UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07390 |

|

Boulder Total Return Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

Fund Administrative Services 2344 Spruce Street, Suite A Boulder, CO | | 80302 |

(Address of principal executive offices) | | (Zip code) |

|

Fund Administrative Services 2344 Spruce Street, Suite A Boulder, CO 80302 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (303) 444-5483 | |

|

Date of fiscal year end: | November 30, 2008 | |

|

Date of reporting period: | November 30, 2008 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

The Report to Stockholders is attached herewith.

BOULDER TOTAL RETURN FUND, INC.

TABLE OF CONTENTS

1 | | Letter from the Advisers | |

| | | |

4 | | Financial Data | |

| | | |

5 | | Portfolio of Investments | |

| | | |

9 | | Statement of Assets and Liabilities | |

| | | |

10 | | Statement of Operations | |

| | | |

11 | | Statements of Changes in Net Assets | |

| | | |

12 | | Financial Highlights | |

| | | |

14 | | Notes to Financial Statements | |

| | | |

25 | | Report of Independent Registered Public Accounting Firm | |

| | | |

26 | | Additional Information | |

| | | |

28 | | Summary of Dividend Reinvestment Plan | |

| | | |

30 | | Directors and Officers | |

LETTER FROM THE ADVISERS | |

|

Dear Stockholder:

In fiscal 2008 the Boulder Total Return Fund (“BTF”), along with the entire US economy, didn’t just have a bad year, they both suffered a cataclysmic shift –downward. What has taken place in our economy and in our Fund is not something that will correct itself in the near term. The total return on NAV for BTF was -40.3% for the fiscal year ending 11/30/08. This compares to the S&P 500 Index which was down 38.1% over the same period.

| | | | | | | | Three | | Five | | | |

| | 3 Months | | 6 Months | | One Year | | Years* | | Years* | | Since | |

| | Ended | | Ended | | Ended | | Ended | | Ended | | August | |

Cumulative Returns | | 11/30/08 | | 11/30/08 | | 11/30/08 | | 11/30/08 | | 11/30/08 | | 1999** | |

Boulder Total Return Fund | | -25.9 | % | -36.9 | % | -40.3 | % | -8.2 | % | -1.6 | % | 2.8 | % |

S&P 500 Index | | -29.6 | % | -35.2 | % | -38.1 | % | -8.7 | % | -1.4 | % | -2.5 | % |

Dow Jones Industrial Average | | -22.8 | % | -29.0 | % | -32.1 | % | -4.2 | % | 0.3 | % | -0.1 | % |

NASDAQ Composite | | -35.0 | % | -38.8 | % | -41.8 | % | -11.0 | % | -4.1 | % | -5.5 | % |

The total returns for BTF in the table above do not include the effect of dilution from the 7/2003 rights offering. If the effect of dilution is included, the annualized return since 8/99 would be 2.1%.

* | Annualized |

** | Annualized since August 1999, when the current Advisers became investment advisers to the Fund. |

An investor who purchased $10,000 of BTF when BIA and SIA became co-advisers to the Fund in August 1999, and was able to buy it at NAV, would have $12,910 on November 30, 2008. Had the investor purchased the S&P 500 Index at the same time, he’d have less than he started with—only $7,912. So after expenses (and assuming no expenses on the S&P), an investor would have 63% more money having purchased BTF. In a year like 2008, it’s worth noting that the Fund’s performance is effected by the leverage it has. The losses of the Fund were amplified this year by this leverage, just as gains we’ve had in prior years were amplified in up markets.

While we held some cash and cash equivalents in the Fund during the year (about 10% at year-end) which helped, nearly all the equities we held declined significantly. We wish we had seen this coming, but the plain and simple truth is we didn’t and don’t have the ability to predict what will happen in the future. Trying to time the market by taking money in and out isn’t a game we try to play. In the long run, we’d lose. What we can do is invest your money in companies who use debt wisely, that have a competitive edge, and that have good margins. We believe these types of companies will survive tumultuous times like this so that when times do get better, they can thrive. There are some companies that didn’t, and won’t survive this economic crisis because of too much debt. And it’s really too bad because some of them were good companies, but they were living too close to the edge. The outcome of this is yet to be determined, but a few companies that survive will see themselves with less competition for a time; a silver lining in this dark cloud.

1

The Fund’s two largest positions, Berkshire Hathaway (44% of the Fund’s assets) and YUM! Brands (12.5% of the Fund’s assets) were down 26% and 27% respectively. The Fund’s third largest position, Wal-Mart (9% of the Fund’s assets) was actually up 17% during the year, one of the better performing stocks in 2008. One of the reasons we own so much of Berkshire Hathaway is Warren Buffet. For the past few years, he has been building a war chest of cash, which he has recently started to put to work. His patience has been rewarded with investments such as the recent $8 billion worth of 10% preferreds he bought from GE and Goldman Sachs. Considering that the cash was likely earning only around 1% to 2%, prior to these investments he just increased Berkshire’s earnings by about $640 million a year with those two investments alone. Furthermore, because of the weakening financial position of other insurers in the US and abroad, Berkshire will likely be able to start charging a premium for the insurance services of its two largest operating companies: GEICO and GeneralRe.

Next to Wal-Mart, another positive we had in the portfolio was Anheuser-Busch, which was recently bought out by In-Bev. Three of the financials we held in the Fund, Citi-group, Washington Mutual, and AIG, were all sold in the last six months. Not before we suffered some losses, but the losses would have been much greater had we not sold when we did. So what did poorly in the Fund? Where to begin; the list is like a trail of tears—long and sad. Legg Mason and Midland Holdings were down 76% and 78% respectively. Legg Mason suffered due to the stock market decline while Midland suffered due to the property decline in Hong Kong. Cheung Kong Holdings, another Hong Kong stock, which holds a significant position in Hutchison Whampoa, was down 50%. Pfizer was down 31% and Johnson & Johnson was only down 13.5%. It’s a sad commentary when you can say a stock was down only 13.5%.

If there were ever a good time to talk about fear, it’s now. In relation to the market, we can put fear into two different camps: warranted fear and unwarranted fear. We’ve seen a lot of both in recent months. When fear strikes and the market price of a security declines rapidly and/or precipitously, the reasons seem to come from short-term circumstances or it comes simply from the fact that the security price is falling. This is unwarranted fear. It’s the kind we look for because an investor can sometimes find great bargains as a result. The question in these cases is when does the unwarranted fear stop? Trying to buy at the right time can be like catching a falling knife. In the other camp, we’ve seen a lot of warranted fear. The economy is such that, as mentioned above, many companies will be worth a lot less for…well, maybe forever. Others will go bankrupt. A healthy fear of such companies is warranted.

In the second half of the year, we made three relatively small purchases: Heineken Holdings, down slightly from where we bought, Constellation Energy, actually up from where we bought, and we added slightly to our Walgreens position. Total dollars spent on these three amounted to about $4.5 million, less than 2% of our assets.

The Fund stopped paying a monthly dividend. The last dividend paid was October 31, 2008. The decision to suspend the dividend had to do with two primary issues. First, a declining stock market has provided some good values which the Fund could take advantage of by using its cash. Second, the declining stock market has caused our leverage ratio to climb. Under the 1940 Investment Company Act, the highest leverage ratio

| BOULDER TOTAL RETURN FUND, INC. | www.boulderfunds.net |

2

permissible using preferreds (AMPs) is 2:1. We were approaching this level. The Fund paid out a total of $2.94 per share in dividends in the fiscal year, all a return of capital. There was no December dividend in 2008. We’ve had a few people ask if the Fund will resume the managed distribution in the future. The answer for now is not likely. Ending the dividend payments does not change our investment objective of total return one bit. We will still strive to invest in the best companies we can find. We take into consideration whether or not dividends are paid by these companies, but it won’t necessarily drive our decision. Remember, total return means both income and capital appreciation from the companies we buy. We expect long-term capital appreciation from companies we buy which don’t pay dividends. You will receive a Form 1099-DIV from your broker or the transfer agent with the tax characteristics of those dividends.

The Fund’s AMPs which were issued as leverage have not had a successful auction since mid-February 2008, meaning holders of the AMPs haven’t had the opportunity to sell their shares in an auction since then. Around this timeframe, the broker-dealers who had regularly been participating in the auctions as buyers, stopped buying. They simply didn’t have the capital to commit. However, when this “backstop” disappeared, auctions began failing. Everyone rushed to sell their shares all at once, but there were no buyers. It has remained that way ever since. Unlike most financials, which have been downgraded in this credit crunch, the Fund’s AMPs still have AAA rated credit quality and the Fund is meeting all its obligations with respect to preferred stockholders. The AMPs continue paying regular monthly dividends, and are backed by all the assets in the Fund. The auction failures have nothing to do with the credit quality of the Fund’s AMPs. Most auction rate preferred stock, including the AMPs issued by the Fund, are rated “AAA.”

The “fail” rate on the Fund’s unsuccessful auctions sets the rate at the greater of 1.25% of 30-day LIBOR or 30-day LIBOR plus 125 basis points. The last rate set on November 25, 2008 was 2.661%, which was the “fail” rate. As of 11/30/08, the Fund’s $77.5 million of auction rate preferreds represent 33% of the Fund’s total assets.

Our website at www.boulderfunds.net is an excellent source for information on the Fund. One of the features on the website is the ability to sign up for electronic delivery of stockholder information. Through electronic delivery, you can enjoy the convenience of receiving and viewing stockholder communications, such as annual reports, managed distribution information, and proxy statements online in addition to, but more quickly than, the hard copies you currently receive in the mail. To enroll, simply go to www.boulderfunds.net/enotify.htm. You will also find information about the Boulder Total Return Fund’s sister fund– the Boulder Growth & Income Fund – on the website.

Sincerely, | | |

| |

|

Stewart R. Horejsi | | Carl D. Johns |

Stewart Investment Advisers | | Boulder Investment Advisers, LLC |

Barbados, W.I. | | Boulder, Colorado |

3

| | | FINANCIAL DATA [Unaudited] |

|

| | Per Share of Common Stock | |

| | Net Asset | | NYSE | | Dividend | |

| | Value | | Closing Price | | Paid | |

11/30/07 | | $ | 24.95 | | $ | 22.70 | | $ | 0.000 | |

12/31/07 | | 24.60 | | 21.89 | | 0.240 | |

1/31/08 | | 23.42 | | 22.15 | | 0.240 | |

2/29/08 | | 22.70 | | 21.50 | | 0.273 | |

3/31/08 | | 21.65 | | 20.08 | | 0.273 | |

4/30/08 | | 22.26 | | 20.80 | | 0.273 | |

5/31/08 | | 21.96 | | 20.46 | | 0.273 | |

6/30/08 | | 18.74 | | 18.05 | | 0.273 | |

7/31/08 | | 17.83 | | 16.60 | | 0.273 | |

8/31/08 | | 17.82 | | 16.69 | | 0.273 | |

9/30/08 | | 17.16 | | 14.57 | | 0.273 | |

10/31/08 | | 14.15 | | 12.62 | | 0.273 | |

11/30/08 | | 12.70 | | 9.17 | | 0.000 | |

| | | | | | | | | | | | | |

The Boulder Total Return Fund was ranked #1 in Lipper Closed-End Equity Fund Performance for the year ended December 31, 2000 by Lipper Inc.

LIPPER and the LIPPER Corporate Marks are propriety trademarks of Lipper, a Reuters Company. Used by permission.

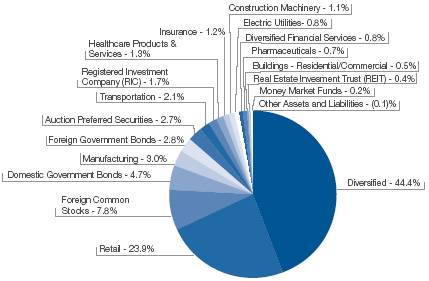

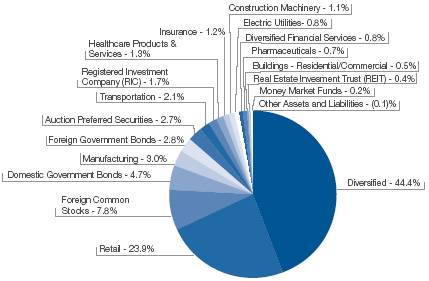

INVESTMENTS AS A % OF NET ASSETS AVAILABLE TO COMMON AND PREFERRED SHARES

4

PORTFOLIO OF INVESTMENTS | |

|

November 30, 2008 |

| | |

Shares | | Description | | Value (Note 1) | |

| | | | | |

LONG TERM INVESTMENTS 92.4% | | | |

DOMESTIC COMMON STOCKS 81.9% | | | |

Buildings - Residential/Commercial 0.5% | | | |

34,100 | | DR Horton, Inc. | | $ | 234,267 | |

10,000 | | KB Home | | 116,300 | |

22,700 | | Ryland Group, Inc. | | 385,219 | |

18,900 | | Toll Brothers, Inc.* | | 376,677 | |

| | | | 1,112,463 | |

| | | | | |

Construction Machinery 1.1% | | | |

60,000 | | Caterpillar, Inc. | | 2,459,400 | |

| | | | | |

Diversified 44.4% | | | |

690 | | Berkshire Hathaway, Inc., Class A* | | 71,760,000 | |

9,200 | | Berkshire Hathaway, Inc., Class B* | | 32,190,800 | |

| | | | 103,950,800 | |

| | | | | |

Diversified Financial Services 0.8% | | | |

106,328 | | Legg Mason, Inc. | | 1,916,031 | |

| | | | | |

Electric Utilities 0.8% | | | |

80,000 | | Constellation Energy Group, Inc. | | 1,957,600 | |

| | | | | |

Healthcare Products & Services 1.3% | | | |

52,000 | | Johnson & Johnson | | 3,046,160 | |

| | | | | |

Insurance 1.2% | | | |

120,000 | | First American Corp. | | 2,882,400 | |

| | | | | |

Manufacturing 3.0% | | | |

150,500 | | Eaton Corp. | | 6,974,170 | |

| | | | | |

Pharmaceuticals 0.7% | | | |

100,000 | | Pfizer, Inc. | | 1,643,000 | |

| | | | | |

Real Estate Investment Trust (REIT) 0.4% | | | |

75,000 | | Redwood Trust, Inc. | | 978,750 | |

| | | | | |

Registered Investment Company (RIC) 1.7% | | | |

549,200 | | Flaherty & Crumrine/Claymore Preferred Securities Income Fund, Inc. | | 4,086,048 | |

| | | | | | | | |

See accompanying notes to financial statements.

5

Shares | | Description | | Value (Note 1) | |

| | | | | |

Retail 23.9% | | | |

72,500 | | The Home Depot, Inc. | | $ | 1,675,475 | |

177,000 | | Walgreen Co. | | 4,378,980 | |

370,000 | | Wal-Mart Stores, Inc. | | 20,675,600 | |

1,085,000 | | Yum! Brands, Inc. | | 29,229,900 | |

| | | | 55,959,955 | |

| | | | | |

Transportation 2.1% | | | |

60,000 | | Burlington Northern Santa Fe Corp. | | 4,596,600 | |

63,100 | | YRC Worldwide, Inc.* | | 251,138 | |

| | | | 4,847,738 | |

| | | | | |

TOTAL DOMESTIC COMMON STOCKS | | | |

(Cost $142,652,173) | | 191,814,515 | |

| | | | | |

FOREIGN COMMON STOCKS 7.8% | | | |

Canada 0.1% | | | |

123,000 | | Canfor Pulp Income Fund | | 296,541 | |

| | | | |

Hong Kong 3.1% | | | |

515,000 | | Cheung Kong Holdings, Ltd. | | 4,850,906 | |

500,000 | | Henderson Investment, Ltd. | | 24,193 | |

104,500 | | Henderson Land Development Co., Ltd. | | 354,621 | |

6,156,000 | | Midland Holdings, Ltd. | | 2,025,496 | |

| | | | 7,255,216 | |

| | | | | |

Japan 0.0%(1) | | | |

340 | | New City Residence Investment Corp.(2) | | 14,764 | |

| | | | |

Netherlands 1.8% | | | |

60,000 | | Heineken Holding NV | | 1,549,759 | |

95,117 | | Heineken NV | | 2,616,325 | |

| | | | 4,166,084 | |

| | | | | |

New Zealand 1.0% | | | |

4,150,136 | | Kiwi Income Property Trust | | 2,304,351 | |

| | | | | |

Turkey 0.0%(1) | | | |

57,183 | | Dogus GE Gayrimenkul Yatirim Ortakligi A.S.* | | 17,148 | |

| | | | | |

United Kingdom 1.8% | | | |

75,000 | | Diageo PLC, Sponsored ADR | | 4,227,750 | |

TOTAL FOREIGN COMMON STOCKS | | | |

(Cost $24,797,904) | | $ | 18,281,854 | |

See accompanying notes to financial statements.

6

Shares/ | | | | | |

Principal | | | | | |

Amount | | Description | | Value (Note 1) | |

| | | | | |

AUCTION PREFERRED SECURITIES 2.7% | | | |

34 | | Cohen & Steers Quality Income Realty Fund, Inc., Series M7(2) | | 850,000 | |

81 | | Cohen & Steers REIT and Utility Income Fund, Inc., Series T7(2) | | 2,025,000 | |

120 | | Duff & Phelps Utility and Corporate Bond Trust, Inc., Series T7(2) | | 3,000,000 | |

15 | | Neuberger Berman Real Estate Securities Income Fund, Inc., Series C(2) | | 375,000 | |

| | | | | |

TOTAL AUCTION PREFERRED SECURITIES | | | |

(Cost $6,250,039) | | 6,250,000 | |

| | | | | |

TOTAL LONG TERM INVESTMENTS | | | |

(Cost $173,700,116) | | 216,346,369 | |

| | | | | |

SHORT TERM INVESTMENTS 7.7% | | | |

DOMESTIC GOVERNMENT BONDS 4.7% | | | |

$ | 11,100,000 | | United States Cash Management Bills, Discount Notes, 0.430%, due 04/29/2009 | | 11,082,085 | |

| | | | | |

TOTAL DOMESTIC GOVERNMENT BONDS | | | |

(Amortized Cost $11,080,246) | | 11,082,085 | |

| | | | | |

FOREIGN GOVERNMENT BONDS 2.8% | | | |

New Zealand 0.9% | | | |

3,630,000 | | New Zealand Treasury Bills, Discount Notes, 5.020%, due 01/28/2009, NZD | | 1,980,091 | |

| | | | | |

United Kingdom 1.9% | | | |

2,900,000 | | United Kingdom Treasury Bills, Discount Notes, 5.050%, due 12/01/2008, GBP | | 4,460,029 | |

| | | | | |

TOTAL FOREIGN GOVERNMENT BONDS | | | |

(Amortized Cost $7,659,747) | | 6,440,120 | |

| | | | | | |

See accompanying notes to financial statements.

7

Shares | | Description | | Value (Note 1) | |

| | | |

MONEY MARKET FUNDS 0.2% | | | |

577,947 | | Dreyfus Treasury Cash Management Money Market Fund, Institutional Class, 7 day yield 0.364% | | $ | 577,947 | |

| | | |

TOTAL MONEY MARKET FUNDS | | | |

(Cost $577,947) | | 577,947 | |

| | | |

TOTAL SHORT TERM INVESTMENTS | | | |

(Cost $19,317,940) | | 18,100,152 | |

| | | |

TOTAL INVESTMENTS 100.1% | | | |

(Cost $193,018,056) | | 234,446,521 | |

| | | |

OTHER ASSETS AND LIABILITIES -0.1% | | (213,824 | ) |

| | | |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK AND PREFERRED STOCK 100.0% | | 234,232,697 | |

| | | |

AUCTION MARKET PREFERRED SHARES (AMPS) REDEMPTION VALUE | | (77,500,000 | ) |

| | | |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK | | $ | 156,732,697 | |

* | Non-income producing security. |

(1) | Less than 0.05% of Total Net Assets Available to Common Stock and Preferred Stock. |

(2) | Fair valued security under procedures established by the Fund’s Board of Directors. Total market value of fair valued securities as of November 30, 2008 is $6,264,764. |

Common Abbreviations:

ADR - American Depositary Receipt

A.S. - Anonim Sirketi (Turkish: Joint Stock Company)

GBP - British Pound

Ltd. - Limited

NV - Naamloze Vennootchap is the Dutch term for a public limited liability corporation

NZD - New Zealand Dollar

PLC - Public Limited Company

For Fund compliance purposes, the Fund’s industry and/or geography classifications refer to any one of the industry/geography sub-classifications used by one or more widely recognized market indexes, and/or as defined by Fund Management. This definition may not apply for purposes of this report, which may combine industry/geography sub-classifications for reporting ease. Industries/geographies are shown as a percent of net assets available to common and preferred shares. These industry/geography classifications are unaudited.

See accompanying notes to financial statements.

8

STATEMENT OF ASSETS AND LIABILITIES | |

|

November 30, 2008 |

| | |

ASSETS: | | | |

Investments, at value (Cost $193,018,056) (Note 1) | | $ | 234,446,521 | |

Foreign currency, at value (Cost $3,913) | | 3,913 | |

Dividends and interest receivable | | 204,494 | |

Prepaid expenses and other assets | | 7,290 | |

Total Assets | | 234,662,218 | |

| | | |

LIABILITIES: | | | |

Investment co-advisory fees payable (Note 2) | | 242,040 | |

Legal and audit fees payable | | 54,277 | |

Administration and co-administration fees payable (Note 2) | | 52,700 | |

Accumulated undeclared dividends on Taxable Auction Market Preferred Shares (Note 5) | | 28,643 | |

Directors’ fees and expenses payable (Note 2) | | 20,089 | |

Printing fees payable | | 12,105 | |

Accrued expenses and other payables | | 19,667 | |

Total Liabilities | | 429,521 | |

FUND TOTAL NET ASSETS | | $ | 234,232,697 | |

| | | |

TAXABLE AUCTION MARKET PREFERRED SHARES: | | | |

$0.01 par value, 10,000,000 shares authorized, 775 shares outstanding, liquidation preference of $100,000 per share (Note 5) | | 77,500,000 | |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 156,732,697 | |

| | | |

NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) CONSIST OF: | | | |

Par value of common stock (Note 4) | | $ | 123,387 | |

Paid-in capital in excess of par value of common stock | | 124,495,248 | |

Accumulated net realized loss on investments sold and foreign currency related transactions | | (9,313,829 | ) |

Net unrealized appreciation on investments and foreign currency translation | | 41,427,891 | |

NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 156,732,697 | |

| | | |

Net Asset Value, $156,732,697/12,338,660 common shares outstanding | | $ | 12.70 | |

| | | | | | |

See accompanying notes to financial statements.

9

| | STATEMENT OF OPERATIONS |

| | For the Year Ended November 30, 2008 |

INVESTMENT INCOME: | | | |

Dividends (net of foreign withholding tax of $81,213) | | $ | 6,426,196 | |

Interest and other income | | 428,004 | |

Securities lending income, net | | 260,026 | |

Total Investment Income | | 7,114,226 | |

| | | |

EXPENSES: | | | |

Investment co-advisory fee (Note 2) | | 4,026,427 | |

Administration and co-administration fees (Note 2) | | 850,623 | |

Preferred stock broker commissions and auction agent fees | | 213,032 | |

Directors’ fees and expenses (Note 2) | | 95,832 | |

Legal and audit fees | | 90,746 | |

Insurance expense | | 45,025 | |

Printing fees | | 29,666 | |

Transfer agency fees | | 24,548 | |

Other | | 54,657 | |

Total Expenses | | 5,430,556 | |

Net Investment Income | | 1,683,670 | |

| | | |

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | |

Net realized loss on: | | | |

Investment securities | | (9,346,384 | ) |

Foreign currency related transactions | | (826,113 | ) |

| | (10,172,497 | ) |

| | | |

Net change in unrealized appreciation of: | | | |

Investment securities | | (103,021,823 | ) |

Foreign currency related transactions | | (2,815 | ) |

| | (103,024,638 | ) |

| | | |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS: | | (113,197,135 | ) |

LESS: PREFERRED STOCK DISTRIBUTIONS (NOTE 9) | | | |

From net investment income | | (822,246 | ) |

From tax return of capital | | (2,568,738 | ) |

Total Distributions: Preferred Stock | | (3,390,984 | ) |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (114,904,449 | ) |

See accompanying notes to financial statements.

10

STATEMENTS OF CHANGES IN NET ASSETS | |

|

| | Year Ended | | Year Ended | |

| | November 30, 2008 | | November 30, 2007 | |

| | | | | |

OPERATIONS: | | | | | |

Net investment income | | $ | 1,683,670 | | $ | 4,345,702 | |

Net realized gain/(loss) on investments sold | | (10,172,497 | ) | 1,678,509 | |

Net change in unrealized appreciation on investments during the year | | (103,024,638 | ) | 27,131,779 | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | (111,513,465 | ) | 33,155,990 | |

| | | | | |

DISTRIBUTIONS: PREFERRED STOCK (NOTE 9) | | | | | |

From net investment income | | (822,246 | ) | (3,180,201 | ) |

From net realized capital gains | | — | | (1,053,132 | ) |

From tax return of capital | | (2,568,738 | ) | — | |

Total Distributions: Preferred Stock | | (3,390,984 | ) | (4,233,333 | ) |

| | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations Applicable to Common Stockholders | | (114,904,449 | ) | 28,922,657 | |

| | | | | |

DISTRIBUTIONS: COMMON STOCK (NOTE 9) | | | | | |

From net investment income | | (1,303,416 | ) | (2,321,372 | ) |

From net realized capital gains | | (448,908 | ) | (10,387,446 | ) |

From tax return of capital | | (34,486,321 | ) | — | |

Total Distributions: Common Stock | | (36,238,645 | ) | (12,708,818 | ) |

Net Increase/(Decrease) in Net Assets | | (151,143,094 | ) | 16,213,839 | |

| | | | | |

NET ASSETS: | | | | | |

Beginning of year | | 385,375,791 | | 369,161,952 | |

End of period (including undistributed net investment income of $0 and $1,300,660, respectively) | | 234,232,697 | | 385,375,791 | |

Auction Market Preferred Shares (AMPS) Redemption Value | | (77,500,000 | ) | (77,500,000 | ) |

Net Assets Applicable to Common Stockholders | | $ | 156,732,697 | | $ | 307,875,791 | |

See accompanying notes to financial statements.

11

| | FINANCIAL HIGHLIGHTS |

| | For a Common Share Outstanding Throughout Each Period. |

Contained below is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the period indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

| | For the Year Ended November 30, | |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | | | | | | | | |

OPERATING PERFORMANCE: | | | | | | | | | | | |

Net Asset Value - Beginning of Year | | $ | 24.95 | | $ | 23.64 | | $ | 21.02 | | $ | 19.91 | | $ | 17.61 | |

| | | | | | | | | | | |

Income/(Loss) From Investment Operations | | | | | | | | | | | |

Net investment income(a) | | 0.14 | | 0.35 | | 0.30 | | 0.15 | | 0.03 | |

Net realized and unrealized gain/(loss) on investments | | (9.18 | ) | 2.34 | | 3.37 | | 1.17 | | 2.35 | |

Total from Investment Operations | | (9.04 | ) | 2.69 | | 3.67 | | 1.32 | | 2.38 | |

| | | | | | | | | | | |

Distributions: Preferred Stock | | | | | | | | | | | |

Dividends paid from net investment income(a) | | (0.06 | ) | (0.26 | ) | (0.04 | ) | (0.05 | ) | (0.09 | ) |

Dividends paid from net realized capital gains(a) | | — | | (0.09 | ) | (0.27 | ) | (0.15 | ) | — | |

Dividends paid from tax return of capital(a) | | (0.21 | ) | — | | — | | — | | — | |

Change in accumulated undeclared dividends on AMPS* | | — | | — | | — | | (0.01 | ) | 0.01 | |

Total Dividends Paid to AMPS* | | (0.27 | ) | (0.35 | ) | (0.31 | ) | (0.21 | ) | (0.08 | ) |

Net Increase/(Decrease) from Operations Applicable to Common Shares | | (9.31 | ) | 2.34 | | 3.36 | | 1.11 | | 2.30 | |

| | | | | | | | | | | |

Distributions: Common Stock | | | | | | | | | | | |

Dividends paid from net investment income | | (0.11 | ) | (0.19 | ) | (0.17 | ) | — | | — | |

Distributions paid from net realized capital gains | | (0.04 | ) | (0.84 | ) | (0.57 | ) | — | | — | |

Distributions paid from tax return of capital | | (2.79 | ) | — | | — | | — | | — | |

Total Dividends Paid to Common Stockholders | | (2.94 | ) | (1.03 | ) | (0.74 | ) | — | | — | |

Net Increase/(Decrease) in Common Net Asset Value | | (12.25 | ) | 1.31 | | 2.62 | | 1.11 | | 2.30 | |

Common Share Net Asset Value - End of Year | | $ | 12.70 | | $ | 24.95 | | $ | 23.64 | | $ | 21.02 | | $ | 19.91 | |

Common Share Market Value - End of Year | | $ | 9.17 | | $ | 22.70 | | $ | 21.59 | | $ | 17.57 | | $ | 17.45 | |

| | | | | | | | | | | |

Total Return, Common Share Net Asset Value (b) | | (40.3 | )% | 10.4 | % | 17.4 | % | 5.6 | % | 13.1 | % |

Total Return, Common Share Market Value (b) | | (52.6 | )% | 10.0 | % | 28.2 | % | 0.7 | % | 19.6 | % |

| | | | | | | | | | | |

RATIOS TO AVERAGE NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS:(c) | | | | | | | | | | | |

Operating Expenses | | 2.22 | % | 2.07 | % | 2.21 | % | 2.24 | % | 2.30 | % |

Net Investment Income (Loss) | | (0.70 | )% | 0.04 | % | 1.06 | % | 0.71 | % | 0.66 | % |

| | | | | | | | | | | |

SUPPLEMENTAL DATA: | | | | | | | | | | | |

Portfolio Turnover Rate | | 6 | % | 28 | % | 23 | % | 32 | % | 25 | % |

Net Assets Applicable to Common Stockholders, End of Year (000s) | | $ | 156,733 | | $ | 307,876 | | $ | 291,662 | | $ | 259,363 | | $ | 245,626 | |

Number of Common Shares Outstanding - End of Year (000s) | | 12,339 | | 12,339 | | 12,339 | | 12,339 | | 12,339 | |

Ratio of Operating Expenses to Total Average Net Assets Including AMPS* | | 1.69 | % | 1.65 | % | 1.71 | % | 1.72 | % | 1.73 | % |

* | | Taxable Auction Market Preferred Stock (“AMPS”). |

(a) | | Calculated based on the average number of common shares outstanding during each fiscal year. |

(b) | | Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period. Total return based on per share market value assumes the purchase of common shares at the market price on the first day and sale of common shares at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Results represent past performance and do not guarantee future results. Current returns may be lower or higher than the performance data quoted. |

Financial Highlights footnotes continued on page 13.

See accompanying notes to financial statements.

12

(c) | | Expense ratios do not include the effect of distributions to preferred stockholders. The net investment income ratios reflect income net of operating expenses and payments and change in undeclared dividends to AMP Stockholders. |

The table below sets out information with respect to Taxable Auction Market Preferred Stock currently outstanding. (1)

| | | | | | | | Involuntary | | Average | |

| | | | | | Asset | | Liquidating | | Market | |

| | Liquidation | | Total Shares | | Coverage | | Preference | | Value | |

| | Value (000) | | Outstanding (000) | | Per Share(2) | | Per Share(3) | | Per Share(3) | |

11/30/08 | | $ | 77,500 | | 0.775 | | $ | 302,273 | | $ | 100,000 | | $ | 100,000 | |

11/30/07 | | 77,500 | | 0.775 | | 497,949 | | 100,000 | | 100,000 | |

11/30/06 | | 77,500 | | 0.775 | | 476,367 | | 100,000 | | 100,000 | |

11/30/05 | | 77,500 | | 0.775 | | 434,662 | | 100,000 | | 100,000 | |

11/30/04 | | 77,500 | | 0.775 | | 416,937 | | 100,000 | | 100,000 | |

| | | | | | | | | | | | | | | |

(1) | | See Note 5 in Notes to Financial Statements. |

(2) | | Calculated by subtracting the Fund’s total liabilities (excluding accumulated unpaid distributions on Preferred Shares) from the Fund’s total assets and dividing by the number of Preferred Shares outstanding. |

(3) | | Excludes accumulated undeclared dividends. |

See accompanying notes to financial statements.

13

NOTES TO FINANCIAL STATEMENTS |

|

November 30, 2008 | |

NOTE 1. SIGNIFICANT ACCOUNTING POLICIES

Boulder Total Return Fund, Inc. (the “Fund”), is a diversified, closed-end management company organized as a Maryland corporation and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The policies described below are followed consistently by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America.

Portfolio Valuation: The net asset value of the Fund’s Common Shares is determined by the Fund’s co-administrator no less frequently than on the last business day of each week and month. It is determined by dividing the value of the Fund’s net assets attributable to common stock by the number of Common Shares outstanding. The value of the Fund’s net assets attributable to Common Shares is deemed to equal the value of the Fund’s total assets less (i) the Fund’s liabilities and (ii) the aggregate liquidation value of the outstanding Taxable Auction Market Preferred Stock. Securities listed on a national securities exchange are valued on the basis of the last sale on such exchange or the NASDAQ Official Close Price on the day of valuation. In the absence of sales of listed securities and with respect to securities for which the most recent sale prices are not deemed to represent fair market value, and unlisted securities (other than money market instruments), securities are valued at the mean between the closing bid and asked prices, or based on a matrix system which utilizes information (such as credit ratings, yields and maturities) from independent sources. Investments for which market quotations are not readily available or do not otherwise accurately reflect the fair value of the investment are valued at fair value as determined in good faith by or under the direction of the Board of Directors of the Fund, including reference to valuations of other securities which are considered comparable in quality, maturity and type. Investments in money market instruments, which mature in 60 days or less at the time of purchase, are valued at amortized cost.

The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”), effective December 1, 2007. In accordance with FAS 157, fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. Under certain circumstances, fair value may equal the mean between the bid and asked prices. FAS 157 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability

14

| NOTES TO FINANCIAL STATEMENTS |

| November 30, 2008 |

developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

· | Level 1—quoted prices in active markets for identical investments |

· | Level 2—significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

· | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The valuation techniques used by the Fund to measure fair value during the twelve months ended November 30, 2008 maximized the use of observable inputs and minimized the use of unobservable inputs. The Fund utilized the following fair value techniques: multi-dimensional relational pricing model, option adjusted spread pricing and estimation of the price that would have prevailed in an active market for an international equity given information available at the time of evaluation.

The following is a summary of the inputs used as of November 30, 2008 in valuing the Fund’s investments carried at fair value:

Valuation Inputs | | Investments in Securities | |

Level 1—Quoted Prices | | $ | 210,659,552 | |

Level 2—Significant Observable Inputs | | 23,772,205 | |

Level 3—Significant Unobservable Inputs | | 14,764 | |

Total | | $ | 234,446,521 | |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| | Investments in Securities | |

Balance as of 11/30/07 | | $ | — | |

Realized gain/(loss) | | — | |

Change in unrealized appreciation | | — | |

Net purchases/(sales) | | — | |

Transfer in and/or out of Level 3 | | 14,764 | |

Balance as of 11/30/08 | | $ | 14,764 | |

Securities Transactions and Investment Income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on ex-dividend dates. Interest income is recorded using the interest method.

15

NOTES TO FINANCIAL STATEMENTS | |

|

November 30, 2008 | | |

The actual amounts of dividend income and return of capital received from investments in real estate investment trusts (“REITS”) and registered investment companies (“RICS”) at calendar year-end are determined after the end of the fiscal year. The Fund therefore estimates these amounts for accounting purposes until the actual characterization of REIT and RIC distributions is known. Distributions received in excess of the estimate are recorded as a reduction of the cost of investments. During the year ended November 30, 2008, the Fund received dividends from REITs of $225,000 and RICs of $1,478,698. It is estimated that none of these dividends were return of capital.

Foreign Currency Translation: The books and records of the Fund are maintained in US dollars. Foreign currencies, investments and other assets and liabilities denominated in foreign currencies are translated in US dollars at the exchange rate prevailing at the end of the period, and purchases and sales of investment securities, income and expenses transacted in foreign currencies are translated at the exchange rate on the dates of such transactions.

Foreign currency gains and losses result from fluctuations in exchange rates between trade date and settlement date on securities transactions, foreign currency transactions and the difference between amounts of interest and dividends recorded on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and the subsequent sale trade date is included in gains and losses as stated in the Statement of Operations under Foreign currency related transactions.

Repurchase Agreements: The Fund may engage in repurchase agreement transactions. The Fund’s Management reviews and approves periodically the eligibility of the banks and dealers with which the Fund enters into repurchase agreement transactions. The value of the collateral underlying such transactions is at least equal at all times to the total amount of the repurchase obligations, including interest. The Fund maintains possession of the collateral and, in the event of counterparty default, the Fund has the right to use the collateral to offset losses incurred. There is the possibility of loss to the Fund in the event the Fund is delayed or prevented from exercising its rights to dispose of the collateral securities. The Fund had no outstanding repurchase agreements as of November 30, 2008.

Lending of Portfolio Securities: Prior to August 1, 2008, the Fund used State Street Bank and Trust Company (“State Street”) as its lending agent, to loan securities to qualified brokers and dealers in exchange for negotiated lenders’ fees. These fees are reported as “Securities lending income” in the Statement of Operations, net of expenses retained by State Street as compensation for its services as lending agent. The Fund received cash collateral, which was invested by the lending agent in short-term money market instruments, in an amount at least equal to the current market value of the loaned securities. The cash collateral was invested in the State Street Navigator Securities Lending Prime Portfolio. To the extent that advisory or other fees paid by State Street Navigator Securities Lending Portfolio were for the same or similar services as fees paid by the Fund, there was a layering of fees, which would have increased expenses and decreased

16

| NOTES TO FINANCIAL STATEMENTS |

| November 30, 2008 |

returns. Although risk was mitigated by the collateral, the Fund could have experienced a delay in recovering its securities and a possible loss of income or value if the borrower failed to return the securities when due. As of November 30, 2008, the Fund was not participating in any securities lending arrangements.

Dividends and Distributions to Stockholders: Dividends to Common Stockholders will be declared in such a manner as to avoid the imposition of the 4% excise tax described in “Federal Income Taxes” below. The stockholders of Taxable Auction Market Preferred Stock (“AMPS”) are entitled to receive cumulative cash dividends as declared by the Fund’s Board of Directors. Distributions to stockholders are recorded on the ex-dividend date. Any net realized short-term capital gains will be distributed to stockholders at least annually. Any net realized long-term capital gains may be distributed to stockholders at least annually or may be retained by the Fund as determined by the Fund’s Board of Directors. Capital gains retained by the Fund are subject to tax at the corporate tax rate. Subject to the Fund qualifying as a registered investment company, any taxes paid by the Fund on such net realized long-term gains may be used by the Fund’s Stockholders as a credit against their own tax liabilities.

Prior to November 10, 2008, it was the policy of the Fund to declare quarterly and pay monthly distributions to common stockholders (the “Policy”). The Fund’s ability to satisfy the Policy depended on a number of factors, including the stability of income received from its investments, the availability of capital gains, distributions paid on the AMPS, and the level of expenses. In an effort to maintain a stable distribution amount, the Fund could have paid distributions consisting of net investment income, realized capital gains and tax return of capital. Tax return of capital should not be considered yield by investors in the Fund. To the extent stockholders receive a return of capital they will be required to adjust their cost basis by the same amount upon the sale of their Fund shares. An IRS Form 1099-DIV will be sent to stockholders indicating the tax characteristic of the distributions they received and exactly how much is from ordinary income, if any, capital gains, if any, and return of capital, if any. Stockholders should seek their own tax advice regarding the reporting of income, the gain or loss on the sale of Fund shares.

The Fund’s Policy was suspended, as approved by the Board of Directors, at the regular meeting held November 10, 2008. The Fund’s Board of Directors considered continuation of the Policy and a number of alternatives and other factors before coming to the conclusion to suspend the Policy.

Use of Estimates: The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Indemnifications: Like many other companies, the Fund’s organizational documents provide that its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its

17

NOTES TO FINANCIAL STATEMENTS |

|

November 30, 2008 | |

principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Fund’s maximum exposure under these arrangements is unknown as this could involve future claims against the Fund.

Federal Income Taxes: For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of the Internal Revenue Code by distributing substantially all of its investment company taxable net income including realized gain not offset by capital loss carry-forwards, if any, to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to (1) differing treatments of income and gains on various investment securities held by the Fund, including temporary differences, (2) the attribution of expenses against certain components of taxable investment income, and (3) federal regulations requiring proportional allocation of income and gains to all classes of Stockholders. The Code imposes a 4% nondeductible excise tax on the Fund to the extent the Fund does not distribute by the end of any calendar year at least (1) 98% of the sum of its net investment income for that year and its capital gains (both long-term and short-term) for its fiscal year and (2) certain undistributed amounts from previous years.

Effective December 1, 2007, the Fund adopted Financial Accounting Standards Board (“FASB”) Interpretation No. 48 (“FIN 48”) “Accounting for Uncertainty in Income Taxes,” which requires that the financial statement effects of a tax position taken or expected to be taken in a tax return be recognized in the financial statements when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. Management has concluded that the Fund has taken no uncertain tax positions that require adjustment to the financial statements to comply with the provisions of FIN 48. The Fund files income tax returns in the U.S. federal jurisdiction and Colorado. The statue of limitations on the Fund’s federal tax filings remains open for the fiscal years ended November 30, 2008, November 30, 2007, November 30, 2006 and November 30, 2005. The statute of limitation on the Fund’s state tax filings remains open for the fiscal years ended November 30, 2008, November 30, 2007, November 30, 2006, November 30, 2005 and November 30, 2004.

NOTE 2. INVESTMENT CO-ADVISORY FEES, DIRECTORS’ FEES, CO-ADMINISTRATION FEE, CUSTODY FEE AND TRANSFER AGENT FEE

Boulder Investment Advisers, L.L.C. (“BIA”) and Stewart Investment Advisers (“SIA”) serve as the Fund’s co-investment advisers (“Advisers”). The Fund pays the Advisers a monthly fee at an annual rate of 1.25% of the value of the Fund’s average monthly

18

| NOTES TO FINANCIAL STATEMENTS |

| November 30, 2008 |

total assets under management (including the principal amount of leverage, if any). At the January 25, 2008 Board of Directors meeting, the Advisers agreed to a waiver of advisory fees such that, in the future, the advisory fees would be calculated at the annual rate of 1.25% on assets up to $400 million, 1.10% on assets between $400-$600 million and 1.00% on assets exceeding $600 million. This fee waiver has a one year term and is renewable annually at the option of the Advisers. The waiver is not subject to recapture. The equity owners of BIA are Evergreen Atlantic, LLC, a Colorado limited liability company (“EALLC”), and the Lola Brown Trust No. 1B (the “Lola Trust”), each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act. Stewart West Indies Trading Company, Ltd. is a Barbados international business company doing business as Stewart Investment Advisers. SIA receives a monthly fee equal to 75% of the fees earned by the Advisers, and BIA receives 25% of the fees earned by the Advisers. The equity owner of SIA is the Stewart West Indies Trust, considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act.

Fund Administrative Services, LLC (“FAS”) serves as the Fund’s co-administrator. Under the Administration Agreement, FAS provides certain administrative and executive management services to the Fund including: providing the Fund’s principal offices and executive officers, overseeing and administering all contracted service providers, making recommendations to the Board regarding policies of the Fund, conducting stockholder relations, authorizing expenses and other administrative tasks. Under the Administration Agreement, the Fund pays FAS a monthly fee calculated at an annual rate of 0.20% of the value of the Fund’s average monthly total assets (including leverage) up to $250 million; 0.18% of the Fund’s average monthly total assets (including leverage) on the next $150 million; and, 0.15% on the value of the Fund’s average monthly total assets (including leverage) over $400 million. The equity owners of FAS are EALLC and the Lola Trust.

ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s co-administrator. As compensation for its services, ALPS receives certain out-of-pocket expenses and asset-based fees, which are accrued daily and paid monthly. Fees paid to ALPS are calculated based on combined assets of the Fund, and certain other funds administered or co-administered by FAS (the “Fund Complex”). ALPS receives the greater of the following, based on combined assets of the Fund Complex: an annual minimum of $460,000, or an annualized fee of 0.045% on assets up to $1 billion, an annualized fee of 0.03% on assets between $1 and $3 billion, and an annualized fee of 0.02% on assets above $3 billion.

The Fund pays each Director who is not a director, officer, employee, or affiliate of the Advisers or FAS a fee of $8,000 per annum, plus $4,000 for each in-person meeting of the Board of Directors and $500 for each telephone meeting. In addition, the Chairman of the Board and the Chairman of the Audit Committee receive $1,000 per meeting and each member of the Audit Committee receives $500 per meeting. The Fund will also reimburse all non-interested Directors for travel and out-of-pocket expenses incurred in connection with such meetings.

19

NOTES TO FINANCIAL STATEMENTS |

|

November 30, 2008 | |

State Street served as the Fund’s co-administrator and custodian prior to August 1, 2008, when ALPS became co-administrator and Bank of New York Mellon (“BNY Mellon”) became the Fund’s custodian.

PNC Global Investment Servicing (“PNC GIS”) serves as the Fund’s Common Stock Servicing Agent (transfer agent), dividend-paying agent and registrar, and as compensation for PNC GIS’s services as such, the Fund pays PNC GIS a monthly fee plus certain out-of-pocket expenses.

Deutsche Bank Trust Company Americas (“Auction Agent”), a wholly owned subsidiary of Deutsche Bank AG, serves as the Fund’s Preferred Stock transfer agent, registrar, dividend disbursing agent and redemption agent.

NOTE 3. PURCHASES AND SALES OF SECURITIES

Purchases and sales of securities (excluding short term securities), including in-kind purchases of $4,071,228 and sales of $4,069,170, during the year ended November 30, 2008 were $20,132,165 and $65,623,810, respectively.

During the year ended November 30, 2008, the Fund had realized gains/(losses) of $(559,861) on securities associated with in-kind sales to a related party, an affiliated fund, Boulder Growth & Income Fund, Inc.

On November 30, 2008, based on cost of $193,018,056 for federal income tax purposes, aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $73,959,100 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value was $32,530,635, resulting in net unrealized appreciation of $41,428,465.

NOTE 4. CAPITAL

At November 30, 2008, 240,000,000 of $0.01 par value Common Stock were authorized, of which 12,338,660 were outstanding.

Transaction in common shares were as follows:

| | Year Ended | | Year Ended | |

| | November 30, 2008 | | November 30, 2007 | |

Common Shares outstanding – beginning of period | | 12,338,660 | | 12,338,660 | |

Common Shares issued as reinvestment of dividends | | — | | — | |

Common Shares outstanding – end of period | | 12,338,660 | | 12,338,660 | |

20

| NOTES TO FINANCIAL STATEMENTS |

| November 30, 2008 |

NOTE 5. TAXABLE AUCTION MARKET PREFERRED STOCK

The Fund’s Articles of Incorporation authorize the issuance of up to 10,000,000 shares of $0.01 par value preferred stock. On August 15, 2000, the Fund’s 775 shares of Money Market Cumulative Preferred StockTM were retired and 775 shares of Taxable Auction Market Preferred Stock (“AMPS”) were issued. AMPS is senior to the Common Stock and results in the financial leveraging of the Common Stock. Such leveraging tends to magnify both the risks and opportunities to Common Stockholders. Dividends on shares of AMPS are cumulative. The Fund’s AMPS have a liquidation preference of $100,000 per share, plus any accumulated unpaid distributions, whether or not earned or declared by the Fund but excluding interest thereon (“Liquidation Value”) and have no set retirement date.

An auction of the AMPS is generally held every 28 days. Existing stockholders may submit an order to hold, bid or sell shares on each auction date. AMPS stockholders may also trade shares in the secondary market.

In February 2008, the auction market across almost all closed-end funds became illiquid resulting in failed auctions for the Fund’s AMPS. A failed auction is not an event of default for the Fund but it has a negative impact on the liquidity of the AMPS. A failed auction occurs when there are more sellers of a fund’s AMPS than buyers. It is impossible to predict how long this imbalance will last. A successful auction for the Fund’s AMPS may not occur for some time, if ever, and even if liquidity does resume, holders of AMPS may not have the ability to sell the AMPS at their liquidation preference. As such, the Fund continues to pay dividends on the AMPS at the maximum rate, set forth in the Fund’s Articles Supplementary, the governing document for the AMPS. The Fund’s maximum rate is set at the greater of 1.25% of 30-day LIBOR or 30-day LIBOR plus 125 basis points.

The Fund may redeem its AMPS, in whole or in part, on the second business day preceding any distribution payment date at Liquidation Value. The Fund is also subject to certain restrictions relating to the AMPS. Specifically, the Fund is required under the 1940 Act to maintain an asset coverage with respect to the AMPS of 200% or greater. The Fund is also required to maintain certain coverage amounts for Standard & Poor’s and Moody’s (“rating agencies”). Failure to comply with these restrictions could preclude the Fund from declaring any distributions to common stockholders or repurchasing common shares and/or could trigger the mandatory redemption of AMPS at Liquidation Value. The Fund was in compliance with these requirements as of November 30, 2008. The holders of AMPS are entitled to one vote per share and will vote with holders of common shares as a single class, except that the AMPS holders will vote separately as a class on certain matters, as required by law or the Fund’s charter. The holders of the AMPS, voting as a separate class, are entitled at all times to elect two Directors of the Fund, and to elect a majority of the Directors of the Fund if the Fund fails to pay distributions on AMPS for two consecutive years.

In connection with the settlement of each AMPS auction, the Fund pays, through the auction agent, a service fee to each participating broker-dealer based upon the aggregate

21

NOTES TO FINANCIAL STATEMENTS |

|

November 30, 2008 | |

liquidation preference of the AMPS held by the broker-dealer’s customers. For any auction preceding a rate period of less than one year, the service fee is paid at the annual rate of 1/4 of 1%; for any auction preceding a rate period of one year or more, the service fee is paid at a rate agreed to by the Fund and the broker-dealer. These fees are paid for failed auctions as well.

On November 30, 2008, 775 shares of AMPS were outstanding at the annual rate of 2.66%. The dividend rate, as set by the auction process, is generally expected to vary with short-term interest rates. These rates may vary in a manner unrelated to the income received on the Fund’s assets, which could have either a beneficial or detrimental impact on net investment income and gains available to Common Stockholders. While the Fund expects to earn a higher return on its assets than the cost associated with the AMPS, including expenses, there can be no assurance that such results will be attained.

NOTE 6. PORTFOLIO INVESTMENTS, CONCENTRATION AND INVESTMENT QUALITY

The Fund operates as a “diversified” management investment company, as defined in the 1940 Act. Under this definition, at least 75% of the value of the Fund’s total assets must at the time of investment consist of cash and cash items (including receivables), U.S. Government securities, securities of other investment companies, and other securities limited in respect of any one issuer to an amount not greater in value than 5% of the value of the Fund’s total assets (at the time of purchase) and to not more than 10% of the voting securities of a single issuer. This limit does not apply, however, to 25% of the Fund’s assets, which may be invested in a single issuer. A more concentrated portfolio may cause the Fund’s net asset value to be more volatile and thus may subject stockholders to more risk. The Fund may hold a substantial position (up to 25% of its assets) in the common stock of a single issuer. As of November 30, 2008, the Fund held more than 25% of its assets in Berkshire Hathaway, Inc., as a direct result of the market appreciation of the issuer since the time of purchase. Thus, the volatility of the Fund’s common stock, and the Fund’s net assets value and its performance in general, depends disproportionately more on the performance of this single issuer than that of a more diversified fund.

The Fund intends to concentrate its common stock investments in a few issuers and to take large positions in those issuers. As a result, the Fund is subject to a greater risk of loss than a fund that diversifies its investments more broadly. Taking larger positions is also likely to increase the volatility of the Fund’s net asset value reflecting fluctuation in the value of its large holdings. Under normal market conditions, the Fund intends to invest in a portfolio of common stocks. The portion of the Fund’s assets invested in each can vary depending on market conditions. The term “common stocks” includes both stocks acquired primarily for their appreciation potential and stocks acquired for their income potential, such as dividend-paying RICs and REITs. The term “income securities” includes bonds, U.S. Government securities, notes, bills, debentures, preferred stocks, convertible securities, bank debt obligations, repurchase agreements and short-term money market obligations.

22

| NOTES TO FINANCIAL STATEMENTS |

| November 30, 2008 |

NOTE 7. SIGNIFICANT SHAREHOLDERS

On November 30, 2008, trusts and other entities affiliated with Stewart R. Horejsi and the Horejsi family owned 5,264,547 shares of Common Stock of the Fund, representing approximately 42.67% of the total Fund shares. Stewart R. Horejsi is the primary portfolio manager for SIA and is the Fund’s primary portfolio manager. He is responsible for the day-to-day strategic management of the Fund.

NOTE 8. SHARE REPURCHASE PROGRAM

In accordance with Section 23(c) of the 1940 Act, the Fund may from time to time, effect redemptions and/or repurchases of its AMPS and/or its Common Stock, in the open market or through private transactions; at the option of the Board of Directors and upon such terms as the Directors shall determine.

For the years ended November 30, 2008 and November 30, 2007, the Fund did not repurchase any of its own stock.

NOTE 9. TAX BASIS DISTRIBUTIONS

As determined on November 30, 2008, permanent differences resulting primarily from different book and tax accounting for gains and losses on foreign currency and certain other investments were reclassified at fiscal year-end. These reclassifications had no effect on net income, net asset value applicable to common stockholders or net asset value per common share of the Fund.

Ordinary income and long-term capital gains are allocated to common stockholders after payment of the available amounts on any outstanding AMPS. To the extent that the amount distributed to common stockholders exceeds the amount of available ordinary income and long-term capital gains after allocation to any outstanding AMPS, these distributions are treated as a tax return of capital. Additionally, to the extent that the amount distributed on any outstanding AMPS exceeds the amount of available ordinary income and long-term capital gains, these distributions are treated as a tax return of capital.

Permanent book and tax basis differences of $(858,668) and $858,668 were reclassified at November 30, 2008 among distributions in excess of net investment income and accumulated net realized losses on investments, respectively, for the Fund.

23

NOTES TO FINANCIAL STATEMENTS |

|

November 30, 2008 | |

The tax character of distributions paid during the years ended November 30, 2008 and November 30, 2007 was as follows:

| | Year Ended | | Year Ended | |

| | November 2008 | | November 2007 | |

Distributions paid from: | | | | | |

Ordinary Income | | $ | 2,125,662 | | $ | 5,501,573 | |

Long-Term Capital Gain | | 448,908 | | 11,440,578 | |

Tax Return of Capital | | 37,055,059 | | — | |

| | $ | 39,629,629 | | $ | 16,942,151 | |

As of November 30, 2008, the Fund had available for tax purposes unused capital loss carryovers of $9,313,829 expiring November 30, 2016.

As of November 30, 2008, the components of distributable earnings (accumulated losses) on a U.S. federal income tax basis were as follows:

Accumulated Capital Losses | | $ | (9,313,829 | ) |

Unrealized Appreciation | | 41,427,891 | |

| | $ | 32,114,062 | |

NOTE 10. OTHER INFORMATION

Rights Offerings: The Fund, like other closed-end funds, may at times raise cash for investment by issuing a fixed number of shares through one or more public offerings, including rights offerings. Proceeds from any such offerings will be used to further the investment objectives of the Fund.

NOTE 11. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENT

In March 2008, FASB issued Statement of Financial Accounting Standards No. 161 (“SFAS 161”) “Disclosures about Derivative Instruments and Hedging Activities”—an amendment of FASB Statement No. 133 (“SFAS 133”), expands the disclosure requirements in SFAS 133 about entity’s derivative instruments and hedging activities. SFAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. Management is currently evaluating the impact the adoption of SFAS No. 161 will have on the Fund’s financial statement disclosures.

24

| REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM |

| November 30, 2008 |

To the Stockholders and Board of Directors of Boulder Total Return Fund, Inc.:

We have audited the accompanying statement of assets and liabilities of Boulder Total Return Fund, Inc., (the “Fund”), including the portfolio of investments, as of November 30, 2008, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights of Boulder Total Return Fund, Inc. for each of the two years in the period ended November 30, 2005 were audited by other auditors whose report, dated January 13, 2006, expresses an unqualified opinion on that statement.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2008, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Boulder Total Return Fund, Inc. as of November 30, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the three years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Denver, Colorado

January 26, 2009

25

ADDITIONAL INFORMATION [Unaudited] |

|

November 30, 2008 | |

Portfolio Information. The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available (1) on the Fund’s website located at http://www.boulderfunds.net; (2) on the SEC’s website at http://www.sec.gov; or (3) for review and copying at the SEC’s Public Reference Room (“PRR”) in Washington, DC. Information regarding the operation of the PRR may be obtained by calling 1-800-SEC-0330.

Proxy Information. The policies and procedures used to determine how to vote proxies relating to portfolio securities held by the Fund are available on the Fund’s website located at http://www.boulderfunds.net. Information regarding how the Portfolio voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available at http://www.sec.gov.

Senior Officer Code of Ethics. The Fund files a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer or controller, or persons performing similar functions (the “Senior Officer Code of Ethics”), with the SEC as an exhibit to its annual report on Form N-CSR. The Fund’s Senior Officer Code of Ethics is available on the Fund’s website located at http://www.boulderfunds.net.

Privacy Statement. Pursuant to SEC Regulation S-P (Privacy of Consumer Financial Information) the Directors of the Fund have established the following policy regarding information about the Fund’s stockholders. We consider all stockholder data to be private and confidential, and we hold ourselves to the highest standards in its safekeeping and use.

General Statement. The Fund may collect nonpublic information (e.g., your name, address, email address, Social Security Number, Fund holdings (collectively, “Personal Information”)) about stockholders from transactions in Fund shares. The Fund will not release Personal Information about current or former stockholders (except as permitted by law) unless one of the following conditions is met: (i) we receive your prior written consent; (ii) we believe the recipient to be you or your authorized representative; (iii) to service or support the business functions of the Fund (as explained in more detail below), or (iv) we are required by law to release Personal Information to the recipient. The Fund has not and will not in the future give or sell Personal Information about its current or former stockholders to any company, individual, or group (except as permitted by law) and as otherwise provided in this policy.

In the future, the Fund may make certain electronic services available to its stockholders and may solicit your email address and contact you by email, telephone or US mail regarding the availability of such services. The Fund may also contact stockholders by email, telephone or US mail in connection with these services, such as to confirm enrollment in electronic stockholders communications or to update your Personal Information. In no event will the Fund transmit your Personal Information via email without your consent.

26

Use of Personal Information. The Fund will only use Personal Information (i) as necessary to service or maintain stockholder accounts in the ordinary course of business and (ii) to support business functions of the Fund and its affiliated businesses. This means that the Fund may share certain Personal Information, only as permitted by law, with affiliated businesses of the Fund, and that such information may be used for non-Fund-related solicitation. When Personal Information is shared with the Fund’s business affiliates, the Fund may do so without providing you the option of preventing these types of disclosures as permitted by law.

Safeguards regarding Personal Information. Internally, we also restrict access to Personal Information to those who have a specific need for the records. We maintain physical, electronic, and procedural safeguards that comply with Federal standards to guard Personal Information. Any doubts about the confidentiality of Personal Information, as required by law, are resolved in favor of confidentiality.

Tax Information. Of the ordinary income (including short-term capital gain) distributions made by the Fund during the fiscal year ended November 30, 2008, 100% qualify for the dividend received deduction available to stockholders.

The amount of long-term capital gains paid for the fiscal year ended November 30, 2008 was $448,908.

For the fiscal year ended November 30, 2008, 100% of the taxable investment income qualifies for the 15% dividend tax rate.

27

SUMMARY OF DIVIDEND REINVESTMENT PLAN [Unaudited]

November 30, 2008 |

|

Registered holders (“Common Stockholders”) of common shares (the “Common Shares”) are automatically enrolled (the “Participants”) in the Fund’s Dividend Reinvestment Plan (the “Plan”) whereupon all distributions of income, capital gains or managed distributions (“Distributions”) are automatically reinvested in additional Common Shares. Common Stockholders who elect to not participate in the Plan will receive all distributions in cash paid by check in United States dollars mailed directly to the stockholders of record (or if the shares are held in street name or other nominee name, then the nominee) by the custodian, as dividend disbursing agent.

PNC Global Investment Servicing (the “Agent”) serves as Agent for each Participant in administering the Plan. After the Fund declares a Distribution, if (1) the net asset value per Common Share is equal to or less than the market price per Common Share plus estimated brokerage commissions on the payment date for a Distribution, Participants will be issued Common Shares at the higher of net asset value per Common Share or 95% of the market price per Common Share on the payment date; or if (2) the net asset value per Common Share exceeds the market price plus estimated brokerage commissions on the payment date for a Distribution, the Agent shall apply the amount of such Distribution to purchase Common Shares on the open market and Participants will receive the equivalent in Common Shares valued at the weighted average market price (including brokerage commissions) determined as of the time of the purchase (generally, following the payment date of the Distribution). If, before the Agent has completed its purchases, the market price plus estimated brokerage commissions exceeds the net asset value of the Common Shares as of the payment date, the purchase price paid by the Agent may exceed the net asset value of the Common Shares, resulting in the acquisition of fewer Common Shares than if such Distribution had been paid in Common Shares issued by the Fund. If the Agent is unable to invest the full Distribution amount in purchases in the open market or if the market discount shifts to a market premium during the purchase period than the Agent may cease making purchases in the open market the instant the Agent is notified of a market premium and may invest the uninvested portion portion of the Distribution in newly issued Common Shares at the net asset value per Common Share at the close of business provided that, if the net asset value is less than or equal to 95% of the then current market price per Common Share, the dollar amount of the Distribution will be divided by 95% of the market price on the payment date. The Fund will not issue Common Shares under the Plan below net asset value.

There is no charge to Participants for reinvesting Distributions, except for certain brokerage commissions, as described below. The Agent’s fees for the handling of the reinvestment of Distributions will be paid by the Fund. There will be no brokerage commissions charged with respect to shares issued directly by the Fund. However, each Participant will pay a pro rata share of brokerage commissions incurred with respect to the Agent’s open market purchase in connection with the reinvestment of Distributions. The automatic reinvestment of Distributions will not relieve Participants of any federal income tax that may be payable on such Distributions.

28

The Fund reserves the right to amend or terminate the Plan upon 90 days’ written notice to Common Stockholders of the Fund.

Participants in the Plan may (i) request a certificate, (ii) request to sell their shares, or (iii) withdraw from the Plan upon written notice to the Agent or by telephone in accordance with the specific procedures and will receive certificates for whole Common Shares and cash for fractional Common Shares.

All correspondence concerning the Plan should be directed to the Agent, PNC Global Investment Servicing, P.O. Box 43027, Providence, RI 02940-3027. To receive a full copy of the Fund’s Dividend Reinvestment Plan, please contact the Agent at 1-800-331-1710.

29

DIRECTORS AND OFFICERS [Unaudited] | |

|

November 30, 2008 | | |

Set forth in the following table is information about the Directors of the Fund, together with their address, age, position with the Fund, term of office, length of time served and principal occupation during the last five years.

INDEPENDENT DIRECTORS

| | | | | | Number of |

| | | | | | Funds in |

| | | | | | Fund |

| | Position, Length | | Principal Occupation(s) and | | Complex |

Name, | | of Term Served, | | Other Directorships held During | | Overseen by |

Address*, Age | | and Term of Office | | the Past Five Years | | Director† |

| | | | | | |

Joel W. Looney

Chairman

Age: 47 | | Director of the Fund since 2001. Current term to expire at the 2009 Annual Meeting. | | Partner (since 1999), Financial Management Group, LLC (investment adviser); Director and Chairman (since October 2007), The Denali Fund Inc.; Director (since 2002) and Chairman (since 2003), Boulder Growth & Income Fund, Inc.; Director and Chairman (since 2003), First Opportunity Fund, Inc. | | 4 |

| | | | | | |

Dr. Dean L. Jacobson Age: 69 | | Director of the Fund since 2004. Current term to expire at the 2009 Annual Meeting. | | Founder and President, Forensic Engineering, Inc. (engineering investigations); Professor Emeritus (since 1997), Arizona State University; Director (since October 2007), The Denali Fund Inc.; Director (since 2006) Boulder Growth & Income Fund, Inc.; Director (since 2003), First Opportunity Fund, Inc. | | 4 |

| | | | | | |

Richard I. Barr