Chubb Limited (CB) FWPFree writing prospectus

Filed: 25 Mar 16, 12:00am

Filed Pursuant to Rule 433

Registration Statement No. 333-207570

Your Accumulation Chubb Capital Plan (CCAP) Balance Decision Guide

make What you your need CCAP to distribution know and do election to

WHAT YOU NEED TO DO:

• |

| Review your payment options and key considerations. |

• |

| Log on to the Chubb Transition Website at www.netbenefits.com/chubb and click on the orange button |

• |

| Make your CCAP balance election by March 2, 2016 |

• |

| The Issuer has Filed a registration statement (including a prospectus) with the SEC for the offerings to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on SEC Web site at www.sec.gov@gov. Alternatively, the issuer will arrange to send you the prospectus if you request it by calling the issuer’s investor relations department at +1 (441)299-9283 or e-mailing at invetorrelations@chubb.com. |

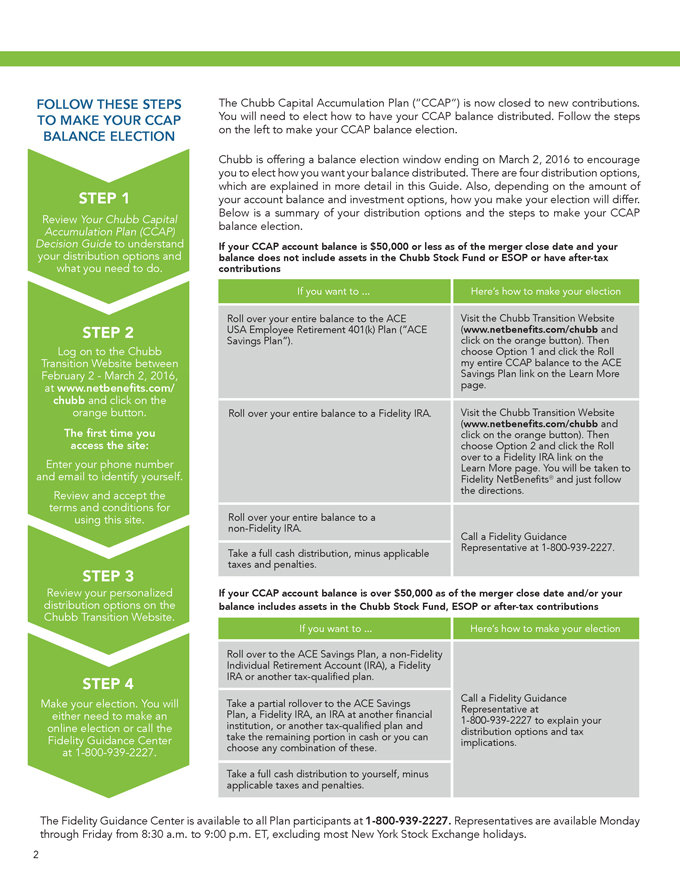

FOLLOW THESE STEPS TO MAKE YOUR CCAP BALANCE ELECTION

STEP 1

Review Your Chubb Capital Accumulation Plan (CCAP) Decision Guide to understand your distribution options and what you need to do.

STEP 2

Log on to the Chubb Transition Website between February 2—March 2, 2016, at www.netbenefits.com/ chubb and click on the orange button.

The access first the time site: you

Enter your phone number and email to identify yourself.

Review and accept the terms and conditions for using this site.

STEP 3

Review your personalized distribution options on the Chubb Transition Website.

STEP 4

Make your election. You will either need to make an online election or call the Fidelity Guidance Center at 1-800-939-2227.

The Chubb Capital Accumulation Plan (“CCAP”) is now closed to new contributions. You will need to elect how to have your CCAP balance distributed. Follow the steps on the left to make your CCAP balance election.

Chubb is offering a balance election window ending on March 2, 2016 to encourage you to elect how you want your balance distributed. There are four distribution options, which are explained in more detail in this Guide. Also, depending on the amount of your account balance and investment options, how you make your election will differ. Below is a summary of your distribution options and the steps to make your CCAP balance election.

If balance your CCAP does account not include balance assets is in $50,000 the Chubb or less Stock as of Fund the merger or ESOP close or have date after-tax and your contributions

If you want to . Here’s how to make your election

Roll over your entire balance to the ACE Visit the Chubb Transition Website USA Employee Retirement 401(k) Plan (“ACE (www.netbenefits.com/chubb and Savings Plan”). click on the orange button). Then choose Option 1 and click the Roll my entire CCAP balance to the ACE

Savings Plan link on the Learn More page.

Roll over your entire balance to a Fidelity IRA. Visit the netbenefits. Chubb Transition com/chubb Website (www. and click on the orange button). Then choose Option 2 and click the Roll over to a Fidelity IRA link on the Learn More page. You will be taken to

Fidelity NetBenefits® and just follow the directions.

Roll over your entire balance to a non-Fidelity IRA.

Call a Fidelity Guidance

Representative at 1-800-939-2227. Take a full cash distribution, minus applicable taxes and penalties.

If your CCAP account balance is over $50,000 as of the merger close date and/or your balance includes assets in the Chubb Stock Fund, ESOP or after-tax contributions

If you want to . Here’s how to make your election

Roll over to the ACE Savings Plan, a non-Fidelity Individual Retirement Account (IRA), a Fidelity

IRA or another tax-qualified plan.

Call a Fidelity Guidance Take a partial rollover to the ACE Savings Representative at

Plan, a Fidelity IRA, an IRA at another financial

1-800-939-2227 to explain your institution, or another tax-qualified plan and distribution options and tax take the remaining portion in cash or you can implications. choose any combination of these.

Take a full cash distribution to yourself, minus applicable taxes and penalties.

The Fidelity Guidance Center is available to all Plan participants at 1-800-939-2227. Representatives are available Monday through Friday from 8:30 a.m. to 9:00 p.m. ET, excluding most New York Stock Exchange holidays.

2 |

|

IMPORTANT!

If you elect a rollover to the ACE Savings Plan, you will be able to change that election up until the close of the election window at 11:59 p.m. ET on March 2, 2016. All other distribution elections will be processed immediately, and you will not be able to change your election.

IF YOU DON’T MAKE AN ELECTION

If you don’t make an election by 11:59 p.m. ET on March 2, 2016:

• |

| Your CCAP account balance will remain in CCAP and continue to be invested in your current CCAP investment options (excluding the Chubb Stock Fund and ESOP). You may continue making exchanges between the funds in the CCAP until CCAP closes (or is “terminated,” by IRS requirements, approximately 12-18 months from the merger date with ACE). During this time, you may elect to roll over your CCAP balance to the ACE Savings Plan, an IRA, or another tax-qualified plan at any time by calling Fidelity at 1-800-939-2227 (representatives are available Monday through Friday from 8:30 a.m. to 9:00 p.m. ET, excluding most New York Stock Exchange holidays). |

• |

| Once the CCAP Plan termination has been approved by the IRS, anyone who has not made an active election will have their balance rolled over to the ACE Savings Plan. |

IF YOU HAVE AN OUTSTANDING LOAN FROM CCAP

If you have a loan from CCAP, you should have made an election on the Chubb Transition Website between January 5-20, 2016.

If you elected to roll over your loan(s) to the ACE Savings Plan, you do not need to make an election during the balance election window. Your CCAP account balance, as well as your outstanding loan balance, will be rolled over to the ACE Savings Plan to maintain ongoing payroll-deducted loan repayments.

If you chose not to roll over your CCAP loan balance to the ACE Savings Plan, you will need to make an election by March 2, 2016, indicating whether you are:

• |

| Rolling your balance over to an IRA (to Fidelity or another financial institution) or another tax-qualified plan. |

• |

| Taking a partial rollover to an IRA or another tax-qualified plan and have the remaining portion paid to you as a cash distribution. |

• |

| Taking your CCAP balance and have it paid to you as a cash distribution, minus taxes and penalties. |

• |

| Keeping your balance in CCAP up until the Plan terminates (approximately 12–18 months from the merger close date with ACE). |

You can continue making monthly loan payments directly to Fidelity until your balance is rolled over or distributed. To set up recurring payments from your bank account, contact Fidelity at 1-800-929-2227. If you take no action or take a distribution of your account before your loan is paid off in full, the loan will be defaulted and you will incur tax consequences and possible penalties.

3 |

|

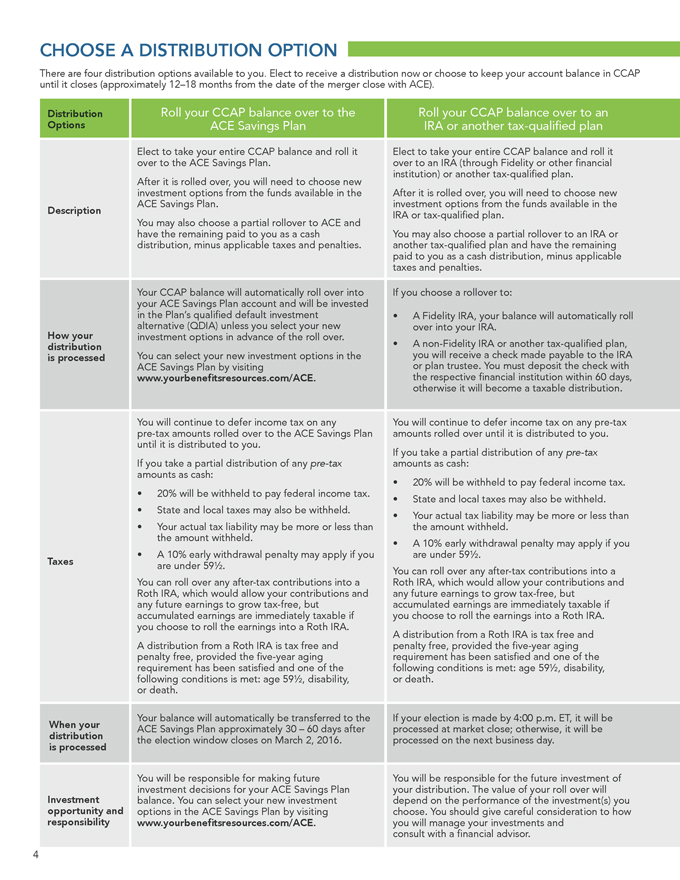

CHOOSE A DISTRIBUTION OPTION

There are four distribution options available to you. Elect to receive a distribution now or choose to keep your account balance in CCAP until it closes (approximately 12–18 months from the date of the merger close with ACE).

Distribution Options Roll your CCAP balance over to the Roll your CCAP balance over to an

ACE Savings Plan IRA or another tax-qualified plan

over Elect to to the take ACE your Savings entire CCAP Plan. balance and roll it Elect over to to an take IRA your (through entire Fidelity CCAP balance or other and financial roll it institution) or another tax-qualified plan.

After investment it is rolled options over, from you the will funds need available to choose in new the After it is rolled over, you will need to choose new ACE Savings Plan. investment options from the funds available in the

Description IRA or tax-qualified plan. have You may the also remaining choose paid a partial to you rollover as a cash to ACE and You may also choose a partial rollover to an IRA or distribution, minus applicable taxes and penalties. paid another to you tax -as qualified a cash plan distribution, and have minus the remaining applicable taxes and penalties.

Your your ACE CCAP Savings balance Plan will account automatically and will roll be over invested into If you choose a rollover to: in alternative the Plan’s (QDIA) qualified unless default you investment select your new • A Fidelity IRA, your balance will automatically roll over into your IRA.

How your investment options in advance of the roll over. distribution • you A non will -Fidelity receive IRA a check or another made tax payable -qualified to the plan, IRA is processed You can select your new investment options in the ACE Savings Plan by visiting or the plan respective trustee .financial You must institution deposit the within check 60 days, with www.yourbenefitsresources.com/ACE. otherwise it will become a taxable distribution.

You pre- tax will amounts continue rolled to defer over income to the tax ACE on Savings any Plan You amounts will continue rolled over to defer until it income is distributed tax on any to you pre . -tax until it is distributed to you.

If you take a partial distribution any If you take acash: partial distribution of any pre-tax amounts as cash: of pre-tax amounts as

• |

| 20% will be withheld to pay federal income tax. 20% will be withheld to pay federal income tax. |

• |

| State and local taxes may also be withheld. State and local taxes may also be withheld. |

• |

| Your actual tax liability may be more or less than the Your amount actual tax withheld liability . may be more or less than the amount withheld. A 10% early withdrawal penalty may apply if you |

• |

| A 10% early withdrawal penalty may apply if you are under 59 1/2. |

Taxes are under 59 1/2.

You can roll over any after-tax contributions into a You Roth can IRA, roll which over would any after allow -tax your contributions contributions into and a any Roth future IRA, which earnings would to grow allow tax your -free, contributions but and any accumulated future earnings earnings to are grow immediately tax-free, but taxable if accumulated you choose to earnings roll the earnings are immediately into a Roth taxable IRA .if you choose to roll the earnings into a Roth IRA. A distribution from a Roth IRA is tax free and A penalty distribution free, provided from a Roth the IRA five -is year tax aging free and penalty requirement free, has provided been satisfied the five- year and one aging of the following requirement conditions has been is satisfied met: age and 59 1/2, one disability, of the following or death. conditions is met: age 59 1/2, disability, or death.

Your balance will automatically be transferred to the If your election is made by 4:00 p.m. ET, it will be When distribution your ACE Savings Plan approximately 30 – 60 days after processed at market close; otherwise, it will be the election window closes on March 2, 2016. processed on the next business day. is processed

You investment will be responsible decisions for for your making ACE future Savings Plan your You will distribution be responsible . The value for the of your future roll investment over will of opportunity Investment and options balance .in You the can ACE select Savings your Plan new by investment visiting depend choose. You on the should performance give careful of the consideration investment(s) to how you responsibility www.yourbenefitsresources.com/ACE. you consult will with manage a financial your investments advisor. and

4 |

|

Take your CCAP balance as a Take no action lump sum cash distribution

Receive sum cash your payment entire paid distribution directly as to a you, one-time minus lump Elect to do nothing at this time. applicable taxes and penalties. Your is terminated CCAP account (approximately balance will 12–18 remain months in the from Plan the until merger CCAP date) an IRA or or until another you elect tax-qualified to roll it plan. over to the ACE Savings Plan,

You directly may into have a bank your lump account sum or payment mailed to either you. deposited the Once merger CCAP date is terminated with ACE), (approximately you will need to 12–18 roll over months your from tax-qualified balance to the plan ACE or Savings have it paid Plan, to an you IRA in or cash, another less applicable taxes and penalties.

wages Payment for of 2016. any pre-tax amounts will be included in your remains You will continue in CCAP until to defer it is income distributed tax while to you. your balance

• |

| 20% will be withheld to pay federal income tax. |

• |

| State and local taxes may also be withheld. |

• |

| Your amount actual withheld. tax liability may be more or less than the |

• |

| A under 10% 59?. early withdrawal penalty may apply if you are After-tax but any earnings contributions on those distributed contributions to you are will fully not taxable be taxable, as follows: income 20% of your tax. earnings will be withheld to pay federal |

• |

| State and local taxes may also be withheld. |

• |

| Your amount actual withheld. tax liability may be more or less than the |

• |

| A under 10% 59 1/2. early withdrawal penalty may apply if you are |

If at your market election close; is otherwise, made by 4:00 it will p. be m. processed ET, it will be on processed the next terminated, Your balance which will have will be to be approximately distributed when 12-18 CCAP months is after the business day. during merger this date timeframe. with ACE. You can take a distribution at any time your You should cash distribution give careful and consideration consult with to a how financial you advisor. will manage your You will CCAP be responsible balance. for making investment decisions for

5 |

|

CHUBB STOCK FUND AND/OR ESOP

The closing of CCAP to new contributions may create a taxable event if you are invested in the Chubb Stock Fund and/or ESOP. Participants who meet the eligibility criteria can minimize the taxes due on their investment gains by preserving the cost basis (the price you initially paid for the Chubb Stock Fund and/or ESOP investments).

Understanding Net Unrealized Appreciation (NUA) You are eligible for NUA preservation

NUA is the difference between the price you paid for Chubb Stock in the provided you are:

Chubb Stock Fund and/or ESOP (your cost basis) and what the stock is • age 59 1/2 or older as of the worth today. Because Chubb is merging with ACE and becoming a new distribution date entity, the Chubb Stock Fund and ESOP will no longer exist. Any shares you currently hold will automatically convert to approximately 50% • you have separated service from in the “New Chubb” Stock Fund and/or ESOP and 50% to a money Chubb or ACE prior to CCAP market fund (the Money Market Portfolio—Chubb Stock—Government terminating (approximately 12-18 and/or the Money Market Portfolio—ESOP Stock—Government) as of months after the merger close date). the merger close date.

How to Retain Your Cost Basis for the Balance in the “New Chubb” Stock Fund and/or ESOP

To preserve your cost basis, you must withdraw the “New Chubb” stock from CCAP and move it to a non-retirement brokerage account. You must also take a full distribution of your remaining account balance by electing to roll it over to the

ACE Savings Plan, an IRA or other tax-qualified plan, or by taking a cash distribution.

How to Retain Your Cost Basis for the Balance in the Money Market Portfolio

If you currently have a balance in the Chubb Stock Fund and/or ESOP, you will have 90 days from the date the converted Chubb Stock Fund or ESOP shares are invested in the Money Market Portfolio—Chubb Stock—Government and/or the Money Market Portfolio—ESOP Stock—Government to purchase stock units in the “New Chubb” Stock Fund or ESOP to preserve your maximum NUA, if you are eligible to do so (see the Transition Guide for eligibility requirements). You can make this exchange on Fidelity NetBenefits®. If you leave your balance in the money market fund beyond 90 days or exchange it into other investment options, you will not retain the cost basis associated with the money market fund and will lose your NUA for those shares.

Due to certain SEC regulatory filings that still need to be completed, participants who have separated service from Chubb prior to the merger date with ACE will not be able to exchange cash proceeds that have been invested in the new money market funds into the “New Chubb” Stock fund and/or ESOP fund until a later date. Information will be available on the

Chubb Transition Website, please check the site for updates. You should discuss your options with your tax and/or financial advisor before you take any action.

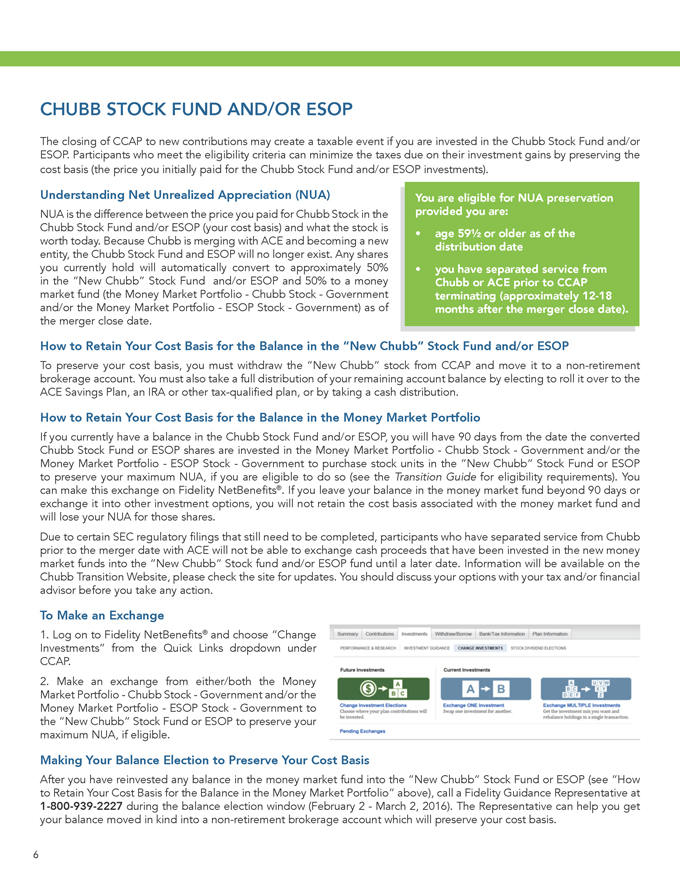

To Make an Exchange

1. Log on to Fidelity NetBenefits® and choose “Change Investments” from the Quick Links dropdown under CCAP.

2. Make an exchange from either/both the Money Market Portfolio—Chubb Stock—Government and/or the Money Market Portfolio—ESOP Stock—Government to the “New Chubb” Stock Fund or ESOP to preserve your maximum NUA, if eligible.

Making Your Balance Election to Preserve Your Cost Basis

After you have reinvested any balance in the money market fund into the “New Chubb” Stock Fund or ESOP (see “How to Retain Your Cost Basis for the Balance in the Money Market Portfolio” above), call a Fidelity Guidance Representative at 1-800-939-2227 during the balance election window (February 2—March 2, 2016). The Representative can help you get your balance moved in kind into a non-retirement brokerage account which will preserve your cost basis.

6 |

|

WHAT TO CONSIDER WHEN MAKING YOUR DECISION

Before you choose your distribution option, you will want to think about your financial/retirement goals and how the different distribution options can help you reach those goals. Consider the following:

• |

| Your age, remaining working years and expected retirement date. |

• |

| Other sources of retirement income, such as Social Security, other accrued pension benefits, savings plan balances and personal savings. |

• |

| Your comfort level with making ongoing investment decisions. |

• |

| If you have a balance in the Chubb Stock Fund and/or ESOP and want to preserve the cost basis of the original stock price (if you are eligible). |

• |

| Your immediate financial needs. |

• |

| The tax consequences of taking a lump sum cash payment today versus the opportunity to defer taxes if you roll over your distribution into the ACE Savings Plan, an IRA, or another tax-qualified plan. |

• |

| If you have a loan, decide if you would like to continue making payments directly to Fidelity (if you keep your balance in CCAP), or pay it off in full. |

You should also discuss your options with your tax and/or financial advisor before you take any action.

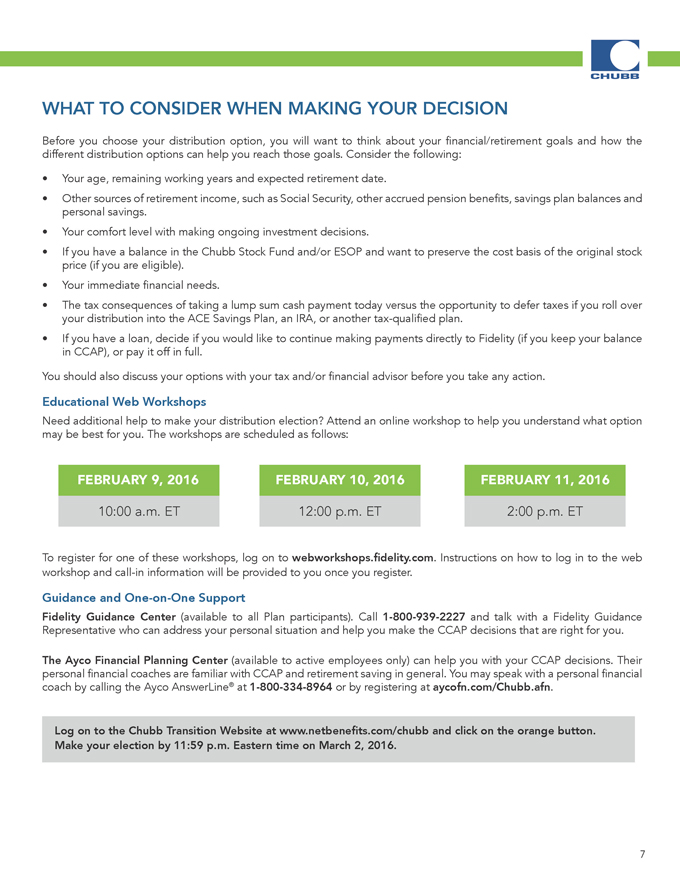

Educational Web Workshops

Need additional help to make your distribution election? Attend an online workshop to help you understand what option may be best for you. The workshops are scheduled as follows:

FEBRUARY 9, 2016 FEBRUARY 10, 2016 FEBRUARY 11, 2016

10:00 a.m. ET 12:00 p.m. ET 2:00 p.m. ET

To register for one of these workshops, log on to webworkshops.fidelity.com. Instructions on how to log in to the web workshop and call-in information will be provided to you once you register.

Guidance and One-on-One Support

Fidelity Guidance Center (available to all Plan participants). Call 1-800-939-2227 and talk with a Fidelity Guidance Representative who can address your personal situation and help you make the CCAP decisions that are right for you.

The Ayco Financial Planning Center (available to active employees only) can help you with your CCAP decisions. Their personal financial coaches are familiar with CCAP and retirement saving in general. You may speak with a personal financial coach by calling the Ayco AnswerLine® at 1-800-334-8964 or by registering at aycofn.com/Chubb.afn.

Log on to the Chubb Transition Website at www.netbenefits.com/chubb and click on the orange button. Make your election by 11:59 p.m. Eastern time on March 2, 2016.

7 |

|

Questions?

For CCAP: Call the Fidelity Guidance Center (available to all Plan participants) at 1-800-939-2227 (representatives are available Monday through Friday from 8:30 a.m. to 9:00 p.m. ET, excluding most New York Stock Exchange holidays).

For the ACE Savings Plan: Call the ACE Benefits Center at 1-855-668-5042 (representatives are available Monday through Friday from 8:00 a.m. to 8:00 p.m. ET).

This Your Capital Accumulation Plan (CCAP) Balance Decision Guide summarizes certain provisions of the Chubb Capital Accumulation Plan (CCAP). It does not, however, attempt to explain all the details, provisions, limitations, restrictions, and exclusions of the Plan. In the event that there is any discrepancy between the Plan documents and this Guide, the Plan documents will prevail. Chubb reserves the right to change or terminate the Plan or specific provisions of the Plan at any time. it AYCO provides. is not Fidelity affiliated disclaims with Fidelity any liability Brokerage arising Services, from your member use of NYSE, this information. SIPC or its affiliates. AYCO is solely responsible for the information and services

Ayco AnswerLine® is a trademark of The Ayco Company, L.P., a Goldman Sachs Company. This service is provided exclusively by The Ayco Company, L.P.

Used full-service with permission. investment The banking, Ayco broker-dealer Company, L.P. and is a asset subsidiary management of The Goldman organization. Sachs Group, Inc. and an affiliate of Goldman, Sachs & Co., a worldwide, Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem St., Smithfield, RI 02917

© 2016 FMR Corp. All rights reserved.

747475.1.0