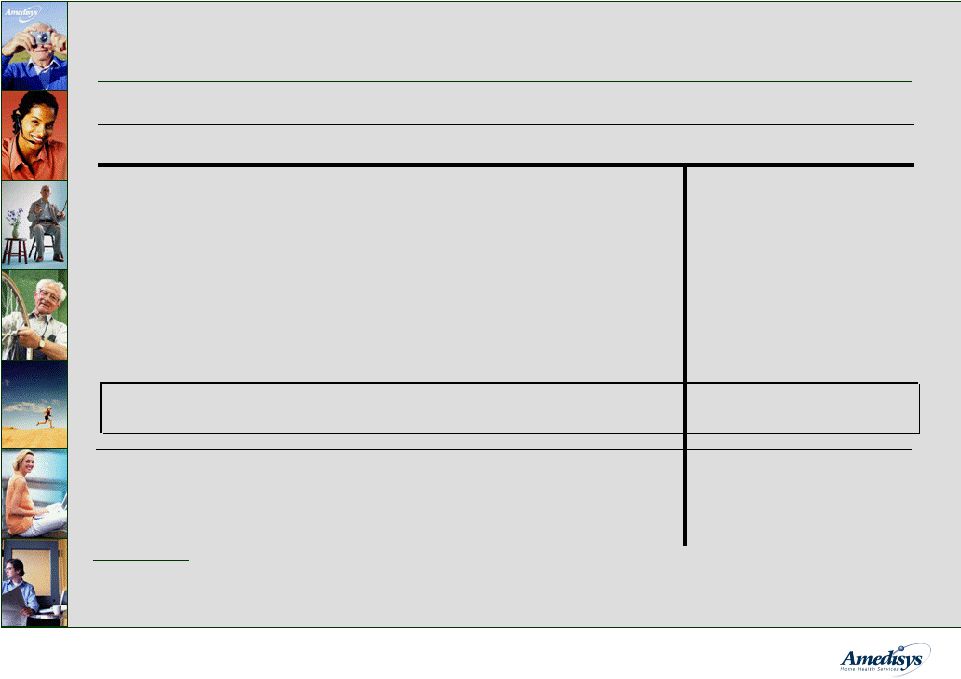

19 EBITDA is defined as net income before provision for income taxes, net interest expense, and depreciation and amortization. EBITDA should not be considered as an alternative to, or more meaningful than, income before income taxes, cash flow from operating activities, or other traditional indicators of operating performance. This calculation of EBITDA may not be comparable to a similarly titled measure reported by other companies, since not all companies calculate this non-GAAP financial measure in the same manner. ($ millions, except per share data) Summary Financial Results 2006 2007 1Q07 Net revenue $541.1 $697.9 $153.6 Period-over-period growth 41.8% 29.0% 20.8% Gross margin¹ 305.7 368.9 82.0 Margin 56.5% 52.9% 53.4% Operating income 65.7 96.6 20.7 Margin 12.1% 13.8% 13.5% EBITDA 75.7 109.8³ 23.6 Margin 14.0% 15.7% 15.4% Fully-diluted EPS $1.75² $0.51 Period-over-period growth 24.1% 32.6% 50.0% 1Q08 $213.1 38.7% 112.3 52.7% 27.8 13.1% 15.2% $0.62 21.6% 32.3 Net Income 65.1 38.3 13.3 16.5 $2.32³ 1)Effective January 1, 2008 we have reclassified certain costs from our general and administrative expenses to our cost of service for the reporting period ended March 31, 2008, as detailed in our 10Q. As of the date of this presentation we have not reclassified 2006 figures. 2) Adjusted to exclude $0.03 charge for write-off of deferred financing fees. 3) Excludes the $4.2 million or $0.16 per diluted share Alliance gain |