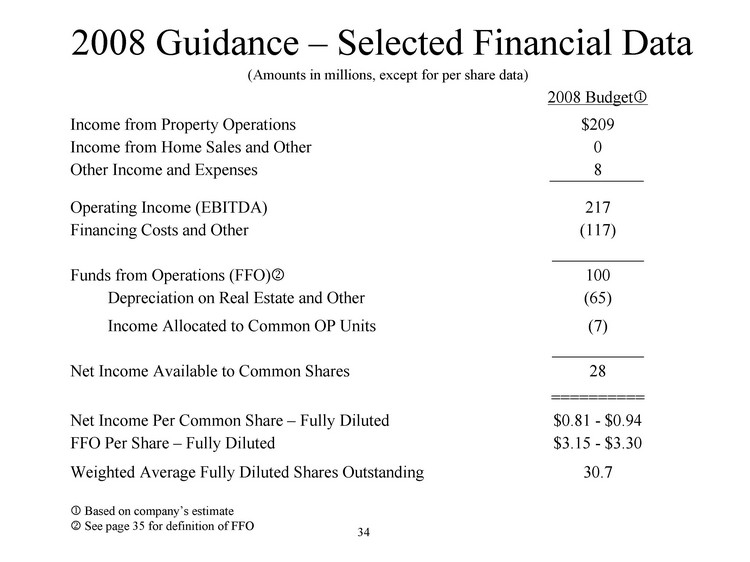

| In an effort to provide additional information regarding the performance of the Company, certain non-GAAP financial measures are used in this presentation. Operating Income is a non-GAAP financial measure. Operating Income is defined as net income, computed in accordance with GAAP, excluding gains or losses from sales of properties, depreciation, interest and related amortization expense, and income taxes. The Company believes that Operating Income is an important indicator because it provides information on our ability to service debt, pay dividends, and fund capital expenditures. Funds From Operations ("FFO") is defined as net income, computed in accordance with GAAP, excluding gains or losses from sales of properties, plus real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. The Company believes that FFO is helpful to investors as one of several measures of the performance of an equity REIT. The Company further believes that by excluding the effect of depreciation, amortization and gains or losses from sales of real estate, all of which are based on historical costs and which may be of limited relevance in evaluating current performance, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. Investors should review FFO, along with GAAP net income and cash flow from operating activities, investing activities and financing activities, when evaluating an equity REIT's operating performance. The Company computes FFO in accordance with standards established by NAREIT, which may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. Investors should review these measures along with GAAP net income and cash flow from operating activities, investing activities and financing activities, when evaluating an equity REIT's operating performance. These do not represent cash generated from operating activities in accordance with GAAP, nor do they represent cash available to pay distributions and should not be considered as an alternative to net income, determined in accordance with GAAP, as an indication of our financial performance, or to cash flow from operating activities, determined in accordance with GAAP, as a measure of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to make cash distributions. Non GAAP Disclosure 35 |