UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2021

Commission File Number 1-11758

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Delaware | 1585 Broadway | 36-3145972 | (212) | 761-4000 | |

(State or other jurisdiction of incorporation or organization) | New York, | NY | 10036 | (I.R.S. Employer Identification No.) | (Registrant’s telephone number, including area code) |

| (Address of principal executive offices, including zip code) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, $0.01 par value | MS | New York Stock Exchange |

| Depositary Shares, each representing 1/1,000th interest in a share of Floating Rate | MS/PA | New York Stock Exchange |

| Non-Cumulative Preferred Stock, Series A, $0.01 par value |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | MS/PE | New York Stock Exchange |

| Non-Cumulative Preferred Stock, Series E, $0.01 par value |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | MS/PF | New York Stock Exchange |

| Non-Cumulative Preferred Stock, Series F, $0.01 par value |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | MS/PI | New York Stock Exchange |

| Non-Cumulative Preferred Stock, Series I, $0.01 par value |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | MS/PK | New York Stock Exchange |

| Non-Cumulative Preferred Stock, Series K, $0.01 par value |

| Depository Shares, each representing 1/1000th interest in a share of 4.875% | MS/PL | New York Stock Exchange |

| Non-Cumulative Preferred Stock, Series L, $0.01 par value |

| Global Medium-Term Notes, Series A, Fixed Rate Step-Up Senior Notes Due 2026 | MS/26C | New York Stock Exchange |

| of Morgan Stanley Finance LLC (and Registrant’s guarantee with respect thereto) |

| Morgan Stanley Cushing® MLP High Income Index ETNs due March 21, 2031 | MLPY | NYSE Arca, Inc. |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 30, 2021, there were 1,860,588,915 shares of the Registrant’s Common Stock, par value $0.01 per share, outstanding.

QUARTERLY REPORT ON FORM 10-Q

For the quarter ended March 31, 2021

| | | | | | | | | | | | | | |

| Table of Contents | Part | Item | Page |

| I | | |

| I | 2 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| I | 3 | | |

| | | |

| | | |

| | | |

| | | |

| I | 1 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | |

| II | | |

| II | 1 | | |

| II | 1A | |

| II | 2 | | |

| I | 4 | | |

| II | 6 | | |

| | | |

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website, www.sec.gov, that contains annual, quarterly and current reports, proxy and information statements and other information that issuers file electronically with the SEC. Our electronic SEC filings are available to the public at the SEC’s website.

Our website is www.morganstanley.com. You can access our Investor Relations webpage at www.morganstanley.com/about-us-ir. We make available free of charge, on or through our Investor Relations webpage, our proxy statements, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (“Exchange Act”), as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We also make available, through our Investor Relations webpage, via a link to the SEC’s website, statements of beneficial ownership of our equity securities filed by our directors, officers, 10% or greater shareholders and others under Section 16 of the Exchange Act.

You can access information about our corporate governance at www.morganstanley.com/about-us-governance, our sustainability initiatives at www.morganstanley.com/about-us/sustainability-at-morgan-stanley and our commitment to diversity and inclusion at www.morganstanley.com/about-us/diversity. Our webpages include:

•Amended and Restated Certificate of Incorporation;

•Amended and Restated Bylaws;

•Charters for our Audit Committee, Compensation, Management Development and Succession Committee, Nominating and Governance Committee, Operations and Technology Committee, and Risk Committee;

•Corporate Governance Policies;

•Policy Regarding Corporate Political Activities;

•Policy Regarding Shareholder Rights Plan;

•Equity Ownership Commitment;

•Code of Ethics and Business Conduct;

•Code of Conduct;

•Integrity Hotline Information;

•Environmental and Social Policies;

•Sustainability Report;

•Task Force on Climate-related Financial Disclosures Report; and

•Diversity and Inclusion Report.

Our Code of Ethics and Business Conduct applies to all directors, officers and employees, including our Chief Executive Officer, Chief Financial Officer and Deputy Chief Financial Officer. We will post any amendments to the Code of Ethics and Business Conduct and any waivers that are required to be disclosed by the rules of either the SEC or the New York Stock Exchange LLC (“NYSE”) on our website. You can request a copy of these documents, excluding exhibits, at no cost, by contacting Investor Relations, 1585 Broadway, New York, NY 10036 (212-761-4000). The information on our website is not incorporated by reference into this report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Introduction

Morgan Stanley is a global financial services firm that maintains significant market positions in each of its business segments—Institutional Securities, Wealth Management and Investment Management. Morgan Stanley, through its subsidiaries and affiliates, provides a wide variety of products and services to a large and diversified group of clients and customers, including corporations, governments, financial institutions and individuals. Unless the context otherwise requires, the terms “Morgan Stanley,” “Firm,” “us,” “we” or “our” mean Morgan Stanley (the “Parent Company”) together with its consolidated subsidiaries. Disclosures reflect the effects of the acquisitions of E*TRADE Financial Corporation (“E*TRADE”) and Eaton Vance Corp. (“Eaton Vance”) prospectively from the acquisition dates, October 2, 2020 and March 1, 2021, respectively. See the “Glossary of Common Terms and Acronyms” for the definition of certain terms and acronyms used throughout this Form 10-Q.

A description of the clients and principal products and services of each of our business segments is as follows:

Institutional Securities provides a variety of products and services to corporations, governments, financial institutions and high to ultra-high net worth clients. Investment banking services consist of capital raising and financial advisory services, including services relating to the underwriting of debt, equity and other securities, as well as advice on mergers and acquisitions, restructurings, real estate and project finance. Our Equity and Fixed Income businesses include sales, financing, prime brokerage, market-making, Asia wealth management services and certain business-related investments. Lending activities include originating corporate loans and commercial real estate loans, providing secured lending facilities, and extending securities-based and other financing to customers. Other activities include research.

Wealth Management provides a comprehensive array of financial services and solutions to individual investors and small to medium-sized businesses and institutions covering: financial advisor-led brokerage and investment advisory services; self-directed brokerage services, including through the E*TRADE platform; financial and wealth planning services; workplace services including stock plan administration; annuity and insurance products; securities-based lending, residential real estate loans and other lending products; banking; and retirement plan services.

Investment Management provides a broad range of investment strategies and products that span geographies, asset classes, and public and private markets to a diverse group of clients across institutional and intermediary channels. Strategies and products, which are offered through a variety of investment vehicles, include equity, fixed income, alternatives and solutions, and liquidity and overlay services. Institutional clients include defined benefit/defined contribution plans, foundations, endowments, government entities, sovereign wealth funds, insurance companies, third-party fund sponsors and corporations. Individual clients are generally served through intermediaries, including affiliated and non-affiliated distributors.

Management’s Discussion and Analysis includes certain metrics that we believe to be useful to us, investors, analysts and other stakeholders by providing further transparency about, or an additional means of assessing, our financial condition and operating results. Such metrics, when used, are defined and may be different from or inconsistent with metrics used by other companies.

The results of operations in the past have been, and in the future may continue to be, materially affected by: competition; risk factors; legislative, legal and regulatory developments; and other factors. These factors also may have an adverse impact on our ability to achieve our strategic objectives. Additionally, the discussion of our results of operations herein may contain forward-looking statements. These statements, which reflect management’s beliefs and expectations, are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of the risks and uncertainties that may affect our future results, see “Forward-Looking Statements,” “Business—Competition,” “Business—Supervision and Regulation,” and “Risk Factors” in the 2020 Form 10-K, and “Liquidity and Capital Resources—Regulatory Requirements” herein.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Executive Summary

Overview of Financial Results

Consolidated Results—Three Months Ended March 31, 2021

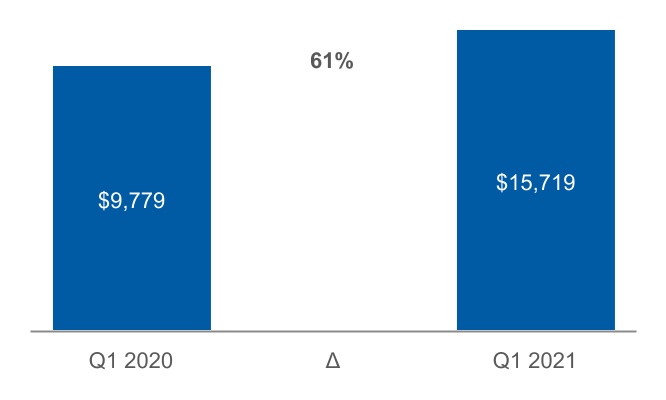

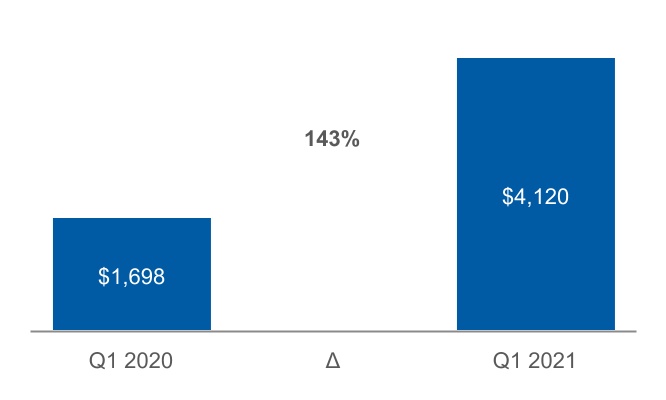

•Firm Net revenues were up 61% and Net income applicable to Morgan Stanley was up 143%, with strong contributions from each of our three business segments, and resulting in an annualized ROTCE of 21.1%, or 21.4% excluding integration-related expenses (see “Selected Non-GAAP Financial Information” herein).

•Institutional Securities Net revenues of $8.6 billion increased 66% reflecting strength across businesses and geographies on continued strong client engagement and higher volumes in a constructive market environment, notwithstanding losses related to a single client event in the quarter.

•Wealth Management delivered pre-tax income of $1.6 billion with a pre-tax profit margin of 26.9%, or 27.9% excluding integration-related expenses (see “Selected Non-GAAP Financial Information” herein). Results reflect strong levels of client engagement, net new assets of $105 billion and fee-based flows of $37 billion, in addition to growth in bank lending.

•Investment Management results reflect strong asset management fees on AUM of $1.4 trillion due to strong investment performance and positive flows across all asset classes, as well as the impact of the Eaton Vance acquisition.

•The Firm expense efficiency ratio was 66.6%, or 66.1% excluding the impact of integration-related expenses (see “Selected Non-GAAP Financial Information” herein).

•At March 31, 2021, our standardized Common Equity Tier 1 capital ratio was 16.7%.

•The Firm repurchased $2.1 billion of its outstanding common stock.

Strategic Transactions

•On March 1, 2021, we completed the acquisition of Eaton Vance. For further information, see “Business Segments—Investment Management” herein.

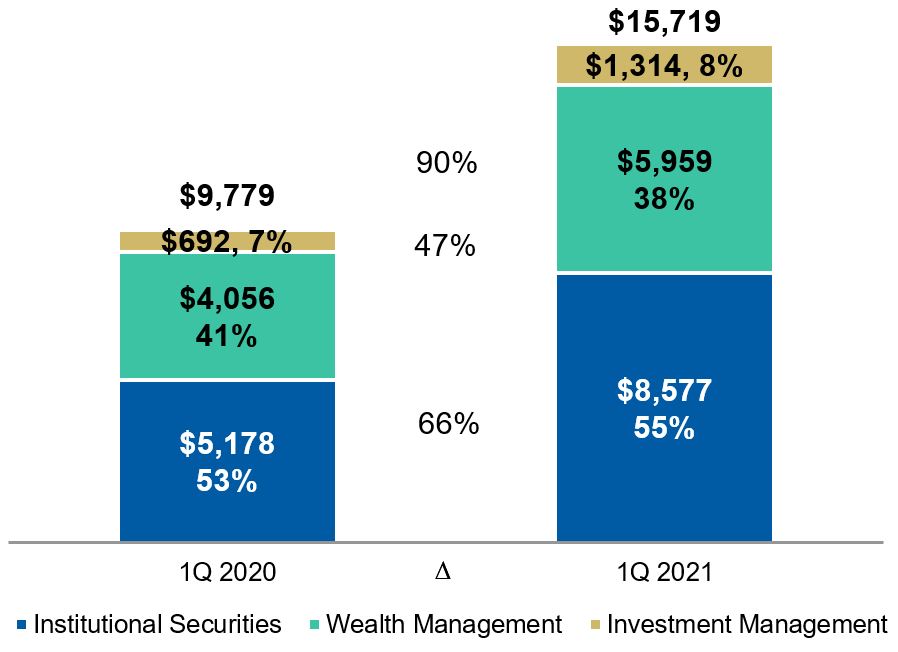

Net Revenues1

($ in millions)

1.Certain prior period amounts have been reclassified to conform to the current presentation. See “Business Segments” herein and Note 1 to the financial statements for more information.

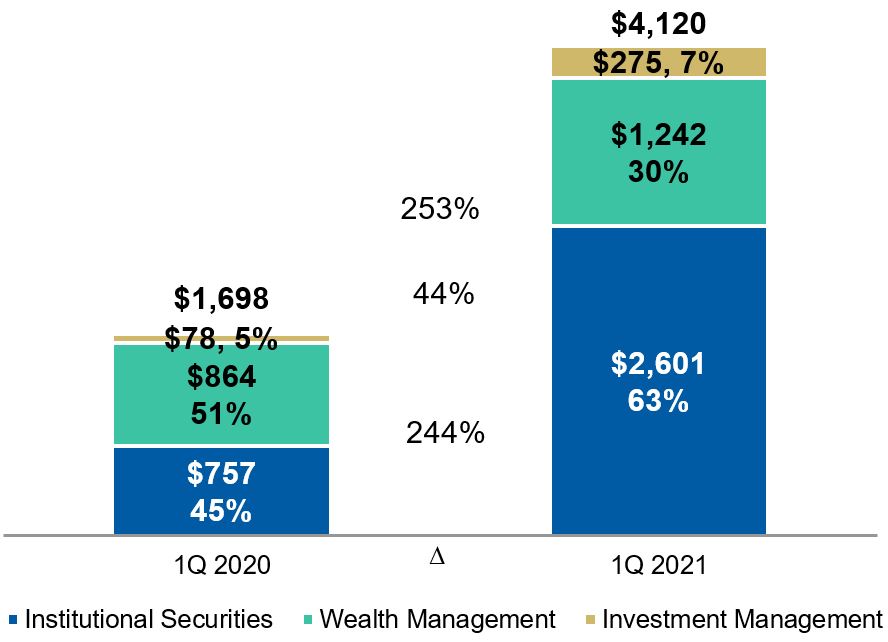

Net Income Applicable to Morgan Stanley

($ in millions)

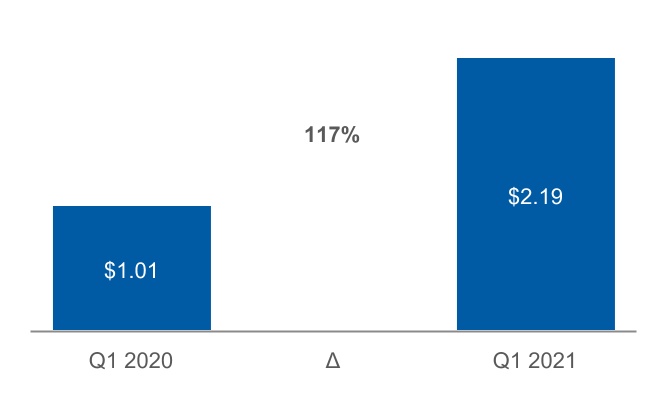

Earnings per Diluted Common Share1

1.Adjusted Diluted EPS for the current quarter was $2.22 (see “Selected Non-GAAP Financial Information” herein).

We reported net revenues of $15.7 billion in the quarter ended March 31, 2021 (“current quarter,” or “1Q 2021”), compared with $9.8 billion in the quarter ended March 31, 2020 (“prior year quarter,” or “1Q 2020”). For the current quarter, net income applicable to Morgan Stanley was $4.1 billion, or $2.19 per diluted common share, compared with $1.7 billion or $1.01 per diluted common share, in the prior year quarter.

| | | | | |

| |

| Management’s Discussion and Analysis | |

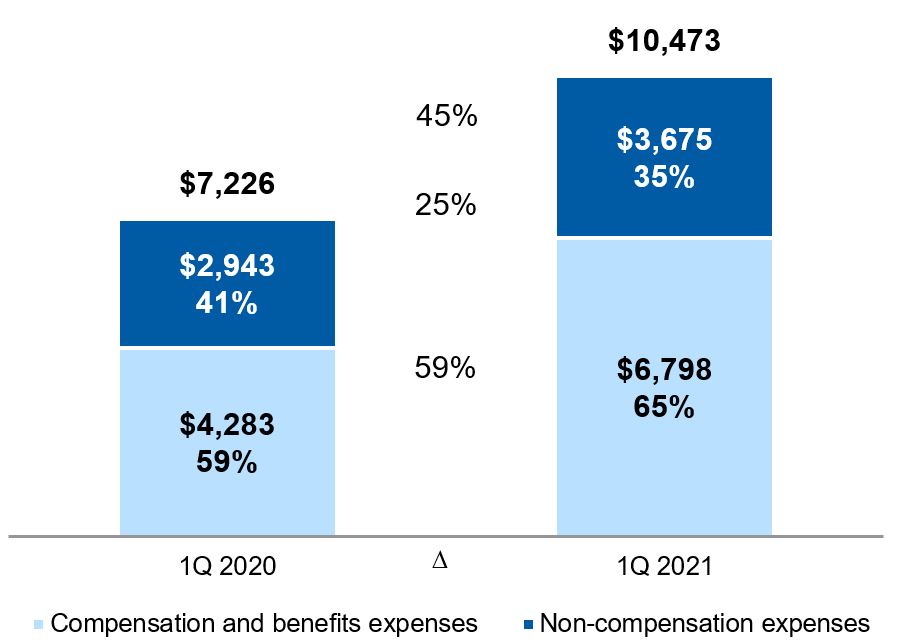

Non-interest Expenses1, 2

($ in millions)

1.The percentages on the bars in the chart represent the contribution of compensation and benefits expenses and non-compensation expenses to the total.

2.Certain prior period amounts have been reclassified to conform to the current presentation. See “Business Segments” herein and Note 1 to the financial statements for more information.

•Compensation and benefits expenses of $6,798 million in the current quarter increased 59% from the prior year quarter, primarily as a result of increases in discretionary incentive compensation and the formulaic payout to Wealth Management representatives, both driven by higher revenues, higher expenses related to certain deferred compensation plans linked to investment performance and the Firm’s share price, and incremental compensation as a result of the E*TRADE and Eaton Vance acquisitions.

•Non-compensation expenses of $3,675 million in the current quarter increased 25% from the prior year quarter, primarily driven by incremental expenses as a result of the E*TRADE and Eaton Vance acquisitions, in addition to higher volume-related expenses and higher investments in technology.

Provision for Credit Losses

The Provision for credit losses on loans and lending commitments was a net release of $98 million in the current quarter primarily driven by improvements in the outlook for macroeconomic conditions and the impact of paydowns on Corporate loans, including by lower-rated borrowers. The Provision for credit losses on loans and lending commitments of $407 million in the prior year quarter was primarily driven by deterioration in the current and expected macroeconomic environment at that time. For further information on the Provision for credit losses, see “Credit Risk” herein.

Income Taxes

The increase in the Firm’s effective tax rate in the current quarter is primarily due to the lower impact of net discrete tax benefits. Net discrete tax benefits in the current quarter of $86 million and $130 million in the prior year quarter were primarily related to the conversion of employee share-based awards.

Business Segment Results

Net Revenues by Segment1, 2

($ in millions)

Net Income Applicable to Morgan Stanley by Segment1

($ in millions)

1.The percentages on the bars in the charts represent the contribution of each business segment to the total of the applicable financial category and may not sum to 100% due to intersegment eliminations. See Note 20 to the financial statements for details of intersegment eliminations.

2.Certain prior period amounts have been reclassified to conform to the current presentation. See “Business Segments” herein and Note 1 to the financial statements for more information.

•Institutional Securities net revenues of $8,577 million in the current quarter increased 66% from the prior year quarter, primarily reflecting higher revenues in equity underwriting driven by higher volumes, as well as higher revenues in credit products and equity derivatives. The current quarter included a loss of $644 million related to a credit event for a single client, and $267 million of subsequent trading losses through the end of the quarter related to the same event.

•Wealth Management net revenues of $5,959 million in the current quarter increased 47% primarily due to higher transactional revenues reflecting gains from investments associated with certain employee deferred compensation plans, as well as higher asset management revenues on increased asset levels and positive fee-based flows. Net

| | | | | |

| |

| Management’s Discussion and Analysis | |

interest also increased primarily reflecting incremental revenues as a result of the E*TRADE acquisition.

•Investment Management net revenues of $1,314 million in the current quarter increased 90% from the prior year quarter, due to higher Asset management and related fees driven by higher average AUM and the effect of the Eaton Vance acquisition, and higher Performance-based income and other revenues, driven by higher accrued carried interest.

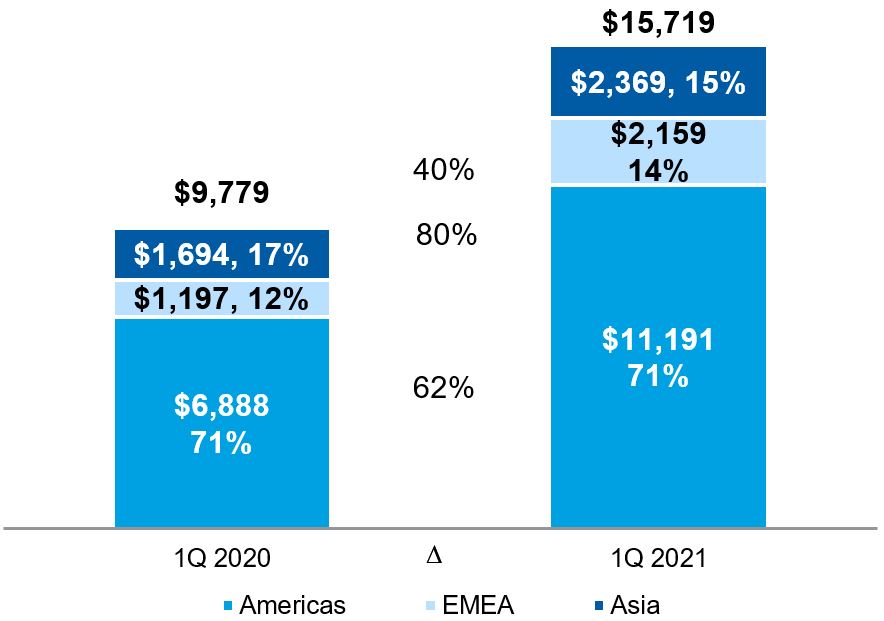

Net Revenues by Region1, 2, 3

($ in millions)

1.The percentages on the bars in the charts represent the contribution of each region to the total.

2.For a discussion of how the geographic breakdown of net revenues is determined, see Note 20 to the financial statements in the 2020 Form 10-K.

3.Certain prior period amounts have been reclassified to conform to the current presentation. See “Business Segments” herein and Note 1 to the financial statements for more information.

Current quarter revenues in Asia increased 40% and EMEA increased 80%, both driven primarily by the equity and fixed income businesses within the Institutional Securities business segment. Americas revenues increased 62%, primarily driven by the Wealth Management and the Institutional Securities business segments.

Selected Financial Information and Other Statistical Data

| | | | | | | | | | |

| | Three Months Ended March 31, | |

| $ in millions | 2021 | 2020 | | |

| Consolidated results | | | | |

Net revenues1 | $ | 15,719 | | $ | 9,779 | | | |

| Earnings applicable to Morgan Stanley common shareholders | $ | 3,982 | | $ | 1,590 | | | |

| Earnings per diluted common share | $ | 2.19 | | $ | 1.01 | | | |

| Consolidated financial measures | |

Expense efficiency ratio1, 2 | 66.6 | % | 73.9 | % | | |

Adjusted expense efficiency ratio1, 2, 4 | 66.1 | % | 73.9 | % | | |

ROE3 | 16.9 | % | 8.5 | % | | |

Adjusted ROE3, 4 | 17.1 | % | 8.5 | % | | |

ROTCE3, 4 | 21.1 | % | 9.7 | % | | |

Adjusted ROTCE3, 4 | 21.4 | % | 9.7 | % | | |

Pre-tax margin1, 5 | 34.0 | % | 21.9 | % | | |

| Effective tax rate | 22.0 | % | 17.1 | % | | |

Pre-tax margin by segment5 | |

Institutional Securities1 | 39.3 | % | 18.3 | % | | |

Wealth Management1 | 26.9 | % | 26.0 | % | | |

Wealth Management, adjusted1, 4 | 27.9 | % | 26.0 | % | | |

| Investment Management | 28.2 | % | 20.7 | % | | |

Investment Management, adjusted4 | 29.0 | % | 20.7 | % | | |

| | | | | | | | |

| in millions, except per share and employee data | At

March 31,

2021 | At

December 31,

2020 |

Liquidity resources6 | $ | 353,304 | | $ | 338,623 | |

Loans7 | $ | 159,123 | | $ | 150,597 | |

| Total assets | $ | 1,158,772 | | $ | 1,115,862 | |

| Deposits | $ | 323,138 | | $ | 310,782 | |

| Borrowings | $ | 215,826 | | $ | 217,079 | |

| Common shares outstanding | 1,869 | | 1,810 | |

| Common shareholders' equity | $ | 98,509 | | $ | 92,531 | |

Tangible common shareholders’ equity4 | $ | 72,828 | | $ | 75,916 | |

Book value per common share8 | $ | 52.71 | | $ | 51.13 | |

Tangible book value per common share4, 8 | $ | 38.97 | | $ | 41.95 | |

Worldwide employees9 (in thousands) | 71 | | 68 | |

Capital Ratios10 | | |

| Common Equity Tier 1 capital—Standardized | 16.7 | % | 17.4 | % |

| Common Equity Tier 1 capital—Advanced | 17.4 | % | 17.7 | % |

| Tier 1 capital—Standardized | 18.5 | % | 19.4 | % |

| Tier 1 capital—Advanced | 19.2 | % | 19.8 | % |

SLR11 | 6.7 | % | 7.4 | % |

| Tier 1 leverage | 7.5 | % | 8.4 | % |

1.Certain prior period amounts have been reclassified to conform to the current presentation. See “Business Segments” herein and Note 1 to the financial statements for more information.

2.The expense efficiency ratio represents total non-interest expenses as a percentage of net revenues.

3.ROE and ROTCE represent earnings applicable to Morgan Stanley common shareholders as a percentage of average common equity and average tangible common equity, respectively.

4.Represents a non-GAAP financial measure. See “Selected Non-GAAP Financial Information” herein.

5.Pre-tax margin represents income before income taxes as a percentage of net revenues.

6.For a discussion of Liquidity resources, see “Liquidity and Capital Resources—Liquidity Risk Management Framework—Liquidity Resources” herein.

7.Amounts include loans held for investment (net of allowance) and loans held for sale but exclude loans at fair value, which are included in Trading assets in the balance sheets (see Note 10 to the financial statements).

8.Book value per common share and tangible book value per common share equal common shareholders’ equity and tangible common shareholders’ equity, respectively, divided by common shares outstanding.

9.As of March 31, 2021, the number of employees includes Eaton Vance.

10.For a discussion of our capital ratios, see “Liquidity and Capital Resources—Regulatory Requirements” herein.

11.At March 31, 2021 and at December 31, 2020, our SLR reflects the impact of a Federal Reserve interim final rule that was in effect until March 31, 2021. For further information, see “Liquidity and Capital Resources—Regulatory Requirements—Regulatory Developments and Other Matters” herein.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Coronavirus Disease (“COVID-19”) Pandemic

The COVID-19 pandemic and related voluntary and government-imposed social and business restrictions have had, and will likely continue to have, a significant impact on global economic conditions and the environment in which we operate our businesses. The Firm continues to be fully operational, with approximately 90% of employees in the Americas and globally working from home as of March 31, 2021.

Though we are unable to estimate the extent of the impact, the economic or other effects of the ongoing COVID-19 pandemic may have adverse impacts on our future operating results. Refer to “Risk Factors” and “Forward-Looking Statements” in the 2020 Form 10-K for more information.

Selected Non-GAAP Financial Information

We prepare our financial statements using U.S. GAAP. From time to time, we may disclose certain “non-GAAP financial measures” in this document or in the course of our earnings releases, earnings and other conference calls, financial presentations, definitive proxy statement and otherwise. A “non-GAAP financial measure” excludes, or includes, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. We consider the non-GAAP financial measures we disclose to be useful to us, investors, analysts and other stakeholders by providing further transparency about, or an alternate means of assessing or comparing our financial condition, operating results and capital adequacy.

These measures are not in accordance with, or a substitute for, U.S. GAAP and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the U.S. GAAP financial measure and the non-GAAP financial measure.

The principal non-GAAP financial measures presented in this document are set forth in the following tables.

Reconciliations from U.S. GAAP to Non-GAAP Consolidated Financial Measures

| | | | | | | | | | |

| | | Three Months Ended

March 31, |

| $ in millions, except per share data | | | 2021 | 2020 |

| Earnings applicable to Morgan Stanley common shareholders | | | $ | 3,982 | | $ | 1,590 | |

| Impact of adjustments: | | | | |

| Integration-related expenses | | | 75 | | — | |

| Related tax benefit | | | (17) | | — | |

Adjusted earnings applicable to Morgan Stanley common shareholders—non-GAAP1 | | | $ | 4,040 | | $ | 1,590 | |

| Earnings per diluted common share | | | $ | 2.19 | | $ | 1.01 | |

| Impact of adjustments | | | 0.03 | | — | |

Adjusted earnings per diluted common share—non-GAAP1 | | | $ | 2.22 | | $ | 1.01 | |

Expense efficiency ratio2 | | | 66.6 | % | 73.9 | % |

| Impact of adjustments | | | (0.5) | % | — | % |

Adjusted expense efficiency ratio—non-GAAP1, 2 | | | 66.1 | % | 73.9 | % |

Wealth Management Pre-tax margin2 | | | 26.9 | % | 26.0 | % |

| Impact of adjustments | | | 1.0 | % | — | % |

Adjusted Wealth Management pre-tax margin—non-GAAP1, 2 | | | 27.9 | % | 26.0 | % |

| Investment Management Pre-tax margin | | | 28.2 | % | 20.7 | % |

| Impact of adjustments | | | 0.8 | % | — | % |

Adjusted Investment Management pre-tax margin—non-GAAP1 | | | 29.0 | % | 20.7 | % |

| | | | | | | | |

| $ in millions | At

March 31,

2021 | At

December 31,

2020 |

| Tangible equity | | |

| Common shareholders' equity | $ | 98,509 | | $ | 92,531 | |

| Less: Goodwill and net intangible assets | (25,681) | | (16,615) | |

| Tangible common shareholders' equity—non-GAAP | $ | 72,828 | | $ | 75,916 | |

| | | | | | | | | | |

| | | Average Monthly Balance |

| | | Three Months Ended March 31, |

| $ in millions | | | 2021 | 2020 |

| Tangible equity | | | | |

| Common shareholders' equity | | | $ | 94,343 | | $ | 74,724 | |

| Less: Goodwill and net intangible assets | | | (18,849) | | (9,200) | |

| Tangible common shareholders' equity—non-GAAP | | | $ | 75,494 | | $ | 65,524 | |

| | | | | | | | | | |

| | | Three Months Ended

March 31, |

| $ in billions | | | 2021 | 2020 |

| Average common equity | | | | |

| Unadjusted—GAAP | | | $ | 94.3 | | $ | 74.7 | |

Adjusted1—Non-GAAP | | | 94.4 | | 74.7 | |

ROE3 | | | | |

| Unadjusted—GAAP | | | 16.9 | % | 8.5 | % |

Adjusted1—Non-GAAP | | | 17.1 | % | 8.5 | % |

| Average tangible common equity—Non-GAAP |

| Unadjusted | | | $ | 75.5 | | $ | 65.5 | |

Adjusted1 | | | 75.5 | | 65.5 | |

ROTCE3—Non-GAAP | | | | |

| Unadjusted | | | 21.1 | % | 9.7 | % |

Adjusted1 | | | 21.4 | % | 9.7 | % |

| | | | | |

| |

| Management’s Discussion and Analysis | |

Non-GAAP Financial Measures by Business Segment

| | | | | | | | | | |

| | | Three Months Ended

March 31, |

| $ in billions | | | 2021 | 2020 |

Average common equity4 | | | |

| Institutional Securities | | | $ | 43.5 | | $ | 42.8 | |

| Wealth Management | | | 28.5 | | 18.2 | |

| Investment Management | | | 4.4 | | 2.6 | |

ROE5 | | | | |

| Institutional Securities | | | 23.0 | % | 6.3 | % |

| Wealth Management | | | 16.9 | % | 18.5 | % |

| Investment Management | | | 24.8 | % | 11.7 | % |

Average tangible common equity4 | | | |

| Institutional Securities | | | $ | 42.9 | | $ | 42.3 | |

| Wealth Management | | | 13.4 | | 10.4 | |

| Investment Management | | | 1.2 | | 1.7 | |

ROTCE5 | | | | |

| Institutional Securities | | | 23.3 | % | 6.4 | % |

| Wealth Management | | | 36.0 | % | 32.3 | % |

| Investment Management | | | 88.2 | % | 18.1 | % |

1.Adjusted amounts exclude the effect of costs related to the integration of E*TRADE and Eaton Vance, net of tax as appropriate. The pre-tax adjustments were as follows: Wealth Management – Compensation expenses of $30 million and Non-compensation expenses of $34 million, Investment Management – Compensation expenses of $3 million and Non-compensation expenses of $8 million.

2.Certain prior period amounts have been reclassified to conform to the current presentation. See “Business Segments” herein and Note 1 to the financial statements for more information.

3.ROE and ROTCE represent earnings applicable to Morgan Stanley common shareholders as a percentage of average common equity and average tangible common equity, respectively. When excluding integration-related costs, both the numerator and average denominator are adjusted.

4.Average common equity and average tangible common equity for each business segment is determined using our Required Capital framework (see "Liquidity and Capital Resources—Regulatory Requirements—Attribution of Average Common Equity According to the Required Capital Framework” herein). The sums of the segments' Average common equity and Average tangible common equity do not equal the Consolidated measures due to Parent equity.

5.The calculation of ROE and ROTCE by segment uses net income applicable to Morgan Stanley by segment less preferred dividends allocated to each segment as a percentage of average common equity and average tangible common equity, respectively, allocated to each segment.

Return on Tangible Common Equity Target

In January 2021, we established a 2-year ROTCE Target of 14% to 16%, excluding integration-related expenses.

Our ROTCE Target is a forward-looking statement that was based on a normal market environment and may be materially affected by many factors, including, among other things: mergers and acquisitions; macroeconomic and market conditions; legislative, accounting, tax and regulatory developments; industry trading and investment banking volumes; equity market levels; interest rate environment; outsized legal expenses or penalties; the ability to control expenses; and capital levels.

Given the economic impact of the COVID-19 pandemic, it is uncertain if the ROTCE Target will be met within the originally stated time frame. See “Coronavirus Disease (COVID–19) Pandemic” herein and “Risk Factors” in the 2020 Form 10-K for further information on market and economic conditions and their effects on our financial results.

For further information on non-GAAP measures (ROTCE excluding integration-related expenses), see “Selected Non-GAAP Financial Information” herein.

Business Segments

Substantially all of our operating revenues and operating expenses are directly attributable to our business segments. Certain revenues and expenses have been allocated to each business segment, generally in proportion to its respective net revenues, non-interest expenses or other relevant measures. See Note 20 to the financial statements for information on intersegment transactions.

For an overview of the components of our business segments, net revenues, compensation expense and income taxes, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Business Segments” in the 2020 Form 10-K.

As part of our effort to continually improve the transparency and comparability of our external financial reporting, several updates to our financial presentation were implemented in the first quarter of 2021. Prior period amounts have been reclassified to conform to the current presentation.

Provision for credit losses

The Provision for credit losses for loans and lending commitments is now presented as a separate line in the income statements. Previously, the provision for credit losses for loans was included in Other revenues and the provision for credit losses for lending commitments was included in Other expense.

Other revenues

Gains and losses on economic derivative hedges associated with certain held-for-sale and held-for-investment corporate loans, which were previously reported in Trading revenues, are now reported within Other revenues in the income statements. The new presentation better aligns with the recognition of mark-to-market gains and losses on held-for-sale loans which continue to be reported in Other revenues.

Institutional Securities

Equity—Financing, Equity—Execution services and Fixed income now include certain Investments and Other revenues to the extent directly attributable to those businesses. The remaining Investments and Other revenues not included in those businesses’ results are reported in Other. Other also includes revenues previously reported as Other Sales and Trading.

Investment Management

We have renamed the previously disclosed revenue line Asset management to Asset management and related fees and have combined the remaining revenue lines into a new category named Performance-based income and other.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Institutional Securities

Income Statement Information

| | | | | | | | | | | |

| Three Months Ended

March 31, | |

| $ in millions | 2021 | 2020 | % Change |

| Revenues | | | |

| Advisory | $ | 480 | | $ | 362 | | 33 | % |

| Equity | 1,502 | | 336 | | N/M |

| Fixed income | 631 | | 446 | | 41 | % |

| Total Underwriting | 2,133 | | 782 | | 173 | % |

| Total Investment Banking | 2,613 | | 1,144 | | 128 | % |

| | | |

| | | |

Equity1 | 2,875 | | 2,449 | | 17 | % |

Fixed Income1 | 2,966 | | 2,062 | | 44 | % |

Other1 | 123 | | (477) | | 126 | % |

Net revenues1 | $ | 8,577 | | $ | 5,178 | | 66 | % |

Provision for credit losses1 | (93) | | 388 | | (124) | % |

| Compensation and benefits | 3,114 | | 1,814 | | 72 | % |

Non-compensation expenses1 | 2,185 | | 2,026 | | 8 | % |

Total non-interest expenses1 | 5,299 | | 3,840 | | 38 | % |

| Income before provision for income taxes | 3,371 | | 950 | | N/M |

| Provision for income taxes | 736 | | 151 | | N/M |

| Net income | 2,635 | | 799 | | N/M |

| Net income applicable to noncontrolling interests | 34 | | 42 | | (19) | % |

| Net income applicable to Morgan Stanley | $ | 2,601 | | $ | 757 | | N/M |

1.Certain prior period amounts have been reclassified to conform to the current presentation. See “Business Segments” herein and Note 1 to the financial statements for additional information.

Investment Banking Revenues Investment Banking Volumes | | | | | | | | | | |

| | Three Months Ended

March 31, |

| $ in billions | | | 2021 | 2020 |

Completed mergers and acquisitions1 | | | $ | 225 | | $ | 119 | |

Equity and equity-related offerings2, 3 | | | 36 | | 14 | |

Fixed income offerings2, 4 | | | 102 | | 94 | |

Source: Refinitiv data as of April 1, 2021. Transaction volumes may not be indicative of net revenues in a given period. In addition, transaction volumes for prior periods may vary from amounts previously reported due to the subsequent withdrawal, change in value or change in timing of certain transactions.

1.Includes transactions of $100 million or more. Based on full credit to each of the advisors in a transaction.

2.Based on full credit for single book managers and equal credit for joint book managers.

3.Includes Rule 144A issuances and registered public offerings of common stock, convertible securities and rights offerings.

4.Includes Rule 144A and publicly registered issuances, non-convertible preferred stock, mortgage-backed and asset-backed securities, and taxable municipal debt. Excludes leveraged loans and self-led issuances.

Investment Banking Revenues

Revenues of $2,613 million in the current quarter increased 128% compared with the prior year quarter, primarily reflecting an increase in equity underwriting revenues.

•Advisory revenues increased primarily as a result of higher volumes of completed M&A activity.

•Equity underwriting revenues increased on higher volumes, primarily in initial public offerings, secondary block share trades and follow-on offerings.

•Fixed income underwriting revenues increased primarily in non-investment grade bond issuances on higher volumes, as well as in non-investment grade loans issuances.

See “Investment Banking Volumes” herein.

Equity, Fixed Income and Other Net Revenues

Equity and Fixed Income Net Revenues

| | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, 2021 |

| | | | Net Interest2 | All Other3 | |

| $ in millions | Trading | Fees1 | Total |

| Financing | $ | 645 | | $ | 130 | | $ | 182 | | $ | 3 | | $ | 960 | |

| Execution services | 1,114 | | 800 | | (62) | | 63 | | 1,915 | |

| Total Equity | $ | 1,759 | | $ | 930 | | $ | 120 | | $ | 66 | | $ | 2,875 | |

| Total Fixed Income | $ | 2,313 | | $ | 81 | | $ | 439 | | $ | 133 | | $ | 2,966 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 20204 |

| | | | Net Interest2 | All Other3 | |

| $ in millions | Trading | Fees1 | Total |

| Financing | $ | 1,034 | | $ | 101 | | $ | (37) | | $ | 5 | | $ | 1,103 | |

| Execution services | 579 | | 783 | | (38) | | 22 | | 1,346 | |

| Total Equity | $ | 1,613 | | $ | 884 | | $ | (75) | | $ | 27 | | $ | 2,449 | |

| Total Fixed Income | $ | 1,773 | | $ | 102 | | $ | 328 | | $ | (141) | | $ | 2,062 | |

1.Includes Commissions and fees and Asset management revenues.

2.Includes funding costs, which are allocated to the businesses based on funding usage.

3.Includes Investments and Other revenues.

4.Certain prior period amounts have been reclassified to conform to the current period presentation. See “Business Segments” herein and Note 1 to the financial statements for additional information.

Equity

Net revenues of $2,875 million in the current quarter increased 17% compared with the prior year quarter, reflecting an increase in execution services, partially offset by a decrease in financing.

•Financing revenues decreased, primarily driven by a loss of $644 million, related to a credit event for a single client, partially offset by higher average client balances and higher client activity.

•Execution services revenues increased, primarily in derivatives due to the impact of market conditions on inventory held to facilitate client activity and higher client activity. Partially offsetting this increase was $267 million of trading losses related to the same credit event.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Fixed Income

Net revenues of $2,966 million in the current quarter increased 44% compared with the prior year quarter, primarily driven by credit products.

•Global macro products revenues decreased in both foreign exchange and rates products primarily due to the effect of tighter bid-offer spreads compared with the prior year quarter, partially offset by the impact of market conditions on inventory held to facilitate client activity.

•Credit products revenues increased primarily due to the impact of market conditions on inventory held to facilitate client activity in securitized products, corporate credit products and municipal securities. In addition, higher client activity in securitized products was partially offset by the effect of tighter bid-offer spreads in corporate credit products compared with the prior year quarter.

•Commodities products and other fixed income revenues increased primarily driven by higher counterparty credit risk management results.

Other Net Revenues

Net revenues of $123 million in the current quarter increased 126% compared with the prior year quarter primarily due to lower mark-to-market losses on corporate loans held for sale, net of related economic hedges, and gains from investments associated with certain employee deferred compensation plans compared with losses in the prior year quarter.

Net Interest

Net interest revenues of $638 million in the current quarter are included within Equity, Fixed Income, and Other, and increased 38% compared with the prior year quarter primarily driven by lower net costs associated with maintaining liquidity as well as higher revenues in corporate lending and secured lending facilities.

Provision for Credit Losses

The Provision for credit losses on loans and lending commitments was a net release of $93 million in the current quarter primarily driven by improvements in the outlook for macroeconomic conditions and the impact of paydowns on Corporate loans, including by lower-rated borrowers. The Provision for credit losses on loans and lending commitments of $388 million in the prior year quarter was primarily driven by deterioration in the current and expected macroeconomic environment at that time. For further information on the Provision for credit losses, see “Credit Risk” herein.

Non-interest Expenses

Non-interest expenses of $5,299 million in the current quarter increased 38% compared with the prior year quarter, primarily reflecting a 72% increase in Compensation and benefits expenses.

•Compensation and benefits expenses increased, primarily due to increases in discretionary incentive compensation driven by higher revenues, and higher expenses related to certain deferred compensation plans linked to investment performance.

•Non-compensation expenses increased, primarily reflecting an increase in volume-related expenses and higher investments in technology.

Income Tax Items

Net discrete tax benefits of $52 million and $66 million, were recognized in Provision for income taxes in the current quarter and the prior year quarter, respectively.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Wealth Management

Income Statement Information

| | | | | | | | | | | |

| | Three Months Ended

March 31, | |

| $ in millions | 2021 | 2020 | % Change |

| Revenues | | | |

| Asset management | $ | 3,191 | | $ | 2,680 | | 19 | % |

Transactional1 | 1,228 | | 399 | | N/M |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net interest | 1,385 | | 896 | | 55 | % |

Other1,2 | 155 | | 81 | | 91 | % |

| Net revenues | 5,959 | | 4,056 | | 47 | % |

Provision for credit losses2 | (5) | | 19 | | (126) | % |

| Compensation and benefits | 3,170 | | 2,212 | | 43 | % |

| Non-compensation expenses | 1,194 | | 770 | | 55 | % |

| Total non-interest expenses | 4,364 | | 2,982 | | 46 | % |

Income before provision for income taxes | $ | 1,600 | | $ | 1,055 | | 52 | % |

| Provision for income taxes | 358 | | 191 | | 87 | % |

Net income applicable to Morgan Stanley | $ | 1,242 | | $ | 864 | | 44 | % |

1.Transactional includes investment banking, trading, and commissions and fees revenues. Other includes investments and other revenues. For further information, see Note 20 to the financial statements.

2.Certain prior period amounts have been reclassified to conform to the current presentation. See "Business Segments" herein and Note 1 to the financial statements for additional information.

Acquisition of E*TRADE

The comparisons of current year results to prior periods are impacted by the acquisition of E*TRADE in the fourth quarter of 2020. For additional information on the acquisition of E*TRADE, see Note 3 to the financial statements in the Form 2020 10-K.

Wealth Management Metrics

| | | | | | | | |

| | |

| |

| $ in billions | At March 31,

2021 | At December 31,

2020 |

| Total client assets | $ | 4,231 | $ | 3,999 |

| | |

| U.S. Bank Subsidiary loans | $ | 104.9 | $ | 98.1 |

Margin and other lending1 | $ | 26.6 | $ | 23.1 |

Deposits2 | $ | 322 | $ | 306 |

Weighted average cost of deposits3 | 0.18% | 0.24% |

| | | | | | | | | | |

| Three Months Ended

March 31, | |

| | | |

| 2021 | 2020 | | |

| | | | |

Net new assets4 | $ | 104.9 | $ | 37.1 | | |

| | | | |

| | | | |

| | | | |

| | | | |

1.Margin and other lending represents Wealth Management margin lending arrangements, which allow customers to borrow against the value of qualifying securities and Wealth Management other lending which includes non‐purpose securities-based lending on non‐bank entities.

2.Deposits are sourced from Wealth Management clients and other sources of funding on the U.S. Bank Subsidiaries. Deposits include sweep deposit programs, savings and other, and time deposits. Excludes approximately $8 billion and $25 billion of off-balance sheet deposits as of March 31, 2021 and December 31, 2020, respectively.

3.Weighted average cost of deposits represents the annualized weighted average cost of deposits as of March 31, 2021 and December 31, 2020.

4.Net new assets represents client inflows (including dividends and interest) less client outflows (excluding activity from business combinations/divestitures and the impact of fees and commissions).

Advisor-led channel

| | | | | | | | | |

| | | |

| | |

| $ in billions | At March 31,

2021 | At December 31,

2020 | |

| | | |

Advisor-led client assets1 | $ | 3,349 | $ | 3,167 | |

Fee-based client assets2 | $ | 1,574 | $ | 1,472 | |

| | | |

Fee-based client assets as a percentage of advisor-led client assets | 47% | 46% | |

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Three Months Ended

March 31, | | |

| 2021 | 2020 | | |

Fee-based asset flows3 | $ | 37.2 | $ | 18.4 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

1.Advisor-led client assets represents client assets in accounts that have a Wealth Management representative assigned.

2.Fee‐based client assets represents the amount of assets in client accounts where the basis of payment for services is a fee calculated on those assets.

3.Fee-based asset flows includes net new fee-based assets, net account transfers, dividends, interest and client fees, and excludes institutional cash management related activity. For a description of the Inflows and Outflows included in Fee-based asset flows, see Fee-based client assets in the 2020 Form 10-K.

Self-directed channel

| | | | | | | | | |

| | | |

| | |

| $ in billions | At March 31,

2021 | At December 31,

2020 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Self-directed assets1 | $ | 882 | $ | 832 | |

| | | |

Self-directed households (in millions)2 | 7.2 | 6.7 | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Three Months Ended

March 31, | |

| 2021 | 2020 | | |

Daily average revenue trades (“DARTs”) (in thousands)3 | 1,619 | 5 | | |

| | | | |

| | | | |

| | | | |

1.Self-directed assets represents active accounts which are not advisor led. Active accounts are defined as having $25 or more in assets.

2.Self-directed households represents the total number of households that include at least one account with self-directed assets. Individual households or participants that are engaged in one or more of our Wealth Management channels will be included in each of the respective channel counts.

3.DARTs represent the total self-directed trades in a period divided by the number of trading days during that period.

Workplace channel1

| | | | | | | | | |

| | | |

| | |

| $ in billions | At March 31,

2021 | At December 31,

2020 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Workplace unvested assets2 | $ | 461 | $ | 435 | |

Number of participants (in millions)3 | 5.1 | 4.9 | |

1.The workplace channel includes equity compensation solutions for companies, their executives and employees.

2.Workplace unvested assets represents the market value of public company securities at the end of the period.

3.Workplace participants represents total accounts with vested or unvested assets >0 in the workplace channel. Individuals with accounts in multiple plans are counted as participants in each plan.

Net Revenues

Asset Management

Asset management revenues of $3,191 million in the current quarter increased 19% compared with the prior year quarter, primarily due to higher fee-based asset levels in the current quarter as a result of market appreciation and positive fee-based flows.

See “Fee-Based Client Assets—Rollforwards” herein.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Transactional Revenues

Transactional revenues of $1,228 million in the current quarter increased substantially compared with the prior year quarter, primarily due to gains from investments associated with certain employee deferred compensation plans, and incremental revenues as a result of the E*TRADE acquisition.

Net Interest

Net interest of $1,385 million increased 55% compared with the prior year quarter, primarily due to incremental Net interest as a result of the E*TRADE acquisition, improved prepayment amortization related to mortgage-backed securities, growth in bank lending and increases in investment portfolio balances driven by higher brokerage sweep deposits. These increases were partially offset by the net effect of lower interest rates.

Other

Other revenues of $155 million in the current quarter increased 91% compared with the prior year quarter, primarily due to incremental revenues as a result of the E*TRADE acquisition.

Non-interest Expenses

Non-interest expenses of $4,364 million in the current quarter increased 46% compared with the prior year quarter, primarily as a result of higher Compensation and benefits expenses and Non-compensation expenses.

•Compensation and benefits expenses increased primarily due to higher expenses related to certain deferred compensation plans linked to investment performance, an increase in the formulaic payout to Wealth Management representatives driven by higher compensable revenues and incremental compensation as a result of the E*TRADE acquisition.

•Non-compensation expenses increased primarily due to incremental operating and other expenses as a result of the E*TRADE acquisition.

Fee-Based Client Assets Rollforwards

| | | | | | | | | | | | | | | | | |

| $ in billions | At

December 31, 2020 | Inflows | Outflows | Market Impact | At

March 31,

2021 |

Separately managed1 | $ | 359 | | $ | 13 | | $ | (7) | | $ | 20 | | $ | 385 | |

| Unified managed | 379 | | 27 | | (14) | | 13 | | 405 | |

| Advisor | 177 | | 12 | | (9) | | 8 | | 188 | |

| Portfolio manager | 509 | | 33 | | (18) | | 25 | | 549 | |

| Subtotal | $ | 1,424 | | $ | 85 | | $ | (48) | | $ | 66 | | $ | 1,527 | |

| Cash management | 48 | | 8 | | (9) | | — | | 47 | |

Total fee-based client assets | $ | 1,472 | | $ | 93 | | $ | (57) | | $ | 66 | | $ | 1,574 | |

| | | | | | | | | | | | | | | | | |

| $ in billions | At

December 31, 2019 | Inflows | Outflows | Market Impact | At

March 31,

2020 |

Separately managed1 | $ | 322 | | $ | 12 | | $ | (7) | | $ | 2 | | $ | 329 | |

| Unified managed | 313 | | 16 | | (13) | | (53) | | 263 | |

| Advisor | 155 | | 10 | | (9) | | (25) | | 131 | |

| Portfolio manager | 435 | | 27 | | (18) | | (65) | | 379 | |

| Subtotal | $ | 1,225 | | $ | 65 | | $ | (47) | | $ | (141) | | $ | 1,102 | |

| Cash management | 42 | | 4 | | (14) | | — | | 32 | |

Total fee-based client assets | $ | 1,267 | | $ | 69 | | $ | (61) | | $ | (141) | | $ | 1,134 | |

1.Includes non-custody account values reflecting prior quarter-end balances due to a lag in the reporting of asset values by third-party custodians.

Average Fee Rates

| | | | | | | | | | |

| | | Three Months Ended

March 31, |

| Fee rate in bps | | | 2021 | 2020 |

| Separately managed | | | 14 | | 14 | |

| Unified managed | | | 97 | | 99 | |

| Advisor | | | 81 | | 85 | |

| Portfolio manager | | | 93 | | 94 | |

| Subtotal | | | 73 | | 72 | |

| Cash management | | | 5 | | 5 | |

| Total fee-based client assets | | | 71 | | 71 | |

For a description of fee-based client assets and rollforward items in the previous tables, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Business Segments—Wealth Management Fee-Based Client Assets” in the 2020 Form 10-K.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Investment Management

Income Statement Information

| | | | | | | | | | | |

| | Three Months Ended

March 31, | |

| $ in millions | 2021 | 2020 | % Change |

| Revenues | | |

|

| Asset management and related fees | $ | 1,103 | | $ | 665 | | 66 | % |

Performance-based income and other1 | 211 | | 27 | | N/M |

| | | |

| Net revenues | 1,314 | | 692 | | 90 | % |

| Compensation and benefits | 514 | | 257 | | 100 | % |

| Non-compensation expenses | 430 | | 292 | | 47 | % |

| Total non-interest expenses | 944 | | 549 | | 72 | % |

| Income before provision for income taxes | 370 | | 143 | | 159 | % |

| Provision for income taxes | 81 | | 25 | | N/M |

| Net income | 289 | | 118 | | 145 | % |

| Net income applicable to noncontrolling interests | 14 | | 40 | | (65) | % |

| Net income applicable to Morgan Stanley | $ | 275 | | $ | 78 | | N/M |

1.Includes Investments, Trading, Commissions and fees, Net interest, and Other revenues. For further information, see Note 20 to the financial statements.

Acquisition of Eaton Vance

On March 1, 2021, we completed the acquisition of Eaton Vance via the issuance of approximately $5.3 billion of common shares and cash consideration of approximately $3.4 billion. The combination increases the capabilities and scale of our investment management franchise, and positions the Investment Management business segment as a premier asset manager. From the acquisition date onward, the business activities of Eaton Vance have been reported within the Investment Management business segment, the substantial majority of which are within Asset management and related fees. The comparisons of current year results to prior periods are impacted by this acquisition. For additional information on the acquisition of Eaton Vance, see Note 3 to the financial statements.

Net Revenues

Asset Management and related fees

Asset management and related fees of $1,103 million in the current quarter increased 66% compared with the prior year quarter, primarily as a result of higher average AUM, driven by strong investment performance and positive net flows across all asset classes, as well as incremental revenues as a result of the Eaton Vance acquisition.

See “Assets Under Management or Supervision” herein.

Performance-based income and other

Performance-based income and other revenues of $211 million in the current quarter increased compared with the prior year quarter, primarily due to higher accrued carried interest, particularly in real estate funds.

Non-interest Expenses

Non-interest expenses of $944 million in the current quarter increased 72% compared with the prior year quarter as a result of higher Compensation and benefits expenses and higher Non-compensation expenses.

•Compensation and benefits expenses increased in the current quarter primarily due to higher discretionary incentive compensation driven by higher revenues, higher compensation associated with carried interest, and incremental compensation as a result of the Eaton Vance acquisition.

•Non-compensation expenses in the current quarter increased compared with the prior year quarter primarily due to higher fee sharing paid to intermediaries driven by higher average AUM, as well as incremental expenses as a result of the Eaton Vance acquisition.

Assets Under Management or Supervision

Rollforwards

| | | | | | | | | | | | | | | | | | | | |

| $ in billions | Equity | Fixed income | Alternatives and Solutions | Long-term AUM Subtotal | Liquidity and Overlay Services | Total |

| December 31, 2020 | $ | 242 | | $ | 98 | | $ | 153 | | $ | 493 | | $ | 288 | | $ | 781 | |

| Inflows | 31 | | 13 | | 15 | | 59 | | 459 | | 518 | |

| Outflows | (23) | | (9) | | (10) | | (42) | | (433) | | (475) | |

| Market Impact | 4 | | (2) | | 10 | | 12 | | — | | 12 | |

Acquisition1 | 119 | | 103 | | 251 | | 473 | | 116 | | 589 | |

| Other | (2) | | (2) | | (1) | | (5) | | (1) | | (6) | |

| March 31, 2021 | $ | 371 | | $ | 201 | | $ | 418 | | $ | 990 | | $ | 429 | | $ | 1,419 | |

1.Related to the Eaton Vance acquisition.

| | | | | | | | | | | | | | | | | | | | |

| $ in billions | Equity | Fixed income | Alternatives and Solutions | Long-term AUM Subtotal | Liquidity and Overlay Services | Total |

| December 31, 2019 | $ | 138 | | $ | 79 | | $ | 139 | | $ | 356 | | $ | 196 | | $ | 552 | |

| Inflows | 14 | | 10 | | 8 | | 32 | | 446 | | 478 | |

| Outflows | (12) | | (9) | | (4) | | (25) | | (395) | | (420) | |

| Market Impact | (18) | | (4) | | (7) | | (29) | | 1 | | (28) | |

| Other | (1) | | (1) | | 5 | | 3 | | (1) | | 2 | |

| March 31, 2020 | $ | 121 | | $ | 75 | | $ | 141 | | $ | 337 | | $ | 247 | | $ | 584 | |

| | | | | |

| |

| Management’s Discussion and Analysis | |

Average AUM | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| $ in billions | | | 2021 | 2020 |

| Equity | | | $ | 288 | | $ | 133 | |

| Fixed income | | | 131 | | 79 | |

| Alternatives and Solutions | | | 242 | | 139 | |

| Long-term AUM subtotal | | | 661 | | 351 | |

| Liquidity and Overlay Services | | | 339 | | 206 | |

| Total AUM | | | $ | 1,000 | | $ | 557 | |

Average Fee Rates | | | | | | | | | | |

| | | Three Months Ended

March 31, |

| Fee rate in bps | | | 2021 | 2020 |

| Equity | | | 77 | | 77 |

| Fixed income | | | 33 | | 31 |

| Alternatives and Solutions | | | 45 | | 60 |

| Long-term AUM | | | 57 | | 60 |

| Liquidity and Overlay Services | | | 8 | | 17 |

| Total AUM | | | 40 | | 44 |

While Asset management and related fees arising from the acquisition will be incremental to the Firm’s results, certain Eaton Vance products have lower average fee rates, and are expected to impact the averages in the previous table in future periods compared with the corresponding prior periods. For a description of the asset classes and rollforward items in the previous tables, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Business Segments—Investment Management—Assets Under Management or Supervision” in the 2020 Form 10-K, except for the following updates to the definitions below, which reflect the inclusion of certain Eaton Vance products.

•Alternatives and Solutions—includes products in fund of funds, real estate, infrastructure, private equity and credit strategies, multi-asset portfolios as well as custom separate account portfolios.

•Liquidity and Overlay Services—includes liquidity fund products as well as overlay services, which represent investment strategies that use passive exposure instruments to obtain, offset or substitute specific portfolio exposures, beyond those provided by the underlying holdings of the fund.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Supplemental Financial Information

U.S. Bank Subsidiaries

Our U.S. bank subsidiaries, Morgan Stanley Bank N.A. (“MSBNA”), Morgan Stanley Private Bank, National Association (“MSPBNA”), E*TRADE Bank (“ETB”), and E*TRADE Savings Bank (“ETSB”) (collectively, “U.S. Bank Subsidiaries”) accept deposits, provide loans to a variety of customers, including large corporate and institutional clients as well as high net worth individuals, and invest in securities. Lending activity recorded in the U.S. Bank Subsidiaries from the Institutional Securities business segment primarily includes secured lending facilities, commercial and residential real estate loans, and corporate loans. Lending activity recorded in the U.S. Bank Subsidiaries from the Wealth Management business segment primarily includes securities-based lending, which allows clients to borrow money against the value of qualifying securities, and residential real estate loans.

For a further discussion of our credit risks, see “Quantitative and Qualitative Disclosures about Risk—Credit Risk.” For a further discussion about loans and lending commitments, see Notes 10 and 14 to the financial statements.

U.S. Bank Subsidiaries’ Supplemental Financial Information1

| | | | | | | | |

| $ in billions | At

March 31,

2021 | At

December 31,

2020 |

| Investment securities portfolio: | | |

| Investment securities—AFS | 84.8 | | 90.3 | |

| Investment securities—HTM | 64.6 | | 52.6 | |

| Total investment securities | $ | 149.4 | | $ | 142.9 | |

Wealth Management Loans2 |

| Residential real estate | $ | 36.8 | | $ | 35.2 | |

Securities-based lending and Other3 | 68.1 | | 62.9 | |

| Total | $ | 104.9 | | $ | 98.1 | |

Institutional Securities Loans2 |

| Corporate | $ | 9.5 | | $ | 7.9 | |

| Secured lending facilities | 27.8 | | 27.4 | |

| Commercial and Residential real estate | 8.9 | | 10.1 | |

| Securities-based lending and Other | 6.3 | | 5.4 | |

| Total | $ | 52.5 | | $ | 50.8 | |

| Total Assets | $ | 357.2 | | $ | 346.5 | |

Deposits4 | $ | 321.6 | | $ | 309.7 | |

1.Amounts exclude transactions between the bank subsidiaries, as well as deposits from the Parent Company and affiliates.

2.For a further discussion of loans in the Wealth Management and Institutional Securities business segments, see “Quantitative and Qualitative Disclosures about Risk—Credit Risk” herein.

3.Other loans primarily include tailored lending.

4.For further information on deposits, see “Liquidity and Capital Resources—Funding Management—Unsecured Financing” herein.

Accounting Development Updates

The Financial Accounting Standards Board has issued certain accounting updates, which we have either determined are not applicable or are not expected to have a significant impact on our financial statements.

Critical Accounting Policies

Our financial statements are prepared in accordance with U.S. GAAP, which requires us to make estimates and assumptions (see Note 1 to the financial statements). We believe that of our significant accounting policies (see Note 2 to the financial statements in the 2020 Form 10-K and Note 2 to the financial statements), the fair value, goodwill and intangible assets, legal and regulatory contingencies and income taxes policies involve a higher degree of judgment and complexity. For a further discussion about our critical accounting policies, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies” in the 2020 Form 10-K. As discussed in Note 2 to the financial statements, our acquisition of Eaton Vance on March 1, 2021 included indefinite lived intangible assets. The initial valuation of an intangible asset, including indefinite lived intangible assets, as part of the acquisition method of accounting and the subsequent valuation of intangible assets as part of impairment assessments are subjective and based, in part, on inputs that are unobservable. These inputs include, but are not limited to, forecasted cash flows, revenue growth rates, attrition rates and discount rates.

Liquidity and Capital Resources

Senior management, with oversight by the Asset/Liability Management Committee and the Board of Directors (“Board”), establishes and maintains our liquidity and capital policies. Through various risk and control committees, senior management reviews business performance relative to these policies, monitors the availability of alternative sources of financing, and oversees the liquidity, interest rate and currency sensitivity of our asset and liability position. Our Treasury department, Firm Risk Committee, Asset/Liability Management Committee, and other committees and control groups assist in evaluating, monitoring and controlling the impact that our business activities have on our balance sheet, liquidity and capital structure. Liquidity and capital matters are reported regularly to the Board and the Risk Committee of the Board.

Balance Sheet

We monitor and evaluate the composition and size of our balance sheet on a regular basis. Our balance sheet management process includes quarterly planning, business-specific thresholds, monitoring of business-specific usage versus key performance metrics and new business impact assessments.

We establish balance sheet thresholds at the consolidated and business segment levels. We monitor balance sheet utilization and review variances resulting from business activity and market fluctuations. On a regular basis, we review current performance versus established thresholds and assess the need to re-allocate our balance sheet based on business unit needs. We also monitor key metrics, including asset and liability size and capital usage.

| | | | | |

| |

| Management’s Discussion and Analysis | |

Total Assets by Business Segment

| | | | | | | | | | | | | | |

| At March 31, 2021 |

| $ in millions | IS | WM | IM | Total |

| Assets | | | | |

| Cash and cash equivalents | $ | 93,021 | | $ | 24,396 | | $ | 701 | | $ | 118,118 | |

| Trading assets at fair value | 307,854 | | 310 | | 4,994 | | 313,158 | |

| Investment securities | 40,888 | | 148,318 | | — | | 189,206 | |

| Securities purchased under agreements to resell | 87,279 | | 27,442 | | — | | 114,721 | |

| Securities borrowed | 100,957 | | 1,192 | | — | | 102,149 | |

| Customer and other receivables | 80,475 | | 33,381 | | 1,187 | | 115,043 | |

Loans1 | 54,163 | | 104,933 | | 27 | | 159,123 | |

Other assets2 | 13,918 | | 21,702 | | 11,634 | | 47,254 | |

| Total assets | $ | 778,555 | | $ | 361,674 | | $ | 18,543 | | $ | 1,158,772 | |

| | | | | | | | | | | | | | |

| At December 31, 2020 |

| $ in millions | IS | WM | IM | Total |

| Assets | | | | |

| Cash and cash equivalents | $ | 74,281 | | $ | 31,275 | | $ | 98 | | $ | 105,654 | |

| Trading assets at fair value | 308,413 | | 280 | | 4,045 | | 312,738 | |

| Investment securities | 41,630 | | 140,524 | | — | | 182,154 | |

| Securities purchased under agreements to resell | 84,998 | | 31,236 | | — | | 116,234 | |

| Securities borrowed | 110,480 | | 1,911 | | — | | 112,391 | |

| Customer and other receivables | 67,085 | | 29,781 | | 871 | | 97,737 | |

Loans1 | 52,449 | | 98,130 | | 18 | | 150,597 | |

Other assets2 | 13,986 | | 22,458 | | 1,913 | | 38,357 | |

| Total assets | $ | 753,322 | | $ | 355,595 | | $ | 6,945 | | $ | 1,115,862 | |

IS—Institutional Securities

WM—Wealth Management

IM—Investment Management

1.Amounts include loans held for investment, net of allowance, and loans held for sale but exclude loans at fair value, which are included in Trading assets in the balance sheets (see Note 10 to the financial statements).

2.Other assets primarily includes Goodwill and Intangible assets, premises, equipment and software, ROU assets related to leases, other investments, and deferred tax assets.

A substantial portion of total assets consists of liquid marketable securities and short-term receivables. In the Institutional Securities business segment, these arise from sales and trading activities, and in the Wealth Management business segment, these arise from banking activities, including management of the investment portfolio, comprising Investment securities, Cash and cash equivalents and Securities purchased under agreements to resell. Total assets increased slightly to $1,159 billion at March 31, 2021 from $1,116 billion at December 31, 2020.

Liquidity Risk Management Framework

The core components of our Liquidity Risk Management Framework are the Required Liquidity Framework, Liquidity Stress Tests and Liquidity Resources, which support our target liquidity profile. For a further discussion about the Firm’s Required Liquidity Framework and Liquidity Stress Tests, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Liquidity Risk Management Framework” in the 2020 Form 10-K.

At March 31, 2021 and December 31, 2020, we maintained sufficient liquidity to meet current and contingent funding obligations as modeled in our Liquidity Stress Tests.

Liquidity Resources

We maintain sufficient liquidity resources, which consist of HQLA and cash deposits with banks (“Liquidity Resources”) to cover daily funding needs and to meet strategic liquidity targets sized by the Required Liquidity Framework and Liquidity Stress Tests. The total amount of Liquidity Resources is actively managed by us considering the following components: unsecured debt maturity profile; balance sheet size and composition; funding needs in a stressed environment, inclusive of contingent cash outflows; legal entity, regional and segment liquidity requirements; regulatory requirements; and collateral requirements.

The amount of Liquidity Resources we hold is based on our risk tolerance and is subject to change depending on market and Firm-specific events. The Liquidity Resources are primarily held within the Parent Company and its major operating subsidiaries. The Total HQLA values in the tables immediately following are different from Eligible HQLA, which, in accordance with the LCR rule, also takes into account certain regulatory weightings and other operational considerations.

Liquidity Resources by Type of Investment

| | | | | | | | |

| $ in millions | At

March 31,

2021 | At

December 31,

2020 |

| Cash deposits with central banks | $ | 59,154 | | $ | 49,669 | |

Unencumbered HQLA Securities1: | | |

| U.S. government obligations | 135,008 | | 136,555 | |

| U.S. agency and agency mortgage-backed securities | 110,659 | | 99,659 | |

Non-U.S. sovereign obligations2 | 37,434 | | 39,745 | |

| Other investment grade securities | 2,015 | | 2,053 | |

Total HQLA1 | $ | 344,270 | | $ | 327,681 | |

| Cash deposits with banks (non-HQLA) | 9,034 | | 10,942 | |

| Total Liquidity Resources | $ | 353,304 | | $ | 338,623 | |

1.HQLA is presented prior to applying weightings and includes all HQLA held in subsidiaries.

2.Primarily composed of unencumbered French, U.K., Japanese, German and Dutch government obligations.

Liquidity Resources by Bank and Non-Bank Legal Entities

| | | | | | | | | | | |

| At

March 31,

2021 | At

December 31,

2020 | Average Daily Balance

Three Months Ended |

| $ in millions | March 31, 2021 |

| Bank legal entities | | |

| U.S. | $ | 184,993 | | $ | 178,033 | | $ | 189,008 | |

| Non-U.S. | 8,889 | | 7,670 | | 7,882 | |

| Total Bank legal entities | 193,882 | | 185,703 | | 196,890 | |

| Non-Bank legal entities | | |

| U.S.: | | | |

| Parent Company | 54,854 | | 59,468 | | 57,194 | |

| Non-Parent Company | 42,299 | | 33,368 | | 40,982 | |

| Total U.S. | 97,153 | | 92,836 | | 98,176 | |

| Non-U.S. | 62,269 | | 60,084 | | 58,735 | |

| Total Non-Bank legal entities | 159,422 | | 152,920 | | 156,911 | |

| Total Liquidity Resources | $ | 353,304 | | $ | 338,623 | | $ | 353,801 | |

| | | | | |

| |

| Management’s Discussion and Analysis | |

Liquidity Resources may fluctuate from period to period based on the overall size and composition of our balance sheet, the maturity profile of our unsecured debt and estimates of funding needs in a stressed environment, among other factors.

Regulatory Liquidity Framework

Liquidity Coverage Ratio

The Firm, MSBNA and MSPBNA are required to comply with, and subject to a transition period, ETB will be required to comply with, LCR requirements, including a requirement to calculate each entity’s LCR on each business day. The requirements are designed to ensure that banking organizations have sufficient Eligible HQLA to cover net cash outflows arising from significant stress over 30 calendar days, thus promoting the short-term resilience of the liquidity risk profile of banking organizations. In determining Eligible HQLA for LCR purposes, weightings (or asset haircuts) are applied to HQLA, and certain HQLA held in subsidiaries is excluded.

As of March 31, 2021, the Firm, MSBNA and MSPBNA are compliant with the minimum required LCR of 100%.

Liquidity Coverage Ratio

| | | | | | | | |

| Average Daily Balance

Three Months Ended |

| $ in millions | March 31, 2021 | December 31, 2020 |

Eligible HQLA1 | | |

| Cash deposits with central banks | $ | 50,815 | | $ | 43,596 | |

Securities2 | 166,060 | | 162,509 | |

Total Eligible HQLA1 | $ | 216,875 | | $ | 206,105 | |

| LCR | 125 | % | 129 | % |

1.Under the LCR rule, Eligible HQLA is calculated using weightings and excluding certain HQLA held in subsidiaries.

2.Primarily includes U.S. Treasuries, U.S. agency mortgage-backed securities, sovereign bonds and investment grade corporate bonds.

Net Stable Funding Ratio

The U.S. banking agencies have finalized a rule to implement the NSFR, which requires large banking organizations to maintain sufficiently stable sources of funding over a one-year time horizon, and will apply to us, MSBNA, MSPBNA and ETB. As of March 31, 2021, we estimate we are compliant with the 100% minimum NSFR and that we will be in compliance with the final rule on July 1, 2021, the effective date of the requirements.

Funding Management

We manage our funding in a manner that reduces the risk of disruption to our operations. We pursue a strategy of diversification of secured and unsecured funding sources (by product, investor and region) and attempt to ensure that the tenor of our liabilities equals or exceeds the expected holding period of the assets being financed.

We fund our balance sheet on a global basis through diverse sources. These sources include our equity capital, borrowings, securities sold under agreements to repurchase, securities lending, deposits, letters of credit and lines of credit. We have active financing programs for both standard and structured products targeting global investors and currencies.

Secured Financing