- ELS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Equity LifeStyle Properties (ELS) 8-KOther Events

Filed: 15 Mar 19, 4:23pm

Exhibit 99.1

Investing in our COMMUNITY FOR 25 YE ARS T H E L I F E I N A D A Y | 2 0 1 8 els

Lake Conroe RV Resort Willis, TX

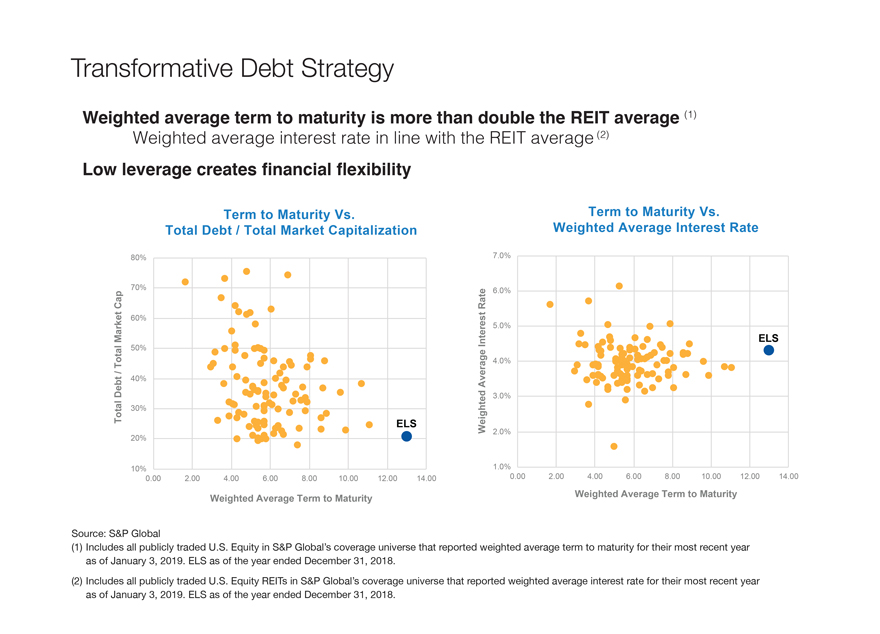

Transformative Debt Strategy Weighted average term to maturity is more than double the REIT average (1) Weighted average interest rate in line with the REIT average (2) Low leverage creates financial flexibility Term to Maturity Vs. Term to Maturity Vs. Total Debt / Total Market Capitalization Weighted Average Interest Rate 80% 7.0% 70% 6.0% CapRate 60% 5.0% Market ELS Interest 50% Total 4.0% / 40% Average Debt 3.0% Total 30% ELS Weighted 2.0% 20% 10% 1.0% 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 Weighted Average Term to Maturity Weighted Average Term to Maturity Source: S&P Global (1) Includes all publicly traded U.S. Equity in S&P Global’s coverage universe that reported weighted average term to maturity for their most recent year as of January 3, 2019. ELS as of the year ended December 31, 2018. (2) Includes all publicly traded U.S. Equity REITs in S&P Global’s coverage universe that reported weighted average interest rate for their most recent year as of January 3, 2019. ELS as of the year ended December 31, 2018.

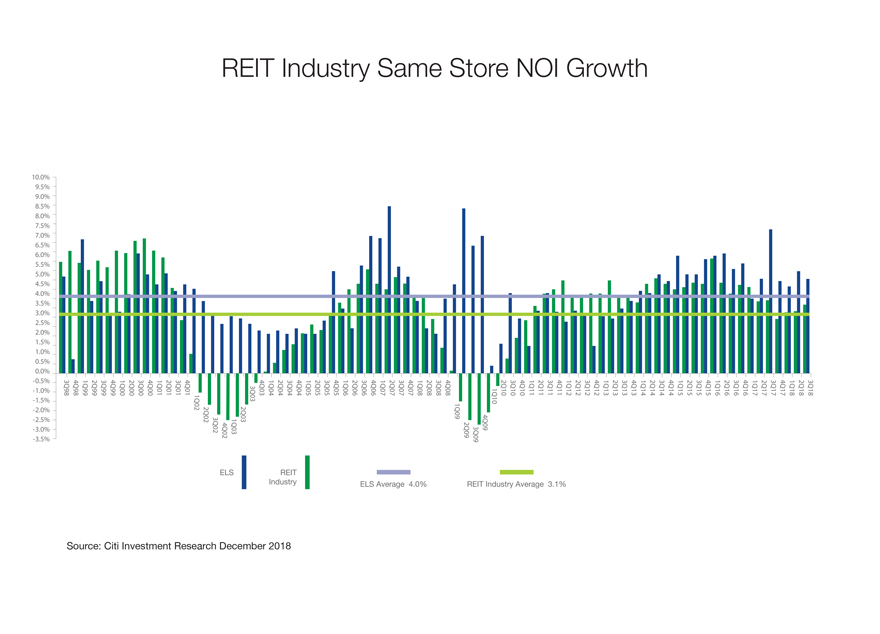

REIT Industry Same Store NOI Growth Source: Citi Investment Research December 2018

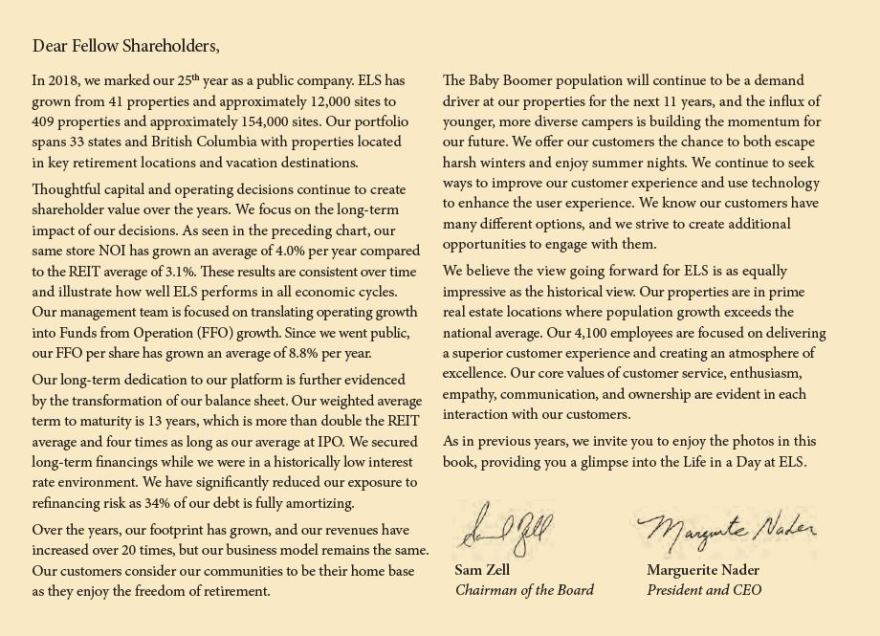

Dear Fellow Shareholders, In 2018, we marked our 25th year as a public company. ELS has grown from 41 properties and approximately 12,000 sites to 409 properties and approximately 154,000 sites. Our portfolio spans 33 states and British Columbia with properties located in key retirement locations and vacation destinations. Thoughtful capital and operating decisions continue to create shareholder value over the years. We focus on the long-term impact of our decisions. As seen in the preceding chart, our same store NOI has grown an average of 4.0% per year compared to the REIT average of 3.1%. These results are consistent over time and illustrate how well ELS performs in all economic cycles. Our management team is focused on translating operating growth into Funds from Operation (FFO) growth. Since we went public, our FFO per share has grown an average of 8.8% per year. Our long-term dedication to our platform is further evidenced by the transformation of our balance sheet. Our weighted average term to maturity is 13 years, which is more than double the REIT average and four times as long as our average at IPO. We secured long-term financings while we were in a historically low interest rate environment. We have significantly reduced our exposure to refinancing risk as 34% of our debt is fully amortizing. Over the years, our footprint has grown, and our revenues have increased over 20 times, but our business model remains the same. Our customers consider our communities to be their home base as they enjoy the freedom of retirement. The Baby Boomer population will continue to be a demand driver at our properties for the next 11 years, and the influx of younger, more diverse campers is building the momentum for our future. We officer our customers the chance to both escape harsh winters and enjoy summer nights. We continue to seek ways to improve our customer experience and use technology to enhance the user experience. We know our customers have many different options, and we strive to create additional opportunities to engage with them. We believe the view going forward for ELS is as equally impressive as the historical view. Our properties are in prime real estate locations where population growth exceeds the national average. Our 4,100 employees are focused on delivering a superior customer experience and creating an atmosphere of excellence. Our core values of customer service, enthusiasm, empathy, communication, and ownership are evident in each interaction with our customers. As in previous years, we invite you to enjoy the photos in this book, providing you a glimpse into the Life in a Day at ELS. Sam Zell Marguerite Nader Chairman of the Board President and CEO

Wilderness Lakes RV Resort - Menifee, CA

OPPORTUNITY today is that tomorrow you talked about yesterday. Our goal is to help our customers turn their wish lists into new realities. From checking another state visit off the list to purchasing a first home, the possibilities are endless.

Neshonoc Lakeside - West Salem, WI

WELCOMING places we call home. Whether our customers stay for the weekend, the month, or a number of years, we want each interaction and visit to feel like home. Every experience should elicit the feeling of being right where they belong, a true sense of comfort.

QUALITY give up the good, go for the great. Our customers have high standards, and we aim to exceed them. Capital investments and investing in our employees combine to create high quality environments that keep our customers coming back.

ViewPoint Golf Resort - Mesa, AZ

FINDING your rhythm. Our onsite teams act as our conductors, making sure each and every guest and resident is in tune with what’s happening onsite. So far, it’s resulted in getting the band back together, year after year. Royal Coachman RV Resort - Nokomis, FL

VISION to see the forest through the trees. Our big picture continues to grow, with a focus on enhancing value and customer experience. Through it all, we’ve maintained our roots and our business model remains the same. Leavenworth Tiny House Village - Leavenworth, WA

Tropical Palms RV Resort - Kissimmee, FL

EMBRACING new experiences. With a strong focus on our customers, we’re able to capitalize on their feedback which helps us create memorable experiences and new opportunities for our guests and residents.

These are our MOMENTS Moments, however small, add up to create the long-term adventure we call life. For us, these moments continue to create shareholder value and customer loyalty across our portfolio. Palm Springs RV Resort - Palm Desert, CA

The people and places of Equity LifeStyle Properties

Date Palm Country Club Cathedral City, CA

De Anza Santa Cruz Santa Cruz, CA

Palm Springs RV Resort Palm Desert, CA

Lake of the Springs Oregon House, CA

Monte Vista Village Resort Mesa, AZ

Monte Vista Village Resort Mesa, AZ

ViewPoint Golf Resort Mesa, AZ

The Highlands at Brentwood Mesa, AZ

Central Park Village Phoenix, AZ

Voyager RV Resort Tucson, AZ

Verde Valley Cottonwood, AZ

Lake Tawakoni Point, TX

Lake Conroe RV Resort Willis, TX

The Reserve at Lake Conroe Willis, TX

Falcon Wood Village Eugene, OR

Pacific City Cloverdale, OR

Kloshe Illahee Federal Way, WA

Portland Fairview Fairview, OR

Circle M Lancaster, PA

Timber Creek Westerly, RI

Bethpage Camp – Resort Urbanna, VA

Bethpage Camp – Resort Urbanna, VA

Grey’s Point Camp Topping, VA

Grey’s Point Camp Topping, VA

Mariner’s Cove Millsboro, DE

Natchez Trace Hohenwald, TN

Goose Creek Resort Newport, NC

Twin Lakes Chocowinity, NC

Narrows Too Trenton, ME

Narrows Too Trenton, ME

Lakeland Milton, WI

Lake George Escape Lake George, NY

Kingswood Riverview, FL

Everglades Lakes Davie, FL

Ridgewood Estates Ellenton, FL

Colony Cove Ellenton, FL

Crystal Lake Zephyrhills, FL

Palm Lake Estates West Palm Beach, FL

Space Coast Rockledge, FL

Tropical Palms RV Resort Kissimmee, FL

Fiesta Key RV Resort The Florida Keys, FL

Sunshine Key RV Resort The Florida Keys, FL

els Equity LifeStyle Properties Two North Riverside Plaza | Chicago, Illinois 60606 | (800)247-5279 | EquityLifeStyleProperties.com