Chubb Limited (CB) FWPFree writing prospectus

Filed: 25 Mar 16, 12:00am

Understanding net unrealized appreciation.

If you hold company stock in your retirement savings plan, eventually, you’ll need to move these shares out of your plan, into either a tax-deferred or taxable account. Which move may make sense for you? The answer may surprise you.

What is net unrealized appreciation?

Why does it matter? ACTION PLAN

Learn the importance of net Net unrealized appreciation (or NUA) is nothing more than the difference between the price you paid for the unrealized appreciation

Find out which distribution method may make company stock in your retirement savings plan account sense for you (your cost basis) and its current market price. As long as you keep your shares within your retirement savings Determine what’s right for you and your company stock plan, you’ll continue to defer paying income taxes on any appreciation of your company shares. But when it’s time to move your account balance out of your plan, there are your employer stock in kind* to an IRA, you’re generally tax consequences. This liability can vary, depending on not taxed at that time. However, the special NUA tax where your company stock ends up. advantages for company stock are lost because all Moving your company stock: possible tax scenarios distributions from IRAs are taxed at ordinary income rates (currently as high as 39.6%). This option may still make sense

Option 1: Transfer your company stock to a rollover IRA if the NUA is a small percentage of the stock’s market When you leave your employer, you have the option of value, or if your investment time horizon is sufficiently moving your company stock from your retirement savings long, since tax-deferred growth may be achieved for many plan account directly to an IRA. When you roll over years in an IRA.

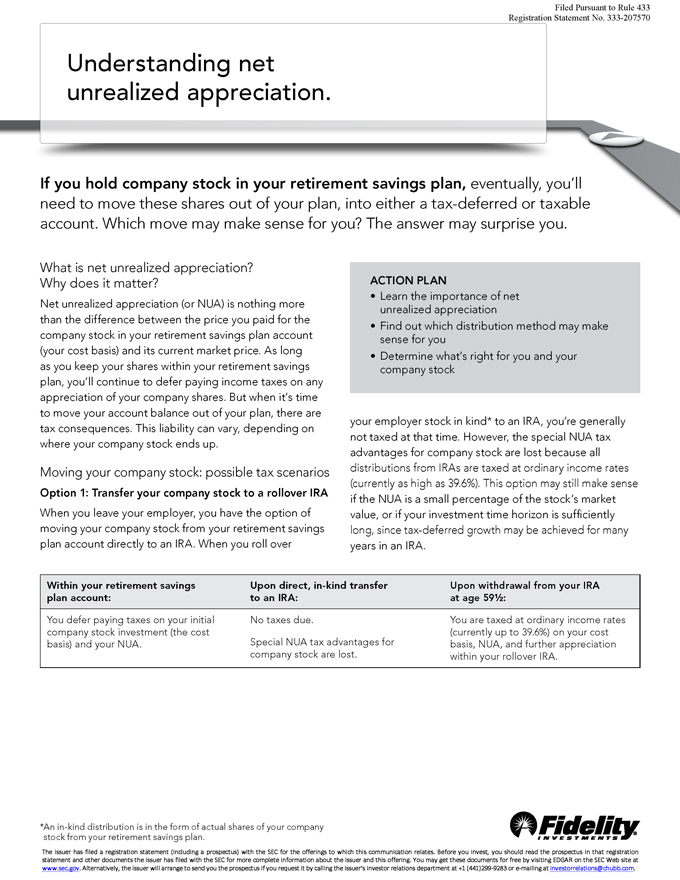

Within your retirement savings Upon direct, in-kind transfer Upon withdrawal from your IRA plan account: to an IRA: at age 59 1/2:

You defer paying taxes on your initial No taxes due. You are taxed at ordinary income rates company stock investment (the cost (currently up to 39.6%) on your cost basis) and your NUA. Special NUA tax advantages for basis, NUA, and further appreciation company stock are lost. within your rollover IRA.

Filed Pursuant to Rule 433

Registration Statement No. 333-207570

The Issuer has Filed a registration statement (including a prospectus) with the SEC for the offerings to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on SEC Web site at www.sec.gov@gov. Alternatively, the issuer will arrange to send you the prospectus if you request it by calling the issuer’s investor relations department at +1 (441)299-9283 or e-mailing at invetorrelations@chubb.com.

*An in-kind distribution is in the form of actual shares of your company stock from your retirement savings plan.

Option 2: Put your company stock in a taxable, depending on your tax bracket) on the net unrealized nonretirement brokerage account appreciation. Any additional appreciation should be taxable When you leave your employer, you may also have the option as short-term or long-term capital gains, depending on how of taking your company shares directly and depositing them long you held the stock after it was distributed in-kind from in kind in a taxable, nonretirement brokerage account. The the plan.‡ basis of the stock is taxed at ordinary income rates in the While this brochure discusses two scenarios for NUA, you year the stock is distributed from the plan.† When you ?nally may have other options available to you as well. Please sell your shares of company stock, you are subject to long- contact your plan’s toll-free number for more information. term capital gains tax (currently 0%, 15%, or 20% for 2014,

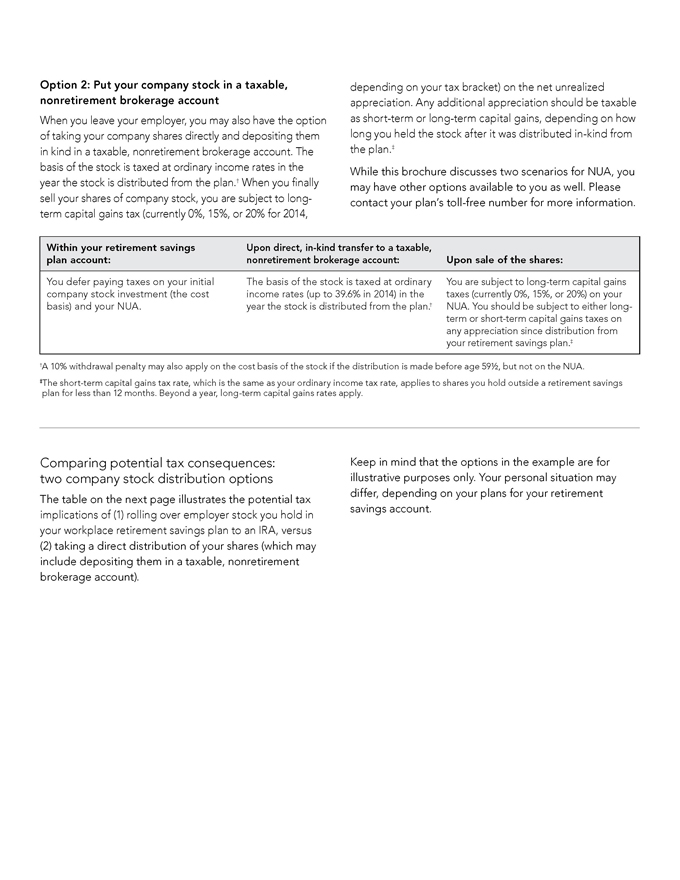

Within your retirement savings Upon direct, in-kind transfer to a taxable, plan account: nonretirement brokerage account: Upon sale of the shares:

You defer paying taxes on your initial The basis of the stock is taxed at ordinary You are subject to long-term capital gains company stock investment (the cost income rates (up to 39.6% in 2014) in the taxes (currently 0%, 15%, or 20%) on your basis) and your NUA. year the stock is distributed from the plan.† NUA. You should be subject to either long-term or short-term capital gains taxes on any appreciation since distribution from your retirement savings plan.‡

†A 10% withdrawal penalty may also apply on the cost basis of the stock if the distribution is made before age 59 1/2, but not on the NUA.

‡The short-term capital gains tax rate, which is the same as your ordinary income tax rate, applies to shares you hold outside a retirement savings plan for less than 12 months. Beyond a year, long-term capital gains rates apply.

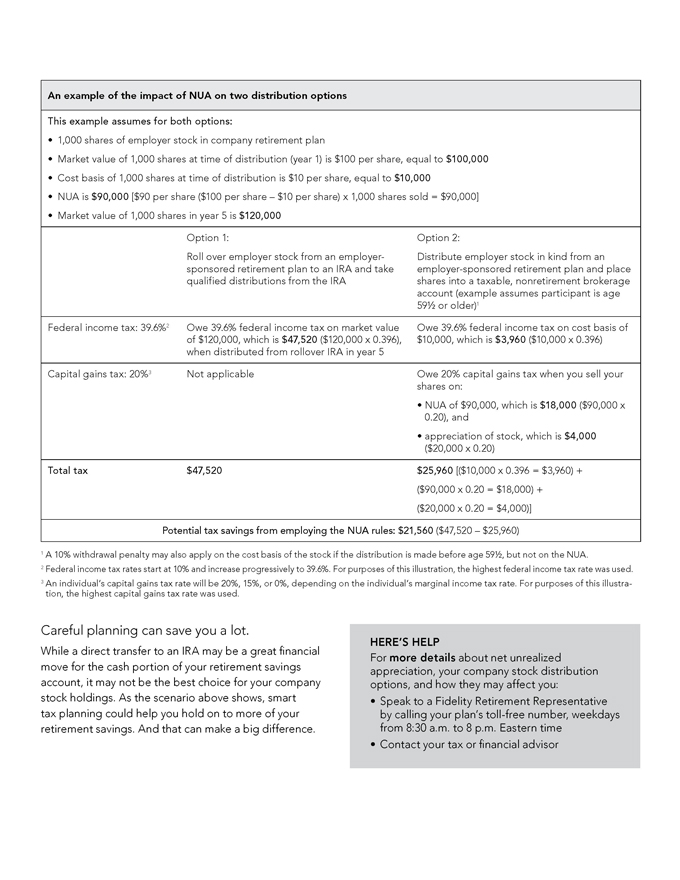

Comparing potential tax consequences: Keep in mind that the options in the example are for two company stock distribution options illustrative purposes only. Your personal situation may differ, depending on your plans for your retirement The table on the next page illustrates the potential tax savings account. implications of (1) rolling over employer stock you hold in your workplace retirement savings plan to an IRA, versus (2) taking a direct distribution of your shares (which may include depositing them in a taxable, nonretirement brokerage account).

An example of the impact of NUA on two distribution options

This example assumes for both options:

1,000 shares of employer stock in company retirement plan

Market value of 1,000 shares at time of distribution (year 1) is $100 per share, equal to $100,000

Cost basis of 1,000 shares at time of distribution is $10 per share, equal to $10,000

NUA is $90,000 [$90 per share ($100 per share – $10 per share) x 1,000 shares sold = $90,000]

Market value of 1,000 shares in year 5 is $120,000

Option 1: Option 2:

Roll over employer stock from an employer- Distribute employer stock in kind from an sponsored retirement plan to an IRA and take employer-sponsored retirement plan and place qualified distributions from the IRA shares into a taxable, nonretirement brokerage account (example assumes participant is age 59 1/2 or older)1

Federal income tax: 39.6%2 Owe 39.6% federal income tax on market value Owe 39.6% federal income tax on cost basis of of $120,000, which is $47,520 ($120,000 x 0.396), $10,000, which is $3,960 ($10,000 x 0.396) when distributed from rollover IRA in year 5

Capital gains tax: 20%3 Not applicable Owe 20% capital gains tax when you sell your shares on:

NUA of $90,000, which is $18,000 ($90,000 x 0.20), and appreciation of stock, which is $4,000

($20,000 x 0.20)

Total tax $47,520 $25,960 [($10,000 x 0.396 = $3,960) +

($90,000 x 0.20 = $18,000) +

($20,000 x 0.20 = $4,000)]

Potential tax savings from employing the NUA rules: $21,560 ($47,520 – $25,960)

1 A 10% withdrawal penalty may also apply on the cost basis of the stock if the distribution is made before age 59 1/2, but not on the NUA.

2 Federal income tax rates start at 10% and increase progressively to 39.6%. For purposes of this illustration, the highest federal income tax rate was used. 3 An individual’s capital gains tax rate will be 20%, 15%, or 0%, depending on the individual’s marginal income tax rate. For purposes of this illustration, the highest capital gains tax rate was used.

Careful planning can save you a lot.

HERE’S HELP

While a direct transfer to an IRA may be a great ?nancial

For more details about net unrealized move for the cash portion of your retirement savings appreciation, your company stock distribution account, it may not be the best choice for your company options, and how they may affect you: stock holdings. As the scenario above shows, smart • Speak to a Fidelity Retirement Representative tax planning could help you hold on to more of your by calling your plan’s toll-free number, weekdays retirement savings. And that can make a big difference. from 8:30 a.m. to 8 p.m. Eastern time

Contact your tax or ?nancial advisor

The tax information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice. Fidelity does not provide legal or tax advice. Fidelity cannot guarantee that such information is accurate, complete, or timely. Laws of a particular state or laws which may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of such information. Federal and state laws and regulations are complex and are subject to change. Changes in such laws and regulations may have a material impact on pre- and/or after-tax investment results. Fidelity makes no warranties with regard to such information or results obtained by its use. Fidelity disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Always consult an attorney or tax professional regarding your speci?c legal or tax situation.

The company stock fund is neither a mutual fund nor a diversi?ed or managed investment option.

NUA treatment is available only with certain lump sum (i.e., quali?ed lump sum) distributions (except for after-tax contributions). It is also permissible to roll over the cash portion and take shares in kind.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets. Approved for use in Advisor and workplace markets. Firm review may apply.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smith?eld, RI 02917

© 2014 FMR LLC. All rights reserved.

419580.9.0 1.765674.114