Total Investment Return (unaudited)

The following table summarizes the average annual Fund performance compared to the Fund’s primary benchmark for the six-month (not annualized), 1-year, 3-year, 5-year and 10-year periods ended March 31, 2024.

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years |

| Net Asset Value (NAV) | 19.80% | 6.61% | -2.39% | 0.99% | 3.60% |

| Market Price | 22.95% | 1.45% | -3.24% | 0.58% | 3.21% |

| Bloomberg Municipal Bond Index | 7.48% | 3.13% | -0.41% | 1.59% | 2.66% |

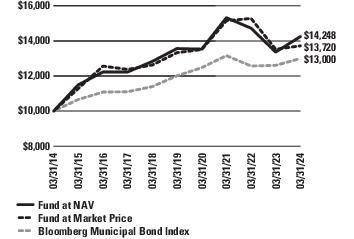

Performance of a $10,000 Investment (as of March 31, 2024)

This graph shows the change in value of a hypothetical investment of $10,000 in the Fund for the periods indicated. For comparison, the same investment is shown in the indicated index.

abrdn Inc. (the "Investment Manager") assumed responsibility for the management of the Fund as investment manager at the close of business on July 7, 2023. Performance prior to this date reflects the performance of an unaffiliated investment manager.

The performance above reflects fee waivers and/or expense reimbursements made by the Fund’s current investment manager. Absent such waivers and/or reimbursements, the Fund’s returns would be lower. Additionally, abrdn entered into an agreement with the Fund to limit investor relations services fees. This agreement aligns with the term of the advisory agreement and may not be terminated prior to the end of the current term of the advisory agreement. See Note 3 in the Notes to Financial Statements.

Returns represent past performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment return at market value is based on changes in the market price at which the Fund’s shares traded on the NYSE American during the period and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV on the financial reporting period ended March 31, 2024. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market price and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent month-end is available at www.abrdnvfl.com or by calling 800-522-5465.

The annualized net operating expense ratio excluding fee waivers based on the six-month period ended March 31, 2024 was 4.44%. The annualized net operating expense ratio net of fee waivers based on the six-month period ended March 31, 2024 was 4.28%.The annualized net operating expenses net of fee waivers and excluding dividend expense based on the six-month period ended March 31, 2024 was 1.08%.

| abrdn National Municipal Income Fund | 3 |

Portfolio Summary (unaudited)

As of March 31, 2024

Quality of Investments(1)

As of March 31, 2024, 62.3% of the Fund’s investments were invested in securities where either the issue or the issuer was rated “A” or better by S&P Global Ratings (“S&P”), Moody’s Investors Service, Inc. ("Moody's") or Fitch Ratings, Inc. (“Fitch”) or, if unrated, was judged to be of equivalent quality by the Investment Manager. The following table shows the ratings of securities held by the Fund as of March 31, 2024:

| Credit Rating | As a percentage of total investments |

| AAA | 3.7% |

| AA | 39.3% |

| A | 19.3% |

| BBB | 18.1% |

| BB | 1.2% |

| B | 0.1% |

| Below B | 0.6% |

| Non-Rated | 17.7% |

| | 100.0% |

| (1) | Generally, the credit ratings range from AAA (highest) to D (lowest). Where bonds held in the Fund are rated by multiple rating agencies (Moody’s, Fitch and S&P), the Higher of the ratings is used. This may not be consistent with data from the benchmark provider. Quality distribution represents ratings of the underlying securities held within the Fund, and not ratings of the Fund itself. |

The following table shows the sector exposure of the securities held by the Fund as at March 31, 2024:

| Sector Exposure | As a percentage of total investments |

| Hospital | 17.0% |

| Higher Education | 7.3% |

| Appropriations | 6.0% |

| Gas Contract | 6.0% |

| Continuing Care Retirement Communities | 5.2% |

| Tobacco Master Securities | 5.2% |

| Sale & Excise Tax | 4.8% |

| Charter School | 4.7% |

| Others | 43.8% |

| | 100.0% |

| 4 | abrdn National Municipal Income Fund |

Notes to Financial Statements (unaudited) (concluded)

March 31, 2024

On April 9, 2024 and May 9, 2024 the Fund announced that it will pay on April 30, 2024 and May 31, 2024, respectively, a distribution of US $0.0450 per share to all shareholders of record as of April 23, 2024 and May 23, 2024, respectively.

On May 24, 2024, the Board of abrdn plc announced Stephen Bird would be leaving abrdn effective June 30, 2024.

| 22 | abrdn National Municipal Income Fund |

Item 2. Code of Ethics.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 3. Audit Committee Financial Expert.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 6. Schedule of Investments.

(a) Schedule of Investments in securities of unaffiliated issuers as of close of the reporting period is included as part of the Reports to Shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

(a) Not applicable to semi-annual report on Form N-CSR.

(b) There has been no change, as of the date of this filing, in any of the portfolio managers identified in response to paragraph (a)(1) of this Item in the registrant’s most recently filed annual report on Form N-CSR.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

No such purchases were made by or on behalf of the Registrant during the period covered by the report.

Item 10. Submission of Matters to a Vote of Security Holders.

During the period ended March 31, 2024, there were no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees.

Item 11. Controls and Procedures.

| (a) | The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a3(b)) and Rule 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d15(b)). |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d))) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable

Item 13. Recovery of Erroneously Awarded Compensation

Not appliable

Item 14. Exhibits.

| (a)(3) | Any written solicitation to purchase securities under Rule 23c-1 under the 1940 Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable. |

| (a)(4) | Change in Registrant’s independent public accountant. Not applicable. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

abrdn National Municipal Income Fund

| By: | /s/ Christian Pittard | |

| | Christian Pittard, | |

| | Principal Executive Officer of | |

| | abrdn National Municipal Income Fund | |

| | |

| Date: June 10, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Christian Pittard | |

| | Christian Pittard, | |

| | Principal Executive Officer of | |

| | abrdn National Municipal Income Fund | |

| | |

| Date: June 10, 2024 | |

| | |

| By: | /s/ Sharon Ferrari | |

| | Sharon Ferrari, | |

| | Principal Financial Officer of | |

| | abrdn National Municipal Income Fund | |

| | |

| Date: June 10, 2024 | |