Exhibit 99.1

| N e w s R e l e a s e Chesapeake Energy Corporation P. O. Box 18496 Oklahoma City, OK 73154 |

FOR IMMEDIATE RELEASE

MAY 4, 2009

| INVESTOR CONTACT: | MEDIA CONTACT: |

JEFFREY L. MOBLEY, CFA SENIOR VICE PRESIDENT – INVESTOR RELATIONS AND RESEARCH (405) 767-4763 jeff.mobley@chk.com | JIM GIPSON DIRECTOR – MEDIA RELATIONS (405) 935-1310 jim.gipson@chk.com |

CHESAPEAKE ENERGY CORPORATION REPORTS FINANCIAL AND OPERATIONAL

RESULTS FOR THE 2009 FIRST QUARTER

Company Reports 2009 First Quarter Net Loss to Common Shareholders of $5.7 Billion,

or $9.63 per Fully Diluted Common Share, on Revenue of $2.0 Billion;

Adjusted Net Income Available to Common Shareholders Was $277 Million,

or $0.46 per Fully Diluted Common Share

2009 First Quarter Production of 2.367 Bcfe per Day Increases 5% over 2008

First Quarter Production and 2% over 2008 Fourth Quarter Production

Company Reports Proved Reserves of 11.9 Tcfe and Delivers 2009 First Quarter

Drilling and Net Acquisition Cost of $1.58 per Mcfe

Company Reduces 2009 and 2010 Drilling Capital Expenditure Budget by $500 Million

OKLAHOMA CITY, OKLAHOMA, MAY 4, 2009 – Chesapeake Energy Corporation (NYSE:CHK) today announced financial and operating results for the 2009 first quarter. For the quarter, Chesapeake reported a net loss to common shareholders of $5.746 billion ($9.63 per fully diluted common share), operating cash flow of $999 million (defined as cash flow from operating activities before changes in assets and liabilities) and ebitda of negative $8.694 billion (defined as net income (loss) before income taxes, interest expense, and depreciation, depletion and amortization expense) on revenue of $1.995 billion and production of 213.0 billion cubic feet of natural gas equivalent (bcfe).

The company’s 2009 first quarter results above include a realized hedging gain of $519 million. The results also include various items that are typically not included in published estimates of the company’s financial results by certain securities analysts. Excluding the items detailed below, Chesapeake generated adjusted net income to common shareholders for the 2009 first quarter of $277 million ($0.46 per fully diluted common share) and adjusted ebitda of $988 million. The excluded items and their effects on 2009 first quarter reported results are detailed as follows:

| · | a noncash after-tax impairment charge of $6.019 billion related to the carrying value of natural gas and oil properties (resulting from a 36% decrease in NYMEX natural gas prices from $5.71 per mcf at December 31, 2008 to $3.63 per mcf at March 31, 2009), certain fixed assets and uncollectible receivables; |

| · | a noncash after-tax impairment charge of $95 million related to certain investments; and |

| · | an unrealized noncash after-tax mark-to-market gain of $91 million resulting from the company’s natural gas, oil and interest rate hedging programs. |

The excluded items do not affect the calculation of operating cash flow. A reconciliation of operating cash flow, ebitda, adjusted ebitda and adjusted net income to comparable financial measures calculated in accordance with generally accepted accounting principles is presented on pages 17 – 19 of this release.

Key Operational and Financial Statistics Summarized

The table below summarizes Chesapeake’s key results during the 2009 first quarter and compares them to results during the 2008 fourth quarter and the 2008 first quarter.

Three Months Ended (a) | ||||||||

| 3/31/09 | 12/31/08 | 3/31/08 | ||||||

| Average daily production (in mmcfe) | 2,367 | 2,316 | 2,244 | |||||

| Natural gas as % of total production | 92 | 92 | 92 | |||||

| Natural gas production (in bcf) | 195.7 | 196.0 | 187.8 | |||||

Average realized natural gas price ($/mcf) (b) | 6.05 | 7.13 | 9.05 | |||||

| Oil production (in mbbls) | 2,874 | 2,848 | 2,746 | |||||

Average realized oil price ($/bbl) (b) | 39.12 | 54.80 | 74.73 | |||||

| Natural gas equivalent production (in bcfe) | 213.0 | 213.1 | 204.2 | |||||

Natural gas equivalent realized price ($/mcfe) (b) | 6.09 | 7.29 | 9.33 | |||||

| Natural gas and oil marketing income ($/mcfe) | .14 | .11 | .11 | |||||

| Service operations income ($/mcfe) | .03 | .04 | .03 | |||||

| Production expenses ($/mcfe) | (1.12 | ) | (1.09 | ) | (.98 | ) | ||

| Production taxes ($/mcfe) | (.11 | ) | (.16 | ) | (.37 | ) | ||

General and administrative costs ($/mcfe) (c) | (.33 | ) | (.33 | ) | (.29 | ) | ||

| Stock-based compensation ($/mcfe) | (.09 | ) | (.09 | ) | (.09 | ) | ||

| DD&A of natural gas and oil properties ($/mcfe) | (2.10 | ) | (2.12 | ) | (2.52 | ) | ||

| D&A of other assets ($/mcfe) | (.27 | ) | (.24 | ) | (.18 | ) | ||

Interest expense ($/mcfe) (b) | (.14 | ) | .05 | (.42 | ) | |||

Operating cash flow ($ in millions) (d) | 999 | 1,054 | 1,532 | |||||

| Operating cash flow ($/mcfe) | 4.15 | 4.95 | 7.50 | |||||

Adjusted ebitda ($ in millions) (e) | 988 | 1,242 | 1,570 | |||||

| Adjusted ebitda ($/mcfe) | 4.69 | 5.83 | 7.69 | |||||

| Net income (loss) to common shareholders ($ in millions) | (5,746 | ) | (1,002 | ) | (142 | ) | ||

| Earnings (loss) per share – assuming dilution ($) | (9.63 | ) | (1.74) | (.29 | ) | |||

Adjusted net income to common shareholders ($ in millions) (f) | 277 | 438 | 562 | |||||

| Adjusted earnings per share – assuming dilution ($) | .46 | .75 | 1.09 | |||||

| (a) | reflects the adoption and retrospective application of FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion” |

| (b) | includes the effects of realized gains (losses) from hedging, but does not include the effects of unrealized gains (losses) from hedging |

| (c) | excludes expenses associated with noncash stock-based compensation |

| (d) | defined as cash flow provided by operating activities before changes in assets and liabilities |

| (e) | defined as net income (loss) before income taxes, interest expense, and depreciation, depletion and amortization expense, as adjusted to remove the effects of certain items detailed on page 19 |

| (f) | defined as net income (loss) available to common shareholders, as adjusted to remove the effects of certain items detailed on page 18 |

Company Details Significant 2009 First Quarter Accounting Items

Chesapeake accounts for its natural gas and oil properties using the full cost method of accounting, which requires the company to perform a ceiling test at the end of each quarter that limits the amount of its capitalized natural gas and oil properties less accumulated amortization and related deferred income taxes to the aggregate of the present value of future net revenues attributable to proved natural gas and oil reserves before tax discounted at 10% (PV-10), plus the present value of certain natural gas and oil hedges and the lower of cost or market value of unproved properties. At the end of the 2009 first quarter, the company was required to recognize a $9.6 billion ($6.0 billion after tax) ceiling test impairment as a result of this test.

The full cost ceiling test impairment charges do not impact the maintenance requirements of the company’s $3.5 billion revolving bank credit facility. Such noncash charges are excluded from the calculation of the company’s “Consolidated Indebtedness to Total Capitalization Ratio” (debt to cap ratio) pursuant to a March 2009 amendment to the credit facility agreement.

On January 1, 2009, the company adopted and applied retrospectively FASB Staff Position No. APB 14-1, “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion.” FSP APB 14-1 requires the company to recognize additional non-cash interest expense for its outstanding contingent convertible senior notes (principal amount of $2.955 billion as of March 31, 2009 and December 31, 2008 and $2.340 billion as of March 31, 2008). The additional noncash interest expense recognized was largely offset by additional capitalized interest. The restatement of 2008 financial results caused no change to diluted earnings per share in the 2008 first quarter and a decrease of $0.23 per share to diluted earnings per share in the 2008 fourth quarter.

2009 First Quarter Average Daily Production Increases 5% over 2008 First Quarter

Production and 2% over 2008 Fourth Quarter Production

Daily production for the 2009 first quarter averaged 2.367 bcfe, an increase of 51 million cubic feet of natural gas equivalent (mmcfe), or 2%, over the 2.316 bcfe produced per day in the 2008 fourth quarter and an increase of 123 mmcfe, or 5%, over the 2.244 bcfe produced per day in the 2008 first quarter. Adjusted for the company’s 2009 first quarter voluntary production curtailments due to low natural gas and oil prices (which averaged approximately 45 mmcfe per day), the company’s three 2008 volumetric production payment sales (which averaged approximately 148 mmcfe per day) and the estimated impact from the company’s 2008 sales of Woodford Shale and Fayetteville Shale properties (which averaged approximately 89 mmcfe per day), Chesapeake’s sequential and year-over-year production growth rates were 3% and 18%, respectively, after making similar adjustments to prior quarters.

Chesapeake’s average daily production for the 2009 first quarter consisted of 2.175 billion cubic feet of natural gas (bcf) and 31,933 barrels of oil and natural gas liquids (bbls). The company’s 2009 first quarter production of 213.0 bcfe was comprised of 195.7 bcf (92% on a natural gas equivalent basis) and 2.9 million barrels of oil and natural gas liquids (mmbbls) (8% on a natural gas equivalent basis).

Company Continues to Curtail Natural Gas Production due to Low Wellhead Prices

On April 16, 2009, Chesapeake announced it had elected to curtail approximately 400 million cubic feet (mmcf) per day of its gross natural gas production due to continued low wellhead prices. The reduction included the approximate 200 mmcf per day curtailment of natural gas production previously announced on March 2, 2009. The company’s approximate 400 mmcf per day curtailment represents approximately 13% of Chesapeake’s current gross operated natural gas production capacity. The wells that have been curtailed are primarily located in the Mid-Continent and Barnett Shale regions. Until natural gas prices strengthen, the company plans to limit production from most newly completed wells in the Barnett and Fayetteville shales to 2 mmcf per day and in the Marcellus and Haynesville shales to 5 and 10 mmcf per day, respectively, in addition to the approximate 400 mmcf per day curtailment.

The company was able to make this decision because of its strong financial condition and extensive natural gas hedging positions. In addition, because of the steeply declining production profile of new natural gas wells and the upward trending slope of the NYMEX natural gas futures curve, Chesapeake believes deferring production and revenue to future periods with higher natural gas prices creates greater shareholder value than selling production into the current unusually low priced natural gas market. The company currently anticipates continuing to curtail natural gas production through approximately mid-year 2009, but will monitor market conditions to determine an appropriate time to resume full production.

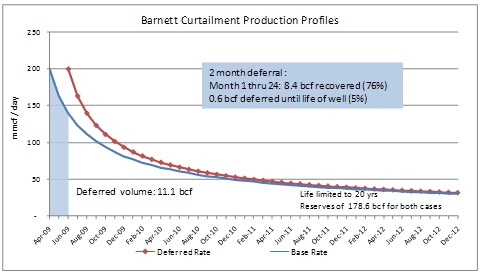

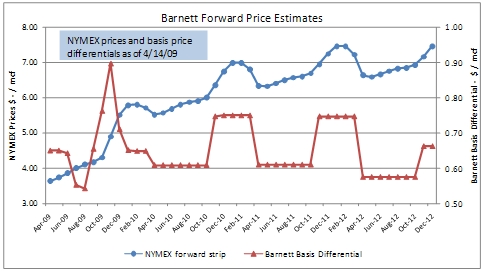

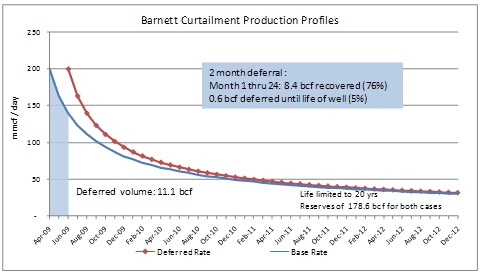

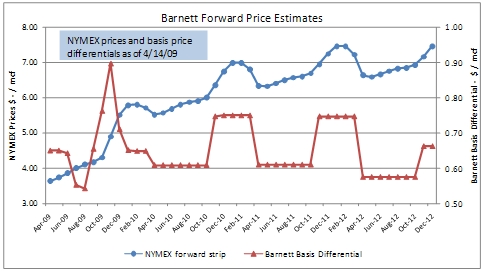

The following table and graphs outline the company’s analytical support for deferring production using the Barnett Shale region as an illustrative example. The analysis compares an estimated base case production and cash flow profile to a deferred case production and cash flow profile assuming full curtailment for two months based on NYMEX forward strip natural gas prices and regional forward basis estimates as of April 14, 2009.

| Barnett Shale Region – 2 Month Deferral Economics | |||

| Deferred Volume (bcf) | 11.1 | ||

Incremental Pre-tax PV-0 (millions) (1) | $19.3 | ||

Incremental Pre-tax PV-10 (millions) (2) | $7.7 | ||

Rate of Return (3) | 29% | ||

Payout (months) (4) | 24 | ||

Discounted Payout (months) (5) | 30 | ||

| (1)Estimated pre-tax undiscounted future cash flow |

| (2) Estimated pre-tax future cash flow discounted at 10% |

| (3) Estimated rate of return from investment of foregoing near-term cash flow in exchange for incremental longer-term cash flow |

| (4) Number of months to recoup deferred revenue using pre-tax undiscounted future cash flow |

| (5) Number of months to recoup deferred revenue using pre-tax future cash flow discounted at 10% |

Average Realized Prices, Hedging Results and Hedging Positions Detailed

Average prices realized during the 2009 first quarter (including realized gains or losses from natural gas and oil derivatives, but excluding unrealized gains or losses on such derivatives) were $6.05 per thousand cubic feet (mcf) and $39.12 per bbl, for a realized natural gas equivalent price of $6.09 per thousand cubic feet of natural gas equivalent (mcfe). Realized gains from natural gas and oil hedging activities during the 2009 first quarter generated a $2.61 gain per mcf and a $3.13 gain per bbl for a 2009 first quarter realized hedging gain of $519 million, or $2.43 per mcfe. Excluding hedging activity, Chesapeake’s average realized pricing basis differentials to NYMEX during the 2009 first quarter were a negative $1.47 per mcf and a negative $7.09 per bbl.

By comparison, average prices realized during the 2008 first quarter (including realized gains or losses from natural gas and oil derivatives, but excluding unrealized gains or losses on such derivatives) were $9.05 per mcf and $74.73 per bbl, for a realized natural gas equivalent price of $9.33 per mcfe. Realized gains from natural gas and oil hedging activities during the 2008 first quarter generated a $1.42 gain per mcf and a $19.41 loss per bbl for a 2008 first quarter realized hedging gain of $214 million, or $1.05 per mcfe. Excluding hedging activity, Chesapeake’s average realized pricing basis differentials to NYMEX during the 2008 first quarter were a negative $0.40 per mcf and a negative $3.76 per bbl.

The following tables summarize Chesapeake’s open hedge position through swaps and collars as of May 4, 2009. Depending on changes in natural gas and oil futures markets and management’s view of underlying natural gas and oil supply and demand trends, Chesapeake may either increase or decrease its hedging positions at any time in the future without notice.

Open Swap Positions as of May 4, 2009

| Natural Gas | Oil | |||||||||||

| Year | % Hedged | $ NYMEX | % Hedged | $ NYMEX | ||||||||

2Q-4Q 2009 Total(a) | 44 | % | 7.64 | 30 | % | 84.81 | ||||||

2010 Total(a) | 14 | % | 9.69 | 40 | % | 90.25 | ||||||

Open Natural Gas Collar Positions as of May 4, 2009

Average Floor | Average Ceiling | ||||||||

| Year | % Hedged | $ NYMEX | $ NYMEX | ||||||

2Q-4Q 2009 Total(a) | 42 | % | 7.08 | 8.81 | |||||

2010 Total(a) | 8 | % | 6.78 | 9.18 | |||||

| (a) | Certain open natural gas swap positions include knockout swaps with knockout provisions at prices ranging from $6.00 to $6.50 per mcf covering 5 bcf in 2009 and $5.45 to $6.75 per mcf covering 70 bcf in 2010, or approximately 57% of the company’s natural gas swap positions in 2010. Certain open natural gas collar positions include three-way collars that include written put options with strike prices ranging from $5.00 to $6.00 per mcf covering 62 bcf in 2009 and ranging from $4.25 to $6.00 per mcf covering 30 bcf in 2010, or approximately 25% and 42% of the company’s natural gas collar positions in 2009 and 2010, respectively. Also, certain open oil swap positions include cap-swaps and knockout swaps with provisions limiting the counterparty’s exposure below prices ranging from $50 to $60 per bbl covering 3 mmbbls in 2009 and $60 per bbl covering 5 mmbbls in 2010, or virtually all of the company’s oil swap positions in 2009 and 2010. |

As of April 30, 2009, Chesapeake’s natural gas and oil hedging positions with 15 different counterparties had a positive mark-to-market value of approximately $1.7 billion.

The company’s updated forecasts for 2009 and 2010 are attached to this release in an Outlook dated May 4, 2009, labeled as Schedule “A,” which begins on page 20. This Outlook has been changed from the Outlook dated February 17, 2009, attached as Schedule “B,” which begins on page 25, to reflect various updated information.

Company Reports Natural Gas and Oil Proved Reserves of 11.9 Tcfe and Delivers 2009 First

Quarter Drilling and Net Acquisition Cost of $1.58 per Mcfe

Chesapeake began 2009 with estimated proved reserves of 12.051 trillion cubic feet of natural gas equivalent (tcfe) and ended the quarter with 11.851 tcfe, a decrease of 200 bcfe, or 2%. During the 2009 first quarter, Chesapeake replaced 213 bcfe of production with an estimated 13 bcfe of new proved reserves for a reserve replacement rate of 6%. The quarter’s reserve movement includes 427 bcfe of extensions, 9 bcfe of acquisitions, 397 bcfe of positive performance revisions and 820 bcfe of downward revisions resulting from natural gas price decreases between December 31, 2008 and March 31, 2009. Had natural gas and oil prices at March 31, 2009 been the same as prices at December 31, 2008, Chesapeake’s 2009 first quarter proved reserves would have been an estimated 12.671 tcfe, an increase of 620 bcfe, for a reserve replacement rate of 391% and the second best quarter of organic estimated proved reserve growth in the company’s history.

Chesapeake’s total drilling and net acquisition costs for the 2009 first quarter were $1.58 per mcfe. This calculation excludes costs of $510 million for the acquisition of unproved properties and leasehold, $154 million for capitalized interest on unproved properties, $74 million for seismic and $2 million relating to asset retirement obligations, and also excludes downward revisions of proved reserves from lower natural gas and oil prices. Excluding these items and acquisition and divestiture activity, Chesapeake’s exploration and development costs through the drillbit during the 2009 first quarter were $1.44 per mcfe, net of $269 million in drilling carries associated with the Haynesville ($86 million), Fayetteville ($172 million) and Marcellus ($11 million) joint ventures. Of the $510 million of costs for acquisition of unproved properties, approximately 50% was funded using Chesapeake common stock and a substantial portion was related to the completion of carryover leasing activity from 2008. A complete reconciliation of proved reserves and finding and acquisition costs is presented on page 15 of this release.

During the 2009 first quarter, Chesapeake continued the industry’s most active drilling program and drilled 307 gross operated wells (237 net wells with an average working interest of 77%) and participated in another 219 gross wells operated by other companies (27 net wells with an average working interest of 12%). The company’s drilling success rate was 98% for company-operated wells and 99% for non-operated wells. Also during the 2009 first quarter, Chesapeake invested $1.020 billion in operated wells (using an average of 113 operated rigs) and $166 million in non-operated wells (using an average of 58 non-operated rigs) for total drilling, completing and equipping costs of $1.186 billion.

As of March 31, 2009, Chesapeake’s PV-10 was $8.885 billion using field differential adjusted prices based on NYMEX quarter-end prices of $3.63 per mcf and $49.65 per bbl. Chesapeake’s PV-10 changes by approximately $400 million for every $0.10 per mcf change in natural gas prices and approximately $55 million for every $1.00 per bbl change in oil prices.

By comparison, the December 31, 2008 PV-10 of the company’s proved reserves was $15.601 billion ($11.833 billion applying the SFAS 69 standardized measure) using field differential adjusted prices based on NYMEX year-end prices of $5.71 per mcf and $44.61 per bbl. The March 31, 2008 PV-10 of the company’s proved reserves was $32.359 billion using field differential adjusted prices based on NYMEX quarter-end prices of $9.37 per mcf and $101.60 per bbl.

The company calculates the standardized measure of future net cash flows in accordance with SFAS 69 only at year end because applicable income tax information on properties, including recently acquired natural gas and oil interests, is not readily available at other times during the year. As a result, the company is not able to reconcile the interim period-end values to the standardized measure at such dates. The only difference between the two measures is that PV-10 is calculated before considering the impact of future income tax expenses, while the standardized measure includes such effects.

In addition to the PV-10 value of its proved reserves and the very significant value of its undeveloped leasehold, particularly in the Haynesville, Marcellus, Barnett and Fayetteville Shale plays, the net book value of the company’s other assets (including gathering systems, compressors, land and buildings, investments and other noncurrent assets) was $6.314 billion as of March 31, 2009, $5.822 billion as of December 31, 2008 and $3.604 billion as of March 31, 2008.

Chesapeake’s Leasehold and 3-D Seismic Inventories Total 15.2 Million Net Acres and 22.3

Million Acres; Risked Unproved Reserves in the Company’s Inventory Total 58 Tcfe

while Unrisked Unproved Reserves Total 166 Tcfe

Since 2000, Chesapeake has invested $13.3 billion in new leasehold and 3-D seismic acquisitions (approximately $8.7 billion after giving effect to the three joint ventures and sales in 2008) and owns the largest combined inventories of onshore leasehold (15.2 million net acres) and 3-D seismic (22.3 million acres) in the U.S. On this leasehold, at March 31, 2009, Chesapeake had an estimated 3.8 tcfe of proved undeveloped reserves and approximately 58 tcfe of risked unproved reserves (166 tcfe of unrisked unproved reserves). The company is currently using 96 operated drilling rigs to further develop its inventory of approximately 36,000 net drillsites, which represents more than a 10-year inventory of drilling projects.

The following table summarizes Chesapeake’s ownership and activity in its conventional and unconventional gas resource plays and the company’s activities in its Big 4 shale plays. In its resource plays, Chesapeake uses a probability-weighted statistical approach to estimate the potential number of drillsites and unproved reserves associated with such drillsites.

Play Type/Area | CHK Net Acreage | Est. Drilling Density (Acres) | Risk Factor | Risked Net Undrilled Wells | Est. Avg. Reserves Per Well (bcfe) | Total Proved Reserves (bcfe) | Risked Unproved Reserves (bcfe) | Total Proved and Risked Unproved Reserves (bcfe) | Unrisked Unproved Reserves (bcfe) | Current Daily Production (mmcfe) | Current Operated Rig Count | |||||||||||

| Big 4 Shale Plays: | ||||||||||||||||||||||

| Haynesville Shale | 470,000 | 80 | 40% | 3,500 | 6.50 | 705 | 16,700 | 17,405 | 28,000 | 90 | 24 | |||||||||||

| Marcellus Shale | 1,300,000 | 80 | 75% | 4,100 | 3.75 | 75 | 12,900 | 12,975 | 51,700 | 30 | 11 | |||||||||||

| Barnett Shale | 310,000 | 60 | 15% | 2,800 | 2.65 | 3,065 | 4,800 | 7,865 | 6,400 | 660 | 21 | |||||||||||

| Fayetteville Shale | 440,000 | 80 | 20% | 4,100 | 2.20 | 810 | 7,300 | 8,110 | 9,100 | 200 | 20 | |||||||||||

Big 4 Shale Play Subtotals | 2,520,000 | 14,500 | 4,655 | 41,700 | 46,355 | 95,200 | 980 | 76 | ||||||||||||||

| Other Unconventional | 7,980,000 | Various | Various | 16,700 | Various | 4,131 | 11,900 | 16,031 | 47,500 | 730 | 12 | |||||||||||

| Conventional | 4,700,000 | Various | Various | 5,100 | Various | 3,065 | 4,600 | 7,665 | 23,600 | 620 | 8 | |||||||||||

| Total | 15,200,000 | 36,300 | 11,851 | 58,200 | 70,051 | 166,300 | 2,330 | 96 |

Haynesville Shale (Northwest Louisiana, East Texas): Chesapeake is the largest leasehold owner and most active driller of new wells in the Haynesville Shale play in Northwest Louisiana and East Texas. Chesapeake and its 20% partner Plains Exploration & Production Company (NYSE:PXP) continue to experience outstanding drilling results in the Haynesville play and have drilled and completed 49 Chesapeake-operated horizontal wells. Chesapeake is currently producing approximately 90 mmcfe net per day (160 mmcfe gross operated) with approximately 40 mmcfe net per day (70 mmcfe gross operated) currently curtailed from the play. The company anticipates reaching a production level of approximately 300 mmcfe net per day (600 mmcfe gross operated) by year-end 2009. Chesapeake is currently drilling with 24 operated rigs and anticipates operating an average of approximately 28 rigs in 2009 and 36 rigs in 2010 to drill approximately 125 net wells in 2009 and 175 net wells in 2010 to further develop its 470,000 net acres of Haynesville leasehold. During 2009 and 2010, 50% of Chesapeake’s drilling costs in the Haynesville, or approximately $1.0 billion, will be paid for by its joint venture partner PXP. The company’s estimated pre-tax rate of return from a targeted 6.5 bcfe Haynesville Shale well drilled for $7.0 million (excluding the benefit of drilling carries) is approximately 21% assuming current NYMEX natural gas and oil strip prices.

Marcellus Shale (West Virginia, Pennsylvania and New York): Chesapeake is the largest leasehold owner in the Marcellus Shale play that spans from northern West Virginia across much of Pennsylvania into southern New York. The company expects to end 2009 as the most active driller and the largest producer of natural gas from the play. Chesapeake is currently producing approximately 30 mmcfe net per day (45 mmcfe gross operated) from the play and anticipates reaching approximately 100 mmcfe net per day (220 mmcfe gross operated) by year-end 2009. The company has achieved attractive drilling results in the play to date, including two recent wells that began producing at rates above 6 and 7 mmcfe per day, respectively, and is planning to significantly increase its Marcellus drilling activity during 2009 and 2010. Chesapeake is currently drilling with 11 operated rigs and anticipates operating an average of approximately 14 rigs in 2009 and 28 rigs in 2010 to drill approximately 85 net wells in 2009 and 160 net wells in 2010 to further develop its 1.3 million net acres of Marcellus leasehold. During 2009 and 2010, 75% of Chesapeake’s drilling costs in the Marcellus, or approximately $650 million, will be paid for by its joint venture partner StatoilHydro (NYSE:STO, OSE:STL). The company’s estimated pre-tax rate of return from a targeted 3.75 bcfe Marcellus Shale well drilled for $4.0 million (excluding the benefit of drilling carries) is approximately 38% assuming current NYMEX natural gas and oil strip prices.

Barnett Shale (North Texas): The Barnett Shale is currently the largest and most prolific unconventional gas resource play in the U.S. In this play, Chesapeake is the second-largest producer of natural gas, the most active driller and the largest leasehold owner in the Core and Tier 1 sweet spots of Tarrant and Johnson counties. During the 2009 first quarter, Chesapeake’s average daily net production of 640 mmcfe in the Barnett increased approximately 55% over the 2008 first quarter and approximately 12% over the 2008 fourth quarter. Chesapeake is currently producing approximately 660 mmcfe net per day (960 mmcfe gross operated) at a curtailed rate from the play. Notably, Chesapeake’s Donna Ray #1-H well in Johnson County has been producing an average of 9.6 mmcfe per day during the past 30 days. The company believes this well has likely registered the highest first 30 days average daily production rate of any well in the entire Barnett Shale play to date. Chesapeake anticipates operating an average of approximately 20 rigs in 2009 and 2010 to drill approximately 305 net wells in 2009 and 290 net wells in 2010 to further develop its 310,000 net acres of leasehold, of which 280,000 net acres are located in the prime Core and Tier 1 areas. The company’s estimated pre-tax rate of return from a targeted 2.65 bcfe Barnett Shale well drilled for $2.6 million is approximately 20% assuming current NYMEX natural gas and oil strip prices.

Fayetteville Shale (Arkansas): The Fayetteville Shale is currently the second most productive shale play in the U.S. and one of the nation’s 10 largest fields of any type. In the Fayetteville, Chesapeake is the second-largest leasehold owner in the Core area of the play. During the 2009 first quarter, Chesapeake’s average daily net production of 202 mmcfe in the Fayetteville increased approximately 66% over the 2008 first quarter and approximately 16% over the 2008 fourth quarter. Chesapeake is currently producing approximately 200 mmcfe net per day (270 mmcfe gross operated) from the play and anticipates reaching approximately 280 mmcfe net per day (420 mmcfe gross operated) by year-end 2009. Drilling results by Chesapeake and other prominent operators in the Fayetteville Shale continue to improve. Chesapeake’s most recent 30 operated wells appear to be 30% more productive than its targeted reserve estimate of 2.2 bcfe per well because of drilling longer laterals, better geo-steering and enhanced completion techniques. Chesapeake anticipates operating an average of approximately 20 rigs in 2009 and 16 rigs in 2010 to drill approximately 165 net wells in 2009 and 140 net wells in 2010 to further develop its 440,000 net acres of Core Fayetteville leasehold. During 2009, nearly all of Chesapeake’s drilling costs, or approximately $550 million, will be paid for by its joint venture partner BP America (NYSE:BP). The company’s estimated pre-tax rate of return from a targeted 2.2 bcfe Fayetteville Shale well drilled for $3.0 million (excluding the benefit of drilling carries) is approximately 16% assuming current NYMEX natural gas and oil strip prices.

Company Reduces 2009-2010 Drilling Capital Expenditure Budget by $500 Million, or

Approximately 8%; Targets Drilling Exploration and Development Costs

of Approximately $1.25 and $1.50 per Mcfe in 2009 and 2010

During 2009 and 2010, Chesapeake anticipates generating attractive returns and delivering drillbit exploration and development costs up to 40% lower than 2008 costs from a combination of lower service costs and the benefit of using approximately $2.4 billion of its joint venture drilling carries in three of its Big 4 shale plays. As a result of lower service costs and a further decrease in planned drilling activity levels, the company has reduced its drilling capital expenditure budget for 2009 and 2010 by approximately $500 million, or approximately 8%, from $6.5 billion to $6.0 billion. Chesapeake anticipates directing approximately 80% of its gross drilling capital expenditures during 2009 and 2010 to its Big 4 shale plays and is targeting drilling exploration and development costs of approximately $1.25 and $1.50 per mcfe in each year, respectively. As a result, Chesapeake believes its maintenance capital expenditure requirement in 2009 and 2010 will only be approximately 20% of projected operating cash flow.

Company Updates Asset Monetization Plans

During 2009 and 2010, Chesapeake plans to increase its liquidity, reduce its borrowings under its revolving credit facility and also strengthen its balance sheet through asset monetizations and the growth of its proved reserve base. As a result of absolute and relative deleveraging, the company aspires to have investment grade credit metrics by year-end 2010, including a key rating agency metric of long-term debt to proved reserves of less than $0.75 per mcfe.

Chesapeake is targeting the monetization of leasehold and producing properties for $1.5 - $2.0 billion in 2009 and $1.0 - $1.5 billion in 2010 and anticipates utilizing the sale proceeds for capital expenditures and to reduce borrowings under its revolving credit facility. The company is currently documenting an agreement to sell certain Chesapeake-operated long-lived producing assets in South Texas in its fifth volumetric production payment transaction (VPP). The assets include proved reserves of approximately 90 bcfe and current net production of approximately 65 mmcfe per day. The company anticipates completing this fifth VPP sale in the 2009 second quarter for proceeds of approximately $475 million, or more than $5.00 per mcfe of proved reserves. The company is planning to sell certain non-Haynesville Shale producing assets in Louisiana in its sixth VPP in the second half of 2009 for approximately $250 million.

The company is in due diligence with a private equity investor to sell a 50% minority interest in its Barnett Shale and Mid-Continent natural gas gathering and processing assets in the company’s midstream business, Chesapeake Midstream Partners. The company anticipates proceeds of more than $550 million and expects to complete the transaction in the 2009 third quarter.

Chesapeake also anticipates selling approximately $300 million of mature producing assets late in the 2009 second quarter and another $200 million in the second half of 2009. Finally, Chesapeake is currently in discussions with several companies about a possible Barnett Shale joint venture transaction and anticipates completing a transaction by year-end 2009 for proceeds of approximately $200-300 million.

Management Comments

Aubrey K. McClendon, Chesapeake’s Chief Executive Officer, commented, “We are pleased to report our financial and operational results for the 2009 first quarter. The strong performance of our drilling program and successful hedging program enabled us to deliver attractive operating margins for the quarter that should compare well among our peers in the industry. We are also pleased to report progress in our asset monetization programs that should lead to even greater financial flexibility and deleveraging of our balance sheet as we progress through the year with approximately $1.5 - $2.0 billion of planned asset monetizations.

“We are now experiencing substantial savings in service costs from our vendors and anticipate directing approximately 80% of our planned drilling capital expenditures in the remaining three quarters of 2009 to our low-cost Big 4 shale plays. As a result, we anticipate generating exceptional drillbit finding and development costs this year, particularly given the impact of the drilling carries we will receive from our joint venture partners in the Haynesville, Fayetteville and Marcellus Shale plays. In addition, we believe it will be possible during the year to reduce our currently budgeted capex by a further 5-10% as we take advantage of further service cost reductions and much lower leasehold acquisition costs.

“Over the past five years, we have worked aggressively to secure powerful assets in the most important U.S. natural gas resource plays. We have positioned Chesapeake well to prosper in the emerging Age of Natural Gas. We look forward to providing powerful returns and capitalizing on our timely and distinctive investments in the years ahead.”

Conference Call Information

A conference call to discuss this release has been scheduled for Tuesday morning, May 5, 2009, at 10:30 a.m. EDT. The telephone number to access the conference call is 913-312-1295 or toll-free 866-290-0880. The passcode for the call is 3748719. We encourage those who would like to participate in the call to dial the access number between 10:20 and 10:30 a.m. EDT. For those unable to participate in the conference call, a replay will be available for audio playback from 3:30 p.m. EDT on May 5, 2009 through midnight EDT on May 19, 2009. The number to access the conference call replay is 719-457-0820 or toll-free 888-203-1112. The passcode for the replay is 3748719. The conference call will also be webcast live on the Internet and can be accessed by going to Chesapeake’s website at www.chk.com in the “Events” subsection of the “Investors” section of our website. The webcast of the conference call will be available on our website for one year.

This press release and the accompanying Outlooks include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our current expectations or forecasts of future events. They include estimates of natural gas and oil reserves, expected natural gas and oil production and future expenses, assumptions regarding future natural gas and oil prices, planned capital expenditures and anticipated asset acquisitions and sales, as well as statements concerning anticipated cash flow and liquidity, business strategy and other plans and objectives for future operations. Disclosures concerning the fair value of derivative contracts and their estimated contribution to our future results of operations are based upon market information as of a specific date. These market prices are subject to significant volatility. We caution you not to place undue reliance on our forward-looking statements, which speak only as of the date of this press release, and we undertake no obligation to update this information.

Factors that could cause actual results to differ materially from expected results are described under “Risk Factors” in Item 1A of our 2008 Annual Report on Form 10-K we filed with the U.S. Securities and Exchange Commission on March 2, 2009. These risk factors include the volatility of natural gas and oil prices; the limitations our level of indebtedness may have on our financial flexibility; impacts the current financial crisis may have on our business and financial condition; declines in the values of our natural gas and oil properties resulting in ceiling test write-downs; the availability of capital on an economic basis, including planned asset monetization transactions, to fund reserve replacement costs; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of natural gas and oil reserves and projecting future rates of production and the amount and timing of development expenditures; exploration and development drilling that does not result in commercially productive reserves; leasehold terms expiring before production can be established; hedging activities resulting in lower prices realized on natural gas and oil sales and the need to secure hedging liabilities; uncertainties in evaluating natural gas and oil reserves of acquired properties and potential liabilities; the negative impact lower natural gas and oil prices could have on our ability to borrow; drilling and operating risks, including potential environmental liabilities; transportation capacity constraints and interruptions that could adversely affect our cash flow; adverse effects of governmental and environmental regulations; and pending or future litigation.

Our production forecasts are dependent upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity. Although we believe the expectations and forecasts reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties.

The SEC has generally permitted natural gas and oil companies, in filings made with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use the terms "risked and unrisked unproved reserves" to describe volumes of natural gas and oil reserves potentially recoverable through additional drilling or recovery techniques that the SEC's guidelines may prohibit us from including in filings with the SEC. These estimates are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the company. While we believe our calculations of unproved drillsites and estimation of unproved reserves have been appropriately risked and are reasonable, such calculations and estimates have not been reviewed by third-party engineers or appraisers.

Chesapeake Energy Corporation is the largest independent producer of natural gas in the U.S. Headquartered in Oklahoma City, the company's operations are focused on the development of onshore unconventional and conventional natural gas in the U.S. in the Barnett Shale, Haynesville Shale, Fayetteville Shale, Marcellus Shale, Anadarko Basin, Arkoma Basin, Appalachian Basin, Permian Basin, Delaware Basin, South Texas, Texas Gulf Coast and East Texas regions of the United States. Further information is available at www.chk.com.

CHESAPEAKE ENERGY CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

($ in millions, except per-share and unit data)

(unaudited)

| THREE MONTHS ENDED: | March 31, | March 31, | ||||||||||

| 2009 | 2008 (a) | |||||||||||

| $ | $/mcfe | $ | $/mcfe | |||||||||

| REVENUES: | ||||||||||||

Natural gas and oil sales | 1,397 | 6.56 | 773 | 3.78 | ||||||||

Natural gas and oil marketing sales | 552 | 2.59 | 796 | 3.90 | ||||||||

Service operations revenue | 46 | 0.22 | 42 | 0.21 | ||||||||

Total Revenues | 1,995 | 9.37 | 1,611 | 7.89 | ||||||||

| OPERATING COSTS: | ||||||||||||

Production expenses | 238 | 1.12 | 201 | 0.98 | ||||||||

Production taxes | 23 | 0.11 | 75 | 0.37 | ||||||||

General and administrative expenses | 90 | 0.42 | 79 | 0.39 | ||||||||

Natural gas and oil marketing expenses | 523 | 2.45 | 774 | 3.79 | ||||||||

Service operations expense | 40 | 0.19 | 35 | 0.17 | ||||||||

Natural gas and oil depreciation, depletion and amortization | 447 | 2.10 | 515 | 2.52 | ||||||||

Depreciation and amortization of other assets | 57 | 0.27 | 36 | 0.18 | ||||||||

Impairment of natural gas and oil properties and other assets | 9,630 | 45.21 | — | — | ||||||||

Total Operating Costs | 11,048 | 51.87 | 1,715 | 8.40 | ||||||||

| INCOME (LOSS) FROM OPERATIONS | (9,053 | ) | (42.50 | ) | (104 | ) | (0.51 | ) | ||||

| OTHER INCOME (EXPENSE): | ||||||||||||

Other income (expense) | 8 | 0.04 | (9 | ) | (0.04 | ) | ||||||

Interest expense | 14 | 0.06 | (99 | ) | (0.49 | ) | ||||||

Impairment of investments | (153 | ) | (0.72 | ) | — | — | ||||||

Total Other Income (Expense) | (131 | ) | (0.62 | ) | (108 | ) | (0.53 | ) | ||||

| INCOME (LOSS) BEFORE INCOME TAXES | (9,184 | ) | (43.12 | ) | (212 | ) | (1.04 | ) | ||||

Income Tax Expense (Benefit): | ||||||||||||

Current | — | — | — | — | ||||||||

Deferred | (3,444 | ) | (16.17 | ) | (82 | ) | (0.40 | ) | ||||

Total Income Tax Expense (Benefit) | (3,444 | ) | (16.17 | ) | (82 | ) | (0.40 | ) | ||||

| NET INCOME (LOSS) | (5,740 | ) | (26.95 | ) | (130 | ) | (0.64 | ) | ||||

Preferred stock dividends | (6 | ) | (0.03 | ) | (12 | ) | (0.05 | ) | ||||

NET INCOME (LOSS) AVAILABLE TO COMMON SHAREHOLDERS | (5,746 | ) | (26.98 | ) | (142 | ) | (0.69 | ) | ||||

| EARNINGS (LOSS) PER COMMON SHARE: | ||||||||||||

Basic | $ | (9.63 | ) | $ | (0.29 | ) | ||||||

Assuming dilution | $ | (9.63 | ) | $ | (0.29 | ) | ||||||

| WEIGHTED AVERAGE COMMON AND COMMON | ||||||||||||

| EQUIVALENT SHARES OUTSTANDING (in millions) | ||||||||||||

Basic | 597 | 493 | ||||||||||

Assuming dilution | 597 | 493 | ||||||||||

| (a) | Adjusted for the retrospective application of FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion” |

CHESAPEAKE ENERGY CORPORATION

CONSOLIDATED BALANCE SHEETS

($ in millions)

(unaudited)

| March 31, | December 31, | ||||||

| 2009 | 2008 (a) | ||||||

| Cash and cash equivalents | $ | 83 | $ | 1,749 | |||

| Other current assets | 2,770 | 2,543 | |||||

Total Current Assets | 2,853 | 4,292 | |||||

| Property and equipment (net) | 25,856 | 33,308 | |||||

| Other assets | 952 | 993 | |||||

Total Assets | $ | 29,661 | $ | 38,593 | |||

| Current liabilities | $ | 3,362 | $ | 3,621 | |||

Long-term debt, net (b) | 12,933 | 13,175 | |||||

| Asset retirement obligation | 275 | 269 | |||||

| Other long-term liabilities | 473 | 311 | |||||

| Deferred tax liability | 800 | 4,200 | |||||

Total Liabilities | 17,843 | 21,576 | |||||

| Stockholders’ Equity | 11,818 | 17,017 | |||||

| Total Liabilities & Stockholders’ Equity | $ | 29,661 | $ | 38,593 | |||

| Common Shares Outstanding (in millions) | 625 | 607 | |||||

CHESAPEAKE ENERGY CORPORATION

CAPITALIZATION

($ in millions)

(unaudited)

March 31, | % of Total Book | December 31, | % of Total Book | ||||||||||||||||||||

| 2009 | Capitalization | 2008 (a) | Capitalization | ||||||||||||||||||||

Total debt, net cash (b) | $ | 12,850 | 52 | % | $ | 11,426 | 40 | % | |||||||||||||||

| Stockholders' equity | 11,818 | 48 | % | 17,017 | 60 | % | |||||||||||||||||

Total | $ | 24,668 | 100 | % | $ | 28,443 | 100 | % | |||||||||||||||

| (a) | Adjusted for the retrospective application of FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion” |

| (b) | Includes $2.389 billion of borrowings under the company’s $3.5 billion revolving bank credit facility and the company’s $460 million midstream revolving bank credit facility. At March 31, 2009, the company had $1.6 billion of additional borrowing capacity under its two revolving bank credit facilities |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF 2009 ADDITIONS TO NATURAL GAS AND OIL PROPERTIES

($ in millions, except per-unit data)

(unaudited)

| Reserves | ||||||||||

| Cost | (in bcfe) | $/mcfe | ||||||||

| Exploration and development costs | $ | 1,186 | 824 | (a) | 1.44 | |||||

| Acquisition of proved properties | 17 | 9 | 1.92 | |||||||

| Other | 115 | (b) | — | — | ||||||

Drilling and net acquisition cost | 1,318 | 833 | 1.58 | |||||||

| Revisions – price | — | (820 | ) | — | ||||||

| Acquisition of unproved properties and leasehold | 510 | — | — | |||||||

| Capitalized interest on leasehold and unproved property | 154 | — | — | |||||||

| Geological and geophysical costs | 74 | — | — | |||||||

| Geological, geophysical and capitalized interest | 738 | — | — | |||||||

Subtotal | 2,056 | 13 | — | |||||||

| Asset retirement obligation and other | 2 | — | — | |||||||

Total | $ | 2,058 | 13 | — | ||||||

| (a) | Includes 397 bcfe of performance revisions (317 bcfe relating to infill drilling and increased density locations and (80) bcfe of other performance related revisions) and excludes downward revisions of 820 bcfe resulting from natural gas and oil price declines between December 31, 2008 and March 31, 2009. |

| (b) | Includes adjustments to certain acquisitions and divestitures that closed during prior periods. |

CHESAPEAKE ENERGY CORPORATION

ROLL-FORWARD OF PROVED RESERVES

THREE MONTHS ENDED MARCH 31, 2009

(unaudited)

| Bcfe | |||||

| Beginning balance, 01/01/09 | 12,051 | ||||

| Production | (213 | ) | |||

| Acquisitions | 9 | ||||

| Revisions – performance | 397 | ||||

| Revisions – price | (820 | ) | |||

| Extensions and discoveries | 427 | ||||

| Ending balance, 03/31/09 | 11,851 | ||||

| Reserve replacement | 13 | ||||

Reserve replacement ratio (a) | 6 | % | |||

| (a) | The company uses the reserve replacement ratio as an indicator of the company’s ability to replenish annual production volumes and grow its reserves. It should be noted that the reserve replacement ratio is a statistical indicator that has limitations. The ratio is limited because it typically varies widely based on the extent and timing of new discoveries and property acquisitions. Its predictive and comparative value is also limited for the same reasons. In addition, since the ratio does not embed the cost or timing of future production of new reserves, it cannot be used as a measure of value creation. |

CHESAPEAKE ENERGY CORPORATION

SUPPLEMENTAL DATA – NATURAL GAS AND OIL SALES AND INTEREST EXPENSE

(unaudited)

March 31, 2009 | March 31, 2008 | ||||||

| THREE MONTHS ENDED: | |||||||

| Natural Gas and Oil Sales ($ in millions): | |||||||

Natural gas sales | $ | 674 | $ | 1,432 | |||

Natural gas derivatives – realized gains (losses) | 510 | 268 | |||||

Natural gas derivatives – unrealized gains (losses) | 68 | (1,002 | ) | ||||

Total Natural Gas Sales | 1,252 | 698 | |||||

Oil sales | 104 | 258 | |||||

Oil derivatives – realized gains (losses) | 9 | (53 | ) | ||||

Oil derivatives – unrealized gains (losses) | 32 | (130 | ) | ||||

Total Oil Sales | 145 | 75 | |||||

Total Natural Gas and Oil Sales | $ | 1,397 | $ | 773 | |||

| Average Sales Price – excluding gains (losses) on derivatives: | |||||||

Natural gas ($ per mcf) | $ | 3.44 | $ | 7.63 | |||

Oil ($ per bbl) | $ | 35.99 | $ | 94.14 | |||

Natural gas equivalent ($ per mcfe) | $ | 3.65 | $ | 8.28 | |||

Average Sales Price – excluding unrealized gains (losses) on derivatives: | |||||||

Natural gas ($ per mcf) | $ | 6.05 | $ | 9.05 | |||

Oil ($ per bbl) | $ | 39.12 | $ | 74.73 | |||

Natural gas equivalent ($ per mcfe) | $ | 6.09 | $ | 9.33 | |||

| Interest Expense (Income) ($ in millions): | |||||||

Interest (a) | $ | 38 | $ | 86 | |||

Derivatives – realized (gains) losses | (7 | ) | — | ||||

Derivatives – unrealized (gains) losses | (45 | ) | 13 | ||||

Total Interest Expense | $ | (14 | ) | $ | 99 | ||

CHESAPEAKE ENERGY CORPORATION

CONDENSED CONSOLIDATED CASH FLOW DATA

($ in millions)

(unaudited)

| THREE MONTHS ENDED: | March 31, | March 31, | |||||

| 2009 | 2008 (a) | ||||||

| Beginning cash | $ | 1,749 | $ | 1 | |||

| Cash provided by operating activities | $ | 1,261 | $ | 1,515 | |||

| Cash (used in) investing activities | $ | (2,367 | ) | $ | (2,692 | ) | |

| Cash provided by (used in) financing activities | $ | (560 | ) | $ | 1,177 | ||

| Ending cash | $ | 83 | $ | 1 | |||

| (a) | Adjusted for the retrospective application of FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion” |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF OPERATING CASH FLOW AND EBITDA

($ in millions)

(unaudited)

| THREE MONTHS ENDED: | March 31, | December 31, | March 31, | ||||||||

| 2009 | 2008 (a) | 2008 (a) | |||||||||

| CASH PROVIDED BY OPERATING ACTIVITIES | $ | 1,261 | $ | 970 | $ | 1,515 | |||||

| Adjustments: | |||||||||||

Changes in assets and liabilities | (262 | ) | 84 | 17 | |||||||

OPERATING CASH FLOW (b) | $ | 999 | $ | 1,054 | $ | 1,532 | |||||

| THREE MONTHS ENDED: | March 31, | December 31, | March 31, | ||||||||

| 2009 | 2008 (a) | 2008 (a) | |||||||||

| NET INCOME (LOSS) | $ | (5,740 | ) | $ | (995 | ) | $ | (130 | ) | ||

| Income tax expense (benefit) | (3,444 | ) | (615 | ) | (82 | ) | |||||

| Interest expense | (14 | ) | 84 | 99 | |||||||

| Depreciation and amortization of other assets | 57 | 50 | 36 | ||||||||

| Natural gas and oil depreciation, depletion and amortization | 447 | 452 | 515 | ||||||||

EBITDA (c) | $ | (8,694 | ) | $ | (1,024 | ) | $ | 438 | |||

| THREE MONTHS ENDED: | March 31, | December 31, | March 31, | ||||||||

| 2009 | 2008 (a) | 2008 (a) | |||||||||

| CASH PROVIDED BY OPERATING ACTIVITIES | $ | 1,261 | $ | 970 | $ | 1,515 | |||||

| Changes in assets and liabilities | (262 | ) | 84 | 17 | |||||||

| Interest expense | (14 | ) | 84 | 99 | |||||||

| Unrealized gains (losses) on natural gas and oil derivatives | 101 | 717 | (1,132 | ) | |||||||

| Impairment of natural gas and oil properties and other assets | (9,630 | ) | (2,830 | ) | — | ||||||

| Impairment of investments | (153 | ) | (180 | ) | — | ||||||

| Other non-cash items | 3 | 131 | (61 | ) | |||||||

EBITDA (c) | $ | (8,694 | ) | $ | (1,024 | ) | $ | 438 | |||

| (a) | Adjusted for the retrospective application of FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion” |

| (b) | Operating cash flow represents net cash provided by operating activities before changes in assets and liabilities. Operating cash flow is presented because management believes it is a useful adjunct to net cash provided by operating activities under accounting principles generally accepted in the United States (GAAP). Operating cash flow is widely accepted as a financial indicator of a natural gas and oil company's ability to generate cash which is used to internally fund exploration and development activities and to service debt. This measure is widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies within the natural gas and oil exploration and production industry. Operating cash flow is not a measure of financial performance under GAAP and should not be considered as an alternative to cash flows from operating, investing or financing activities as an indicator of cash flows, or as a measure of liquidity. |

(c) | Ebitda represents net income (loss) before income tax expense, interest expense and depreciation, depletion and amortization expense. Ebitda is presented as a supplemental financial measurement in the evaluation of our business. We believe that it provides additional information regarding our ability to meet our future debt service, capital expenditures and working capital requirements. This measure is widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies. Ebitda is also a financial measurement that, with certain negotiated adjustments, is reported to our lenders pursuant to our bank credit agreements and is used in the financial covenants in our bank credit agreements and our senior note indentures. Ebitda is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income, income from operations, or cash flow provided by operating activities prepared in accordance with GAAP. Ebitda is reconciled to cash provided by operating activities as follows: |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED NET INCOME AVAILABLE TO COMMON SHAREHOLDERS

($ in millions, except per-share data)

(unaudited)

| March 31, | December 31, | March 31, | ||||||||||

| THREE MONTHS ENDED: | 2009 | 2008 (a) | 2008 (a) | |||||||||

| Net income (loss) available to common shareholders | $ | (5,746 | ) | $ | (1,001 | ) | $ | (142 | ) | |||

| Adjustments: | ||||||||||||

| Unrealized (gains) losses on derivatives, net of tax | (91 | ) | (380 | ) | 704 | |||||||

| Impairment of natural gas and oil properties and other assets, net of tax | 6,019 | 1,726 | — | |||||||||

| Impairment of investments, net of tax | 95 | 110 | — | |||||||||

| (Gain) loss on exchanges or repurchases of Chesapeake debt, net of tax | — | (17 | ) | — | ||||||||

Adjusted net income available to common shareholders (b) | 277 | 438 | 562 | |||||||||

| Preferred stock dividends | 6 | 6 | 12 | |||||||||

| Total adjusted net income | $ | 283 | $ | 444 | $ | 574 | ||||||

Weighted average fully diluted shares outstanding (c) | 613 | 590 | 524 | |||||||||

Adjusted earnings per share assuming dilution(b) | $ | 0.46 | $ | 0.75 | $ | 1.09 | ||||||

| (a) | Adjusted for the retrospective application of FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion” | |

| (b) | Adjusted net income available to common shareholders and adjusted earnings per share assuming dilution exclude certain items that management believes affect the comparability of operating results. The company discloses these non-GAAP financial measures as a useful adjunct to GAAP earnings because: | |

| i. | Management uses adjusted net income available to common to evaluate the company’s operational trends and performance relative to other natural gas and oil producing companies. | |

| ii. | Adjusted net income available to common is more comparable to earnings estimates provided by securities analysts. | |

| iii. | Items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items. | |

| (c) | Weighted average fully diluted shares outstanding include shares that were considered antidilutive for calculating earnings per share in accordance with GAAP. | |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED EBITDA

($ in millions)

(unaudited)

| March 31, | December 31, | March 31, | ||||||||||

| THREE MONTHS ENDED: | 2009 | 2008 (a) | 2008 (a) | |||||||||

| EBITDA | $ | (8,694 | ) | $ | (1,024 | ) | $ | 438 | ||||

| Adjustments, before tax: | ||||||||||||

Unrealized (gains) losses on natural gas and oil derivatives | (101 | ) | (717 | ) | 1,132 | |||||||

(Gain) loss on exchanges or repurchases of Chesapeake debt | — | (27 | ) | — | ||||||||

Impairment of natural gas and oil properties and other assets | 9,630 | 2,830 | — | |||||||||

Impairment of investments | 153 | 180 | — | |||||||||

Adjusted ebitda (b) | $ | 988 | $ | 1,242 | $ | 1,570 | ||||||

| (a) | Adjusted for the retrospective application of FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion” | ||

| (b) | Adjusted ebitda excludes certain items that management believes affect the comparability of operating results. The company discloses these non-GAAP financial measures as a useful adjunct to ebitda because: | ||

| i. | Management uses adjusted ebitda to evaluate the company’s operational trends and performance relative to other natural gas and oil producing companies. | ||

| ii. | Adjusted ebitda is more comparable to estimates provided by securities analysts. | ||

| iii. | Items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items. | ||

SCHEDULE “A”

CHESAPEAKE’S OUTLOOK AS OF MAY 4, 2009

Years Ending December 31, 2009 and 2010

Our policy is to periodically provide guidance on certain factors that affect our future financial performance. As of May 4, 2009, we are using the following key assumptions in our projections for 2009 and 2010.

The primary changes from our February 17, 2009 Outlook are in italicized bold and are explained as follows:

| 1) | Our production guidance has been updated to reflect estimated production curtailments starting in March 2009 and estimated to continue through June 2009 as well as anticipated volumetric production payment transactions in 2009 and in 2010; |

| 2) | Projected effects of changes in our hedging positions have been updated, particularly the restructuring of certain 2010 knockout swap positions; |

| 3) | Our NYMEX natural gas and oil price assumptions for realized hedging effects and estimating future operating cash flow have been reduced for 2009; |

| 4) | Certain cost, book and cash income tax rate and share assumptions have been updated; and |

| 5) | Our rate of DD&A for natural gas and oil assets has been reduced to reflect our 2009 first quarter impairment charge. |

| Year Ending 12/31/2009 | Year Ending 12/31/2010 | ||

| Estimated Production: | |||

| Natural gas – bcf | 795 – 805 | 840 – 880 | |

| Oil – mbbls | 12,000 | 12,000 | |

| Natural gas equivalent – bcfe | 865 – 875 | 915 – 955 | |

| Daily natural gas equivalent midpoint – mmcfe | 2,380 | 2,560 | |

| Year-over-year estimated production increase | 3 – 4% | 7 – 8% | |

| Year-over-year estimated production increase excluding divestitures and curtailments | 7 – 8% | 9 – 10% | |

NYMEX Prices (a) (for calculation of realized hedging effects only): | |||

| Natural gas - $/mcf | $4.93 | $7.00 | |

| Oil - $/bbl | $48.27 | $70.00 | |

| Estimated Realized Hedging Effects (based on assumed NYMEX prices above): | |||

| Natural gas - $/mcf | $2.29 | $0.89 | |

| Oil - $/bbl | $1.71 | $7.37 | |

| Estimated Differentials to NYMEX Prices: | |||

| Natural gas - $/mcf | 20 – 30% | 15 – 20% | |

| Oil - $/bbl | 7 – 10% | 5 – 7% | |

| Operating Costs per Mcfe of Projected Production: | |||

| Production expense | $1.10 – 1.20 | $1.10 – 1.20 | |

Production taxes (~ 5% of O&G revenues)(b) | $0.20 – 0.25 | $0.30 – 0.35 | |

General and administrative(c) | $0.33 – 0.37 | $0.33 – 0.37 | |

| Stock-based compensation (non-cash) | $0.10 – 0.12 | $0.10 – 0.12 | |

| DD&A of natural gas and oil assets | $1.50 – 1.70 | $1.50 – 1.70 | |

| Depreciation of other assets | $0.25 – 0.30 | $0.25 – 0.30 | |

Interest expense(d) | $0.30 – 0.35 | $0.35 – 0.40 | |

| Other Income per Mcfe: | |||

| Natural gas and oil midstream income | $0.10 – 0.12 | $0.09 – 0.11 | |

| Service operations income | $0.04 – 0.06 | $0.04 – 0.06 | |

| Book Tax Rate (all deferred) | 37.5% | 39% | |

| Equivalent Shares Outstanding (in millions): | |||

| Basic | 605 – 610 | 615 – 620 | |

| Diluted | 615 – 620 | 625 – 630 | |

Year Ending 12/31/2009 | Year Ending 12/31/2010 | ||

| Cash Flow Projections ($ in millions): | |||

| Net inflows: | |||

Operating cash flow before changes in assets and liabilities(e)(f) | $3,600 – 3,650 | $3,900 – 4,600 | |

| Leasehold and producing property transactions: | |||

| Sale of leasehold and producing properties | $1,500 – 2,000 | $1,000 – 1,500 | |

| Acquisition of leasehold and producing properties: | $(450 – $600) | $(350 - $500) | |

| Net leasehold and producing property transactions | $1,050 – 1,400 | $650 – 1,000 | |

| Midstream financings | $500 – 600 | $500 – 600 | |

| Proceeds from investments and other | $450 | – | |

Total Cash Inflows | $5,600 – 6,100 | $5,050 – 6,200 | |

| Net outflows: | |||

| Drilling | $2,700 – 2,900 | $3,100 – 3,400 | |

| Geophysical costs | $100 – 125 | $100 – 125 | |

| Midstream infrastructure and compression | $700 – 900 | $300 – 400 | |

| Other PP&E | $400 – 450 | $200 – 250 | |

| Dividends, senior notes redemption, capitalized interest, etc. | $600 – 800 | $600 – 700 | |

| Cash income taxes | $175 – 200 | – | |

Total Cash Outflows | $4,675 – 5,375 | $4,300 – 4,875 | |

| Net Cash Change | $725 – 925 | $750 – 1,325 |

At March 31, 2009, the company had $1.7 billion of cash and cash equivalents and additional borrowing capacity under its two revolving bank credit facilities.

| (a) | NYMEX natural gas prices have been updated for actual contract prices through May 2009 and NYMEX oil prices have been updated for actual contract prices through March 2009. |

| (b) | Severance tax per mcfe is based on NYMEX prices of $48.27 per bbl of oil and $5.00 to $6.00 per mcf of natural gas during 2009 and $70.00 per bbl of oil and $7.00 to $8.00 per mcf of natural gas during 2010. |

| (c) | Excludes expenses associated with noncash stock compensation. |

| (d) | Does not include gains or losses on interest rate derivatives (SFAS 133). |

| (e) | A non-GAAP financial measure. We are unable to provide a reconciliation to projected cash provided by operating activities, the most comparable GAAP measure, because of uncertainties associated with projecting future changes in assets and liabilities. |

| (f) | Assumes NYMEX natural gas prices of $5.00 to $6.00 per mcf and NYMEX oil prices of $50.00 per bbl in 2009 and NYMEX natural gas prices of $6.00 to $7.00 per mcf and NYMEX oil prices of $70.00 per bbl in 2010. |

Commodity Hedging Activities

The company utilizes hedging strategies to hedge the price of a portion of its future natural gas and oil production. These strategies include:

| 1) | For swap instruments, Chesapeake receives a fixed price and pays a floating market price to the counterparty. The fixed-price payment and the floating-price payment are netted, resulting in a net amount due to or from the counterparty. |

| 2) | Basis protection swaps are arrangements that guarantee a price differential for oil or natural gas from a specified delivery point. For Mid-Continent basis protection swaps, which have negative differentials to NYMEX, Chesapeake receives a payment from the counterparty if the price differential is greater than the stated terms of the contract and pays the counterparty if the price differential is less than the stated terms of the contract. For Appalachian basis protection swaps, which have positive differentials to NYMEX, Chesapeake receives a payment from the counterparty if the price differential is less than the stated terms of the contract and pays the counterparty if the price differential is greater than the stated terms of the contract. |

| 3) | For knockout swaps, Chesapeake receives a fixed price and pays a floating market price. The fixed price received by Chesapeake includes a premium in exchange for the possibility to reduce the counterparty’s exposure to zero, in any given month, if the floating market price is lower than certain predetermined knockout prices. |

| 4) | For cap-swaps, Chesapeake receives a fixed price and pays a floating market price. The fixed price received by Chesapeake includes a premium in exchange for a "cap" limiting the counterparty's exposure. In other words, there is no limit to Chesapeake's exposure but there is a limit to the downside exposure of the counterparty. |

| 5) | For written call options, Chesapeake receives a premium from the counterparty in exchange for the sale of a call option. If the market price exceeds the fixed price of the call option, Chesapeake pays the counterparty such excess. If the market price settles below the fixed price of the call option, no payment is due from Chesapeake. |

| 6) | Collars contain a fixed floor price (put) and ceiling price (call). If the market price exceeds the call strike price or falls below the put strike price, Chesapeake receives the fixed price and pays the market price. If the market price is between the call and the put strike price, no payments are due from either party. |

| 7) | A three-way collar contract consists of a standard collar contract plus a written put option with a strike price below the floor price of the collar. In addition to the settlement of the collar, the put option requires Chesapeake to make a payment to the counterparty equal to the difference between the put option price and the settlement price if the settlement price for any settlement period is below the put option strike price. |

Commodity markets are volatile, and as a result, Chesapeake’s hedging activity is dynamic. As market conditions warrant, the company may elect to settle a hedging transaction prior to its scheduled maturity date and lock in the gain or loss on the transaction.

Chesapeake enters into natural gas and oil derivative transactions in order to mitigate a portion of its exposure to adverse market changes in natural gas and oil prices. Accordingly, associated gains or losses from the derivative transactions are reflected as adjustments to natural gas and oil sales. All realized gains and losses from natural gas and oil derivatives are included in natural gas and oil sales in the month of related production. Pursuant to SFAS 133, certain derivatives do not qualify for designation as cash flow hedges. Changes in the fair value of these nonqualifying derivatives that occur prior to their maturity (i.e., because of temporary fluctuations in value) are reported currently in the consolidated statement of operations as unrealized gains (losses) within natural gas and oil sales. Following provisions of SFAS 133, changes in the fair value of derivative instruments designated as cash flow hedges, to the extent effective in offsetting cash flows attributable to hedged risk, are recorded in other comprehensive income until the hedged item is recognized in earnings. Any change in fair value resulting from ineffectiveness is recognized currently in natural gas and oil sales.

Excluding the swaps assumed in connection with the acquisition of CNR which are described below, the company currently has the following open natural gas swaps in place and also has the following gains from lifted natural gas trades:

Open Swaps (Bcf) | Avg. NYMEX Strike Price of Open Swaps | Assuming Natural Gas Production (Bcf) | Open Swap Positions as a % of Estimated Total Natural Gas Production | Total Gains from Lifted Trades ($ millions) | Total Lifted Gain per Mcf of Estimated Total Natural Gas Production | |||||||

| Q2 2009 | 64.4 | $ | 7.70 | $ | 18.9 | |||||||

| Q3 2009 | 68.5 | $ | 7.83 | $ | 19.4 | |||||||

| Q4 2009 | 120.4 | $ | 7.57 | $ | 31.2 | |||||||

Q2-Q4 2009(a) | 253.3 | $ | 7.67 | 604 | 42% | $ | 69.5 | $ | 0.12 | |||

Total 2010(a) | 121.2 | $ | 9.69 | 860 | 14% | $ | 224.6 | $ | 0.26 | |||

| (a) | Certain hedging arrangements include knockout swaps with provisions limiting the counterparty’s exposure at prices ranging from $6.00 to $6.50 covering 5 bcf in 2009 and $5.45 to $6.75 covering 70 bcf in 2010. |

The company currently has the following open natural gas collars in place:

Open Collars (Bcf) | Avg. NYMEX Floor Price | Avg. NYMEX Ceiling Price | Assuming Natural Gas Production (Bcf) | Open Collars as a % of Estimated Total Natural Gas Production | |||||||

| Q2 2009 | 97.8 | $ | 7.02 | $ | 8.83 | ||||||

| Q3 2009 | 102.7 | $ | 7.02 | $ | 8.76 | ||||||

| Q4 2009 | 52.1 | $ | 7.34 | $ | 8.88 | ||||||

Q2-Q4 2009(a) | 252.6 | $ | 7.08 | $ | 8.81 | 604 | 42% | ||||

Total 2010(a) | 70.6 | $ | 6.78 | $ | 9.18 | 860 | 8% | ||||

| (a) | Certain collar arrangements include three-way collars that include written put options with strike prices ranging from $5.00 to $6.00 covering 62 bcf in 2009 and ranging from $4.25 to $6.00 covering 30 bcf in 2010. |

The company currently has the following natural gas written call options in place:

Call Options (Bcf) | Avg. NYMEX Floor Price | Avg. Premium per mcf | Assuming Natural Gas Production (Bcf) | Call Options as a % of Estimated Total Natural Gas Production | |||||||

| Q2 2009 | 21.1 | $ | 7.64 | $ | 1.14 | ||||||

| Q3 2009 | 18.9 | $ | 7.53 | $ | 1.19 | ||||||

| Q4 2009 | 18.9 | $ | 7.58 | $ | 1.15 | ||||||

| Q2-Q4 2009 | 58.9 | $ | 7.59 | $ | 1.16 | 604 | 10% | ||||

| Total 2010 | 298.5 | $ | 10.19 | $ | 0.58 | 860 | 35% | ||||

The company has the following natural gas basis protection swaps in place:

| Mid-Continent | Appalachia | |||||||||

| Volume (Bcf) | NYMEX less(a) | Volume (Bcf) | NYMEX plus(a) | |||||||

| 2009 | 27.3 | $ | 1.46 | 13.1 | $ | 0.28 | ||||

| 2010 | — | — | 10.2 | 0.26 | ||||||

| 2011 | 45.1 | 0.82 | 12.1 | 0.25 | ||||||

| 2012 | 43.2 | 0.85 | — | — | ||||||

Totals | 115.6 | $ | 0.98 | 35.4 | $ | 0.26 | ||||

| (a) | weighted average |

We assumed certain liabilities related to open derivative positions in connection with the CNR acquisition in November 2005. In accordance with SFAS 141, these derivative positions were recorded at fair value in the purchase price allocation as a liability of $592 million ($27 million as of March 31, 2009). The recognition of the derivative liability and other assumed liabilities resulted in an increase in the total purchase price which was allocated to the assets acquired. Because of this accounting treatment, only cash settlements for changes in fair value subsequent to the acquisition date for the derivative positions assumed result in adjustments to our natural gas and oil revenues upon settlement. For example, if the fair value of the derivative positions assumed does not change, then upon the sale of the underlying production and corresponding settlement of the derivative positions, cash would be paid to the counterparties and there would be no adjustment to natural gas and oil revenues related to the derivative positions. If, however, the actual sales price is different from the price assumed in the original fair value calculation, the difference would be reflected as either a decrease or increase in natural gas and oil revenues, depending upon whether the sales price was higher or lower, respectively, than the prices assumed in the original fair value calculation. For accounting purposes, the net effect of these acquired hedges is that we hedged the production volumes listed below at their fair values on the date of our acquisition of CNR.

Pursuant to SFAS 149 “Amendment of SFAS 133 on Derivative Instruments and Hedging Activities,” the assumed CNR derivative instruments are deemed to contain a significant financing element and all cash flows associated with these positions are reported as financing activity in the statement of cash flows.

The following details the CNR derivatives (natural gas swaps) we have assumed:

Open Swaps (Bcf) | Avg. NYMEX Strike Price Of Open Swaps | Avg. Fair Value Upon Acquisition of Open Swaps | Initial Liability Acquired | Assuming Natural Gas Production (Bcf) | Open Swap Positions as a % of Estimated Total Natural Gas Production | |||||||

| Q2 2009 | 4.6 | $ | 5.18 | $ | 6.87 | $ | (1.69) | |||||

| Q3 2009 | 4.6 | $ | 5.18 | $ | 6.89 | $ | (1.71) | |||||

| Q4 2009 | 4.6 | $ | 5.18 | $ | 7.32 | $ | (2.14) | |||||

| Q2-Q4 2009 | 13.8 | $ | 5.18 | $ | 7.28 | $ | (2.10) | 604 | 2% | |||

Note: Not shown above are collars covering 2.75 bcf of production in 2009 at an average floor and ceiling of $4.50 and $6.00.

The company also has the following crude oil swaps in place:

Open Swaps (mbbls) | Avg. NYMEX Strike Price | Assuming Oil Production (mbbls) | Open Swap Positions as a % of Estimated Total Oil Production | Total Gains (Losses) from Lifted Trades ($ millions) | Total Lifted Gains (Losses) per bbl of Estimated Total Oil Production | ||||||||

| Q2 2009 | 637 | $ | 77.38 | $ | 4.4 | ||||||||

| Q3 2009 | 1,058 | $ | 87.05 | $ | (0.3) | ||||||||

| Q4 2009 | 1,058 | $ | 87.04 | $ | (0.4) | ||||||||

Q2-Q4 2009(a) | 2,753 | $ | 84.81 | 9,126 | 30% | $ | 3.7 | $ | 0.41 | ||||

Total 2010(a) | 4,745 | $ | 90.25 | 12,000 | 40% | $ | (6.9) | $ | (0.58) | ||||

| (a) | Certain hedging arrangements include cap-swaps and knockout swaps with provisions limiting the counterparty’s exposure below prices ranging from $50.00 to $60.00 covering 3 mmbbls in 2009 and $60.00 covering 5 mmbbls in 2010. |

Note: Not shown above are written call options covering 3,850 mbbls of oil production in 2009 at a weighted average price of $101.79 per bbl for a weighted average premium of $0.64 per bbl and 5,110 mbbls of oil production in 2010 at a weighted average price of $100.71 per bbl for a weighted average premium of $1.20 per bbl.

SCHEDULE “B”

CHESAPEAKE’S PREVIOUS OUTLOOK AS OF FEBRUARY 17, 2009

(PROVIDED FOR REFERENCE ONLY)

NOW SUPERSEDED BY OUTLOOK AS OF MAY 4, 2009

Years Ended December 31, 2009 and 2010

We have adopted a policy of periodically providing guidance on certain factors that affect our future financial performance. As of February 17, 2009, we are using the following key assumptions in our projections for 2009 and 2010.

The primary changes from our December 7, 2009 Outlook are in italicized bold and are explained as follows:

| 1) | Projected effects of changes in our hedging positions have been updated; |

| 2) | Our NYMEX natural gas and oil price assumptions for realized hedging effects and estimating future operating cash flow have been reduced; and |

| 3) | Certain cost, cash income tax and book income tax rate assumptions have been updated; and |

| 4) | The company has discontinued its practice of providing quarterly estimates. |

Year Ending 12/31/2009 | Year Ending 12/31/2010 | |||

| Estimated Production: | ||||

| Natural gas – bcf | 803 – 813 | 904 – 944 | ||

| Oil – mbbls | 12,000 | 12,000 | ||

| Natural gas equivalent – bcfe | 875 – 885 | 976 –1,016 | ||

| Daily natural gas equivalent midpoint – mmcfe | 2,410 | 2,730 | ||

| Year-over-year estimated production increase | 4.8% | 13.3% | ||

NYMEX Prices (a) (for calculation of realized hedging effects only): | ||||

| Natural gas - $/mcf | $5.80 | $7.00 | ||

| Oil - $/bbl | $47.66 | $70.00 | ||

| Estimated Realized Hedging Effects (based on assumed NYMEX prices above): | ||||

| Natural gas - $/mcf | $1.67 | $1.15 | ||

| Oil - $/bbl | $0.49 | $5.71 | ||

| Estimated Differentials to NYMEX Prices: | ||||

| Natural gas - $/mcf | 15 – 20% | 15 – 20% | ||

| Oil - $/bbl | 5 – 7% | 5 – 7% | ||

| Operating Costs per Mcfe of Projected Production: | ||||

| Production expense | $1.10 – 1.20 | $1.15 – 1.25 | ||

Production taxes (~ 5% of O&G revenues)(b) | $0.25 – 0.35 | $0.30 – 0.35 | ||

General and administrative(c) | $0.33 – 0.37 | $0.33 – 0.37 | ||

| Stock-based compensation (non-cash) | $0.10 – 0.12 | $0.10 – 0.12 | ||

| DD&A of natural gas and oil assets | $1.90 – 2.00 | $1.90 – 2.00 | ||

| Depreciation of other assets | $0.24 – 0.28 | $0.24 – 0.28 | ||

Interest expense(d) | $0.30 – 0.35 | $0.35 – 0.40 | ||

| Other Income per Mcfe: | ||||

| Natural gas and oil marketing income | $0.09 – 0.11 | $0.09 – 0.11 | ||

| Service operations income | $0.04 – 0.06 | $0.04 – 0.06 | ||

| Book Tax Rate | 39% | 39% | ||

| Cash Income Taxes – in millions | – | $100 – 200 | ||

| Equivalent Shares Outstanding (in millions): | ||||