Exhibit 99.2

The Next Strategic Step in Our Transformation February 20, 2020

No t ice Important Information about the Transaction and Where to Find It In connection with the proposed transaction between Morgan Stanley (“Morgan Stanley”) and E*TRADE (“E*TRADE”), Morgan Stanley and E*TRADE will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a Morgan Stanley registration statement on Form S - 4 that will include a proxy statement of E*TRADE that also constitutes a prospectus of Morgan Stanley, and a definitive proxy statement/prospectus will be mailed to stockholders of E*TRADE. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF MORGAN STANLEY AND E*TRADE ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing information about Morgan Stanley or E*TRADE, without charge at the SEC’s Internet website ( www.sec.gov ) or by contacting the investor relations department of Morgan Stanley or E*TRADE at the following: Morgan Stanley 1585 Broadway New York, NY 10036 Attention: Investor Relations 1 - 212 - 762 - 8131 investorrelations@morganstanley.com E*TRADE 671 North Glebe Road, Ballston Tower Arlington, VA 22203 Attention: Investor Relations 1 - 646 - 521 - 4406 IR@etrade.com Participants in the Solicitation Morgan Stanley, E*TRADE, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding the directors and executive officers of Morgan Stanley and E*TRADE, and their direct or indirect interests in the transaction, by security holdings or otherwise will be set forth in the proxy statement/prospectus and other relevant matters when they are filed with the SEC. Information regarding the directors and executive officers of Morgan Stanley is contained in Morgan Stanley’s Form 10 - K for the year ended December 31, 2018 and its proxy statement filed with the SEC on April 5, 2019. Information regarding the directors and executive officers of E*TRADE is contained in E*TRADE’s Form 10 - K for the year ended December 31, 2019 and its proxy statement filed with the SEC on March 26, 2019. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available. No Offer or Solicitation This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Forward - Looking Statements This communication contains “forward - looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward - looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward - looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. 2

No t ice 3 All such forward - looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in such forward - looking statements. Important risk factors that may cause such a difference include, but are not limited to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining required stockholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the acquisition, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period, (ii) the ability of Morgan Stanley and E*TRADE to integrate the business successfully and to achieve anticipated synergies, risks and costs, (iii) potential litigation relating to the proposed transaction that could be instituted against Morgan Stanley, E*TRADE or their respective directors, (iv) the risk that disruptions from the proposed transaction will harm Morgan Stanley’s and E*TRADE’s business, including current plans and operations, (v) the ability of Morgan Stanley or E*TRADE to retain and hire key personnel, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the acquisition, (vii) continued availability of capital and financing and rating agency actions, (viii) legislative, regulatory and economic developments, (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the acquisition that could affect Morgan Stanley’s and/or E*TRADE’s financial performance, (x) certain restrictions during the pendency of the acquisition that may impact Morgan Stanley’s or E*TRADE’s ability to pursue certain business opportunities or strategic transactions, (xi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors, (xii) dilution caused by Morgan Stanley’s issuance of additional shares of its common stock in connection with the proposed transaction, (xiii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (xiv) those risks described in Item 1A of Morgan Stanley’s most recently filed Annual Report on Form 10 - K and subsequent reports on Forms 10 - Q and 8 - K, (xv) those risks described in Item 1A of E*TRADE’s most recently filed Annual Report on Form 10 - K and subsequent reports on Forms 10 - Q and 8 - K and (xvi) those risks that will be described in the proxy statement/prospectus on Form S - 4 available from the sources indicated above. These risks, as well as other risks associated with the proposed acquisition, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S - 4 that will be filed with the SEC in connection with the proposed acquisition. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S - 4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward - looking statements. Consequences of material differences in results as compared with those anticipated in the forward - looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Morgan Stanley’s or E*TRADE’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Morgan Stanley nor E*TRADE assumes any obligation to publicly provide revisions or updates to any forward - looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Presentation The Morgan Stanley information provided herein includes certain non - GAAP financial measures. The definition of such measures and/or the reconciliation of such measures to the comparable U.S. GAAP figures are included in this presentation, or in the Morgan Stanley's (the "Company") Annual Report on Form 10 - K, Definitive Proxy Statement, Quarterly Reports on Form 10 - Q and the Company’s Current Reports on Form 8 - K, as applicable, including any amendments thereto, which are available on www.morganstanley.com The E*TRADE information contained herein has been extracted from E*TRADE's Annual Report on Form 10 - K for the year ended December 31, 2019, Current Report on Form 8 - K, dated January 23, 2020 or E*TRADE's Investor Presentation, dated January 2020, which is available on us.etrade.com . The End Notes are an integral part of this presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation. Please note this presentation is available at www.morganstanley.com .

Strategic Rationale 1 Accelerates Business Mix Towards Balance Sheet Light and More Durable Sources of Revenue (1) 2 Leverages Dynamic Tech - Driven Company with Iconic Brand, Providing Access to the Next Generation 3 Services the Full Spectrum of Wealth Through Advisory, Workplace, and Direct Channels 4 Immediately Fills in Product and Service Gaps for Both E*TRADE and Morgan Stanley Clients 5 Produces Meaningful Growth Opportunities Through Combined Offering 6 Generates Significant Potential Cost and Funding Synergies 7 Provides Opportunity for International Digital Wealth Platform The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 4

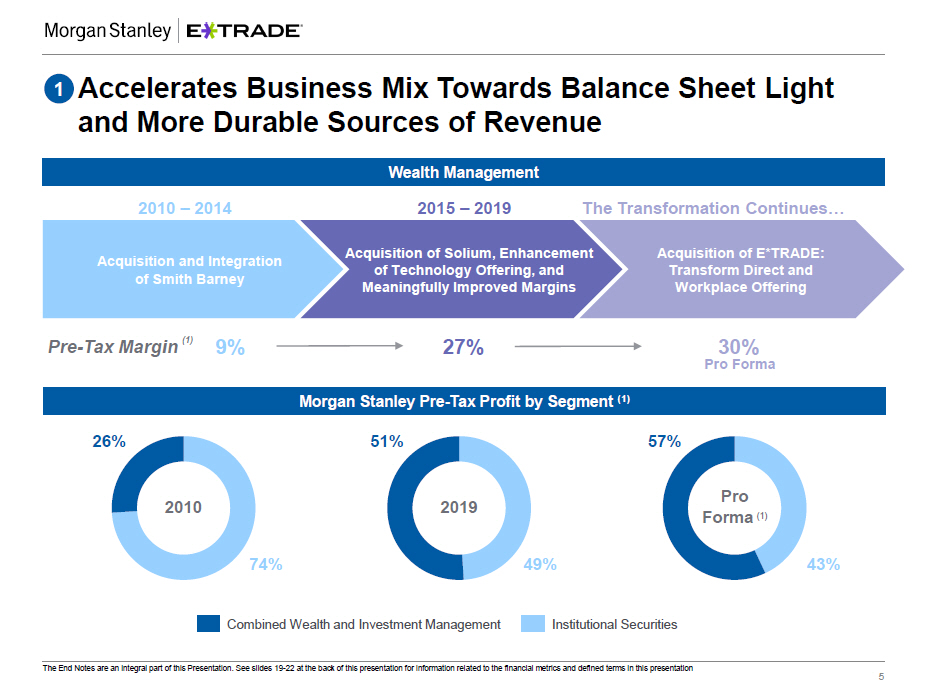

Accelerates Business Mix Towards Balance Sheet Light and More Durable Sources of Revenue 1 Wealth Management 2010 – 2014 2015 – 2019 The Transformation Continues… 9% 27% 43% 49% 26 % 51 % 57% 74% Institutional Securities Combined Wealth and Investment Management 2010 2019 Pro Forma (1) Wealth Management Morgan Stanley Pre - Tax Profit by Segment (1) 30% Pro Forma The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 5 Pre - Tax Margin (1) Acquisition of Solium, Enhancement of Technology Offering, and Meaningfully Improved Margins Acquisition of E*TRADE: Transform Direct and Workplace Offering Acquisition and Integration of Smith Barney

Leverages Dynamic Tech - Driven Company with Iconic Brand, Providing Access to the Next Generation 2 Pioneering Brokerage Platform with an Iconic Brand Digital Banking Capabilities Including Checking and Savings Accounts ~$360Bn of Retail Client Assets across ~5.2MM Client Accounts (1) $39Bn of Deposits; additional $18Bn of Off - Balance Sheet Deposits (2) Leading Stock Plan Administrator ~$300Bn of Corporate Services Assets across ~1.9MM Accounts (3) Innovative Technology Platforms Backed by Professional Grade Support Mobile and Cloud - Based Platforms Power E*TRADE Equity Edge Online The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 6

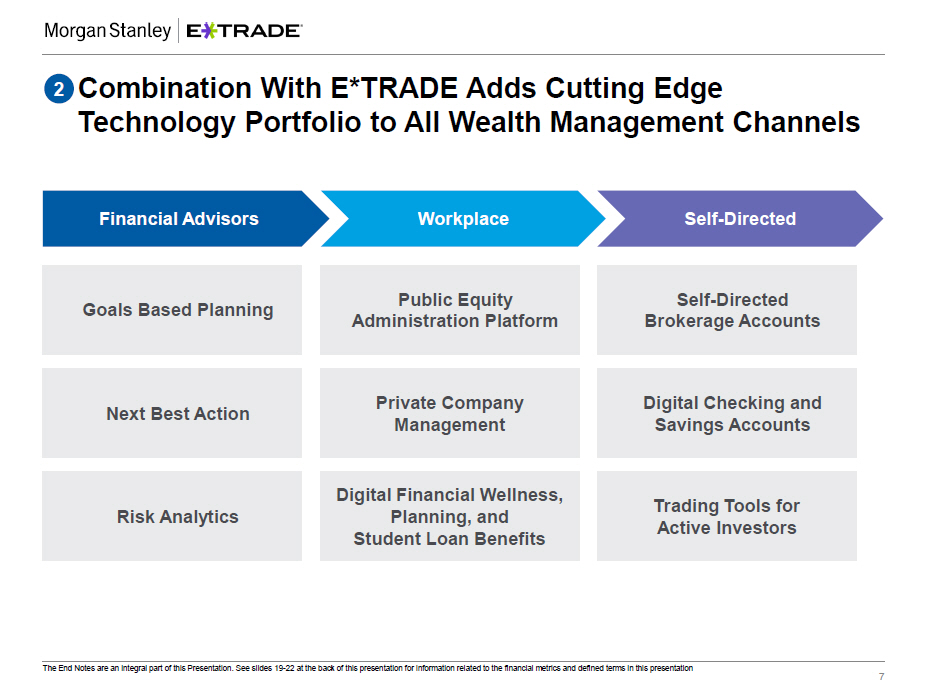

Combination With E*TRADE Adds Cutting Edge Technology Portfolio to All Wealth Management Channels 2 Financial Advisors W o rk p lace Self - Directed The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 7 Goals Based Planning Next Best Action Risk Analytics Digital Financial Wellness, Planning, and Student Loan Benefits Private Company Management Public Equity Administration Platform Digital Checking and Savings Accounts Self - Directed Brokerage Accounts Trading Tools for Active Investors

Combination Services Full Spectrum of Wealth Across All Channels of Client Acquisition… 3 The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 8 Financial Advisors (1) Self - Directed (3) Workplace (2) #1 47% Fee - Based Assets $2.7Tn Client Assets 3MM+ Client Relationships 291K Daily Average Revenue Trades ~$360Bn Retail Client Assets ~5.2MM Client Accounts ~$580Bn Combined Stock Plan Balances ~4.6MM Stock Plan Participants 15% E*TRADE Proceeds Retained Top 3 Top 3

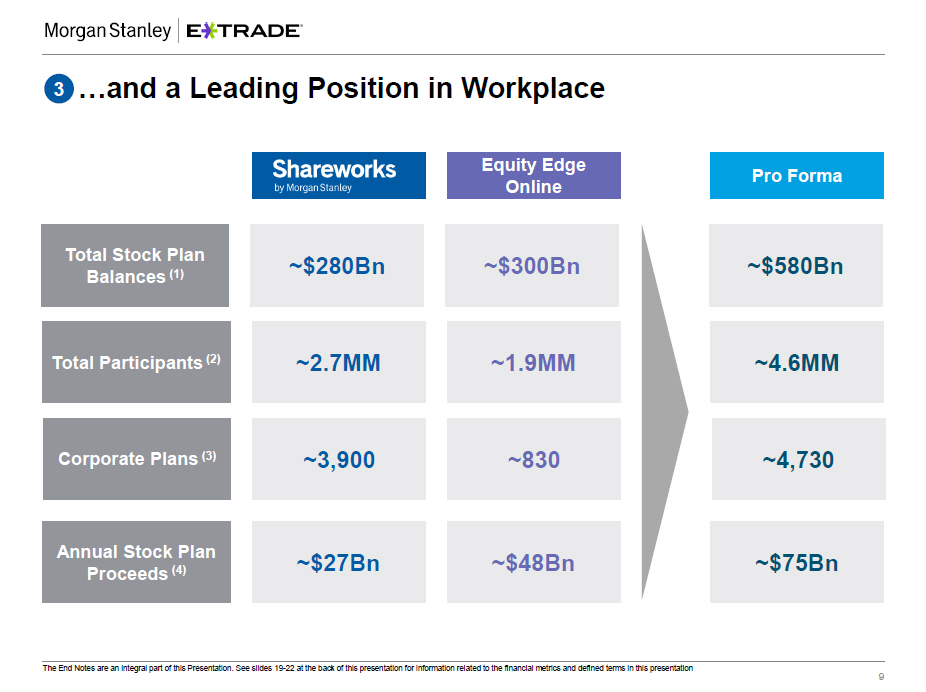

…and a Leading Position in Workplace 3 Equity Edge Online Pro Forma Total Participants (2) ~2.7MM ~1.9MM ~4.6MM Corporate Plans (3) ~3,900 ~830 ~4,730 Total Stock Plan Balances (1) ~$280Bn ~$300Bn ~$580Bn Annual Stock Plan Proceeds (4) ~$27Bn ~$48Bn ~$75Bn The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 9

Immediately Fills in Product and Service Gaps for Both E*TRADE and Morgan Stanley Clients 4 Full Offering Partial Offering / Not at Scale Morgan Stanley E*TRADE Pro Forma Equities, ETFs, and Mutual Funds Fixed Income Derivatives Se l f - Di r ec t ed Brokerage Public Stock Plan Administration Private Company Financial Wellness and Planning Workplace High Yield Savings Accounts Checking Accounts Digital Banking (1) Wealth M a n a g e me n t Full Service Advisory Research Asset Management Products Virtual Advisor No Offering x x x x x x x x x x x x The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 10

Combination Accelerates Growth Initiatives 5 Morgan Stanley Characteristics E*TRADE Characteristics Established Deep Relationships Very Wealthy Next Generation High Rate of Client Acquisition 850K+ New Accounts Over 5 Years (1) Pipeline of Emerging Wealth Ser v ices Offered Depth of Relationships (2) Financial Advisory Services, Tailored Lending, Trust and Estate Planning ~50% of Wallet Captured Self - Directed, Active Trader Platforms, Virtual Advisor ~10% of Wallet Captured The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 11

Technology Penetration and Service Capabilities Will Help Capture Greater Share of Wealth 5 Retail Clients The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 12 Stock Plan P a r t i ci p an ts Retail Clients and Stock Plan Participants Combined $3 . 2 + ~$7.3+ $2 .6 $1 .5 E*TRADE (2) Morgan Stanley (1) Pro Forma x Deepen relationships with E*TRADE clients with attractive demographics x Accelerate combined Workplace efforts x Capture self - directed assets of Morgan Stanley clients held away x Provide advisory product offerings to E*TRADE clients x Establish advice relationships with E*TRADE’s Stock Plan Participants x Position Morgan Stanley to become the primary banking relationship for our clients Growth Opportunities to Capture Assets Client Assets Held Away ($Tn)

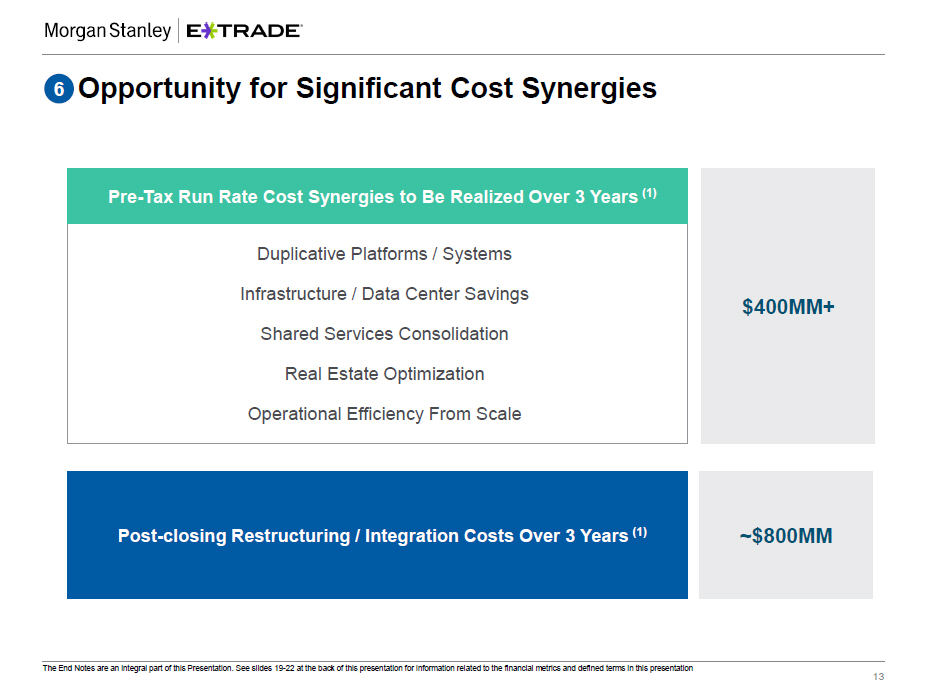

Opportunity for Significant Cost Synergies 6 $400MM+ ~$800MM Duplicative Platforms / Systems Infrastructure / Data Center Savings Shared Services Consolidation Real Estate Optimization Operational Efficiency From Scale Pre - Tax Run Rate Cost Synergies to Be Realized Over 3 Years (1) The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 13 Post - closing Restructuring / Integration Costs Over 3 Years (1)

Combination Generates Significant Funding Synergies and Enhanced Deposit Profile 6 E*TRADE (2) Morgan Stanley Pro Forma 64% 15% 21% $190Bn (105bps) 61% 8% $56Bn (34bps) Total Deposits and Cost of Deposits (1) Replace Morgan Stanley’s Wholesale Bank Funding with E*TRADE’s Off - Balance Sheet Customer Cash Holdings Optimize Combined Liquidity Position + = 31% Bank Deposit Program Savings Deposits Time Deposits Off - Balance Sheet Deposits 70% The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 14 13% 17% ~$247Bn (89bps)

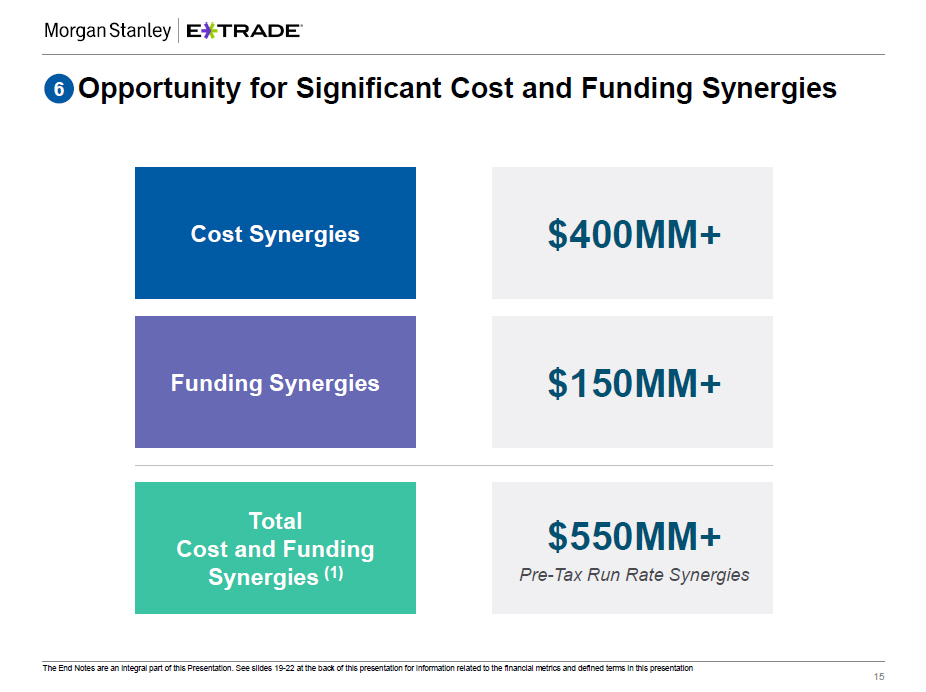

$550MM+ Pre - Tax Run Rate Synergies Opportunity for Significant Cost and Funding Synergies 6 Total Cost and Funding Synergies (1) $150MM+ Funding Synergies Cost Synergies The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 15 $400MM+

Transaction Summary The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 16 Key Transaction Terms Summary Transaction Assumptions (1) Governance / Brand Timing / Approvals • $13 billion transaction value; 100% stock consideration • Fixed exchange ratio of 1.0432 per Morgan Stanley share; implies $58.74 per share value based on Morgan Stanley’s closing price of $56.31 on February 19, 2020 • Cost synergies of $400MM, phased - in over three years • Funding synergies of $150MM, phased - in over two years • Post - closing restructuring / integration costs of approximately $800MM pre - tax over a three year period • One member of E*TRADE Board to be added to the Morgan Stanley Board of Directors • Retention of iconic E*TRADE brand • Expected to close in 4Q 2020 • Subject to customary receipt of regulatory approvals and E*TRADE shareholder approval

Pro Forma Summary Financial Impact The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 17 ROTCE / TBVPS (3) • Dilution to Tangible Book Value Per Share, offset by 100 bps+ accretion to ROTCE once estimated cost and funding synergies are realized EPS (2) • Accretive once fully phased - in estimated cost and funding synergies are realized • Incremental synergies provide upside to future EPS Capital (2) • 30bps+ accretive to CET1 • Maintain current buyback, subject to certain restrictions; future buybacks subject to CCAR • Improves CCAR / stress testing profile Wealth Management (1) Morgan Stanley Revenue $21Bn 30% ~8.2MM $3.1Tn ~4.6MM ~$580Bn Pre - Tax Margin Client Relationships And Accounts Client Assets Stock Plan Partici p a n ts Stock Plan Balances

Strategic Rationale 1 Accelerates Business Mix Towards Balance Sheet Light and More Durable Sources of Revenue (1) 2 Leverages Dynamic Tech - Driven Company with Iconic Brand, Providing Access to the Next Generation 3 Services the Full Spectrum of Wealth Through Advisory, Workplace, and Direct Channels 4 Immediately Fills in Product and Service Gaps for Both E*TRADE and Morgan Stanley Clients 5 Produces Meaningful Growth Opportunities Through Combined Offering 6 Generates Significant Potential Cost and Funding Synergies 7 Provides Opportunity for International Digital Wealth Platform The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 18

End Notes 19 These notes refer to the financial metrics and/or defined term presented on Slide 4 1. Balance Sheet Light , as it relates to the Morgan Stanley Wealth Management segment, refers to a lower Risk Weighted Assets (‘RWAs’) intensity. Durable Sources of Revenues , as it relates to the Morgan Stanley, represent revenues associated with fee - based pricing arrangements, financing and lending that are generally less susceptible to significant fluctuation as a result of market volatility when compared to other Firm revenues, and are comprised of: Asset Management revenues in the Wealth and Investment Management segments; revenues from Financing and Secured Lending activities in the Institutional Securities and Wealth Management segments; and revenues from Investment Banking Advisory services. These notes refer to the financial metrics and/or defined term presented on Slide 5 1. Pre - Tax Margin represents Pre - Tax Profit divided by Net revenues. Pre - Tax Profit represents Income from continuing operations before income taxes. Pre - Tax Profit for 2010 excludes the negative impact of DVA of approximately $873 million. DVA represents the change in fair value resulting from fluctuations in our debt credit spreads and other credit factors related to borrowings and other liabilities carried under the fair value option. The full amount of the Net revenues DVA adjustment was recorded in the Institutional Securities segment. Pre - Tax Profit, excluding DVA is a non - GAAP financial measure that the Firm considers useful for analysts, investors and other stakeholders to assess operating performance. E*TRADE’s Pre - Tax Margin and Pre - Tax Profit based on E*TRADE’s Annual Report on Form 10 - K for the year ended December 31, 2019 (‘E*TRADE’s 2019 Form 10 - K’ ). Pro Forma Pre - Tax Margin and Pro Forma Pre - Tax Profit by Segment does not include estimated cost and funding synergies and post - closing restructuring / integration costs associated with the transaction and does not factor in any potential attrition of assets or revenues post closing due to limited anticipated disruption to the existing business models. These notes refer to the financial metrics and/or defined term presented on Slide 6 and unless otherwise indicated were extracted from E*TRADE’s 2019 Form 10 - K 1. Retail Client Assets of $362 billion at December 31, 2019 represent the market value of retail customer assets held by E*TRADE including security holdings and customer cash and deposits, exclusive of advisor services accounts based on E*TRADE’s Current Report on Form 8 - K, dated January 23, 2020 (‘E*TRADE’s January 2020 Form 8 - K’). Client Accounts represent retail services accounts, defined as those with a minimum balance of $25 or a trade within the prior six months. End of period (at December 31, 2019) retail accounts were 5.2 million. 2. $39 billion of On - Balance Sheet Deposits at December 31, 2019 consist of: brokerage sweep deposits of $27.9 billion; bank sweep deposits of $6.4 billion; and savings, checking, and other banking assets of $4.3 billion. Beginning November 2019, bank sweep deposits include E*TRADE’s Premium Savings Accounts participating in a sweep deposit account program. $18 billion of Off - Balance Sheet Deposits at December 31, 2019 represent brokerage sweep deposits of $16.9 billion and bank sweep deposits of $0.8 billion held at unaffiliated financial institutions. 3. Corporate Services Assets are inclusive of vested equity holdings, vested options holdings, and unvested holdings and totaled $296 billion as of December 31, 2019. End of period (at December 31, 2019) corporate services accounts of ~1.9 million represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months.

End Notes 20 These notes refer to the financial metrics and/or defined term presented on Slide 8 1. Position in Financial Advisory represents estimated client assets based on internal analysis aggregated for Morgan Stanley and the following peers, per company filings: Bank of America, Wells Fargo and UBS. Peer data reflects client assets or client balances as of December 31, 2019. Client balances for Bank of America Global Wealth Management excludes balances within U.S. Trust. Financial Advisory Client Relationships are based on Morgan Stanley internal data as of December 31, 2019. Morgan Stanley client relationships may include more than one retail client account. Morgan Stanley’s Client Assets are as of December 31, 2019. Fee - Based Assets represent the amount of assets in client accounts where the basis of payment for services is a fee calculated on those assets. Fee based assets are as of December 31, 2019. 2. Pro forma Workplace Rank Position derived from Morgan Stanley internal analysis informed by latest available data for Bank of America, Carta, Certent, Charles Schwab, Computershare, Fidelity, and UBS. Pro forma Stock Plan Participants are defined as accounts of the corporate plans serviced with vested and unvested awards. Shareworks by Morgan Stanley stock plan participants of ~2.7 million are as of December 31, 2019. E*TRADE’s ~1.9 million accounts represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Pro forma Stock Plan Balances consist of vested and unvested awards. Shareworks by Morgan Stanley balances of ~$280 billion are as of December 31, 2019. E*TRADE’s corporate services assets are inclusive of vested equity holdings, vested options holdings, and unvested holdings totaling $296 billion are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Proceeds Retained for E*TRADE refers to sales proceeds converted into E*TRADE brokerage accounts 12 months post exercise as reported in the January 2020 Investor presentation posted on the E*TRADE Investor Relations website (‘January 2020 Investor Presentation’) at us.etrade.com 3. Position in Self - Directed derived from Aite Group “New Realities in Wealth Management: U.S. Client Asset Growth Stalls in Down Market” report (May 2019). Peers include Fidelity, Charles Schwab / TD Ameritrade, Merrill Edge and others. Client Accounts represent retail services accounts, defined as those with a minimum balance of $25 or a trade within the prior six months. End of period (December 31, 2019) retail accounts of 5.2 million based on E*TRADE’s 2019 Form 10 - K. Retail Client Assets of $362 billion at December 31, 2019 represent the market value of retail customer assets held by E*TRADE including security holdings and customer cash and deposits, exclusive of advisor services accounts based on E*TRADE’s January 2020 Form 8 - K. Daily Average Revenue Trades (‘DARTs’) defined as total commissionable trades in a period divided by the number of trading days during that period. Beginning in November 2019, the definition of DARTs was updated to reflect all customer - directed trades. This includes trades associated with no - transaction - fee mutual funds, options trades through the Dime Buyback Program, and all exchange - traded funds transactions (including those formerly classified as commission - free). DARTs is calculated by dividing these customer - directed trades by the number of trading days during the period. DARTs metric included in E*TRADE’s 2019 Form 10 - K. These notes refer to the financial metrics and/or defined term presented on Slide 9 1. Total Stock Plan balances consist of vested and unvested securities held by the company. Shareworks by Morgan Stanley balances of ~$280 billion are as of December 31, 2019. E*TRADE’s corporate services assets are inclusive of vested equity holdings, vested options holdings, and unvested hold ing s totaling $296 billion are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. 2. Total Participants are defined as accounts of the corporate plans serviced with vested and unvested securities held by company. Shareworks by Morgan Stanley stock plan participants of ~2.7 million are as of December 31, 2019. E*TRADE’s ~1.9 million accounts represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. 3. Corporate Plans reflects aggregate public and private companies serviced by the respective parties as of December 31, 2019. E*TRADE provides plan administration services for public and private companies globally through corporate services channel. E*TRADE’s 831 total US publicly traded companies is as reported in the January 2020 Investor presentation at us.etrade.com 4. Stock Plan Proceeds: ~$27 billion distributions of Shareworks by Morgan Stanley refer to legacy Morgan Stanley (excluding Solium) stock plan annual domestic and international proceeds as of December 31, 2019. E*TRADE annual stock distributions of ~$48 billion refer to annual domestic and international participant proceeds as of December 31, 2019 and are based on reported amounts in the January 2020 Investor Presentation at us.etrade.com

End Notes 21 These notes refer to the financial metrics and/or defined term presented on Slide 10 1. Current Morgan Stanley Digital Banking offering is through the broker - dealer entity and not through Morgan Stanley bank entities. These notes refer to the financial metrics and/or defined term presented on Slide 11 1. Net New Retail Accounts are based on quarterly earnings reports included in E*TRADE’s Current Reports on Form 8 - K for the periods from the first quarter of 2015 through the fourth quarter of 2019, adjusted in 2018 for the acquisition of approximately one million retail brokerage accounts from Capital One completed on November 6, 2018 as described in E*TRADE ’s 2019 Form 10 - K . 2. Wallet Captured is representative of the estimated percentage of assets Morgan Stanley/E*TRADE hold of clients’ total wallet in aggregate. Morgan Stanley client wallet share per IXI as of April 2019. E*TRADE client wallet share is estimated by Morgan Stanley using brokerage assets only and leveraging IXI data as of June 2019 for existing customers, and for households that joined E*TRADE after June 2019, IXI data is as of their sign up date. For households where E*TRADE’s assets are greater than IXI assets, IXI assets were updated to equal to E*TRADE’s assets (making share of wallet 100%). These notes refer to the financial metrics and/or defined term presented on Slide 12 1. $2.6 trillion of Morgan Stanley’s Retail Clients’ Assets Held Away is estimated using data from IXI as of April 2019. $1.5 trillion of Morgan Stanley’s Stock Plan Participants’ Assets Held Away , which includes both legacy Solium and Morgan Stanley participants, is estimated using data from IXI as of November 2018. 2. $3.2+ trillion of E*TRADE’s Retail Clients and Stock Plan Participants Assets Held Away is estimated using data from IXI as of June 2019. These notes refer to the financial metrics and/or defined term presented on Slide 13 1. Expected Pre - Tax Run Rate Cost Synergies and Post - closing Restructuring/Integration Costs are Morgan Stanley estimates, expected to be realized three years from the closing date of the transaction. These notes refer to the financial metrics and/or defined term presented on Slide 14 1. Morgan Stanley and E*TRADE Deposits are as of December 31, 2019. Cost of Deposits is calculated as total interest expense divided by average balances for full - year 2019 for Morgan Stanley, E*TRADE and on a Pro Forma basis. E*TRADE amounts are based on their 2019 Form 10 - K. 2. $39 billion of On - Balance Sheet Deposits at December 31, 2019 consist of: brokerage sweep deposits of $27.9 billion; bank sweep deposits of $6.4 billion; and savings, checking, and other banking assets of $4.3 billion. Beginning November 2019, bank sweep deposits include E*TRADE’s Premium Savings Accounts participating in a sweep deposit account program. $18 billion of Off - Balance Sheet Deposits at December 31, 2019 represent brokerage sweep deposits of $16.9 billion and bank sweep deposits of $0.8 billion held at unaffiliated financial institutions. Amounts included in E*TRADE’s 2019 Form 10 - K.

End Notes 22 These notes refer to the financial metrics and/or defined term presented on Slide 15 1. Total Cost and Funding Synergies are Morgan Stanley estimates. Estimated cost synergies are phased in over three years, and estimated funding synergies are phased in over two years, from the closing date of the transaction. These notes refer to the financial metrics and/or defined term presented on Slide 16 1. Cost and Funding Synergies and Post - closing Restructuring / Integration Costs are Morgan Stanley estimates. Estimated cost synergies are phased in over three years, estimated funding synergies are phased in over two years, and post - closing restructuring / integration costs are phased in over three years, from the closing date of the transaction. These notes refer to the financial metrics and/or defined term presented on Slide 17 1. Financial Advisory Client Assets and Client Relationships and Client Accounts on a Pro Forma basis are as of December 31, 2019. Morgan Stanley client relationships may include more than one retail client account. E*TRADE Retail Client Accounts and Retail Client Assets are based on E*TRADE’s 2019 Form 10 - K and January 2020 8 - K, respectively. Pro Forma Stock Plan Participants are defined as accounts of the corporate plans serviced with vested and unvested awards. Shareworks by Morgan Stanley stock plan participants of ~2.7 million are as of December 31, 2019. E*TRADE’s ~1.9 million accounts represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Pro forma Stock Plan Balances consist of vested and unvested awards. Shareworks by Morgan Stanley balances of ~$280 billion are as of December 31, 2019. E*TRADE’s corporate services assets are inclusive of vested equity holdings, vested options holdings, and unvested holdings totaling $296 billion are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Pro Forma Revenues are equal to the combined full - year 2019 revenues of Morgan Stanley Wealth Management, of $17.7 billion, and E*TRADE, of $2.9 billion based on E*TRADE’s 2019 Form 10 - K. Pre - Tax Margin represents Pre - Tax Profit divided by Net revenues. Pre - Tax Profit represents Income from continuing operations before income taxes. E*TRADE’s Pre - Tax Margin and Pre - Tax Profit based on E*TRADE’s 2019 Form 10 - K. Pro Forma Pre - Tax Margin does not include estimated cost and funding synergies and post - closing restructuring / integration costs associated with the transaction and does not factor in any potential attrition of assets or revenues post closing due to limited anticipated disruption to the existing business models. 2. EPS and CET1 Accretion are Morgan Stanley estimates. Estimated funding synergies are phased in over two years, and estimated cost synergies are phased in over three years, from the closing date of the transaction 3. The calculation of ROTCE uses pro forma net income applicable to Morgan Stanley less preferred dividends as a percentage of pro forma average tangible common equity (‘TCE’). Tangible Book Value per Common Share (‘TBVPS’) equals pro forma TCE divided by period end common shares outstanding, as adjusted for the transaction. Pro forma ROTCE and Tangible Book Value per Share are non - GAAP financial measures that the Firm considers useful for analysts, investors and other stakeholders to assess operating performance. These notes refer to the financial metrics and/or defined term presented on Slide 18 1. Balance Sheet Light , as it relates to the Morgan Stanley Wealth Management segment, refers to a lower Risk Weighted Assets (‘RWAs’) intensity. Durable Sources of Revenues , as it relates to the Morgan Stanley, represent revenues associated with fee - based pricing arrangements, financing and lending that are generally less susceptible to significant fluctuation as a result of market volatility when compared to other Firm revenues, and are comprised of: Asset Management revenues in the Wealth and Investment Management segments; revenues from Financing and Secured Lending activities in the Institutional Securities and Wealth Management segments; and revenues from Investment Banking Advisory services.

The Next Strategic Step in Our Transformation February 20, 2020