FOIA Confidential Treatment Request by

Wolfspeed, Inc. Pursuant to Rule 83 (17 C.F.R. 200.83)

May 24, 2023

CERTAIN PORTIONS OF THIS LETTER AS FILED VIA EDGAR HAVE BEEN OMITTED AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR THE OMITTED PORTIONS, WHICH HAVE BEEN REPLACED WITH THE FOLLOWING PLACEHOLDER “[***]” IN THE LETTER FILED VIA EDGAR.

VIA EDGAR

Office of Manufacturing

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Attention:

Jeffrey Gordon

Martin James

| | | | | |

| Re: | Wolfspeed, Inc. Form 10-K for the fiscal year ended June 26, 2022 Filed August 22, 2022 Form 8-K Filed January 25, 2023 CORRESP filed March 24, 2023 File No. 001-40863 |

Dear Messrs. Gordon and James:

Set forth below are the responses of Wolfspeed, Inc. (the “Company”) to the comments of the staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “SEC”) contained in the comment letter dated May 10, 2023 (the “Comment Letter”) relating to the Form 10-K for the fiscal year ended June 26, 2022 (the “2022 Form 10-K”) and the Form 8-K filed January 25, 2023 (the “2023 Form 8-K”).

This response letter includes each comment from the Comment Letter in italics, with the Company’s response set forth immediately below. The Company has repeated the headings and paragraph numbers from the Comment Letter for your convenience.

Confidential Treatment Request

Due to the commercially sensitive nature of certain information contained herein, this letter is also accompanied by the Company’s request for confidential treatment for selected portions of this letter (designated by “[***]” in the letter filed via EDGAR). The Company has filed a separate letter with the Office of Freedom of Information and Privacy Act Operations in connection with the confidential treatment request pursuant to Rule 83 of the SEC’s Rules on Information and Requests, 17 C.F.R. § 200.83. The Company has also filed a separate copy of

United States Securities and Exchange Commission

Division of Corporation Finance

Page 2

this letter, marked to show the portions redacted from the version filed via EDGAR and for which the Company is requesting confidential treatment. In the event that the Staff receives a request for access to the confidential portions herein, whether pursuant to the Freedom of Information Act or otherwise, we respectfully request that we be notified immediately so that we may further substantiate this request for confidential treatment. Please address any notification of a request for access to such documents to the undersigned.

Form 10-K for the Fiscal Year Ended June 26, 2022

Note 2 – Basis of Presentation and Summary of Significant Accounting Policies

Segment Information, page 54

1.We have reviewed your response to prior comment 3, where you state that the CODM receives revenue and limited directly attributable costs at the product line level. Please describe these costs in detail and quantify them. Please also tell us why these costs are provided to the CODM and how the CODM uses them. Finally, please tell us whether these costs are included in the budget the CODM reviews, and if performance against budget is assessed at this level.

RESPONSE:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the only metrics provided to the CODM at the product line level are revenue and limited directly attributable costs. Gross margin, contribution margin and other metrics are only provided at the Company-wide, consolidated level.

As a matter of clarification, the CODM is provided revenue disaggregated by product line but cost information directly related to the product lines is provided to the CODM in the aggregate across all product lines. Aggregated product line costs are presented to the CODM within one caption against other corporate cost categories such as Finance, Legal and Human Resources as part of consolidated SG&A and R&D cost details for the CODM's evaluation of the business at a consolidated level.

Directly attributable costs for the product lines included labor, travel, supplies, depreciation and factory charges, however a disaggregated breakout of these costs at this level is not presented to the CODM.

-For the third quarter of fiscal 2023, directly attributable product lines costs for SG&A were approximately 20% of total SG&A. Cost categories presented to the CODM other than product line costs included IT, Facilities, HR, Legal, Finance, Executive, and Global Sales.

-For the third quarter of fiscal 2023, directly attributable product line costs for R&D were approximately 85% of total R&D. Cost categories for R&D presented to the CODM other than product line costs included IT, Facilities, Procurement, and Environmental Health & Safety.

-No directly attributable costs relating to cost of revenue are presented in the CODM package.

CONFIDENTIAL TREATMENT REQUESTED BY WOLFSPEED, INC.

United States Securities and Exchange Commission

Division of Corporation Finance

Page 3

Product line costs are included in forecast information, along with the other SG&A and R&D cost categories described above. The business manages to forecasts and each period the previously identified forecast information is compared to actual results to assess performance of the consolidated business.

The CODM reviews the Company’s overall costs, which includes directly attributable costs as a component, to analyze the overall progress and performance of the consolidated business in order to make operating decisions.

2.You state in your response to prior comment 3 that revenues are available by market, and that investment decisions and resource allocation are, in part, based on the markets in which the company chooses to compete. Please tell us whether the CODM receives cost information by market. If so, please provide the information requested in the above comment for said costs.

RESPONSE:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the CODM reviews estimated revenues by market, but no other economic measures are available, including cost information. The Company does not have discrete cost information available by which the CODM could assess performance by market.

Form 8-K Filed January 25, 2023

Exhibit 99.1, page 7

3.We have reviewed your response to prior comment 5. Please address the following:

•Provide us with a breakdown of the (i) project costs, (ii) transformation costs, and (iii) transaction costs reflected in the non-GAAP adjustments you presented in reconciling your non-GAAP measures for the fiscal years ended June 26, 2022 and June 27, 2021, respectively, as well for the nine months ended March 26, 2023 and March 27, 2022, respectively. In your breakdown, identify and quantify the material components of each of the three groups of costs.

•Describe to us the nature of the specific costs included in each group of costs.

•In particular, describe to us in detail the costs that comprise the internal transformation program costs for which you have adjusted your non-GAAP financial measures.

•Explain to us how you determined that the adjustments related to each group of costs are appropriate based on the guidance in Question 100.01 of the Division of Corporation Finance’s Compliance & Disclosure Interpretations on Non-GAAP Financial Measures.

CONFIDENTIAL TREATMENT REQUESTED BY WOLFSPEED, INC.

United States Securities and Exchange Commission

Division of Corporation Finance

Page 4

RESPONSE:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the Company believes that these adjustments are consistent with Question 100.01 of the Non-GAAP Financial Measures Compliance and Disclosure Interpretations, including the emphasis on a company’s individual facts and circumstances. The transformation and transaction costs identified for the periods requested relate to the following specific projects:

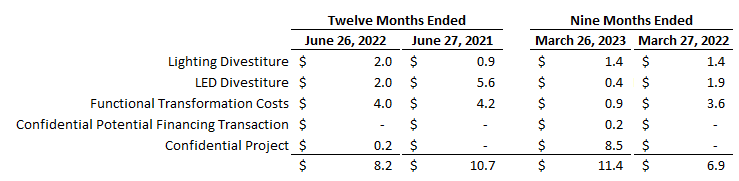

Project and Transaction Costs:

-Lighting Divestiture: These identified costs are specific to the divestiture of the Lighting Products business unit which was completed on May 13, 2019. These costs consist of external legal fees incurred after the divestiture relating to the prosecution and administration of ongoing indemnification claims in connection with the transaction.

-LED Divestiture: These identified costs are specific to costs related to the LED Products business divestiture that was completed on March 1, 2021 as further described within Note 3 – Discontinued operations in the Company’s Form 10-K for the fiscal year ended June 26, 2022. Costs for fiscal 2022 and 2023 consist of external legal fees and other professional services relating to that specific transaction.

-Confidential Potential Financing Transaction: These external professional services and legal costs are associated with a confidential transaction related to a potential future financing arrangement.

-Confidential Project: These costs are associated with a confidential project [***], separate from the Company’s current operations. Costs were primarily incurred in fiscal 2023 with the largest portion attributed to external professional services fees.

Transformation Costs:

-Functional Transformation Costs: These costs are primarily costs incurred as a result of Wolfspeed’s organizational transformation efforts and include projects such as changing the corporate name from Cree, Inc. to Wolfspeed, Inc. effective October 4, 2021. In addition, the Company transferred the listing of its common stock to the New York Stock Exchange from The Nasdaq Global Select Market at this time. The costs associated with this project were primarily one-time external legal and marketing costs with the majority of the costs incurred in fiscal 2021 and 2022. Additional external professional service costs were incurred as a result of various one-time projects aimed at organizational efficiency and identification of IT system needs to drive efficiencies in the organization.

As noted within the Form 8-K filed on January 25, 2023, the majority of the projects identified relate to prior divestitures or potential projects or transformation programs such as the Company’s name change from Cree, Inc. to Wolfspeed, Inc. and therefore the Company believes these projects and programs are not reflective of the ongoing operating results of Wolfspeed’s business.

CONFIDENTIAL TREATMENT REQUESTED BY WOLFSPEED, INC.

United States Securities and Exchange Commission

Division of Corporation Finance

Page 5

The breakdown of the costs included within transaction and transformation costs by project is as follows:

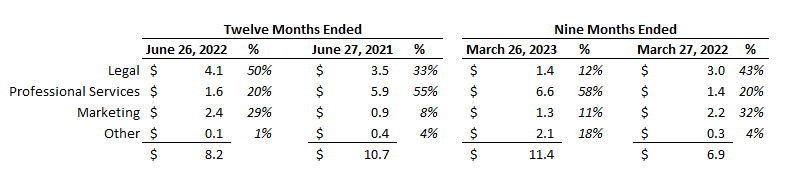

The primary category of costs for each of the identified projects are external legal fees, external professional services/consulting fees and marketing fees. Refer below for costs by category.

Based on the facts and circumstances described above, the Company does not believe excluding adjustments related to the identified project, transformation and transaction program costs result in non-GAAP measures that are misleading based on the guidance under Question 100.01 of the Non-GAAP Financial Measures Compliance and Disclosure Interpretations. Based on their nature and effect, these costs do not represent normal, recurring, cash operating expenses necessary to operate the Company’s ongoing business; rather, they relate to specific corporate projects that are limited in duration and are not connected with the Company’s revenue generating activities. Management believes that, upon completion (including the expiration of indemnification and related obligations), the Company will cease incurring the expenses related to each project and each project described above is unlikely to be undertaken again in the foreseeable future. Where the nature of costs for other legal or consulting services are determined to be normal, recurring, cash operating expenses necessary to operate its business (such as legal costs related to ordinary course litigation, intellectual property, regulatory compliance, etc.), they are not excluded when the Company presents non-GAAP measures.

Given the business transformation that the Company has undergone over the last five years, management believes that the non-GAAP measures provide important information to investors about the ongoing operations of the Company’s current business. By adjusting for these extraordinary projects, investors are provided with information about the core operations at a base level so that they can assess the fundamentals of the ongoing core business and related trends, which may be less clear when considering the GAAP financial measures as a whole,

CONFIDENTIAL TREATMENT REQUESTED BY WOLFSPEED, INC.

United States Securities and Exchange Commission

Division of Corporation Finance

Page 6

because the GAAP financial measures include various other corporate initiatives that do not impact current operations. Further, the Company provides explanations for all non-GAAP adjustments which clearly articulate to the public the Company’s rationale for the adjustments, and the Company is transparent and consistent with adjustments made throughout each period.

4.We note you adjust certain non-GAAP financial measures for “Loss on Wafer Supply Agreement." Please describe to us the nature of these losses, and tell us how they relate in anyway to the $31 million liability you recorded at the inception of your agreement to provide CreeLed with certain Silicon Carbide materials and fabrication services for up to four years. Tell us whether you expect to continue to record additional losses beyond the liability that was initially recorded and is now fully amortized. In addition, please explain to us how you determined this adjustment is appropriate based on the guidance in Question 100.01 of the Division of Corporation Finance’s Compliance & Disclosure Interpretations on Non-GAAP Financial Measures or tell us how you plan to revise your non-GAAP financial measures in future filings.

RESPONSE:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that the losses recorded for the Wafer Supply Agreement are comprised of direct manufacturing costs and inventory reserve adjustments incurred in the fulfillment of the Company’s supply agreement with CreeLED, Inc. (“CreeLED”), a subsidiary of SMART Global Holdings, Inc. (“SGH”), for LED-type silicon carbide wafers, that was entered into in connection with the divestiture of the LED business. These costs are directly related to the $31 million loss contract liability recorded at the inception of the supply agreement. The initial liability was valued using estimated direct manufacturing costs and the initial purchasing forecast provided by CreeLED. This liability was fully amortized earlier than the Company anticipated due to increased direct manufacturing costs and unfavorable variances from initial purchase forecasts. The Company expects to incur additional losses to meet the supply commitment to CreeLED through the term of the agreement in fiscal 2024.

As a result, the Company believes that the costs to produce the LED-type silicon carbide wafers do not represent normal, recurring, cash operating expenses necessary to operate its business and these adjustments are consistent with Question 100.01 of the Division of Corporation Finance’s Compliance & Disclosure Interpretations on Non-GAAP Financial Measures. The wafers supplied under this agreement are specialized for LED applications and are unrelated and not transferrable to the silicon carbide and gallium nitride materials and devices the Company currently produces for power and RF applications. The wafers supplied to CreeLED are no longer an output of the Company’s ordinary activities as the Company exited the LED market with the sale of the LED business to SGH in fiscal year 2021. CreeLED is the sole consumer of these wafers. All production for the LED-type silicon carbide wafers will cease when the supply agreement terminates.

Based on the facts and circumstances above, the Company does not believe the adjustments related to costs incurred from the Wafer Supply Agreement with CreeLED result in

CONFIDENTIAL TREATMENT REQUESTED BY WOLFSPEED, INC.

United States Securities and Exchange Commission

Division of Corporation Finance

Page 7

non-GAAP measures that are misleading based on the guidance under Question 100.01 of the Non-GAAP Financial Measures Compliance and Disclosure Interpretations because these costs are not normal operating expenses of the Company’s current business.

5.As a related matter, please support your conclusion that the losses on your Wafer Supply Agreement should be presented outside of your cost of revenues and operating loss amounts on your statements of operations.

RESPONSE:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that that the Company believes the Wafer Supply Agreement is outside of the scope of ASC 606 because the LED-type wafers are no longer an output of the entity’s ordinary activities after the divestiture of the LED business. As discussed in the response to Comment 4, the LED-type wafers are produced solely for the Wafer Supply Agreement and the Company intends to cease production of these wafers at the termination of that agreement. The income from the sale of the LED-type wafers is recorded as part of non-operating expense on the Company’s statement of operations. The related costs of production and the amortization of the loss contract liability are also recorded in non-operating expense because the costs of production are outside the Company’s normal business operations. The Company believes that it is appropriate to match the classification of the cost of revenue with the revenue recognized from the Wafer Supply Agreement in non-operating (income) expense, net.

****

If you have any questions regarding any of the responses in this letter, please contact me at (919) 407-7098.

Sincerely,

WOLFSPEED, INC.

/s/ Neill Reynolds

Neill P. Reynolds

Executive Vice President and

Chief Financial Officer

CONFIDENTIAL TREATMENT REQUESTED BY WOLFSPEED, INC.