Washington, D.C. 20549

Nuveen Premium Income Municipal Fund 4, Inc.

Kevin J. McCarthy

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Table of Contents

| Chairman’s Letter to Shareholders | 4 |

| | |

| Portfolio Managers’ Comments | 5 |

| | |

| Fund Leverage | 8 |

| | |

| Common Share Information | 10 |

| | |

| Risk Considerations | 12 |

| | |

| Performance Overview and Holding Summaries | 13 |

| | |

| Portfolios of Investments | 16 |

| | |

| Statement of Assets and Liabilities | 65 |

| | |

| Statement of Operations | 66 |

| | |

| Statement of Changes in Net Assets | 67 |

| | |

| Statement of Cash Flows | 68 |

| | |

| Financial Highlights | 70 |

| | |

| Notes to Financial Statements | 75 |

| | |

| Reinvest Automatically, Easily and Conveniently | 84 |

| | |

| Glossary of Terms Used in this Report | 86 |

| | |

| Additional Fund Information | 91 |

Chairman’s

Letter to Shareholders

Dear Shareholders,

After nine years of serving as lead director and independent chairman of the Nuveen Fund Board, my term of office is coming to an end. It has been a privilege to use this space to communicate with you on some of the broad economic trends in the U.S. and abroad and how they are impacting the investment environment in which your funds operate. In addition, I have enjoyed offering some perspective on how your Board views the various Nuveen investment teams as they apply their investment disciplines in that investment environment.

My term has coincided with a particularly challenging period for both mutual fund sponsors and investors. Since 2000 there have been three periods of unusually strong stock market growth and two major market declines. Recent years have been characterized by a search for yield in fixed income securities to compensate for an extended period of very low interest rates. Funds are investing more in foreign and emerging markets that require extensive research capabilities to overcome the more limited transparency and higher volatility in those markets. New fund concepts often incorporate derivative financial instruments that offer efficient ways to hedge investment risk or gain exposure to selected markets. Fund trading teams operate in many new domestic and international venues with quite different characteristics. Electronic trading and global communication networks mean that fund managers must be able to thrive in financial markets that react instantaneously to newsworthy events and are more interconnected than ever.

Nuveen has committed additional resources to respond to these changes in the fund industry environment. It has added IT and research resources to assemble and evaluate the increased flow of detailed information on economies, markets and individual companies. Based on its experience during the financial crisis of 2008-09, Nuveen has expanded its resources dedicated to valuing and trading portfolio securities with a particular focus on stressed financial market conditions. It has added systems and experienced risk management professionals to work with investment teams to better help evaluate whether their funds’ risk exposures are appropriate in view of the return targets. The investment teams have also reflected on recent experience to reaffirm or modify their investment disciplines. Finally, experienced professionals and IT resources have been added to address new regulatory requirements designed to better inform and protect investors. The Board has enthusiastically encouraged these initiatives.

The Nuveen Fund Board has always viewed itself as your representatives to assure that Nuveen brings together experienced people, proven technologies and effective processes designed to produce results that meet investor expectations. It is important to note that our activities are highlighted by the annual contract renewal process. Despite its somewhat formal language, I strongly encourage you to read the summary because it offers an insight into our oversight process. The report is included in the back of this or a subsequent shareholder report. The renewal process is very comprehensive and includes a number of evaluations and discussions between the Board and Nuveen during the year. The summary also describes what has been achieved across the Nuveen fund complex and at individual funds such as yours.

As I leave the chairmanship and resume my role as a member of the Board, please be assured that I and my fellow Board members will continue to hold your interests uppermost in our minds as we oversee the management of your funds and that we greatly appreciate your confidence in your Nuveen fund.

Very sincerely,

Robert P. Bremner

Chairman of the Board

June 21, 2013

Portfolio Managers’ Comments

Nuveen Premium Income Municipal Fund, Inc. (NPI)

Nuveen Premium Income Municipal Fund 2, Inc. (NPM)

Nuveen Premium Income Municipal Fund 4, Inc. (NPT)

Portfolio managers Paul Brennan and Chris Drahn discuss key investment strategies and the six-month performance of these three national Funds. Paul has managed NPI and NPM since 2006 and Chris assumed portfolio management responsibility for NPT in January 2011.

What key strategies were used to manage these Funds during the six-month reporting period ended April 30, 2013?

In an environment characterized by tight supply, strong demand and lower yields, we continued to take a bottom-up approach to discovering sectors that appeared undervalued as well as individual credits that had the potential to perform well over the long term. However, the municipal market also encountered some additional volatility generated by the political environment, particularly the “fiscal cliff” at the end of 2012 and the approach of federal tax season. On the revenue side, state tax collections have grown for eleven straight quarters, exceeding pre-recession levels beginning in September 2011, while on the expense side, the states made headway in cutting and controlling costs. The current low level of municipal issuance reflects the current political distaste for additional borrowing by state and local governments facing fiscal constraints and the prevalent atmosphere of municipal budget austerity. During this period, we continued to see municipal yields remain relatively low. Borrowers seeking to take advantage of the low rate environment sparked an increase in refunding activity, with approximately 50% of municipal paper issued by borrowers that were calling existing debt and refinancing at lower rates.

During this period, all three Funds found value in health care, transportation, infrastructure and broad based essential services bonds backed by taxes or other revenues. In NPT, we added dedicated tax bonds secured by governmental tax or fee revenues such as sales, excise or gas taxes. Also in NPT, we added exposure to prepaid gas debt, a category of bond issuance that rallied during the period. These securities are used by municipalities to prepay natural gas costs and control energy spending.

In general during this period, we emphasized bonds with longer maturities. This enabled us to take advantage of more attractive yields at the longer end of the municipal yield curve and also provided some protection for the Funds’ duration and yield curve positioning. In NPI and NPM, we also purchased lower rated bonds when we

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s, Moody’s Investors Service, Inc., or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

found attractive opportunities, as we believed these bonds continued to offer relative value. In NPT, our purchases were diversified across bonds with ratings ranging from AA to BBB- ratings. Our opportunities in these areas were somewhat constrained by the structure of bonds typically issued as part of refinancing deals, which tend to be characterized by shorter maturities and higher credit quality.

As of April 30, 2013, all three of these Funds continued to use inverse floating rate securities. We employ inverse floaters for a variety of reasons, including duration management, income enhancement and total return enhancement.

How did the Funds perform during the six-month reporting period ended April 30, 2013?

The tables in each Fund’s Performance Overview and Holding Summaries section of this report provide total returns for the Funds for the six-month, one-year, five-year and ten-year periods ended April 30, 2013. Each Fund’s total returns are compared with the performance of a corresponding market index and Lipper classification average.

For the six-months ended April 30, 2013, the total returns on common share net asset value (NAV) for all three of these Nuveen Funds exceeded the return for the S&P Municipal Bond Index. For this same period, the NPI and NPT performed in line with the Lipper General & Insured Leveraged Municipal Debt Funds Classification Average, while NPM lagged the average return for the Lipper General & Insured Leveraged Municipal Debt Funds Classification Average.

Key management factors that influenced the Funds’ returns during this period included duration and yield curve positioning and credit exposure. While sector allocation positively impacted NPI and NPM, it had a more neutral impact on NPT. In addition, the use of regulatory leverage was an important positive factor affecting the Funds’ performance over this period. Leverage is discussed in more detail later in this report.

Municipal bonds with longer maturities generally outperformed those with shorter maturities during this period. Overall, credits at the longest end of the municipal yield curve posted the strongest returns, while bonds at the shortest end produced the weakest results. For this period, duration and yield curve positioning was a major positive contributor to the performance of these Funds, with the net impact varying according to each Fund’s individual weightings along the yield curve. In particular, the Funds benefited from their holdings of long duration bonds, many of which had zero percent coupons, which generally outperformed the market during this period. NPI’s shorter duration detracted from its performance for the period.

Credit exposure was another important factor in the Funds’ performance during this six-month reporting period as lower quality bonds generally outperformed higher quality bonds. This outperformance was due in part to the greater demand for lower rated bonds as investors looked for investment vehicles offering higher yields. As investors became more comfortable taking on additional investment risk, credit spreads, or the difference in yield spreads between U.S. Treasury securities and comparable investments such as municipal bonds, narrowed through a variety of rating categories. As a result of this spread compression, these Funds benefited from their holdings of lower rated credits, especially NPT, which was overweight in BBB and A rated bonds. NPM, on the other hand, had the smallest weighting of BBB-rated bonds, which detracted from its performance.

During this period, revenue bonds as a whole outperformed the general municipal market. Holdings that generally made positive contributions to the Funds’ return included industrial development revenue (IDR) credits, health care (together with hospitals), transportation and housing bonds. In particular, the Funds’ health care exposure was positive for performance. Tobacco credits backed by the 1998 master tobacco settlement agreement also were one of the top performing market sectors, helped by their longer effective durations and the increased demand for higher yielding investments by investors who had become less risk-averse. In addition, based on recent data showing that cigarette sales had fallen less steeply than anticipated, the 46 states participating in the agreement stand to receive increased payments from the tobacco companies. As of April 30, 2013, all three Funds were slightly overweight in tobacco bonds, which benefited their performance as tobacco credits rallied.

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of all these Funds relative to the comparative indexes was the Funds’ use of leverage. The Funds use leverage because their managers believe that, over time, leveraging provides opportunities for additional income and total return for common shareholders. However, use of leverage also can expose common shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on common share net asset value and common shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance common share returns during periods when the prices of securities held by a Fund generally are rising. Leverage made a positive contribution to the performance of these Funds over this reporting period.

As of April 30, 2013, the Funds’ percentages of effective and regulatory leverage are shown in the accompanying table.

| | | | | |

| | Effective | | Regulatory | |

| | Leverage | * | Leverage | * |

| NPI | 36.35% | | 29.09% | |

| NPM | 37.20% | | 30.23% | |

| NPT | 35.74% | | 29.29% | |

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. Regulatory leverage is sometimes referred to as “‘40 Act Leverage” and is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUNDS’ REGULATORY LEVERAGE

As of April 30, 2013, the Funds have issued and outstanding Variable Rate MuniFund Term Preferred (VMTP) Shares and Variable Rate Demand Preferred (VRDP) Shares as shown in the accompanying tables.

VMTP Shares

| | | | | |

| | | | VMTP Shares Issued | |

| Fund | Series | | at Liquidation Value | |

| NPI | 2015 | | $ 407,000,000 | |

During the current reporting period, NPI successfully exchanged all of its outstanding 4,024 Shares of Series 2014 VMTP for 4,024 Shares of Series 2015 VMTP. Concurrent with this exchange, the Fund also issued an additional $4,600,000 at liquidation value, of Series 2015 VMTP Shares. 3Both of these transactions were completed in privately negotiated offerings.

The Fund completed the exchange offer in which it refinanced its existing VMTP Shares with new VMTP Shares at a reduced cost and with a term redemption date of December 1, 2015. The proceeds from the additional VMTP Shares will be used to take advantage of opportunities in the current municipal market. Dividends on the VMTP Shares are set weekly at a fixed spread to the Securities Industry and Financial Markets Association Municipal Swap Index (SIFMA).

VRDP Shares

| | | | |

| | VRDP Shares Issued | |

| Fund | at Liquidation Value | |

| NPM | $ | 489,500,000 | |

| NPT | $ | 262,200,000 | |

Refer to Notes to Financial Statements, Footnote 1 – General Information and Significant Accounting Policies for further details on VMTP Shares and VRDP Shares.

Common Share Information

COMMON SHARE DIVIDEND INFORMATION

During the current reporting period ended April 30, 2013, the Funds’ monthly dividends to shareholders were as shown in the accompanying table.

| | | | | |

| | | Per Common Share Amounts | |

| | | | NPI | | | NPM | | | NPT | |

| November | | $ | 0.0765 | | $ | 0.0745 | | $ | 0.0710 | |

| December | | | 0.0720 | | | 0.0720 | | | 0.0680 | |

| January | | | 0.0720 | | | 0.0720 | | | 0.0680 | |

| February | | | 0.0720 | | | 0.0720 | | | 0.0680 | |

| March | | | 0.0720 | | | 0.0720 | | | 0.0680 | |

| April | | | 0.0720 | | | 0.0720 | | | 0.0680 | |

| Ordinary Income Distribution** | | $ | — | | $ | 0.0009 | | $ | — | |

| | | | | | | | | | | |

| Market Yield*** | | | 5.90% | | | 5.81% | | | 5.71% | |

| Taxable-Equivalent Yield*** | | | 8.19% | | | 8.07% | | | 7.93% | |

| ** | Distribution paid in December 2012. |

| *** | Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a federal income tax rate of 28.0%. When comparing a Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

All of the Funds in this report seek to pay stable dividends at rates that reflect each Fund’s past results and projected future performance. During certain periods, each Fund may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Fund during the period. If a Fund has cumulatively earned more than it has paid in dividends, it holds the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s NAV. Conversely, if a Fund has cumulatively paid dividends in excess of its earnings, the excess constitutes negative UNII that is likewise reflected in the Fund’s NAV. Each Fund will, over time, pay all of its net investment income as dividends to shareholders. As of April 30, 2013, all of the Funds in this report had positive UNII balances, based on our best estimate, for tax purposes and positive UNII balances for financial reporting purposes.

COMMON SHARE REPURCHASES

During November 2012, the Nuveen Funds’ Board of Directors/Trustees reauthorized the Funds’ open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding common shares.

As of April 30, 2013, and since the inception of the Funds’ repurchase programs, NPM has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table. Since the inception of the Funds’ repurchase programs, NPI and NPT have not repurchased any of their outstanding common shares.

| | | | | | |

| | | Common Shares | | % of Common Shares | |

| Fund | | Repurchased and Retired | | Authorized for Repurchase | |

| NPM | | 422,900 | | 6.0% | |

During the current reporting period, NPM did not repurchase any of its outstanding common shares.

COMMON SHARE OTHER INFORMATION

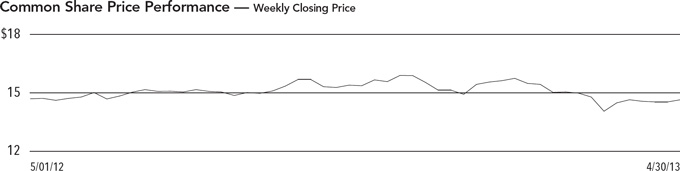

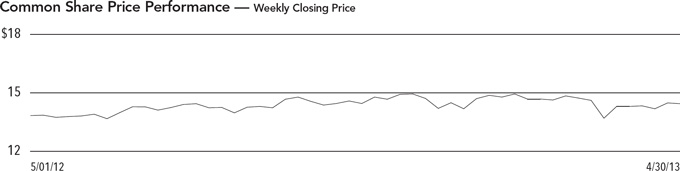

As of April 30, 2013, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their NAV as shown in the accompanying table.

| | | | | | | | | | | |

| | | | NPI | | | NPM | | | NPT | |

| Common Share NAV | | $ | 15.49 | | $ | 15.98 | | $ | 14.60 | |

| Common Share Price | | $ | 14.65 | | $ | 14.88 | | $ | 14.30 | |

| Premium/(Discount) to NAV | | | -5.42 | % | | -6.88 | % | | -2.05 | % |

| 6-Month Average Premium/(Discount) to NAV | | | -2.39 | % | | -3.92 | % | | -0.27 | % |

| Nuveen Investments | | | 11 | | | | | | | |

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the municipal securities owned by the Fund, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like these Funds frequently trade at a discount to their net asset value (NAV). Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations.

Issuer Credit Risk. This is the risk that a security in a Fund’s portfolio will fail to make dividend or interest payments when due.

Interest Rate Risk. Fixed-income securities such as bonds, preferred, convertible and other debt securities will decline in value if market interest rates rise.

Reinvestment Risk. If market interest rates decline, income earned from a Fund’s portfolio may be reinvested at rates below that of the original bond that generated the income.

Call Risk or Prepayment Risk. Issuers may exercise their option to prepay principal earlier than scheduled, forcing a Fund to reinvest in lower-yielding securities.

Inverse Floater Risk. The Funds may invest in inverse floaters. Due to their leveraged nature, these investments can greatly increase a Fund’s exposure to interest rate risk and credit risk. In addition, investments in inverse floaters involve the risk that the Fund could lose more than its original principal investment.

Leverage Risk. Each Fund’s use of leverage creates the possibility of higher volatility for the Fund’s per share NAV, market price, distributions and returns. There is no assurance that a Fund’s leveraging strategy will be successful.

Nuveen Premium Income Municipal Fund, Inc. (NPI)

Performance Overview and Holding Summaries as of April 30, 2013

Average Annual Total Returns as of April 30, 2013

| | | | Cumulative | | | Average Annual | |

| | | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| NPI at Common Share NAV | | | 3.25% | | 9.58% | | 8.32% | | 6.30% |

| NPI at Common Share Price | | | (3.09)% | | 6.53% | | 8.93% | | 6.38% |

| S&P Municipal Bond Index | | | 2.01% | | 5.74% | | 6.08% | | 5.16% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | | | 3.21% | | 10.58% | | 8.88% | | 6.74% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| | | | | |

Portfolio Composition1 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/Limited | | | 17.0 | % |

| Health Care | | | 17.0 | % |

| Transportation | | | 16.5 | % |

| U.S. Guaranteed | | | 14.7 | % |

| Tax Obligation/General | | | 11.2 | % |

| Water and Sewer | | | 6.0 | % |

| Utilities | | | 5.4 | % |

| Other | | | 12.2 | % |

Credit Quality1,2,3 | | | | |

| (as a % of total investment exposure) | | | | |

| AAA/U.S. Guaranteed | | | 20.6 | % |

| AA | | | 34.7 | % |

| A | | | 26.9 | % |

| BBB | | | 11.2 | % |

| BB or Lower | | | 4.1 | % |

| N/R | | | 1.1 | % |

States1 | | | | |

| (as a % of total investments) | | | | |

| California | | | 14.9 | % |

| Texas | | | 10.3 | % |

| New York | | | 9.7 | % |

| Illinois | | | 8.3 | % |

| Florida | | | 7.1 | % |

| New Jersey | | | 4.6 | % |

| Massachusetts | | | 3.0 | % |

| Pennsylvania | | | 3.0 | % |

| Louisiana | | | 2.9 | % |

| South Carolina | | | 2.8 | % |

| Minnesota | | | 2.7 | % |

| Alabama | | | 2.5 | % |

| Ohio | | | 2.4 | % |

| Michigan | | | 2.2 | % |

| Wisconsin | | | 2.2 | % |

| Washington | | | 1.8 | % |

| Other | | | 19.6 | % |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this page.

| 1 | Holdings are subject to change. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Percentage may not add to 100% due to the exclusion of Other Assets Less Liabilities from the table. |

Nuveen Premium Income Municipal Fund 2, Inc. (NPM)

Performance Overview and Holding Summaries as of April 30, 2013

Average Annual Total Returns as of April 30, 2013

| | | | Cumulative | | | Average Annual | |

| | | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| NPM at Common Share NAV | | | 2.68% | | 8.74% | | 8.67% | | 6.43% |

| NPM at Common Share Price | | | (1.63)% | | 4.66% | | 9.03% | | 6.52% |

| S&P Municipal Bond Index | | | 2.01% | | 5.74% | | 6.08% | | 5.16% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | | | 3.21% | | 10.58% | | 8.88% | | 6.74% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| | | | | |

Portfolio Composition1 | | | | |

| (as a % of total investments) | | | | |

| Tax Obligation/Limited | | | 18.3 | % |

| Health Care | | | 16.9 | % |

| Tax Obligation/General | | | 14.7 | % |

| U.S. Guaranteed | | | 12.5 | % |

| Transportation | | | 11.3 | % |

| Water and Sewer | | | 7.3 | % |

| Education and Civic Organizations | | | 6.1 | % |

| Utilities | | | 5.7 | % |

| Other | | | 7.2 | % |

Credit Quality1,2,3 | | | | |

| (as a % of total investment exposure) | | | | |

| AAA/U.S. Guaranteed | | | 19.5 | % |

| AA | | | 38.6 | % |

| A | | | 26.9 | % |

| BBB | | | 8.4 | % |

| BB or Lower | | | 2.9 | % |

| N/R | | | 2.2 | % |

States1 | | | | |

| (as a % of total investments) | | | | |

| Florida | | | 17.6 | % |

| California | | | 11.6 | % |

| Illinois | | | 9.5 | % |

| Texas | | | 7.3 | % |

| New York | | | 6.5 | % |

| Nevada | | | 4.1 | % |

| Louisiana | | | 4.0 | % |

| New Jersey | | | 3.5 | % |

| Michigan | | | 3.5 | % |

| Washington | | | 3.3 | % |

| Ohio | | | 3.1 | % |

| Massachusetts | | | 2.2 | % |

| Alabama | | | 2.1 | % |

| Pennsylvania | | | 2.0 | % |

| Other | | | 19.7 | % |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this page.

| 1 | Holdings are subject to change. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Percentage may not add to 100% due to the exclusion of Other Assets Less Liabilities from the table. |

Nuveen Premium Income Municipal Fund 4, Inc. (NPT)

Performance Overview and Holding Summaries as of April 30, 2013

Average Annual Total Returns as of April 30, 2013

| | | | Cumulative | | | Average Annual | |

| | | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| NPT at Common Share NAV | | | 3.49% | | 10.48% | | 9.25% | | 6.81% |

| NPT at Common Share Price | | | 1.59% | | 9.82% | | 11.38% | | 7.30% |

| S&P Municipal Bond Index | | | 2.01% | | 5.74% | | 6.08% | | 5.16% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | | | 3.21% | | 10.58% | | 8.88% | | 6.74% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| | | | | |

Portfolio Composition1 | | | | |

| (as a % of total investments) | | | | |

| Health Care | | | 22.5 | % |

| Tax Obligation/Limited | | | 17.1 | % |

| Tax Obligation/General | | | 14.1 | % |

| U.S. Guaranteed | | | 11.7 | % |

| Transportation | | | 9.3 | % |

| Water and Sewer | | | 7.3 | % |

| Education and Civic Organizations | | | 4.6 | % |

| Other | | | 13.4 | % |

Credit Quality1,2,3 | | | | |

| (as a % of total investment exposure) | | | | |

| AAA/U.S. Guaranteed | | | 17.8 | % |

| AA | | | 27.0 | % |

| A | | | 29.4 | % |

| BBB | | | 19.6 | % |

| BB or Lower | | | 2.1 | % |

| N/R | | | 2.9 | % |

States1 | | | | |

| (as a % of total investments) | | | | |

| California | | | 14.0 | % |

| Texas | | | 12.6 | % |

| Illinois | | | 12.4 | % |

| Colorado | | | 5.7 | % |

| Florida | | | 4.8 | % |

| Louisiana | | | 4.3 | % |

| Arizona | | | 3.1 | % |

| Michigan | | | 3.0 | % |

| Pennsylvania | | | 2.5 | % |

| Alabama | | | 2.5 | % |

| New York | | | 2.5 | % |

| Georgia | | | 2.4 | % |

| Wisconsin | | | 2.3 | % |

| Ohio | | | 2.3 | % |

| Indiana | | | 2.3 | % |

| Washington | | | 2.0 | % |

| Puerto Rico | | | 1.9 | % |

| Other | | | 19.4 | % |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this page.

| 1 | Holdings are subject to change. |

| 2 | Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies. |

| 3 | Percentage may not add to 100% due to the exclusion of Other Assets Less Liabilities from the table. |

| | | Nuveen Premium Income Municipal Fund, Inc. |

| NPI | | Portfolio of Investments |

| | | April 30, 2013 (Unaudited) |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | Municipal Bonds – 148.4% (100.0% of Total Investments) | | | | | | |

| | | | Alabama – 3.7% (2.5% of Total Investments) | | | | | | |

| | | | Alabama Special Care Facilities Financing Authority, Revenue Bonds, Ascension Health, Series 2006C-2: | | | | | | |

| $ | 1,435 | | 5.000%, 11/15/36 (UB) | 11/16 at 100.00 | AA+ | | $ | 1,587,239 | |

| | 4,000 | | 5.000%, 11/15/39 (UB) | 11/16 at 100.00 | AA+ | | | 4,424,360 | |

| | 6,000 | | Alabama Special Care Facilities Financing Authority, Revenue Bonds, Ascension Health, Series 2006D, 5.000%, 11/15/39 (UB) | 11/16 at 100.00 | AA+ | | | 6,636,540 | |

| | | | Birmingham Special Care Facilities Financing Authority, Alabama, Revenue Bonds, Baptist Health System Inc., Series 2005A: | | | | | | |

| | 6,000 | | 5.250%, 11/15/20 | 11/15 at 100.00 | Baa2 | | | 6,483,600 | |

| | 1,300 | | 5.000%, 11/15/30 | 11/15 at 100.00 | Baa2 | | | 1,351,987 | |

| | 12,000 | | Birmingham Waterworks and Sewerage Board, Alabama, Water and Sewerage Revenue Bonds, Series 2007A, 4.500%, 1/01/43 – BHAC Insured | 1/17 at 100.00 | AA+ | | | 12,554,640 | |

| | 2,890 | | Courtland Industrial Development Board, Alabama, Pollution Control Revenue Bonds, International Paper Company, Series 2005A, 5.000%, 6/01/25 | 6/15 at 100.00 | BBB | | | 3,004,184 | |

| | 1,000 | | Montgomery BMC Special Care Facilities Financing Authority, Alabama, Revenue Bonds, Baptist Medical Center, Series 2004C, 5.250%, 11/15/29 (Pre-refunded 11/15/14) | 11/14 at 100.00 | A3 (4) | | | 1,075,110 | |

| | 34,625 | | Total Alabama | | | | | 37,117,660 | |

| | | | Alaska – 1.4% (1.0% of Total Investments) | | | | | | |

| | | | Anchorage, Alaska, General Obligation Refunding Bonds, Series 2003A: | | | | | | |

| | 2,000 | | 5.250%, 9/01/17 (Pre-refunded 9/01/13) – FGIC Insured | 9/13 at 100.00 | AA+ (4) | | | 2,033,760 | |

| | 2,035 | | 5.250%, 9/01/18 (Pre-refunded 9/01/13) – FGIC Insured | 9/13 at 100.00 | AA+ (4) | | | 2,069,351 | |

| | 10,500 | | Northern Tobacco Securitization Corporation, Alaska, Tobacco Settlement Asset-Backed Bonds, Series 2006A, 5.000%, 6/01/32 | 6/14 at 100.00 | B+ | | | 9,824,955 | |

| | 14,535 | | Total Alaska | | | | | 13,928,066 | |

| | | | Arizona – 1.7% (1.1% of Total Investments) | | | | | | |

| | | | Glendale Industrial Development Authority, Arizona, Revenue Bonds, John C. Lincoln Health Network, Series 2005B: | | | | | | |

| | 500 | | 5.250%, 12/01/24 | 12/15 at 100.00 | BBB+ | | | 527,130 | |

| | 660 | | 5.250%, 12/01/25 | 12/15 at 100.00 | BBB+ | | | 693,416 | |

| | 9,720 | | Phoenix Civic Improvement Corporation, Arizona, Junior Lien Airport Revenue Bonds, Series 2010A, 5.000%, 7/01/40 | 7/20 at 100.00 | A+ | | | 10,678,975 | |

| | 4,100 | | Salt Verde Financial Corporation, Arizona, Senior Gas Revenue Bonds, Citigroup Energy Inc Prepay Contract Obligations, Series 2007, 5.000%, 12/01/37 | No Opt. Call | A– | | | 4,606,145 | |

| | 14,980 | | Total Arizona | | | | | 16,505,666 | |

| | | | Arkansas – 0.2% (0.1% of Total Investments) | | | | | | |

| | 2,000 | | Washington County, Arkansas, Hospital Revenue Bonds, Washington Regional Medical Center, Series 2005B, 5.000%, 2/01/25 | 2/15 at 100.00 | Baa1 | | | 2,060,560 | |

| | | | California – 22.1% (14.9% of Total Investments) | | | | | | |

| | 9,200 | | Alameda Corridor Transportation Authority, California, Revenue Bonds, Refunding Subordinate Lien Series 2004A, 0.000%, 10/01/20 – AMBAC Insured | No Opt. Call | BBB+ | | | 7,257,328 | |

| | 10,000 | | Anaheim Public Finance Authority, California, Senior Lease Bonds, Public Improvement Project, Refunding Series 2007A-1, 4.375%, 3/01/37 – FGIC Insured | 9/17 at 100.00 | A1 | | | 10,340,600 | |

| | 5,400 | | California Educational Facilities Authority, Revenue Bonds, University of Southern California, Series 2005, 4.750%, 10/01/28 (UB) | 10/15 at 100.00 | Aa1 | | | 5,863,158 | |

| | 1,500 | | California Educational Facilities Authority, Revenue Bonds, University of the Pacific, Series 2006, 5.000%, 11/01/30 | 11/15 at 100.00 | A2 | | | 1,619,940 | |

| | 5,425 | | California Health Facilities Financing Authority, Revenue Bonds, Catholic Healthcare West, Series 2004I, 4.950%, 7/01/26 (Mandatory put 7/01/14) | No Opt. Call | A | | | 5,705,147 | |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | California (continued) | | | | | | |

| $ | 8,560 | | California Health Facilities Financing Authority, Revenue Bonds, Cedars-Sinai Medical Center, Series 2005, 5.000%, 11/15/27 | 11/15 at 100.00 | A+ | | $ | 9,256,442 | |

| | 8,570 | | California Health Facilities Financing Authority, Revenue Bonds, Kaiser Permanante System, Series 2006, 5.000%, 4/01/37 | 4/16 at 100.00 | A+ | | | 9,331,702 | |

| | 4,250 | | California Health Facilities Financing Authority, Revenue Bonds, Providence Health & Services, Series 2009B, 5.500%, 10/01/39 | 10/19 at 100.00 | AA | | | 5,005,905 | |

| | | | California Health Facilities Financing Authority, Revenue Bonds, Stanford Hospitals and Clinics, Tender Option Bond Trust 3294: | | | | | | |

| | 2,140 | | 9.308%, 2/15/20 (IF) (5) | No Opt. Call | AA– | | | 2,654,285 | |

| | 825 | | 9.308%, 2/15/20 (IF) | No Opt. Call | AA– | | | 1,023,264 | |

| | 790 | | 9.301%, 2/15/20 (IF) | No Opt. Call | AA– | | | 979,679 | |

| | 3,015 | | California Health Facilities Financing Authority, Revenue Bonds, Sutter Health, Series 2007A, 5.000%, 11/15/42 (UB) | 11/16 at 100.00 | AA– | | | 3,325,786 | |

| | 7,205 | | California State Public Works Board, Lease Revenue Bonds, Department of Corrections, Series 1993E, 5.500%, 6/01/15 | No Opt. Call | A2 | | | 7,501,198 | |

| | 1,000 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series 2010A-1, 6.000%, 3/01/35 | 3/20 at 100.00 | A2 | | | 1,228,170 | |

| | 3,130 | | California State, Economic Recovery Revenue Bonds, Series 2004A, 5.250%, 7/01/14 | No Opt. Call | Aa3 | | | 3,312,041 | |

| | 905 | | California State, Economic Recovery Revenue Bonds, Series 2004A, 5.250%, 7/01/14 (ETM) | No Opt. Call | Aaa | | | 957,970 | |

| | | | California State, General Obligation Bonds, Series 2004: | | | | | | |

| | 1,160 | | 5.125%, 2/01/25 | 2/14 at 100.00 | A1 | | | 1,199,243 | |

| | 10,000 | | 5.125%, 2/01/26 | 2/14 at 100.00 | A1 | | | 10,330,600 | |

| | | | California Statewide Community Development Authority, Revenue Bonds, Daughters of Charity Health System, Series 2005A: | | | | | | |

| | 1,640 | | 5.250%, 7/01/30 | 7/15 at 100.00 | BBB– | | | 1,726,953 | |

| | 4,730 | | 5.000%, 7/01/39 | 7/15 at 100.00 | BBB– | | | 4,907,375 | |

| | 5,000 | | California Statewide Community Development Authority, Revenue Bonds, St. Joseph Health System, Series 2007A, 5.750%, 7/01/47 – FGIC Insured | 7/18 at 100.00 | AA– | | | 5,784,650 | |

| | 7,130 | | California Statewide Community Development Authority, Revenue Bonds, Sutter Health, Tender Option Bond Trust 3175, 13.651%, 5/15/14 (IF) | No Opt. Call | AA– | | | 11,048,220 | |

| | 3,575 | | Chula Vista, California, Industrial Development Revenue Bonds, San Diego Gas and Electric Company, Series 1996A, 5.300%, 7/01/21 | 6/14 at 102.00 | A+ | | | 3,822,426 | |

| | 4,890 | | Clovis Unified School District, Fresno County, California, General Obligation Bonds, Series 2006B, 0.000%, 8/01/26 – NPFG Insured | No Opt. Call | AA+ | | | 3,043,243 | |

| | | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2007A-1: | | | | | | |

| | 7,520 | | 5.000%, 6/01/33 | 6/17 at 100.00 | B | | | 6,937,050 | |

| | 2,000 | | 5.750%, 6/01/47 | 6/17 at 100.00 | B | | | 1,910,940 | |

| | 3,000 | | 5.125%, 6/01/47 | 6/17 at 100.00 | B | | | 2,612,880 | |

| | 5,000 | | Kern Community College District, California, General Obligation Bonds, Series 2006, 0.000%, 11/01/24 – AGM Insured | No Opt. Call | Aa2 | | | 3,335,650 | |

| | 15,000 | | Los Angeles Department of Water and Power, California, Waterworks Revenue Bonds, Series 2011A, 5.000%, 7/01/41 | 1/21 at 100.00 | AA | | | 16,915,200 | |

| | 465 | | Martinez, California, Home Mortgage Revenue Bonds, Series 1983A, 10.750%, 2/01/16 (ETM) | No Opt. Call | Aaa | | | 535,029 | |

| | 14,430 | | Pomona, California, GNMA/FNMA Collateralized Securities Program Single Family Mortgage Revenue Bonds, Series 1990A, 7.600%, 5/01/23 (ETM) | No Opt. Call | Aaa | | | 19,045,436 | |

| | 5,000 | | Rancho Mirage Joint Powers Financing Authority, California, Revenue Bonds, Eisenhower Medical Center, Series 2004, 5.875%, 7/01/26 (Pre-refunded 7/01/14) | 7/14 at 100.00 | Baa2 (4) | | | 5,326,050 | |

| | 2,570 | | Sacramento Municipal Utility District, California, Electric Revenue Bonds, Series 2003R, 5.000%, 8/15/22 (Pre-refunded 8/15/13) – NPFG Insured | 8/13 at 100.00 | A1 (4) | | | 2,606,777 | |

| | | Nuveen Premium Income Municipal Fund, Inc. (continued) |

| NPI | | Portfolio of Investments |

| | | April 30, 2013 (Unaudited) |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | California (continued) | | | | | | |

| $ | 1,130 | | Sacramento Municipal Utility District, California, Electric Revenue Bonds, Series 2003R, 5.000%, 8/15/22 – NPFG Insured | 8/13 at 100.00 | AA– | | $ | 1,145,888 | |

| | | | San Diego County, California, Certificates of Participation, Burnham Institute, Series 2006: | | | | | | |

| | 400 | | 5.000%, 9/01/21 | 9/15 at 102.00 | Baa2 | | | 423,276 | |

| | 445 | | 5.000%, 9/01/23 | 9/15 at 102.00 | Baa2 | | | 466,698 | |

| | 3,500 | | San Diego Unified Port District, California, Revenue Bonds, Series 2004B, 5.000%, 9/01/29 – NPFG Insured | 9/14 at 100.00 | A+ | | | 3,685,710 | |

| | | | San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road Revenue Refunding Bonds, Series 1997A: | | | | | | |

| | 10,450 | | 0.000%, 1/15/31 – NPFG Insured | No Opt. Call | Baa2 | | | 4,418,887 | |

| | 7,150 | | 0.000%, 1/15/32 – NPFG Insured | No Opt. Call | Baa2 | | | 2,853,851 | |

| | 50,400 | | 0.000%, 1/15/34 – NPFG Insured | No Opt. Call | Baa2 | | | 17,979,192 | |

| | 24,025 | | 0.000%, 1/15/36 – NPFG Insured | No Opt. Call | Baa2 | | | 7,622,172 | |

| | | | Union City Community Redevelopment Agency, California, Tax Allocation Revenue Bonds, Redevelopment Project, Subordinate Lien Series 2011: | | | | | | |

| | 1,000 | | 6.500%, 12/01/24 | 12/21 at 100.00 | A | | | 1,286,410 | |

| | 1,000 | | 6.625%, 12/01/25 | 12/21 at 100.00 | A | | | 1,285,320 | |

| | 1,325 | | 6.750%, 12/01/26 | 12/21 at 100.00 | A | | | 1,701,207 | |

| | 265,850 | | Total California | | | | | 219,318,948 | |

| | | | Colorado – 1.8% (1.2% of Total Investments) | | | | | | |

| | 2,500 | | Centennial Water and Sanitation District, Colorado, Water and Sewerage Revenue Bonds, Series 2004, 5.000%, 12/01/21 (Pre-refunded 12/01/14) – FGIC Insured | 12/14 at 100.00 | AA+ (4) | | | 2,685,300 | |

| | 690 | | Colorado Educational and Cultural Facilities Authority, Charter School Revenue Bonds, Bromley School, Series 2005, 5.125%, 9/15/20 – SYNCORA GTY Insured | 9/15 at 100.00 | A | | | 731,904 | |

| | 2,125 | | Colorado Health Facilities Authority, Revenue Bonds, Evangelical Lutheran Good Samaritan Society, Series 2005, 5.000%, 6/01/29 | 6/16 at 100.00 | A– | | | 2,220,264 | |

| | 1,000 | | Colorado Health Facilities Authority, Revenue Bonds, Parkview Medical Center, Series 2004, 5.000%, 9/01/25 | 9/14 at 100.00 | A3 | | | 1,006,010 | |

| | 800 | | Colorado Health Facilities Authority, Revenue Bonds, Poudre Valley Health Care, Series 2005F, 5.000%, 3/01/25 | 3/15 at 100.00 | A+ | | | 830,840 | |

| | 1,670 | | Denver City and County, Colorado, Airport System Revenue Bonds, Series 1991D, 7.750%, 11/15/13 (Alternative Minimum Tax) | No Opt. Call | A+ | | | 1,736,666 | |

| | 20,500 | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B, 0.000%, 9/01/32 – NPFG Insured | No Opt. Call | Baa2 | | | 7,986,595 | |

| | 250 | | Regional Transportation District, Colorado, Denver Transit Partners Eagle P3 Project Private Activity Bonds, Series 2010, 6.000%, 1/15/41 | 7/20 at 100.00 | Baa3 | | | 291,833 | |

| | 29,535 | | Total Colorado | | | | | 17,489,412 | |

| | | | Connecticut – 0.5% (0.3% of Total Investments) | | | | | | |

| | 1,930 | | Connecticut, General Obligation Bonds, Series 2001C, 5.500%, 12/15/16 | No Opt. Call | AA | | | 2,266,592 | |

| | 2,310 | | Greater New Haven Water Pollution Control Authority, Connecticut, Regional Wastewater System Revenue Bonds, Series 2005A, 5.000%, 11/15/30 – NPFG Insured | 11/15 at 100.00 | A1 | | | 2,503,047 | |

| | 4,240 | | Total Connecticut | | | | | 4,769,639 | |

| | | | Delaware – 0.1% (0.1% of Total Investments) | | | | | | |

| | 1,000 | | Delaware Health Facilities Authority, Revenue Bonds, Christiana Care Health Services Inc., Series 2010A, 5.000%, 10/01/40 – NPFG Insured | 10/20 at 100.00 | AA | | | 1,115,570 | |

| | | | District of Columbia – 2.1% (1.4% of Total Investments) | | | | | | |

| | 2,640 | | District of Columbia Housing Finance Agency, GNMA Collateralized Single Family Mortgage Revenue Bonds, Series 1988E-4, 6.375%, 6/01/26 (Alternative Minimum Tax) | 6/13 at 100.00 | AA+ | | | 2,646,442 | |

| | 9,505 | | District of Columbia, General Obligation Bonds, Series 1998B, 6.000%, 6/01/20 – NPFG Insured | No Opt. Call | Aa2 | | | 12,336,064 | |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | District of Columbia (continued) | | | | | | |

| $ | 2,130 | | Washington Convention Center Authority, District of Columbia, Dedicated Tax Revenue Bonds, Tender Option Bond Trust 1606, 11.456%, 10/01/30 – AMBAC Insured (IF) (5) | 10/16 at 100.00 | AA+ | | $ | 2,444,409 | |

| | 3,335 | | Washington Convention Center Authority, District of Columbia, Dedicated Tax Revenue Bonds, Tender Option Bond Trust 1730, 11.452%, 10/01/30 – AMBAC Insured (IF) (5) | 10/16 at 100.00 | AA+ | | | 3,827,079 | |

| | 17,610 | | Total District of Columbia | | | | | 21,253,994 | |

| | | | Florida – 10.5% (7.1% of Total Investments) | | | | | | |

| | 2,875 | | Brevard County Health Facilities Authority, Florida, Revenue Bonds, Health First Inc. Project, Series 2005, 5.000%, 4/01/24 | 4/16 at 100.00 | A– | | | 3,045,459 | |

| | 2,000 | | Florida Ports Financing Commission, Revenue Bonds, State Transportation Trust Fund, Refunding Series 2011B, 5.375%, 10/01/29 (Alternative Minimum Tax) | 10/21 at 100.00 | AA+ | | | 2,356,680 | |

| | 8,000 | | Hillsborough County Aviation Authority, Florida, Revenue Bonds, Tampa International Airport, Series 2003A, 5.375%, 10/01/16 – NPFG Insured (Alternative Minimum Tax) | 10/13 at 100.00 | A+ | | | 8,166,320 | |

| | 5,400 | | Hillsborough County Industrial Development Authority, Florida, Exempt Facilities Remarketed Revenue Bonds, National Gypsum Company, Apollo Beach Project, Series 2000B, 7.125%, 4/01/30 (Alternative Minimum Tax) | 10/13 at 100.00 | N/R | | | 5,402,970 | |

| | 8,000 | | JEA, Florida, Water and Sewer System Revenue Bonds, Series 2010D, 5.000%, 10/01/39 | 4/20 at 100.00 | AA | | | 9,038,240 | |

| | 2,930 | | Miami-Dade County Educational Facilities Authority, Florida, Revenue Bonds, University of Miami Issue, Series 2012A, 5.000%, 4/01/42 | No Opt. Call | A– | | | 3,289,042 | |

| | 19,750 | | Miami-Dade County Expressway Authority, Florida, Toll System Revenue Bonds, Series 2006, 4.500%, 7/01/33 – AMBAC Insured | 7/16 at 100.00 | A– | | | 20,647,045 | |

| | | | Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Refunding Series 2012A: | | | | | | |

| | 1,000 | | 5.000%, 10/01/29 (Alternative Minimum Tax) | No Opt. Call | A | | | 1,127,580 | |

| | 1,800 | | 5.000%, 10/01/30 (Alternative Minimum Tax) | No Opt. Call | A | | | 2,020,392 | |

| | 7,840 | | Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Series 2010B, 5.000%, 10/01/41 | 10/20 at 100.00 | A | | | 8,784,485 | |

| | 1,800 | | Miami-Dade County, Florida, Subordinate Special Obligation Refunding Bonds Series 2012B, 5.000%, 10/01/37 | 10/22 at 100.00 | A+ | | | 2,014,254 | |

| | 11,100 | | Miami-Dade County, Florida, Transit System Sales Surtax Revenue Bonds, Series 2012, 5.000%, 7/01/42 | 7/22 at 100.00 | AA | | | 12,530,568 | |

| | 6,910 | | South Miami Health Facilities Authority, Florida, Hospital Revenue, Baptist Health System Obligation Group, Series 2007, 5.000%, 8/15/42 (UB) (5) | 8/17 at 100.00 | AA | | | 7,571,702 | |

| | 1,785 | | Tallahassee, Florida, Energy System Revenue Bonds, Series 2005, 5.000%, 10/01/28 – NPFG Insured | 10/15 at 100.00 | AA | | | 1,938,439 | |

| | 12,690 | | Tampa-Hillsborough County Expressway Authority, Florida, Revenue Bonds, Refunding Series 2012B, 5.000%, 7/01/42 | No Opt. Call | A– | | | 14,166,228 | |

| | 2,375 | | Volusia County School Board, Florida, Certificates of Participation, Series 2005B, 5.000%, 8/01/22 – AGM Insured | 8/15 at 100.00 | Aa3 | | | 2,502,846 | |

| | 96,255 | | Total Florida | | | | | 104,602,250 | |

| | | | Georgia – 1.5% (1.0% of Total Investments) | | | | | | |

| | 2,625 | | Fulton County Development Authority, Georgia, Revenue Bonds, Georgia Tech Molecular Science Building, Series 2004, 5.250%, 5/01/24 – NPFG Insured | 5/14 at 100.00 | Aa3 | | | 2,741,393 | |

| | 1,900 | | Fulton-DeKalb Hospital Authority, Georgia, Revenue Refunding Certificates, Series 2003, 5.250%, 1/01/20 – AGM Insured | No Opt. Call | Aa2 | | | 1,962,377 | |

| | 4,125 | | Fulton-DeKalb Hospital Authority, Georgia, Revenue Refunding Certificates, Series 2003, 5.250%, 1/01/20 (Pre-refunded 1/01/14) – AGM Insured | 1/14 at 100.00 | Aa2 (4) | | | 4,264,136 | |

| | 5,010 | | Metropolitan Atlanta Rapid Transit Authority, Georgia, Sales Tax Revenue Refunding Bonds, Series 1992P, 6.250%, 7/01/20 – AMBAC Insured | No Opt. Call | Aa2 | | | 5,790,007 | |

| | 13,660 | | Total Georgia | | | | | 14,757,913 | |

| | | Nuveen Premium Income Municipal Fund, Inc. (continued) |

| NPI | | Portfolio of Investments |

| | | April 30, 2013 (Unaudited) |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | Hawaii – 1.0% (0.7% of Total Investments) | | | | | | |

| $ | 5,000 | | Hawaii State, General Obligation Bonds, Series 2003DA, 5.250%, 9/01/21 – NPFG Insured | 9/13 at 100.00 | AA | | $ | 5,083,300 | |

| | 5,000 | | Hawaii State, General Obligation Bonds, Series 2003DA, 5.250%, 9/01/21 (Pre-refunded 9/01/13) – NPFG Insured | 9/13 at 100.00 | Aa2 (4) | | | 5,084,400 | |

| | 10,000 | | Total Hawaii | | | | | 10,167,700 | |

| | | | Idaho – 0.3% (0.2% of Total Investments) | | | | | | |

| | | | Madison County, Idaho, Hospital Revenue Certificates of Participation, Madison Memorial Hospital, Series 2006: | | | | | | |

| | 2,185 | | 5.250%, 9/01/30 | 9/16 at 100.00 | BB+ | | | 2,260,077 | |

| | 600 | | 5.250%, 9/01/37 | 9/16 at 100.00 | BB+ | | | 617,220 | |

| | 2,785 | | Total Idaho | | | | | 2,877,297 | |

| | | | Illinois – 12.4% (8.3% of Total Investments) | | | | | | |

| | | | Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1998B-1: | | | | | | |

| | 8,890 | | 0.000%, 12/01/16 – FGIC Insured | No Opt. Call | A+ | | | 8,467,103 | |

| | 10,000 | | 0.000%, 12/01/20 – FGIC Insured | No Opt. Call | A+ | | | 8,126,000 | |

| | 10,130 | | 0.000%, 12/01/24 – FGIC Insured | No Opt. Call | A+ | | | 6,690,460 | |

| | | | Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax Revenues, Series 1999A: | | | | | | |

| | 15,000 | | 0.000%, 12/01/21 – FGIC Insured | No Opt. Call | A+ | | | 11,522,850 | |

| | 10,000 | | 0.000%, 12/01/23 – FGIC Insured | No Opt. Call | A+ | | | 6,913,300 | |

| | 3,800 | | Chicago Transit Authority, Illinois, Sales Tax Receipts Revenue Bonds, Series 2011, 5.250%, 12/01/40 | 12/21 at 100.00 | AA | | | 4,354,610 | |

| | 3,130 | | Chicago, Illinois, Sales Tax Revenue Bonds, Series 2011A, 5.000%, 1/01/41 | 1/22 at 100.00 | AAA | | | 3,499,434 | |

| | 13,310 | | Cook County, Illinois, General Obligation Bonds, Refunding Series 2010A, 5.250%, 11/15/33 | 11/20 at 100.00 | AA | | | 15,177,925 | |

| | 8,810 | | Illinois Development Finance Authority, Pollution Control Revenue Refunding Bonds, Illinois Power Company, Series 1994A, 5.700%, 2/01/24 – NPFG Insured | 8/13 at 100.00 | A– | | | 8,828,061 | |

| | | | Illinois Finance Authority, Revenue Bonds, OSF Healthcare System, Series 2004: | | | | | | |

| | 1,050 | | 5.250%, 11/15/22 (Pre-refunded 5/15/14) | 5/14 at 100.00 | A (4) | | | 1,103,624 | |

| | 3,000 | | 5.250%, 11/15/23 (Pre-refunded 5/15/14) | 5/14 at 100.00 | A (4) | | | 3,153,210 | |

| | 985 | | Illinois Finance Authority, Revenue Bonds, Proctor Hospital, Series 2006, 5.125%, 1/01/25 | 1/16 at 100.00 | BB+ | | | 973,860 | |

| | 2,880 | | Illinois Finance Authority, Revenue Bonds, Provena Health, Series 2009A, 7.750%, 8/15/34 | 8/19 at 100.00 | BBB+ | | | 3,701,779 | |

| | 1,970 | | Illinois Finance Authority, Revenue Bonds, The University of Chicago, Series 2012A, 5.000%, 10/01/51 | 10/21 at 100.00 | Aa1 | | | 2,192,177 | |

| | 10,280 | | Illinois Health Facilities Authority, Revenue Bonds, Sherman Health Systems, Series 1997, 5.250%, 8/01/27 – AMBAC Insured | 8/13 at 100.00 | BBB | | | 10,290,794 | |

| | 1,115 | | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Tender Option Bond Trust 4304, 17.980%, 1/01/21 (WI/DD, Settling 5/16/13) (IF) | No Opt. Call | AA– | | | 1,708,738 | |

| | 1,000 | | Lombard Public Facilities Corporation, Illinois, Second Tier Conference Center and Hotel Revenue Bonds, Series 2005B, 5.250%, 1/01/30 | 1/16 at 100.00 | CCC | | | 470,990 | |

| | 10,000 | | Metropolitan Pier and Exposition Authority, Illinois, McCormick Place Expansion Project Refunding Bonds, Series 2010A, 5.500%, 6/15/50 | 6/20 at 100.00 | AAA | | | 11,201,000 | |

| | 5,290 | | Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 1993A, 0.000%, 6/15/15 – FGIC Insured | No Opt. Call | A3 | | | 5,186,792 | |

| | | | Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 1993A: | | | | | | |

| | 3,590 | | 0.000%, 6/15/15 – FGIC Insured (ETM) | No Opt. Call | A3 (4) | | | 3,551,479 | |

| | 1,160 | | 0.000%, 6/15/15 – FGIC Insured (ETM) | No Opt. Call | A3 (4) | | | 1,147,553 | |

| | 3,000 | | Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Hospitality Facility, Series 1996A, 7.000%, 7/01/26 (ETM) | No Opt. Call | Aaa | | | 4,310,850 | |

| | 128,390 | | Total Illinois | | | | | 122,572,589 | |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | Indiana – 0.6% (0.4% of Total Investments) | | | | | | |

| $ | 2,005 | | Hamilton County Public Building Corporation, Indiana, First Mortgage Bonds, Series 2004, 5.000%, 8/01/22 (Pre-refunded 8/01/14) – AGM Insured | 8/14 at 100.00 | Aaa | | $ | 2,123,556 | |

| | 1,260 | | Indiana Finance Authority, Hospital Revenue Bonds, Community Health Network Project, Series 2012A, 5.000%, 5/01/42 | 5/23 at 100.00 | A | | | 1,397,579 | |

| | 2,500 | | Indiana Finance Authority, Revenue Bonds, Trinity Health Care Group, Refunding Series 2010B., 5.000%, 12/01/37 | 12/20 at 100.00 | AA | | | 2,747,000 | |

| | 5,765 | | Total Indiana | | | | | 6,268,135 | |

| | | | Iowa – 1.4% (1.0% of Total Investments) | | | | | | |

| | 2,105 | | Iowa Finance Authority, Industrial Remarketed Revenue Refunding Bonds, Urbandale Hotel Corporation, Series 1989A, 8.500%, 8/01/16 (Alternative Minimum Tax) (ETM) | No Opt. Call | AA+ (4) | | | 2,254,329 | |

| | | | Iowa Tobacco Settlement Authority, Asset Backed Settlement Revenue Bonds, Series 2005C: | | | | | | |

| | 10,000 | | 5.500%, 6/01/42 | 6/15 at 100.00 | B+ | | | 9,712,800 | |

| | 2,000 | | 5.625%, 6/01/46 | 6/15 at 100.00 | B+ | | | 1,961,620 | |

| | 14,105 | | Total Iowa | | | | | 13,928,749 | |

| | | | Kansas – 0.6% (0.4% of Total Investments) | | | | | | |

| | 6,000 | | Kansas Department of Transportation, Highway Revenue Bonds, Series 2004A, 5.000%, 3/01/21 (Pre-refunded 3/01/14) | 3/14 at 100.00 | AAA | | | 6,238,500 | |

| | | | Kentucky – 2.0% (1.3% of Total Investments) | | | | | | |

| | 3,800 | | Kentucky Economic Development Finance Authority, Hospital Facilities Revenue Bonds, Owensboro Medical Health System, Series 2010A, 6.500%, 3/01/45 | 6/20 at 100.00 | BBB+ | | | 4,582,610 | |

| | 9,195 | | Lexington-Fayette Urban County Government Public Facilities Corporation, Kentucky State Lease Revenue Bonds, Eastern State Hospital Project, Series 2011A, 5.250%, 6/01/30 | 6/21 at 100.00 | Aa3 | | | 10,717,140 | |

| | | | Marshall County School District Finance Corporation, Kentucky, School Building Revenue Bonds, Series 2004: | | | | | | |

| | 1,210 | | 5.000%, 6/01/19 (Pre-refunded 6/01/14) – AMBAC Insured | 6/14 at 100.00 | Aa3 (4) | | | 1,272,182 | |

| | 1,270 | | 5.000%, 6/01/20 (Pre-refunded 6/01/14) – AMBAC Insured | 6/14 at 100.00 | Aa3 (4) | | | 1,335,265 | |

| | 1,335 | | 5.000%, 6/01/21 (Pre-refunded 6/01/14) – AMBAC Insured | 6/14 at 100.00 | Aa3 (4) | | | 1,403,606 | |

| | 16,810 | | Total Kentucky | | | | | 19,310,803 | |

| | | | Louisiana – 4.3% (2.9% of Total Investments) | | | | | | |

| | | | Louisiana Public Facilities Authority, Extended Care Facilities Revenue Bonds, Comm-Care Corporation Project, Series 1994: | | | | | | |

| | 115 | | 11.000%, 2/01/14 (ETM) | No Opt. Call | N/R (4) | | | 123,634 | |

| | 1,055 | | 11.000%, 2/01/14 (ETM) | No Opt. Call | N/R (4) | | | 1,133,787 | |

| | 2,000 | | Louisiana Public Facilities Authority, Hospital Revenue Bonds, Franciscan Missionaries of Our Lady Health System, Series 2005A, 5.250%, 8/15/31 | 8/15 at 100.00 | A+ | | | 2,076,100 | |

| | 5,800 | | Louisiana Public Facilities Authority, Revenue Bonds, Ochsner Clinic Foundation Project, Series 2007A, 5.500%, 5/15/47 | 5/17 at 100.00 | Baa1 | | | 6,167,894 | |

| | 4,305 | | Louisiana Public Facilities Authority, Revenue Bonds, Ochsner Clinic Foundation Project, Series 2011, 6.750%, 5/15/41 | 5/21 at 100.00 | Baa1 | | | 5,206,037 | |

| | | | Louisiana State, Gasoline and Fuels Tax Revenue Bonds, Series 2005A: | | | | | | |

| | 1,200 | | 5.000%, 5/01/25 (Pre-refunded 5/01/15) – FGIC Insured | 5/15 at 100.00 | Aa1 (4) | | | 1,311,900 | |

| | 2,210 | | 5.000%, 5/01/26 (Pre-refunded 5/01/15) – FGIC Insured | 5/15 at 100.00 | Aa1 (4) | | | 2,416,083 | |

| | 2,500 | | 5.000%, 5/01/27 (Pre-refunded 5/01/15) – FGIC Insured | 5/15 at 100.00 | Aa1 (4) | | | 2,733,125 | |

| | | | Louisiana State, Gasoline and Fuels Tax Revenue Bonds, Series 2006A: | | | | | | |

| | 930 | | 4.750%, 5/01/39 – AGM Insured (UB) | 5/16 at 100.00 | Aa1 | | | 1,013,793 | |

| | 10,105 | | 4.500%, 5/01/41 – FGIC Insured (UB) | 5/16 at 100.00 | Aa1 | | | 10,905,519 | |

| | | | Tobacco Settlement Financing Corporation, Louisiana, Tobacco Settlement Asset-Backed Bonds, Series 2001B: | | | | | | |

| | 270 | | 5.500%, 5/15/30 | 5/13 at 100.00 | A1 | | | 271,488 | |

| | 8,785 | | 5.875%, 5/15/39 | 5/13 at 100.00 | A– | | | 8,833,405 | |

| | 39,275 | | Total Louisiana | | | | | 42,192,765 | |

| | | Nuveen Premium Income Municipal Fund, Inc. (continued) |

| NPI | | Portfolio of Investments |

| | | April 30, 2013 (Unaudited) |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | Maryland – 0.9% (0.6% of Total Investments) | | | | | | |

| $ | 2,200 | | Baltimore, Maryland, Senior Lien Convention Center Hotel Revenue Bonds, Series 2006A, 5.250%, 9/01/27 – SYNCORA GTY Insured | 9/16 at 100.00 | BB+ | | $ | 2,267,980 | |

| | 450 | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Mercy Medical Center, Series 2011, 6.000%, 7/01/25 | 7/21 at 100.00 | BBB | | | 545,877 | |

| | 2,000 | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Washington County Hospital, Series 2008, 5.750%, 1/01/33 | 1/18 at 100.00 | BBB | | | 2,181,838 | |

| | 3,465 | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Western Maryland Health, Series 2006A, 4.750%, 7/01/36 – NPFG Insured | 7/16 at 100.00 | Baa2 | | | 3,605,850 | |

| | 735 | | Montgomery County Housing Opportunities Commission, Maryland, Multifamily Housing Development Bonds, Series 2000B, 6.200%, 7/01/30 (Alternative Minimum Tax) | 7/13 at 100.00 | Aaa | | | 736,470 | |

| | 8,850 | | Total Maryland | | | | | 9,338,015 | |

| | | | Massachusetts – 4.5% (3.0% of Total Investments) | | | | | | |

| | 805 | | Massachusetts Development Finance Agency, Revenue Bonds, Boston University, Series 2013X, 5.000%, 10/01/48 | 10/23 at 100.00 | A1 | | | 910,487 | |

| | 2,300 | | Massachusetts Development Finance Agency, Revenue Bonds, Olin College, Series 2013E, 5.000%, 11/01/43 (WI/DD, Settling 5/09/13) | 11/23 at 100.00 | A+ | | | 2,589,179 | |

| | 2,025 | | Massachusetts Health and Educational Facilities Authority, Revenue Refunding Bonds, Suffolk University Issue, Series 2009A, 5.750%, 7/01/39 | 7/19 at 100.00 | BBB | | | 2,290,741 | |

| | 700 | | Massachusetts Port Authority, Special Facilities Revenue Bonds, ConRac Project, Series 2011A, 5.125%, 7/01/41 | 7/21 at 100.00 | A | | | 784,672 | |

| | 3,820 | | Massachusetts State, Special Obligation Dedicated Tax Revenue Bonds, Series 2004, 5.250%, 1/01/24 (Pre-refunded 1/01/14) – FGIC Insured | 1/14 at 100.00 | A1 (4) | | | 3,946,213 | |

| | 13,000 | | Massachusetts Water Pollution Abatement Trust, Pooled Loan Program Bonds, Series 2006, 4.375%, 8/01/36 (UB) | 8/16 at 100.00 | AAA | | | 13,646,360 | |

| | 5,590 | | Massachusetts Water Resources Authority, General Revenue Bonds, Series 2005A, 5.250%, 8/01/25 – NPFG Insured | 8/17 at 100.00 | AA+ | | | 6,545,555 | |

| | 370 | | Massachusetts Water Resources Authority, General Revenue Bonds, Series 2005A, 5.250%, 8/01/25 (Pre-refunded 8/01/17) – NPFG Insured | 8/17 at 100.00 | Aa1 (4) | | | 441,976 | |

| | 5,535 | | Massachusetts Water Resources Authority, General Revenue Bonds, Series 2007A, 4.500%, 8/01/46 – AGM Insured (UB) (5) | 2/17 at 100.00 | AA+ | | | 5,841,307 | |

| | 6,700 | | Metropolitan Boston Transit Parking Corporation, Massachusetts, Systemwide Senior Lien Parking Revenue Bonds, Series 2011, 5.000%, 7/01/41 | 7/21 at 100.00 | A+ | | | 7,517,132 | |

| | 40,845 | | Total Massachusetts | | | | | 44,513,622 | |

| | | | Michigan – 3.3% (2.2% of Total Investments) | | | | | | |

| | 2,650 | | Detroit Water and Sewerage Department, Michigan, Sewage Disposal System Revenue Bonds, Refunding Senior Lien Series 2012A, 5.250%, 7/01/39 | 7/22 at 100.00 | A+ | | | 2,896,715 | |

| | 3,000 | | Kent Hospital Finance Authority, Michigan, Revenue Bonds, Metropolitan Hospital, Series 2005A, 6.000%, 7/01/35 | 7/15 at 100.00 | BB+ | | | 3,187,530 | |

| | 3,665 | | Lansing Board of Water and Light, Michigan, Utility System Revenue Bonds, Series 2011A, 5.500%, 7/01/41 | 7/21 at 100.00 | AA– | | | 4,343,282 | |

| | 10,000 | | Michigan State Building Authority, Revenue Refunding Bonds, Facilities Program, Series 2003II, 5.000%, 10/15/23 – NPFG Insured | 10/13 at 100.00 | Aa3 | | | 10,208,100 | |

| | 1,000 | | Michigan State Building Authority, Revenue Refunding Bonds, Facilities Program, Series 2011-I-A, 5.375%, 10/15/41 | 10/21 at 100.00 | Aa3 | | | 1,153,240 | |

| | 5,200 | | Michigan State Hospital Finance Authority, Revenue Bonds, Trinity Health Care Group, Series 2009C, 5.000%, 12/01/48 | 6/22 at 100.00 | AA | | | 5,753,384 | |

| | | | Michigan State Hospital Finance Authority, Revenue Bonds, Trinity Health Care Group, Series 2006A: | | | | | | |

| | 725 | | 5.000%, 12/01/31 (Pre-refunded 12/01/16) (UB) | 12/16 at 100.00 | N/R (4) | | | 836,650 | |

| | 3,275 | | 5.000%, 12/01/31 (UB) | 12/16 at 100.00 | AA | | | 3,613,209 | |

| | 850 | | Monroe County Hospital Finance Authority, Michigan, Mercy Memorial Hospital Corporation Revenue Bonds, Series 2006, 5.500%, 6/01/35 | 6/16 at 100.00 | BBB | | | 908,149 | |

| | 30,365 | | Total Michigan | | | | | 32,900,259 | |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | Minnesota – 3.9% (2.7% of Total Investments) | | | | | | |

| $ | 13,650 | | Cohasset, Minnesota, Pollution Control Revenue Bonds, Allete Inc., Series 2004, 4.950%, 7/01/22 | 7/14 at 100.00 | A | | $ | 14,023,874 | |

| | 2,000 | | Duluth Economic Development Authority, Minnesota, Healthcare Facilities Revenue Bonds, Benedictine Health System – St. Mary’s Duluth Clinic, Series 2004, 5.375%, 2/15/22 (Pre-refunded 2/15/14) | 2/14 at 100.00 | N/R (4) | | | 2,079,940 | |

| | 3,000 | | Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, Airport Revenue Bonds, Senior Lien Series 2010A, 5.000%, 1/01/35 | 1/20 at 100.00 | AA– | | | 3,388,170 | |

| | 90 | | Minnesota Agricultural and Economic Development Board, Healthcare System Revenue Bonds, Fairview Hospital and Healthcare Services, Series 1997A, 5.750%, 11/15/26 – NPFG Insured | 5/13 at 100.00 | A | | | 90,173 | |

| | 1,500 | | Minnesota Municipal Power Agency, Electric Revenue Bonds, Series 2004A, 5.250%, 10/01/24 | 10/14 at 100.00 | A3 | | | 1,597,440 | |

| | 1,545 | | St. Paul Housing and Redevelopment Authority, Minnesota, Revenue Bonds, Healtheast Inc., Series 2005, 6.000%, 11/15/25 | 11/15 at 100.00 | BBB– | | | 1,672,076 | |

| | 13,815 | | St. Paul Housing and Redevelopment Authority, Minnesota, Sales Tax Revenue Refunding Bonds, Civic Center Project, Series 1996, 7.100%, 11/01/23 – AGM Insured | 11/15 at 103.00 | AA– | | | 16,152,084 | |

| | 35,600 | | Total Minnesota | | | | | 39,003,757 | |

| | | | Mississippi – 0.7% (0.5% of Total Investments) | | | | | | |

| | 6,875 | | Mississippi Hospital Equipment and Facilities Authority, Revenue Bonds, Baptist Memorial Healthcare, Series 2004B-1, 5.000%, 9/01/24 (UB) | 9/14 at 100.00 | AA– | | | 7,244,806 | |

| | | | Missouri – 0.6% (0.4% of Total Investments) | | | | | | |

| | 2,000 | | Cole County Industrial Development Authority, Missouri, Revenue Bonds, Lutheran Senior Services – Heisinger Project, Series 2004, 5.250%, 2/01/24 | 2/14 at 100.00 | BBB+ | | | 2,023,000 | |

| | 500 | | Hannibal Industrial Development Authority, Missouri, Health Facilities Revenue Bonds, Hannibal Regional Hospital, Series 2006, 5.000%, 3/01/22 | 3/16 at 100.00 | BBB+ | | | 520,820 | |

| | | | Missouri Development Finance Board, Infrastructure Facilities Revenue Bonds, Branson Landing Project, Series 2005A: | | | | | | |

| | 1,565 | | 6.000%, 6/01/20 | No Opt. Call | A | | | 1,792,128 | |

| | 1,660 | | 5.000%, 6/01/35 | 6/15 at 100.00 | A | | | 1,704,073 | |

| | 5,725 | | Total Missouri | | | | | 6,040,021 | |

| | | | Nebraska – 0.3% (0.2% of Total Investments) | | | | | | |

| | 1,620 | | Omaha Public Power District, Nebraska, Separate Electric System Revenue Bonds, Nebraska City 2, Series 2006A, 19.934%, 8/01/40 – AMBAC Insured (IF) | 2/17 at 100.00 | AA+ | | | 2,798,809 | |

| | | | Nevada – 1.7% (1.1% of Total Investments) | | | | | | |

| | 8,800 | | Clark County, Nevada, Airport Revenue Bonds, Subordinate Lien Series 2010B, 5.750%, 7/01/42 | 1/20 at 100.00 | A+ | | | 10,354,344 | |

| | 2,700 | | Las Vegas Redevelopment Agency, Nevada, Tax Increment Revenue Bonds, Series 2009A, 8.000%, 6/15/30 | 6/19 at 100.00 | BBB– | | | 3,095,037 | |

| | 2,600 | | Las Vegas Valley Water District, Nevada, General Obligation Bonds, Water Series 2012B, 5.000%, 6/01/42 | 6/22 at 100.00 | AA+ | | | 2,947,750 | |

| | 14,100 | | Total Nevada | | | | | 16,397,131 | |

| | | | New Jersey – 6.9% (4.6% of Total Investments) | | | | | | |

| | 190 | | Middlesex County Improvement Authority, New Jersey, Senior Revenue Bonds, Heldrich Center Hotel/Conference Center Project, Series 2005A, 5.000%, 1/01/15 | No Opt. Call | Caa1 | | | 132,998 | |

| | | | New Jersey Economic Development Authority, School Facilities Construction Bonds, Series 2005P: | | | | | | |

| | 3,655 | | 5.250%, 9/01/24 (Pre-refunded 9/01/15) | 9/15 at 100.00 | A+ (4) | | | 4,073,242 | |

| | 2,000 | | 5.250%, 9/01/26 (Pre-refunded 9/01/15) | 9/15 at 100.00 | A+ (4) | | | 2,228,860 | |

| | 300 | | New Jersey Educational Facilities Authority, Revenue Refunding Bonds, University of Medicine and Dentistry of New Jersey, Series 2009B, 7.500%, 12/01/32 | 6/19 at 100.00 | A– | | | 373,728 | |

| | 800 | | New Jersey Health Care Facilities Financing Authority, New Jersey, Revenue Bonds, Saint Peters University Hospital, Series 2007, 5.750%, 7/01/37 | 7/18 at 100.00 | BB+ | | | 871,176 | |

| | 3,850 | | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding Series 2006A, 5.250%, 12/15/20 | No Opt. Call | A+ | | | 4,780,699 | |

| | | Nuveen Premium Income Municipal Fund, Inc. (continued) |

| NPI | | Portfolio of Investments |

| | | April 30, 2013 (Unaudited) |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | New Jersey (continued) | | | | | | |

| | | | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2003C: | | | | | | |

| $ | 5,410 | | 5.500%, 6/15/20 (Pre-refunded 6/15/13) | 6/13 at 100.00 | Aaa | | $ | 5,445,977 | |

| | 9,250 | | 5.500%, 6/15/23 (Pre-refunded 6/15/13) | 6/13 at 100.00 | Aaa | | | 9,311,513 | |

| | 7,330 | | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series 2011B, 5.500%, 6/15/31 | 6/21 at 100.00 | A+ | | | 8,709,213 | |

| | | | New Jersey Turnpike Authority, Revenue Bonds, Series 2000A: | | | | | | |

| | 3,915 | | 6.000%, 1/01/14 – NPFG Insured (ETM) | No Opt. Call | A+ (4) | | | 4,065,884 | |

| | 7,585 | | 6.000%, 1/01/14 – NPFG Insured (ETM) | No Opt. Call | A+ (4) | | | 7,877,326 | |

| | 2,500 | | New Jersey Turnpike Authority, Revenue Bonds, Series 2003A, 5.000%, 1/01/19 (Pre-refunded 7/01/13) – FGIC Insured | 7/13 at 100.00 | A+ (4) | | | 2,520,250 | |

| | 9,130 | | New Jersey Turnpike Authority, Revenue Bonds, Series 2005A, 5.000%, 1/01/25 – AGM Insured | 1/15 at 100.00 | AA– | | | 9,749,562 | |

| | 1,315 | | New Jersey Turnpike Authority, Revenue Bonds, Tender Option Bond Trust 1154, 17.041%, 1/01/43 (IF) (5) | 7/22 at 100.00 | A+ | | | 1,921,123 | |

| | | | Tobacco Settlement Financing Corporation, New Jersey, Tobacco Settlement Asset-Backed Bonds, Series 2007-1A: | | | | | | |

| | 4,455 | | 4.500%, 6/01/23 | 6/17 at 100.00 | B1 | | | 4,458,119 | |

| | 2,000 | | 4.750%, 6/01/34 | 6/17 at 100.00 | B2 | | | 1,761,780 | |

| | 63,685 | | Total New Jersey | | | | | 68,281,450 | |

| | | | New Mexico – 0.7% (0.5% of Total Investments) | | | | | | |

| | 5,585 | | Santa Fe County, New Mexico, Correctional System Gross Receipts Tax Revenue Bonds, Series 1997, 6.000%, 2/01/27 – AGM Insured | No Opt. Call | AA– | | | 6,992,532 | |

| | | | New York – 14.5% (9.7% of Total Investments) | | | | | | |

| | | | Brooklyn Arena Local Development Corporation, New York, Payment in Lieu of Taxes Revenue Bonds, Barclays Center Project, Series 2009: | | | | | | |

| | 2,000 | | 6.000%, 7/15/30 | 1/20 at 100.00 | BBB– | | | 2,389,520 | |

| | 5,000 | | 0.000%, 7/15/44 | No Opt. Call | BBB– | | | 1,185,650 | |

| | 4,800 | | Dormitory Authority of the State of New York, Revenue Bonds, New York University, Series 2012A, 5.000%, 7/01/42 | 7/22 at 100.00 | AA– | | | 5,524,944 | |

| | | | Dormitory Authority of the State of New York, Revenue Bonds, University of Rochester, Series 2004A: | | | | | | |

| | 1,000 | | 5.250%, 7/01/22 | 7/14 at 100.00 | AA– | | | 1,051,630 | |

| | 500 | | 5.250%, 7/01/24 | 7/14 at 100.00 | AA– | | | 525,815 | |

| | 1,025 | | Dormitory Authority of the State of New York, Revenue Bonds, University of Rochester, Series 2004A, 5.250%, 7/01/20 (Pre-refunded 7/01/14) | 7/14 at 100.00 | AA+ (4) | | | 1,083,743 | |

| | 1,995 | | Dormitory Authority of the State of New York, State and Local Appropriation Lease Bonds, Upstate Community Colleges, Series 2004B, 5.250%, 7/01/20 | 7/14 at 100.00 | AA– | | | 2,111,528 | |

| | 5,325 | | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, General Purpose Series 2011C, 5.000%, 3/15/41 | 3/21 at 100.00 | AAA | | | 6,044,887 | |

| | 2,335 | | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, Series 2005F, 5.000%, 3/15/24 – AMBAC Insured | 3/15 at 100.00 | AAA | | | 2,530,323 | |

| | | | Dormitory Authority of the State of NY, Rochester Institute of Technology Revenue Bond, Series 2012: | | | | | | |

| | 1,100 | | 5.000%, 7/01/38 | No Opt. Call | A1 | | | 1,263,295 | |

| | 1,500 | | 5.000%, 7/01/42 | No Opt. Call | A1 | | | 1,722,675 | |

| | 6,915 | | Hudson Yards Infrastructure Corporation, New York, Revenue Bonds, Series 2006A, 4.500%, 2/15/47 – NPFG Insured | 2/17 at 100.00 | A | | | 7,156,264 | |

| | 6,000 | | Liberty Development Corporation, New York, Goldman Sachs Headquarter Revenue Bonds, Series 2005, 5.250%, 10/01/35 | No Opt. Call | A | | | 7,137,960 | |

| | | | Long Island Power Authority, New York, Electric System General Revenue Bonds, Series 2006A: | | | | | | |

| | 7,000 | | 5.000%, 12/01/23 – FGIC Insured | 6/16 at 100.00 | A | | | 7,762,650 | |

| | 5,000 | | 5.000%, 12/01/24 – FGIC Insured | 6/16 at 100.00 | A | | | 5,531,950 | |

| | Principal | | | Optional Call | | | | | |

| | Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | | | Value | |

| | | | New York (continued) | | | | | | |

| $ | 5,000 | | Long Island Power Authority, New York, Electric System Revenue Bonds, Series 2006F, 4.250%, 5/01/33 – NPFG Insured | 11/16 at 100.00 | A | | $ | 5,134,050 | |

| | 15,605 | | Metropolitan Transportation Authority, New York, Dedicated Tax Fund Bonds, Refunding Series 2012A, 0.000%, 11/15/32 | No Opt. Call | AA | | | 7,826,064 | |

| | 3,900 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Series 2005B, 5.000%, 11/15/30 – AMBAC Insured | 11/15 at 100.00 | A | | | 4,207,671 | |

| | 5,780 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Series 2005F, 5.000%, 11/15/30 | 11/15 at 100.00 | A | | | 6,235,984 | |

| | 750 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Series 2011A, 5.000%, 11/15/41 | 11/21 at 100.00 | A | | | 837,420 | |