Exhibit 99.1

Exhibit 99.1

Equity LifeStyle Properties

Our Story

One of the nation’s largest real estate networks with 390 properties containing 145,804 sites in 32 states and British Columbia

Unique business model

Own the land

Low maintenance costs/customer turnover costs

Lease developed sites

High-quality real estate locations

More than 80 properties with lake, river or ocean frontage

More than 100 properties within 10 miles of coastal United States

Property locations are strongly correlated with population migration

Property locations in retirement and vacation destinations

Stable, predictable financial performance and fundamentals

Balance sheet flexibility

In business for more than 40 years

1

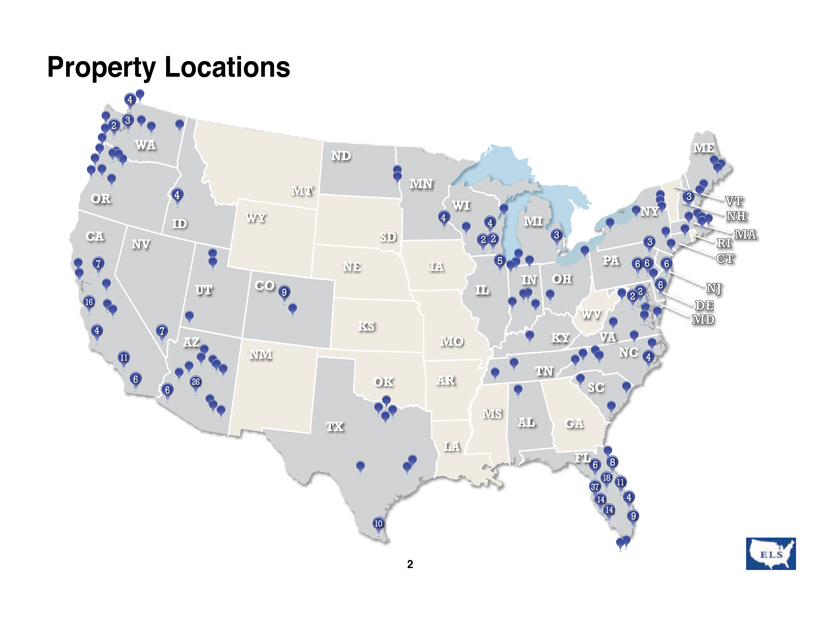

Property Locations

4 3 2

WA ME ND MN

4 MT 3 OR VT

WI NY

WY 4 MI NH ID 4 CA SD 2 2 3 MA CT

NV 3 RI

7 NE IA 5 PA 6 6 6 IN OH

UT CO IL 6 NJ

9 2 2

16 WV DE MD

4 7 KS

AZ MO KY VA

11 NM NC 4 TN

6 26 OK AR

6 SC

MS

TX AL GA LA

FL 8

6

18 11 37

14 4 14

9

10

2

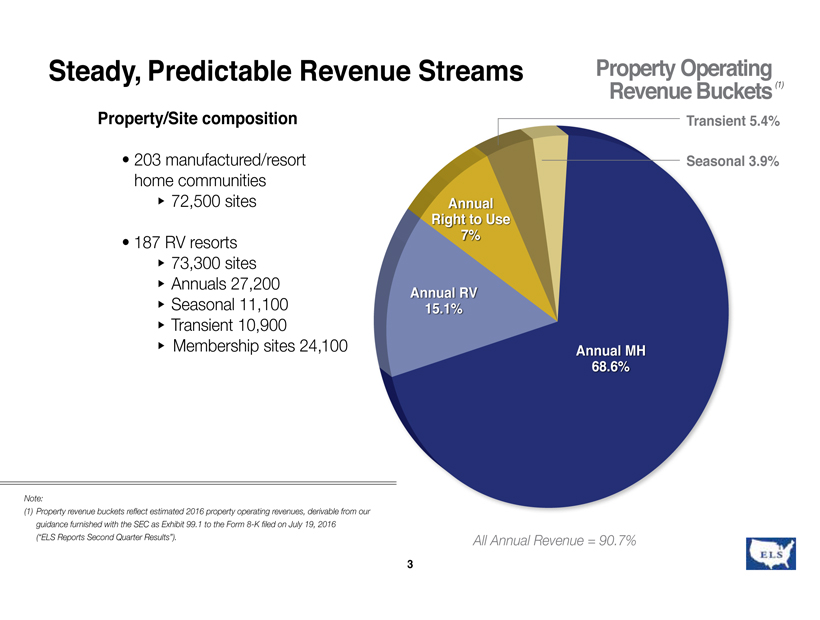

Steady, Predictable Revenue Streams

Property/Site composition

203 manufactured/resort home communities

72,500 sites

187 RV resorts

73,300 sites

Annuals 27,200

Seasonal 11,100

Transient 10,900

Membership sites 24,100

Property Operating Revenue Buckets(1)

Transient 5.4%

Seasonal 3.9%

Annual Right to Use 7%

Annual RV 15.1%

Annual MH 68.6%

Note:

(1) Property revenue buckets reflect estimated 2016 property operating revenues, derivable from our guidance furnished with the SEC as Exhibit 99.1 to the Form 8-K filed on July 19, 2016 (“ELS Reports Second Quarter Results”).

All Annual Revenue = 90.7%

3

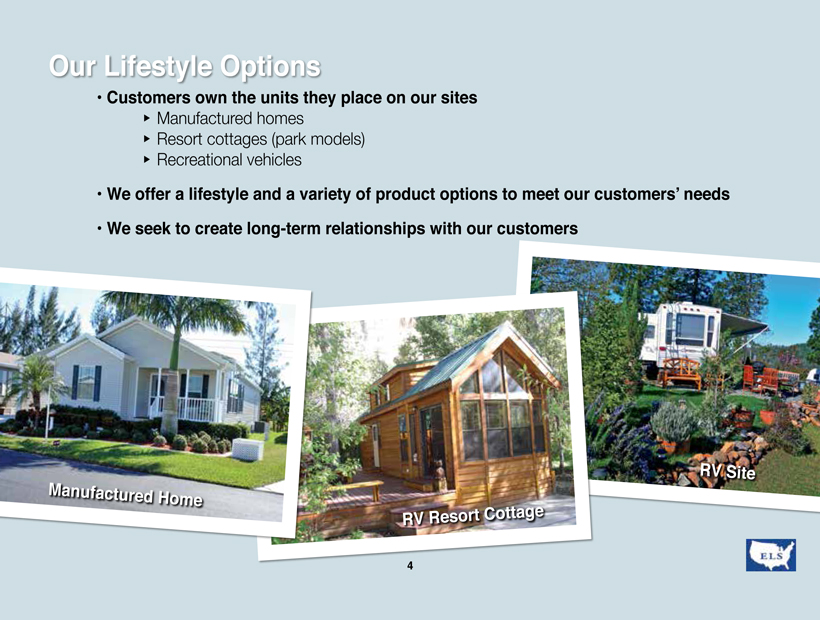

Our Lifestyle Options

Customers own the units they place on our sites

Manufactured homes

Resort cottages (park models)

Recreational vehicles

We offer a lifestyle and a variety of product options to meet our customers’ needs

We seek to create long-term relationships with our customers

RV Site

Manufactured Home

RV Resort Cottage

4

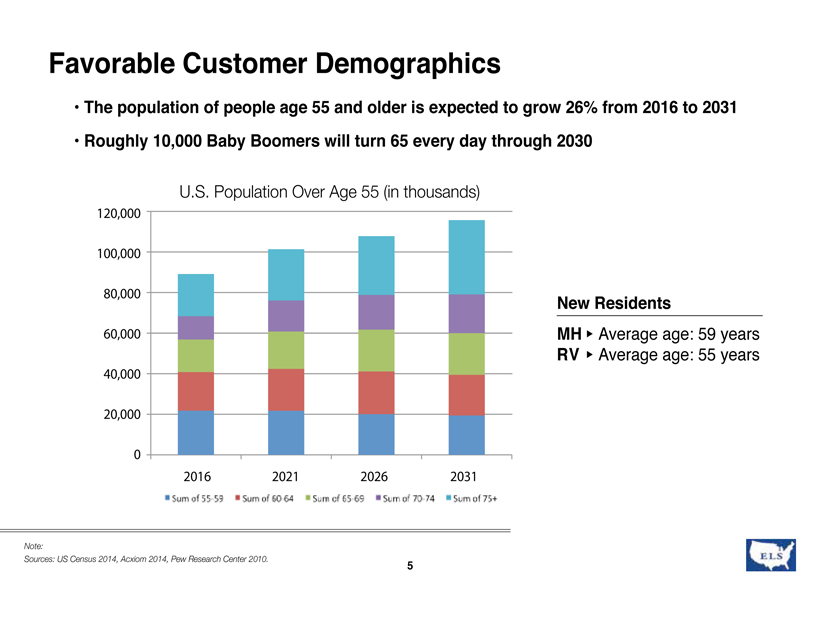

Favorable Customer Demographics

The population of people age 55 and older is expected to grow 26% from 2016 to 2031

Roughly 10,000 Baby Boomers will turn 65 every day through 2030

U.S. Population Over Age 55 (in thousands)

120,000 100,000 80,000 60,000 40,000 20,000 0

2016 2021 2026 2031

Sum of 55-59

Sum of 60-64

Sum of 65-69

Sum of 70-74

Sum of 75+

New Residents

MH Average age: 59 years

RV Average age: 55 years

Note:

Sources: US Census 2014, Acxiom 2014, Pew Research Center 2010.

5

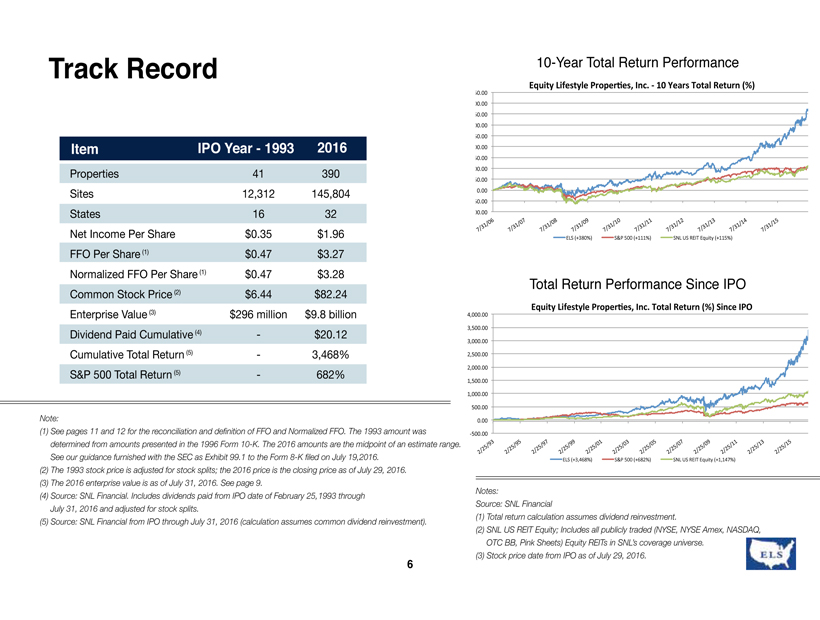

Track Record

Item IPO Year—1993 2016

Properties 41 390

Sites 12,312 145,804

States 16 32

Net Income Per Share $0.35 $1.96

FFO Per Share (1) $0.47 $3.27

Normalized FFO Per Share (1) $0.47 $3.28

Common Stock Price (2) $6.44 $82.24

Enterprise Value (3) $296 million $9.8 billion

Dividend Paid Cumulative (4)—$20.12

Cumulative Total Return (5)—3,468%

S&P 500 Total Return (5)—682%

Note:

(1) See pages 11 and 12 for the reconciliation and definition of FFO and Normalized FFO. The 1993 amount was determined from amounts presented in the 1996 Form 10-K. The 2016 amounts are the midpoint of an estimate range. See our guidance furnished with the SEC as Exhibit 99.1 to the Form 8-K filed on July 19,2016.

(2) The 1993 stock price is adjusted for stock splits; the 2016 price is the closing price as of July 29, 2016. (3) The 2016 enterprise value is as of July 31, 2016. See page 9.

(4) Source: SNL Financial. Includes dividends paid from IPO date of February 25, 1993 through July 31, 2016 and adjusted for stock splits.

(5) Source: SNL Financial from IPO through July 31, 2016 (calculation assumes common dividend reinvestment).

10-Year Total Return Performance

Equity

Lifestyle

Proper1es,

Inc.

--?

10

Years

Total

Return

(%)

450.00

400.00

350.00

300.00

250.00

200.00

150.00

100.00

50.00

0.00

50.00

100.00

7/31/06

7/31/07

7/31/08

7/31/09

7/31/10

7/31/11

7/31/12

7/31/13

7/31/14

7/31/15

ELS

(+380%)

S&P

500

(+111%)

SNL

US

REIT

Equity

(+115%)

Total Return Performance Since IPO

Equity

Lifestyle

Proper1es,

Inc.

Total

Return

(%)

Since

IPO

4,000.00

3,500.00

3,000.00

2,500.00

2,000.00

1,500.00

1,000.00

500.00

0.00

--?500.00

2/25/93

2/25/95

2/25/97

2/25/99

2/25/01

2/25/03

2/25/05

2/25/07

2/25/09

2/25/11

2/25/13

2/25/15

ELS

(+3,468%)

S&P

500

(+682%)

SNL

US

REIT

Equity

(+1,147%)

Notes:

Source: SNL Financial

(1) Total return calculation assumes dividend reinvestment.

(2) SNL US REIT Equity; Includes all publicly traded (NYSE, NYSE Amex, NASDAQ, OTC BB, Pink Sheets) Equity REITs in SNL’s coverage universe.

(3) Stock price date from IPO as of July 29, 2016.

6

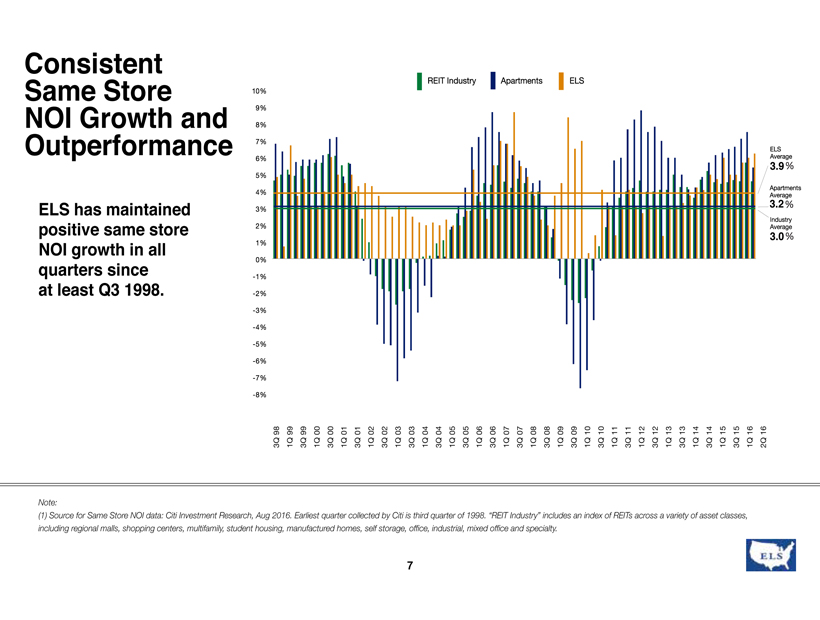

Consistent

Same Store

NOI Growth and

Outperformance

ELS has maintained

positive same store

NOI growth in all

quarters since

at least Q3 1998.

Note:

(1) Source for Same Store NOI data: Citi Investment Research, Aug 2016. Earliest quarter collected by Citi is third quarter of 1998. “REIT Industry” includes an index of REITs across a variety of asset classes,

including regional malls, shopping centers, multifamily, student housing, manufactured homes, self storage, office, industrial, mixed office and specialty.

REIT Industry Apartments ELS

ELS Average 3.9%

Apartments Average 3.2%

Industry Average 3.0%

10% 9% 8% 7% 6% 5% 4% 3% 2% 1% 0% -1% -2% -3% -4% -5% -6% -7% -8%

7

3.2

3.9

3.0

3Q 98

1Q 99

3Q 99

1Q 00

3Q 00

1Q 01

3Q 01

1Q 02

3Q 02

1Q 03

3Q 03

1Q 04

3Q 04

1Q 05

3Q 05

1Q 06

3Q 06

1Q 07

3Q 07

1Q 08

3Q 08

1Q 09

3Q 09

1Q 10

3Q 10

1Q 11

3Q 11

1Q 12

3Q 12

1Q 13

3Q 13

1Q 14

3Q 14

1Q 15

3Q 15

1Q 16

2Q 16

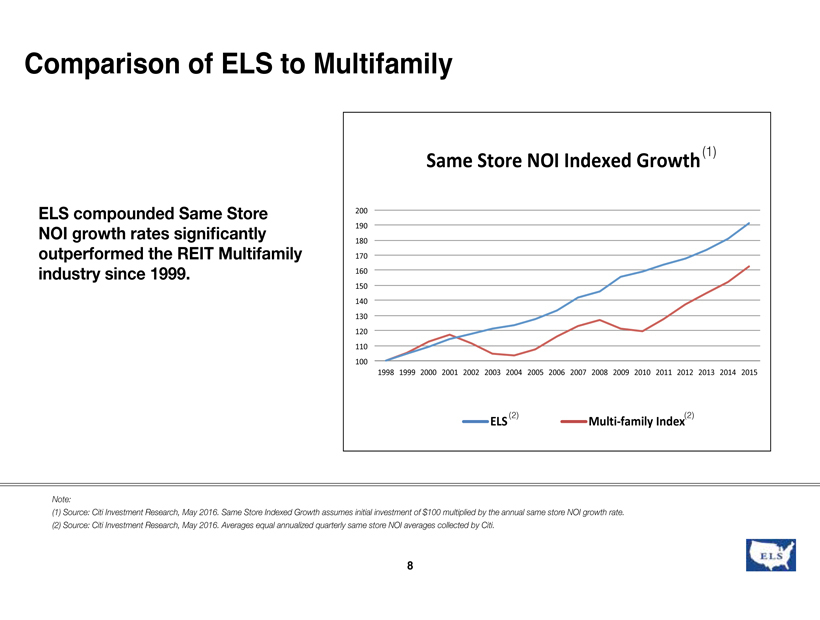

Comparison of ELS to Multifamily

ELS compounded Same Store NOI growth rates significantly outperformed the REIT Multifamily industry since 1999.

Note:

(1) Source: Citi Investment Research, May 2016. Same Store Indexed Growth assumes initial investment of $100 multiplied by the annual same store NOI growth rate.

(2) Source: Citi Investment Research, May 2016. Averages equal annualized quarterly same store NOI averages collected by Citi.

100

110

120

130

140

150

160

170

180

190

200

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Same Store NOI Indexed Growth (1)

Multi-family Index (2) ELS Index (2)

8

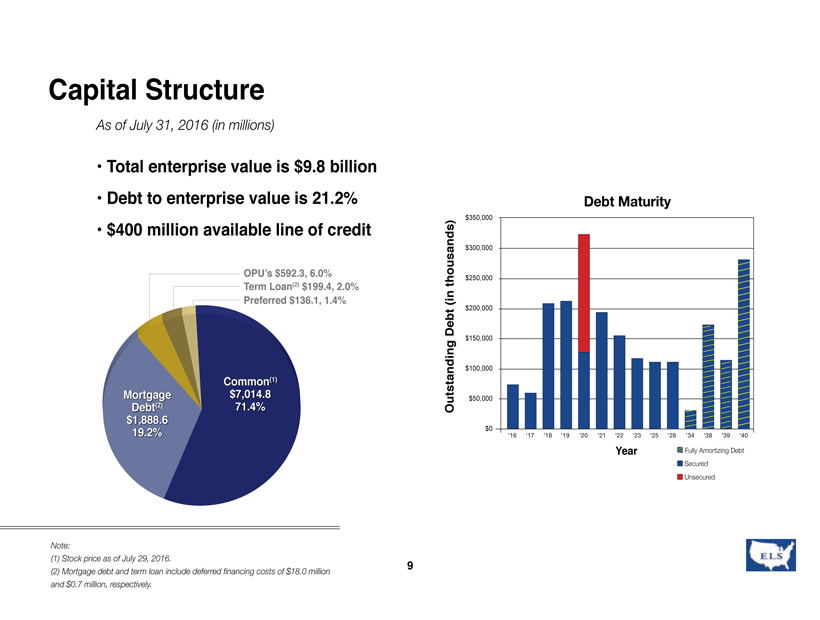

Capital Structure

As of July 31, 2016 (in millions)

Total enterprise value is $9.8 billion

Debt to enterprise value is 21.2%

$400 million available line of credit

OPU’s $592.3, 6.0%

Term Loan(2) $199.4, 2.0%

Preferred $136.1, 1.4%

Mortgage

Debt(2)

$1,888.6

19.2%

Common(1)

$7,014.8

71.4%

Note:

(1) Stock price as of July 29, 2016.

(2) Mortgage debt and term loan include deferred financing costs of $18.0 million and $0.7 million, respectively.

Debt Maturity

Outstanding Debt (in thousands)

‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 ‘23 ‘25 ‘28 ‘34 ‘38 ‘39 ‘40

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

Year

Fully Amortizing Debt

Secured

Unsecured

9

Performance Update

199 Manufactured Home Communities(1)

Core(2) occupancy of 94% as of 08/31/2016

Core occupancy has grown 27 consecutive quarters through 06/30/2016

Core community base rental income growth for the two months ended 08/31/2016 is 4.6%(3)

186 RV Resorts(1)

Core resort base rental income growth for the two months ended 08/31/2016 is 6.6%(3)

Core rental income growth rate from annuals for the two months ended 08/31/2016 is 5.5%(3)

Core rental income growth rate from transients for the two months ended 08/31/2016 is 9.4%(3)

Note:

(1) Excludes joint venture properties.

(2) Core Portfolio is defined as properties acquired prior to December 31, 2014.

The Core Portfolio may change from time-to-time depending on acquisitions, dispositions and significant transactions or unique situations.

(3) Compared to the two months ended August 31, 2015.

10

Safe Harbor Statement

Under the Private Securities Litigation Reform Act of 1995: the The heading forward-looking “Risk Factors” statements in our contained 2015 Annual in this Report presentation on Form are 10-K subject and our to certain Quarterly economic Report on risks Form and 10-Q uncertainties for the quarter described ended under March 31, 2016. looking See Form statements 8-K filed July that 19, become 2016 untrue for the because full text of of our subsequent forward-looking events. statements. All projections We are assume based no on obligation 2016 budgets, to update reforecasts or supplement and pro forward- forma expectations on recent investments.

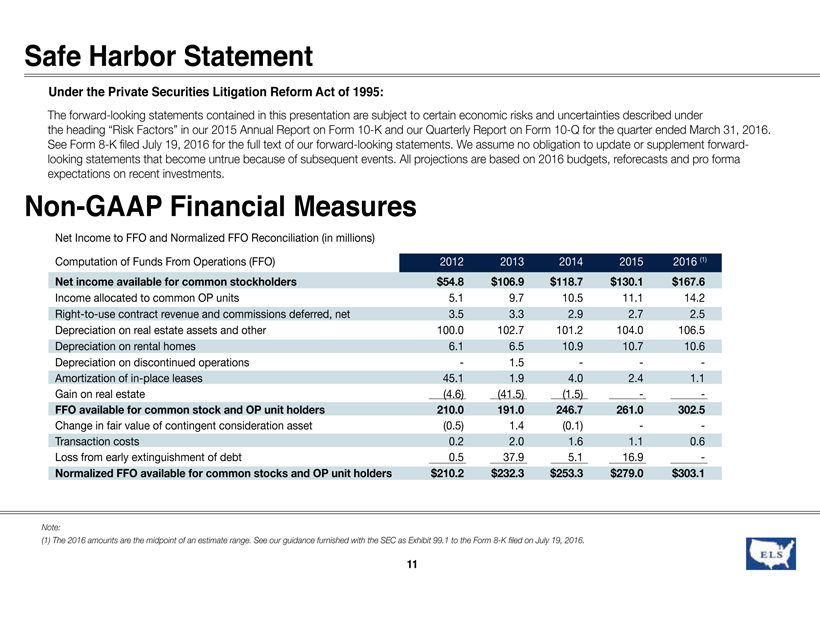

Non-GAAP Financial measures

Net Income to FFO and Normalized FFO Reconciliation (in millions)

Computation of Funds From Operations (FFO) 2012 2013 2014 2015 2016 (1)

Net income available for common stockholders $54.8 $106.9 $118.7 $130.1 $167.6

Income allocated to common OP units 5.1 9.7 10.5 11.1 14.2

Right-to-use contract revenue and commissions deferred, net 3.5 3.3 2.9 2.7 2.5

Depreciation on real estate assets and other 100.0 102.7 101.2 104.0 106.5

Depreciation on rental homes 6.1 6.5 10.9 10.7 10.6

Depreciation on discontinued operations—1.5 — -

Amortization of in-place leases 45.1 1.9 4.0 2.4 1.1

Gain on real estate (4.6) (41.5) (1.5) —

FFO available for common stock and OP unit holders 210.0 191.0 246.7 261.0 302.5

Change in fair value of contingent consideration asset (0.5) 1.4 (0.1) —

Transaction costs 0.2 2.0 1.6 1.1 0.6

Loss from early extinguishment of debt 0.5 37.9 5.1 16.9 -

Normalized FFO available for common stocks and OP unit holders $210.2 $232.3 $253.3 $279.0 $303.1

Note:

(1) The 2016 amounts are the midpoint of an estimate range. See our guidance furnished with the SEC as Exhibit 99.1 to the Form 8-K filed on July 19, 2016.

11

Non-GAAP Financial Measures

discussed This document in the contains paragraphs certain below. non-GAAP We believe measures investors used should by management review Funds that from we believe Operations are helpful (“FFO”), in and understanding Normalized our Funds business, from Operations as further (“Normalized an equity REIT’s FFO”), operating along with performance. GAAP net Our income definitions and cash and flow calculations from operating of these activities, non-GAAP investing financial activities and operating and financing measures activities, and other when terms evaluating may differ measures from do the not definitions represent and cash methodologies generated from used operating by other activities REITs and, in accordance accordingly, with may GAAP, not be nor comparable. do they represent These non-GAAP cash available financial to pay and distributions operating to and cash should flow not from be operating considered activities, as an alternative determined to in net accordance income, determined with GAAP, in as accordance a measure with of our GAAP, liquidity, as an nor indication is it indicative of our of financial funds available performance, to fund or our cash needs, including our ability to make cash distributions. losses FUNDS from FROM sales OPERATIONS of properties, (FFO) plus real . We estate define related FFO as depreciation net income, and computed amortization, in accordance impairments, with if GAAP, any, and excluding after adjustments gains and actual for unconsolidated or estimated compute partnerships FFO and in accordance joint ventures. with Adjustments our interpretation for unconsolidated of standards established partnerships by and the joint National ventures Association are calculated of Real to Estate reflect Investment FFO on the Trusts same (“NAREIT”), basis. We which interpret may the not current be comparable NAREIT definition to FFO differently reported than by other we do. REITs We that receive do not up-front define non-refundable the term in accordance payments from with the the entry current of NAREIT right-to-use definition contracts. or that In Although accordance the with NAREIT GAAP, definition the upfront of FFO non-refundable does not address payments the treatment and related of commissions non-refundable are right-to- deferred use and payments, amortized we over believe the estimated that it is appropriate customer life. to adjust for the impact of the deferral activity in our calculation of FFO. widely We believe used FFO, measure as defined of operating by the Board performance of Governors for equity of NAREIT, REITs, itis does generally not represent a measure cash of performance flow from operations for an equity or net REIT. income While FFO as defined is a relevant by GAAP, and and it should not be considered as an alternative to these indicators in evaluating liquidity or operating performance. income NORMALIZED and expense FUNDS items: FROM a) the financial OPERATIONS impact of (NORMALIZED contingent consideration; FFO). We b)define gains Normalized and losses from FFO early as FFO debt excluding extinguishment, the following including non-operating prepayment penalties non-comparable and defeasance items. Normalized costs; c) FFO property presented acquisition herein and is not other necessarily transaction comparable costs related to Normalized to mergers FFO and presented acquisitions; by other and d) real other estate miscellaneous companies due to the fact that not all real estate companies use the same methodology for computing this amount.

12

Equity LifeStyle Properties

Two North Riverside Plaza, Chicago, Illinois 60606 800-247-5279 | www.EquityLifeStyle.com

9/16