Amedisys Strategy 2021 & Beyond Exhibit 99.1

This presentation may include forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current expectations and assumptions about our business that are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those described in this presentation. You should not rely on forward-looking statements as a prediction of future events. Additional information regarding factors that could cause actual results to differ materially from those discussed in any forward-looking statements are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business and clinical operations and control processes, and SEC filings. Forward-looking statements

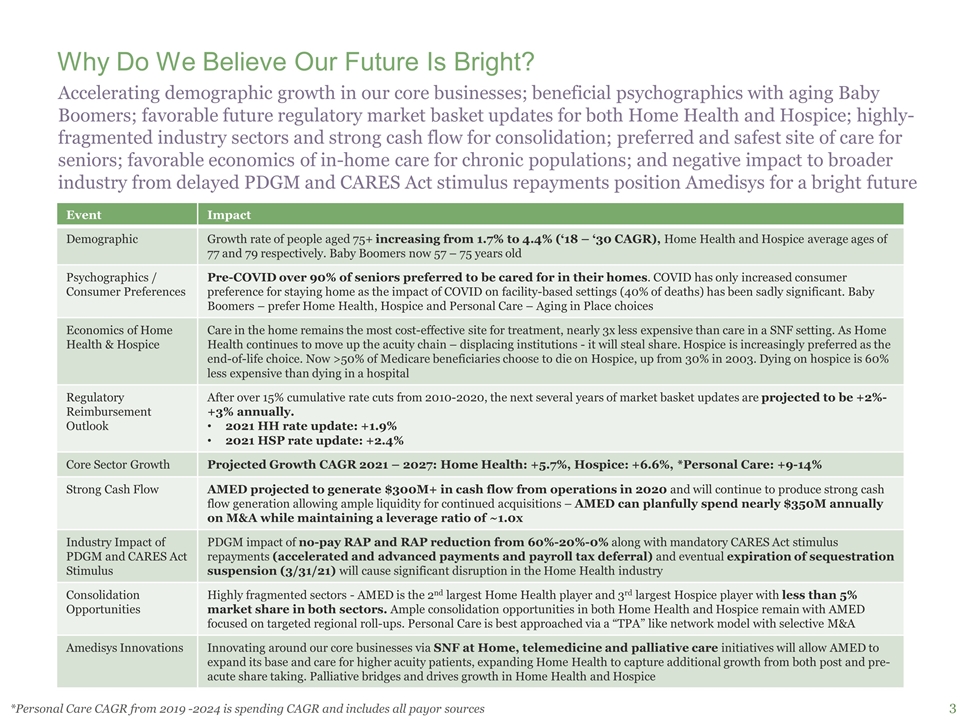

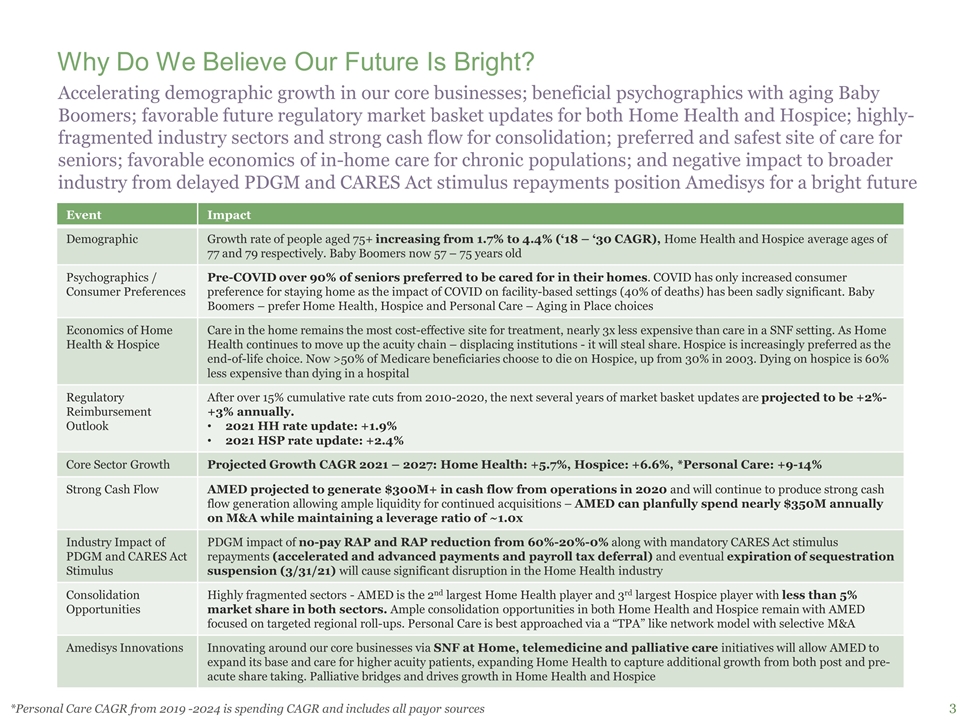

Accelerating demographic growth in our core businesses; beneficial psychographics with aging Baby Boomers; favorable future regulatory market basket updates for both Home Health and Hospice; highly- fragmented industry sectors and strong cash flow for consolidation; preferred and safest site of care for seniors; favorable economics of in-home care for chronic populations; and negative impact to broader industry from delayed PDGM and CARES Act stimulus repayments position Amedisys for a bright future Why Do We Believe Our Future Is Bright? Event Impact Demographic Growth rate of people aged 75+ increasing from 1.7% to 4.4% (‘18 – ‘30 CAGR), Home Health and Hospice average ages of 77 and 79 respectively. Baby Boomers now 57 – 75 years old Psychographics / Consumer Preferences Pre-COVID over 90% of seniors preferred to be cared for in their homes. COVID has only increased consumer preference for staying home as the impact of COVID on facility-based settings (40% of deaths) has been sadly significant. Baby Boomers – prefer Home Health, Hospice and Personal Care – Aging in Place choices Economics of Home Health & Hospice Care in the home remains the most cost-effective site for treatment, nearly 3x less expensive than care in a SNF setting. As Home Health continues to move up the acuity chain – displacing institutions - it will steal share. Hospice is increasingly preferred as the end-of-life choice. Now >50% of Medicare beneficiaries choose to die on Hospice, up from 30% in 2003. Dying on hospice is 60% less expensive than dying in a hospital Regulatory Reimbursement Outlook After over 15% cumulative rate cuts from 2010-2020, the next several years of market basket updates are projected to be +2%-+3% annually. 2021 HH rate update: +1.9% 2021 HSP rate update: +2.4% Core Sector Growth Projected Growth CAGR 2021 – 2027: Home Health: +5.7%, Hospice: +6.6%, *Personal Care: +9-14% Strong Cash Flow AMED projected to generate $300M+ in cash flow from operations in 2020 and will continue to produce strong cash flow generation allowing ample liquidity for continued acquisitions – AMED can planfully spend nearly $350M annually on M&A while maintaining a leverage ratio of ~1.0x Industry Impact of PDGM and CARES Act Stimulus PDGM impact of no-pay RAP and RAP reduction from 60%-20%-0% along with mandatory CARES Act stimulus repayments (accelerated and advanced payments and payroll tax deferral) and eventual expiration of sequestration suspension (3/31/21) will cause significant disruption in the Home Health industry Consolidation Opportunities Highly fragmented sectors - AMED is the 2nd largest Home Health player and 3rd largest Hospice player with less than 5% market share in both sectors. Ample consolidation opportunities in both Home Health and Hospice remain with AMED focused on targeted regional roll-ups. Personal Care is best approached via a “TPA” like network model with selective M&A Amedisys Innovations Innovating around our core businesses via SNF at Home, telemedicine and palliative care initiatives will allow AMED to expand its base and care for higher acuity patients, expanding Home Health to capture additional growth from both post and pre-acute share taking. Palliative bridges and drives growth in Home Health and Hospice *Personal Care CAGR from 2019 -2024 is spending CAGR and includes all payor sources

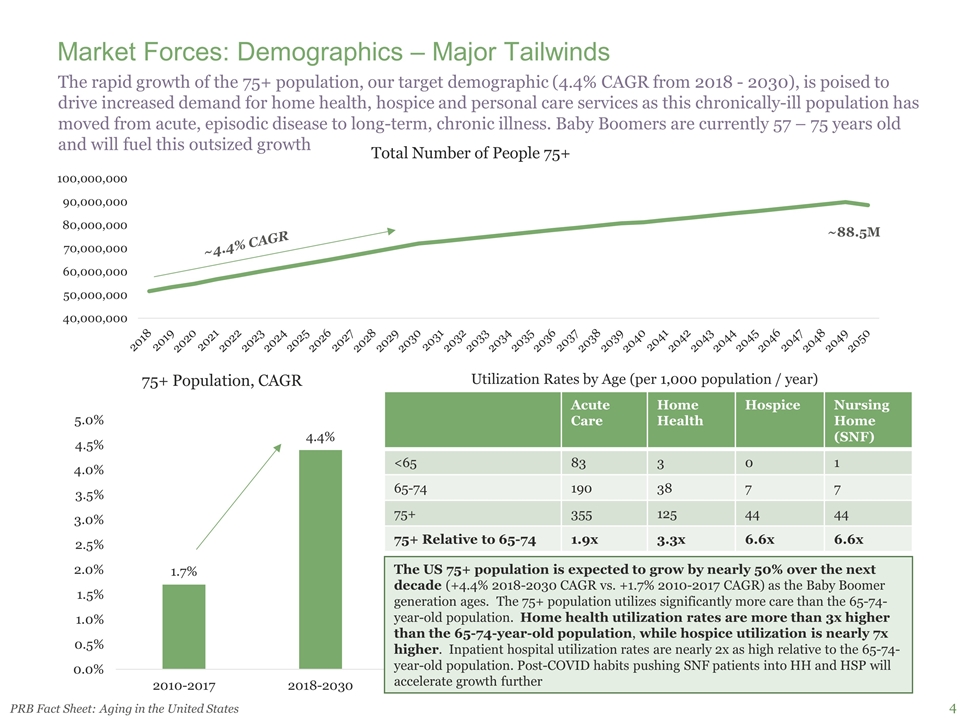

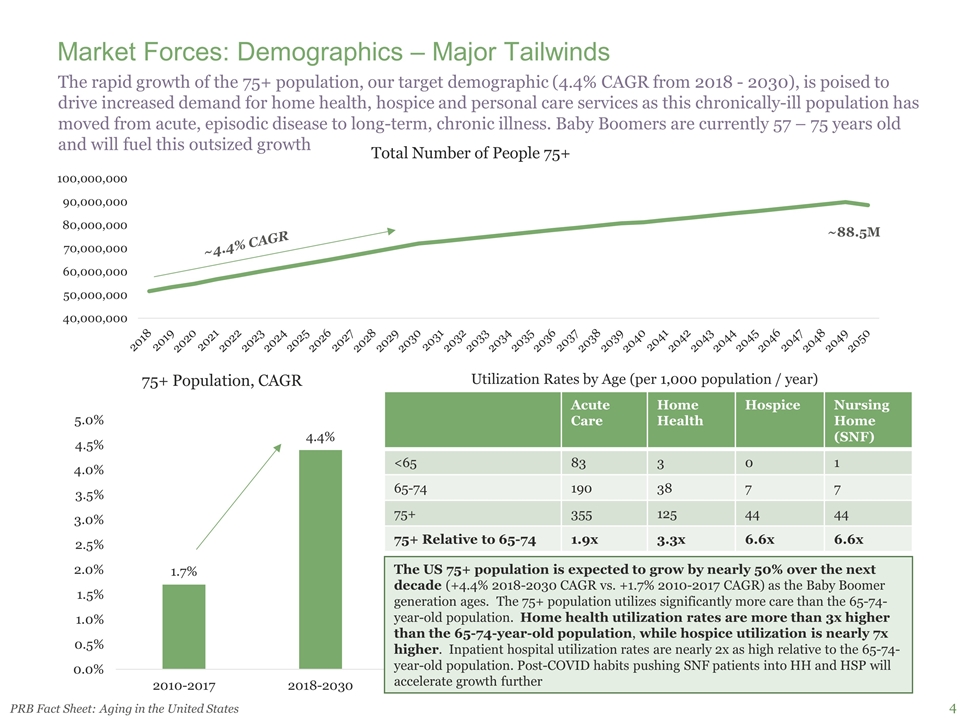

The rapid growth of the 75+ population, our target demographic (4.4% CAGR from 2018 - 2030), is poised to drive increased demand for home health, hospice and personal care services as this chronically-ill population has moved from acute, episodic disease to long-term, chronic illness. Baby Boomers are currently 57 – 75 years old and will fuel this outsized growth Market Forces: Demographics – Major Tailwinds The US 75+ population is expected to grow by nearly 50% over the next decade (+4.4% 2018-2030 CAGR vs. +1.7% 2010-2017 CAGR) as the Baby Boomer generation ages. The 75+ population utilizes significantly more care than the 65-74-year-old population. Home health utilization rates are more than 3x higher than the 65-74-year-old population, while hospice utilization is nearly 7x higher. Inpatient hospital utilization rates are nearly 2x as high relative to the 65-74-year-old population. Post-COVID habits pushing SNF patients into HH and HSP will accelerate growth further Acute Care Home Health Hospice Nursing Home (SNF) <65 83 3 0 1 65-74 190 38 7 7 75+ 355 125 44 44 75+ Relative to 65-74 1.9x 3.3x 6.6x 6.6x Utilization Rates by Age (per 1,000 population / year) ~4.4% CAGR ~88.5M PRB Fact Sheet: Aging in the United States

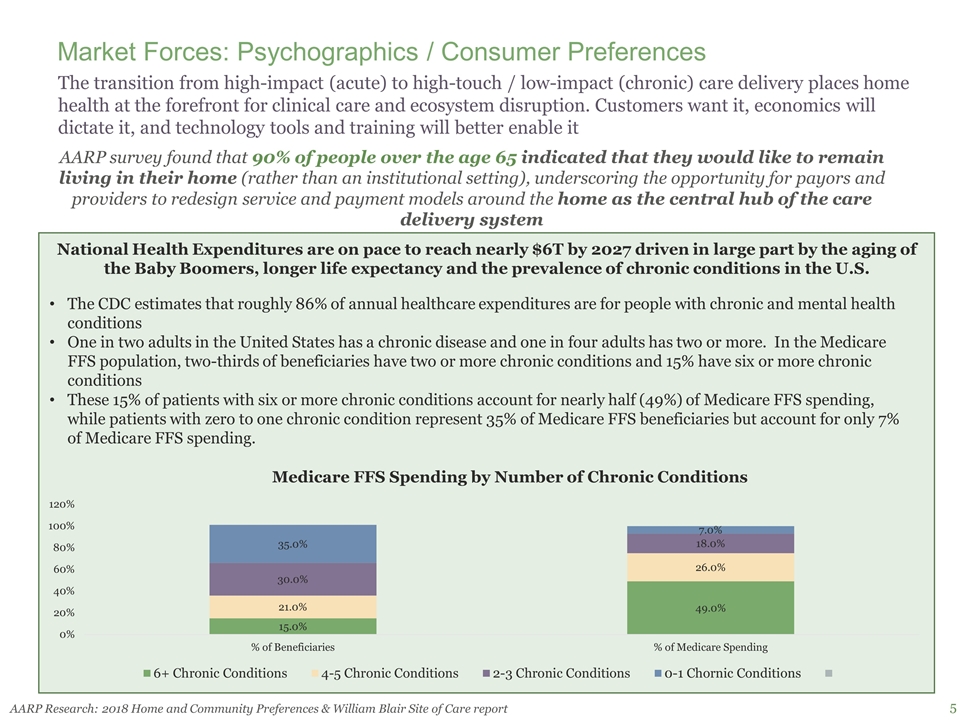

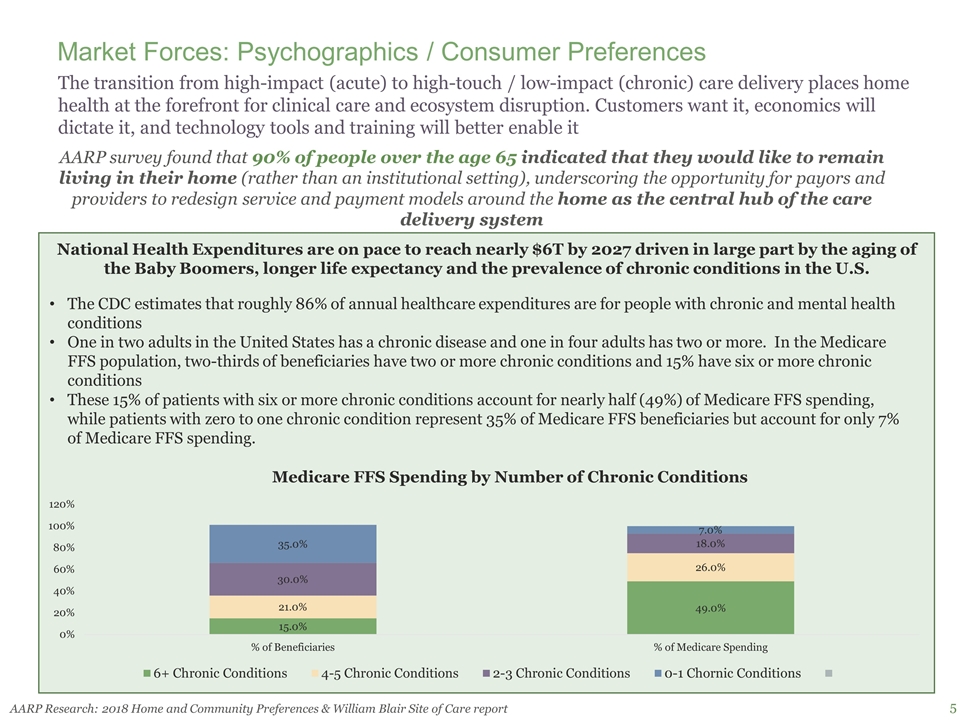

The transition from high-impact (acute) to high-touch / low-impact (chronic) care delivery places home health at the forefront for clinical care and ecosystem disruption. Customers want it, economics will dictate it, and technology tools and training will better enable it Market Forces: Psychographics / Consumer Preferences AARP survey found that 90% of people over the age 65 indicated that they would like to remain living in their home (rather than an institutional setting), underscoring the opportunity for payors and providers to redesign service and payment models around the home as the central hub of the care delivery system National Health Expenditures are on pace to reach nearly $6T by 2027 driven in large part by the aging of the Baby Boomers, longer life expectancy and the prevalence of chronic conditions in the U.S. The CDC estimates that roughly 86% of annual healthcare expenditures are for people with chronic and mental health conditions One in two adults in the United States has a chronic disease and one in four adults has two or more. In the Medicare FFS population, two-thirds of beneficiaries have two or more chronic conditions and 15% have six or more chronic conditions These 15% of patients with six or more chronic conditions account for nearly half (49%) of Medicare FFS spending, while patients with zero to one chronic condition represent 35% of Medicare FFS beneficiaries but account for only 7% of Medicare FFS spending. AARP Research: 2018 Home and Community Preferences & William Blair Site of Care report

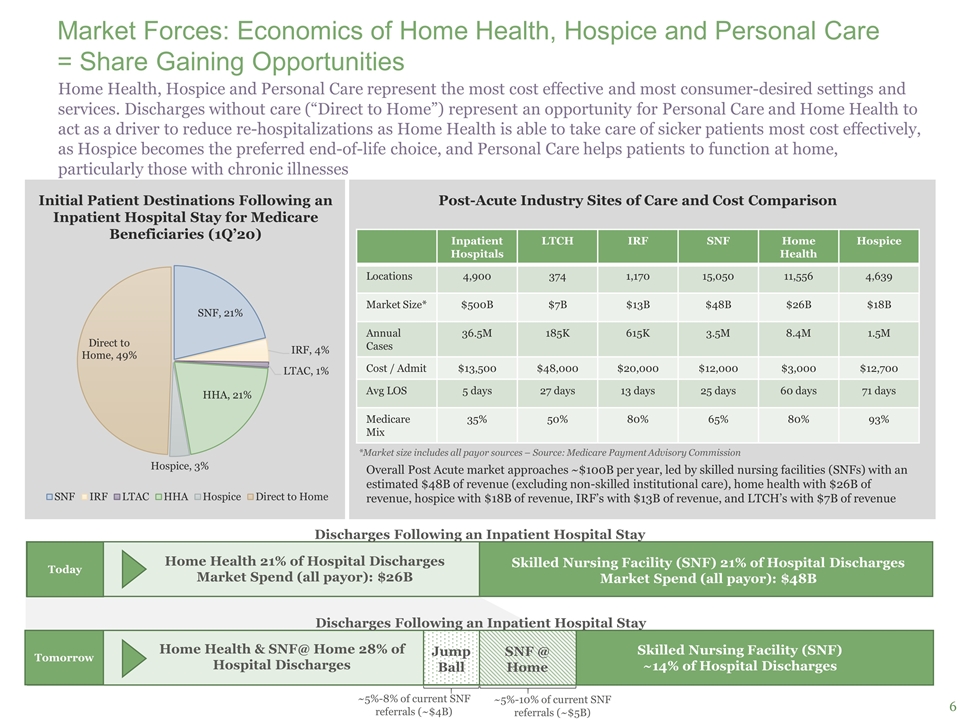

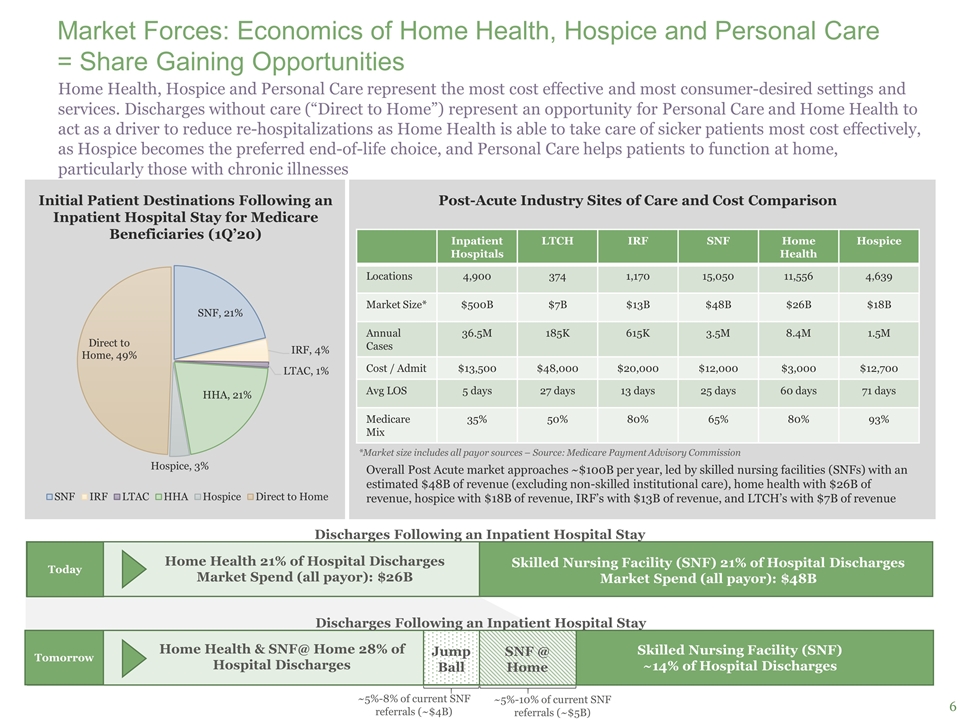

Home Health, Hospice and Personal Care represent the most cost effective and most consumer-desired settings and services. Discharges without care (“Direct to Home”) represent an opportunity for Personal Care and Home Health to act as a driver to reduce re-hospitalizations as Home Health is able to take care of sicker patients most cost effectively, as Hospice becomes the preferred end-of-life choice, and Personal Care helps patients to function at home, particularly those with chronic illnesses Market Forces: Economics of Home Health, Hospice and Personal Care = Share Gaining Opportunities Initial Patient Destinations Following an Inpatient Hospital Stay for Medicare Beneficiaries (1Q’20) Inpatient Hospitals LTCH IRF SNF Home Health Hospice Locations 4,900 374 1,170 15,050 11,556 4,639 Market Size* $500B $7B $13B $48B $26B $18B Annual Cases 36.5M 185K 615K 3.5M 8.4M 1.5M Cost / Admit $13,500 $48,000 $20,000 $12,000 $3,000 $12,700 Avg LOS 5 days 27 days 13 days 25 days 60 days 71 days Medicare Mix 35% 50% 80% 65% 80% 93% Post-Acute Industry Sites of Care and Cost Comparison Overall Post Acute market approaches ~$100B per year, led by skilled nursing facilities (SNFs) with an estimated $48B of revenue (excluding non-skilled institutional care), home health with $26B of revenue, hospice with $18B of revenue, IRF’s with $13B of revenue, and LTCH’s with $7B of revenue *Market size includes all payor sources – Source: Medicare Payment Advisory Commission Home Health 21% of Hospital Discharges Market Spend (all payor): $26B Skilled Nursing Facility (SNF) 21% of Hospital Discharges Market Spend (all payor): $48B Discharges Following an Inpatient Hospital Stay Home Health & SNF@ Home 28% of Hospital Discharges Skilled Nursing Facility (SNF) ~14% of Hospital Discharges Discharges Following an Inpatient Hospital Stay SNF @ Home ~5%-10% of current SNF referrals (~$5B) ~5%-8% of current SNF referrals (~$4B) Jump Ball Today Tomorrow

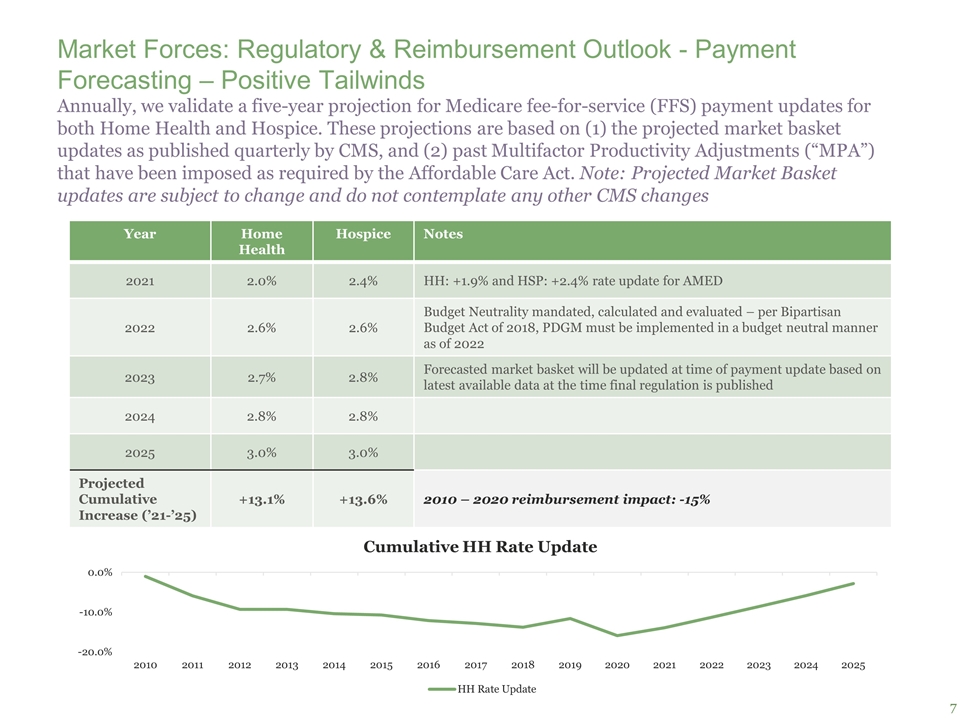

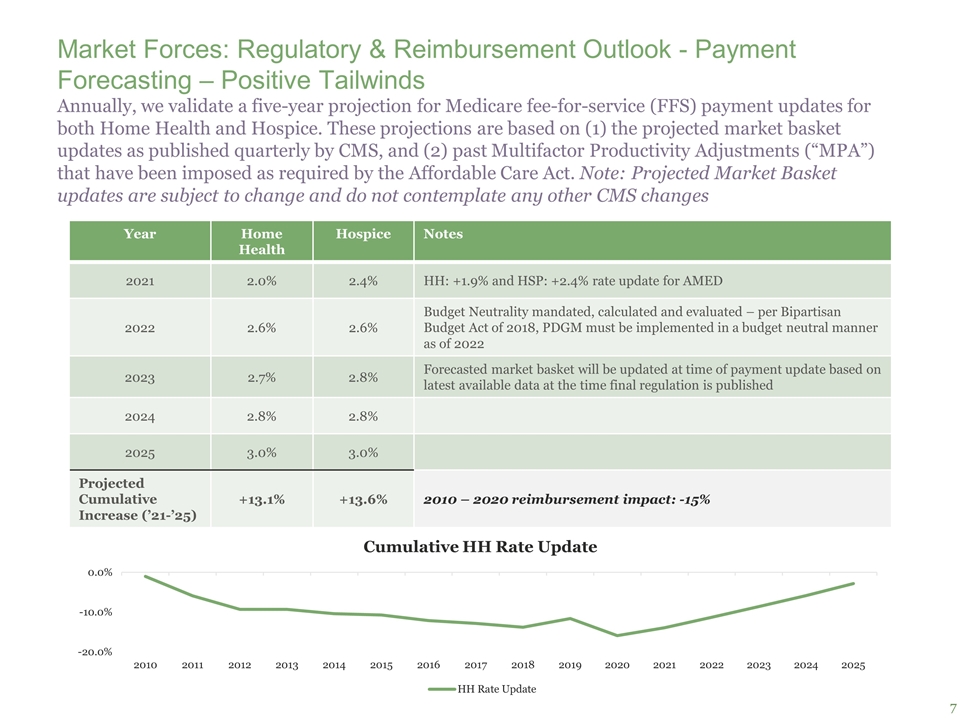

Annually, we validate a five-year projection for Medicare fee-for-service (FFS) payment updates for both Home Health and Hospice. These projections are based on (1) the projected market basket updates as published quarterly by CMS, and (2) past Multifactor Productivity Adjustments (“MPA”) that have been imposed as required by the Affordable Care Act. Note: Projected Market Basket updates are subject to change and do not contemplate any other CMS changes Market Forces: Regulatory & Reimbursement Outlook - Payment Forecasting – Positive Tailwinds Year Home Health Hospice Notes 2021 2.0% 2.4% HH: +1.9% and HSP: +2.4% rate update for AMED 2022 2.6% 2.6% Budget Neutrality mandated, calculated and evaluated – per Bipartisan Budget Act of 2018, PDGM must be implemented in a budget neutral manner as of 2022 2023 2.7% 2.8% Forecasted market basket will be updated at time of payment update based on latest available data at the time final regulation is published 2024 2.8% 2.8% 2025 3.0% 3.0% Projected Cumulative Increase (’21-’25) +13.1% +13.6% 2010 – 2020 reimbursement impact: -15%

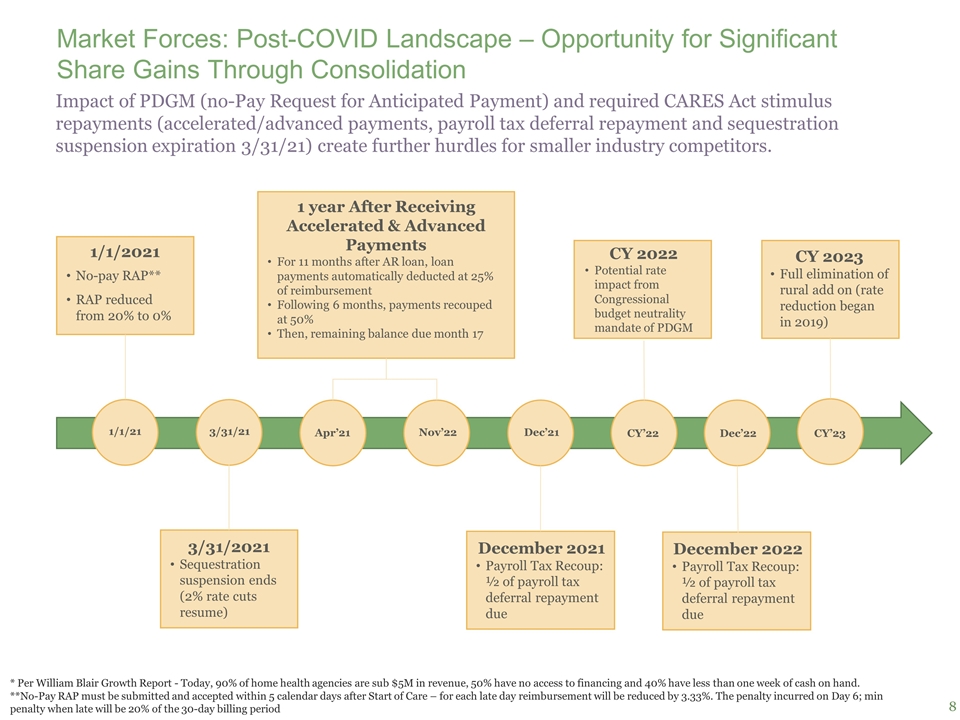

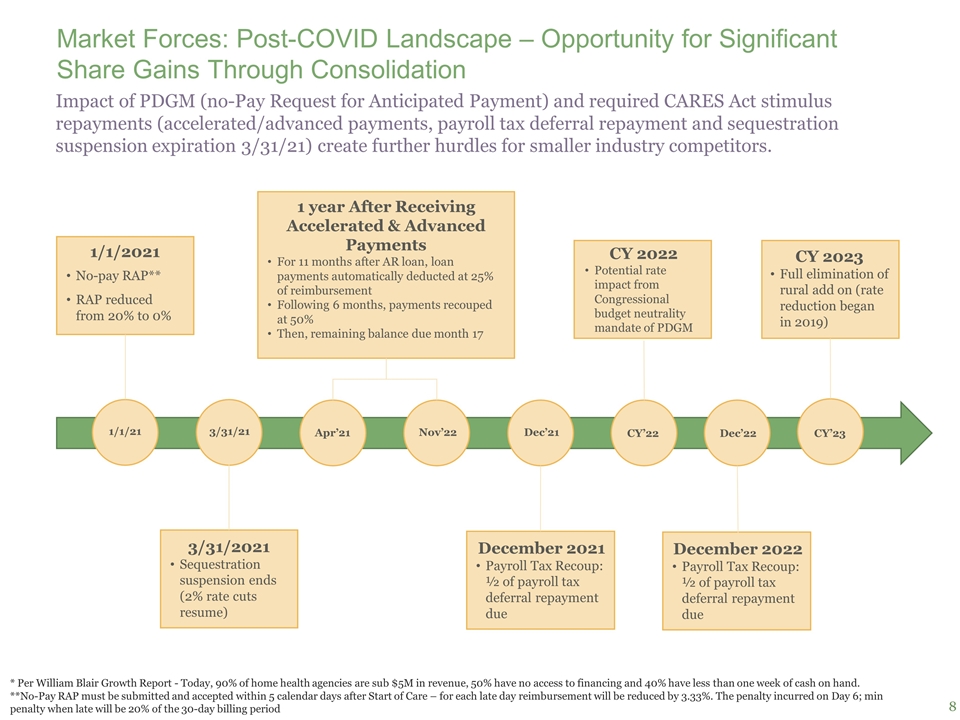

Impact of PDGM (no-Pay Request for Anticipated Payment) and required CARES Act stimulus repayments (accelerated/advanced payments, payroll tax deferral repayment and sequestration suspension expiration 3/31/21) create further hurdles for smaller industry competitors. Market Forces: Post-COVID Landscape – Opportunity for Significant Share Gains Through Consolidation 1/1/2021 No-pay RAP** RAP reduced from 20% to 0% 3/31/2021 Sequestration suspension ends (2% rate cuts resume) 1 year After Receiving Accelerated & Advanced Payments For 11 months after AR loan, loan payments automatically deducted at 25% of reimbursement Following 6 months, payments recouped at 50% Then, remaining balance due month 17 December 2021 Payroll Tax Recoup: ½ of payroll tax deferral repayment due CY 2022 Potential rate impact from Congressional budget neutrality mandate of PDGM CY 2023 Full elimination of rural add on (rate reduction began in 2019) 1/1/21 3/31/21 Nov’22 CY’22 Dec’22 CY’23 * Per William Blair Growth Report - Today, 90% of home health agencies are sub $5M in revenue, 50% have no access to financing and 40% have less than one week of cash on hand. **No-Pay RAP must be submitted and accepted within 5 calendar days after Start of Care – for each late day reimbursement will be reduced by 3.33%. The penalty incurred on Day 6; min penalty when late will be 20% of the 30-day billing period Apr’21 Dec’21 December 2022 Payroll Tax Recoup: ½ of payroll tax deferral repayment due

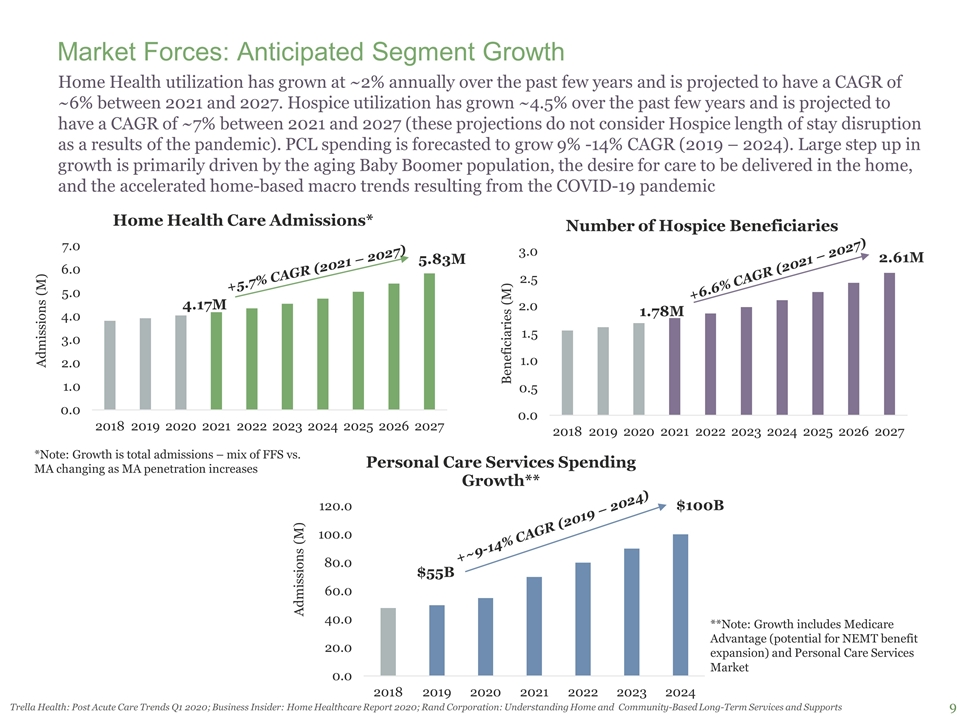

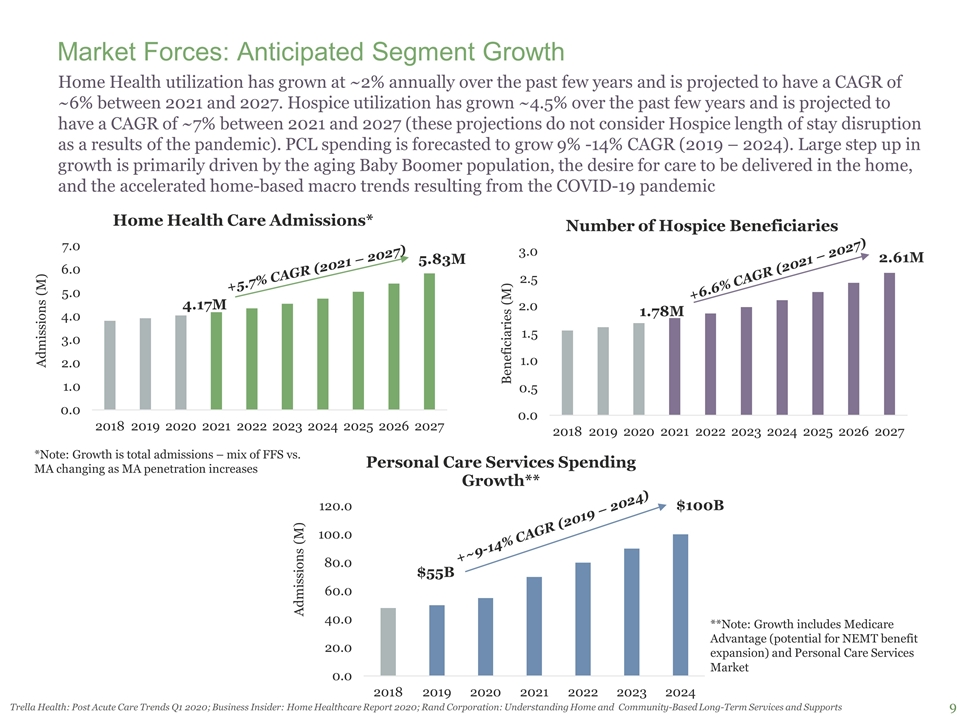

Home Health utilization has grown at ~2% annually over the past few years and is projected to have a CAGR of ~6% between 2021 and 2027. Hospice utilization has grown ~4.5% over the past few years and is projected to have a CAGR of ~7% between 2021 and 2027 (these projections do not consider Hospice length of stay disruption as a results of the pandemic). PCL spending is forecasted to grow 9% -14% CAGR (2019 – 2024). Large step up in growth is primarily driven by the aging Baby Boomer population, the desire for care to be delivered in the home, and the accelerated home-based macro trends resulting from the COVID-19 pandemic Market Forces: Anticipated Segment Growth 4.17M 5.83M +5.7% CAGR (2021 – 2027) 1.78M 2.61M +6.6% CAGR (2021 – 2027) *Note: Growth is total admissions – mix of FFS vs. MA changing as MA penetration increases $55B $100B +~9-14% CAGR (2019 – 2024) **Note: Growth includes Medicare Advantage (potential for NEMT benefit expansion) and Personal Care Services Market Trella Health: Post Acute Care Trends Q1 2020; Business Insider: Home Healthcare Report 2020; Rand Corporation: Understanding Home and Community-Based Long-Term Services and Supports

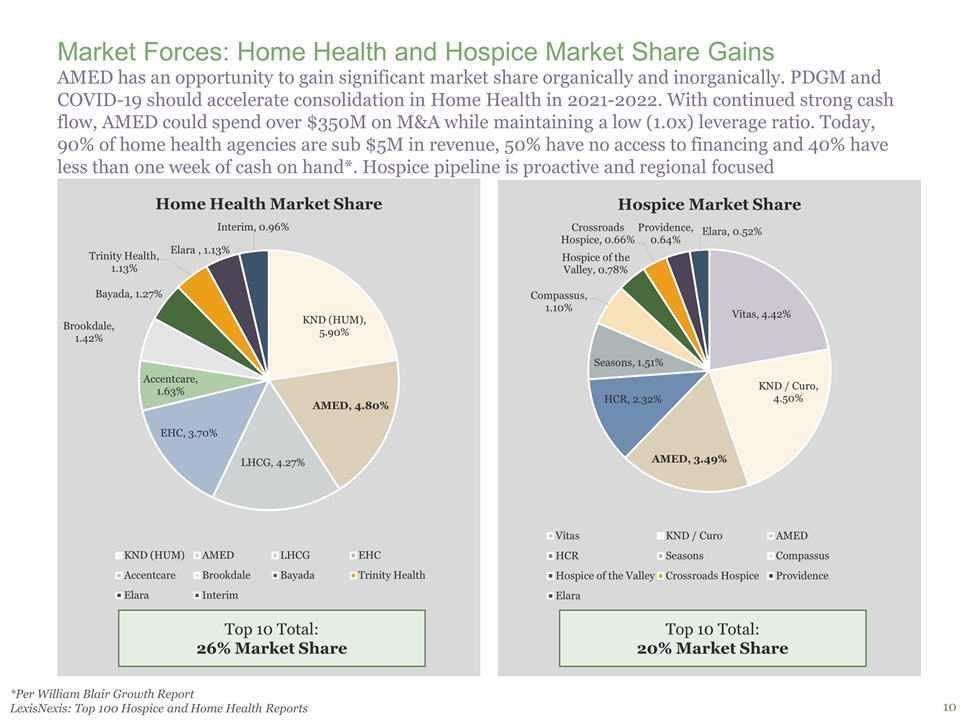

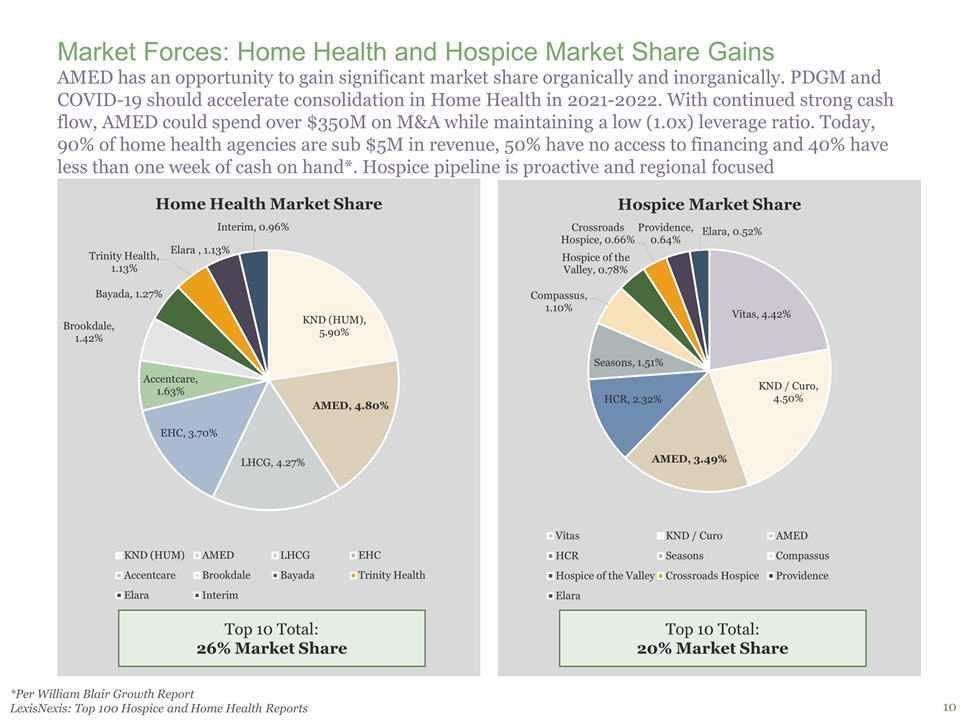

AMED has an opportunity to gain significant market share organically and inorganically. PDGM and COVID-19 should accelerate consolidation in Home Health in 2021-2022. With continued strong cash flow, AMED could spend over $350M on M&A while maintaining a low (1.0x) leverage ratio. Today, 90% of home health agencies are sub $5M in revenue, 50% have no access to financing and 40% have less than one week of cash on hand*. Hospice pipeline is proactive and regional focused Market Forces: Home Health and Hospice Market Share Gains Top 10 Total: 26% Market Share Top 10 Total: 20% Market Share *Per William Blair Growth Report LexisNexis: Top 100 Hospice and Home Health Reports

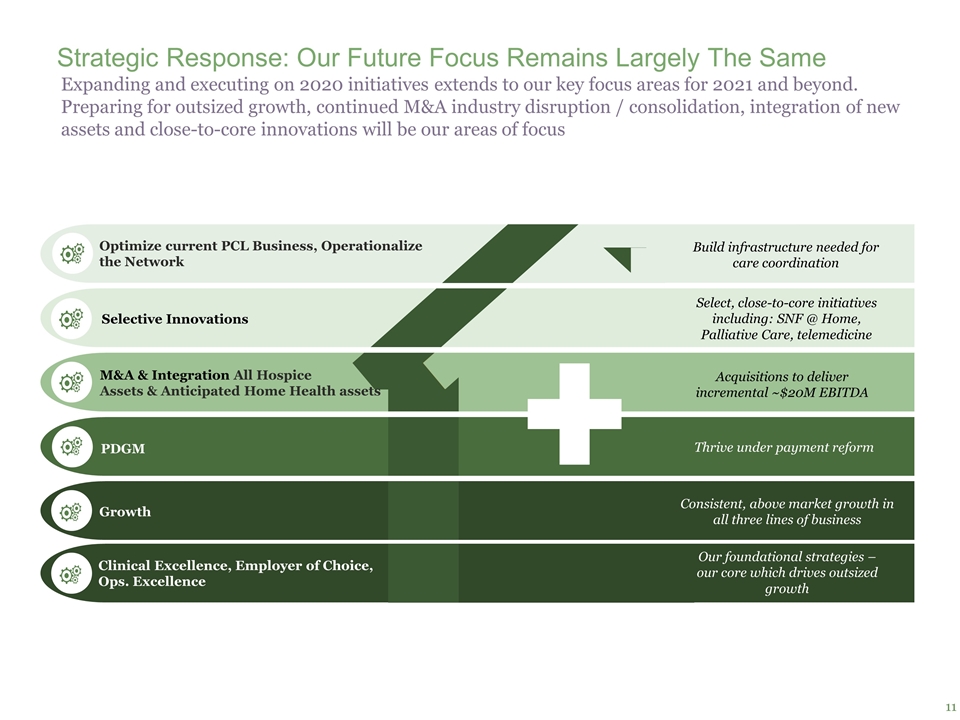

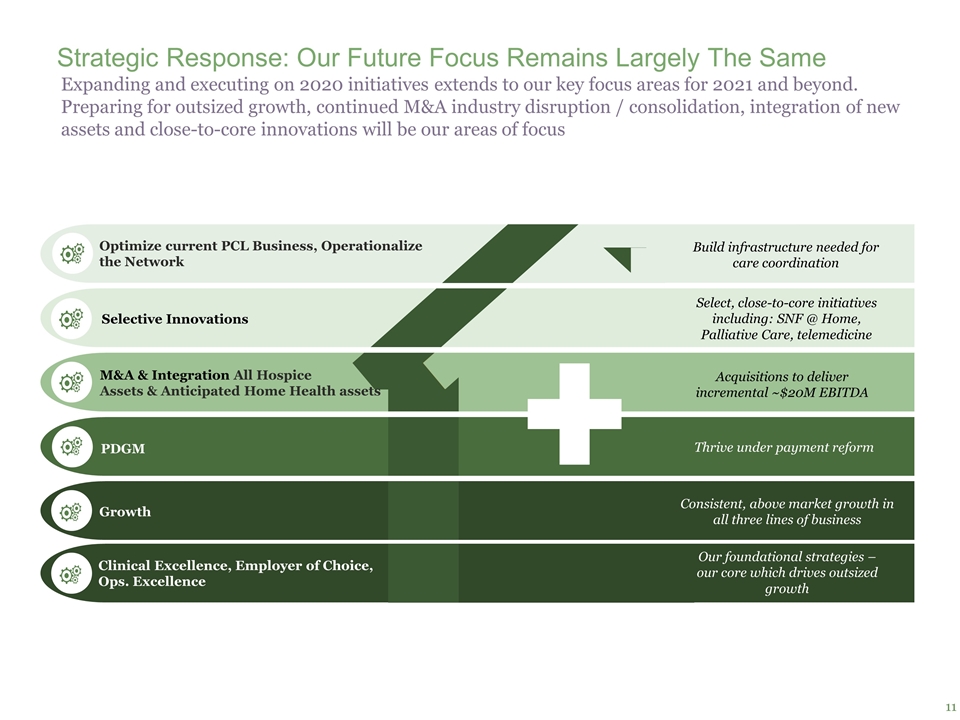

Expanding and executing on 2020 initiatives extends to our key focus areas for 2021 and beyond. Preparing for outsized growth, continued M&A industry disruption / consolidation, integration of new assets and close-to-core innovations will be our areas of focus Optimize current PCL Business, Operationalize the Network M&A & Integration All Hospice Assets & Anticipated Home Health assets PDGM Growth Acquisitions to deliver incremental ~$20M EBITDA Build infrastructure needed for care coordination Thrive under payment reform Consistent, above market growth in all three lines of business Strategic Response: Our Future Focus Remains Largely The Same Clinical Excellence, Employer of Choice, Ops. Excellence Our foundational strategies – our core which drives outsized growth Selective Innovations Select, close-to-core initiatives including: SNF @ Home, Palliative Care, telemedicine

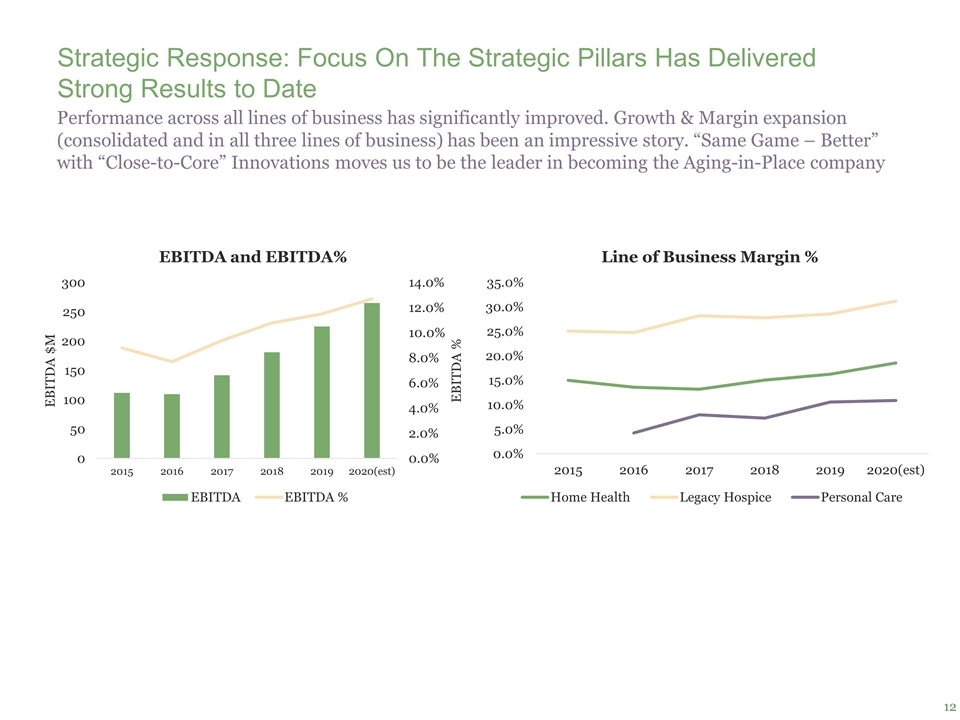

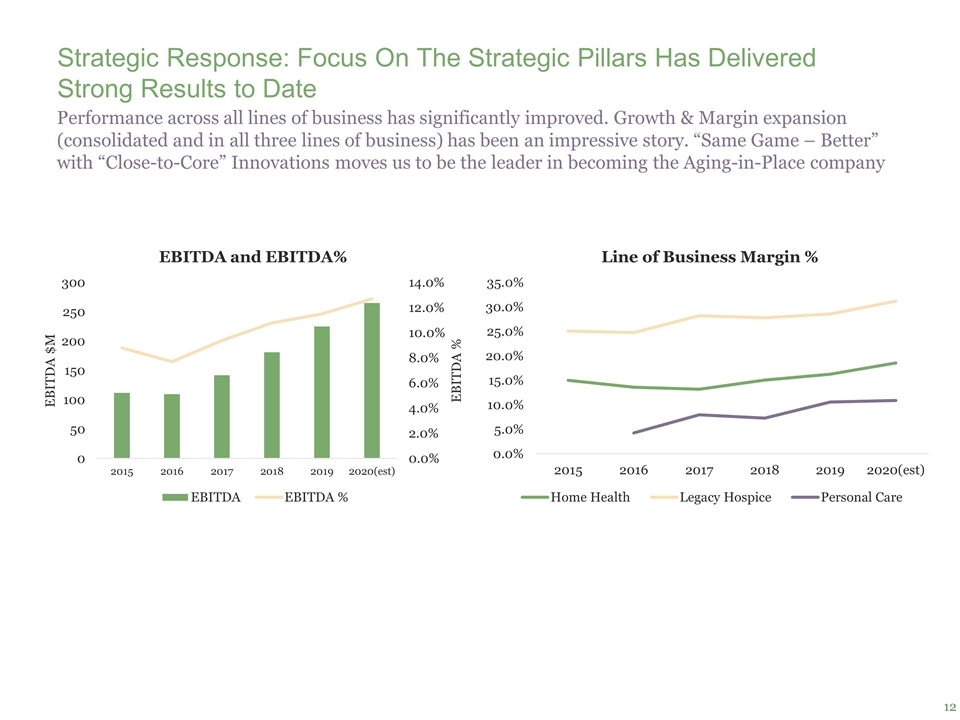

Strategic Response: Focus On The Strategic Pillars Has Delivered Strong Results to Date Performance across all lines of business has significantly improved. Growth & Margin expansion (consolidated and in all three lines of business) has been an impressive story. “Same Game – Better” with “Close-to-Core” Innovations moves us to be the leader in becoming the Aging-in-Place company

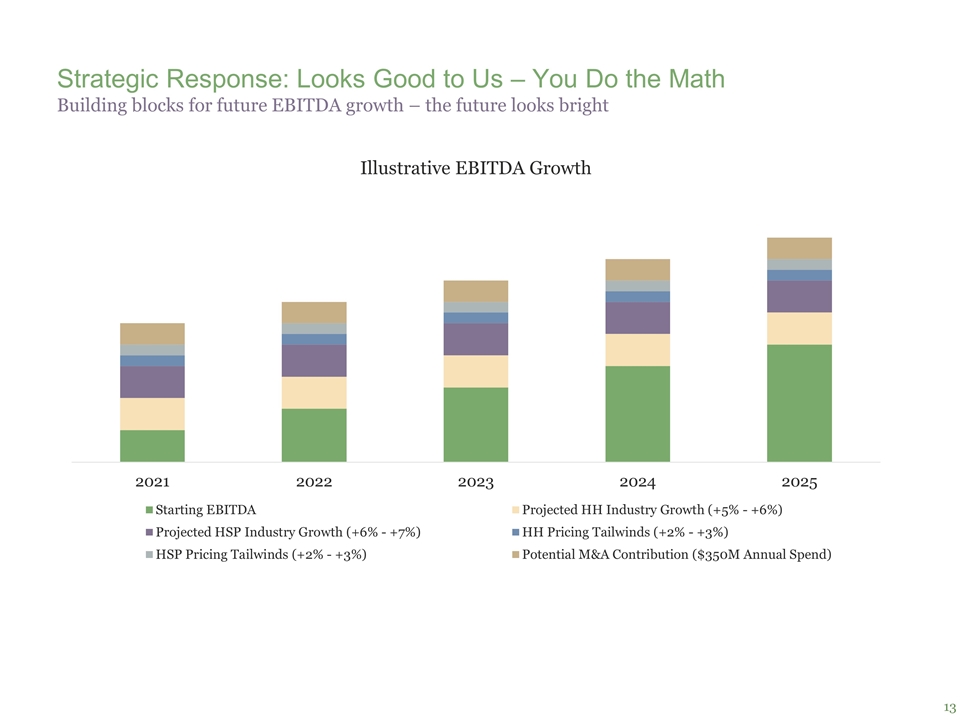

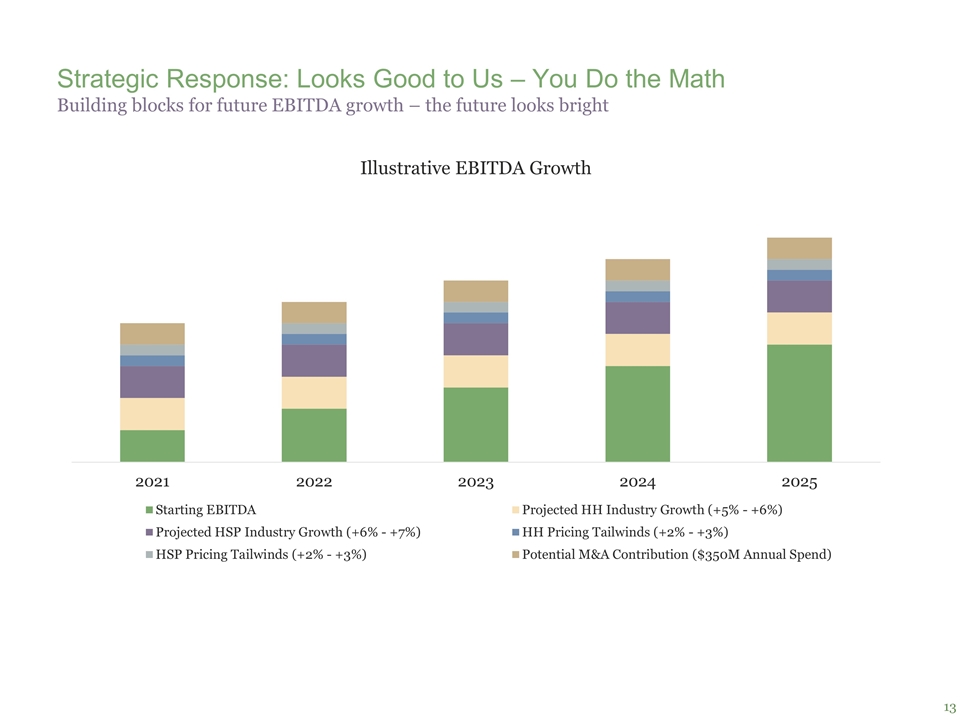

Strategic Response: Looks Good to Us – You Do the Math Building blocks for future EBITDA growth – the future looks bright

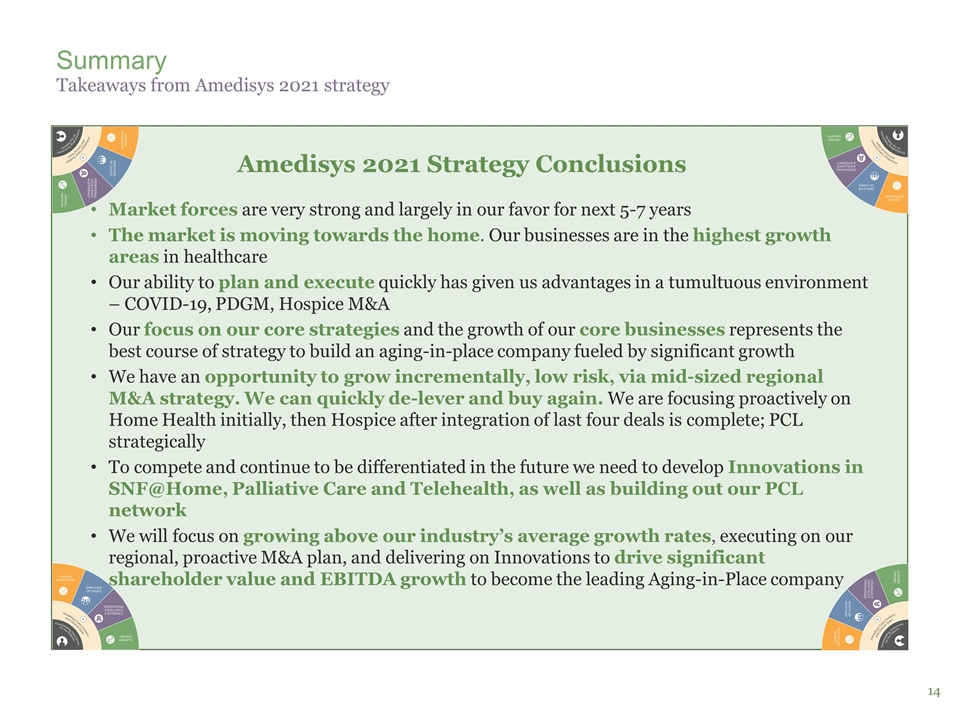

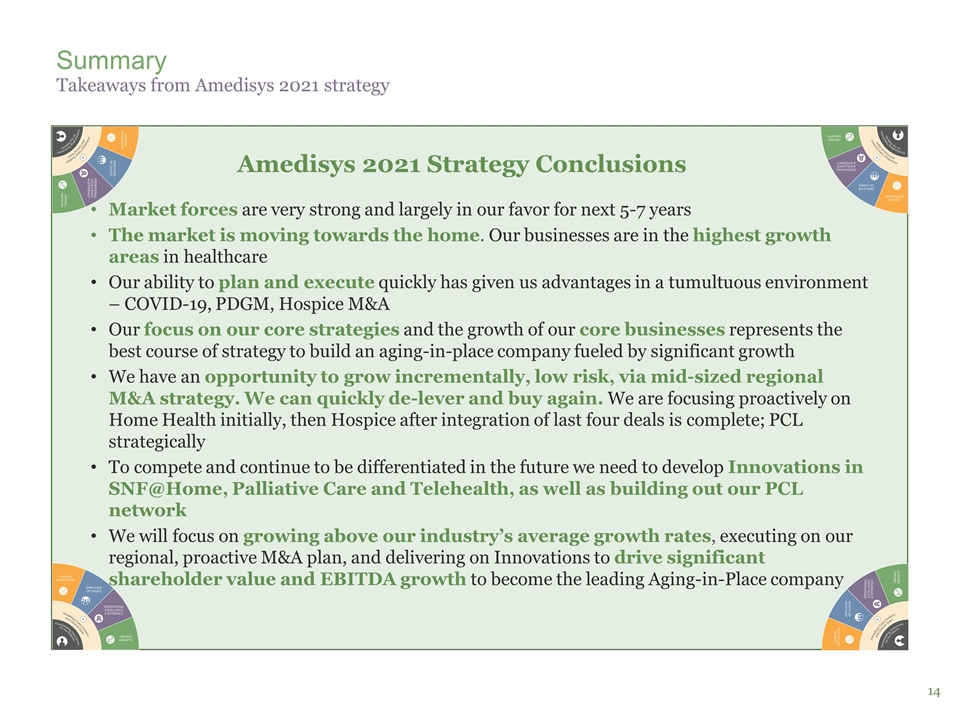

Summary Takeaways from Amedisys 2021 strategy Market forces are very strong and largely in our favor for next 5-7 years The market is moving towards the home. Our businesses are in the highest growth areas in healthcare Our ability to plan and execute quickly has given us advantages in a tumultuous environment – COVID-19, PDGM, Hospice M&A Our focus on our core strategies and the growth of our core businesses represents the best course of strategy to build an aging-in-place company fueled by significant growth We have an opportunity to grow incrementally, low risk, via mid-sized regional M&A strategy. We can quickly de-lever and buy again. We are focusing proactively on Home Health initially, then Hospice after integration of last four deals is complete; PCL strategically To compete and continue to be differentiated in the future we need to develop Innovations in SNF@Home, Palliative Care and Telehealth, as well as building out our PCL network We will focus on growing above our industry’s average growth rates, executing on our regional, proactive M&A plan, and delivering on Innovations to drive significant shareholder value and EBITDA growth to become the leading Aging-in-Place company Amedisys 2021 Strategy Conclusions

Citations Demographic Info: https://www.prb.org/aging-unitedstates-fact-sheet/ https://www.aarp.org/research/topics/community/info-2018/2018-home-community-preference.html#:~:text=While%2076%25%20of%20Americans%20age,within%20their%20community%20(13%25). Home Health Industry Info: https://www.healthaffairs.org/doi/abs/10.1377/hlthaff.2019.01451 https://www.trellahealth.com/portfolio_page/blog-post-acute-care-trends-q1-2020-trends-home-health-skilled-nursing-hospice-utilization-admission/ https://www.businessinsider.com/us-home-healthcare-market http://www.medpac.gov/docs/default-source/reports/mar20_medpac_ch9_sec.pdf https://aspe.hhs.gov/pdf-report/patterns-care-and-home-health-utilization-community-admitted-medicare-patients Hospice Industry Info: https://www.cms.gov/newsroom/fact-sheets/fiscal-year-2020-hospice-payment-rate-update-final-rule https://hospicenews.com/2020-hspn-outlook-survey/ http://www.medpac.gov/docs/default-source/reports/mar20_medpac_ch12_sec.pdf https://risk.lexisnexis.com/insights-resources/research/top-100-hospice-and-home-health Personal Care Industry Info: https://www.macpac.gov/subtopic/home-and-community-based-services/ https://www.rand.org/content/dam/rand/pubs/rgs_dissertations/RGSD400/RGSD426/RAND_RGSD426.pdf Medicare Advantage Info: https://atiadvisory.com/wp-content/uploads/2020/10/ATI-Advisory-Chart-Book_Medicare-Advantage-2021-New-Primarily-Health-Related-Benefits-1.pdf