Filed by: ING Mutual Funds (SEC File Nos.: 33-56094; 811-07428) and ING Equity Trust (SEC File Nos.: 333-56881; 811-08817) pursuant to Rule 425 under the Securities Act of 1933, as amended.

September 19, 2012

ING U.S. Investment Management

Client Talking Points

For Internal Use Only — Not To Be Shared With The Public.

Tradewinds Update

The Fund’s Adviser, ING Investments, LLC, proposed a new course of action following the departure of co-founder and CIO David Iben and several other investment personnel from the Funds’ Sub-Adviser, Tradewinds Global Investors, LLC (“Tradewinds”).

· ING Value Choice Fund (“Value Choice Fund”)

· ING Global Value Choice Fund (“Global Value Choice Fund”)

· ING International Value Choice Fund (“International Value Choice Fund”)

· What is happening?

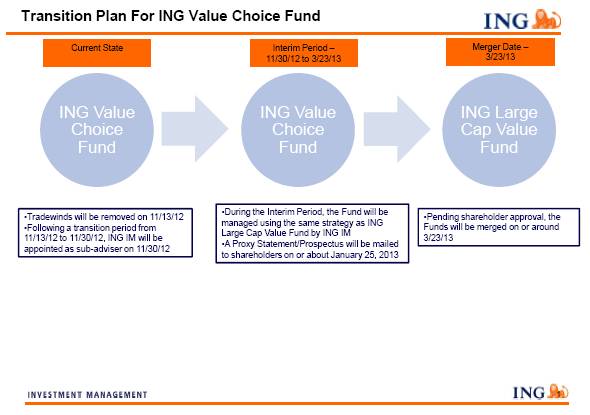

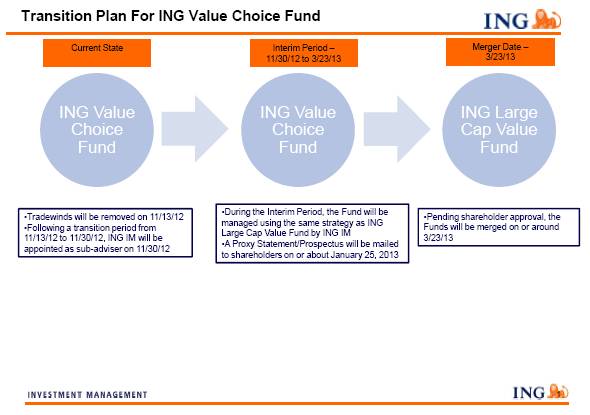

· Tradewinds will be removed as sub-adviser to be effective on November 13, 2012, followed by a two-week transition period

· The proposed actions will have an Interim Period followed by a merger with the ultimate Surviving Funds

· ING Investment Management Co. LLC (“ING IM”) will be appointed and manage the Funds during the Interim Period, which is expected to last from November 30, 2012 to March 23, 2013

· Pending approval, the mergers will occur on or around March 23, 2013

· Why is there a two-step transition?

· The Funds’ Board of Trustees believed expedited action was reasonable given the changes Tradewinds, and approved the removal of Tradewinds as sub-adviser to be effective on November 13, 2012

· During the Interim Period, the Funds will be managed by ING IM using the same strategy as the Surviving Funds

· During Interim Period, shareholders will vote to approve the changes and accompanying mergers

· What are potential benefits to investors as a result of these changes?

· Reduction in Fund expense limitation agreements, effective November 30, 2012, will provide shareholders with a benefit. For example, the proposed Class A expense limits are set out below:

· ING Value Choice - 1.40% reduced to 1.25%

· ING Global Value Choice – 1.50% reduced to 1.35%

For Internal Use Only — Not To Be Shared With The Public.

· ING International Value Choice – 1.60% reduced to 1.35%

· ING Value Choice Fund

· Removal of Tradewinds on November 13, 2012 followed by transition period

· Appointment of ING IM as sub-adviser effective November 30, 2012

· Portfolio Managers Chris Corapi and Bob Kloss

· Pending shareholder approval, reorganization of ING Value Choice Fund into ING Large Cap Value Fund, on or about March 23, 2013

· What is the experience of the ING Large Cap Value team?

· The Value Choice Fund will be managed by the ING IM team of Chris Corapi and Bob Kloss using the same strategy as ING Large Cap Value Fund during the Interim Period.

· Pending shareholder approval, ING Value Choice Fund will merge into ING Large Cap Value Fund on or around March 23, 2013.

· The surviving Fund, ING Large Cap Value Fund, has been sub-advised by ING IM since inception in December 2007.

The performance is set out below. The ING Large Cap Value Fund was launched in December 2007.

As of August 31, 2012 | | YTD | | 1 year | | 3 year | | 5 year | | 10 year | |

ING Large Cap Value Fund — Class I | | 11.21 | % | 18.24 | % | — | | — | | — | |

ING Value Choice Fund — Class I | | -3.77 | | -8.53 | | 8.39 | | 3.33 | | — | |

· What are the Funds’ expenses?

ING Value Choice Fund

Annual Fund Operating Expenses(1)

Expenses you pay each year as a % of the value of your investment

Class | | A | | B | | C | | I | | O | | W | |

Management Fees | % | 0.90 | | 0.90 | | 0.90 | | 0.90 | | 0.90 | | 0.90 | |

Distribution and/or Shareholder Services (12b-1) Fees | % | 0.25 | | 1.00 | | 1.00 | | None | | 0.25 | | None | |

Administrative Services Fees | % | 0.10 | | 0.10 | | 0.10 | | 0.10 | | 0.10 | | 0.10 | |

Other Expenses | % | 0.21 | | 0.21 | | 0.21 | | 0.14 | | 0.21 | | 0.21 | |

Acquired Fund Fees and Expenses | % | 0.02 | | 0.02 | | 0.02 | | 0.02 | | 0.02 | | 0.02 | |

Total Annual Fund Operating Expenses(2) | % | 1.48 | | 2.23 | | 2.23 | | 1.16 | | 1.48 | | 1.23 | |

Waivers and Reimbursements(3) | % | (0.27 | ) | (0.27 | ) | (0.27 | ) | (0.34 | ) | (0.27 | ) | (0.27 | ) |

Total Annual Fund Operating Expenses after Waivers and Reimbursements | % | 1.21 | | 1.96 | | 1.96 | | 0.82 | | 1.21 | | 0.96 | |

(1) Expense ratios have been adjusted to reflect current contractual rates.

(2) Total Annual Fund Operating Expenses may be higher than the Fund’s ratio of expenses to average net assets shown in the Fund’s Financial Highlights, which reflect the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

(3) Effective November 30, 2012, the adviser is contractually obligated to limit expenses to 1.25%, 2.00%, 2.00%, 0.80%, 1.25%, and 1.00% for Class A, Class B, Class C, Class I, Class O, and Class W shares, respectively, through October 1, 2014; the obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees. The obligation will automatically renew for one-year terms unless it is terminated by the Fund or the adviser upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years.

ING Large Cap Value Fund

Annual Fund Operating Expenses

Expenses you pay each year as a % of the value of your investment

Class | | A | | B | | C | | I | | R(1),(2) | | W | |

Management Fees | % | 0.65 | | 0.65 | | 0.65 | | 0.65 | | 0.65 | | 0.65 | |

Distribution and/or Shareholder Services (12b-1) Fees | % | 0.25 | | 1.00 | | 1.00 | | None | | 0.50 | | None | |

Administrative Services Fees | % | 0.10 | | 0.10 | | 0.10 | | 0.10 | | 0.10 | | 0.10 | |

Other Expenses | % | 0.20 | | 0.20 | | 0.20 | | 0.13 | | 0.20 | | 0.20 | |

Total Annual Fund Operating Expenses | % | 1.20 | | 1.95 | | 1.95 | | 0.88 | | 1.45 | | 0.95 | |

Waivers and Reimbursements(3) | % | None | | None | | None | | (0.08 | ) | (0.05 | ) | None | |

Total Annual Fund Operating Expenses after Waivers and Reimbursements | % | 1.20 | | 1.95 | | 1.95 | | 0.80 | | 1.40 | | 0.95 | |

(1) Based on Class A shares’ expenses adjusted for class specific differences.

(2) Expense ratios have been adjusted to reflect current contractual rates.

(3) The adviser is contractually obligated to limit expenses to 1.25%, 2.00%, 2.00%, 1.00%, 1.50%, and 1.00% for Class A, Class B, Class C, Class I, Class R, and Class W shares, respectively, through October 1, 2012. The obligation will automatically renew for one-year terms unless it is terminated by the Fund or the adviser upon written notice within 90 days of the end of the current term or upon termination of the management agreement and is subject to possible recoupment by the adviser within three years. In addition, the adviser is contractually obligated to further limit expenses of Class I shares to 0.80% through October 1, 2012. There is no guarantee that this obligation will continue after October 1, 2012. The obligation will only renew if the adviser elects to renew it and is subject to possible recoupment by the adviser within three years. These obligations do not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. Lastly, the distributor is contractually obligated to waive 0.05% of the distribution fee for Class R shares of the Fund through October 1, 2013. There is no guarantee that the distribution fee waiver will continue after October 1, 2013. The distribution fee waiver will continue only if the distributor elects to renew it.

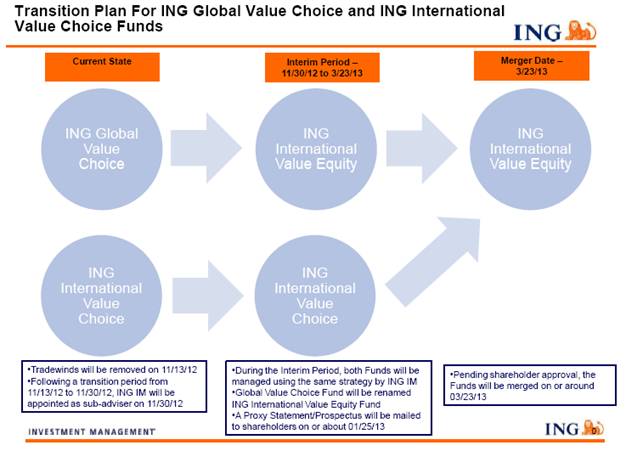

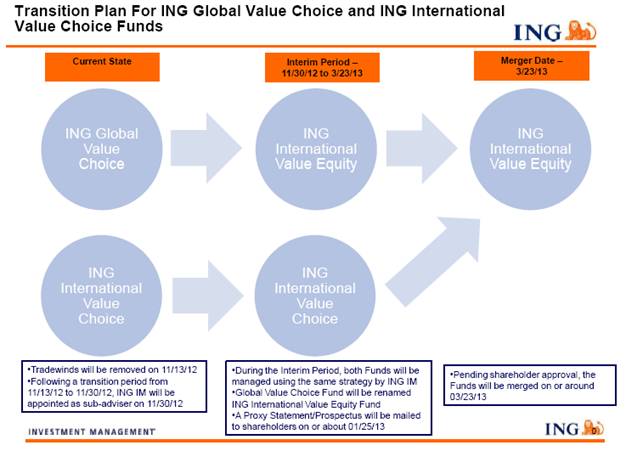

· ING Global Value Choice

· Removal of Tradewinds on November 13, 2012 followed by transition period

· Appointment of ING IM as sub-adviser with concurrent name and strategy change to “ING International Value Equity Fund,” effective November 30, 2012

· Martin Jansen, David Rabinowitz and Joseph Vultaggio will manage the Fund

· ING International Value Choice Fund

· Removal of Tradewinds on November 13, 2012 followed by transition period

· Appointment of ING IM as sub-adviser, effective November 30, 2012

· Martin Jansen, David Rabinowitz and Joseph Vultaggio will manage the Fund

· Pending shareholder approval, reorganization of ING International Value Choice Fund into ING International Value Equity Fund (formerly ING Global Value Choice Fund), effective March 23, 2012

The performance is set out below. ING IM has sub-advised the Portfolio since July 2002. Martin Jansen has been the Portfolio Manager since January 2011. ING IM completed their hiring and build-out of the team in January 2012.

As of August 31, 2012 | | YTD | | 1 year | | 3 year | | 5 year | | 10 year | |

ING International Value Portfolio — Class I | | 7.38 | % | -0.32 | % | -1.20 | % | -6.13 | % | 4.61 | % |

ING Global Value Choice Fund — Class I | | -6.11 | | -12.59 | | 5.46 | | 3.19 | | — | |

ING International Value Choice Fund — Class I | | -2.96 | | -12.01 | | -1.41 | | -3.49 | | — | |

· Will there be any impact to ING International Value Fund?

· Management notes that ING International Value Fund, which is managed by sub-advisers ING Investment Management, Brandes Investment Partners and del Rey Global Investors, will not be affected by these changes.

· What are the Funds’ expenses?

ING Global Value Choice Fund (to be renamed ING International Value Equity Fund)

Annual Fund Operating Expenses(1)

Expenses you pay each year as a % of the value of your investment

Class | | A | | B | | C | | I | | W | |

Management Fees | % | 0.88 | | 0.88 | | 0.88 | | 0.88 | | 0.88 | |

Distribution and/or Shareholder Services (12b-1) Fees | % | 0.25 | | 1.00 | | 1.00 | | None | | None | |

Administrative Services Fees | % | 0.10 | | 0.10 | | 0.10 | | 0.10 | | 0.10 | |

Other Expenses | % | 0.20 | | 0.20 | | 0.20 | | 0.10 | | 0.20 | |

Acquired Fund Fees and Expenses | % | 0.01 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | |

Total Annual Fund Operating Expenses(2) | % | 1.44 | | 2.19 | | 2.19 | | 1.09 | | 1.19 | |

Waivers and Reimbursements(3) | % | (0.08 | ) | (0.08 | ) | (0.08 | ) | None | | (0.08 | ) |

Total Annual Fund Operating Expenses after Waivers and Reimbursements | % | 1.36 | | 2.11 | | 2.11 | | 1.09 | | 1.11 | |

(1) | Expense ratios have been adjusted to reflect current contractual rates. |

(2) | Total Annual Fund Operating Expenses may be higher than the Fund’s ratio of expenses to average net assets shown in the Fund’s Financial Highlights, which reflect the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

(3) | Effective November 30, 2012, the adviser is contractually obligated to limit expenses to 1.35%, 2.10%, 2.10%, 1.10%, and 1.10% for Class A, Class B, Class C, Class I, and Class W shares, respectively, through March 1, 2014; the |

| obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees. The obligation will automatically renew for one-year terms unless it is terminated by the Fund or the adviser upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. |

ING International Value Choice Fund

Annual Fund Operating Expenses(1)

Expenses you pay each year as a % of the value of your investment

Class | | A | | B | | C | | I | | W | |

Management Fees | % | 1.00 | | 1.00 | | 1.00 | | 1.00 | | 1.00 | |

Distribution and/or Shareholder Services (12b-1) Fees | % | 0.25 | | 1.00 | | 1.00 | | None | | None | |

Administrative Services Fees | % | 0.10 | | 0.10 | | 0.10 | | 0.10 | | 0.10 | |

Other Expenses | % | 0.47 | | 0.47 | | 0.47 | | 0.28 | | 0.47 | |

Acquired Fund Fees and Expenses | % | 0.01 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | |

Total Annual Fund Operating Expenses(2) | % | 1.83 | | 2.58 | | 2.58 | | 1.39 | | 1.58 | |

Waivers and Reimbursements(3) | % | (0.47 | ) | (0.47 | ) | (0.47 | ) | (0.28 | ) | (0.47 | ) |

Total Annual Fund Operating Expenses after Waivers and Reimbursements | % | 1.36 | | 2.11 | | 2.11 | | 1.11 | | 1.11 | |

(1) | Expense ratios have been adjusted to reflect current contractual rates. |

(2) | Total Annual Fund Operating Expenses may be higher than the Fund’s ratio of expenses to average net assets shown in the Fund’s Financial Highlights, which reflect the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

(3) | The adviser is contractually obligated to limit expenses to 1.70%, 2.45%, 2.45%, 1.45%, and 1.45% for Class A, Class B, Class C, Class I, and Class W shares, respectively, through March 1, 2013. The obligation will automatically renew for one-year terms unless it is terminated by the Fund or the adviser upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. In addition, effective November 30, 2012, the adviser is contractually obligated to further limit expenses to 1.35%, 2.10%, 2.10%, 1.10%, and 1.10% for Class A, Class B, Class C, Class I, and Class W shares, respectively, through March 1, 2014. There is no guarantee the additional expense limitation will continue after March 1, 2014 and the obligation will only continue if the adviser elects to renew it. Any fees waived pursuant to this obligation shall be eligible for recoupment. These obligations do not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. Finally, the adviser is contractually obligated to waive 0.10% of the management fee through March 1, 2013. There is no guarantee that the management fee waiver will continue after March 1, 2013. The management fee waiver will continue only if the adviser elects to renew it. |

ING International Value Portfolio

Annual Fund Operating Expenses

Expenses you pay each year as a % of the value of your investment

Class | | ADV(1) | | I(2) | | S(3) | | S2(4) | |

Management Fees | % | 0.80 | | 0.80 | | 0.80 | | 0.80 | |

Distribution and/or Shareholder Services (12b-1) Fees | % | 0.50 | | None | | 0.25 | | 0.50 | |

Administrative Services Fees | % | 0.10 | | 0.10 | | 0.10 | | 0.10 | |

Other Expenses | % | 0.16 | | 0.16 | | 0.16 | | 0.16 | |

Total Annual Portfolio Operating Expenses | % | 1.56 | | 1.06 | | 1.31 | | 1.56 | |

Waivers and Reimbursements | % | (0.05 | ) | (0.05 | ) | (0.10 | ) | (0.15 | ) |

Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 1.51 | | 1.01 | | 1.21 | | 1.41 | |

(1) | The adviser is contractually obligated to limit expenses to 1.50% through May 1, 2013; the obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. The obligation will automatically renew for one-year terms unless it is terminated by the Portfolio or the adviser upon written notice within 90 days of the end of the then current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. |

(2) | The adviser is contractually obligated to limit expenses to 1.00% through May 1, 2013; the obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. The obligation will automatically renew for one-year terms unless it is terminated by the Portfolio or the adviser upon written notice within 90 days of the end of the then current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. |

(3) | The adviser is contractually obligated to limit expenses to 1.20% through May 1, 2013; the obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. The obligation will automatically renew for one-year terms unless it is terminated by the Portfolio or the adviser upon written notice within 90 days of the end of the then current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. The distributor is also contractually obligated to waive 0.05% of the 0.25% shareholder services fee through May 1, 2013. There is no guarantee that the shareholder services fee waiver will continue after May 1, 2013. The shareholder services fee waiver will only renew if the distributor elects to renew it. |

(4) | The adviser is contractually obligated to limit expenses to 1.40% through May 1, 2013; the obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. The obligation will automatically renew for one-year terms unless it is terminated by the Portfolio or the adviser upon written notice within 90 days of the end of the then current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. The distributor is also contractually obligated to waive 0.10% of the 0.25% distribution fee through May 1, 2013. There is no guarantee that the distribution fee waiver will continue after May 1, 2013. The distribution fee waiver will only renew if the distributor elects to renew it |

For Internal Use Only

Not for Inspection by or Distribution to the General Public.

Contents of this communication may contain information regarding past performance, market opinions, competitor data, projections, forecasts and other forward-looking statements that cannot be shared with clients, prospective clients or current investors of ING investment products. The information presented has been obtained from sources ING Investment Management (“ING IM”) deems to be reliable, however, this data is subject to unintentional errors, omissions and changes prior to distribution without notice. This information is provided to ING IM employees for internal or educational use only and cannot be used as sales or marketing material, nor can it be distributed outside of the firm. Please only use compliance-approved marketing materials with clients and prospects. These materials contain compliant sales language, appropriate risk disclosures and other relevant disclaimers that provide a sound basis for evaluating our investment products and services. This information cannot be reproduced in whole or in part in any manner without the prior permission of an ING IM Compliance Officer.

CID - 4477