Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the year ended December 31, 2018

Commission File Number1-11758

(Exact name of Registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 1585 Broadway New York, NY 10036 (Address of principal executive offices, | 36-3145972 (I.R.S. Employer Identification No.) | (212)761-4000 (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered | |||

Common Stock, $0.01 par value | New York Stock Exchange | |||

Depositary Shares, each representing 1/1,000th interest in a share of Floating RateNon-Cumulative Preferred Stock, Series A, $0.01 par value | New York Stock Exchange | |||

Depositary Shares, each representing 1/1,000th interest in a share ofFixed-to-Floating RateNon-Cumulative Preferred Stock, Series E, $0.01 par value | New York Stock Exchange | |||

Depositary Shares, each representing 1/1,000th interest in a share ofFixed-to-Floating RateNon-Cumulative Preferred Stock, Series F, $0.01 par value | New York Stock Exchange | |||

Depositary Shares, each representing 1/1,000th interest in a share of 6.625%Non-Cumulative Preferred Stock, Series G, $0.01 par value | New York Stock Exchange | |||

Depositary Shares, each representing 1/1,000th interest in a share ofFixed-to-Floating RateNon-Cumulative Preferred Stock, Series I, $0.01 par value | New York Stock Exchange | |||

Depositary Shares, each representing 1/1,000th interest in a share ofFixed-to-Floating RateNon-Cumulative Preferred Stock, Series K, $0.01 par value | New York Stock Exchange | |||

Global Medium-Term Notes, Series A, Fixed RateStep-Up Senior Notes Due 2026 of Morgan Stanley Finance LLC (and Registrant’s guarantee with respect thereto) | New York Stock Exchange | |||

Market Vectors ETNs due March 31, 2020 (two issuances); Market Vectors ETNs due April 30, 2020 (two issuances) | NYSE Arca, Inc. | |||

Morgan Stanley Cushing® MLP High Income Index ETNs due March 21, 2031 | NYSE Arca, Inc. |

Indicate by check mark if Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of RegulationS-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of RegulationS-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to thisForm 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ☒ | Accelerated Filer ☐ | |||

Non-Accelerated Filer ☐ | Smaller reporting company ☐ | |||

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether Registrant is a shell company (as defined in Exchange Act Rule12b-2). YES ☐ NO ☒

As of June 30, 2018, the aggregate market value of the common stock of Registrant held bynon-affiliates of Registrant was approximately $79,320,949,858. This calculation does not reflect a determination that persons are affiliates for any other purposes.

As of January 31, 2019, there were 1,708,787,567 shares of Registrant’s common stock, $0.01 par value, outstanding.

Documents Incorporated by Reference: Portions of Registrant’s definitive proxy statement for its 2018 annual meeting of shareholders are incorporated by reference in Part III of this Form10-K.

Table of Contents

|

ANNUAL REPORT ON FORM10-K

for the year ended December 31, 2018

| Table of Contents | Part | Item | Page | |||||

| I | 1 | 1 | ||||||

| 1 | ||||||||

| 1 | ||||||||

| 1 | ||||||||

| 2 | ||||||||

| 10 | ||||||||

| 1A | 11 | |||||||

| 6 | 24 | |||||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | II | 7 | 25 | |||||

| 25 | ||||||||

| 26 | ||||||||

| 31 | ||||||||

| 45 | ||||||||

| 46 | ||||||||

| 47 | ||||||||

| 49 | ||||||||

| 49 | ||||||||

| 55 | ||||||||

| 7A | 64 | |||||||

| 64 | ||||||||

| 67 | ||||||||

| 71 | ||||||||

| 77 | ||||||||

| 8 | 83 | |||||||

| 83 | ||||||||

| 84 | ||||||||

| 85 | ||||||||

| 86 | ||||||||

| 87 | ||||||||

| 88 | ||||||||

| 89 | ||||||||

| 89 | ||||||||

| 90 | ||||||||

| 101 | ||||||||

| 112 | ||||||||

| 117 | ||||||||

| 119 | ||||||||

7. Loans, Lending Commitments and Allowance for Credit Losses |

|

| 122 | |||||

i

Table of Contents

|

| Table of Contents | Part | Item | Page | |||||||

| 125 | ||||||||||

| 125 | ||||||||||

| 126 | ||||||||||

| 126 | ||||||||||

| 128 | ||||||||||

13. Variable Interest Entities and Securitization Activities | 133 | |||||||||

| 138 | ||||||||||

| 140 | ||||||||||

| 143 | ||||||||||

| 144 | ||||||||||

| 144 | ||||||||||

| 146 | ||||||||||

| 149 | ||||||||||

| 151 | ||||||||||

| 155 | ||||||||||

| 158 | ||||||||||

| 159 | ||||||||||

| 160 | ||||||||||

| 164 | ||||||||||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 9 | 166 | ||||||||

| 9A | 166 | |||||||||

| 9B | 168 | |||||||||

| I | 1B | 168 | ||||||||

| 2 | 168 | |||||||||

| 3 | 169 | |||||||||

| 4 | 173 | |||||||||

| II | 5 | 174 | ||||||||

| III | 10 | 176 | ||||||||

| 11 | 176 | |||||||||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 12 | 176 | ||||||||

Certain Relationships and Related Transactions and Director Independence | 13 | 177 | ||||||||

| 14 | 177 | |||||||||

| IV | 15 | 177 | ||||||||

| 16 | 177 | |||||||||

| E-1 | ||||||||||

|

|

|

|

| S-1 | ||||||

ii

Table of Contents

|

Forward-Looking Statements

We have included in or incorporated by reference into this report, and from time to time may make in our public filings, press releases or other public statements, certain statements, including (without limitation) those under “Legal Proceedings”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Quantitative and Qualitative Disclosures about Risk” that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control.

The nature of our business makes predicting the future trends of our revenues, expenses, and net income difficult. The risks and uncertainties involved in our businesses could affect the matters referred to in such statements, and it is possible that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include (without limitation):

| • | the effect of market conditions, particularly in the global equity, fixed income, currency, credit and commodities markets, including corporate and mortgage (commercial and residential) lending and commercial real estate markets and energy markets; |

| • | the level of individual investor participation in the global markets as well as the level of client assets; |

| • | the flow of investment capital into or from assets under management or supervision; |

| • | the level and volatility of equity, fixed income and commodity prices, interest rates, inflation and currency values and other market indices; |

| • | the availability and cost of both credit and capital as well as the credit ratings assigned to our unsecured short-term and long-term debt; |

| • | technological changes instituted by us, our competitors or counterparties and technological risks, business continuity and related operational risks, including breaches or other disruptions of our or a third party’s (or third parties thereof) operations or systems; |

| • | risk associated with cybersecurity threats, including data protection and cybersecurity risk management; |

| • | our ability to manage effectively our capital and liquidity, including approval of our capital plans by our banking regulators; |

| • | the impact of current, pending and future legislation (including with respect to the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) or changes thereto, regulation (including capital, leverage, funding, liquidity and recovery and resolution requirements and our ability to address such requirements), policies including fiscal and monetary policies established by central banks and financial regulators; |

| • | changes to global trade policies and tariffs, government debt ceilings and funding, reforms of LIBOR, EURIBOR and other indices, and other legal and regulatory actions in the U.S. and worldwide; |

| • | changes in tax laws and regulations globally, including the interpretation and application of the U.S. Tax Cuts and Jobs Act (“Tax Act”); |

| • | the effectiveness of our risk management processes; |

| • | our ability to effectively respond to an economic downturn, or other market disruptions; |

| • | the effect of economic and political conditions and geopolitical events, including, for example, the U.K.’s anticipated withdrawal from the E.U. and a government shutdown in the United States; |

| • | the actions and initiatives of current and potential competitors as well as governments, central banks, regulators and self-regulatory organizations; |

| • | our ability to provide innovative products and services and execute our strategic objectives; |

| • | sovereign risk; |

| • | the performance and results of our acquisitions, divestitures, joint ventures, strategic alliances or other strategic arrangements; |

| • | investor, consumer and business sentiment and confidence in the financial markets; |

| • | our reputation and the general perception of the financial services industry; |

| • | natural disasters, pandemics and acts of war or terrorism; and |

| • | other risks and uncertainties detailed under “Business—Competition” and “Business—Supervision and Regulation”, “Risk Factors” and elsewhere throughout this report. |

Accordingly, you are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any forward-looking statements to reflect the impact of circumstances or events that arise after the dates they are made, whether as a result of new information, future events or otherwise except as required by applicable law. You should, however, consult further disclosures we may make in future filings of our Annual Reports on Form10-K, Quarterly Reports on Form10-Q and Current Reports on Form8-K and any amendments thereto or in future press releases or other public statements.

iii

Table of Contents

|

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet site,www.sec.gov, that contains annual, quarterly and current reports, proxy and information statements and other information that issuers file electronically with the SEC. Our electronic SEC filings are available to the public at the SEC’s internet site.

Our internet site iswww.morganstanley.com. You can access our Investor Relations webpage atwww.morganstanley.com/about-us-ir. We make available free of charge, on or through our Investor Relations webpage, our Proxy Statements, Annual Reports on Form10-K, Quarterly Reports onForm 10-Q, Current Reports on Form8-K and any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (“Exchange Act”), as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We also make available, through our Investor Relations webpage, via a link to the SEC’s internet site, statements of beneficial ownership of our equity securities filed by our directors, officers, 10% or greater shareholders and others under Section 16 of the Exchange Act.

You can access information about our corporate governance atwww.morganstanley.com/about-us-governance. Our Corporate Governance webpage includes:

| • | Amended and Restated Certificate of Incorporation; |

| • | Amended and Restated Bylaws; |

| • | Charters for our Audit Committee, Compensation, Management Development and Succession Committee, Nominating and Governance Committee, Operations and Technology Committee, and Risk Committee; |

| • | Corporate Governance Policies; |

| • | Policy Regarding Corporate Political Activities; |

| • | Policy Regarding Shareholder Rights Plan; |

| • | Equity Ownership Commitment; |

| • | Code of Ethics and Business Conduct; |

| • | Code of Conduct; |

| • | Integrity Hotline Information; and |

| • | Environmental and Social Policies. |

Our Code of Ethics and Business Conduct applies to all directors, officers and employees, including our Chief Executive Officer, Chief Financial Officer and Deputy Chief Financial Officer. We will post any amendments to the Code of Ethics and Business Conduct and any waivers that are required to be disclosed by the rules of either the SEC or the New York Stock Exchange LLC (“NYSE”) on our internet site. You can request a copy of these documents, excluding exhibits, at no cost, by contacting Investor Relations, 1585 Broadway, New York, NY 10036(212-761-4000). The information on our internet site is not incorporated by reference into this report.

iv

Table of Contents

|

We are a global financial services firm that, through our subsidiaries and affiliates, advises, and originates, trades, manages and distributes capital for, governments, institutions and individuals. We were originally incorporated under the laws of the State of Delaware in 1981, and our predecessor companies date back to 1924. We are an FHC regulated by the Board of Governors of the Federal Reserve System (“Federal Reserve”) under the Bank Holding Company Act of 1956, as amended (“BHC Act”). We conduct our business from our headquarters in and around New York City, our regional offices and branches throughout the U.S. and our principal offices in London, Tokyo, Hong Kong and other world financial centers. As of December 31, 2018, we had 60,348 employees worldwide. Unless the context otherwise requires, the terms “Morgan Stanley,” the “Firm,” “us,” “we,” and “our” mean Morgan Stanley (the “Parent Company”) together with its consolidated subsidiaries. We define the following as part of our consolidated financial statements (“financial statements”): consolidated income statements (“income statements”), consolidated balance sheets (“balance sheets”), and consolidated cash flow statements (“cash flow statements”). See the “Glossary of Common Acronyms” for the definition of certain acronyms used throughout the 2018 Form10-K.

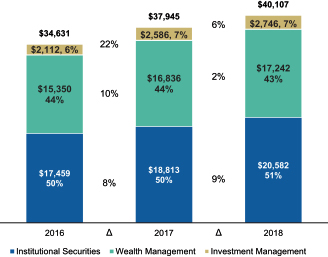

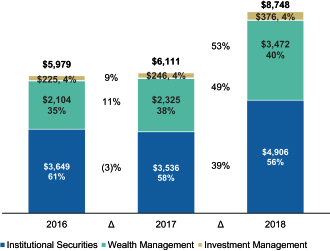

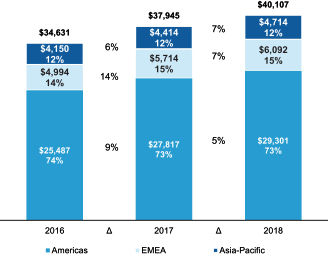

Financial information concerning us, our business segments and geographic regions for each of the 12 months ended December 31, 2018, December 31, 2017 and December 31, 2016 is included in the financial statements and the notes thereto and in “Financial Statements and Supplementary Data.”

We are a global financial services firm that maintains significant market positions in each of our business segments—Institutional Securities, Wealth Management and Investment Management. Through our subsidiaries and affiliates, we provide a wide variety of products and services to a large and diversified group of clients and customers, including corporations, governments, financial institutions and individuals. Additional information related to our business segments, respective clients, and products and services provided is included under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

All aspects of our businesses are highly competitive, and we expect them to remain so. We compete in the U.S. and globally for clients, market share and human talent. Operating within the financial services industry on a global basis

presents, among other things, technological, risk management, regulatory and other infrastructure challenges that require effective resource allocation in order for us to remain competitive. Our competitive position depends on our reputation and the quality and consistency of our long-term investment performance. Our ability to sustain or improve our competitive position also depends substantially on our ability to continue to attract and retain highly qualified employees while managing compensation and other costs. We compete with commercial banks, brokerage firms, insurance companies, exchanges, electronic trading and clearing platforms, financial data repositories, sponsors of mutual funds, hedge funds and private equity funds, energy companies, financial technology firms and other companies offering financial or ancillary services in the U.S., globally and digitally or through the internet. In addition, restrictive laws and regulations applicable to certain U.S. financial services institutions, such as Morgan Stanley, which may prohibit us from engaging in certain transactions and impose more stringent capital and liquidity requirements, can put us at a competitive disadvantage to competitors in certain businesses not subject to these same requirements. See also “Supervision and Regulation” herein and “Risk Factors.”

Institutional Securities and Wealth Management

Our competitive position for our Institutional Securities and Wealth Management business segments depends on innovation, execution capability and relative pricing. We compete directly in the U.S. and globally with other securities and financial services firms and broker-dealers and with others on a regional or product basis. Additionally, there is increased competition driven by established firms as well as the emergence of new firms and business models (including innovative uses of technology) competing for the same clients and assets or offering similar products and services.

Our ability to access capital at competitive rates (which is generally impacted by our credit ratings), to commit and to deploy capital efficiently, particularly in our capital-intensive underwriting and sales, trading, financing and market-making activities, also affects our competitive position. Corporate clients may request that we provide loans or lending commitments in connection with certain investment banking activities and such requests are expected to continue.

It is possible that competition may become even more intense as we continue to compete with financial or other institutions that may be larger, or better capitalized, or may have a stronger local presence and longer operating history in certain geographies or products. Many of these firms have the ability to offer a wide range of products and services, and on different platforms, that may enhance their competitive position and could result in pricing pressure on our businesses. In addition, our business is subject to extensive regulation in the

| 1 | December 2018 Form 10-K |

Table of Contents

|

U.S. and abroad, while certain of our competitors may be subject to less stringent legal and regulatory regimes than us, thereby putting us at a competitive disadvantage.

We continue to experience intense price competition in some of our businesses. In particular, the ability to execute securities trades electronically on exchanges and through other automated trading markets has increased the pressure on trading commissions and comparable fees. The trend toward direct access to automated, electronic markets will likely increase as additional trading moves to more automated platforms. It is also possible that we will experience competitive pressures in these and other areas in the future as some of our competitors seek to obtain market share by reducing prices (in the form of commissions or pricing).

Investment Management

Our ability to compete successfully in the asset management industry is affected by several factors, including our reputation, investment objectives, quality of investment professionals, performance of investment strategies or product offerings relative to peers and appropriate benchmark indices, advertising and sales promotion efforts, fee levels, the effectiveness of and access to distribution channels and investment pipelines, and the types and quality of products offered. Our investment products, including alternative investment products, may compete with investments offered by other investment managers with passive investment products or who may be subject to less stringent legal and regulatory regimes than us.

As a major financial services firm, we are subject to extensive regulation by U.S. federal and state regulatory agencies and securities exchanges and by regulators and exchanges in each of the major markets where we conduct our business. Legislative and regulatory responses to the 2007-2008 financial crisis, both in the U.S. and worldwide, have resulted in major changes to the way we are regulated and conduct our business. These laws and regulations include: the Dodd-Frank Act; risk-based capital, leverage and liquidity standards adopted or being developed by the Basel Committee on Banking Supervision (“Basel Committee”), including Basel III, and the national implementation of those standards; capital planning and stress testing requirements; and new recovery and resolution regimes in the U.S. and other jurisdictions. Some areas of post-financial crisis regulation are still subject to final rulemaking or transition periods.

We continue to monitor the changing political, tax and regulatory environment; it is likely that there will be further changes in the way major financial institutions are regulated in both the U.S. and other markets in which we operate,

although it remains difficult to predict the exact impact these changes will have on our business, financial condition, results of operations and cash flows for a particular future period and we expect to remain subject to extensive supervision and regulation.

Financial Holding Company

Consolidated Supervision. We have operated as a BHC and FHC under the BHC Act since September 2008. As a BHC, we are subject to comprehensive consolidated supervision, regulation and examination by the Federal Reserve. The Federal Reserve has heightened authority to examine, prescribe regulations and take action with respect to all of our subsidiaries. In particular, we are, or will become, subject to (among other things): significantly revised and expanded regulation and supervision; intensive scrutiny of our businesses and plans for expansion of those businesses; limitations on activities; a systemic risk regime that imposes heightened capital and liquidity requirements; restrictions on activities and investments imposed by a section of the BHC Act added by the Dodd-Frank Act referred to as the “Volcker Rule”; and comprehensive derivatives regulation. In addition, the Consumer Financial Protection Bureau has primary rulemaking, enforcement and examination authority over us and our subsidiaries with respect to federal consumer protection laws, to the extent applicable.

Scope of Permitted Activities. The BHC Act limits the activities of BHCs and FHCs and grants the Federal Reserve authority to limit our ability to conduct activities. We must obtain the Federal Reserve’s approval before engaging in certain banking and other financial activities both in the U.S. and internationally.

The BHC Act grandfathers “activities related to the trading, sale or investment in commodities and underlying physical properties,” provided that we were engaged in “any of such activities as of September 30, 1997 in the U.S.” and provided that certain other conditions that are within our reasonable control are satisfied. We currently engage in our commodities activities pursuant to the BHC Act grandfather exemption as well as other authorities under the BHC Act.

Activities Restrictions under the Volcker Rule. The Volcker Rule prohibits “banking entities,” including us and our affiliates, from engaging in certain “proprietary trading” activities, as defined in the Volcker Rule, subject to exemptions for underwriting, market-making-related activities, risk-mitigating hedging and certain other activities. The Volcker Rule also prohibits certain investments and relationships by banking entities with “covered funds,” with a number of exemptions and exclusions. Banking entities were required to bring all of their activities and investments into conformance with the Volcker Rule by July 21, 2015, subject to certain

| December 2018 Form 10-K | 2 |

Table of Contents

|

extensions. In June 2017, the Federal Reserve approved our application for a five-year extension of the transition period to conform investments in certain legacy covered funds that are also illiquid funds. The approval covers essentially all of ournon-conforming investments in, and relationships with, legacy covered funds subject to the Volcker Rule. The Volcker Rule also requires that deductions be made from a BHC’s Tier 1 capital for permissible investments in covered funds. In addition, the Volcker Rule requires banking entities to have comprehensive compliance programs reasonably designed to ensure and monitor compliance with the Volcker Rule.

The federal financial regulatory agencies responsible for the Volcker Rule’s implementing regulations have proposed, but have not yet finalized, revisions to certain elements of those regulations. The proposed changes focus on proprietary trading and certain requirements imposed in connection with permitted market making, underwriting and risk-mitigating hedging activities. The impact of this proposal on us will not be known with certainty until final rules are issued.

Capital Standards. The Federal Reserve establishes capital requirements, including well-capitalized standards, for large BHCs and evaluates our compliance with such requirements. The OCC establishes similar capital requirements and standards for Morgan Stanley Bank, N.A. (“MSBNA”) and Morgan Stanley Private Bank, National Association (“MSPBNA”) (collectively, our “U.S. Bank Subsidiaries”).

Regulatory Capital Framework. The regulatory capital requirements for us and our U.S. Bank Subsidiaries are largely based on the Basel III capital standards established by the Basel Committee, as supplemented by certain provisions of the Dodd-Frank Act. We are subject to various risk-based capital requirements with various transition provisions, measured against our Common Equity Tier 1 capital, Tier 1 capital and Total capital bases, leverage-based capital requirements, including the SLR, and additional capital buffers above generally applicable minimum standards for BHCs.

The Basel Committee has published a comprehensive set of revisions to its Basel III Framework. The revised requirements are expected to take effect starting January 2022, subject to U.S. banking agencies issuing implementation proposals. The impact on us of any revisions to the Basel Committee’s capital standards is uncertain and depends on future rulemakings by the U.S. banking agencies.

Regulated Subsidiaries. In addition, many of our regulated subsidiaries are, or are expected to be in the future, subject to regulatory capital requirements, including regulated subsidiaries registered as “swap dealers” with the CFTC or “security-based swap dealers” with the SEC (collectively,

“Swaps Entities”) or registered as broker-dealers or futures commission merchants. Specific regulatory capital requirements vary by regulated subsidiary, and in many cases these standards are not yet established or are subject to ongoing rulemakings that could substantially modify requirements.

For more information about the specific capital requirements applicable to us and our U.S. Bank Subsidiaries, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Regulatory Requirements.”

Capital Planning, Stress Tests and Capital Distributions. Pursuant to the Dodd-Frank Act, the Federal Reserve has adopted capital planning and stress test requirements for large BHCs, including Morgan Stanley. For more information about the capital planning and stress test requirements, including proposed changes to those requirements that would integrate them with certain ongoing regulatory capital requirements, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Regulatory Requirements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Regulatory Developments—Proposed Stress Buffer Requirements.”

In addition to capital planning requirements, the Federal Reserve, the OCC and the FDIC have the authority to prohibit or to limit the payment of dividends by the banking organizations they supervise, including us and our U.S. Bank Subsidiaries, if, in the banking regulator’s opinion, payment of a dividend would constitute an unsafe or unsound practice in light of the financial condition of the banking organization. All of these policies and other requirements could affect our ability to pay dividends and/or repurchase stock, or require us to provide capital assistance to our U.S. Bank Subsidiaries under circumstances which we would not otherwise decide to do so.

Liquidity Standards. In addition to capital regulations, the U.S. banking agencies and the Basel Committee have adopted, or are in the process of adopting, liquidity standards. We and our U.S. Bank Subsidiaries are subject to the U.S. banking agencies’ LCR requirements, which generally follow Basel Committee standards. Similarly, if the proposed NSFR requirements are adopted by the U.S. banking agencies, we and our U.S. Bank Subsidiaries will become subject to NSFR requirements, which generally follow Basel Committee standards.

In addition to the LCR and NSFR, we and many of our regulated subsidiaries, including those registered as Swaps Entities with the CFTC or SEC, are, or are expected to be in the future, subject to other liquidity standards, including liquidity stress-testing and associated liquidity reserve requirements.

| 3 | December 2018 Form 10-K |

Table of Contents

|

For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Regulatory Liquidity Framework.”

Systemic Risk Regime. The Dodd-Frank Act, as amended by the Economic Growth, Regulatory Relief and Consumer Protection Act (“EGRRCPA”), establishes a systemic risk regime to which certain large BHCs, including Morgan Stanley, are subject. Under rules issued by the Federal Reserve to implement certain requirements of the Dodd-Frank Act’s enhanced prudential standards, such large BHCs must conduct internal liquidity stress tests, maintain unencumbered highly liquid assets to meet projected net cash outflows for 30 days over the range of liquidity stress scenarios used in internal stress tests, and comply with various liquidity risk management requirements. These large BHCs also must comply with a range of risk management and corporate governance requirements.

The Federal Reserve has adopted a framework to impose single-counterparty credit limits (“SCCL”) for large banking organizations. U.S.G-SIBs, including us, are subject to a limit of 15% of Tier 1 capital for aggregate net credit exposures to any “major counterparty” (defined to include other U.S.G-SIBs, foreignG-SIBs, and nonbank systemically important financial institutions supervised by the Federal Reserve). In addition, we are subject to a limit of 25% of Tier 1 capital for aggregate net credit exposures to any other unaffiliated counterparty. We must comply with the SCCL framework beginning on January 1, 2020.

The Federal Reserve has proposed rules that would create a new early remediation framework to address financial distress or material management weaknesses. The Federal Reserve also has the ability to establish additional prudential standards, including those regarding contingent capital, enhanced public disclosures and limits on short-term debt, includingoff-balance sheet exposures. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Regulatory Requirements—Total Loss-Absorbing Capacity and Long-Term Debt Requirement.”

Under the systemic risk regime, if the Federal Reserve or the Financial Stability Oversight Council determines that a BHC with $250 billion or more in consolidated assets poses a “grave threat” to U.S. financial stability, the institution may be, among other things, restricted in its ability to merge or offer financial products and/or required to terminate activities and dispose of assets.

See also “Capital Standards” and “Liquidity Standards” herein and “Resolution and Recovery Planning” below.

Resolution and Recovery Planning. Pursuant to the Dodd-Frank Act, we are required to periodically submit to the Federal Reserve and the FDIC a resolution plan that describes our strategy for a rapid and orderly resolution under the U.S. Bankruptcy Code in the event of our material financial distress or failure. Our preferred resolution strategy, which is set out in our 2017 resolution plan, is an SPOE strategy. An SPOE strategy generally contemplates the provision of additional capital and liquidity by the Parent Company to certain of its subsidiaries so that such subsidiaries have the resources necessary to implement the resolution strategy after the Parent Company has filed for bankruptcy.

Certain of our domestic and foreign subsidiaries are also subject to resolution and recovery planning requirements in the jurisdictions in which they operate. For example the FDIC requires certain insured depository institutions (“IDIs”), including our U.S. Bank Subsidiaries, to submit an annual resolution plan that describes the IDI’s strategy for a rapid and orderly resolution in the event of material financial distress or failure of the IDI (an “IDI plan”).

Further, we are required to submit an annual recovery plan to the Federal Reserve that outlines the steps that management could take over time to generate or conserve financial resources in times of prolonged financial stress.

In December 2018, the OCC finalized revisions to its recovery planning guidelines for national banks and certain other institutions that increase the threshold at which the guidelines apply from $50 billion to $250 billion in total consolidated assets. As a result, our U.S. Bank Subsidiaries are no longer required to prepare recovery plans.

In addition, certain financial companies, including BHCs such as the Firm and certain of its covered subsidiaries, can be subjected to a resolution proceeding under the orderly liquidation authority in Title II of the Dodd-Frank Act with the FDIC being appointed as receiver, provided that certain procedures are met, including certain extraordinary financial distress and systemic risk determinations by the U.S. Treasury Secretary in consultation with the U.S. President. The orderly liquidation authority rulemaking is proceeding in stages, with some regulations now finalized and others not yet proposed. If we were subject to the orderly liquidation authority, the FDIC would have considerable powers, including: the power to remove directors and officers responsible for our failure and to appoint new directors and officers; the power to assign our assets and liabilities to a third party or bridge financial company without the need for creditor consent or prior court review; the ability to differentiate among our creditors, including by treating certain creditors within the same class better than others, subject to a minimum recovery right on the part of disfavored creditors to receive at least what they would have received in bankruptcy

| December 2018 Form 10-K | 4 |

Table of Contents

|

liquidation; and broad powers to administer the claims process to determine distributions from the assets of the receivership. The FDIC has been developing an SPOE strategy that could be used to implement the orderly liquidation authority.

Regulators have also taken and proposed various actions to facilitate an SPOE strategy under the U.S. Bankruptcy Code, the orderly liquidation authority or other resolution regimes.

For example, the Federal Reserve has established rules that impose contractual requirements on certain qualified financial contracts (“covered QFCs”) to which U.S.G-SIBs, including us, and their subsidiaries are parties. The OCC has also established rules that impose substantively identical requirements on national banks that are subsidiaries of U.S.G-SIBs, including our U.S. Bank Subsidiaries, as well as certain other institutions (together with the entities covered by the Federal Reserve’s rules, the “covered entities”). Under these rules, covered QFCs must expressly provide that transfer restrictions and default rights against covered entities are limited to the same extent as they would be under the Federal Deposit Insurance Act and Title II of the Dodd-Frank Act and their implementing regulations. In addition, covered QFCs may not, among other things, permit the exercise of any cross-default right against covered entities based on an affiliate’s entry into insolvency, resolution or similar proceedings, subject to certain creditor protections. There is aphased-in compliance schedule based on counterparty type, and the first compliance date was January 1, 2019.

For more information about our resolution plan-related submissions and associated regulatory actions, see “Risk Factors—Legal, Regulatory and Compliance Risk”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Regulatory Requirements—Total Loss-Absorbing Capacity, Long-Term Debt and Clean Holding Company Requirements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Regulatory Requirements—Resolution and Recovery Planning.”

Cyber and Information Security Risk Management

As a general matter, the financial services industry faces increased global regulatory focus regarding cyber and information security risk management practices. Many aspects of our businesses are subject to cybersecurity legal and regulatory requirements enacted by U.S. federal and state governments and othernon-U.S. jurisdictions in the Americas, Europe, the Middle East, Africa and Asia. These laws are aimed at codifying basic cybersecurity protections and mandating data breach notification requirements.

Our businesses are also subject to privacy and data protection information security legal requirements concerning the use and protection of certain personal information. For example, the General Data Protection Regulation (“GDPR”) became effective in the E.U. on May 25, 2018 as a replacement for the E.U. Data Protection Directive. The GDPR imposes mandatory breach notification obligations, including significant fines for noncompliance, enhanced governance and accountability requirements and has extraterritorial impact. In addition, other jurisdictions have adopted or are proposing GDPR or similar standards, such as California, Australia, Singapore, Japan, Colombia, Argentina, India, Turkey, Hong Kong, Brazil, Russia and Switzerland.

Protection of Client Information

Many aspects of our businesses are subject to legal requirements concerning the use and protection of certain customer information. These include those adopted pursuant to the Gramm-Leach-Bliley Act and the Fair and Accurate Credit Transactions Act of 2003 in the U.S., the GDPR and various laws in Asia, including the Japanese Personal Information Protection Law, the Hong Kong Personal Data (Protection) Ordinance and the Australian Privacy Act. We have adopted measures designed to comply with these and related applicable requirements in all relevant jurisdictions.

U.S. Bank Subsidiaries

U.S. Bank Subsidiaries. MSBNA, primarily a wholesale commercial bank, offers commercial lending and certain retail securities-based lending services in addition to deposit products, and also conducts certain foreign exchange activities.

MSPBNA offers certain mortgage and other secured lending products, including retail securities-based lending products, primarily for customers of our affiliate retail broker-dealer, Morgan Stanley Smith Barney LLC (“MSSB LLC”). MSPBNA also offers certain deposit products and prime brokerage custody services.

Both MSBNA and MSPBNA are FDIC-insured national banks subject to supervision, regulation and examination by the OCC. They are both subject to the OCC’s risk governance guidelines, which establish heightened standards for a large national bank’s risk governance framework and the oversight of that framework by the bank’s board of directors.

Prompt Corrective Action. The Federal Deposit Insurance Corporation Improvement Act of 1991 provides a framework for regulation of depository institutions and their affiliates, including parent holding companies, by their federal banking regulators. Among other things, it requires the relevant federal banking regulator to take prompt corrective action

| 5 | December 2018 Form 10-K |

Table of Contents

|

with respect to a depository institution if that institution does not meet certain capital adequacy standards. These regulations generally apply only to insured banks and thrifts such as MSBNA or MSPBNA and not to their parent holding companies. The Federal Reserve is, however, separately authorized to take appropriate action at the holding company level, subject to certain limitations. Under the systemic risk regime, as described above, we also would become subject to an early remediation protocol in the event of financial distress. In addition, BHCs, such as Morgan Stanley, are required to serve as a source of strength to their U.S. bank subsidiaries and commit resources to support these subsidiaries in the event such subsidiaries are in financial distress.

Transactions with Affiliates. Our U.S. Bank Subsidiaries are subject to Sections 23A and 23B of the Federal Reserve Act, which impose restrictions on “covered transactions” with any affiliates. Covered transactions include any extension of credit to, purchase of assets from, and certain other transactions by insured banks with an affiliate. These restrictions limit the total amount of credit exposure that our U.S. Bank Subsidiaries may have to any one affiliate and to all affiliates. Sections 23A and 23B also set collateral requirements and require all such transactions to be made on market terms. Derivatives, securities borrowing and securities lending transactions between our U.S. Bank Subsidiaries and their affiliates are subject to these restrictions. The Federal Reserve has indicated that it will propose a rulemaking to implement changes to these restrictions made by the Dodd-Frank Act.

In addition, the Volcker Rule generally prohibits covered transactions between (i) us or any of our affiliates and (ii) covered funds for which we or any of our affiliates serve as the investment manager, investment adviser, commodity trading advisor or sponsor, or other covered funds organized and offered by us or any of our affiliates pursuant to specific exemptions in the Volcker Rule. See also “Financial Holding Company—Activities Restriction under the Volcker Rule” above.

FDIC Regulation. An FDIC-insured depository institution is generally liable for any loss incurred or expected to be incurred by the FDIC in connection with the failure of an insured depository institution under common control by the same BHC. As commonly controlled FDIC-insured depository institutions, each of MSBNA and MSPBNA could be responsible for any loss to the FDIC from the failure of the other. In addition, both institutions are exposed to changes in the cost of FDIC insurance.

Institutional Securities and Wealth Management

Broker-Dealer and Investment Adviser Regulation. Our primary U.S. broker-dealer subsidiaries, Morgan Stanley & Co. LLC (“MS&Co.”) and MSSB LLC, are registered broker-dealers with the SEC and in all 50 states, the District of

Columbia, Puerto Rico and the U.S. Virgin Islands, and are members of various self-regulatory organizations, including FINRA, and various securities exchanges and clearing organizations. Broker-dealers are subject to laws and regulations covering all aspects of the securities business, including sales and trading practices, securities offerings, publication of research reports, use of customers’ funds and securities, capital structure, risk management controls in connection with market access, recordkeeping and retention, and the conduct of their directors, officers, representatives and other associated persons. Broker-dealers are also regulated by securities administrators in those states where they do business. Violations of the laws and regulations governing a broker-dealer’s actions could result in censures, fines, the issuance ofcease-and-desist orders, revocation of licenses or registrations, the suspension or expulsion from the securities industry of such broker-dealer or its officers or employees, or other similar consequences by both federal and state securities administrators. Our broker-dealer subsidiaries are also members of the Securities Investor Protection Corporation, which provides certain protections for customers of broker-dealers against losses in the event of the insolvency of a broker-dealer.

MSSB LLC is also a registered investment adviser with the SEC. MSSB LLC’s relationship with its investment advisory clients is subject to the fiduciary and other obligations imposed on investment advisers under the Investment Advisers Act of 1940, and the rules and regulations promulgated thereunder as well as various state securities laws. These laws and regulations generally grant the SEC and other supervisory bodies broad administrative powers to addressnon-compliance, including the power to restrict or limit MSSB LLC from carrying on its investment advisory and other asset management activities. Other sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain activities for specified periods of time or for specified types of clients, the revocation of registrations, other censures and significant fines.

The Firm is subject to various regulations that affect broker-dealer sales practices and customer relationships. For example, under the Dodd-Frank Act, the SEC is authorized to impose a fiduciary duty rule applicable to broker-dealers when providing personalized investment advice about securities to retail customers. The SEC released for public comment a package of proposed rulemaking on the standards of conduct and required disclosures for broker-dealers and investment advisers. One of the proposals, entitled “Regulation Best Interest,” would require broker-dealers to act in the “best interest” of retail customers at the time a recommendation is made without placing the financial or other interests of the broker-dealer ahead of the interest of the retail customer. Additionally, the SEC proposed a new requirement for both broker-dealers and investment advisers to provide a brief

| December 2018 Form 10-K | 6 |

Table of Contents

|

relationship summary to retail investors with information intended to clarify the relationship between the parties. The SEC issued a proposed interpretation regarding the fiduciary duty that investment advisers owe their clients. None of these proposals have yet been finalized.

Margin lending by broker-dealers is regulated by the Federal Reserve’s restrictions on lending in connection with customer and proprietary purchases and short sales of securities, as well as securities borrowing and lending activities. Broker-dealers are also subject to maintenance and other margin requirements imposed under FINRA and other self-regulatory organization rules. In many cases, our broker-dealer subsidiaries’ margin policies are more stringent than these rules.

As registered U.S. broker-dealers, certain of our subsidiaries are subject to the SEC’s net capital rule and the net capital requirements of various exchanges, other regulatory authorities and self-regulatory organizations. These rules are generally designed to measure the broker-dealer subsidiary’s general financial integrity and/or liquidity and require that at least a minimum amount of net and/or liquid assets be maintained by the subsidiary. See also “Financial Holding Company—Consolidated Supervision” and “Financial Holding Company—Liquidity Standards” above. Rules of FINRA and other self-regulatory organizations also impose limitations and requirements on the transfer of member organizations’ assets.

Research. Research-related regulations have been implemented in many jurisdictions, including in the U.S., where FINRA has adopted rules that cover research relating to both equity and debt securities. In addition, European regulators have introduced new requirements in the Markets in Financial Instruments Directive II (“MiFID II”) relating to the unbundling of research services and execution services. Both U.S. andnon-U.S. regulators continue to focus on research conflicts of interest and may impose additional regulations.

Regulation of Futures Activities and Certain Commodities Activities. MS&Co., as a futures commission merchant, and MSSB LLC, as an introducing broker, are subject to net capital requirements of, and certain of their activities are regulated by, the CFTC, the NFA, CME Group, and various commodity futures exchanges. MS&Co. and MSSB LLC and certain of their affiliates are registered members of the NFA in various capacities. Rules and regulations of the CFTC, NFA and commodity futures exchanges address obligations related to, among other things, customer protections, the segregation of customer funds and the holding of secured amounts, the use by futures commission merchants of customer funds, recordkeeping and reporting obligations of futures commission merchants and introducing brokers, risk disclosure, risk management and discretionary trading.

Our commodities activities are subject to extensive and evolving energy, commodities, environmental, health and safety, and other governmental laws and regulations in the U.S. and abroad. Intensified scrutiny of certain energy markets by U.S. federal, state and local authorities in the U.S. and abroad and by the public has resulted in increased regulatory and legal enforcement and remedial proceedings involving companies conducting the activities in which we are engaged.

Derivatives Regulation. Under the U.S. regulatory regime for “swaps” and “security-based swaps” (collectively, “Swaps”) implemented pursuant to the Dodd-Frank Act, we are subject to regulations including, among others, public and regulatory reporting, central clearing and mandatory trading on regulated exchanges or execution facilities for certain types of Swaps. The CFTC has completed the majority of its regulations in this area, most of which are in effect. The SEC has also finalized many of its Swaps regulations, although a significant number are not yet in effect. The Dodd-Frank Act also requires the registration of “swap dealers” with the CFTC and “security-based swap dealers” with the SEC. Certain of our subsidiaries have registered with the CFTC as swap dealers and will in the future be required to register with the SEC as security-based swap dealers. Such Swaps Entities are or will be subject to a comprehensive regulatory regime with new obligations for the Swaps activities for which they are registered, including capital requirements, margin requirements for uncleared Swaps and comprehensive business conduct rules. Each of the CFTC and SEC have proposed rules to impose capital standards on Swaps Entities subject to its respective jurisdiction, which include our subsidiaries, but these rules have not yet been finalized.

The specific parameters of some of these requirements for Swaps have been and continue to be developed through the CFTC, SEC and bank regulator rulemakings. In 2015, the federal banking regulators and the CFTC separately issued final rules establishing uncleared swap margin requirements for Swaps Entities subject to their respective regulation, including MSBNA, Morgan Stanley Capital Services LLC and Morgan Stanley & Co. International plc (“MSIP”), respectively. The variation margin requirements under these rules were effective as of March 1, 2017. The rulesphase-in initial margin requirements from September 1, 2016 through September 1, 2020, depending on the level of OTC derivatives activity of the swap dealer and the relevant counterparty. Margin rules with the same or similar compliance dates have been adopted or are in the process of being finalized by regulators outside the U.S., and certain of our subsidiaries may be subject to such rules.

Although important areas within the global derivatives regulatory framework have been finalized in recent years, additional

| 7 | December 2018 Form 10-K |

Table of Contents

|

changes are expected. For example, in November 2018, the CFTC proposed revisions to the rules governing swap execution facilities. As the derivatives regulatory framework evolves, we expect to continue to face increased costs and regulatory oversight. Complying with registration and other regulatory requirements has required, and is expected to require in the future, systems and other changes. Compliance with Swaps-related regulatory capital requirements may also require us to devote more capital to our Swaps business.

Our Institutional Securities and Wealth Management business segment activities are also regulated in jurisdictions outside the U.S. See“Non-U.S. Regulation” herein.

Investment Management

Many of the subsidiaries engaged in our asset management activities are registered as investment advisers with the SEC. Many aspects of our asset management activities are also subject to federal and state laws and regulations primarily intended to benefit the investor or client. These laws and regulations generally grant supervisory agencies and bodies broad administrative powers, including the power to limit or restrict us from carrying on our asset management activities in the event that we fail to comply with such laws and regulations. Sanctions that may be imposed for such failure include the suspension of individual employees, limitations on our engaging in various asset management activities for specified periods of time or specified types of clients, the revocation of registrations, other censures and significant fines. In order to facilitate our asset management business, a U.S. broker-dealer subsidiary of ours, Morgan Stanley Distribution, Inc., acts as distributor to the Morgan Stanley mutual funds and as placement agent to certain private investment funds managed by our Investment Management business segment.

Our asset management activities are subject to certain additional laws and regulations, including, but not limited to, additional reporting and recordkeeping requirements (including with respect to clients that are private funds) and restrictions on sponsoring or investing in, or maintaining certain other relationships with, “covered funds,” as defined in the Volcker Rule, subject to certain limited exemptions. Many of these requirements have increased the expenses associated with our asset management activities and/or reduced the investment returns we are able to generate for us and our asset management clients. See also “Financial Holding Company—Activities Restrictions under the Volcker Rule.”

In addition, certain of our affiliates are registered as commodity trading advisors and/or commodity pool operators, or are operating under certain exemptions from such registration pursuant to CFTC rules and other guidance, and have certain responsibilities with respect to each pool they advise. Violations of the rules of the CFTC, the NFA or the

commodity exchanges could result in remedial actions, including fines, registration restrictions or terminations, trading prohibitions or revocations of commodity exchange memberships. See also “Institutional Securities and Wealth Management—Broker-Dealer and Investment Adviser Regulation,” “Institutional Securities and Wealth Management—Regulation of Futures Activities and Certain Commodities Activities,” and “Institutional Securities and Wealth Management—Derivatives Regulation” above and“Non-U.S. Regulation,” below for a discussion of other regulations that impact our Investment Management business activities, including MiFID II.

Our Investment Management business activities are also regulated outside the U.S. For example, the U.K. Financial Conduct Authority (“FCA”) is the primary regulator of our business in the U.K.; the Financial Services Agency regulates our business in Japan; the Securities and Futures Commission of Hong Kong regulates our business in Hong Kong; and the Monetary Authority of Singapore regulates our business in Singapore. See also“Non-U.S. Regulation” herein.

Non-U.S. Regulation

All of our businesses are regulated extensively bynon-U.S. regulators, including governments, securities exchanges, commodity exchanges, self-regulatory organizations, central banks and regulatory bodies, especially in those jurisdictions in which we maintain an office. Certain regulators have prudential, conduct and other authority over us or our subsidiaries, as well as powers to limit or restrict us from engaging in certain businesses or to conduct administrative proceedings that can result in censures, fines, the issuance ofcease-and-desist orders, or the suspension or expulsion of a regulated entity or its affiliates.

Some of our subsidiaries are regulated as broker-dealers and other regulated entity types under the laws of the jurisdictions in which they operate. Subsidiaries engaged in banking and trust activities outside the U.S. are regulated by various government agencies in the particular jurisdiction where they are chartered, incorporated and/or conduct their business activity. For instance, the PRA, the FCA and several securities and futures exchanges in the U.K., including the London Stock Exchange and ICE Futures Europe, regulate our activities in the U.K.; the Bundesanstalt für Finanzdienstleistungsaufsicht (the Federal Financial Supervisory Authority) and the Deutsche Börse AG regulate our activities in the Federal Republic of Germany; the Financial Services Agency, the Bank of Japan, the Japan Securities Dealers Association and several Japanese securities and futures exchanges and ministries regulate our activities in Japan; the Securities and Futures Commission of Hong Kong, the Hong Kong Monetary Authority and the Hong Kong Exchanges and Clearing Limited regulate our operations in Hong Kong; and the

| December 2018 Form 10-K | 8 |

Table of Contents

|

Monetary Authority of Singapore and the Singapore Exchange Limited regulate our business in Singapore.

Our largestnon-U.S. entity, MSIP, is subject to extensive regulation and supervision by the PRA, which has broad legal authority to establish prudential and other standards applicable to MSIP that seek to ensure its safety and soundness and to minimize adverse effects on the stability of the U.K. financial system. MSIP is also regulated and supervised by the FCA with respect to business conduct matters.

Non-U.S. policymakers and regulators, including the European Commission and European Supervisory Authorities (among others, the European Banking Authority and the European Securities and Markets Authority), continue to propose and adopt numerous reforms, including those that may further impact the structure of banks or subject us to new prudential requirements, and to formulate regulatory standards and measures that will be of relevance and importance to our European operations.

In November 2016, the European Commission published a package of proposals including various risk reduction measures. These include proposed amendments to the Capital Requirements Directive and Regulation providing updates to risk-based capital, liquidity, leverage and other prudential standards on a consolidated basis, consistent with final Basel standards. In addition, the proposals would require certain large,non-E.U. financial groups with two or more institutions established in the E.U. to establish an E.U. IHC. The proposals would require E.U. banks and broker-dealers to be held below the E.U. IHC; until more specific regulations are proposed, it remains unclear which other E.U. entities would need to be held beneath the E.U. IHC. The E.U. IHC would be subject to direct supervision and authorization by the European Central Bank or the relevant national E.U. regulator. Further amendments were also proposed to the E.U. bank recovery and resolution regime under the E.U. Bank Recovery and Resolution Directive (“BRRD”). It is expected that the proposals will be adopted in early 2019, however their final form, as well as the date of their adoption, is not yet certain.

The amendments to the BRRD build on previous proposals by regulators in the U.K., E.U. and other major jurisdictions to finalize recovery and resolution planning frameworks and related regulatory requirements that will apply to certain of our subsidiaries that operate in those jurisdictions. For instance, the BRRD established a recovery and resolution framework for E.U. credit institutions and investment firms, including MSIP. In addition, certain jurisdictions, including the U.K. and other E.U. jurisdictions, have implemented, or are in the process of implementing, changes to resolution regimes to provide resolution authorities with the ability to recapitalize a failing entity organized in such jurisdictions by

writing down certain unsecured liabilities or converting certain unsecured liabilities into equity.

Regulators in the U.K., E.U. and other major jurisdictions have also finalized other regulatory standards applicable to certain of our subsidiaries that operate in those jurisdictions. For instance, the European Market Infrastructure Regulation introduced new requirements regarding the central clearing and reporting of derivatives, as well as margin requirements for uncleared derivatives. MiFID II, which took effect on January 3, 2018, introduced comprehensive and new trading and market infrastructure reforms in the E.U., including new trading venues, enhancements topre- and post-trading transparency, and additional investor protection requirements, among others. We have had to make extensive changes to our operations, including systems and controls in order to comply with MiFID II.

Financial Crimes Program

Our Financial Crimes program is coordinated on an enterprise-wide basis and supports our financial crime prevention efforts across all regions and business units with responsibility for governance, oversight and execution of our AML, economic sanctions (“Sanctions”) and anti-corruption programs.

In the U.S., the Bank Secrecy Act, as amended by the USA PATRIOT Act of 2001, imposes significant obligations on financial institutions to detect and deter money laundering and terrorist financing activity, including requiring banks, BHCs and their subsidiaries, broker-dealers, futures commission merchants, introducing brokers and mutual funds to implement AML programs, verify the identity of customers that maintain accounts, and monitor and report suspicious activity to appropriate law enforcement or regulatory authorities. Outside the U.S., applicable laws, rules and regulations similarly require designated types of financial institutions to implement AML programs.

We have implemented policies, procedures and internal controls that are designed to comply with all applicable AML laws and regulations. Regarding Sanctions, we have implemented policies, procedures and internal controls that are designed to comply with the regulations and economic sanctions programs administered by the U.S. Treasury’s Office of Foreign Assets Control (“OFAC”), which target foreign countries, entities and individuals based on external threats to U.S. foreign policy, national security or economic interests, and to comply, as applicable, with similar sanctions programs imposed by foreign governments or global or regional multilateral organizations such as the United Nations Security Council and the E.U. Council.

We are also subject to applicable anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act, in the jurisdictions in which we operate. Anti-corruption

| 9 | December 2018 Form 10-K |

Table of Contents

|

laws generally prohibit offering, promising, giving or authorizing others to give anything of value, either directly or indirectly, to a government official or private party in order to influence official action or otherwise gain an unfair business advantage, such as to obtain or retain business. We have implemented policies, procedures and internal controls that are designed to comply with such laws, rules and regulations.

Executive Officers of Morgan Stanley

The executive officers of Morgan Stanley and their age and titles as of February 26, 2019 are set forth below. Business experience is provided in accordance with SEC rules.

Jeffrey S. Brodsky (54). Executive Vice President and Chief Human Resources Officer of Morgan Stanley (since January 2016). Vice President and Global Head of Human Resources (January 2011 to December 2015).Co-Head of Human Resources (January 2010 to December 2011). Head of Morgan Stanley Smith Barney Human Resources (June 2009 to January 2010).

James P. Gorman (60). Chairman of the Board of Directors and Chief Executive Officer of Morgan Stanley (since January 2012). President and Chief Executive Officer (January 2010 to December 2011) and member of the Board of Directors (since January 2010).Co-President (December 2007 to December 2009) andCo-Head of Strategic Planning (October 2007 to December 2009). President and Chief Operating Officer of Wealth Management (February 2006 to April 2008).

Eric F. Grossman (52). Executive Vice President and Chief Legal Officer of Morgan Stanley (since January 2012). Global Head of Legal (September 2010 to January 2012). Global Head of Litigation (January 2006 to September 2010) and General Counsel of the Americas (May 2009 to September 2010). General Counsel of Wealth Management (November 2008 to September 2010). Partner at the law firm of Davis Polk & Wardwell LLP (June 2001 to December 2005).

Keishi Hotsuki (56). Executive Vice President (since May 2014) and Chief Risk Officer of Morgan Stanley (since May 2011). Interim Chief Risk Officer (January 2011 to May 2011) and Head of Market Risk Department (March 2008 to April 2014). Director of Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. (since May 2010). Global Head of Market Risk Management at Merrill Lynch (June 2005 to September 2007).

Colm Kelleher (61). President of Morgan Stanley (since January 2016). Executive Vice President (October 2007 to January 2016). President of Institutional Securities (January 2013 to January 2016). Head of International (January 2011 to January 2016).Co-President of Institutional Securities (January 2010 to December 2012). Chief Financial Officer andCo-Head of Strategic Planning (October 2007 to December 2009). Head of Global Capital Markets (February 2006 to October 2007).Co-Head of Fixed Income Europe (May 2004 to February 2006). Director of Norfolk Southern Corporation (since January 2019).

Jonathan M. Pruzan (50). Executive Vice President and Chief Financial Officer of Morgan Stanley (since May 2015) and Head of Corporate Strategy (since December 2016).Co-Head of Global Financial Institutions Group (January 2010 to April 2015).Co-Head of North American Financial Institutions Group M&A (September 2007 to December 2009). Head of the U.S. Bank Group (April 2005 to August 2007).

Daniel A. Simkowitz (53). Head of Investment Management of Morgan Stanley (since October 2015).Co-Head of Global Capital Markets (March 2013 to September 2015). Chairman of Global Capital Markets (November 2009 to March 2013). Managing Director in Global Capital Markets (December 2000 to November 2009).

| December 2018 Form 10-K | 10 |

Table of Contents

|

For a discussion of the risks and uncertainties that may affect our future results and strategic objectives, see “Forward-Looking Statements” immediately preceding “Business” and “Return on Equity and Tangible Common Equity Targets” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Market Risk

Market risk refers to the risk that a change in the level of one or more market prices, rates, indices, volatilities, correlations or other market factors, such as market liquidity, will result in losses for a position or portfolio owned by us. For more information on how we monitor and manage market risk, see “Quantitative and Qualitative Disclosures about Risk—Risk Management—Market Risk.”

Our results of operations may be materially affected by market fluctuations and by global and economic conditions and other factors, including changes in asset values.

Our results of operations have been in the past and may, in the future, be materially affected by market fluctuations due to global financial markets, economic conditions, changes to the global trade policies and tariffs and other factors, including the level and volatility of equity, fixed income and commodity prices, the level and term structure of interest rates, inflation and currency values, and the level of other market indices.

The results of our Institutional Securities business segment, particularly results relating to our involvement in primary and secondary markets for all types of financial products, are subject to substantial market fluctuations due to a variety of factors that we cannot control or predict with great certainty. These fluctuations impact results by causing variations in business flows and activity and in the fair value of securities and other financial products. Fluctuations also occur due to the level of global market activity, which, among other things, affects the size, number and timing of investment banking client assignments and transactions and the realization of returns from our principal investments.

During periods of unfavorable market or economic conditions, the level of individual investor participation in the global markets, as well as the level of client assets, may also decrease, which would negatively impact the results of our Wealth Management business segment.

In addition, fluctuations in global market activity could impact the flow of investment capital into or from AUM and the way customers allocate capital among money market, equity, fixed

income or other investment alternatives, which could negatively impact our Investment Management business segment.

The value of our financial instruments may be materially affected by market fluctuations. Market volatility, illiquid market conditions and disruptions in the credit markets may make it extremely difficult to value and monetize certain of our financial instruments, particularly during periods of market displacement. Subsequent valuations in future periods, in light of factors then prevailing, may result in significant changes in the values of these instruments and may adversely impact historical or prospective fees and performance-based fees (also known as incentive fees, which include carried interest) in respect of certain businesses. In addition, at the time of any sales and settlements of these financial instruments, the price we ultimately realize will depend on the demand and liquidity in the market at that time and may be materially lower than their current fair value. Any of these factors could cause a decline in the value of our financial instruments, which may have an adverse effect on our results of operations in future periods.

In addition, financial markets are susceptible to severe events evidenced by rapid depreciation in asset values accompanied by a reduction in asset liquidity. Under these extreme conditions, hedging and other risk management strategies may not be as effective at mitigating trading losses as they would be under more normal market conditions. Moreover, under these conditions, market participants are particularly exposed to trading strategies employed by many market participants simultaneously and on a large scale. Our risk management and monitoring processes seek to quantify and mitigate risk to more extreme market moves. However, severe market events have historically been difficult to predict and we could realize significant losses if extreme market events were to occur.

Holding large and concentrated positions may expose us to losses.

Concentration of risk may reduce revenues or result in losses in our market-making, investing, block trading, underwriting and lending businesses in the event of unfavorable market movements, or when market conditions are more favorable for our competitors. We commit substantial amounts of capital to these businesses, which often results in our taking large positions in the securities of, or making large loans to, a particular issuer or issuers in a particular industry, country or region. For further information regarding our country risk exposure, see also “Quantitative and Qualitative Disclosures about Risk—Risk Management—Credit Risk—Country Risk Exposure.”

| 11 | December 2018 Form 10-K |

Table of Contents

|

Credit Risk

Credit risk refers to the risk of loss arising when a borrower, counterparty or issuer does not meet its financial obligations to us. For more information on how we monitor and manage credit risk, see “Quantitative and Qualitative Disclosures about Risk—Risk Management—Credit Risk.”

We are exposed to the risk that third parties that are indebted to us will not perform their obligations.

We incur significant credit risk exposure through our Institutional Securities business segment. This risk may arise from a variety of business activities, including, but not limited to: extending credit to clients through various lending commitments; entering into swap or other derivative contracts under which counterparties have obligations to make payments to us; providing short- or long-term funding that is secured by physical or financial collateral whose value may at times be insufficient to fully cover the loan repayment amount; posting margin and/or collateral and other commitments to clearing houses, clearing agencies, exchanges, banks, securities firms and other financial counterparties; and investing and trading in securities and loan pools, whereby the value of these assets may fluctuate based on realized or expected defaults on the underlying obligations or loans.

We also incur credit risk in our Wealth Management business segment lending to mainly individual investors, including, but not limited to, margin- and securities-based loans collateralized by securities, residential mortgage loans and HELOCs.

While we believe current valuations and reserves adequately address our perceived levels of risk, adverse economic conditions may negatively impact our clients and our credit exposures. In addition, as a clearing member of several central counterparties, we finance our customer positions and could be held responsible for the defaults or misconduct of our customers. Although we regularly review our credit exposures, default risk may arise from events or circumstances that are difficult to detect or foresee.

A default by a large financial institution could adversely affect financial markets.

The commercial soundness of many financial institutions may be closely interrelated as a result of credit, trading, clearing or other relationships among the institutions. Increased centralization of trading activities through particular clearing houses, central agents or exchanges as required by provisions of the Dodd-Frank Act may increase our concentration of risk with respect to these entities. As a result, concerns about, or a default or threatened default by, one institution could lead to significant market-wide liquidity and credit problems, losses or defaults by other institutions.