1 Amedisys Second Quarter 2022 Earnings Call Supplemental Slides July 28th, 2022 Exhibit 99.2

2 This presentation may include forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current expectations and assumptions about our business that are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those described in this presentation. You should not rely on forward-looking statements as a prediction of future events. Additional information regarding factors that could cause actual results to differ materially from those discussed in any forward-looking statements are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business, clinical operations and control processes and SEC filings. Forward-looking statements

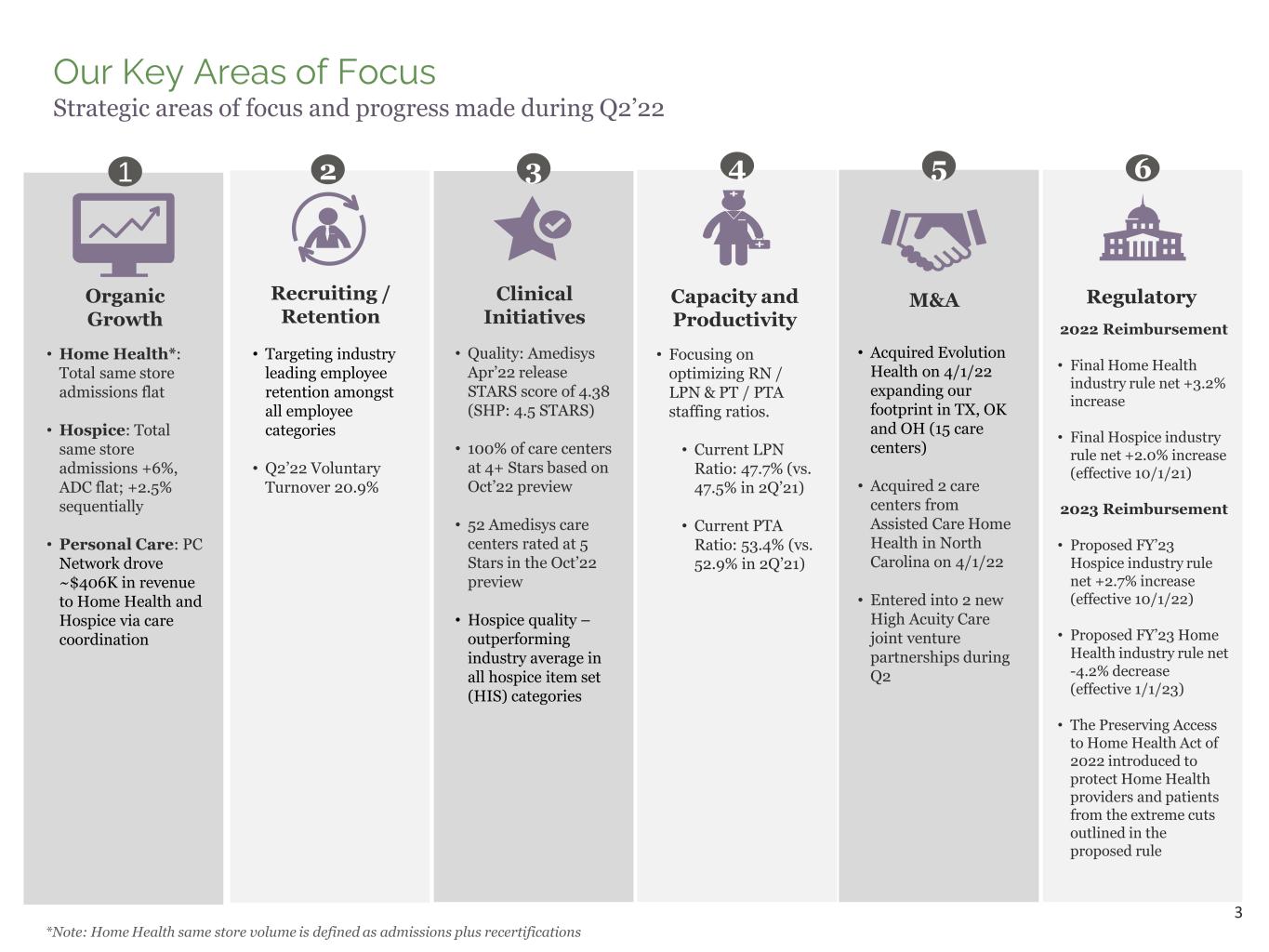

3 Our Key Areas of Focus Strategic areas of focus and progress made during Q2’22 • Home Health*: Total same store admissions flat • Hospice: Total same store admissions +6%, ADC flat; +2.5% sequentially • Personal Care: PC Network drove ~$406K in revenue to Home Health and Hospice via care coordination 1 Organic Growth • Quality: Amedisys Apr’22 release STARS score of 4.38 (SHP: 4.5 STARS) • 100% of care centers at 4+ Stars based on Oct’22 preview • 52 Amedisys care centers rated at 5 Stars in the Oct’22 preview • Hospice quality – outperforming industry average in all hospice item set (HIS) categories 3 Clinical Initiatives • Focusing on optimizing RN / LPN & PT / PTA staffing ratios. • Current LPN Ratio: 47.7% (vs. 47.5% in 2Q’21) • Current PTA Ratio: 53.4% (vs. 52.9% in 2Q’21) 4 Capacity and Productivity • Acquired Evolution Health on 4/1/22 expanding our footprint in TX, OK and OH (15 care centers) • Acquired 2 care centers from Assisted Care Home Health in North Carolina on 4/1/22 • Entered into 2 new High Acuity Care joint venture partnerships during Q2 5 M&A 2 Recruiting / Retention • Targeting industry leading employee retention amongst all employee categories • Q2’22 Voluntary Turnover 20.9% *Note: Home Health same store volume is defined as admissions plus recertifications 2022 Reimbursement • Final Home Health industry rule net +3.2% increase • Final Hospice industry rule net +2.0% increase (effective 10/1/21) 2023 Reimbursement • Proposed FY’23 Hospice industry rule net +2.7% increase (effective 10/1/22) • Proposed FY’23 Home Health industry rule net -4.2% decrease (effective 1/1/23) • The Preserving Access to Home Health Act of 2022 introduced to protect Home Health providers and patients from the extreme cuts outlined in the proposed rule 6 Regulatory

4 Highlights and Summary Financial Results (Adjusted): 2Q 2022(1) Home Health total same store admissions flat; Hospice same store admissions +6%; EBITDA margin decline driven by the addition of Contessa, labor costs and the return of sequestration 1. The financial results for the three-month periods ended June 30, 2021 and June 30, 2022 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Same Store volume – Includes admissions and recertifications. 3. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. 4. Free cash flow is defined as cash flow from operations less routine capital expenditures and required debt repayments. 5. Medicare sequestration suspended May 1, 2020; reinstated at 1% effective April 1, 2022. Growth Metrics: • Total Admissions: 345 • Number of admitting JV’s: 9 Other Statistics: • Patient Satisfaction: 89% High Acuity Care Adjusted Financial Results Growth Metrics: • Billable hours/quarter: -22% • Clients served: -17% Other Statistics: • Revenue per hour: +13% • Cost per hour: +13% Personal Care Same Store Volume (3): • Admissions: +6% • ADC: Flat Other Statistics: • Revenue per Day: $164.55 (+3.7%) • Cost per day: $88.21 (+3.4%) HospiceHome Health Same Store (2)(3) : • Total Admissions: Flat • Total Volume: -2% Other Statistics: • Revenue per Episode(5): $3,048 (+2.1%) • Visiting Clinician Cost per Visit: $95.49 (+6.0%) • Medicare VPE decreased 1.0 (-7.0%) Amedisys Consolidated • Revenue Growth: +2% • EBITDA: $74M (-11%, ex. Contessa -2%) • EBITDA Margin: 13.1% (ex. Contessa: 14.6%) • EPS: $1.47 (-13%) Amedisys Consolidated Amedisys Consolidated Balance Sheet & Cash Flow • Net debt: $410.2M • Net Leverage ratio: 1.5x • Revolver availability: $507.3M • CFFO: $57.4M • Free cash flow (4): $52.7M • DSO: 46.8 (vs. Q4’21 of 43.2 and up 0.5 days since Q1) $ in Millions, except EPS 2Q21 2Q22 Home Health 349.3$ 348.5$ Hospice 191.4 198.4 Personal Care 17.0 14.9 High Acuity Care - 4.4 Total Revenue 557.6$ 566.3$ Gross Margin % 45.4% 44.9% Adjusted EBITDA 83.8$ 74.4$ 15.0% 13.1% Adjusted EPS 1.69$ 1.47$ Free cash flow (4) 64.3$ 52.7$

5 66.1%13.2% 20.7% Home Health Revenue Medicare FFS Private Episodic Per Visit 61.6% 35.0% 2.6% 0.8% Amedisys Consolidated Revenue Home Health Hospice Personal Care High Acuity Care • Medicare FFS: Reimbursed over a 30-day period of care • Private Episodic: MA and Commercial plans who reimburse us over a 30-day period of care, majority of which range from 95% - 100% of Medicare rates • Per Visit: Managed care, Medicaid and private payors reimbursing us per visit performed 94.5% 5.5% Hospice Revenue Medicare FFS Private Hospice Per Day Reimbursement: • Routine Care: Patient at home with symptoms controlled ~97% of the Hospice care AMED provides, in line with overall hospice industry provision of care • Continuous Care: Patient at home with uncontrolled symptoms • Inpatient Care: Patient in facility with uncontrolled symptoms • Respite Care: Patient at facility with symptoms controlled • Home Health: 353 care centers; 34 states & D.C. • Hospice: 174 care centers; 34 states • Personal Care: 14 care centers; 3 states • High Acuity Care: 9 admitting joint ventures; 7 states; 25 referring hospitals • Total AMED: 550 care centers; 38 states and D.C. Our Revenue Sources: 2Q’22

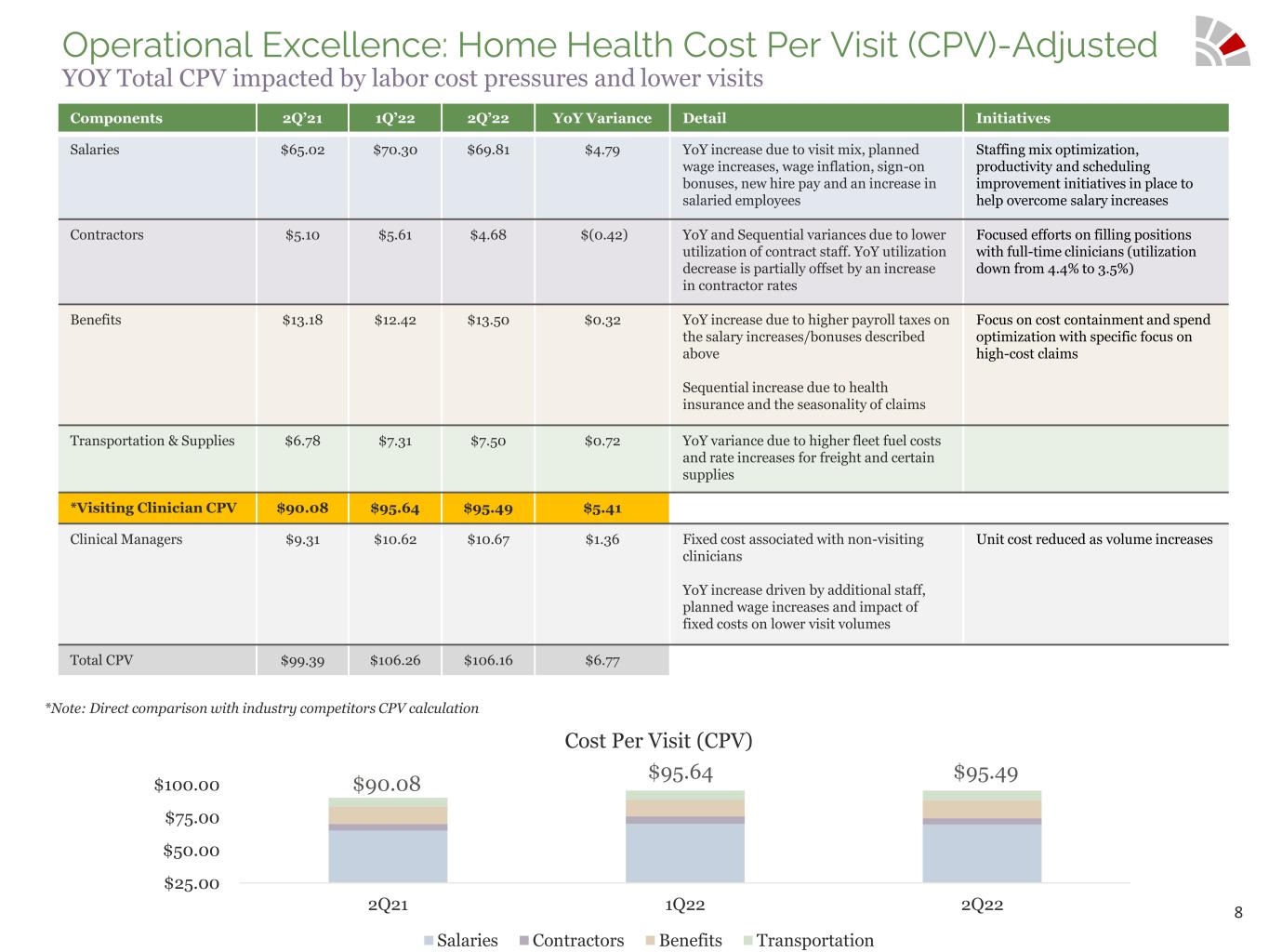

6 Home Health and Hospice Segment (Adjusted) – 2Q 2022(1) • Revenue per Episode up 2.1% (primarily due to +3.2% rate increase effective 1/1/2022 partially offset by the reinstatement of sequestration at 1%) • Y/Y Total CPV up $6.77 (+6.8%, primarily due to planned wage increases, wage inflation, sign-on bonuses, higher new hire pay, an increase in salaried employees and visit mix) • Visits per episode decreased 1.0 (Medicare) • Cost per episode down 1.8% (Medicare) Home Health Highlights • Net revenue per day +3.7% (primarily due to +2.0% Hospice rate update effective 10/1/2021 and lower revenue adjustments partially offset by the reinstatement of sequestration at 1%) • Cost per day up $2.88 (+3.4% primarily due to planned wage increases, wage inflation and sign-on bonuses) • ADC +2.5% sequentially Hospice Highlights 1. The financial results for the three-month periods ended June 30, 2021 and June 30, 2022 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Pre-Corporate EBITDA does not include any corporate G&A expenses. 3. Same Store information represents the percent change in volume, admissions or ADC for the period as a percent of the volume, admissions or ADC of the prior period. 4. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. 5. Average Medicare revenue per completed episode reflects the suspension of sequestration for the period May 1, 2020 – March 31, 2022 and the reinstatement of sequestration at 1% for the period April 1, 2022 – June 30, 2022. $ in Millions 2Q21 2Q22 Medicare 234.8$ 230.3$ Non-Medicare 114.5 118.2 Home Health Revenue $349.3 $348.5 Gross Margin % 46.1% 45.6% Pre-Corporate EBITDA (2) $80.1 $71.5 22.9% 20.5% Operating Statistics Same Store Growth (3 )(4 ) Total admissions 20% 0% Total volume 12% -2% Medicare revenue per episode (5 ) $2,986 $3,048 Medicare recert rate 34.4% 33.6% Total cost per visit $99.39 $106.16 HOME HEALTH $ in Millions 2Q21 2Q22 Medicare 180.4$ 187.5$ Non-Medicare 11.0 10.9 Hospice Revenue $191.4 $198.4 Gross Margin % 46.2% 46.4% Pre-Corporate EBITDA (2) $40.6 $41.8 21.2% 21.1% Operating Statistics Admit growth - same store (3)(4) 2% 6% ADC growth - same store (3)(4) -3% 0% ADC 13,254 13,249 Avg. discharge length of stay 97 87 Revenue per day (net) $158.67 $164.55 Cost per day $85.33 $88.21 HOSPICE

7 2Q21 3Q21 4Q21 1Q22 2Q22 Salary and Benefits 22.0 22.1 21.7 23.8 23.3 Other 11.6 12.8 10.4 10.2 6.7 Corp. G&A Subtotal 33.6 34.9 32.1 34.0 30.1 Non-cash comp 4.5 2.8 4.0 1.6 2.6 Adjusted Corporate G&A 38.1 37.7 36.1 35.6 32.7 $ in Millions 2Q21 3Q21 4Q21 1Q22 2Q22 Home Health Segment - Total 81.3 82.4 84.7 83.2 87.8 % of HH Revenue 23.3% 24.3% 25.1% 24.8% 25.2% Hospice Segment - Total 48.4 49.5 54.0 51.3 50.8 % of HSP Revenue 25.3% 25.1% 26.4% 26.6% 25.6% Personal Care Segment - Total 3.1 2.6 2.4 2.2 2.3 % of PC Revenue 18.1% 16.5% 15.7% 15.8% 15.2% High Acuity Care Segment - Total - 3.8 6.2 7.1 8.8 % of HAC Revenue -% 255.2% 305.7% 256.9% 199.8% Total Corporate Expenses 38.1 37.7 36.1 35.6 32.7 % of Total Revenue 6.8% 6.8% 6.5% 6.5% 5.8% Total 170.9 176.0 183.4 179.4 182.4 % of Total Revenue 30.7% 31.8% 32.8% 32.9% 32.2% General & Administrative Expenses – Adjusted (1,2) Notes: • Year over year total G&A as a percentage of revenue increased 150 basis points ($12 million); $1 million decrease excluding Contessa ($9 million) and home health acquisitions ($4 million) (G&A as a % of revenue excluding Contessa and home health acquisitions = 30.9%) • Decrease due to a favorable legal settlement and higher gains on the sale of fleet vehicles partially offset by the addition of resources to support growth, planned wage increases, higher travel and training spend and increased information technology fees. • Total G&A decreased $1 million sequentially excluding our home health acquisitions 1. The financial results for the three-month periods ended June 30, 2021, September 30, 2021, December 31, 2021, March 31, 2022 and June 30, 2022 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Adjusted G&A expenses do not include depreciation and amortization. Impacted by acquisitions, raises and the addition of resources to support growth 30.7% 31.8% 32.8% 32.9% 32.2% 30.7% 31.1% 31.7% 31.6% 30.7% 28.0% 30.0% 32.0% 34.0% 2Q21 3Q21 4Q21 1Q22 2Q22 Total G&A as a Percent of Revenue G&A as a Percent of Revenue Ex-Contessa

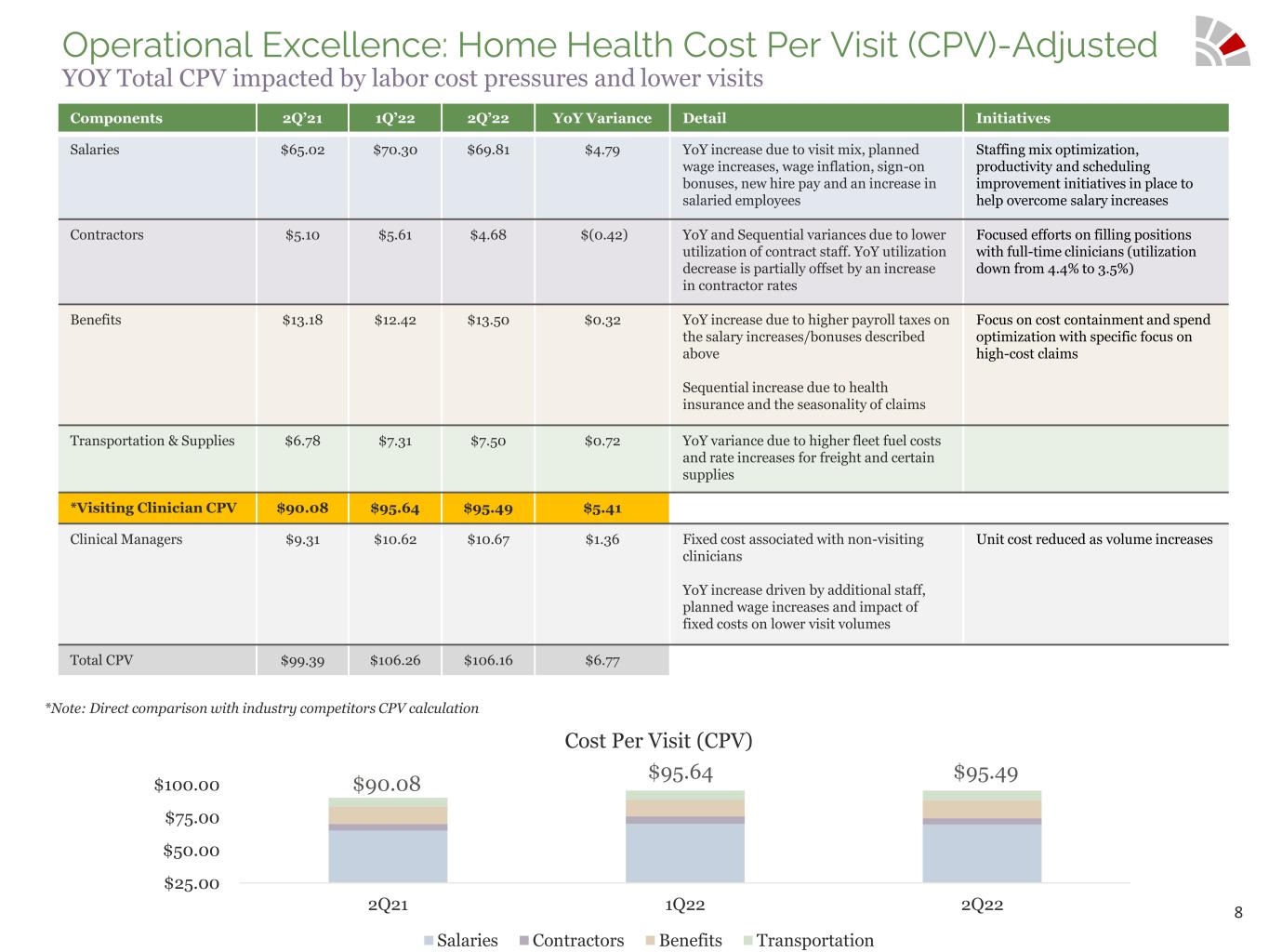

8 Operational Excellence: Home Health Cost Per Visit (CPV)-Adjusted YOY Total CPV impacted by labor cost pressures and lower visits *Note: Direct comparison with industry competitors CPV calculation $25.00 $50.00 $75.00 $100.00 2Q21 1Q22 2Q22 Cost Per Visit (CPV) Salaries Contractors Benefits Transportation $90.08 $95.64 $95.49 Components 2Q’21 1Q’22 2Q’22 YoY Variance Detail Initiatives Salaries $65.02 $70.30 $69.81 $4.79 YoY increase due to visit mix, planned wage increases, wage inflation, sign-on bonuses, new hire pay and an increase in salaried employees Staffing mix optimization, productivity and scheduling improvement initiatives in place to help overcome salary increases Contractors $5.10 $5.61 $4.68 $(0.42) YoY and Sequential variances due to lower utilization of contract staff. YoY utilization decrease is partially offset by an increase in contractor rates Focused efforts on filling positions with full-time clinicians (utilization down from 4.4% to 3.5%) Benefits $13.18 $12.42 $13.50 $0.32 YoY increase due to higher payroll taxes on the salary increases/bonuses described above Sequential increase due to health insurance and the seasonality of claims Focus on cost containment and spend optimization with specific focus on high-cost claims Transportation & Supplies $6.78 $7.31 $7.50 $0.72 YoY variance due to higher fleet fuel costs and rate increases for freight and certain supplies *Visiting Clinician CPV $90.08 $95.64 $95.49 $5.41 Clinical Managers $9.31 $10.62 $10.67 $1.36 Fixed cost associated with non-visiting clinicians YoY increase driven by additional staff, planned wage increases and impact of fixed costs on lower visit volumes Unit cost reduced as volume increases Total CPV $99.39 $106.26 $106.16 $6.77

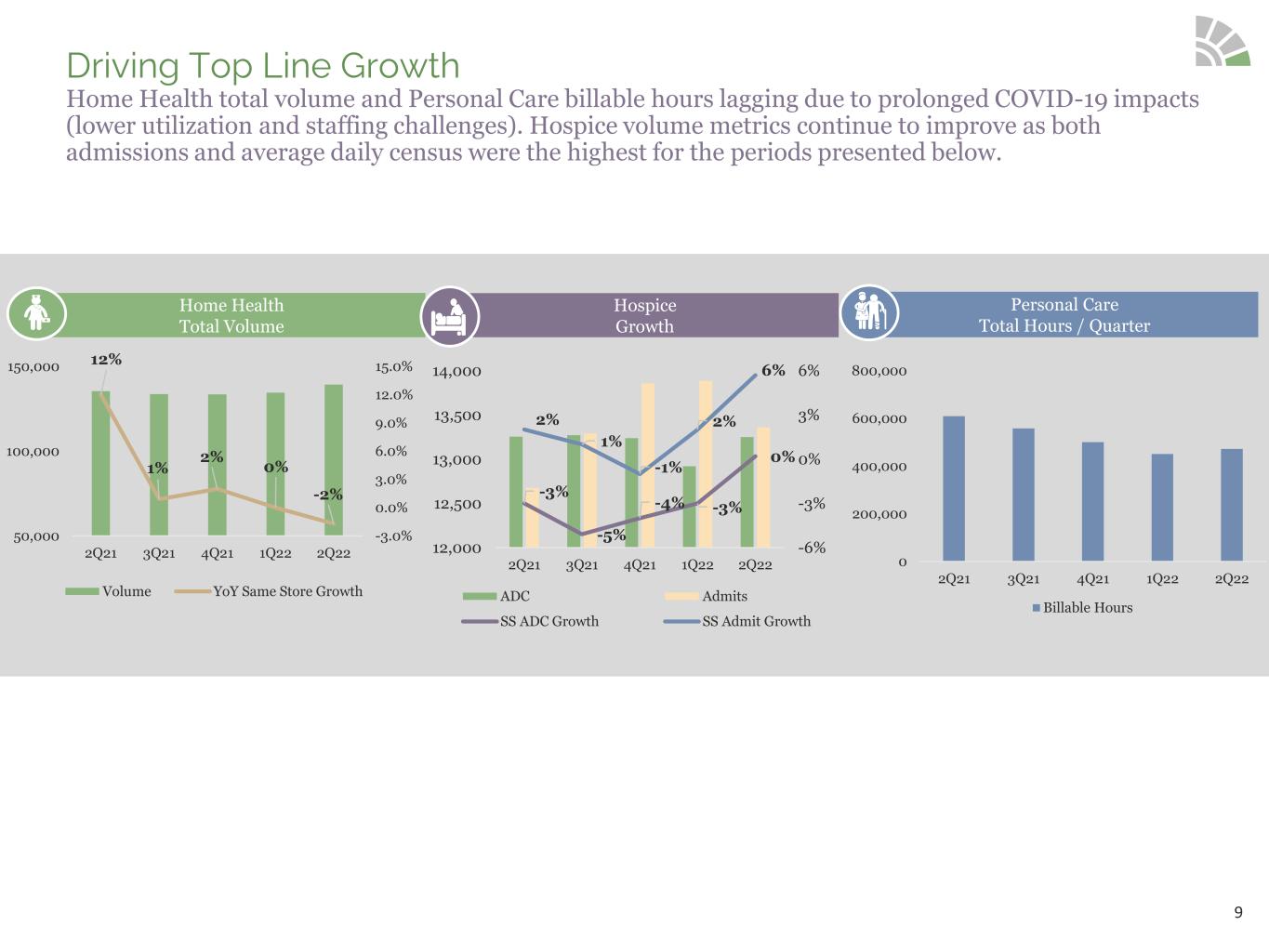

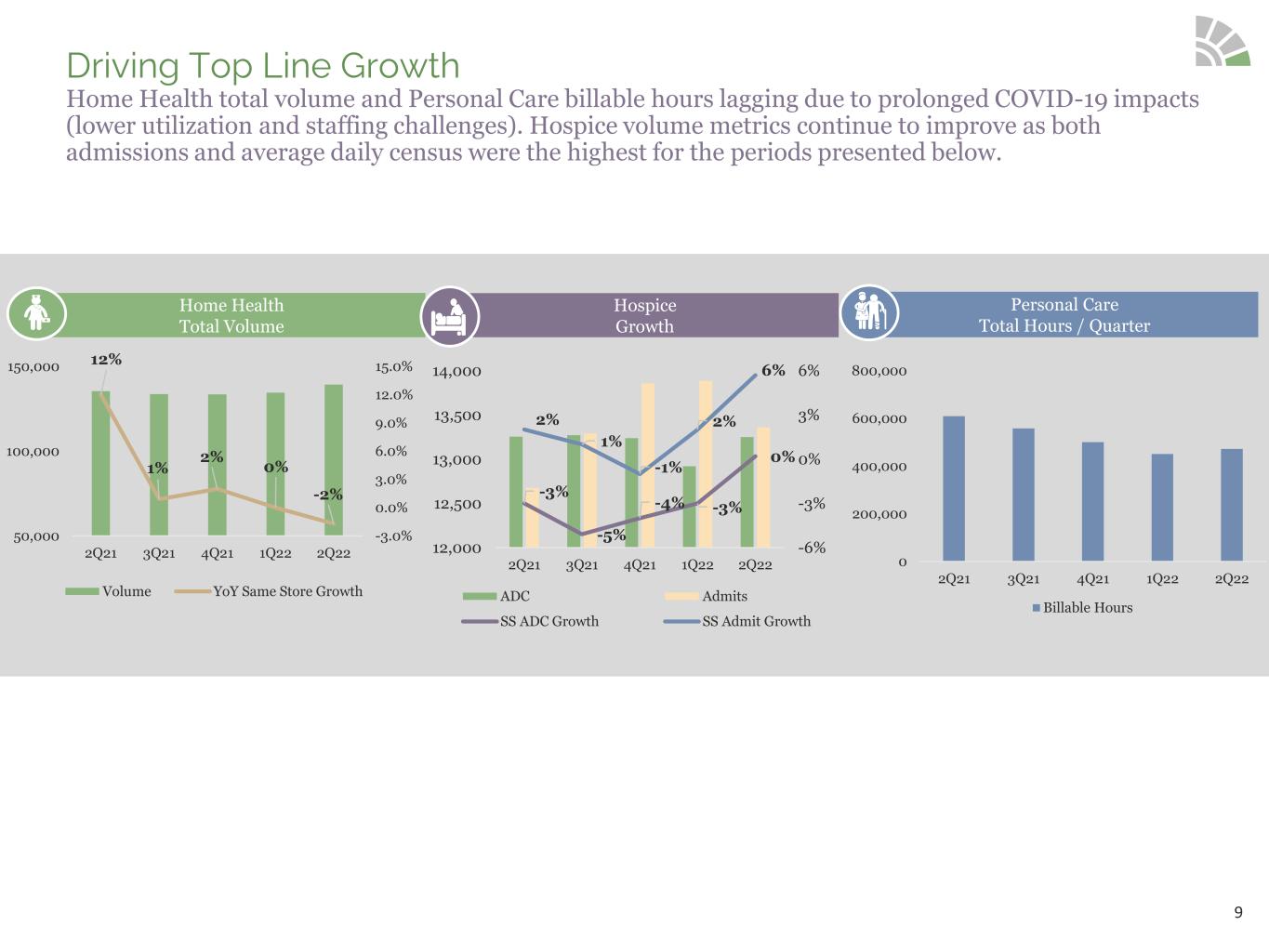

9 Driving Top Line Growth Home Health total volume and Personal Care billable hours lagging due to prolonged COVID-19 impacts (lower utilization and staffing challenges). Hospice volume metrics continue to improve as both admissions and average daily census were the highest for the periods presented below. 12% 1% 2% 0% -2% -3.0% 0.0% 3.0% 6.0% 9.0% 12.0% 15.0% 50,000 100,000 150,000 2Q21 3Q21 4Q21 1Q22 2Q22 Volume YoY Same Store Growth Home Health Total Volume Hospice Growth Personal Care Total Hours / Quarter 0 200,000 400,000 600,000 800,000 2Q21 3Q21 4Q21 1Q22 2Q22 Billable Hours -3% -5% -4% -3% 0% 2% 1% -1% 2% 6% -6% -3% 0% 3% 6% 12,000 12,500 13,000 13,500 14,000 2Q21 3Q21 4Q21 1Q22 2Q22 ADC Admits SS ADC Growth SS Admit Growth

10 Industry Leading Quality Scores Metric JAN 22 Release APR 22 Release Jul 22 Preview Oct 22 Preview Quality of Patient Care 4.33 4.38 4.46 4.49 Entities at 4+ Stars 92% 97% 99% 100% Metric OCT 20 Release JAN 22 Release APR 22 Release Jul 22 Preview Patient Satisfaction Star 4.28 3.61 3.73 3.92 Performance Over Industry +7% +3% +3% +5% Quality of Patient Care (QPC) Patient Satisfaction (PS) Notes: (1) CMS did not provide QPC Star and HH-CAHPS performance releases in 2021 due to COVID-19 PHE. (2) Oct 2022 QPC Star Preview performance period = CY 2021 (Jul 2020 - Jun 2021 for ACH). (3) Jul 2022 HH-CAHPS Preview performance period = CY 2021 (4) QPC Star and HH-CAHPS Results for Amedisys Legacy providers only. • Amedisys maintains a 4-Star average in the Oct 2022 HHC Preview with 100% of our providers (representing 100% of care centers) at 4+ Stars and 82% of our providers (representing 86% of care centers) at 4.5+ Stars. •29 Amedisys providers (representing 52 care centers) rated at 5 Stars. 3.00 3.50 4.00 4.50 QPC Industry Performance Amedisys QPC Industry Avg QPC Top Competitor CMS Blind Period 3.00 3.50 4.00 4.50 PS Industry Performance Amedisys PS Score PS Industry Avg PS Top Competitor CMS Blind Period

11 Hospice Quality: Amedisys Hospice Continues to Move Towards Best-in-Class Hospice Quality Notes: Included in the above analysis are active care centers. HIS data includes all active care centers. CAHPS excludes Asana, AseraCare, and CCH acquisitions as they were acquired after the start of the reporting window.

12 Debt and Liquidity Metrics Net leverage ~1.5x 1. Net debt defined as total debt outstanding ($459.0M) less cash ($48.8M). 2. Leverage ratio (net) is defined as net debt divided by last twelve months adjusted EBITDA ($277.8M). 3. Liquidity defined as the sum of cash balance and available revolving line of credit. Outstanding Revolver 15.0 Outstanding Term Loan 441.6 Promissory Notes 0.2 Finance Leases 2.2 Total Debt Outstanding 459.0 Less: Deferred Debt Issuance Costs (4.1) Total Debt - Balance Sheet 454.9 Total Debt Outstanding 459.0 Less Cash (48.8) Net Debt (1) 410.2 Leverage Ratio (net) (2) 1.5 Term Loan 450.0 Revolver Size 550.0 Borrowing Capacity 1,000.0 Revolver Size 550.0 Outstanding Revolver (15.0) Letters of Credit (27.7) Available Revolver 507.3 Plus Cash 48.8 Total Liquidity (3) 556.1 As of: 6/30/22 Credit Facility Outstanding Debt As of: 6/30/22

13 Cash Flow Statement Highlights (1) Q2 cash flow statement reflects two home health acquisitions and the buyback of 150,000 shares during the quarter. The second half of the COVID-19 relief payroll tax deferral ($27M) is due in December 2022. 1. Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments. $ in Millions 2Q21 3Q21 4Q21 1Q22 2Q22 GAAP Net Income 80.6 45.2 34.0 31 .7 29.0 Changes in working capital (9.1 ) (7 .0) (27 .1 ) (5.4) 1 3 .6 Depreciation and amortization 6.7 7 .5 9.1 8.0 6.2 Non-cash compensation 6.2 4.4 5.9 7 .3 5.1 Deferred income taxes 1 5.3 1 2.0 9.9 3 .2 2 .8 Other (31 .7 ) (0.3) (26.6) 3 .8 0.7 Cash flow from operations 68.0 61.8 5.2 48.6 57.4 Capital expenditures - routine (1 .0) (2.2) (0.7 ) (0.9) (1 .5) Required debt repay ments (2.7 ) (0.5) (3 .3) (3 .8) (3.2) Free cash flow 64.3 59.1 1.2 43.9 52.7 Capital Deployment Acquisitions (2.5) (262.4) (5.1 ) - (7 3.3) Share Repurchases (1 .2) (1 0.8) (1 5.0) - (1 7 .4) Total (3.7) (273.2) (20.1) - (90.7)

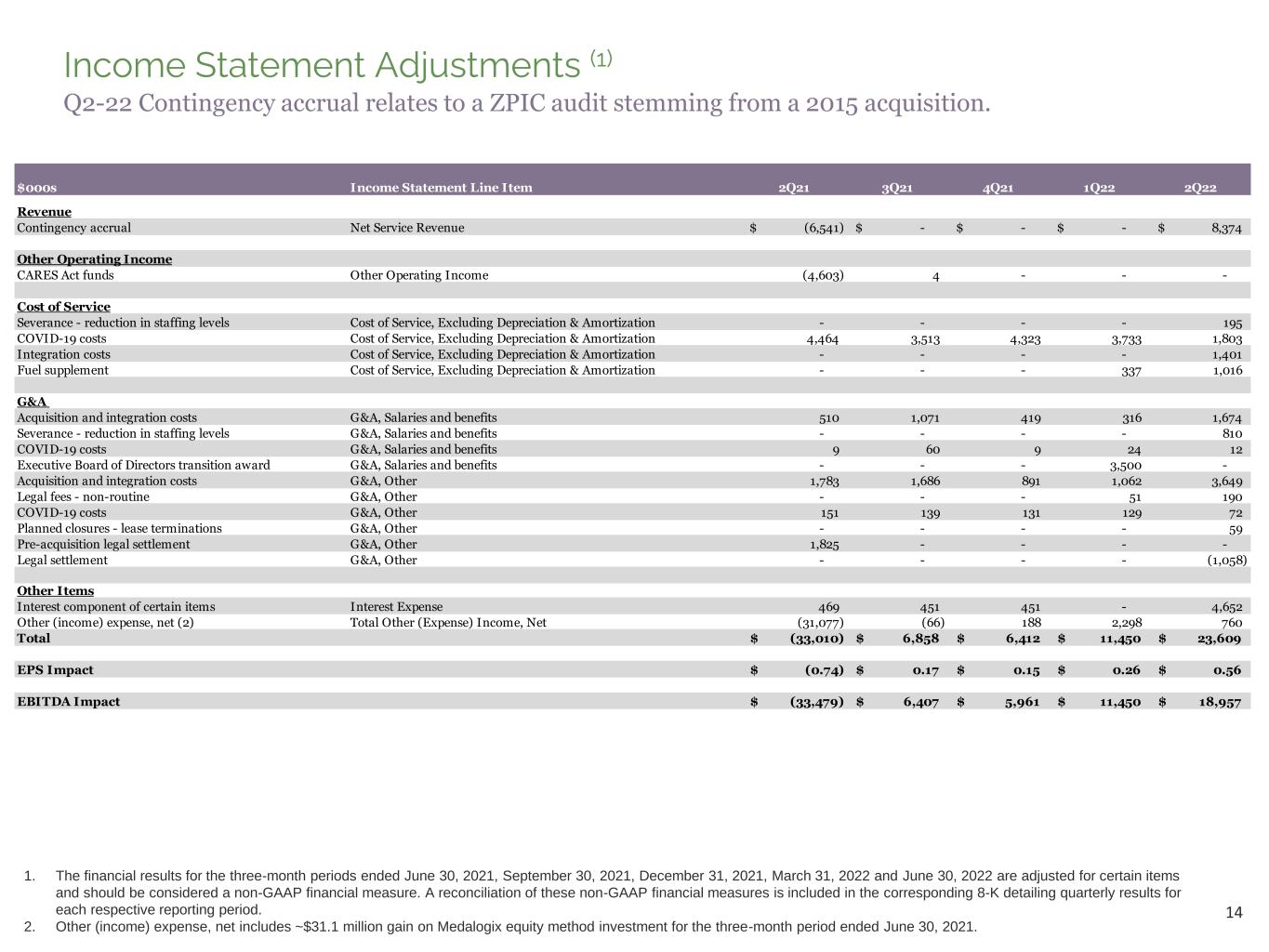

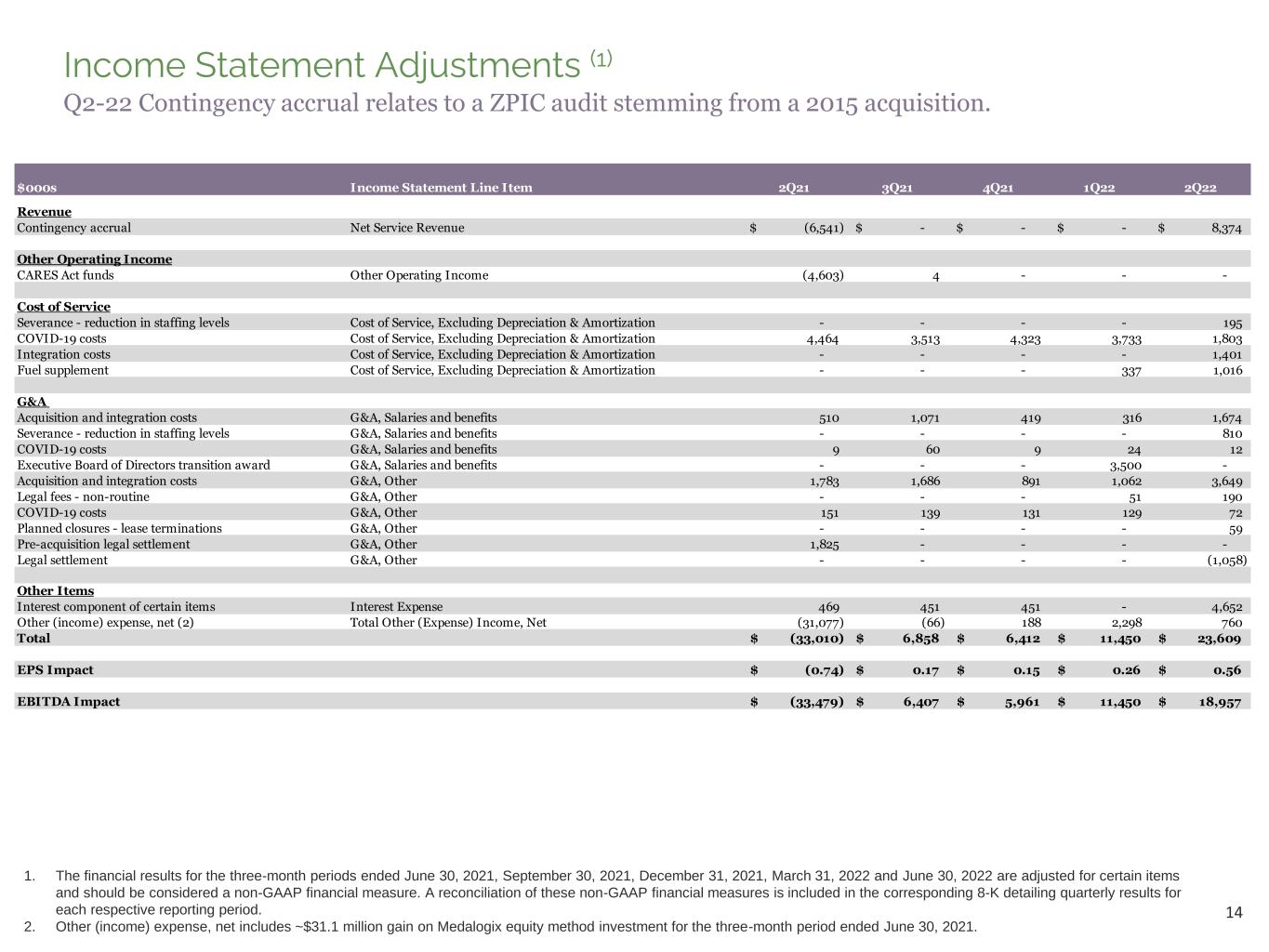

14 Income Statement Adjustments (1) 1. The financial results for the three-month periods ended June 30, 2021, September 30, 2021, December 31, 2021, March 31, 2022 and June 30, 2022 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Other (income) expense, net includes ~$31.1 million gain on Medalogix equity method investment for the three-month period ended June 30, 2021. $000s Income Statement Line Item 2Q21 3Q21 4Q21 1Q22 2Q22 Revenue Contingency accrual Net Service Revenue (6,541)$ -$ -$ -$ 8,374$ Other Operating Income CARES Act funds Other Operating Income (4,603) 4 - - - Cost of Service Severance - reduction in staffing levels Cost of Service, Excluding Depreciation & Amortization - - - - 195 COVID-19 costs Cost of Service, Excluding Depreciation & Amortization 4,464 3,513 4,323 3,733 1,803 Integration costs Cost of Service, Excluding Depreciation & Amortization - - - - 1,401 Fuel supplement Cost of Service, Excluding Depreciation & Amortization - - - 337 1,016 G&A Acquisition and integration costs G&A, Salaries and benefits 510 1,071 419 316 1,674 Severance - reduction in staffing levels G&A, Salaries and benefits - - - - 810 COVID-19 costs G&A, Salaries and benefits 9 60 9 24 12 Executive Board of Directors transition award G&A, Salaries and benefits - - - 3,500 - Acquisition and integration costs G&A, Other 1,783 1,686 891 1,062 3,649 Legal fees - non-routine G&A, Other - - - 51 190 COVID-19 costs G&A, Other 151 139 131 129 72 Planned closures - lease terminations G&A, Other - - - - 59 Pre-acquisition legal settlement G&A, Other 1,825 - - - - Legal settlement G&A, Other - - - - (1,058) Other Items Interest component of certain items Interest Expense 469 451 451 - 4,652 Other (income) expense, net (2) Total Other (Expense) Income, Net (31,077) (66) 188 2,298 760 Total (33,010)$ 6,858$ 6,412$ 11,450$ 23,609$ EPS Impact (0.74)$ 0.17$ 0.15$ 0.26$ 0.56$ EBITDA Impact (33,479)$ 6,407$ 5,961$ 11,450$ 18,957$ Q2-22 Contingency accrual relates to a ZPIC audit stemming from a 2015 acquisition.

15 2022 Guidance

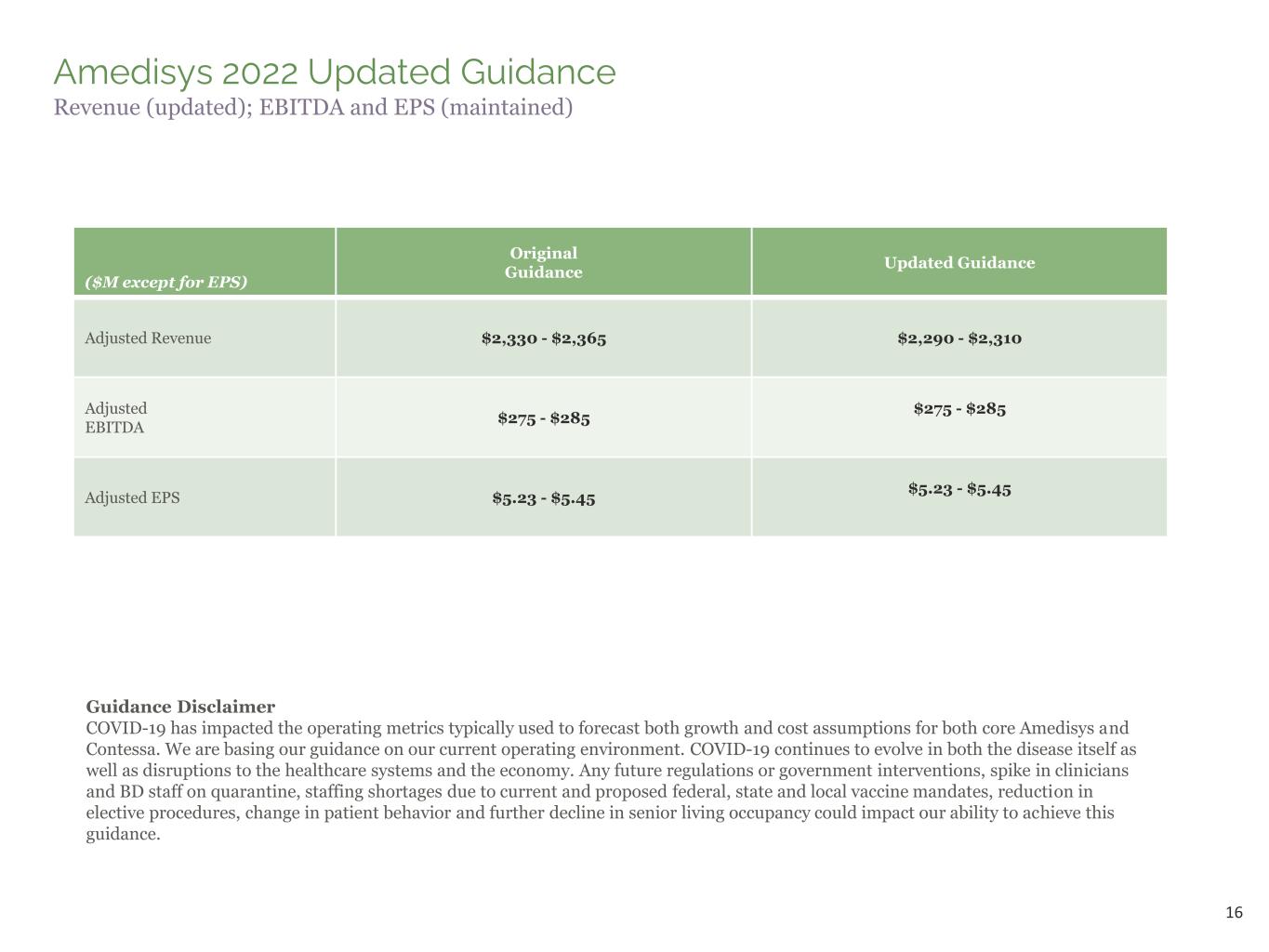

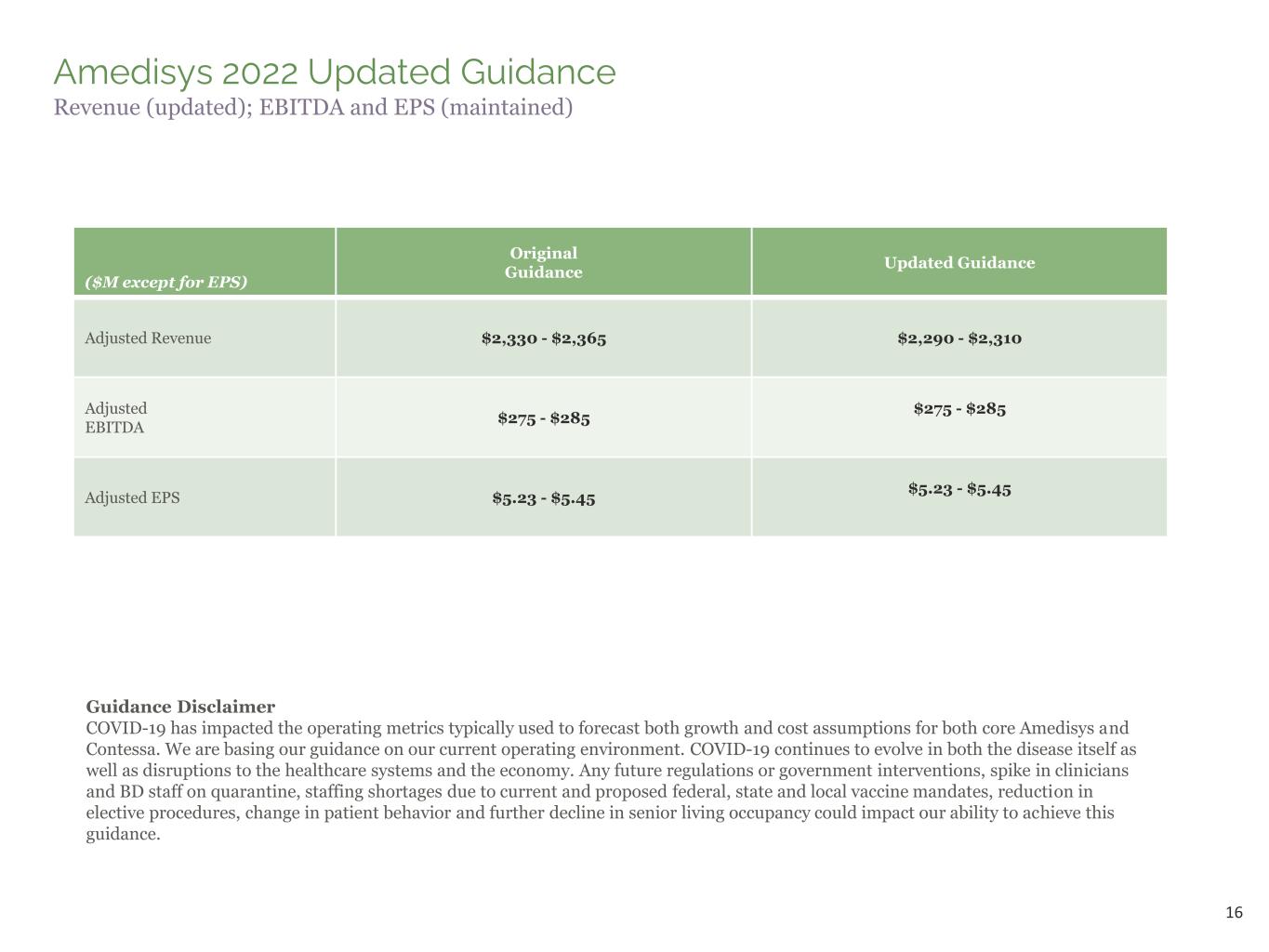

16 Amedisys 2022 Updated Guidance Revenue (updated); EBITDA and EPS (maintained) ($M except for EPS) Original Guidance Updated Guidance Adjusted Revenue $2,330 - $2,365 $2,290 - $2,310 Adjusted EBITDA $275 - $285 $275 - $285 Adjusted EPS $5.23 - $5.45 $5.23 - $5.45 Guidance Disclaimer COVID-19 has impacted the operating metrics typically used to forecast both growth and cost assumptions for both core Amedisys and Contessa. We are basing our guidance on our current operating environment. COVID-19 continues to evolve in both the disease itself as well as disruptions to the healthcare systems and the economy. Any future regulations or government interventions, spike in clinicians and BD staff on quarantine, staffing shortages due to current and proposed federal, state and local vaccine mandates, reduction in elective procedures, change in patient behavior and further decline in senior living occupancy could impact our ability to achieve this guidance.

17 Environmental, Social, Governance (E.S.G.) Considerations

18 Environmental, Social, Governance (E.S.G.) Considerations Sustainable, high-quality, patient focused, home-based care model Environmental • Amedisys is dedicated to the sustainability of our business and the communities in which we serve • Environmental health has a strong correlation with physical health • A greener fleet – newer vehicles, in circulation for a shorter time, optimize fuel usage. Sophisticated scheduling practices reduce our clinicians’ driving time and fuel usage helping to minimize our carbon footprint • Virtual care centers, along with flexible working schedules and locations, have created fewer emissions Social • Amedisys strives to create an organizational culture and climate in which every individual is valued, all team members have a sense of belonging with one another and to the organization and feel empowered to do their best work • Provider of Home Health and Hospice services to frail, elderly patients in their most preferred care location – their homes • Highest quality Home Health company as measured by Quality of Patient Care Star scores (4.46 Stars) • The Amedisys Foundation was formed to provide support to our patients and employees. The Amedisys Foundation has two funds: the Patients’ Special Needs Fund and the Amedisys Employees 1st Fund. The Patients’ Special Needs Fund provides financial assistance to our home health, hospice and personal care patients during a difficult time Governance • Amedisys has a culture of compliance starting with oversight from the Board of Directors and cascading down to the care center level • Our Board of Directors operates several sub-committees including: • Quality of Care Committee • Compliance & Ethics Committee • Audit Committee • Compensation Committee • Nominating & Corporate Governance Committee • Nominating and Corporate Governance Committee oversees our strategy on corporate social responsibility, including evaluating the impact of Company practices on communities and individuals, and develops and recommends to our Board of Directors for approval matters relating to the Company’s corporate social responsibility and ESG considerations