Exhibit 99.1

| N e w s R e l e a s e Chesapeake Energy Corporation P. O. Box 18496 Oklahoma City, OK 73154 |

FOR IMMEDIATE RELEASE

MAY 3, 2010

INVESTOR CONTACTS: JEFFREY L. MOBLEY, CFA (405) 767-4763 jeff.mobley@chk.com JOHN J. KILGALLON (405) 935-4441 john.kilgallon@chk.com | MEDIA CONTACT: JIM GIPSON (405) 935-1310 jim.gipson@chk.com |

CHESAPEAKE ENERGY CORPORATION PROVIDES QUARTERLY

OPERATIONAL UPDATE

Company Reports 2010 First Quarter Production of 2.586 Bcfe per Day, an

Increase of 9% over 2009 First Quarter Production; Production Increases

19% Year-Over-Year Adjusted for Asset Sales; Production of

Oil and Natural Gas Liquids Increases 35% Year-Over-Year

Proved Reserves Reach 14.8 Tcfe; Company Reports 2010 First Quarter

Drilling and Completion Costs of $0.67 per Mcfe

Company Discloses Details on 12 Unconventional Liquids-Rich Plays on 1.9 Million

Net Acres with Risked Unproved Resources of 2.0 Bboe; Company Expects to

Increase its Oil and Natural Gas Liquids Production to More Than 100,000 Bbls

per Day, or 15%-20% of Total Production, by Year-End 2012

OKLAHOMA CITY, OKLAHOMA, MAY 3, 2010 – Chesapeake Energy Corporation (NYSE:CHK) today provided an update on its operational activities. For the 2010 first quarter, daily production averaged 2.586 billion cubic feet of natural gas equivalent (bcfe), a decrease of 32 million cubic feet of natural gas equivalent (mmcfe), or 1%, below the 2.618 bcfe produced per day in the 2009 fourth quarter and an increase of 219 mmcfe, or 9%, over the 2.367 bcfe produced per day in the 2009 first quarter. Adjusted for 2010 first quarter asset sales of a 25% joint venture interest in the company’s Barnett Shale assets (averaging approximately 155 mmcfe per day of production during the 2010 first quarter) and the company’s sixth volumetric production payment transaction (averaging approximately 14 mmcfe per day duri ng the 2010 first quarter), Chesapeake’s sequential and year-over-year daily production growth rates would have been 5% and 19%, respectively.

Chesapeake’s average daily production of 2.586 bcfe for the 2010 first quarter consisted of 2.328 billion cubic feet of natural gas (bcf) and 43,011 barrels of oil and natural gas liquids (bbls). The company’s 2010 first quarter production of 232.8 bcfe was comprised of 209.6 bcf (90% on a natural gas equivalent basis) and 3.9 million barrels of oil and natural gas liquids (mmbbls) (10% on a natural gas equivalent basis). The company’s year-over-year growth rate of natural gas production was 7% and its year-over-year growth rate of oil and natural gas liquids production was 35%.

Chesapeake anticipates reporting full-year production growth of approximately 8-10% in 2010 and 16-18% in 2011.

Chesapeake’s Proved Natural Gas and Oil Reserves Increase by 4% in the

2010 First Quarter to 14.8 Tcfe; Company Reports 2010 First Quarter

Drilling and Completion Costs of $0.67 per Mcfe

The following table compares Chesapeake’s 2010 first quarter proved reserves and percentage increase over its year-end 2009 proved reserves, estimated future net cash flows from proved reserves, discounted at an annual rate of 10% before income taxes (PV-10), and proved developed percentage based on the trailing 12-month average price required under SEC rules and the 10-year average NYMEX strip prices at March 31, 2010.

| Pricing Method | Natural Gas Price ($/mcf) | Oil Price ($/bbl) | Proved Reserves (tcfe) | First Quarter Proved Reserves Growth(a) | Reserve Replacement Ratio | PV-10 (billions) | Proved Developed Percentage |

| Trailing 12-month average (SEC) | $3.99 | $69.61 | 14.8 | 3.6% | 320% | $11.2 | 54% |

| 3/31/10 10-year average NYMEX strip | $6.51 | $88.46 | 15.8 | 1.6% | 207% | $26.8 | 54% |

| (a) | Compares proved reserve growth rate for the 2010 first quarter under comparable pricing methods. At year-end 2009, Chesapeake’s proved reserves were 14.3 tcfe using trailing 12-month average prices, which are required by SEC reporting rules, and 15.5 tcfe using the 10-year average NYMEX strip prices at December 31, 2009, which management believes provide a better indicator of the likely economic producibility of the company’s proved reserves. |

The following table summarizes Chesapeake’s finding and development costs for the 2010 first quarter using each of the two pricing methods described above.

| Finding and Development Cost Category | 12-Month Average (SEC) Pricing ($/mcfe) | 3/31/10 10-year Average NYMEX Strip Pricing ($/mcfe) |

Drilling and completion costs (1) | $0.67 | $0.69 |

Drilling, completion and net acquisition costs (1) | $0.01 | $0.02 |

| Total capitalized costs for natural gas and oil properties | $1.11 | $1.71 |

| (1) | Includes performance-related revisions and the benefit of drilling carries and excludes price-related revisions |

A complete reconciliation of proved reserves, reserve replacement ratios and costs based on these two alternative pricing methods is presented on pages 9 – 10 of this release.

In addition to the PV-10 value of its proved reserves and the significant value of its undeveloped leasehold, particularly in the Haynesville, Marcellus, Barnett and Fayetteville Shale plays and the company’s unconventional liquids-rich plays, particularly the Granite Wash and Eagle Ford Shale plays, the net book value of the company’s other assets (including gathering systems, compressors, land and buildings, investments and other non-current assets) was $5.6 billion as of March 31, 2010 compared to $6.7 billion as of December 31, 2009. The decline in other assets is due to the deconsolidation of the company’s midstream joint venture reflecting the implementation of new accounting guidance for certain investments.

During the 2010 first quarter, Chesapeake continued the industry’s most active drilling program, drilling 324 gross operated wells (209 net wells with an average working interest of 65%) and participating in another 255 gross wells operated by other companies (34 net wells with an average working interest of 13%). The company’s drilling success rate was 99% for company-operated wells and 97% for non-operated wells. During the 2010 first quarter, Chesapeake invested $918 million in operated wells (using an average of 118 operated rigs) and $127 million in non-operated wells (using an average of 94 non-operated rigs) for total drilling, completing and equipping costs of $1.045 billion.

Chesapeake’s Leasehold and 3-D Seismic Inventories Total 13.8 Million Net Acres

and 24.1 Million Acres; Risked Unproved Resources in the Company’s Inventory

Total 80 Tcfe; Company Discloses Details on 12 Unconventional Liquids-Rich

Plays on 1.9 Million Net Acres with Risked Unproved Resources of 2.0 Bboe

Since 2000, Chesapeake has built the largest combined inventories of onshore leasehold (13.8 million net acres) and 3-D seismic (24.1 million acres) in the U.S. and the largest inventory of U.S. Big 6 shale play leasehold (3.1 million net acres). On its total leasehold inventory, as of March 31, 2010, pro forma for recent Eagle Ford Shale leasehold transactions, Chesapeake had identified an estimated 15.8 tcfe of proved reserves, 80 tcfe of risked unproved resources and 195 tcfe of unrisked unproved resources. The company is currently using 122 operated drilling rigs to further develop its inventory of approximately 38,000 net drillsites, which represents more than a 10-year inventory of drilling projects. Of its 122 operated rigs, 100 are drilling wells primarily focused on natural gas and 22 are drill ing wells primarily focused on oil and natural gas liquids. In addition, 114 of its 122 operated rigs are drilling horizontal wells.

In recognition of the value gap between oil and natural gas prices, during the past two years, Chesapeake has directed a significant portion of its technological and leasehold acquisition expertise to identify, secure and commercialize new unconventional liquids-rich plays. To date, Chesapeake has built leasehold positions and established production in 12 liquids-rich plays on approximately 1.9 million net leasehold acres with 2.0 billion barrels of oil equivalent (bboe) (11.9 tcfe) of risked unproved resources and 6.8 bboe (40.7 tcfe) of unrisked unproved resources. As a result of its success to date, Chesapeake expects to increase its oil and natural gas liquids production to more than 100,000 bbls per day, or 15%-20% of total production, by year-end 2012 through organic growth.

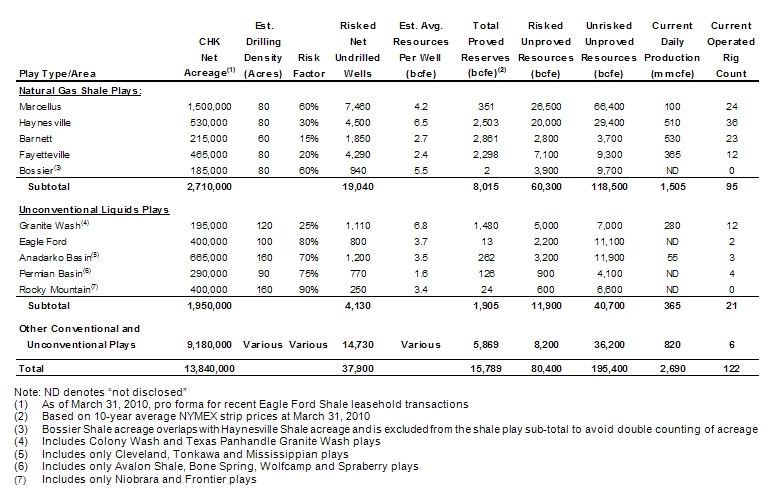

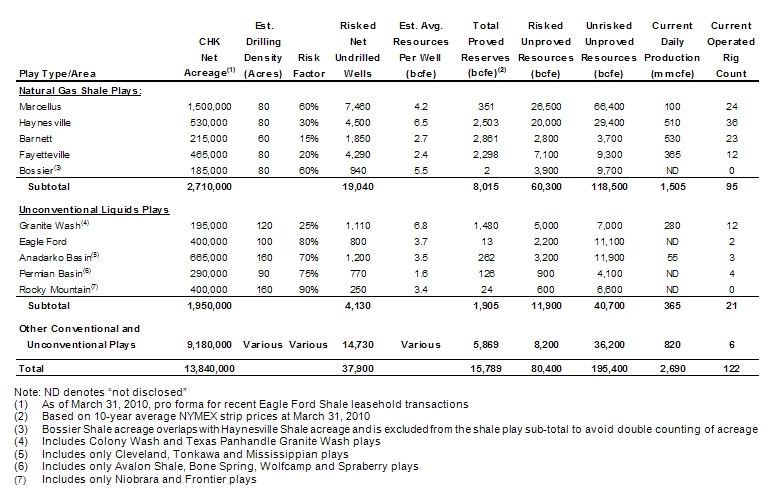

The following table summarizes Chesapeake’s ownership and activity in its natural gas shale plays, its unconventional liquids-rich plays and its other conventional and unconventional plays. Chesapeake uses a probability-weighted statistical approach to estimate the potential number of drillsites and unproved resources associated with such drillsites.

Marcellus Shale (West Virginia, Pennsylvania and New York): With approximately 1.5 million net acres, Chesapeake is the largest leasehold owner in the Marcellus Shale play that spans from northern West Virginia across much of Pennsylvania into southern New York. On its Marcellus leasehold, Chesapeake estimates it has approximately 26 tcfe of risked unproved resources and 66 tcfe of unrisked unproved resources.

During the 2010 first quarter, Chesapeake’s average daily net production of 65 mmcfe in the Marcellus increased approximately 40% over the 2009 fourth quarter and approximately 815% over the 2009 first quarter. Chesapeake is currently producing approximately 100 mmcfe net per day from the Marcellus. Chesapeake is currently drilling with 24 operated rigs in the Marcellus and anticipates operating an average of approximately 31 rigs in 2010 to drill approximately 170 net wells. During the 2010 first quarter, approximately $90 million of Chesapeake’s drilling costs in the Marcellus were paid for by its joint venture partner Statoil (NYSE:STO, OSE:STL). From April 2010 through 2012, 75% of Chesapeake’s drilling costs in the Marcellus, or approximately $1.9 billion, will be paid for by STO.

Three notable recent wells completed by Chesapeake in the Marcellus are as follows:

| · | The James Barrett 2H in Bradford County, PA achieved a peak 24-hour rate of 12.7 million cubic feet of natural gas (mmcf) per day; |

| · | The James Barrett 1H in Bradford County, PA achieved a peak 24-hour rate of 11.8 mmcf per day; and |

| · | The Strom 1H in Bradford County, PA achieved a peak 24-hour rate of 8.2 mmcf per day. |

Haynesville and Bossier shales (Northwest Louisiana, East Texas): Chesapeake is the largest leasehold owner and most active driller of new wells in the Haynesville Shale play in Northwest Louisiana and East Texas. Chesapeake now owns approximately 530,000 net acres of leasehold in the Haynesville Shale play. The company also has approximately 185,000 net acres of leasehold it believes is prospective for the Bossier Shale. On its Haynesville and Bossier leasehold, Chesapeake estimates it has approximately 24 tcfe of risked unproved resources and 39 tcfe of unrisked unproved resources.

The company has drilled and completed 215 gross Chesapeake-operated horizontal wells in the Haynesville and Bossier since discovering the play in 2007. During the 2010 first quarter, Chesapeake’s average daily net production of 425 mmcfe in the Haynesville increased approximately 15% over the 2009 fourth quarter and approximately 465% over the 2009 first quarter. Chesapeake is currently producing approximately 510 mmcfe net per day from the Haynesville and Bossier shales. The company is currently drilling with 36 operated rigs in the Haynesville and anticipates operating an average of approximately 35 rigs in 2010 to drill approximately 170 net wells.

Three notable recent wells completed by Chesapeake in the Haynesville are as follows:

| · | The Fuller 8-13-13 H-1 in De Soto Parish, LA achieved a peak 24-hour rate of 23.7 mmcf per day; |

| · | The Sloan 4-13-13 H-1 in De Soto Parish, LA achieved a peak 24-hour rate of 21.9 mmcf per day; and |

| · | The Pankey 23-14N-15W H-1 in De Soto Parish, LA achieved a peak 24-hour rate of 18.9 mmcf per day. |

Barnett Shale (North Texas): The Barnett Shale is currently the largest natural gas producing field in the U.S. In this play, Chesapeake is the second-largest producer, the most active driller and the largest leasehold owner in the Core and Tier 1 sweet spots of Tarrant and Johnson counties.

In January 2010, Chesapeake completed its $2.25 billion Barnett Shale joint venture transaction with Total E&P USA, Inc., a wholly owned subsidiary of Total S.A. (NYSE:TOT, FP:FP) (Total), whereby Total acquired a 25% interest in the company’s upstream Barnett Shale assets. Total paid Chesapeake approximately $800 million in cash at closing and will pay a further $1.45 billion over time by funding 60% of Chesapeake’s share of drilling and completion expenditures until the $1.45 billion obligation has been funded, which Chesapeake expects to occur by year-end 2012. Following the sale of 25% of its interests in the Barnett Shale to Total, the company now owns approximately 215,000 net acres of leasehold and estimates it has approximately 3 tcfe of risked unproved resources and 4 tcfe of unrisked unpr oved resources in the Barnett play.

During the 2010 first quarter, Chesapeake’s average daily net production of approximately 560 mmcfe in the Barnett decreased approximately 20% compared to the 2009 fourth quarter and decreased approximately 15% compared to the 2009 first quarter. Adjusted for the company’s sale of a 25% joint venture interest to Total, the company’s sequential and year-over-year production growth rate in the Barnett Shale was 4% and 10%, respectively. Chesapeake is currently producing approximately 530 mmcfe net per day from the Barnett. Chesapeake is currently drilling with 23 operated rigs in the Barnett and anticipates operating an average of approximately 24 rigs in the Barnett in 2010 to drill approximately 275 net wells. During the 2010 first quarter, Chesapeake received approximately $190 million in drilling carries from Total. From April 2010 through 2012, 60% of Chesapeake’s drilling costs in the Barnett, or approximately $1.25 billion, will be paid for by Total.

Three notable recent wells completed by Chesapeake in the Barnett are as follows:

| · | The Donna Ray East 3H in Johnson County, TX achieved a peak 24-hour rate of 12.0 mmcf per day; |

| · | The Darby 1H in Johnson County, TX achieved a peak 24-hour rate of 9.7 mmcf per day; and |

| · | The Brown 2H in Johnson County, TX achieved a peak 24-hour rate of 9.2 mmcf per day. |

Fayetteville Shale (Arkansas): In the Fayetteville, Chesapeake is the second-largest leasehold owner in the Core area of the play with 465,000 net acres. On its Fayetteville leasehold, the company estimates it has approximately 7 tcfe of risked unproved resources and 9 tcfe of unrisked unproved resources.

During the 2010 first quarter, Chesapeake’s average daily net production of 345 mmcfe in the Fayetteville increased approximately 10% over the 2009 fourth quarter and approximately 70% over the 2009 first quarter. Chesapeake is currently producing approximately 365 mmcfe net per day from the Fayetteville. The company is currently drilling with 12 operated rigs in the Fayetteville and anticipates operating an average of approximately 10 rigs in the Fayetteville in 2010 to drill approximately 90 net wells.

Three notable recent wells completed by Chesapeake in the Fayetteville are as follows:

| · | The Stroud 7-9 1-23H14 in White County, AR achieved a peak 24-hour rate of 7.9 mmcf per day; |

| · | The Billy 7-8 2-11H3 in White County, AR achieved a peak 24-hour rate of 6.4 mmcf per day; and |

| · | The Deen 7-8 2-4H10 in White County, AR achieved a peak 24-hour rate of 5.9 mmcf per day. |

Granite Wash (western Oklahoma, Texas Panhandle): Chesapeake is the largest leasehold owner with approximately 195,000 net acres in the unconventional liquids-rich Granite Wash plays in the Anadarko Basin, which include the Colony, Texas Panhandle and various other Wash plays. On its Granite Wash leasehold, Chesapeake estimates it has approximately 835 million barrels of oil equivalent (mmboe) (5 tcfe) of risked unproved resources and 1,200 mmboe (7 tcfe) of unrisked unproved resources.

During the 2010 first quarter, Chesapeake’s average daily net production of 250 mmcfe (42 thousand barrels of oil equivalent (mboe)) in the Greater Granite Wash play increased approximately 20% over 2009 fourth quarter and 60% over 2009 first quarter. The company is currently producing approximately 280 mmcfe net per day (47 mboe) from the Granite Wash. Chesapeake anticipates operating an average of approximately 13 rigs in the Granite Wash in 2010 to drill approximately 70 net wells. Due in large part to the play’s high oil and natural gas liquids content, the Granite Wash is Chesapeake’s highest rate-of-return play.

Three notable recent wells completed by Chesapeake in the Granite Wash are as follows:

| · | The Young 303H in Hemphill County, TX achieved a peak 24-hour rate of 20.9 mmcf and 2,400 bbls per day; |

| · | The James 1-33H in Washita County, OK achieved a peak 24-hour rate of 12.0 mmcf and 3,300 bbls per day; and |

| · | The Thurman Horn 4-2H in Wheeler County, TX achieved a peak 24-hour rate of 15.4 mmcf and 2,200 bbls per day. |

Eagle Ford Shale (South Texas): Chesapeake is building a leading position in the liquids-rich portion of the Eagle Ford Shale in South Texas. On its 400,000 net acres of Eagle Ford Shale leasehold, Chesapeake estimates it has approximately 370 mmboe (2 tcfe) of risked unproved resources and 1,850 mmboe (11 tcfe) of unrisked unproved resources. Chesapeake has drilled and completed three gross wells to date and anticipates operating an average of approximately four rigs in the Eagle Ford in 2010 to drill approximately 40 net wells.

Anadarko Basin Unconventional Liquids (western Oklahoma, Texas Panhandle, southern Kansas): Chesapeake is the largest leasehold owner with approximately 665,000 net acres in the Anadarko Basin unconventional liquids plays, which includes horizontal drilling in the Cleveland, Tonkawa and Mississippian formations. On this leasehold, the company estimates it has approximately 535 mmboe (3 tcfe) of risked unproved resources and 1,980 mmboe (12 tcfe) of unrisked unproved resources. The company has operated 58 gross wells to date in these three plays. Chesapeake anticipates operating an average of approximately five rigs in its Anadarko Basin unconventional liquids plays in 2 010 to drill approximately 50 net wells.

Permian Basin Unconventional Liquids (West Texas, southern New Mexico): Chesapeake has built a strong position in four Permian Basin unconventional liquids plays: the Avalon Shale, Bone Spring, Wolfcamp and Spraberry in West Texas and southern New Mexico. On its 290,000 net acres of leasehold in these plays, Chesapeake estimates it has approximately 150 mmboe (1 tcfe) of risked unproved resources and 680 mmboe (4 tcfe) of unrisked unproved resources. The company has operated 136 gross wells to date in these four plays. Chesapeake anticipates operating an average of approximately six rigs in its Permian Basin unconventional liquids plays in 2010 to drill appro ximately 50 net wells.

Rocky Mountain Unconventional Liquids Plays (Wyoming, northern Colorado): Chesapeake has developed a leading position in the Niobrara and Frontier plays in the Powder River Basin in Wyoming and has also recently entered the Niobrara play in northern Colorado. On its 400,000 net acres of Niobrara and Frontier leasehold, Chesapeake estimates it has approximately 100 mmboe (1 tcfe) of risked unproved resources and 1,100 mmboe (7 tcfe) of unrisked unproved resources. The company has operated two gross wells to date in these plays.

Conference Call Information

Chesapeake is scheduled to release its 2010 first quarter financial results after the close of trading on the New York Stock Exchange on Tuesday, May 4, 2010. Also, a conference call to discuss this release and the May 4 release has been scheduled for Wednesday, May 5, 2010, at 10:00 a.m. EDT. The telephone number to access the conference call is 913-312-0677 or toll-free 888-812-8589. The passcode for the call is 4406803. We encourage those who would like to participate in the call to dial the access number between 9:50 and 10:00 a.m. EDT. For those unable to participate in the conference call, a replay will be available for a udio playback from 2:00 p.m. EDT on May 5, 2010 through midnight EDT on May 19, 2010. The number to access the conference call replay is 719-457-0820 or toll-free 888-203-1112. The passcode for the replay is 4406803. The conference call will also be webcast live on the Internet and can be accessed by going to Chesapeake’s website at www.chk.com in the “Events” subsection of the “Investors” section of the website. The webcast of the conference call will be available on Chesapeake’s website for one year.

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our current expectations or forecasts of future events. They include estimates of natural gas and oil proved reserves and unproved resources, projections of future natural gas and oil production, planned drilling activity and costs, as well as statements concerning anticipated cash flow and liquidity, business strategy and other plans and objectives for future operations. We caution you not to place undue reliance on our forward-looking statements, which speak only as of the date of this press release, and we undertake no obligation to update this information.

Factors that could cause actual results to differ materially from expected results are described under “Risk Factors” in our 2009 Form 10-K filed with the U.S. Securities and Exchange Commission on March 1, 2010. These risk factors include the volatility of natural gas and oil prices; the limitations our level of indebtedness may have on our financial flexibility; declines in the values of our natural gas and oil properties resulting in ceiling test write-downs; the availability of capital on an economic basis, including planned asset monetization transactions, to fund reserve replacement costs; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of natural gas and oil reserves and projecting future rates of production and the amount and timi ng of development expenditures; potential differences in our interpretations of new reserve disclosure rules and future SEC guidance; inability to generate profits or achieve targeted results in drilling and well operations; leasehold terms expiring before production can be established; hedging activities resulting in lower prices realized on natural gas and oil sales and the need to secure hedging liabilities; a reduced ability to borrow or raise additional capital as a result of lower natural gas and oil prices; drilling and operating risks, including potential environmental liabilities; legislative and regulatory changes adversely affecting our industry and our business; general economic conditions negatively impacting us and our business counterparties; transportation capacity constraints and interruptions that could adversely affect our cash flow; and adverse results in pending or future litigation.

Our production forecasts are dependent upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity. Although we believe the expectations and forecasts reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties.

The SEC requires natural gas and oil companies, in filings made with the SEC, to disclose proved reserves, which are those quantities of natural gas and oil that by analysis of geoscience and engineering data can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations. In this press release, we use the terms "risked and unrisked unproved resources" and "estimated average resources per well" to describe Chesapeake’s internal estimates of volumes of natural gas and oil that are not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. These are broader descripti ons of potentially recoverable volumes than probable and possible reserves, as defined by SEC regulations. Estimates of unproved resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the company. We believe our estimates of unproved resources, both risked and unrisked, are reasonable, but such estimates have not been reviewed by independent engineers. Estimates of unproved resources may change significantly as development provides additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates.

The company calculates the standardized measure of future net cash flows of proved reserves only at year end because applicable income tax information on properties, including recently acquired natural gas and oil interests, is not readily available at other times during the year. As a result, the company is not able to reconcile interim period-end PV-10 values to the standardized measure at such dates. The only difference between the two measures is that PV-10 is calculated before considering the impact of future income tax expenses, while the standardized measure includes such effects. Year-end standardized measure calculations are provided in the financial statement notes in our annual reports on Form 10-K.

Chesapeake Energy Corporation is the second-largest producer of natural gas and the most active driller of new wells in the U.S. Headquartered in Oklahoma City, the company's operations are focused on discovering and developing unconventional natural gas and oil fields onshore in the U.S. Chesapeake owns leading positions in the Barnett, Fayetteville, Haynesville, Marcellus and Bossier natural gas shale plays and in the Eagle Ford, Granite Wash and various other unconventional oil plays. The company has also vertically integrated its operations and owns substantial midstream, compression, drilling and oilfield service assets. Further information is available at www.chk.com.

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF 2010 FIRST QUARTER ADDITIONS TO NATURAL GAS AND OIL PROPERTIES

BASED ON SEC PRICING OF TRAILING 12-MONTH AVERAGE PRICES

($ in millions, except per-unit data)

(unaudited)

Proved Reserves | ||||||

| Cost | Bcfe(a) | $/mcfe | ||||

| Drilling and completion costs | $ 1,045 | 1,558(b) | 0.67 | |||

| Acquisition of proved properties | 7 | 8 | 0.94 | |||

| Sale of proved properties | (1,043) | (892) | 1.17 | |||

Drilling, completion and net acquisition costs | 9 | 674 | 0.01 | |||

| Revisions – price | — | 70 | — | |||

| Acquisition of unproved properties and leasehold | 758 | — | — | |||

| Sale of unproved properties and leasehold | (136) | — | — | |||

| Net unproved properties and leasehold acquisition | 622 | — | — | |||

Capitalized interest on leasehold and unproved property Capitalized interest on leasehold and unproved property | 161 | — | — | |||

| Geological and geophysical costs | 35 | — | — | |||

| Capitalized interest and geological and geophysical costs | 196 | — | — | |||

Subtotal | 827 | 744 | 1.11 | |||

| Asset retirement obligation and other | (1) | — | — | |||

Total costs | $ 826 | 744 | 1.11 | |||

CHESAPEAKE ENERGY CORPORATION

ROLL-FORWARD OF PROVED RESERVES

THREE MONTHS ENDED MARCH 31, 2010

BASED ON SEC PRICING OF TRAILING 12-MONTH AVERAGE PRICES

(unaudited)

Bcfe(a) | ||

| Beginning balance, 1/01/10 | 14,254 | |

| Production | (233) | |

| Acquisitions | 8 | |

| Divestitures | (892) | |

| Revisions – changes to previous estimates | 328 | |

| Revisions – price | 70 | |

| Extensions and discoveries | 1,230 | |

| Ending balance, 3/31/10 | 14,765 | |

| Proved reserves growth rate | 3.6% | |

| Proved developed reserves | 8,023 | |

| Proved developed reserves percentage | 54% | |

| Reserve replacement | 744 | |

Reserve replacement ratio (c) | 320% |

| (a) | Reserve volumes estimated using SEC reserve recognition standards and pricing assumptions based on the trailing 12-month average first-day-of-the-month prices as of March 2010 of $3.99 per mcf of natural gas and $69.61 per bbl of oil, before field differential adjustments. |

| (b) | Includes 328 bcfe of positive revisions resulting from changes to previous estimates and excludes positive revisions of 70 bcfe resulting from higher natural gas and oil prices using the average first-day-of-the-month price for the twelve months ended March 2010 compared to the twelve months ended December 2009. |

| (c) | The company uses the reserve replacement ratio as an indicator of the company’s ability to replenish annual production volumes and grow its reserves. It should be noted that the reserve replacement ratio is a statistical indicator that has limitations. The ratio is limited because it typically varies widely based on the extent and timing of new discoveries and property acquisitions. Its predictive and comparative value is also limited for the same reasons. In addition, since the ratio does not embed the cost or timing of future production of new reserves, it cannot be used as a measure of value creation. |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF 2010 FIRST QUARTER ADDITIONS TO NATURAL GAS AND OIL PROPERTIES

BASED ON 10-YEAR AVERAGE NYMEX STRIP PRICES AT MARCH 31, 2010

($ in millions, except per-unit data)

(unaudited)

Proved Reserves | ||||||

| Cost | Bcfe(a) | $/mcfe | ||||

| Drilling and completion costs | $ 1,045 | 1,521(b) | 0.69 | |||

| Acquisition of proved properties | 7 | 8 | 0.91 | |||

| Sale of proved properties | (1,043) | (958) | 1.09 | |||

Drilling, completion and net acquisition costs | 9 | 571 | 0.02 | |||

| Revisions – price | — | (89) | — | |||

| Acquisition of unproved properties and leasehold | 758 | — | — | |||

| Sale of unproved properties and leasehold | (136) | — | — | |||

| Net unproved properties and leasehold acquisition | 622 | — | — | |||

| Capitalized interest on leasehold and unproved property | 161 | — | — | |||

| Geological and geophysical costs | 35 | — | — | |||

| Capitalized interest and geological and geophysical costs | 196 | — | — | |||

Subtotal | 827 | 482 | 1.72 | |||

| Asset retirement obligation and other | (1) | — | — | |||

Total costs | $ 826 | 482 | 1.71 | |||

CHESAPEAKE ENERGY CORPORATION

ROLL-FORWARD OF PROVED RESERVES

THREE MONTHS ENDED MARCH 31, 2010

BASED ON 10-YEAR AVERAGE NYMEX STRIP PRICES AT MARCH 31, 2010

(unaudited)

Bcfe(a) | ||

| Beginning balance, 1/01/10 | 15,540 | |

| Production | (233) | |

| Acquisitions | 8 | |

| Divestitures | (958) | |

| Revisions – changes to previous estimates | 265 | |

| Revisions – price | (89) | |

| Extensions and discoveries | 1,256 | |

| Ending balance, 3/31/10 | 15,789 | |

| Proved reserves annual growth rate | 1.6% | |

| Proved developed reserves | 8,603 | |

| Proved developed reserves percentage | 54% | |

| Reserve replacement | 482 | |

Reserve replacement ratio (c) | 207% |

| (a) | Reserve volumes estimated using SEC reserve recognition standards and 10-year average NYMEX strip prices as of March 31, 2010 of $6.51 per mcf of natural gas and $88.46 per bbl of oil, before field differential adjustments. Chesapeake uses such forward-looking market-based data in developing its drilling plans, assessing its capital expenditure needs and projecting future cash flows. Chesapeake believes these prices are better indicators of the likely economic producibility of proved reserves than the trailing 12-month average price required by the SEC's reporting rule. |

| (b) | Includes 265 bcfe of positive revisions resulting from changes to previous estimates and excludes downward revisions of 89 bcfe resulting from lower natural gas and oil prices using 10-year average NYMEX strip prices as of March 31, 2010 compared to NYMEX strip prices as of December 31, 2009. |

| (c) | The company uses the reserve replacement ratio as an indicator of the company’s ability to replenish annual production volumes and grow its reserves. It should be noted that the reserve replacement ratio is a statistical indicator that has limitations. The ratio is limited because it typically varies widely based on the extent and timing of new discoveries and property acquisitions. Its predictive and comparative value is also limited for the same reasons. In addition, since the ratio does not embed the cost or timing of future production of new reserves, it cannot be used as a measure of value creation. |