CREDIT SUISSE 23RD ANNUAL ENERGY SUMMIT Vail, Colorado | February 13, 2018 Nick Dell’Osso Executive Vice President and Chief Financial Officer Exhibit 99.1

FORWARD-LOOKING STATEMENTS This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are statements other than statements of historical fact. They include statements that give our current expectations, guidance or forecasts of future events, production and well connection forecasts, estimates of operating costs, anticipated capital and operational efficiencies, planned development drilling and expected drilling cost reductions, general and administrative expenses, capital expenditures, the timing of anticipated asset sales and proceeds to be received therefrom, projected cash flow and liquidity, our ability to enhance our cash flow and financial flexibility, plans and objectives for future operations, and the assumptions on which such statements are based. Although we believe the expectations and forecasts reflected in the forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate or changed assumptions or by known or unknown risks and uncertainties. Factors that could cause actual results to differ materially from expected results include those described under “Risk Factors” in Item 1A of our annual report on Form 10-K and any updates to those factors set forth in Chesapeake‟s subsequent quarterly reports on Form 10-Q or current reports on Form 8-K (available at http://www.chk.com/investors/ sec-filings). These risk factors include: the volatility of oil, natural gas and NGL prices; the limitations our level of indebtedness may have on our financial flexibility; our inability to access the capital markets on favorable terms; the availability of cash flows from operations and other funds to finance reserve replacement costs or satisfy our debt obligations; our credit rating requiring us to post more collateral under certain commercial arrangements; write-downs of our oil and natural gas asset carrying values due to low commodity prices; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of oil, natural gas and NGL reserves and projecting future rates of production and the amount and timing of development expenditures; our ability to generate profits or achieve targeted results in drilling and well operations; leasehold terms expiring before production can be established; commodity derivative activities resulting in lower prices real ized on oil, natural gas and NGL sales; the need to secure derivative liabilities and the inability of counterparties to satisfy their obligations; adverse developments or losses from pending or future litigation and regulatory proceedings, including royalty claims; charges incurred in response to market conditions and in connection with our ongoing actions to reduce financial leverage and complexity; drilling and operating risks and resulting liabilities; effects of environmental protection laws and regulation on our business; legislative and regulatory initiatives further regulating hydraulic fracturing; our need to secure adequate supplies of water for our drilling operations and to dispose of or recycle the water used; impacts of potential legislative and regulatory actions addressing climate change; federal and state tax proposals affecting our industry; potential OTC derivatives regulation limiting our ability to hedge against commodity price fluctuations; competition in the oil and gas exploration and production industry; a deterioration in general economic, business or industry conditions; negative public perceptions of our industry; limited control over properties we do not operate; pipeline and gathering system capacity constraints and transportation interruptions; terrorist activities and/or cyber-attacks adversely impacting our operations; potential challenges by SSE‟s former creditors of our spin-off of in connection with SSE‟s recently completed bankruptcy under Chapter 11 of the U.S. Bankruptcy Code; an interruption in operations at our headquarters due to a catastrophic event; the continuation of suspended dividend payments on our common stock; the effectiveness of our remediation plan for a material weakness; certain anti-takeover provisions that affect shareholder rights; and our inability to increase or maintain our liquidity through debt repurchases, capital exchanges, asset sales, joint ventures, farmouts or other means. In addition, disclosures concerning the estimated contribution of derivative contracts to our future results of operations are based upon market information as of a specific date. These market prices are subject to significant volatility. Our production forecasts are also dependent upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity. Expected asset sales may not be completed in the time frame anticipated or at all. We caution you not to place undue reliance on our forward-looking statements, which speak only as of the date of this presentation, and we undertake no obligation to update any of the information provided in this presentation, except as required by applicable law. In addition, this presentation contains time-sensitive information that reflects management‟s best judgment only as of the date of this presentation. We use certain terms in this presentation such as “Resource Potential,” “Net Reserves” and similar terms that the SEC‟s guide lines strictly prohibit us from including in filings with the SEC. These terms include reserves with substantially less certainty, and no discount or other adjustment is included in the presentation of such reserve numbers. U.S. investors are urged to consider closely the disclosure in our Form 10-K for the year ended December 31, 2016, File No. 1-13726 and in our other filings with the SEC, available from us at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118. These forms can also be obtained from the SEC by calling 1-800-SEC-0330. 2 Credit Suisse 23rd Annual Energy Summit

STRATEGIC GOALS Debt reduction of $2 – $3 billion ultimate goal of net debt to EBITDA of 2X Free cash flow neutrality Margin enhancement 2 3 1 OUR STRATEGY AND GOALS Our strategy remains unchanged – resilient to commodity price volatility > Financial discipline > Profitable and efficient growth from captured resources > Exploration > Business development Credit Suisse 23rd Annual Energy Summit 3

2017 ACCOMPLISHMENTS Credit Suisse 23rd Annual Energy Summit 4 (1) Includes production expenses, general and administrative expenses (including stock-based compensation) and gathering, processing and transportation expenses. Excludes restructuring and other termination costs and interest expense. (2) Agency reportable spills ~$500 million Reduced costs by ~18%(1) Improved cost structure by ~$0.58/boe ~$1.3 billion Of net proceeds collected from asset and property sales ~11% growth In oil production 4Q16 to 4Q17, exceeded goal of 10% ~$1.3 billion Reduced term secured debt by 32% Continued reduction in legal complexity Record EH&S performance ~0.045 TRIR 15% reduction in reported spills(2)

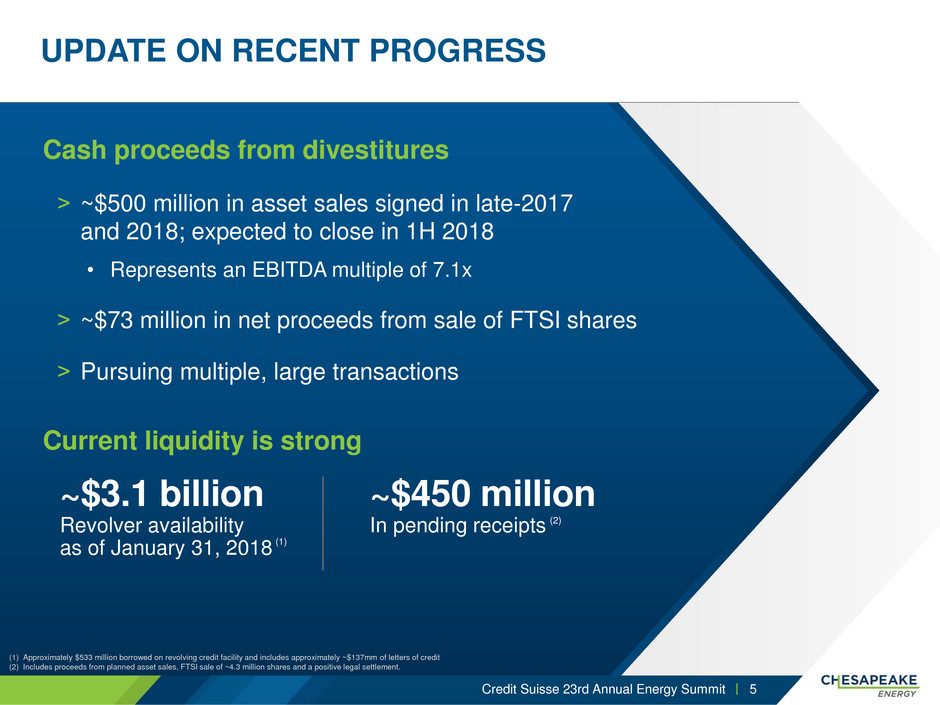

UPDATE ON RECENT PROGRESS Credit Suisse 23rd Annual Energy Summit 5 (1) Approximately $533 million borrowed on revolving credit facility and includes approximately ~$137mm of letters of credit (2) Includes proceeds from planned asset sales, FTSI sale of ~4.3 million shares and a positive legal settlement. Cash proceeds from divestitures ˃ ~$500 million in asset sales signed in late-2017 and 2018; expected to close in 1H 2018 • Represents an EBITDA multiple of 7.1x ˃ ~$73 million in net proceeds from sale of FTSI shares ˃ Pursuing multiple, large transactions Current liquidity is strong ~$3.1 billion Revolver availability as of January 31, 2018 (1) ~$450 million In pending receipts (2)

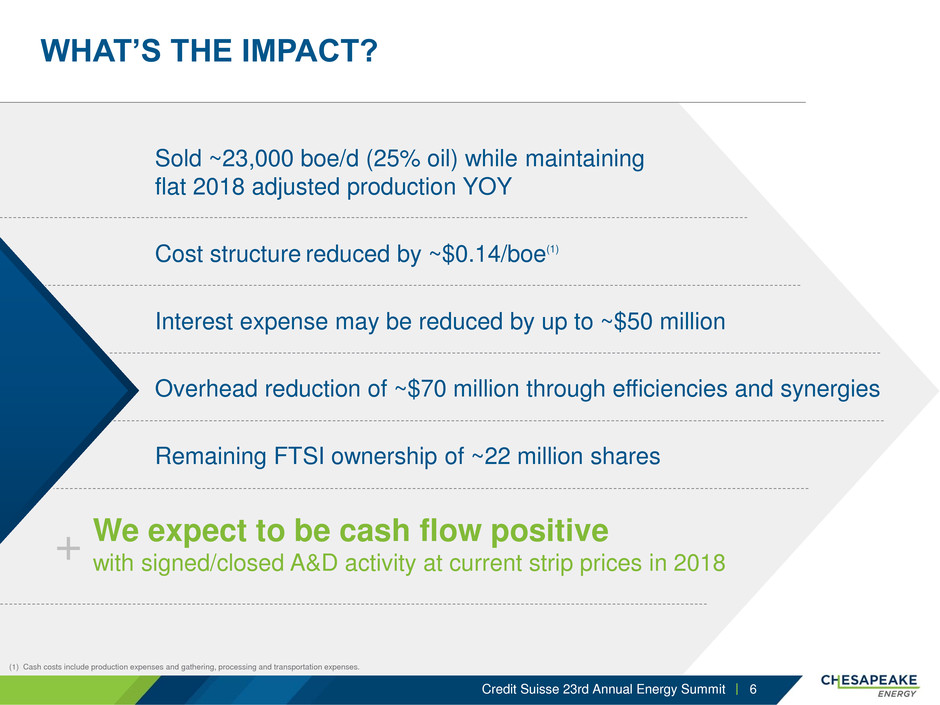

WHAT’S THE IMPACT? (1) Cash costs include production expenses and gathering, processing and transportation expenses. Sold ~23,000 boe/d (25% oil) while maintaining flat 2018 adjusted production YOY Cost structure reduced by ~$0.14/boe(1) Interest expense may be reduced by up to ~$50 million Overhead reduction of ~$70 million through efficiencies and synergies Remaining FTSI ownership of ~22 million shares Credit Suisse 23rd Annual Energy Summit 6 + We expect to be cash flow positive with signed/closed A&D activity at current strip prices in 2018

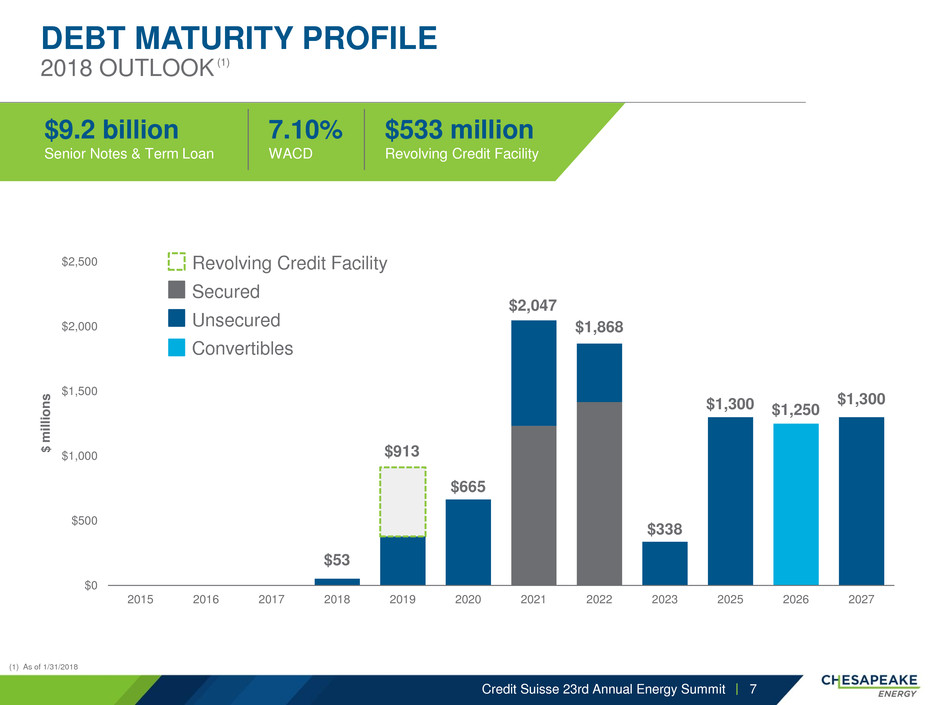

$53 $665 $338 $1,300 $1,250 $1,300 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2015 2016 2017 2018 2019 2020 2021 2022 2023 2025 2026 2027 $2,047 $1,868 $913 Revolving Credit Facility Secured Unsecured Convertibles $ millio n s $533 million Revolving Credit Facility DEBT MATURITY PROFILE 2018 OUTLOOK (1) Credit Suisse 23rd Annual Energy Summit 7 (1) As of 1/31/2018 $9.2 billion Senior Notes & Term Loan 7.10% WACD

Credit Suisse 23rd Annual Energy Summit 8 ˃ Portfolio depth ˃ Growing capital efficiency ˃ Operational scale ˃ Advancing technology ˃ EH&S excellence Driving value across our portfolio

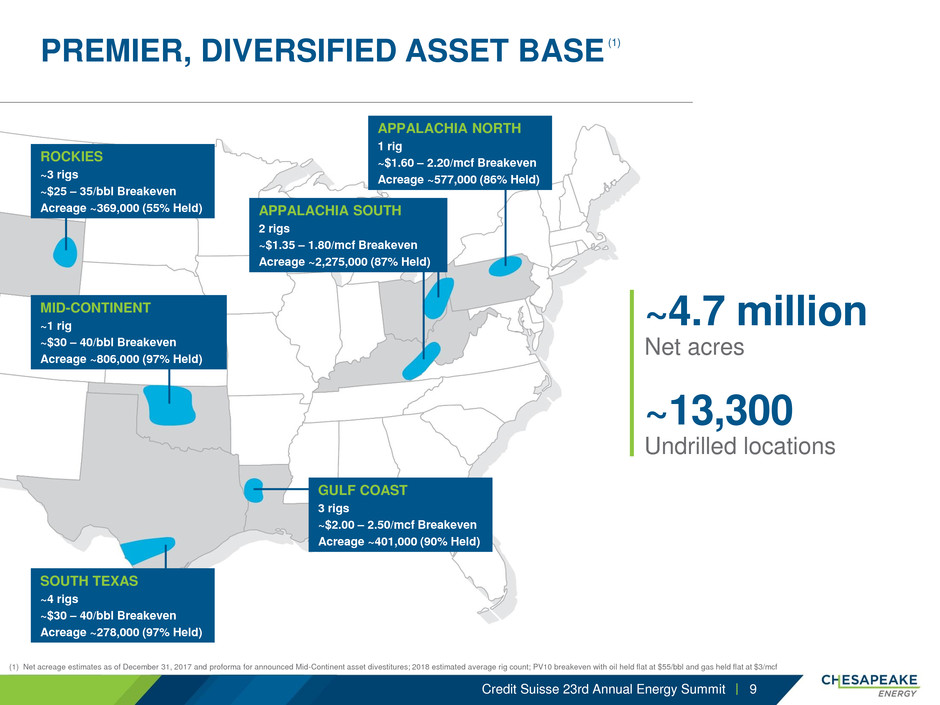

Credit Suisse 23rd Annual Energy Summit 9 (1) Net acreage estimates as of December 31, 2017 and proforma for announced Mid-Continent asset divestitures; 2018 estimated average rig count; PV10 breakeven with oil held flat at $55/bbl and gas held flat at $3/mcf APPALACHIA NORTH 1 rig ~$1.60 – 2.20/mcf Breakeven Acreage ~577,000 (86% Held) MID-CONTINENT ~1 rig ~$30 – 40/bbl Breakeven Acreage ~806,000 (97% Held) SOUTH TEXAS ~4 rigs ~$30 – 40/bbl Breakeven Acreage ~278,000 (97% Held) GULF COAST 3 rigs ~$2.00 – 2.50/mcf Breakeven Acreage ~401,000 (90% Held) ROCKIES ~3 rigs ~$25 – 35/bbl Breakeven Acreage ~369,000 (55% Held) APPALACHIA SOUTH 2 rigs ~$1.35 – 1.80/mcf Breakeven Acreage ~2,275,000 (87% Held) ~4.7 million Net acres ~13,300 Undrilled locations PREMIER, DIVERSIFIED ASSET BASE (1)

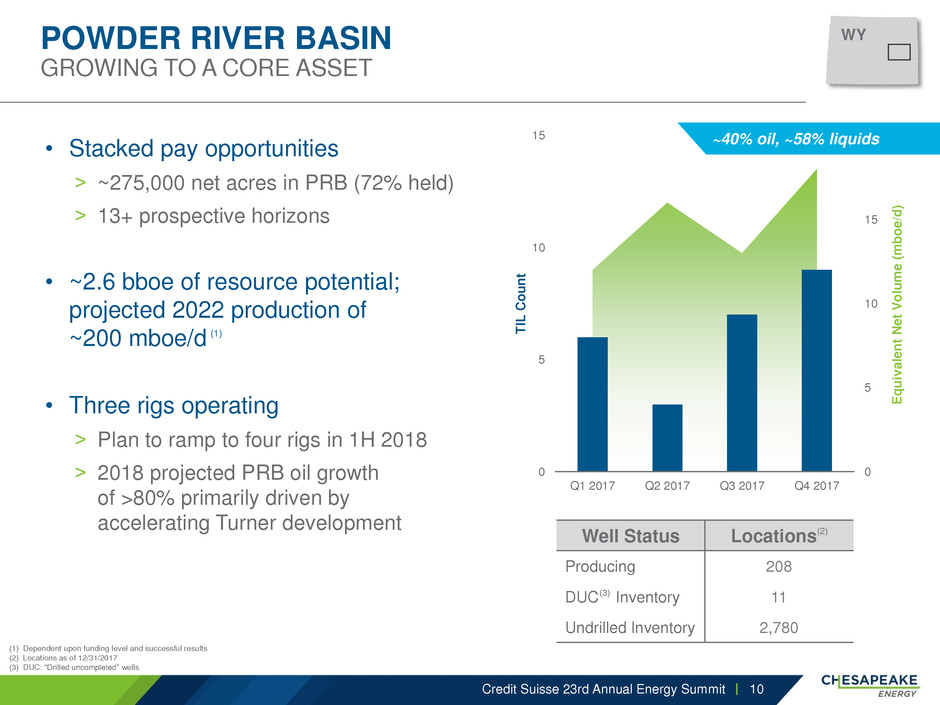

POWDER RIVER BASIN GROWING TO A CORE ASSET • Stacked pay opportunities ˃ ~275,000 net acres in PRB (72% held) ˃ 13+ prospective horizons • ~2.6 bboe of resource potential; projected 2022 production of ~200 mboe/d (1) • Three rigs operating ˃ Plan to ramp to four rigs in 1H 2018 ˃ 2018 projected PRB oil growth of >80% primarily driven by accelerating Turner development Credit Suisse 23rd Annual Energy Summit 10 Well Status Locations(2) Producing 208 DUC (3) Inventory 11 Undrilled Inventory 2,780 0 5 10 15 20 0 5 10 15 Q1 2017 Q2 2017 Q3 2017 Q4 2017 E q u iv al e n t Ne t V o lu m e ( m b o e/d ) T IL C o u n t WY ~40% oil, ~58% liquids (1) Dependent upon funding level and successful results (2) Locations as of 12/31/2017 (3) DUC: “Drilled uncompleted” wells

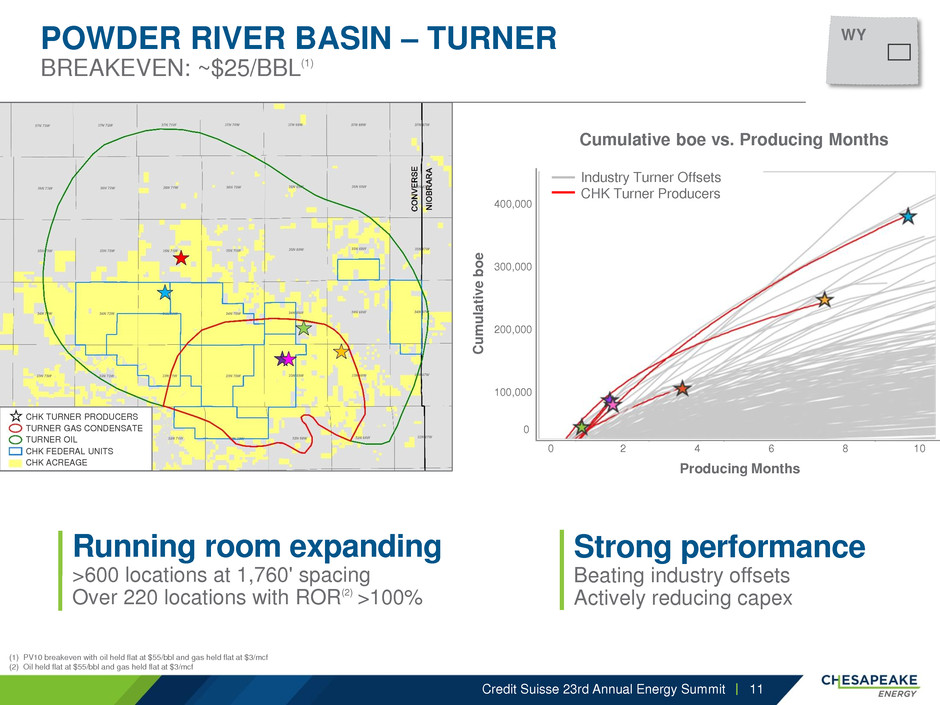

POWDER RIVER BASIN – TURNER BREAKEVEN: ~$25/BBL(1) Credit Suisse 23rd Annual Energy Summit (1) PV10 breakeven with oil held flat at $55/bbl and gas held flat at $3/mcf (2) Oil held flat at $55/bbl and gas held flat at $3/mcf Running room expanding >600 locations at 1,760' spacing Over 220 locations with ROR(2) >100% Strong performance Beating industry offsets Actively reducing capex 11 WY Cumulative boe vs. Producing Months Producing Months Industry Turner Offsets CHK Turner Producers 400,000 300,000 200,000 100,000 0 C umula ti v e b o e 2 4 6 8 10 0 CHK TURNER PRODUCERS TURNER GAS CONDENSATE TURNER OIL CHK FEDERAL UNITS CHK ACREAGE

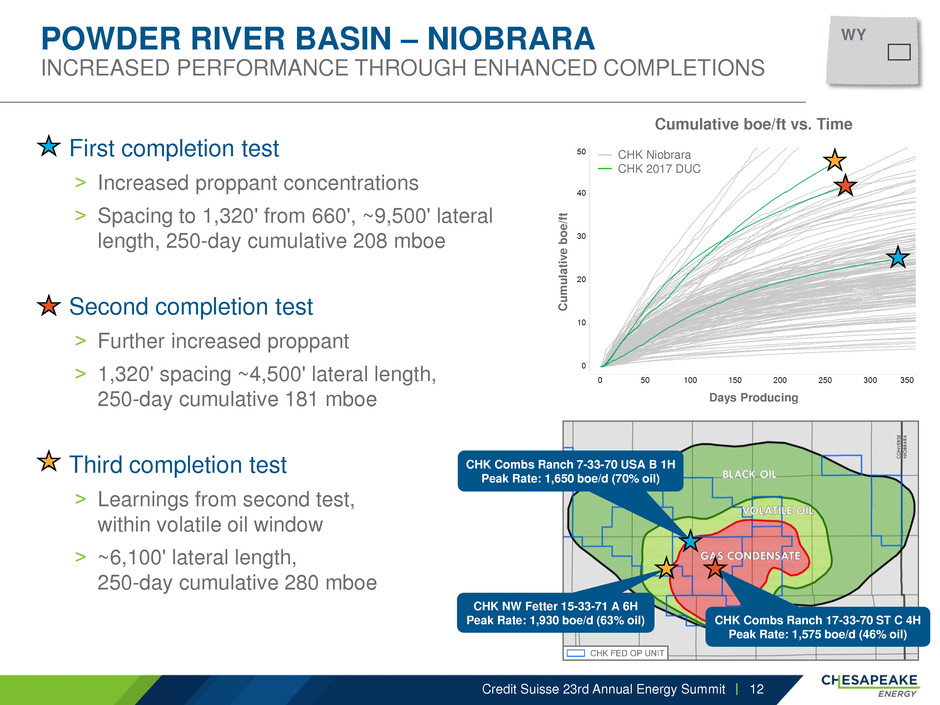

POWDER RIVER BASIN – NIOBRARA INCREASED PERFORMANCE THROUGH ENHANCED COMPLETIONS • First completion test ˃ Increased proppant concentrations ˃ Spacing to 1,320' from 660', ~9,500' lateral length, 250-day cumulative 208 mboe • Second completion test ˃ Further increased proppant ˃ 1,320' spacing ~4,500' lateral length, 250-day cumulative 181 mboe • Third completion test ˃ Learnings from second test, within volatile oil window ˃ ~6,100' lateral length, 250-day cumulative 280 mboe Credit Suisse 23rd Annual Energy Summit 12 Cumulative boe/ft vs. Time CHK Niobrara CHK 2017 DUC Days Producing Cu m u la ti v e b o e /f t CHK Combs Ranch 7-33-70 USA B 1H Peak Rate: 1,650 boe/d (70% oil) CHK Combs Ranch 17-33-70 ST C 4H Peak Rate: 1,575 boe/d (46% oil) CHK NW Fetter 15-33-71 A 6H Peak Rate: 1,930 boe/d (63% oil) WY

POWDER RIVER BASIN PLENTY OF RUNNING ROOM Credit Suisse 23rd Annual Energy Summit 13 205 mmboe resource base 425+ undrilled locations 1,980' spacing 1.2 bboe resource base 600+ undrilled locations 1,760' spacing 67 mmboe resource base 72 undrilled locations 1,980' spacing 538 mmboe resource base 650+ undrilled locations 1,100' – 1,320' spacing 570 mmboe resource base 875+ undrilled locations 1,320' spacing Parkman Sussex Niobrara Turner Mowry Other Future Potential Formations Teckla, Teapot, Surrey, Frontier, Muddy, Dakota/Lakota and Pennsylvanian Powder River Basin Acreage 275,000 (72% Held) WY

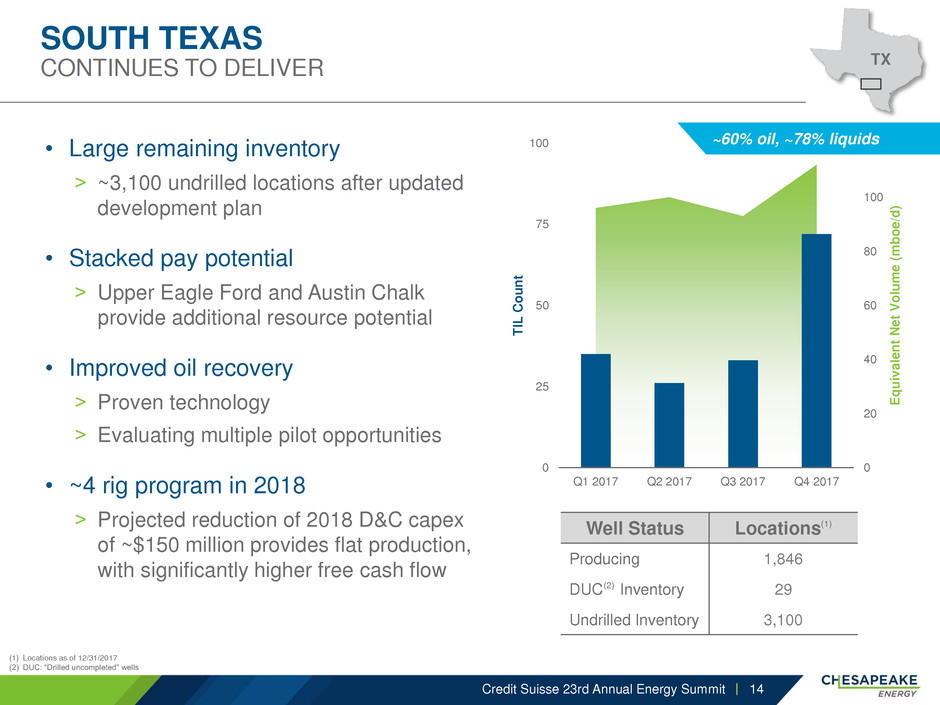

0 20 40 60 80 100 120 0 25 50 75 100 Q1 2017 Q2 2017 Q3 2017 Q4 2017 E q u iv al e n t Ne t V o lu m e ( m b o e/d ) T IL C o u n t Well Status Locations(1) Producing 1,846 DUC (2) Inventory 29 Undrilled Inventory 3,100 SOUTH TEXAS CONTINUES TO DELIVER • Large remaining inventory ˃ ~3,100 undrilled locations after updated development plan • Stacked pay potential ˃ Upper Eagle Ford and Austin Chalk provide additional resource potential • Improved oil recovery ˃ Proven technology ˃ Evaluating multiple pilot opportunities • ~4 rig program in 2018 ˃ Projected reduction of 2018 D&C capex of ~$150 million provides flat production, with significantly higher free cash flow (1) Locations as of 12/31/2017 (2) DUC: “Drilled uncompleted” wells Credit Suisse 23rd Annual Energy Summit 14 TX ~60% oil, ~78% liquids

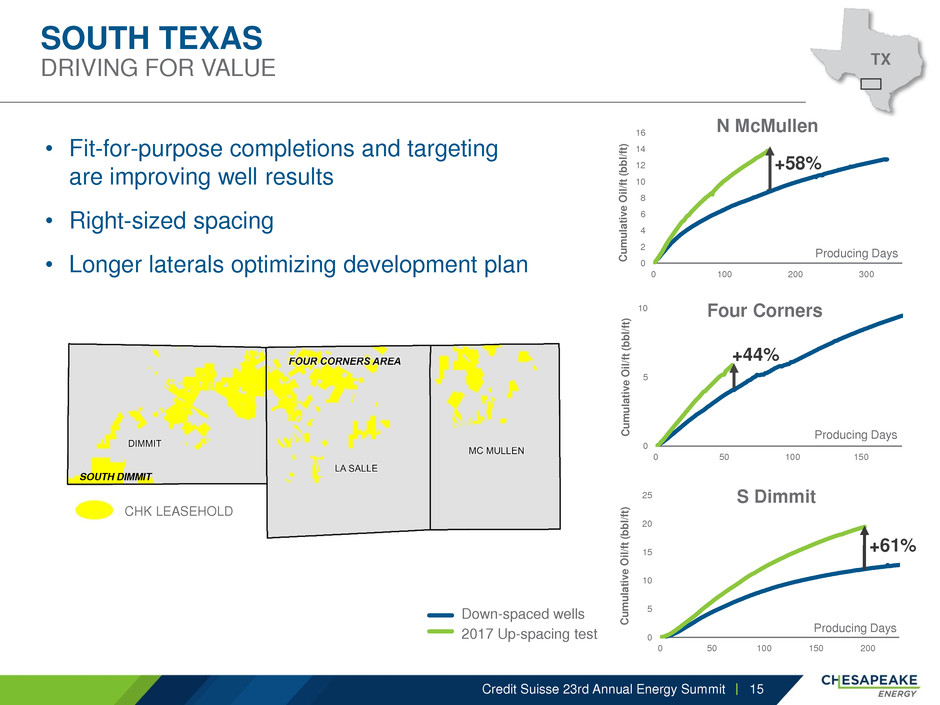

SOUTH TEXAS DRIVING FOR VALUE • Fit-for-purpose completions and targeting are improving well results • Right-sized spacing • Longer laterals optimizing development plan Credit Suisse 23rd Annual Energy Summit 15 Down-spaced wells 2017 Up-spacing test 0 5 10 15 20 25 0 50 100 150 200 C u m u la ti v e O il /f t (bb l/ ft ) Producing Days S Dimmit +61% 0 5 10 0 50 100 150 C u m u la ti v e O il /f t (bb l/ ft ) Producing Days Four Corners +44% NORTH MCMULLEN 0 2 4 6 8 10 12 14 16 0 100 200 300 C u m u la ti v e O il /f t (bb l/ ft ) Producing Days N McMullen +58% SOUTH DIMMIT CHK LEASEHOLD TX

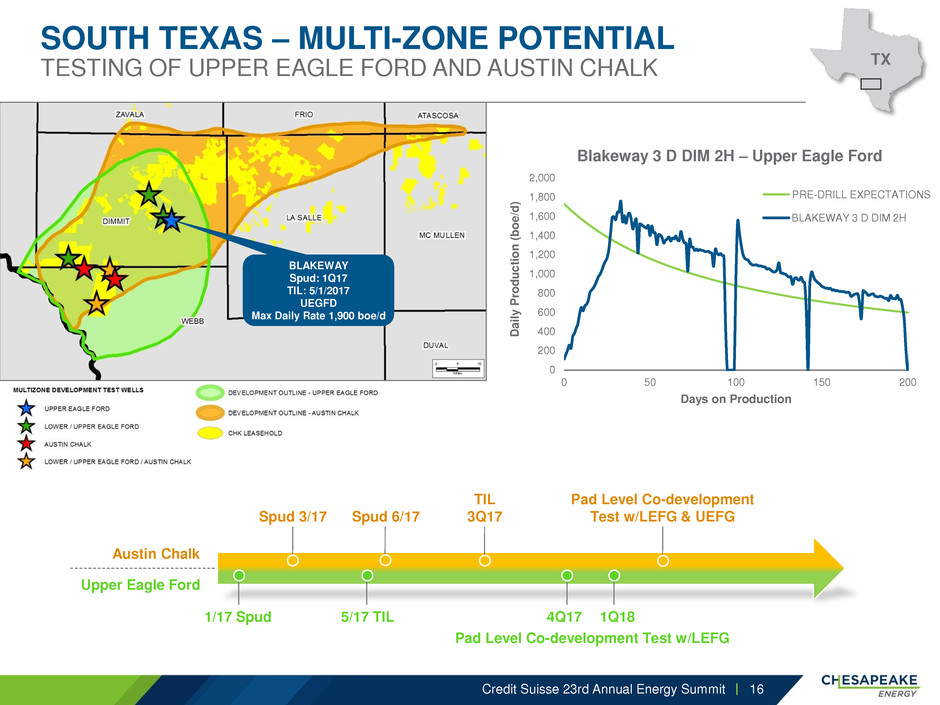

SOUTH TEXAS – MULTI-ZONE POTENTIAL TESTING OF UPPER EAGLE FORD AND AUSTIN CHALK Credit Suisse 23rd Annual Energy Summit 16 Austin Chalk Upper Eagle Ford Spud 3/17 Spud 6/17 5/17 TIL 4Q17 Pad Level Co-development Test w/LEFG & UEFG TIL 3Q17 Pad Level Co-development Test w/LEFG 1Q18 1/17 Spud 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 0 50 100 150 200 Da il y Prod u c ti o n (b o e /d ) Days on Production Blakeway 3 D DIM 2H – Upper Eagle Ford SERIES2 BLAKEWAY 3 D DIM 2H PRE-DRILL EXPECTATIONS TX BLAKEWAY Spud: 1Q17 TIL: 5/1/2017 UEGFD Max Daily Rate 1,900 boe/d

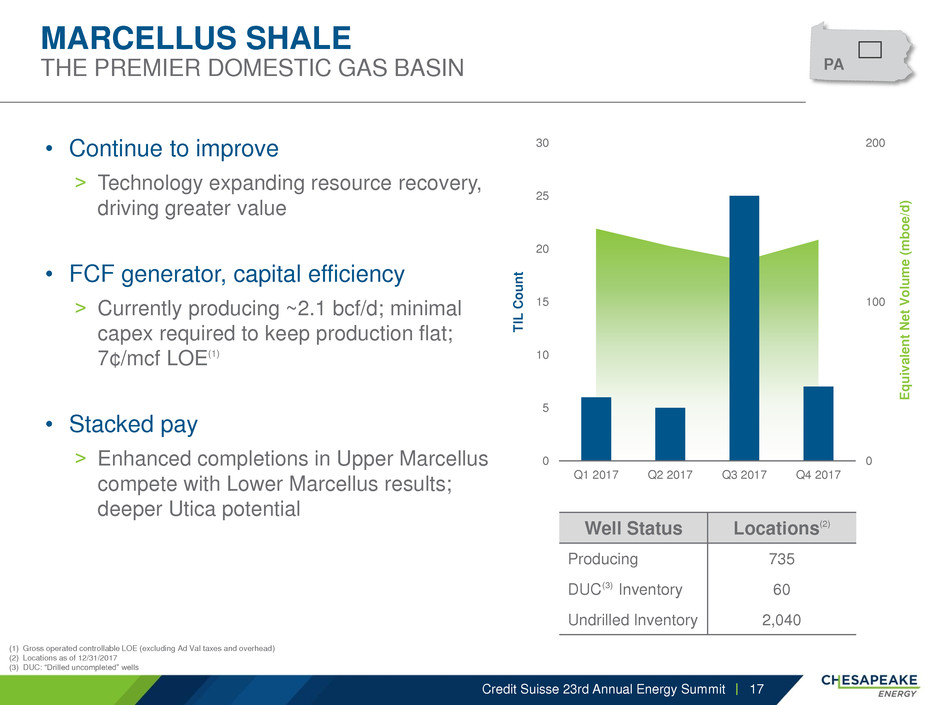

MARCELLUS SHALE THE PREMIER DOMESTIC GAS BASIN • Continue to improve ˃ Technology expanding resource recovery, driving greater value • FCF generator, capital efficiency ˃ Currently producing ~2.1 bcf/d; minimal capex required to keep production flat; 7¢/mcf LOE(1) • Stacked pay ˃ Enhanced completions in Upper Marcellus compete with Lower Marcellus results; deeper Utica potential (1) Gross operated controllable LOE (excluding Ad Val taxes and overhead) (2) Locations as of 12/31/2017 (3) DUC: “Drilled uncompleted” wells Credit Suisse 23rd Annual Energy Summit 17 Well Status Locations(2) Producing 735 DUC (3) Inventory 60 Undrilled Inventory 2,040 0 100 200 0 5 10 15 20 25 30 Q1 2017 Q2 2017 Q3 2017 Q4 2017 E q u iv al e n t Ne t V o lu m e ( m b o e/d ) T IL C o u n t PA

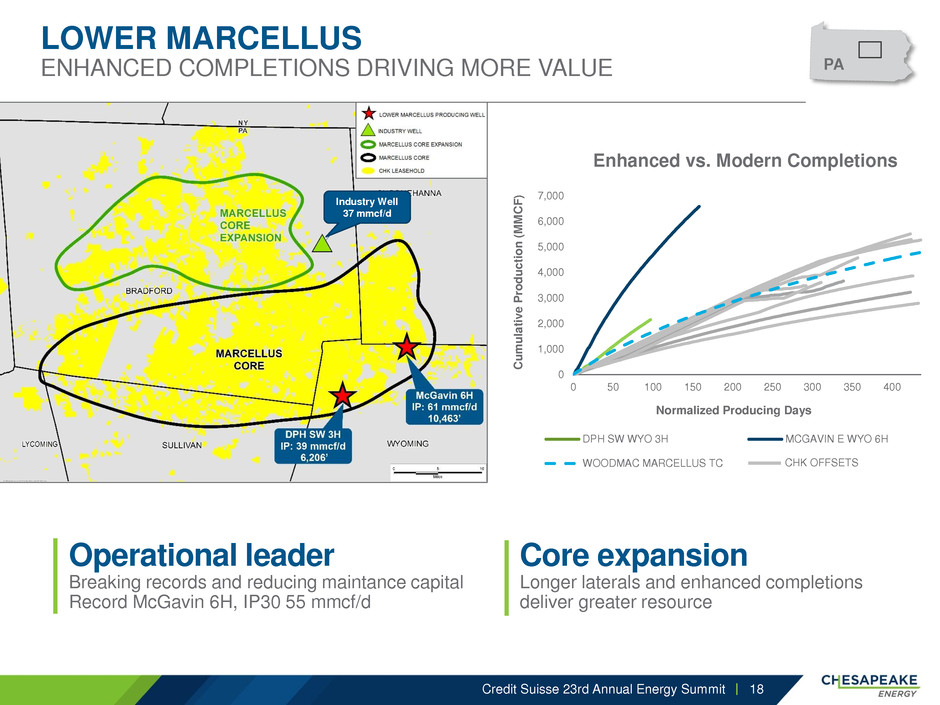

LOWER MARCELLUS ENHANCED COMPLETIONS DRIVING MORE VALUE Credit Suisse 23rd Annual Energy Summit Operational leader Breaking records and reducing maintance capital Record McGavin 6H, IP30 55 mmcf/d Core expansion Longer laterals and enhanced completions deliver greater resource 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 0 50 100 150 200 250 300 350 400 Cu m u la ti v e Prod u c ti o n ( M M CF ) Normalized Producing Days Enhanced vs. Modern Completions DPH SW WYO 3H MCGAVIN E WYO 6H WOODMAC MARCELLUS TC 18 Industry Well 37 mmcf/d CHK OFFSETS PA

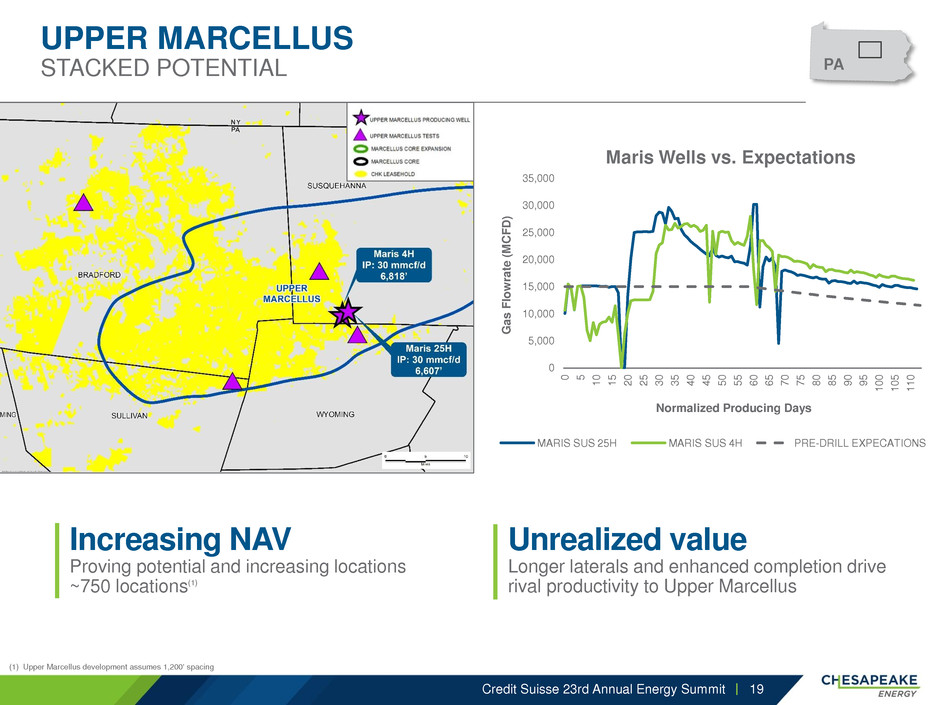

UPPER MARCELLUS STACKED POTENTIAL Credit Suisse 23rd Annual Energy Summit (1) Upper Marcellus development assumes 1,200' spacing Increasing NAV Proving potential and increasing locations ~750 locations(1) Unrealized value Longer laterals and enhanced completion drive rival productivity to Upper Marcellus 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 0 5 1 0 1 5 2 0 2 5 3 0 3 5 4 0 4 5 5 0 5 5 6 0 6 5 7 0 7 5 8 0 8 5 9 0 9 5 1 0 0 1 0 5 1 1 0 G a s F lo w rat e ( M CFD ) Normalized Producing Days Maris Wells vs. Expectations MARIS SUS 25H MARIS SUS 4H PRE-DRILL EXPECATIONS 19 PA

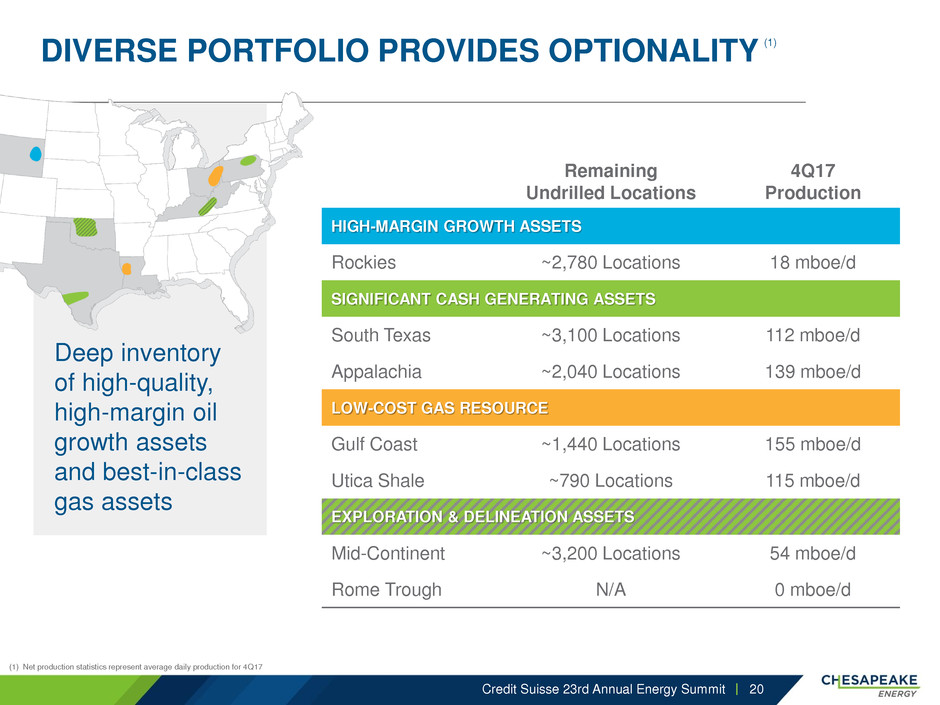

DIVERSE PORTFOLIO PROVIDES OPTIONALITY (1) Credit Suisse 23rd Annual Energy Summit 20 (1) Net production statistics represent average daily production for 4Q17 Remaining Undrilled Locations 4Q17 Production HIGH-MARGIN GROWTH ASSETS Rockies ~2,780 Locations 18 mboe/d SIGNIFICANT CASH GENERATING ASSETS South Texas ~3,100 Locations 112 mboe/d Appalachia ~2,040 Locations 139 mboe/d LOW-COST GAS RESOURCE Gulf Coast ~1,440 Locations 155 mboe/d Utica Shale ~790 Locations 115 mboe/d EXPLORATION & DELINEATION ASSETS Mid-Continent ~3,200 Locations 54 mboe/d Rome Trough N/A 0 mboe/d Deep inventory of high-quality, high-margin oil growth assets and best-in-class gas assets

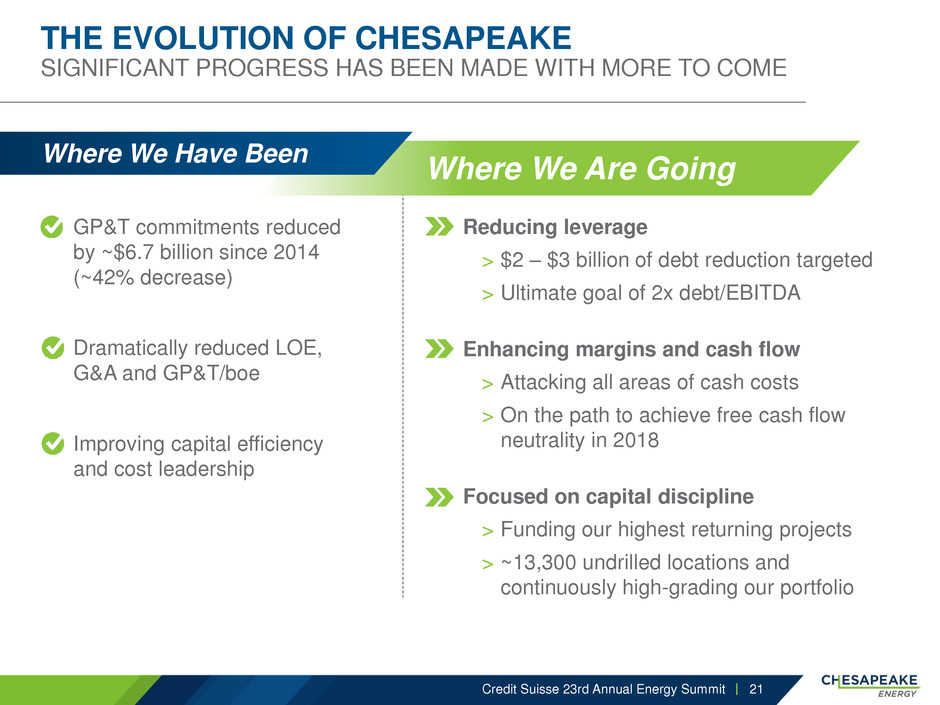

Where We Are Going Reducing leverage > $2 – $3 billion of debt reduction targeted > Ultimate goal of 2x debt/EBITDA Enhancing margins and cash flow > Attacking all areas of cash costs > On the path to achieve free cash flow neutrality in 2018 Focused on capital discipline > Funding our highest returning projects > ~13,300 undrilled locations and continuously high-grading our portfolio THE EVOLUTION OF CHESAPEAKE SIGNIFICANT PROGRESS HAS BEEN MADE WITH MORE TO COME Where We Have Been GP&T commitments reduced by ~$6.7 billion since 2014 (~42% decrease) Dramatically reduced LOE, G&A and GP&T/boe Improving capital efficiency and cost leadership Credit Suisse 23rd Annual Energy Summit 21

Appendix Credit Suisse 23rd Annual Energy Summit 22

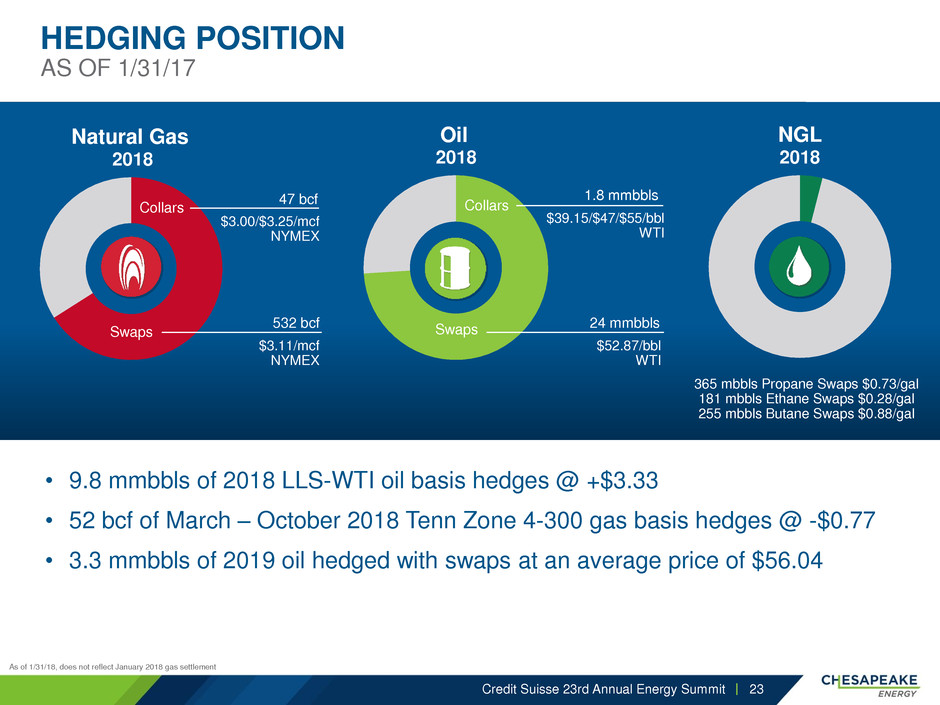

HEDGING POSITION AS OF 1/31/17 Credit Suisse 23rd Annual Energy Summit 23 As of 1/31/18, does not reflect January 2018 gas settlement NGL 2018 365 mbbls Propane Swaps $0.73/gal 181 mbbls Ethane Swaps $0.28/gal 255 mbbls Butane Swaps $0.88/gal Natural Gas 2018 $3.11/mcf NYMEX Swaps Collars $3.00/$3.25/mcf NYMEX 47 bcf 532 bcf Oil 2018 $52.87/bbl WTI Swaps $39.15/$47/$55/bbl WTI Collars 1.8 mmbbls 24 mmbbls • 9.8 mmbbls of 2018 LLS-WTI oil basis hedges @ +$3.33 • 52 bcf of March – October 2018 Tenn Zone 4-300 gas basis hedges @ -$0.77 • 3.3 mmbbls of 2019 oil hedged with swaps at an average price of $56.04

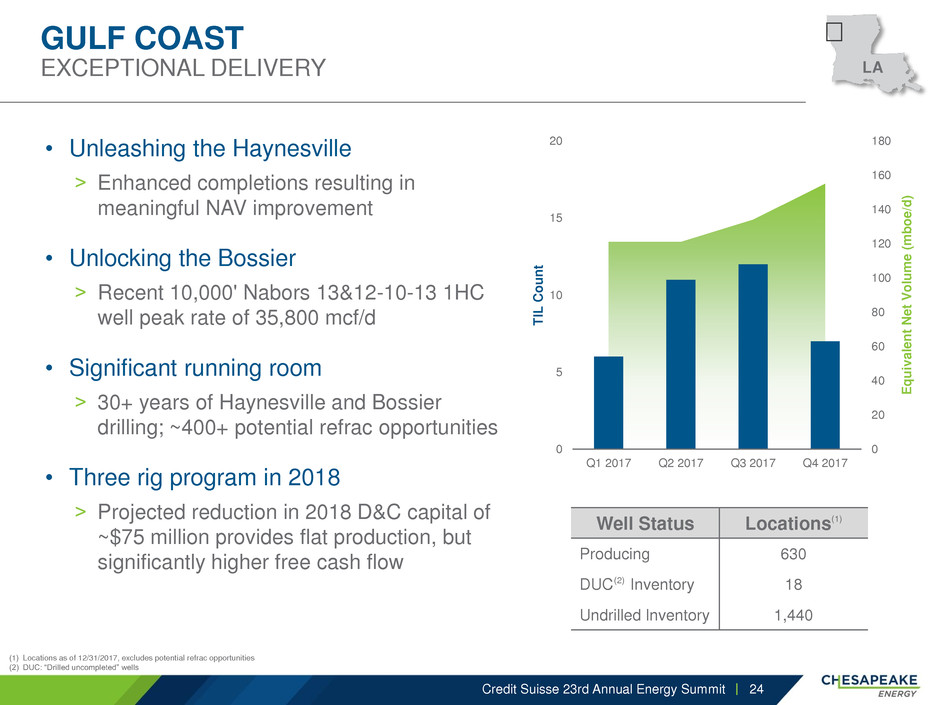

GULF COAST EXCEPTIONAL DELIVERY • Unleashing the Haynesville ˃ Enhanced completions resulting in meaningful NAV improvement • Unlocking the Bossier ˃ Recent 10,000' Nabors 13&12-10-13 1HC well peak rate of 35,800 mcf/d • Significant running room ˃ 30+ years of Haynesville and Bossier drilling; ~400+ potential refrac opportunities • Three rig program in 2018 ˃ Projected reduction in 2018 D&C capital of ~$75 million provides flat production, but significantly higher free cash flow (1) Locations as of 12/31/2017, excludes potential refrac opportunities (2) DUC: “Drilled uncompleted” wells Credit Suisse 23rd Annual Energy Summit 24 Well Status Locations(1) Producing 630 DUC (2) Inventory 18 Undrilled Inventory 1,440 0 20 40 60 80 100 120 140 160 180 0 5 10 15 20 Q1 2017 Q2 2017 Q3 2017 Q4 2017 E q u iv al e n t Ne t V o lu m e ( m b o e/d ) T IL C o u n t LA

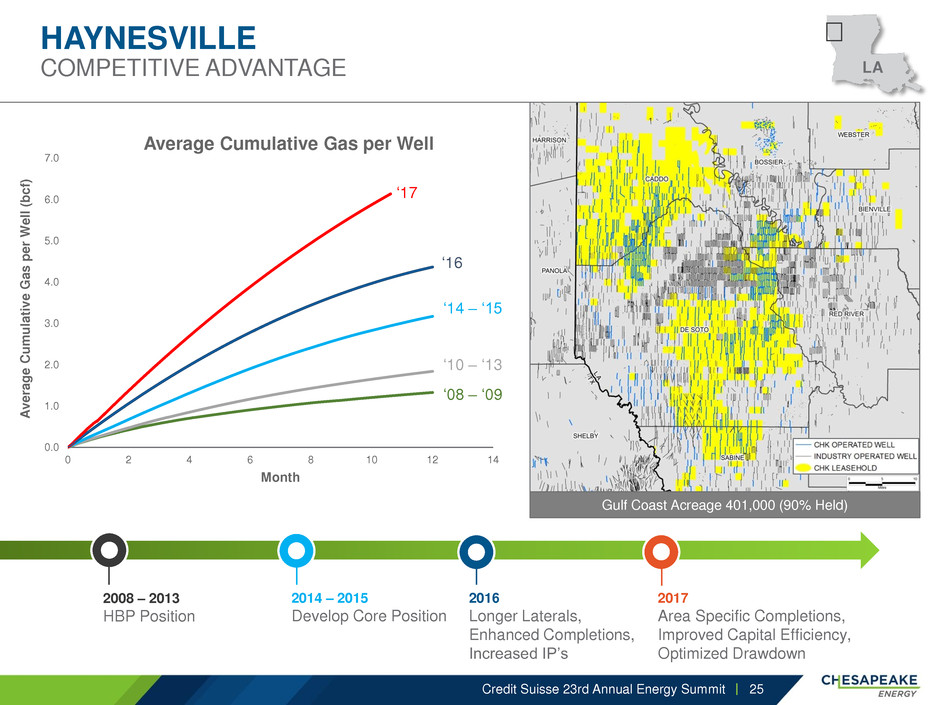

0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 0 2 4 6 8 10 12 14 A v e rage C u m u lati v e Gas p e r W el l (b cf ) Month Average Cumulative Gas per Well „08 – „09 „10 – „13 „14 – „15 „16 „17 HAYNESVILLE COMPETITIVE ADVANTAGE Credit Suisse 23rd Annual Energy Summit 2008 – 2013 HBP Position 2014 – 2015 Develop Core Position 2016 Longer Laterals, Enhanced Completions, Increased IP‟s 2017 Area Specific Completions, Improved Capital Efficiency, Optimized Drawdown 25 LA Gulf Coast Acreage 401,000 (90% Held)

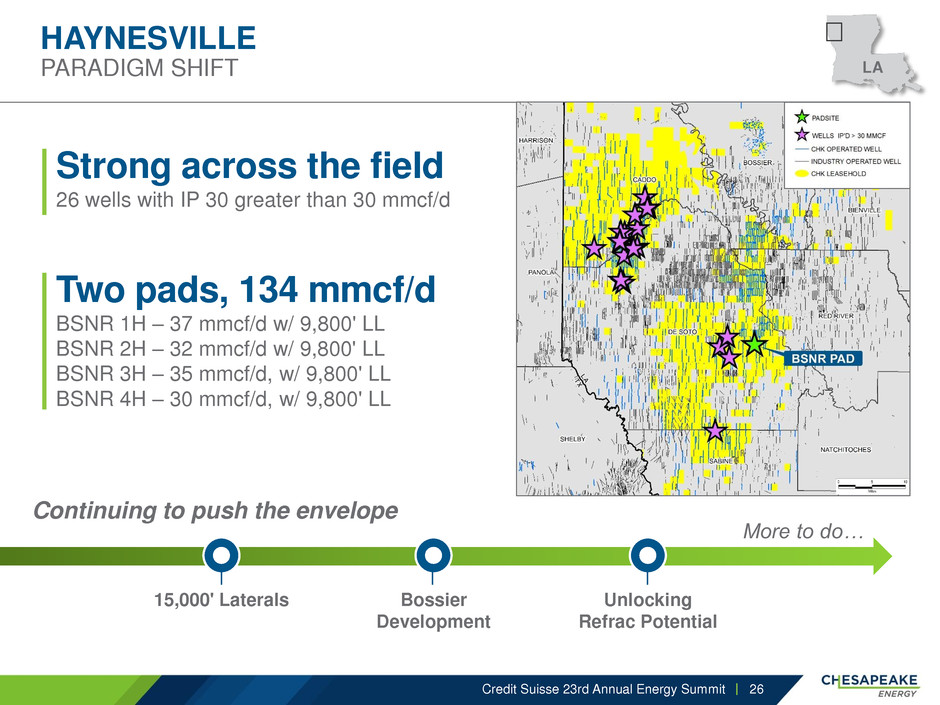

HAYNESVILLE PARADIGM SHIFT Credit Suisse 23rd Annual Energy Summit Two pads, 134 mmcf/d BSNR 1H – 37 mmcf/d w/ 9,800' LL BSNR 2H – 32 mmcf/d w/ 9,800' LL BSNR 3H – 35 mmcf/d, w/ 9,800' LL BSNR 4H – 30 mmcf/d, w/ 9,800' LL Continuing to push the envelope More to do… Strong across the field 26 wells with IP 30 greater than 30 mmcf/d 26 LA 15,000' Laterals Bossier Development Unlocking Refrac Potential

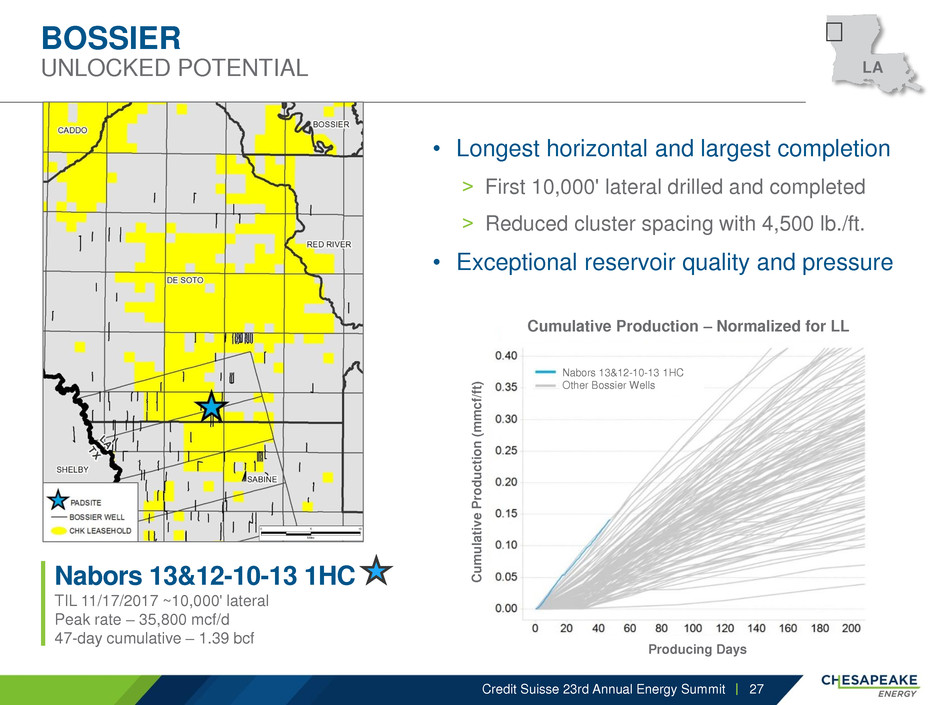

BOSSIER UNLOCKED POTENTIAL Credit Suisse 23rd Annual Energy Summit 27 Nabors 13&12-10-13 1HC TIL 11/17/2017 ~10,000' lateral Peak rate – 35,800 mcf/d 47-day cumulative – 1.39 bcf • Longest horizontal and largest completion ˃ First 10,000' lateral drilled and completed ˃ Reduced cluster spacing with 4,500 lb./ft. • Exceptional reservoir quality and pressure LA Cumulative Production – Normalized for LL Producing Days C u m u lati v e P ro d u cti o n ( m m cf/ ft ) Nabors 13&12-10-13 1HC Other Bossier Wells

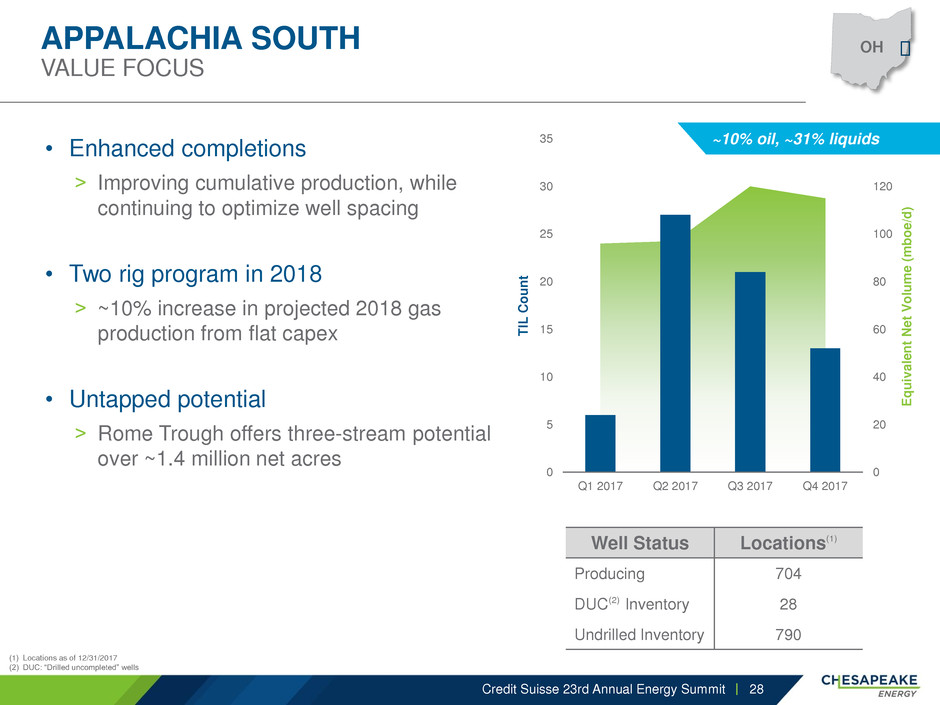

APPALACHIA SOUTH VALUE FOCUS • Enhanced completions ˃ Improving cumulative production, while continuing to optimize well spacing • Two rig program in 2018 ˃ ~10% increase in projected 2018 gas production from flat capex • Untapped potential ˃ Rome Trough offers three-stream potential over ~1.4 million net acres (1) Locations as of 12/31/2017 (2) DUC: “Drilled uncompleted” wells Credit Suisse 23rd Annual Energy Summit 28 Well Status Locations(1) Producing 704 DUC (2) Inventory 28 Undrilled Inventory 790 0 20 40 60 80 100 120 140 0 5 10 15 20 25 30 35 Q1 2017 Q2 2017 Q3 2017 Q4 2017 E q u iv al e n t Ne t V o lu m e ( m b o e/d ) T IL C o u n t OH ~10% oil, ~31% liquids

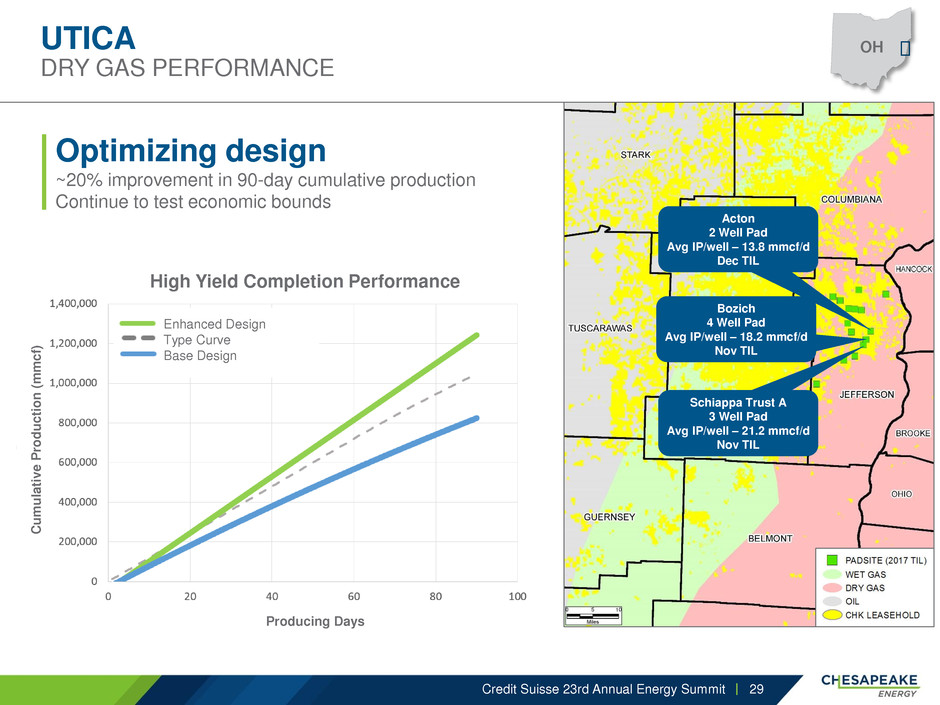

UTICA DRY GAS PERFORMANCE Credit Suisse 23rd Annual Energy Summit Optimizing design ~20% improvement in 90-day cumulative production Continue to test economic bounds 29 High Yield Completion Performance Producing Days C u m u lati v e P ro d u cti o n ( m m cf ) Enhanced Design Type Curve Base Design OH Acton 2 Well Pad Avg IP/well – 13.8 mmcf/d Dec TIL Schiappa Trust A 3 Well Pad Avg IP/well – 21.2 mmcf/d Nov TIL Bozich 4 Well Pad Avg IP/well – 18.2 mmcf/d Nov TIL

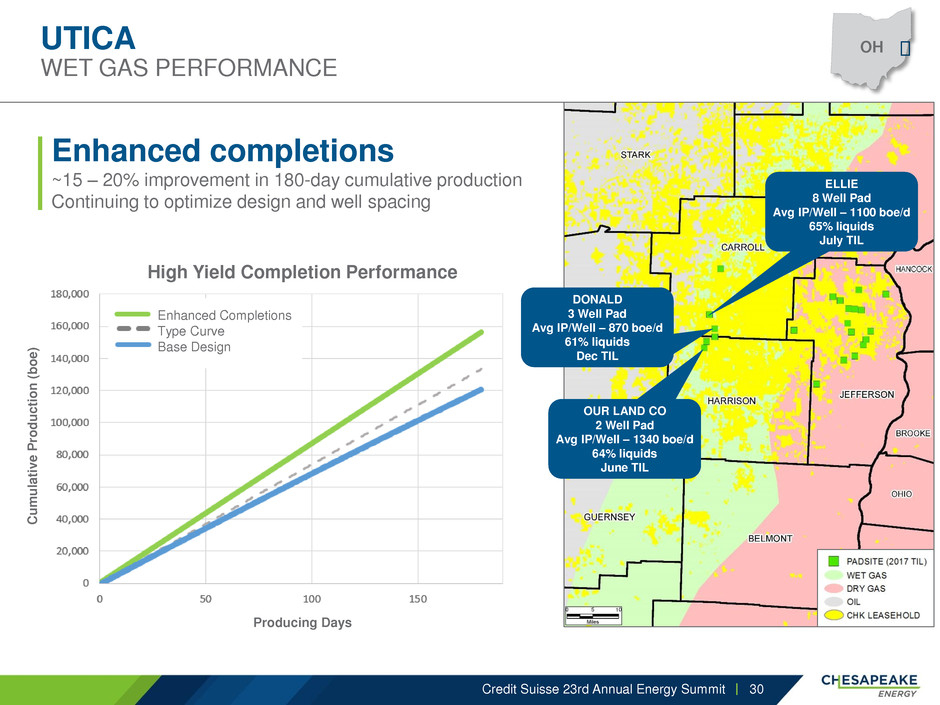

High Yield Completion Performance Producing Days C u m u lati v e P ro d u cti o n ( b o e ) Enhanced Completions Type Curve Base Design UTICA WET GAS PERFORMANCE Credit Suisse 23rd Annual Energy Summit Enhanced completions ~15 – 20% improvement in 180-day cumulative production Continuing to optimize design and well spacing ELLIE 8 Well Pad Avg IP/Well – 1100 boe/d 65% liquids July TIL DONALD 3 Well Pad Avg IP/Well – 870 boe/d 61% liquids Dec TIL OUR LAND CO 2 Well Pad Avg IP/Well – 1340 boe/d 64% liquids June TIL 30 OH

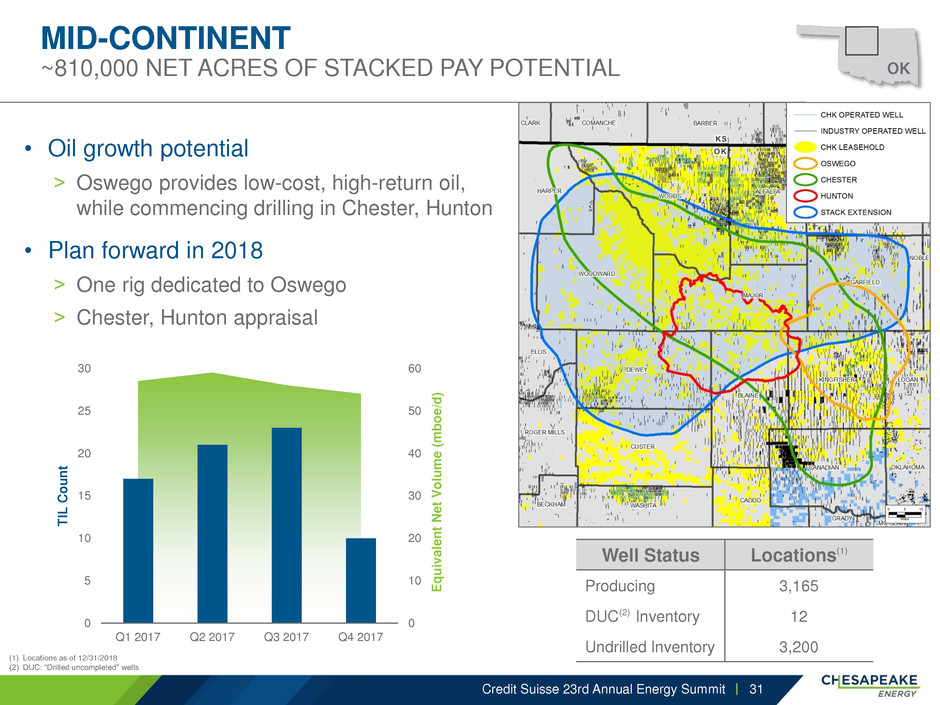

MID-CONTINENT ~810,000 NET ACRES OF STACKED PAY POTENTIAL • Oil growth potential ˃ Oswego provides low-cost, high-return oil, while commencing drilling in Chester, Hunton • Plan forward in 2018 ˃ One rig dedicated to Oswego ˃ Chester, Hunton appraisal (1) Locations as of 12/31/2018 (2) DUC: “Drilled uncompleted” wells Credit Suisse 23rd Annual Energy Summit 31 Well Status Locations(1) Producing 3,165 DUC (2) Inventory 12 Undrilled Inventory 3,200 0 10 20 30 40 50 60 0 5 10 15 20 25 30 Q1 2017 Q2 2017 Q3 2017 Q4 2017 E q u iv al e n t Ne t V o lu m e ( m b o e /d ) T IL C o u n t OK

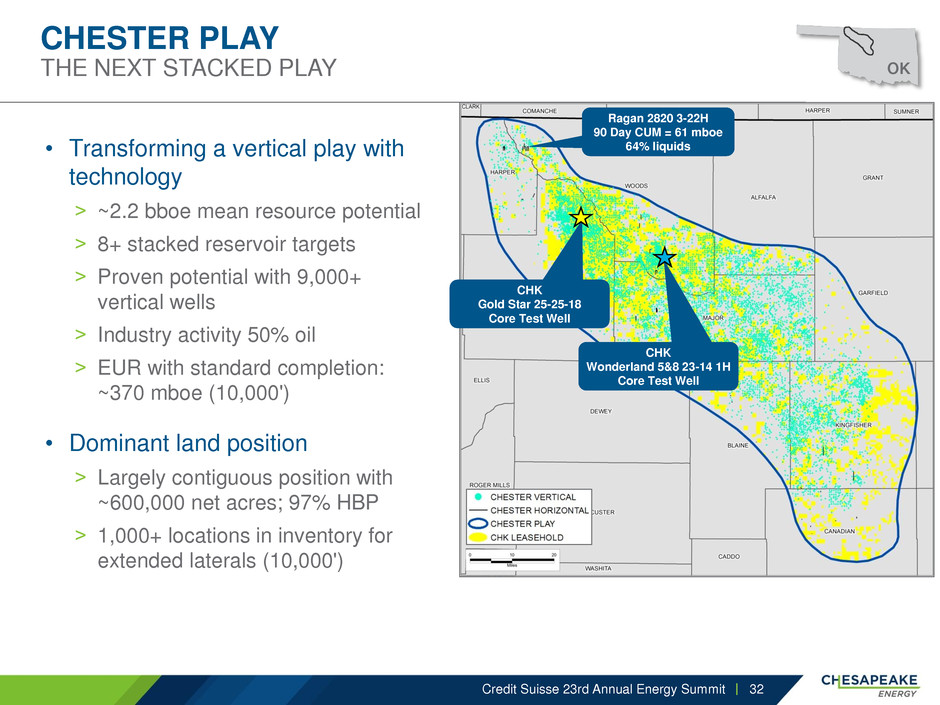

CHESTER PLAY THE NEXT STACKED PLAY • Transforming a vertical play with technology ˃ ~2.2 bboe mean resource potential ˃ 8+ stacked reservoir targets ˃ Proven potential with 9,000+ vertical wells ˃ Industry activity 50% oil ˃ EUR with standard completion: ~370 mboe (10,000') • Dominant land position ˃ Largely contiguous position with ~600,000 net acres; 97% HBP ˃ 1,000+ locations in inventory for extended laterals (10,000') Credit Suisse 23rd Annual Energy Summit 32 OK Ragan 2820 3-22H 90 Day CUM = 61 mboe 64% liquids CHK Wonderland 5&8 23-14 1H Core Test Well CHK Gold Star 25-25-18 Core Test Well

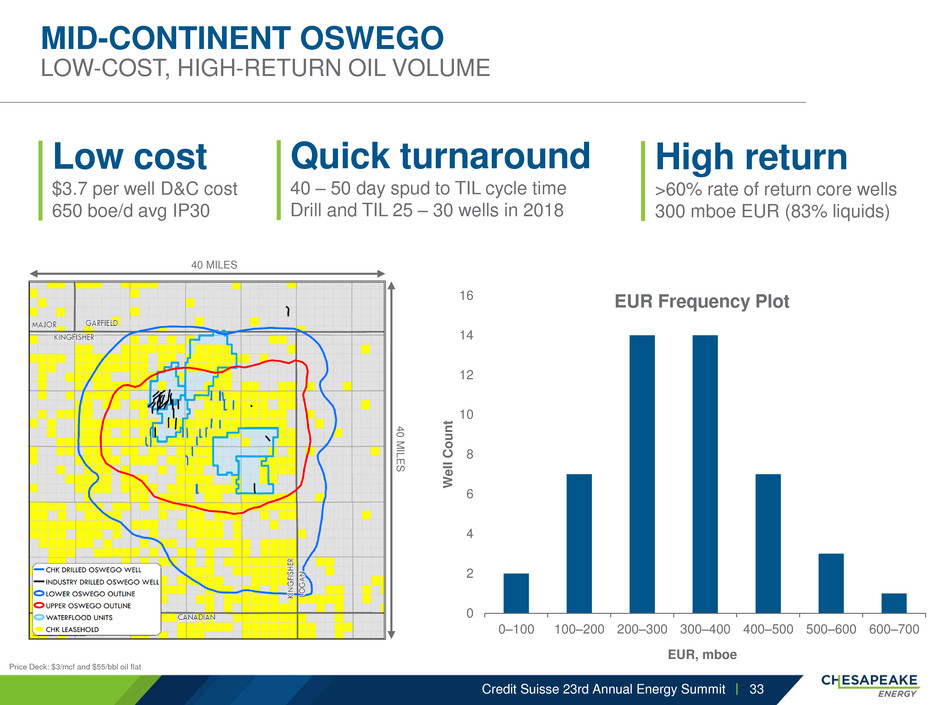

MID-CONTINENT OSWEGO LOW-COST, HIGH-RETURN OIL VOLUME Credit Suisse 23rd Annual Energy Summit Price Deck: $3/mcf and $55/bbl oil flat Quick turnaround 40 – 50 day spud to TIL cycle time Drill and TIL 25 – 30 wells in 2018 40 MILES 4 0 M IL E S 33 0 2 4 6 8 10 12 14 16 0–100 100–200 200–300 300–400 400–500 500–600 600–700 W el l C o u n t EUR, mboe EUR Frequency Plot Low cost $3.7 per well D&C cost 650 boe/d avg IP30 High return >60% rate of return core wells 300 mboe EUR (83% liquids)

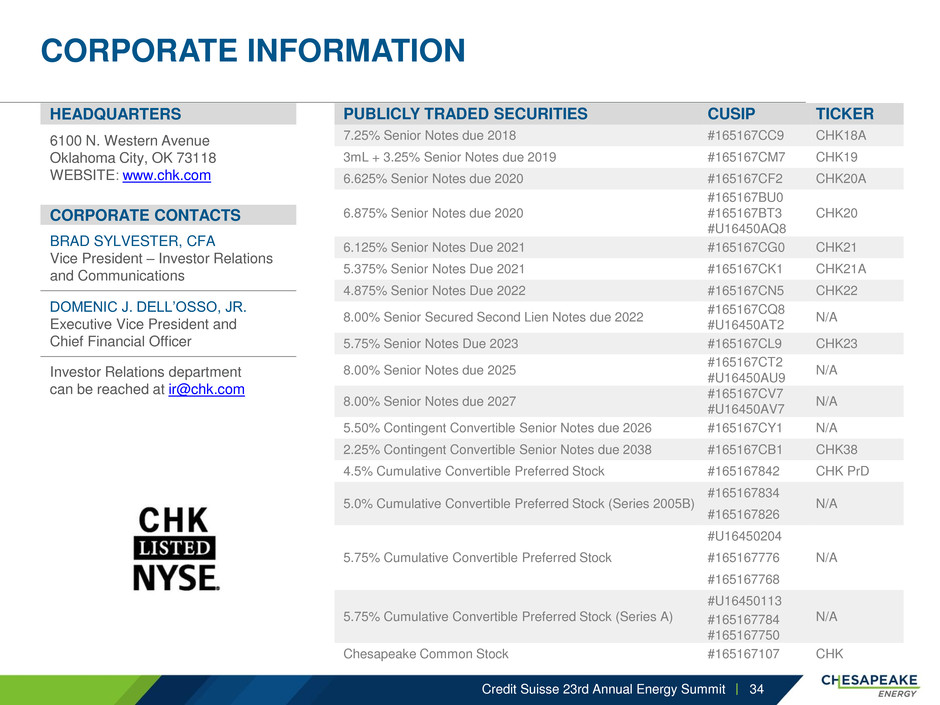

CORPORATE INFORMATION Credit Suisse 23rd Annual Energy Summit HEADQUARTERS 6100 N. Western Avenue Oklahoma City, OK 73118 WEBSITE: www.chk.com CORPORATE CONTACTS BRAD SYLVESTER, CFA Vice President – Investor Relations and Communications DOMENIC J. DELL‟OSSO, JR. Executive Vice President and Chief Financial Officer Investor Relations department can be reached at ir@chk.com 34 PUBLICLY TRADED SECURITIES CUSIP TICKER 7.25% Senior Notes due 2018 #165167CC9 CHK18A 3mL + 3.25% Senior Notes due 2019 #165167CM7 CHK19 6.625% Senior Notes due 2020 #165167CF2 CHK20A 6.875% Senior Notes due 2020 #165167BU0 #165167BT3 #U16450AQ8 CHK20 6.125% Senior Notes Due 2021 #165167CG0 CHK21 5.375% Senior Notes Due 2021 #165167CK1 CHK21A 4.875% Senior Notes Due 2022 #165167CN5 CHK22 8.00% Senior Secured Second Lien Notes due 2022 #165167CQ8 #U16450AT2 N/A 5.75% Senior Notes Due 2023 #165167CL9 CHK23 8.00% Senior Notes due 2025 #165167CT2 #U16450AU9 N/A 8.00% Senior Notes due 2027 #165167CV7 #U16450AV7 N/A 5.50% Contingent Convertible Senior Notes due 2026 #165167CY1 N/A 2.25% Contingent Convertible Senior Notes due 2038 #165167CB1 CHK38 4.5% Cumulative Convertible Preferred Stock #165167842 CHK PrD 5.0% Cumulative Convertible Preferred Stock (Series 2005B) #165167834 N/A #165167826 5.75% Cumulative Convertible Preferred Stock #U16450204 N/A #165167776 #165167768 5.75% Cumulative Convertible Preferred Stock (Series A) #U16450113 N/A #165167784 #165167750 Chesapeake Common Stock #165167107 CHK