1 Amedisys Second Quarter 2024 Earnings Release Supplemental Slides July 24th, 2024 EXHIBIT 99.2

2 This presentation may include forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current expectations and assumptions about our business that are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those described in this presentation. You should not rely on forward-looking statements as a prediction of future events. Additional information regarding factors that could cause actual results to differ materially from those discussed in any forward-looking statements are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business, clinical operations and control processes and SEC filings. FORWARD-LOOKING STATEMENTS EXHIBIT 99.2

3 OUR KEY AREAS OF FOCUS Strategic areas of focus and progress made during Q2’24 • Home Health: Total same store admissions +13% • Hospice: Total same store ADC +0.4% • High Acuity Care: Admissions +56% 1 Organic Growth • Quality: Amedisys Jul’24 STARS score of 4.32 • 92% of care centers at 4+ Stars based on Jul’24 final release • 40 Amedisys care centers rated at 5 Stars in the Jul’24 final release • Hospice quality – outperforming industry average in all hospice item set (HIS) categories 3 Clinical Initiatives • Focusing on optimizing RN / LPN & PT / PTA staffing ratios. • Current LPN Ratio: 47.9% (vs. 48.2% in 2Q’23) • Current PTA Ratio: 54.6% (vs. 54.2% in 2Q’23) 4 Capacity and Productivity • Pending merger with UnitedHealth Group Inc. 5 M&A 2 Recruiting / Retention • Targeting industry leading employee retention amongst all employee categories • Q2’24 Voluntary Turnover 19.2% 2024 Reimbursement • Final Hospice industry rule – Amedisys estimated impact +3.1% increase (effective 10/1/23) • Final Home Health industry rule – Amedisys estimated impact +0.8% increase (effective 1/1/24) 2025 Reimbursement • Proposed Hospice industry rule – industry estimated impact +2.6% increase (effective 10/1/24) • Proposed Home Health industry rule – industry estimated impact -1.7% decrease (effective 1/1/25) 6 Regulatory EXHIBIT 99.2

4 HIGHLIGHTS AND SUMMARY FINANCIAL RESULTS (ADJUSTED): 2Q 2024(1) EBITDA decreased $1 million over prior year on a $38 million increase in revenue. Excluding the impact of lower gains on the sale of fleet vehicles and a legal settlement, our EBITDA increased $3 million due to rate increases, home health volume growth, clinical optimization and reorganization initiatives and the recognition of savings generated on the first performance year of our risk-based palliative care contract. 1. The financial results for the three-month periods ended June 30, 2023 and June 30, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Same Store volume – Includes admissions and recertifications. 3. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. 4. Free cash flow is defined as cash flow from operations less routine capital expenditures and required debt repayments. Growth Metrics: • Total Admissions: 832 (+56%) • Number of admitting JVs: 9 Other Statistics: • Patient Satisfaction: 86% High Acuity Care Adjusted Financial Results Same Store Volume (3): • Admissions: -2% • ADC: +0.4% Other Statistics: • Revenue per Day(5): $172.88 (+2.0%) • Cost per day: $88.14 (+5.3%) HospiceHome Health Same Store (2)(3) : • Total Admissions: +13% • Total Volume: +9% Other Statistics: • Revenue per Episode: $3,036 (+1.0%) • Visiting Clinician Cost per Visit: $105.25 (+6.1%) Amedisys Consolidated • Revenue: +7% • EBITDA: $73M • EBITDA Margin: 12.4% • EPS: $1.32 Amedisys Consolidated Amedisys Consolidated Balance Sheet & Cash Flow • Net debt: $241.3M • Net Leverage ratio: 1.0x • Revolver availability: $514.2M • CFFO: $52.3M • Free cash flow (4): $42.3M • DSO: 52.1 (vs. Q1’24 of 54.1 and up 8.7 days over prior year) $ in Millions, except EPS 2Q23 2Q24 Home Health 349.8$ 377.4$ Hospice 199.2 204.0 High Acuity Care 4.0 9.8 Total Revenue 553.0$ 591.2$ Gross Margin % 46.5% 45.0% Adjusted EBITDA 74.6$ 73.2$ 13.5% 12.4% Adjusted EPS 1.37$ 1.32$ Free cash flow (4) 54.1$ 42.3$ EXHIBIT 99.2

5 57.3% 12.9% 29.8% Home Health Revenue Medicare FFS Private Episodic Per Visit & Case Rate 63.8% 34.5% 1.7% Amedisys Consolidated Revenue Home Health Hospice High Acuity Care • Medicare FFS: Reimbursed for a 30-day period of care • Private Episodic: MA and Commercial plans who reimburse us for a 30-day period of care or 60-day episode of care, majority of which range from 90% - 100% of Medicare rates • Per Visit & Case Rate: Managed care, Medicaid and private payors who reimburse us per visit performed or per admission 95.0% 5.0% Hospice Revenue Medicare FFS Private Hospice Per Day Reimbursement: • Routine Care: Patient at home with symptoms controlled, ~97% of the Hospice care provided • Continuous Care: Patient at home with uncontrolled symptoms • Inpatient Care: Patient in facility with uncontrolled symptoms • Respite Care: Patient at facility with symptoms controlled • Home Health: 346 care centers; 34 states & D.C. • Hospice: 164 care centers; 31 states • High Acuity Care: 9 admitting joint ventures; 9 states; 34 referring hospitals • Total: 519 care centers/joint ventures; 37 states and D.C. OUR REVENUE SOURCES: 2Q’24 EXHIBIT 99.2

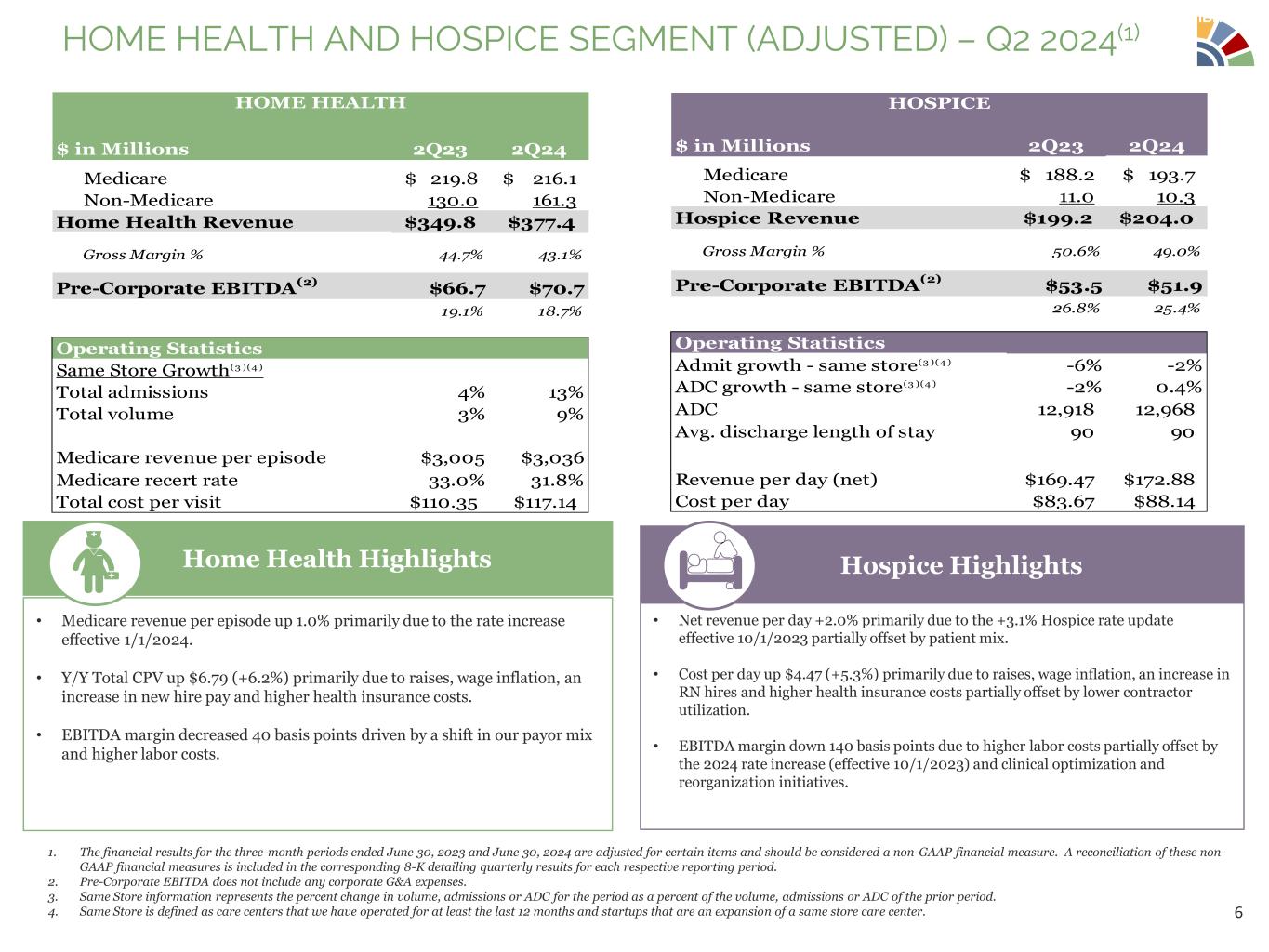

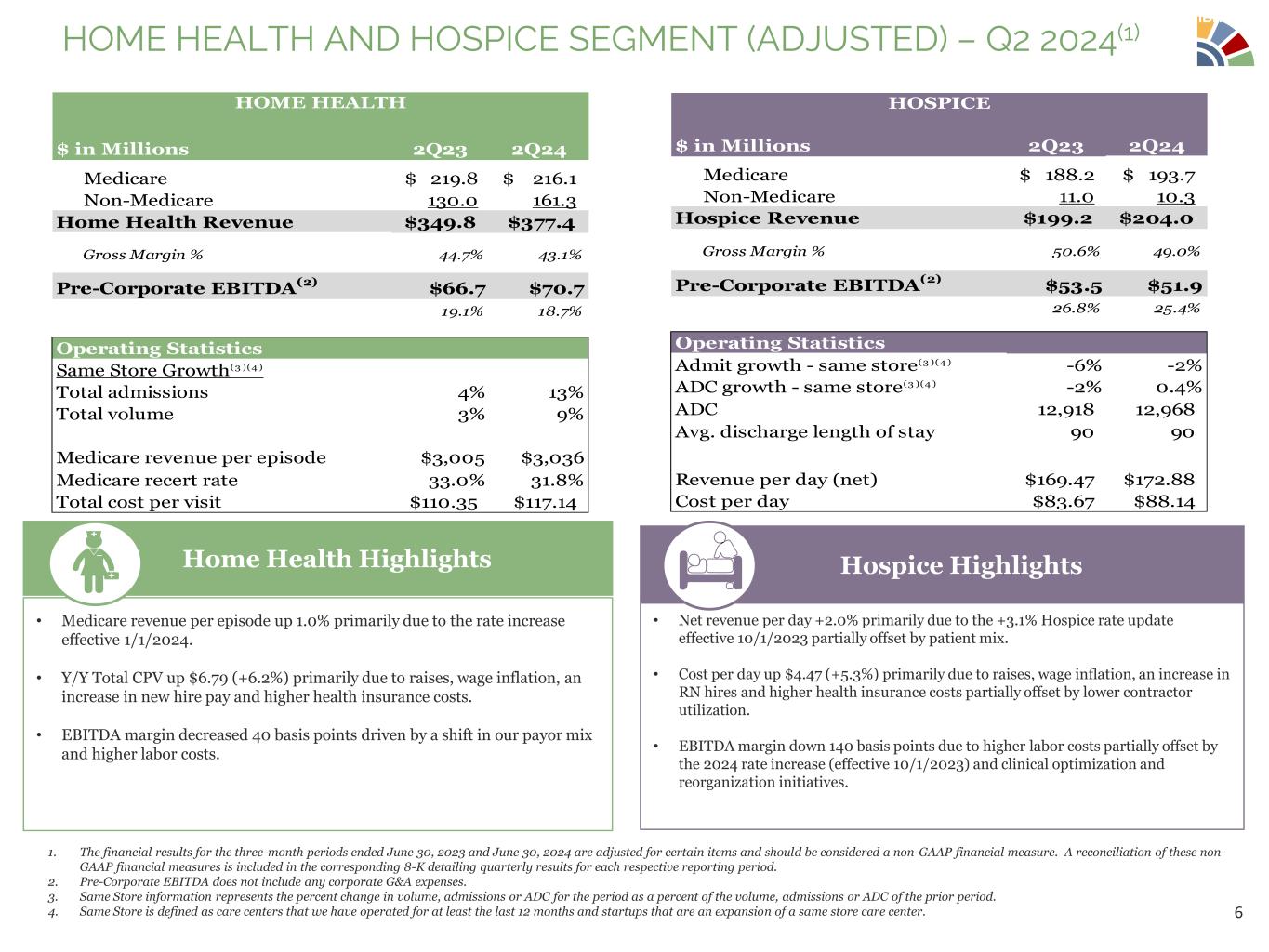

6 HOME HEALTH AND HOSPICE SEGMENT (ADJUSTED) – Q2 2024(1) • Medicare revenue per episode up 1.0% primarily due to the rate increase effective 1/1/2024. • Y/Y Total CPV up $6.79 (+6.2%) primarily due to raises, wage inflation, an increase in new hire pay and higher health insurance costs. • EBITDA margin decreased 40 basis points driven by a shift in our payor mix and higher labor costs. Home Health Highlights • Net revenue per day +2.0% primarily due to the +3.1% Hospice rate update effective 10/1/2023 partially offset by patient mix. • Cost per day up $4.47 (+5.3%) primarily due to raises, wage inflation, an increase in RN hires and higher health insurance costs partially offset by lower contractor utilization. • EBITDA margin down 140 basis points due to higher labor costs partially offset by the 2024 rate increase (effective 10/1/2023) and clinical optimization and reorganization initiatives. Hospice Highlights 1. The financial results for the three-month periods ended June 30, 2023 and June 30, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non- GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Pre-Corporate EBITDA does not include any corporate G&A expenses. 3. Same Store information represents the percent change in volume, admissions or ADC for the period as a percent of the volume, admissions or ADC of the prior period. 4. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. $ in Millions 2Q23 2Q24 Medicare 219.8$ 216.1$ Non-Medicare 130.0 161.3 Home Health Revenue $349.8 $377.4 Gross Margin % 44.7% 43.1% Pre-Corporate EBITDA (2) $66.7 $70.7 19.1% 18.7% Operating Statistics Same Store Growth(3 )(4 ) Total admissions 4% 13% Total volume 3% 9% Medicare revenue per episode $3,005 $3,036 Medicare recert rate 33.0% 31.8% Total cost per visit $110.35 $117.14 HOME HEALTH $ in Millions 2Q23 2Q24 Medicare 188.2$ 193.7$ Non-Medicare 11.0 10.3 Hospice Revenue $199.2 $204.0 Gross Margin % 50.6% 49.0% Pre-Corporate EBITDA (2) $53.5 $51.9 26.8% 25.4% Operating Statistics Admit growth - same store(3 )(4 ) -6% -2% ADC growth - same store(3 )(4 ) -2% 0.4% ADC 12,918 12,968 Avg. discharge length of stay 90 90 Revenue per day (net) $169.47 $172.88 Cost per day $83.67 $88.14 HOSPICE EXHIBIT 99.2

7 GENERAL & ADMINISTRATIVE EXPENSES – ADJUSTED (1,2) Notes: • Year over year total G&A as a percentage of revenue decreased 100 basis points • $7.3 million increase in total G&A is primarily due to planned wage increases, higher incentive compensation costs, an increase in our health insurance costs and higher legal and information technology fees partially offset by clinical optimization and reorganization initiatives • Total G&A increased ~$2 million sequentially primarily due to a seasonality driven increase in health insurance costs 1. The financial results for the three-month periods ended June 30, 2023, September 30, 2023, December 31, 2023, March 31, 2024 and June 30, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Adjusted G&A expenses do not include depreciation and amortization. Impacted by raises, incentive compensation costs and health insurance costs 34.1% 34.4% 34.5% 33.8% 33.1% 32.0% 34.0% 36.0% 2Q23 3Q23 4Q23 1Q24 2Q24 Total G&A as a Percent of Revenue G&A as a Percent of Revenue $ in Millions 2Q23 3Q23 4Q23 1Q24 2Q24 Home Health Segment - Total 90.1$ 91.3$ 92.7$ 91.0$ 92.4$ % of HH Revenue 25.8% 26.0% 25.8% 25.0% 24.5% Hospice Segment - Total 47.9 48.4 48.6 48.0 48.7 % of HSP Revenue 24.0% 24.2% 23.6% 23.9% 23.9% High Acuity Care Segment - Total 5.2 5.2 5.4 5.9 5.4 % of HAC Revenue 131.1% 119.2% 91.4% 92.5% 55.1% Total Corporate Expenses 45.2 46.2 50.3 48.4 49.2 % of Total Revenue 8.2% 8.3% 8.8% 8.5% 8.3% Total 188.4$ 191.1$ 197.0$ 193.3$ 195.7$ % of Total Revenue 34.1% 34.4% 34.5% 33.8% 33.1% 2Q23 3Q23 4Q23 1Q24 2Q24 Salary and Benefits 26.5 27.7 29.4 27.6 27.4 Other 15.1 14.9 16.9 16.6 17.4 Corp. G&A Subtotal 41.6 42.6 46.3 44.2 44.8 Non-cash comp 3.6 3.6 4.0 4.2 4.4 Adjusted Corporate G&A 45.2 46.2 50.3 48.4 49.2 EXHIBIT 99.2

8 $25.00 $50.00 $75.00 $100.00 $125.00 2Q23 1Q24 2Q24 Cost Per Visit (CPV) Salaries Contractors Benefits Transportation OPERATIONAL EXCELLENCE: HOME HEALTH COST PER VISIT (CPV)-ADJUSTED YOY Total CPV impacted by higher labor costs and health insurance costs. *Note: Direct comparison with industry competitors CPV calculation $99.21 $104.65 $105.25 Components 2Q’23 1Q’24 2Q’24 YoY Variance Detail Initiatives Salaries $73.35 $77.31 $76.99 $3.64 YoY increase due to planned wage increases, wage inflation, an increase in new hire pay and visit mix (discipline and visit type) Staffing mix optimization, productivity and scheduling improvement initiatives in place to help overcome salary increases Contractors $5.71 $6.38 $5.98 $0.27 YoY variance due to an increase in utilization Sequential variance due to lower rates partially offset by higher utilization Focused efforts on filling positions with full-time clinicians Benefits $13.10 $13.81 $15.00 $1.90 YoY variance due to higher payroll taxes on the salary increases described above and higher health insurance costs Sequential increase due to higher health insurance costs due to the seasonality of claims Focus on cost containment and spend optimization with specific focus on high-cost claims Transportation & Supplies $7.05 $7.15 $7.28 $0.23 YoY and sequential variances due to higher mileage costs *Visiting Clinician CPV $99.21 $104.65 $105.25 $6.04 Clinical Managers $11.14 $11.99 $11.89 $0.75 Fixed cost associated with non-visiting clinicians YoY variance due to planned wage increases and additional staff Unit cost reduced as volume increases Total CPV $110.35 $116.64 $117.14 $6.79 EXHIBIT 99.2

9 DRIVING TOP LINE GROWTH 3% 3% 5% 8% 9% 4% 4% 7% 10% 13% 0.0% 4.0% 8.0% 12.0% 16.0% 120,000 130,000 140,000 150,000 160,000 2Q23 3Q23 4Q23 1Q24 2Q24 Volume SS Volume Growth SS Admit Growth Home Health Growth Hospice Growth -2% -2% -0.2% 0.3% 0.4% -3.0% -2.0% -1.0% 0.0% 1.0% 12,600 12,700 12,800 12,900 13,000 2Q23 3Q23 4Q23 1Q24 2Q24 ADC SS ADC Growth EXHIBIT 99.2

10 INDUSTRY LEADING QUALITY SCORES Quality of Patient Care (QPC) Patient Satisfaction (PS) • Amedisys maintains a 4-Star average in the Jul 2024 HHC Final release with 93% of our providers (representing 92% of care centers) at 4+ Stars and 59% of our providers (representing 60% of care centers) at 4.5+ Stars. •21 Amedisys providers (representing 40 care centers) rated at 5 Stars. Notes: (1) Jul 2024 QPC Star Final performance period = Oct 2022 – Sep 2023 (ACH = CY 2022). (2) Jul 2024 PS Final performance period = Jan 2023 – Dec 2023. (3) QPC Star and PS Results for Amedisys Legacy providers only. (4) Only currently active care centers included in care center results. 3.00 3.50 4.00 4.50 Jan 2022 Apr 2022 Jul 2022 Oct 2022 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 PS Industry Performance Amedisys PS Industry Avg PS Top Competitor 3.00 3.50 4.00 4.50 Jan 2022 Apr 2022 Jul 2022 Oct 2022 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 QPC Industry Performance Amedisys QPC Industry Avg QPC Top Competitor Metric Oct 23 Release Jan 24 Release Apr 24 Final Jul 24 Final Quality of Patient Care 4.44 4.41 4.35 4.32 Entities at 4+ Stars 98% 96% 95% 93% Metric Oct 23 Release Jan 24 Release Apr 24 Final July 24 Final Patient Satisfaction Star 3.73 3.61 3.72 3.77 Performance Over Industry +2% +3% +2% +3% EXHIBIT 99.2

11 HOSPICE QUALITY: AMEDISYS HOSPICE CONTINUES TO MOVE TOWARDS BEST-IN-CLASS Hospice Quality Notes: Included in the above analysis are only active providers. EXHIBIT 99.2

12 DEBT AND LIQUIDITY METRICS Net leverage ~1.0x 1. Net debt defined as total debt outstanding ($391.2M) less cash and cash equivalents ($149.9M). 2. Leverage ratio (net) is defined as net debt divided by last twelve months adjusted EBITDA ($247.6M). 3. Liquidity defined as the sum of cash balance and available revolving line of credit. Outstanding Term Loan 360.6$ Outstanding Revolver - Finance Leases 30.6 Total Debt Outstanding 391.2 Less: Deferred Debt Issuance Costs (2.1) Total Debt - Balance Sheet 389.1 Total Debt Outstanding 391.2 Less Cash & Cash Equivalents (Excludes Restricted Cash) (149.9) Net Debt (1) 241.3$ Leverage Ratio (net) (2) 1.0 Term Loan 450.0$ Revolver Size 550.0 Borrowing Capacity 1,000.0 Revolver Size 550.0 Outstanding Revolver - Letters of Credit (35.8) Available Revolver 514.2 Plus Cash & Cash Equivalents (Excludes Restricted Cash) 149.9 Total Liquidity (3) 664.1$ As of: 6/30/24 Credit Facility Outstanding Debt As of: 6/30/24 EXHIBIT 99.2

13 CASH FLOW STATEMENT HIGHLIGHTS (1) Total cash flow from operations for Q2-24 positively impacted by the collection of accounts receivable balances that were impacted by the Change Healthcare outage in Q1. 1. Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments. $ in Millions 2Q23 3Q23 4Q23 1Q24 2Q24 GAAP net income (loss) (80.5)$ 25.6$ 1 9.0$ 1 4.6$ 32.6$ Changes in working capital 23.9 (56.4) 21 .4 (36.8) 1 .0 Depreciation and amortization 6.2 6.1 5.9 6.1 6.4 Non-cash compensation 9.1 7 .2 9.4 7 .9 8.3 Deferred income taxes 5.3 7 .3 5.2 2 .6 4.0 Merger termination fee 1 06.0 - - - - Other (9.3) 0.4 (0.6) (0.9) - Cash flow from operations 60.7 (9.8) 60.3 (6.5) 52.3 Capital expenditures - routine (0.9) (0.5) (0.9) (1 .2) (0.6) Required debt repay ments (5.7 ) (6.1 ) (8.9) (8.9) (9.4) Free cash flow 54.1$ (16.4)$ 50.5$ (16.6)$ 42.3$ EXHIBIT 99.2

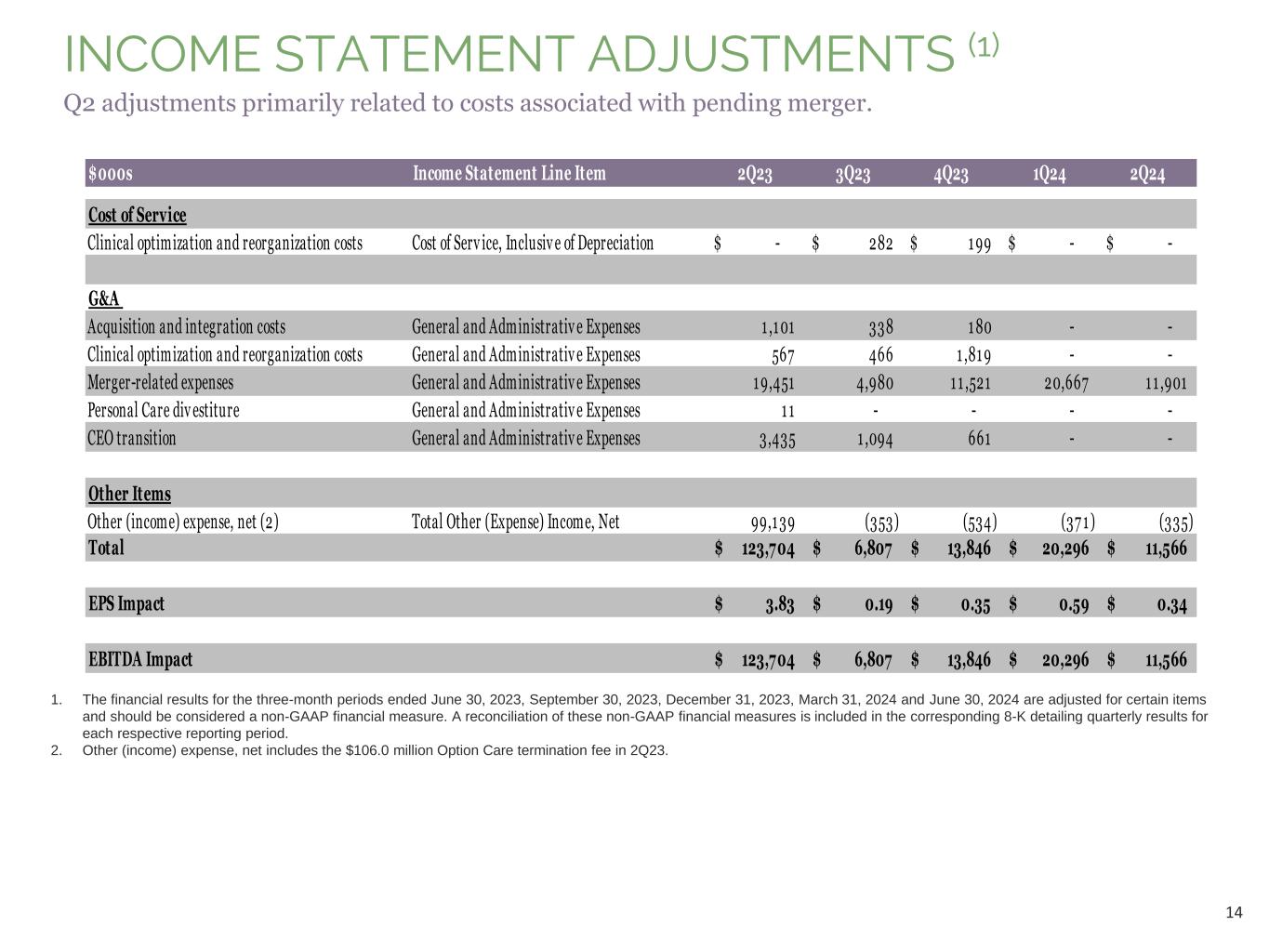

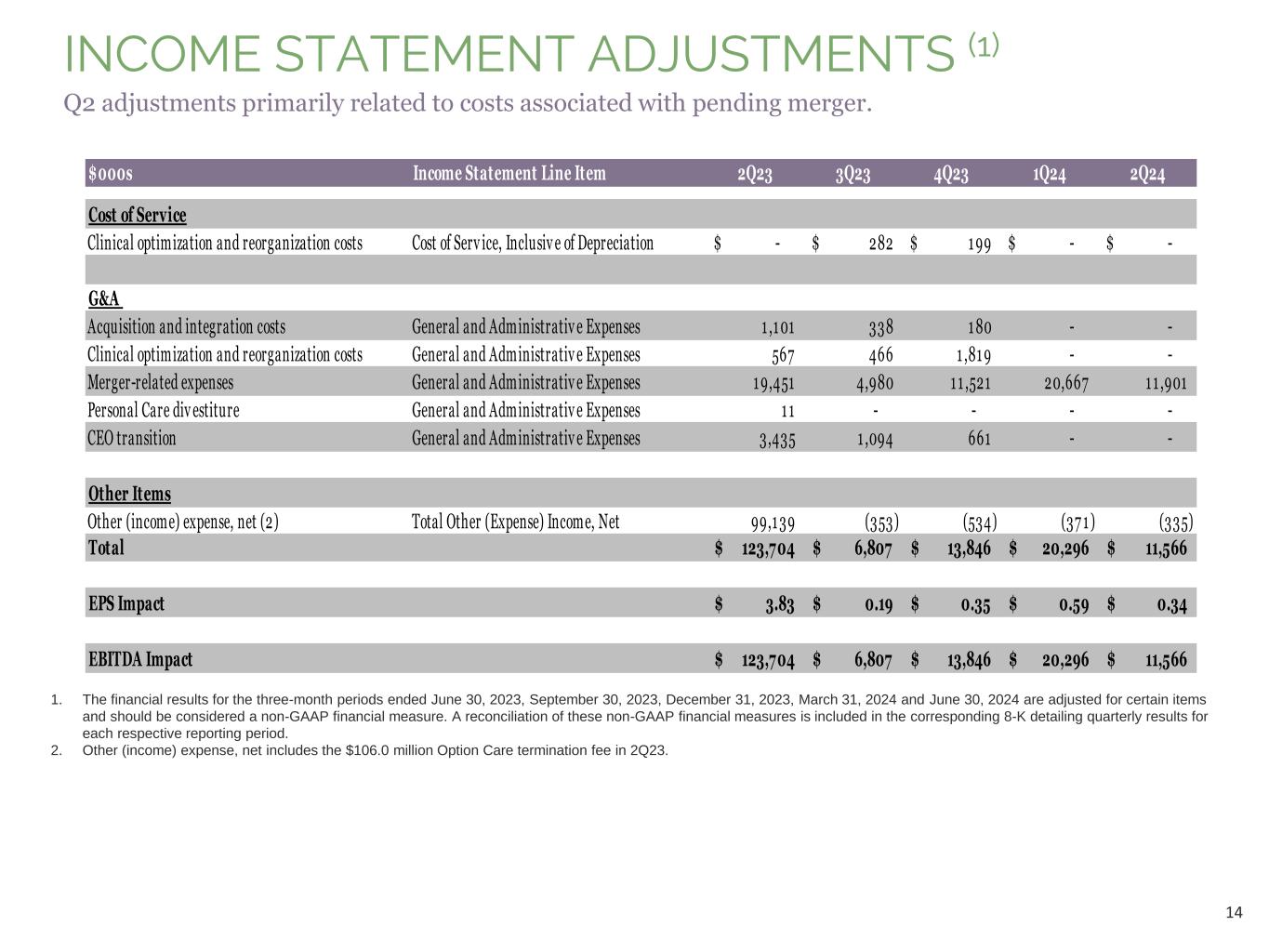

14 INCOME STATEMENT ADJUSTMENTS (1) 1. The financial results for the three-month periods ended June 30, 2023, September 30, 2023, December 31, 2023, March 31, 2024 and June 30, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Other (income) expense, net includes the $106.0 million Option Care termination fee in 2Q23. Q2 adjustments primarily related to costs associated with pending merger. $000s Income Statement Line Item 2Q23 3Q23 4Q23 1Q24 2Q24 Cost of Service Clinical optimization and reorganization costs Cost of Serv ice, Inclusiv e of Depreciation -$ 282$ 1 99$ -$ -$ G&A Acquisition and integration costs General and Administrativ e Expenses 1 ,1 01 338 1 80 - - Clinical optimization and reorganization costs General and Administrativ e Expenses 567 466 1 ,81 9 - - Merger-related expenses General and Administrativ e Expenses 1 9,451 4,980 1 1 ,521 20,667 1 1 ,901 Personal Care div estiture General and Administrativ e Expenses 1 1 - - - - CEO transition General and Administrativ e Expenses 3,435 1 ,094 661 - - Other Items Other (income) expense, net (2) Total Other (Expense) Income, Net 99,1 39 (353) (534) (37 1 ) (335) Total 123,704$ 6,807$ 13,846$ 20,296$ 11,566$ EPS Impact 3.83$ 0.19$ 0.35$ 0.59$ 0.34$ EBITDA Impact 123,704$ 6,807$ 13,846$ 20,296$ 11,566$ EXHIBIT 99.2

15 Environmental, Social, Governance (E.S.G.) Considerations EXHIBIT 99.2

16 ENVIRONMENTAL, SOCIAL, GOVERNANCE (E.S.G.) CONSIDERATIONS Sustainable, high-quality, patient focused, home-based care model E n vi ro nmental, Social, Govern an ce Environmental • Amedisys is dedicated to the sustainability of our business and the communities in which we serve • Environmental health has a strong correlation with physical health • A greener fleet – newer vehicles, in circulation for a shorter time, optimize fuel usage. Sophisticated scheduling practices reduce our clinicians’ driving time and fuel usage helping to minimize our carbon footprint • Virtual care centers, along with flexible working schedules and locations, have created fewer emissions Social • Amedisys strives to create an organizational culture and climate in which every individual is valued, all team members have a sense of belonging with one another and to the organization and feel empowered to do their best work • Provider of Home Health and Hospice services to frail, elderly patients in their most preferred care location – their homes • Highest quality Home Health company as measured by Quality of Patient Care Star scores (4.32 Stars) • The Amedisys Foundation was formed to provide support to our patients and employees. The Amedisys Foundation has two funds: the Patients’ Special Needs Fund and the Amedisys Employees 1st Fund. The Patients’ Special Needs Fund provides financial assistance to our home health, hospice and high acuity care patients during a difficult time Governance • Amedisys has a culture of compliance starting with oversight from the Board of Directors and cascading down to the care center level • Our Board of Directors operates several sub-committees including: • Quality of Care Committee • Compliance & Ethics Committee • Audit Committee • Compensation Committee • Nominating & Corporate Governance Committee • The Nominating and Corporate Governance Committee oversees our strategy on corporate social responsibility, including evaluating the impact of Company practices on communities and individuals, and develops and recommends to our Board of Directors for approval matters relating to the Company’s corporate social responsibility and ESG considerations EXHIBIT 99.2