Amedisys William Blair Growth Stock Conference Monday June 6th, 2022 Exhibit 99.1

Introduction: Chris Gerard, President and CEO Chris Gerard is President & Chief Executive Officer of Amedisys (AMED), a publicly traded, leading provider of home health, hospice, palliative, personal care and high-acuity care services with approximately 21,000 employees in 38 states and the District of Columbia, making over 11.5 million patient visits per year. Mr. Gerard has a track record of more than 20 years’ experience in home health and hospice. He was co-founder, President and Chief Executive Officer of IntegraCare Home Health, where he built a single home health start-up location into 54 branches, generating $71 million in annual revenues. He sold the company to Kindred Healthcare in 2012. He then served as Vice President of South-Central Region for the Kindred at Home division, currently a $2.5 billion home health, hospice and community care services business with approximately 700 locations and 42,000 employees nationwide. Mr. Gerard was promoted to Chief Operating Officer at Kindred at Home, where he was responsible for integrating a $140 million home health company and standardizing processes across a division involving 187 locations, a staff of 3,300 and revenue of $360 million. He served as President for the South-Central Region of Kindred at Home with responsibility for day-to-day operations, including the integration of the Gentiva Home Health acquisition within his region, oversight of clinical excellence, financial performance and operational efficiencies for 153 home health and hospice locations in six states with annual revenue in excess of $400 million. Most recently, he served as President and Chief Operating Officer for Amedisys where he grew the Company to become the second largest home health provider and the third largest hospice provider in the U.S. Under his leadership, Amedisys also invested in new business lines by acquiring Contessa, a risk-bearing, tech-enabled company that offers high acuity care in the home. Mr. Gerard serves on the Board of Directors for Medalogix. Mr. Gerard received his bachelor’s degree in finance from Texas Tech University.

Introduction: Scott Ginn, Executive Vice President and CFO Scott Ginn is Executive Vice President and Chief Financial Officer and oversees all aspects of the company’s financial operations, capital and financing strategy, public reporting and investor relations. Mr. Ginn has been a leader of the Amedisys financial team for more than 13 years. Prior to being named CFO in 2017, he served as the company’s Chief Accounting Officer, overseeing all accounting operations, cost control systems and financial reporting. As Senior Vice President of Accounting and Controller and Senior Vice President of Finance and Accounting at Amedisys, Mr. Ginn played a pivotal role in leading financial operations and building strong relationships with analysts, lenders and shareholders. In his various roles, he helped oversee the growth of the company from a $500 million organization to over $2.0 billion. Prior to joining Amedisys, Mr. Ginn served as a Director at Postlethwaite & Netterville, a professional accounting and business advisory firm. He is a Certified Public Accountant and earned his bachelor’s degree in accounting from Louisiana State University.

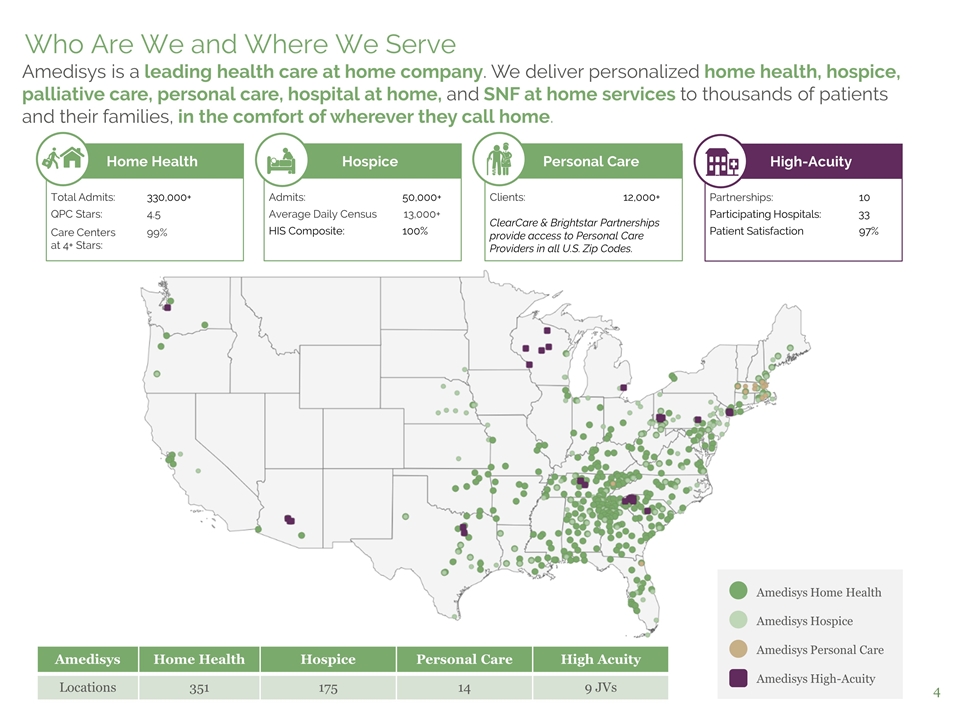

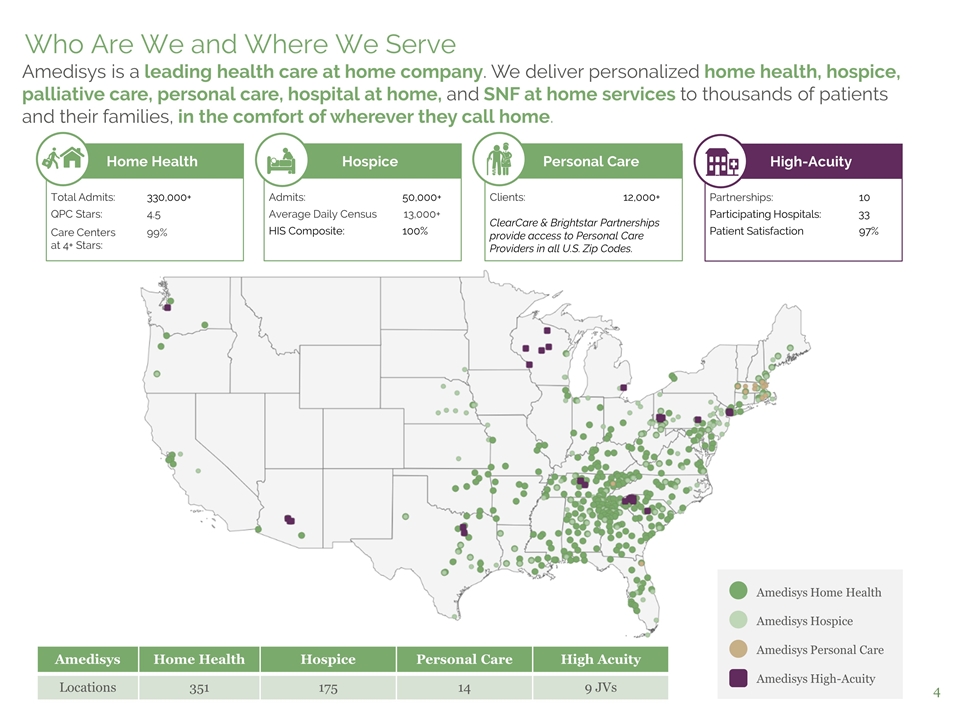

xyz Home Health Total Admits: 330,000+ QPC Stars: 4.5 Care Centers 99% at 4+ Stars: Amedisys Home Health Amedisys Hospice Amedisys Personal Care Amedisys High-Acuity Amedisys Home Health Hospice Personal Care High Acuity Locations 351 175 14 9 JVs xyz Hospice Admits: 50,000+ Average Daily Census 13,000+ HIS Composite: 100% xyz Personal Care Clients: 12,000+ ClearCare & Brightstar Partnerships provide access to Personal Care Providers in all U.S. Zip Codes. xyz High-Acuity Partnerships: 10 Participating Hospitals: 33 Patient Satisfaction 97% Who Are We and Where We Serve Amedisys is a leading health care at home company. We deliver personalized home health, hospice, palliative care, personal care, hospital at home, and SNF at home services to thousands of patients and their families, in the comfort of wherever they call home.

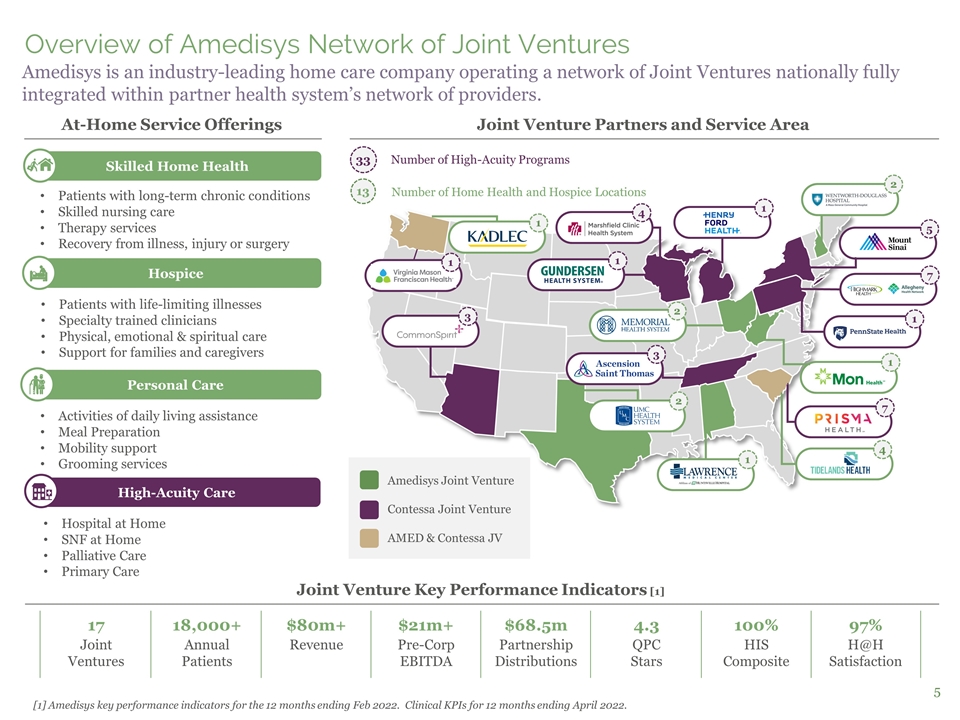

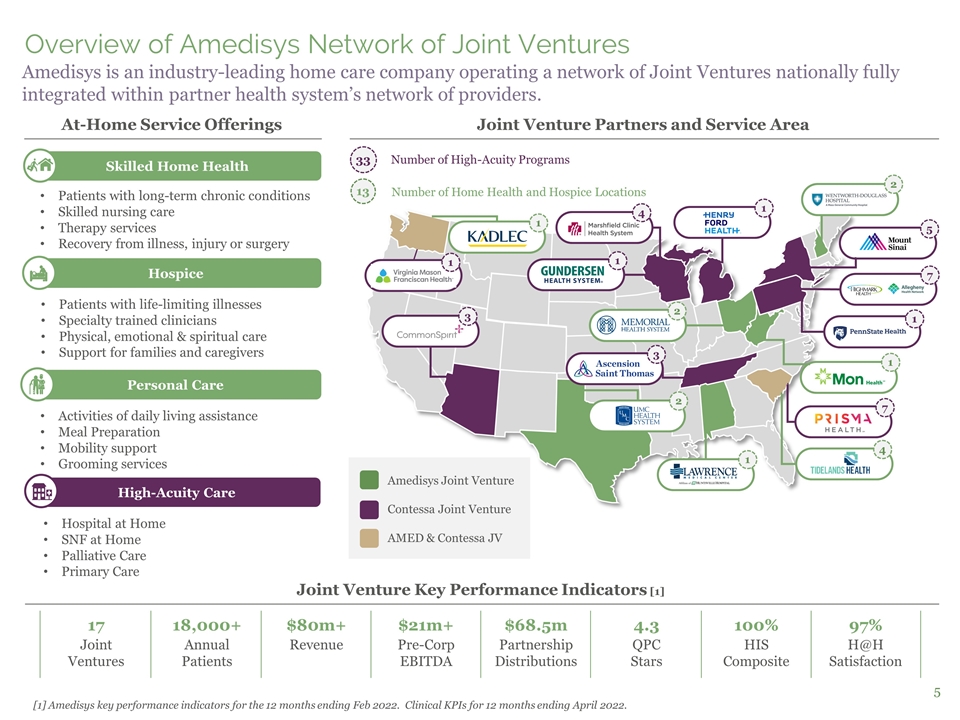

17 Joint Ventures 18,000+ Annual Patients $80m+ Revenue $21m+ Pre-Corp EBITDA $68.5m Partnership Distributions 4.3 QPC Stars 100% HIS Composite 97% H@H Satisfaction Overview of Amedisys Network of Joint Ventures Amedisys is an industry-leading home care company operating a network of Joint Ventures nationally fully integrated within partner health system’s network of providers. Patients with long-term chronic conditions Skilled nursing care Therapy services Recovery from illness, injury or surgery Skilled Home Health Patients with life-limiting illnesses Specialty trained clinicians Physical, emotional & spiritual care Support for families and caregivers Hospice Activities of daily living assistance Meal Preparation Mobility support Grooming services Personal Care Hospital at Home SNF at Home Palliative Care Primary Care High-Acuity Care 7 4 1 2 1 2 1 2 3 3 4 1 1 5 7 1 1 At-Home Service Offerings Joint Venture Partners and Service Area 33 13 Number of High-Acuity Programs Number of Home Health and Hospice Locations Joint Venture Key Performance Indicators [1] Amedisys Joint Venture Contessa Joint Venture AMED & Contessa JV [1] Amedisys key performance indicators for the 12 months ending Feb 2022. Clinical KPIs for 12 months ending April 2022.

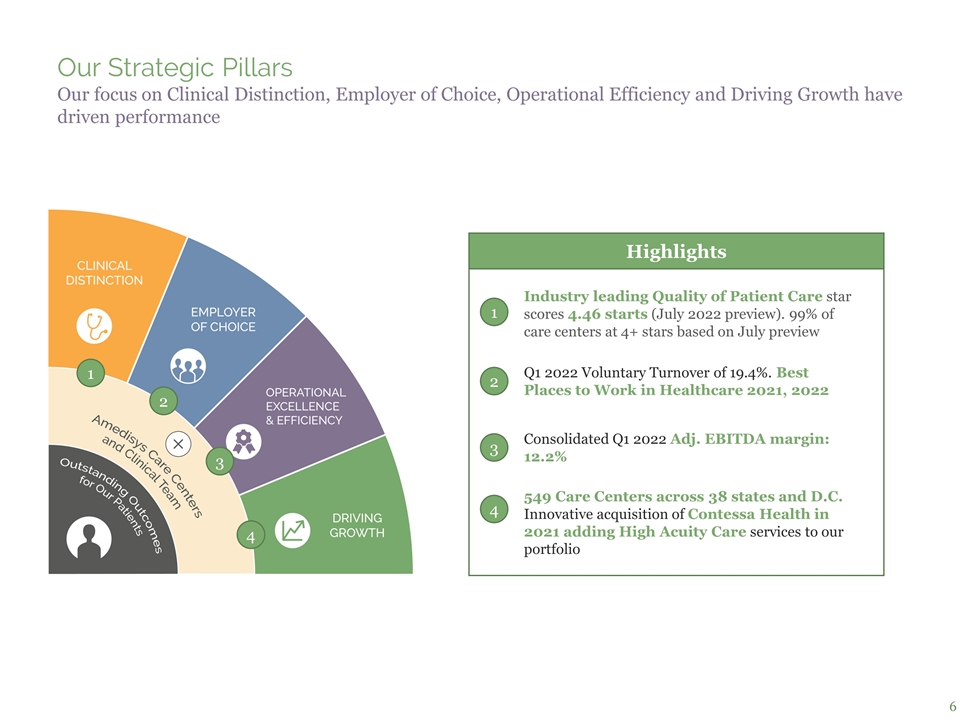

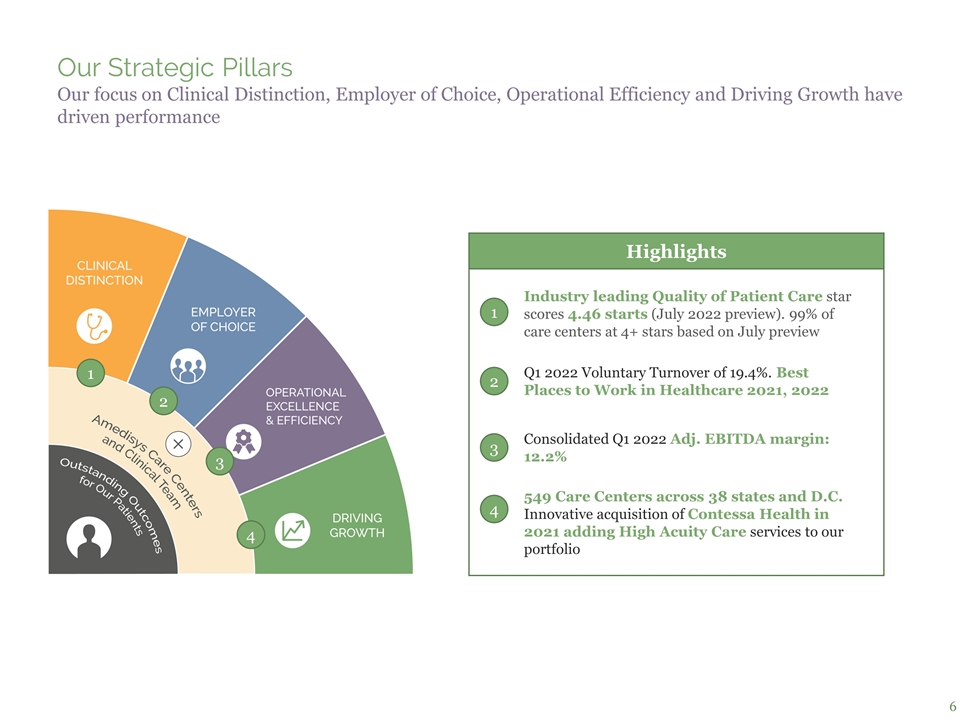

Our Strategic Pillars Our focus on Clinical Distinction, Employer of Choice, Operational Efficiency and Driving Growth have driven performance 1 Industry leading Quality of Patient Care star scores 4.46 starts (July 2022 preview). 99% of care centers at 4+ stars based on July preview 2 Q1 2022 Voluntary Turnover of 19.4%. Best Places to Work in Healthcare 2021, 2022 3 Consolidated Q1 2022 Adj. EBITDA margin: 12.2% Highlights 1 2 3 4 4 549 Care Centers across 38 states and D.C. Innovative acquisition of Contessa Health in 2021 adding High Acuity Care services to our portfolio

Medicare FFS: Reimbursed over a 30-day period of care Private Episodic: MA and Commercial plans who reimburse us over a 30-day period of care, majority of which range from 95% - 100% of Medicare rates Per Visit: Managed care, Medicaid and private payors reimbursing us per visit performed Hospice Per Day Reimbursement: Routine Care: Patient at home with symptoms controlled ~97% of the Hospice care AMED provides, in line with overall hospice industry provision of care Continuous Care: Patient at home with uncontrolled symptoms Inpatient Care: Patient in facility with uncontrolled symptoms Respite Care: Patient at facility with symptoms controlled Our Revenue Sources: Q1 2022

Industry Dynamics

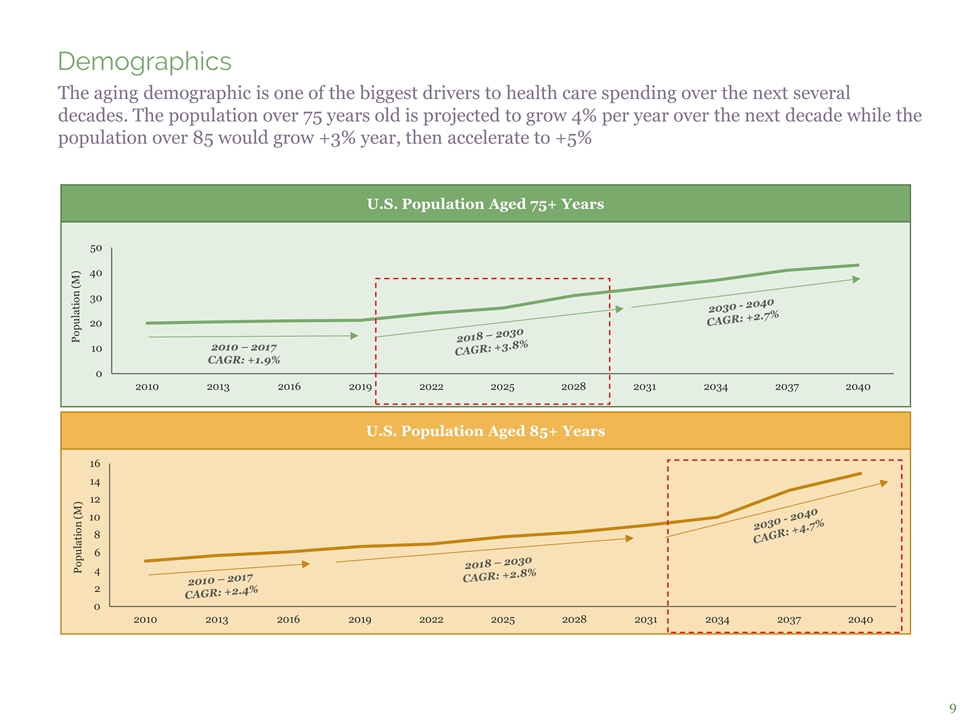

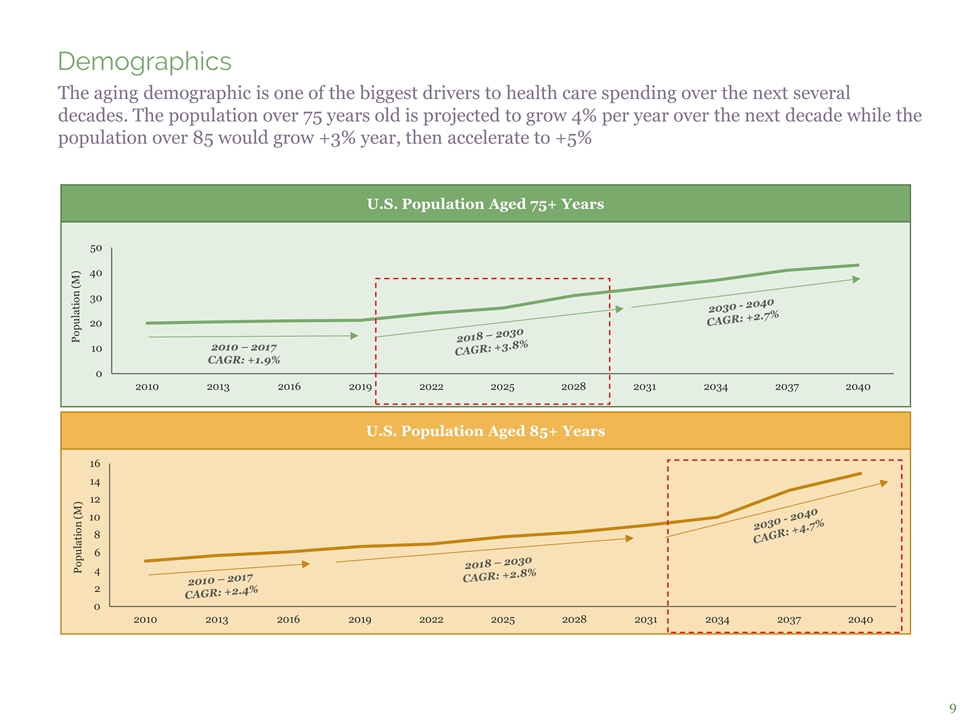

The aging demographic is one of the biggest drivers to health care spending over the next several decades. The population over 75 years old is projected to grow 4% per year over the next decade while the population over 85 would grow +3% year, then accelerate to +5% Demographics 2010 – 2017 CAGR: +1.9% 2018 – 2030 CAGR: +3.8% 2030 - 2040 CAGR: +2.7% 2010 – 2017 CAGR: +2.4% 2018 – 2030 CAGR: +2.8% 2030 - 2040 CAGR: +4.7% U.S. Population Aged 75+ Years U.S. Population Aged 85+ Years

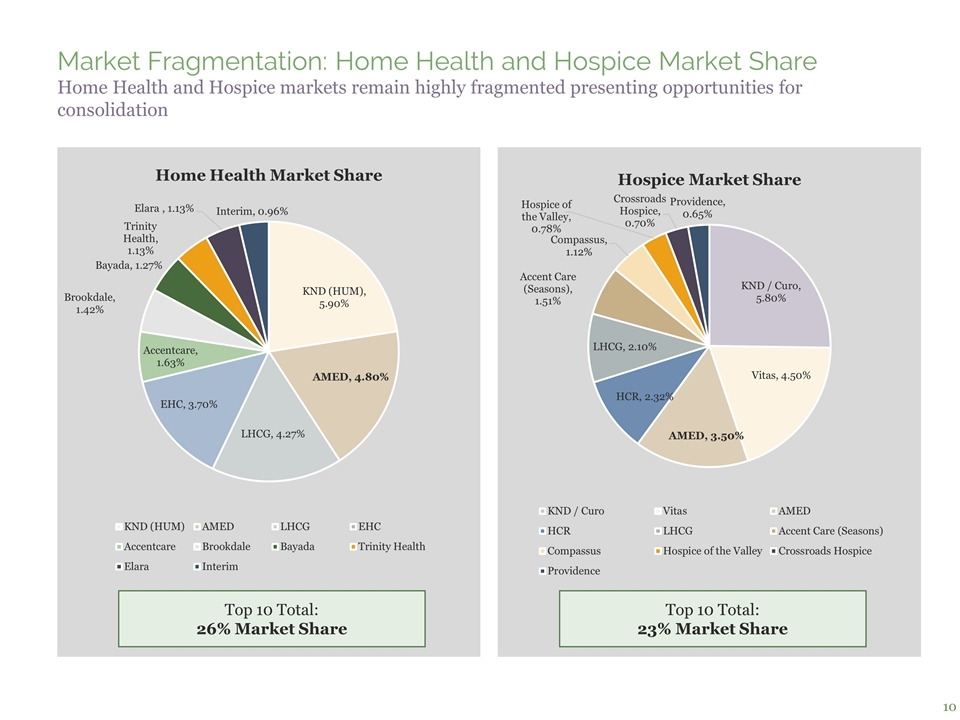

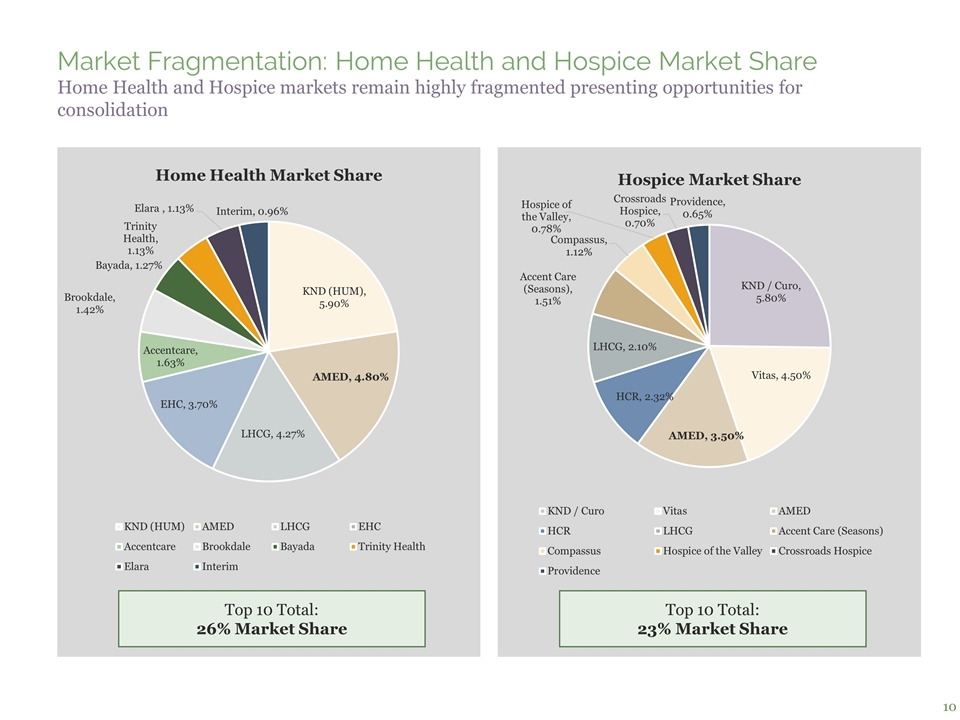

Home Health and Hospice markets remain highly fragmented presenting opportunities for consolidation Market Fragmentation: Home Health and Hospice Market Share Top 10 Total: 26% Market Share Top 10 Total: 23% Market Share

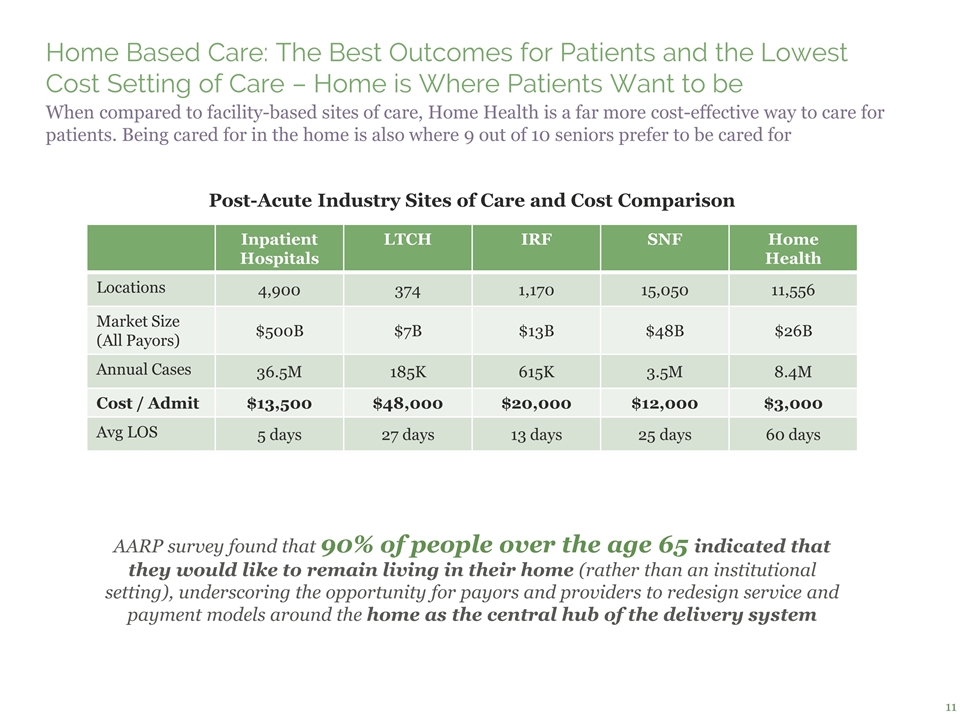

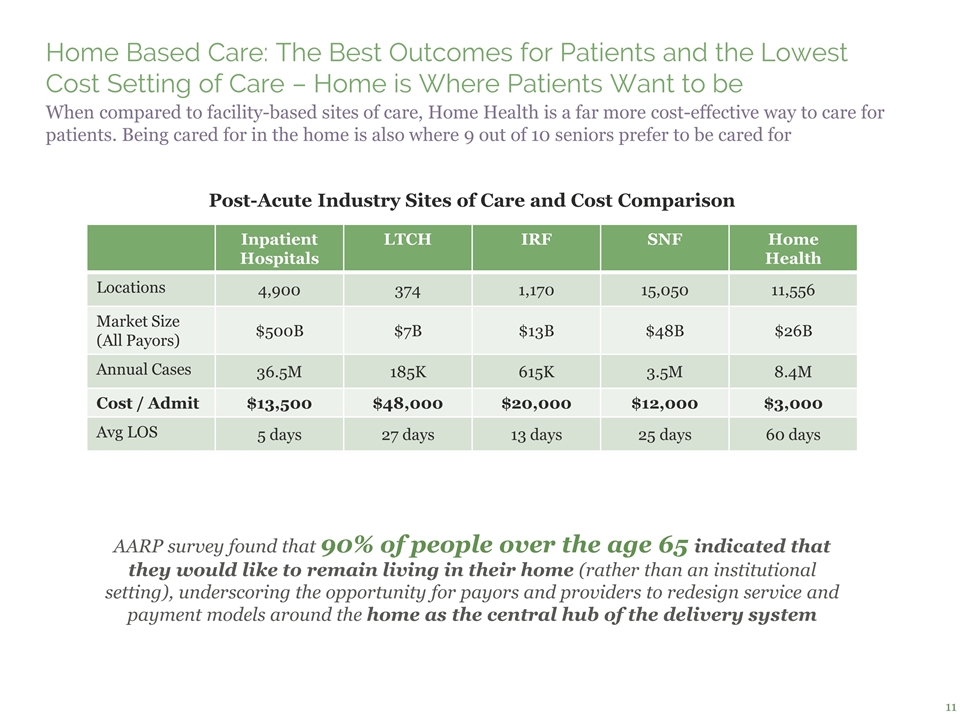

When compared to facility-based sites of care, Home Health is a far more cost-effective way to care for patients. Being cared for in the home is also where 9 out of 10 seniors prefer to be cared for Home Based Care: The Best Outcomes for Patients and the Lowest Cost Setting of Care – Home is Where Patients Want to be Inpatient Hospitals LTCH IRF SNF Home Health Locations 4,900 374 1,170 15,050 11,556 Market Size (All Payors) $500B $7B $13B $48B $26B Annual Cases 36.5M 185K 615K 3.5M 8.4M Cost / Admit $13,500 $48,000 $20,000 $12,000 $3,000 Avg LOS 5 days 27 days 13 days 25 days 60 days Post-Acute Industry Sites of Care and Cost Comparison AARP survey found that 90% of people over the age 65 indicated that they would like to remain living in their home (rather than an institutional setting), underscoring the opportunity for payors and providers to redesign service and payment models around the home as the central hub of the delivery system

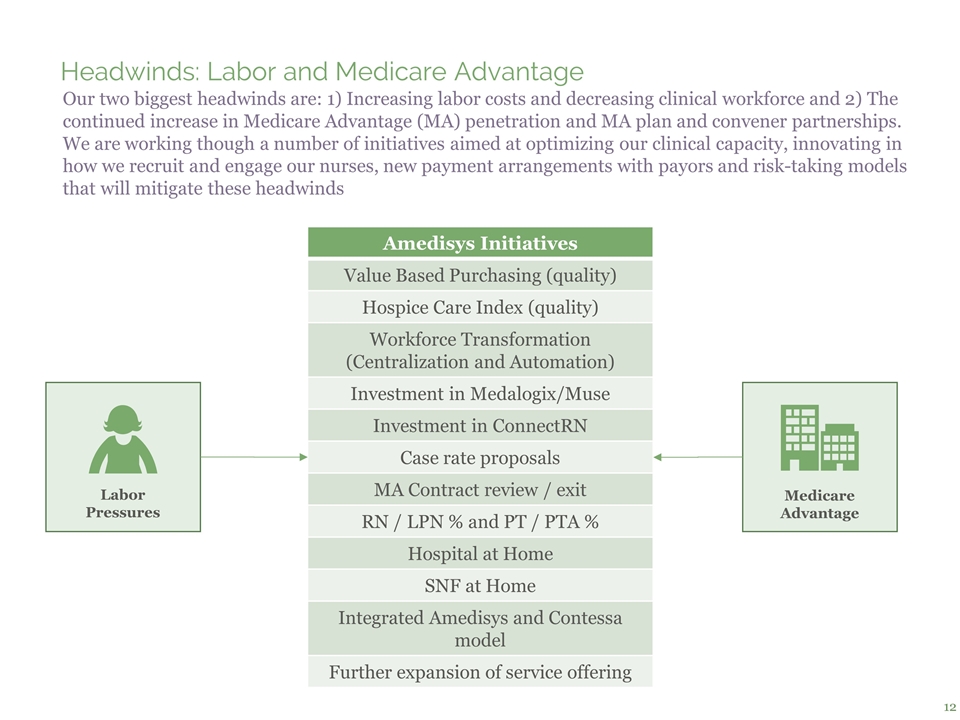

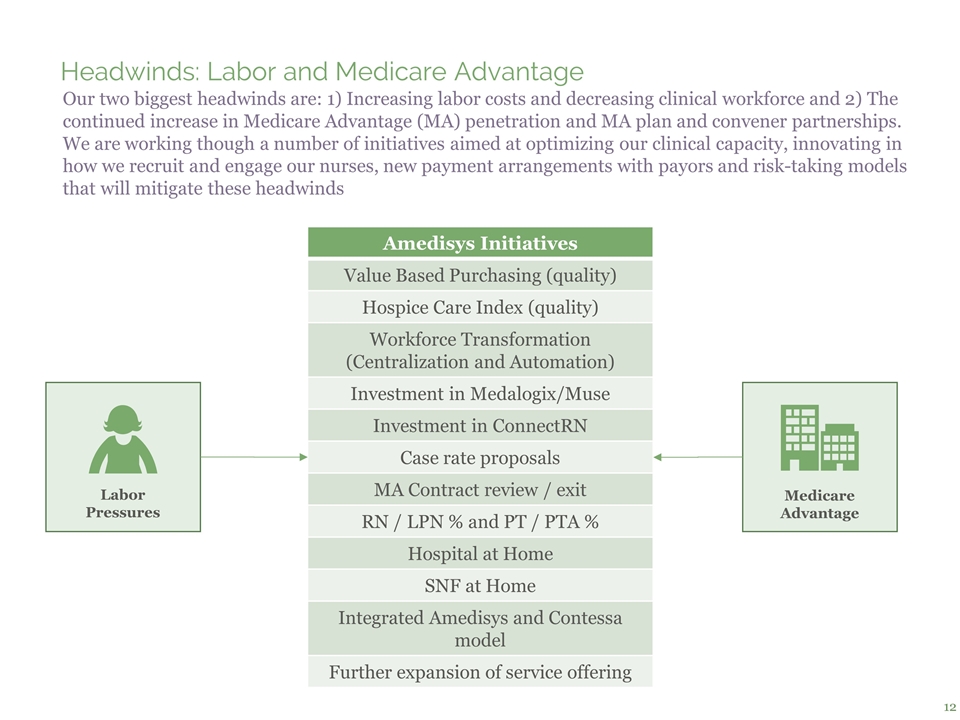

Our two biggest headwinds are: 1) Increasing labor costs and decreasing clinical workforce and 2) The continued increase in Medicare Advantage (MA) penetration and MA plan and convener partnerships. We are working though a number of initiatives aimed at optimizing our clinical capacity, innovating in how we recruit and engage our nurses, new payment arrangements with payors and risk-taking models that will mitigate these headwinds Headwinds: Labor and Medicare Advantage Labor Pressures Medicare Advantage Amedisys Initiatives Value Based Purchasing (quality) Hospice Care Index (quality) Workforce Transformation (Centralization and Automation) Investment in Medalogix/Muse Investment in ConnectRN Case rate proposals MA Contract review / exit RN / LPN % and PT / PTA % Hospital at Home SNF at Home Integrated Amedisys and Contessa model Further expansion of service offering

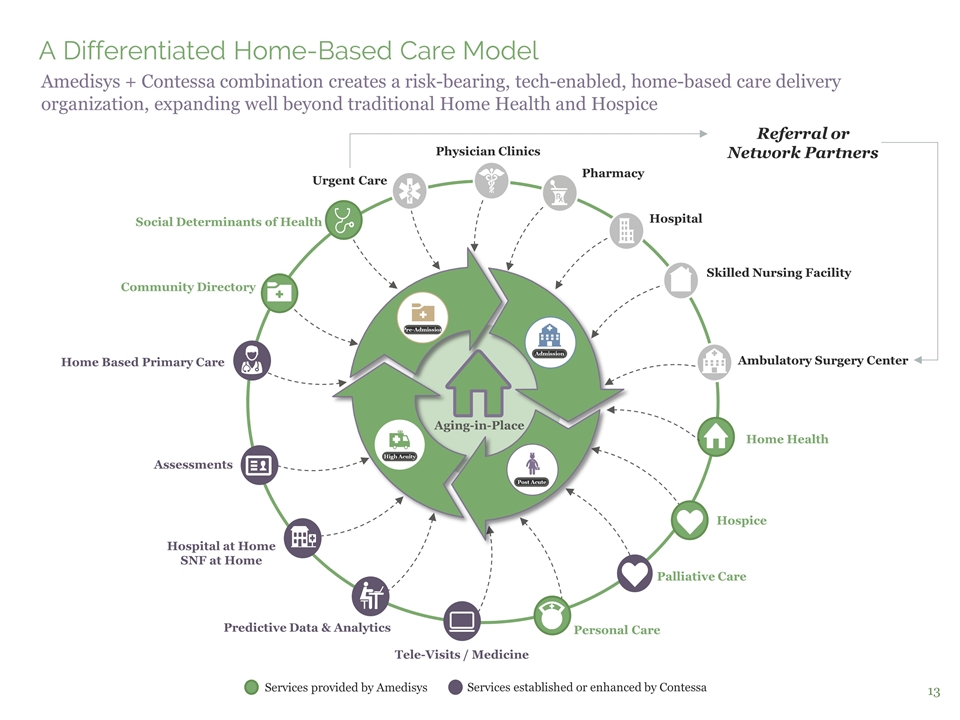

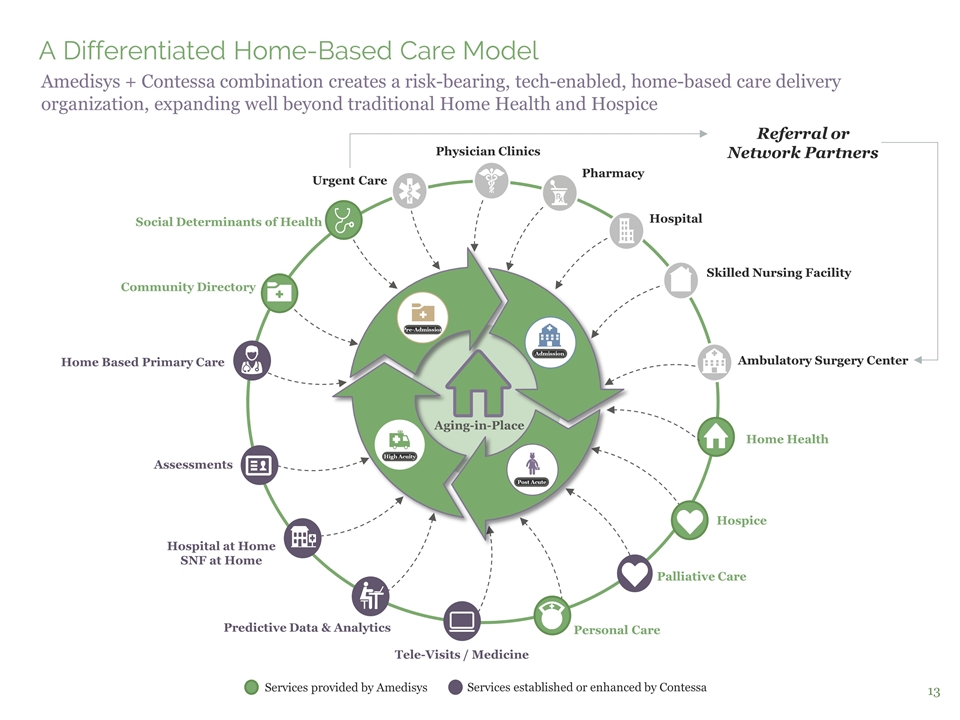

Pharmacy Ambulatory Surgery Center Urgent Care Assessments Physician Clinics Predictive Data & Analytics Hospital at Home SNF at Home Home Health Palliative Care Hospice Personal Care Hospital Skilled Nursing Facility Social Determinants of Health Home Based Primary Care Tele-Visits / Medicine Pre-Admission Admission Post Acute High Acuity Community Directory Amedisys + Contessa combination creates a risk-bearing, tech-enabled, home-based care delivery organization, expanding well beyond traditional Home Health and Hospice Aging-in-Place Referral or Network Partners Services provided by Amedisys Services established or enhanced by Contessa A Differentiated Home-Based Care Model

Q1 2022 Financial Performance

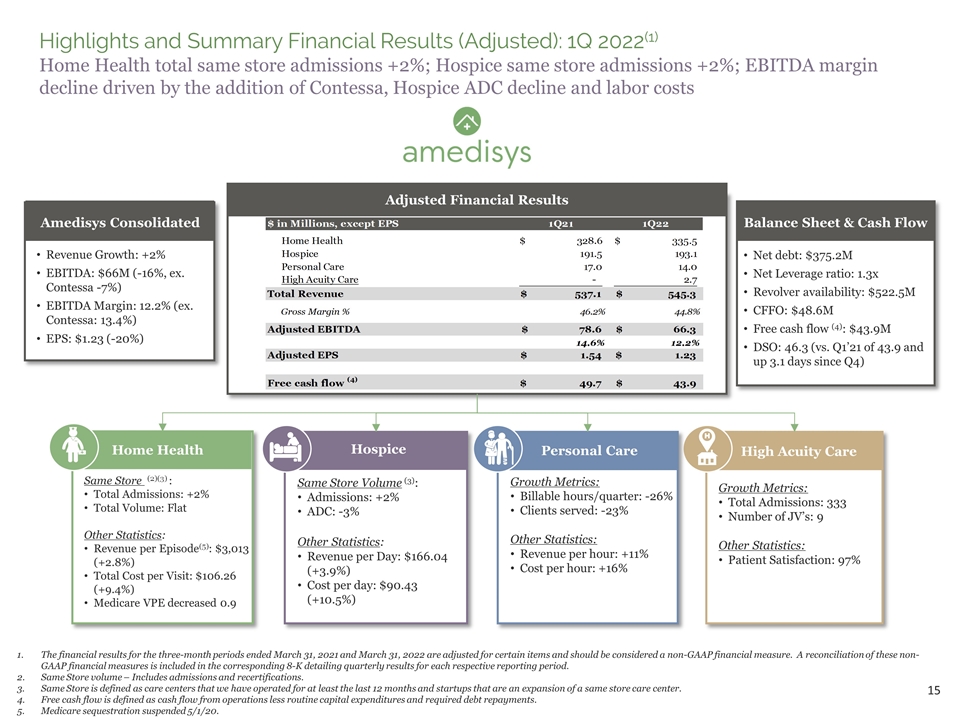

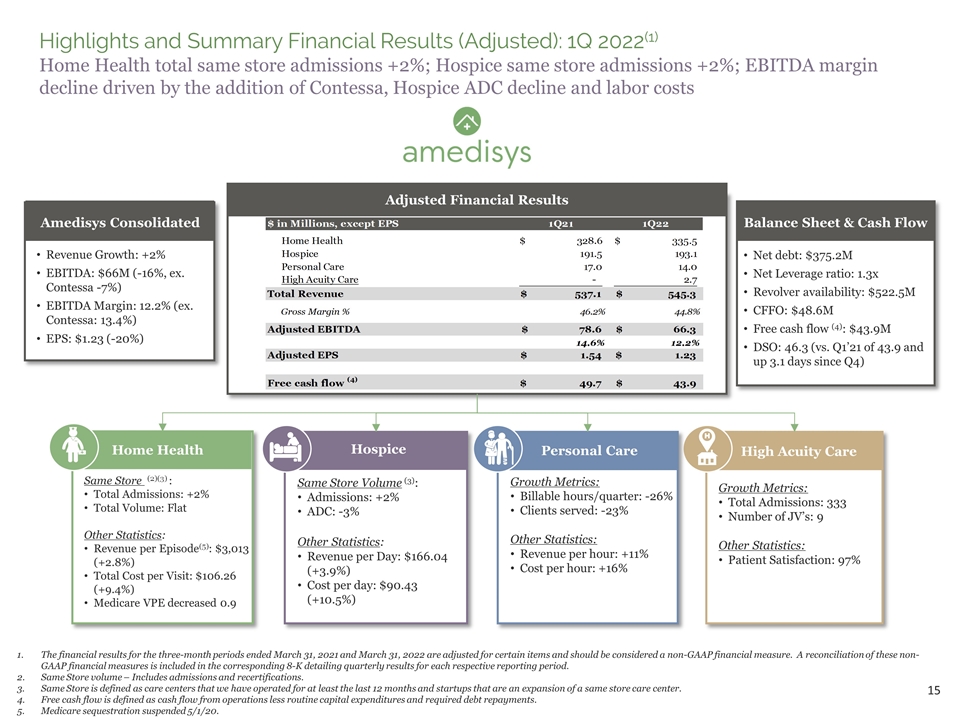

Highlights and Summary Financial Results (Adjusted): 1Q 2022(1) Home Health total same store admissions +2%; Hospice same store admissions +2%; EBITDA margin decline driven by the addition of Contessa, Hospice ADC decline and labor costs The financial results for the three-month periods ended March 31, 2021 and March 31, 2022 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Same Store volume – Includes admissions and recertifications. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. Free cash flow is defined as cash flow from operations less routine capital expenditures and required debt repayments. Medicare sequestration suspended 5/1/20. Growth Metrics: Total Admissions: 333 Number of JV’s: 9 Other Statistics: Patient Satisfaction: 97% High Acuity Care Adjusted Financial Results Growth Metrics: Billable hours/quarter: -26% Clients served: -23% Other Statistics: Revenue per hour: +11% Cost per hour: +16% Personal Care Same Store Volume (3): Admissions: +2% ADC: -3% Other Statistics: Revenue per Day: $166.04 (+3.9%) Cost per day: $90.43 (+10.5%) Hospice Home Health Same Store (2)(3) : Total Admissions: +2% Total Volume: Flat Other Statistics: Revenue per Episode(5): $3,013 (+2.8%) Total Cost per Visit: $106.26 (+9.4%) Medicare VPE decreased 0.9 Amedisys Consolidated Revenue Growth: +2% EBITDA: $66M (-16%, ex. Contessa -7%) EBITDA Margin: 12.2% (ex. Contessa: 13.4%) EPS: $1.23 (-20%) Amedisys Consolidated Amedisys Consolidated Balance Sheet & Cash Flow Net debt: $375.2M Net Leverage ratio: 1.3x Revolver availability: $522.5M CFFO: $48.6M Free cash flow (4): $43.9M DSO: 46.3 (vs. Q1’21 of 43.9 and up 3.1 days since Q4)

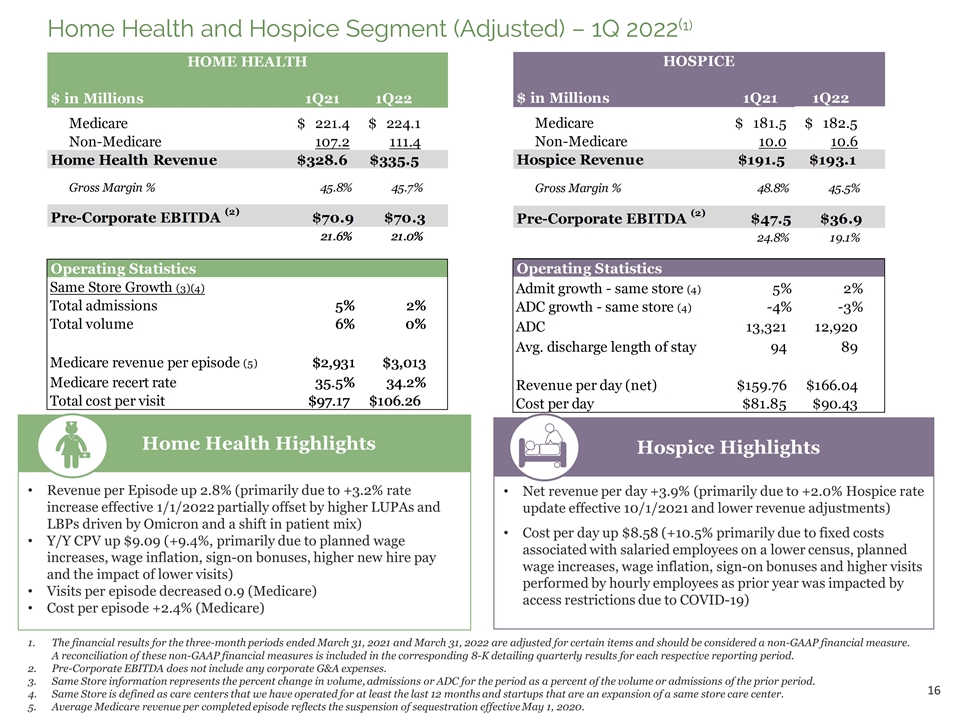

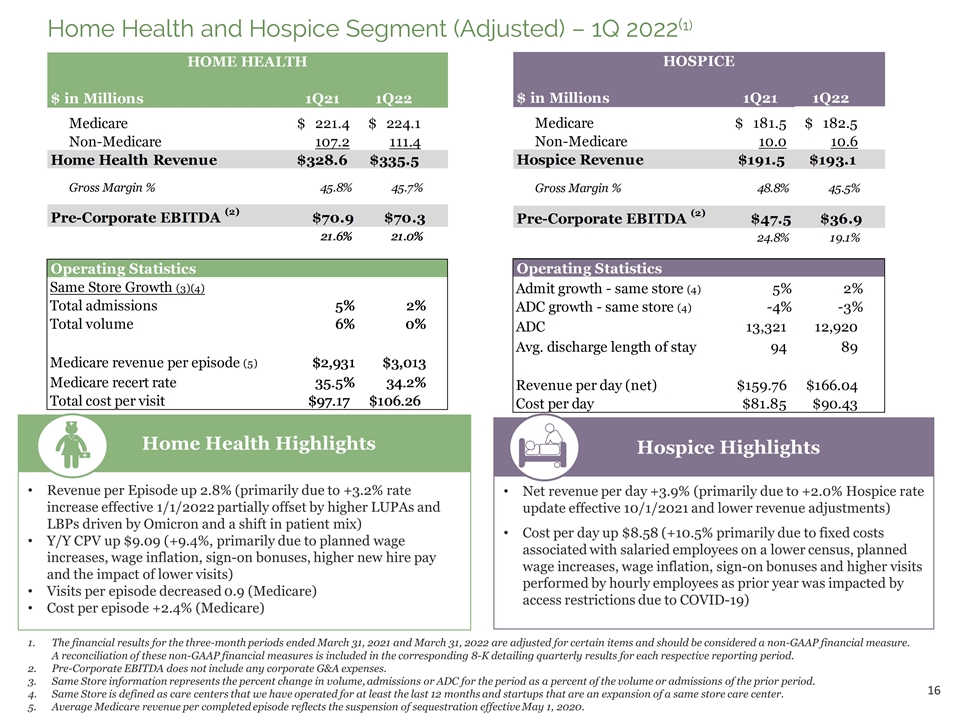

Home Health and Hospice Segment (Adjusted) – 1Q 2022(1) Revenue per Episode up 2.8% (primarily due to +3.2% rate increase effective 1/1/2022 partially offset by higher LUPAs and LBPs driven by Omicron and a shift in patient mix) Y/Y CPV up $9.09 (+9.4%, primarily due to planned wage increases, wage inflation, sign-on bonuses, higher new hire pay and the impact of lower visits) Visits per episode decreased 0.9 (Medicare) Cost per episode +2.4% (Medicare) Home Health Highlights Net revenue per day +3.9% (primarily due to +2.0% Hospice rate update effective 10/1/2021 and lower revenue adjustments) Cost per day up $8.58 (+10.5% primarily due to fixed costs associated with salaried employees on a lower census, planned wage increases, wage inflation, sign-on bonuses and higher visits performed by hourly employees as prior year was impacted by access restrictions due to COVID-19) Hospice Highlights The financial results for the three-month periods ended March 31, 2021 and March 31, 2022 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Pre-Corporate EBITDA does not include any corporate G&A expenses. Same Store information represents the percent change in volume, admissions or ADC for the period as a percent of the volume or admissions of the prior period. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. Average Medicare revenue per completed episode reflects the suspension of sequestration effective May 1, 2020. HOSPICE $ in Millions 1Q21 1Q22 Medicare $181.5 $182.5 Non-Medicare 10 10.6 Hospice Revenue $191.5 $193.1 Gross Margin % 0.48799999999999999 0.45500000000000002 Pre-Corporate EBITDA (2) $47.5 $36.9 0.248 0.19109269808389434 Operating Statistics Admit growth - same store (4) 0.05 0.02 ADC growth - same store (4) -0.04 -0.03 ADC 13321 12920 Avg. discharge length of stay 94 89 Revenue per day (net) $159.76 $166.04 Cost per day $81.849999999999994 $90.43 HOME HEALTH $ in Millions 1Q21 1Q22 2021 Medicare $221.4 $224.1 914.5 Non-Medicare 107.2 111.4 439.3 Home Health Revenue $328.6 $335.5 $1,353.8 Gross Margin % 0.45800000000000002 0.45700000000000002 0.45100000000000001 Pre-Corporate EBITDA (2) $70.900000000000006 $70.3 $281.60000000000002 0.21576384662203288 0.21 0.20799999999999999 Operating Statistics Same Store Growth (3)(4) Total admissions 0.05 0.02 0.06 Total volume 0.06 0 0.05 Medicare revenue per episode (5) $2,931 $3,013 $2,959 Medicare recert rate 0.35499999999999998 0.34200000000000003 0.35099999999999998 Total cost per visit $97.17 $106.26 $101.46