- AMED Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Amedisys (AMED) 8-KFollow-On Offering of Common Stock

Filed: 2 Sep 04, 12:00am

Amedisys, Inc.

NASDAQ: AMED

Follow-On Offering of Common Stock

September 2004

Forward Looking Statements

Statements contained in this presentation which are not historical facts are forward-looking statements. These forward-looking statements and all other statements that may be contained in this presentation that are not historical facts are subject to a number of risks and uncertainties, and actual results may differ materially than those forecasted. Such forward-looking statements are estimates reflecting the best judgment of Amedisys, Inc. management based upon currently available information. Certain factors which could affect the accuracy of such forward-looking statements are identified in the public filings made by Amedisys, Inc. with the Securities and Exchange Commission, and forward-looking statements contained herein, or other public statements of Amedisys, Inc. or its management should be considered in light of those factors.

1

Offering Summary

Issuer Amedisys, Inc.

Offering size:

Shares 2.0 million

Over-allotment 7.5% primary

7.5% secondary

Use of proceeds General corporate purposes,

including working capital and

possible acquisitions

Expected pricing September 15, 2004

Underwriters Raymond James & Associates, Inc.

Jefferies & Company, Inc.

Legg Mason Wood Walker, Inc.

2

Investment Highlights

Large, growing, and fragmented industry Focus on Medicare home nursing Strong internal growth

Demonstrated ability to identify and integrate acquisitions Proven operating model Experienced management team

3

Management Team

William F. Borne, Chairman and Chief Executive Officer

- CEO since founding the Company in 1982

- Registered nurse, extensive hospital administrative and clinical experience

Larry R. Graham, President and Chief Operating Officer

- Joined Amedisys in 1996; COO since 1999; President in 2004

- General Health Systems; Arthur Andersen

Gregory H. Browne, Chief Financial Officer

- Joined Amedisys as CFO in 2002

- CEO for PeopleWorks, Ramsay Health Care, Ramsay-HMO

4

Corporate Overview

Leading provider of home nursing to Medicare beneficiaries Medicare accounts for > 90.0% of revenue 96 locations in the southern United States

Services include:

- Skilled nursing

- Physical, occupational, and speech therapy

- Specialized disease management programs

5

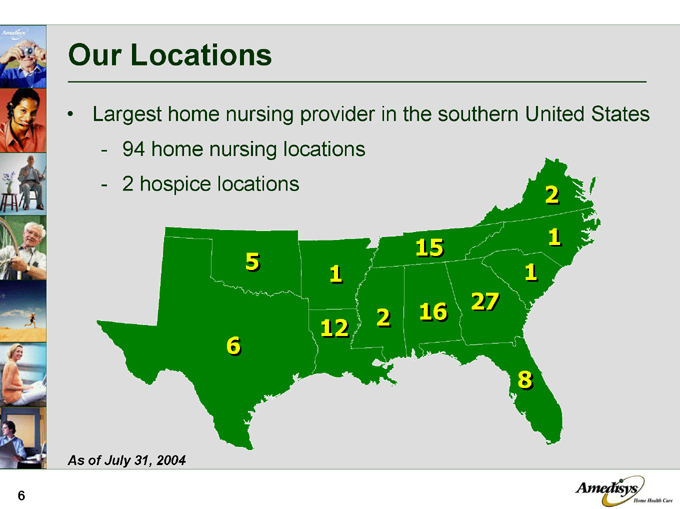

Our Locations

Largest home nursing provider in the southern United States

- 94 home nursing locations

- 2 hospice locations

As of July 31, 2004

6

Our Strategy

Focus on Medicare-eligible patients Prioritize internal growth Grow through strategic acquisitions Leverage cost-efficient operating structure Develop and deploy specialized nursing programs

7

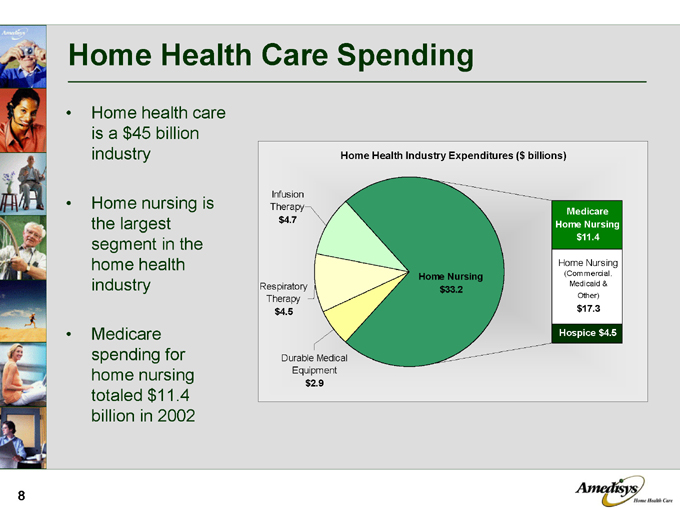

Home Health Care Spending

Home health care is a $45 billion industry

Home nursing is the largest segment in the home health industry

Medicare spending for home nursing totaled $11.4 billion in 2002

Home Health Industry Expenditures ($ billions)

Infusion Therapy $4.7

Respiratory Therapy $4.5

Durable Medical Equipment $2.9

Home Nursing $33.2

Medicare Home Nursing $11.4

Home Nursing

(Commercial, Medicaid & Other)

$17.3

Hospice $4.5

8

Home Nursing Market

Industry is highly fragmented

7,000 Medicare-certified nursing agencies

Most are single site or small regional providers:

- Independently owned agencies

- Visiting nurse associations

- Facility- and hospital-based agencies

Publicly-owned providers account for less than 5.0% of the home nursing market

9

Trend from inpatient to home-based care:

- Patient preference

- Payor incentives

- Technology advancements Demographics – aging population

Increased prevalence of chronic and co-morbid conditions

10

Medicare Reimbursement Status

Medicare home nursing is an $11.4 billion market

Prospective Payment System (PPS):

- Implemented in October 2000

- Base payment for 60-day episode of care

Currently $2,213 per episode

Adjusted for patient acuity and market factors

Reviewed and updated annually

- Encourages efficient delivery of care

11

Medicare Reimbursement Outlook

Expect 2.15% average price increase in CY2005

5.0% rural add-on expires March 31, 2005 Other considerations:

- Annual changes to base episode rate

- Case mix weighting

- MSA-based wage index

- Therapy threshold

12

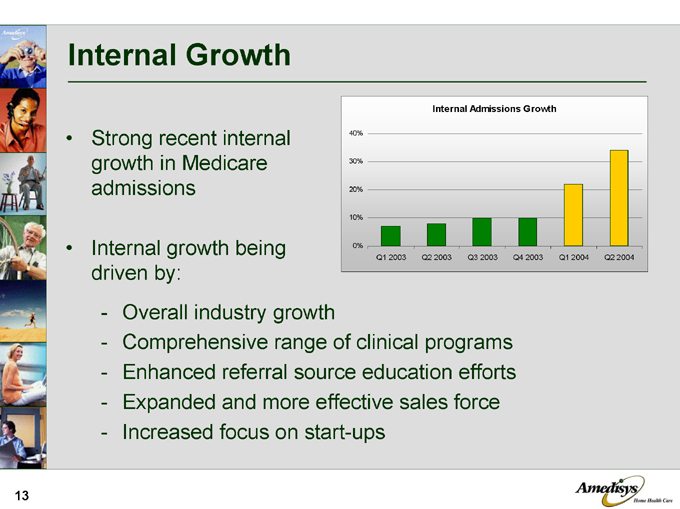

Internal Growth

Strong recent internal growth in Medicare admissions

Internal growth being driven by:

- Overall industry growth

- Comprehensive range of clinical programs

- Enhanced referral source education efforts

- Expanded and more effective sales force

- Increased focus on start-ups

Internal Admissions Growth

40% 30% 20% 10% 0%

Q1 2003 Q2 2003 Q3 2003 Q4 2003 Q1 2004 Q2 2004

13

Acquisition Strategy

Disciplined approach

Acquisition criteria:

- Defined pricing objectives

- Targeted geographic profile

- Compatible payor mix

- Consistent clinical metrics

- Expandable referral base

- Opportunities for internal growth

Target hospital-based and multi-site agencies Five acquisitions over the past twelve months

14

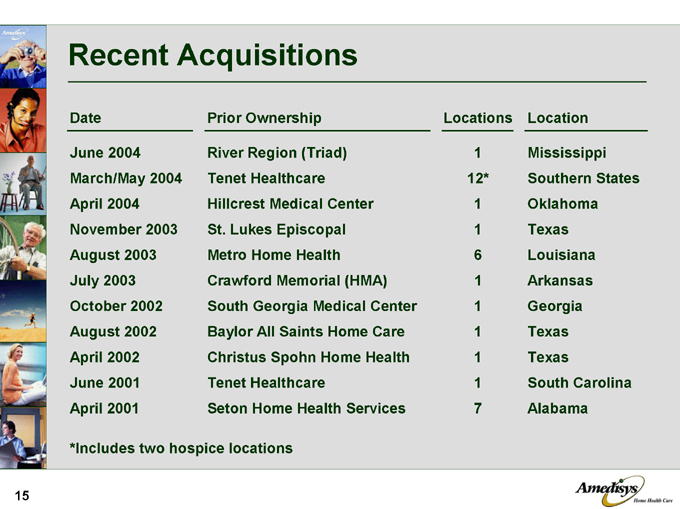

Recent Acquisitions

Date Prior Ownership Locations Location

June 2004 River Region (Triad) 1 Mississippi

March/May 2004 Tenet Healthcare 12* Southern States

April 2004 Hillcrest Medical Center 1 Oklahoma

November 2003 St. Lukes Episcopal 1 Texas

August 2003 Metro Home Health 6 Louisiana

July 2003 Crawford Memorial (HMA) 1 Arkansas

October 2002 South Georgia Medical Center 1 Georgia

August 2002 Baylor All Saints Home Care 1 Texas

April 2002 Christus Spohn Home Health 1 Texas

June 2001 Tenet Healthcare 1 South Carolina

April 2001 Seton Home Health Services 7 Alabama

*Includes two hospice locations

15

Tenet Acquisition

Acquired ten home health agencies and two hospice operations

Paid approximately $19.1 million in cash

$26.7 million in annualized revenue

Operate in Southern states

- Alabama - Georgia - Mississippi - Texas

- Florida - Louisiana - Tennessee Expect agencies to be accretive to EPS

- CY2004 — $0.05 to $0.07 per share

16

Investments in Technology

Realizing strategic advantages from investment in information technology Standardized processes:

- Automatic scheduling

- Scanning, uploading, and automated review of assessment forms

- Web-based HR and payroll system

Centralized management of clinical oversight and utilization:

- Real time episode analysis

- Daily / weekly review of quality indicators

- Executive information system

17

Recent Financial Results

CY2004

CY2003 Q1 Q2 YTD

Net revenue $ 142.5 $ 47.3 $ 56.9 $ 104.2

Year-over-year growth (1) 9.2% 52.1% 76.7% 64.6%

Gross margin 83.9 27.8 33.3 61.1

Percentage of revenue 58.9% 58.7% 58.5% 58.6%

Operating income 14.3 6.9 8.1 15.0

Percentage of revenue 10.1% 14.6% 14.2% 14.4%

EBITDA 17.5 7.9 9.0 16.9

Percentage of revenue 12.3% 16.7% 15.8% 16.2%

Fully-diluted EPS $0.83 $ 0.34 $ 0.39 $0.72

Year-over-year growth (1) 40.7% 183.3% 143.8% 157.1%

$ millions, except per share data

(1) CY2003 growth based on adjusted CY2002 results that exclude nonrecurring and one-time charges

EBITDA is net income before provision for income taxes, interest expense, and depreciation and amortization. EBITDA should not be considered as an alternative to, or more meaningful than, income before income taxes, cash flow from operating activities, or other traditional indicators of operating performance. Rather, EBITDA is presented because it is a widely accepted supplemental financial measure that we believe provides relevant and useful information. Our calculation of EBITDA may not be comparable to a similarly titled measure reported by other companies, since all companies do not calculate this non-GAAP measure in the same manner.

18

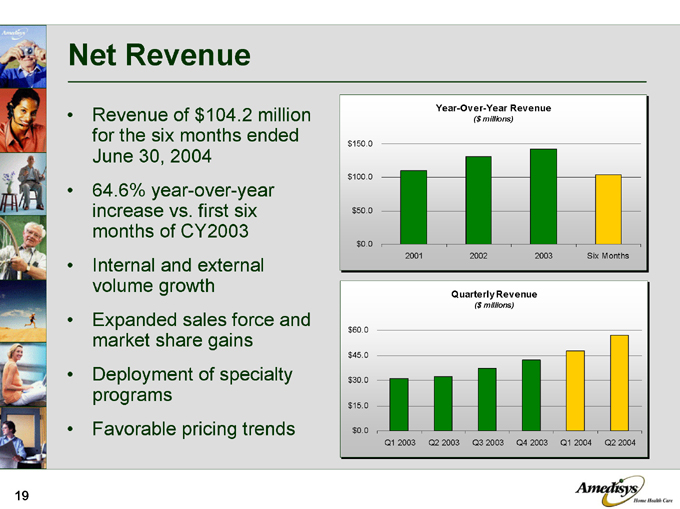

Net Revenue

Revenue of $104.2 million for the six months ended June 30, 2004 64.6% year-over-year increase vs. first six months of CY2003 Internal and external volume growth Expanded sales force and market share gains Deployment of specialty programs Favorable pricing trends

Year-Over-Year Revenue

($ millions)

$150.0 $100.0 $50.0 $0.0

2001 2002 2003 Six Months

Quarterly Revenue

($ millions) $60.0 $45.0 $30.0 $15.0 $0.0

Q1 2003 Q2 2003 Q3 2003 Q4 2003 Q1 2004 Q2 2004

19

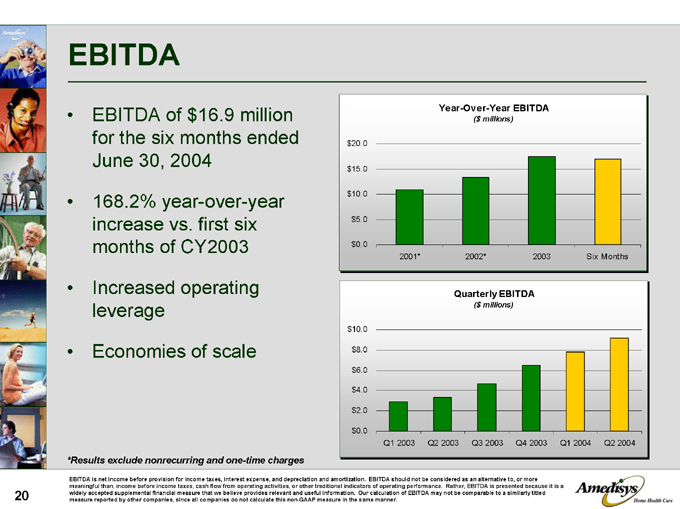

EBITDA

EBITDA of $16.9 million for the six months ended June 30, 2004

168.2% year-over-year increase vs. first six months of CY2003

Increased operating leverage

Economies of scale

Year-Over-Year EBITDA

($ millions) $20.0 $15.0 $10.0 $5.0 $0.0

2001* 2002* 2003 Six Months

Quarterly EBITDA

($ millions) $10.0 $8.0 $6.0 $4.0 $2.0 $0.0

Q1 2003 Q2 2003 Q3 2003 Q4 2003 Q1 2004 Q2 2004

*Results exclude nonrecurring and one-time charges

EBITDA is net income before provision for income taxes, interest expense, and depreciation and amortization. EBITDA should not be considered as an alternative to, or more meaningful than, income before income taxes, cash flow from operating activities, or other traditional indicators of operating performance. Rather, EBITDA is presented because it is a widely accepted supplemental financial measure that we believe provides relevant and useful information. Our calculation of EBITDA may not be comparable to a similarly titled measure reported by other companies, since all companies do not calculate this non-GAAP measure in the same manner.

20

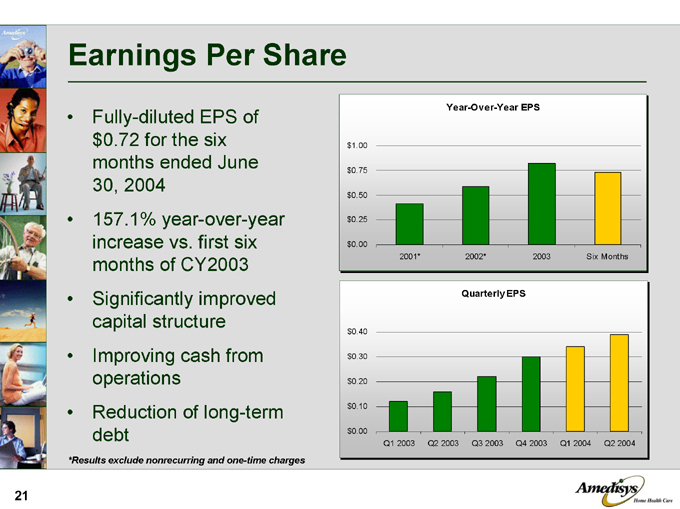

Earnings Per Share

Fully-diluted EPS of $0.72 for the six months ended June 30, 2004 157.1% year-over-year increase vs. first six months of CY2003 Significantly improved capital structure Improving cash from operations Reduction of long-term debt

Year-Over-Year EPS

$1.00 $0.75 $0.50 $0.25 $0.00

2001* 2002* 2003 Six Months

Quarterly EPS

$0.40 $0.30 $0.20 $0.10 $0.00

Q1 2003 Q2 2003 Q3 2003 Q4 2003 Q1 2004 Q2 2004

*Results exclude nonrecurring and one-time charges

21

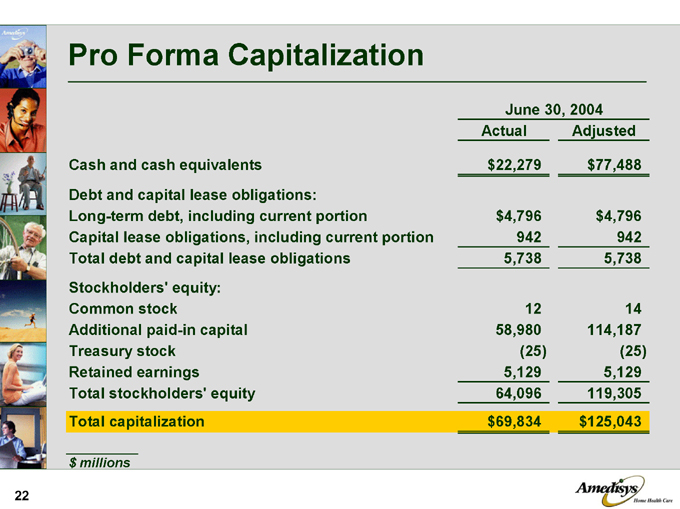

Pro Forma Capitalization

June 30, 2004

Actual Adjusted

Cash and cash equivalents $ 22,279 $ 77,488

Debt and capital lease obligations:

Long-term debt, including current portion $ 4,796 $ 4,796

Capital lease obligations, including current portion 942 942

Total debt and capital lease obligations 5,738 5,738

Stockholders’ equity:

Common stock 12 14

Additional paid-in capital 58,980 114,187

Treasury stock (25) (25)

Retained earnings 5,129 5,129

Total stockholders’ equity 64,096 119,305

Total capitalization $ 69,834 $ 125,043

$ millions

22

Investment Highlights

Large, growing, and fragmented industry Focus on Medicare home nursing Strong internal growth

Demonstrated ability to identify and integrate acquisitions Proven operating model Experienced management team

23