Domenic J. Dell'Osso, Jr.

Executive Vice President and

Chief Financial Officer

|

|

|

6100 North Western Avenue Oklahoma City, Oklahoma 73118 |

April 21, 2016

Via EDGAR

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-7010

Attention: Ethan Horowitz, Branch Chief

|

| |

| RE: | Chesapeake Energy Corporation Form 10-K for Fiscal Year Ended December 31, 2015 Filed February 25, 2016 Form 8-K filed February 24, 2016 File No. 1-13726 |

Ladies and Gentlemen:

This letter sets forth the responses of Chesapeake Energy Corporation (the “Company” or “Chesapeake”) to the comments of the staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) received by letter dated April 7, 2016. We have repeated below the Staff’s comments and followed each comment with the Company’s response.

Form 10-K for Fiscal Year Ended December 31, 2015

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 40

Results of Operations, page 55

Impairment of Natural Gas Properties, page 60

| |

| 1. | You have stated that management reasonably expects downward revisions to proved reserves of approximately 8% as of March 31, 2016 due to the continued decrease in first-of-the-month index prices and current strip prices in the first quarter of fiscal year 2016. You have also stated an estimated $1.2 billion reduction in the present value of estimated future net revenue of proved reserves, as indicator of impairment, based on similar |

United States Securities and Exchange Commission

Page 2

index and strip prices during this interim period. Please disclose whether the $1.2 billion estimated indication of impairment to your oil and natural gas properties takes into account the 8% expected reduction in proved reserve estimates. If not, please quantify the additional reasonably expected reduction in the present value of estimated future net revenue due to this 8% expected revision to reserves. In your response, please also tell us whether the 8% revision to proved reserves relates to proved development reserve quantities, proved undeveloped reserve quantities or both.

Response:

In estimating the impact on the quantities of proved reserves and the present value of estimated future net revenue therefrom resulting from declining commodity prices in the first quarter of 2016, we confirm the estimated $1.2 billion reduction in the present value of estimated future net revenue of our proved reserves included the impact from the associated 8% expected reduction to total proved reserves (developed and undeveloped). In future filings, we will clarify this disclosure accordingly.

Notes to Consolidated Financial Statements

Note 1. Basis of Presentation and Summary of Significant Accounting Policies, page 82

Reclassifications, page 90

| |

| 2. | We note that beginning in the fourth quarter of 2015 you have reclassified your presentation of third party transportation and gathering costs to report the costs as a component of operating expenses. Previously, these costs were reflected as deductions to oil, natural gas and NGL sales. Please explain the reason for the reclassification and why you believe the reclassification is appropriate. |

Response:

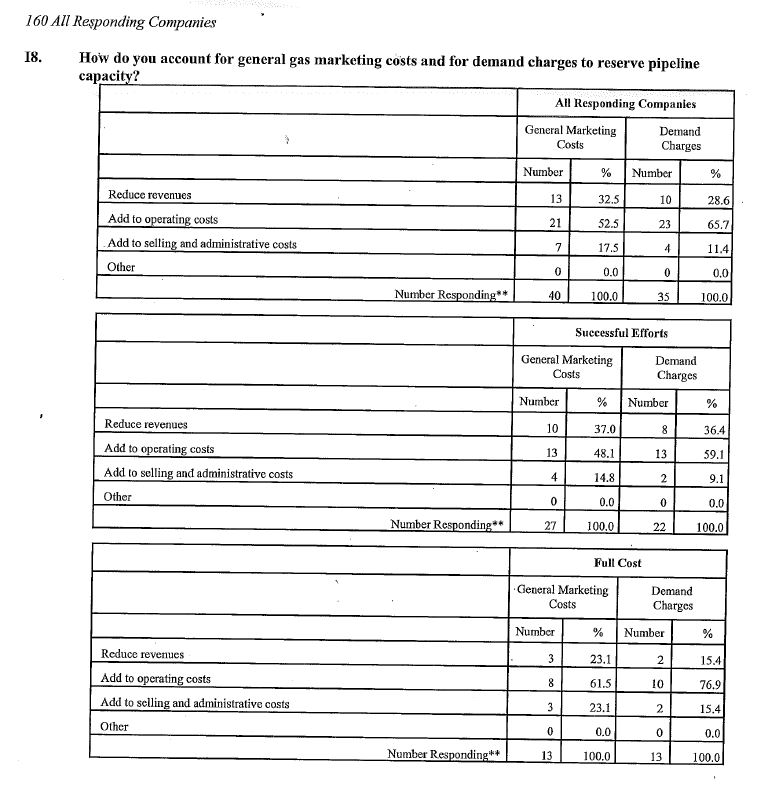

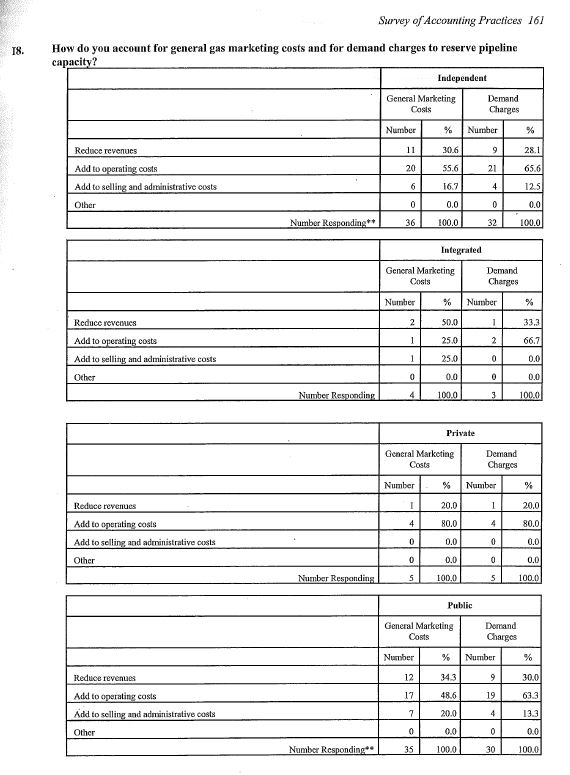

As noted in the responses to Question I8 from the 2011 PwC Survey of U.S. Petroleum Accounting Practices (see attached), there is considerable diversity in practice regarding how oil and gas producing entities account for gathering and transportation costs. While the Company’s historical practice of including such costs within revenue remains an acceptable presentation, we note that the majority of our peers follow a practice of including such costs within operating expenses. Accordingly, in the spirit of improving a reader’s ability to compare our results of operations to those of our peers, we reclassified such costs to a separate line-item under Operating Expenses for all periods presented.

United States Securities and Exchange Commission

Page 3

Exhibit 4.10.1

| |

| 3. | We note that the schedules and exhibits to your credit agreement have not been filed. Please re-file your credit agreement in include omitted schedules and exhibits. |

Response:

The Company did not file the schedules and exhibits to the Company’s Credit Agreement dated as of December 15, 2014 (the “Credit Agreement”) because such schedules and exhibits do not contain information that is material to an investment decision and do nothing more than further describe the terms and conditions already set forth in the Credit Agreement or information otherwise disclosed in the Company’s periodic filings.

The Company believes the information contained in the exhibits and schedules to the Credit Agreement does not contribute materially to an investor’s understanding of the Credit Agreement. The exhibits to the Credit Agreement consist of form documents (borrowing notices, guarantees, certificates and similar documents) that are customary and routine in loan agreements. Any substantive information in the exhibits is already described in the body of the Credit Agreement. Likewise, the schedules to the Credit Agreement do little more than further describe the terms and conditions already set forth in the Credit Agreement. Further, much of the information in the schedules was provided as of the date of the Credit Agreement and is now more than 18 months old, and analogous updated information has been disclosed in other period filings of the Company. For example, information analogous to that contained within the schedules related to litigation, indebtedness, liens and affiliate transactions is available to investors as part of its disclosures contained in its annual report on Form 10-K or in its quarterly reports on Form 10-Q.

The Company further notes that, when filing amendments to the Credit Agreement, it considered whether any exhibits or schedules to the amendment were material to an investor’s understanding of the amendment or the Credit Agreement and filed those exhibits or schedules, as appropriate. For example, the Third Amendment to Credit Agreement, dated as of April 8, 2016 and filed on Form 8-K on April 11, 2016, includes exhibits that are both material to an understanding of the amendment and Credit Agreement and not otherwise available to investors.

While we note that Item 601(b)(10) does not contain a provision similar to Item 601(b)(2), which provides for the omission of schedules and exhibits, the Company believes the principle established in Item 601(b)(2) is instructive. Because the information contained in the omitted schedules and exhibits (i) provides little disclosure value to investors, (ii) is not material to an investment decision and/or (iii) is dated or otherwise disclosed in the Credit Agreement or the

United States Securities and Exchange Commission

Page 4

Company’s periodic filings, we do not believe that it is necessary to re-file the Agreement to include the omitted schedules and exhibits. We agree to furnish supplementally a copy of the schedules and exhibits to the Commission upon request. To the extent that any schedule or exhibit contains confidential information, we reserve the right to redact that confidential information and request confidential treatment for such information.

Form 8-K filed February 24, 2016

Exhibit 99.1

| |

| 4. | We note in Exhibit 99.1 of your earnings release your discussion of the financial results of the full year and fourth quarter appears to provide greater prominence to your non-GAAP measures than your GAAP measures. For example, in the highlighted section, we note you present 2015 adjusted net loss of $0.20 per diluted share and 2015 adjusted ebitda of $2.385 billion without a corresponding discussion of the most directly comparable GAAP measurement. Please explain to us why you believe this highlighted presentation of non-GAAP results complies with the guidance in Instruction 2 of Item 2.02 of Form 8-K and Item 10(e)(1)(i)(A) of Regulation S-K. |

Response:

In consideration of the Staff’s comment, in accordance with Item 10(e)(1)(i)(A) of Regulation S-K, the Company will revise its future earnings releases to present the most directly comparable GAAP financial measure with equal or greater prominence than the non-GAAP financial measure.

| |

| 5. | You have presented the non-GAAP measure of adjusted net earnings (loss) per fully diluted share for the three months and year ended December 31, 2015 and 2014, without direct reconciliation to the most directly comparable per share amount calculated in accordance with GAAP. Please revise the tables presented on pages 15 and 16 to include a reconciliation of these per share amounts. You may refer to Question 102.05 of the Compliance and Disclosure Interpretations for Non-GAAP Financial Measures dated July 8, 2011 for further guidance. |

Response:

In future filings, the Company agrees to add a reconciliation of “adjusted earnings per share assuming dilution” to earnings per share on a GAAP basis.

* * * * *

United States Securities and Exchange Commission

Page 5

Should any member of the Staff have a question regarding our responses to the comments set forth above, or need additional information, please do not hesitate to call Mike Johnson, our Chief Accounting Officer, at (405) 935-9229, J. David Hershberger, our Corporate Counsel, at (405) 935-3878 or me at (405) 935-6125.

As you request in the comment letter, we acknowledge that:

| |

| • | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| |

| • | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

|

| |

| | Very truly yours, |

| | |

| | /s/ Domenic J. Dell'Osso, Jr. |

| | Domenic J. Dell'Osso, Jr. |

| | Executive Vice President and Chief Financial Officer |

|

| | |

| cc: | Securities and Exchange Commission |

| | | Wei Lu, Staff Accountant |

| | | Shannon Buskirk, Staff Accountant |

| | | |

| | Tull Florey, Baker Botts L.L.P. |