SCHEDULE 14A

(Rule 14a-101)INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATIONProxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )| Filed by the Registrant x | | |

| Filed by a Party other than the Registrant o | | |

| | | |

| Check the appropriate box: | | |

| o Preliminary Proxy Statement | o | Confidential, For Use of the Commission Only |

| | | (as permitted by Rule 14a-6(e)(2)) |

| o Definitive Proxy Statement | | |

| | | |

| o Definitive Additional Materials | | |

| x Soliciting Material Under Rule 14a-12 | | |

ARGOSY GAMING COMPANY |

|

| (Name of Registrant as Specified In Its Charter) |

| |

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filingfor which the offsetting fee was paid previously. Identify the previous filing by registration statementnumber, or the form or schedule and the date of its filing. |

| | | |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

Filed by Argosy Gaming Company pursuant to Rule 14a-12

of the Securities and Exchange Act

PENN NATIONAL GAMING, INC.

ACQUISITION OF ARGOSY GAMING COMPANY 400

NOVEMBER 2004 |

Safe Harbor Disclosure

This presentation contains forward-looking statements from Penn National and Argosy Gaming (collectively, the "Companies") within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Some of these statements include without limitation those regarding the accretive nature of the merger, synergies arising from the merger, future capital expenditures and prospects for future growth. These statements are subject to a number of risks and uncertainties that could cause the statements made to be incorrect and the actual results to differ materially. The Companies describe certain of these risks and uncertainties in their filings with the Securities and Exchange Commission, including their Annual Reports on Form 10-K for the year ended December 31, 2003. Some of these risks include without limitation those relating to the ability of the Penn National to integrate and manage facilities it acquires, risks relating to the development and expansion of properties, risks of increased competition, risks relating to the economy and interest rates, risks relating to possible increases in our effective rate of taxation, risks associated with failure by Penn National to obtain acquisition financing, and risks relating to the fact that both entities are heavily regulated by gaming authorities. In addition, consummation of Penn National's acquisition of Argosy Gaming is subject to several conditions including the approval of various governmental entities, including certain gaming regulatory authorities to which the Companies are subject. Furthermore, the Companies do not intend to update publicly any forward-looking statements except as required by law. The cautionary advice in this paragraph is permitted by the Private Securities Litigation Reform Act of 1995. This presentation includes "Non-GAAP financial measures" within the meaning of SEC Regulation G. A reconciliation of all Non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP can be found at www.pngaming.com, in the Recent News section. |

Transaction Overview

Transaction value of $2.2 billion

$47.00 per share in cash

16.4% premium to closing price of $40.38 (11/02/04)

30% premium to average closing price over the last 90 days

Aggregate $1.4 billion in total equity consideration

Repay $805 million of Argosy's outstanding indebtedness

TTM transaction EBITDA multiple of 8.5x

Fully committed financing

Expected closing: 2H '05

Expected to be immediately accretive to EPS upon closing |

Transaction Rationale

Will create the nation's third largest casino operator

In excess of $2 billion in pro forma annual revenues

In excess of $550 million in LTM EBITDA (includes $20 million in corporate synergies)

Significant near-term growth prospects at both entities

Expansion into three new jurisdictions Indiana, Missouri, Iowa

Complimentary geographic asset base

Further diversifies cash flows

Combined company will be broadly diversified by property and region

No single property will account for more than 20% of revenue

No single property will account for more than 25% of EBIDTA

Consistent with Penn Nationals successful long-term growth strategy

Regional properties operationally similar to PENNs existing portfolio |

Combined Portfolio Overview

Property Casino Sq. Ft. Gaming Machines Table Games Hotel Rooms EBITDA(1)

Hollywood Aurora 53,000 1,161 22 $70.3

Charles Town 114,000 3,793 106.8

Casino Rouge 28,000 1,065 31 33.0

Casino Magic 39,500 1,212 28 492 21.3

Hollywood Tunica 54,000 1,616 31 494 25.6

Boomtown 33,600 1,100 20 15.2

Racing

(3 Racetracks, 7 OTWs) 5.4

Casino Rama (mgmt. fee) 75,000 2,313 121 300 14.7

Bullwhackers 20,700 904 4.4

Pennwood JV/Freehold 1.5

Argosy Lawrenceburg 74,300 2,248 95 300 144.9

Alton Belle 26,700 1,067 20 18.6

Argosy Kansas City 62,000 1,750 42 37.1

Argosy Baton Rouge 28,900 849 12 300 18.5

Belle of Sioux City 20,300 616 18 13.9

Empress - Joliet 50,000 1,148 24 102 54.9

TOTALS 701,400 20,842 464 2,477 586.1

|

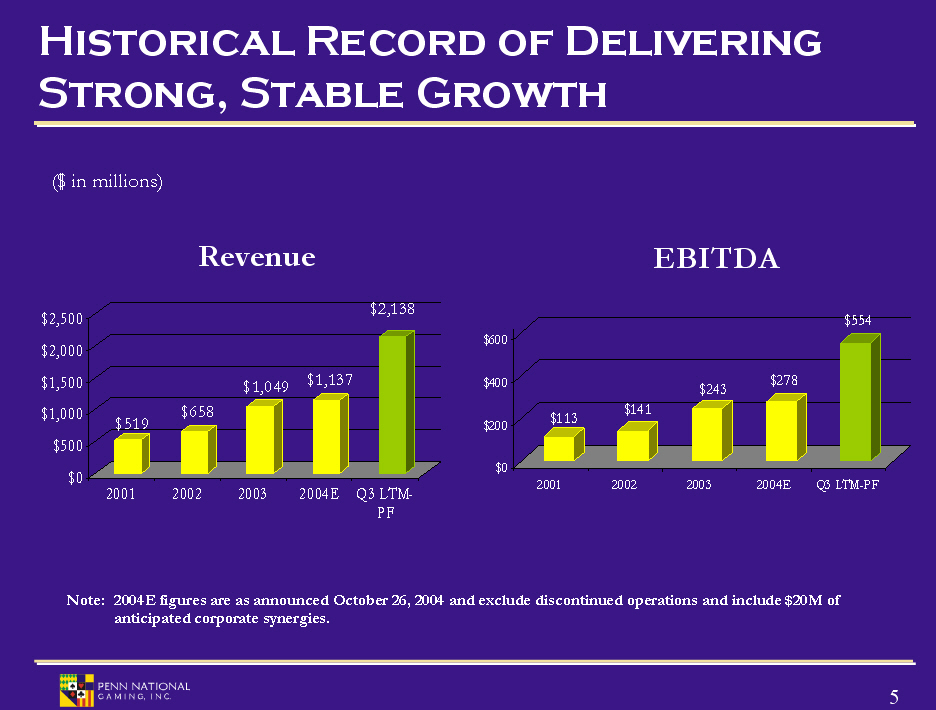

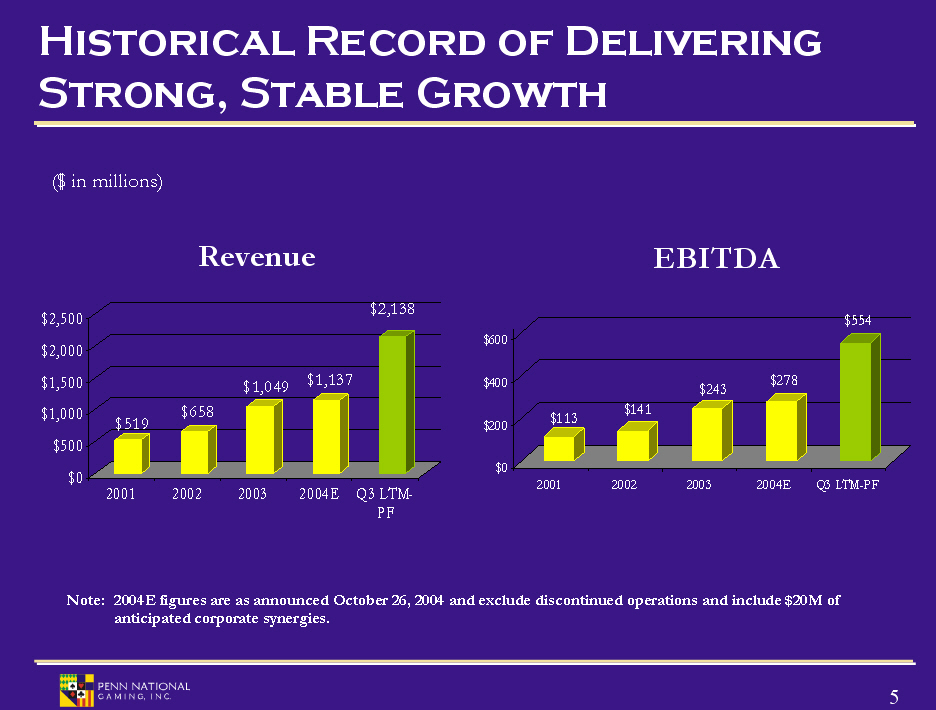

Historical Record of Delivering Strong, Stable Growth

($ in millions)

Revenue

2001 $519

2002 $658

2003 $1,049

2004E $1,137

Q3 LTM-PF $2,138

EBITDA

2001 $113

2002 $141

2003 $243

2004E $278

Q3 LTM-PF $554

Note: 2004E figures are as announced October 26, 2004 and exclude discontinued operations and include $20M of anticipated corporate synergies. |

Revenue Diversification by Region

PENN LTM = $1.1 B Pro Forma LTM = $2.1 B

Note: Excludes discontinued operations, corporate eliminations and overhead. LTM 9/30/04. Excludes Bangor and Toledo Raceways. |

EBITDA Diversification by Region

PENN LTM = $298 M Pro Forma LTM = $586 M

Note: Excludes discontinued operations, corporate eliminations and overhead. LTM 9/30/04. Excludes Bangor and Toledo Raceways. |

EBITDA Diversification by Property PENN LTM = $298 M Pro Forma LTM = $586 M

Note: Excludes discontinued operations, corporate eliminations and overhead. LTM 9/30/04. Excludes Bangor and Toledo Raceways. |

Sources and Uses of Funds

($ in millions)

Sources of Funds ($)

Cash $108.8

Senior Credit Facilities 2,639.0

Total Sources of Funds $2,747.8

Uses of Funds ($)

Total Equity Consideration $1,410.4

Argosy Retired Debt 805.3

Penn National Retired Debt 319.9

Fees & Expenses 212.2

Total Uses of Funds $2,747.8

|

Capitalization

September 30, 2004 ($ in millions)

PENN Pro Forma(1)

Cash $ 83.2 $ 120.0

11 1/8% Sr. Sub Notes due 08callable 3/05 200.0 200.0

8 7/8% Sr. Sub Notes due 10callable 3/06 175.0 175.0

6 7/8% Sr. Sub Notes due 11callable 12/07 200.0 200.0

Senior Credit Facilities 320.0 2,639.0

Capital Leases & Other 14.8 17.7

Total Debt $909.8 $3,231.7

(1) Reflects the financing of the Argosy Gaming Company acquisition and assumes $175 million of net proceeds from the sale of Penns Pocono Downs. |

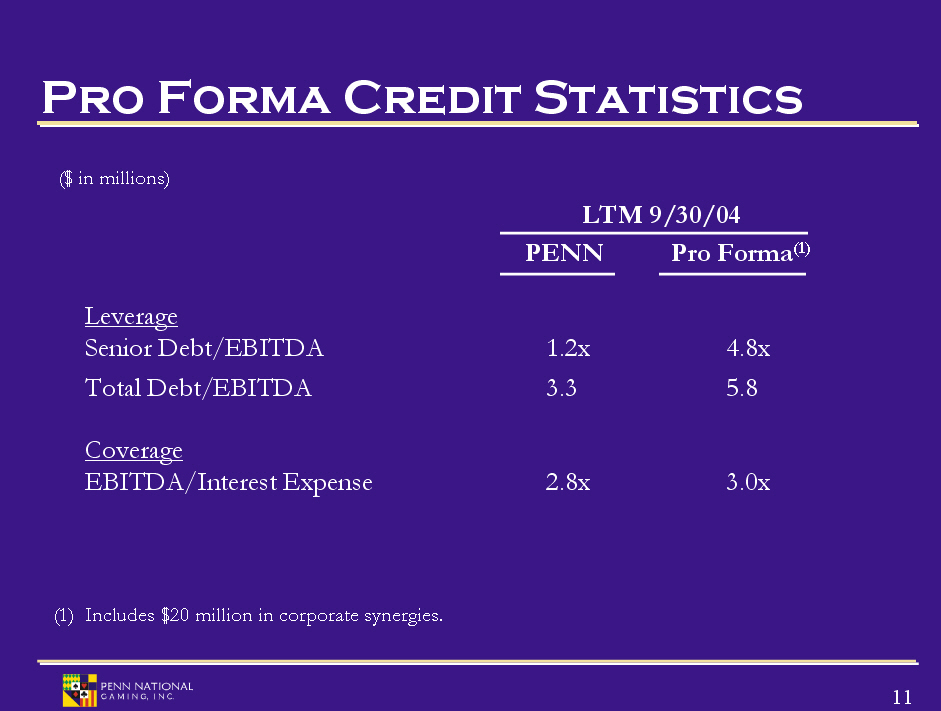

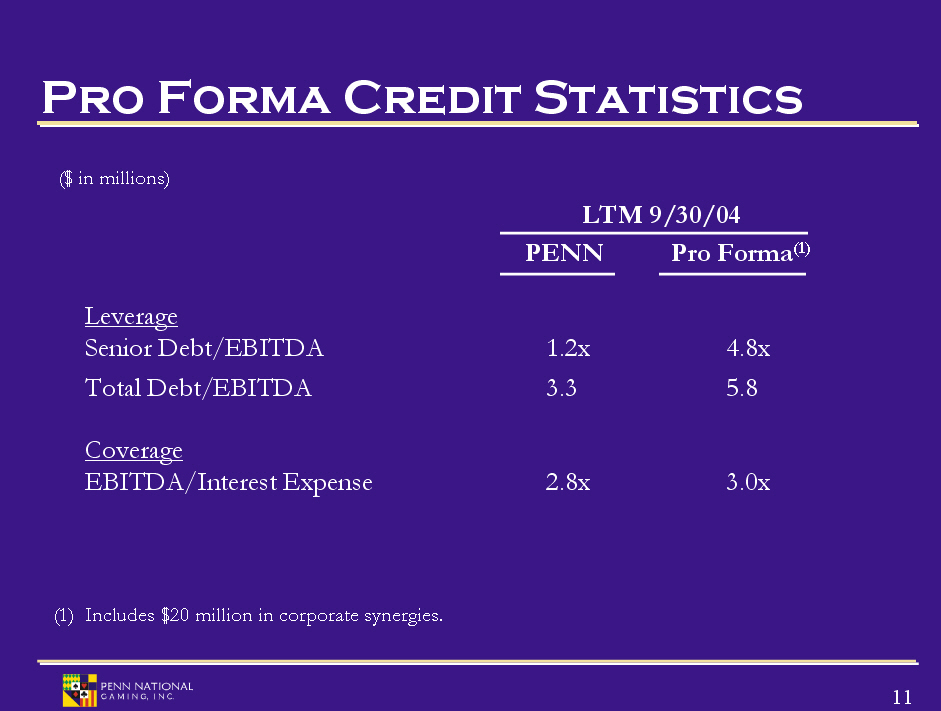

Pro Forma Credit Statistics ($ in millions)

LTM 9/30/04

PENN Pro Forma(1)

Leverage

Senior Debt/EBITDA 1.2x 4.8x

Total Debt/EBITDA 3.3 5.8

Coverage

EBITDA/Interest Expense 2.8x 3.0x

(1) Includes $20 million in corporate synergies. |

Value Investor/Growth Operator

Rapidly growing operator of regional gaming properties

Expanding into new markets

Capitalizing on jurisdictional growth opportunities

Slot focus in strong regional drive-to markets

Growing cash flow, well-diversified by market and property

Proven, disciplined acquisition strategy

Successfully integrated three acquisitions in last four years

In each case, reduced total transaction value as multiple of EBITDA in first twelve months of operations

Experienced management team with 10-year track record of building shareholder value

36% compound annual growth in share price since May '94 IPO

Significant near-term growth prospects at Penn National and Argosy Gaming |

INVESTOR RELATIONS

PENN NATIONAL GAMING, INC.

Senior VP and CFO: William Clifford 610.373.2400

Investor Relations: Joseph Jaffoni 212.835.8500 penn@jcir.com

|

Additional Information

In connection with the proposed merger, Argosy Gaming Company (“Argosy”) will file a proxy statement and other relevant documents with the Securities and Exchange Commission (SEC). INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE AS IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER AND RELATED MATTERS. INVESTORS AND SECURITY HOLDERS WILL HAVE ACCESS TO FREE COPIES OF THE PROXY STATEMENT (WHEN AVAILABLE) AND OTHER DOCUMENTS FILED WITH THE SEC BY ARGOSY THROUGH THE SEC WEB SITE AT WWW.SEC.GOV. THE PROXY STATEMENT AND RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE (WHENAVAILABLE) FROM ARGOSY BY DIRECTING A REQUEST TO: Argosy Gaming Company, Attn: Investor Relations Department, 219 Piasa Street, Alton, IL 62002, telephone (618) 474-7500

Argosy and its directors, executive officers, certain members of management and employees, may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Argosy's stockholders in connection with the proposed merger is set forth in Argosy's annual report on Form 10-K for the fiscal year ended December 31, 2003 filed with the SEC on March 12, 2004 and proxy statement for its 2004 annual meeting of stockholders filed with the SEC on March 12, 2004. Additional information will be set forth in the proxy statement when it is filed with the SEC.