SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

| Filed by the Registrants | [X] |

| Filed by a Party other than the Registrants | [ ] |

| Check the appropriate box: |

| |

| [X] | Preliminary Proxy Statement |

| | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| [ ] | Definitive Proxy Statement |

| | |

| [ ] | Definitive Additional Materials |

| | |

| [ ] | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

| Delaware Investments Dividend and Income Fund, Inc. |

| Delaware Investments Colorado Municipal Income Fund, Inc. |

| Delaware Investments National Municipal Income Fund |

| Delaware Investments Minnesota Municipal Income Fund II, Inc |

| (Name of Registrants as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrants) |

| Payment of Filing Fee (Check the appropriate box): |

| |

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1. | Title of each class of securities to which transaction applies: |

| | | |

| | 2. | Aggregate number of securities to which transaction applies: |

| | | |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4. | Proposed maximum aggregate value of transaction: |

| | | |

| | 5. | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary proxy materials. |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

____________________________________________________________

2) Form, Schedule or Registration Statement No.:

____________________________________________________________

3) Filing Party:

____________________________________________________________

4) Date Filed:

____________________________________________________________

PRELIMINARY COPY SUBJECT TO COMPLETION

COMBINED PROXY STATEMENT AND

NOTICE OF JOINT ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 15, 2018

Important notice regarding the availability of proxy materials for the shareholder

meeting to be held on August 15, 2018: this proxy statement is available at

delawarefunds.com/ceproxy.

To the Shareholders of:

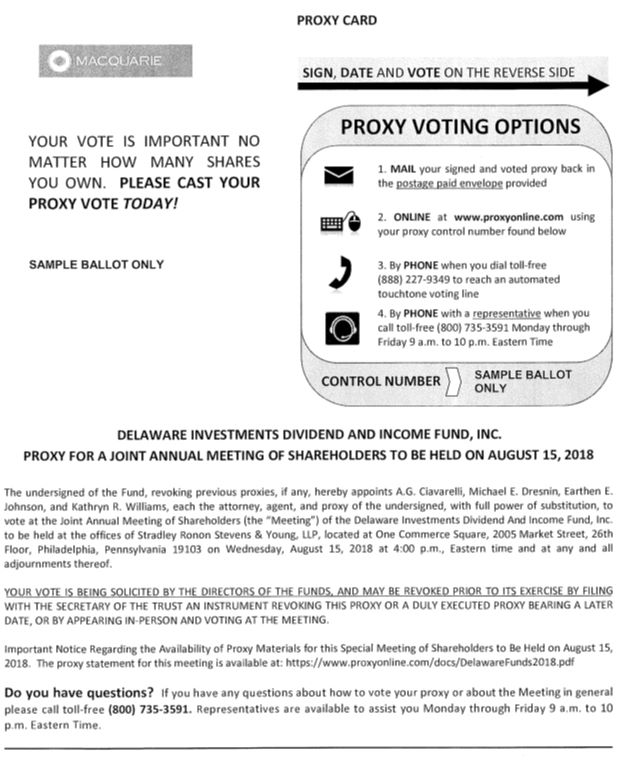

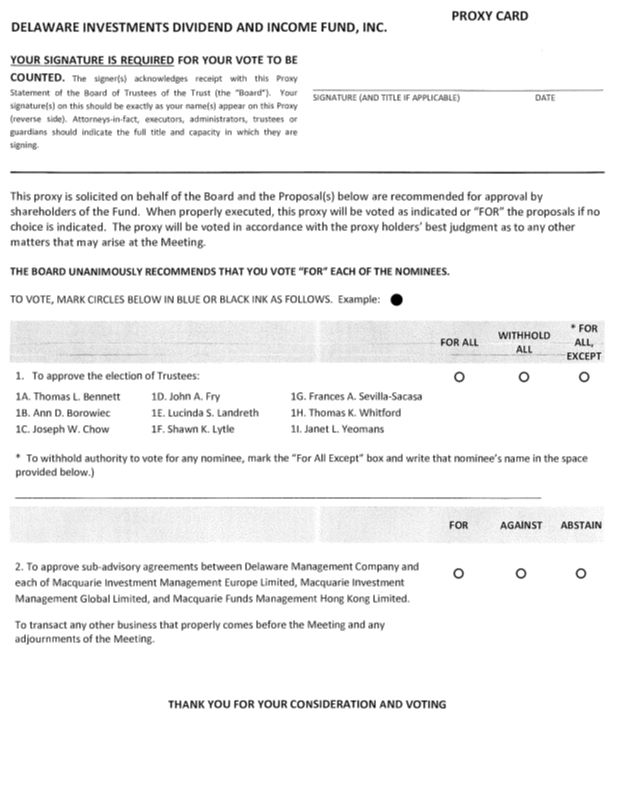

Delaware Investments Dividend and Income Fund, Inc.

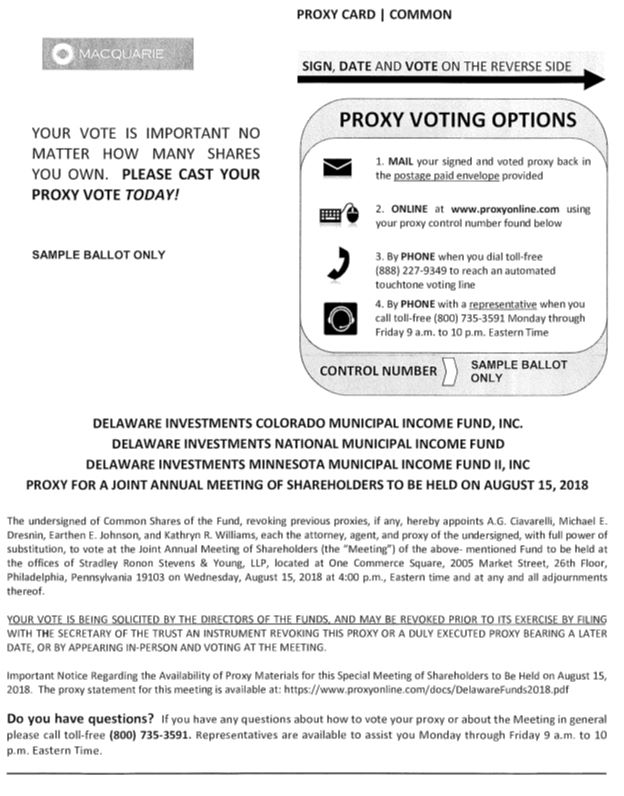

Delaware Investments Colorado Municipal Income Fund, Inc.

Delaware Investments National Municipal Income Fund

Delaware Investments Minnesota Municipal Income Fund II, Inc.

This is your official notice that the Joint Annual Meeting of Shareholders ("Meeting") of each Macquarie Investment Management (formerly, Delaware Investments) closed-end registered investment company listed above (each, individually, a "Fund" and, collectively, the "Funds") will be held at the offices of Stradley Ronon Stevens & Young, LLP, located at One Commerce Square, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103 on Wednesday, August 15, 2018 at 4:00 p.m., Eastern time. The purpose of the Meeting is:

| 1. | To elect a Board of Directors or Trustees for each Fund; |

| 2. | For Delaware Investments Dividend and Income Fund, Inc. only: To approve sub-advisory agreements between Delaware Management Company and each of Macquarie Investment Management Europe Limited, Macquarie Investment Management Global Limited, and Macquarie Funds Management Hong Kong Limited; and |

| 3. | To transact any other business that properly comes before the Meeting and any adjournments of |

the Meeting.

Please vote and send in your proxy card(s) promptly to avoid the need for further mailings. Your vote is important.

Richard Salus

Senior Vice President and Chief Financial Officer

June 27, 2018

| 2005 Market Street Philadelphia, PA 19103 1-866-437-0252 |

COMBINED PROXY STATEMENT

JOINT ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, AUGUST 15, 2018

Meeting Information. The Board of Directors or Trustees (each Board is hereinafter referred to as a "Board" and Board members are referred to as "Directors") of Delaware Investments Dividend and Income Fund, Inc., Delaware Investments Colorado Municipal Income Fund, Inc., Delaware Investments National Municipal Income Fund, and Delaware Investments Minnesota Municipal Income Fund II, Inc. (each, individually, a "Fund" and, collectively, the "Funds") is soliciting your proxy to be voted at the Joint Annual Meeting of Shareholders to be held on Wednesday, August 15, 2018, at 4:00 p.m., Eastern time, at the offices of Stradley Ronon Stevens & Young, LLP located at One Commerce Square, 2005 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103 and/or at any adjournments of the meeting (the "Meeting"). Participating in the Meeting are holders of common shares of beneficial interest or common stock, as applicable (the "Common Shares"), and the holders of preferred shares of beneficial interest or preferred stock, as applicable (the "Preferred Shares"), for those Funds with outstanding Preferred Shares.

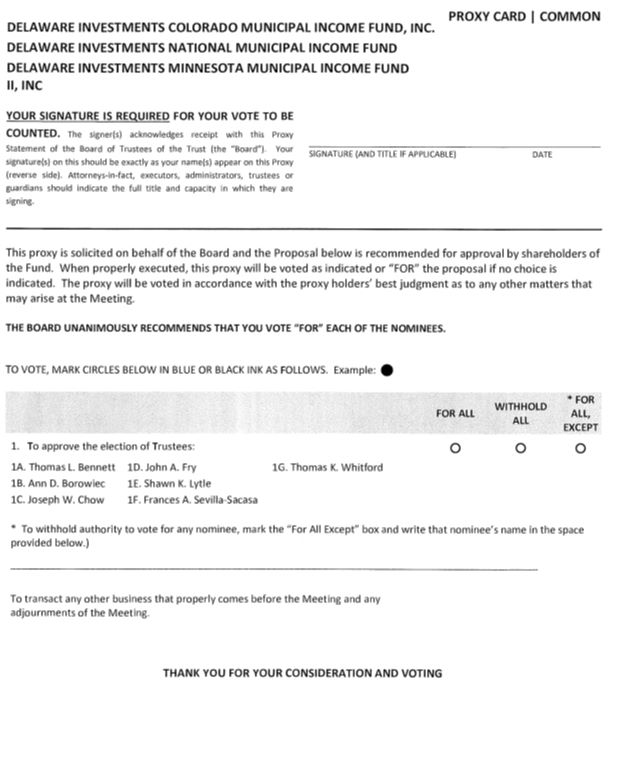

General Voting Information. You may provide proxy instructions by returning the enclosed proxy card(s) ("Proxy Card") by mail in the enclosed envelope. The persons designated on the Proxy Card(s) as proxies will vote your shares as you instruct on each Proxy Card. If you return a signed Proxy Card without any voting instructions, your shares will be voted "FOR ALL" of the Director nominees in accordance with the recommendation of the Board. The persons designated on the Proxy Card as proxies will also be authorized to vote (or to withhold their votes) in their discretion on any other matters which properly come before the Meeting. They may also vote in their discretion to adjourn the Meeting. If you sign and return a Proxy Card, you may still attend the Meeting to vote your shares in person. If your shares are held of record by a broker and you wish to vote in person at the Meeting, you should obtain a legal proxy from your broker and present it at the Meeting. You may revoke your proxy at any time before the Meeting (i) by notifying Macquarie Investment Management in writing at 2005 Market Street, Philadelphia, PA 19103; (ii) by submitting a later signed Proxy Card; or (iii) by voting your shares in person at the Meeting. If your shares are held in the name of your broker, you will have to make arrangements with your broker to revoke any previously executed proxy.

Each shareholder may cast one vote for each full share, and a partial vote for each partial share, of a Fund that they owned of record on June 8, 2018 (the "Record Date"). Exhibit A shows the number of shares of each Fund that were outstanding on the Record Date and Exhibit B lists the shareholders who owned 5% or more of the outstanding shares of any class of any Fund on that date. It is expected that this Combined Proxy Statement and the accompanying Proxy Card(s) will be first mailed to shareholders on or about July 3, 2018.

This proxy solicitation is being made primarily by mail, but may also be made by officers or employees of the Funds or their investment manager or affiliates, through telephone, facsimile, or other communications. Because a proxy solicitor is being used, the cost for this service is borne by the Funds. The Funds may reimburse banks, brokers or dealers for their reasonable expenses in forwarding soliciting materials to beneficial owners of the Funds' shares.

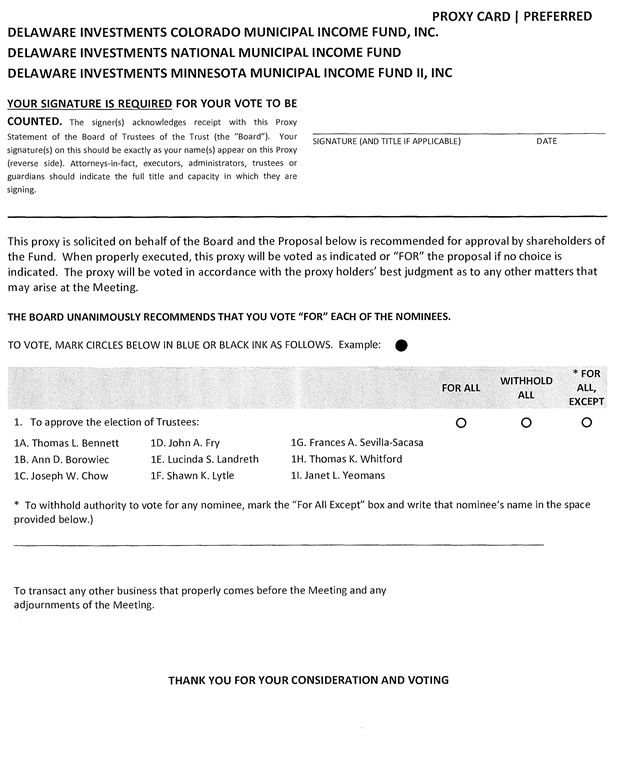

All shareholders of a Fund vote together to elect Directors, regardless of whether a Fund has both common and preferred shareholders, with one exception. For Delaware Investments Colorado Municipal Income Fund, Inc., Delaware Investments National Municipal Income Fund, and Delaware Investments

Minnesota Municipal Income Fund II, Inc. (each, a "Municipal Fund" and, collectively, the "Municipal Funds"), each of which has outstanding Preferred Shares, the holders of Preferred Shares have the exclusive right to separately elect two Directors (the "Preferred Share Directors"), in addition to the right to vote for the remaining Directors together with the holders of the Common Shares.

The presence in person or by proxy of holders of a majority of a Fund's outstanding shares shall constitute a quorum for such Fund. With respect to the Municipal Funds, the presence in person or by proxy of holders of 331/3% of the outstanding Preferred Shares entitled to vote at the Meeting shall constitute a quorum of the preferred share class of the respective Municipal Fund for purposes of electing the two Preferred Share Directors. In the event that a quorum is not present or if sufficient votes are not received consistent with the Board's recommendation regarding the proposal, management may propose an adjournment or adjournments of the Meeting for a Fund. Any adjournment would require a vote in favor of the adjournment by the holders of a majority of the shares present at the Meeting in person or by proxy. The persons named as proxies on the Proxy Card(s) may vote (or withhold their votes) in their discretion on any proposed adjournment.

Abstentions and Broker Non-Votes. Broker non-votes occur when a meeting has (1) a "routine" proposal, such as the election of directors in Proposal 1, where the applicable stock exchange permits brokers to vote their clients' shares in their discretion, and (2) a "non-routine" proposal, such as the approval of a sub-advisory agreement in Proposal 2, where the applicable exchange does not permit brokers to vote their clients' shares in their discretion. The shares that are considered to be present as a result of the broker discretionary vote on the routine proposal but that are not voted on the non-routine proposal are called "broker non-votes." Abstentions and broker non-votes will be included for purposes of determining whether a quorum is present for each Fund at the Meeting and will be treated as votes present at the Meeting, but will not be treated as votes cast. Therefore, abstentions and broker non-votes may have the same effect as a vote "against" Proposal 2, but will not have an effect on Proposal 1, which requires a plurality of votes cast for approval.

Copies of each Fund's most recent annual report and semi-annual report, including financial statements, have previously been delivered to shareholders. Copies of these reports are available upon request, at no charge, by writing the Funds at the address shown on the top of the first page of this Combined Proxy Statement, by calling toll-free (866) 437-0252, or through the Funds' website at delawarefunds.com.

PROPOSAL 1: TO ELECT A BOARD OF DIRECTORS

FOR EACH FUND

You are being asked to reelect each of the current members of the Board of your Fund. The nominees are: Thomas L. Bennett, Ann D. Borowiec, Joseph W. Chow, John A. Fry, Lucinda S. Landreth, Shawn K. Lytle, Frances A. Sevilla-Sacasa, Thomas K. Whitford, and Janet L. Yeomans. All of the nominees have previously been elected by Fund shareholders.

If elected, these persons will serve as Directors until the next annual meeting of shareholders called for the purpose of electing Directors and/or until their successors have been elected and qualify for office. It is not expected that any nominee will withdraw or become unavailable for election, but in such a case, the power given by you in the Proxy Card may be used by the persons named as proxies to vote for a substitute nominee or nominees as recommended by the Board.

Each Municipal Fund issues Common Shares and Preferred Shares. The holders of Preferred Shares of each Municipal Fund exclusively are entitled to elect two of their respective Preferred Share Directors, and the remaining Directors are to be elected by the holders of the Preferred Shares and Common Shares voting together. The nominees for Preferred Share Directors of the Municipal Funds are Lucinda S. Landreth and Janet L. Yeomans.

INFORMATION ON THE NOMINEES

| Name, Address, and Birthdate | Position(s) Held with the Funds | Length of Time Served | Principal Occupation(s) During the Past Five Years | Number of Funds in Fund Complex Overseen by Director | Other Directorships Held by Director During the Past Five Years |

| Interested Director |

Shawn K. Lytle1

2005 Market Street Philadelphia, PA 19103 February 1970 | President, Chief Executive Officer, and Director | Director since September 2015 President and Chief Executive Officer since August 2015 | President — Macquarie Investment Management (June 2015 - Present) Regional Head of Americas — UBS Global Asset Management (April 2010 - May 2015) | 60 | Trustee — UBS Relationship Funds, SMA Relationship Trust, and UBS Funds (May 2010–April 2015) |

| Independent Directors |

Thomas L. Bennett 2005 Market Street Philadelphia, PA 19103 October 1947 | Chair and Director | Director since March 2005 Chair since March 2015 | Private Investor — (March 2004–Present) | 60 | None |

Ann D. Borowiec 2005 Market Street Philadelphia, PA 19103 November 1958 | Director | Since March 2015 | Chief Executive Officer, Private Wealth Management (2011–2013) and Market Manager, New Jersey Private Bank (2005-2011) — J.P. Morgan Chase & Co. | 60 | Director — Banco Santander International (October 2016–Present) Director — Santander Bank N.A. (December 2016–Present) |

Joseph W. Chow 2005 Market Street Philadelphia, PA 19103 January 1953 | Director | Since January 2013 | Private investor (April 2011–Present) | 60 | Director and Audit Committee Member — Hercules Technology Growth Capital, Inc. (July 2004–July 2014) |

John A. Fry 2005 Market Street Philadelphia, PA 19103 May 1960 | Director | Since January 2001 | President — Drexel University (August 2010–Present) President — Franklin & Marshall College (July 2002–June 2010) | 60 | Director; Compensation Committee and Governance Committee Member — Community Health Systems Director — Drexel Morgan & Co. Director; Audit Committee — vTv |

| Name, Address, and Birthdate | Position(s) Held with the Funds | Length of Time Served | Principal Occupation(s) During the Past Five Years | Number of Funds in Fund Complex Overseen by Director | Other Directorships Held by Director During the Past Five Years |

| | | | | | Therapeutics LLC Director; Audit Committee Member — FS Credit Real Estate Income Trust, Inc. |

Lucinda S. Landreth 2005 Market Street Philadelphia, PA 19103 June 1947 | Director | Since March 2005 | Private Investor (2004–Present) | 60 | None |

Frances A. Sevilla-Sacasa 2005 Market Street Philadelphia, PA 19103 January 1956 | Director | Since September 2011 | Private Investor (January 2017–Present) Chief Executive Officer — Banco Itaú International (April 2012–December 2016) Executive Advisor to Dean (August 2011–March 2012) and Interim Dean (January 2011–July 2011) — University of Miami School of Business Administration President — U.S. Trust, Bank of America Private Wealth Management (Private Banking) (July 2007–December 2008) | 60 | Trust Manager and Audit Committee Member — Camden Property Trust (August 2011–Present) Director – Carrizo Oil & Gas, Inc. (March 2018–Present) |

Thomas K. Whitford 2005 Market Street Philadelphia, PA 19103 March 1956 | Director | Since January 2013 | Vice Chairman (2010–April 2013)— PNC Financial Services Group | 60 | Director — HSBC Finance Corporation and HSBC North America Holdings Inc. (December 2013–Present) Director — HSBC Bank USA, Inc. (July 2014–March 2017) |

Janet L. Yeomans 2005 Market Street Philadelphia, PA 19103 | Director | Since April 1999 | Vice President and Treasurer (January 2006–July 2012) Vice President — Mergers & Acquisitions | 60 | Director (2009‑2017); Personnel and Compensation |

| Name, Address, and Birthdate | Position(s) Held with the Funds | Length of Time Served | Principal Occupation(s) During the Past Five Years | Number of Funds in Fund Complex Overseen by Director | Other Directorships Held by Director During the Past Five Years |

| July 1948 | | | (January 2003–January 2006), and Vice President and Treasurer (July 1995–January 2003) — 3M Company | | Committee Chair; Member of Nominating, Investments, and Audit Committees for various periods throughout directorship — Okabena Company |

1 Shawn K. Lytle is considered to be an "Interested Director" because he is an executive officer of the Funds' investment advisor. He serves in similar capacities for the six portfolios of the Optimum Fund Trust, which have the same investment advisor and transfer agent as the Funds.

The following table shows each Director's ownership of shares of each Fund and of all other funds in the Delaware FundsSM by Macquarie (the "Fund Complex") as of March 31, 2018.

| Name of Director | | Dollar Range of Equity Securities in each Fund | | Aggregate Dollar Range of Equity Securities1 in All Registered Investment Companies Overseen by Director in Fund Complex |

| Interested Director |

| Shawn K. Lytle | | [None] | | $10,001–$50,000 |

| Independent Directors |

| Thomas L. Bennett | | None | | Over $100,000 |

| Ann D. Borowiec | | None | | Over $100,000 |

| Joseph W. Chow | | None | | Over $100,000 |

| John A. Fry | | [None] | | Over $100,000 |

| Lucinda S. Landreth | | None | | Over $100,000 |

| Frances A. Sevilla-Sacasa | | None | | Over $100,000 |

| Thomas K. Whitford | | None | | Over $100,000 |

| Janet L. Yeomans | | None | | Over $100,000 |

1 The ranges for equity securities ownership by each Director are: none; $1-$10,000; $10,001-$50,000; $50,001-$100,000; or over $100,000.

Board Leadership Structure and Functions

Common Board of Directors. The business of each Fund is managed under the direction of its Board. The Directors also serve on the Boards of all the other investment companies that comprise the Fund Complex. The Directors believe that having a common Board for all funds in the complex is efficient and enhances the ability of the Board to address its responsibilities to each fund in the complex. The Directors believe that the common board structure allows the Directors to leverage their individual expertise and that their judgment is enhanced by being Directors of all of the funds in the complex.

Board Chair. Mr. Bennett serves as the Board's Chair. As fund governance best practices have evolved, more and more fund boards have opted to have an independent director serve as chair. Among other reasons, the Board selected Mr. Bennett as Chair due to his substantial financial industry experience and his tenure on the Board. As the Chair, Mr. Bennett, in consultation with Fund management, legal counsel, and the other Directors, proposes Board agenda topics, actively participates in developing Board meeting agendas, and ensures that appropriate and timely information is provided to the Board in connection with Board meetings. Mr. Bennett also conducts meetings of the Independent Directors. He also generally serves as a liaison among

outside Directors, Fund officers, and legal counsel, and is an ex officio member of the Nominating and Corporate Governance Committee.

Size and Composition of Board. The Board is currently comprised of nine Directors. Eight of the nine Directors are independent. The Directors believe that the current size of the Board is conducive to Board interaction, dialogue, and debate, resulting in an effective decision-making body. The Board comprises Directors with a variety of professional backgrounds. The Board believes that the skill sets of its members are complementary and add to the overall effectiveness of the Board. The Directors regard diversity as an important consideration in the present composition of the Board and the selection of qualified candidates to fill vacancies on the Board.

Board Meetings. Each Municipal Fund held five Board meetings during its last fiscal year, ended March 31, 2018. Delaware Investments Dividend and Income Fund, Inc. ("DDF") held five Board meetings during its last fiscal year, ended November 30, 2017. Each Director attended at least 75% of the Board meetings described above and of the meetings of committees on which the Director served. Directors are encouraged to attend each annual meeting of shareholders either in person or by telephone, if possible. All Directors were present at the Funds' annual meeting held on August 16, 2017.

Board Committees. The Board has established several committees, each of which focuses on a particular substantive area and provides reports and recommendations to the full Board. The committee structure enables the Board to manage efficiently and effectively the large volume of information relevant to the Board's oversight of the Funds. The committees benefit from the professional expertise of their members. At the same time, membership on a committee enhances the expertise of its members and benefits the overall effectiveness of the Board.

Each Fund has an Audit Committee that monitors accounting and financial reporting policies, practices and internal controls for the Fund. It also oversees the quality and objectivity of the Fund's financial statements and the independent audit thereof, and acts as a liaison between the Fund's independent registered public accounting firm and the full Board. The Audit Committee of each Fund consists of the following Independent Directors appointed by the Board: Joseph W. Chow, Chair; John A. Fry; Lucinda S. Landreth; Thomas K. Whitford; and Janet Yeomans. Each Audit Committee member also meets the standard of independence for Audit Committee members set forth in the listing standards of the New York Stock Exchange (the "NYSE") and NYSE American ("NYSE American") (formerly the NYSE MKT). Members of the Audit Committee serve for one-year terms or until their successors have been appointed and qualified. The Audit Committee held five meetings for DDF for the fiscal year ended November 30, 2017, and four meetings for the Municipal Funds for the fiscal year ended March 31, 2018. The Board of each Fund has adopted a written charter for the Fund's Audit Committee, which is available on the Funds' website at delawarefunds.com.

Each Fund has an Independent Directors Committee that develops and recommends to the Board a set of corporate governance principles and oversees the evaluation of the Board, its committees and its activities. The committee comprises all of the Fund's Independent Directors. The Independent Directors Committee held four meetings during the fiscal year ended November 30, 2017 for DDF, and four meetings for the Municipal Funds for the fiscal year ended March 31, 2018.

Each Fund has an Investments Committee. The primary purposes of the Investments Committee are to: (i) assist the Board at its request in its oversight of the investment advisory services provided to the Funds by the Fund's investment advisor as well as any sub-advisors; (ii) review all proposed advisory and sub-advisory agreements for new funds or proposed amendments to existing agreements and to recommend what action the full Board and the Independent Directors should take regarding the approval of all such proposed agreements; and (iii) review reports supplied by the investment advisor regarding investment performance, portfolio risk and expenses and to suggest changes to such reports. The Investments Committee consists of the following Directors: Janet L. Yeomans, Chair; Ann D. Borowiec; Joseph W. Chow; Lucinda S. Landreth; and Frances A. Sevilla-Sacasa. The Investments Committee held four meetings during the fiscal year ended November 30, 2017 for DDF, and four meetings for the Municipal Funds for the fiscal year ended March 31, 2018.

Each Fund's Nominating and Corporate Governance Committee (the "Nominating Committee")

recommends Board nominees, fills Board vacancies that arise in between meetings of shareholders, and considers the qualifications and independence of Board members. The committee also monitors the performance of counsel for the Independent Directors. The Nominating Committee is comprised of the following five Independent Directors appointed by the Board: John A. Fry, Chair; Thomas L. Bennett (ex officio); Frances A. Sevilla-Sacasa; and Thomas K. Whitford, all of whom meet the independence requirements set forth in the listing standards of the NYSE and NYSE American. The Nominating Committee recommends nominees for Independent Directors for consideration by the incumbent Independent Directors of each Fund, and the Nominating Committee recommends nominees for Interested Directors for consideration by the full Board of each Fund. The Nominating Committee held five meetings during the fiscal year ended November 30, 2017 for DDF, and five meetings for the Municipal Funds for the fiscal year ended March 31, 2018. Each Fund's Board has adopted a formal charter for the Nominating Committee setting forth its responsibilities, which is available on the Funds' website at delawarefunds.com.

The Nominating Committee will consider shareholder recommendations for nomination to the Board only in the event that there is a vacancy on the Board. Shareholders who wish to submit recommendations for nominations to the Board to fill a vacancy must submit their recommendations in writing to the Nominating and Corporate Governance Committee, c/o Delaware FundsSM by Macquarie at 2005 Market Street, Philadelphia, Pennsylvania 19103-7094. Shareholders should include appropriate information on the background and qualifications of any person recommended (e.g., a resume), as well as the candidate's contact information and a written consent from the candidate to serve if nominated and elected. Shareholder recommendations for nominations to the Board will be accepted on an ongoing basis and such recommendations will be kept on file for consideration when there is a vacancy on the Board.

In reaching its determination that an individual should serve or continue to serve as a Director of a Fund, the Nominating Committee considers, in light of the Fund's business and structure, the individual's experience, qualifications, attributes and skills (the "Selection Factors"). No one Selection Factor is determinative, but some of the relevant factors that have been considered include: (i) the Director's business and professional experience and accomplishments, including prior experience in the financial services industry or on other boards; (ii) the ability to work effectively and collegially with other people; and (iii) how the Director's background and attributes contribute to the overall mix of skills and experience on the Board as a whole.

Director Qualifications

In evaluating and selecting candidates for the Board, the Board intends to seek individuals who will serve the best interests of the Funds' shareholders and whose attributes will, among other factors, also complement the experience, skills and diversity of the other Directors and add to the overall effectiveness of the Board. In the evaluation of such candidates, the Board believes that diversity with respect to factors such as background, education, experience, skills, differences of viewpoint, race, gender, national origin, and other factors that contribute to the Board's having an appropriate range of expertise, talents, experiences and viewpoints is an important consideration in the Board's composition. In addition to discussing diversity considerations in connection with the evaluation of each candidate for Board membership, the Board requests that the Nominating Committee discuss diversity considerations on a periodic basis in connection with the composition of the Board as a whole. Below is a brief summary of the Selection Factors that relate to each Director as of the date of this Combined Proxy Statement.

Thomas L. Bennett. Currently the Board's Chair, Mr. Bennett has over 30 years of experience in the investment management industry, particularly with fixed income portfolio management and credit analysis. He has served in senior management for a number of money management firms. Mr. Bennett has also served as a board member of another investment company, an educational institution, nonprofit organizations and for-profit companies. He has an M.B.A. from the University of Cincinnati. Mr. Bennett has served on the Board since March 2005.

Ann D. Borowiec. Ms. Borowiec has over 25 years of experience in the banking and wealth management industry. Ms. Borowiec also serves as a board member on several nonprofit organizations. In nominating her to the Board in 2015, the Independent Directors of the Funds found that her experience as a

Chief Executive Officer in the private wealth management business at a leading global asset manager and private bank, including the restructuring of business lines and defining client recruitment strategies, complemented the skills of existing board members. Her experience would also provide additional oversight skill in the area of fund distribution. Ms. Borowiec holds a B.B.A. from Texas Christian University and an M.B.A. from Harvard University. Ms. Borowiec joined the Board in March 2015.

Joseph W. Chow. Mr. Chow has over 30 years of experience in the banking and financial services industry. In electing him in 2013, the Independent Directors of the Funds found that his extensive experience in business strategy in non-US markets complemented the skills of existing Board members and also reflected the increasing importance of global financial markets in investment management. The Independent Directors also found that Mr. Chow's management responsibilities as a former Executive Vice President of a leading global asset servicing and investment management firm as well as his experience as Chief Risk and Corporate Administration Officer would add helpful oversight skills to the Board's expertise. Mr. Chow holds a B.A. degree from Brandeis University and M.C.P. and M.S. in Management degree from the Massachusetts Institute of Technology. Mr. Chow has served on the Board since January 2013.

John A. Fry. Mr. Fry has over 25 years of experience in higher education. He has served in senior management for three major institutions of higher learning including serving as president of a leading research university. Mr. Fry has also served as a board member of many nonprofit organizations and several for-profit companies. Mr. Fry has extensive experience in overseeing areas such as finance, investments, risk-management, internal audit and information technology. He holds a B.A. degree in American Civilization from Lafayette College and an M.B.A. from New York University. Mr. Fry has served on the Board since January 2001.

Lucinda S. Landreth. Ms. Landreth has over 35 years of experience in the investment management industry, particularly with equity management and analysis. She has served as Chief Investment Officer for a variety of money management firms including a bank, a broker, and an insurance company. Ms. Landreth has advised mutual funds, pension funds, and family wealth managers and has served on the board and executive committees of her college, two foundations and several nonprofit institutions. In addition to holding a B.A. from Wilson College, she is a Chartered Financial Analyst. Ms. Landreth has served on the Board since March 2005.

Frances A. Sevilla-Sacasa. Ms. Sevilla-Sacasa has over 30 years of experience in banking and wealth management. In electing her in 2011, the Independent Directors of the Board found that her extensive international wealth management experience, in particular, complemented the skills of existing Board members and also reflected the increasing importance of international investment management not only for dollar-denominated investors but also for investors outside the US. The Independent Directors also found that Ms. Sevilla-Sacasa's management responsibilities as the former President and Chief Executive Officer of a major trust and wealth management company would add a helpful oversight skill to the Board's expertise, and her extensive nonprofit board experience gave them confidence that she would make a meaningful, experienced contribution to the Board. Finally, in electing Ms. Sevilla-Sacasa to the Board, the Independent Directors valued her perceived dedication to client service as a result of her overall career experience. Ms. Sevilla-Sacasa holds B.A. and M.B.A. degrees from the University of Miami and the Thunderbird School of Global Management. Ms. Sevilla-Sacasa has served on the Board since September 2011.

Thomas K. Whitford. Mr. Whitford has over 25 years of experience in the banking and financial services industry, and served as Vice Chairman of a major banking, asset management, and residential mortgage banking institution. In electing him in 2013, the Independent Directors of the Funds found that Mr. Whitford's senior management role in wealth management and experience in the mutual fund servicing business would provide valuable current management and financial industry insight, in particular, and complemented the skills of existing Board members. The Independent Directors also found that his senior management role in integrating company acquisitions, technology and operations and his past role as Chief Risk Officer would add a helpful oversight skill to the Board's expertise. Mr. Whitford holds a B.S. degree from the University of Massachusetts and an M.B.A. degree from The Wharton School of the University of Pennsylvania. Mr. Whitford has served on the Board since January 2013.

Janet L. Yeomans. Ms. Yeomans has over 28 years of business experience with a large global

diversified manufacturing company, including service as Treasurer for this company. In this role, Ms. Yeomans had significant broad-based financial experience, including global financial risk-management and mergers and acquisitions. Sheserved as a board member of a for-profit company and also is a current board member of a hospital and a public university system. She holds degrees in mathematics and physics from Connecticut College, an M.S. in mathematics from Illinois Institute of Technology, and an M.B.A. from the University of Chicago. Ms. Yeomans has served on the Board since April 1999.

Shawn K. Lytle. Mr. Lytle has over 20 years of experience in the investment management industry. He has been the president of Macquarie Investment Management – Americas since June 2015, and he is responsible for all aspects of the firm's business. Prior to that time, Mr. Lytle served in various executive management, investment management, and distribution positions at two major banking institutions. He holds a B.A. degree from The McDonough School of Business at Georgetown University. Mr. Lytle has served on the Board since September 2015. Mr. Lytle serves as chair elect on the board of directors of the National Association of Securities Professionals, and he is on the board of directors of the Sustainability Accounting Standards Board.

Board Role in Risk Oversight. The Board performs a risk oversight function for the Funds consisting, among other things, of the following activities: (1) receiving and reviewing reports related to the performance and operations of the Funds; (2) reviewing, approving, or modifying, as applicable, the compliance policies and procedures of the Funds; (3) meeting with portfolio management teams to review investment strategies, techniques and the processes used to manage related risks; (4) addressing security valuation risk in connection with its review of fair valuation decisions made by Fund management pursuant to Board-approved procedures; (5) meeting with representatives of key service providers, including the Funds' investment advisor, transfer agent, custodian and independent registered public accounting firm, to review and discuss the activities of the Funds and to provide direction with respect thereto; (6) engaging the services of the Funds' Chief Compliance Officer to test the compliance procedures of the Funds and its service providers; and (7) requiring management's periodic presentations on specified risk topics.

The Directors perform this risk oversight function throughout the year in connection with each quarterly Board meeting. The Directors routinely discuss certain risk-management topics with Fund management at the Board level and also through the standing committees of the Board. In addition to these recurring risk-management discussions, Fund management raises other specific risk-management issues relating to the Funds with the Directors at Board and committee meetings. When discussing new product initiatives with the Board, Fund management also discusses risk – either the risks associated with the new proposals or the risks that the proposals are designed to mitigate. Fund management also provides periodic presentations to the Board to give the Directors a general overview of how the Funds' investment advisor and its affiliates identify and manage risks pertinent to the Funds.

The Audit Committee looks at specific risk-management issues on an ongoing basis. The Audit Committee is responsible for certain aspects of risk oversight relating to financial statements, the valuation of Fund assets, and certain compliance matters. In addition, the Audit Committee meets with the investment advisor's internal audit and risk-management personnel on a quarterly basis to review the reports on their examinations of functions and processes affecting the Funds.

The Board's other committees also play a role in assessing and managing risk. The Nominating Committee and the Independent Director Committee play a role in managing governance risk by developing and recommending to the Board corporate governance principles and, in the case of the Independent Director Committee, by overseeing the evaluation of the Board, its committees and its activities. The Investments Committee plays a significant role in assessing and managing risk through its oversight of investment performance, investment process, investment risk controls, and Fund expenses.

Because risk is inherent in the operation of any business endeavor, and particularly in connection with the making of financial investments, there can be no assurance that the Board's approach to risk oversight will be able to minimize or even mitigate any particular risk. Each Fund is designed for investors that are prepared to accept investment risk, including the possibility that as yet unforeseen risks may emerge in the future.

Board Compensation. Each Independent Director receives: (i) an annual retainer fee of $180,000 for serving as a Director for all 26 investment companies in the Macquarie Investment Management family of funds (60 funds in the complex), plus $14,000 per meeting for attending each Board Meeting in person held on behalf of all investment companies in the complex; and (ii) a $3,000 fee for attending telephonic board meetings on behalf of the investment companies in the complex. The committee members and committee/board chairs also receive the following fees: (i) members of the Nominating Committee, Audit Committee, and Investments Committee will receive additional compensation of $5,200 for each Committee meeting attended; (ii) the chair for each of the Audit Committee, the Investments Committee, and the Nominating Committee receives an annual retainer of $25,000; and (iii) the Board Chair will receive an additional annual retainer of $75,000.

The following table sets forth the compensation received by each Director from each Fund and the total compensation received from the Fund Complex as a whole during the twelve months ended April 30, 2018. Mr. Lytle is not compensated by the Funds for his service as Director.

| Director | | Aggregate Compensation from the Funds | | Total Compensation from the Investment Companies in the Fund Complex |

| Thomas L. Bennett (Chair) | | $4,198.18 | | $368,533.36 |

| Ann D. Borowiec | | $2,852.107 | | $250,633.36 |

| Joseph W. Chow | | $3,382.31 | | $297,233.44 |

| John A. Fry | | $3,333.77 | | $293,033.44 |

| Lucinda S. Landreth | | $3,049.68 | | $268,033.36 |

| Frances A. Sevilla-Sacasa | | $3,095.01 | | $271,933.36 |

| Thomas K. Whitford | | $3,097.87 | | $272,233.36 |

| Janet L. Yeomans | | $3,345.03 | | $293,933.44 |

____________________

Officers. The following individuals are executive officers of one or more of the Funds: David F. Connor, Daniel V. Geatens, and Richard Salus. Exhibit C includes certain information concerning these officers. The shares of each Fund that are owned by the executive officers as a group is less than one percent. In addition, to the knowledge of the Funds' management, the Directors and officers of the Funds owned, as a group, less than one percent of the outstanding shares of each class of the Funds.

Section 16(a) Beneficial Ownership Reporting Compliance. Section 16 of the Securities Exchange Act of 1934, as amended (the "1934 Act"), requires that Forms 3, 4, and 5 be filed with the SEC, the relevant securities exchange and the relevant Fund, by or on behalf of certain persons, including directors, certain officers, and certain affiliated persons of the investment advisor. The Funds believe that these requirements were met for each Fund's last fiscal year.

Required Vote. All shareholders of a Fund vote together to elect Directors, except that the preferred shareholders of the Municipal Funds have the exclusive right to separately elect two Preferred Share Directors, in addition to the right to vote for the remaining Directors together with the holders of the Common Shares. The Preferred Share Director nominees are Lucinda S. Landreth and Janet L. Yeomans. Provided that a quorum is present at the Meeting, either in person or by proxy, the following votes are required to elect each Fund's Board.

| | Proposal Election of Directors |

| FUND | Bennett, Borowiec, Chow, Fry, Lytle, Sevilla-Sacasa, and Whitford | Landreth and Yeomans |

| DDF | Plurality of votes cast. |

| Municipal Funds | Plurality of Common and Preferred Share votes cast. | Plurality of Preferred Share votes cast. |

THE BOARD UNANIMOUSLY

RECOMMENDS THAT YOU VOTE "FOR"

EACH OF THE NOMINEES

PROPOSAL 2: TO APPROVE SUB-ADVISORY AGREEMENTS

(Delaware Investments Dividend and Income Fund, Inc. only)

Proposal 2 relates solely to shareholders of DDF. DDF's investment advisor, Delaware Management Company ("DMC"), seeks to collaborate with its affiliates, Macquarie Investment Management Europe Limited ("MIMEL"), Macquarie Investment Management Global Limited ("MIMGL"), and Macquarie Funds Management Hong Kong Limited ("MFMHKL"), each a registered investment advisor with the SEC, on its management of DDF. DMC will continue to serve as the Fund's investment advisor, and DMC's current portfolio managers will continue to have ultimate portfolio management discretion over DDF. MIMEL, DMC's United Kingdom domiciled affiliate and MIMGL, DMC's Australian domiciled affiliate, will provide investment recommendations, discuss strategy, and share investment ideas, including with respect to specific securities, on a regular basis for consideration and evaluation by DMC's fixed income portfolio managers.. MIMGL will provide quantitative support for DMC's management of DDF's equity securities and, along with MFMHKL, DMC's Hong Kong domiciled affiliate, will provide equity research and equity trading capabilities to facilitate a "follow-the-sun" trading model. DDF's investment objectives, policies, and limitations will not change in connection with this Proposal. DMC will retain portfolio management responsibilities for DDF consistent with current practice and its current investment process will not change.

Factors relating to the Board's approval of MIMEL, MIMGL, and MFMHKL to serve as sub-advisors to DDF

Following is a discussion of the factors considered by the Board in approving the sub-advisory contracts between DMC and each of MIMEL, MIMGL and MFMHKL. In evaluating the proposed sub-advisory agreements, the Board, including a majority of the independent trustees, made a separate finding, reflected in the Board minutes, that the sub-advisory agreements are in the best interests of DDF and its shareholders, and do not involve a conflict of interest from which any of DMC, MIMEL, MIMGL or MFMHKL derives an inappropriate advantage.

Nature, extent, and quality of services to be provided under the proposed sub-advisory agreements

Macquarie Group affiliates have investment capabilities located around the world in multiple jurisdictions With respect to DDF's investments in fixed income securities, DMC, MIMEL and MIMGL, desire to function as a single investment team, and expand the scope of their collaboration to enable personnel located in the different locations to share specific investment recommendations and client information. With respect to DDF's investments in equity securities, DMC desires to utilize MIMGL's quantitative support services and MIMGL's and MFMHKL's research and equity trading capabilities to implement a follow-the-sun model to facilitate real-time trading in ex-US markets.

Accordingly, DMC seeks to appoint MIMEL, MIMGL, and MFMHKL as sub-advisors to DDF. Appointing MIMEL, MIMGL, and MFMHKL as sub-advisors to DDF will enable DMC to share Fund-specific information with MIMEL, MIMGL, and MFMHKL and, as applicable, to receive their specific research and quantitative support recommendations and access equity trading capabilities in order to enhance the investment advisory services DMC provides to DDF. Moreover, the appointment of MIMEL, MIMGL, and MFMHKL facilitates real-time access to local markets across the three major time zones (Asia, Europe, Americas) as well as the potential for collaboration on asset classes managed in these locations. The Board believes that this global coverage will be beneficial for DDF, as it translates into potentially more resources and diversity of viewpoints that could assist in the management of DDF.

About MIMEL, MIMGL, and MFMHKL

Like DMC, MIMEL, MIMGL, and MFMHKL are investment advisory entities within Macquarie

Investment Management ("MIM"), which is a division of Macquarie Asset Management ("MAM"). MAM is Macquarie Group's funds management business. MAM is a full-service asset manager, offering a diverse range of capabilities and products including infrastructure and real asset management, securities investment management and structured access to funds, equity-based products, and alternative assets.

MIM offers securities investment management capabilities across a number of asset classes including fixed interest, currencies, equities, infrastructure securities, private markets, hedge funds, and multi-asset allocation solutions. MIM delivers a full-service offering to both institutional and retail clients in Australia and the US with selective offerings in other regions.

1. MIMEL

MIMEL is a U.K. incorporated entity authorized and regulated by the Financial Conduct Authority and the SEC. The Macquarie Investment Management Fixed Income and Currency team located in the U.K. forms part of MIMEL. The team includes three portfolio managers with responsibility, in conjunction with team members in other locations, for the day to day management of Macquarie's global bond assets totaling AUD$656 million in assets as of March 31, 2018.

2. MIMGL

MIMGL is an Australian incorporated entity with an Australian Financial Services License and is registered with the SEC.

MIMGL provides investment advisory services for mandates managed across a range of asset classes. Macquarie Fixed Income (MFI) forms part of MIMGL and is the team responsible for managing cash, fixed income, currency and derivatives mandates. The MFIC team has been managing fixed income assets since 1980, launching Australia's first cash management trust. MFIC now manages approximately AUD $54.6 billion as of March 31, 2018 across cash, credit, fixed interest, and currency for a range of Australian and international clients. The Macquarie Systematic Investment team (MSI) is part of MIMGL and will provide quantitative support to DDF's equity investments. MSI is made up of five portfolio managers and a team of quantitative analysts. Portfolio managers and analysts have varied backgrounds, including engineering, computer science and mathematics. MSI has a strong track record of managing quantitative strategies, having managed such portfolios since the late 1980's. With respect to equity trading, MIMGL also has two equity traders supporting the Asian Listed Equities team and the Systematic Investment team and one equity trader supporting the Global Listed Infrastructure team; a fourth Sydney based trader supporting the Quantitative Hedge Fund team may also be leveraged to support the Funds. The team is currently servicing assets under management in excess of [US$15bn] [as of ___] across developed and emerging markets.

3. MFMHKL

MFMHKL is a Hong Kong incorporated entity authorized and regulated by the China Securities Regulatory Commission and Hong Kong – Securities and Futures Commission, and is registered with the SEC. MFMHKL has served previously as a sub-advisor for, and was responsible for the day-to-day management of, an open-end fund in the Delaware Funds complex.

MFMHKL now manages approximately A$ 3,246,168,550.86 in Equities for a range of Hong Kong and international clients.

Benefits of the Proposed Sub-Advisory Agreements

The Board considered the following benefits in approving the sub-advisory agreements:

| · | the teams within MIMEL, MIMGL, and MFMHKL have developed effective global research resources which have assisted them with generating a strong track record and delivering attractive risk-adjusted outcomes for their clients in their global credit and income based strategies. Utilizing the investment |

expertise and experience of DMC's affiliates located in London, Sydney, and Hong Kong will provide DMC with more comprehensive investment resources to use in its management of DDF;

| · | the potential to attract additional assets in DDF. Many of DDF's competitors have access to ex-U.S. affiliates in connection with their management of similar strategies. Access to its ex-U.S. affiliates may assist DMC with attracting assets and make DDF more competitive. Leveraging its affiliates' locations will provide DMC with 24 hour coverage of global markets, follow-the-sun trading and enhance its investment process; and |

| · | as certain Macquarie Group investment affiliates become a single global team, it will manage all products across the various locations in a consistent manner and have greater access to information in real time worldwide. |

The costs of the services to be provided

The proposed sub-advisory agreements do not provide for DMC or DDF to pay for the services of MIMEL, MIMGL, or MFMHKL. The fees to be charged under the sub-advisory agreements are set at zero (0). The zero fee reflects the reciprocal nature of the services being provided across locations and that the overhead relating to trading will be absorbed consistent with how DMC currently handles its trading costs. If and when DMC desires to utilize additional services from MIMEL, MIMGL, and/or MFMHKL, such as discretionary portfolio management, DMC will seek approval from the Board for any sub-advisory fees to be charged. Sub-advisory fees will not be paid from DDF assets but will be paid for by DMC, so there will be no increase in Fund expenses for shareholders even in the event fees are charged in the future.

With no fees to be charged under the proposed sub-advisory agreements, the Board recognized that DDF may benefit from the additional investment resources with no associated costs. Because no fees will be charged, no profits are to be realized by MIMEL, MIMGL, or MFMHKL from their relationship with DDF, and comparisons of the fees and services to be provided under the contract as well as economies of scale are not relevant.

Regulatory requirements

Under the Investment Company Act of 1940, as amended (the "1940 Act"), the definition of "investment adviser" is broad and encompasses the types of services anticipated to be provided by MIMEL, MIMGL, and MFMHKL. Because MIMEL, MIMGL, and MFMHKL will be considered to be investment advisors, section 15 of the 1940 Act requires that DMC enter into sub-advisory agreements with those entities on behalf of DDF. The 1940 Act requires that DDF's shareholders approve the proposed sub-advisory agreements with MIMEL, MIMGL, and MFMHKL before DDF enters into such agreements.

If shareholders approve Proposal 2, MIMEL, MIMGL, and MFMHKL would begin providing services to DDF as soon as the third quarter of 2018.

FOR THE REASONS DISCUSSED ABOVE, THE BOARD OF DELAWARE INVESTMENTS DIVIDEND AND INCOME FUND, INC. UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR PROPOSAL 2.

INDEPENDENT ACCOUNTANTS AND AUDIT COMMITTEE REPORT

The firm of PricewaterhouseCoopers LLP ("PwC") was selected as the independent registered public accounting firm ("independent auditors") for Delaware Investments Dividend and Income Fund, Inc. (DDF) for the fiscal year ending November 30, 2018 on November 15, 2017. PwC was selected as the independent auditors for Delaware Investments National Municipal Income Fund (VFL), Delaware Investments Colorado Municipal Income Fund, Inc. (VCF), and Delaware Investments Minnesota Municipal Income Fund II, Inc. (VMM) for the fiscal year ending March 31, 2019 on February 27, 2018. PwC also acted as independent auditors of the Funds for their most recently completed fiscal years.

The Audit Committee must approve all audit and non-audit services provided to the Funds by their independent auditors, as well as non-audit services provided by their independent auditors DMC and its affiliates that provide ongoing services to the Funds if such non-audit services relate to the operations or financial reporting of the Funds. The Audit Committee reviews any audit or non-audit services to determine whether they are appropriate and permissible under applicable law.

Each Fund's Audit Committee has adopted policies and procedures to provide a framework for the Audit Committee's consideration of audit and non-audit services by the independent auditors. These policies and procedures require that: (i) any audit and non-audit services to be provided by the independent auditors to a Fund, and (ii) non-audit services relating directly to the operations or financial reporting of the Funds that are provided by the Funds' independent auditors to DMC or to any entity controlling, controlled by or under common control with DMC that provides ongoing services to the Funds are subject to pre-approval by the Audit Committee or the Chair of the Audit Committee before such service is provided. The Audit Committee has pre-approved certain services with respect to the Funds, DMC and its affiliates up to certain specified fee limits.

As required by its charter, each Fund's Audit Committee has reviewed and discussed with Fund management and representatives from PwC the audited financial statements for each Fund's last fiscal year. The Audit Committee has discussed with PwC its judgments as to the quality, not just the acceptability, of the Funds' accounting principles and such other matters required to be discussed with the Audit Committee by Public Company Accounting Oversight Board ("PCAOB") Auditing Standard No. 1301: Communications with Audit Committees (formerly Auditing Standard No. 16). The Audit Committee also received the written disclosures and the letter from PwC required by PCAOB Rule 3526, and discussed with representatives of PwC the independent auditor's independence. Each Fund's Audit Committee considered fees received by PwC from DMC and its affiliates during the last fiscal year in connection with its consideration of the auditors' independence.

Based on the foregoing discussions with management and the independent auditors, each Fund's Audit Committee unanimously recommended to the respective Fund's Board that the aforementioned audited financial statements be included in each Fund's annual report to shareholders for the fiscal year.

All members of each Fund's Audit Committee, including Joseph W. Chow, John A. Fry, Lucinda S. Landreth, Thomas K. Whitford, and Janet L. Yeomans, are not considered to be "interested persons" under the 1940 Act. Each Fund's Board has adopted a formal charter for the Audit Committee setting forth its responsibilities. A copy of the Audit Committee's charter is available at delawarefunds.com.

Representatives of PwC are expected to attend the Meeting. The PwC representatives will have the opportunity to make a statement if they desire to do so and will be available to answer appropriate questions.

Audit and Other Fees. The Funds and "Covered Entities" (the investment advisor, excluding sub-advisors unaffiliated with the investment advisor, and any entity controlling, controlled by or under common control with the investment advisor that provides ongoing services to the Funds) were billed the amounts listed below by PwC during each Fund's last two fiscal years. None of the fees in the table below were approved by the registrant's Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X.

| Fund | Fiscal Year End | Audit Fees | Non-Audit Fees |

| | | Audit Fees | Audit Related Fees(1) | Tax Fees(2) | All Other |

| Delaware Investments Dividend and Income Fund, Inc. | 11/30/17 | $36,050 | $- | $5,732 | $- |

| 11/30/16 | $36,050 | $- | $5,558 | $- |

| Delaware Investments Colorado Municipal Income Fund, Inc. | 3/31/18 | $37,360 | $- | $4,723 | $- |

| 3/31/17 | $37,360 | $- | $4,580 | $- |

| Delaware Investments National Municipal Income Fund | 3/31/18 | $37,360 | $- | $4,723 | $- |

| 3/31/17 | $37,360 | $- | $4,580 | $- |

| Delaware Investments Minnesota Municipal Income Fund II, Inc. | 3/31/18 | $37,360 | $- | $4,723 | $- |

| 3/31/17 | $37,360 | $- | $4,580 | $- |

| Covered Entities | 11/30/17 | $- | $640,000 | $- | $- |

| 11/30/16 | $- | $640,000 | $- | $- |

| 3/31/18 | $- | $640,000 | $- | $- |

| 3/31/17 | $- | $640,000 | $- | $- |

1 Includes fees billed for year-end audit procedures, reporting up and subsidiary statutory.

2 Includes fees billed to the Funds for the review of income tax returns and annual excise distribution calculations.

Aggregate non-audit fees to the Funds, the investment advisor and service provider affiliates. The aggregate non-audit fees billed by the independent auditors for services rendered to VCF, VFL and VMM and to Covered Entities were $11,657,000 and $11,180,000 for the fiscal years ended March 31, 2018 and March 31, 2017, respectively. The aggregate non-audit fees billed by the independent auditors for services rendered to DDF and to Covered Entities, were $11,180,000 and $8,665,000 for the fiscal years ended November 30, 2017 and November 30, 2016, respectively.

In connection with its selection of PwC, the Audit Committee has considered PwC's provision of non-audit services to the investment advisor and other service providers under common control with the investment advisor that were not required to be pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X. The Audit Committee has determined that the independent auditors' provision of these services is compatible with maintaining the auditors' independence.

COMMUNICATIONS TO THE BOARD

Shareholders who wish to communicate to the full Board may address correspondence to Thomas L. Bennett, Board Chair for the Funds, c/o the Fund at 2005 Market Street, Philadelphia, Pennsylvania 19103. Shareholders may also send correspondence to any individual Director c/o the Fund at 2005 Market Street, Philadelphia, Pennsylvania 19103. Without opening any such correspondence, Fund management will promptly forward all such correspondence to the addressed recipient(s).

OTHER INFORMATION

Investment Advisor. DMC, a series of Macquarie Investment Management Business Trust (formerly, Delaware Management Business Trust), 2005 Market Street, Philadelphia, PA 19103, serves as investment advisor to each Fund.

Administrator. Delaware Investments Fund Services Company, 2005 Market St., Philadelphia, PA 19103, an affiliate of DMC, performs administrative and fund accounting oversight services for the Funds.

Auditors. PwC serves as the Funds' auditors. PwC's principal address is Two Commerce Square, Suite 1800, 2001 Market Street, Philadelphia, PA 19103-7042.

Proxy Solicitation. Your vote is being solicited by the Directors of the Funds. The solicitation costs for Proposal 1 will be split evenly among the Funds and the solicitation costs for Proposal 2 will be borne by DMC. Subject to the foregoing, the Funds reimburse brokerage firms and other financial intermediaries for their expenses in forwarding proxy materials to the beneficial owners and soliciting them to execute proxies.

The Funds have contracted with AST Fund Solutions, LLC ("AST") to assist with solicitation of proxies. The Funds anticipate that the cost of retaining AST will be up to approximately [$28,728], plus reimbursement of reasonable out-of-pocket expenses (which amount is included in the estimate of total

expenses below). AST anticipates that approximately 40 of its employees or other persons will be involved in soliciting shareholders of the Funds.

In addition to solicitation services to be provided by AST, proxies may be solicited by the Funds and their Directors and executive officers, and/or regular employees and officers of the Funds' investment advisor, administrator, or any of their affiliates, none of whom will receive any additional compensation for these solicitations.

The Funds expect that the solicitation will be primarily by mail, but also may include advertisement, telephone, telecopy, facsimile transmission, electronic, oral, or other means of communication, or by personal contacts. If the Funds do not receive your proxy by a certain time you may receive a telephone call from a proxy soliciting agent asking you to vote.

Although no precise estimate can be made at the present time, it is currently estimated that the aggregate amount to be spent in connection with the solicitation of proxies by the Funds (excluding the salaries and fees of officers and employees) will be approximately $[____]. To date, approximately $[_____] has been spent on the solicitation. These estimates include fees for attorneys, accountants, public relations or financial advisors, proxy solicitors, advertising, printing, transportation, litigation, and other costs incidental to the solicitation, but exclude costs normally expended for the election of Directors in the absence of a contest, and costs represented by salaries and wages of regular employees and officers.

Householding. Unless you have instructed the Funds not to, only one copy of this proxy solicitation will be mailed to multiple Fund shareholders of record who share a mailing address (a "Household"). If you need additional copies of this proxy solicitation, please contact your participating broker-dealer firm or other financial intermediary or, if you hold Fund shares directly with the Funds, you may write to the Funds c/o Macquarie Investment Management, 2005 Market Street, Philadelphia, PA 19103 or call toll-free (866) 437-0252. If you do not want the mailing of your proxy solicitation materials to be combined with those of other members of your Household in the future, or if you are receiving multiple copies and would rather receive just one copy for your Household, please contact your participating broker-dealer firm or other financial intermediary or, if you hold Fund shares directly with the Funds, you may write to the Funds c/o Macquarie Investment Management, 2005 Market Street, Philadelphia, PA 19103 or call toll-free (866) 437-0252.

Shareholder Proposals. For the Funds' annual meeting of shareholders in 2019, shareholder proposals to be included in the Funds' Combined Proxy Statement for that meeting must be received no later than March 7, 2019. Such proposals should be sent to the Fund, directed to the attention of its Secretary, at the address of its principal executive office printed on the first page of this Combined Proxy Statement. The inclusion and/or presentation of any such proposal is subject to the applicable requirements of the proxy rules under the 1934 Act, other applicable law and each Fund's governing instruments. The persons designated as proxies will vote in their discretion on any matter if the Funds do not receive notice of such matter prior to May 21, 2019.

Fund Reports. Each Fund's most recent annual report and semi-annual report were previously mailed to shareholders. Copies of these reports are available upon request, without charge, by writing the Funds c/o Macquarie Investment Management, 2005 Market Street, Philadelphia, PA 19103, or by calling toll-free (866) 437-0252.

EXHIBIT A

OUTSTANDING SHARES AS OF RECORD DATE (JUNE 8, 2018)

| Delaware Investments Dividend and Income Fund, Inc. | |

| Common Shares | [7,688,159.00] |

| Delaware Investments Colorado Municipal Income Fund, Inc. | |

| Common Shares | [4,837,100.00] |

| Preferred Shares | [300.00] |

| Delaware Investments National Municipal Income Fund | |

| Common Shares | [4,528,443.51] |

| Preferred Shares | [300.00] |

| Delaware Investments Minnesota Municipal Income Fund II, Inc. | |

| Common Shares | [11,504,975.09] |

| Preferred Shares | [750.00] |

EXHIBIT B

SHAREHOLDERS OWNING 5% OR MORE OF A FUND

According to disclosure publicly filed with the SEC, as of May 31, 2018, the following accounts held of record 5% or more of the outstanding shares of the Funds listed below. Except as noted below, management does not have knowledge of beneficial owners.

| Fund | Name and Address | Class of Shares | Number of Shares | Percent of Outstanding Shares |

| Delaware Investments Dividend and Income Fund, Inc. | Shaker Financial Services, LLC 839 Bestgate Rd., Suite 400 Annapolis, MD 21401 | Common Shares | 743,254 | 9.7% |

| Delaware Investments Colorado Municipal Income Fund, Inc. | Wells Fargo Bank, National Association 101 N. Phillips Avenue Sioux Falls, South Dakota 57104 | Preferred Shares | 300 | 100.00% |

| Delaware Investments National Municipal Income Fund | MacKay Shields LLC 1345 Avenue of Americas New York, NY 10105 | Common Shares | 256,199 | 5.66% |

| Delaware Investments National Municipal Income Fund | Wells Fargo Bank, National Association 101 N. Phillips Avenue Sioux Falls, South Dakota 57104 | Preferred Shares | 300 | 100.00% |

| Delaware Investments Minnesota Municipal Income Fund II, Inc. | Wells Fargo Bank, National Association 101 N. Phillips Avenue Sioux Falls, South Dakota 57104 | Preferred Shares | 750 | 100.00% |

EXHIBIT C

EXECUTIVE OFFICERS OF THE FUNDS

The Board and the senior management of each Fund appoint officers each year, and from time to time as necessary. Listed below are the executive officers, their years of birth and addresses, positions and length of service with the Funds, and principal occupations during the past five years. Each executive officer is also an officer of DMC, the investment advisor of each Fund, and considered to be an "interested person" of the Funds under the 1940 Act. No officer receives compensation from the Funds.

| Name, Address, and Birthdate | Position(s) Held with the Funds | Length of Time Served | Principal Occupation(s) During Past Five Years |

David F. Connor 2005 Market Street Philadelphia, PA 19103 December 1963 | Senior Vice President, General Counsel, and Secretary | Senior Vice President since May 2013; General Counsel since May 2015; Secretary since October 2005 | David F. Connor has served in various capacities at different times at Macquarie Investment Management. |

Daniel V. Geatens 2005 Market Street Philadelphia, PA 19103 October 1972 | Vice President and Treasurer | Vice President and Treasurer since October 2007 | Daniel V. Geatens has served in various capacities at different times at Macquarie Investment Management. |

Richard Salus 2005 Market Street Philadelphia, PA 19103 October 1963 | Senior Vice President and Chief Financial Officer | Senior Vice President and Chief Financial Officer since November 2006 | Richard Salus has served in various executive capacities at different times at Macquarie Investment Management. |

| |

DELAWARE INVESTMENTS DIVIDEND AND INCOME FUND, INC. DELAWARE INVESTMENTS COLORADO MUNICIPAL INCOME FUND, INC. DELAWARE INVESTMENTS NATIONAL MUNICIPAL INCOME FUND DELAWARE INVESTMENTS MINNESOTA MUNICIPAL INCOME FUND II, INC. |

| |

| |

| |

| |

| COMBINED PROXY STATEMENT |

| Notice of Joint Annual Meeting of Shareholders |

| AUGUST 15, 2018 |

| |

| |

| |

| |

|

|

| |

|