Exhibit 99.1

Exhibit 99.1

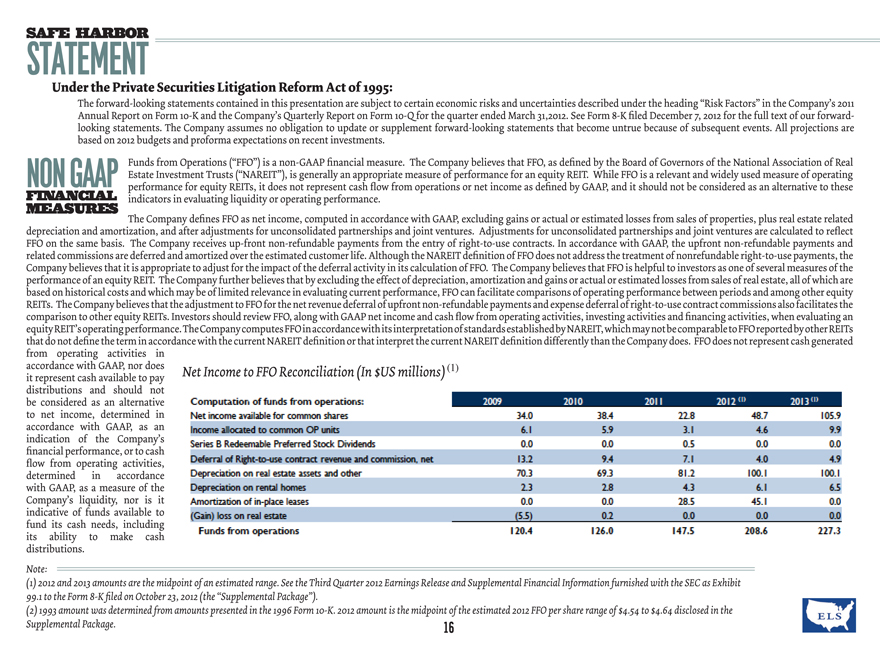

Equity LifeStyle Properties

INVESTOR

PRESENTATION

DECEMBER 2012

Colony Cove | Ellenton, FL

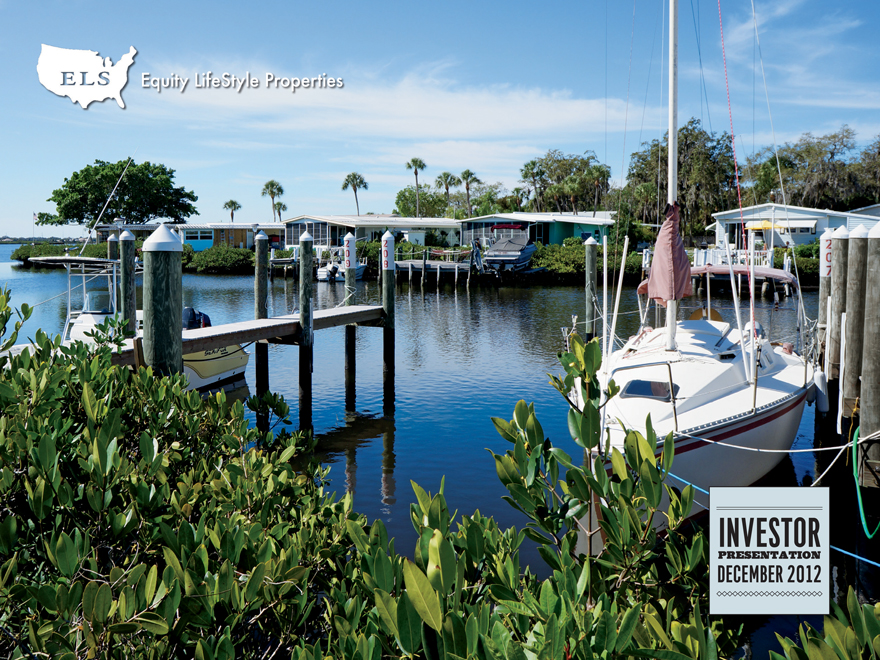

OUR STORY

One of the nation’s largest real estate networks with 382 properties containing over 141,000 sites in 32 states and British Columbia

Unique business model

Own the land

Low maintenance costs/customer turnover costs

Lease developed sites

High-quality real estate locations

>80 properties with lake, river or ocean frontage

>100 properties within 10 miles of coastal United States

Property locations are strongly correlated with population migration

Property locations in retirement and vacation destinations

Stable, Predictable Financial Performance and Fundamentals

Balance Sheet Flexibility

In business for more than 40 years

1

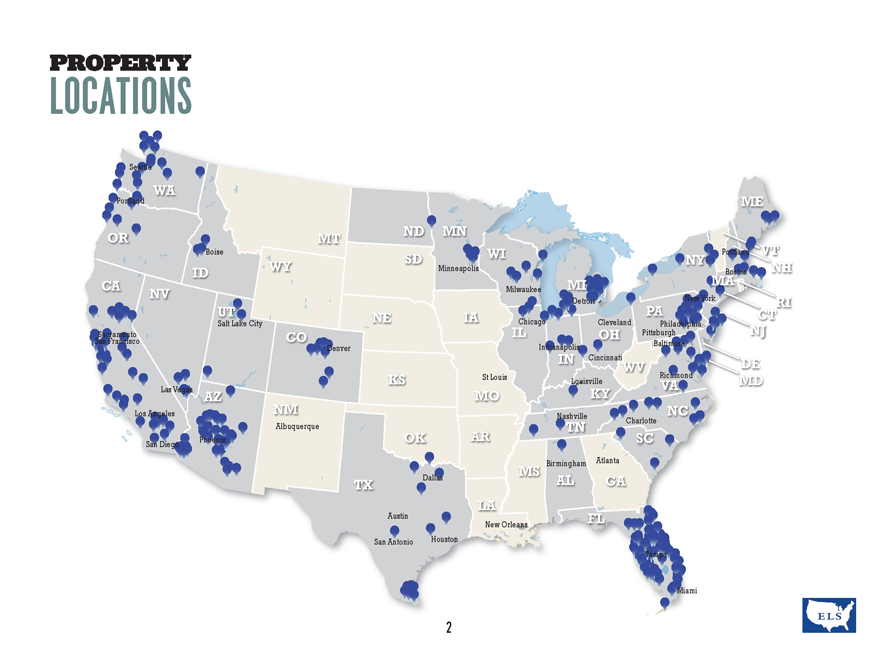

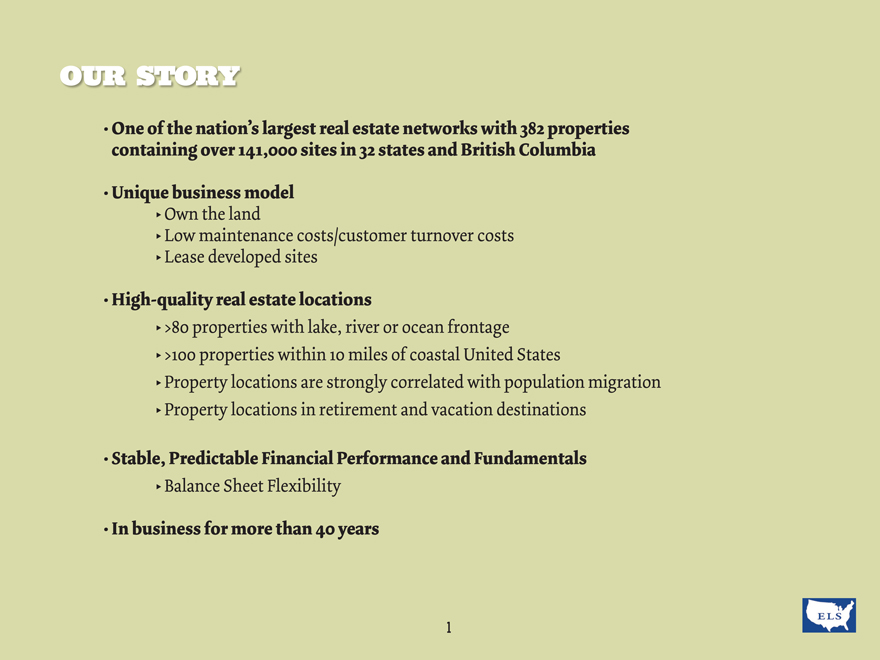

PROPERTY

LOCATIONS

Seattle

WA

Portland ME

ND MN OR MT

Boise SD WI Portland VT

NY

ID WY Minneapolis Boston NH

CA MI MA

NV Milwaukee

Detroit New York RI

UT IA PA CT

Salt Lake City NE Chicago Cleveland

Philadelphia NJ Sacramento CO IL OH Pittsburgh San Francisco Baltimore Denver Indianapolis IN Cincinnati DE

WV

St Louis Richmond

Las Vegas KS Bluegrass Louisville Pkwy VA MD

AZ MO KY

Los Angeles NM NC Nashville Charlotte Albuquerque TN

Phoenix OK AR SC San Diego MS Birmingham Atlanta

TX Dallas AL GA

Austin LA FL New Orleans San Antonio Houston

F l o r

Tampa i da’ s

Tpk

Pkwy Miami

2

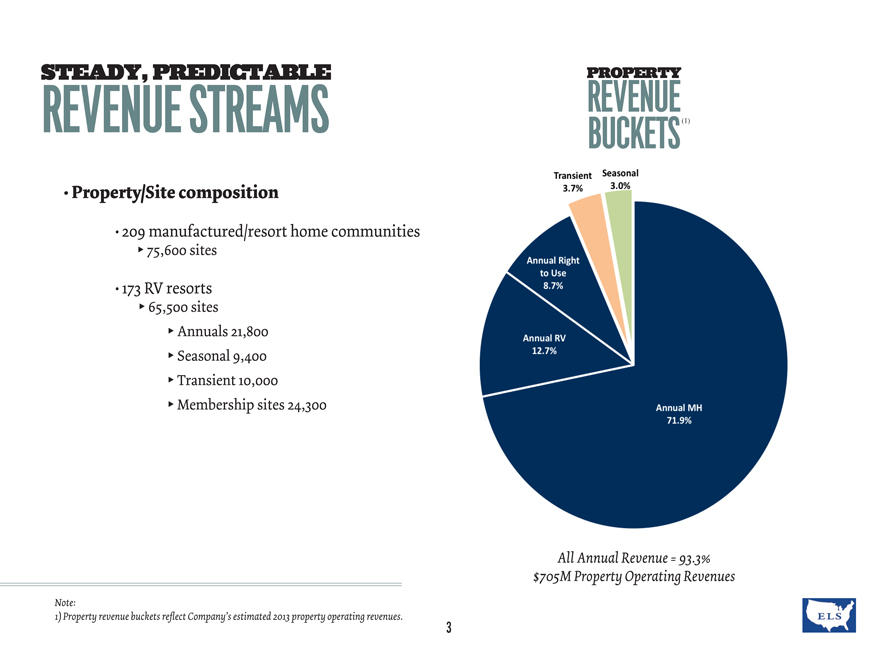

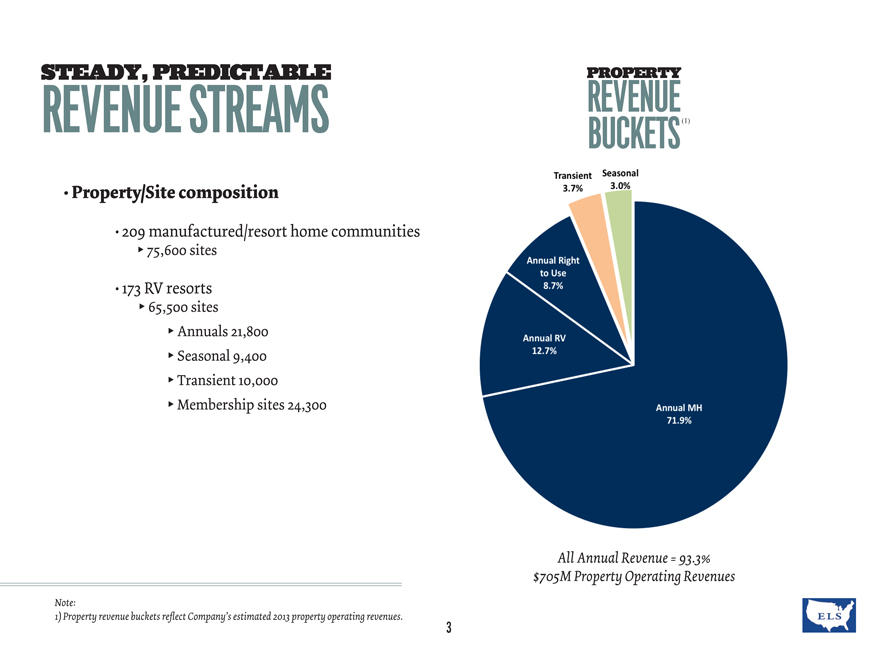

STEADY, PREDICTABLE

REVENUE STREAMS

Property/Site composition

209 manufactured/resort home communities

75,600 sites

173RV resorts

65,500 sites

Annuals 21,800

Seasonal 9,400

Transient 10,000

Membership sites 24,300

PROPERTY

REVENUE BUCKETS(1)

Transient

3.7%

Seasonal

3.0%

Annual Right to Use

8.7%

Annual RV

12.7%

Annual MH

71.9%

Note:

1) Property revenue buckets reflect Company’s estimated 2013 property operating revenues.

All Annual Revenue = 93.3% $705M Property Operating Revenues

3

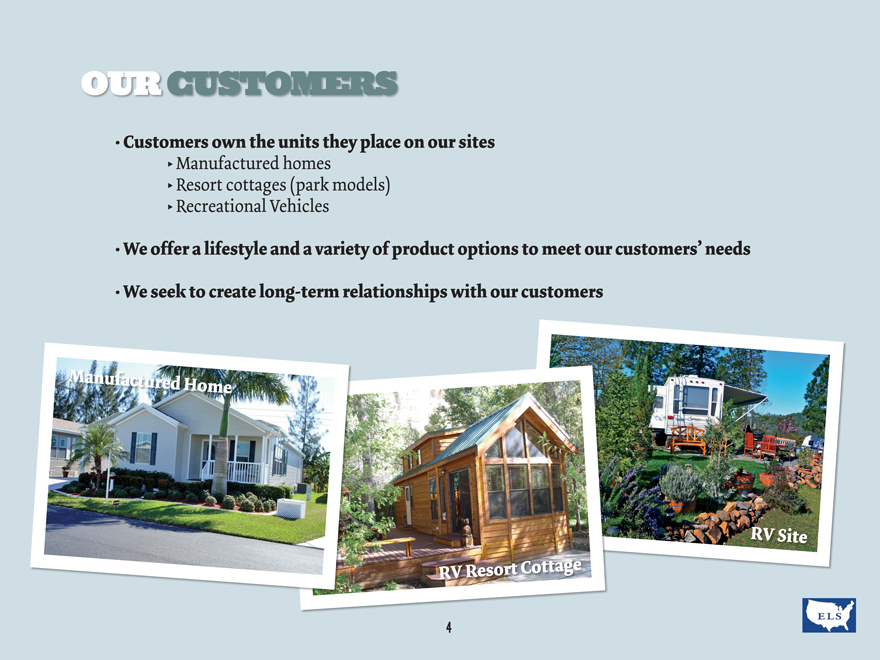

OUR CUSTOMERS

Customers own the units they place on our sites

Manufactured homes

Resort cottages (park models) Recreational Vehicles

We offer a lifestyle and a variety of product options to meet our customers’ needs

We seek to create long-term relationships with our customers

Manufactured Home

RV Resort Cottage

RV Site

4

FAVORABLE CUSTOMER DEMOGRAPHICS

80M Baby Boomers

The population of people 50-74 is expected to grow 24% from 2010 to 2025.

U.S. Population Over Age 50 (in millions)

100M

80M

60M 40M 20M

2010 2015 2020 2025

Ages 50-54 55-59 60-64 65-69 70-74

RV Owners

8M-9MRV Owners

192KRVsales in 2011

Average of 42KRV

Owners within 100 miles of each ELS

Resort

Note:

Sources: University of Michigan’s Survey Research Center 2005, Acxiom 2009, Statistical Surveys 2011, US Census 2008.

5

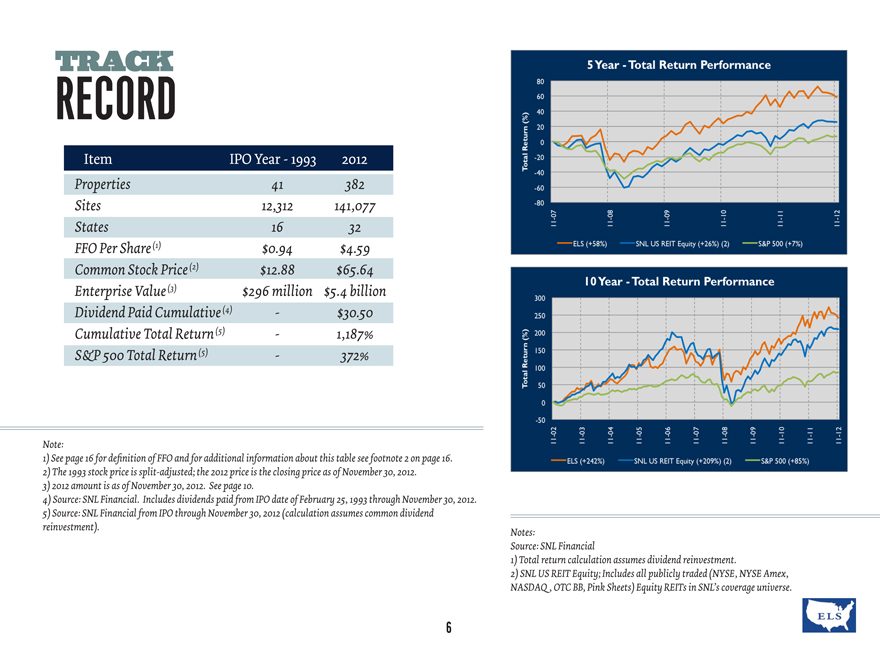

TRACK

RECORD

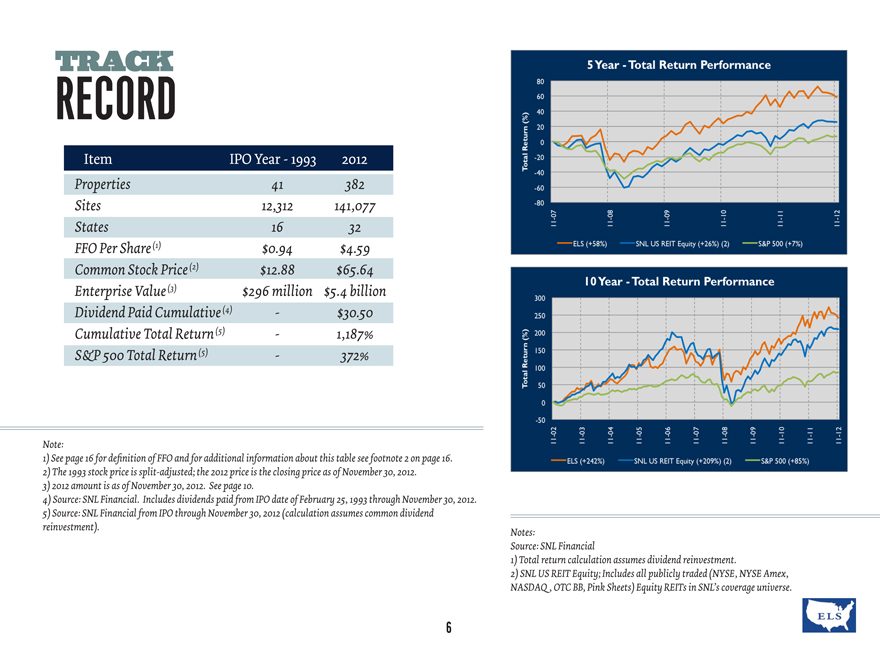

Item IPO Year-1993 2012

Properties 41 382

Sites 12,312 141,077

States 16 32

FFO Per Share (1) $0.94 $4.59

Common Stock Price (2) $12.88 $65.64

Enterprise Value (3) $296 million $5.4 billion

Dividend Paid Cumulative (4) — $30.50

Cumulative Total Return (5) — 1,187%

S&P 500 Total Return (5) — 372%

Note:

1) See page 16 for definition of FFO and for additional information about this table see footnote 2 on page 16.

2) The 1993 stock price is split-adjusted; the 2012 price is the closing price as of November 30, 2012.

3) 2012 amount is as of November 30, 2012. See page 10.

4) Source: SNL Financial. Includes dividends paid from IPO date of February 25, 1993 through November 30, 2012.

5) Source: SNL Financial from IPO through November 30, 2012 (calculation assumes common dividend

reinvestment).

5 Year – Total Return Perfomance

Total Return (%)

80

60

40

20

0

-20

-40

-60

-80

11-07 11-08 11-09 11-10 11-11 11-12

ELS (+58%) SNL US REIT Equity (+26%) (2) S&P 500 (+7%)

10 Year – Total Return Performance

Total Return (%)

300

250

200

150

100

50

0

-50

11-02 11-03 11-04 11-05 11-06 11-07 11-08 11-09 11-10 11-11 11-12

ELS (+242%) SNL US REIT Equity (+20%) (2) S&P 500 (+85%)

Notes:

Source: SNL Financial

1) Total return calculation assumes dividend reinvestment.

2) SNL US REIT Equity; Includes all publicly traded (NYSE, NYSE Amex, NASDAQ , OTC BB, Pink Sheets) Equity REITs in SNL’s coverage universe.

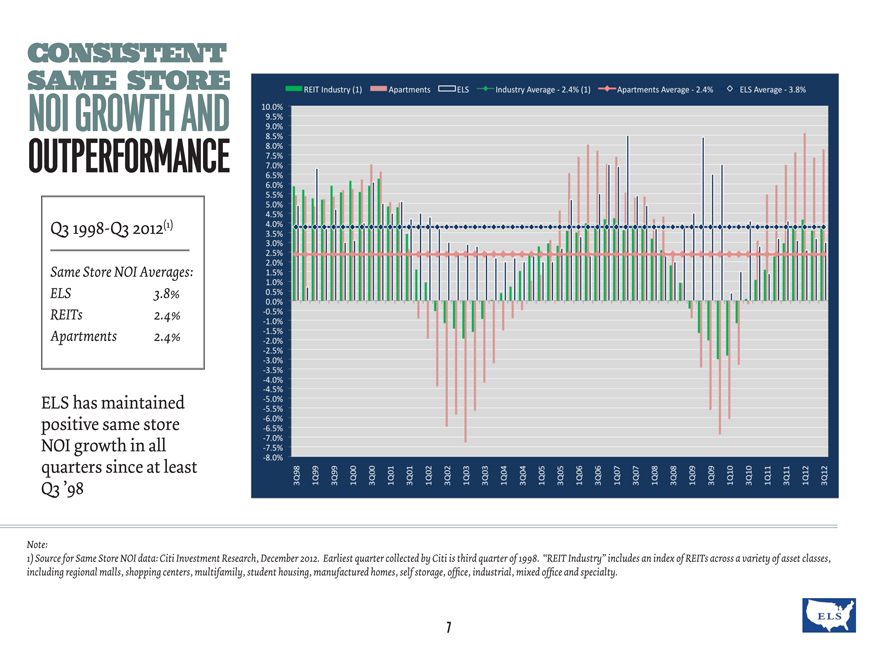

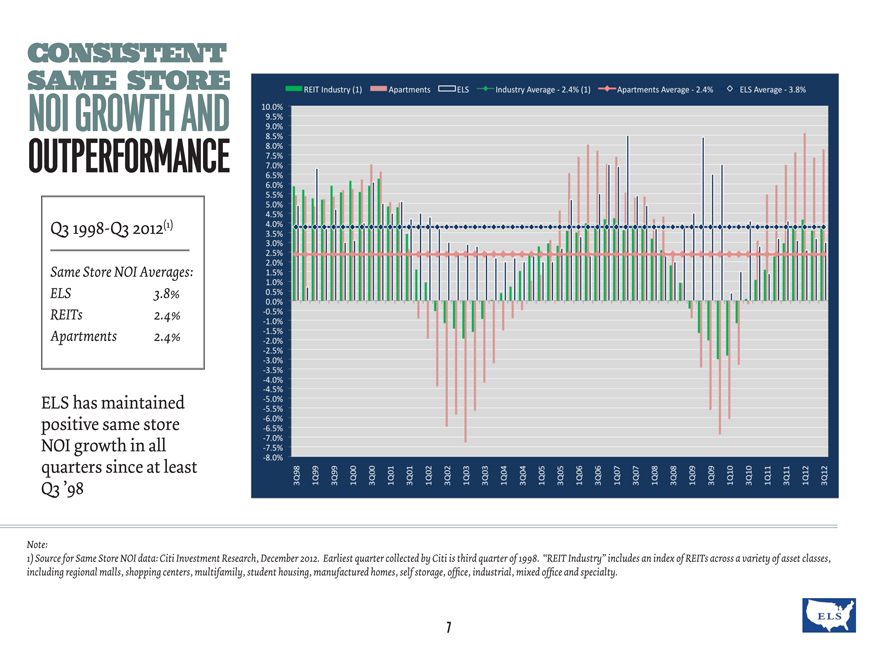

CONSISTENT

NOI SAME GROWTH STORE AND

OUT PERFORMANCE

Q31998-Q32012(1)

Same Store NOI Averages:

ELS 3.8%

REITs 2.4%

Apartments 2.4%

ELS has maintained positive same store NOI growth in all quarters since at least

Q3’98

10.0% 9.5% 9.0% 8.5% 8.0% 7.5% 7.0% 6.5% 6.0% 5.5% 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% -0.5% -1.0% -1.5% -2.0% -2.5% -3.0% -3.5% -4.0% -4.5% -5.0% -5.5% -6.0% -6.5% -7.0% -7.5% -8.0%

REIT Industry (1) Apartments ELS Industry Average – 2.4% (1) Apartments Average – 2.4% ELS Average – 3.8%

3Q98 1Q99 3Q99 1Q00 3Q00 1Q01 3Q01 1Q02 3Q02 1Q03 3Q03 1Q04 3Q04 1Q05 3Q05 1Q06 3Q06 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 1Q11 3Q11 1Q12 3Q12

Note:

1) Source for Same Store NOI data: Citi Investment Research, December 2012. Earliest quarter collected by Citi is third quarter of 1998. “REIT Industry” includes an index of REITs across a variety of asset classes, including regional malls, shopping centers, multifamily, student housing, manufactured homes, self storage, office, industrial, mixed office and specialty.

7

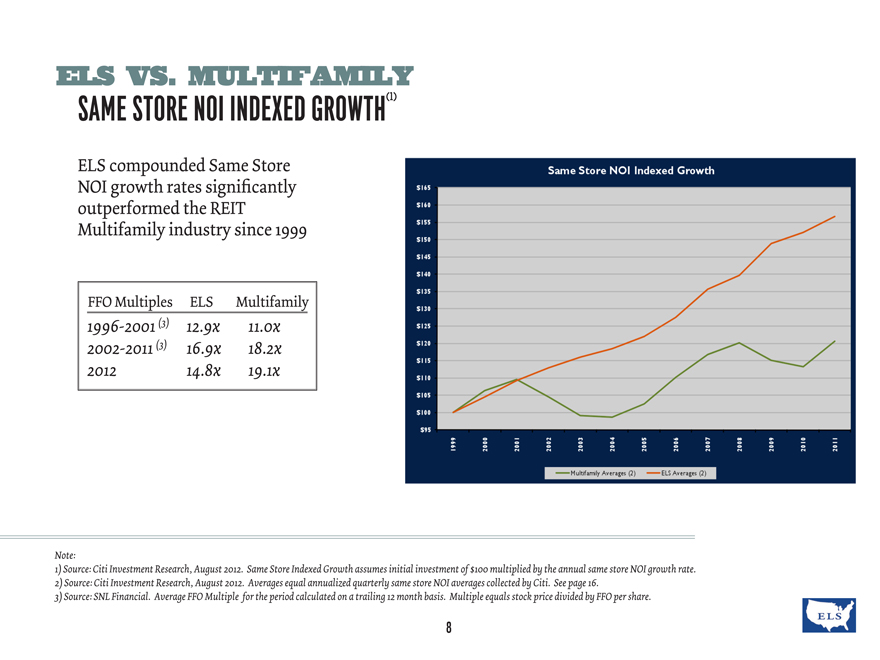

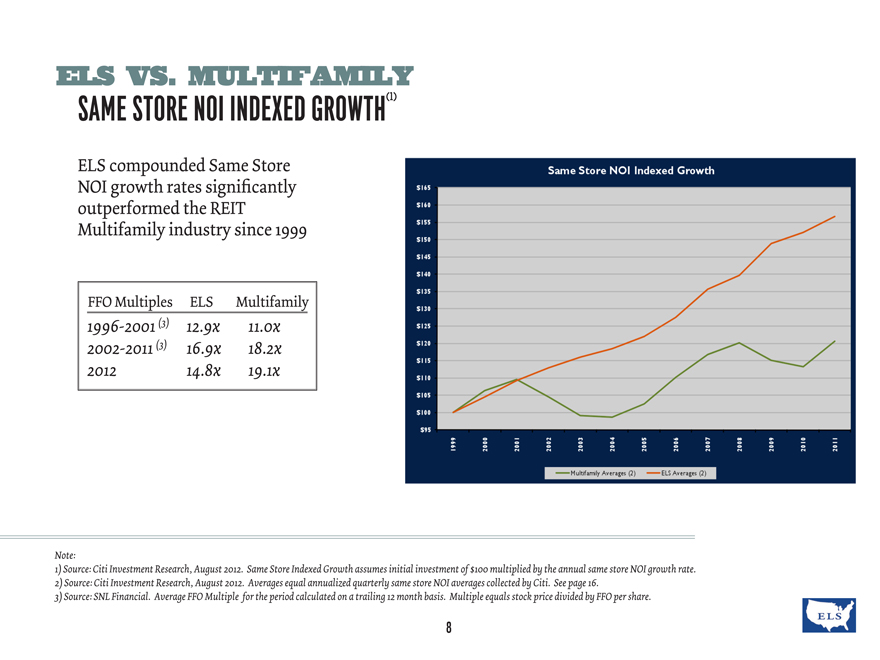

ELS VS. MULTIFAMILY

SAME STORE NOI INDEXED GROWTH(1)

ELS compounded Same Store NOI growth rates significantly outperformed the REIT Multifamily industry since 1999

FFO Multiples ELS Multifamily

1996-2001 (3) 12.9x 11.0x

2002-2011 (3) 16.9x 18.2x

2012 14.8x 19.1x

Same Store NOI Indexed Growth

$165 $160 $155 $150 $145 $140 $135 $130 $125 $120 $115 $110 $105 $100 $95

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Multifamily Average (2) ELS Average (2)

Note:

1) Source: Citi Investment Research, August 2012. Same Store Indexed Growth assumes initial investment of $100 multiplied by the annual same store NOI growth rate.

2) Source: Citi Investment Research, August 2012. Averages equal annualized quarterly same store NOI averages collected by Citi. See page 16.

3) Source: SNL Financial. Average FFO Multiple for the period calculated on a trailing 12 month basis. Multiple equals stock price divided by FFO per share.

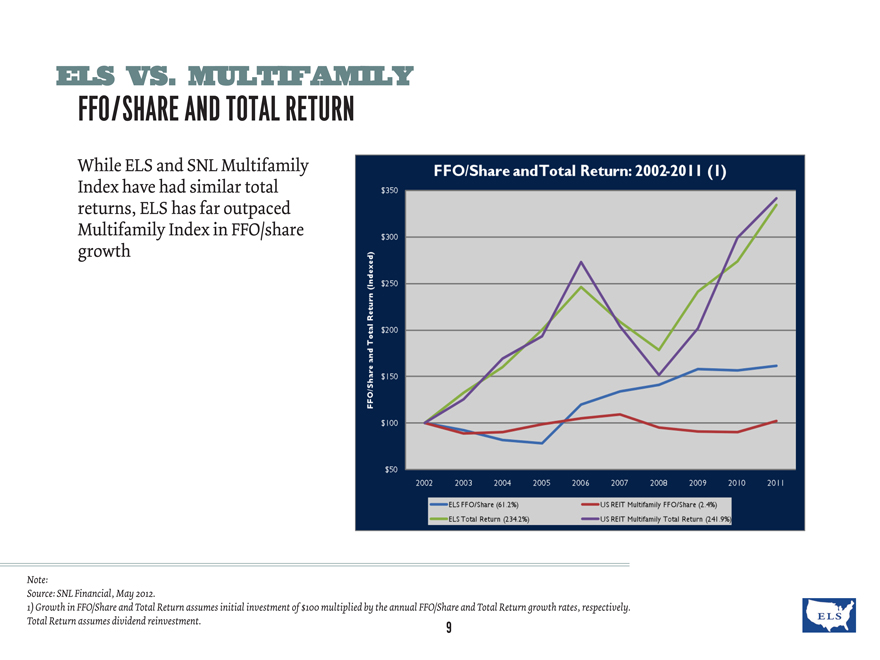

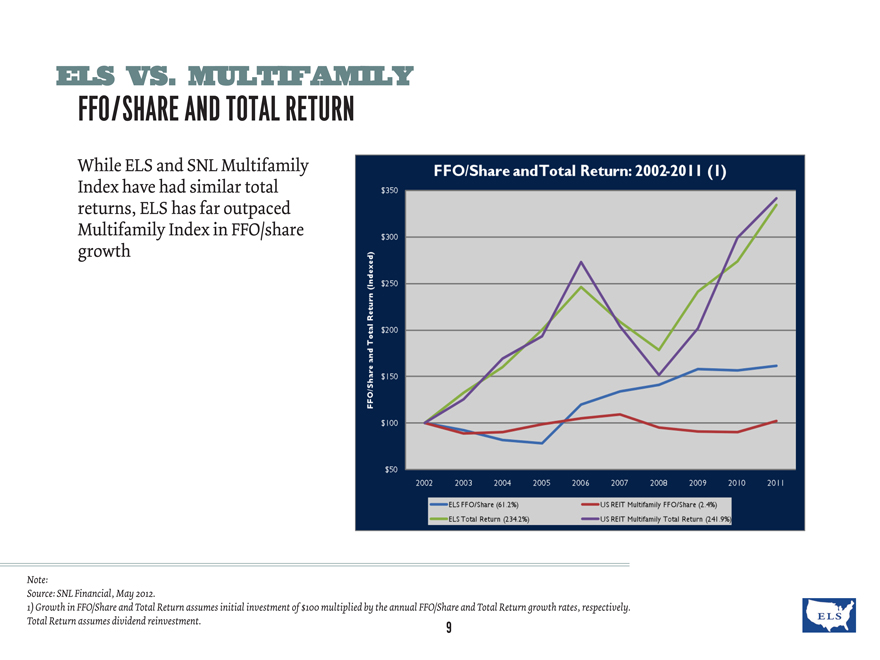

ELS VS. MULTIFAMILY

FFO/SHARE AND TOTAL RETURN

While ELS and SNL Multifamily Index have had similar total returns, ELS has far outpaced Multifamily Index in FFO/share growth

FFO/Share and Total Return: 2002-2011 (1)

FFO/Share and Total Return (Indexed)

$350 $300 $250 $200 $150 $100 $50 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

ELS FFO/Share (61.2%) US REIT Multifamily FFO/Share (2.4%)

ELS Total Return (234.2%) US REIT Multifamily Total Return (241.9%)

Note:

Source: SNL Financial, May 2012.

1) Growth in FFO/Share and Total Return assumes initial investment of $100 multiplied by the annual FFO/Share and Total Return growth rates, respectively.

Total Return assumes dividend reinvestment.

9

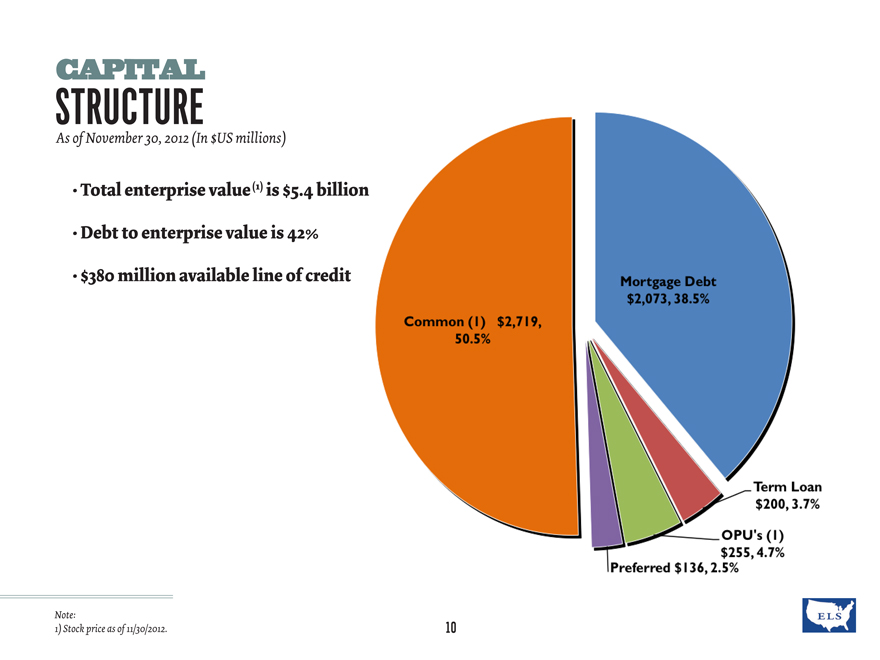

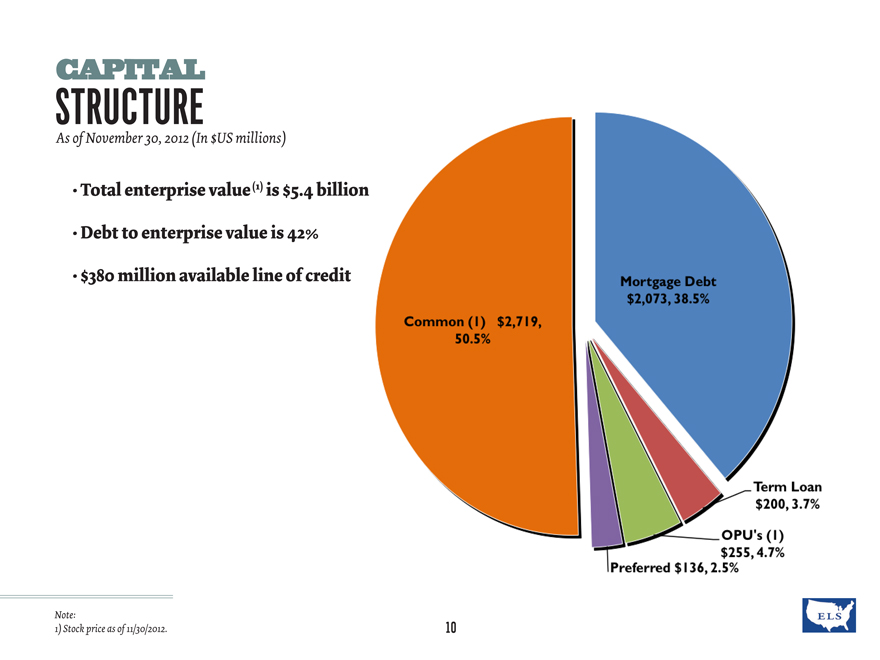

CAPITAL

STRUCTURE

As of November 30, 2012 (In $US millions)

Total enterprise value (1) is $5.4 billion

Debt to enterprise value is 42%

$380 million available line of credit

Common (1) $2,719, 50.5%

Mortgage Debt

$2,073, 38.5%

Term Loan $200, 3.7%

OPU’s (1) $255, 4.7%

Preferred $136, 2.5%

Note:

1) Stock price as of 11/30/2012.

10

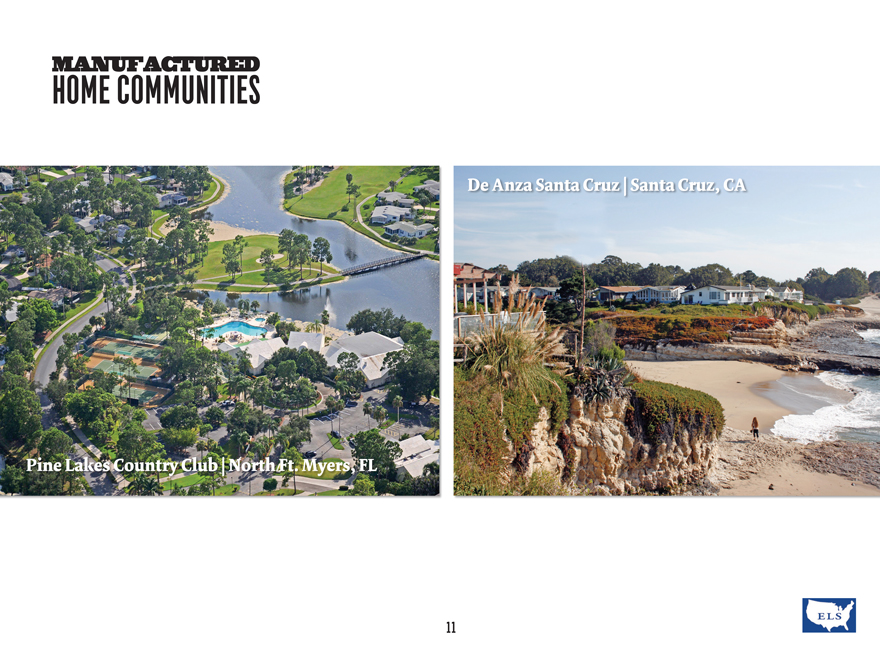

MANUFACTURED

HOME COMMUNITIES

Pine Lakes Country Club | North Ft. Myers, FL

De Anza Santa Cruz | Santa Cruz, CA

11

MANUFACTURED

HOME COMMUNITIES

Casa del Sol East | Glendale, AZ

Coral Cay | Margate, FL

12

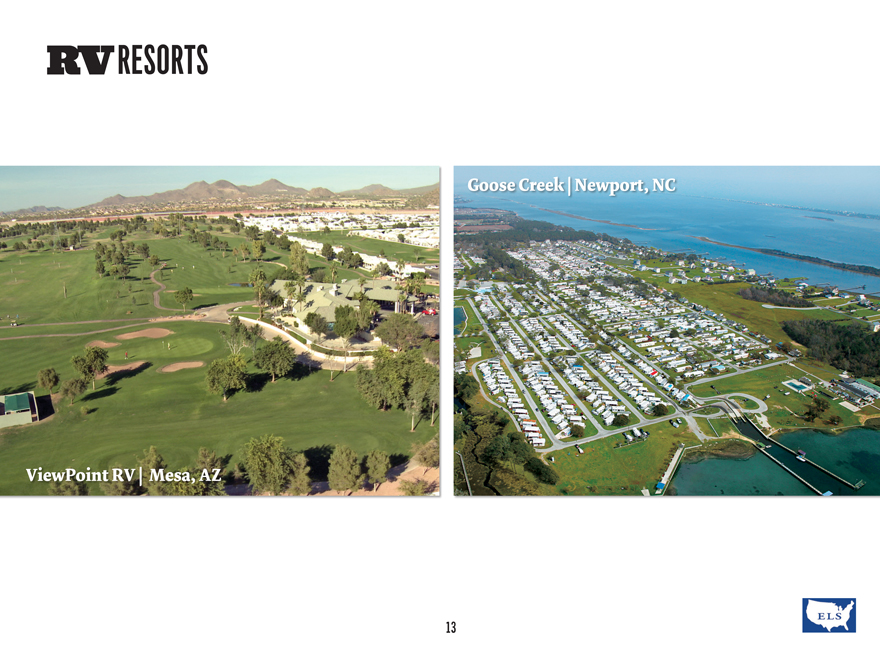

RV RESORTS

View Point RV | Mesa, AZ

Goose Creek | Newport, NC

13

RV RESORTS

Hidden Cove at Lake Conroe | Willis, TX

Gulf View | Punta Gorda, FL

14

OUR LIFESTYLE

Monte Vista | Mesa, AZ

Pine Lakes Country Club | North Ft. Myers, FL

15

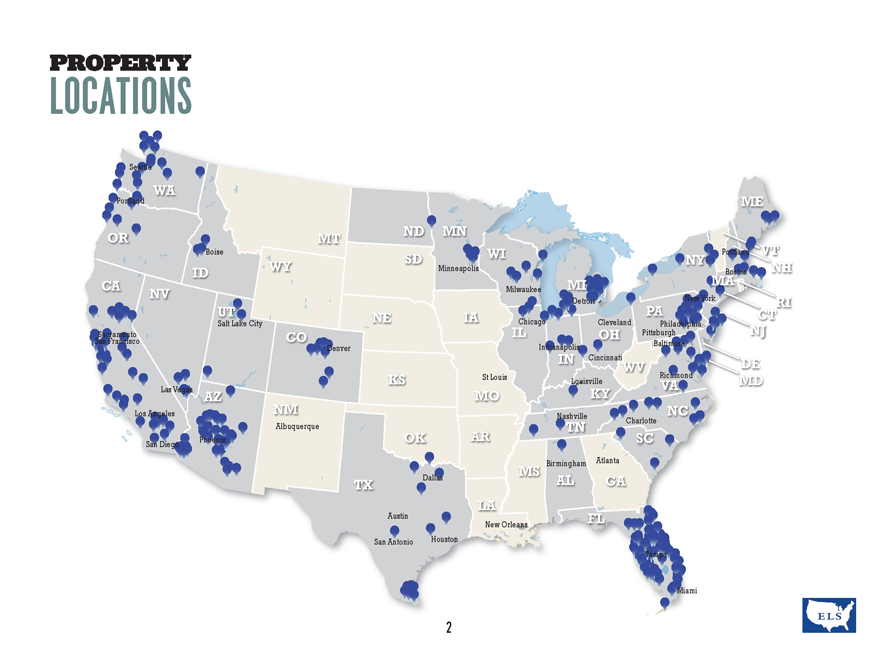

STATEMENT SAFE HARBOR

Under the Private Securities Litigation Reform Act of 1995:

The forward-looking statements contained in this presentation are subject to certain economic risks and uncertainties described under the heading “Risk Factors” in the Company’s 2011 Annual Report on Form 10-K and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2012. See Form 8-K filed December 7, 2012 for the full text of our forward-looking statements. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events. All projections are based on 2012 budgets and proforma expectations on recent investments.

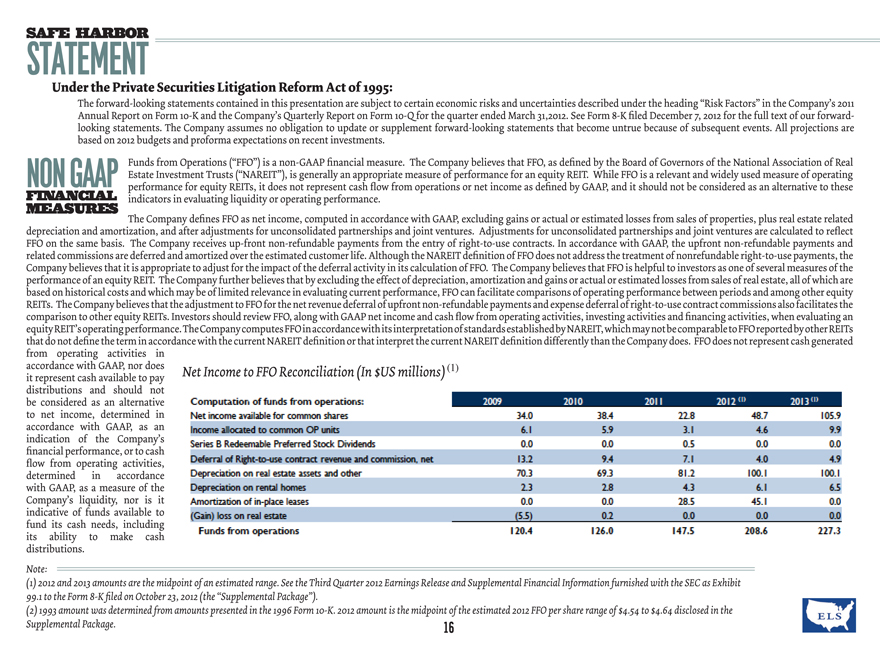

Funds from Operations (“FFO”) is a non-GAAP financial measure. The Company believes that FFO, as defined by the Board of Governors of the National Association of Real NON GAAP Estate Investment Trusts (“NAREIT”), is generally an appropriate measure of performance for an equity REIT. While FFO is a relevant and widely used measure of operating FINANCIAL performance for equity REITs, it does not represent cash flow from operations or net income as defined by GAAP, and it should not be considered as an alternative to these MEASURES indicators in evaluating liquidity or operating performance.

The Company defines FFO as net income, computed in accordance with GAAP, excluding gains or actual or estimated losses from sales of properties, plus real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and jointventures are calculated to reflect FFO on the same basis. The Company receives up-front non-refundable payments from the entry of right-to-use contracts. In accordance with GAAP, the upfront non-refundable payments and related commissions are deferred and amortized over the estimated customer life. Although the NAREIT definition of FFO does not address the treatment of nonrefundable right-to-use payments, the Company believes that it is appropriate to adjust for the impact of the deferral activity in its calculation of FFO. The Company believes that FFO is helpful to investors as one of several measures of the performance of an equity REIT. The Company further believes that by excluding the effect of depreciation, amortization and gains or actual or estimated losses from sales of real estate, all of which are based on historical costs and which may be of limited relevance in evaluating current performance, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. The Company believes that the adjustment to FFO for the net revenue deferral of up front non-refundable payments and expense deferral of right-to-use contract commissions also facilitates the comparison to other equity REITs. Investors should review FFO, along with GAAP net income and cash flow from operating activities, investing activities and financing activities, when evaluating an equity REIT ’s operating performance. The Company computes FFO in accordance with its interpretation of standards established by NAREIT, which may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than the Company does. FFO does not represent cash generated from operating activities in accordance with GAAP, nor does it represent cash available to pay distributions and should not be considered as an alternative to net income, determined in accordance with GAAP, as an indication of the Company’s financial performance, or to cash flow from operating activities, determined in accordance with GAAP, as a measure of the Company’s liquidity, nor is it indicative of funds available to fund its cash needs, including its ability to make cash distributions.

Note:

(1) 2012 and 2013 amounts are the midpoint of an estimated range. See the Third Quarter 2012 Earnings Release and Supplemental Financial Information furnished with the SEC as Exhibit 99.1 to the Form 8-K filed on October 23, 2012 (the “Supplemental Package”).

(2) 1993 amount was determined from amounts presented in the 1996 Form 10-K. 2012 amount is the midpoint of the estimated 2012 FFO per share range of $4.54 to $4.64 disclosed in the Supplemental Package.

Net Income to FFO Reconciliation (In $US millions) (1)

Computation of funds from operations: 2009 2010 2011 2012 (1) 2013 (1)

Net Income available for common shares 34.0 38.4 22.8 48.7 105.9

Income allocated to common OP units 6.1 5.9 3.1 4.6 9.9

Series B Redeemable Preferred Stock Dividends 0.0 0.0 0.5 0.0 0.0

Deferral of Right-to-use contract revenue and commission, net 13.2 9.4 7.1 4.0 4.9

Depreciation on real estate assets and other 70.3 69.3 81.2 100.1 100.1

Depreciation on rental homes 2.3 2.8 4.3 6.1 6.5

Amortization of in-place leases 0.0 0.0 28.5 45.1 0.0

(Gain) loss on real estate (5.5) 0.2 0.0 0.0 0.0

Funds from operations 120.4 126.0 147.5 208.6 227.3

16

Monte Vista | Mesa, AZ