CHESAPEAKE ENERGY: THE TRANSFORMATION AND THE FUTURE Doug Lawler President and Chief Executive Officer Exhibit 99.2

FORWARD-LOOKING STATEMENTS This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are statements other than statements of historical fact. They include statements that give our current expectations, guidance or forecasts of future events, production and well connection forecasts, estimates of operating costs, anticipated capital and operational efficiencies, planned development drilling and expected drilling cost reductions, general and administrative expenses, capital expenditures, the timing of anticipated asset sales and proceeds to be received therefrom, projected cash flow and liquidity, our ability to enhance our cash flow and financial flexibility, plans and objectives for future operations, and the assumptions on which such statements are based. Although we believe the expectations and forecasts reflected in the forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate or changed assumptions or by known or unknown risks and uncertainties. Factors that could cause actual results to differ materially from expected results include those described under “Risk Factors” in Item 1A of our annual report on Form 10-K and any updates to those factors set forth in Chesapeake’s subsequent quarterly reports on Form 10-Q or current reports on Form 8-K (available at http://www.chk.com/investors/ sec-filings). These risk factors include: the volatility of oil, natural gas and NGL prices; the limitations our level of indebtedness may have on our financial flexibility; our inability to access the capital markets on favorable terms; the availability of cash flows from operations and other funds to finance reserve replacement costs or satisfy our debt obligations; our credit rating requiring us to post more collateral under certain commercial arrangements; write-downs of our oil and natural gas asset carrying values due to low commodity prices; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of oil, natural gas and NGL reserves and projecting future rates of production and the amount and timing of development expenditures; our ability to generate profits or achieve targeted results in drilling and well operations; leasehold terms expiring before production can be established; commodity derivative activities resulting in lower prices real ized on oil, natural gas and NGL sales; the need to secure derivative liabilities and the inability of counterparties to satisfy their obligations; adverse developments or losses from pending or future litigation and regulatory proceedings, including royalty claims; charges incurred in response to market conditions and in connection with our ongoing actions to reduce financial leverage and complexity; drilling and operating risks and resulting liabilities; effects of environmental protection laws and regulation on our business; legislative and regulatory initiatives further regulating hydraulic fracturing; our need to secure adequate supplies of water for our drilling operations and to dispose of or recycle the water used; impacts of potential legislative and regulatory actions addressing climate change; federal and state tax proposals affecting our industry; potential OTC derivatives regulation limiting our ability to hedge against commodity price fluctuations; competition in the oil and gas exploration and production industry; a deterioration in general economic, business or industry conditions; negative public perceptions of our industry; limited control over properties we do not operate; pipeline and gathering system capacity constraints and transportation interruptions; terrorist activities and/or cyber-attacks adversely impacting our operations; potential challenges by SSE’s former creditors of our spin-off of in connection with SSE’s recently completed bankruptcy under Chapter 11 of the U.S. Bankruptcy Code; an interruption in operations at our headquarters due to a catastrophic event; the continuation of suspended dividend payments on our common stock; the effectiveness of our remediation plan for a material weakness; certain anti-takeover provisions that affect shareholder rights; and our inability to increase or maintain our liquidity through debt repurchases, capital exchanges, asset sales, joint ventures, farmouts or other means. In addition, disclosures concerning the estimated contribution of derivative contracts to our future results of operations are based upon market information as of a specific date. These market prices are subject to significant volatility. Our production forecasts are also dependent upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity. Expected asset sales may not be completed in the time frame anticipated or at all. We caution you not to place undue reliance on our forward-looking statements, which speak only as of the date of this presentation, and we undertake no obligation to update any of the information provided in this presentation, except as required by applicable law. In addition, this presentation contains time-sensitive information that reflects management’s best judgment only as of the date of this presentation. We use certain terms in this presentation such as “Resource Potential,” “Net Reserves” and similar terms that the SEC’s guide lines strictly prohibit us from including in filings with the SEC. These terms include reserves with substantially less certainty, and no discount or other adjustment is included in the presentation of such reserve numbers. U.S. investors are urged to consider closely the disclosure in our Form 10-K for the year ended December 31, 2016, File No. 1-13726 and in our other filings with the SEC, available from us at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118. These forms can also be obtained from the SEC by calling 1-800-SEC-0330. 2 CHK: The Transformation & The Future

UNCONVENTIONAL TRAILBLAZER The Early Years CHK: The Transformation & The Future 3

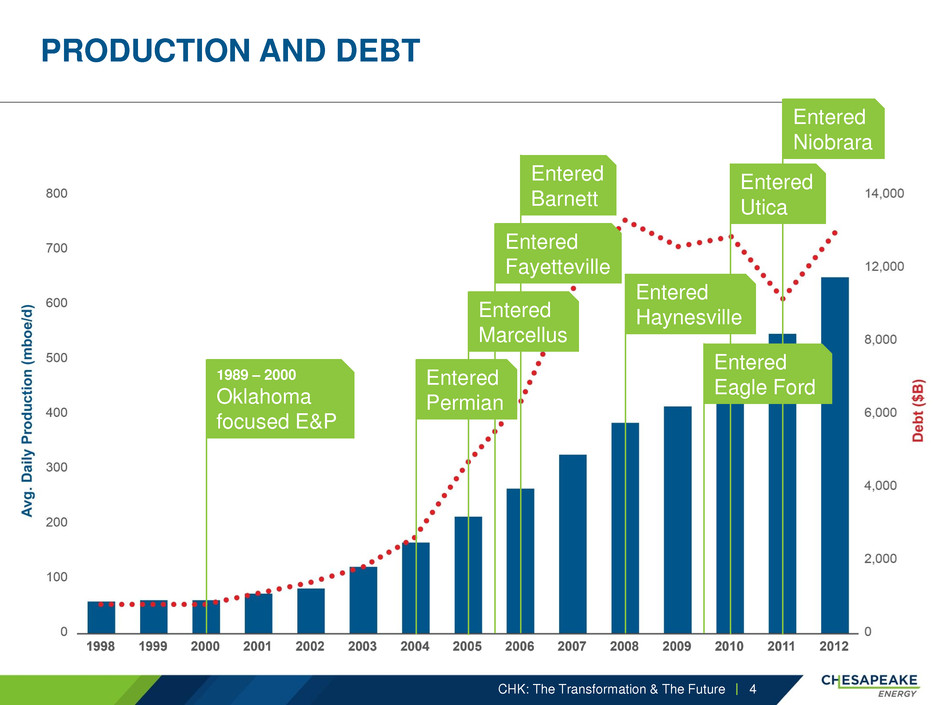

PRODUCTION AND DEBT 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 0 100 200 300 400 500 600 700 800 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017F 2018F Deb t ($ B ) A v g. Da ily P ro d u c ti o n ( m b o e/ d ) CHK Capital & Production 2017F/2018F as of 11+1 Avg. Daily Prod. (boe/d) Total Debt CHK: The Transformation & The Future 4 Entered Barnett Entered Haynesville 1989 – 2000 Oklahoma focused E&P Entered Niobrara Entered Utica Entered Eagle Ford Entered Fayetteville Entered Marcellus Entered Permian

COMPLEXITY ACROSS ALL ASPECTS OF THE COMPANY Companies CHK owned or invested in: As of 12/31/2012 CHK: The Transformation & The Future 5 $21.25 billion Total leverage 45,400 gross wells Interests 7 joint ventures With 5 different companies 10 VPPS 12,000 employees Governance challenges Leads to activist investors

CHK: The Transformation & The Future The Transformation 6

THE GREATEST CHALLENGE IN THE INDUSTRY CHK: The Transformation & The Future 7 In 2013, by any measure, a bottom-quartile-performing company HIGH CASH COSTS HIGH DEBT POOR CAPITAL EFFICIENCY HIGH TRANSPORTATION COSTS LOW MARGINS + + + +

CHK: The Transformation & The Future 8

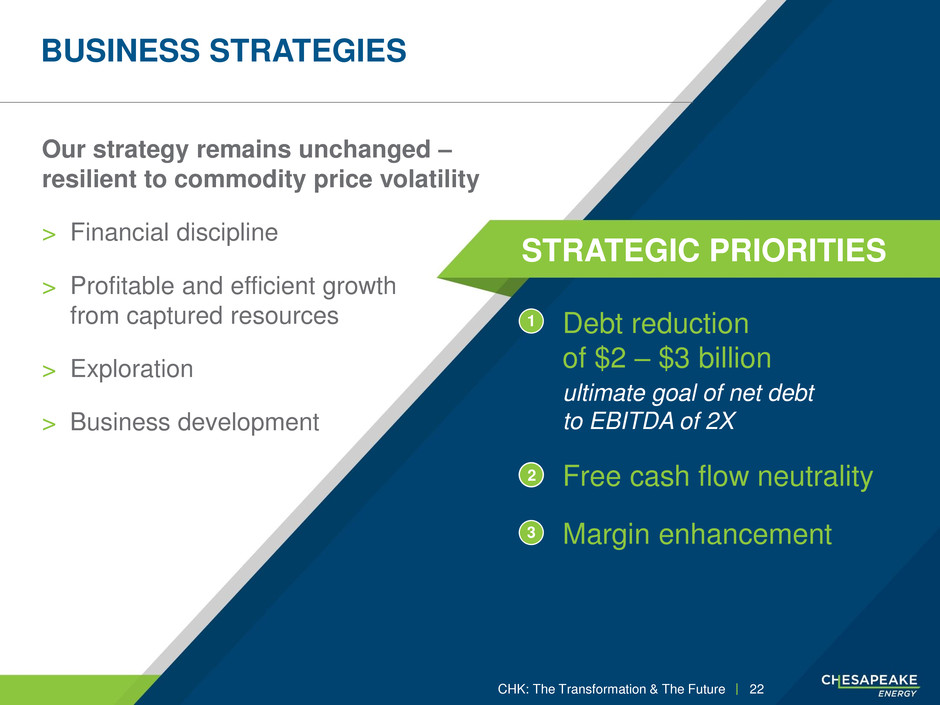

BUSINESS STRATEGIES > Financial discipline > Profitable and efficient growth from captured resources > Exploration > Business development CORE VALUES > Integrity and trust > Respect > Transparency and open communication > Commercial focus > Change leadership CHK: The Transformation & The Future 9

THE TRANSFORMATION BEGINS CHK: The Transformation & The Future 10 Focused on Value TRANSFORMATION TEAMS: Organizational Structure Financial & Corporate Planning Capital Efficiency Portfolio Characterization Affiliated/Subsidiary Evaluation Cash Costs Marketing & GP&T Performance Evaluation Field Operations Focused on Volume #2 most active driller in the U.S. Peak rig count = 180 #1 driller of horizontal shale wells in the world ~11mm net acres under lease (U.S. onshore) 23 years of production growth

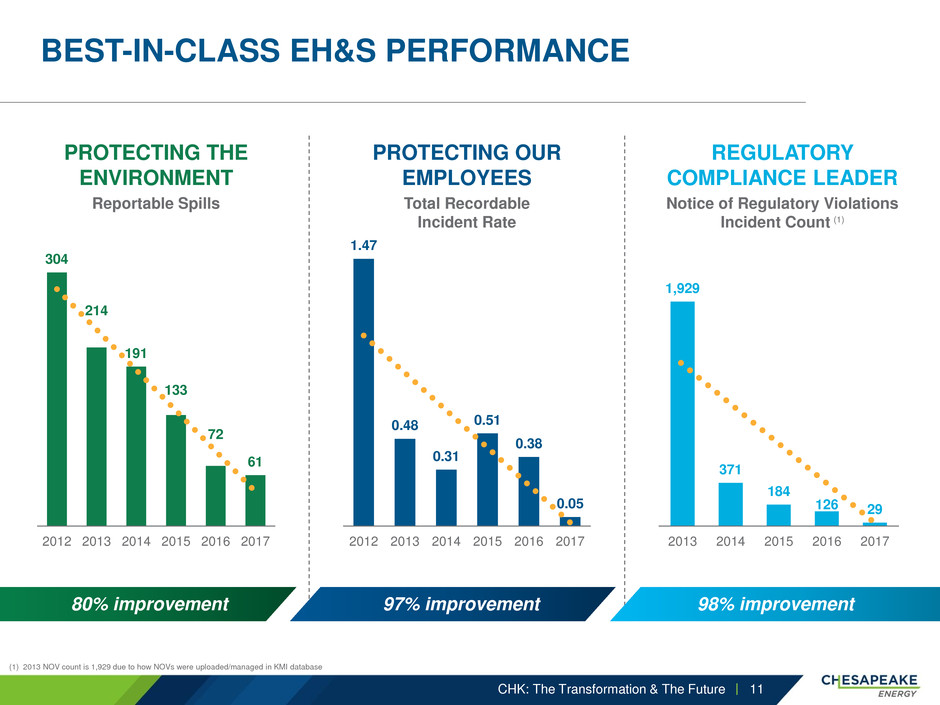

BEST-IN-CLASS EH&S PERFORMANCE CHK: The Transformation & The Future (1) 2013 NOV count is 1,929 due to how NOVs were uploaded/managed in KMI database 11 80% improvement 97% improvement 98% improvement PROTECTING THE ENVIRONMENT Reportable Spills 304 214 191 133 72 61 2012 2013 2014 2015 2016 2017 1.47 0.48 0.31 0.51 0.38 0.05 2012 2013 2014 2015 2016 2017 PROTECTING OUR EMPLOYEES Total Recordable Incident Rate 1,929 371 184 126 29 2013 2014 2015 2016 2017 REGULATORY COMPLIANCE LEADER Notice of Regulatory Violations Incident Count (1)

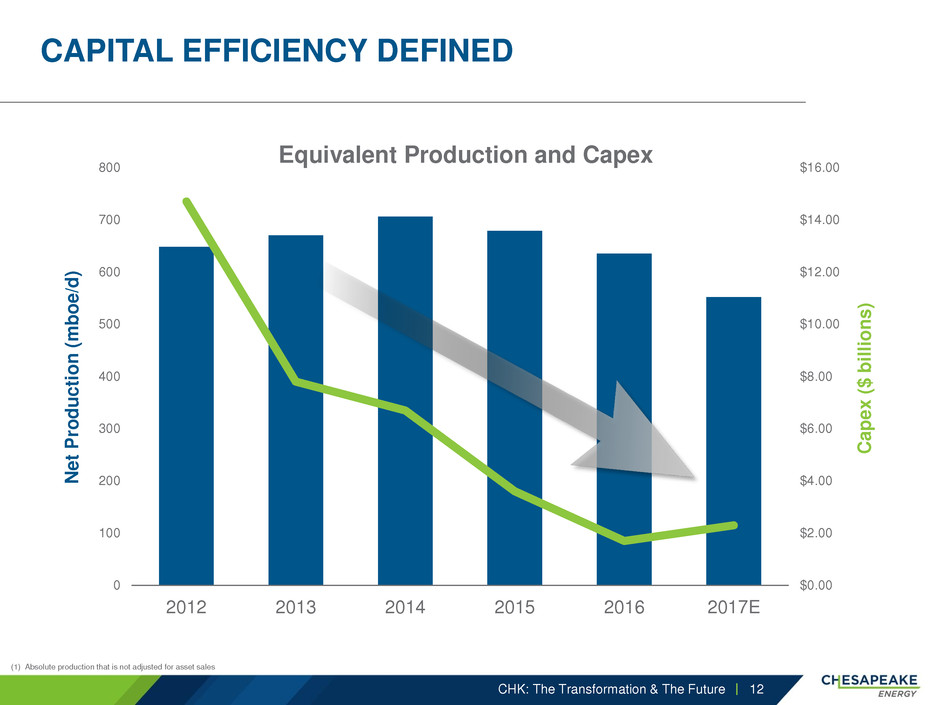

$0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 0 100 200 300 400 500 600 700 800 2012 2013 2014 2015 2016 2017E C a p ex ($ b il li o n s ) N et Pr o d u cti o n (m b o e/ d ) Equivalent Production and Capex CAPITAL EFFICIENCY DEFINED (1) Absolute production that is not adjusted for asset sales CHK: The Transformation & The Future 12

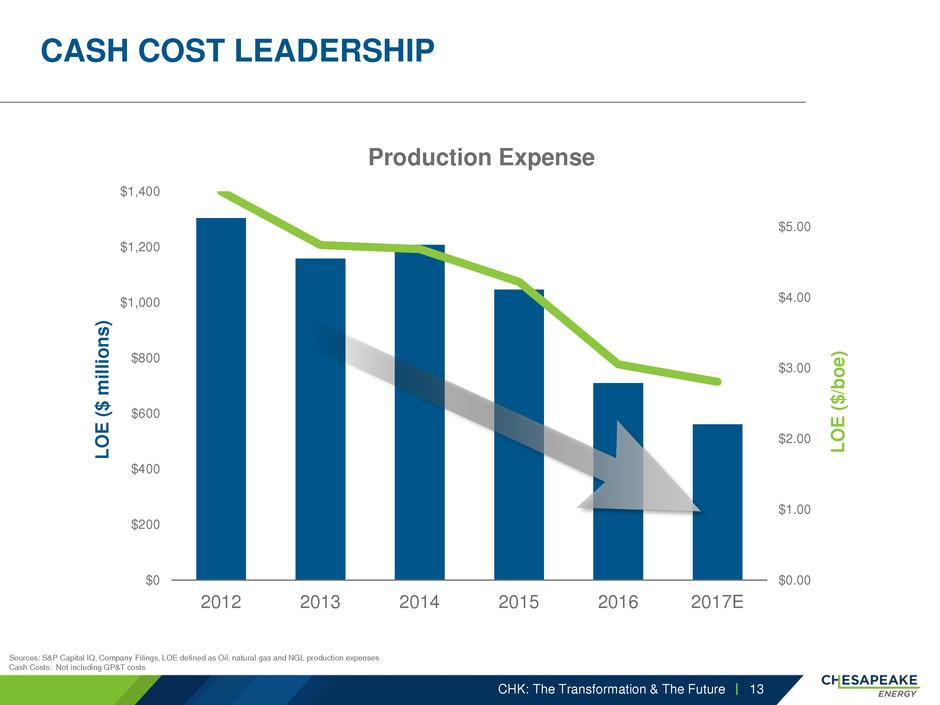

$0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2012 2013 2014 2015 2016 2017E L OE ($ /b o e ) L OE ($ m il li o n s ) Production Expense CASH COST LEADERSHIP Sources: S&P Capital IQ, Company Filings, LOE defined as Oil, natural gas and NGL production expenses Cash Costs: Not including GP&T costs CHK: The Transformation & The Future 13

CASH COST LEADERSHIP $- $0.50 $1.00 $1.50 $2.00 $2.50 $- $100 $200 $300 $400 $500 $600 2012 2013 2014 2015 2016 2017E G & A ($ /b o e ) G & A ($ m il li o n s ) G&A CHK: The Transformation & The Future 14

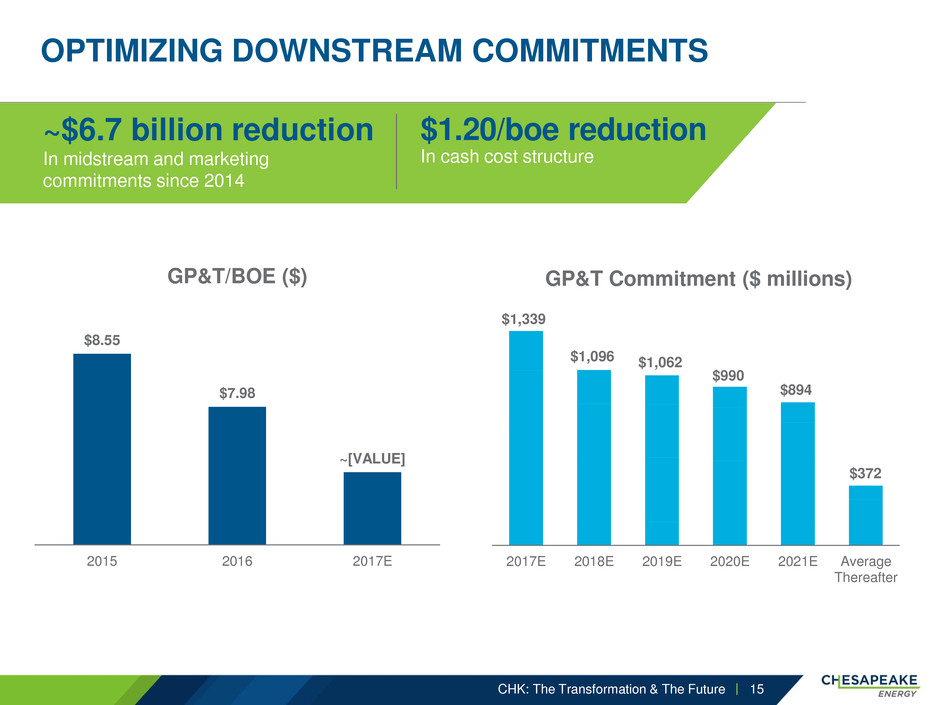

OPTIMIZING DOWNSTREAM COMMITMENTS CHK: The Transformation & The Future 15 $8.55 $7.98 ~[VALUE] 2015 2016 2017E GP&T/BOE ($) 2017E 2018E 2019E 2020E 2021E Average Thereafter GP&T Commitment ($ millions) $1,339 $1,096 $1,062 $990 $894 $372 $1.20/boe reduction In cash cost structure ~$6.7 billion reduction In midstream and marketing commitments since 2014

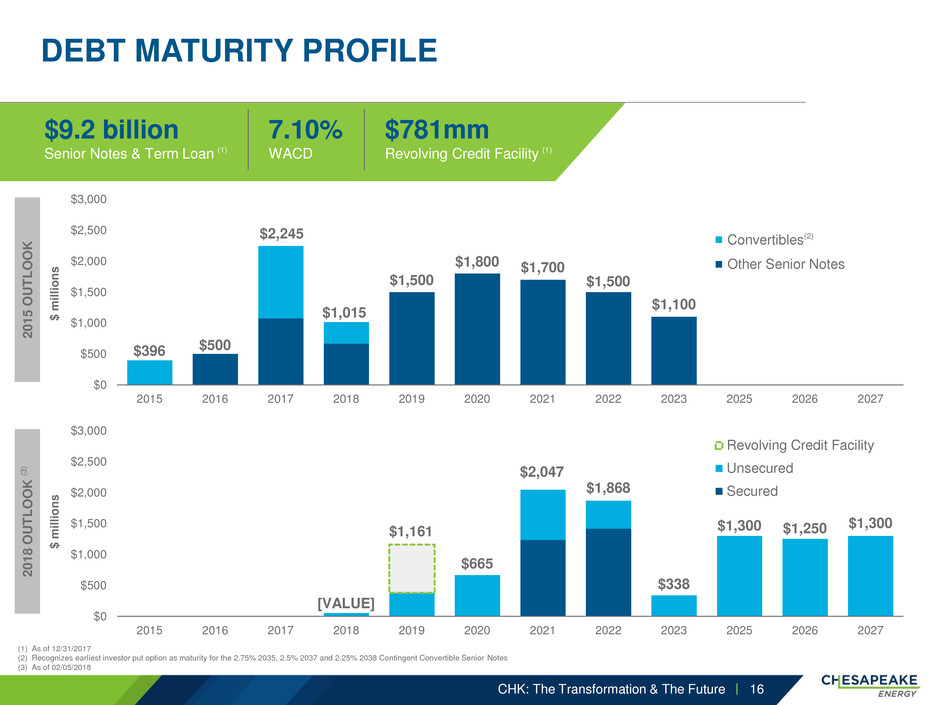

[VALUE] $665 $338 $1,300 $1,250 $1,300 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2015 2016 2017 2018 2019 2020 2021 2022 2023 2025 2026 2027 Revolving Credit Facility Unsecured Secured $2,047 $1,868 $1,161 $ m il li o n s ev l ing edit ilit nsecure ecure 2 0 1 8 O U T L O O K (3 ) $500 $1,500 $1,800 $1,700 $1,500 $1,100 $396 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2015 2016 2017 2018 2019 2020 2021 2022 2023 2025 2026 2027 #REF! Convertibles $2,245 $1,015 Convertibles(2) Other Senior Notes $ m il li o n s 2 0 1 5 O U T L O O K $781mm Revolving Credit Facility (1) DEBT MATURITY PROFILE (1) As of 12/31/2017 (2) Recognizes earliest investor put option as maturity for the 2.75% 2035, 2.5% 2037 and 2.25% 2038 Contingent Convertible Senior Notes (3) As of 02/05/2018 CHK: The Transformation & The Future 16 $9.2 billion Senior Notes & Term Loan (1) 7.10% WACD

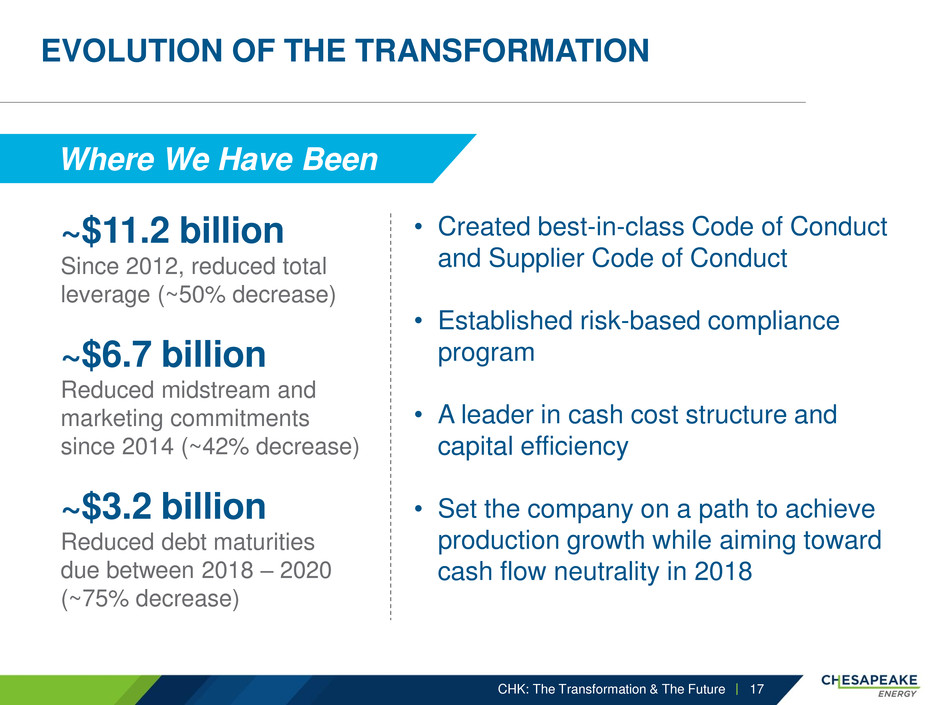

EVOLUTION OF THE TRANSFORMATION • Created best-in-class Code of Conduct and Supplier Code of Conduct • Established risk-based compliance program • A leader in cash cost structure and capital efficiency • Set the company on a path to achieve production growth while aiming toward cash flow neutrality in 2018 CHK: The Transformation & The Future 17 Where We Have Been ~$11.2 billion Since 2012, reduced total leverage (~50% decrease) ~$6.7 billion Reduced midstream and marketing commitments since 2014 (~42% decrease) ~$3.2 billion Reduced debt maturities due between 2018 – 2020 (~75% decrease)

The Future CHK: The Transformation & The Future 18

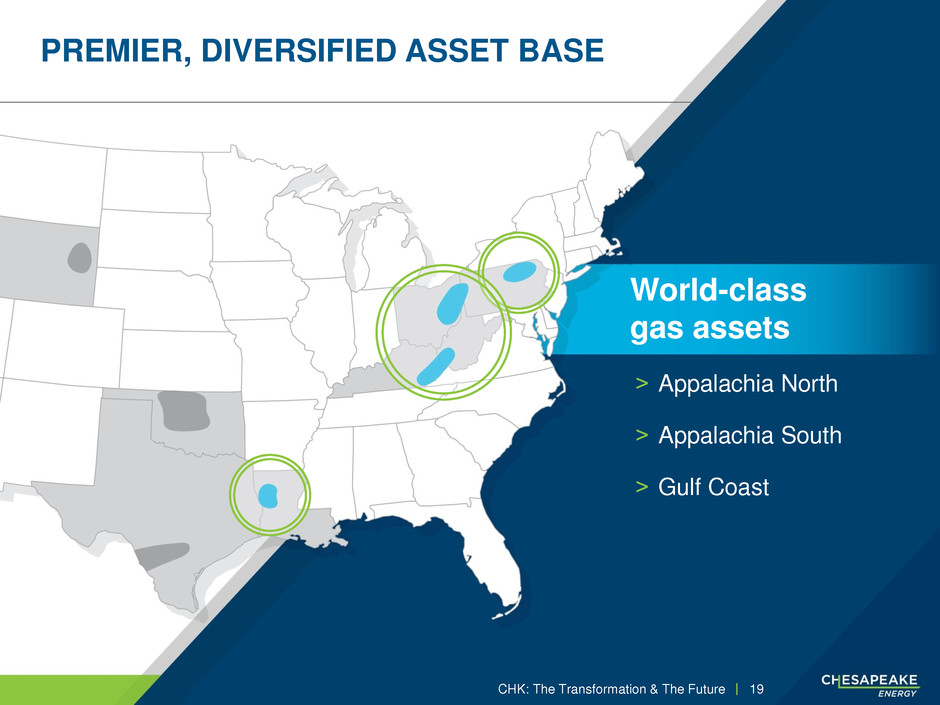

PREMIER, DIVERSIFIED ASSET BASE CHK: The Transformation & The Future 19 World-class gas assets ˃ Appalachia North ˃ Appalachia South ˃ Gulf Coast

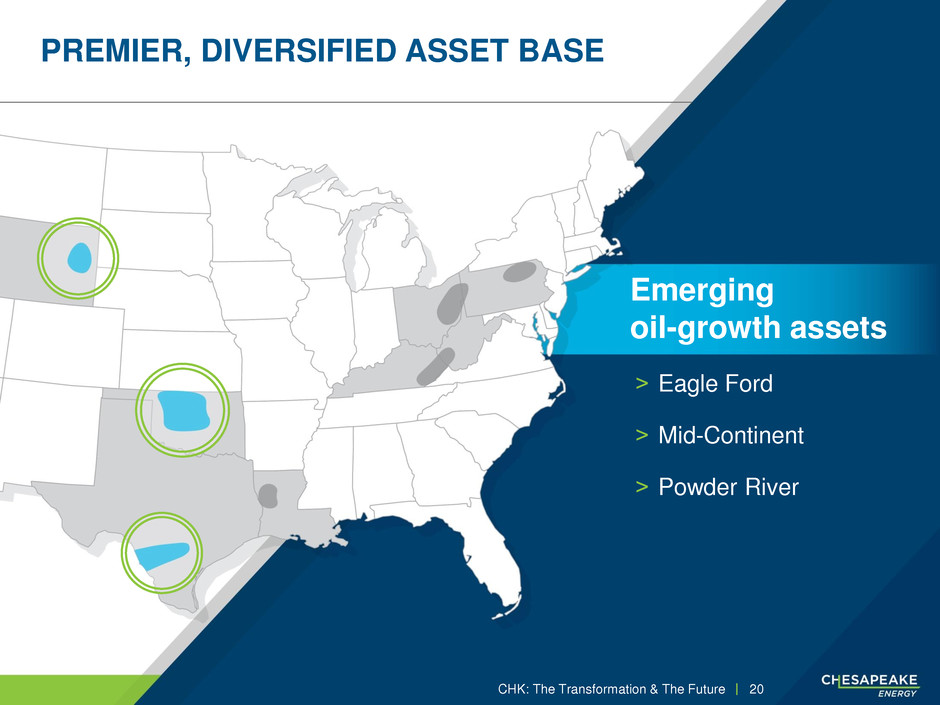

PREMIER, DIVERSIFIED ASSET BASE CHK: The Transformation & The Future 20 Emerging oil-growth assets ˃ Eagle Ford ˃ Mid-Continent ˃ Powder River

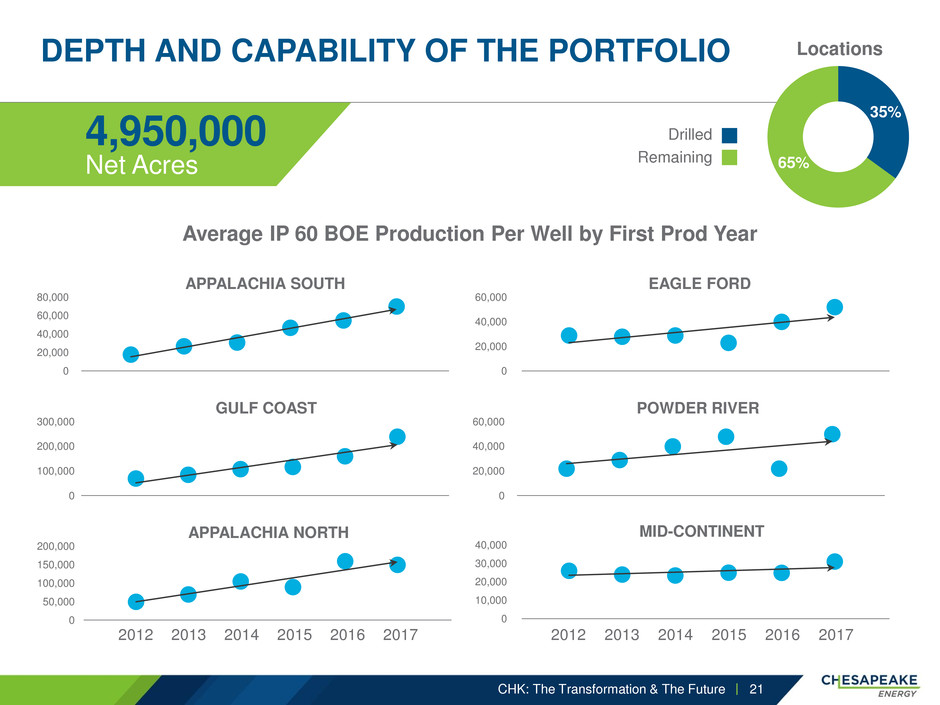

DEPTH AND CAPABILITY OF THE PORTFOLIO CHK: The Transformation & The Future 21 35% 65% Locations Average IP 60 BOE Production Per Well by First Prod Year Drilled Remaining 4,950,000 Net Acres 0 50,000 100,000 150,000 200,000 APPALACHIA NORTH 0 20,000 40,000 60,000 80,000 APPALACHIA SOUTH 0 100,000 200,000 300,000 GULF COAST 2017 2016 2015 2014 2013 2012 0 20,000 40,000 60,000 EAGLE FORD 0 10,000 20,000 30,000 40,000 MID-CONTINENT 0 20,000 40,000 60,000 POWDER RIVER 2017 2016 2015 2014 2013 2012

STRATEGIC PRIORITIES Debt reduction of $2 – $3 billion ultimate goal of net debt to EBITDA of 2X Free cash flow neutrality Margin enhancement 2 3 1 BUSINESS STRATEGIES Our strategy remains unchanged – resilient to commodity price volatility > Financial discipline > Profitable and efficient growth from captured resources > Exploration > Business development CHK: The Transformation & The Future 22

RECENT PROGRESS ON OUR PRIORITIES CHK: The Transformation & The Future 23 593,000 boe per day Q4 2017 production Achieved Q4 2017 goal of 100,000 barrels of oil per day Record EH&S performance In 2017 Signed three separate sales agreements totaling ~$500mm Expected to close mid-2018 Monetized a portion of FTSI investment Net proceeds of $78mm and hold ~22mm additional shares ~$3 billion In asset sales in 2016 and 2017

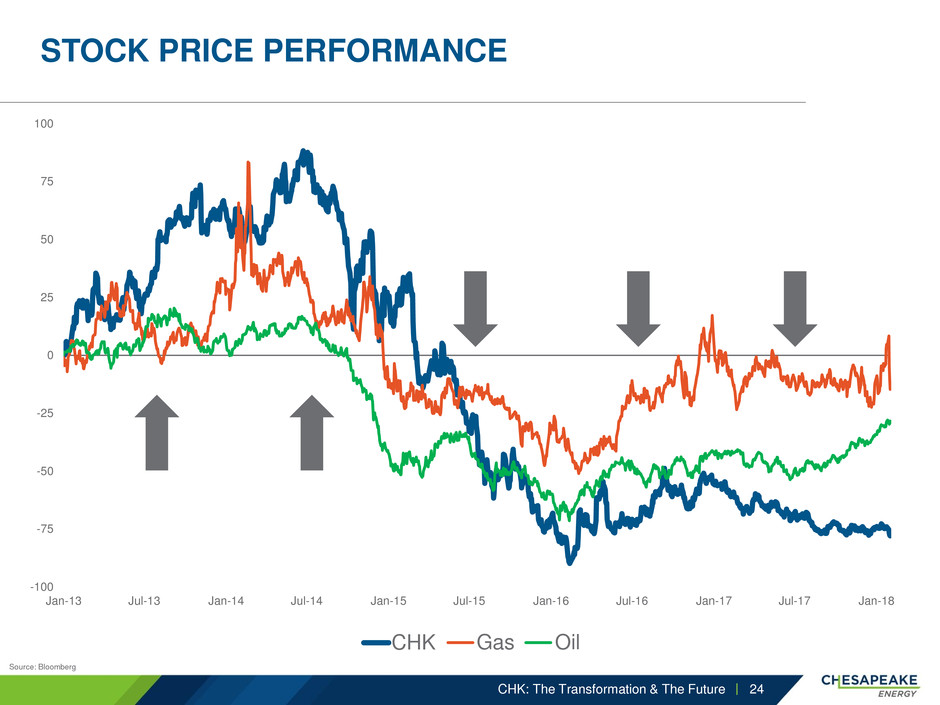

STOCK PRICE PERFORMANCE CHK: The Transformation & The Future 24 Source: Bloomberg -100 -75 -50 -25 0 25 50 75 100 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 CHK NG1 CL1Gas Oil

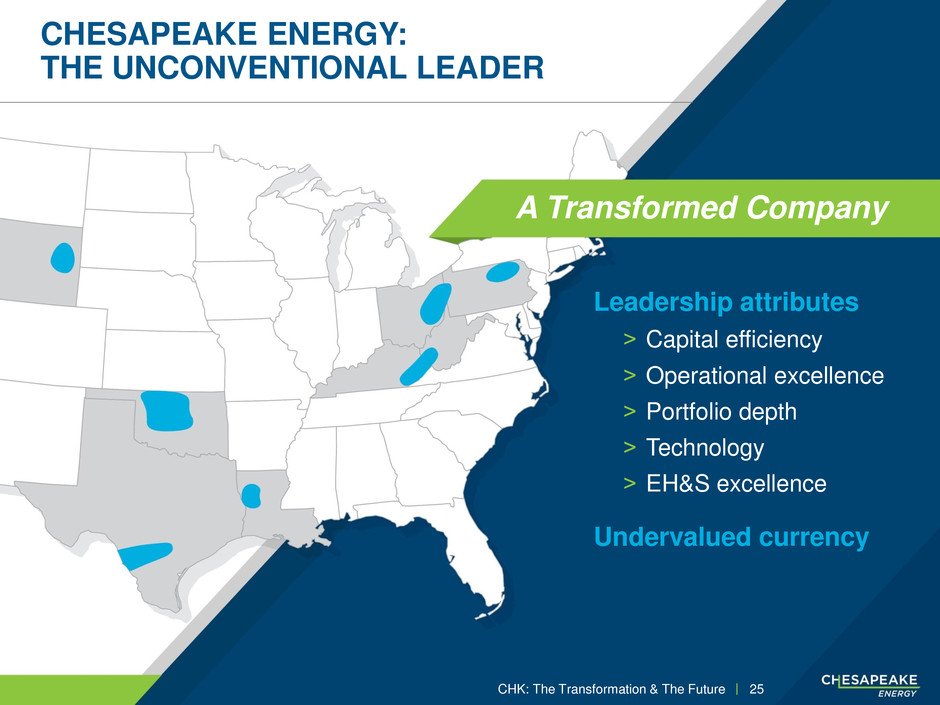

CHESAPEAKE ENERGY: THE UNCONVENTIONAL LEADER CHK: The Transformation & The Future 25 Leadership attributes ˃ Capital efficiency ˃ Operational excellence ˃ Portfolio depth ˃ Technology ˃ EH&S excellence Undervalued currency A Transformed Company

Appendix CHK: The Transformation & The Future 26

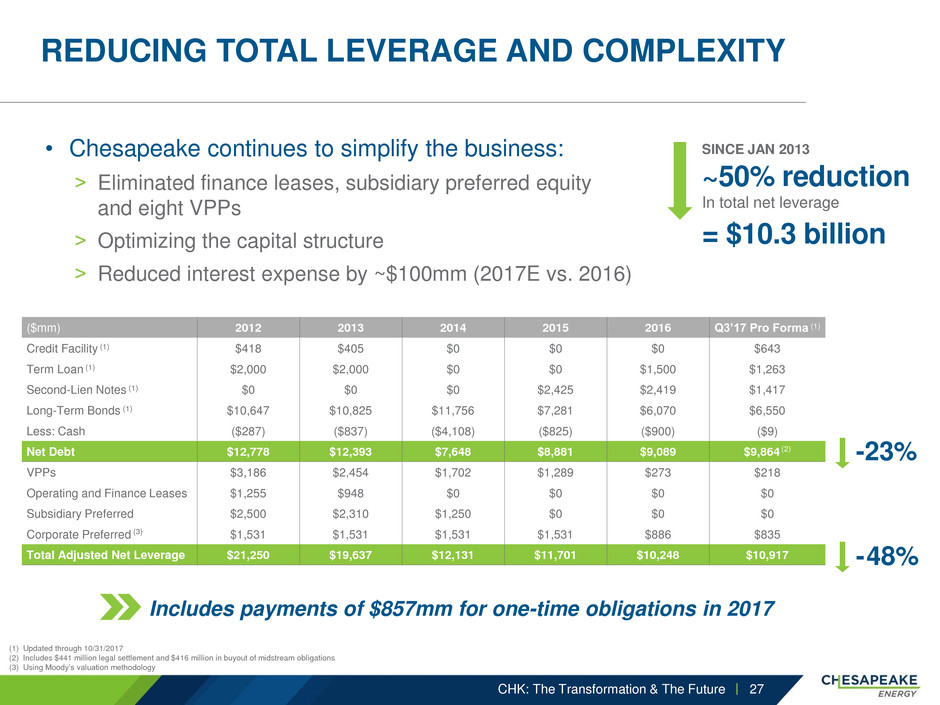

REDUCING TOTAL LEVERAGE AND COMPLEXITY • Chesapeake continues to simplify the business: ˃ Eliminated finance leases, subsidiary preferred equity and eight VPPs ˃ Optimizing the capital structure ˃ Reduced interest expense by ~$100mm (2017E vs. 2016) (1) Updated through 10/31/2017 (2) Includes $441 million legal settlement and $416 million in buyout of midstream obligations (3) Using Moody’s valuation methodology CHK: The Transformation & The Future ($mm) 2012 2013 2014 2015 2016 Q3’17 Pro Forma (1) Credit Facility (1) $418 $405 $0 $0 $0 $643 Term Loan (1) $2,000 $2,000 $0 $0 $1,500 $1,263 Second-Lien Notes (1) $0 $0 $0 $2,425 $2,419 $1,417 Long-Term Bonds (1) $10,647 $10,825 $11,756 $7,281 $6,070 $6,550 Less: Cash ($287) ($837) ($4,108) ($825) ($900) ($9) Net Debt $12,778 $12,393 $7,648 $8,881 $9,089 $9,864 (2) VPPs $3,186 $2,454 $1,702 $1,289 $273 $218 Operating and Finance Leases $1,255 $948 $0 $0 $0 $0 Subsidiary Preferred $2,500 $2,310 $1,250 $0 $0 $0 Corporate Preferred (3) $1,531 $1,531 $1,531 $1,531 $886 $835 Total Adjusted Net Leverage $21,250 $19,637 $12,131 $11,701 $10,248 $10,917 -23% SINCE JAN 2013 ~50% reduction In total net leverage = $10.3 billion - 48% 27 Includes payments of $857mm for one-time obligations in 2017

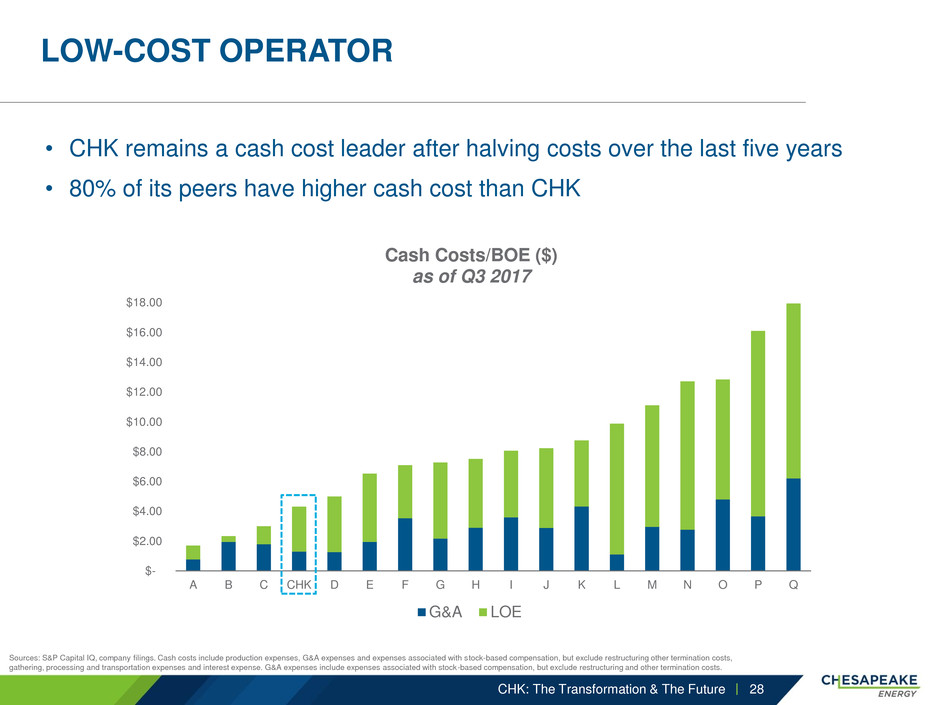

$- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 A B C CHK D E F G H I J K L M N O P Q Cash Costs/BOE ($) as of Q3 2017 G&A LOE LOW-COST OPERATOR • CHK remains a cash cost leader after halving costs over the last five years • 80% of its peers have higher cash cost than CHK Sources: S&P Capital IQ, company filings. Cash costs include production expenses, G&A expenses and expenses associated with stock-based compensation, but exclude restructuring other termination costs, gathering, processing and transportation expenses and interest expense. G&A expenses include expenses associated with stock-based compensation, but exclude restructuring and other termination costs. CHK: The Transformation & The Future 28

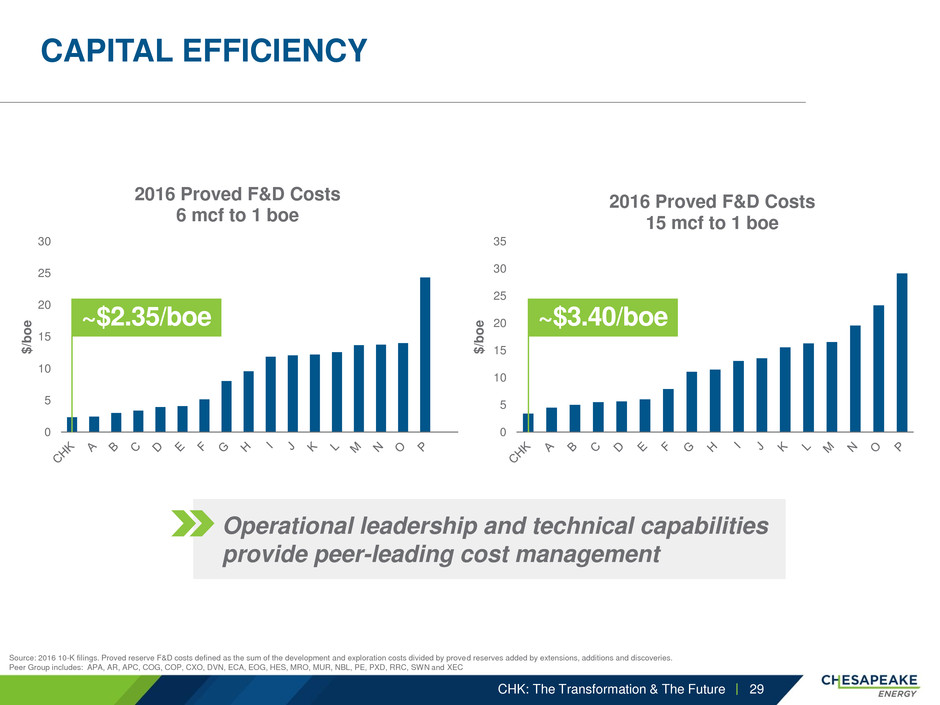

CAPITAL EFFICIENCY Source: 2016 10-K filings. Proved reserve F&D costs defined as the sum of the development and exploration costs divided by proved reserves added by extensions, additions and discoveries. Peer Group includes: APA, AR, APC, COG, COP, CXO, DVN, ECA, EOG, HES, MRO, MUR, NBL, PE, PXD, RRC, SWN and XEC CHK: The Transformation & The Future 29 0 5 10 15 20 25 30 $/b o e 2016 Proved F&D Costs 6 mcf to 1 boe 0 5 10 15 20 25 30 35 $/b o e 2016 Proved F&D Costs 15 mcf to 1 boe ~$2.35/boe ~$3.40/boe Operational leadership and technical capabilities provide peer-leading cost management