Filing under Rule 425 under the U.S. Securities Act of 1933

Filing by: JFE Holdings, Inc.

Subject Company: JFE Shoji Holdings, Inc.

Commission File Number: 132-

Dated October 26, 2011

October 26, 2011

JFE Holdings, Inc.

JFE Shoji Holdings, Inc

JFE Shoji Trade to Become Wholly Owned Subsidiary of JFE Holdings

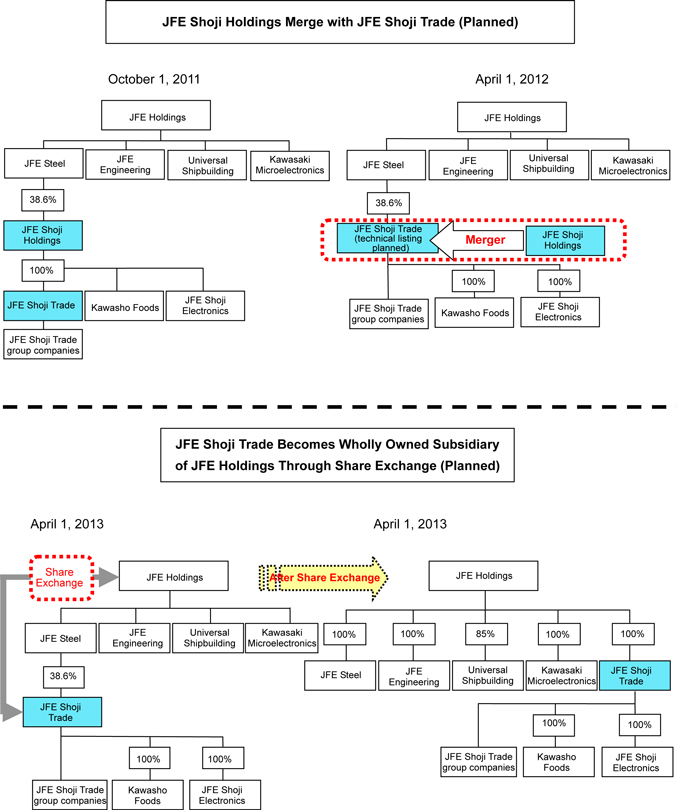

Tokyo – JFE Holdings, Inc., JFE Steel Corporation, JFE Shoji Holdings, Inc. and JFE Shoji Trade Corporation announced today their agreement on the basic details of a plan to turn JFE Shoji Trade into JFE Holdings wholly owned subsidiary, the new JFE Shoji Trade, through a share exchange using treasury shares of JFE Holdings on April 1, 2013. The four companies, following approval of the plan by their respective boards of directors, signed a memorandum of understanding on the agreement today and will now consider additional details going forward.

With the environment surrounding the group becoming increasingly severe due to weak and shrinking domestic demand, the yen’s sharp appreciation and soaring prices of raw materials, JFE Holdings, JFE Steel (JFE Holdings operating subsidiary), JFE Shoji Holdings (JFE Steel equity-method affiliate) and JFE Shoji Trade (JFE Shoji Holdings operating subsidiary) agreed to revise the capital structure of the new JFE Shoji Trade to leverage its trading functions throughout the group. JFE Shoji Trade will be turned into a wholly owned subsidiary of JFE Holdings through the share exchange on April 1, 2013, following its technical delisting from the Tokyo Stock Exchange on March 27, 2013.

By turning the new JFE Shoji Trade into a direct subsidiary of JFE Holdings, JFE Steel, JFE Engineering Corporation, Universal Shipbuilding Corporation and Kawasaki Microelectronics, Inc. expect to leverage the company’s special capabilities in areas such as market research, marketing and project management for activities including project facilitation, new customer development, procurements and others worldwide. The arrangement is expected to enable the group to make faster decisions and leverage its full strength through closer consultation and broader cooperation between operating companies and the new JFE Shoji Trade.

The JFE Group is looking to improve its competitiveness both in the Japanese and international steel business by restructuring and streamlining its overall supply chain for steel production and sales, from raw materials procurement, production and processing to distribution and global expansion. As a result, the JFE Group expects to enhance both its presence in the global market and its corporate value.

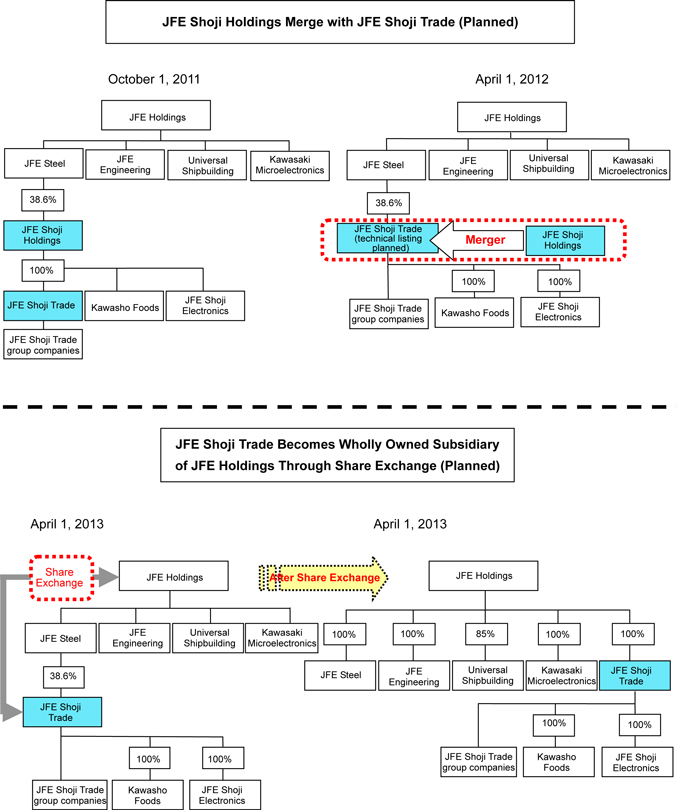

JFE Shoji Holdings has been preparing for its merger with JFE Shoji Trade and the subsequent technical listing of JFE Shoji Trade since the merger was announced last April. The new JFE Shoji Trade is scheduled to be technically listed on April 1, 2012, prior to be turned into a wholly owned subsidiary of JFE Holdings approximately one year later.

| | |

| Future schedule |

|

| (1) Technical listing of JFE Shoji Trade |

| |

| March 28, 2012 | | Delisting of JFE Shoji Holdings |

| |

| April 1, 2012 | | Merger between JFE Shoji Holdings (extinct company) and JFE Shoji Trade (surviving company) and technically listing of JFE Shoji Trade |

|

| (2) Conversion of JFE Shoji Trade into wholly owned subsidiary |

| |

| August 2012 | | Settlement of share exchange ratio |

| |

| December 2012 | | JFE Shoji Trade’s extraordinary meeting of shareholders (approval of share exchange by extraordinary resolution) |

| |

| March 27, 2013 | | Delisting of JFE Shoji Trade |

| |

| April 1, 2013 | | Share exchange (allotment of JFE Holdings shares to JFE Shoji Trade shareholders based on exchange conditions resolved at JFE Shoji Trade’s extraordinary meeting of shareholders) |

If the final confirmation of the shareholder list of JFE Shoji Holdings reveals that the ratio of U.S. shareholders falls below the standard ratio specified in U.S. securities regulations, thereby negating the need to make certain filings with the U.S. Securities and Exchange Commission, the above schedule may be moved forward. Details will be announced as they are clarified.

(3) Ratio of Allotment in Connection with Share Exchange

The ratio of allotment in connection with the share exchange will be determined upon consultation among the relevant parties, with consideration for the analysis, advice, etc. of financial advisors and other external experts.

Future Prospects

The agreement will not impact JFE Holdings’ earnings for the current fiscal year.

# # #

For further information, please contact:

Public Relations Sec., General Administration Dept.

JFE Holdings, Inc.

Tel: +81-3-3597-3842

Public Relations Sec., General Affairs Dept.

JFE Shoji Holdings, Inc.

Tel: +81-3-5203-5055

(Attachment) Outlines of the Share Exchange Companies

| | | | |

| | | Sole parent company As of March 31, 2011 | | Wholly owned subsidiary As of April 1, 2012 (planned or prospective if not otherwise specified) |

| (1) Name | | JFE Holdings Inc. | | JFE Shoji Trade Corporation |

| | |

| (2) Location | | 2-2-3 Uchisaiwaicho, Chiyoda-ku, Tokyo, Japan | | 1-6-20 Dojima, Kita-ku, Osaka, Japan |

| | |

| (3) Name and title of representative | | Hajime Bada, President and CEO | | Mikio Fukushima, President |

| | |

| (4) Business | | Governance and management of steel, engineering, shipbuilding, etc. operating companies by holding the shares of these companies | | Primarily domestic trading and import/export of steel products, steelmaking materials, nonferrous metals, chemical products, machinery and marine vessels |

| | |

| (5) Capital | | JPY 147,143 million | | JPY 14,539 million |

| | |

| (6) Founded | | September 27, 2002 | | January 5, 1954 |

| | |

| (7) Issued Shares | | 614,438,399 | | 236,777,704 |

| | |

| (8) Fiscal Year End | | March 31 | | March 31 |

| | |

| (9) Employees | | 54,962 (consolidated) (as of September 30, 2011) | | 6,104 (consolidated) (as of September 30, 2011) |

| | |

| (10) Major business relationships | | Not applicable to pure holding company | | Suppliers: JFE Steel Corporation, JFE Bars & Shapes Corporation, Kawasaki Heavy Industries, Ltd. Customers: JFE Steel Corporation, Hyundai Group, Kawasaki Kisen Kaisha, Ltd. |

| | |

| (11) Major banking relationships | | Mizuho Corporate Bank, Ltd., Sumitomo Mitsui Banking Corporation, Bank of Tokyo-Mitsubishi UFJ, Ltd. | | Mizuho Corporate Bank, Ltd., Sumitomo Mitsui Banking Corporation, Bank of Tokyo-Mitsubishi UFJ, Ltd. |

| | |

| (12) Major shareholders and ratio of shareholding | | The Master Trust Bank of Japan, Ltd. (trust account) 5.76%, Japan Trustee Services Bank, Ltd. (trust account) 4.22%, Nippon Life Insurance Company 3.68%, Mizuho Corporate Bank, Ltd. 2.47%, The Dai-ichi Llife Insurance Company, Limited. 2.08% (as of September 30, 2011) | | JFE Steel Corporation 38.56%, Kawasaki Heavy Industries, Ltd. 2.72%, Mizuho Trust & Custody Bank, Ltd. As a trustee for Mizuho Trust retirement Benefits Trust Account for Kawasaki Heavy Industries 2.32%, Japan Trustee Services Bank, Ltd. (trust account) 2.28% (as of September 30, 2011, JFE Shoji Holdings) |

| | |

| (13) Relationship between relevant companies | | Capital relationship (as of September 30, 2011) | | JFE Steel, 100% owned subsidiary of JFE Holdings, holds 38.56% share of JFE Shoji Holdings, the sole parent of JFE Shoji Trade. JFE Shoji Trade holds 0.12% of JFE Holdings’ shares. |

| | Personnel relationship (as of March 31, 2011) | | None |

| | Business relationship (as of March 31, 2011) | | None |

| | Status of related parties (as of March 31, 2011) | | JFE Shoji Trade is a related party because it is a wholly owned subsidiary of JFE Shoji Holdings, an equity-method affiliate of JFE Steel, which is a wholly owned subsidiary of JFE Holdings. |

| | | | | | | | | | | | | | | | | | | | | | | | |

(14) Business performance and financial position in most recent three-year period | |

| | |

| | | JFE Holdings (consolidated) | | | JFE Shoji Holdings (consolidated) | |

Accounting period | | Mar. 2009 | | | Mar. 2010 | | | Mar. 2011 | | | Mar. 2009 | | | Mar. 2010 | | | Mar. 2011 | |

Net assets | | | 1,378,041 | | | | 1,465,898 | | | | 1,478,310 | | | | 114,684 | | | | 107,060 | | | | 117,426 | |

Total assets | | | 4,328,901 | | | | 3,918,317 | | | | 3,976,644 | | | | 635,481 | | | | 526,788 | | | | 571,364 | |

Net assets per share (yen) | | | 2,526.26 | | | | 2,689.88 | | | | 2,708.51 | | | | 381.02 | | | | 432.64 | | | | 457.57 | |

Net sales | | | 3,908,282 | | | | 2,844,356 | | | | 3,195,560 | | | | 2,706,576 | | | | 1,811,887 | | | | 2,011,526 | |

Operating income | | | 407,806 | | | | 88,775 | | | | 182,810 | | | | 40,238 | | | | 15,140 | | | | 23,363 | |

Ordinary income | | | 400,562 | | | | 69,289 | | | | 165,805 | | | | 39,009 | | | | 14,491 | | | | 23,783 | |

Net income | | | 194,229 | | | | 45,659 | | | | 58,608 | | | | 19,848 | | | | 7,506 | | | | 13,645 | |

Net income per share (yen) | | | 355.64 | | | | 86.35 | | | | 110.73 | | | | 82.54 | | | | 31.78 | | | | 57.79 | |

Dividend per share (yen) | | | 90.00 | | | | 20.00 | | | | 35.00 | | | | 10.00 | | | | 5.00 | | | | 10.00 | |

(million yen, if not otherwise specified)

Reference

Reorganization Scheme

Cautionary Statement Regarding Forward-Looking Statements

This announcement contains certain forward-looking statements that reflect the plans and expectations of JFE Holdings, Inc., JFE Shoji Holdings, Inc. and JFE Shoji Trade Corporation in relation to, and the benefits resulting from, a proposed share exchange between JFE Holdings, Inc. and “New JFE Shoji Trade”, the company that will result from the planned merger of JFE Shoji Holdings, Inc. and JFE Shoji Trade Corporation, whereby New JFE Shoji Trade will become a wholly owned subsidiary of JFE Holdings, Inc. These forward-looking statements may be identified by words such as ‘believes’, ‘expects’, ‘anticipates’, ‘projects’, ‘intends’, ‘should’, ‘seeks’, ‘estimates’, ‘future’ or similar expressions or by discussion of, among other things, strategy, goals, plans or intentions. Actual results may differ materially in the future from those reflected in forward-looking statements contained in this document, due to various factors including but not limited to: (1) macroeconomic and general industry conditions such as the competitive environment for companies in the steel and iron industries; (2) changes in supply and demand conditions and prices for raw materials used in the manufacture of steel; (3) regulatory and litigation matters and risks; (4) legislative developments; (5) changes in tax and other laws and the effect of changes in general economic conditions; (6) the risk that a condition or regulatory approval that may be required for the share exchange is not obtained or is obtained subject to conditions that are not anticipated; and (7) other risks to consummation of the share exchange.

Additional Information and Where to Find It

JFE Holdings, Inc. may file a registration statement on Form F-4 with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its proposed share exchange with New JFE Shoji Trade. The Form F-4, if filed, will contain a prospectus and other documents. If the Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 is expected to be mailed to U.S. shareholders of New JFE Shoji Trade prior to the shareholders’ meeting at which the proposed share exchange will be voted upon. The Form F-4, if filed, and prospectus, as they may be amended from time to time, will contain important information about JFE Holdings, Inc. and New JFE Shoji Trade, the share exchange and related matters including the terms and conditions of the transaction. U.S. shareholders of JFE Shoji Holdings, Inc. (or of New JFE Shoji Trade after the planned merger of JFE Shoji Holdings, Inc. and JFE Shoji Trade Corporation) are urged to read carefully the Form F-4, the prospectus and the other documents, as they may be amended from time to time, that have been or may be filed with the SEC in connection with the transaction before they make any decision at the shareholders meeting with respect to the share exchange. The Form F-4, if filed, the prospectus and all other documents filed with the SEC in connection with the share exchange will be available when filed, free of charge, on the SEC’s web site atwww.sec.gov. In addition, the prospectus and all other documents filed with the SEC in connection with the share exchange will be made available to U.S. shareholders of JFE Shoji Holdings, Inc. (or of New JFE Shoji Trade after the planned merger of JFE Shoji Holdings, Inc. and JFE Shoji Trade Corporation), free of charge, by faxing a request to JFE Holdings, Inc. at +81-3-3597-4397 or to JFE Shoji Holdings, Inc. at +81-3-5203-5289.