UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2004

Western Silver Corporation

(Translation of registrant’s name into English)

Suite 1550, 1185 West Georgia Street, Vancouver, B.C., V6E 4E6, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l):

Note: Regulation S-T Rule 101(b)(l) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 10l(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | | | | Western Silver Corporation

|

| | | | | (Registrant) |

| | |

Date: November 22, 2004 | | By: | | /s/ Lawrence Page

|

| | | | | (Signature) * |

| | | | | Lawrence Page, Corporate Secretary |

| * | Print the name and title under the signature of the signing officer. |

| | |

SEC 1815 (11-02) | | Persons who are to respond to the collection of Information contained In this form are not required to respond unless the form displays a currently valid OMB control number. |

REVISED

WESTERN SILVER CORPORATION

Initial Annual Information Form

For the year ended September 30, 2003

Dated as of November 9, 2004

Table of Contents

2

INCORPORATION OF FINANCIAL STATEMENTS AND DATE OF INFORMATION

Incorporated by reference into this Initial Annual Information Form (“AIF”) are the audited Financial Statements of Western Silver Corporation (“Western Silver” or the “Company” or the “Issuer”) for the years ended September 30, 2003 and 2002 together with the auditors’ report thereon. All financial information in this AIF is prepared in accordance with Canadian generally accepted accounting principles.

All dollar amounts referred to in this AIF are in Canadian dollars unless otherwise indicated.

All information in this AIF is as of November 9, 2004 unless otherwise indicated.

The AIF is being filed pursuant to Part 3 of National Instrument 44-101. The AIF incorporates the Company’s Form 20-F (the “Form 20-F”) as the Company’s alternative form of annual information form for the fiscal year ended September 30, 2003 and updates the information in the Form 20-F as described in the general disclosure in this AIF and incorporates specific additional information as disclosed under the heading “Additional Information Incorporated by Reference”. The Form 20-F was prepared pursuant to the Securities Exchange Act of 1934. The agreements listed under the heading “Material Contracts” of the Form 20-F and the Exhibits 2.1 through 32.1 of the Form 20-F are not incorporated by reference into this AIF.

Cautionary Statements Regarding Forward Looking Statements

This Annual Information Form and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, silver and copper, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, limitations on insurance coverage and the timing and possible outcome of pending litigation. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Western Silver to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, risks related to the integration of acquisitions; risks related to international operations; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold, silver and copper; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled “Risk Factors” in this Annual Information Form. Although Western Silver has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be

3

other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

CORPORATION STRUCTURE

Refer to Item 4 “Information on the Company” in the Form 20-F attached as Appendix A hereto.

GENERAL DEVELOPMENT OF THE BUSINESS

Western Silver Corporation is a Canadian mineral exploration and development company with an emphasis on silver, gold, lead and zinc projects located in North America. Since 2001, the Company has focussed almost exclusively on the Peñasquito Project located in Zacatecas State, Mexico. The Chile Colorado zone within the Peñasquito property is the subject of a Pre-Feasibility study completed in March, 2004, the summary of which is reproduced below. As the Peñasquito project has gained prominence, the Company’s other projects, being the San Nicolas project in joint venture with Teck Cominco Limited (“Teck Cominco”), and the Carmacks project owned 100% by the Company have been maintained on a “care and maintenance” basis only.

Refer to Item 4 “Information on the Company” in the Form 20-F attached as Appendix A hereto. The Form 20-F is updated by the Material Change Reports incorporated by reference under “Additional Information Incorporated by Reference” in this AIF and additional information provided in this AIF.

Recent Developments

The Company’s material property is its Peñasquito property in Mexico. Since the date of the Form 20-F, the Company has received

| | 1. | a technical report entitled “Peñasquito Pre-Feasibility Study” dated March 2004 (the “Pre-Feasibility Study”) (as amended to reflect changes in section “1.2 Introduction & Terms of Reference” and re-filed on SEDAR on November 15, 2004) prepared by M3 Engineering Technology Corporation” (“M3”) recommending the Company proceed with a full feasibility with respect to the Chile Colorado Zone of the Company’s Peñasquito property. See the disclosure under “Narrative Description of the Business” below. The executive summary of the Pre-Feasibility Study may be viewed on SEDAR. See “Additional Documents” herein; and |

| | 2. | an independent resource estimate at Peñasco that significantly expands the mineral resource at the Company’s wholly-owned Peñasquito property in central Mexico. See the Material Change Report dated October 4, 2004 which is incorporated by reference in this AIF and may be viewed on SEDAR”. See “Additional Documents Incorporated by Reference” herein. |

The Company also completed a brokered private placement financing in December 2003 with Kingsdale Capital Markets Inc., Kingsdale Capital Partners Inc. and Orion Securities Inc. and raised gross proceeds of $12,360,000. The Company issued 2,400,000 common shares at $5.15 each, and 240,000 underwriter’s options exercisable for two years at $5.78 each.

4

NARRATIVE DESCRIPTION OF THE BUSINESS

Refer to Item 4 “Information on the Company” in the Form 20-F attached as Appendix A hereto. The Form 20-F is updated by the Material Change Reports incorporated by reference under “Additional Information Incorporated by Reference” in this AIF and additional disclosure provided herein.

The following information regarding the Chile Colorado zone of the Peñasquito property is extracted from the executive summary of the Pre-Feasibility Study:

“Western Silver Corporation (Western Silver) owns 100% of the mineral rights to a large area covering approximately 39,000 hectares located in the north-eastern portion of the State of Zacatecas in northern Mexico. The portion of this area referred to as the Peñasquito property lies approximately 27 km west of the town of Concepcíon del Oro in a wide, generally flat valley covered by coarse grasses and cacti.

Investigations on this property have revealed indications of several major intrusive related zones of silver, gold, zinc and lead mineralization. This study considers only one of those zones, the Chile Colorado zone, which has been the subject of most of the investigations to date. All monies in this study are in US dollars.

The Chile Colorado sulphide resource** has been estimated by SNC-Lavalin Engineers and Constructors at a $3.75 cut-off and has 81.2 million tonnes grading 43.4 g/t(1)silver, 0.36 g/t gold, 0.37% lead and 0.98% Zn in the measured category, 67.5 million tonnes grading 23.4 g/t silver, 0.31 g/t gold, 0.18% lead and 0.67% zinc in the indicated category and 28.8 million tonnes in the inferred category grading 21.9 g/t silver, 0.23 g/t gold, 0.18% lead and 0.50% zinc. In accordance with guidelines, only material in the measured and indicated categories has been used in the economic evaluation of this deposit.

The proven and probable reserves for the deposit are contained within an engineered pit design based on a floating cone analysis of the resource block model using the measured and indicated sulphide resources. The estimated reserve for the Chile Colorado deposit is 98.4 million tonnes, classified as proven and probable, above a $3.75/tonne cut-off, with an average grade of 39.65g/tonne silver, 0.36g/tonne gold, 0.34% lead and 0.93% zinc. The life-of-mine strip ratio is 2.41:1.

The plan is to develop the property as an open pit mine with an average ore production rate of 20,000 tonnes per day. Ore will be mined using two electric shovels and a fleet of diesel haul trucks, the number will vary depending on the phase of the development. The ore processing is generally conventional; haul trucks will deliver ore to a primary crusher, from where it will be conveyed to a SAG (2) mill, ball mill, pebble crusher combination. The flotation circuit will first remove carbonaceous material before floating a lead concentrate and then a zinc concentrate. The concentrate slurries will first be thickened and then dewatered using pressure filters. The dewatered concentrates will be stockpiled before loading onto road vehicles for transport to the smelters.

Process water will be obtained from wells located on site and from pit dewatering. Process design will highlight water conservation. Tailings and waste will be stored on a clay base and carefully structured to facilitate closure and reclamation. A new power line will be constructed as part of the project from the existing substation at Concepcíon del Oro to supply electric power for the project. Concentrate from the plant is expected to be processed both locally and overseas.

5

For the purpose of this study it is has been assumed that the lead concentrate sales will be sent to the Torreon smelter some 200km west of Peñasquito. Zinc concentrate will most probably be split between Mexican and overseas markets in either Asia or Europe. Concentrate destined for overseas markets will be trucked to the railhead at Terminal and railed from there to the appropriate port; on the west coast for Asian sales and the east coast for European sales.

Over the 13.5 year mine life it is expected that approximately 1.44 million tonnes of zinc concentrate and 509 thousand tonnes of lead concentrate will be produced, containing a total of 103 million oz of silver, 626 thousand oz of gold, 287 thousand tonnes of lead and 835 thousand tonnes of zinc.

Total capital investment in the project is estimated to be $164.4 million over the life of the mine. The operating costs are estimated to average $5.63 per tonne of ore. After the deduction of a 2% NSR (3) royalty payable to Kennecott(4), the economic model for the project indicates an after-tax internal rate of return (IRR) of 15.3%, based on 100% equity, using metal prices of $5.50/oz silver, $350.00/oz gold, $0.30/lb lead and $0.45/lb zinc.

It is M3’s opinion that the development of the Chile Colorado deposit on its own, as envisaged in this report, offers significant economic potential. There are opportunities to improve the economic potential with, for example, used equipment if available, improved precious metals recovery and increased reserves. The presence of other mineralized zones in close proximity, which are being investigated at the moment, offers even further opportunities. To date, the oxide material has been treated as waste. This oxide material presents a strong opportunity to improve the economic viability of the project in the form of a heap leach operation as this material is known to be amenable to direct leaching.

The project should be carried forward to the full feasibility study stage to increase the level of confidence in the conclusions of this report. The feasibility should incorporate, to the maximum extent possible, the opportunities noted in the previous paragraph. The possibility of this being a flagship property exists. With the recent significant improvement in all metal prices this work should proceed as quickly as possible and the plan to implement the design and construction of the project should similarly proceed on a fast-track basis.”

| (2) | SAG or Semi-autogenous grinding is a method of grinding rock in which the grinding media consist of larger pieces of rock and steel balls. |

| (4) | Kennecott Canada Explorations Inc. |

| ** | The Company has received an independent resource estimate at Penasco which increases the resources at the Company’s wholly-owned Peñasquito property in central Mexico. This increased resource estimate was obtained subsequent to and is therefore not reflected in the reserve calculations in the M3 2004 Report. The increased resource estimate was calculated by Jim Marlow, P. Eng., Principal of Marlow Mining Engineering Services as the independent qualified person for the purposes of National Instrument 43-101. See the Material Change Report dated October 4, 2004 which is incorporated by reference in this AIF. |

6

RISK FACTORS

In addition to the other information presented in this AIF, the following risk factors should be considered carefully in evaluating the Company and its business.

1.The Company Has Incurred Losses. Since its merger with Thermal Exploration Company in 1995, the Company has incurred net losses and will continue to incur losses until it can derive sufficient revenues from its projects.

2.The Company Must Obtain Additional Financing to Conduct Exploration and Development on Its Properties. The Company does not have sufficient financial resources available to undertake extensive exploration or, if warranted, development programs. Further exploration or commercial development, if warranted, would require additional financing. There can be no assurance that needed future financing will be available in a timely or economically advantageous manner, or at all.

3.The Company Is In The Exploration Stage. The Company is in the exploration stage. None of the properties in which it has interests are in commercial production. In order to obtain more reliable information on which to base decisions about possible development of a property, it is necessary to expend significant time and money, and many such properties will turn out not to be worth further expense. The Company may thus expend significant amounts of financing and effort on any or all of its properties without reaching a stage of commercial production.

4.Mineral Exploration and Development Activities Inherently Risky.The business of mineral exploration and extraction involves a high degree of geological, technical and economic uncertainty because of the difficulty of locating a viable mineral deposit, the costs and other risks involved in bringing a deposit into production and the uncertainty of future mineral prices. Few properties that are explored are ultimately developed into production.

Although the Chile Colorado Zone of the Company’s Peñasquito Property has proven reserves as defined in Canadian securities laws, the commercial viability of developing the project will depend on the results of a full feasibility study which is not yet complete. The Peñasquito Property does not have proven reserves as defined in U.S. securities laws. At present, none of the Company’s other properties should be considered to have a known body of commercial ore as feasibility studies on the Company’s San Nicolas and Carmacks projects have not been updated for several years.

Unusual or unexpected formations, formation pressures, fires, power outages, labour disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in extraction operations and the conduct of exploration programs. Although the Company carries liability insurance with respect to its mineral exploration operations, the Company may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards against which it cannot insure or against which it may elect not to insure.

If the Company’s Peñasquito Property or its properties are found to have commercial quantities of ore, the Company would be subject to additional risks respecting any development and production activities. The Company does not presently own surface rights to the land required for any mining on the Peñasquito Property and has not yet entered into negotiations to obtain the land. There is no assurance that the Company will obtain adequate surface rights to the land.

5. Fluctuation of Mineral Prices.Factors beyond the control of the Company may affect the marketability of any ore or minerals discovered at and extracted from the Company’s properties. Resource prices have fluctuated widely, particularly in recent years, and are affected by numerous factors

7

beyond the Company’s control including international economic and political trends, inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and increased production due to new and improved extraction and production methods. The effect of these factors cannot accurately be predicted.

6. No Experience in Placing Properties Into Production.The Company has no experience in placing mineral deposit properties into production, and its ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that the Company will have available to it the necessary expertise when and if the Company places mineral deposit properties into production.

7. Title Risks.The acquisition of title to resource properties or interests therein is a very detailed and time-consuming process. Title to and the area of resource concessions may be disputed. The Company has conducted an internal investigation of title to its significant resource properties. Based on a review of records maintained by the relevant government agencies in Mexico, and, based upon legal opinions prepared for the Company in the case of the Peñasquito Property, its resource properties or interests therein are registered in the name of the Company or its appropriate joint venture partner. There is no guarantee of title to any of the Company’s properties. The properties may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. Title may be based upon interpretation of a country’s laws, which laws may be ambiguous, inconsistently applied and subject to reinterpretation or change. The Company has not surveyed the boundaries of any of its mineral properties and consequently the boundaries of the properties may be disputed.

8. The Company’s Interests in Its San Nicolas Joint Venture is Subject to Dilution and Other Risks. Under the terms of its joint venture agreements for the San Nicolas project, the Company may earn a specified percentage in a joint venture provided that the Company spends a required amount on project expenditures for the joint venture. In the event the Company ceases to make its project expenditures, its interest in the joint venture will be subject to dilution. In addition, the existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on the Company’s financial condition or the viability of its interests held through joint or cooperative ventures: (i) disagreements with joint or cooperative venture partners on how to conduct exploration; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; (iii) mismanagement of the operations by a joint venture partner; and (iv) disputes or litigation between joint venture partners regarding budgets, development activities, reporting requirements and other joint venture matters.

9.Risks Related to Doing Business in Mexico. Various matters, which are specific to doing business in Mexico, may create additional risks or increase the degree of such risks associated with the Company’s activities. These risks include the following:

a.The Company Must Seek Government Approval to Develop Mines. The establishment, operation and terms of the joint ventures through which any particular mineral property is to be explored or operated are all subject to obtaining Mexican government approvals at various levels and for particular matters, including mining rights, importation of equipment, hiring of labor, and environmental regulations. The Company currently, either on its own or though joint venture partners, has obtained licenses to conduct mineral exploration activities, but will be required to obtain a mining license to, if warranted, develop and conduct operations on any property. Depending on the scope of the operation, its location and the particular issues involved, the level of government from which approvals must be sought and the process involved may vary potentially restricting the Company’s operations. The process for obtaining these approvals can be costly and lengthy.

8

b.Environmental Regulations May Adversely Affect the Company’s Projects. The Company’s operations are subject to environmental regulations promulgated by various Mexican government agencies from time to time. Violation of existing or future Mexican environmental rules may result in various fines and penalties. As Mexico’s economy modernizes and expands, it is expected that regulations covering environmental protection and the reclamation and remediation of industrial sites would be strengthened which could increase the operating costs in Mexico.

It is industry practice for North American mining companies like Teck Cominco, the Company’s joint venture partner at its San Nicolas project, to apply the more stringent standards of their home countries to foreign operations regardless of local practices. Should Teck Cominco choose to initiate production of a property in joint venture with the Company, its operations would likely be carried out using North American environmental standards. It is common practice for the estimated costs of reclamation and remediation of mine sites to be included in the capital cost of a project. A project would have to be able to provide an adequate return on all capital, including estimated reclamation costs, to be considered viable.

c.Politics of Mexico May Adversely Affect the Company’s Investments. The Company’s investments may be adversely affected by political, economic and social uncertainties in Mexico. Changes in leadership, social or political disruption or unforeseen circumstances affecting Mexico’s political, economic and social structure could adversely affect the Company’s property interests or restrict its operations. The Company’s mining exploration and development activities may be affected by changes in government regulations relating to the mining industry and may include regulations on production, price controls, labour, export controls, income taxes, expropriation of property, environmental legislation and safety factors.

d.Economic Uncertainty May Adversely Affect the Company’s Investments. The Company’s operations in Mexico may be adversely affected by economic conditions in Mexico which could have a material adverse effect on the Company’s results of operations and financial condition.

10. Foreign Currency Fluctuation.The Company minimizes the risks associated with Mexican currency fluctuations by paying its expenses in Mexico in U.S. dollars. Since the Company’s financial results are reported in Canadian dollars and most of the Company’s financial assets are maintained in Canadian dollars, its financial position and results are impacted by exchange rate fluctuations between the Canadian and U.S. dollars and increases in the U.S. dollar relative to the Canadian dollar could have a negative impact on operations. The Company does not engage in foreign currency hedging transactions.

11.Western Silver is a Passive Foreign Investment Company for United State Federal Income Tax Purpose. Western Silver believes that it is a passive foreign investment company (“PFIC”) for United States Federal income tax purposes. As a result, a United States holder of Western Silver’s common shares could be subject to increased tax liability, possibly including an interest charge, upon the sale or other disposition of the United States holders’ common shares or upon receipt of “excess distributions,” unless such holder of common shares elect to be taxed currently on his or her pro rata portion of the Company’s income, whether or not the income was distributed in the form of dividends or otherwise. The election requires certain conditions be met such as filing on or before the due date, as extended, for filing the shareholder’s income tax return for the first taxable year to which the election will apply. Otherwise, the election may only partially apply. Further, the elections will increase the administrative and regulatory burden on Western Silver.

9

12. Risks Relating to Statutory and Regulatory Compliance.The current and future operations of the Company, from exploration through development activities and commercial production, if any, are and will be governed by laws and regulations governing mineral concession acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. The Company has received all necessary permits for the exploration work it is presently conducting, however such permits are, as a practical matter, subject to the discretion of government authorities and there can be no assurance that the Company will be successful in maintaining such permits. Further, there can be no assurance that all permits which the Company may require for future exploration, construction of mining facilities and conduct of mining operations, if any, will be obtainable on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any project which the Company may undertake.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. The Company is not currently covered by any form of environmental liability insurance. See “Insurance Risk”, below.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or require abandonment or delays in exploration.

13.Insurance Risk.No assurance can be given that insurance to cover the risks to which the Company’s activities are subject will be available at all or at commercially reasonable premiums. The Company currently maintains insurance within ranges of coverage which it believes to be consistent with industry practice for companies of a similar stage of development. The Company carries liability insurance with respect to its mineral exploration operations, but is not currently covered by any form of political risk insurance or any form of environmental liability insurance, since insurance against political risks and environmental risks (including liability for pollution) or other hazards resulting from exploration and development activities is prohibitively expensive. The payment of any such liabilities would reduce the funds available to the Company. If the Company is unable to fully fund the cost of remedying an environmental problem, it might be required to suspend operations or enter into costly interim compliance measures pending completion of a permanent remedy.

14.Competition.Significant and increasing competition exists for mineral deposits in each of the jurisdictions in which the Company conducts operations. As a result of this competition, much of which is with large established mining companies with substantially greater financial and technical resources than the Company, the Company may be unable to acquire additional attractive mining claims or financing on terms it considers acceptable. The Company also competes with other mining companies in the recruitment and retention of qualified employees.

15.Dependence on Key Management and Employees. The Company’s development depends on the efforts of key members of management and employees. Loss of any of these people could have a

10

material adverse effect on the Company. The Company does have consulting agreements with its key employees, which provide, among other things, that either party may terminate on 30 days notice. The Company does not have key person insurance with respect to any of its key employees.

16.Share Price Volatility.Securities markets have a high level of price and volume volatility, and the market price of securities of many companies, including the Company, have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. There can be no assurance that continual fluctuations in price will not occur.

SELECTED CONSOLIDATED FINANCIAL INFORMATION

Refer to Item 3 “Key Information” in the Form 20-F attached as Appendix A hereto.

MANAGEMENT DISCUSSION AND ANALYSIS

Refer to Item 5 “Operating and Financial Review and Prospects” in the Form 20-F attached as Appendix A hereto.

MARKET FOR SECURITIES

Refer to Item 9 “The Offering and Listing” in the Form 20-F attached as Appendix A hereto.

DIRECTORS AND OFFICERS

The following table sets forth all current directors and executive officers as of the date of this AIF, with each position and office held by them in the Company and the period of service as such. Each director’s term of office expires at the next annual general meeting of shareholders, expected to be held in March 2005.

| | | | | | |

Name, Position and Country of Residence(1)

| | Principal Occupation During the Past 5 Years(1)

| | Director, Officer or Shareholder Since

| | Number of Shares(1)

|

Dale Corman Director, Chairman of the Board and Chief Executive Officer USA. | | Chairman of the Board and Chief Executive Officer of the Company. | | October 31, 1995 | | 420,000 |

| | | |

Thomas C. Patton Director, President and Chief Operating Officer USA | | President and Chief Operating Officer of the Company. | | January 1, 1998 | | 317,000 |

| | | |

Lawrence Page, Q.C. Director and Secretary Canada | | Securities Lawyer. | | January 28, 1997 | | Nil |

| | | |

David Williams(2) Director Canada | | President, Roxborough Holdings Limited, a private investment company. | | August 10, 2003 | | 374,800 |

11

| | | | | | |

Name, Position and Country of Residence(1)

| | Principal Occupation During the Past 5 Years(1)

| | Director, Officer or Shareholder Since

| | Number of Shares(1)

|

Klaus Zeitler(2) Director Canada | | Senior Vice-president, Teck Cominco Limited from March, 1997 to October 2002. | | September 18, 2000 | | Nil |

| | | |

Robert Gayton(2) Director Canada | | Chartered Accountant; Vice-President Finance of the Company (1995 to Jan. 2004); financial consultant to the mineral exploration and technology industries since 1990. | | January 1, 1996 | | 14,200 |

| | | |

Lee Bilheimer Director Canada | | Engineering consultant since 1994; formerly Vice-President Construction, Teck Cominco Limited. | | July 25, 1997 | | Nil |

| | | |

Jonathan Clegg Project Manager Canada | | Mining Engineer. | | January 20, 2004 | | Nil |

| | | |

Gerald Prosalendis Vice-president, Corporate Development Canada | | Corporate development consultant. | | January 7, 2004 | | Nil |

| | | |

Joseph Litnosky Vice-president, Finance Canada | | Business, corporate development and financial consultant since 1990. | | January 20, 2004 | | Nil |

| | | |

Jeffrey Giesbrecht Vice-president, Legal Canada | | Securities and mining lawyer; General Counsel to Western Silver since 1998. | | July 13, 1998 | | 3,000 |

NOTES:

| (1) | The information as to country of residence, principal occupation, and shares beneficially owned or controlled, not being within the knowledge of the Company, has been furnished by the respective individuals. |

| (2) | Denotes member of Audit Committee. |

F. Dale Corman, B.Sc., P.Eng.

Chairman & Chief Executive Officer

Mr. Corman graduated with a Bachelor of Science degree in geology from Rensselaer Polytechnic Institute in Troy, New York in 1961 and obtained Professional Engineer status in Ontario in 1972. He has 30 years experience as a senior corporate officer of publicly listed companies and has extensive expertise in mineral and geothermal exploration and development, property evaluation and acquisition, project financing and corporate management.

Thomas C. Patton,B.Sc., M.Sc., Ph.D.

President & Chief Operating Officer

Dr. Patton graduated from the University of Washington in 1971 (Ph.D.) and has since worked with both junior and senior mining companies. His exploration efforts have concentrated on North America and

12

have resulted in several significant discoveries and reserve expansions of existing operations. Prior to joining Western Silver, Dr. Patton held senior positions with Rio Tinto PLC and Kennecott Canada Explorations Inc., where he served as Senior Vice President, Exploration and Business Development. Dr. Patton is a member of the Society of Economic Geologists and the American Institute of Mining & Metallurgical Engineers.

Lawrence Page, B.A., LL.B., Q.C.

Director & Secretary

Mr. Page obtained his law degree from the University of British Columbia in 1964 and was called to the Bar of British Columbia in 1965. Thereafter he studied labour law and industrial relations in Sydney, Australia as a Commonwealth Scholar, returning to active practice in Vancouver in 1967. In 1970, he was a founding partner of Worrall Scott and Page where he practiced until 1995. Mr. Page was counsel for and a Director of Corona Corporation (now Homestake) and Prime Resources Corporation which have brought into production and operate Canadian gold mines.

Robert J. Gayton,B.Comm., Ph.D., FCA

Director, Audit Committee Member

Dr. Gayton, F.C.A., graduated from the University of British Columbia in 1962 with a Bachelor of Commerce and in 1964 earned the chartered accountant (C.A.) designation while at Peat Marwick Mitchell. Dr. Gayton joined the Faculty of Business Administration at the University of British Columbia in 1965, beginning 10 years in the academic world, including time at the University of California, Berkeley, earning a Ph.D. in Business. Dr. Gayton rejoined Peat Marwick Mitchell in 1974 and became a partner in 1976 where he provided audit and consulting services to private and public company clients for 11 years. Dr. Gayton has directed the accounting and financial matters of public companies in the resource and non-resource fields since 1987. Dr. Gayton is a director of several public companies.

Klaus Zeitler,Ph. D.

Director, Audit Committee Member

Dr. Zeitler was Senior Vice President of Teck Cominco Limited from 1997 until 2002, and previously was on the Board of Directors of Teck Corp. from 1981 to 1997 and Cominco Limited from 1986 to 1996. Dr. Zeitler remains active in mineral exploration and development through a number of ventures in addition to Western Silver.

David Williams, MBA

Director, Audit Committee Member

Mr. Williams obtained a Master of Business Administration Degree from Queen’s University in 1964 and was a recipient of a Doctor of Civil Laws from Bishop’s University in 1966. Mr. Williams currently manages investments for a private family holding company and is involved in community affairs, including Bishop’s University where the Faculty of Business and Economics is named in his honour. He is a director of Bennett Environmental Inc., Metro One Telecommunications Inc. and ReFocus Group Inc. and is a past director of Drug Royalty Corporation Inc., Equisure Financial and Duff & Phelps.

Lee Bilheimer,B.Sc., P.Eng.

Mr. Billheimer has served as a director of Western Silver since its creation, and served as a consultant to the Company in the development of the Carmacks project. Mr. Billheimer was formerly Vice-president Construction for Teck Cominco Limited and Vice President, Project Development for Cominco Alaska Inc.

13

Jonathan Clegg,P.Eng.

Project Manager

Since receiving his degree in civil engineering from Cambridge University in 1974, Mr. Clegg has nearly 30 years of experience in the design, management and construction of mining related projects. This experience has encompassed all phases of project development from initial studies to project start-up. Mr. Clegg has also worked on infrastructure and petrochemical projects. From 1974 to 1979 Mr. Clegg worked in South Africa on a number of projects before joining Kilborn Engineering. In 1979 he moved to Canada with Kilborn and remained with the company until 2002. During the last ten years he held a number of positions of responsibility with Kilborn; from 1999 to 2002 he was Vice President and General Manager of Kilborn Engineering Pacific Ltd.

Joseph Litnosky, B. Comm, C.M.A.

Vice-president, Finance

Mr. Litnosky obtained his degree in Commerce from the University of British Columbia in 1986 and his Certified Management Accounting designation in 1990. He has more than seventeen years of experience in business, corporate finance, and financial management including four years as manager of Finance and Administration for Billiton Metals Canada Ltd. and the BHP Billiton Investment Group; six years as Chief Financial Officer for various junior mining companies; and, six years as Chief Financial Officer for Glacier National Life Assurance Company, a Canadian national insurance company.

Gerald Prosalendis

Vice-president, Corporate Development

Mr. Prosalendis was Vice President of Corporate Development of Dia Met Minerals Ltd. and was involved in developing the Ekati mine, Canada’s first diamond mine, and the sale of Dia Met to BHP Billiton for $687 million. Mr. Prosalendis has consulted to Anderson & Schwab Inc., a mineral and business consulting firm based in New York; is vice president of corporate development of Shear Minerals Ltd.; a former business editor ofThe Vancouver Sun; former senior counselor to James Hoggan and Associates, Western Canada’s leading communications firm.

Jeffrey Giesbrecht, B. Eng., Ll.B.

Vice-president, Legal

Mr. Giesbrecht completed his degree in engineering geophysics in 1989 and worked in mineral exploration throughout North America before receiving a law degree in 1994. During his legal career he has specialized in mining and securities law and has acted as Western Silver’s General Counsel since 1998.

Corporate Cease Trade Orders or Bankruptcies

No director, officer of the Company, or shareholder holding a sufficient number of securities of the Company to affect materially the control of the Company, is, or within the ten years prior to the date hereof has been, a director or officer of any other Company that, while that person was acting in that capacity was the subject of a cease trade order or similar order or an order that denied the other Company access to any exemptions under Canadian securities legislation for a period of more than thirty consecutive days, was became bankrupt or made a proposal under any legislation relating to bankruptcy

14

or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, save as described below:

Lawrence Page, Robert Gayton, Thomas Patton and Jeffrey Giesbrecht were directors or officers of Newcoast Silver Mines Ltd. at the date of a Cease Trade Order issued by the British Columbia Securities Commission on September 30, 2003 and by the Alberta Securities Commission on October 31, 2003 for failure to file financial statements. The orders were revoked on October 23, 2003 and March 25, 2004 respectively.

Lawrence Page is a director and the President of Saturna Beach Estates Ltd., a private company formed under the laws of British Columbia, Canada (“SBEL”). This company conducts the business of a vineyard and winery. On August 17, 2004 SBEL obtained an Order from the Supreme Court of British Columbia under the provisions of theCompanies’ Creditors Arrangement Act (Canada) that allows the Company to continue to run the daily business affairs of the Company without creditor action during financial reorganization.

ADDITIONAL INFORMATION

A. Additional Information Incorporated by Reference

The undernoted documents of Western Silver, filed with the securities commissions in British Columbia, Alberta and Ontario, are specifically incorporated by reference into, and form an integral part of, this AIF.

Material Change Reports:

| 1. | Material Change Report dated November 21, 2003, respecting execution of an underwriting agreement with Kingsdale Capital Markets Inc., Kingsdale Capital Partners Inc. and Orion Securities Inc. for private placement financing; |

| 2. | Material Change Report dated December 16, 2003, respecting the closing of the private placement financing for gross proceeds of $12,360,000; |

| 3. | Material Change Report dated April 13, 2004, respecting completion by M3 Engineering Technology Corporation of a pre-feasibility study on Chile Colorado zone at Peñasquito, Mexico; and |

| 4. | Material Change Report dated October 4, 2004, respecting a mineral resource estimate at Peñasco which increases the mineral resource at its wholly-owned Peñasquito property in Mexico. |

B. Additional Information

Technical Reports:

The Company has filed the following technical reports (collectively, the “Technical Reports”) on SEDAR respecting its Peñasquito property in Mexico, which is the Company’s material property for the purpose of National Instrument 43-101:

| 1. | “Minera Peñasquito, S.A. de C.V. Peñasquito Project, Mineral Resource Estimate for Chile Colorado Zone” dated March 2003 (excluding Appendices), prepared by SNC Lavalin Engineers and Constructors as amended (in the Notice to Reader) and re-filed on SEDAR on November 15, 2004; and |

15

| 2. | Executive Summary from the “Peñasquito Pre-Feasibility Study” dated March 2004, prepared by M3 Engineering Technology Corporation, as amended (to reflect changes in section “1.2 Introduction & Terms of Reference”)and re-filed on SEDAR on November 15, 2004. |

C. Access to Additional Information

Additional information, including directors’ and officers’ remuneration and indebtedness, principal holders of the Company’s securities and securities authorized for issuance under equity compensation plans, is contained in the Company’s information circular for the Annual Meeting of Shareholders held on March 4, 2004.

The Company, upon request being made to the Company’s Vice-president, Legal, Jeffrey Giesbrecht at 1550 – 1185 West Georgia Street, Vancouver, British Columbia, V6E 4E6, fax (604) 688-4670, will provide to any person or company:

| (a) | when the securities of the Company are in the course of a distribution under a preliminary short form prospectus or a short form prospectus, |

| | (i) | one copy of this AIF together with one copy of each document, or the pertinent pages of any document, incorporated by reference into this AIF; |

| | (ii) | one copy of the comparative financial statements for its most recently completed financial year for which financial statements have been filed and one copy of the most recent interim financial statements of the Company that have been filed, if any, for any period after the end of its most recently completed financial year; |

| | (iii) | one copy of the information circular for its annual general meeting held March 4, 2004; and |

| | (iv) | one copy of any other documents that are incorporated by reference into the preliminary short form prospectus or the short form prospectus and are not required to be provided under clauses (i), (ii) or (iii); or |

| (b) | at any other time, one copy of any documents referred to in clauses (a)(i), (ii) and (iii), provided that the Company may require payment of a reasonable charge if the request is made by a person or company who is not a security holder of the Company. |

Additional financial information is provided in the Company’s financial statements and MD&A for its most recently completed financial year.

Additional information relating to the Company may be found on SEDAR at www.sedar.com.

16

APPENDIX A

U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2003.

| ¨ | TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSACTION PERIOD FROM TO

Commission File Number 0-13933

Western Silver Corporation

(Exact name of Registrant as specified in its charter)

A Corporation Formed Under The Laws Of British Columbia

(Jurisdiction of Incorporation or Organization)

Suite 1550, 1185 West Georgia Street

Vancouver, British Columbia, Canada V6E 4E6

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act

| | |

| Common Shares | | American Stock Exchange |

| Title of each class | | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (as of September 30, 2003) - 35,184,081

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 x Item 18 ¨

APPENDIX A

TABLE OF CONTENTS

- 2 -

Introduction And Use of Certain Terms

Western Silver Corporation is a corporation incorporated under the laws of the province of British Columbia, Canada. As used herein, except as the context otherwise requires, the term “Western”, “Western Silver” or the “Company” refers to Western Silver Corporation and its consolidated subsidiaries. The Company’s consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles and are presented in Canadian dollars. Unless otherwise indicated, reference to dollar amounts in this Annual Report shall refer to Canadian dollars.

Western Silver files reports and other information electronically with the Securities and Exchange Commission (the “SEC”) located at Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549. You may obtain copies of Western Silver’s filings on EDGAR with the SEC by accessing their website located atwww.sec.gov. You may access Western Silver’s reports filed with Canadian securities administrators via SEDAR by accessing their website at www.sedar.com.

The Company’s head office and principal place of business are located at Suite 1550, 1185 West Georgia Street, Vancouver, British Columbia, V6E 4E6. The registered and records offices of the Company are also located at the same address.

Forward-Looking Statements

The following information and discussion in the Annual Report contains forward-looking statements regarding events and financial trends which may affect the Company’s future operating results and financial position. Such statements are subject to risks and uncertainties that could cause the Company’s actual results and financial position to differ materially from those anticipated in forward looking statements. These factors include, but are not limited to, the fact that the Company is in the exploration stage, will need additional financing to develop its properties and will be subject to certain risks since its prospects are principally in Mexico, all of which factors are set forth in more detail in the section entitled “Risk Factors” in Item 3.D.

Glossary of Mining Terms

| | |

| Alteration | | changes in the chemical or mineralogical composition of a rock, generally produced by weathering or hydro-thermal solutions. |

| |

| Anomalous | | inconsistent with or deviating from what is usual, normal or expected. |

| |

| Anomaly | | the geographical area corresponding to anomalous geochemical or geophysical values. |

| |

| Assay | | a chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained. |

| |

| Carried interest | | an interest which does not require funding. |

| |

| Felsic | | light-colored igneous rock poor in iron and magnesium content, abundant in feldspars and quartz. |

| |

| Geology | | a science that deals with the history of the earth as recorded in rocks. |

- 3 -

| | |

| Geophysical survey | | an exploration method that measures magnetic, electrical or other physical characteristics of the earth, the results of which can be interpreted and used to predict the possibility of economic mineral concentrations beneath the surface of the earth. |

| |

| Grade | | the concentration of an ore metal in a rock sample, given either as weight percent for base metals or in grams per tonne (g/t) or ounces per short ton (oz/t) for precious metals. The grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from throughout the deposit. |

| |

| Intrusive/intrusion | | an igneous rock that was once molten and has “intruded” into pre-existing rocks in that state, after which it cools. |

| |

| Mineralization | | minerals of value occurring in rocks. |

| |

| Ore | | a naturally occurring material from which one or more minerals may be mined and sold at a profit, or from which some part may be profitably separated. |

| |

| Sulphide | | a compound containing sulphur and some other metal. |

| |

| Teck or Teck Cominco | | Teck Cominco Limited, a mining company with its head office in Vancouver, Canada. Teck Cominco is a joint venture partner of Western Silver. |

| |

| VMS | | Volcanogenic Massive Sulphide – a deposit of massive sulfide mineralization of volcanic origin commonly containing pyrite and variable amounts of gold, silver, copper, lead and zinc mineraliztion. |

- 4 -

Part I

Item 1. Identity of Directors, Senior Management and Advisers

The following table sets forth as of January 31, 2004, the names, business addresses and functions of Western’s directors and senior management.

| | | | |

Name

| | Business Address

| | Position

|

Dale Corman, P.Eng. | | Suite 1550 – 1185 W. Georgia Street, Vancouver, British Columbia, Canada V6E 4E6 | | Chairman of the Board and Chief Executive Officer of the Company |

| | |

Thomas C. Patton, Ph.D. | | Suite 1550 – 1185 W. Georgia Street, Vancouver, British Columbia, Canada V6E 4E6 | | President and Chief Operating Officer of the Company |

| | |

Lawrence Page, Q.C. | | Suite 1550 – 1185 W. Georgia Street, Vancouver, British Columbia, Canada V6E 4E6 | | Director & Secretary |

| | |

David Williams, MBA | | 42 St. Clair Avenue West Suite 1202 Toronto, Ontario, Canada M4V 1K9 | | Director& Member of Audit Committee |

| | |

Robert Gayton, Ph.D., FCA | | 5145 Ashfeild Road West Vancouver, British Columbia, Canada V7W 2X4 | | Director & Member of Audit Committee |

| | |

Klaus Zeitler, Ph. D. | | Suite 2684 Four Bentall Centre, 1055 Dunsmuir Street, Vancouver, British Columbia, Canada V7X 1L3 | | Director & Member of Audit Committee |

| | |

Lee Bilheimer, P. Eng. | | 5270 Meadfeild Road, West Vancouver, British Columbia, Canada V6E 4E6 | | Director |

| | |

Michael Halvorson(1) | | 7928 Rowland Road Edmonton, Alberta, Canada T6A 3W1 | | Director |

| | |

R. Joseph Litnosky | | Suite 1550 – 1185 W. Georgia Street, Vancouver, British Columbia, Canada V6E 4E6 | | Vice-president, Finance and Chief Financial Officer |

| | |

Gerald Proselandis | | Suite 1550 – 1185 W. Georgia Street, Vancouver, British Columbia, Canada V6E 4E6 | | Vice-president, Corporate Development |

- 5 -

| | | | |

Name

| | Business Address

| | Position

|

Jeffrey Giesbrecht | | Suite 1550 – 1185 W. Georgia Street, Vancouver, British Columbia, Canada V6E 4E6 | | Vice-president, Legal, and General Counsel |

| | |

Jonathan Clegg | | Suite 1550 – 1185 W. Georgia Street, Vancouver, British Columbia, Canada V6E 4E6 | | Project Manager |

| (1) | Mr. Halvorson has declined to stand for re-election at the Company’s annual general meeting to be held March 4, 2004. |

Western’s auditors are PricewaterhouseCoopers LLP, Chartered Accountants. Their address is 250 Howe Street, Vancouver, British Columbia, Canada V6C 3S7. PricewaterhouseCoopers has been Western’s auditors since 1995.

Western’s transfer agent and registrar for the common shares is the Computershare Trust Company of Canada in Vancouver, British Columbia, Canada, and Computershare Investor Services of Denver, Colorado, U.S.A.

Item 2. Offer Statistics and Expected Timetable

Not Applicable

Item 3. Key Information

A. Selected Financial Data

The following selected financial information for the fiscal years ended September 30, 2003, 2002, 2001, 2000 and 1999 is derived from the financial statements of Western Silver and is reported in Canadian dollars. Western Silver’s financial statements are prepared in accordance with Canadian Generally Accepted Accounting Principles (“GAAP”). There are significant differences between Canadian GAAP and U.S. GAAP including the recording of exploration costs, stock-based compensation and available-for-sale securities. See notes to Western Silver’s financial statements.

The following tables summarize financial data for the Company for the last five recent financial years ended September 30th:

| | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2002

| | | 2001

| | 2000

| | 1999

| |

Operations under Canadian GAAP | | | | | | | | | | | | | | | | | | |

Exploration expenses | | $ | 20,005 | | | $ | 10,749 | | | $ | 83,773 | | $ | 118,643 | | $ | 28,742 | |

(Recovery) Write-off of mineral properties | | $ | 329,503 | | | $ | (258,577 | ) | | $ | 8,075,116 | | $ | 44,234 | | $ | 661,011 | |

Administration expenses | | $ | 1,572,571 | | | $ | 784,811 | | | $ | 725,854 | | $ | 791,345 | | $ | 806,389 | |

Other (income) expenses | | $ | (82,098 | ) | | $ | (26,623 | ) | | $ | 16,603 | | $ | 208,717 | | $ | (2,186 | ) |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Loss for the year | | $ | 1,839,981 | | | $ | 510,360 | | | $ | 8,901,346 | | $ | 1,162,939 | | $ | 1,493,956 | |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Loss per common share | | $ | 0.06 | | | $ | 0.02 | | | $ | 0.39 | | $ | 0.07 | | $ | 0.10 | |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Weighted average number of common shares outstanding | | $ | 33,087,922 | | | $ | 27,086,487 | | | $ | 23,066,194 | | $ | 17,825,284 | | $ | 15,324,989 | |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

- 6 -

| | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

Operations under U.S. GAAP | | | | | | | | | | | | | | | | | | | | |

Loss under Canadian GAAP | | $ | 1,839,981 | | | $ | 510,360 | | | $ | 8,901,346 | | | $ | 1,162,939 | | | $ | 1,493,956 | |

Adjustments from Canadian GAAP to US GAAP: | | | | | | | | | | | | | | | | | | | | |

Exploration expenditures for the year | | $ | 4,549,783 | | | $ | 2,993,378 | | | $ | 2,894,079 | | | $ | 1,625,473 | | | $ | 3,607,262 | |

Exploration costs written-off during the year that would have been expensed in the year incurred | | $ | (329,503 | ) | | $ | (448,000 | ) | | $ | (172,560 | ) | | $ | (44,234 | ) | | $ | (949,903 | ) |

Accretion of convertible loan | | | — | | | | — | | | | — | | | $ | 474,287 | | | $ | 200,512 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Loss for the year – under US GAAP | | $ | 6,060,261 | | | $ | 3,055,738 | | | $ | 11,622,865 | | | $ | 3,218,465 | | | $ | 4,351,827 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Loss per common share – under US GAAP | | $ | 0.18 | | | $ | 0.11 | | | $ | 0.50 | | | $ | 0.18 | | | $ | 0.28 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

| | | | | |

Consolidated balance sheet under Canadian GAAP | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Assets | | $ | 42,654,402 | | | $ | 38,774,466 | | | $ | 30,349,230 | | | $ | 35,503,873 | | | $ | 36,054,096 | |

Mineral Properties | | $ | 39,447,235 | | | $ | 33,985,709 | | | $ | 30,012,071 | | | $ | 35,166,440 | | | $ | 33,584,245 | |

Shareholders’ Equity | | $ | 41,782,835 | | | $ | 35,750,121 | | | $ | 27,918,663 | | | $ | 34,879,053 | | | $ | 34,268,673 | |

| | | | | |

Consolidated balance sheet under U.S. GAAP | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Mineral properties – under Canadian GAAP | | $ | 39,447,235 | | | $ | 33,985,709 | | | $ | 30,012,071 | | | $ | 35,166,440 | | | $ | 33,584,245 | |

Cumulative exploration expenditures written off under U.S. GAAP | | $ | (32,777,729 | ) | | $ | (28,557,449 | ) | | $ | (26,012,071 | ) | | $ | (23,290,552 | ) | | $ | (21,709,313 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Mineral properties – under U.S. GAAP | | $ | 6,669,506 | | | $ | 5,428,260 | | | $ | 4,000,000 | | | $ | 11,875,888 | | | $ | 11,874,932 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

The following table sets forth information as to the period ended, the average, the high and the low exchange rate (on a monthly basis) of Canadian Dollars for one U.S. Dollar for the periods indicated based on the noon buying rate from Bank of New York for cable transfers in Canadian Dollars as certified for customs purposes by the Federal Reserve Bank of New York.

| | | | | | | | |

Year Ended: September 30

| | Average

| | Period End

| | High

| | Low

|

1999 | | 1.4768 | | 1.4768 | | 1.4798 | | 1.4735 |

2000 | | 1.4862 | | 1.4852 | | 1.4882 | | 1.4824 |

2001 | | 1.5677 | | 1.5675 | | 1.5703 | | 1.5632 |

2002 | | 1.5734 | | 1.5863 | | 1.5997 | | 1.5318 |

2003 | | 1.4642 | | 1.3504 | | 1.5942 | | 1.3342 |

The following table sets forth the average exchange rate for the past six months.

| | |

Month

| | Average

|

January 2004 | | 1.2960 |

December 2003 | | 1.3129 |

November 2003 | | 1.3126 |

October 2003 | | 1.3218 |

September 2003 | | 1.3632 |

August 2003 | | 1.3956 |

- 7 -

B. Capitalization and indebtedness.

The Company’s capitalization for the five years ended September 30, 2003 is as follows:

| | | | | | | | | | | | | | | |

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

| | | $ | | | $ | | | $ | | | $ | | | $ | |

Capitalization | | | | | | | | | | | | | | | |

| | | | | |

Shareholders’ equity – under Canadian GAAP | | 41,782,835 | | | 35,750,121 | | | 27,918,663 | | | 34,879,053 | | | 34,268,673 | |

Measurement differences: | | | | | | | | | | | | | | | |

Deficit – under Canadian GAAP | | 17,550,437 | | | 15,710,456 | | | 15,200,096 | | | 6,298,750 | | | 4,661,524 | |

Deficit – under U.S. GAAP | | (50,243,120 | ) | | (44,445,089 | ) | | (41,195,352 | ) | | (29,656,097 | ) | | (26,370,837 | ) |

Convertible loan shown as equity under Canadian GAAP | | — | | | — | | | — | | | — | | | (4,895,927 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Shareholders’ equity – under U.S. GAAP | | 9,090,152 | | | 7,015,488 | | | 1,923,407 | | | 11,521,706 | | | 7,663,433 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Indebtedness | | | | | | | | | | | | | | | |

Convertible loan shown as debt under U.S. GAAP | | — | | | — | | | — | | | — | | | 4,895,927 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

C. Reasons for the offer and use of proceeds.

Not Applicable.

D. Risk Factors

In addition to the other information presented in this Annual Report, the following should be considered carefully in evaluating the Company and its business. This Annual Report contains forward-looking statements that involve risks and uncertainties. The Company’s actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed below and elsewhere in this Annual Report.

1.The Company Has Incurred Losses. Since its merger with Thermal Exploration Company in 1995, the Company has incurred net losses and will continue to incur losses until it can derive sufficient revenues from its projects.

2.The Company Is In The Exploration Stage And Has No Proven Reserves as defined under United States Securities Exchange Commission regulations. The Company is in the exploration stage. None of the properties in which it has interests are in commercial production. In order to obtain more reliable information on which to base decisions about possible development of a property, it is necessary to expend significant time and money, and many such properties will turn out not to be worth further expense. The Company may thus expend significant amounts of financing and effort on any or all of its properties without reaching a stage of commercial production.

3.The Company Must Obtain Additional Financing to Conduct Exploration on Its Properties. Because the Company is in the exploration stage, it does not have sufficient financial resources available to undertake extensive exploration or, if warranted, development programs. Further exploration or commercial development, if warranted, would require additional financing. There can be no assurance that needed future financing will be available in a timely or economically advantageous manner, or at all.

- 8 -

4.The Company’s Interests in Its Joint Ventures May Be Subject to Dilution. Under the terms of their joint venture agreements, the Company may earn a specified percentage in a joint venture provided that the Company spends a required amount on project expenditures for the joint venture. In the event the Company ceases to make its project expenditures, its interest in the joint venture will be subject to dilution.

5.The Mining Industry Is Highly Speculative. The Company is engaged in the exploration for minerals which involves a high degree of geological, technical and economic uncertainty because of the inability to predict future mineral prices, as well as the difficulty of determining the extent of a mineral deposit and the feasibility of extracting it without the expenditure of considerable money. There is a high level of risk involved.

6.It May Be Difficult to Enforce Civil Liabilities Against the Company. Because all of the assets of the Company and its subsidiaries, as well as the Company’s jurisdiction of incorporation and the residences of many of its officers and directors, are located outside of the United States, it may be difficult or impossible to enforce judgments granted by a court in the United States against the assets of the Company and its subsidiaries or the directors and officers of the Company who reside outside the United States.

7.Western Silver is a Passive Foreign Investment Company for United State Federal Income Tax Purpose. Western Silver believes that it is a passive foreign investment company (“PFIC”) for United States Federal income tax purposes because it earns 75% or more of its gross income from passive sources. As a result, a United States holder of Western Silver’s common shares could be subject to increased tax liability, possibly including an interest charge, upon the sale or other disposition of the United States holders’ common shares or upon receipt of “excess distributions,” unless such holder of common shares elect to be taxed currently on his or her pro rata portion of the Company’s income, whether or not the income was distributed in the form of dividends or otherwise. The election requires certain conditions be met such as filing on or before the due date, as extended, for filing the shareholder’s income tax return for the first taxable year to which the election will apply. Otherwise, the election may only partially apply. Further, the elections will increase the administrative and regulatory burden on Western Silver. See Item 10.E. “Taxation - United States Tax Consequences - Passive Foreign Investment Companies.”

8.Risks Related to Doing Business in Mexico. Various matters, which are specific to doing business in Mexico, may create additional risks or increase the degree of such risks associated with the Company’s activities. These risks include the following:

a.The Company Must Seek Government Approval to Develop Mines. The establishment, operation and terms of the joint ventures through which any particular mineral property is to be explored or operated are all subject to obtaining Mexican government approvals at various levels and for particular matters, including mining rights, importation of equipment, hiring of labor, and environmental regulations. The Company currently, either on its own or though joint venture partners, has obtained licenses to conduct mineral exploration activities, but will be required to obtain a mining license to, if warranted, develop and conduct operations on any property. Depending on the scope of the operation, its location and the particular issues involved, the level of government from which approvals must be sought and the process involved may vary potentially restricting the Company’s operations.

- 9 -

b.Environmental Regulations May Adversely Affect the Company’s Projects. The Company’s operations are subject to environmental regulations promulgated by various Mexican government agencies from time to time. Violation of existing or future Mexican environmental rules may result in various fines and penalties. As Mexico’s economy modernizes and expands, it is expected that regulations covering environmental protection and the reclamation and remediation of industrial sites would be strengthened which could increase the operating costs in Mexico

It is industry practice for North American mining companies like Teck, the Company’s joint venture partner, to apply the more stringent standards of their home countries to foreign operations regardless of local practices. Should Teck choose to initiate production of a property in joint venture with the Company, its operations would be carried out using North American environmental standards. It is common practice for the estimated costs of reclamation and remediation of mine sites to be included in the capital cost of a project. A project would have to be able to provide an adequate return on all capital, including estimated reclamation costs, to be considered viable. See the “Environmental Considerations” section under the individual property description in Item 4.D. for more details.

c.Politics of Mexico May Adversely Affect the Company’s Investments. The Company’s investments may be adversely affected by political, economic and social uncertainties in Mexico. Changes in leadership, social or political disruption or unforeseen circumstances affecting Mexico’s political, economic and social structure could adversely affect the Company’s property interests or restrict its operations.

Item 4. Information on the Company

Introduction

Western Silver Corporation (“Western Silver” or the “Company”) was incorporated as Western Copper Holdings Limited under the laws of the Province of British Columbia on July 11, 1984 by registration of its memorandum and articles pursuant to theCompany Act (British Columbia). Western Silver changed its name to its current name by registration of an amendment to its Memorandum on March 20, 2003.

The registered and records offices of the Company are located at Suite 1550, 1185 West Georgia Street, Vancouver, British Columbia, V6E 4E6, and its head office and principal place of business is located at Suite 1550, 1185 West Georgia Street, Vancouver, British Columbia, V6E 4E6. Its telephone number is (604) 684-9497.

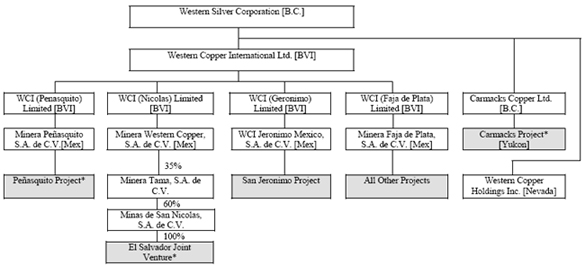

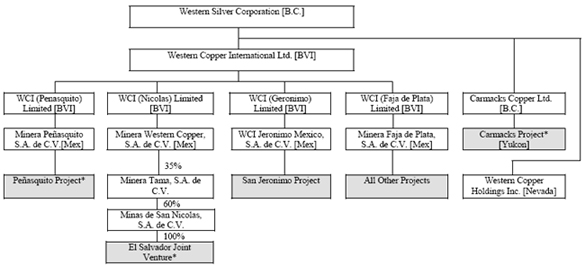

Western Silver has nine subsidiaries that are organized as set out below. Each of the subsidiaries incorporated in Mexico are held as to 99.99% by the entity indicated below and 0.01% by a Mexican individual in accordance with Mexican corporate law. Minera Western Copper, S.A. de C.V. is a corporation formed under the laws of Mexico on December 4, 1995. Minera Penasquito S.A. de C.V., Minera Faja de Plata, S.A. de C.V. and WCI Jeronimo Mexico, S.A. de C.V. are corporations formed under the laws of Mexico on February 21, 1999. Western Copper Holdings Inc. is a corporation formed under the laws of the State of Nevada, United States of America, on May 7, 1996, and which is wholly owned by Western Silver. Carmacks Copper is a corporation formed under the laws of British Columbia on September 19, 1996, by registration of a memorandum and articles, and which is wholly-owned by Western Silver. Western Copper International Ltd., WCI (Penasquito) Limited, WCI (Nicolas) Limited and WCI (Geronimo) Limited were incorporated under the laws of the British Virgin Islands on April 18, 1998.

- 10 -

| * | Denotes the Company’s primary projects. |

Business and Properties of the Company - Overview

Western Silver is a natural resource company actively engaged in the acquisition, and exploration of mineral resource properties. The following is a discussion of the Company’s primary projects:

Carmacks

The Company acquired the rights to the Carmacks Property in August, 1989 and was active in exploration and development of the Carmacks Property from that time until 1998 when copper prices made further development uneconomic. Since that time, the project has essentially been operated on a “care and maintenance” basis. A commercial ore body has been identified on the Carmacks Property, and the Company has continued to work with the environmental authorities to obtain the required development permits. Basic engineering for the Carmacks Property is complete. For further information see “Material Properties - The Carmacks Property, Yukon Territory” herein.

Up until September 30, 1996, Western Silver owned 50% of the Carmacks Property, and Thermal Exploration Company (“Thermal”) owned the remaining 50%. In 1996, Western Silver and Thermal merged, with Western Silver as the survivor, and thereby placing the Carmacks Property under control of Western Silver.

El Salvador Project

Western Silver signed a letter of intent with Minera Dolores Angustias Y Anexas, S.A. de C.V. (“Minera Dolores”) on November 4, 1994, whereby the Company was granted an option to acquire the El Salvador Property in the State of Zacatecas, Mexico over a four year period. The option was granted in return for the Company making a US$250,000 loan to Minera Dolores. The El Salvador Property was acquired in August, 1996, and a joint venture formed with Teck Cominco (then Teck Corp.) wherein Western Silver contributed the El Salvador Property to the joint venture, and Teck Cominco contributed all ground held by Teck Cominco to complete a 15 km by 15 km block, all of which was placed into the joint venture. See “Material Properties - The El Salvador Project and San Nicolas Deposit” herein.

- 11 -