and dispositive power with respect to these shares. | |

| (9) | Beneficial ownership is based on the books and records of the Company. According to a Schedule 13G filed on October 11, 2018 and amendments to the Schedule 13G filed on February 19, 2020 by Wealth Strategy Holding Limited (“WSH”), WSH has sole voting power and dispositive power over the shares. | |

| (10) | Beneficial ownership is based on the books and records of the Company and based in part on a Schedule 13D filed on January 12, 2018, a Schedule 13D/A filed on April 4, 2018 and a second amendment to Schedule 13D/A filed on March 24, 2020, Emerging Technology Partners, LLC (“ETP”), a Delaware limited liability company, is the general partner of ETP Global Fund L.P. (“ETP Global”), a Delaware limited partnership. ETP is the general partner of ETP BioHealth III Fund, L.P. (“ETP BioHealth”), a Delaware limited partnership. ETP Global has shared voting and dispositive power with respect to 8,766,914 shares of common stock. ETP BioHealth has shared voting and dispositive power with respect to 3,000,000 shares of common stock. ETP has shared voting and dispositive power with respect to 12,207,986 shares of common stock. Dr. He, as founder and managing member of each of ETP and ETP Global, may be deemed the indirect beneficial owner of the 12,207,986 shares of common stock owned by ETP, ETP Global and ETP BioHealth.

| |

| (11) | Based solely on a Schedule 13G filed jointly by Consonance Capital Management LP, Consonance Capital Opportunity Fund Management LP, Mitchell Blutt and Consonance Capman GP LLC on February 17, 2021. Consonance Capital Management LP shares voting and dispositive power with respect to 5,401,296 shares. Consonance Capital Opportunity Fund Management LP shares voting and dispositive power with respect to 2,175,135 shares. Mitchell Blutt shares voting and dispositive power with respect to 7,576,431 shares. Consonance Capman GP LLC shares voting and dispositive power with respect to 7,576,431 shares. The reported number of shares does not include any shares that may have been purchased in the Company’s March 2021 public offering. | |

| (12) | Based solely on a Schedule 13G filed on February 12, 2021 jointly by Federated Hermes, Inc. and Voting Shares Irrevocable Trust, each of which has sole voting and dispositive power with respect to 7,000,000 shares, and Thomas R. Donahue, Rhodora J. Donahue and J. Christopher Donahue, each of whom has shared voting and dispositive power with respect to 7,000,000 shares. The reported number of shares does not include any shares that may have been purchased in the Company’s March 2021 public offering. | |

| * | Represents less than 1% of the common stock outstanding. | |

9

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of six members and is divided into three classes with terms currently expiring at the Annual Meeting and the annual meetings of stockholders to be held in 2023 and 2024. At the Annual Meeting, two directors will be elected by the stockholders to serve the terms described herein. Upon the recommendation of the independent members of the Board of Directors, the Board of Directors recommends that Dr. He and Dr. Shrotriya be elected as directors of the Company, and it is intended that the accompanying proxy will be voted FOR the election of Dr. He and Dr. Shrotriya as directors, unless the proxy contains contrary instructions. The Company has no reason to believe that any of the nominees will not be a candidate or will be unable to serve. However, in the event that any nominee should become unable or unwilling to serve as a director, the persons named in the proxy have advised that they will vote (unless authority has been withdrawn) for the election of such person as shall be designated by the independent members of the Board of Directors.

Dr. He and Dr. Shrotriya currently serve as directors of the Company and have consented to being named in this Proxy Statement and to serve if elected.

The following table sets forth each nominee to be elected at the Annual Meeting, our continuing directors, the year each such nominee or director was first elected a director, the positions with the Company currently held by the nominee or director and the year the nominee’s or director’s current term will expire:

Nominee’s or Director’s Name and Year First Became a Director |

Position(s) with the Company | If Elected, Year Term will Expire | ||

| Wei-Wu He. – 2012 | Chairman and CEO | 2024 | ||

| Rajesh C. Shrotriya, MD – 2014 | Director | 2024

| ||

| Continuing Directors: | Position(s) with the Company | Year Term will Expire | ||

| James Huang – 2013 | Director | 2022 | ||

| Quan Zhou, Ph.D. – 2016 | Director | 2022 | ||

| Franklin Salisbury, Jr. – 2014 | Director | 2023 | ||

| Y. Alexander Wu, Ph.D. – 2013 | Director | 2023 |

Vote Required

Election of a director requires the affirmative vote of a plurality of the shares of common stock present or represented and entitled to vote at the meeting. This means that each nominee will be elected if he receives more affirmative votes than votes withheld for such nominee. Broker non-votes will not affect the outcome of the election.

Board of Directors Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINATED DIRECTORS AND SIGNED PROXIES THAT ARE RETURNED WILL BE SO VOTED UNLESS OTHERWISE INSTRUCTED ON THE PROXY CARD.

10

MANAGEMENT

Directors and Executive Officers

The following table sets forth the director nominees to be elected at the Annual Meeting, the continuing directors and the executive officers of the Company, their ages, and the positions currently held by each such person with the Company as of April 14, 2021.

| Name | Age | Positions |

| Director Nominees for Election: | ||

| Wei-Wu He, Ph.D. | 55 | Chairman and CEO |

| Rajesh C. Shrotriya, MD | 77 | Director |

| Continuing Directors: | ||

| Franklin C. Salisbury, Jr.(1)(2) | 65 | Director |

| Y. Alexander Wu, Ph.D.(1)(2) | 57 | Director |

| James Huang(3) | 55 | Director |

| Quan Zhou, Ph.D.(4) | 63 | Director |

| Executive Officers: | ||

| Wei-Wu He, Ph.D. | 55 | Chairman & CEO |

| Wei (Larry) Zhang | 62 | President |

| Alexander A. Zukiwski, MD | 63 | Chief Medical Officer |

| (1) | Member of Compensation Committee | |

| (2) | Member of Audit Committee | |

| (3) | Chairman of Audit Committee | |

| (4) | Chairman of Compensation Committee. |

Set forth below is a brief description of the principal occupation and business experience of each nominee and continuing director, as well as the summary of our views as to the qualifications of each nominee and continuing director to serve on the Board of Directors and each board committee of which he is a member. Our views are informed not only by the current and prior employment and educational background of our directors, but also by the Board of Directors’ experience in working with their fellow directors. Each director has had the opportunity to assess the contributions that the directors have made to our Board of Directors as well as their industry knowledge, judgment and leadership capabilities.

Nominees for Election

Wei-Wu He, Ph.D. Dr. He has served as Chairman and CEO since April 2, 2019. Dr. He served as Executive Chairman of the Company from February 23, 2018 to April 2, 2019, as Chairman of the Company from May 2013 to February 23, 2018, and as Executive Chairman from February 2012 to May 2013. Dr. He has been serving as Executive Chairman of Human Longevity Inc. (a privately-held biotechnology firm specializing in combining DNA sequencing with machine learning) since July 2019. He also is the founder and General Partner of Emerging Technology Partners, LLC, a life sciences focused venture fund established in 2000. Dr. He has been involved in founding or funding over 20 biotech companies throughout his career, some of which went on to be acquired by significantly larger firms. In the earlier part of his career, Dr. He was one of the first few scientists at Human Genome Sciences, and prior to that, was a research fellow at Massachusetts General Hospital and Mayo Clinic. Dr. He is an author to more than 25 research publications and inventor of over 30 issued patents. Dr. He received his Ph.D. from Baylor College of Medicine and MBA from The Wharton School of University of Pennsylvania. We believe that as a seasoned leader in the biotechnology industry and demonstrated financing and business acumen in both the United States and China, Dr. He adds valuable insight and expertise to the Board of Directors. Dr. He’s knowledge of the drug development process provides valuable insight to the Company. His leadership skills, strategic analysis, industry knowledge and substantial experience in the biotech sector give him the qualifications and skills to serve as a director and the Chairman of the Company.

Rajesh C. Shrotriya, MD. Dr. Shrotriya has been a director of the Company since September 2014. From 2000 – 2017, he was President and Chief Operating Officer and Chief Executive Officer of Spectrum Pharmaceuticals, a biopharmaceutical company. He is also a Trustee of the UNLV Foundation. Prior to joining Spectrum, from September 2000 to August 2002, Dr. Shrotriya was President and COO of Neotherapeutics, Inc., and prior to that he was Executive Vice President and Chief Scientific Officer for SuperGen, Inc. and Vice President, Medical Affairs and Vice President, Chief Medical Officer at MGI Pharma, Inc. For 18 years he held various positions at Bristol-Myers Squibb Company, the most recent being Executive Director Worldwide CNS Clinical Research. Dr. Shrotriya’s significant leadership experience in the biopharmaceutical sector, along with his experience as a physician and his expertise in drug development, make him well-qualified to serve on our Board of Directors.

11

Continuing Directors

James Huang. Mr. Huang has been a director of the Company since April 2013. Mr. Huang joined Kleiner Perkins China, a venture capital company, as a managing partner in 2011 and focuses on the firm’s life sciences practice. Mr. Huang is also managing partner of Panacea Venture, a global healthcare venture capital company he founded in 2017. His main investment interests are innovative and transformative early and growth stage healthcare companies. Mr. Huang has made more than 31 global investments since 2007. Before Kleiner Perkins and Panacea Venture, James was a managing partner at Vivo Ventures, a venture capital firm specializing in life sciences investments. While at Vivo, James led numerous investments in China. Before joining Vivo in 2007, James was president of Anesiva, a biopharmaceutical company focused on pain-management treatments. During his 20-year career in the pharmaceutical and biotech industry, he also held senior roles in business development, sales, marketing and R&D with Tularik Inc. (acquired by Amgen), GlaxoSmithKline LLC, Bristol-Meyers Squibb and ALZA Corp. (acquired by Johnson & Johnson). Mr. Huang is Chairman of the Board at Ziopharm Oncology, Windtree Therapeutics, Eden Biologics, TriArm Therapeutics, Tactiva Therapeutics, Chime Biologics and XW Pharma and Director at Orion Biotech, Kindstar Global and Asian Pacific Medical. James received an M.B.A. from the Stanford Graduate School of Business and a B.S. degree in chemical engineering from the University of California, Berkeley. Mr. Huang’s deep experience and numerous contacts with a large number of life science companies, extensive industry knowledge in both U.S. and China, business development expertise, coupled with his financial background, provides significant abilities to guide the Company as a member of the Board of Directors as well as serving as Chair of the Audit Committee.

Quan Zhou, Ph.D. Dr. Zhou has been a director of the Company since June 2016. Dr. Zhou has been the managing partner of IDG Capital since 1995. IDG Capital manages a number of venture capital and private equity funds, including IDG-Accel China Growth Fund III LP and IDG-Accel China III Investors LP. Dr. Zhou also serves as a director of a number of private companies. Dr. Zhou received a bachelor’s degree in chemistry from China Science and Technology University, a master’s degree in chemical physics from the Chinese Academy of Sciences and a Ph.D. degree in fiber optics from Rutgers University. Dr. Zhou’s qualifications to serve on the Board of Directors, as well as serving as the Chair of the Compensation Committee, include his substantial and successful financing, business and operation experience.

Franklin C. Salisbury, Jr. Mr. Salisbury has been a director of the Company since June 2014. Mr. Salisbury is a co-founder and director of AIM-HI Translational Research, a nonprofit accelerator fund which is an extension of the National Foundation for Cancer Research (NFCR). Prior to AIM-HI, Mr. Salisbury was Chief Executive Officer of the National Foundation for Cancer Research (NFCR) from 1997 to 2018. NFCR is an organization that supports basic science research at universities and research hospitals in order to accelerate new approaches to preventing, diagnosing and treating cancer. Under his leadership, NFCR has forged greater collaboration among scientists at universities, research hospitals, and pharmaceutical companies in the U.S. and China in an effort to bring new and innovative care to cancer patients. Mr. Salisbury also led NFCR to launch several research consortia that have enabled cancer researchers to pool their resources and reduce duplicate efforts, thereby accelerating discoveries being made and reducing the cost of achieving them. Mr. Salisbury also holds a B.A. in economics from Yale, a Juris Doctor, J.D., from the University of Georgia School of Law, a Masters of the Arts degree from the University of Chicago, and an M.Div. from Yale Divinity School. Mr. Salisbury’s leadership experience and significant background in supporting cancer research give him the qualifications and skills necessary to guide the Company’s Board of Directors, including as a member of the Compensation Committee and Audit Committee.

Y. Alexander Wu, Ph.D. Dr. Wu has been a director of the Company since April 2013. From 2006 to 2017, Dr. Wu was co- founder and Chief Executive Officer of Crown Bioscience, Inc., a drug discovery and preclinical research organization in the oncology sector with over 600 employees. The company was acquired by JSR for over $400 million in 2017. Before co-founding Crown Bioscience, Dr. Wu was Chief Business Officer of Starvax International Inc., a biopharmaceutical R&D company focusing on the development of novel therapeutic drugs for the treatment of infectious disease and cancer. Prior to Starvax, he was the Head of Asian Operations with Burrill & Company, a life science venture capital and merchant bank. Dr. Wu also co-founded and was Chief Operating Officer of Unimicro Technologies, a life science instrumentation company. He started his career with Hoffmann-La Roche, where he was Manager of Business Development and Strategic Planning. Dr. Wu obtained his B.S. in biochemistry from Fudan University, China, a M.S. in Biochemistry from the University of Illinois, and a Ph.D. in molecular cell biology and MBA from the University of California, Berkeley. Dr. Wu’s experience in the biopharmaceutical industry and research in the oncology and small molecule areas, practical experience as a senior executive operating in U.S. and China, and entrepreneurial vision makes him uniquely qualified to serve as a Director, as well as a member of the Compensation Committee and Audit Committee.

12

Executive Officers

The names and biographies of our executive officers, as of April 20, 2021, are set forth below:

Wei-Wu He, Ph.D. See “ ─ Nominees for Election” above.

Wei (Larry) Zhang. Mr. Zhang joined the Company in September 2018 as President of CASI (Beijing) Pharmaceuticals Co., Ltd., now known as CASI Pharmaceuticals (China) Co., Ltd. (“CASI China”), which is a subsidiary of the Company, and his role expanded to President of the Company in September 2019 and has more than 20 years management experience in the healthcare and biopharmaceutical industries in the U.S., Asia Pacific, and China. Prior to joining the Company’s Beijing office, Mr. Zhang was Vice President, Head of Public Affairs and Corporate Responsibility at Novartis Group (China) focusing on the public affairs/public relations strategy including initiating Novartis’ China policy focusing on National Medical Product Administration (NMPA) new drug approval reform, IP protection, generic quality consistency evaluation and new regulations on biosimilars. From 2021-2016, he was Chief Executive Officer of Sandoz Pharmaceutical (China), a Novartis Company. Mr. Zhang has also held executive leadership roles with Bayer Healthcare and Baxter International Corporation in the U.S. and Asia Pacific. He holds a bachelor and master degree in nuclear physics from University of Science & Technology of China, an MBA in marketing/finance from the University of California at Los Angeles (UCLA), and received Ph.D. training in political science from University of Utah.

Alexander A. Zukiwski, MD. Dr. Zukiwski joined the Company in April of 2017 as Chief Medical Officer. Prior to joining the Company, Dr. Zukiwski was Chief Executive Officer and Chief Medical Officer of Arno Therapeutics and has been a Director of Arno Therapeutics (“Arno”) since 2014. At Arno, his responsibilities included leading the clinical development and regulatory affairs teams to support the company’s pipeline. Prior to Arno in 2007, Dr. Zukiwski served as Chief Medical Officer and Executive Vice President of Clinical Research at MedImmune LLC (“MedImmune”). Prior to MedImmune, Dr. Zukiwski held several roles of increasing responsibility at Johnson & Johnson’s (“J&J”) medical affairs and clinical development functions at Johnson & Johnson Pharmaceutical Research & Development LLC (“J&JPRD”); Centocor R&D and Ortho Biotech. Before joining J&J, he served in clinical oncology positions at pharmaceutical companies such as Hoffmann-LaRoche, Glaxo Wellcome and Rhone-Poulenc Rorer. Dr. Zukiwski has more than 21 years of experience in global drug development and supported the clinical evaluation and registration of many successful oncology therapeutic agents, including Taxotere®, Xeloda®, Procrit®/Eprex®, Velcade®, Yondelis®, and Doxil®. He previously served as a Member of Medical Advisory Board at Gem Pharmaceuticals, LLC and served as a Director of Ambit Biosciences Corporation. Dr. Zukiwski holds a bachelor’s degree in pharmacy from the University of Alberta and a Doctor of Medicine degree from the University of Calgary. He conducted his post-graduate training at St. Thomas Hospital Medical Center in Akron, Ohio and the University of Texas MD Anderson Cancer Center.

All executive officers of the Company are elected by the Board of Directors on an annual basis and serve until their successors have been duly elected and qualified.

13

CORPORATE GOVERNANCE

Director Independence

Our Board of Directors currently consists of six members and is divided into three classes.

The Board of Directors affirmatively determined that each of the directors and nominees, with the exception of Dr. Wei-Wu He, our Chairman and CEO, qualify as “independent” as defined by applicable NASDAQ and SEC rules. In making this determination, the Board of Directors concluded that none of these members has a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Dr. He does not serve on any independent committees.

Board of Directors Meetings and Attendance

The Board of Directors of the Company held four regular meetings and four special board meetings during the fiscal year ended December 31, 2020 (“fiscal 2020”). Each director attended 75% or more of the meetings of the Board of Directors and committees of which they were members during fiscal 2020. The Company generally encourages, but does not require, directors to attend the Company’s annual meeting of stockholders. The Company considers the international travel associated with directors attending the annual meeting and the Company’s objective of preserving its cash resources. No directors attended the last annual meeting of stockholders.

Board Committees

The Board of Directors has two standing committees: the Audit Committee and the Compensation Committee. For greater efficiency, the Nominating and Corporate Governance Committee was disbanded in 2013 and the committee’s function was delegated to the independent members of the Board of Directors. Each member of these committees is independent as defined under applicable NASDAQ and SEC rules. Each of the Audit and Compensation Committees has a written charter approved by the Board of Directors. The current members of each of the committees are identified below:

| Director | Audit | Compensation | ||

| Wei-Wu He, Chairman and CEO | ||||

| James Huang | X (chairman and financial expert) | |||

| Quan Zhou | X (chairman) | |||

| Franklin C. Salisbury, Jr. | X | X | ||

| Rajesh C. Shrotriya | ||||

| Y. Alexander Wu | X | X |

Audit Committee

The primary purpose of the Audit Committee is to oversee: (a) management’s preparation of the financial statements and management’s conduct of the Company’s accounting and financial reporting process, (b) management’s maintenance of the Company’s internal control over financial reporting, (c) the Company’s compliance with legal and regulatory requirements, and (d) the qualifications, independence and performance of the Company’s independent registered public accounting firm. The Audit Committee held four meetings during fiscal 2020.

The Company’s independent registered public accounting firm is ultimately accountable to the Audit Committee in its capacity as a committee of the Board of Directors. The Audit Committee has sole authority and responsibility to appoint, compensate, oversee, evaluate, and, where appropriate, replace the Company’s independent registered public accounting firm. In addition, the Audit Committee must approve any audit and permitted non-audit services to be provided by the Company’s independent registered public accounting firm.

The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is available on our website at www.casipharmaceuticals.com. All members of the Audit Committee meet the independence and financial literacy requirements as defined by applicable NASDAQ and SEC rules. The Board of Directors has determined that James Huang, chairman of the Audit Committee, is an “audit committee financial expert” as defined by the rules and regulations of the SEC.

14

Compensation Committee

The Compensation Committee develops and recommends to the Board of Directors the compensation and benefits of the CEO and other executive officers of the Company, reviews general policy matters relating to compensation and benefits of employees of the Company and administers the Company’s stock option plans. The Compensation Committee also reviews, and if appropriate, approves employment agreements, severance agreements, change in control agreements and provisions, and any special or supplemental benefits for each of our executive officers. The Compensation Committee held three meetings during fiscal 2020. Committee related matters were also discussed at meetings of either the entire Board of Directors or independent executive sessions of the Board of Directors.

The Board of Directors has adopted a written charter for the Compensation Committee, a copy of which is available on our website at www.casipharmaceuticals.com. All members of the Compensation Committee are “independent” as defined by applicable NASDAQ rules.

Board of Directors Leadership Structure and Role in Risk Oversight

The Board does not believe that mandating a particular structure, such as designating an independent lead director or having a separate Chairman and CEO is necessary to achieve effective oversight. As a result, our board of directors has not designated an independent lead director nor has it designated a separate Chairman and CEO. The Board of Directors believes that Dr. He is the best situated to identify strategic opportunities for our Company and to focus the activities of the Board of Directors due to his commitment to the business and his long tenure with CASI. The Board of Directors also believes that Dr. He’s dual roles as Chairman of the Board and CEO promotes effective execution of our business strategy and facilitates information flow between management and the Board of Directors.

The Board of Directors has ultimate authority and responsibility for overseeing our risk management. The Board of Directors does not have a standing risk committee, but primarily administers its oversight role during meetings of our Board of Directors and its committees. During regular meetings of the Board of Directors, members discuss the operating results for the current fiscal quarter and the status of our product candidates with senior management. These discussions allow the members of the Board of Directors to analyze any significant financial, operational, competitive, economic, regulatory and legal risks of our business model, as well as how effectively we implement our strategic and budgetary goals. The Board of Directors is also routinely informed of developments that affect our risk profile and those that are material to other aspects of our business. Further, significant transactions and decisions require approval by the Board of Directors, or the appropriate board committee.

The Compensation Committee is responsible for overseeing risks related to our cash and equity-based compensation programs and practices as well as for evaluating whether our compensation plans encourage participants to take excessive risks that are reasonably likely to have a material adverse effect on the Company. We believe that our executive and employee compensation plans are appropriately structured so as not to incent excessive risk taking and are not reasonably likely to have a material adverse effect on our business.

Director Candidates

The independent members of the Board of Directors identify potential nominees from various sources, including personal contacts and the recommendations of current directors and executive officers. In the past, the Company has used third party consultants to assist in identifying and evaluating potential nominees and the Board of Directors may do so in the future.

The Board of Directors will consider nominees for director recommended by a stockholder. Stockholders who wish to recommend a director nominee for consideration by the independent members of the Board of Directors should submit a nomination in accordance with the procedures outlined in the Company’s Bylaws or other procedures adopted by the Board of Directors, if any. Currently, the Company’s bylaws require stockholders to provide written notice of a proposed nominee to: CASI Pharmaceuticals, Inc., Attn: Secretary, 9620 Medical Center Drive, Suite 300, Rockville, Maryland 20850, not less than 60, nor more than 90, calendar days before the date on which the previous year’s proxy was mailed. Such notice must include all information specified in the bylaws relating to the proposed nominee.

15

The Board of Directors does not have specific, minimum qualifications for nominees and has not established specific qualities or skills that it regards as necessary for one or more of the Company’s directors to possess. In evaluating potential director candidates, the independent members of the Board of Directors may take into account all factors and criteria it considers appropriate, which shall include, among others:

| • | whether the director/potential director possesses personal and professional integrity, sound judgment and forthrightness; |

| • | the director/potential director’s educational, business or scientific experience and other directorship experience; |

| • | whether the director/potential director assists in achieving a mix of directors that represents a diversity of background and experience; |

| • | whether the director/potential director, by virtue of particular business, professional or technical expertise, experience or specialized skill relevant to the Company’s current or future business, will add specific value as a member of the Board of Directors; |

| • | whether the director/potential director meets the independence requirements of NASDAQ listing standards; and |

| • | whether the director/potential director is free from conflicts of interest with the Company. |

The Board of Directors does not have a formal policy with respect to diversity. To carry out its obligations with respect to the proper composition and functioning of the Board of Directors, the independent directors review the qualifications of all directors, evaluating skills and talents to assure a complementary balance of disciplines and perspectives. The independent directors also seek to further enhance the Board of Directors through diversity of experience, as well as gender and ethnic diversity. Through these and other activities, the independent directors seek to assemble a Board of Directors that can responsibly, critically and collegially work through major decisions based on each director’s experience, talent, skills and knowledge.

There are no differences in the manner in which the Board of Directors evaluates potential director nominees based on whether the potential nominee was recommended by a stockholder or through any other source.

Executive Sessions of Independent Directors

The independent members of the Board of Directors typically meet in executive sessions following regularly scheduled meetings of the Board of Directors. The Board of Directors continues to meet in closed sessions (without the presence of management) following each regularly scheduled meeting. The Board of Directors holds executive sessions of the independent directors without the presence of our Chairman and Chief Executive Officer, and James Huang, chairman of our Audit Committee, is responsible for leading these executive sessions.

Code of Ethics

The Company has adopted a Code of Ethics, as defined in applicable SEC and NASDAQ rules, which applies to the Company’s directors, officers and employees, including the Company’s principal executive officer and principal financial and accounting officer. The Code of Ethics is available on the Company’s website at www.casipharmaceuticals.com. The Company intends to disclose any amendment to or waiver of a provision of the Code of Ethics that applies to its principal executive officer, principal accounting officer or controller, or persons performing such information on its website.

Communications with the Board of Directors

Any stockholder who wishes to send any communications to the Board of Directors or to individual directors should deliver such communications to the Company’s executive offices, 9620 Medical Center Drive, Suite 300, Rockville, Maryland 20850, Attn: Investor Relations. Any such communication should indicate whether the communication is intended to be directed to the entire Board of Directors or to a particular director(s), and must indicate the number of shares of Company stock beneficially owned by the stockholder. Our investor relations department will forward appropriate communications to the Board of Directors and/or the appropriate director(s). Inappropriate communications include correspondence that does not relate to the business or affairs of the Company or the functioning of the Board of Directors or its committees, advertisements or other commercial solicitations or communications, and communications that are frivolous, threatening, illegal or otherwise not appropriate for delivery to directors.

16

DIRECTOR COMPENSATION

In setting director compensation, the Company considers the significant amount of time that directors expended in fulfilling their duties to the Company as well as the skill-level required by the Company of members of the Board of Directors. We compensate our non-employee members of the Board of Directors through a mixture of (i) cash and (ii) equity-based compensation.

For 2020, our non-employee members of the Board of Directors were paid through a mixture of (i) cash and (ii) equity-based compensation. Directors are paid $134,000 annually. Committee chairmen are paid an additional annual fee, ranging from $13,500 to $20,000. In order to help the Company conserve cash, it was determined that each director would receive approximately 20 percent of his compensation in cash and the remaining portion would be converted into stock options based on the Black-Scholes-Merton option-pricing method.

2020 Director Compensation

The table below summarizes the compensation paid by the Company to non-employee directors during the fiscal year ended December 31, 2020.

| Fees Earned or Paid in Cash |

Stock Awards(1) |

Option Awards(2)(3) | Non- Equity Incentive Plan Compensation |

All Other Compensation |

Total | ||||||||||||||||||

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||

| James Huang | $ | 38,500 | — | $ | 123,200 | — | — | $ | 161,700 | |||||||||||||||

| Y. Alexander Wu, Ph.D. | $ | 37,625 | — | $ | 120,400 | — | — | $ | 158,025 | |||||||||||||||

| Franklin C. Salisbury, Jr. | $ | 37,625 | — | $ | 120,400 | — | — | $ | 158,025 | |||||||||||||||

| Rajesh C. Shrotriya, MD | $ | 33,500 | — | $ | 107,200 | — | — | $ | 140,700 | |||||||||||||||

| Quan Zhou, Ph.D. | $ | 36,875 | — | $ | 118,000 | — | — | $ | 154,875 | |||||||||||||||

| (1) | The amounts in this column represent the grant date fair value calculated in accordance with ASC 718. There were no stock awards in 2020. |

| (2) | The amounts in this column represent the grant date fair value of options awarded, as calculated in accordance with ASC 718. Using the Black-Scholes-Merton option-pricing method, fair value was calculated as $1.75 per share, for all Board members. Assumptions used in the calculation of these amounts are included in Note 16 to the Company’s audited financial statements for the year ended December 31, 2020, set forth in the Company’s Annual Report on Form 10-K filed with the SEC on March 30, 2021. |

| (3) | As of December 31, 2020, each of the non-employee directors had the following aggregate number of options exercisable for shares of common stock: James Huang: 569,431; Y. Alexander Wu: 307,285; Franklin C. Salisbury, Jr.: 282,285; Rajesh C. Shrotriya: 272,167 and Quan Zhou: 240,446. |

17

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

The following summary compensation table includes information concerning compensation for each of our named executive officers during fiscal years ended December 31, 2020 and 2019.

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) (1) |

Option Awards ($) (1) | Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) | ||||||||||||||||||||||||

| Wei-Wu He, Ph.D. (2) | 2020 | $ | 577,656 | — | — | — | — | $ | 241,831 | (3) | $ | 819,487 | ||||||||||||||||||||

| Chief Executive Officer | 2019 | $ | 423,848 | — | — | $ | 8,600,000 | — | $ | 241,555 | $ | 9,265,103 | ||||||||||||||||||||

| Wei (Larry) Zhang (4) | 2020 | $ | 437,094 | — | — | — | — | $ | 278,675 | (5) | $ | 715,769 | ||||||||||||||||||||

| President | 2019 | $ | 339,207 | — | — | $ | 450,000 | — | $ | 166,889 | $ | 985,186 | ||||||||||||||||||||

| Alexander Zukiwski, MD | 2020 | $ | 414,529 | — | — | $ | — | — | $ | 28,250 | (6) | $ | 442,779 | |||||||||||||||||||

| Chief Medical Officer | 2019 | $ | 407,600 | $ | 100,000 | — | $ | 426,000 | — | $ | 27,750 | $ | 961,350 | |||||||||||||||||||

| Weihao Xu | 2020 | $ | 14,583 | — | — | $ | 1,440,000 | — | — | $ | 1,454,583 | |||||||||||||||||||||

| Former Chief Financial Officer (7) | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| (1) | The amounts in this column represent the aggregate grant date fair value of these awards as calculated in accordance with ASC 718. Assumptions used in the calculation of these amounts are included in Note 16 to the Company’s audited financial statements for the year ended December 31, 2020, set forth in the Company’s Annual Report on Form 10-K filed with the SEC on March 30, 2021. |

| (2) | Dr. He was appointed Chief Executive Officer effective April 2, 2019. |

| (3) | Includes 401(k) matching contributions ($19,020), housing allowance for an apartment in Beijing ($123,414), allowance for tuition for pre-college age children ($79,348), and Company paid health insurance ($20,049). |

| (4) | Mr. Zhang was appointed President, CASI China, effective September 1, 2018, and appointed President of CASI Pharmaceuticals, Inc., effective September 10, 2019. |

| (5) | Includes reimbursement for total annual expenditures, including housing rental, meals, laundry services, and costs for children’s education and language training ($246,693). Also includes Company paid health insurance ($31,982). |

| (6) | Represents 401(k) matching and profit sharing contributions by the Company. |

| (7) | Mr. Xu was appointed Chief Financial Officer effective December 16, 2020. As of March 29, 2021, Weihao Xu resigned as Chief Financial Officer and forfeited all outstanding stock option awards. |

18

OUTSTANDING EQUITY AWARDS

The following table includes certain information with respect to the value of all unexercised options previously awarded to the executive officers named above at the fiscal year ended December 31, 2020.

Name and Principal Position | Number of Securities Underlying | Number of Securities Underlying | Option Exercise Price ($) | Option Expiration Date (1) | ||||||||||||

| Wei-Wu He, Ph.D. | — | 4,000,000 | (2) | $ | 2.85 | 04/02/2029 | ||||||||||

| Chairman and Chief Executive Officer | ||||||||||||||||

| Wei (Larry) Zhang | 500,000 | (3) | 500,000 | (3) | $ | 6.95 | 09/01/2028 | |||||||||

| President | 50,000 | (3) | 150,000 | (3) | $ | 3.35 | 06/22/2029 | |||||||||

| Alexander Zukiwski, MD | 300,000 | (4) | — | $ | 1.34 | 04/03/2027 | ||||||||||

| Chief Medical Officer | 50,000 | (3) | 150,000 | (3) | $ | 3.16 | 12/15/2029 | |||||||||

| Weihao Xu | ||||||||||||||||

Former Chief Financial Officer (5) | 800,000 | (6) | $ | 2.61 | 12/16/2030 | |||||||||||

| (1) | The term of each option is ten years. |

| (2) | Options vest at the earlier of (i) the completion of a transformative event by the Company as determined in the discretion of the Compensation Committee and (ii) the second anniversary of the date of grant. |

| (3) | Options vest as follows: 25% on each of the first, second, third and fourth anniversary of the date of grant. |

| (4) | Options became exercisable 25% on date of grant and then in equal monthly installments over the next three years. |

| (5) | Mr. Xu was appointed Chief Financial Officer effective December 16, 2020. As of March 29, 2021, Weihao Xu resigned as Chief Financial Officer and forfeited all outstanding stock option awards. |

| (6) | Options vest as follows: 160,000 options on each of the first and second anniversaries of the date of grant and 240,000 options on each of the third and fourth anniversaries of the date of grant. Due to Mr. Xu’s resignation on March 29, 2021, these stock options have been forfeited or cancelled. |

Employment Arrangements

The Company is currently a party to employment agreements with Wei-Wu He, Wei (Larry) Zhang, and Alexander Zukiwski. The terms of such agreements and the respective payments payable upon termination are set forth below.

Wei-Wu He, Ph.D., Chairman and CEO

Dr. He started as CEO on April 2, 2019 pursuant to the terms of an offer letter (the “Offer Letter”) from the Company, dated March 22, 2019. Under the terms of the Offer Letter, Dr. He was entitled to

| • | an annual base salary of $568,000; and |

| • | an expatriate allowance consisting of tuition for pre-college age children (up to $120,000 per year) and a housing allowance for an apartment in Beijing. |

Dr. He was also awarded a grant of options to purchase four million shares of the Company’s common stock at an exercise price of $2.85, the closing price on April 2, 2019, the grant date, vesting at the earlier of (i) the completion of a transformative event by the Company as determined in the discretion of the Compensation Committee or (ii) the second anniversary of the date of grant, April 2, 2021.

19

On April 27, 2021, the Compensation Committee revised the annual compensation and benefits of Dr. He. Under the revised terms, effective the day after the Annual Meeting, Dr. He is entitled to:

| • | an annual base salary of $100,000; and |

| • | continuation of an housing allowance for an apartment in Beijing, an allowance for tuition for pre-college age children, and Company paid health insurance. |

Upon the recommendation of the Compensation Committee, on April 27, 2021 the Board approved a grant of stock options to Dr. He, conditioned on stockholder approval at the Annual Meeting, as set forth below in “Proposal 4 ─ Approval of the CEO Award”.

Wei (Larry) Zhang, President

Effective September 1, 2018, CASI (Beijing) Pharmaceuticals, Inc., now known as CASI Pharmaceuticals (China) Co., Ltd., entered into a labor contract with Wei (Larry) Zhang, governed by the laws of the People’s Republic of China. The term of the agreement is set for three years, until August 31, 2021. The contract will automatically terminate if not renewed, but the contract can be renewed if the parties agree to the terms of the renewal.

The contract provides for a base salary pre-tax of 170,000 yuan per month.

Mr. Zhang was also awarded an option to purchase 1,000,000 shares of common stock of the Company at an exercise price of $6.95, representing the closing price of our stock price on the Nasdaq Stock Market on September 1, 2018 (the date of grant). The stock options will vest 25% (250,000 shares) on each of the first four anniversaries of the date of grant.

CASI China can terminate the labor contact if it provides 30 days’ written notice or after it pays Mr. Zhang an extra month’s wages in cases where: (a) Mr. Zhang is injured and cannot resume his position; (b) Mr. Zhang fails the performance appraisal; or (c) where the employment contract cannot be performed. CASI China can terminate the labor contract at any time if (a) Mr. Zhang seriously violates the rules and regulations of CASI China; (b) Mr. Zhang is grossly negligent resulting in a loss of 10,000 Yuan or greater; (c) Mr. Zhang is investigated for criminal responsibility; or (d) Mr. Zhang has a labor relationship with other employers. Mr. Zhang can terminate the employment contract if CASI China (a) fails to provide appropriate working conditions; (b) fails to provide labor remuneration in a full and timely manner; or (c) fails to pay social insurance premiums. The contract is terminated if (a) CASI China is declared bankrupt and business license is revoked; or (b) if Mr. Zhang retires, resigns, dies or goes missing.

Under his contract, Mr. Zhang is also entitled to reimbursement for total annual expenditures up to 1,020,000 RMB per year. Included in that 1,020,000 RMB is up to 600,000 RMB for housing rental, up to 10,000 RMB for meals, up to 10,000 RMB for laundry services, and reimbursed costs for his children’s education and language training. In the event the amount of invoice for these items is less than 1,020,000 RMB, the remaining amount will be consolidated into Mr. Zhang’s annual bonus.

Alexander A. Zukiwski, MD, Chief Medical Officer

On April 3, 2017, the Company entered into an employment agreement with Alexander A. Zukiwski, MD. The term of the employment agreement is subject to automatic one-year extensions unless either party gives at least sixty days prior written notice not to extend.

The agreement provides for an annualized minimum base salary of $400,000. Dr. Zukiwski shall be eligible to earn incentive compensation up to an aggregate of $180,000, based upon the attainment of pre-established specific milestones related to his duties, the exact amount of which are determined by the Board of Directors or the Compensation Committee. Dr. Zukiwski’s base salary for fiscal 2020 was $414,529. In addition, upon the commencement of his employment, the Company granted stock options to Dr. Zukiwski covering 300,000 shares of Common Stock with a per share exercise price of $1.34, vested as to 25% 90 days from the date of grant, and the remainder ratably over three years on a monthly basis. These option awards are subject to the terms and conditions of the Company’s form of non-qualified stock option award agreement.

If the Company terminates Dr. Zukiwski “without cause,” Dr. Zukiwski will receive a severance benefit equal to six months of salary, payable in accordance with the Company’s customary pay practices, a pro-rata portion of any incentive compensation he would have been entitled to for that year, and continued insurance coverage for up to six months. Dr. Zukiwski also may resign at any time for “good reason,” (which generally means any material diminution or change in salary, responsibilities or title; relocation to an office more than 50 miles from Company headquarters; failure to continue health benefits; a failure to pay deferred compensation due under any plan; or the failure to honor any material aspect of the employment agreement), by providing at least thirty days’ prior written notice. Resignation for “good reason” or non-extension of the term of his agreement will be deemed a termination without cause. In addition, if Dr. Zukiwski’s employment is terminated upon disability or death, Dr. Zukiwski or his estate will be entitled to receive a payment equal to six months’ salary plus a pro-rated amount of any incentive compensation he would have been entitled to for that year.

20

The employment agreement imposes confidentiality obligations and a 6-month non-compete (12 months in the event of a resignation for other than good reason) on Dr. Zukiwski following termination of employment.

On April 3, 2017, the Company entered into a change-in-control agreement with Dr. Zukiwski. See “Change-in-Control Severance Agreements” for information on change-in-control termination payments. These change-in-control severance payments will be made in lieu of the severance payments under the executive’s employment agreement.

Change-In-Control Severance Agreements

The Company currently is a party to a Change in Control Agreement with Alexander A. Zukiwski.

Dr. Zukiwski’s Change in Control Agreement provides for certain benefits either upon an involuntary termination of employment, other than for cause, or resignation for “good reason,” upon a “Triggering Event.”

A Triggering Event includes a merger of the Company with and into an unaffiliated corporation if the Company is not the surviving corporation or the sale of all or substantially all of the Company’s assets. “Good reason” generally means any material diminution or change in salary, responsibilities or title; relocation to an office more than 50 miles from Company headquarters or office; a failure to continue health benefits; a failure to pay deferred compensation due under any plan; or the failure to honor any material aspect of the employment agreement.

The benefits to be received by Dr. Zukiwski, in the event his employment is terminated after a Triggering Event occurs, include: (i) receipt of a lump sum severance payment equal to Dr. Zukiwski’s then current annual salary and the average of the two prior year’s bonuses; (ii) pro rata current year bonus; (iii) continuation of life, health and disability benefits for twelve months after the termination of employment and (iv) in accordance with the terms of Dr. Zukiwski’s option agreement, all outstanding options would accelerate and become immediately exercisable. The closing stock price of our common stock on December 31, 2020 was $2.95 per share.

DELINQUENT SECTION 16(A) REPORTS