UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-07390

Boulder Total Return Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

Fund Administrative Services, LLC

2344 Spruce Street, Suite A

Boulder, CO 80302

(Address of Principal Executive Offices)(Zip Code)

Fund Administrative Services, LLC

2344 Spruce Street, Suite A

Boulder, CO 80302

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

(303) 444-5483

Date of Fiscal Year End: November 30

Date of Reporting Period: May 31, 2013

Item 1. Reports to Stockholders.

The Report to Stockholders is attached herewith.

| | |

| Boulder Total Return Fund, Inc. | | Letter from the Advisers |

| | May 31, 2013 (Unaudited) |

Dear Stockholders:

Before delving into a discussion about the strong absolute and relative performance of the Boulder Total Return Fund, Inc. (the “Fund”) over the six-month period ending May 31, 2013, I would like to take a few moments to reflect back on what has been a year of transition. The US trudged through a hotly contested presidential election cycle, Europe continued to manage through its sovereign debt issues, and economic indicators slowly turned positive. At the Fund level, the Fund’s leverage was re-financed into a new bank facility with a lower interest rate. It was even a year of transition at a personal level as I made the move to Colorado in February of last year and began my role as a Portfolio Manager with Boulder Investment Advisers, LLC. While this transition has kept me quite busy, it has been a smooth one thanks in large part to the high quality individuals I am fortunate to work alongside every day. After over a year on the job, I am proud of what we have accomplished in the past year and am excited about the actions we are currently taking to better serve the Fund’s stockholders in the future. I will discuss some of these actions in greater detail later in this letter, but for now let us proceed with the discussion of the Fund’s performance.

Over the six-month period ending May 31, 2013, the Fund generated a strong absolute return of 20.4% on net assets, resulting in a material outperformance relative to the Fund’s benchmarks. Over the same period, the S&P 500 generated a 16.4% return, the Dow Jones Industrial Average (DJIA) generated a 17.6% return and the NASDAQ Composite generated a 15.8% return. The Fund’s absolute and relative performance for the period was driven by a combination of favorable market conditions and solid execution upon our investment philosophy of buying good businesses at attractive valuations. We believe our commitment to this philosophy allowed us to identify and take advantage of multiple attractive investment opportunities over the past year, many of which proved to be key contributors to the Fund’s overall performance for the period. The chart below further illustrates the Fund’s strong performance over multiple historical periods.

| | | | | | | | | | | | | | |

| | | 3 Months | | 6 Months | | One Year | | Three Years* | | Five Years* | | Ten Years** | | Since August 1999*** |

Boulder Total Return Fund (NAV) | | 9.7% | | 20.4% | | 34.8% | | 20.5% | | 6.4% | | 9.1% | | 7.8% |

Boulder Total Return Fund (Market) | | 8.8% | | 19.9% | | 35.9% | | 18.5% | | 3.0% | | 7.3% | | 7.3% |

S&P 500 Index | | 8.2% | | 16.4% | | 27.3% | | 16.8% | | 5.4% | | 7.6% | | 3.5% |

Dow Jones Industrial Average | | 8.2% | | 17.6% | | 25.3% | | 17.3% | | 6.6% | | 8.2% | | 4.9% |

NASDAQ Composite | | 9.7% | | 15.8% | | 24.2% | | 16.7% | | 7.7% | | 9.2% | | 2.6% |

| ** | Annualized. Does not include the effect of dilution on non-participating stockholders from the July 2003 rights offering. |

| *** | Annualized since August 1999, when the current advisers became investment advisers to the Fund. Does not include the effect of dilution on non-participating stockholders from the July 2003 rights offering. |

The performance data quoted represents past performance. Past performance is no guarantee of future results. Fund returns include reinvested dividends and distributions, but do not reflect the reduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares and do not reflect brokerage commissions, if any. Returns of the S&P 500 Index, the DJIA and the NASDAQ Composite include reinvested dividends and distributions, but do not reflect the effect of commissions, expenses or taxes, as applicable. You cannot invest directly in any of these indices. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

| | |

Semi-Annual Report | May 31, 2013 | | 1 |

| | |

| Letter from the Advisers | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

A key contributor to the Fund’s performance on an absolute and relative basis for the six-month period was the Fund’s combined position in the Class A and Class B shares of Berkshire Hathaway, Inc. (Berkshire Hathaway), which generated total returns of 29.9% and 29.5% for the period, respectively. In addition to its strong performance for the period, the contribution from the combined Berkshire Hathaway position was amplified by its large weight in the Fund. At period end, the combined Berkshire Hathaway position accounted for approximately 41.9% of the total portfolio. While the aggregate position in Berkshire Hathaway accounts for a large portion of the total portfolio, we believe its diverse underlying holdings mitigate some of the risk of having such a concentrated position.

Another key contributor to the Fund’s performance on an absolute and relative basis was the Fund’s position in JP Morgan Chase & Company (JP Morgan). In May of 2012, JP Morgan’s share price fell sharply as the company disclosed large trading losses as part of the then-developing “London Whale” story. Upon researching the situation, we felt this was a negative for the company, but one it would be able to manage without materially damaging its business value over the long-run. More importantly, we believed the share price at the time represented an attractive discount to our estimate of the company’s underlying intrinsic value. As a result, we took the opportunity to build a sizable position in JP Morgan, which generated a 34.6% return over the period and grew to account for roughly 4.8% of the Fund’s total assets as of the period end. Despite the strong share price performance over the last several months, we believe the market continues to underappreciate the company and its stock.

An additional contributor to performance on an absolute and relative basis was the Fund’s position in Johnson & Johnson, which generated a total return of 22.6% for the period. At period end, the position accounted for approximately 4.5% of the total portfolio. While Johnson & Johnson has been a solid performer for the Fund over the last several months, we remain comfortable with the company for a variety of reasons including its strong financial position, the recovery of its consumer business and a solid product pipeline for its pharmaceutical business.

Other key contributors to performance on an absolute and relative basis were the Fund’s positions in Wells Fargo & Company (Wells Fargo) and the American Depository Receipts (ADRs) of Sanofi. The Fund’s position in Wells Fargo generated a total return of 24.7% for the period and accounted for approximately 4.1% of the total portfolio at period end. The Fund’s position in Sanofi generated a total return of 22.4% for the period and accounted for approximately 2.5% of the total portfolio at period end.

On the other end of the spectrum, a key detractor to the Fund’s performance on an absolute and relative basis was its position in Freeport-McMoRan Copper & Gold, Inc. (Freeport McMoRan). For the period, the Fund’s position in Freeport McMoRan generated a negative 19.4% return and accounted for roughly 1.2% of total assets at period end. The poor performance during the period was driven by two primary factors. The first of these was a decline in copper prices during the period amid growing concerns of a potential near-term supply glut. The second factor was the market’s negative reception of the company’s plans to acquire two oil and gas companies: McMoRan Exploration Company (McMoRan) and Plains Exploration & Production Company (Plains).

In the case of the planned acquisitions, we believe the market simply underappreciates the large potential upside provided by the resource reserves being acquired by Freeport McMoRan. In regards to a potential near-term supply glut for copper, we tend to agree with the market. The data does suggest new supply growth will outpace demand growth in the near future potentially pushing the copper market into a period of oversupply. However, where the market sees risk, we see opportunity. The divergence in viewpoints is primarily due to a difference in investment holding

| | |

| Boulder Total Return Fund, Inc. | | Letter from the Advisers |

| | May 31, 2013 (Unaudited) |

periods. Due to the rise of high frequency trading, among other factors, a large portion of today’s market participants attempt to generate returns by speculating on the short-term movements in a stock. We focus on investing in good businesses for the long-run. By doing this, we strive to look through short-term issues to understand a business’s underlying fundamentals and long-term prospects. In Freeport McMoRan, we see a high quality asset base operated by one of the copper industry’s leading and lowest cost operators that has the ability to generate solid free cash flow even at lower copper prices. We anticipate that this free cash flow will go to support an attractive dividend and to quickly de-leverage the company’s balance sheet. While we expect supply and demand fundamentals will be weak in the near-term, we believe they will improve over the longer-run as demand gradually recovers and new supply growth remains limited past near-term capacity additions. In the end, we believe the share price for Freeport McMoRan materially discounts the company’s long-term prospects and added to the position during the period.

Another key detractor to performance on an absolute and relative basis was the Fund’s position in Linn Energy, LLC (Linn Energy). Linn Energy is an oil and natural gas company focused on the development of reserves in multiple regions of the United States. For the period, Linn Energy generated a negative 13.5% return and accounted for roughly 0.2% of the total portfolio at period end. Due to the weak recent performance of the position, we continue to monitor it closely.

Additional key detractors to performance on an absolute and relative basis were Cheung Kong Holdings Ltd. (Cheung Kong) and Midland Holdings Limited (Midland). The Fund’s position in Cheung Kong accounted for approximately 1.8% of total assets at period end and generated a negative 5.1% return during the period. Cheung Kong is a property development and holding company based in Hong Kong. Over the past year government authorities have introduced new policies aimed at cooling Hong Kong’s property markets, which we believe negatively impacted the company’s stock during the period. As Midland is primarily a real estate agency firm in Hong Kong, it was also negatively impacted by these policies, which reduced property transaction volumes and pressured transaction values. For the period, the Fund’s position in Midland generated a negative 4.3% return and accounted for 0.6% of total assets at period end. We continue to remain comfortable with Midland as the company is one of only two dominant players in Hong Kong, generates solid free cash flow and remains in our view attractively valued, especially after accounting for the company’s large cash position.

The Fund’s position in Diageo PLC (Diageo) was also a detractor to performance on an absolute and relative basis for the period as it generated a total return of negative 1.8%. Importantly, the Fund no longer held a position in Diageo at period end due to it being sold. The primary reason for selling out of this position was our belief that more attractive investment opportunities were available elsewhere in the market.

In the end, the net result for the Fund was a strong absolute and relative performance for the six-month period ending May 31, 2013. While satisfied with the result, we firmly believe there is always room for improvement. As I mentioned earlier, we are in the process of implementing a variety of actions that we expect will allow us to better serve the Fund’s stockholders and hopefully reduce the Fund’s share price discount to net asset value per share. While many of these initiatives are still being analyzed and developed, it is too early for us to discuss them in detail at this time. However, we are progressing quickly on the initiatives announced in the last stockholder letter. The chief among these will be the launch of our new website in the next couple of months. After listening to stockholder feedback, we recognized the need to address the market’s perception of the Fund and the Advisers. We hope that the new website presentation will attend to this issue by providing current and potential stockholders an enhanced understanding of the Fund, the Advisers, and our investment philosophy. In addition, we remain focused on improving the quality of our stockholder

| | |

Semi-Annual Report | May 31, 2013 | | 3 |

| | |

| Letter from the Advisers | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

communications. This includes the stockholder letter, which I hope has provided an increasing amount of insight into the Fund and how it is being managed. As part of this effort, I encourage stockholders to let us know if there are any topics you would like us to address in future letters.

As stated earlier, I am excited about the actions we are currently taking to better serve the Fund’s stockholders and look forward to their eventual rollout. In the meantime, I hope you have a safe and happy summer.

Sincerely,

Brendon Fischer, CFA

Portfolio Manager

July 8, 2013

The views and opinions in the preceding commentary are as of the date of this letter and are subject to change at any time. The author does not assume any obligation to update any facts, statements or opinions in this letter. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Portfolio weightings and other figures in the foregoing commentary are provided as of period-end, unless otherwise stated.

Note to Stockholders on the Fund’s Discount. As most stockholders are aware, the Fund’s shares presently trade at a significant discount to net asset value. The Fund’s board of directors is aware of this, monitors the discount and periodically reviews the limited options available to mitigate the discount. In addition, there are several factors affecting the Fund’s discount over which the board and management have little control. In the end, the market sets the Fund’s share price. For long-term stockholders of a closed-end fund, we believe the Fund’s discount should only be one of many factors taken into consideration at the time of your investment decision.

Note to Stockholders on Leverage. The Fund is currently leveraged through a credit facility. The Fund may utilize leverage to seek to enhance the returns for its stockholders over the long-term; however, this objective may not be achieved in all interest rate environments. Leverage creates certain risks for stockholders, including the likelihood of greater volatility of the Fund’s NAV and market price. There are certain risks associated with borrowing through a line of credit, including, but not limited to risks associated with purchasing securities on margin. In addition, borrowing through a line of credit subjects the Fund to contractual restrictions on its operations and requires the Fund to maintain certain asset coverage ratios on its outstanding indebtedness.

Note to Stockholders on Concentration of Investments. The Fund’s investment advisers feel it is important that stockholders be aware that the Fund is highly concentrated in a small number of positions. Concentrating investments in a fewer number of securities may involve a degree of risk that is greater than a fund which has less concentrated investments spread out over a greater number of securities.

| | |

| Boulder Total Return Fund, Inc. | | Financial Data |

| | May 31, 2013 (Unaudited) |

| | | | | | | | |

| | | Net Asset Value | | Per Share of Common Stock Market Price | | Dividend Paid | | |

11/30/12 | | $ 22.86 | | $ 18.11 | | $ 0.00 | | |

12/31/12 | | 23.03 | | 18.04 | | 0.00 | | |

1/31/13 | | 24.47 | | 19.46 | | 0.00 | | |

2/28/13 | | 25.09 | | 19.96 | | 0.00 | | |

3/31/13 | | 26.22 | | 20.90 | | 0.00 | | |

4/30/13 | | 26.45 | | 21.18 | | 0.00 | | |

5/31/13 | | 27.52 | | 21.71 | | 0.00 | | |

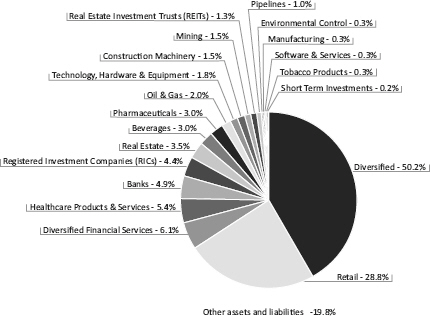

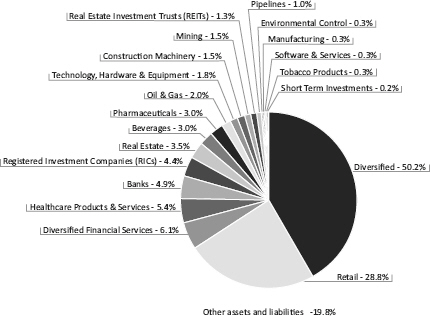

INVESTMENTS AS A % OF TOTAL NET ASSETS AVAILABLE TO COMMON STOCK

| | |

Semi-Annual Report | May 31, 2013 | | 5 |

| | |

| Portfolio of Investments | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| |

| |

LONG TERM INVESTMENTS 119.6% | | | | |

DOMESTIC COMMON STOCK 108.5% | | | | |

Banks 4.9% | | | | |

410,511 | | Wells Fargo & Co.(1) | | | $16,646,221 | |

| |

Construction Machinery 1.5% | | | | |

60,000 | | Caterpillar, Inc.(1) | | | 5,148,000 | |

| |

Diversified 50.2% | | | | |

690 | | Berkshire Hathaway, Inc., Class A*(1) | | | 118,197,000 | |

460,000 | | Berkshire Hathaway, Inc., Class B*(1) | | | 52,472,200 | |

| | | | | | |

| | | | | 170,669,200 | |

Diversified Financial Services 6.1% | | | | |

5,700 | | Franklin Resources, Inc.(1) | | | 882,417 | |

361,650 | | JPMorgan Chase & Co.(1) | | | 19,742,473 | |

| | | | | | |

| | | | | 20,624,890 | |

Environmental Control 0.3% | | | | |

30,000 | | Republic Services, Inc.(1) | | | 1,023,000 | |

| |

Healthcare Products & Services 5.4% | | | | |

216,000 | | Johnson & Johnson(1) | | | 18,182,880 | |

| |

Manufacturing 0.3% | | | | |

8,000 | | 3M Co.(1) | | | 882,160 | |

| |

Mining 1.5% | | | | |

163,000 | | Freeport-McMoRan Copper & Gold, Inc.(1) | | | 5,061,150 | |

| |

Oil & Gas 1.4% | | | | |

31,500 | | Chevron Corp.(1) | | | 3,866,625 | |

30,000 | | Linn Energy LLC(1) | | | 987,000 | |

| | | | | | |

| | | | | 4,853,625 | |

Pipelines 1.0% | | | | |

54,950 | | Enterprise Products Partners L.P.(1) | | | 3,263,481 | |

| |

Real Estate 0.3% | | | | |

17,300 | | WP Carey & Co. LLC | | | 1,171,902 | |

| |

Registered Investment Companies (RICs) 4.4% | | | | |

736,836 | | Cohen & Steers Infrastructure Fund, Inc. | | | 14,596,721 | |

18,726 | | RMR Real Estate Income Fund | | | 397,928 | |

| | | | | | |

| | | | | 14,994,649 | |

Retail 28.8% | | | | |

160,900 | | Kohl’s Corp.(1) | | | 8,271,869 | |

| | |

| Boulder Total Return Fund, Inc. | | Portfolio of Investments |

| | May 31, 2013 (Unaudited) |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| |

| |

Retail (continued) | | | | |

370,000 | | Wal-Mart Stores, Inc.(1) | | | $27,690,800 | |

915,000 | | Yum! Brands, Inc.(1) | | | 61,991,250 | |

| | | | | | |

| | | | | 97,953,919 | |

Software & Services 0.3% | | | | |

5,000 | | International Business Machines Corp. | | | 1,040,100 | |

| |

Technology, Hardware & Equipment 1.8% | | | | |

253,500 | | Cisco Systems, Inc.(1) | | | 6,104,280 | |

| |

Tobacco Products 0.3% | | | | |

9,700 | | Philip Morris International, Inc.(1) | | | 881,827 | |

| |

TOTAL DOMESTIC COMMON STOCK

(Cost $158,095,302) | | | 368,501,284 | |

| | | | | | |

| |

FOREIGN COMMON STOCK 11.1% | | | | |

Beverages 3.0% | | | | |

60,000 | | Heineken Holding NV | | | 3,558,840 | |

95,117 | | Heineken NV | | | 6,649,956 | |

| | | | | | |

| | | | | 10,208,796 | |

Oil & Gas 0.6% | | | | |

39,200 | | Transocean, Ltd.(1) | | | 1,969,016 | |

| |

Pharmaceuticals 3.0% | | | | |

190,000 | | Sanofi, ADR | | | 10,087,100 | |

| |

Real Estate 3.2% | | | | |

529,500 | | Cheung Kong Holdings, Ltd. | | | 7,489,643 | |

104,500 | | Henderson Land Development Co., Ltd. | | | 736,370 | |

6,156,000 | | Midland Holdings, Ltd. | | | 2,648,731 | |

| | | | | | |

| | | | | 10,874,744 | |

Real Estate Investment Trusts (REITs) 1.3% | | | | |

4,779,336 | | Kiwi Income Property Trust | | | 4,558,333 | |

| |

TOTAL FOREIGN COMMON STOCK

(Cost $27,890,861) | | | 37,697,989 | |

| | | | | | |

| |

TOTAL LONG TERM INVESTMENTS

(Cost $185,986,163) | | | 406,199,273 | |

| | | | | | |

| | |

Semi-Annual Report | May 31, 2013 | | 7 |

| | |

| Portfolio of Investments | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| |

| |

SHORT TERM INVESTMENTS 0.2% | | | | |

MONEY MARKET FUNDS 0.2% | | | | |

543,277 | | Dreyfus Treasury & Agency Cash Management Money Market Fund, Institutional Class, 7-Day Yield - 0.010% | | | $543,277 | |

| | | | | | |

| |

TOTAL MONEY MARKET FUNDS

(Cost $543,277) | | | 543,277 | |

| | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS

(Cost $543,277) | | | 543,277 | |

| | | | | | |

| |

TOTAL INVESTMENTS 119.8%

(Cost $186,529,440) | | | 406,742,550 | |

| |

OTHER ASSETS AND LIABILITIES (19.8%) | | | (67,134,503 | ) |

| | | | | | |

| |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS 100.0% | | | $339,608,047 | |

| | | | | | |

| * | Non-income producing security. |

| (1) | Pledged security; a portion or all of the security is pledged as collateral for borrowings as of May 31, 2013. (See Note 11.) |

Percentages are stated as a percent of the Total Net Assets Available to Common Stockholders.

Common Abbreviations:

ADR - American Depositary Receipt.

LLC - Limited Liability Company.

L.P. - Limited Partnership.

Ltd. - Limited.

NV - Naamloze Vennootchap is the Dutch term for a public limited liability corporation.

See accompanying notes to financial statements.

| | |

| Boulder Total Return Fund, Inc. | | Portfolio of Investments |

| | May 31, 2013 (Unaudited) |

| | | | |

| Regional Breakdown as a % of Total Net Assets Available to Common Stockholders | |

| |

United States | | | 108.7% | |

Hong Kong | | | 3.2% | |

Netherlands | | | 3.0% | |

France | | | 3.0% | |

New Zealand | | | 1.3% | |

Switzerland | | | 0.6% | |

Other Assets and Liabilities | | | (19.8)% | |

See accompanying notes to financial statements.

| | |

Semi-Annual Report | May 31, 2013 | | 9 |

| | |

| Statement of Assets and Liabilities | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

| | | | |

ASSETS: | | | | |

Investments, at value (Cost $186,529,440) (Note 1) | | $ | 406,742,550 | |

Segregated cash with brokers | | | 266,780 | |

Foreign currency, at value (Cost $176,434) | | | 175,271 | |

Dividends and interest receivable | | | 1,115,004 | |

Prepaid expenses and other assets | | | 26,091 | |

| |

Total Assets | | | 408,325,696 | |

| |

| |

LIABILITIES: | | | | |

Loan payable (Note 11) | | | 68,116,464 | |

Investment co-advisory fees payable (Note 2) | | | 394,454 | |

Administration and co-administration fees payable (Note 2) | | | 72,564 | |

Audit fees payable | | | 36,494 | |

Directors’ fees and expenses payable (Note 2) | | | 26,168 | |

Legal fees payable | | | 20,761 | |

Printing fees payable | | | 17,984 | |

Custody fees payable | | | 10,190 | |

Rating agency fees payable | | | 7,537 | |

Interest due on loan payable (Note 11) | | | 3,520 | |

Accrued expenses and other payables | | | 11,513 | |

| |

Total Liabilities | | | 68,717,649 | |

| |

TOTAL NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS | | $ | 339,608,047 | |

| |

| |

NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) CONSIST OF: | | | | |

Par value of common stock (Note 4) | | $ | 123,387 | |

Paid-in capital in excess of par value of common stock | | | 123,229,457 | |

Overdistributed net investment income | | | (544,658) | |

Accumulated net realized loss on investments sold and foreign currency related transactions | | | (3,407,754) | |

Net unrealized appreciation on investments and foreign currency translation | | | 220,207,615 | |

| |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 339,608,047 | |

| |

| |

Net Asset Value, $339,608,047/12,338,660 common stock outstanding | | $ | 27.52 | |

See accompanying notes to financial statements.

| | |

| Boulder Total Return Fund, Inc. | | Statement of Operations |

| | For the Six Months Ended May 31, 2013 (Unaudited) |

| | | | |

INVESTMENT INCOME: | | | | |

Dividends (net of foreign withholding taxes $87,277) | | $ | 3,681,387 | |

| |

Total Investment Income | | | 3,681,387 | |

| |

| |

EXPENSES: | | | | |

Investment co-advisory fees (Note 2) | | | 2,359,102 | |

Administration and co-administration fees (Note 2) | | | 394,991 | |

Interest on loan | | | 95,814 | |

Directors’ fees and expenses (Note 2) | | | 56,107 | |

Legal fees | | | 52,770 | |

Insurance expense | | | 24,446 | |

Custody fees | | | 23,654 | |

Audit fees | | | 22,719 | |

Printing fees | | | 14,786 | |

Transfer agency fees | | | 9,482 | |

Preferred stock broker commissions and auction agent fees | | | 4,606 | |

Other | | | 42,979 | |

| |

Total Expenses | | | 3,101,456 | |

Less fees waived by investment advisers | | | (188,792) | |

| |

Net Expenses | | | 2,912,664 | |

| |

Net Investment Income | | | 768,723 | |

| |

| |

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

Net realized gain/(loss) on: | | | | |

Investment securities | | | 8,636,621 | |

Foreign currency related transactions | | | 11,012 | |

| |

| | | 8,647,633 | |

| |

Net change in unrealized appreciation/(depreciation) on: | | | | |

Investment securities | | | 48,663,991 | |

Foreign currency related translation | | | (6,390) | |

| |

| | | 48,657,601 | |

| |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 57,305,234 | |

| |

PREFERRED STOCK TRANSACTIONS: | | | | |

Distributions from net investment income | | | (541,557) | |

| |

Total Preferred Stock Transactions | | | (541,557) | |

| |

NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 57,532,400 | |

| |

See accompanying notes to financial statements.

| | |

Semi-Annual Report | May 31, 2013 | | 11 |

| | |

| Statements of Changes in Net Assets | | Boulder Total Return Fund, Inc. |

| | |

| | | | | | | | |

| | | For the Six

Months Ended May 31, 2013

(Unaudited) | | | For the Year Ended November 30, 2012 | |

| |

| | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 768,723 | | | $ | 459,516 | |

Net realized gain on investment securities and foreign currency related

transactions | | | 8,647,633 | | | | 7,017,986 | |

Net change in unrealized appreciation on investment securities and foreign currency translations | | | 48,657,601 | | | | 41,285,047 | |

| |

| | | 58,073,957 | | | | 48,762,549 | |

| |

| | |

PREFERRED STOCK TRANSACTIONS (NOTE 5): | | | | | | | | |

Distributions from net investment income | | | (541,557) | | | | (1,207,772) | |

Gain on redemption of Taxable Auction Market Preferred Stock | | | – | | | | 418,000 | |

| |

Total Preferred Stock Transactions | | | (541,557) | | | | (789,772) | |

| |

| | |

Net Increase in Net Assets Applicable to Common Stockholders Resulting from Operations | | | 57,532,400 | | | | 47,972,777 | |

| |

| | |

REDEMPTION OF TAXABLE AUCTION MARKET PREFERRED STOCK (PAR VALUE) | | | (68,000,000 | ) | | | (4,100,000 | ) |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 350,075,647 | | | | 306,202,870 | |

| |

End of year (including overdistributed net investment income of $(544,658) and $(771,824), respectively) | | | 339,608,047 | | | | 350,075,647 | |

| |

Taxable Auction Market Preferred Stock, Par Value | | | – | | | | (68,000,000) | |

| |

Net Assets Applicable to Common Stockholders | | $ | 339,608,047 | | | $ | 282,075,647 | |

| |

See accompanying notes to financial statements.

| | |

| Boulder Total Return Fund, Inc. | | Statement of Cash Flows |

| | For the Six Months Ended May 31, 2013 (Unaudited) |

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net increase in net assets from operations excluding dividends on Auction Preferred Shares and gains on Auction Preferred Shares redemption | | $ | 58,073,957 | |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: | | | | |

Purchase of investment securities | | | (15,079,999 | ) |

Proceeds from disposition of investment securities | | | 15,179,451 | |

Net proceeds from disposition of short-term investment securities | | | 280,761 | |

Net realized gain from investment securities | | | (8,636,621 | ) |

Net realized gain n foreign currency related transactions | | | (11,012 | ) |

Net change in unrealized appreciation on investment securities | | | (48,663,991 | ) |

Net change in unrealized depreciation on foreign currency related transactions | | | 6,390 | |

Increase in dividends and interest receivable | | | (687,140 | ) |

Decrease in prepaid expenses and other assets | | | 4,893 | |

Increase in interest due on loan payable | | | 3,520 | |

Increase in co-advisory fees payable | | | 64,079 | |

Decrease in audit fees payable | | | (5,821 | ) |

Increase in legal fees payable | | | 13,692 | |

Increase in administration and co-administration fees payable | | | 11,262 | |

Increase in printing fees payable | | | 6,112 | |

Increase in payable for directors’ fees and expenses payable | | | 25,791 | |

Decrease in custody fees payable | | | (11,554 | ) |

Increase in accrued expenses and other payables | | | 10,294 | |

| |

Net Cash Provided by Operating Activities | | | 584,064 | |

| |

| |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Cash provided by loan | | | 68,116,464 | |

Cash distributions paid on Auction Preferred Shares | | | (583,263 | ) |

Retirement of Auction Preferred Shares | | | (68,000,000 | ) |

| |

Net Cash Used in Financing Activities | | | (466,799 | ) |

| |

| |

Effect of exchange rates on cash | | | 5,092 | |

| | | | |

Net increase in cash | | | 122,357 | |

Cash and foreign currency, beginning balance | | | 319,694 | |

| | | | |

Cash and foreign currency, ending balance | | $ | 442,051 | |

| | | | |

| |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | |

Cash paid for interest on loan net of rebate during the period was $92,294. | | | | |

See accompanying notes to financial statements.

| | |

Semi-Annual Report | May 31, 2013 | | 13 |

| | |

| Financial Highlights | | Boulder Total Return Fund, Inc. |

| | |

Contained below is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the period indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

|

OPERATING PERFORMANCE: |

Net asset value - Beginning of Year |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment income(a) |

Net realized and unrealized gain/(loss) on investments |

Total from Investment Operations |

PREFERRED STOCK TRANSACTIONS |

Distributions from net investment income |

Distributions from tax return of capital |

Gain on redemption of AMPS* |

Total Preferred Stock Transactions |

Net Increase/(Decrease) from Operations Applicable to Common Stock |

DISTRIBUTIONS: COMMON STOCK |

Distributions from net investment income |

Distributions from net realized capital gains |

Distributions from tax return of capital |

Total Distributions Paid to Common Stockholders |

Net Increase/(Decrease) in Net Asset Value |

Common Share Net Asset Value - End of Year |

Common Share Market Value - End of Year |

Total Return, Common Share Net Asset Value(b) |

Total Return, Common Share Market Value(b) |

RATIOS TO AVERAGE NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS:(c) |

Ratio of operating expenses to average net assets including waiver |

Ratio of operating expenses to average net assets excluding waiver |

Ratio of net investment income/(loss) to average net assets including waiver |

Ratio of net investment income/(loss) to average net assets excluding waiver |

SUPPLEMENTAL DATA: |

Portfolio turnover rate |

Net Assets Applicable to Common Stockholders, End of Period (000’s) |

Number of Common Shares Outstanding, End of Period (000’s) |

Ratio of Net Operating Expenses including waiver, when applicable, to Total Average Net Assets including AMPS(c)* |

|

Borrowings at End of Period |

Aggregate Amount Outstanding (000s) |

Asset Coverage Per $1,000 (000s) |

| | |

| Boulder Total Return Fund, Inc. | | Financial Highlights |

| | |

| | | | | | | | | | | | | | | | | | | | | | |

For the Six

Months

Ended May 31,

2013

(Unaudited) | | | For the Year

Ended

November 30,

2012 | | | For the Year

Ended

November 30,

2011 | | | For the Year

Ended

November 30,

2010 | | | For the Year

Ended

November 30,

2009 | | | For the Year

Ended

November 30,

2008 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 22.86 | | | $ | 18.97 | | | $ | 18.66 | | | $ | 15.21 | | | $ | 12.70 | | | $ | 24.95 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.06 | | | | 0.04 | | | | 0.08 | | | | 0.07 | | | | 0.03 | | | | 0.14 | |

| | 4.64 | | | | 3.92 | | | | 0.32 | | | | 3.43 | | | | 2.56 | | | | (9.18 | ) |

| | 4.70 | | | | 3.96 | | | | 0.40 | | | | 3.50 | | | | 2.59 | | | | (9.04 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.04 | ) | | | (0.10 | ) | | | (0.05 | ) | | | (0.05 | ) | | | – | | | | (0.06 | ) |

| | – | | | | – | | | | (0.04 | ) | | | (0.04 | ) | | | (0.11 | ) | | | (0.21 | ) |

| | – | | | | 0.03 | | | | – | | | | 0.04 | | | | 0.03 | | | | – | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.09 | ) | | | (0.05 | ) | | | (0.08 | ) | | | (0.27 | ) |

| | 4.66 | | | | 3.89 | | | | 0.31 | | | | 3.45 | | | | 2.51 | | | | (9.31 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | – | | | | – | | | | – | | | | – | | | | – | | | | (0.11 | ) |

| | – | | | | – | | | | – | | | | – | | | | – | | | | (0.04 | ) |

| | – | | | | – | | | | – | | | | – | | | | – | | | | (2.79 | ) |

| | – | | | | – | | | | – | | | | – | | | | – | | | | (2.94 | ) |

| | 4.66 | | | | 3.89 | | | | 0.31 | | | | 3.45 | | | | 2.51 | | | | (12.25 | ) |

| $ | 27.52 | | | $ | 22.86 | | | $ | 18.97 | | | $ | 18.66 | | | $ | 15.21 | | | $ | 12.70 | |

| $ | 21.71 | | | $ | 18.11 | | | $ | 15.23 | | | $ | 15.52 | | | $ | 12.69 | | | $ | 9.17 | |

| | 20.4 | % | | | 20.5 | % | | | 1.7 | % | | | 22.7 | % | | | 19.8 | % | | | (40.3 | )% |

| | 19.9 | % | | | 18.9 | % | | | (1.9 | )% | | | 22.3 | % | | | 38.4 | % | | | (52.6 | )% |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 1.87% | (d) | | | 1.90 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 1.99% | (d) | | | 2.03 | % | | | 2.12 | % | | | 2.19 | % | | | 2.53 | % | | | 2.22 | % |

| | 0.15% | (d) | | | (0.29 | )% | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | 0.02% | (d) | | | (0.41 | )% | | | 0.18 | % | | | 0.13 | % | | | 0.22 | % | | | (0.70 | )% |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 4 | % | | | 10 | % | | | 3 | % | | | 6 | % | | | 12 | % | | | 6 | % |

| $ | 339,608 | | | $ | 282,076 | | | $ | 234,103 | | | $ | 230,287 | | | $ | 187,653 | | | $ | 156,733 | |

| | 12,339 | | | | 12,339 | | | | 12,339 | | | | 12,339 | | | | 12,339 | | | | 12,339 | |

| | N/A | | | | 1.51 | % | | | 1.62 | % | | | 1.63 | % | | | 1.70 | % | | | 1.69 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | $68,116 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | $5,986 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

See accompanying notes to financial statements.

| | |

Semi-Annual Report | May 31, 2013 | | 15 |

| | |

| Financial Highlights | | Boulder Total Return Fund, Inc. |

| | |

| * | Taxable Auction Market Preferred Shares (“AMPS”). |

| (a) | Calculated based on the average number of common shares outstanding during each fiscal period. |

| (b) | Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period. Total return based on common share market value assumes the purchase of common shares at the market price on the first day and sale of common shares at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s distribution reinvestment plan. |

| (c) | Expense ratios do not include the effect of transactions with preferred stockholders. The income ratio includes income earned on assets attributable to AMPS outstanding. |

The table below sets out information with respect to Taxable Auction Market Preferred Stock currently outstanding.(1)(2)

| | | | | | | | | | | | | | |

| | | Par Value (000) | | | Total Shares

Outstanding (000) | | Asset Coverage Per

Share(3) | | | Involuntary

Liquidating

Preference Per

Share(4) | |

11/30/12 | | $ | 68,000 | | | 0.68 | | $ | 514,878 | | | $ | 100,000 | |

11/30/11 | | | 72,100 | | | 0.72 | | | 424,725 | | | | 100,000 | |

11/30/10 | | | 72,100 | | | 0.72 | | | 419,429 | | | | 100,000 | |

11/30/09 | | | 74,900 | | | 0.75 | | | 350,563 | | | | 100,000 | |

11/30/08 | | | 77,500 | | | 0.78 | | | 302,273 | | | | 100,000 | |

| (1) | See Note 5 in Notes to Financial Statements. |

| (2) | The AMPS issued by the Fund were fully redeemed at par value on April 10, 2013. |

| (3) | Calculated by subtracting the Fund’s total liabilities from the Fund’s total assets and dividing by the number of AMPS outstanding. |

| (4) | Excludes accumulated undeclared dividends. |

See accompanying notes to financial statements.

| | |

| Boulder Total Return Fund, Inc. | | Notes to Financial Statements |

| | May 31, 2013 (Unaudited) |

NOTE 1. SIGNIFICANT ACCOUNTING POLICIES

Boulder Total Return Fund, Inc. (the “Fund”), is a diversified, closed-end management company organized as a Maryland corporation and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”).

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements is in accordance with generally accepted accounting principles in the United States of America (“GAAP”) which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Portfolio Valuation: Equity securities for which market quotations are readily available (including securities listed on national securities exchanges and those traded over-the-counter) are valued based on the last sales price at the close of the applicable exchange. If such equity securities were not traded on the valuation date, but market quotations are readily available, they are valued at the bid price provided by an independent pricing service or by principal market makers. Equity securities traded on NASDAQ are valued at the NASDAQ Official Closing Price. Debt securities are valued at the mean between the closing bid and asked prices, or based on a matrix system which utilizes information (such as credit ratings, yields and maturities) from independent pricing services, principal market maker, or other independent sources. Short-term securities which mature in more than 60 days are valued at current market quotations. Short-term securities which mature in 60 days or less are valued at amortized cost, which approximates fair value.

The Fund’s Board of Directors (the “Board”) has delegated to the advisers, through approval of the appointment of the members of the advisers’ Valuation Committee, the responsibility of determining the fair value of any security or financial instrument owned by the Fund for which market quotations are not readily available or where the pricing agent or market maker does not provide a valuation or methodology, or provides a valuation or methodology that, in the judgment of the advisers, does not represent fair value (“Fair Value Securities”). The advisers use a third-party pricing consultant to assist the advisers in analyzing, developing, applying and documenting a methodology with respect to certain Fair Value Securities. The advisers and their Valuation Consultant, as appropriate, use valuation techniques that utilize both observable and unobservable inputs. In such circumstances, the Valuation Committee of the advisers are responsible for (i) identifying Fair Value Securities, (ii) analyzing the Fair Value Security and developing, applying and documenting a methodology for valuing Fair Value Securities, and (iii) periodically reviewing the appropriateness and accuracy of the methods used in valuing Fair Value Securities. The appointment of any officer or employee of the advisers to the Valuation Committee shall be promptly reported to the Board and ratified by the Board at its next regularly scheduled meeting. The advisers are responsible for reporting to the Board, on a quarterly basis, valuations and certain findings with respect to the Fair Value Securities. Such valuations and findings are reviewed by the entire Board on a quarterly basis.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under certain circumstances. If the Fund determines that developments between the close of a foreign market and the close of the New York Stock Exchange (“NYSE”) will, in its judgment, materially affect the value of some or all of its portfolio securities, the Fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In

| | |

Semi-Annual Report | May 31, 2013 | | 17 |

| | |

| Notes to Financial Statements | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

deciding whether it is necessary to adjust closing prices to reflect fair value, the Fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The Fund may also fair value securities in other situations, such as when a particular foreign market is closed but the U.S. market is open. The Fund uses outside pricing services to provide it with closing prices. The advisers may consider whether it is appropriate, in light of relevant circumstances, to adjust such valuation in accordance with the Fund’s valuation procedures. The Fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. If the Fund uses adjusted prices, the Fund will periodically compare closing prices, the next day’s opening prices in the same markets, and those adjusted prices as a means of evaluating its security valuation process.

Various inputs are used to determine the value of the Fund’s investments. Observable inputs are inputs that reflect the assumptions market participants would use based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions based on the best information available in the circumstances.

These inputs are summarized in the three broad levels listed below.

| | | | |

Level 1 | | - | | Unadjusted quoted prices in active markets for identical investments |

Level 2 | | - | | Significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

Level 3 | | - | | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used as of May 31, 2013 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | |

Investments in Securities at Value* | | Level 1 - Quoted

Prices | | | Level 2 -

Significant

Observable Inputs | | Level 3 -

Significant

Unobservable

Inputs | | Total | |

Domestic Common Stock | | | $368,501,284 | | | $– | | $– | | | $368,501,284 | |

Foreign Common Stock | | | 37,697,989 | | | – | | – | | | 37,697,989 | |

Short Term Investments | | | 543,277 | | | – | | – | | | 543,277 | |

| | | | | | | | | | | | | |

TOTAL | | | $406,742,550 | | | $– | | $– | | | $406,742,550 | |

| | | | | | | | | | | | | |

* For detailed descriptions, see the accompanying Portfolio of Investments.

The Fund evaluates transfers into or out of Level 1, Level 2 and Level 3 as of the end of the reporting period. During the six months ended May 31, 2013, there were no transfers between Level 1 and 2 securities.

| | |

| Boulder Total Return Fund, Inc. | | Notes to Financial Statements |

| | May 31, 2013 (Unaudited) |

Recent Accounting Pronouncements: In December 2011, the FASB issued ASU No. 2011-11 “Related Disclosures about Offsetting Assets and Liabilities.” The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The ASU is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The guidance requires retrospective application for all comparative periods presented. Management is currently evaluating the impact ASU 2011-11 may have on the financial statement disclosures.

Securities Transactions and Investment Income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded as of the ex-dividend date or for certain foreign securities when the information becomes available to the Fund. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis using the interest method.

Dividend income from investments in real estate investment trusts (“REITs”) is recorded at management’s estimate of income included in distributions received. Distributions received in excess of this amount are recorded as a reduction of the cost of investments. The actual amount of income and return of capital are determined by each REIT only after its fiscal year-end, and may differ from the estimated amounts. Such differences, if any, are recorded in the Fund’s following year.

Foreign Currency Translations: The Fund may invest a portion of its assets in foreign securities. In the event that the Fund executes a foreign security transaction, the Fund will generally enter into a forward foreign currency contract to settle the foreign security transaction. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks. See Foreign Issuer Risk under Note 6.

The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate prevailing at the end of the period, and purchases and sales of investment securities, income and expenses transacted in foreign currencies are translated at the exchange rate on the dates of such transactions. Foreign currency gains and losses result from fluctuations in exchange rates between trade date and settlement date on securities transactions, foreign currency transactions, and the difference between the amounts of foreign interest and dividends recorded on the books of the Fund and the amounts actually received.

The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Dividends and Distributions to Stockholders: It is the Fund’s policy to distribute substantially all net investment income and net realized gains to stockholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The stockholders of Taxable Auction Market Preferred Stock (“AMPS”) were previously entitled to receive cumulative cash dividends as declared by the Fund’s Board. Distributions to stockholders are

| | |

Semi-Annual Report | May 31, 2013 | | 19 |

| | |

| Notes to Financial Statements | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

recorded on the ex-dividend date. Any net realized short-term capital gains will be distributed to stockholders at least annually. Any net realized long-term capital gains may be distributed to stockholders at least annually or may be retained by the Fund as determined by the Fund’s Board. Capital gains retained by the Fund are subject to tax at the corporate tax rate. Subject to the Fund qualifying as a registered investment company, any taxes paid by the Fund on such net realized long-term gains may be used by the Fund’s stockholders as a credit against their own tax liabilities.

Indemnifications: Like many other companies, the Fund’s organizational documents provide that its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Fund’s maximum exposure under these arrangements is unknown as this could involve future claims against the Fund.

Federal Income Tax: For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its earnings to its stockholders. Accordingly, no provision for federal income or excise taxes has been made.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

As of and during the period ended May 31, 2013, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

NOTE 2. ADVISORY FEES, ADMINISTRATION FEES AND OTHER AGREEMENTS

Boulder Investment Advisers, L.L.C. (“BIA”) and Stewart Investment Advisers (“SIA”) serve as co-investment advisers to the Fund (the “Advisers”). The Fund pays the Advisers a monthly fee (the “Advisory Fee”) at an annual rate of 1.25% of the value of the Fund’s average monthly total net assets plus the principal amount of leverage, if any (“Net Assets”). Effective December 1, 2011, BIA and SIA agreed to waive 0.10% of the Advisory Fee such that the Advisory Fee will be calculated at the annual rate of 1.15% of Net Assets. The fee waiver agreement has a one-year term and is renewable annually. Effective December 1, 2012, the Advisers renewed their agreement to waive 0.10% of the Advisory Fee such that the Advisory Fee will be calculated at an annual rate of 1.15% of Net Assets.

The equity owners of BIA are Evergreen Atlantic, LLC, a Colorado limited liability company (“EALLC”), and the Lola Brown Trust No. 1B (the “Lola Trust”), each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act. Stewart West Indies Trading Company, Ltd. is a Barbados international business company doing business as Stewart Investment

| | |

| Boulder Total Return Fund, Inc. | | Notes to Financial Statements |

| | May 31, 2013 (Unaudited) |

Advisers. The equity owner of SIA is the Stewart West Indies Trust. SIA and BIA are considered “affiliated persons”, as that term is defined in the 1940 Act, of the Fund and Fund Administrative Services, LLC (“FAS”). SIA receives a monthly fee equal to 75% of the fees earned by the Advisers, and BIA receives 25% of the fees earned by the Advisers.

FAS serves as the Fund’s co-administrator. Under the Administration Agreement, FAS provides certain administrative and executive management services to the Fund. The Fund pays FAS a monthly fee, calculated at an annual rate of 0.20% of the value of the Fund’s Net Assets up to $100 million, and 0.15% of the Fund’s Net Assets over $100 million. The equity owners of FAS are EALLC and the Lola Trust.

As BIA, SIA and FAS are considered affiliates of the Fund, as the term is defined in the 1940 Act, agreements between the Fund and those entities are considered affiliated transactions.

ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s co-administrator. As compensation for its services, ALPS receives certain out-of-pocket expenses and asset-based fees, which are accrued daily and paid monthly. Fees paid to ALPS are calculated based on combined Net Assets of the Fund and the following affiliates of the Fund: Boulder Growth & Income Fund, Inc., The Denali Fund Inc., and First Opportunity Fund, Inc. (the “Fund Group”). ALPS receives the greater of the following, based on combined Net Assets of the Fund Group: an annual minimum fee of $460,000, or an annualized fee of 0.045% on Net Assets up to $1 billion, an annualized fee of 0.03% on Net Assets between $1 and $3 billion, and an annualized fee of 0.02% on Net Assets above $3 billion.

The Fund pays each member of the Board (a “Director”) who is not a director, officer, employee, or affiliate of the Advisers, FAS, or any of their affiliates a fee of $8,000 per annum, plus $4,000 for each in-person meeting, $500 for each audit committee meeting, $500 for each nominating committee meeting, and $500 for each telephonic meeting of the Board. The chairman of the audit committee receives an additional $1,000 per meeting. The Fund will also reimburse all non-interested Directors for travel and out-of-pocket expenses incurred in connection with such meetings.

Bank of New York Mellon (“BNY Mellon”) serves as the Fund’s custodian. Computershare Shareowner Services (“Computershare”) serves as the Fund’s Common Stock servicing agent, dividend-paying agent and registrar. As compensation for BNY Mellon’s and Computershare’s services, the Fund pays each a monthly fee plus certain out-of-pocket expenses.

Deutsche Bank Trust Company Americas (“Auction Agent”), a wholly owned subsidiary of Deutsche Bank AG, served as the Fund’s Preferred Stock transfer agent, registrar, dividend disbursing agent and redemption agent until the redemption of the shares on April 10, 2013.

NOTE 3. SECURITIES TRANSACTIONS

Purchases and sales of securities, excluding short term securities, during the six months ended May 31, 2013 were $15,079,999 and $15,179,451, respectively.

| | |

Semi-Annual Report | May 31, 2013 | | 21 |

| | |

| Notes to Financial Statements | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

NOTE 4. CAPITAL

At May 31, 2013, 240,000,000 of $0.01 par value common stock (the “Common Stock”) were authorized, of which 12,338,660 were outstanding.

Transaction in common stock were as follows:

| | | | | | | | |

| | | For the Six

Months Ended

May 31, 2013 | | | For the Year Ended

November 30, 2012 | |

| | |

Common Stock outstanding - beginning of period | | | 12,338,660 | | | | 12,338,660 | |

Common Stock outstanding - end of period | | | 12,338,660 | | | | 12,338,660 | |

| | | | | | | | | |

NOTE 5. TAXABLE AUCTION MARKET PREFERRED STOCK

The Fund’s Articles of Incorporation authorize the issuance of up to 10,000,000 shares of $0.01 par value preferred stock. On August 15, 2000, the Fund’s 775 shares of Money Market Cumulative Preferred Stock™ were retired and 775 shares of AMPS were issued. AMPS are senior to the Common Stock and result in the financial leveraging of the Common Stock. Such leveraging tends to magnify both the risks and opportunities to common stockholders. Dividends on shares of AMPS are cumulative. The Fund’s AMPS had a liquidation preference of $100,000 per share, plus any accumulated unpaid distributions, whether or not earned or declared by the Fund but excluding interest thereon (“Liquidation Value”) and had no set retirement date.

The Fund retired 26 shares of AMPS during the fiscal year ended November 30, 2009, with a total par value of $2,600,000. Those shares were purchased at a discount, an average price of $84,923 per share, resulting in a realized gain of $392,000. During the fiscal year ended November 30, 2010, the Fund retired 28 shares of AMPS, with a total par value of $2,800,000 . These shares were purchased at a discount, an average price of $81,857 per share, resulting in a realized gain of $508,000. During the year ended November 30, 2012, the Fund retired 41 shares of AMPS, with a total par value of $4,100,000. These shares were purchased at a discount, an average price of $90,000, resulting in a realized gain of $418,000.

In March 2013 the Fund announced its intent to redeem all outstanding shares of its AMPS. Proper notice was sent to AMPS holders on or before April 10, 2013, and all outstanding AMPS issued by the Fund were redeemed at par, in their entirety, pursuant to their terms.

The Fund obtained alternative financing to provide new funding in order to redeem the AMPS and provide leverage to the Fund going forward. See Note 11 - Line of Credit, for further information on the borrowing facility used by the Fund during the six months ended, and as of, May 31, 2013.

An auction of the AMPS was generally held every 28 days. Existing stockholders could submit an order to hold, bid or sell shares on each auction date. AMPS stockholders could also trade shares in the secondary market. In February 2008, the auction preferred shares market for closed-end funds became illiquid resulting in failed auctions for the AMPS. As a result of the failed auctions, the Fund paid dividends at the maximum rate (set forth in the Fund’s Articles Supplementary, the governing document for the AMPS), which prior to July 12, 2012, was set at the greater of 1.25% of 30-day LIBOR or 30-day LIBOR plus 125 basis points. On July 12, 2012, Moody’s Investors Service

| | |

| Boulder Total Return Fund, Inc. | | Notes to Financial Statements |

| | May 31, 2013 (Unaudited) |

(“Moody’s”), one of two nationally recognized statistical rating organizations currently rating the Fund’s AMPS announced that it had downgraded the AMPS from Aaa to A2. This action occurred following a review by Moody’s of its ratings of the securities of all closed-end registered investment companies, which was undertaken in conjunction with the adoption of changes to the methodology Moody’s uses to rate securities issued by closed-end funds. The Fund’s AMPS continued to have a credit rating in the highest rating category from Standard & Poor’s ratings. As a result of the downgrade by Moody’s of the Fund’s AMPS, the maximum rate was set at the greater of 2.00% of 30-day LIBOR, or 30-day LIBOR plus 200 basis points.

The Fund was subject to certain limitations and restrictions while AMPS were outstanding. Failure to comply with these limitations and restrictions could have precluded the Fund from declaring any dividends or distributions to common stockholders or repurchasing common shares and/or could trigger the mandatory redemption of AMPS at their liquidation value. Specifically, the Fund was required under the Fund’s Articles Supplementary and the 1940 Act to maintain certain asset coverage with respect to the outstanding AMPS. The holders of AMPS were entitled to one vote per share and voted with holders of Common Stock as a single class, except that the AMPS voted separately as a class on certain matters, as required by law or the Fund’s charter. The holders of the AMPS, voting as a separate class, were entitled at all times to elect two Directors of the Fund, and to elect a majority of the Directors of the Fund if the Fund failed to pay distributions on AMPS for two consecutive years.

For the period from December 1, 2012 to the redemption date of April 10, 2013, distribution rates ranged from 2.20% to 2.21%. The Fund declared distributions to preferred stockholders for the period from December 1, 2012 to April 10, 2013 of $541,557.

In connection with the settlement of each AMPS auction, the Fund paid, through the Auction Agent, a service fee to each participating broker-dealer based upon the aggregate liquidation preference of the AMPS held by the broker-dealer’s customers. Prior to February 19, 2009 the Fund paid at an annual rate of 0.25% and upon this date the annual rate was reduced to 0.05% until redemption of the AMPS. These fees were for failed auctions as well.

NOTE 6. PORTFOLIO INVESTMENTS AND CONCENTRATION

Under normal market conditions, the Fund intends to invest in a portfolio of common stocks. The portion of the Fund’s assets invested in each stock can vary depending on market conditions. The term “common stocks” includes both stocks acquired primarily for their appreciation potential and stocks acquired for their income potential, such as dividend-paying RICs and REITs.

Concentration Risk: The Fund operates as a “diversified” management investment company, as defined in the 1940 Act. Under this definition, at least 75% of the value of the Fund’s total assets must at the time of investment consist of cash and cash items (including receivables), U.S. Government securities, securities of other investment companies, and other securities limited in respect of any one issuer to an amount not greater in value than 5% of the value of the Fund’s total assets (at the time of purchase) and to not more than 10% of the voting securities of a single issuer. This limit does not apply, however, to 25% of the Fund’s assets, which may be invested in securities representing more than 5% of the Fund’s total assets or even in a single issuer.

| | |

Semi-Annual Report | May 31, 2013 | | 23 |

| | |

| Notes to Financial Statements | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

As of May 31, 2013, the Fund held more than 25% of its assets in Berkshire Hathaway, Inc., as a direct result of the market appreciation of the issuer since the time of purchase. In addition, the Fund contains highly concentrated positions in other stocks as well. Thus, the volatility of the Fund’s net asset value and its performance in general, depends disproportionately more on the performance of this single issuer and its other larger positions than that of a more diversified fund. As a result, the Fund may be subject to a greater risk of loss than a fund that diversifies its investments more broadly.

Effective July 30, 2010, the Fund implemented a Board initiated and approved fundamental investment policy which prohibits the Fund from investing more than 4% of its total assets (including leverage) in any single issuer at the time of purchase. The Fund’s holdings as of July 30, 2010 were grandfathered into the policy and so any positions already greater than 4% of total assets are exempt from this limitation.

Foreign Issuer Risk: Investment in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers. These risks may include, but are not limited to: (i) less information about non-U.S. issuers or markets may be available due to less rigorous disclosure, accounting standards or regulatory practices; (ii) many non-U.S. markets are smaller, less liquid and more volatile thus, in a changing market, the advisers may not be able to sell the Fund’s portfolio securities at times, in amounts and at prices they consider reasonable; (iii) currency exchange rates or controls may adversely affect the value of the Fund’s investments; (iv) the economies of non-U.S. countries may grow at slower rates than expected or may experience downturns or recessions; and, (v) withholdings and other non-U.S. taxes may decrease the Fund’s return.

Changes in Investment Policies: On May 2, 2011, stockholders approved elimination of the Fund’s fundamental investment policy prohibiting the Fund from purchasing securities on margin.

NOTE 7. SIGNIFICANT STOCKHOLDERS

On May 31, 2013, trusts and other entities affiliated with Stewart R. Horejsi and the Horejsi family owned 5,200,661 shares of Common Stock of the Fund, representing approximately 42.15% of the total Common Stock outstanding. Stewart R. Horejsi is the Chief Investment Officer of BIA and SIA and is a portfolio manager of the Fund. Entities affiliated with Mr. Horejsi and the Horejsi family also own the Advisers and FAS.

NOTE 8. SHARE REPURCHASE PROGRAM

In accordance with Section 23(c) of the 1940 Act, the Fund may from time to time effect redemptions and/or repurchases of its AMPS and/or its Common Stock, in the open market or through private transactions; at the option of the Board and upon such terms as the Board shall determine.

For the six months ended May 31, 2013, the Fund did not repurchase any of its Common Stock. For the six months ended May 31, 2013 the Fund purchased and retired the remaining 680 shares AMPS at par value. For the year ended November 30, 2012, the Fund purchased 41 shares of AMPS at a discount and retired them at par value.

| | |

| Boulder Total Return Fund, Inc. | | Notes to Financial Statements |

| | May 31, 2013 (Unaudited) |

NOTE 9. TAX BASIS DISTRIBUTIONS

Ordinary income and long-term capital gains are allocated to common stockholders after payment of the available amounts on any outstanding AMPS. To the extent that the amount distributed to common stockholders exceeds the amount of available ordinary income and long-term capital gains after allocation to any outstanding AMPS, these distributions are treated as a tax return of capital. Additionally, to the extent that the amount distributed on any outstanding AMPS exceeds the amount of available ordinary income and long-term capital gains, these distributions are treated as a tax return of capital.

The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year end; accordingly, tax basis balances have not been determined as of May 31, 2013.

The character of distributions paid on a tax basis during the year ending November 30, 2013 and November 30, 2012 is as follows:

| | | | |

| | | For the Year Ended

November 30, 2012 | |

Distributions paid from: | | | | |

Ordinary Income | | $ | 1,207,772 | |

| | | $ | 1,207,772 | |

| | | | | |

As of November 30, 2012, the Fund had available for tax purposes unused capital loss carryovers totaling $12,381,094, of which $1,738,291 expires November 30, 2016, $9,855,326 expires November 30, 2017, $32,789 expires November 30, 2018, and $754,688 expires November 30, 2019.

Capital loss carryovers used during the period ended November 30, 2012 were $(7,707,680).

On May 31, 2013, based on cost of $186,611,629 for federal income tax purposes, aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $222,922,543, aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value was $2,791,622, resulting in net unrealized appreciation of $220,130,921.

NOTE 10. OTHER INFORMATION

Rights Offerings: The Fund, like other closed-end funds, may at times raise cash for investment by issuing a fixed number of shares through one or more public offerings, including rights offerings. Proceeds from any such offerings will be used to further the investment objectives of the Fund.

NOTE 11. LINE OF CREDIT

On March 1, 2013 the Fund entered into a financing package that includes a Committed Facility Agreement (the “Agreement”) with BNP Paribas Prime Brokerage, Inc. (“BNP”) that allowed the Fund to borrow up to $70,000,000 (“Initial Maximum Commitment”) and a Lending Agreement, as defined below. Borrowings under the Agreement are secured by assets of the Fund that are held by the Fund’s custodian in a separate account (the “pledged collateral”). Under the terms of the

| | |

Semi-Annual Report | May 31, 2013 | | 25 |

| | |

| Notes to Financial Statements | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

Agreement, BNP was permitted in its discretion, with 270 calendar days advance notice (the “Notice Period”), to reduce or call the entire Initial Maximum Commitment. Interest on the borrowing is charged at the one month LIBOR (London Inter-bank Offered Rate) plus 0.80% on the amount borrowed.

For the period ended May 31, 2013, the average amount borrowed under the Agreement and the average interest rate for the amount borrowed were $68,116,464 and 0.998%, respectively. As of May 31, 2013, the amount of such outstanding borrowings is $68,116,464. The interest rate applicable to the borrowings on May 31, 2013 was 0.994%. As of May 31, 2013, the amount of pledged collateral was $191,804,048.

The Lending Agreement is a separate side-agreement between the Fund and BNP pursuant to which BNP may borrow a portion of the pledged collateral (the “Lent Securities”) in an amount not to exceed the outstanding borrowings owed by the Fund to BNP under the Agreement. The Lending Agreement is intended to permit the Fund to reduce the cost of its borrowings under the Agreement. BNP has the ability to reregister the Lent Securities in its own name or in another name other than the Fund to pledge, re-pledge, sell, lend or otherwise transfer or use the collateral with all attendant rights of ownership. The Fund may designate any security within the pledged collateral as ineligible to be a Lent Security, provided there are eligible securities within the pledged collateral in an amount equal to the outstanding borrowing owed by the Fund. During the period in which the Lent Securities are outstanding, BNP must remit payment to the Fund equal to the amount of all dividends, interest or other distributions earned or made by the Lent Securities. The Fund receives income from BNP based on the value of the Lent Securities. This income is recorded as Securities lending income on the Statement of Operations.

Under the terms of the Lending Agreement, the Lent Securities are marked to market daily, and if the value of the Lent Securities exceeds the value of the then-outstanding borrowings owed by the Fund to BNP under the Agreement (the “Current Borrowings”), BNP must, on that day, either (1) return Lent Securities to the Fund’s custodian in an amount sufficient to cause the value of the outstanding Lent Securities to equal the Current Borrowings; or (2) post cash collateral with the Fund’s custodian equal to the difference between the value of the Lent Securities and the value of the Current Borrowings. If BNP fails to perform either of these actions as required, the Fund will recall securities, as discussed below, in an amount sufficient to cause the value of the outstanding Lent Securities to equal the Current Borrowings. The Fund can recall any of the Lent Securities and BNP shall, to the extent commercially possible, return such security or equivalent security to the Fund’s custodian no later than three business days after such request. If the Fund recalls a Lent Security pursuant to the Lending Agreement, and BNP fails to return the Lent Securities or equivalent securities in a timely fashion, BNP shall remain liable to the Fund’s custodian for the ultimate delivery of such Lent Securities, or equivalent securities, and for any buy-in costs that the executing broker for the sales transaction may impose with respect to the failure to deliver. The Fund shall also have the right to apply and set-off an amount equal to one hundred percent (100%) of the then-current fair market value of such Lent Securities against the Current Borrowings. As of May 31, 2013, the value of securities on loan was $63,063,896.

The Board has approved the Agreement and the Lending Agreement. No violations of the Agreement or the Lending Agreement occurred during the period ended May 31, 2013.

| | |

| Boulder Total Return Fund, Inc. | | Notes to Financial Statements |

| | May 31, 2013 (Unaudited) |

The interest incurred on borrowed amounts is recorded as Interest on loan in the Statement of Operations, a part of Total Expenses. Total Expenses are used to calculate some of the ratios shown in the Financial Highlights. This differs from the way the dividends paid on the Preferred Shares were recorded in prior years as those amounts were excluded from Total Expenses on the Statement of Operations. This change in presentation, based on accounting principles generally accepted in the U.S., has caused the ratio of expenses to average net assets (as shown in the Financial Highlights) to increase for the periods ended May 31, 2013. This change in presentation is a reflection of how the information is presented on the financial statements, rather than a true increase in the cost of leverage (financing vs. the Preferred Shares, now redeemed).

| | |

Semi-Annual Report | May 31, 2013 | | 27 |

| | |

| Additional Information | | Boulder Total Return Fund, Inc. |

May 31, 2013 (Unaudited) | | |

PORTFOLIO INFORMATION

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available (1) on the Fund’s website at www.boulderfunds.net; (2) on the SEC’s website at www.sec.gov; or (3) for review and copying at the SEC’s Public Reference Room (“PRR”) in Washington, DC. Information regarding the operation of the PRR may be obtained by calling 1-800-SEC-0330.

PROXY VOTING

The policies and procedures used to determine how to vote proxies relating to portfolio securities held by the Fund are available, without charge, on the Fund’s website located at www.boulderfunds.net, on the SEC’s website at www.sec.gov, or by calling 303-449-0426. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available at www.sec.gov.

SENIOR OFFICER CODE OF ETHICS

The Fund files a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer or controller, or persons performing similar functions (the “Senior Officer Code of Ethics”), with the SEC as an exhibit to its annual report on Form N-CSR. The Fund’s Senior Officer Code of Ethics is available on the Fund’s website located at www.boulderfunds.net.

PRIVACY STATEMENT