SECURITIES AND EXHCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement |

¨ | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant toRule 14a-11(c) orRule 14a-12 |

CREE, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | Principal Executive Offices: 4600 Silicon Drive Durham, North Carolina 27703 (919) 313-5300 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders:

The 2002 Annual Meeting of Shareholders of Cree, Inc. will be held at our offices at 4425 Silicon Drive, Durham, North Carolina on Tuesday, October 29, 2002, at 10:00 a.m. local time, to consider and vote upon the following matters and to transact such other business as may be properly brought before the meeting:

| | • | | Proposal No. 1—Election of seven directors |

| | • | | Proposal No. 2—Approval of an amendment of the 1999 Employee Stock Purchase Plan to authorize an additional 750,000 shares for sale under the Plan |

All shareholders are invited to attend the meeting in person. Only shareholders of record at the close of business on September 13, 2002 are entitled to notice of and to vote at the meeting.

By order of the Board of Directors,

Adam H. Broome

Secretary

Durham, North Carolina

September 20, 2002

IMPORTANT: Whether or not you plan to attend the meeting in person, please submit voting instructions for your shares promptly using the directions on your proxy card to vote by one of the following methods: (1) by telephone, by calling the toll-free telephone number printed on your proxy card; (2) over the Internet, by accessing the website address printed on your proxy card; or (3) by marking, dating and signing your proxy card and returning it in the accompanying postage-paid envelope.

PROXY STATEMENT: | | |

| | 1 |

| | 1 |

| | 1 |

| | 1 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 3 |

| | 4 |

| | 4 |

| | 6 |

| | 6 |

| | 7 |

| | 7 |

| | 7 |

| | 9 |

| | 10 |

| | 13 |

| | 13 |

| | 13 |

| | 14 |

| | 14 |

| | 15 |

| | 15 |

| | 16 |

| | 16 |

| | 17 |

| | 18 |

| | 18 |

| | 18 |

| | 19 |

| | 19 |

| | 19 |

| | 19 |

| | 19 |

| | 19 |

| | A-1 |

CREE, INC.

PROXY STATEMENT

The Board of Directors of Cree, Inc. (the “Company”) is asking for your proxy for use at the 2002 Annual Meeting of Shareholders and any adjournments of the meeting. The meeting will be held at the Company’s offices at 4425 Silicon Drive, Durham, North Carolina, on Tuesday, October 29, 2002, at 10:00 a.m. local time.

At the meeting, shareholders will elect seven directors, vote on approval of a proposed amendment of the Company’s 1999 Employee Stock Purchase Plan to authorize an additional 750,000 shares for sale under the Plan and transact such other business as may be properly brought before the meeting.

The Board of Directors recommends that you vote FOR the election of the director nominees listed in this proxy statement and FOR approval of the proposed amendment to the Employee Stock Purchase Plan.

Only shareholders of record at the close of business on September 13, 2002 are entitled to vote at the meeting and any adjournments of the meeting. At that time there were 72,765,415 shares of the Company’s common stock outstanding, each of which is entitled to one vote on each matter submitted to a vote at the meeting. The common stock is the only class of securities of the Company having the right to vote at the meeting.

You may vote shares by proxy or in person using one of the following methods:

| | • | | Voting by Telephone. You can vote by proxy using the directions on your proxy card by calling the toll-free telephone number printed on the card. The deadline for voting by telephone is Monday, October 28, 2002, at 11:59 p.m. Eastern time. If you vote by telephone you need not return your proxy card. |

| | • | | Voting by Internet. You can vote over the Internet using the directions on your proxy card by accessing the website address printed on the card. The deadline for voting over the Internet is Monday, October 28, 2002, at 11:59 p.m. Eastern time. If you vote over the Internet you need not return your proxy card. |

| | • | | Voting by Proxy Card. You can vote by completing and returning your signed proxy card. To vote using your proxy card, please mark, date and sign the card and return it by mail in the accompanying postage-paid envelope. You should mail your signed proxy card sufficiently in advance for it to be received by Monday, October 28, 2002. |

| | • | | Voting in Person. You can vote in person at the meeting if you are the record owner of the shares to be voted. You can also vote in person at the meeting if you present a properly signed proxy that authorizes you to vote shares on behalf of the record owner. If your shares are held by a broker, bank, custodian or other nominee, to vote in person at the meeting you must present a letter or other proxy appointment, signed on behalf of the broker or nominee, granting you authority to vote the shares. |

You can revoke your proxy and change your vote (including voting instructions submitted by telephone or over the Internet as described above) by: (1) attending the meeting and voting in person; (2) delivering written notice of revocation of your proxy to the Secretary at any time before voting is closed; (3) timely submitting another signed proxy card bearing a later date; or (4) timely submitting new voting instructions by telephone or over the Internet.

If you timely submit your proxy by telephone, over the Internet or by proxy card as described above and have not revoked it, your shares will be voted or withheld from voting in accordance with the voting instructions you gave. If you timely submit your proxy without giving contrary voting instructions, your shares will be voted “FOR” election of the director nominees listed in this proxy statement and “FOR” the proposed amendment of the 1999 Employee Stock Purchase Plan.

If your shares are held by a broker, bank, custodian or other nominee, you may have received a voting instruction form with this proxy statement instead of a proxy card. The voting instruction form is provided on behalf of the broker or other nominee to permit you to give directions to the broker or nominee on how to vote your shares. Please refer to the voting instruction form or contact the broker or nominee to determine the voting methods available to you.

A quorum must be present at the meeting before business can be conducted. A quorum will be present if a majority of the shares entitled to vote are represented in person or by proxy at the meeting. Shares represented by a proxy with instructions to withhold authority to vote or to abstain from voting on any matter will be considered present for purposes of determining the existence of a quorum. Shares represented by a proxy as to which a broker, bank, custodian or other nominee has indicated that it does not have discretionary authority to vote on any matter (sometimes referred to as a “broker non-vote”) will also be considered present for purposes of determining the existence of a quorum.

Directors will be elected by a plurality of the votes cast, meaning that the nominees who receive the most votes will be elected to fill the available positions. Only votes cast for a nominee will be counted. Shareholders do not have the right to vote cumulatively in electing directors. Withholding authority in your proxy to vote for a nominee will result in the nominee receiving fewer votes.

The proposed amendment of the 1999 Employee Stock Purchase Plan will be approved if the votes cast for approval exceed the votes cast against approval. Abstentions and broker non-votes will not be counted for purposes of determining whether the proposal has received sufficient votes for approval.

-2-

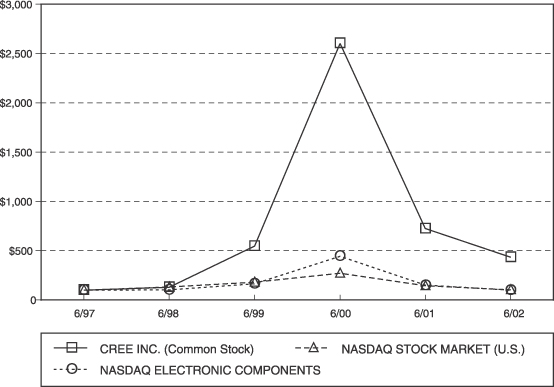

The graph below compares, for the five-year period ended June 30, 2002, the cumulative total return of the Company’s common stock at each fiscal year end with a market index based on The Nasdaq Stock Market and an industry index based on Nasdaq-traded stocks of electronic components businesses. The market index is the Nasdaq Stock Market—U.S. Companies and the industry index is the Nasdaq Electronic Components. The graph assumes an investment of $100 on June 30, 1997 in the Company’s common stock and in each index and also assumes the reinvestment of all dividends during the period shown.

Comparison of Five-Year Cumulative Total Return

Cree, Inc. Common Stock, Nasdaq Stock Market Index and

Nasdaq Electronic Components Index

Performance Graph Data

| | June 1997

| | June 1998

| | June 1999

| | June 2000

| | June 2001

| | June 2002

|

| Cree, Inc. Common Stock | | $ | 100 | | $ | 128 | | $ | 545 | | $ | 2604 | | $ | 723 | | $ | 432 |

| Nasdaq Stock Market (U.S.) | | $ | 100 | | $ | 130 | | $ | 179 | | $ | 270 | | $ | 143 | | $ | 103 |

| Nasdaq Electronic Components | | $ | 100 | | $ | 101 | | $ | 163 | | $ | 444 | | $ | 149 | | $ | 98 |

-3-

All seven of the persons nominated for election to the Board of Directors at the annual meeting are currently serving as directors of the Company. The Company is not aware of any nominee who will be unable or will decline to serve as a director. If a nominee becomes unable or declines to serve, the accompanying proxy may be voted for a substitute nominee, if any, designated by the Board of Directors. The term of office of each person elected as a director will continue until the later of the next annual meeting of shareholders or until such time as his successor has been duly elected and qualified.

The following table lists the nominees for election and information about each.

Name

| | Age

| | Principal Occupation and Background

| | Director Since

|

| F. Neal Hunter | | 40 | | Mr. Hunter, one of the Company’s founders, has served as Chairman of the Board of Directors since 1995 and as a member of the Board of Directors since the Company’s inception in 1987. He was the Chief Executive Officer of the Company from 1994 to June 2001 and President from 1994 to 1999. Prior to 1994, Mr. Hunter served as General Manager for the Company’s optoelectronic products business and as Secretary and Treasurer. | | 1987 |

|

| Charles M. Swoboda | | 35 | | Mr. Swoboda has served as the Company’s Chief Executive Officer since June 2001, as a member of the Board of Directors since October 2000 and as President since January 1999. He was Chief Operating Officer of the Company from 1997 to June 2001 and Vice President for Operations from 1997 to 1999. Prior to his appointment as Chief Operating Officer, Mr. Swoboda served as Operations Manager from 1996 to 1997, as General Manager of the Company’s former subsidiary, Real Color Displays, Incorporated, from 1994 to 1996 and as LED Product Manager from 1993 to 1994. He was previously employed by Hewlett-Packard Company. | | 2000 |

|

| John W. Palmour, Ph.D. | | 41 | | Dr. Palmour, also one of the Company’s founders, has been a member of the Board of Directors since October 1995 and has served as the Company’s Director of Advanced Devices since 1995 and as an Executive Vice President since August 2002. As Director of Advanced Devices, Dr. Palmour manages all of the research and development programs of the Company focused on wide band gap RF, microwave and power devices. He previously served on the Board of Directors from 1992 to 1993. | | 1995 |

|

| Dolph W. von Arx | | 68

| | Mr. von Arx has been a member of the Board of Directors since October 1991 and is the former Chairman, President and Chief Executive Officer of Planters Lifesavers Company, an affiliate of RJR Nabisco, Inc. Since his retirement from Planters Lifesavers Company in 1991, Mr. von Arx has served as non-executive Chairman of Morrison Restaurants Inc., a publicly held family dining business, from 1996 to 1998, and is currently a director of Ruby Tuesday, Inc., International Multifoods Corporation, Northern Trust of Florida Corp. and BMC Fund, Inc. | | 1991 |

-4-

Name

| | Age

| | Principal Occupation and Background

| | Director since

|

|

| James E. Dykes | | 64

| | Mr. Dykes has served on the Board of Directors since January 1992. He was formerly President and Chief Executive Officer of Signetics Company, a semiconductor manufacturer and wholly-owned subsidiary of North American Philips Corporation, from 1989 until his retirement in 1993, and from 1987 to 1988 served as the first President and Chief Executive Officer of Taiwan Semiconductor Manufacturing Company Ltd., a semiconductor foundry. From 1994 to 1997, Mr. Dykes was President and Chief Operating Officer of Intellon Corp., a semiconductor company supplying products for home networking applications, and from 1997 to 1998 served as Executive Vice President for Corporate Development with Thomas Group, Inc., a management services company. Mr. Dykes is currently a director of EXAR Corporation and Thomas Group, Inc. | | 1992 |

|

| William J. O’Meara | | 65

| | Mr. O’Meara was elected to the Board of Directors in October 2000. He previously served as President and Chief Executive Officer of C-Cube Microsystems, Inc., a semiconductor company supplying products for digital video applications, until his retirement in 1995 and thereafter served as its Vice Chairman until 1997. Before joining C-Cube Microsystems Mr. O’Meara was Chairman, Chief Executive Officer and President of Headland Technology, Inc., an entity affiliated with LSI Logic Corporation, a semiconductor company he co-founded in 1981, and served as Vice President of Worldwide Sales and Marketing for LSI Logic. Mr. O’Meara also served as a member of the Board of Directors of Cisco Systems, Inc. from 1987 to 1994. | | 2000 |

|

| Robert J. Potter, Ph.D. | | 69 | | Dr. Potter has served on the Board of Directors since April 2001. He is currently President and Chief Executive Officer of R. J. Potter Company, a business consulting firm based in Irving, Texas. Prior to establishing R. J. Potter Company, Dr. Potter was President and Chief Executive Officer of Datapoint Corporation, a producer of local area networking and video conferencing products, from 1987 to 1990, and held senior management positions in other telecommunications equipment and information technology businesses, including Northern Telecom Ltd. where he served as Group Vice President responsible for the customer premises telecommunications equipment business. He is currently a director of Molex Corporation. | | 2001 |

In addition to Mr. Hunter, Mr. Swoboda and Dr. Palmour, all of whom presently serve both as directors and as executive officers, the other executive officers of the Company are as follows:

Cynthia B. Merrell (age 41) has served as Chief Financial Officer and Treasurer of the Company since 1998 and previously served as the Company’s Controller from 1996 to 1998 after joining the Company in 1996. Her prior financial experience includes service in various capacities with Kaset International, a subsidiary of The Times Mirror Company, Tropicana Products, Inc. and an international accounting firm. She is licensed as a certified public accountant in the state of Florida.

M. Todd Tucker (age 39) has served as the Company’s Executive Vice President for Operations since December 2000 and as an executive officer of the Company since June 2001. Prior to joining the Company, Mr. Tucker was employed by JDS Uniphase Corporation, an optical components and module provider to the communications industry, where he was Senior Vice President, Chief Improvement Officer and Vice President for

-5-

Operations from 1998 to 2000, Director of Operations in 1998 and Plant Manager from 1997 to 1998. His previous positions include Director, National Service of Brother International Corporation, a consumer electronics business, where he was employed from 1996 to 1997, and various positions in the telecommunications equipment businesses of AT&T Corporation and Lucent Technologies Inc. from 1983 to 1996.

The Board of Directors of the Company held six meetings during the fiscal year ended June 30, 2002. Each director attended or participated in 75% or more of all meetings of the Board of Directors held in fiscal 2002 during the period he served as a director.

The Board has standing Audit, Compensation and Executive Committees. During fiscal 2002, the Audit Committee held eight meetings and the Compensation Committee held four meetings. The Executive Committee did not meet during the year. Each director attended or participated during the year in 75% or more of all meetings of committees on which he served that were held during the period of his service. The Compensation Committee serves as the nominating committee for evaluating and nominating candidates for election as directors. Directors presently serving on Board committees are as follows:

Audit Committee

| | Compensation Committee

| | Executive Committee

|

| Mr. von Arx (Chairman) | | Mr. Dykes (Chairman) | | Mr. Hunter (Chairman) |

| Mr. Dykes | | Mr. Von Arx | | Mr. Dykes |

| Mr. O’Meara | | Mr. O’Meara | | Mr. von Arx |

| Dr. Potter | | Dr. Potter | | |

The Audit Committee is authorized by the Board of Directors to review with the Company’s independent auditors the annual financial statements of the Company prior to publication, to review the work of and approve non-audit services performed by the independent auditors, and to make annual recommendations to the Board of Directors for the appointment of independent auditors for the ensuing year. The Committee also reviews the effectiveness of the financial and accounting functions, organization, operations and management of the Company. The Board of Directors has adopted a written charter for the functioning of the Audit Committee. The charter is set forth in Appendix A to this proxy statement. All directors serving as members of the Audit Committee are independent within the meaning of Rule 4200(a)(14) of the Nasdaq Stock Market Marketplace Rules.

The Compensation Committee determines the compensation of the Company’s chief executive officer and reviews and approves the compensation of all other officers of the Company. In addition, the Committee is responsible for administration of the Company’s stock option and stock purchase plans and, in that capacity, reviews and approves proposed grants of stock options. The Compensation Committee also serves as the nominating committee for evaluating and nominating candidates for election as directors.

The Executive Committee was established to render advice and recommendations to the Board of Directors with regard to policies of the Company and the conduct of its affairs, to consider matters submitted to the Committee during intervals between meetings of the Board of Directors and, subject to ratification by the full Board, to approve contracts, agreements and other material corporate matters. The Executive Committee held no meetings during fiscal 2002.

Directors who are also employed by the Company are not separately compensated for their service on the Board or any Board committee.

Directors not employed by the Company have been compensated solely through stock option grants for service on the Board during their current term of office and for prior years. Each non-employee director presently serving on the Board was granted, in July 2001, an option to purchase 20,000 shares of common stock at a price of $25.30 per share, which was the closing market price on the grant date. The option terms provided for vesting in equal monthly increments over the one-year period ending with the election of directors at the 2002 Annual Meeting (or October 31, 2002, if earlier).

-6-

Commencing with the 2002 Annual Meeting, non-employee directors will be compensated for their Board service through a combination of cash meeting fees and option grants. For Board meetings, non-employee directors will be paid $2,500 for each meeting attended in person and $1,000 for each meeting attended by telephone or other means. For committee meetings, non-employee directors serving on the committee will be paid $1,000 for each meeting attended (whether in person or by telephone) except that the person serving as the committee chair will be paid $2,000 per meeting. Total cash compensation earned by a director for attendance at meetings during any fiscal year may not exceed $40,000 unless otherwise approved by the Board.

Non-employee directors nominated for election at the 2002 Annual Meeting were each granted, in September 2002, an option to purchase 16,000 shares of common stock at a price of $12.51 per share, which was the closing market price on the grant date. These options will vest, subject to continued service as a director or as an employee of the Company, in equal increments on the last day of each calendar quarter following election as a director at the 2002 Annual Meeting or, if earlier, upon the election of directors at the annual meeting of shareholders to be held in 2003.

The Company also reimburses directors for expenses incurred in serving as a director.

1999 EMPLOYEE STOCK PURCHASE PLAN

The Board of Directors adopted the 1999 Employee Stock Purchase Plan (the “Purchase Plan”) in July 1999 and the shareholders approved the Purchase Plan in November 1999. The Purchase Plan provides employees of the Company and its majority-owned subsidiaries with an opportunity to purchase common stock through payroll deductions at a price that is 85% of the lower of the fair market value of common stock at the beginning of a participation period or on a purchase date.

Of the 600,000 shares originally authorized for issuance under the Purchase Plan, 437,305 shares have been issued to date leaving 162,695 shares available for future issuance. In August 2002, the Board of Directors unanimously approved an amendment of the plan, subject to obtaining shareholder approval, to increase the number of shares authorized for sale under the plan by 750,000 shares. If the amendment is approved by the shareholders, a total of 912,695 shares will be available for future issuance under the Purchase Plan. The amendment would not change any other terms of the Purchase Plan.

Unless otherwise noted, all share amounts stated in this proxy statement have been appropriately adjusted to reflect stock splits.

Purpose.The purpose of the Purchase Plan is to provide employees (including officers) of the Company and its majority-owned subsidiaries with an opportunity to purchase common stock through payroll deductions.

Administration.The Purchase Plan provides that it to be administered by the Board of Directors or by a committee appointed by the Board of Directors. All questions of interpretation or application of the plan are to be determined by the Board of Directors or the committee, and the decisions of the Board or committee are final, conclusive and binding upon all parties. The Compensation Committee of the Board of Directors oversees administration of the Purchase Plan.

Eligibility and Participation.Any individual who is an employee for tax purposes of the Company or any of its majority-owned subsidiaries designated from time to time by the Board of Directors is eligible to participate in the Purchase Plan, provided that he or she begins employment at least 30 calendar days prior to the date his or her participation in the Purchase Plan is effective, and subject to additional limitations imposed by Section 423(b) of the Internal Revenue Code of 1986, as amended (the “Code”) and limitations on stock ownership

-7-

described in the Purchase Plan. Eligible employees become participants in the Purchase Plan by delivering to the Company’s stock plan administrator, prior to the commencement of the applicable participation period, a subscription agreement authorizing payroll deductions.

Participation Periods.The Purchase Plan is implemented by consecutive, overlapping participation periods generally of 12 months duration, with new participation periods beginning in November and May of each year. Each participation period has two purchase dates, one in October and the other in April. The Board of Directors has the power to alter the duration of the participation periods and purchase dates without shareholder approval.

Purchase Price.The price at which shares are purchased on each purchase date under the Purchase Plan is 85% of the lower of (i) the fair market value of common stock on the date of commencement of the participation period or (ii) the fair market value of the common stock on the purchase date. For purposes of determining the fair market value on the date of commencement of the participation period, the closing sale price on the Nasdaq Stock Market for the trading day immediately proceeding the commencement date is used. For purposes of determining the fair market value on the purchase date, the closing sale price on the Nasdaq Stock Market for that day is used.

Payroll Deductions.The purchase price of the shares acquired under the Purchase Plan is accumulated by payroll deductions over the participation period. The rate of deductions may not exceed 15% of a participant’s compensation. A participant may discontinue his or her participation in the Purchase Plan or may change the rate of payroll deductions two times during any purchase period by filing with the Company a new authorization for payroll deductions. All payroll deductions made for a participant are credited to his or her account under the Purchase Plan and are deposited with the general funds of the Company to be used for any corporate purpose.

Grant and Exercise of Option.At the beginning of a participation period, each participant is granted an option to purchase on the purchase dates up to that number of shares equal to the participant’s accumulated payroll deductions for the participation period divided by the applicable purchase price; provided that the number of shares subject to an option shall not exceed 2,000 shares of common stock on any purchase date. On each purchase date the maximum number of full shares subject to an option that are purchasable with the accumulated payroll deductions in the participant’s account are purchased for the participant at the applicable purchase price. If, on any purchase date the number of shares available for purchase under the Purchase Plan exceeds the number of shares remaining available, the Company may make a pro rata allocation of the shares remaining available for purchase in as uniform a manner as practicable, and then either terminate the participation periods then in effect or permit them to continue.

No employee may participate in the Purchase Plan if, immediately after the grant of an option, the employee would own 5% or more of the total combined voting power or value of all classes of stock of the Company or of its majority-owned subsidiaries (including stock that may be purchased under the Purchase Plan or pursuant to any outstanding options), nor will any employee be entitled to buy more than $25,000 worth of stock (determined based on the fair market value of the common stock at the time the option is granted) under all employee stock purchase plans of the Company or any subsidiary in any calendar year.

Withdrawal.An employee may terminate his or her participation in a given participation period by giving written notice to the Company of his or her election to withdraw at any time prior to the end of the applicable participation period. All payroll deductions taken during the participation period are returned to the participant upon receipt of the withdrawal notice. Such withdrawal automatically terminates the participant’s interest in that participation period but does not have any effect upon the participant’s eligibility to participate in subsequent participation periods.

Termination of Employment.Termination of a participant’s employment for any reason, including retirement or death, immediately terminates his or her participation in the Purchase Plan.

Adjustments for Changes in Capitalization.In the event any change is made in the Company’s capitalization during a participation period, such as a stock split or stock dividend on common stock, which results in an increase or decrease in the number of shares of common stock outstanding without receipt of consideration by the Company, appropriate adjustments will be made in the purchase price and in the number of shares subject to purchase under the Purchase Plan, as well as in the number of shares reserved for issuance under the Purchase Plan.

-8-

In the event of the proposed dissolution or liquidation of the Company, the participation periods then in progress will be shortened. A new purchase date prior to the date of the proposed dissolution or liquidation will be set, and the Purchase Plan will terminate thereafter. In the event of a merger or sale of substantially all of the assets of the Company, the successor corporation must assume outstanding options under the Purchase Plan or substitute equivalent options, or the participation periods then in effect must be shortened and a new purchase date set.

Nonassignability.No rights or accumulated payroll deductions of an employee under the Purchase Plan may be pledged, assigned, transferred or otherwise disposed of in any way for any reason other than death. Any attempt to do so may be treated by the Company as an election to withdraw from the Purchase Plan.

Amendment and Termination of Purchase Plan.The Board of Directors may at any time amend or terminate the Purchase Plan, except that neither termination of the Purchase Plan nor any amendment may adversely affect options previously granted or the rights of any participant. The Company will seek shareholder approval of any amendments to the Purchase Plan to the extent that shareholder approval is necessary or desirable to comply with the applicable Code sections and related regulations governing employee stock purchase plans, as in effect at the time of the approval of the proposed amendment, or any other applicable laws, rules or regulations. The Purchase Plan will terminate on November 2, 2009 unless sooner terminated.

The Purchase Plan is intended to qualify as an “employee stock purchase plan” under the provisions of Sections 421 and 423 of the Code. Under these provisions, participants do not recognize income for federal income tax purposes either upon enrollment in the Purchase Plan or upon any purchase of stock under the Plan. All tax consequences are deferred until a participant sells the stock acquired under the Purchase Plan, disposes of such stock by gift or dies.

Upon disposition of the shares, a participant will be subject to tax, and the amount of the tax will depend upon the holding period. If the shares have been held by the participant for more than two years after the date of the option grant and more than one year after exercise of the option, the lesser of (a) the excess of the fair market value of the shares at the time of such disposition over the option price, or (b) the excess of the fair market value of the shares at the time the option was granted over the option price (which option price will be calculated as of the grant date) will be treated as ordinary income, and any further gain will be taxed as long-term capital gain. If the participant disposes of the shares before the expiration of these holding periods, the participant will generally recognize ordinary income for federal income tax purposes equal to the excess of the fair market value of the shares on the exercise date over the option price. Any further gain or loss will be long-term or short-term capital gain or loss, depending on the holding period.

The Company will be entitled to a deduction for amounts taxed as ordinary income to a participant only to the extent that ordinary income must be reported upon disposition of shares by the participant before the expiration of the holding periods described above.

The foregoing does not purport to be a complete summary of the effect of federal income taxation of Purchase Plan transactions upon participants and the Company. It also does not discuss the tax consequences of a participant’s death or the provisions of the income tax laws of any municipality, state or foreign country in which a participant may reside.

-9-

The following table provides information, as of June 30, 2002, for all compensation plans of the Company (including individual arrangements) under which the Company is authorized to issue equity securities.

Equity Compensation Plan Information

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights (1)

| | | Weighted average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(1)

| |

| | | | |

| Equity compensation plans approved by security holders | | 11,434,888 | (2) | | $ | 27.61 | | 2,690,503 | (3) |

| Equity compensation plans not approved by security holders | | 3,249,395 | (4) | | $ | 19.68 | | 827,554 | (5) |

| Total | | 14,684,283 | | | $ | 25.86 | | 3,355,362 | |

| (1) | | Refers to shares of the Company’s common stock. All amounts are as of June 30, 2002. |

| (2) | | Includes shares issuable upon exercise of outstanding options under the following plans in the amounts indicated: Amended and Restated Equity Compensation Plan—11,194,888 shares; and Stock Option Plan for Non-Employee Directors—240,000 shares. |

| (3) | | Includes shares remaining for future issuance under the following plans in the amounts indicated: Amended and Restated Equity Compensation Plan—2,527,808 shares; and 1999 Employee Stock Purchase Plan—162,695 shares (before giving effect to the proposed amendment described above). |

| (4) | | Includes shares issuable upon exercise of outstanding options under the following plans in the amounts indicated: 2001 Nonqualified Stock Option Plan—2,688,140 shares; Fiscal 2002 Stock Option Bonus Plan—84,306 shares; Fiscal 2001 Stock Option Bonus Plan—304,440 shares; and Nitres, Inc. 1999 Stock Option/Issuance Plan—172,509 shares. The options outstanding under the Nitres, Inc. 1999 Stock Option/Issuance Plan, which have a weighted average exercise price of $0.01 per share, were assumed by the Company in connection with its acquisition of Nitres, Inc. in May 2000. |

| (5) | | Includes shares remaining for future issuance under the following plans in the amounts indicated: 2001 Nonqualified Stock Option Plan—311,860 shares; and Fiscal 2002 Stock Option Bonus Plan—515,694 shares. No options have been granted under the Fiscal 2002 Stock Option Bonus Plan since October 2001, and the plan will expire by its terms on September 30, 2002 without any additional options having been granted under the plan. |

Other than the Purchase Plan, the only compensation plans or arrangements under which the Company is authorized to issue equity securities are the following (collectively, the “Option Plans”): (1) the Amended and Restated Equity Compensation Plan, which was originally adopted in 1989 (referred to below as the “Equity Compensation Plan”); (2) the 2001 Nonqualified Stock Option Plan; (3) the Fiscal 2002 Stock Option Bonus Plan; (4) the Fiscal 2001 Stock Option Bonus Plan; (5) the Stock Option Plan for Non-Employee Directors; and (6) options assumed under the Nitres, Inc. 1999 Stock Option/Issuance Plan in connection with the Company’s acquisition of Nitres, Inc. in May 2000. The only Option Plans under which the Company remains authorized to make future awards are the Equity Compensation Plan and the 2001 Nonqualified Stock Option Plan.

The Purchase Plan, as adopted in 1999, and all of the Option Plans, have been previously approved by the Company’s shareholders with the exception of the 2001 Nonqualified Stock Option Plan, the two Stock Option Bonus Plans, and the options assumed under the Nitres, Inc. 1999 Stock Option/Issuance Plan. The Equity Compensation Plan was originally adopted by the Board of Directors in 1989 and approved by the shareholders

-10-

in 1995. As permitted by its terms, the Equity Compensation Plan was amended by the Board of Directors in 1999 and 2000, without a shareholder vote, to authorize an additional 859,800 shares for nonqualified stock option grants to newly hired employees where the grants were deemed essential to induce such individuals to accept employment with the Company. A further amendment of the Equity Compensation Plan, increasing the shares authorized for issuance under the plan since its adoption to a total of 19,819,800 shares (including the 859,800 shares previously authorized by the Board of Directors) was approved by the shareholders in October 2000.

The following description of the Company’s Option Plans is merely a summary of some of their respective terms and provisions, is not intended to be a complete description and is qualified in its entirety by reference to the full text of the applicable plan.

Option Plans—General.The Option Plans are administered under the direction of the Compensation Committee of the Board of Directors, which is comprised entirely of directors not employed by the Company. The Committee has broad discretion to determine the terms and conditions of options granted under the Option Plans and must approve, among other things, recommendations regarding grants and grant guidelines with respect to: (1) the individuals to whom option grants are to be made; (2) the time or times at which options are granted; (3) the number of shares subject to each option; (4) the vesting terms of each option; and (5) the term of each option. The Option Plans prohibit the grant of options with an exercise price less than the fair market value of the Company’s common stock on the date of grant.

Each of the Option Plans provides that the option price, as well as the number of shares subject to options granted or to be granted under the plan, shall be appropriately adjusted in the event of any stock split, stock dividend, recapitalization or other specified events involving a change in the capitalization of the Company. The terms of the Option Plans generally permit the Board of Directors to amend or terminate the plans, provided that no modification or termination may adversely affect prior awards without the participant’s approval and subject, in the case of the Equity Compensation Plan, to obtaining shareholder approval to the extent required for incentive stock option grants under Section 422 of the Code.

Equity Compensation Plan.The Equity Compensation Plan provides for grants to participants in the form of both incentive stock options and nonqualified stock options. Incentive stock options are awards intended to qualify for certain favorable tax treatment under Section 422 of the Internal Revenue Code, as amended (the “Code”). To date no incentive stock options have been granted under the plan and none are presently contemplated. As of June 30, 2002, there were outstanding nonqualified stock options to purchase 11,194,888 shares, and 2,527,808 shares remained available for future awards under the plan. During fiscal 2002, options to purchase a total of 1,367,000 shares were granted under the plan at an average exercise price of $23.00 per share. The Compensation Committee has the exclusive right to determine those persons eligible to participate in the Equity Compensation Plan. Subject to the foregoing, any employee of the Company (including its controlled subsidiaries) or any other person, including directors, may participate in the Equity Compensation Plan if the Committee determines such participation is in the best interest of the Company.

Non-Employee Director Stock Option Plan.The Stock Option Plan for Non-Employee Directors (the “Director Plan”) was adopted by the Board of Directors and approved by the shareholders in 1995. The Director Plan provided for fixed annual grants to the Company’s non-employee directors of nonqualified stock options to purchase shares of the Company’s common stock. The Director Plan was terminated as to future grants in 1997; as of June 30, 2002, there were options to purchase 240,000 shares outstanding under this plan.

2001 Nonqualified Stock Option Plan.The 2001 Nonqualified Stock Plan (the “Nonqualified Plan”) was adopted by the Board of Directors in April 2001. As amended to date, the Nonqualified Plan authorizes grants to eligible participants of nonqualified stock options to purchase shares of the Company’s common stock. During fiscal 2002, options to purchase a total of 1,836,633 shares were granted under the Nonqualified Plan at an average exercise price of $18.62 per share. As of June 30, 2002, there were options outstanding under the Nonqualified Plan to purchase 2,688,140 shares, and 311,860 shares were available for future awards under the plan. No directors or officers of the Company are eligible to receive awards under the Nonqualified Plan. Excluding directors and officers, all employees of the Company (including its controlled subsidiaries) may participate in the Nonqualified Plan.

-11-

Fiscal 2001 and Fiscal 2002 Stock Option Bonus Plans.The Board of Directors adopted the Fiscal 2001 Stock Option Bonus Plan (“Fiscal 2001 Bonus Plan”) in October 1999 in order to provide for grants of nonqualified stock options to eligible employees of the Company (including its controlled subsidiaries) for each quarter of fiscal 2001 if the Company achieved pre-established financial targets for the quarter. Directors and officers of the Company were not eligible for awards under the plan, and employees participating in cash incentive compensation programs of the Company did not participate in the plan. Participants in the Fiscal 2001 Bonus Plan received stock option grants for all four quarters representing rights to purchase a total of 372,400 shares at an average exercise price of $29.34 per share. The Fiscal 2001 Bonus Plan terminated as to additional grants in September 2001.

The Fiscal 2002 Stock Option Bonus Plan (“Fiscal 2002 Bonus Plan”) was adopted by the Board of Directors in July 2001 with substantially the same terms as the Fiscal 2001 Bonus Plan. Under the Fiscal 2002 Bonus Plan, participants received only the first of the four potential option grants for fiscal 2002, with the options awarded representing rights to purchase a total of 84,306 shares at an average exercise price of $18.75 per share. The Fiscal 2002 Bonus Plan expires by its terms on September 30, 2002. No stock option bonus plan has been adopted for Fiscal Year 2003.

Nitres, Inc. 1999 Stock Option/Issuance Plan.In connection with the acquisition of Nitres, Inc. in May 2000, pursuant to which Nitres became a wholly-owned subsidiary of the Company and changed its name to Cree Lighting Company, the Company assumed certain outstanding stock options granted under the Nitres, Inc. 1999 Stock Option/Issuance Plan (the “Nitres Plan”). Since the closing of the acquisition, no additional stock options have been awarded, nor are any authorized to be awarded, under the Nitres Plan. As of June 30, 2002, there were 172,509 nonqualified stock options outstanding under the Nitres Plan with an average exercise price of $0.005 per share.

-12-

The following table sets forth information regarding the beneficial ownership of the Company’s common stock as of September 13, 2002 by (i) each person known to the Company to be the beneficial owner of more than 5% of the outstanding common stock (of which there were none), (ii) each executive officer named in the Summary Compensation Table on page14, (iii) each person serving as a director or nominated for election as a director, and (iv) all executive officers and directors as a group. Unless otherwise noted, each of the persons listed below is believed to hold sole voting and sole investment power with respect to the shares indicated.

Name and Address (1)

| | Common Stock Beneficially Owned (2)

| | Percentage of Outstanding Shares

| |

| John W. Palmour, Ph.D. | | 1,285,591 | | 1.8 | |

| Dolph W. von Arx | | 967,500 | | 1.3 | |

| F. Neal Hunter | | 731,303 | | 1.0 | |

| Charles M. Swoboda | | 571,841 | | 0.8 | |

| Cynthia B. Merrell | | 373,211 | | 0.5 | |

| James E. Dykes | | 298,000 | | 0.4 | |

| M. Todd Tucker | | 202,615 | | 0.3 | |

| William J. O’Meara | | 52,000 | | 0.1 | |

| Robert J. Potter, Ph.D. | | 45,000 | | 0.1 | |

| All directors and executive officers as a group (9 persons) | | 4,527,061 | | 6.2 | % |

| (1) | | All addresses are in care of the Company at 4600 Silicon Drive, Durham, NC 27703. |

| (2) | | Includes the following share amounts with respect to which the named person had the right to acquire beneficial ownership within sixty days after September 13, 2002: Dr. Palmour, 312,000; Mr. von Arx, 236,000; Mr. Hunter, 270,000; Mr. Swoboda, 510,000; Ms. Merrell, 369,200; Mr. Dykes, 284,000; Mr. Tucker, 200,000; Mr. O’Meara, 52,000; Dr. Potter, 38,000; and all directors and executive officers as a group, 2,271,200. The share amount reported for Mr. Swoboda includes 780 shares held in a revocable trust over which Mr. Swoboda has sole investment control. The share amount reported for Dr. Palmour includes 40,000 shares owned by his spouse and with respect to which he may be deemed to possess shared voting and investment power; Dr. Palmour disclaims beneficial ownership of these shares. The share amount reported for Mr. von Arx includes 20,000 shares owned by a charitable foundation of which he is a director and with respect to which he may be deemed to possess shared voting and investment power. The share amount reported for Mr. von Arx also includes 10,000 shares owned by a charitable remainder unitrust of which Mr. von Arx has no investment control. Mr. von Arx disclaims beneficial ownership of the 20,000 shares held by the charitable foundation and the 10,000 shares held by the charitable remainder unitrust. |

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Directors, officers and greater-than-ten-percent (10%) beneficial owners are required by Commission rules to furnish the Company with copies of all reports they file under Section 16(a). To the Company’s knowledge, based solely on its review of the copies of such reports furnished to the Company and written representations that no other reports were required, all Section 16(a) filing requirements applicable to its directors, officers and beneficial owners were complied with on a timely basis during the fiscal year ended June 30, 2002.

-13-

The following table summarizes the cash compensation, for the fiscal years indicated, of the Company’s chief executive officer and all other persons who served as executive officers at the end of fiscal 2002.

Summary Compensation Table

| | | | | Annual Compensation

| | Long Term Compensation Awards

| | | |

Name and Principal Position

| | Year Ended

| | Salary ($)

| | Bonus ($)

| | Securities Underlying Options (#)

| | | All Other Compensation ($) (1)

|

F. Neal Hunter Chairman | | 2002 2001 2000 | | $ | 120,000 230,000 230,000 | | $ | 0 0 138,000 | | 100,000 270,000 240,000 | (3) (3) | | $ | 230 216 216 |

Charles M. Swoboda President and Chief Executive Officer | | 2002 2001 2000 | | $ | 300,000 210,000 210,000 | | $ | 0 0 100,800 | | 320,000 400,000 240,000 | (3) (3) | | $ | 336 192 192 |

M. Todd Tucker Executive Vice President Operations (2) | | 2002 2001 2000 | | $ | 210,000 120,627 — | | $ | 335,775 110,000 — | | 75,000 600,000 — | | | $ $ | 336 196 — |

Cynthia B. Merrell Chief Financial Officer and Treasurer | | 2002 2001 2000 | | $ | 165,000 135,000 135,000 | | $ | 11,139 0 48,600 | | 75,000 70,000 92,800 | | | $ | 317 240 240 |

| (1) | | Represents group term life insurance premiums paid by the Company. |

| (2) | | Mr. Tucker was hired on December 1, 2000 and became an executive officer of the Company effective June 25, 2001. |

| (3) | | In April 2002, Mr. Hunter and Mr. Swoboda each released and consented to cancellation of certain options to purchase shares of the Company’s common stock. The option rights Mr. Hunter released were rights to purchase 120,000 shares at $41.97 per share and 120,000 shares at $71.53 per share under option awards made in January 2000 and July 2000, respectively. The option rights Mr. Swoboda released were rights to purchase 100,000 shares at $41.97 per share and 120,000 shares at $71.53 per share, also under option awards made in January 2000 and July 2000, respectively. Mr. Hunter and Mr. Swoboda each voluntarily released the option rights, without any payment or commitment from the Company to award replacement grants or other compensation, in order to make the shares previously reserved for the cancelled options available to the Company for grants to other key employees. |

-14-

The following table provides information about stock options granted to the named executive officers during fiscal 2002.

Option Grants in Last Fiscal Year

| | | No. of Securities Underlying Options Granted

| | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price

($/sh)

| | Expiration Date (1)

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name

| | | | | | 5%

| | 10%

|

| F. Neal Hunter (2) | | 100,000 | | 3.0 | % | | $ | 25.30 | | 7/2/08 | | $ | 1,029,964 | | $ | 2,400,254 |

| Charles M. Swoboda (3) | | 320,000 | | 9.7 | | | | 25.30 | | 7/2/08 | | | 3,295,885 | | | 7,680,814 |

| M. Todd Tucker (4) | | 75,000 | | 2.3 | | | | 13.89 | | 4/1/09 | | | 424,097 | | | 988,326 |

| Cynthia B. Merrell (5) | | 75,000 | | 2.3 | | | | 25.30 | | 7/2/08 | | | 772,473 | | | 1,800,191 |

| (1) | | The options listed were granted under the Company’s Equity Compensation Plan. Each option expires on the earlier of the expiration date shown or 90 days after termination of the recipient’s employment, except in cases of death or disability. The option may be exercised to purchase vested shares only. Upon termination of employment the option is forfeited with respect to any shares not then vested. In the event of a change in control, as defined in the Plan, the option becomes fully vested and exercisable unless it is assumed by a surviving entity. |

| (2) | | The option vested in its entirety in July 2002. |

| (3) | | The option vests in two installments, with 120,000 shares vesting in July 2003 and 200,000 additional shares vesting in July 2004, provided Mr. Swoboda remains an employee of the Company, except that the option becomes fully vested in the event Mr. Swoboda’s employment is terminated without cause. |

| (4) | | The option vests in three annual installments, with 25,000 shares vesting in April 2003, 25,000 additional shares vesting in April 2004 and 25,000 additional shares vesting in April 2005, provided Mr. Tucker remains an employee of the Company. |

| (5) | | The option vests in three annual installments, with 10,000 shares vesting in July 2002, 30,000 additional shares vesting in July 2003 and 35,000 additional shares vesting in July 2004, provided Ms. Merrell remains an employee of the Company. |

The following table provides information about stock options exercised by the named executive officers during fiscal 2002.

Aggregated Option Exercises in Last Fiscal Year and

Fiscal Year-End Option Values

Name

| | Shares Acquired on Exercise

| | Value Realized (1)

| | Number of Securities Underlying Unexercised Options at FY-End (#) Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at FY-End ($) Exercisable/Unexercisable (2)

|

| F. Neal Hunter | | 388,000 | | $ | 3,438,118 | | 170,000 / 200,000 | | $0 / $0 |

| Charles M. Swoboda | | 120,000 | | $ | 2,265,379 | | 510,000 / 400,000 | | $1,600,975 / $0 |

| M. Todd Tucker | | 0 | | | 0 | | 200,000 / 475,000 | | $0 / $0 |

| Cynthia B. Merrell | | 0 | | | 0 | | 278,400 / 195,800 | | $2,158,359 / $27,336 |

| (1) | | Represents the market value of shares acquired at the date of exercise less the exercise price paid to the Company, without adjustment for income and other taxes payable upon exercise. |

| (2) | | Represents the value of the shares issuable upon exercise, calculated using the value at the fiscal year end, less the exercise price. The fiscal year end value was $13.23 per share based on the last sale price on June 28, 2002 as reported by The Nasdaq Stock Market. |

-15-

With the exception of Mr. Tucker, none of the Company’s executive officers have employment agreements with the Company. Mr. Tucker has been employed since December 1, 2000 as the Company’s Executive Vice President for Operations under an employment agreement that extends for a term of five years. The agreement established an annual salary of $210,000, subject to review in accordance with the Company’s policies, procedures and practices. The agreement also provided for a sign-on bonus of $50,000 payable upon commencement of employment and for additional non-recurring compensation totaling $400,000, payable in 20 monthly increments of $10,000 each following employment and a one-time payment of $200,000 in December 2001. The sign-on bonus and non-recurring compensation have been paid in full in accordance with the terms of the agreement. The agreement also provides that if Mr. Tucker is terminated without cause (as defined in the agreement) the Company will pay him a total of $1,500,000, in three equal annual installments on the first, second and third anniversaries of the termination date, or sooner at the Company’s option, except that the Company is not obligated to make or continue the payments if Mr. Tucker engages in certain activities deemed detrimental to the Company. If the Company terminates his employment for cause, the Company has no further obligation to make any payments to or on behalf of Mr. Tucker, except as may be required by applicable law.

The Compensation Committee determines the compensation of the Company’s chief executive officer. It also reviews and approves compensation recommendations submitted by the chief executive officer for all other executive and non-executive officers. In addition, the Committee administers the Company’s Equity Compensation Plan and other employee stock option plans and, in that capacity, is responsible for reviewing and approving stock options awarded under the plans. This report describes the policies followed by the Committee with respect to compensation of executive officers during fiscal 2002, and the bases for the compensation of Mr. Swoboda, who served as the Chief Executive Officer during the year.

Executive Compensation Policies. The Committee believes the Company’s overall compensation program should relate to creating shareholder value. Accordingly, the Committee seeks to adhere to executive compensation practices that will enable the Company to attract and retain talented executives, align the interests of executives with shareholder interests through equity-based plans and motivate executives to achieve targeted Company objectives. In furtherance of these goals, cash compensation is generally set annually at levels which take into account both competitive and performance factors. The Company also relies to a substantial degree on stock options to attract and motivate its executives.

For fiscal 2002 executive officer compensation consisted of base salary, participation in an annual management incentive compensation program and stock option grants, in addition to other benefits available to Company employees generally. The Committee sought to establish each overall package at competitive market levels based on executive compensation surveys, executive compensation at other publicly held semiconductor companies and other relevant information.

Cash Compensation. The Committee examined both qualitative and quantitative factors relating to corporate and individual performance in approving salary adjustments. The qualitative factors in many instances necessarily involved a subjective assessment by the Committee. The Committee did not base its considerations on any single factor nor specifically assign relative weights to factors. It instead considered a variety of factors and evaluated individual performance against those factors both in absolute terms and in relation to the executive’s peers at similar companies. With respect to executive officers other than Mr. Swoboda and Mr. Hunter, who served as Executive Chairman during the year, the Committee also relied substantially on Mr. Swoboda’s evaluations and recommendations. Based on its review, the Committee authorized that the base salaries of Mr. Swoboda and the other named executive officers for fiscal 2002 be increased, except that the base salary of Mr. Hunter was set at a lower amount in view of his transition to an Executive Chairman role at the beginning of the year. The Committee also approved a revised management incentive compensation program for fiscal 2002. Under the revised program, each participant was assigned a target award for the fiscal year, expressed as a percentage of base salary, to be paid if certain pre-established goals were achieved. For each of

-16-

Messrs. Hunter and Swoboda, all of the target incentive payment was conditioned upon achieving, as a corporate goal, a specified net income target for fiscal year 2002. For other participants, 60% of the target incentive payment was conditioned upon achieving the same corporate goal for the year, and the remaining 40% of the target was payable quarterly if individual quarterly goals established by Mr. Swoboda were met. No amounts were paid under the plan for fiscal 2002 with respect to the corporate net income goal, which was not achieved.

Equity Compensation. The Company utilizes stock options granted to executive officers under the Company’s Equity Compensation Plan to align shareholder and management interests by giving executive officers a substantial economic stake in long-term appreciation of the Company’s stock. Only nonqualified stock options have been awarded under this Plan, and all awards have been made at exercise prices not less than the market value of the underlying stock at the time of the grant.

In reviewing proposed grants to executive officers, the Compensation Committee takes into account all factors it deems appropriate, including the officer’s position and level of responsibility, the officer’s existing unvested option holdings, the potential reward to the officer if the stock price appreciates and the competitiveness of the officer’s overall compensation arrangements. Outstanding performance by an individual may also be taken into consideration. Option grants are often made to new executives upon commencement of employment and, on occasion, to executives in connection with a significant change in job responsibility. The Committee also relies on the chief executive officer’s recommendations in approving option grants to other executive officers. The Committee approved stock option grants to executive officers during fiscal 2002 based on the policies described above and Mr. Swoboda’s recommendations.

Bases for Chief Executive Officer Compensation. The Compensation Committee followed the general policies described above in approving Mr. Swoboda’s cash compensation for fiscal 2002 and the stock options awarded him during the year, taking into consideration a number of factors relating to corporate and individual performance.

Based on these factors the Committee approved an annual salary of $300,000 for Mr. Swoboda commencing in fiscal 2002, with a target incentive award equal to 50% of his base salary. No award was paid to Mr. Swoboda under the management incentive compensation program for fiscal 2002. Mr. Swoboda also received one option grant during the fiscal year, representing the right to purchase 320,000 shares of common stock at $25.30 per share, with the exercise price equal to the closing market price on the grant date. This option vests as to 120,000 shares in July 2003 and 200,000 shares in July 2004, subject to continued employment at the applicable vesting date, except that it becomes fully-vested in the event Mr. Swoboda’s employment is terminated without cause.

THE COMPENSATION COMMITTEE

James E. Dykes, Chairman

Dolph W. von Arx

William J. O’Meara

Robert J. Potter, Ph.D.

None of the current members of the Compensation Committee or the members who served during fiscal 2002 has ever served as an officer or employee of the Company. No interlocking relationships exist between the Company’s Board of Directors or Compensation Committee and the board of directors or compensation committee of any other company.

-17-

Ernst & Young LLP served as independent auditors of the Company for the fiscal year ended June 30, 2002 and has been selected to serve as independent auditors of the Company for the current fiscal year. A representative of Ernst & Young LLP is expected to be present at the annual meeting, will have the opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to appropriate questions. During fiscal 2002, the Company paid its independent auditors, Ernst & Young LLP, the amounts shown below for services in the indicated categories:

| Audit fees | | $ | 230,506 |

| Financial information systems design and implementation fees | | | 0 |

| Audit related services | | | 99,650 |

| All other fees (1) | | | 278,873 |

| | |

|

|

| Total | | $ | 609,029 |

| (1) | | These fees were for tax planning services. |

The role of the Audit Committee is to assist the Board of Directors in its oversight of the Company’s financial reporting process. Management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements, the Company’s accounting and financial reporting principles, and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for auditing the Company’s financial statements and expressing an opinion as to their conformity with generally accepted accounting principles.

In the performance of its oversight function, the Audit Committee has reviewed and discussed the audited financial statements with management and the independent auditors. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as currently in effect. In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as currently in effect, has considered whether the provision of non-audit services by the independent auditors to the Company is compatible with maintaining the auditor’s independence and has discussed with the auditors the auditors’ independence.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting. Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal control and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that the Company’s auditors are in fact independent.

Based upon the review and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the Audit Committee Charter, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2002 to be filed with the Securities and Exchange Commission.

THE AUDIT COMMITTEE

Dolph W. von Arx, Chairman

James E. Dykes

William J. O’Meara

Robert J. Potter, Ph.D.

-18-

Other than the proposals described in this proxy statement, the Board of Directors presently knows of no other business to be conducted at the annual meeting. Under the Company’s Bylaws, any shareholder desiring to present a proposal for consideration at the meeting, including any director nomination, was required to give the Company written notice of the proposal by a certain date. No timely proposals have been received. Should any other business properly come before the meeting, the persons named in the accompanying form of proxy may vote the shares represented by the proxy in their discretion except as noted below.

Pursuant to the Company’s Bylaws, the size of the Board of Directors was fixed at nine members in 1988 but since then generally no more than seven persons have served on the Board at any one time. Consistent with prior practice only seven persons have been nominated for election at the annual meeting, and under the rules of the Securities and Exchange Commission the accompanying proxy cannot be voted for more than seven nominees.

Pursuant to the rules of the Securities and Exchange Commission, shareholder proposals submitted for inclusion in the Company’s proxy statement and form of proxy for the annual meeting to be held in 2003 must be received by the Company not later than May 23, 2003, and must comply with the Commission’s rules in other respects.

Other shareholder proposals to be presented at the annual meeting in 2003, including director nominations, must comply with the notice requirements of the Company’s Bylaws and be delivered to the Company not later than August 30, 2003, nor earlier than July 31, 2003. Any such proposals should be sent via means that afford proof of delivery to the Secretary at the Company’s principal executive offices.

The Company will bear the cost of this solicitation, including the preparation, printing and mailing of the proxy statement, proxy card and any additional soliciting materials sent by the Company to shareholders. In addition, the Company’s directors, officers and employees may solicit proxies personally or by telephone without additional compensation. The Company will also reimburse brokerage firms and other persons representing beneficial owners of shares for reasonable expenses incurred in forwarding proxy-soliciting materials to the beneficial owners.

The Company will mail its 2002 Annual Report, this proxy statement and the accompanying proxy card to shareholders beginning on or about September 27, 2002. The annual report and proxy statement will also be available on the Internet atwww.cree.com/annualmeeting.The annual report is not part of the Company’s proxy soliciting materials.

A copy of the Company’s report on Form 10-K for the fiscal year ended June 30, 2002 will be furnished without charge to any shareholder whose proxy is solicited hereby upon written request directed to: Investor Relations Manager, Cree, Inc., 4600 Silicon Drive, Durham, North Carolina 27703-8475 (telephone 919-313-5300).

The Company’s principal executive offices are located at 4600 Silicon Drive, Durham, North Carolina 27703-8475, and the main telephone number at that location is (919) 313-5300.

Dated: September 20, 2002

-19-

APPENDIX A

Organization

The Audit Committee of the Board of Directors shall have at least three directors, all of whom are financially literate, with at least one member who has accounting or financial management expertise. All members of this committee must be independent of management and the Company.

Statement of Policy

The Audit Committee shall provide assistance to the Board of Directors in fulfilling its responsibilities to the shareholders, potential shareholders, and the investment community relating to corporate accounting, reporting practices of the Company, and the quality and integrity of financial reports of the Company. In doing so, it is the responsibility of the Audit Committee to maintain free and open communication between the directors, the independent auditors and the financial management of the Company.

Responsibilities

In carrying out its responsibilities, the Audit Committee believes its policies and procedures should remain flexible in order to best react to changing conditions and to ensure to the directors and shareholders that the corporate accounting and reporting practices of the Company are in accordance with generally accepted accounting principles, the Securities and Exchange Commission and all other requirements and are of the highest quality.

In carrying out these responsibilities, the Audit Committee will:

| | • | | Obtain the full Board of Directors’ approval of this Charter and review and reassess this Charter as conditions dictate, but at least annually. |

| | • | | Review and recommend to the directors the independent auditors to be selected to audit the consolidated financial statements of the Company. |

| | • | | Have a clear understanding with the independent auditors that they are ultimately accountable to the Audit Committee and to the Board of Directors, as the shareholders’ representatives, who have the ultimate authority in deciding to engage, evaluate, and if appropriate, terminate their services. |

| | • | | Meet at least quarterly with the independent auditors and financial management of Cree to review the scope of the proposed audit, the timing of quarterly reviews for the current fiscal year and the procedures to be utilized. At the conclusion of each audit and quarterly review, discuss the results, including any comments or recommendations by the independent auditors. |

| | • | | Periodically review with the independent auditors, and with the Company’s financial and accounting personnel, the adequacy and effectiveness of the Company’s accounting and financial internal controls. Also elicit any recommendations for the improvement of such internal controls or of particular areas where new or more detailed controls or procedures are desirable. Emphasis should be given to the adequacy of internal controls to expose any payments, transactions, or procedures that might be deemed illegal or improper. |

| | • | | Review communications received by the Company from the Securities and Exchange Commission, U.S. Government auditors or other regulators together with any other legal matters that may have a material effect on the financial statements of the Company. |

| | • | | Inquire of management and the independent auditors about significant risks or exposures and assess the steps management has taken to minimize such risks to the Company. |

| | • | | Review the quarterly financial statements with the Chief Financial Officer and the independent auditors prior to the filing of the Form 10-Q and prior to the press release of results, if possible. |

Appendix A-1

| | • | | Determine that the independent auditors do not take exception to the disclosure and the content of the financial statements. Discuss other matters as appropriate including significant adjustments, management’s judgments and accounting estimates, new accounting policies and any disagreements with management. The Chair of the Committee may represent the entire committee for purposes of this review. |

| | • | | Before filing the Form 10-K, review the financial statements contained in the Form 10-K with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and content of the financial statements to be presented to the shareholders. Review with financial management and the independent auditors the results of their timely analysis of significant financial reporting issues and practices, including changes in, or adoptions of, accounting principles and disclosure practices, and discuss any other matters communicated to the committee by the auditors. Also review with financial management and the independent auditors their judgments about the quality, not just acceptability, of the Company’s accounting principles and the clarity of the financial disclosure practices used. Also assess the degree of aggressiveness or conservatism of Cree’s accounting principles and underlying estimates, and other significant decisions made in preparing the financial statements. This should be an open and frank discussion. |

| | • | | Provide sufficient opportunity for the independent auditors to meet with the members of the Audit Committee without members of management present. Among the items to be discussed in these meetings are the independent auditors’ evaluation of Cree’s financial and accounting personnel and that the independent auditors receive cooperation from Company personnel during the course of their audit and reviews. Also inquire about the quality of accounting principles applied and significant judgments made affecting the financial statements and that the Company’s financial statements are prepared in accordance to generally accepted accounting principles in all material respects. |

| | • | | Review at least annually with the Chief Financial Officer the accounting and financial personnel and succession planning. |

| | • | | Review the results of the annual audit with the Board of Directors. If requested by the Board, invite the independent auditors to attend the Board of Directors meeting to assist in reporting results of the annual audit or answer other directors’ questions. |

| | • | | On an annual basis, obtain from the independent auditors a written communication delineating their relationship with the Company as required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees”. In addition, actively engage in dialog to review with the independent auditors any disclosed relationships or professional services that impact the objectivity or independence of the auditor, or recommend that the Board of Directors take appropriate action to ensure the continuing independence of the auditors. |

| | • | | Submit the minutes of all meetings of the Audit Committee to the Board of Directors. |

| | • | | Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose if, in its judgment, that is appropriate. |

| | • | | Establish, review and update periodically a Code of Ethical Conduct and ensure that management has established a system to enforce this Code. Also review management’s monitoring of the Company’s compliance with the Code. |

Appendix A-2

APPENDIX B

CREE, INC.

1999 EMPLOYEE STOCK PURCHASE PLAN

[As amended August 5, 2002, subject to shareholder approval

with respect to amended Section 13(a)]

| 1. | | Purpose. The purpose of the Plan is to provide employees of the Company and its Designated Subsidiaries with an opportunity to purchase Common Stock of the Company through accumulated payroll deductions and Interest accrued thereon. It is the intention of the Company to have the Plan qualify as an “Employee Stock Purchase Plan” under Section 423 of the Internal Revenue Code of 1986, as amended. Accordingly, the provisions of the Plan shall be construed so as to extend and limit participation in a manner consistent with the requirements of that section of the Code. |

| | (a) | | “Board” shall mean the Board of Directors of the Company or, as applicable, a committee to which the Board has delegated authority or responsibility hereunder pursuant to Section 14(b). |

| | (b) | | “Code” shall mean the Internal Revenue Code of 1986, as amended. |

| | (c) | | “Common Stock” shall mean the common stock of the Company. |