AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON NOVEMBER 26, 2004

REGISTRATION STATEMENT NO. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

WESTERN SILVER CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | |

| BRITISH COLUMBIA, CANADA | | 1090 | | NONE |

(Province or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial Classification

Code Number (if applicable)) | | (I.R.S. Employer Identification

Number (if applicable)) |

SUITE 1550, 1185 WEST GEORGIA STREET

VANCOUVER, BRITISH COLUMBIA, CANADA V6E 4E6

(604) 684-9497

(Address and telephone number of Registrant’s principal executive offices)

Donald J. Puglisi

Puglisi & Associates

850 Library Avenue, Suite 204

P.O. Box 885

Newark, Delaware 19715

(302) 738-6680

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Copies to:

| | | |

| Jonathan C. Guest | | Norman F. Findlay |

| Perkins Smith & Cohen LLP | | Cassels Brock & Blackwell LLP |

| One Beacon Street, 30th floor | | Suite 2100, Scotia Plaza |

| Boston, MA 02108 | | 40 King Street West |

| (617) 854-4000 | | Toronto, ON M5H 3C2 |

| | (416) 869-5300 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE OF THE SECURITIES TO THE PUBLIC:

As soon as practicable after the effective date of this Registration Statement.

BRITISH COLUMBIA, CANADA

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box):

A. o upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

B. þ at some future date (check the appropriate box below)

1. o pursuant to Rule 467(b) on at (designate a time not sooner than seven calendar days after filing).

2. o pursuant to Rule 467(b) on at (designate a time seven calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on .

3. o pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

4. þ after the filing of the next amendment to this form (if preliminary material is being filed).

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box.o

CALCULATION OF REGISTRATION FEE

| | | | | | | | | |

| Title of Each | | | | Proposed Maximum | | Proposed Maximum | | |

| Class of Securities | | Amount to be | | Offering Price per | | Aggregate Offering | | Amount of |

to be Registered

| | Registered

| | Security (1)

| | Price (1)

| | Registration Fee

|

| Common Shares | | 5,000,000 | | U.S.$10.64 | | U.S.$53,200,000 | | U.S.$6,740.44 |

| (1) | | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, based upon the average of high and low prices of the Registrant’s common shares as reported on the American Stock Exchange on November 23, 2004 of U.S.$10.64 per share. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE AS PROVIDED IN RULE 467 UNDER THE SECURITIES ACT OF 1933 OR ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a) OF THE ACT, MAY DETERMINE.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

| Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This preliminary short form prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any state. |

SUBJECT TO COMPLETION, DATED NOVEMBER 26, 2004

New Issue

Preliminary Short Form Prospectus

Western Silver Corporation

Cdn.$ l

l Common Shares

This preliminary short form prospectus (“Prospectus”) qualifies for distribution (the “Offering”) l common shares (the “Common Shares”) of Western Silver Corporation (“Western Silver” or the “Company”) at a price of $ l per Common Share. The Common Shares are offered pursuant to an underwriting agreement (the “Underwriting Agreement”) dated l , 2004 among Orion Securities Inc., CIBC World Markets Inc. and Kingsdale Capital Markets Inc. (collectively, the “Underwriters”) and Western Silver. The offering price of $ l per Common Share was determined by negotiation between Western Silver and the Underwriters, and in the context of the market. The Company has granted the Underwriters an option (the “Over-Allotment Option”), exercisable in whole or in part in the sole discretion of the Underwriters until noon (Toronto time) on the 30th day following the closing of the Offering, to purchase up to an additional l common shares of the Company (the “Over-Allotment Shares”), at a price of $ l per Over-Allotment Share. This Prospectus qualifies the distribution of the Over-Allotment Option and the distribution of the Over-Allotment Shares. See “Plan of Distribution”. References to “Common Shares” in this Prospectus shall include the l Common Shares together with the Over-Allotment Shares, as applicable in the context used.

Price: $ l per Common Share

| | | | | | | |

| | Price to | | Underwriters’ | | Net Proceeds |

| | the Public | | Fee (1) | | to the Company (2) |

| |

| |

| |

|

| Per Common Share | | $ l | | $ l | | $ l |

Total (3)(4) | | $ l | | $ l | | $ l |

| |

| (1) | In consideration for the services rendered by the Underwriters in connection with the Offering, the Company has agreed to pay the Underwriters a fee (the “Underwriters’ Fee”) of $ l , representing 5% of the gross proceeds of the Offering. See “Plan of Distribution”. |

| |

| (2) | Before deducting other expenses of this Offering, estimated to be approximately $ l , which will be paid by the Company from the net proceeds of the Offering. |

| |

| (3) | If the Over-Allotment Option is exercised in full, the total number of Common Shares sold under the Offering will be l , the total price to the public will be $ l , the total Underwriters’ Fee will be $ l and the total net proceeds to the Company will be $ l before deducting expenses of the Offering. |

| |

| (4) | For Common Shares sold in the United States, the price to the public, Underwriters’ Fee and net proceeds to the Company are payable in U.S. dollars. For Common Shares sold in Canada, the price to the public, Underwriters’ Fee and net proceeds to the Company are payable in Canadian dollars at the Canadian dollar equivalent to such amounts based on a prevailing U.S.-Canadian dollar exchange rate as of the date of the pricing of the Offering. |

An investment in the Common Shares is subject to certain risks. Prospective investors should carefully consider the risk factors described in this Prospectus under “Risk Factors”.

The Company has applied to list the Common Shares to be distributed pursuant to the Offering on each of the TSX and the AMEX. Listing will be subject to the Company fulfilling all of the listing requirements of the TSX and the AMEX.

This offering is made by a foreign issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this prospectus in accordance with the disclosure requirements of Canada. Prospective investors should be aware that such requirements are different from those of the United States. Financial statements included or incorporated herein have been prepared in accordance with Canadian generally accepted accounting principles, and may be subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and Canada, including as a result of the issuer being a “passive foreign investment company” for United States federal income tax purposes. Such consequences for investors who are resident in, or citizens of, the United States may not be fully described herein.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that Western Silver Corporation is incorporated under the laws of British Columbia, that some or all of its officers and directors are residents of Canada, that some or all of the underwriters or experts named in the registration statement may be residents of Canada and that all or a substantial portion of the assets of Western Silver Corporation and said persons may be located outside of the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Information has been incorporated by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada.Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of Western Silver Corporation at Suite 1550-1185 West Georgia Street, Vancouver, British Columbia, V6E 4E6 (Telephone (604) 684-9497).

| | | |

| Orion Securities Inc. | | CIBC World Markets Inc. |

| Kingsdale Capital Markets Inc. |

The date of this prospectus is , 2004.

TABLE OF CONTENTS

FINANCIAL INFORMATION AND ACCOUNTING PRINCIPLES

References to “$” in this Prospectus are to Canadian dollars, unless otherwise indicated. References in this Prospectus to “U.S.$” are to United States dollars. As of November 24, 2004, the Bank of Canada noon rate of exchange between Canadian dollars and United States dollars was $1.1814 = U.S.$1. The financial statements of the Company included herein and incorporated by reference are reported in Canadian dollars and have been prepared in accordance with Canadian generally accepted accounting principles.

The following table discloses the high, low, average and period ended exchange noon rates for one Canadian dollar in exchange for one United States dollar for each of the periods indicated, as quoted by the Bank of Canada.

| | | | | | | | | | | | | | | | | |

| | | | | | | Year ended September 30

|

| | | One Month ended | | | | | | |

| | | October 31, 2004

$

| | 2004

$

| | 2003

$

| | 2002

$

|

| High | | | 1.2725 | | | | 1.3968 | | | | 1.5942 | | | | 1.6132 | |

| Low | | | 1.2197 | | | | 1.2639 | | | | 1.3342 | | | | 1.5110 | |

| Average | | | 1.2458 | | | | 1.3251 | | | | 1.4642 | | | | 1.5730 | |

| Period End | | | 1.2230 | | | | 1.2639 | | | | 1.3504 | | | | 1.5858 | |

FORWARD-LOOKING STATEMENTS

This Prospectus and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this Prospectus or,

in the case of documents incorporated by reference herein, as of the date of such documents and the Company does not intend, and does not assume any obligation, to update these forward-looking statements.

Forward-looking statements include, but are not limited to, statements with respect to pre-feasibility studies performed on the Peñasquito Project (as defined below), the future price of gold, silver, copper, lead and zinc, the estimation of mineral reserves and resources, the realization of mineral reserve and resource estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, limitations on insurance coverage and the timing and possible outcome of pending litigation. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Western Silver to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, risks related to the integration of acquisitions; risks related to international operations; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold, silver and copper; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled “Risk Factors” in this Prospectus. Although Western Silver has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents of Western Silver, filed with the securities commissions or similar regulatory authorities in each of the provinces of Canada, are specifically incorporated by reference into, and form an integral part of, this Prospectus:

| 1. | | Initial Annual Information Form dated November 9, 2004 as revised (the “AIF”), including the management’s discussion and analysis of financial condition and results of operations for the financial years ended September 30, 2003 and 2002 incorporated therein but excluding the agreements listed under the heading “Material Contracts” and the Exhibits 2.1 through 32.1 of the Form 20-F which forms part of the AIF. |

| |

| 2. | | The audited consolidated balance sheets of Western Silver for the years ended September 30, 2003 and 2002, and the consolidated statements of loss and deficit and cash flows for the years ended September 30, 2003, 2002 and 2001 together with the notes thereto and the auditors’ report thereon as contained in pages 23 to 40 of the Company’s Annual Report for the year ended September 30, 2003. |

| |

| 3. | | Comparative consolidated unaudited interim financial statements of Western Silver for the nine month periods ended June 30, 2004 and 2003, together with the notes thereto. |

| |

| 4. | | Management’s Discussion & Analysis of financial condition and results of operations for the nine month periods ended June 30, 2004 and 2003. |

2

| 5. | | Management Information Circular dated January 26, 2004 prepared in connection with Western Silver’s annual meeting of shareholders held March 4, 2004 (excluding the Report on Executive Compensation and the Performance Graph under the heading “Executive Compensation” and excluding the Statement of Corporate Governance practices attached to the Information Circular). |

| |

| 6. | | Material Change Report dated November 21, 2003 relating to the entering into of an underwriting agreement with Kingsdale Capital Markets Inc., Kingsdale Capital Partners Inc. and Orion Securities Inc. in connection with a private placement of common shares. |

| |

| 7. | | Material Change Report dated December 16, 2003 relating to the closing of the private placement of common shares for gross proceeds of $12,360,000. |

| |

| 8. | | Material Change Report dated April 13, 2004 relating to the completion by M3 Engineering & Technology Corp. of a pre-feasibility study on the Chile Colorado zone of the Company’s Peñasquito Project in Zacatecas State, Mexico. |

| |

| 9. | | Material Change Report dated October 4, 2004 relating to the completion of an independent resource estimate by Marlow Mining Engineering Services for the Peñasco deposit at the Peñasquito Project in Zacatecas State, Mexico. |

Any documents of the type referred to above (excluding confidential material change reports) filed by Western Silver, pursuant to the requirements of applicable securities legislation in Canada, subsequent to the date of this Prospectus and prior to completion or withdrawal of this Offering shall be deemed to be incorporated by reference into this Prospectus.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superceded for the purposes of this Prospectus to the extent that a statement contained in this Prospectus or any other subsequently filed document that is also incorporated or deemed to be incorporated by reference into this Prospectus modifies or supercedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute part of this Prospectus. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Copies of the documents incorporated herein by reference may be obtained on request, without charge, from the Secretary of Western Silver at Suite 1550 — 1185 West Georgia Street, Vancouver, British Columbia, V6E 4E6 (Telephone (604) 684-9497). These documents are also available through the Internet on the System for Electronic Document Analysis and Retrieval (SEDAR), which can be accessed online at www.sedar.com. For the purposes of the Province of Québec, this simplified prospectus contains information to be completed by consulting the permanent information record. A copy of this permanent information record may be obtained from the Secretary of the Company at the above-mentioned address and telephone number.

Cautionary Note to U.S. Investors

The discussion under the heading “Peñasco Deposit” uses the terms “indicated” and “inferred” in reference to mineral resources. We advise U.S. investors that while these terms are recognised and required by Canadian regulations, the United States Securities and Exchange Commission (the “SEC”) does not recognise them. U.S. investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves.

3

NAME AND INCORPORATION

The Company was incorporated as Western Copper Holdings Limited under theCompany Act(British Columbia) on July 11, 1984, by the registration of its memorandum and articles. The Company registered an amendment to its memorandum on May 8, 1998, pursuant to which it increased its authorized capital from 20,000,000 common shares to 100,000,000 common shares and registered a further amendment to its memorandum on March 20, 2003 to change its name to its present name.

The Company is now governed by theBusiness Corporations Act(British Columbia) which replaced theCompany Act(British Columbia) as of March 29, 2004.

The Company’s registered office, head office and principal place of business are located at Suite 1550 — 1185 West Georgia Street, Vancouver, British Columbia, Canada V6E 4E6.

INTERCORPORATE RELATIONSHIPS

The following chart illustrates the corporate structure of Western Silver, its active subsidiaries, the jurisdiction of incorporation of each corporation and the percentage of voting securities beneficially owned or over which control or direction is exercised by the Company:

| * | | Denotes the Company’s material project. |

SUMMARY DESCRIPTION OF THE BUSINESS

The Company is a Canadian mineral exploration and development company engaged in the acquisition and exploration of mineral resources properties, with an emphasis on silver, gold, lead and zinc projects located in North America. Since 2001, the Company has focussed almost exclusively on the Peñasquito Project located in Zacatecas State, Mexico. As the Peñasquito Project has gained prominence, and has become the Company’s material project, the Company’s other projects, being the San Nicolas project in joint venture with Teck Cominco Limited located in Mexico, and the Carmacks project owned 100% by the Company and located in the Yukon Territory, Canada, are being maintained on a “care and maintenance” basis only. The Company does not presently intend to pursue the development of these other properties and the Underwriting Agreement provides that no portion of the net proceeds of this Offering may be expended on, or used in connection with, the maintenance or development of these other properties. Statements made by the Company prior to the date of this Prospectus regarding these other properties are now out of date, and, in view of the change in the

4

Company’s focus, previous statements as to the Company’s intentions concerning their development should not be relied upon by investors in making an investment decision with respect to the Common Shares. All such statements and disclosures including, without limitation, the following portions of the AIF: “Additional Information — B. Additional Information — paragraph 1.”; “Appendix A — Item 4. Information on the Company — Material Projects — B. El Salvador and San Nicolas Deposit, Mexico — History and Geology — C. The Carmacks Property, Yukon Territory”; “Appendix A — Item 10. Additional Information — C. Material Contracts — Item 19. Exhibits”, are hereby superceded and replaced by the statements contained herein. The Company may pursue value realization opportunities with respect to these other properties but does not anticipate that these activities will require the expenditure of material amounts of the Company’s funds. The Company does not regard these other properties as material and, accordingly, any technical or scientific disclosure with respect to these other properties contained in the documents incorporated by reference herein under the heading “Documents Incorporated by Reference” should be disregarded for the purpose of making an investment decision with respect to the Common Shares.

The Company also owns interests in a number of additional exploration properties in Mexico. For further details about the Company’s business, see “Item 4 — Information on the Company — Other Projects” contained in the Company’s AIF.

Peñasquito Project

Overview

The Company’s principal project is the Peñasquito Project. Western Silver’s exploration has focussed primarily on two zones of the Peñasquito Project, the Chile Colorado zone and the Peñasco deposit.

The Chile Colorado zone was the subject of a pre-feasibility study completed by M3 Engineering & Technology Corp. (“M3”), the results of which are disclosed in the technical report entitled “Peñasquito Pre-Feasibility Study” dated March 2004, as amended and restated November 8, 2004, (the “Pre-Feasibility Study”). The reserve estimates detailed in the Pre-Feasibility Study were prepared under the direction of Dr. Conrad E. Huss, P.E., Ph.D. and Jerry T. Hanks, P.E. of M3, each being independent of the Company and a “Qualified Person” as defined in National Instrument 43-101Standards of Disclosure for Mineral Projects(“NI 43-101”).

An independent preliminary resource estimate for the Peñasco deposit was completed for Western Silver by Marlow Mining Engineering Services, and the estimates are contained in a technical report entitled “Preliminary Resource Estimate for the Peñasco Deposit, Peñasquito Project, State of Zacatecas, Mexico” dated November 3, 2004 (the “Peñasco Report”). The Peñasco Report was prepared by Jim Marlow, P.Eng., a principal of Marlow Mining Engineering Services (“Marlow Mining”), who is independent of the Company and a “Qualified Person” as defined in NI 43-101.

Information in this section of the Prospectus of an economic, scientific or technical nature in respect of the Chile Colorado zone is based upon the Pre-Feasibility Study prepared by Dr. Conrad E. Huss, P.E., Ph.D. and Jerry T. Hanks, P.E. of M3, and in respect of the Peñasco deposit is based on the Peñasco Report prepared by Jim Marlow of Marlow Mining. The summary of information below, based on the Pre-Feasibility Study, has been prepared with the consent of each of M3 and Messrs. Huss and Hanks. The summary of information below, based on the Peñasco Report, has been prepared with the consent of each of Marlow Mining and Jim Marlow.

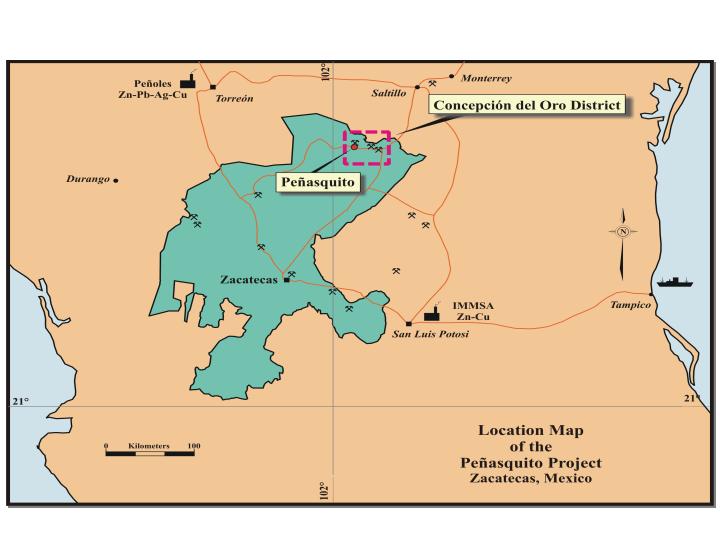

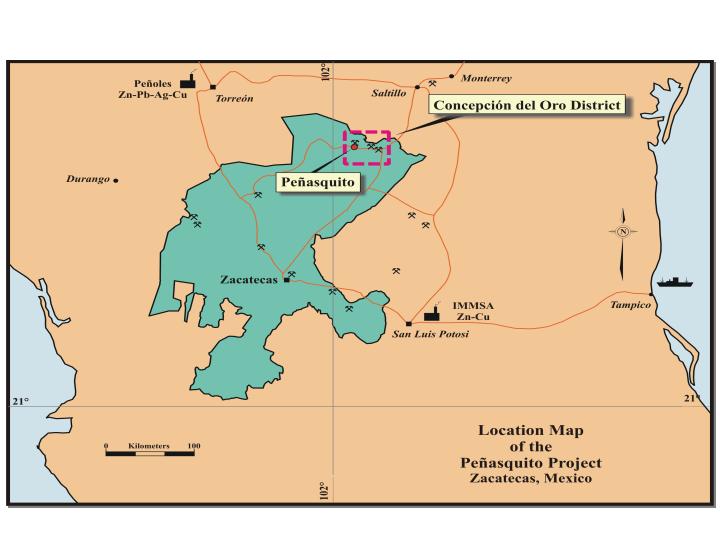

Property Description and Location

The Peñasquito Project is situated in the western half of the Concepción del Oro district in the north-east of Zacatecas State, Mexico, approximately 200 kilometres north-east of the City of Zacatecas. The closest major town is Concepción del Oro, which lies on Mexican highway 54, a well maintained, paved highway which links the major cities of Zacatecas.

5

The Company owns 100% of the mineral rights on 14 concessions covering an area of approximately 39,000 hectares. The geological exploration and property development work that the Company is conducting in this area is known as the “Peñasquito Project”. The specific area under investigation at present encompasses both the Chile Colorado and Peñasco deposits as well as a number of other targets of interest and covers approximately 3,254 hectares within five contiguous concessions, namely the La Peña, El Peñasquito, Las Peñas, Alfa and Beta concessions.

The Company is required to pay a 2% net smelter return (“NSR”) royalty to Kennecott Canada Explorations Inc. (“Kennecott”) on production from several concessions, including concessions that encompass the Chile Colorado zone and Peñasco deposit. In addition, a 3% NSR royalty is payable to Grupo Industrial de Coahuila S.A. de C.V., as assignee from Minera Catasillas, S.A. de C.V., on the El Peñasquito, Las Peñas, La Peña, Mazapil and Mazapil 2 concessions. This 3% NSR royalty can be purchased for U.S.$5 million, and would include any production from the Peñasco deposit, but not the Chile Colorado zone. Other than the above royalties and government assessment obligations, there are no payments or other future obligations due from the Company with respect to the concessions.

The Company is currently in possession of all valid exploration permits for the drill work currently being conducted in the Chile Colorado zone, however, the development of a mine will require additional permits from Mexican state and federal authorities.

The Company does not presently own surface rights to the land required for the development of the Chile Colorado zone and has not yet entered into negotiations to obtain the land. Surface rights in the area are held by one private individual and three ejidos (government created farm communities). Relations with these parties through the exploration process to date has been positive.

History

The Concepción del Oro district has historically produced approximately 250 million ounces of silver and 1.5 million ounces of gold plus copper-lead-zinc from numerous mines that exploited limestone-hosted skarn and chimney replacement deposits as well as an intrusive-hosted disseminated sulphide deposit. Minera Tayahua is producing silver, lead and zinc from a newly discovered chimney deposit located 25 kilometres to the east of Peñasquito beneath the old San Marcos Mine near Salaverna in the eastern Mazapil valley.

The Company acquired a 100% interest in the Peñasquito Project concessions from Minera Kennecott S.A. de C.V. in March 1998. Since that time, the Company has conducted geophysical surveys and has done extensive drilling on the property. The work by the Company has resulted in reserve estimates for the Chile Colorado zone, a resource estimate for the Peñasco deposit and identification of numerous exploration targets in the immediate area.

Chile Colorado Zone

Mineral Reserve Estimate for Chile Colorado Zone

The Pre-feasibility Study prepared by M3 estimated a reserve for the Chile Colorado zone of 98.4 million tonnes, classified as proven and probable, above a U.S.$3.75 per tonne cut-off NSR with an average grade of 39.65 grams per tonne silver, 0.36 grams per tonne gold, 0.34% lead and 0.93% zinc.

6

The conclusions of the Pre-feasibility Study are set forth in tabular form below:

Chile Colorado Pre-Feasibility Study

| | | | | |

| Initial Open-Pit Mine Design: | | 98.4 million tonnes | | |

| Mine Life: | | 13.5 Years | | |

| Mine Throughput: | | 20,000 tonnes per day | | |

| Average Stripping Ratio: | | 2.41 to 1 | | |

| Initial Capital Cost: | | U.S.$122,700,000 | | |

| Sustaining Capital: | | U.S.$41,700,000 | | |

| Average Net Smelter Return: | | U.S.$11.74 per tonne | | |

| Operating Cost: | | U.S.$5.63 per tonne | | |

| Silver Cash Cost per Ounce: | | U.S.$0.32 | | |

| Internal Rate of Return After Tax 100% Equity: | | 15.30% | | 20.50% |

| Payback: | | 4.9 years (1) | | 2.8 years (2) |

| (1) | Silver U.S.$5.50 per ounce, Gold U.S.$350 per ounce |

| (2) | Silver U.S.$7.00 per ounce, Gold U.S.$400 per ounce |

| |

| Source: | | M3 Engineering & Technology Corp. |

Peñasco Deposit

Preliminary Resource Estimate for Peñasco Deposit

The Peñasco Report confirmed that, in accordance with CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines, the quality of information available for the Peñasco deposit was sufficient for mineral resource estimation and classification of the deposit into indicated and inferred categories.

Total indicated and inferred resources are shown in tabular form below:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Grade

|

| | | Tonnes

| | NSR

| | Silver

| | Gold

| | Lead

| | Zinc

|

| | | (Millions) | | (U.S.$ per tonne) | | (grams per tonne) | | (grams per tonne) | | (%) | | (%) |

| Sulphide Zone | | | | | | | | | | | | | | | | | | | | | | | | |

Indicated(1) | | | 124.3 | | | | 9.43 | | | | 27.5 | | | | 0.50 | | | | 0.31 | | | | 0.64 | |

Inferred(1) | | | 84.2 | | | | 9.25 | | | | 26.0 | | | | 0.51 | | | | 0.29 | | | | 0.65 | |

| Oxide Zone | | | | | | | | | | | | | | | | | | | | | | | | |

Indicated(2) | | | 26.2 | | | | | | | | 19.7 | | | | 0.19 | | | | | | | | | |

Inferred(2) | | | 8.0 | | | | | | | | 15.3 | | | | 0.19 | | | | | | | | | |

| (1) | Cut off grade is U.S.$3.75 per tonne NSR.

|

| (2) | Cut off grade is 5.0 grams per tonne silver. |

| |

| Source: | | Marlow Mining Engineering Services. |

The mineral resource estimate represents the totalin situ and undilutedmineral resources for the Peñasco deposit to the end of the completed ten-phase drilling campaign.

Future Work for Peñasquito Project

The Company has retained M3 to complete a full feasibility study on the Peñasquito Project, incorporating both the Chile Colorado zone and the Peñasco deposits, which is currently underway and will include an environmental impact assessment (including results of a ground water study), determination of

7

permitting requirements, geotechnical investigation and metallurgical testing, additional resource estimation work, initial exploration program and metallurgical testing for adjacent orebodies and development of an economic model and mine plan. As part of this process, the Company will determine the extent of higher grade gold mineralization recently identified in the Peñasco deposit and the potential for selective underground mining of this higher grade gold mineralization.

If the Company obtains a positive feasibility study, the Company will then proceed to obtain the necessary permits for construction and commence pre-strip/oxide development of the Peñasquito Project. As the evaluation process will also include the Peñasco deposit, further drilling will be undertaken to update the resource estimate at Peñasco. Drilling to date has focussed on three principal areas of the Peñasquito Project: the Chile Colorado zone, Azul zone (which includes the Azul Breccia zone, the Azul Northeast zone and the Luna Azul zone) and the Peñasco deposit. As part of its future drilling program, the Company proposes to conduct extensive additional exploration on the Noche Buena, Azul Breccia and Azul Northeast zones, with a total of 50,000 metres of drilling projected in calendar 2005, with a total budget of approximately U.S.$5,000,000.

CONSOLIDATED CAPITALIZATION

The following table sets forth the Company’s consolidated capitalization as of the dates indicated, adjusted to give effect to the material changes in the share and loan capital of the Company since September 30, 2003, the date of the audited consolidated financial statements of the Company’s most recently completed financial year that have been released. The table should be read in conjunction with the audited consolidated financial statements of the Company, including the notes thereto, and management’s discussion and analysis incorporated by reference into this Prospectus.

| | | | | | | | | | | |

| | | | | | | As at June 30, 2004 | | As at June 30, 2004, |

| | | | | | | Before Giving Effect to | | After Giving Effect to |

| | | As at September 30, 2003

| | the Offering(2)

| | the Offering(1)(2)

|

| Common Shares | | $59,064,015

(35,184,081 shares) | | $77,397,199

(40,783,581 shares) | | $l

(l shares) |

| Share Purchase Options | | $269,257

(3,205,500 options) | | $3,116,643

(2,823,500 options) | | Nil -

(l options) |

| Share Purchase Warrants | | Nil -

(2,070,000 warrants) | | $176,178

(467,500 warrants) | | $l

(l warrants) |

| Deficit | | | ($17,550,437 | ) | | | ($21,853,434 | ) | | $l |

| Total Capitalization | | | $41,782,835 | | | | $58,836,586 | | | $l |

| | |

| | | |

| | |

|

| (1) | | After deducting the Underwriters’ Fee and expenses of the Offering estimated to be approximately $l, and assuming no exercise of the Over-Allotment Option. |

| (2) | | Subsequent to June 30, 2004, the Company issued an aggregate of 626,500 common shares upon exercise of share purchase options and share purchase warrants. |

8

USE OF PROCEEDS

The net proceeds from this Offering, after deducting fees payable to the Underwriters and the estimated expenses of the Offering, are estimated to be approximately $l, assuming no exercise of the Over-Allotment Option. If the Over-Allotment is exercised in full, the net proceeds to the Company from the Offering, after deducting the Underwriters’ Fee and the estimated expenses of the Offering of approximately $l, are estimated to be approximately $l. Western Silver will use the net proceeds of the Offering for further exploration and development of the Peñasquito Project, including the completion of a full feasibility study and a drilling program, and for general corporate purposes, subject to the limitations described under the heading “Summary Description of the Business” above.

PLAN OF DISTRIBUTION

Pursuant to the Underwriting Agreement datedl, 2004, between the Company and the Underwriters, the Company has agreed to issue and sell, and the Underwriters have agreed to purchase, subject to compliance with all necessary legal requirements and with the terms and conditions of the Underwriting Agreement, on December 20, 2004, or on such other date as the Company and the Underwriters may mutually agree, all but not less than all of thel Common Shares at a price of $l per Common Share for total consideration of $l payable in cash to the Company against delivery of certificates representing such Common Shares.

The offering price of $l per Common Share was determined by negotiation between the Company and the Underwriters, and in the context of the market. The Company has agreed to pay the Underwriters the Underwriters’ Fee of $l per Common Share (assuming no exercise of the Over Allotment-Option), representing 5% of the gross proceeds of the Offering, in consideration of services rendered by the Underwriters in connection with the Offering.

The Company has also granted to the Underwriters the Over-Allotment Option to purchase up tol Over-Allotment Shares, representing 15% of the Common Shares sold pursuant to the Offering, at a price of $l per Over-Allotment Share. The Over-Allotment Option is exercisable in whole or in part at any time until noon (Toronto time) on the 30th day following the Closing Date solely to cover any over-allotments. If the Over-Allotment Option is fully exercised, the total number of Common Shares sold under the Offering will bel, the total price to the public will be $l, the total Underwriters’ Fee will be $l and the total net proceeds to the Company will be $l.

The obligations of the Underwriters under the terms of the Underwriting Agreement are several and may be terminated at their discretion upon the occurrence of certain stated events, including any major financial occurrence of national or international consequence which materially adversely affects the financial markets in Canada and the United States. The Underwriters are, however, obligated to take up and pay for all of the Common Shares if any of the Common Shares are purchased under the Underwriting Agreement.

Under the terms of the Underwriting Agreement, the Underwriters, their broker/dealer affiliates and their respective directors, officers, employees, partners, agents, advisors and shareholders may be entitled to indemnification by the Company against certain liabilities, including liabilities for misrepresentation in this Prospectus and liabilities under the United States securities laws.

The Company has applied to each of the TSX and the AMEX to list the Common Shares to be distributed hereunder. Listing of the Common Shares on the TSX and the AMEX will be subject to the Company fulfilling all of the listing requirements of the TSX and the AMEX.

The Offering is being made concurrently in all of the provinces of Canada and in the United States pursuant to the multijurisdictional disclosure system implemented by securities regulatory authorities in Canada and in the United States.

9

The Company has agreed that it will not, directly or indirectly, sell, issue or announce the issuance of, or enter into any agreement to sell or issue, any securities of the Company, without the prior consent of the Underwriters, such consent not to be unreasonably withheld, for a period of 90 days following the Closing Date, other than: (a) pursuant to the Offering; (b) the issuance of securities on the exercise of outstanding rights or agreements, including options, warrants and other convertible securities and any rights which have been granted or issued, subject to any necessary regulatory approval; (c) the grant of options pursuant to and in accordance with the Company’s stock option plan; or (d) pursuant to any bona fide arm’s length acquisition of a business, whether by way of purchase of shares or assets, merger, plan of arrangement, amalgamation or otherwise, provided that the shares issued does not exceed 10% of the common shares of the Company outstanding immediately following the completion of the Offering.

The Company has further agreed that, subject to the Offering being completed, it will cause its principal shareholders, directors and officers, as the Underwriters may reasonably require, to execute and deliver written undertakings in favour of the Underwriters agreeing not to sell, transfer, assign, pledge or otherwise dispose of any securities of the Company owned, directly or indirectly, by such principal shareholders, directors or officers for a period of 90 days following the Closing Date, without the prior written consent of the Underwriters, such consent not to be unreasonably withheld.

None of the Underwriters are registered as broker-dealers under section 15 of the United StatesSecurities Exchange Act of 1934, as amended (the “Exchange Act”), and each has agreed that, in connection with the Offering, no person will offer or sell any Common Shares in, or to persons who are nationals or residents of, the United States other than through a United States registered broker-dealer, which may be its affiliate.

Pursuant to the policy statements of the Ontario Securities Commission and the Autorité des marchés financiers, the Underwriters may not, throughout the period of distribution under this Prospectus, bid for or purchase common shares of the Company. The foregoing restriction is subject to certain exceptions, on the condition that the bid or purchase not be engaged in for the purpose of creating actual or apparent active trading in or raising the price of the common shares of the Company. These exceptions include a bid or purchase permitted under the by-laws and rules of the TSX relating to market stabilization and passive market marking activities and a bid or purchase made for or on behalf of a customer where the order was not solicited during the period of distribution. In connection with the Offering, subject to the foregoing and applicable laws, the Underwriters may over-allot or effect transactions intended to stabilize or maintain the market price of the common shares of the Company at levels above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time.

The Underwriters, acting pursuant to Regulation M promulgated by the SEC, may engage in transactions, including stabilizing bids or syndicate covering transactions, that may have the effect of stabilizing or maintaining the market price of the common shares of the Company at a level above that which might otherwise prevail in the open market. A “stabilizing bid” is a bid for or the purchase of common shares of the Company on behalf of the Underwriters for the purpose of fixing or maintaining the price of the common shares of the Company. A “syndicate covering transaction” is a bid for the purchase of common shares of the Company on behalf of the Underwriters to reduce a short position incurred by the Underwriters in connection with the Offering. Stabilizing bids and open market purchases may be effected on the AMEX, in the over-the-counter market or otherwise and, if commenced, may be discontinued at any time.

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

The authorized capital of Western Silver consists of 100,000,000 common shares without par value. As at November 25, 2004, there were 41,410,081 common shares of the Company issued and outstanding.

The holders of common shares of the Company are entitled to one vote per common share at all meetings of shareholders, to receive dividends as and when declared by the directors, and to receive a pro rata

10

share of the remaining property and assets of the Company in the event of liquidation, dissolution or winding up of the Company. The common shares of the Company have no pre-emptive, redemption, purchase or conversion rights. There are no sinking fund provisions in relation to the common shares of the Company and they are not liable to further calls or to assessment by the Company. TheBusiness Corporations Act(British Columbia) provides that the rights and provisions attached to any class of shares may not be modified, amended or varied unless consented to by special resolution of the Company’s shareholders. At the present time, the special majority required to pass a special resolution of the Company is not less than 75% of the votes cast in person or by proxy by holders of shares of that class.

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

In the opinion of DuMoulin Black, counsel to the Company, and Cassels Brock & Blackwell LLP, counsel to the Underwriters, the following is, as of the date of this Prospectus, a summary of the principal Canadian federal income tax considerations under theIncome Tax Act(Canada) (the “Tax Act”) generally applicable to holders of Common Shares acquired under the Offering. This summary applies to holders who, for the purposes of the Tax Act: (i) deal at arm’s length and are not affiliated with the Company; (ii) are not “financial institutions” as defined in the Tax Act for purposes of the mark-to-market rules; (iii) are not “specified financial institutions” as defined in the Tax Act; and (iv) hold their Common Shares as capital property. Such securities will generally be “capital property” to a holder unless they are held in the course of carrying on a business of trading or dealing in securities or have been acquired in a transaction or transactions considered to be an adventure in the nature of trade. Certain holders who are resident in Canada for purposes of the Tax Act and who might not otherwise be considered to hold their Common Shares as capital property may, in certain circumstances, be entitled to have them treated as capital property by making the irrevocable election permitted by subsection 39(4) of the Tax Act.

This summary is based upon the current provisions of the Tax Act and the regulations thereunder (the “Regulations”) in force as of the date hereof, all specific proposals (the “Proposed Amendments”) to amend the Tax Act or the Regulations that have been publicly announced by, or on behalf of, the Minister of Finance (Canada) prior to the date hereof, the current provisions of theCanada-United States Income Tax Convention (1980)(the “Convention”), and counsel’s understanding of the current published administrative and assessing practices of the Canada Customs and Revenue Agency (“CCRA”). No assurance can be given that the Proposed Amendments will be enacted in their current proposed form, if at all; however, the Canadian federal income tax considerations generally applicable to holders with respect to the Common Shares will not be different in a material adverse way if the Proposed Amendments are not enacted. This summary does not take into account or anticipate any other changes to the law, whether by legislative, governmental or judicial decision or action, nor does it take into account provincial, territorial or foreign income tax legislation or considerations, which may differ from the Canadian federal income tax considerations.

This summary is of a general nature only, is not exhaustive of all possible Canadian federal income tax considerations and is not intended to be, nor should it be construed to be, legal or tax advice to any particular holder. Therefore, holders should consult their own tax advisors with respect to their particular circumstances.

Holders Resident in Canada

The following discussion applies to a holder (a “Canadian Holder”) of Common Shares who, at all relevant times, is or is deemed to be resident in Canada for purposes of the Tax Act.

Dividends

Dividends received or deemed to be received on the Common Shares will be included in computing the Canadian Holder’s income. In the case of an individual Canadian Holder such dividends will be subject to the gross-up and dividend tax credit rules normally applicable in respect of taxable dividends received from taxable Canadian corporations (as defined in the Tax Act). Dividends received by a corporation on the Common Shares

11

must be included in computing its income but generally will be deductible in computing its taxable income. Private corporations (as defined in the Tax Act) and certain other corporations controlled by or for the benefit of an individual (other than a trust) or related group of individuals (other than trusts) generally will be liable to pay a 33 1/3% refundable tax under Part IV of the Tax Act on dividends to the extent such dividends are deductible in computing taxable income. This refundable tax generally will be refunded to a corporate holder at the rate of $1 for every $3 of taxable dividends paid while it is a private corporation.

Disposition of Common Shares

A disposition or deemed disposition by a Canadian Holder of Common Shares will generally give rise to a capital gain (or capital loss) equal to the amount by which the proceeds of disposition, net of any reasonable costs of disposition, are greater (or less) than such Canadian Holder’s adjusted cost base of the Common Shares. The tax treatment of capital gains and losses is discussed in greater detail below under the subheading “Capital Gains and Losses”.

Capital Gains and Losses

Upon a disposition (or a deemed disposition) of a Common Share, a Canadian Holder generally will realize a capital gain (or a capital loss) equal to the amount by which the proceeds of disposition of such share, net of any reasonable costs of disposition, are greater (or are less) than the adjusted cost base of such share to the Canadian Holder. One-half of any capital gain will be included in income as a taxable capital gain and one-half of any capital loss may normally be deducted as an allowable capital loss against taxable capital gains realized in the year of disposition. Any unused allowable capital losses may be applied to reduce net taxable capital gains realized in the three preceding taxation years or any subsequent taxation year, subject to the provisions of the Tax Act in that regard.

The amount of any capital loss realized on the disposition or deemed disposition of Common Shares by a Canadian Holder that is a corporation may be reduced by the amount of dividends received or deemed to have been received by it on such shares or shares substituted for such shares to the extent and in the circumstance prescribed by the Tax Act. Similar rules may apply where a Canadian Holder that is a corporation is a member of a partnership or beneficiary of a trust that owns such shares or that is itself a member of a partnership or a beneficiary of a trust that owns such shares.

A Canadian Holder that is throughout the relevant taxation year a “Canadian-controlled private corporation” (as defined in the Tax Act) also may be liable to pay an additional refundable tax of 6 2/3% on its “aggregate investment income” for the year which will include taxable capital gains. This refundable tax generally will be refunded to a corporate holder at the rate of $1 for every $3 of taxable dividends paid while it is a private corporation. Individuals (other than certain trusts) may be subject to alternative minimum tax in respect of realized capital gains.

Holders Resident in the United States

The following summary is generally applicable to holders who (i) for the purposes of the Tax Act have not been and will not be deemed to be resident in Canada at any time while they hold Common Shares and who do not use or hold the Common Shares in carrying on a business in Canada; and (ii) are residents of the United States for purposes of the Convention (“U.S. Holders”). Special rules, which are not discussed in this summary, may apply to a U.S. Holder that is an insurer carrying on business in Canada and elsewhere.

Dividends paid or credited or deemed under the Tax Act to be paid or credited to a U.S. Holder will generally be subject to Canadian withholding tax at the rate of 15%. This rate is reduced to 5% in the case of a U.S. Holder that is a corporation that owns at least 10% of the voting stock of the Company.

12

A U.S. Holder will not be subject to tax under the Tax Act in respect of any capital gain arising on a disposition or deemed disposition of Common Shares unless the Common Shares constitute “taxable Canadian property” of the U.S. Holder within the meaning of the Tax Act and the U.S. Holder is not entitled otherwise to relief under the Convention. Generally, Common Shares will not constitute taxable Canadian property of a U.S. Holder provided that (i) the Common Shares are listed on a prescribed stock exchange (which includes the TSX) for the purposes of the Tax Act at the time of disposition; and (ii) at no time during the 60 month period immediately preceding the disposition of the Common Shares were 25% or more of the issued shares of any class or series of the capital stock of the Company owned by the U.S. Holder, by persons with whom the U.S. Holder did not deal at arm’s length, or by the U.S. Holder together with such persons.

Under the Convention, capital gains derived by a U.S. Holder from the disposition of Common Shares, even where they constitute taxable Canadian Property to the U.S. Holder, generally will not be taxable in Canada unless the value of the Company’s shares is derived principally from real property situated in Canada.

A disposition or deemed disposition of Common Shares by a U.S. Holder whose Common Shares are taxable Canadian property and who is not entitled to an exemption under the Convention will give rise to a capital gain (or a capital loss) equal to the amount, if any, by which the proceeds of disposition, less the reasonable costs of disposition, exceed (or are less than) the adjusted cost base of the Common Shares to the U.S. Holder at the time of the actual or deemed disposition. Generally, one-half of any capital gain realized will be required to be included in income as a taxable capital gain and one-half of any capital loss will be deductible, subject to certain limitations, against taxable capital gains in the year of disposition or the three preceding years or any subsequent year in accordance with the detailed provisions in the Tax Act.

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

In the opinion of Perkins Smith & Cohen LLP, United States counsel to the Company, the following is a summary of certain United States federal income tax considerations relevant to United States Persons (as defined below) that acquire Common Shares pursuant to this Offering. This summary is based upon the Internal Revenue Code of 1986 (the “Code”), as amended, Treasury regulations promulgated thereunder, judicial decisions, and the Internal Revenue Service’s current administrative rules, practices and interpretations of law, all as in effect on the date of this Prospectus, and all of which are subject to change, possibly with retroactive effect. This summary also takes into account proposed Treasury regulations regarding passive foreign investment companies, which are not currently in effect but would purport to apply on a retroactive basis (the “Proposed Regulations”). There can be no assurance as to whether, when or in what form the Proposed Regulations will be adopted as final Treasury regulations. For purposes of this summary, a “United States Person” means (i) a citizen or resident of the United States, (ii) a corporation or partnership created or organized in or under the laws of the United States, any state thereof or the District of Columbia, (iii) an estate, the income of which is subject to United States federal income taxation regardless of its source, or (iv) a trust if: (a) a court within the United States is able to exercise primary supervision over the administration of such trust, and (b) one or more United States Persons have the authority to control all substantial decisions of such trust. If a partnership holds Common Shares, the United States federal income tax treatment of a partner in the partnership generally will depend on the status of the partner and the activities of the partnership. A partner of a partnership holding Common Shares should consult its own tax advisors with respect to the United States federal income tax consequences of the acquisition and ownership of Common Shares.

This summary is only a general discussion and is not intended to be, and should not be construed to be, legal or tax advice to any prospective investor. In addition, this summary does not discuss all aspects of United States federal income taxation that may be relevant to a United States Person in light of such person’s particular circumstances, including certain United States Persons that may be subject to special treatment under the Code (for example, persons (i) that are tax-exempt organizations, qualified retirement plans, individual retirement accounts and other tax-deferred accounts; (ii) that are financial institutions, insurance companies, real estate investment trusts, regulated investment companies, or brokers, dealers or traders in securities; (iii) that are subject to the alternative minimum tax provisions of the Code; or (iv) that own Common Shares as part of a

13

straddle, hedging, conversion transaction, constructive sale or other arrangement involving more than one position), United States Persons that already own common shares and United States Persons that hold Common Shares other than as capital assets. Moreover, this summary does not include any discussion of state, local or foreign income or other tax consequences.

THE UNITED STATES FEDERAL INCOME TAX TREATMENT OF THE COMMON SHARES IS COMPLEX, AND, POTENTIALLY UNFAVORABLE TO UNITED STATES PERSONS WHO DO NOT MAKE A QEF ELECTION, AS DESCRIBED BELOW. ACCORDINGLY, EACH UNITED STATES PERSON WHO ACQUIRES COMMON SHARES UNDER THIS PROSPECTUS IS STRONGLY URGED TO CONSULT HIS, HER OR ITS OWN TAX ADVISOR WITH RESPECT TO THE UNITED STATES FEDERAL, STATE, LOCAL AND FOREIGN INCOME, ESTATE AND OTHER TAX CONSEQUENCES OF THE ACQUISITION OF COMMON SHARES, WITH SPECIFIC REFERENCE TO SUCH PERSON’S PARTICULAR FACTS AND CIRCUMSTANCES.

Passive Foreign Investment Company Treatment

The Company believes that it is a “passive foreign investment company” for United States federal income tax purposes, and it expects to continue to be a passive foreign investment company until it generates sufficient revenue from its mineral exploration and extraction activities. The tax rules generally applicable to passive foreign investment companies are very complex and, in some cases, uncertain. Each United States Person is strongly urged to consult his or her own tax advisor with respect to such rules.

If a United States Person holding Common Shares is treated under these rules as owning stock of a passive foreign investment company, any gain recognized by such person upon a sale or other disposition of Common Shares may be ordinary (rather than capital), and any resulting United States federal income tax may be increased by an interest charge, as discussed further below. Rules similar to those applicable to dispositions generally will apply to certain excess distributions in respect of a Common Share. A United States Person generally may avoid these unfavorable United States federal income tax consequences by making a “qualified electing fund” (“QEF”) election or alternatively, making a mark-to market election (the “mark-to-market election”) with respect to the Company, both as described below.

The tax consequences to a United States Person who owns, directly or, in certain cases, indirectly, Common Shares depend on whether or not a QEF election or a mark-to-market election (“mark-to-market election”) is made by such person with respect to the Company.

QEF Election

A United States Person that owns Common Shares may elect, provided that the Company provides such person with certain information, to have the Company treated, with respect to that person, as a QEF. A QEF election must be made by a shareholder before the due date (with regard to extensions) for such person’s tax return for the taxable year for which the election is made and, once made, will be effective for all subsequent taxable years of such person unless revoked with the consent of the Internal Revenue Service. (A United States Person who makes a QEF election with respect to the Company is referred to herein as an “Electing Shareholder”.) THE COMPANY INTENDS TO MAKE AVAILABLE TO HOLDERS OF COMMON SHARES THE ANNUAL STATEMENT CURRENTLY REQUIRED BY THE INTERNAL REVENUE SERVICE, WHICH WILL INCLUDE INFORMATION AS TO THE ALLOCATION OF THE COMPANY’S ORDINARY EARNINGS AND NET CAPITAL GAIN AMONG THE COMMON SHARES AND AS TO DISTRIBUTIONS ON SUCH COMMON SHARES. SUCH STATEMENT MAY BE USED BY ELECTING SHAREHOLDERS FOR PURPOSES OF COMPLYING WITH THE REPORTING REQUIREMENTS APPLICABLE TO THE QEF ELECTION.

An Electing Shareholder will be required to include currently in gross income his, her to its pro rata share of the Company’s annual ordinary earnings and annual net capital gains if any, in any taxable year that the

14

Company is a passive foreign investment company. The Company anticipates that it will not have any earnings in taxable years that it is a passive foreign investment company, although no assurances can be given that this will be the case. Any income inclusion will be required whether or not such shareholder owns Common Shares for an entire year or at the end of the Company’s taxable year. The amount so includable will be determined without regard to the amount of cash distributions, if any, received from the Company. Electing Shareholders will be required to pay tax currently on such imputed income, unless, as described below, an election is made to defer such payment.

The amount currently included in income will be treated as ordinary income to the extent of the Electing Shareholder’s allocable share of the Company’s ordinary earnings and generally will be treated as long-term capital gain to the extent of such shareholder’s allocable share of the Company’s net capital gains. Such net capital gains ordinarily would be subject to a maximum 15% United States federal income tax rate in the case of non-corporate United States persons, unless the Company elects to treat the entire amount of its net capital gain as ordinary income.

So long as an Electing Shareholder’s QEF election is in effect with respect to the entire holding period for his or her Common Shares, any gain or loss realized by such shareholder on the disposition of such Common Shares held as capital assets ordinarily would be a capital gain or loss. Such capital gain or loss ordinarily would be long-term if such Electing Shareholder had held the Common Shares for more than one year at the time of the disposition. For non-corporate United States persons, long-term capital gain is generally subject to a maximum federal income tax rate of 15%.

Under temporary Treasury regulations, an individual is required to include in income his or her proportionate share of the investment expenses of certain “pass-through” entities. It is not clear under such Treasury regulations whether a passive foreign investment company for which a QEF election is in effect may be treated as a “pass-through” entity. If these provisions were to apply to the Company, each individual Electing Shareholder would be required to include in income an amount equal to a portion of the Company’s investment expenses and would be permitted an offsetting deduction (if otherwise allowable under the Code) to the extent that the amount of such expenses included in income, plus certain other miscellaneous itemized deductions of such shareholder, exceed 2% of such shareholder’s adjusted gross income.

Mark-to-Market Election

A United States Person generally may make a mark-to-market election with respect to shares of “marketable stock” of a passive foreign investment company. Under the Code and Treasury regulations, the term “marketable stock” includes stock of a passive foreign investment company that is “regularly traded” on a “qualified exchange or other market”. Generally, a “qualified exchange or other market” means (i) a national securities exchange which is registered with the Securities and Exchange Commission or the national market system established pursuant to Section 11A of the Securities Exchange Act of 1934 or (ii) a foreign securities exchange that is regulated or supervised by a governmental authority of the country in which the market is located and has the following characteristics: (a) the exchange has trading volume, listing, financial disclosure, and other requirements designed to prevent fraudulent and manipulative acts and practices, to remove impediments to and perfect the mechanism of a free and open market, and to protect investors, and the laws of the country in which the exchange is located and the rules of the exchange ensure that such requirements are actually enforced; and (b) the rules of the exchange ensure active trading of listed stocks. A class of stock is “regularly traded” on a qualified exchange or other market for any calendar year during which such class of stock is traded (other than in de minimis quantities) on at least 15 days during each calendar quarter. Based upon the foregoing, the Company expects that the Common Shares will be “marketable stock” for such purposes.

As a result of such an election, in any taxable year that the Company is a passive foreign investment company, a United States Person would generally be required to report gain or loss annually to the extent of the difference between the fair market value of the shares at the end of the taxable year and the adjusted tax basis of

15

the shares at that time. Any gain under this computation, and any gain on an actual disposition of the passive foreign investment company shares, would be treated as ordinary income. Any loss under this computation and any loss on an actual disposition would be treated as an ordinary loss to the extent of the cumulative net mark-to-market gain and thereafter would be considered capital loss. The United States Person’s tax basis in the shares is adjusted for any gain or loss taken into account under the mark-to-market election.

Unless either (i) the mark-to-market election is made as of the beginning of the United States Person’s holding period for the passive foreign investment company shares or (ii) a QEF election has been in effect for such person’s entire holding period, any mark-to-market gain for the election year generally will be subject to the rules applicable to dispositions by non-Electing Shareholders described below.

Non-Electing Shareholders

If a QEF election is not made by a United States Person, or is not in effect with respect to the entire period that such person holds (or is treating as holding) his or her Common Shares, then, unless such person has made the mark-to-market election as described above, any gain on his or her sale or other disposition of Common Shares (directly or, in certain circumstances, indirectly) generally will be treated as ordinary income realized pro rata over such holding period for such Common Shares.

A United States Person will be required to include as ordinary income in the year of disposition the portion of the gain attributed to such year. In addition, such person’s United States federal income tax for the year of disposition will be increased by the sum of (i) the tax computed by using the highest statutory rate applicable to such person for each year (without regard to other income or expenses of such person) on the portion of the gain attributed to years prior to the year of disposition plus (ii) interest on the tax determined under clause (i), at the rate applicable to underpayments of tax, from the due date of the return (without regard to extensions) for each year described in clause (i) to the due date of the return (without regard to extensions) for the year of disposition. Under the Proposed Regulations, a “disposition” may include, under certain circumstances, transfers at death, gifts, pledges and other transactions with respect to which gain ordinarily is not recognized. Under certain circumstances, the adjustment generally made to the tax basis of property held by a decedent may not apply to the tax basis of Common Shares if a QEF election was not in effect for the deceased United States Person’s entire holding period. Rules similar to those applicable to dispositions generally apply to excess distributions in respect of a Common Share (i.e., distributions that exceed 125% of the average amount of distributions in respect of such Common Share received during the preceding three years or, if shorter, during the United States Person’s holding period prior to the distribution year). Any loss realized by a non-Electing Shareholder on the disposition of Common Shares held as a capital asset ordinarily will be capital loss.

Treatment of Certain Distributions

To the extent that a distribution paid on a Common Share to a United States Person is not an “excess distribution” received by a non-Electing Shareholder, and is not treated as a non-taxable distribution paid from earnings previously included in income by an Electing Shareholder under the QEF rules, such distribution (including amounts withheld in respect of Canadian federal income tax) will be taxable as ordinary income to the extent of the Company’s current or accumulated earnings and profits (as computed on the basis of United States federal income tax principles) and, to the extent the distribution exceeds such earnings and profits, generally will be treated as a non-taxable return of capital to the extent of the tax basis of the Common Share and then as capital gain from the sale or exchange of the Common Share. Dividends on the Common Shares will not be eligible for the maximum 15% United States federal income tax rate generally applicable to dividends paid by a “qualified foreign corporation” to non-corporate United States persons if the Company qualifies as a passive foreign investment company for its taxable year during which it pays a dividend on the Common Shares, or for its immediately preceding taxable year. In addition, dividends on the Common Shares generally will not be eligible for the deduction for dividends received by corporations. Dividends on the Common Shares generally will be foreign source income for United States foreign tax credit purposes, except as described below under “Canadian Withholding Taxes.” Such income generally will be treated as “passive

16

income,” or, in the case of certain United States Persons, “financial services income.” For taxable years beginning after December 31, 2006, such income generally will be treated as “passive category income,” or, in the case of certain United States Persons, “general category income.”

The amount of any dividend on the Common Shares paid in Canadian dollars will equal the United States dollar value of the Canadian dollars received calculated by reference to the exchange rate in effect on the date the dividend is actually or constructively received by the United States Person, regardless of whether the Canadian dollars are converted into United States dollars. If the Canadian dollars received are not converted into United States dollars on the day of receipt, a United States Person will have a basis in the Canadian dollars equal to their United States dollar value on the date of receipt. Any gain or loss that a United States Person realizes on a subsequent conversion or other disposition of the Canadian dollars will be treated as United States source income or loss.

Canadian Withholding Taxes

Subject to complex limitations set forth in the Code and the United States-Canada Income Tax Convention, shareholders who are United States Persons may be entitled to claim a credit against their United States federal income tax liability for Canadian federal income tax withheld from dividends on the Common Shares. Among other things, any dividends or inclusions under the passive foreign investment company rules for a year in which more than 50% of the total voting power or value of the Company’s shares is owned by United States Persons may be treated in part as United States source income under Section 904(g) of the Code. Taxpayers who do not elect to claim foreign tax credits for a taxable year may be able to deduct any such Canadian federal income tax withheld.

Information Reporting and Backup Withholding

United States information reporting requirements and backup withholding tax generally will apply to certain non-corporate holders of Common Shares. Information reporting generally will apply to payments of dividends on, and to proceeds from the sale or redemption of, Common Shares by a paying agent within the United States to a holder of Common Shares (other than an “exempt recipient” which includes non-U.S. shareholders that provide an appropriate certification and certain other persons). A paying agent or other intermediary within the United States will be required to withhold at a rate of 28% on any payment of proceeds from the sale or redemption of Common Shares within the United States to a United States Person (other than a corporation or an “exempt recipient”) if such shareholder fails to furnish its correct taxpayer identification number or otherwise fails to comply with such backup withholding requirements. Any amounts withheld under the backup withholding rules from a payment to a United States Person generally may be refunded (or credited against such United States Person’s United States federal income tax liability, if any) provided the required information is furnished to the Internal Revenue Service. United States Persons should consult their tax advisors as to their qualification for exemption from backup withholding and the procedure for obtaining such an exemption. If information reporting requirements apply to a United States Person, the amount of dividends paid with respect to such Common Shares will be reported annually to the Internal Revenue Service and such United States Person.

ENFORCEMENT OF CERTAIN CIVIL LIABILITIES

The Company is governed by theBusiness Corporations Act(British Columbia). All of the Company’s assets are located outside of the United States, and certain of its directors and officers, as well as the experts named in this Prospectus, are residents of Canada or other jurisdictions outside of the United States. As a result, it may be difficult for investors to effect service within the United States upon the Company or those directors, officers and experts who are not residents of the United States or to realize in the United States upon judgements of courts of the United States predicated upon the civil liability provisions of the United States federal securities laws.

17

In addition, there is some doubt as to the enforceability in Canada by a court in original actions, or in actions to enforce judgements of United States courts, of civil liabilities predicated upon United States federal securities law.

RISK FACTORS

The Company is engaged in exploration activities which, by their nature, are speculative due to the high-risk nature of its business and the present stage of its development. An investment in the Common Shares involves significant risks, which should be carefully considered by prospective investors before purchasing the Common Shares. In addition to information set out elsewhere, or incorporated by reference, in this Prospectus, investors should carefully consider the risk factors set out below. Such risk factors could materially affect the Company’s future financial results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company, each of which could cause investors to lose part or all of their investment in the common shares of the Company.

The Company has incurred losses.

The Company has incurred net losses in the past and may incur losses in the future and will continue to incur losses until and unless it can derive sufficient revenues from its projects. Such future losses could have an adverse effect on the market price of our common shares, which could cause investors to lose part or all of their investment in the Company’s shares.

The Company currently depends on one principal exploration stage property.

The Company is currently dependent on one principal mineral property, being its Peñasquito Project, which is an exploration stage project. The Penasquito Project may never develop into a commercially viable ore body, which would have a materially adverse affect on the Company’s potential mineral resource production, profitability, financial performance and results of operations.

The Company is an exploration company and may never develop a commercially viable ore body.