Exhibit 99.1

News Release |  |

FOR IMMEDIATE RELEASE | |

| FEBRUARY 22, 2011 |

CHESAPEAKE ENERGY CORPORATION REPORTS FINANCIAL AND OPERATIONAL

RESULTS FOR THE 2010 FOURTH QUARTER AND FULL YEAR

Company Reports 2010 Fourth Quarter Net Income to Common Stockholders of

$180 Million, or $0.28 per Fully Diluted Common Share, on Revenue of $2.0 Billion;

Company Reports Adjusted Net Income Available to Common Stockholders of

$478 Million, or $0.70 per Fully Diluted Common Share, Adjusted Ebitda of

$1.3 Billion and Operating Cash Flow of $1.2 Billion

2010 Full Year Net Income to Common Stockholders Was $1.7 Billion, or $2.51 per

Fully Diluted Common Share, on Revenue of $9.4 Billion; 2010 Full Year Adjusted

Net Income Available to Common Stockholders Was $2.0 Billion, or $2.95 per

Fully Diluted Common Share, 2010 Full Year Adjusted Ebitda and Operating

Cash Flow Were $5.1 Billion and $4.5 Billion, Respectively

2010 Full Year Production Averages 2.836 Bcfe per Day, an Increase of 14% Year over Year;

2010 Year-End Proved Reserves Reach 17.1 Tcfe; Company Adds Proved

Reserves of 5.1 Tcfe through the Drillbit at a 2010 Full Year

Drilling and Completion Cost of $1.07 per Mcfe

OKLAHOMA CITY, OKLAHOMA, FEBRUARY 22, 2011 – Chesapeake Energy Corporation (NYSE:CHK) today announced financial and operational results for the 2010 fourth quarter and full year. For the 2010 fourth quarter, Chesapeake reported net income to common stockholders of $180 million ($0.28 per fully diluted common share) and operating cash flow (defined as cash flow from operating activities before changes in assets and liabilities) of $1.186 billion on revenue of $1.975 billion and production of 269 billion cubic feet of natural gas equivalent (bcfe). For the 2010 full year, Chesapeake reported net income to common stockholders of $1.663 billion ($2.51 per fully diluted common share) and operating cash flow of $4.548 billion on revenue of $9.366 billion and production of 1.035 trillion cubic feet of natural gas e quivalent (tcfe).

The company’s 2010 fourth quarter and full year results include realized natural gas and oil hedging gains of $571 million and $2.056 billion, respectively. The results also include various items that are typically not included in published estimates of the company’s financial results by certain securities analysts. Excluding the items detailed below, for the 2010 fourth quarter, Chesapeake reported adjusted net income to common stockholders of $478 million ($0.70 per fully diluted common share) and adjusted ebitda of $1.274 billion and, for the 2010 full year, Chesapeake reported adjusted net income to common stockholders of $1.971 billion ($2.95 per fully diluted common share) and adjusted ebitda of $5.083 billion. The excluded items and their effects on the 2010 fourth quarter and full ye ar reported results are detailed as follows:

| · | a net unrealized after-tax mark-to-market loss of $392 million for the 2010 fourth quarter and $364 million for the full year resulting from the company’s natural gas, oil and interest rate hedging programs; |

| · | a net after-tax gain of $95 million for the 2010 fourth quarter and $84 million for the full year related to the sale of certain of the company’s fixed assets; |

| · | an after-tax gain of $74 million for the full year associated with certain equity investments where the investee sold additional equity to third parties at a price in excess of the company’s basis; |

| · | an after-tax loss of $80 million for the full year related to the redemption or exchange of certain of the company’s senior notes; |

| · | an after-tax charge of $1 million for the 2010 fourth quarter and $22 million for the full year for the impairment of certain of the company’s assets. |

The various items described above do not materially affect the calculation of operating cash flow. A reconciliation of operating cash flow, adjusted ebitda and adjusted net income to comparable financial measures calculated in accordance with generally accepted accounting principles is presented on pages 17 – 22 of this release.

| INVESTOR CONTACTS: | MEDIA CONTACTS: | CHESAPEAKE ENERGY CORPORATION | ||||

| Jeffrey L. Mobley, CFA | John J. Kilgallon | Jim Gipson | 6100 North Western Avenue | |||

| (405) 767-4763 | (405) 935-4441 | (405) 935-1310 | P.O. Box 18496 | |||

| jeff.mobley@chk.com | john.kilgallon@chk.com | jim.gipson@chk.com | Oklahoma City, OK 73154 | |||

Key Operational and Financial Statistics Summarized

The table below summarizes Chesapeake’s key results during the 2010 fourth quarter and compares them to results during the 2010 third quarter and the 2009 fourth quarter and also compares the 2010 full year to the 2009 full year.

| Three Months Ended | Full Year Ended | |||||||||||||||||

| 12/31/10 | 9/30/10 | 12/31/09 | 12/31/10 | 12/31/09 | ||||||||||||||

Average daily production (in mmcfe)(a) | 2,920 | 3,043 | 2,618 | 2,836 | 2,481 | |||||||||||||

| Natural gas as % of total production | 88 | 90 | 93 | 89 | 92 | |||||||||||||

| Natural gas production (in bcf) | 235.3 | 252.8 | 224.5 | 924.9 | 834.8 | |||||||||||||

Average realized natural gas price ($/mcf) (b) | 5.22 | 5.20 | 6.05 | 5.57 | 5.93 | |||||||||||||

| Oil production (in mbbls) | 5,562 | 4,533 | 2,737 | 18,395 | 11,790 | |||||||||||||

Average realized oil price ($/bbl) (b) | 62.62 | 59.81 | 71.61 | 62.71 | 58.38 | |||||||||||||

| Natural gas equivalent production (in bcfe) | 268.7 | 280.0 | 240.9 | 1,035.2 | 905.5 | |||||||||||||

Natural gas equivalent realized price ($/mcfe) (b) | 5.87 | 5.67 | 6.45 | 6.09 | 6.22 | |||||||||||||

| Marketing, gathering and compression | ||||||||||||||||||

net margin ($/mcfe) (c) | .13 | .12 | .23 | .12 | .16 | |||||||||||||

Service operations net margin ($/mcfe) (c) | .05 | .03 | .02 | .03 | .01 | |||||||||||||

| Production expenses ($/mcfe) | (.90 | ) | (.83 | ) | (.86 | ) | (.86 | ) | (.97 | ) | ||||||||

| Production taxes ($/mcfe) | (.14 | ) | (.12 | ) | (.15 | ) | (.15 | ) | (.12 | ) | ||||||||

General and administrative costs ($/mcfe) (d) | (.34 | ) | (.37 | ) | (.28 | ) | (.36 | ) | (.29 | ) | ||||||||

| Stock-based compensation ($/mcfe) | (.08 | ) | (.07 | ) | (.09 | ) | (.08 | ) | (.09 | ) | ||||||||

| DD&A of natural gas and oil properties ($/mcfe) | (1.37 | ) | (1.35 | ) | (1.39 | ) | (1.35 | ) | (1.51 | ) | ||||||||

| D&A of other assets ($/mcfe) | (.23 | ) | (.20 | ) | (.28 | ) | (.21 | ) | (.27 | ) | ||||||||

Interest (expense) income ($/mcfe) (b) | .01 | (.00 | ) | (.19 | ) | (.08 | ) | (.22 | ) | |||||||||

Operating cash flow ($ in millions) (e) | 1,186 | 1,068 | 1,212 | 4,548 | 4,333 | |||||||||||||

| Operating cash flow ($/mcfe) | 4.41 | 3.82 | 5.03 | 4.39 | 4.78 | |||||||||||||

Adjusted ebitda ($ in millions) (f) | 1,274 | 1,282 | 1,256 | 5,083 | 4,407 | |||||||||||||

| Adjusted ebitda ($/mcfe) | 4.75 | 4.58 | 5.21 | 4.91 | 4.87 | |||||||||||||

| Net income (loss) to common stockholders ($ in millions) | 180 | 515 | (530 | ) | 1,663 | (5,853 | ) | |||||||||||

| Earnings (loss) per share – assuming dilution ($) | .28 | .75 | (.84 | ) | 2.51 | (9.57 | ) | |||||||||||

Adjusted net income to common stockholders ($ in millions) (g) | 478 | 478 | 490 | 1,971 | 1,585 | |||||||||||||

| Adjusted earnings per share – assuming dilution ($) | .70 | .70 | .77 | 2.95 | 2.55 | |||||||||||||

| (a) | 2010 production reflects the sale of a 25% joint venture interest in the company’s Barnett Shale assets on January 25, 2010, and various other asset sales, including VPP 6, VPP 7 and VPP 8. | |||||||||||||||||

| (b) | Includes the effects of realized gains (losses) from hedging, but does not include the effects of unrealized gains (losses) from hedging. | |||||||||||||||||

(c) (d) | Includes revenue and operating costs and excludes depreciation and amortization of other assets. Excludes expenses associated with non-cash stock-based compensation. | |||||||||||||||||

| (e) | Defined as cash flow provided by operating activities before changes in assets and liabilities. | |||||||||||||||||

| (f) | Defined as net income (loss) before income taxes, interest expense, and depreciation, depletion and amortization expense, as adjusted to remove the effects of certain items detailed on pages 19 and 20. | |||||||||||||||||

| (g) | Defined as net income (loss) available to common stockholders, as adjusted to remove the effects of certain items detailed on pages 21 and 22. | |||||||||||||||||

2010 Full Year Average Daily Production Increases 14% over 2009 Full Year

Average Daily Production, Setting Record for 21st Consecutive Year

Chesapeake’s daily production for the 2010 fourth quarter averaged 2.920 bcfe, a decrease of 4% from the 3.043 bcfe produced per day in the 2010 third quarter and an increase of 12% over the 2.618 bcfe of daily production in the 2009 fourth quarter. At the end of the 2010 third quarter, the company sold future production through a volumetric production payment covering a portion of its Barnett Shale assets, including approximately 350 million cubic feet of natural gas equivalent (mmcfe) per day of production in the 2010 fourth quarter. Excluding this sale, the company’s 2010 fourth quarter production would have increased 7% sequentially and 25% year over year. Chesapeake’s average daily production of 2.920 bcfe for the 2010 fourth quarter consisted of approximately 2.558 billion cubic feet of natural gas (bcf) (88% on a natural gas equivalent basis) and 60,457 barrels (bbls) of oil and natural gas liquids (NGLs) (12% on a natural gas equivalent basis). For the 2010 fourth quarter, the company’s year over year growth rate of natural gas production was 5% and its year over year growth rate of oil and NGLs production was 103%.

The company’s daily production for the 2010 full year averaged 2.836 bcfe, an increase of 14% over the 2.481 bcfe of daily production for the 2009 full year. Chesapeake’s average daily production for the 2010 full year of 2.836 bcfe consisted of 2.534 bcf (89% on a natural gas equivalent basis) and 50,397 bbls (11% on a natural gas equivalent basis). The 2010 full year was Chesapeake’s 21st consecutive year of sequential production growth. Chesapeake anticipates delivering a production growth rate of 25% over the next two years, net of property divestitures pursuant to its 25/25 Plan discussed on page 7 of this release.

Proved Natural Gas and Oil Reserves Increase by 2.8 Tcfe, or 20% for the 2010 Full Year to

17.1 Tcfe; Company Adds Proved Reserves of 5.1 Tcfe through the Drillbit in

2010 at a Drilling and Completion Cost of $1.07 per Mcfe

During 2010, Chesapeake continued the industry’s most active drilling program, drilling 1,445 gross operated wells (938 net wells with an average working interest of 65%) and participating in another 1,586 gross wells operated by other companies (211 net wells with an average working interest of 13%). The company’s drilling success rate was 98% for both company-operated and non-operated wells. During 2010, Chesapeake’s drilling and completion costs include the benefit of approximately $1.151 billion of drilling and completion carries from its joint venture partners.

The following table compares Chesapeake’s December 31, 2010 proved reserves, the increase over its year-end 2009 proved reserves, reserve replacement ratio, estimated future net cash flows from proved reserves (discounted at an annual rate of 10% before income taxes (PV-10)), and proved developed percentage based on the trailing 12-month average price required under SEC rules and the 10-year average NYMEX strip prices at December 31, 2010.

| Pricing Method | Natural Gas Price ($/mcf) | Oil Price ($/bbl) | Proved Reserves (tcfe)(a) | Proved Reserves Growth (tcfe)(b) | Proved Reserves Growth %(b) | Reserve Replacement Ratio | PV-10 (billions) | Proved Developed Percentage |

Trailing 12-month average (SEC)(c) | $4.38 | $79.42 | 17.1 | 2.8 | 20% | 375% | $15.1 | 53% |

12/31/10 10-year average NYMEX strip(d) | $5.67 | $93.53 | 17.6 | 2.1 | 13% | 300% | $21.7 | 53% |

| (a) | After sales of proved reserves of approximately 1.5 tcfe during 2010. |

| (b) | Compares proved reserves and growth for 2010 under comparable pricing methods. At year-end 2009, Chesapeake’s proved reserves were 14.3 tcfe using trailing 12-month average prices, which are required by SEC reporting rules, and 15.5 tcfe using the 10-year average NYMEX strip prices at December 31, 2009. |

| (c) | Reserve volumes estimated using SEC reserve recognition standards and pricing assumptions based on the trailing 12-month average first-day-of-the-month prices as of December 31, 2010. This pricing yields estimated "proved reserves" for SEC reporting purposes. Natural gas and oil volumes estimated under the 10-year average NYMEX strip reflect an alternative pricing scenario that illustrates the sensitivity of proved reserves to a different pricing assumption. |

| (d) | Futures prices represent an unbiased consensus estimate by market participants about the likely prices to be received for future production. Management believes that 10-year average NYMEX strip prices provide a better indicator of the likely economic producibility of the company’s proved reserves than the historical 12-month average price. |

The following table summarizes Chesapeake’s development costs for 2010 full year using the two pricing methods described above.

| Development Cost Category | Trailing 12-Month Average (SEC) Pricing ($/mcfe) | 12/31/10 10-year Average NYMEX Strip Pricing ($/mcfe) |

Drilling and completion costs (a) | $1.07 | $1.07 |

Drilling, completion and net acquisition costs of proved properties (a) | $0.76 | $0.78 |

| (a) | Includes performance-related reserve revisions and excludes price-related revisions. Costs are net of drilling and completion carries paid by the company’s joint venture partners. |

A complete reconciliation of proved reserves and reserve replacement ratios based on these two alternative pricing methods, along with total costs, is presented on pages 12 and 13 of this release. Also, a reconciliation of PV-10 to the standardized measure is presented on page 14 of this release.

In addition to the PV-10 value of its proved reserves, the company also has substantial value in its undeveloped leasehold, particularly in the Haynesville, Marcellus, Barnett, Bossier and Fayetteville unconventional natural gas shale plays and the company’s unconventional liquids-rich plays, particularly in the Granite Wash, Cleveland, Tonkawa and Mississippian plays of the Anadarko Basin; the Eagle Ford Shale in South Texas; the Niobrara Shale in the Powder River and Denver-Julesburg (DJ) basins; the Avalon, Bone Spring, Wolfcamp and Wolfberry plays in the Permian Basin; and various plays in the Williston Basin.

Additionally, the net book value of the company’s other assets (including gathering systems, compressors, land and buildings, investments and other non-current assets) was $6.1 billion as of December 31, 2010, compared to $6.7 billion as of December 31, 2009. The decline in other assets is primarily due to the deconsolidation of the company’s midstream joint venture reflecting the implementation of new accounting guidance for certain investments and the sale of the company’s Springridge natural gas gathering system and related facilities to our affiliate, Chesapeake Midstream Partners, L.P.

Chesapeake’s Leasehold and 3-D Seismic Inventories Total 13.3 Million Net Acres

and 27.9 Million Acres, Respectively; Risked Unproved Resources in the

Company’s Inventory Total 103 Tcfe

Since 2000, Chesapeake has built the largest combined inventories of onshore leasehold (13.3 million net acres) and 3-D seismic (27.9 million acres) in the U.S. This position includes the largest inventory of U.S. natural gas shale play leasehold (2.5 million net acres) as well as the largest combined leasehold position in two of the three largest new unconventional liquids-rich plays in the U.S. – the Eagle Ford Shale and the Niobrara Shale.

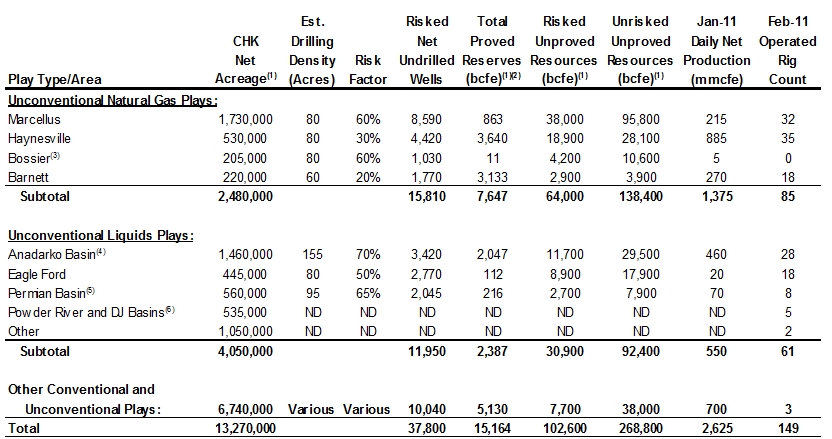

On its total leasehold inventory, pro forma for the company’s recently announced sale of its Fayetteville Shale assets and the Powder River and DJ Basin cooperation agreement with CNOOC International Limited (CNOOC), a wholly owned subsidiary of CNOOC Limited (NYSE:CEO; SEHK:00883), Chesapeake has identified an estimated 15.2 tcfe of proved reserves (using volume estimates based on the 10-year average NYMEX strip prices at December 31, 2010), 103 tcfe of risked unproved resources and 269 tcfe of unrisked unproved resources. Pro forma for the Fayetteville Shale sale, the company is currently using 149 operated drilling rigs to further develop its inventory of approximately 37,800 net drillsites. Of Chesapeake’s 149 operated rigs, 85 are drilling wells primarily focused on unconventional natural gas play s (including 50 operated rigs benefiting from drilling carries) and 61 are drilling wells primarily focused on unconventional liquids-rich plays (including 23 operated rigs benefiting from drilling carries) and 3 operated rigs are drilling in other plays. In addition, 143 of the company’s 149 operated rigs are drilling horizontal wells.

In recognition of the value gap between oil and natural gas prices, during the past two years Chesapeake has directed a significant portion of its technological and leasehold acquisition expertise to identify, secure and commercialize new unconventional liquids-rich plays. To date, Chesapeake has built leasehold positions and established production in multiple unconventional liquids-rich plays on approximately 4.1 million net leasehold acres with 5.2 billion barrels of oil equivalent (bboe) (30.9 tcfe) of risked unproved resources and 15.4 bboe (92.4 tcfe) of unrisked unproved resources. As a result of its success to date, Chesapeake expects to increase its oil and natural gas liquids production through its drilling activities to more than 150,000 bbls per day, or 20%-25% of total production, by year-end 2012 and to more than 250,000 bbls per day, or 30%-35% of total production, through organic growth by year-end 2015.

The following table summarizes Chesapeake’s ownership and activity in its unconventional natural gas shale plays, its unconventional liquids-rich plays and its other conventional and unconventional plays. Chesapeake uses a probability-weighted statistical approach to estimate the potential number of drillsites and unproved resources associated with such drillsites.

Note: ND denotes “not disclosed”; data is pro forma for announced Fayetteville sale and Powder River and DJ Basin cooperation agreement.

(1) As of December 31, 2010.

(2) Based on 10-year average NYMEX strip prices at December 31, 2010.

(3) Bossier Shale acreage overlaps with Haynesville Shale acreage and is excluded from the shale play sub-total to avoid double counting of acreage.

(4) Includes Colony, Texas Panhandle and other Granite Washes, Cleveland, Tonkawa and Mississippian plays.

(5) Includes only Delaware and Midland Basin plays.

(6) Includes Niobrara, Frontier and Codell plays.

Average Realized Prices, Hedging Results and Hedging Positions Detailed

Average prices realized during the 2010 fourth quarter (including realized gains or losses from natural gas and oil derivatives, but excluding unrealized gains or losses on such derivatives) were $5.22 per thousand cubic feet of natural gas (mcf) and $62.62 per bbl, for a realized natural gas equivalent price of $5.87 per thousand cubic feet of natural gas equivalent (mcfe). Realized gains from natural gas and oil hedging activities during the 2010 fourth quarter generated a $2.39 gain per mcf and a $1.43 gain per bbl for a 2010 fourth quarter realized hedging gain of $571 million, or $2.13 per mcfe.

By comparison, average prices realized during the 2009 fourth quarter (including realized gains or losses from natural gas and oil derivatives, but excluding unrealized gains or losses on such derivatives) were $6.05 per mcf and $71.61 per bbl, for a realized natural gas equivalent price of $6.45 per mcfe. Realized gains from natural gas and oil hedging activities during the 2009 fourth quarter generated a $2.42 gain per mcf and a $0.69 gain per bbl for a 2009 fourth quarter realized hedging gain of $544 million, or $2.26 per mcfe.

For the 2010 full year, average prices realized (including realized gains or losses from natural gas and oil derivatives, but excluding unrealized gains or losses on such derivatives) were $5.57 per mcf and $62.71 per bbl, for a realized natural gas equivalent price of $6.09 per mcfe. Realized gains from natural gas and oil hedging activities during the 2010 full year generated a $2.14 gain per mcf and a $4.04 gain per bbl for a 2010 full year realized hedging gain of $2.056 billion, or $1.99 per mcfe.

By comparison, average prices realized during the 2009 full year (including realized gains or losses from natural gas and oil derivatives, but excluding unrealized gains or losses on such derivatives) were $5.93 per mcf and $58.38 per bbl, for a realized natural gas equivalent price of $6.22 per mcfe. Realized gains from natural gas and oil hedging activities during the 2009 full year generated a $2.77 gain per mcf and a $2.78 gain per bbl for a 2009 full year realized hedging gain of $2.346 billion, or $2.59 per mcfe.

The company’s realized cash hedging gains since January 1, 2001 have been $6.478 billion or $1.18 per mcfe.

Company Provides Update on Hedging Positions

To provide protection against potentially weak natural gas prices in 2011 and 2012, Chesapeake has entered into hedges for a portion of its production in those two years. Depending on changes in natural gas and oil futures markets and management’s view of underlying natural gas and oil supply and demand trends, Chesapeake may increase or decrease some or all of its hedging positions at any time in the future without notice. The following table summarizes Chesapeake’s 2011 and 2012 open swap positions as of February 22, 2011.

| Natural Gas | Oil | |||||||

| Year | % of Forecasted Production | $ NYMEX | % of Forecasted Production | $ NYMEX | ||||

| 2011 | 92% | $5.27 | 5% | $99.39 | ||||

| 2012 | 21% | $6.20 | 1% | $109.50 | ||||

In addition to the open hedging positions disclosed above, as of February 22, 2011, the company had an additional $832 million and $42 million of net hedging gains on closed contracts and premiums collected on call options that will be realized in 2011 and 2012, respectively.

| Natural Gas | Oil | |||||||||||

| Year | Forecasted Production (bcf) | Gains (Losses) ($ in millions) | Gains (Losses) ($/mcf) | Forecasted Production (mbbls) | Gains (Losses) ($ in millions) | Gains (Losses) ($/bbl) | ||||||

| 2011 | 915 | $781 | 0.85 | 34,000 | $51 | 1.49 | ||||||

| 2012 | 980 | $(9) | (0.01) | 54,000 | $51 | 0.94 | ||||||

Assuming future NYMEX natural gas settlement prices average $4.50 and $5.50 per mcf for 2011 and 2012, respectively, and including the effect of the company’s open hedges, closed contracts and previously collected call premiums, the company estimates its average NYMEX natural gas prices will be $5.98 and $5.62 per mcf for 2011 and 2012, respectively. Additionally, assuming future NYMEX oil settlement prices average $90.00 per bbl for 2011 and 2012, the company estimates its average NYMEX oil prices will be $89.28 and $89.60 per bbl for 2011 and 2012, respectively. These estimates do not include the effect of basis differentials and gathering costs.

Details of the company’s quarter-end hedging positions, including sold call options, are provided in the company’s Form 10-Q and Form 10-K filings with the SEC and current positions are disclosed in summary format in the company’s Outlook. The company’s updated forecasts for 2011 and 2012 are attached to this release in the Outlook dated February 22, 2011, labeled as Schedule “A,” which begins on page 23. This Outlook has been changed from the Outlook dated November 3, 2010, attached as Schedule “B,” which begins on page 27, to reflect various updated information.

Company Provides Update on 25/25 Plan

On January 6, 2011, Chesapeake announced its 25/25 Plan, which outlined the company’s plan to reduce its long-term debt by 25% during 2011-12 while also growing net natural gas and oil production by 25% during these two years. The company expects to achieve the reduction in debt primarily with proceeds from asset sales and from substantially reduced leasehold spending during this period.

Two recently announced transactions reflect the company’s substantial progress already made in implementing its 25/25 Plan. On February 11, 2011, the company closed its Niobrara Shale cooperation agreement through which CNOOC purchased a 33.3% undivided interest in Chesapeake’s 800,000 net natural gas and oil leasehold acres in the DJ and Powder River Basins in Colorado and Wyoming for approximately $4,750 per net acre. The company received approximately $570 million in cash at closing, and CNOOC has agreed to fund 66.7% of Chesapeake’s share of drilling and completion costs until an additional $697 million has been paid, which Chesapeake expects to occur by year-end 2014.

In addition, on February 21, 2011, Chesapeake announced an agreement to sell all its upstream and midstream assets in the Fayetteville Shale to BHP Billiton Petroleum, a wholly owned subsidiary of BHP Billiton Limited (NYSE:BHP; ASX:BHP), for $4.75 billion in cash before certain deductions and standard closing adjustments. The company anticipates the transaction will close in the first half of 2011.

2010 Fourth Quarter and Full Year Financial and Operational Results

Conference Call Information

A conference call to discuss this release has been scheduled for Wednesday, February 23, 2011, at 11:00 a.m. EST. The telephone number to access the conference call is 913-981-5549 or toll-free 888-211-7383. The passcode for the call is 6147630. We encourage those who would like to participate in the call to dial the access number between 10:50 and 11:00 a.m. EST. For those unable to participate in the conference call, a replay will be available for audio playback from 3:00 p.m. EST on February 23, 2011, through midnight EST on March 9, 2011. The number to access the conference call replay is 719-457-0820 or toll-free 888-203-1112. The passcode for the replay is 6147630. The conference call will also be webcast live on Chesapeake’s website at www.chk.com in the “Events” subsection of the “Investors” section of the website. The webcast of the conference call will be available on Chesapeake’s website for one year.

This news release and the accompanying Outlooks include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are statements other than statements of historical fact and give our current expectations or forecasts of future events. They include estimates of natural gas and oil reserves and resources, expected natural gas and oil production and future expenses, assumptions regarding future natural gas and oil prices, planned drilling activity, drilling and completion costs and anticipated asset sales, projected cash flow and liquidity, business strategy and other plans and objectives for future operations. Disclosures concerning the fair value of derivative contracts and their estimated contribution to our future results of operations are based upon market information as of a specific date. These market prices are subject to significant volatility. We caution you not to place undue reliance on our forward-looking statements, which speak only as of the date of this news release, and we undertake no obligation to update this information.

Factors that could cause actual results to differ materially from expected results are described under “Risks Related to Our Business” in our Prospectus Supplement filed with the U.S. Securities and Exchange Commission on February 9, 2011. These risk factors include the volatility of natural gas and oil prices; the limitations our level of indebtedness may have on our financial flexibility; declines in the values of our natural gas and oil properties resulting in ceiling test write-downs; the availability of capital on an economic basis, including through planned asset monetization transactions, to fund reserve replacement costs; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of natural gas and oil reserves and projecting future rat es of production and the amount and timing of development expenditures; inability to generate profits or achieve targeted results in drilling and well operations; leasehold terms expiring before production can be established; hedging activities resulting in lower prices realized on natural gas and oil sales; the need to secure hedging liabilities and the inability of hedging counterparties to satisfy their obligations; a reduced ability to borrow or raise additional capital as a result of lower natural gas and oil prices; drilling and operating risks, including potential environmental liabilities; legislative and regulatory changes adversely affecting our industry and our business; general economic conditions negatively impacting us and our business counterparties; transportation capacity constraints and interruptions that could adversely affect our cash flow; and losses possible from pending or future litigation.

Our production forecasts are dependent upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity. Although we believe the expectations and forecasts reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties.

The SEC requires natural gas and oil companies, in filings made with the SEC, to disclose proved reserves, which are those quantities of natural gas and oil that by analysis of geoscience and engineering data can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. In this news release, we use the terms “risked and unrisked unproved resources” to describe Chesapeake’s internal estimates of volumes of na tural gas and oil that are not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. These are broader descriptions of potentially recoverable volumes than probable and possible reserves, as defined by SEC regulations. Estimates of unproved resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the company. We believe our estimates of unproved resources are reasonable, but such estimates have not been reviewed by independent engineers. Estimates of unproved resources may change significantly as development provides additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates.

Chesapeake Energy Corporation is the second-largest producer of natural gas and the most active driller of new wells in the U.S. Headquartered in Oklahoma City, the company's operations are focused on discovering and developing unconventional natural gas and oil fields onshore in the U.S. Chesapeake owns leading positions in the Barnett, Fayetteville, Haynesville, Marcellus and Bossier natural gas shale plays and in the Eagle Ford, Granite Wash, Cleveland, Tonkawa, Mississippian, Wolfcamp, Bone Spring, Avalon, Niobrara and Williston Basin unconventional liquids plays. The company has also vertically integrated its operations and owns substantial midstream, compression, drilling and oilfield service assets. Further information is available at www.chk.com where Chesapeake routinely posts announcements, updates, events, investor information and presentations and all recent press releases.

CHESAPEAKE ENERGY CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

($ in millions, except per-share and unit data)

(unaudited)

| THREE MONTHS ENDED: | December 31, | December 31, | ||||||||||

| 2010 | 2009 | |||||||||||

| $ | $/mcfe | $ | $/mcfe | |||||||||

| REVENUES: | ||||||||||||

Natural gas and oil sales | 949 | 3.53 | 1,368 | 5.68 | ||||||||

Marketing, gathering and compression sales | 959 | 3.57 | 803 | 3.33 | ||||||||

Service operations revenue | 67 | 0.25 | 51 | 0.21 | ||||||||

Total Revenues | 1,975 | 7.35 | 2,222 | 9.22 | ||||||||

| OPERATING COSTS: | ||||||||||||

Production expenses | 241 | 0.90 | 206 | 0.86 | ||||||||

Production taxes | 38 | 0.14 | 36 | 0.15 | ||||||||

General and administrative expenses | 114 | 0.42 | 89 | 0.37 | ||||||||

Marketing, gathering and compression expenses | 923 | 3.44 | 747 | 3.10 | ||||||||

Service operations expense | 55 | 0.20 | 47 | 0.19 | ||||||||

Natural gas and oil depreciation, depletion and amortization | 368 | 1.37 | 335 | 1.39 | ||||||||

Depreciation and amortization of other assets | 61 | 0.23 | 67 | 0.28 | ||||||||

Impairment of natural gas and oil properties | — | — | 1,400 | 5.81 | ||||||||

(Gains) losses on sale of other property and equipment | (154 | ) | (0.57 | ) | — | — | ||||||

Other impairments | 1 | — | 8 | 0.03 | ||||||||

Total Operating Costs | 1,647 | 6.13 | 2,935 | 12.18 | ||||||||

| INCOME (LOSS) FROM OPERATIONS | 328 | 1.22 | (713 | ) | (2.96 | ) | ||||||

| OTHER INCOME (EXPENSE): | ||||||||||||

Interest expense | (7 | ) | (0.03 | ) | (62 | ) | (0.25 | ) | ||||

Earnings (losses) from equity investees | 37 | 0.14 | (7 | ) | (0.03 | ) | ||||||

Losses on redemptions or exchanges of debt | — | — | (21 | ) | (0.09 | ) | ||||||

Other income | 5 | 0.02 | 5 | 0.02 | ||||||||

Total Other Income (Expense) | 35 | 0.13 | (85 | ) | (0.35 | ) | ||||||

| INCOME (LOSS) BEFORE INCOME TAXES | 363 | 1.35 | (798 | ) | (3.31 | ) | ||||||

Income tax expense (benefit): | ||||||||||||

Current income taxes | (4 | ) | (0.02 | ) | 3 | 0.01 | ||||||

Deferred income taxes | 144 | 0.54 | (302 | ) | (1.25 | ) | ||||||

Total Income Tax Expense (Benefit) | 140 | 0.52 | (299 | ) | (1.24 | ) | ||||||

| NET INCOME (LOSS) | 223 | 0.83 | (499 | ) | (2.07 | ) | ||||||

Net (income) attributable to noncontrolling interest | — | — | (25 | ) | (0.11 | ) | ||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO CHESAPEAKE | 223 | 0.83 | (524 | ) | (2.18 | ) | ||||||

Preferred stock dividends | (43 | ) | (0.16 | ) | (6 | ) | (0.02 | ) | ||||

NET INCOME (LOSS) AVAILABLE TO COMMON STOCKHOLDERS | 180 | 0.67 | (530 | ) | (2.20 | ) | ||||||

| EARNINGS (LOSS) PER COMMON SHARE: | ||||||||||||

Basic | $ | 0.29 | $ | (0.84 | ) | |||||||

Diluted | $ | 0.28 | $ | (0.84 | ) | |||||||

| WEIGHTED AVERAGE COMMON AND COMMON | ||||||||||||

| EQUIVALENT SHARES OUTSTANDING (in millions) | ||||||||||||

Basic | 632 | 628 | ||||||||||

Diluted | 639 | 628 | ||||||||||

CHESAPEAKE ENERGY CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

($ in millions, except per-share and unit data)

(unaudited)

| TWELVE MONTHS ENDED: | December 31, | December 31, | ||||||||||

| 2010 | 2009 | |||||||||||

| $ | $/mcfe | $ | $/mcfe | |||||||||

| REVENUES: | ||||||||||||

Natural gas and oil sales | 5,647 | 5.46 | 5,049 | 5.57 | ||||||||

Marketing, gathering and compression sales | 3,479 | 3.36 | 2,463 | 2.72 | ||||||||

Service operations revenue | 240 | 0.23 | 190 | 0.21 | ||||||||

Total Revenues | 9,366 | 9.05 | 7,702 | 8.50 | ||||||||

| OPERATING COSTS: | ||||||||||||

Production expenses | 893 | 0.86 | 876 | 0.97 | ||||||||

Production taxes | 157 | 0.15 | 107 | 0.12 | ||||||||

General and administrative expenses | 453 | 0.44 | 349 | 0.38 | ||||||||

Marketing, gathering and compression expenses | 3,352 | 3.24 | 2,316 | 2.56 | ||||||||

Service operations expense | 208 | 0.20 | 182 | 0.20 | ||||||||

Natural gas and oil depreciation, depletion and amortization | 1,394 | 1.35 | 1,371 | 1.51 | ||||||||

Depreciation and amortization of other assets | 220 | 0.21 | 244 | 0.27 | ||||||||

Impairment of natural gas and oil properties | — | — | 11,000 | 12.15 | ||||||||

(Gains) losses on sale of other property and equipment | (137 | ) | (0.13 | ) | 38 | 0.04 | ||||||

Other impairments | 21 | 0.02 | 130 | 0.14 | ||||||||

Restructuring costs | — | — | 34 | 0.04 | ||||||||

Total Operating Costs | 6,561 | 6.34 | 16,647 | 18.38 | ||||||||

| INCOME (LOSS) FROM OPERATIONS | 2,805 | 2.71 | (8,945 | ) | (9.88 | ) | ||||||

| OTHER INCOME (EXPENSE): | ||||||||||||

Interest expense | (19 | ) | (0.02 | ) | (113 | ) | (0.13 | ) | ||||

Earnings (losses) from equity investees | 227 | 0.22 | (39 | ) | (0.04 | ) | ||||||

Losses on redemptions or exchanges of debt | (129 | ) | (0.12 | ) | (40 | ) | (0.04 | ) | ||||

Impairment of investments | (16 | ) | (0.02 | ) | (162 | ) | 0.18 | ) | ||||

Other income (expense) | 16 | 0.02 | 11 | (0.01 | ) | |||||||

Total Other Income (Expense) | 79 | 0.08 | (343 | ) | (0.38 | ) | ||||||

| INCOME (LOSS) BEFORE INCOME TAXES | 2,884 | 2.79 | (9,288 | ) | (10.26 | ) | ||||||

Income tax expense (benefit): | ||||||||||||

Current income taxes | — | — | 4 | — | ||||||||

Deferred income taxes | 1,110 | 1.07 | (3,487 | ) | (3.85 | ) | ||||||

Total Income Tax Expense (Benefit) | 1,110 | 1.07 | (3,483 | ) | (3.85 | ) | ||||||

| NET INCOME (LOSS) | 1,774 | 1.72 | (5,805 | ) | (6.41 | ) | ||||||

Net (income) loss attributable to noncontrolling interest | — | — | (25 | ) | (0.03 | ) | ||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO CHESAPEAKE | 1,774 | 1.72 | (5,830 | ) | (6.44 | ) | ||||||

Preferred stock dividends | (111 | ) | (0.11 | ) | (23 | ) | (0.02 | ) | ||||

NET INCOME (LOSS) AVAILABLE TO COMMON STOCKHOLDERS | 1,663 | 1.61 | (5,853 | ) | (6.46 | ) | ||||||

| EARNINGS (LOSS) PER COMMON SHARE: | ||||||||||||

Basic | $ | 2.63 | $ | (9.57 | ) | |||||||

Diluted | $ | 2.51 | $ | (9.57 | ) | |||||||

| WEIGHTED AVERAGE COMMON AND COMMON | ||||||||||||

| EQUIVALENT SHARES OUTSTANDING (in millions) | ||||||||||||

Basic | 631 | 612 | ||||||||||

Diluted | 706 | 612 | ||||||||||

CHESAPEAKE ENERGY CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

($ in millions)

(unaudited)

| December 31, | December 31, | ||||||

| 2010 | 2009 | ||||||

| Cash and cash equivalents | $ | 102 | $ | 307 | |||

| Other current assets | 3,164 | 2,139 | |||||

Total Current Assets | 3,266 | 2,446 | |||||

| Property and equipment (net) | 32,378 | 26,710 | |||||

| Other assets | 1,535 | 758 | |||||

Total Assets | $ | 37,179 | $ | 29,914 | |||

| Current liabilities | $ | 4,490 | $ | 2,688 | |||

Long-term debt, net of discounts (a) | 12,640 | 12,295 | |||||

| Asset retirement obligations | 301 | 282 | |||||

| Other long-term liabilities | 2,100 | 1,249 | |||||

| Deferred tax liability | 2,384 | 1,059 | |||||

Total Liabilities | 21,915 | 17,573 | |||||

| Chesapeake stockholders’ equity | 15,264 | 11,444 | |||||

Noncontrolling interest(b) | — | 897 | |||||

Total Equity | 15,264 | 12,341 | |||||

| Total Liabilities & Equity | $ | 37,179 | $ | 29,914 | |||

| Common Shares Outstanding (in millions) | 654 | 648 | |||||

CHESAPEAKE ENERGY CORPORATION

CAPITALIZATION

($ in millions)

(unaudited)

| December 31, | % of Total Book | December 31, | % of Total Book | ||||||||||||||||||||

| 2010 | Capitalization | 2009 | Capitalization | ||||||||||||||||||||

Total debt, net of cash(a) | $ | 12,538 | 45 | % | $ | 11,988 | 49 | % | |||||||||||||||

Chesapeake stockholders' equity | 15,264 | 55 | % | 11,444 | 47 | % | |||||||||||||||||

Noncontrolling interest(b) | — | — | 897 | 4 | % | ||||||||||||||||||

Total | $ | 27,802 | 100 | % | $ | 24,329 | 100 | % | |||||||||||||||

| (a) | At December 31, 2010, includes $3.706 billion of combined borrowings under the company’s $4.0 billion revolving bank credit facility and the company’s $300 million midstream revolving bank credit facility. At December 31, 2010, the company had $581 million of additional borrowing capacity under these two revolving bank credit facilities. |

| (b) | Effective January 1, 2010, we no longer consolidate the company’s midstream joint venture and consequently no longer report a noncontrolling interest related to this investment. |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF 2010 ADDITIONS TO NATURAL GAS AND OIL PROPERTIES

BASED ON SEC PRICING OF TRAILING 12-MONTH AVERAGE PRICES AT DECEMBER 31, 2010

($ in millions, except per-unit data)

(unaudited)

| Proved Reserves | ||||||||||||

| Cost | Bcfe(a) | $/Mcfe | ||||||||||

Drilling and completion costs(b) | $ | 5,430 | 5,092 | (c) | 1.07 | |||||||

| Acquisition of proved properties | 243 | 89 | 2.73 | |||||||||

| Sale of proved properties | (2,876 | ) | (1,493 | ) | 1.93 | |||||||

Drilling, completion and net acquisition costs of proved properties | 2,797 | 3,688 | 0.76 | |||||||||

| Revisions – price | — | 189 | — | |||||||||

| Acquisition of unproved properties and leasehold | 6,266 | — | — | |||||||||

| Sale of unproved properties and leasehold | (1,524 | ) | — | — | ||||||||

Net unproved properties and leasehold acquisition | 4,742 | — | — | |||||||||

| Capitalized interest on leasehold and unproved property | 711 | — | — | |||||||||

| Geological and geophysical costs | 157 | — | — | |||||||||

Capitalized interest and geological and geophysical costs | 868 | — | — | |||||||||

Subtotal | 8,407 | 3,877 | 2.17 | |||||||||

| Asset retirement obligation and other | 2 | — | — | |||||||||

Total costs | $ | 8,409 | 3,877 | 2.17 | ||||||||

CHESAPEAKE ENERGY CORPORATION

ROLL-FORWARD OF PROVED RESERVES

TWELVE MONTHS ENDED DECEMBER 31, 2010

BASED ON SEC PRICING OF TRAILING 12-MONTH AVERAGE PRICES AT DECEMBER 31, 2010

(unaudited)

Bcfe(a) | |||

| Beginning balance, 01/01/10 | 14,254 | ||

| Production | (1,035 | ) | |

| Acquisitions | 89 | ||

| Divestitures | (1,493 | ) | |

| Revisions – changes to previous estimates | (6 | ) | |

| Revisions – price | 189 | ||

| Extensions and discoveries | 5,098 | ||

| Ending balance, 12/31/10 | 17,096 | ||

| Proved reserves growth rate | 20 | % | |

| Proved developed reserves | 9,143 | ||

| Proved developed reserves percentage | 53 | % | |

| Reserve replacement | 3,877 | ||

Reserve replacement ratio (d) | 375 | % | |

| (a) | Reserve volumes estimated using SEC reserve recognition standards and pricing assumptions based on the trailing 12-month average first-day-of-the-month prices as of December 31, 2010, of $4.38 per mcf of natural gas and $79.42 per bbl of oil, before field differential adjustments. |

| (b) | Net of drilling and completion carries of $1.151 billion associated with the Statoil, Total and CNOOC-Eagle Ford joint ventures. |

| (c) | Includes 6 bcfe of downward revisions resulting from changes to previous estimates and excludes positive revisions of 189 bcfe resulting from higher natural gas and oil prices using the average first-day-of-the-month price for the twelve months ended December 31, 2010, compared to the twelve months ended December 31, 2009. |

| (d) | The company uses the reserve replacement ratio as an indicator of the company’s ability to replenish annual production volumes and grow its reserves. It should be noted that the reserve replacement ratio is a statistical indicator that has limitations. The ratio is limited because it typically varies widely based on the extent and timing of new discoveries and property acquisitions. Its predictive and comparative value is also limited for the same reasons. In addition, since the ratio does not embed the cost or timing of future production of new reserves, it cannot be used as a measure of value creation. |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF 2010 ADDITIONS TO NATURAL GAS AND OIL PROPERTIES

BASED ON 10-YEAR AVERAGE NYMEX STRIP PRICES AT DECEMBER 31, 2010

($ in millions, except per-unit data)

(unaudited)

| Proved Reserves | ||||||||||||

| Cost | Bcfe(a) | $/Mcfe | ||||||||||

Drilling and completion costs(b) | $ | 5,430 | 5,062 | (c) | 1.07 | |||||||

| Acquisition of proved properties | 243 | 82 | 2.96 | |||||||||

| Sale of proved properties | (2,876 | ) | (1,574 | ) | 1.83 | |||||||

Drilling, completion and net acquisition costs of proved properties | 2,797 | 3,570 | 0.78 | |||||||||

| Revisions – price | — | (470 | ) | — | ||||||||

| Acquisition of unproved properties and leasehold | 6,266 | — | — | |||||||||

| Sale of unproved properties and leasehold | (1,524 | ) | — | — | ||||||||

Net unproved properties and leasehold acquisition | 4,742 | — | — | |||||||||

| Capitalized interest on leasehold and unproved property | 711 | — | — | |||||||||

| Geological and geophysical costs | 157 | — | — | |||||||||

Capitalized interest and geological and geophysical costs | 868 | — | — | |||||||||

Subtotal | 8,407 | 3,100 | 2.71 | |||||||||

| Asset retirement obligation and other | 2 | — | — | |||||||||

Total costs | $ | 8,409 | 3,100 | 2.71 | ||||||||

CHESAPEAKE ENERGY CORPORATION

ROLL-FORWARD OF PROVED RESERVES

TWELVE MONTHS ENDED DECEMBER 31, 2010

BASED ON 10-YEAR AVERAGE NYMEX STRIP PRICES AT DECEMBER 31, 2010

(unaudited)

Bcfe(a) | |||

| Beginning balance, 01/01/10 | 15,540 | ||

| Production | (1,035 | ) | |

| Acquisitions | 82 | ||

| Divestitures | (1,574 | ) | |

| Revisions – changes to previous estimates | 350 | ||

| Revisions – price | (470 | ) | |

| Extensions and discoveries | 4,712 | ||

| Ending balance, 12/31/10 | 17,605 | ||

| Proved reserves growth rate | 13 | % | |

| Proved developed reserves | 9,399 | ||

| Proved developed reserves percentage | 53 | % | |

| Reserve replacement | 3,100 | ||

Reserve replacement ratio (d) | 300 | % | |

| (a) | Reserve volumes estimated using SEC reserve recognition standards and 10-year average NYMEX strip prices as of December 31, 2010 of $5.67 per mcf of natural gas and $93.53 per bbl of oil, before field differential adjustments. Futures prices, such as the 10-year average NYMEX strip prices, represent an unbiased consensus estimate by market participants about the likely prices to be received for our future production. Chesapeake uses such forward-looking market-based data in developing its drilling plans, assessing its capital expenditure needs and projecting future cash flows. Chesapeake believes these prices are better indicators of the likely economic producibility of proved reserves than the trailing 12-month average price required by the SEC's reporting rule. |

| (b) | Net of drilling and completion carries of $1.151 billion associated with the Statoil, Total and CNOOC-Eagle Ford joint ventures. |

| (c) | Includes 350 bcfe of positive revisions resulting from changes to previous estimates and excludes downward revisions of 470 bcfe resulting from lower natural gas prices using 10-year average NYMEX strip prices as of December 31, 2010 compared to NYMEX strip prices as of December 31, 2009. |

| (d) | The company uses the reserve replacement ratio as an indicator of the company’s ability to replenish annual production volumes and grow its reserves. It should be noted that the reserve replacement ratio is a statistical indicator that has limitations. The ratio is limited because it typically varies widely based on the extent and timing of new discoveries and property acquisitions. Its predictive and comparative value is also limited for the same reasons. In addition, since the ratio does not embed the cost or timing of future production of new reserves, it cannot be used as a measure of value creation. |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF PV-10

($ in millions)

(unaudited)

December 31, 2010 | December 31, 2009 | ||||

| Standardized measure of discounted future | $ | 13,183 | $ | 8,203 | |

| net cash flows | |||||

| Discounted future cash flows for income taxes | 1,963 | 1, 246 | |||

| Discounted future net cash flows before income | |||||

| taxes (PV-10) | $ | 15,146 | $ | 9,449 | |

PV-10 is discounted (at 10%) future net cash flows before income taxes. The standardized measure of discounted future net cash flows includes the effects of estimated future income tax expenses and is calculated in accordance with Accounting Standards Topic 932. Management uses PV-10 as one measure of the value of the company's current proved reserves and to compare relative values among peer companies without regard to income taxes. We also understand that securities analysts and rating agencies use this measure in similar ways. While PV-10 is based on prices, costs and discount factors which are consistent from company to company, the standardized measure is dependent on the unique tax situation of each individual company.

The company’s December 31, 2010 PV-10 and standardized measure were calculated using the trailing 12-moth average first-day-of-the-month prices as of December 31, 2010 of $4.38 per mcf and $79.42 per bbl. The company’s December 31, 2009 PV-10 and standardized measure were calculated using the trailing 12-month average first day-of-the-month prices as of December 31, 2009 of $3.87 per mcf and $61.14 per bbl.

CHESAPEAKE ENERGY CORPORATION

SUPPLEMENTAL DATA – NATURAL GAS AND OIL SALES AND INTEREST EXPENSE

(unaudited)

| THREE MONTHS ENDED | TWELVE MONTHS ENDED | |||||||||||||||

| DECEMBER 31, | DECEMBER 31, | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

| Natural Gas and Oil Sales ($ in millions): | ||||||||||||||||

Natural gas sales | $ | 666 | $ | 816 | $ | 3,169 | $ | 2,635 | ||||||||

Natural gas derivatives – realized gains (losses) | 563 | 542 | 1,982 | 2,313 | ||||||||||||

Natural gas derivatives – unrealized gains (losses) | (109 | ) | (94 | ) | 425 | (492 | ) | |||||||||

Total Natural Gas Sales | 1,120 | 1,264 | 5,576 | 4,456 | ||||||||||||

Oil sales | 340 | 194 | 1,079 | 656 | ||||||||||||

Oil derivatives – realized gains (losses) | 8 | 2 | 74 | 33 | ||||||||||||

Oil derivatives – unrealized gains (losses) | (519 | ) | (92 | ) | (1,082 | ) | (96 | ) | ||||||||

Total Oil Sales | (171 | ) | 104 | 71 | 593 | |||||||||||

Total Natural Gas and Oil Sales | $ | 949 | $ | 1,368 | $ | 5,647 | $ | 5,049 | ||||||||

Average Sales Price – excluding gains (losses) on derivatives: | ||||||||||||||||

Natural gas ($ per mcf) | $ | 2.83 | $ | 3.63 | $ | 3.43 | $ | 3.16 | ||||||||

Oil ($ per bbl) | $ | 61.19 | $ | 70.92 | $ | 58.67 | $ | 55.60 | ||||||||

Natural gas equivalent ($ per mcfe) | $ | 3.74 | $ | 4.19 | $ | 4.10 | $ | 3.63 | ||||||||

| Average Sales Price – excluding unrealized gains (losses) on derivatives: | ||||||||||||||||

Natural gas ($ per mcf) | $ | 5.22 | $ | 6.05 | $ | 5.57 | $ | 5.93 | ||||||||

Oil ($ per bbl) | $ | 62.62 | $ | 71.61 | $ | 62.71 | $ | 58.38 | ||||||||

Natural gas equivalent ($ per mcfe) | $ | 5.87 | $ | 6.45 | $ | 6.09 | $ | 6.22 | ||||||||

| Interest Expense ($ in millions): | ||||||||||||||||

Interest | $ | 6 | $ | 50 | $ | 99 | $ | 227 | ||||||||

Derivatives – realized (gains) losses | (8 | ) | (4 | ) | (14 | ) | (23 | ) | ||||||||

Derivatives – unrealized (gains) losses | 9 | 16 | (66 | ) | (91 | ) | ||||||||||

Total Interest Expense (Income) | $ | 7 | $ | 62 | $ | 19 | $ | 113 | ||||||||

CHESAPEAKE ENERGY CORPORATION

CONDENSED CONSOLIDATED CASH FLOW DATA

($ in millions)

(unaudited)

| THREE MONTHS ENDED: | December 31, | December 31, | |||||

| 2010 | 2009 | ||||||

| Beginning cash | $ | 609 | $ | 520 | |||

| Cash provided by operating activities | $ | 1,145 | $ | 1,226 | |||

| Cash (used in) provided by investing activities: | |||||||

Exploration and development of natural gas and oil properties | $ | (1,524 | ) | $ | (782 | ) | |

| Acquisitions of natural gas and oil proved and unproved properties | (2,676 | ) | (920 | ) | |||

Divestitures of proved and unproved properties | 1,185 | 197 | |||||

| Other property and equipment, net | 198 | (302 | ) | ||||

Investments, net | (21 | ) | — | ||||

Other | 1 | (1 | ) | ||||

Total cash (used in) investing activities | $ | (2,837 | ) | $ | (1,808 | ) | |

| Cash provided by financing activities | $ | 1,185 | $ | 369 | |||

| Ending cash | $ | 102 | $ | 307 | |||

| TWELVE MONTHS ENDED: | December 31, | December 31, | |||||

| 2010 | 2009 | ||||||

| Beginning cash | $ | 307 | $ | 1,749 | |||

| Cash provided by operating activities | $ | 5,117 | $ | 4,356 | |||

| Cash (used in) provided by investing activities: | |||||||

Exploration and development of natural gas and oil properties | $ | (5,242 | ) | $ | (3,572 | ) | |

Acquisitions of natural gas and oil proved and unprovedproperties | (6,945 | ) | (2,268 | ) | |||

Divestitures of proved and unproved properties | 4,292 | 1,926 | |||||

Other property and equipment, net | (443 | ) | (1,507 | ) | |||

Investments, net | (134 | ) | (40 | ) | |||

Other | (31 | ) | (1 | ) | |||

Total cash (used in) investing activities | $ | (8,503 | ) | $ | (5,462 | ) | |

| Cash provided by (used in) financing activities | $ | 3,181 | $ | (336 | ) | ||

| Ending cash | $ | 102 | $ | 307 | |||

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF OPERATING CASH FLOW AND EBITDA

($ in millions)

(unaudited)

| THREE MONTHS ENDED: | December 31, | September 30, | December 31, | ||||||||

| 2010 | 2010 | 2009 | |||||||||

| CASH PROVIDED BY OPERATING ACTIVITIES | $ | 1,145 | $ | 993 | $ | 1,226 | |||||

Changes in assets and liabilities | 41 | 75 | (14 | ) | |||||||

OPERATING CASH FLOW(a) | $ | 1,186 | $ | 1,068 | $ | 1,212 | |||||

| THREE MONTHS ENDED: | December 31, | September 30, | December 31, | ||||||||

| 2010 | 2010 | 2009 | |||||||||

| NET INCOME (LOSS) | $ | 223 | $ | 558 | $ | (499 | ) | ||||

| Income tax expense (benefit) | 140 | 349 | (299 | ) | |||||||

| Interest expense | 7 | 3 | 62 | ||||||||

| Depreciation and amortization of other assets | 61 | 56 | 67 | ||||||||

Natural gas and oil depreciation, depletion andamortization | 368 | 378 | 335 | ||||||||

EBITDA (b) | $ | 799 | $ | 1,344 | $ | (334 | ) | ||||

| THREE MONTHS ENDED: | December 31, | September 30, | December 31, | ||||||||

| 2010 | 2010 | 2009 | |||||||||

| CASH PROVIDED BY OPERATING ACTIVITIES | $ | 1,145 | $ | 993 | $ | 1,226 | |||||

| Changes in assets and liabilities | 41 | 75 | (14 | ) | |||||||

| Interest expense (income) | 7 | 3 | 62 | ||||||||

Unrealized gains (losses) on natural gas and oilderivatives | (628 | ) | 53 | (186 | ) | ||||||

| Realized gains on financing derivatives | 185 | 165 | 101 | ||||||||

| Impairment of natural gas and oil properties | — | — | (1,400 | ) | |||||||

| Gains (losses) on sale of other property and equipment | 154 | (17 | ) | — | |||||||

| Other impairments | (1 | ) | (20 | ) | (8 | ) | |||||

| Gains (losses) on equity investments | (13 | ) | 155 | (7 | ) | ||||||

| Impairment of investments | — | (16 | ) | — | |||||||

| Stock-based compensation | (36 | ) | (44 | ) | (36 | ) | |||||

| Other items | (55 | ) | (3 | ) | (72 | ) | |||||

EBITDA(b) | $ | 799 | $ | 1,344 | $ | (334 | ) | ||||

| (a) | Operating cash flow represents net cash provided by operating activities before changes in assets and liabilities. Operating cash flow is presented because management believes it is a useful adjunct to net cash provided by operating activities under accounting principles generally accepted in the United States (GAAP). Operating cash flow is widely accepted as a financial indicator of a natural gas and oil company's ability to generate cash which is used to internally fund exploration and development activities and to service debt. This measure is widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies within the natural gas and oil exploration and production industry. Operating cash flow is not a measure of financial per formance under GAAP and should not be considered as an alternative to cash flows from operating, investing or financing activities as an indicator of cash flows, or as a measure of liquidity. |

| (b) | Ebitda represents net income (loss) before income tax expense, interest expense and depreciation, depletion and amortization expense. Ebitda is presented as a supplemental financial measurement in the evaluation of our business. We believe that it provides additional information regarding our ability to meet our future debt service, capital expenditures and working capital requirements. This measure is widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies. Ebitda is also a financial measurement that, with certain negotiated adjustments, is reported to our lenders pursuant to our bank credit agreements and is used in the financial covenants in our bank credit agreements and our senior note indentures. Ebitda is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income, income from operations, or cash flow provided by operating activities prepared in accordance with GAAP. |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF OPERATING CASH FLOW AND EBITDA

($ in millions)

(unaudited)

| TWELVE MONTHS ENDED: | December 31, | December 31, | |||||

| 2010 | 2009 | ||||||

| CASH PROVIDED BY OPERATING ACTIVITIES | $ | 5,117 | $ | 4,356 | |||

Changes in assets and liabilities | (569 | ) | (23 | ) | |||

OPERATING CASH FLOW(a) | $ | 4,548 | $ | 4,333 | |||

| TWELVE MONTHS ENDED: | December 31, | December 31, | |||||

| 2010 | 2009 | ||||||

| NET INCOME (LOSS) | $ | 1,774 | $ | (5,805 | ) | ||

| Income tax expense (benefit) | 1,110 | (3,483 | ) | ||||

| Interest expense | 19 | 113 | |||||

| Depreciation and amortization of other assets | 220 | 244 | |||||

| Natural gas and oil depreciation, depletion and amortization | 1,394 | 1,371 | |||||

EBITDA(b) | $ | 4,517 | $ | (7,560 | ) | ||

| TWELVE MONTHS ENDED: | December 31, | December 31, | |||||

| 2010 | 2009 | ||||||

| CASH PROVIDED BY OPERATING ACTIVITIES | $ | 5,117 | $ | 4,356 | |||

| Changes in assets and liabilities | (569 | ) | (23 | ) | |||

| Interest expense | 19 | 113 | |||||

| Unrealized gains (losses) on natural gas and oil derivatives | (658 | ) | (588 | ) | |||

| Realized gains on financing derivatives | 621 | 154 | |||||

| Impairment of natural gas and oil properties | — | (11,000 | ) | ||||

| Gains (losses) on sale of other property and equipment | 137 | (38 | ) | ||||

| Other impairments | (21 | ) | (130 | ) | |||

| Gains (losses) on equity investments | 107 | (39 | ) | ||||

| Impairment of investments | (16 | ) | (162 | ) | |||

| Stock-based compensation | (147 | ) | (140 | ) | |||

| Restructuring costs | — | (12 | ) | ||||

| Other items | (73 | ) | (51 | ) | |||

EBITDA(b) | $ | 4,517 | $ | (7,560 | ) | ||

| (a) | Operating cash flow represents net cash provided by operating activities before changes in assets and liabilities. Operating cash flow is presented because management believes it is a useful adjunct to net cash provided by operating activities under accounting principles generally accepted in the United States (GAAP). Operating cash flow is widely accepted as a financial indicator of a natural gas and oil company's ability to generate cash which is used to internally fund exploration and development activities and to service debt. This measure is widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies within the natural gas and oil exploration and production industry. Operating cash flow is not a measure of financial perfor mance under GAAP and should not be considered as an alternative to cash flows from operating, investing or financing activities as an indicator of cash flows, or as a measure of liquidity. |

| (b) | Ebitda represents net income (loss) before income tax expense, interest expense and depreciation, depletion and amortization expense. Ebitda is presented as a supplemental financial measurement in the evaluation of our business. We believe that it provides additional information regarding our ability to meet our future debt service, capital expenditures and working capital requirements. This measure is widely used by investors and rating agencies in the valuation, comparison, rating and investment recommendations of companies. Ebitda is also a financial measurement that, with certain negotiated adjustments, is reported to our lenders pursuant to our bank credit agreements and is used in the financial covenants in our bank credit agreements and our senior note indentures. Ebitda is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income, income from operations, or cash flow provided by operating activities prepared in accordance with GAAP. |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED EBITDA

($ in millions)

(unaudited)

| December 31, | September 30, | December 31, | ||||||||||

| THREE MONTHS ENDED: | 2010 | 2010 | 2009 | |||||||||

| EBITDA | $ | 799 | $ | 1,344 | $ | (334 | ) | |||||

| Adjustments: | ||||||||||||

Unrealized (gains) losses on natural gas and oilderivatives | 628 | (53 | ) | 186 | ||||||||

Impairment of natural gas and oil properties | — | 1,400 | ||||||||||

Impairment of investments | — | 16 | — | |||||||||

(Gains) losses on sale of other property and equipment | (154 | ) | 17 | — | ||||||||

| Other impairments | 1 | 20 | 8 | |||||||||

Losses on redemptions or exchanges of debt | — | 59 | 21 | |||||||||

(Gains) losses on investments | — | (121 | ) | — | ||||||||

(Income) attributable to noncontrolling interest | — | — | (25 | ) | ||||||||

Adjusted EBITDA(a) | $ | 1,274 | $ | 1,282 | $ | 1,256 | ||||||

| (a) | Adjusted ebitda excludes certain items that management believes affect the comparability of operating results. The company discloses these non-GAAP financial measures as a useful adjunct to ebitda because: | |

| i. | Management uses adjusted ebitda to evaluate the company’s operational trends and performance relative to other natural gas and oil producing companies. | |

| ii. | Adjusted ebitda is more comparable to estimates provided by securities analysts. | |

| iii. | Items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items. | |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED EBITDA

($ in millions)

(unaudited)

| December 31, | December 31, | |||||||

| TWELVE MONTHS ENDED: | 2010 | 2009 | ||||||

| EBITDA | $ | 4,517 | $ | (7,560 | ) | |||

| Adjustments: | ||||||||

Unrealized (gains) losses on natural gas and oilderivatives | 658 | 588 | ||||||

Impairment of natural gas and oil properties | — | 11,000 | ||||||

Impairment of investments | 16 | 162 | ||||||

(Gains) losses on sale of other property and equipment | (137 | ) | 38 | |||||

| Other impairments | 21 | 130 | ||||||

Losses on redemptions or exchanges of debt | 129 | 40 | ||||||

(Gains) losses on investments | (121 | ) | — | |||||

Restructuring costs | — | 34 | ||||||

(Income) attributable to noncontrolling interest | — | (25 | ) | |||||

Adjusted EBITDA(a) | $ | 5,083 | $ | 4,407 | ||||

| (a) | Adjusted ebitda excludes certain items that management believes affect the comparability of operating results. The company discloses these non-GAAP financial measures as a useful adjunct to ebitda because: | |

| i. | Management uses adjusted ebitda to evaluate the company’s operational trends and performance relative to other natural gas and oil producing companies. | |

| ii. | Adjusted ebitda is more comparable to estimates provided by securities analysts. | |

| iii. | Items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items. | |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED NET INCOME AVAILABLE TO COMMON STOCKHOLDERS

($ in millions, except per-share data)

(unaudited)

| December 31, | September 30, | December 31, | ||||||||||

| THREE MONTHS ENDED: | 2010 | 2010 | 2009 | |||||||||

| Net income available to common stockholders | $ | 180 | 515 | $ | (530 | ) | ||||||

| Adjustments: | ||||||||||||

| Unrealized (gains) losses on derivatives, net of tax | 392 | (31 | ) | 126 | ||||||||

| Impairment of natural gas and oil properties, net of tax | — | — | 875 | |||||||||

| Impairment of investments, net of tax | — | 9 | — | |||||||||

(Gain) losses on sale of other property and equipment, net of tax | (95 | ) | 11 | — | ||||||||

| Other impairments, net of tax | 1 | 12 | 5 | |||||||||

| Losses on redemptions or exchanges of debt, net of tax | — | 36 | 14 | |||||||||

| (Gains) losses on investment activity, net of tax | — | (74 | ) | — | ||||||||

Adjusted net income available to common stockholders (a) | 478 | 478 | 490 | |||||||||

| Preferred stock dividends | 43 | 43 | 6 | |||||||||

Total adjusted net income | $ | 521 | $ | 521 | $ | 496 | ||||||

Weighted average fully diluted shares outstanding(b) | 746 | 744 | 644 | |||||||||

Adjusted earnings per share assuming dilution(a) | $ | 0.70 | $ | 0.70 | $ | 0.77 | ||||||

| (a) | Adjusted net income available to common stockholders and adjusted earnings per share assuming dilution exclude certain items that management believes affect the comparability of operating results. The company discloses these non-GAAP financial measures as a useful adjunct to GAAP earnings because: | |

| i. | Management uses adjusted net income available to common stockholders to evaluate the company’s operational trends and performance relative to other natural gas and oil producing companies. | |

| ii. | Adjusted net income available to common stockholders is more comparable to earnings estimates provided by securities analysts. | |

| iii. | Items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items. | |

(b) | Weighted average fully diluted shares outstanding include shares that were considered antidilutive for calculating earnings per share in accordance with GAAP. | |

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED NET INCOME AVAILABLE TO COMMON STOCKHOLDERS

($ in millions, except per-share data)

(unaudited)

| December 31, | December 31, | |||||||

| TWELVE MONTHS ENDED: | 2010 | 2009 | ||||||

| Net income (loss) available to common stockholders | $ | 1,663 | $ | (5,853 | ) | |||

| Adjustments: | ||||||||

| Unrealized (gains) losses on derivatives, net of tax | 364 | 311 | ||||||

| Impairment of natural gas and oil properties, net of tax | — | 6,875 | ||||||

| Impairment of investments, net of tax | 9 | 102 | ||||||

(Gains) losses on sale of other property and equipment, net of tax | (84 | ) | 24 | |||||

| Other impairments, net of tax | 13 | 81 | ||||||

| Losses on redemptions or exchanges of debt, net of tax | 80 | 24 | ||||||

| (Gains) losses on investment activity, net of tax | (74 | ) | — | |||||

| Restructuring costs, net of tax | — | 21 | ||||||

Adjusted net income available to common stockholders (a) | 1,971 | 1,585 | ||||||

| Preferred stock dividends | 111 | 23 | ||||||

Total adjusted net income | $ | 2,082 | $ | 1,608 | ||||

Weighted average fully diluted shares outstanding(b) | 706 | 631 | ||||||

Adjusted earnings per share assuming dilution(a) | $ | 2.95 | $ | 2.55 | ||||

| (a) | Adjusted net income available to common stockholders and adjusted earnings per share assuming dilution exclude certain items that management believes affect the comparability of operating results. The company discloses these non-GAAP financial measures as a useful adjunct to GAAP earnings because: | |

| i. | Management uses adjusted net income available to common stockholders to evaluate the company’s operational trends and performance relative to other natural gas and oil producing companies. | |

| ii. | Adjusted net income available to common stockholders is more comparable to earnings estimates provided by securities analysts. | |

| iii. | Items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items. | |

(b) | Weighted average fully diluted shares outstanding include shares that were considered antidilutive for calculating earnings per share in accordance with GAAP. | |

SCHEDULE “A”

CHESAPEAKE’S OUTLOOK AS OF FEBRUARY 22, 2011

Years Ending December 31, 2011 and 2012

Our policy is to periodically provide guidance on certain factors that affect our future financial performance. As of February 22, 2011, we are using the following key assumptions in our projections for 2011 and 2012.

The primary changes from our November 3, 2010 Outlook are in italicized bold and are explained as follows:

| 1) | Our production guidance has been updated and reflects anticipated asset sales; |

| 2) | Projected effects of changes in our hedging positions have been updated; |

| 3) | Our NYMEX natural gas and oil price assumptions for gathering/marketing/transportation differentials have been updated; |

| 4) | Certain cost assumptions have been updated; and |

| 5) | Our cash flow projections have been updated, including increased drilling and completion costs. |

Year Ending 12/31/2011 | Year Ending 12/31/2012 | ||||||||||

| Estimated Production: | |||||||||||

Natural gas – bcf | 900 – 930 | 960 – 1,000 | |||||||||

Oil – mbbls | 32,000 – 36,000 | 51,000 – 57,000 | |||||||||

Natural gas equivalent – bcfe | 1,092 – 1,146 | 1,266 – 1,342 | |||||||||

| Daily natural gas equivalent midpoint – mmcfe | 3,065 | 3,560 | |||||||||

| Year over year (YOY) estimated production increase | 6 – 11% | 13 - 20% | |||||||||

| YOY estimated production increase excluding asset sales | 17 – 22% | 17 - 24% | |||||||||

NYMEX Price(a) (for calculation of realized hedging effects only): | |||||||||||

Natural gas - $/mcf | $4.46 | $5.50 | |||||||||

Oil - $/bbl | $89.96 | $90.00 | |||||||||

| Estimated Realized Hedging Effects (based on assumed NYMEX prices above): | |||||||||||

Natural gas - $/mcf | $1.52 | $0.12 | |||||||||

Oil - $/bbl | $(0.68) | $(0.40) | |||||||||

| Estimated Gathering/Marketing/Transportation Differentials to NYMEX Prices: | |||||||||||

Natural gas - $/mcf | $0.90 – $1.10 | $0.90 – $1.10 | |||||||||

Oil - $/bbl(b) | $20.00 – $25.00 | $20.00 – $25.00 | |||||||||

| Operating Costs per Mcfe of Projected Production: | |||||||||||

Production expense | $0.90 – 1.00 | $0.90 – 1.00 | |||||||||

| Production taxes (~ 5% of O&G revenues) | $0.25 – 0.30 | $0.25 – 0.30 | |||||||||

General and administrative(c) | $0.34 – 0.39 | $0.34 – 0.39 | |||||||||

| Stock-based compensation (non-cash) | $0.07 – 0.09 | $0.07 – 0.09 | |||||||||

| DD&A of natural gas and oil assets | $1.15 – 1.30 | $1.15 – 1.30 | |||||||||

| Depreciation of other assets | $0.20 – 0.25 | $0.20 – 0.25 | |||||||||

Interest expense(d) | $0.05 – 0.10 | $0.05 – 0.10 | |||||||||

| Other Income per Mcfe: | |||||||||||

| Marketing, gathering and compression net margin | $0.09 – 0.11 | $0.09 – 0.11 | |||||||||

Service operations net margin | $0.02 – 0.04 | $0.02 – 0.04 | |||||||||

Other income (including equity investments) | $0.06 – 0.08 | $0.06 – 0.08 | |||||||||

| Book Tax Rate | 39% | 39% | |||||||||

| Equivalent Shares Outstanding (in millions): | |||||||||||

| Basic | 640 – 645 | 647 – 652 | |||||||||

| Diluted | 750 – 755 | 760 – 765 | |||||||||

Operating cash flow before changes in assets and liabilities(e)(f) | $5,000 – 5,100 | $5,600 – 6,400 | |||||||||

| Drilling and completion costs, net of joint venture carries | ($5,000 – 5,400) | ($5,400 – 5,800) | |||||||||

| Note: please refer to footnotes on following page |

| (a) | NYMEX natural gas prices have been updated for actual contract prices through February 2011 and NYMEX oil prices have been updated for actual contract prices through January 2011. |

| (b) | Differentials include effects of natural gas liquids. |

| (c) | Excludes expenses associated with noncash stock compensation. |

| (d) | Does not include gains or losses on interest rate derivatives. |

| (e) | A non-GAAP financial measure. We are unable to provide a reconciliation to projected cash provided by operating activities, the most comparable GAAP measure, because of uncertainties associated with projecting future changes in assets and liabilities. |

| (f) | Assumes NYMEX prices of $4.00 to $5.00 per mcf and $90.00 per bbl in 2011 and $5.00 to $6.00 per mcf and $90.00 per bbl in 2012. |

Commodity Hedging Activities

The company utilizes hedging strategies to hedge the price of a portion of its future natural gas and oil production. These strategies include:

| 1) | Swaps: Chesapeake receives a fixed price and pays a floating market price to the counterparty for the hedged commodity. |

| 2) | Call options: Chesapeake sells call options in exchange for a premium from the counterparty. At the time of settlement, if the market price exceeds the fixed price of the call option, Chesapeake pays the counterparty such excess and if the market price settles below the fixed price of the call option, no payment is due from either party. |

| 3) | Put options: Chesapeake receives a premium from the counterparty in exchange for the sale of a put option. At the time of settlement, if the market prices falls below the fixed price of the put option, Chesapeake pays the counterparty such shortfall, and if the market price settles above the fixed price of the put option, no payment is due from either party. |

| 4) | Knockout swaps: Chesapeake receives a fixed price and pays a floating market price. The fixed price received by Chesapeake includes a premium in exchange for the possibility to reduce the counterparty’s exposure to zero, in any given month, if the floating market price is lower than certain pre-determined knockout prices. |

| 5) | Basis protection swaps: These instruments are arrangements that guarantee a price differential to NYMEX for natural gas from a specified delivery point. For non-Appalachian Basin basis protection swaps, which typically have negative differentials to NYMEX, Chesapeake receives a payment from the counterparty if the price differential is greater than the stated terms of the contract and pays the counterparty if the price differential is less than the stated terms of the contract. For Appalachian Basin basis protection swaps, which typically have positive differentials to NYMEX, Chesapeake receives a payment from the counterparty if the price differential is less than the stated terms of the contract and pays the counterparty if the price differential i s greater than the stated terms of the contract. |

All of our derivative instruments are net settled based on the difference between the fixed-price payment and the floating-price payment, resulting in a net amount due to or from the counterparty.

Commodity markets are volatile, and as a result, Chesapeake’s hedging activity is dynamic. As market conditions warrant, the company may elect to settle a hedging transaction prior to its scheduled maturity date and lock in the gain or loss on the transaction. Since the latter half of 2009 through February 22, 2011, the company has taken advantage of attractive strip prices in 2012 through 2017 and sold natural gas and oil call options to its counterparties in exchange for 2010, 2011 and 2012 natural gas swaps with strike prices above the then current market price. This effectively allowed the company to sell out-year volatility through call options at terms acceptable to Chesapeake in exchange for straight natural gas swaps with strike prices in excess of the market price for natural gas at that time.