QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| /x/ | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| / / | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

ARGOSY GAMING COMPANY

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| /x/ | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

ARGOSY GAMING COMPANY

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

APRIL 16, 2002

The Annual Meeting of Stockholders of Argosy Gaming Company ("Argosy" or the "Company") will be held at the conference center of the Empress Casino Joliet at 2300 Empress Drive, Joliet, Illinois 60434 on Tuesday, April 16, 2002, at 2:00 p.m., local time, for the following purposes:

- 1.

- To elect one director to hold office until the 2004 Annual Meeting of Stockholders;

- 2.

- To approve an amendment to the Company's Amended and Restated Certificate of Incorporation to increase the number of shares of common stock that the Company has the authority to issue by 60,000,000 shares, from 60,000,000 shares to 120,000,000 shares;

- 3.

- To approve an amendment to the Company's 1993 Stock Option Plan, as amended, to increase the number of shares of common stock reserved for issuance thereunder by 1,000,000 shares, from 2,500,000 shares to 3,500,000 shares;

- 4.

- To approve an amendment to the Company's 1993 Directors Stock Option Plan, as amended, to increase the number of shares of common stock reserved for issuance thereunder by 50,000 shares, from 50,000 shares to 100,000 shares; and

- 5.

- To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items are fully discussed in the proxy statement accompanying this notice. A copy of the Company's Annual Report is also enclosed.

The close of business on February 22, 2002, has been fixed as the record date for the meeting. Only stockholders of record at that time are entitled to notice of and to vote at the meeting and any adjournment or postponement thereof.

All stockholders are cordially invited to attend the meeting. However, to assure your representation at the meeting, the Board of Directors urges you to date, execute and return promptly the enclosed proxy to give voting instructions with respect to your shares of Common Stock. The return of the proxy will not affect your right to vote in person if you do attend the meeting.

| | |

DONALD J. MALLOY

Secretary

|

March , 2002

ARGOSY GAMING COMPANY

219 Piasa Street

Alton, Illinois 62002

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Argosy Gaming Company ("Argosy" or the "Company") for use in voting at the Annual Meeting of Stockholders (the "Meeting") to be held at the conference center of the Empress Casino Joliet, 2300 Empress Drive, Joliet, Illinois 60434, on Tuesday, April 16, 2002, at 2:00 p.m. local time, and at any postponement or adjournment thereof, for the purposes set forth in the attached notice. This proxy statement, the attached notice and the enclosed proxy are being sent to stockholders on or about March 12, 2002.

The Board of Directors does not intend to bring any matters before the Meeting except those indicated in the notice. If any other matters properly come before the Meeting, however, the persons named in the enclosed proxy, or their duly constituted substitutes acting at the Meeting, will be authorized to vote or otherwise act thereon in accordance with their judgment on such matters.

If proxies are properly dated, executed and returned, the shares they represent will be voted at the Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted as follows:

- •

- FOR the election of the nominee for director set forth herein;

- •

- FOR the amendment to the Company's Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation") set forth herein;

- •

- FOR the amendment to the Company's 1993 Stock Option Plan, as amended, (the "Stock Option Plan") set forth herein;

- •

- FOR the amendment to the Company's 1993 Directors Stock Option Plan, as amended, (the "Directors Option Plan") set forth herein; and

- •

- with respect to any other matter that may properly come before the Meeting, in the discretion of the persons voting the respective proxies.

A stockholder giving a proxy has the power to revoke it at any time prior to its exercise by voting in person at the meeting, by giving written notice to the Secretary of the Company prior to the Meeting, or by giving a later dated proxy.

The solicitation of proxies from the stockholders is being made by the Board of Directors and management of the Company and the cost of solicitation, including the cost of preparing and making the proxy statement, the proxy, notice of annual meeting and annual report is being paid for by the Company.

1

RECORD DATE, REQUIRED VOTE,

OUTSTANDING SHARES AND HOLDINGS

OF CERTAIN STOCKHOLDERS

Record Date and Outstanding Shares

At the close of business on February 22, 2002, the record date fixed for the determination of stockholders entitled to notice of and to vote at the Meeting, there were outstanding 28,833,664 shares of the Company's common stock, par value $0.01 per share, ("Common Stock"), the only class of voting securities outstanding. Only the record holders of Common Stock as of the close of business on February 22, 2002, will be entitled to vote at the Meeting. The presence at the Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes which all stockholders are entitled to cast will constitute a quorum. Each share of Common Stock is entitled to one vote, without cumulation, on each matter to be voted upon at the Meeting.

Required Vote

Only votes cast in person at the Meeting or by proxy received by the Company before commencement of the Meeting will be counted at the Meeting. The election of the nominee for director, the amendment to the Certificate of Incorporation, the amendment to the Stock Option Plan, the amendment to the Directors Option Plan and approval of any other matter that may properly come before the Meeting (each a "Proposal") will become effective only upon the affirmative vote of shares of Common Stock representing a majority of the votes cast on such Proposal (whether for or against or abstained on such Proposal). Votes cast as abstentions will not be counted as a vote for or against a Proposal, but will nevertheless have the effect of increasing the total votes cast on the matter and thus increase the number of votes necessary to effectuate such Proposal. So called "broker non-votes" (brokers failing to vote by proxy shares of the Common Stock held in nominee name for customers) will not be counted at the Meeting. The effect of such broker non-votes is to decrease the total votes cast on the matter and thus decrease the number of votes necessary to effectuate a Proposal. The executive officers and directors of the Company own shares, and exercisable rights to acquire shares, representing an aggregate of 3,948,510 shares of Common Stock or 13.7% of the outstanding shares of Common Stock (See "Security Ownership of Certain Beneficial Owners and Management"). Such officers and directors have indicated an intention to the Company to vote in favor of each Proposal.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of the close of business on February 22, 2002, certain information with respect to the beneficial ownership of Common Stock beneficially owned by (i) each director of the Company, (ii) the chief executive officer of the Company and four most highly compensated executive officers of the Company other than the chief executive officer (collectively, the "named officers"), (iii) all executive officers and directors as a group and (iv) each stockholder who is known to the Company to be the beneficial owner, as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), of more than 5% of the outstanding Common Stock. Each of the persons listed below has sole voting and investment power with respect to such shares, unless otherwise indicated.

2

Name of Beneficial Owner

| | Common Stock

Beneficially Owned

| | Percent

of Class

|

|---|

| Directors and Named Officers: | | |

William F. Cellini

219 Piasa Street

Alton, IL 62002 | | 1,651,456 | (a)(b) | 5.7 |

Edward F. Brennan

219 Piasa Street

Alton, IL 62002 | | 9,000 | | * |

George L. Bristol

219 Piasa Street

Alton, IL 62002 | | 3,000 | | * |

F. Lance Callis

219 Piasa Street

Alton, IL 62002 | | 883,778 | | 3.1 |

Jimmy F. Gallagher

219 Piasa Street

Alton, IL 62002 | | 658,428 | | 2.3 |

John B. Pratt, Sr.

219 Piasa Street

Alton, IL 62002 | | 163,000 | | * |

James B. Perry

219 Piasa Street

Alton, IL 62002 | | 362,000 | (c) | 1.3 |

James A. Gulbrandsen

219 Piasa Street

Alton, IL 62002 | | 38,148 | (c) | * |

Virginia M. McDowell

219 Piasa Street

Alton, IL 62002 | | 62,666 | (c) | * |

Dale R. Black

219 Piasa Street

Alton, IL 62002 | | 30,925 | (c) | * |

Donald J. Malloy

219 Piasa Street

Alton, IL 62002 | | 55,925 | (c) | * |

| All directors and executive officers as a group (12 persons) | | 3,948,510 | | 13.7 |

| Principal Stockholders: | | | | |

Goldman Sachs Asset Management

32 Old Ship

New York, NY 10005 | | 1,642,155 | (d) | 5.7 |

- *

- Less than 1%

- (a)

- Includes 341,945 shares of Common Stock held in Trust for William F. Cellini, Jr., as beneficiary with an independent third party as sole trustee and 341,944 shares of Common Stock held in Trust for William F. Cellini, Jr., as beneficiary, with William F. Cellini, Jr. and William F. Cellini, father of William F. Cellini, Jr., as co-trustees. Mr. Cellini disclaims beneficial ownership of the 341,945 shares

3

of Common Stock held in the William F. Cellini, Jr. Trust by an independent third party as sole trustee.

- (b)

- Includes 341,945 shares of Common Stock held in Trust for Claudia Marie Cellini, as beneficiary, with an independent third party as sole trustee and 341,945 shares of Common Stock held in Trust for Claudia Marie Cellini as beneficiary with Claudia Marie Cellini and William F. Cellini, father of Claudia Marie Cellini, as co-trustees. Mr. Cellini disclaims beneficial ownership of the 341,945 shares of Common Stock held in the Claudia Marie Cellini Trust by an independent third party as sole trustee.

- (c)

- Amounts shown include 183,333 shares of Common Stock for James B. Perry, 2,716 shares of Common Stock for James A. Gulbrandsen, 57,222 shares of Common Stock for Virginia M. McDowell, 26,875 shares of Common Stock for Dale R. Black, 51,975 shares of Common Stock for Donald J. Malloy, and 343,616 of Common Stock for all directors and executive officers as a group represented by stock options exercisable within 60 days of February 22, 2002.

- (d)

- According to a Schedule 13G filed with the Securities and Exchange Commission under the Exchange Act, Goldman Sachs Asset Management and certain affiliates have shared voting power with respect to 1,500,000 of such shares.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's executive officers and directors and persons who own more than ten percent of a registered class of the Company's equity securities (collectively, the "reporting persons") to file reports of ownership and changes in ownership with the Securities and Exchange Commission and to furnish the Company with copies of these reports. Based on the Company's review of the copies of these reports received by it, and written representations, if any, received from reporting persons with respect to such filings, the Company believes that all filings required to be made by the reporting persons for the period January 1, 2001, to December 31, 2001, were made on a timely basis except for a filing covering the sale of 10,000 shares by Edward F. Brennan and a filing reflecting the termination of a voting trust agreement with Stephanie Pratt representing 1,000,000 shares.

4

PROPOSAL #1

ELECTION OF BOARD OF DIRECTORS NOMINEE

The Company has a classified Board of Directors consisting of three classes. At each annual meeting of stockholders, directors are elected for a full term of three years to succeed those directors whose terms are expiring.

At the Meeting, the stockholders will elect one director to hold office, subject to the provisions of the Company's By-laws, until the annual meeting of stockholders in 2005 and until his successor shall have been duly elected and qualified. Unless contrary instructions are given, the shares represented by the enclosed proxy will be voted FOR the election of Mr. William F. Cellini, the nominee set forth below. Proxies cannot be voted for a greater number of directors than the number of nominees named. See "Record Date, Required Vote, Outstanding Shares and Holdings of Certain Stockholders."

Mr. Cellini has consented to being named in this proxy statement and to serve if elected. However, if Mr. Cellini at the time of his election is unable or unwilling to serve or is otherwise unavailable for election, and as a result another nominee is designated by the Board of Directors, the persons named in the enclosed proxy, or his or her substitute, will have discretion and authority to vote or refrain from voting for such nominee in accordance with their judgment.

Each director of the Company is currently required to be licensed to serve as a director of the Company by the applicable gaming regulatory authorities in Illinois, Missouri, Louisiana, Indiana and Iowa, and may be subject to similar requirements in other jurisdictions in which the Company may conduct business. The nominee has met these requirements in Illinois, Missouri, Louisiana, Indiana and Iowa. However, should the nominee or any director be found no longer suitable by any regulatory authority having jurisdiction over the Company, that individual shall become ineligible to serve on the Board of Directors and a majority of the remaining directors may appoint a qualified replacement to serve as director for the remaining term of the disqualified director.

The nominee for election as director, together with certain information about him, is contained below.

Name

| | Age

| | Director

Since

| | Present Position with the Company

|

|---|

| William F. Cellini | | 67 | | 1993 | | Director |

William F. Cellini has been Chairman of the Company's Board of Directors since February 1993. Mr. Cellini has served as Chief Executive Officer of New Frontier Group, a real estate development, management and construction concern with offices in Chicago and Springfield, Illinois since 1977. Mr. Cellini is a member of the Nominating Committee of the Board of Directors.

RECOMMENDATION

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF

ITS NOMINEE TO SERVE ON THE COMPANY'S BOARD OF DIRECTORS

PROPOSAL #2

AMENDMENT OF COMPANY'S CERTIFICATE OF INCORPORATION

TO INCREASE NUMBER OF AUTHORIZED

SHARES OF COMMON STOCK TO 120,000,000 SHARES

On February 7, 2002, the Board of Directors adopted a resolution approving a proposal to amend Article FOURTH of the Certificate of Incorporation in order to increase the total number of shares of capital stock that the Company is authorized to issue by 60,000,000 shares from 70,000,085 shares to 130,000,085 shares by increasing the number of shares of Common Stock that the Company is authorized to issue by 60,000,000 shares from 60,000,000 shares to 120,000,000 shares. The Board of Directors

5

determined that such amendment is advisable and directed that the proposed amendment be considered at the Meeting. The affirmative vote of the holders of at least a majority of the outstanding shares of Common Stock is required to approve the proposed amendment. There are no rights of appraisal or dissenter's rights that arise as a result of a vote on this issue.

The full text of the proposed amendment to the Certificate of Incorporation is set forth in Appendix A to this proxy statement. The proposed amendment would not affect the number of authorized shares of Redeemable Common Stock, par value $.01 per share of the Company (the "Redeemable Common Stock"), or Preferred Stock, par value $.01 per share of the Company (the "Preferred Stock").

Purposes and Effects of Increasing the Number of Authorized Shares of Common Stock.

Under the Certificate of Incorporation, there are currently 70,000,085 authorized shares of capital stock, of which 60,000,000 shares are classified as Common Stock, 85 shares are classified as Redeemable Common Stock and 10,000,000 shares are classified as Preferred Stock. As of February 22, 2002, there were 28,833,664 shares of Common Stock issued and outstanding, 1,373,883 shares of Common Stock reserved for issuance pursuant to the Stock Option Plan, 41,000 shares of Common Stock reserved for issuance pursuant to the Directors Option Plan and 91,440 shares of Common Stock reserved for issuance pursuant to the Warrants. As of February 22, 2002, there were no shares of Redeemable Common Stock or Preferred Stock outstanding.

Adoption of the proposed amendment would increase the number of authorized shares of capital stock by 60,000,000 shares, all of which would be classified as Common Stock. Therefore, upon adoption of the proposed amendment the number of shares of Common Stock available for future issuance would increase by 60,000,000 shares to 120,000,000 shares. Upon adoption of the proposed amendment, the Board of Directors would be authorized to issue additional shares of Common Stock at such time or times, to such persons and for such consideration as it may determine, except as may be otherwise required by law. The additional shares of Common Stock for which authorization is sought would, if and when issued, have the same rights and privileges as the presently outstanding shares of Common Stock. Holders of shares of Common Stock do not have preemptive rights to subscribe for or purchase any part of any new or additional issuance of shares of Common Stock or securities convertible into shares of Common Stock.

The Board of Directors believes that the number of authorized shares of Common Stock should be increased by 60,000,000 to provide sufficient shares for use for such corporate purposes as may be determined advisable by the Board of Directors, without further action or authorization by the stockholders. Such corporate purposes might include the acquisition of capital funds through the sale of stock, the acquisition of other corporations, businesses or properties, or the declaration of stock dividends in the nature of a stock split. There are no current plans, agreements, arrangements, or understandings with respect to the issuance of any of the shares of Common Stock which would be authorized by the proposed amendment; however, the Board of Directors believes that the availability of shares would afford the Company flexibility in considering and implementing any of the corporate transactions enumerated above to take advantage of favorable market conditions and opportunities without the delay and expense associated with the holding of a special meeting of its shareholders.

The issuance of additional shares of Common Stock may have a dilutive effect on earnings per share. In addition, the issuance of additional shares may have a dilutive effect on the voting power of the current stockholders because such stockholders do not have preemptive rights. Finally, the proposed amendment could, under certain circumstances, have an anti-takeover effect, because it would enable the Board of Directors to issue shares of Common Stock to persons who are opposed to a takeover bid. This could deter transactions that may result in a change of control of the Company, including transactions in which stockholders may receive a premium for their shares over the current market prices. The Board of Directors, however, has presented the proposed amendment for the purposes described above and not with the intent that it be utilized as a type of anti-takeover device.

6

RECOMMENDATION

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE AMENDMENT OF THE COMPANY'S CERTIFICATE OF

INCORPORATION TO INCREASE THE NUMBER OF

AUTHORIZED SHARES OF COMMON STOCK TO 120,000,000 SHARES

PROPOSAL #3

AMENDMENT OF THE STOCK OPTION PLAN

TO INCREASE THE NUMBER OF SHARES

RESERVED FOR ISSUANCE TO 3,500,000 SHARES

On February 7, 2002, the Board of Directors adopted a resolution approving a proposal to amend the Company's Stock Option Plan to (i) increase the number of shares authorized for grant under the Stock Option Plan by 1,000,000 shares from 2,500,000 shares to 3,500,000 shares and (ii) establish 600,000 shares of Common Stock as the maximum number of shares that may be subject to options granted under the Stock Option Plan during any calendar year to any one optionee. The specific proposed amendments to the Stock Option Plan are attached as Appendix B to this proxy statement. The Board of Directors determined that such amendments were advisable and directed that the proposed amendments be considered at the Meeting. The proposed amendments to the Stock Option Plan will be effective upon the approval of the holders of at least a majority of the outstanding shares of Common Stock. There are no rights of appraisal or dissenter's rights that arise as a result of a vote on this issue. A summary of the material terms of the Stock Option Plan is set forth below and is qualified in its entirety by reference to the Stock Option Plan, a copy of which is attached as Exhibit A.

Purpose and Administration of Stock Option Plan. The purpose of the Stock Option Plan is to provide additional incentive to employees of the Company. The Stock Option Plan is administered by the Compensation Committee of the Board of Directors, which is composed of three directors who are not employees of the Company.

Shares Subject to the Plan. Currently, a total of 2,500,000 shares of Common Stock are authorized and reserved for issuance under the Stock Option Plan. Since its inception through March 8, 2002, options, net of forfeitures, representing the right to acquire 1,126,117 shares of Common Stock have been granted under the Stock Option Plan. Upon approval of the amendments, an additional 1,000,000 shares of Common Stock, for a total of 3,500,000 shares of Common Stock, will be reserved for issuance under the Stock Option Plan. In addition, if the Company is involved in a change of capitalization, the options granted under the Stock Option Plan will be adjusted or, under certain conditions, will terminate. If any option expires or terminates for any reason, without having been exercised in full, the unpurchased shares subject to such option will be available again for the purposes of the Stock Option Plan.

Participation. The Stock Option Plan provides for the grant of non-qualified stock options to key employees of the Company and its subsidiaries, including officers. Currently, approximately 52 employees are eligible to participate in the Stock Option Plan. The number of participants could increase based upon future growth by the Company. The selection of participants will be based upon the Compensation Committee's opinion that the participant is in a position to contribute materially to the Company's continued growth and development and to its long-term financial success. No employee may receive in any calendar year options on more than 500,000 shares. Upon approval of the amendments, the maximum number of options granted during any calendar year to any one optionee will be increased to 600,000 shares.

Terms of Options. The term of each option will be fixed by the Compensation Committee on the date of grant of such options, provided that the maximum term of each option is 10 years from the date of grant.

7

Option Price. Shares subject to an option granted under the Stock Option Plan may be purchased for cash or, at the discretion of the Compensation Committee, through the delivery of shares of Common Stock or such other means as the Compensation Committee deems appropriate. The option price for such shares will be fixed by the Compensation Committee on the date of grant of such options.

Tax Consequences of Options. There will be no federal income tax consequences to the optionee or to the Company upon the grant of a nonqualified stock option under the Stock Option Plan. When the optionee exercises a nonqualified option, however, he or she will realize ordinary income in an amount equal to the excess of the fair market value of the shares of Common Stock received upon exercise of the option at the time of exercise over the exercise price, and the Company will be allowed a corresponding deduction. Any gain that the optionee realizes when he or she later sells or disposes of the option shares will be short-term or long-term capital gain, depending on how long the shares were held.

Approval and Termination. The Company adopted the Stock Option Plan in February 1993. The Board of Directors may amend, suspend, or terminate the Stock Option Plan, except that, unless approved by the stockholders of the Company, no amendment will increase the total number of shares of Common Stock that may be issued under the Stock Option Plan.

New Plan Benefits. It is not possible to state the persons who will receive options or awards under the Stock Option Plan in the future, nor the amount of options or awards that will be granted thereunder. The following table provides information with respect to options granted since the beginning of fiscal year 2001 under the Stock Option Plan to (i) each of the named officers, (ii) all current executive officers as a group, (iii) all current directors who are not executive officers as a group and (iii) all employees who are not executive officers or directors of the Company.

Name and Position

| | Number of Options

| | Dollar Value(1)

|

|---|

| James B. Perry, President and Chief Executive Officer | | — | | $ | — |

| James A. Gulbrandsen, Senior Vice President—Operations | | — | | | — |

| Virginia M. McDowell, Senior Vice President—Sales and Marketing | | — | | | — |

| Dale R. Black, Senior Vice President and Chief Financial Officer | | — | | | — |

| Donald J. Malloy, Senior Vice President, Secretary and General Counsel | | — | | | — |

| All current directors who are not executive officers(2) | | — | | | — |

| All current executive officers | | — | | | — |

| All employees who are not executive officers or directors | | 5,089 | | | 59,058 |

| | |

| |

|

| | Total | | 5,089 | | $ | 59,058 |

| | |

| |

|

- (1)

- The dollar value of each option granted is estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions: dividend yield of zero; expected volatility 51.3%; risk-free interest rate of 4.75%; and expected option life of five years.

- (2)

- Directors are not eligible to participate in the Stock Option Plan.

8

RECOMMENDATION

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE FOR THE AMENDMENT OF THE STOCK OPTION PLAN

TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE TO 3,500,000 SHARES

PROPOSAL #4

AMENDMENT OF THE DIRECTORS OPTION PLAN

TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE TO 100,000 SHARES

On February 7, 2002, the Board of Directors adopted a resolution approving a proposal to amend the Company's 1993 Directors Stock Option Plan to increase the number of shares authorized for grant under the Directors Option Plan by 50,000 shares from 50,000 shares to 100,000 shares. The specific proposed amendments to the Directors Option Plan are attached as Appendix C to this proxy statement. The Board of Directors also made certain technical amendments to the Directors Option Plan that are not subject to the stockholder approval solicited by this proxy statement. The Board of Directors determined that such amendments were advisable and directed that the proposed amendments be considered at the Meeting. The proposed amendments to the Directors Option Plan will be effective upon the approval of the holders of at least a majority of the outstanding shares of Common Stock. There are no rights of appraisal or dissenter's rights that arise as a result of a vote on this issue. A summary of the material terms of the Directors Option Plan is set forth below and is qualified in its entirety by reference to the Directors Option Plan, a copy of which is attached as Exhibit B.

Purpose and Administration of Directors Option Plan. The purpose of the Directors Option Plan is to provide additional incentive to directors of the Company. The Directors Option Plan is administered by the Compensation Committee of the Board of Directors, which is composed of three directors who are not employees of the Company.

Shares Subject to the Plan. Currently, a total of 50,000 shares of Common Stock are authorized and reserved for issuance under the Directors Option Plan. Since its inception through March 8, 2002, options, net of forfeitures, representing the right to acquire 9,000 shares of Common Stock have been granted under the Directors Option Plan. Upon approval of the amendments, an additional 50,000 shares of Common Stock will be reserved for issuance under the Directors Option Plan. In addition, if the Company is involved in a change of capitalization, the options granted under the Directors Option Plan will be adjusted or, under certain conditions, will terminate. If any option expires or terminates for any reason, without having been exercised in full, the unpurchased shares subject to such option will be available again for the purposes of the Directors Option Plan.

Participation. The Directors Option Plan provides for the grant of non-qualified stock options to non-employee directors of the Company. Pursuant to the Directors Option Plan each non-employee director is granted as of the date of their election a non-qualified stock option for 3,000 shares of Common Stock exercisable 1,000 as of date of grant and 1,000 on the first and second anniversaries of the date of grant. Additional stock option grants under the Directors Option Plan may be approved by the Compensation Committee provided that no director may receive more than 5,000 options in any one year.

Terms of Options. The term of each option will be fixed by the Compensation Committee on the date of grant of such options; provided that the maximum term of each option is 5 years from the date of grant.

Option Price. Shares subject to an option granted under the Directors Option Plan may be purchased for cash or, at the discretion of the Compensation Committee, through the delivery of shares of Common Stock or such other means as the Compensation Committee deems appropriate. The option price for such shares will be the reported closing price of the Company's Common Stock on the date of grant of such options.

9

Tax Consequences of Options. There will be no federal income tax consequences to the optionee or to the Company upon the grant of a nonqualified stock option under the Directors Option Plan. When the optionee exercises a nonqualified option, however, he or she will realize ordinary income in an amount equal to the excess of the fair market value of the shares of Common Stock received upon exercise of the option at the time of exercise over the exercise price, and the Company will be allowed a corresponding deduction. Any gain that the optionee realizes when he or she later sells or disposes of the option shares will be short-term or long-term capital gain, depending on how long the shares were held.

New Plan Benefits. It is not possible to state the persons who will receive options or awards under the Directors Option Plan in the future, nor the amount of options or awards that will be granted thereunder. The following table provides information with respect to options granted since the beginning of fiscal year 2001 under the Directors Option Plan.

Name and Position

| | Number of Options

| | Dollar Value(1)

|

|---|

| William F. Cellini | | 1,500 | | $ | 17,265 |

| George L. Bristol | | 1,500 | | | 17,265 |

| Jimmy F. Gallagher | | 1,500 | | | 17,265 |

| F. Lance Callis | | 1,500 | | | 17,265 |

| John B. Pratt, Sr. | | 1,500 | | | 17,265 |

| Edward F. Brennan | | 1,500 | | | 17,265 |

| | |

| |

|

| | Total | | 9,000 | | $ | 103,590 |

| | |

| |

|

- (1)

- The dollar value of each option granted is estimated on the date of grant using the Black-Scholes option pricing model with the following price assumptions: dividend yield of zero; expected volatility 51.3%; risk-free interest rate of 4.75%; and expected option life of five years.

Approval and Termination. The Company adopted the Directors Option Plan in February 1993. The Board of Directors may amend, suspend, or terminate the Directors Option Plan, except that, unless approved by the stockholders of the Company, no amendment will increase the total number of shares of Common Stock that may be issued under the Directors Option Plan.

10

RECOMMENDATION

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE AMENDMENT OF THE DIRECTORS OPTION PLAN

TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE TO 100,000 SHARES

EQUITY COMPENSATION PLAN DATA

The following table gives information about the Company's Common Stock that may be issued upon exercise of options under all of the Company's existing compensation plans as of December 31, 2001, including the Stock Option Plan and Directors Option Plan.

| | (a)

| | (b)

| | (c)

|

|---|

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column (a)

|

|---|

| Equity compensation plans approved by security holders: | | | | | | | |

| | Stock Option Plan | | 610,585 | | $ | 7.57 | | 1,373,883 |

| | Directors Option Plan | | 9,000 | | $ | 22.30 | | 41,000 |

Equity compensation plans not approved by security holders: |

|

|

|

|

|

|

|

| | None | | N/A | | | N/A | | N/A |

| | |

| |

| |

|

| Total | | 619,585 | | $ | 7.78 | | 1,414,883 |

| | |

| |

| |

|

11

MANAGEMENT

Directors and Executive Officers

The following table sets forth the names and ages of the Company's directors and executive officers.

Name

| | Age

| | Position

|

|---|

| William F. Cellini | | 67 | | Chairman of the Board of Directors |

| George L. Bristol (a) | | 61 | | Director |

| Jimmy F. Gallagher (a) | | 73 | | Director |

| F. Lance Callis (b) | | 66 | | Director |

| John B. Pratt, Sr. (b) | | 79 | | Director |

| Edward F. Brennan (b) | | 61 | | Director |

| James B. Perry (a) | | 52 | | Director, President and Chief Executive Officer |

| James A. Gulbrandsen | | 61 | | Senior Vice President—Operations |

| Virginia M. McDowell | | 44 | | Senior Vice President—Sales and Marketing |

| Dale R. Black | | 38 | | Senior Vice President and Chief Financial Officer |

| Donald J. Malloy | | 40 | | Senior Vice President, Secretary and General Counsel |

| R. Ronald Burgess | | 58 | | Senior Vice President—Human Resources |

- (a)

- Messrs. Bristol, Perry and Gallagher comprise a class of directors whose term expires in 2003.

- (b)

- Messrs. Callis, Pratt and Brennan comprise a class of directors whose term expires in 2004.

William F. Cellini has been Chairman of the Company's Board of Directors since February 1993. Mr. Cellini has served as Chief Executive Officer of New Frontier Group, a real estate development, management and construction concern with offices in Chicago and Springfield, Illinois since 1977. Mr. Cellini is a member of the Nominating Committee of the Board of Directors.

George L. Bristol has been President of GLB, Inc., a consulting firm, for over 20 years. He has been a member of the Board of Directors of the Company since January 1995 and is a member of its Audit Committee. Mr. Bristol was the Acting Chief Executive Officer of the Company from January 13, 1997 to April 20, 1997.

Jimmy F. Gallagher has been a director of the Company since February 1993 and is currently a member of its Nominating Committee and Audit Committee. Mr. Gallagher retired from the gaming industry in March 1991. From March 1990 to March 1991, he was Supervisor of Casino Games for the Park Hotel and Casino in Las Vegas, Nevada.

F. Lance Callis has been a partner with the law firm of Callis, Papa, Jackstadt, Szewczyk, Rongey & Danzinger P.C. (formerly Pratt & Callis, P.C.), with offices in St. Louis, Missouri and Granite City, Illinois for over 15 years. Mr. Callis has been a member of the Board of Directors of the Company since February 1993 and is a member of its Compensation Committee and Nominating Committee.

John B. Pratt, Sr. has practiced law in White Hall, Illinois as a sole practitioner for over 15 years. He has been a member of the Board of Directors of the Company since February 1993 and is a member of its Compensation Committee, Nominating Committee and Audit Committee.

Edward F. Brennan has been a partner with the law firm of Brennan, Jones & Brennan P.C. (formerly Brennan, Cates & Constance) in Belleville, Illinois for over 15 years. He has been a member of the Board

12

of Directors of the Company since January 1995 and also serves on the Audit Committee and Compensation Committee.

James B. Perry has been President and Chief Executive Officer of the Company since April 21, 1997. Mr. Perry was elected to the Board of Directors during 2000. From August 1996 to April 1997, Mr. Perry was President of the Hospitality Group of Keating Building Group. From 1976 to August 1996, Mr. Perry was employed by Aztar Corporation in numerous positions, including President and General Manager of TropWorld Casino and Entertainment Resort in Atlantic City, New Jersey.

James A. Gulbrandsen has been Senior Vice President—Operations since June 1, 1997. From late 1996 to May 1997, Mr. Gulbrandsen was retired. From 1992 to 1996, Mr. Gulbrandsen was an owner/operator of the Womack Casino in Cripple Creek, Colorado.

Virginia M. McDowell has been Senior Vice President—Sales and Marketing since June 1, 1997. From September 1996 to May 1997, Ms. McDowell was General Manager of the Northeast Office of Casino Data Systems, Inc. From 1984 to August 1996, Ms. McDowell held numerous positions with Aztar Corporation including Vice President of Business Development of TropWorld Casino and Entertainment Resort in Atlantic City, New Jersey.

Dale R. Black has been the Senior Vice President and Chief Financial Officer since April 1998. From April 1993 to March 1998, Mr. Black served as Corporate Controller. Prior to joining the Company, Mr. Black held various financial management positions throughout his career in both industry and with a "Big Five" public accounting firm.

Donald J. Malloy has been Senior Vice President, Secretary and General Counsel since April 1999. From January 1996 to April 1999 Mr. Malloy served as Vice President and Corporate Counsel. On January 8, 1999, Mr. Malloy assumed the additional role of Secretary. From June 1990 to December 1995, Mr. Malloy was an attorney with Winston & Strawn in Chicago Illinois.

R. Ronald Burgess has been Senior Vice President, Human Resources since June 1999. From July 1986 to June 1999, Mr. Burgess served in several human resources leadership roles with Harrah's Entertainment and the predecessor organization Promus Companies and Holiday Corporation in Memphis.

Compensation of Directors

Directors who are not employees of the Company receive a fee of $25,000 per annum plus $1,000 per board meeting and $900 per committee meeting. An additional annual fee of $2,500 is paid to each committee chairman. The Board of Directors has created a Business Continuity Committee comprised of two directors, George L. Bristol and Edward F. Brennan, to examine and recommend improvements to the Company's contingency plans in the event of unforeseen business interruptions, such as a terrorist attack. Because of the substantial additional work involved, Business Continuity Committee members receive $2,500 per committee meeting. Directors who are employees of the Company do not receive additional compensation for service as a director. In addition, pursuant to the Directors Option Plan each non-employee director is granted as of the date of their election a non-qualified stock option for 3,000 shares of Common Stock exercisable 1,000 as of date of grant and 1,000 on the first and second anniversaries of the date of grant. Additional stock option grants under the Directors Option Plan may be approved by the Compensation Committee provided that no director may receive more than 5,000 options in any one year. The option price for directors is the reported closing price of the Common Stock as of the date of grant. As of the date of this proxy statement, 9,000 options are outstanding under the Directors Option Plan.

13

MEETINGS OF THE BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors met eight times during 2001. Six members of the Board of Directors participated in all of the meetings of the Board of Directors and in all committees on which such director served. One Board member, John B. Pratt, Sr., whose attendance was impacted by a short-term illness, participated in 63% of the aggregate total number of Board of Directors meetings and 85% of his committee meetings.

The Board of Directors has established permanent audit, compensation and nominating committees. The membership of each of these committees is determined from time to time by the Board of Directors and, to date, only outside directors have served on these committees.

The Audit Committee held four meetings during 2001 and consists of Messrs. Brennan, Pratt, Gallagher and Bristol. The Audit Committee is currently composed of independent directors (as independence is defined in Section 303.01(B) of the NYSE listing standards). The Audit Committee, subject to the requirements of the applicable state gaming laws and regulatory authorities, appoints a firm of independent certified public accountants to audit the books and accounts of the Company. In addition, the Committee reviews and approves the scope and cost of all services (including non-audit services) provided by the firm selected to conduct the audit. The Committee also monitors the effectiveness of the audit effort and financial reporting, and inquires into the adequacy of financial and operating controls. The Board of Directors has adopted a written charter for the Audit Committee, and a copy of this charter is included as an appendix to this proxy statement The report of this Committee is set forth later in this proxy statement.

The Compensation Committee held three meetings in 2001 and consists of Messrs. Callis, Brennan and Pratt. The Compensation Committee reviews and approves salaries and other matters relating to compensation of the senior officers of the Company, including the administration of the Stock Option Plan. The Compensation Committee also formulates the Company's compensation policies and recommends compensation programs to the Board of Directors, including the administration of the Directors Stock Option Plan. The report of the Compensation Committee is set forth later in this proxy statement.

The Nominating Committee held one meeting in 2001 and consists of Messrs. Callis, Cellini, Pratt, and Gallagher. The Nominating Committee met in February 2002 to propose the nominee whose election to the Company's Board of Directors is a subject of this proxy statement. The Nominating Committee will consider nominees who are recommended by stockholders, provided such nominees are recommended in accordance with the nominating procedures set forth in the Company's By-laws.

14

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth annual and long-term compensation for the Company's Chief Executive Officer and four other most highly compensated officers during 2001 (collectively, the "named officers"), as well as certain other compensation information for the named officers during the years indicated.

Summary Compensation Table

| |

| | Annual Compensation

| | Long Term

Compensation(a)

| |

| |

|---|

Name and Principal Position

| |

| |

| |

| | Other Annual

Compensation (b)

| | All Other

Compensation

| |

|---|

| | Year

| | Salary

| | Bonus

| | Stock Options (#)

| |

|---|

James B. Perry

Director, President and Chief Executive Officer | | 2001

2000

1999 | | $

| 563,465

500,006

466,162 | | $

| 929,506

—

263,387 | | —

—

— | | —

—

200,000 | | $

| 5,324,309(c

826,041(c

80,908(c | )

)

) |

James A. Gulbrandsen

Senior Vice President Operations | | 2001

2000

1999 | | | 275,002

260,577

242,788 | | | 406,355

167,678

— | | —

—

— | | —

8,148

— | | | 2,078,981(d

413,458(d

11,779(d | )

)

) |

Virginia M. McDowell

Senior Vice President Sales and Marketing | | 2001

2000

1999 | | | 225,000

211,539

192,788 | | | 333,135

204,181

— | | —

—

— | | —

6,666

— | | | 618,223(e

262,668(e

10,090(e | )

)

) |

Dale R. Black

Senior Vice President and Chief Financial Officer | | 2001

2000

1999 | | | 200,000

186,538

167,788 | | | 354,915

392,204

473,707 | | —

—

— | | —

5,925

— | | | 679,246(f

17,096(f

12,739(f | )

)

) |

Donald J. Malloy

Senior Vice President, Secretary and General Counsel | | 2001

2000

1999 | | | 200,000

186,538

159,134 | | | 354,915

391,832

448,461 | | —

—

— | | —

5,925

— | | | 12,164(g

8,129(g

11,327(g | )

)

) |

- (a)

- The Company does not have long-term incentive plans and has not granted stock appreciation rights.

- (b)

- For each person named, "Other Annual Compensation" is below the level where disclosure would be required.

- (c)

- 2001—Other compensation includes a car allowance of $9,600, matching contributions to the Company's 401(k) Plan of $2,000, stock option exercises of $5,305,625 (representing the aggregate difference between weighted average stock price at exercise of $24.635 and weighted average stock option price of $3.4125 and reimbursement of medical expenses.

2000—Other compensation includes a car allowance of $9,600, compensation from restricted stock of $808,125, matching contributions to the Company's 401(k) Plan of $2,000, and reimbursement of medical expenses.

1999—Other compensation includes a car allowance of $9,600, dues of $17,850, house sale commission of $35,377, matching contributions to the Company's 401(k) Plan of $2,000 and reimbursement of medical expenses.

- (d)

- 2001—Other compensation includes a car allowance of $7,200, matching contributions to the Company's 401(k) Plan of $2,000, stock option exercises of $2,055,375 (representing the aggregate difference between stock price at exercise of $22.70 and stock option price of $3.125) and reimbursement of medical expenses.

2000—Other compensation includes a car allowance of $7,200, matching contributions to the Company's 401(k) Plan of $2,000, stock option exercises of $398,250 and reimbursement of medical expenses.

1999—Other compensation includes a car allowance of $7,200, matching contributions to the Company's 401(k) Plan of $2,000 and reimbursement of medical expenses.

- (e)

- 2001—Other compensation includes a car allowance of $7,200, matching contributions to the Company's 401(k) plan of $2,000, stock option exercises of $596,000 (representing the aggregate difference between stock price at exercise of $32.925 and stock option price of $3.125) and reimbursement of medical expenses.

2000—Other compensation includes a car allowance of $7,200, matching contributions to the Company's 401(k) Plan of $2,000, stock option exercises of $248,906 and reimbursement of medical expenses.

1999—Other compensation includes a car allowance of $7,200, matching contributions to the Company's 401(k) Plan of $2,000 and reimbursement of medical expenses.

15

- (f)

- 2001—Other compensation includes a car allowance of $6,000, matching contributions to the Company's 401(k) plan of $2,000, stock option exercises of $665,000 (representing the aggregate difference between stock price at exercise of $30.85 and stock option price of $4.25) and reimbursement of medical expenses.

2000—Other compensation includes a car allowance of $6,000, matching contributions to the Company's 401(k) plan of $2,000 and reimbursement of medical expenses.

1999—Other compensation includes a car allowance of $6,000, matching contributions to the Company's 401(k) plan of $2,000 and reimbursement of medical expenses.

- (g)

- 2001—Other compensation includes a car allowance of $6,000, matching contributions to the Company's 401(k) plan of $2,000 and reimbursement of medical expenses.

2000—Other compensation includes a car allowance of $6,000 and matching contributions to the Company's 401(k) plan of $2,000.

1999—Other compensation includes a car allowance of $6,000, matching contributions to the Company's 401(k) plan of $2,000 and reimbursement of medical expenses.

16

Option Grants in Last Fiscal Year

The Company granted no options to named officers during the year ended December 31, 2001.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information concerning options exercised during 2001 and presents the value of unexercised options held by the named officers at fiscal year end.

Name

| | Shares Acquired on

Exercise (#)(a)

| | Value

Realized ($)

| | Number of

Unexercised Options

at Fiscal Year End (#)

Exercisable/Unexercisable

| | Value of Unexercised

In-The-Money Options

at Fiscal Year End (b)

Exercisable/Unexercisable

|

|---|

| James B. Perry | | 250,000 | | $ | 5,305,625 | | 183,333/66,667 | | $3,999,875/2,545,750 |

| James A. Gulbrandsen | | 105,000 | | | 2,055,375 | | 2,716/5,432 | | 39,436/78,873 |

| Virginia M. McDowell | | 20,000 | | | 596,000 | | 57,222/4,444 | | 1,638,676/64,527 |

| Dale R. Black | | 25,000 | | | 665,000 | | 26,975/3,950 | | 758,420/57,354 |

| Donald J. Malloy | | — | | | — | | 51,975/3,950 | | 1,489,052/57,354 |

- (a)

- Options totaling 400,000 were exercised by the named executive officers during 2001.

- (b)

- The last reported sale price of the Common Stock on the New York Stock Exchange on December 31, 2001, was $32.52.

Employment and Other Agreements

Mr. James B. Perry entered into a four year employment agreement on April 22, 1999, pursuant to which Mr. Perry agreed to serve as President and Chief Executive Officer of the Company. This new agreement replaced an agreement that was set to expire in April 2000. Under the terms of the agreement, Mr. Perry is to be paid $500,000 annually for the first two years and $600,000 annually for the last two years. In addition, Mr. Perry received a signing bonus of $263,387, reimbursement for club dues, not to exceed $75,000, and an additional 200,000 options under the Company's 1993 Employee Stock Option Plan. The entire 100,000 restricted share block of Common Stock previously granted to Mr. Perry pursuant to his original employment agreement was released from escrow on April 21, 2000. In the event of a change in control of the Company, Mr. Perry receives a payment equal to one times his annual salary. The non-competition provision of the agreement restricts Mr. Perry from engaging in competition in any jurisdictions where the Company maintains gaming facilities (including managed properties) for a period of 12 months following resignation or termination.

Mr. James A. Gulbrandsen entered into an employment agreement dated as of January 1, 2002, pursuant to which Mr. Gulbrandsen agreed to serve as Senior Vice President of Operations of the Company. Under the terms of the agreement, Mr. Gulbrandsen is to be paid $300,000 annually. In addition, Mr. Gulbrandsen is a participant in the Company's Corporate Incentive Bonus Plan. In the event of a change of control of the Company in which Mr. Gulbrandsen is not retained or is offered a lesser position or elects to leave following the change of control, Mr. Gulbrandsen receives a payment equal to three times his annual salary. The non-competition provision of the agreement restricts Mr. Gulbrandsen from engaging in competition in any jurisdiction where the Company maintains gaming facilities (including managed properties) for a period of 12 months following termination.

Ms. Virginia M. McDowell entered into an employment agreement dated as of January 1, 2002, pursuant to which Ms. McDowell agreed to serve as Senior Vice President of Sales and Marketing of the Company. Under the terms of the agreement, Ms. McDowell is to be paid $250,000 annually. In addition, Ms. McDowell is a participant in the Company's Corporate Incentive Bonus Plan. In the event of a change of control of the Company in which Ms. McDowell is not retained or is offered a lesser position or elects to leave following the change of control, Ms. McDowell receives a payment equal to three times her annual

17

salary. The non-competition provision of the agreement restricts Ms. McDowell from engaging in competition in any jurisdiction where the Company maintains gaming facilities (including managed properties) for a period of 12 months following termination.

Mr. Dale R. Black entered into an employment agreement dated as of January 1, 2002, pursuant to which Mr. Black agreed to serve as Senior Vice President and Chief Financial Officer. Under the terms of the agreement, Mr. Black is to be paid $240,000 annually. In addition, Mr. Black is a participant in the Company's Corporate Incentive Bonus Plan. In the event of a change of control of the Company in which Mr. Black is not retained or is offered a lesser position or elects to leave following the change of control, Mr. Black receives a payment equal to three times his annual salary. The non-competition provision of the agreement restricts Mr. Black from engaging in competition in any jurisdiction where the Company maintains gaming facilities (including managed properties) for a period of 12 months following termination.

Mr. Donald J. Malloy entered into an employment agreement dated as of January 1, 2002, pursuant to which Mr. Malloy agreed to serve as Senior Vice President, Secretary and General Counsel. Under the terms of the agreement, Mr. Malloy is to be paid $240,000 annually. In addition, Mr. Malloy is a participant in the Company's Corporate Incentive Bonus Plan. In the event of a change of control of the Company in which Mr. Malloy is not retained or is offered a lesser position or elects to leave following the change of control, Mr. Malloy receives a payment equal to three times his annual salary. The non-competition provision of the agreement restricts Mr. Malloy from engaging in competition in any jurisdiction where the Company maintains gaming facilities (including managed properties) for a period of 12 months following termination.

Mr. R. Ronald Burgess entered into an employment agreement dated as of January 1, 2002, pursuant to which Mr. Burgess agreed to serve as Senior Vice President—Human Resources. Under the terms of the agreement, Mr. Burgess is to be paid $200,000 annually. In addition, Mr. Burgess is a participant in the Company's Corporate Incentive Bonus Plan. In the event of a change of control of the Company in which Mr. Burgess is not retained or is offered a lesser position or elects to leave following the change of control, Mr. Burgess receives a payment equal to three times his annual salary. The non-competition provision of the agreement restricts Mr. Burgess from engaging in competition in any jurisdiction where the Company maintains gaming facilities (including managed properties) for a period of 12 months following termination.

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

No member of the Compensation Committee of the Company was, during the year ended December 31, 2001, an officer, former officer or employee of the Company or any of its subsidiaries. No executive officer of the Company served as a member of (i) the compensation committee of another entity in which one of the executive officers of such entity served on the Company's Compensation Committee, (ii) the Board of Directors of another entity in which one of the executive officers of such entity served on the Company's Compensation Committee, or (iii) the compensation committee of another entity in which one of the executive officers of such entity served as a member of the Company's Board of Directors, during the year ended December 31, 2001.

COMMITTEE REPORTS

Notwithstanding anything to the contrary set forth in any of the Company's previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this proxy statement or future filings with the Securities and Exchange Commission, in whole or in part, the following report and Performance Graph shall not be deemed to be incorporated by reference into any such filings.

18

COMPENSATION COMMITTEE REPORT

The Compensation Committee

The Compensation Committee is responsible for the administration of the Company's executive compensation program. The Committee is made up of three Directors who are not employees of the Company. It is responsible for setting the compensation levels of the Company's Chief Executive Officer and other senior executives, including the executives named in the Summary Compensation Table. The Committee is also responsible for the administration of certain compensation and benefit plans. The Committee met three times during fiscal year 2001.

Compensation Philosophy

The Committee believes that the Company's executive compensation program should attract and retain talented executives. The Committee provides its executives with the opportunity to earn significant compensation if the Company and the individual meet or exceed challenging performance goals. This strategy has helped the Company attract, retain and motivate high quality executives. The Committee periodically reviews a number of independent compensation surveys as guidelines to determine competitive pay practices. The survey data is reviewed directly and is also summarized by independent compensation consultants. Generally, the survey data used is primarily for gaming and entertainment companies of similar size to the Company and based in the United States. However, since the Company's competition for executive talent is not limited to the gaming industry, compensation data for other companies of similar size is also considered. The survey data used to assess the Company's executive compensation includes some companies that are small and mid-cap sized casino companies as well as other entertainment and non-entertainment companies.

The income tax deductions of publicly traded companies may be limited to the extent total compensation for particular executive officers exceeds $1 million during any year. This deduction limit, however, does not apply to payments which qualify as "performance based." The Committee has reviewed the regulations issued by the Internal Revenue Service and will continue to review the application of these rules to future compensation. However, the Committee intends to continue basing its executive compensation decisions primarily upon performance achieved, both corporate and individual, while retaining the right to make subjective decisions and to award compensation that may or may not meet all of the Internal Revenue Service's requirements for deductibility.

The Committee believes that the total compensation provided to the Company's executives is both prudent and competitive. Also, the Committee believes that the program has helped to successfully focus the Company's executive team on increasing Company performance and stockholder value.

Base Salaries

Base salaries are determined at the discretion of the Committee based on a review of competitive market pay practices, performance evaluations and expected future individual contributions. The Committee uses the median of the range of base salaries from independent compensation surveys to target the Company's base salary levels. However, it also considers an individual's unique position, responsibilities and performance in setting salary levels. In reviewing individual performances, the Committee considers the views of the Chief Executive Officer, Mr. James B. Perry, with respect to other executive officers.

Annual Incentives

The Company has adopted a Value Added Incentive Plan (the "Value Added Plan"). The Value Added Plan's objectives are to enhance commitment to the long-term success of the Company by linking personal financial rewards to the growth in value of the Company, by increasing the Company's Value Added (as defined below), and to increase the Company's ability to attract and retain key executives.

19

Under the Value Added Plan, annual incentives are determined by establishing target incentive awards based on a percentage of base salary. Actual earned bonus awards are based on performance depending upon the responsibilities of the participant. Performance is measured by the cumulative growth of Value Added and then by comparing the actual Value Added against a target Value Added as designated by the Committee. The term "Value Added" is defined as after-tax operating cash flow (before interest expense), less a capital charge for all capital invested in the Company or division, as applicable. The term "capital charge" is defined as the Company's weighted average, after-tax, cost of capital, representing a blend of the Company's equity and debt capital cost.

The Company has also adopted the Stock Price Incentive Plan (the "Stock Price Plan"). The Stock Price Plan's objective is to enhance commitment to the long-term growth in the Company's Common Stock price and to increase the Company's ability to attract and retain key executives. Under the Stock Price Plan, annual incentives are determined based upon the amount of the increase or decrease in the stock price for the quarter versus the prior quarter. Decreases in the stock price in a quarter versus the prior quarter result in reductions of the unpaid amounts from the previous quarters.

For 2002, corporate executives and managers bonus awards will be based 60% on the Value Added Plan, as measured on a consolidated basis, and 40% on the Stock Price Plan. The Company's General Manager bonus awards will be based 70% on the Value Added Plan as measured on a consolidated basis, 15% on the Value Added Plan as measured for their respective property and 15% on the Stock Price Plan. Direct reports to property General Managers bonus awards will be based 90% on the Value Added Plan as measured for their respective property and 10% on the Stock Price Plan.

Annual incentive target awards for the Chief Executive Officer and the other executives named in the Summary Compensation Table range from 25% to 75% of salary. Actual cash awards are paid out over the succeeding four quarters out of the participant's bonus reserve account, an account maintained for each participant which includes any earned but unpaid bonuses from prior quarters. This bonus reserve account may also contain a negative balance from prior quarters, and in such cases the negative amount must be offset against any positive reserve amount. The annual incentive for the Chief Executive Officer is discussed under the "Chief Executive Officer Compensation" section below.

Long-Term Incentives

From time to time, the Committee has granted stock options and restricted shares to the Company's executives in order to align their interests with the interests of stockholders. Since stock options are granted at market price, the actual value of the stock options is wholly dependent on an increase in the price of the Company's Common Stock. Stock options are considered effective long-term incentives by the Committee because an executive is rewarded only if the value of the Company's Common Stock increases, thus increasing stockholder value. In determining grants of stock awards for executives, the Committee has reviewed competitive data of long-term incentive practices at other gaming and entertainment companies and companies of similar size to the Company but in other industries. The Committee also takes into account the level of past stock compensation grants and the value of those grants in determining awards for the Company's executives.

No stock options were granted under the Stock Option Plan during 2001. The number of stock awards granted is generally based on the Committee's review of the individual executive's position and potential within the Company and the level of past stock compensation awards granted to the individual executive.

In September 1999, the Committee adopted a Management Deferred Compensation Plan for executives of the Company and the divisional general managers. The plan permits the eligible employee to defer up to 25% of base salary and 50% of bonus to the quarter in which the employee is terminated or upon change in control. The payout of the deferred compensation can be on a lump sum basis or in 5 or 10 year installments.

20

Chief Executive Officer Compensation

Based upon the assessment of the criteria outlined above, the Compensation Committee also established the compensation levels of the Company's Chief Executive Officer, James B. Perry, and entered into a four-year employment agreement in April 1999. Under the terms of such agreement, Mr. Perry, who also serves as President of the Company, was granted an annual base salary of $500,000 annually for the first two years and $600,000 annually for the last two years. In addition, Mr. Perry was given a signing bonus of $263,387, reimbursement for club dues not to exceed $75,000, and an additional 200,000 options under the Company's incentive stock option program. In April 2001, the Compensation Committee determined effective January 1, 2001, Mr. Perry was eligible to participate in the Annual Incentive Plan in a target amount of 75% of his base salary.

This report is submitted by F. Lance Callis, Edward F. Brennan and John B. Pratt, Sr., being all of the members of the Compensation Committee.

| | | F. LANCE CALLIS

EDWARD F. BRENNAN

JOHN B. PRATT, SR. |

21

AUDIT COMMITTEE REPORT

The Audit Committee is composed of four independent directors and operates under a written charter adopted by the Board of Directors, attached as Appendix D. The Company's management is responsible for its internal accounting controls and the financial reporting process. The Company's independent auditors, Ernst & Young LLP, are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with auditing standards generally accepted in the United States and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In discharging its oversight responsibility as to the audit process, the Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors' independence consistent with Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees," discussed with the auditors any relationships that may impact their objectivity and independence and satisfied itself as to the auditors' independence. The Committee also discussed with management, the internal auditors and the independent auditors, the quality and adequacy of the Company's internal controls and the internal audit department's organization, responsibilities, budget and staffing. The Committee reviewed both with the independent and internal auditors their audit plans, audit scope, and identification of audit risks.

The Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, "Communication with Audit Committees," and, with and without management present, discussed and reviewed the results of the independent auditors' examination of the financial statements. The Committee also discussed the results of the internal audit examinations.

Based on the Audit Committee's discussions with management and the independent auditors and the audit committee's review of the representations of management and the report of the independent accountants, the audit committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the Securities and Exchange Commission.

The following table presents fees billed for professional services rendered for the audit of our annual financial statements and review of our Forms 10-Q and fees billed for other services rendered by Ernst & Young LLP for 2001:

| Audit fees | | $ | 473,000 |

| Financial information systems design and implementation fees | | | — |

| All other fees: | | | |

| | Audit related fees (primarily accounting consultations, SEC registration statements and required compliance audits) | | $ | 437,000 |

| | Non-audit fees | | | 54,000 |

| | |

|

| Total of all other fees | | $ | 491,000 |

| | |

|

The Audit Committee has considered whether the independent accountant's provision of non-audit services is compatible with maintaining the independent accountant's independence.

This report is respectfully submitted by the Audit Committee of the Board of Directors.

| | | EDWARD F. BRENNAN

JOHN B. PRATT, SR.

JIMMY F. GALLAGHER

GEORGE L. BRISTOL |

22

PERFORMANCE GRAPH

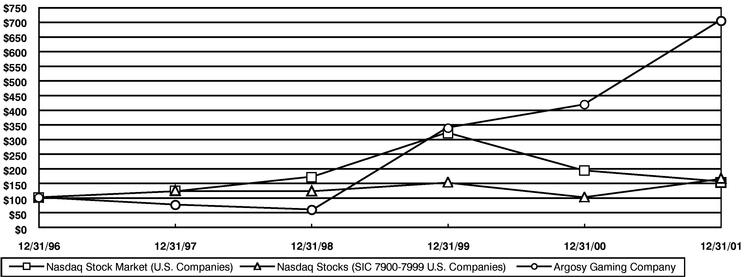

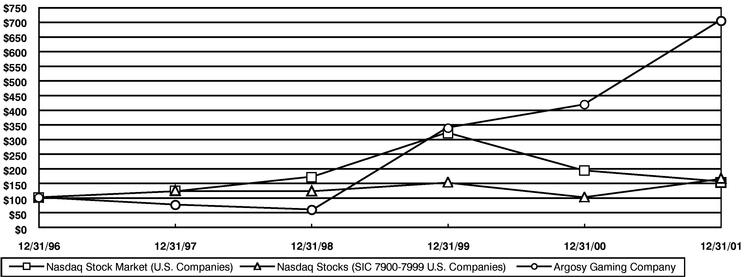

The following graph sets forth the cumulative total stockholder return from December 31, 1996 through December 31, 2001, of the Company, the Nasdaq Broad Market and the Nasdaq Amusement and Recreation Services Index (the "Peer Group Index"), which the Company considers to be its peer industry group. The graph assumes an investment of $100 on December 31, 1996, in each of the Common Stock, the stocks comprising the Nasdaq Broad Market, and the stocks comprising the Peer Group Index.

COMPARISON OF FIVE-YEAR TOTAL CUMULATIVE RETURN* AMONG ARGOSY

GAMING CO., NASDAQ STOCK MARKET INDEX (U.S. Companies), AND A PEER GROUP OF

NASDAQ STOCKS (SIC 7900-7999—Amusement and Recreation Services—U.S. Companies)

- *

- Assumes $100 investment in the common stock of Argosy Gaming Co., Nasdaq Stock Market Index (U.S. Companies) and Peer Group Nasdaq Stocks (SIC 7900-7999 U.S. Companies) derived from compounded daily returns with dividend reinvestment on the exdate.

23

MARKET FOR REGISTRANT'S COMMON EQUITY AND DIVIDEND POLICY

The Company's Common Stock trades on the New York Stock Exchange under the symbol AGY. On February 22, 2002, the Common Stock was held by 517 stockholders of record. The following table sets forth the high and low sales prices per share of Common Stock, as reported by the New York Stock Exchange, for the periods indicated. These quotations and sales prices do not include retail mark-ups, mark-downs or commissions.

| | Price Range of

Common Stock

|

|---|

Year Ending December 31, 2000

|

|---|

| | High

| | Low

|

|---|

| 1st Quarter | | $ | 17.25 | | $ | 9.75 |

| 2nd Quarter | | $ | 18.375 | | $ | 13.00 |

| 3rd Quarter | | $ | 18.4375 | | $ | 13.00 |

| 4th Quarter | | $ | 19.6875 | | $ | 15.8125 |

| | Price Range of

Common Stock

|

|---|

Year Ending December 31, 2001

|

|---|

| | High

| | Low

|

|---|

| 1st Quarter | | $ | 26.87 | | $ | 16.3125 |

| 2nd Quarter | | $ | 28.63 | | $ | 22.80 |

| 3rd Quarter | | $ | 30.25 | | $ | 22.30 |

| 4th Quarter | | $ | 34.85 | | $ | 25.01 |

On March , 2002, the reported last sales price for the Common Stock was $ .

Since the Company's initial public offering in February 1993, the Company has not declared any cash dividends or distributions on its Common Stock. The Company currently intends to retain its earnings to reduce its outstanding indebtedness and to finance future growth and therefore has no present intention of paying dividends. This policy will be reviewed annually by the Company's Board of Directors in light of, among other things, its results of operations, capital requirements, any restrictions imposed by applicable gaming regulations and restrictions imposed by the Company's indentures and loan documents. At present the Company's Amended and Restated Credit Agreement dated July 31, 2001, requires the consent of the lenders in order to declare a dividend.

CERTAIN TRANSACTIONS

The Company has entered into an indemnification agreement with each of its directors and executive officers to provide them with the maximum indemnification allowed under the Company's Certificate of Incorporation, By-Laws and applicable law.

STOCKHOLDER PROPOSALS

Stockholder proposals intended to be presented at the 2003 Annual Meeting of Stockholders of the Company must be received in writing by the Company no later than November 12, 2002, and no sooner than October 14, 2002, for inclusion in the Company's proxy statement and proxy card relating to the 2003 Annual Meeting.

INDEPENDENT PUBLIC ACCOUNTANTS

The Company has been advised that a representative of Ernst & Young LLP, its independent auditors, will be present at the Annual Meeting, will be available to respond to appropriate questions, and will be given an opportunity to make a statement if he or she so desires.

24

OTHER MATTERS

If any other matters properly come before the Annual Meeting, it is the intention of the person named in the enclosed form of proxy to vote the shares they represent in accordance with the judgments of the persons voting the proxies.

The Annual Report of the Company for the year ending December 31, 2001, was mailed to stockholders together with this proxy statement.