HIYA HEALTH PRODUCTS, LLC Financial Statements September 30, 2024 and December 31, 2023 With Independent Auditor’s Report

Hiya Health Products, LLC Table of Contents September 30, 2024 and December 31, 2023 Independent Auditor’s Report 1-2 Financial Statements Balance Sheets 3 Statements of Operations 4 Statements of Changes in Members’ Equity 5 Statements of Cash Flows 6 Notes to Financial Statements 7-15

INDEPENDENT AUDITOR'S REPORT To the Members of Hiya Health Products, LLC: Report on the Audit of the Financial Statements Opinion We have audited the financial statements of Hiya Health Products, LLC (the “Company”), which comprise the balance sheets as of September 30, 2024 and December 31, 2023, and the related statements of operations, changes in members’ equity, and cash flows for the nine months ended September 30, 2024 and for the year ended December 31, 2023, and the related notes to the financial statements. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of Hiya Health Products, LLC as of September 30, 2024 and December 31, 2023, and the results of its operations and its cash flows for the nine months ended September 30, 2024 and the year ended December 31, 2023 in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (“GAAS”). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Hiya Health Products, LLC and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about Hiya Health Products, LLC’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

2 In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Hiya Health Products, LLC’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Hiya Health Products, LLC’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit. December 16, 2024

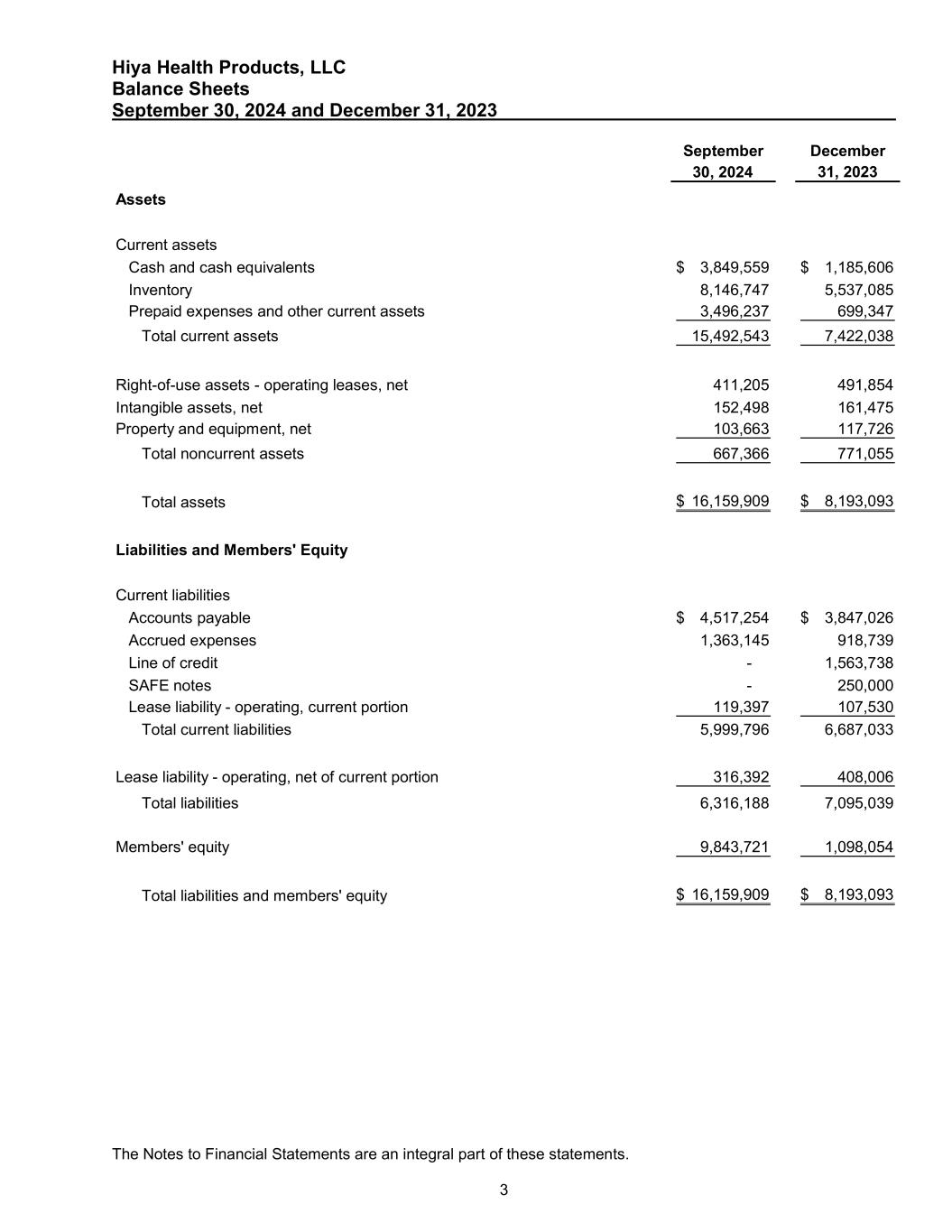

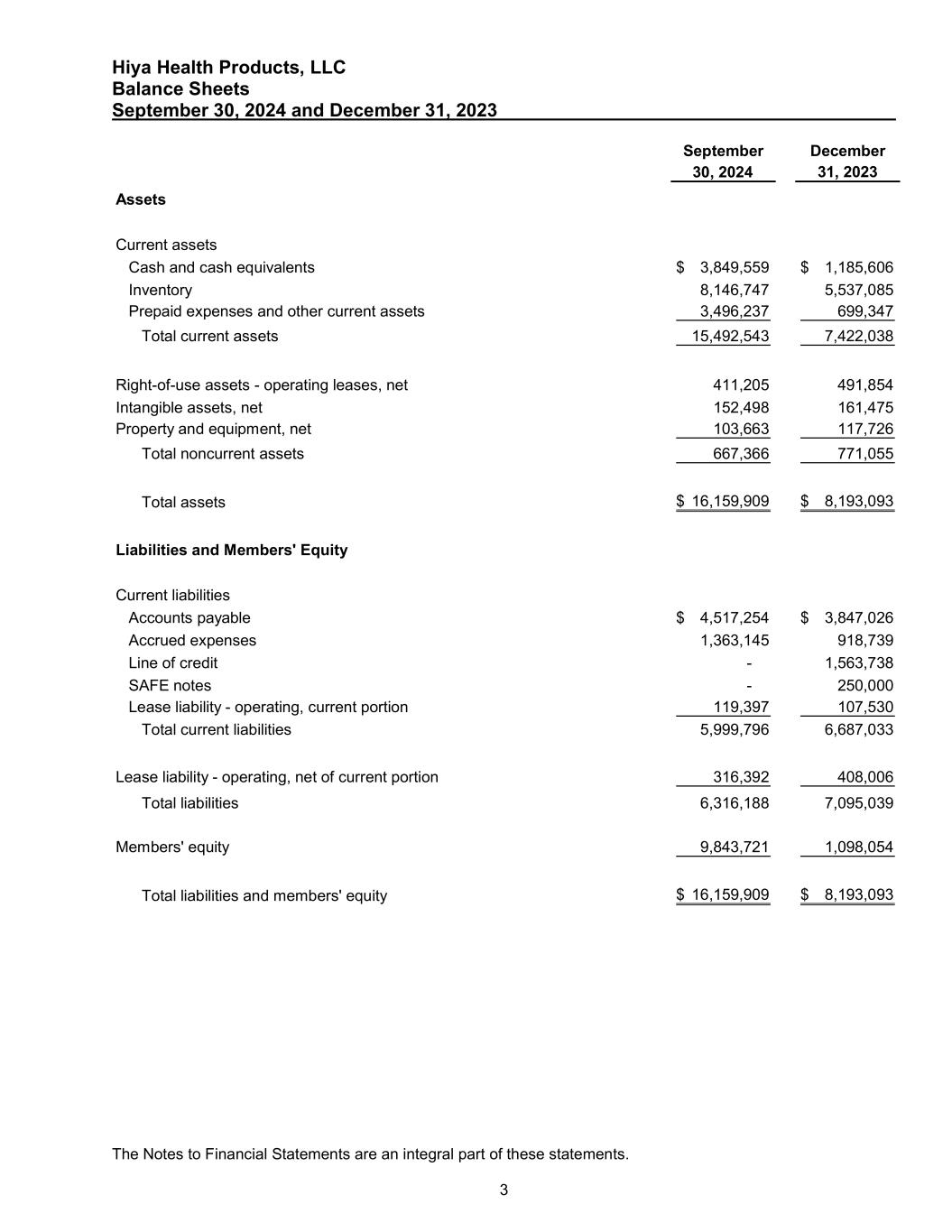

Hiya Health Products, LLC Balance Sheets September 30, 2024 and December 31, 2023 The Notes to Financial Statements are an integral part of these statements. 3 September December 30, 2024 31, 2023 Assets Current assets Cash and cash equivalents 3,849,559$ 1,185,606$ Inventory 8,146,747 5,537,085 Prepaid expenses and other current assets 3,496,237 699,347 Total current assets 15,492,543 7,422,038 Right-of-use assets - operating leases, net 411,205 491,854 Intangible assets, net 152,498 161,475 Property and equipment, net 103,663 117,726 Total noncurrent assets 667,366 771,055 Total assets 16,159,909$ 8,193,093$ Liabilities and Members' Equity Current liabilities Accounts payable 4,517,254$ 3,847,026$ Accrued expenses 1,363,145 918,739 Line of credit - 1,563,738 SAFE notes - 250,000 Lease liability - operating, current portion 119,397 107,530 Total current liabilities 5,999,796 6,687,033 Lease liability - operating, net of current portion 316,392 408,006 Total liabilities 6,316,188 7,095,039 Members' equity 9,843,721 1,098,054 Total liabilities and members' equity 16,159,909$ 8,193,093$

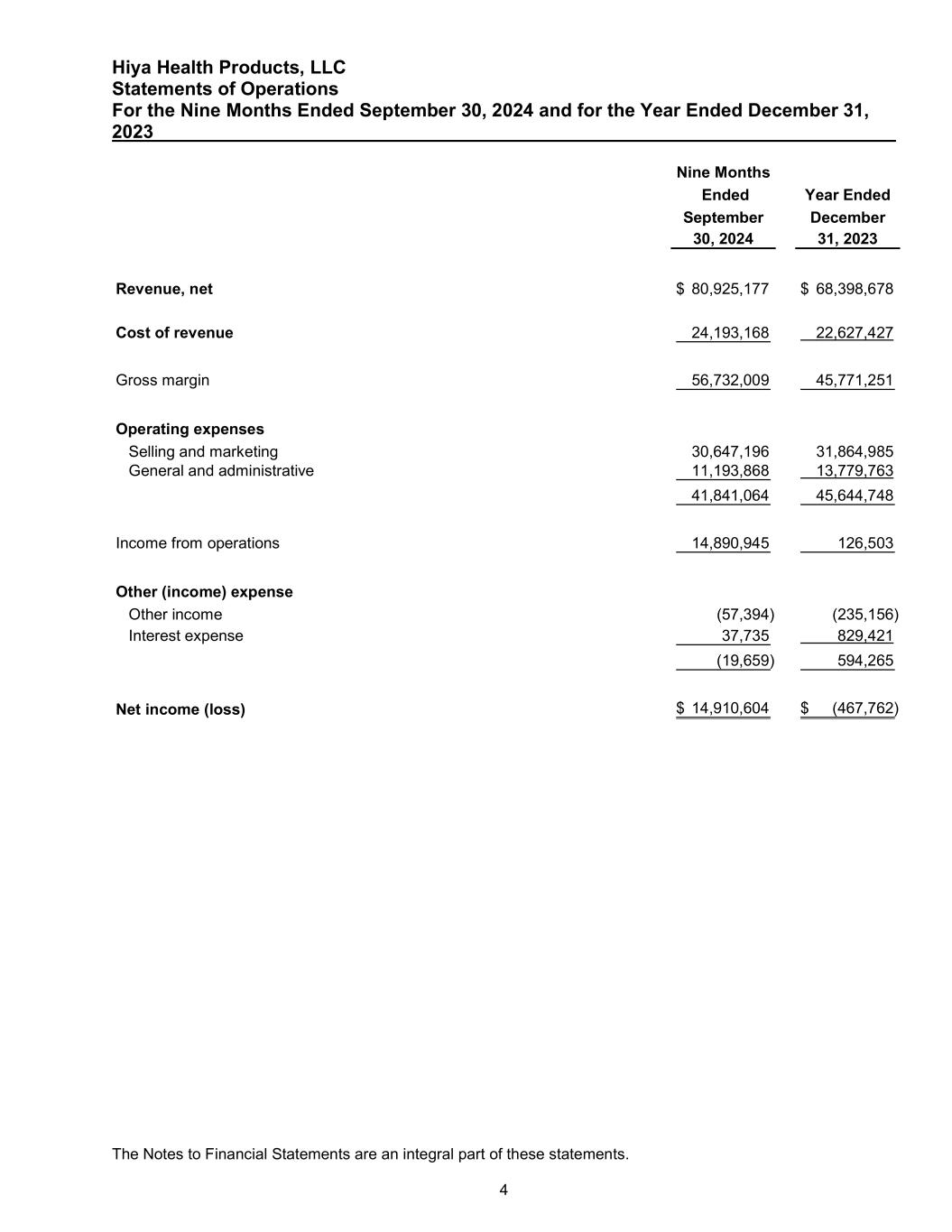

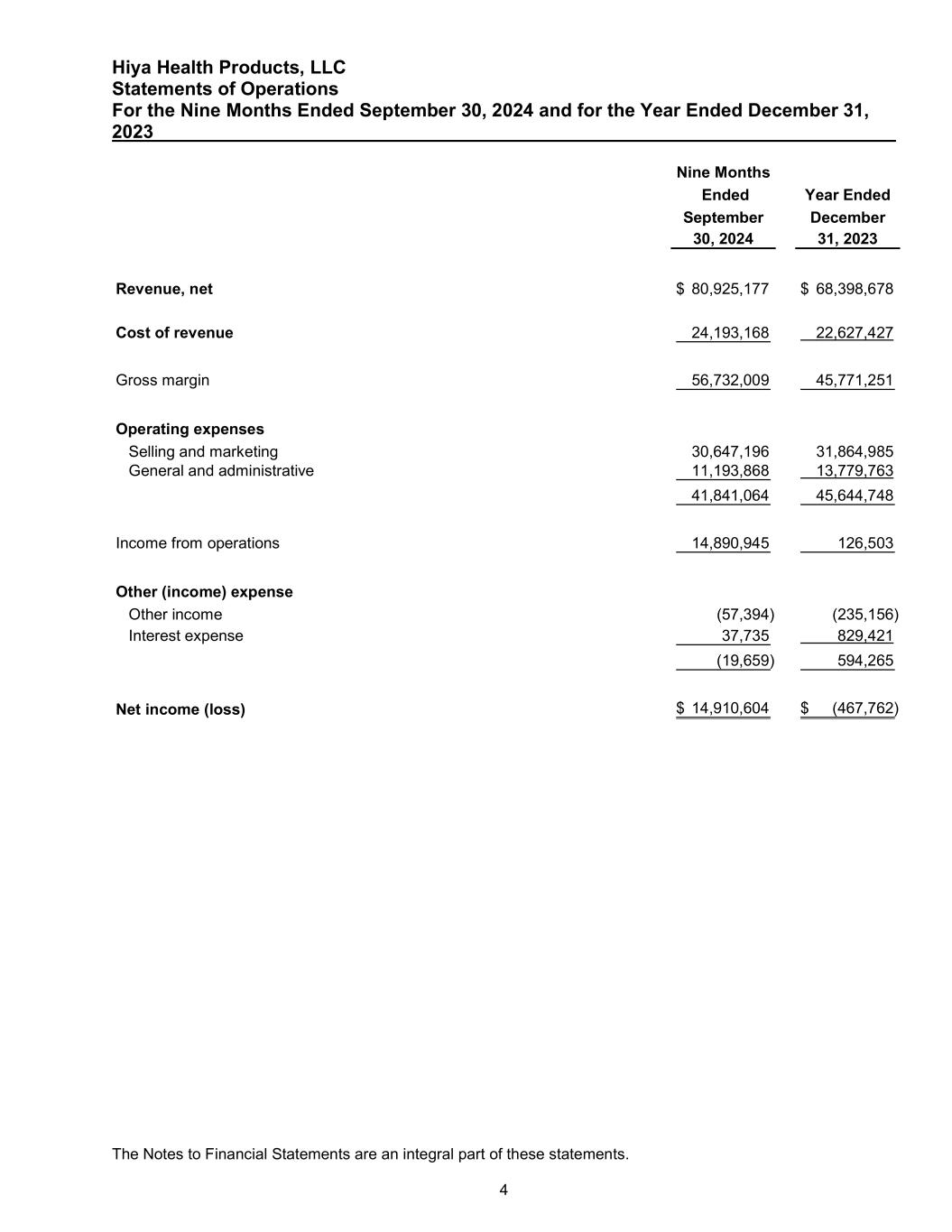

Hiya Health Products, LLC Statements of Operations For the Nine Months Ended September 30, 2024 and for the Year Ended December 31, 2023 The Notes to Financial Statements are an integral part of these statements. 4 Nine Months Ended Year Ended September December 30, 2024 31, 2023 Revenue, net 80,925,177$ 68,398,678$ Cost of revenue 24,193,168 22,627,427 Gross margin 56,732,009 45,771,251 Operating expenses Selling and marketing 30,647,196 31,864,985 General and administrative 11,193,868 13,779,763 41,841,064 45,644,748 Income from operations 14,890,945 126,503 Other (income) expense Other income (57,394) (235,156) Interest expense 37,735 829,421 (19,659) 594,265 Net income (loss) 14,910,604$ (467,762)$

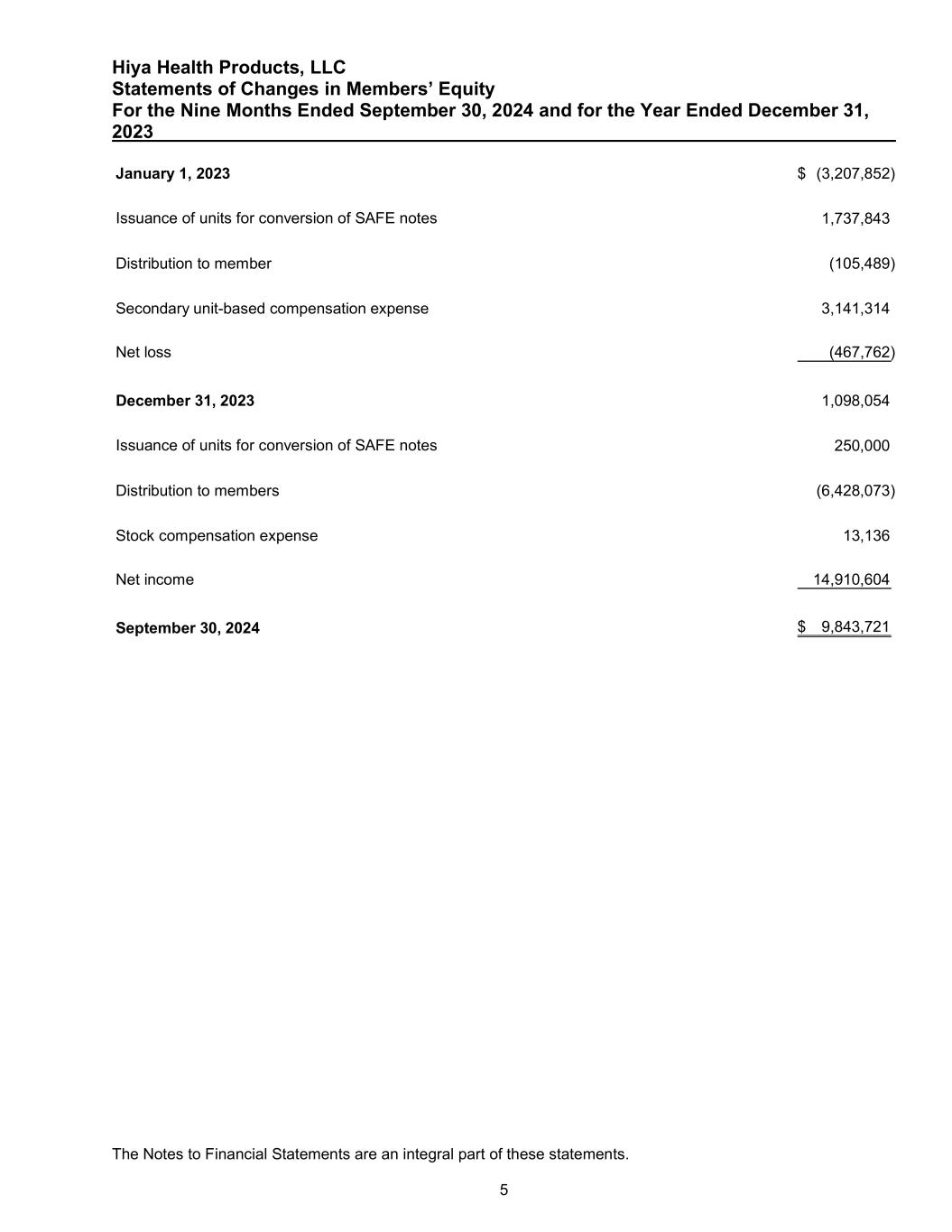

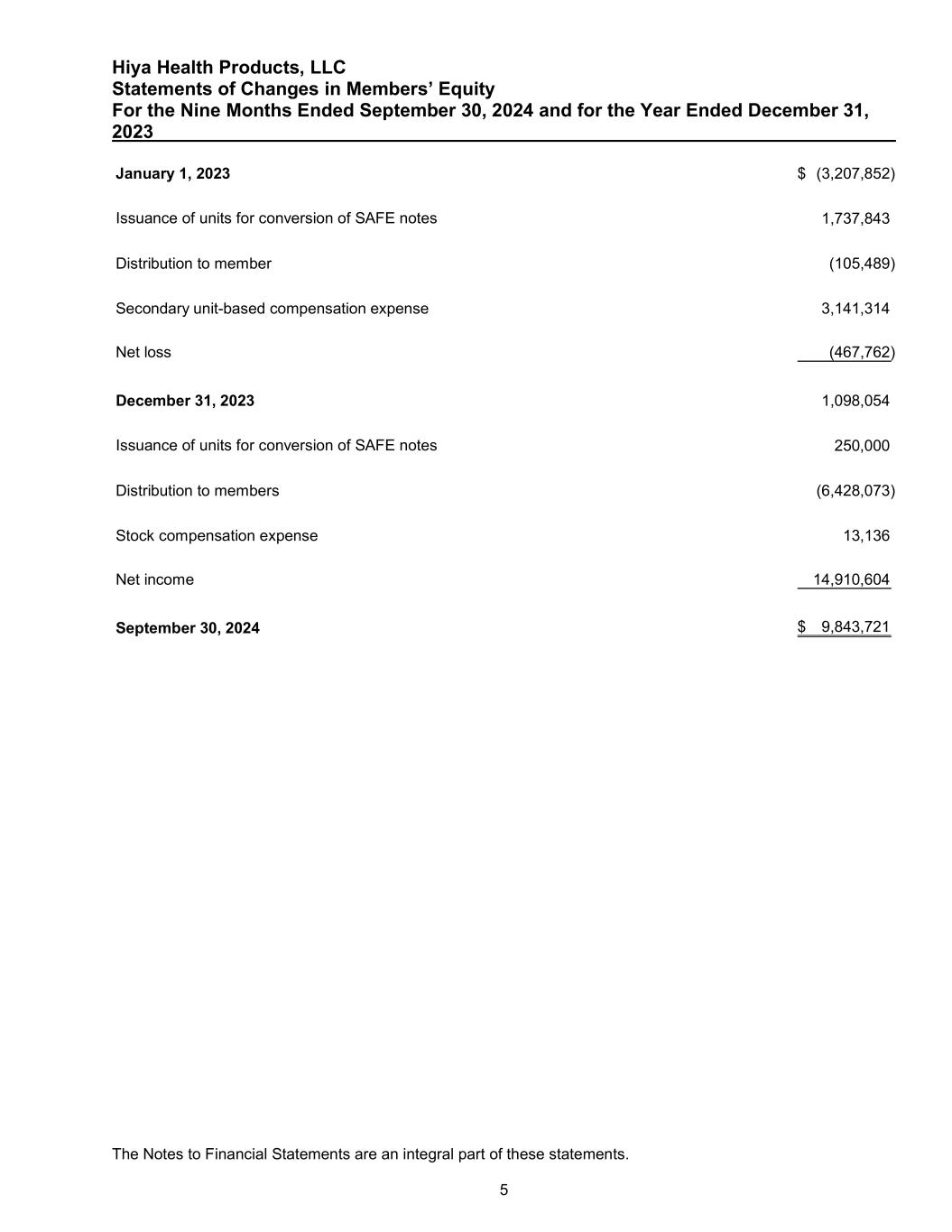

Hiya Health Products, LLC Statements of Changes in Members’ Equity For the Nine Months Ended September 30, 2024 and for the Year Ended December 31, 2023 The Notes to Financial Statements are an integral part of these statements. 5 January 1, 2023 (3,207,852)$ Issuance of units for conversion of SAFE notes 1,737,843 Distribution to member (105,489) Secondary unit-based compensation expense 3,141,314 Net loss (467,762) December 31, 2023 1,098,054 Issuance of units for conversion of SAFE notes 250,000 Distribution to members (6,428,073) Stock compensation expense 13,136 Net income 14,910,604 September 30, 2024 9,843,721$

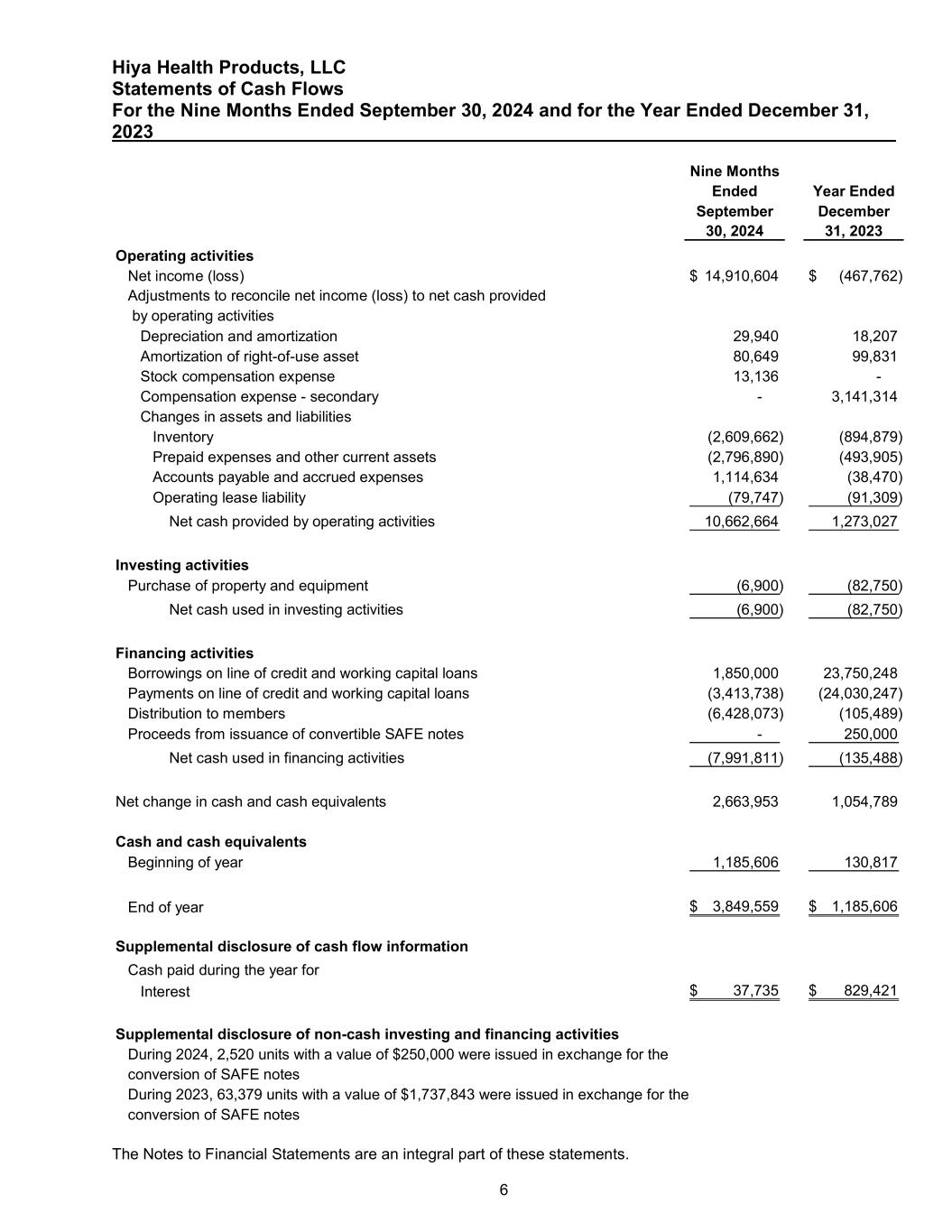

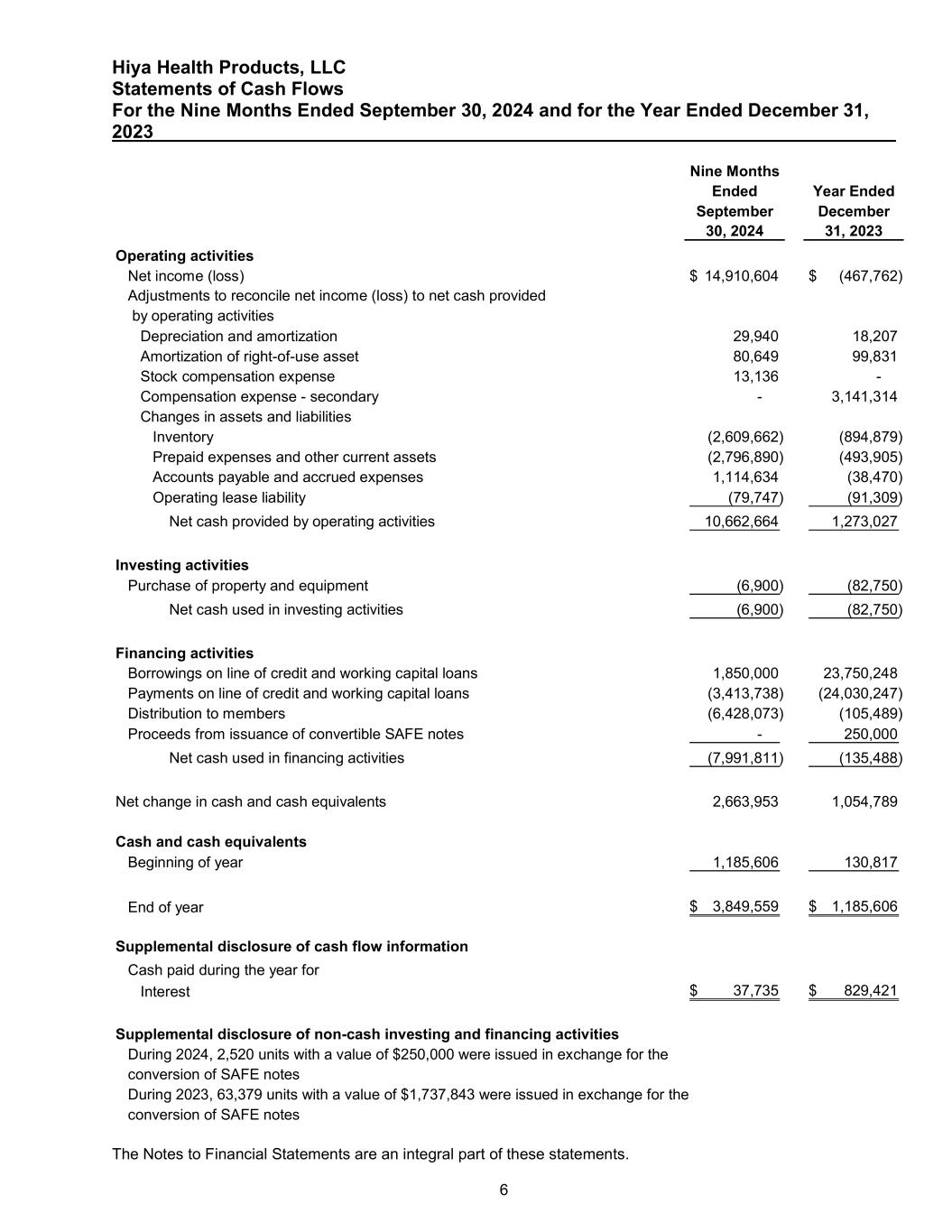

Hiya Health Products, LLC Statements of Cash Flows For the Nine Months Ended September 30, 2024 and for the Year Ended December 31, 2023 The Notes to Financial Statements are an integral part of these statements. 6 Nine Months Ended Year Ended September December 30, 2024 31, 2023 Operating activities Net income (loss) 14,910,604$ (467,762)$ Adjustments to reconcile net income (loss) to net cash provided by operating activities Depreciation and amortization 29,940 18,207 Amortization of right-of-use asset 80,649 99,831 Stock compensation expense 13,136 - Compensation expense - secondary - 3,141,314 Changes in assets and liabilities Inventory (2,609,662) (894,879) Prepaid expenses and other current assets (2,796,890) (493,905) Accounts payable and accrued expenses 1,114,634 (38,470) Operating lease liability (79,747) (91,309) Net cash provided by operating activities 10,662,664 1,273,027 Investing activities Purchase of property and equipment (6,900) (82,750) Net cash used in investing activities (6,900) (82,750) Financing activities Borrowings on line of credit and working capital loans 1,850,000 23,750,248 Payments on line of credit and working capital loans (3,413,738) (24,030,247) Distribution to members (6,428,073) (105,489) Proceeds from issuance of convertible SAFE notes - 250,000 Net cash used in financing activities (7,991,811) (135,488) Net change in cash and cash equivalents 2,663,953 1,054,789 Cash and cash equivalents Beginning of year 1,185,606 130,817 End of year 3,849,559$ 1,185,606$ Supplemental disclosure of cash flow information Cash paid during the year for Interest 37,735$ 829,421$ Supplemental disclosure of non-cash investing and financing activities During 2024, 2,520 units with a value of $250,000 were issued in exchange for the conversion of SAFE notes During 2023, 63,379 units with a value of $1,737,843 were issued in exchange for the conversion of SAFE notes

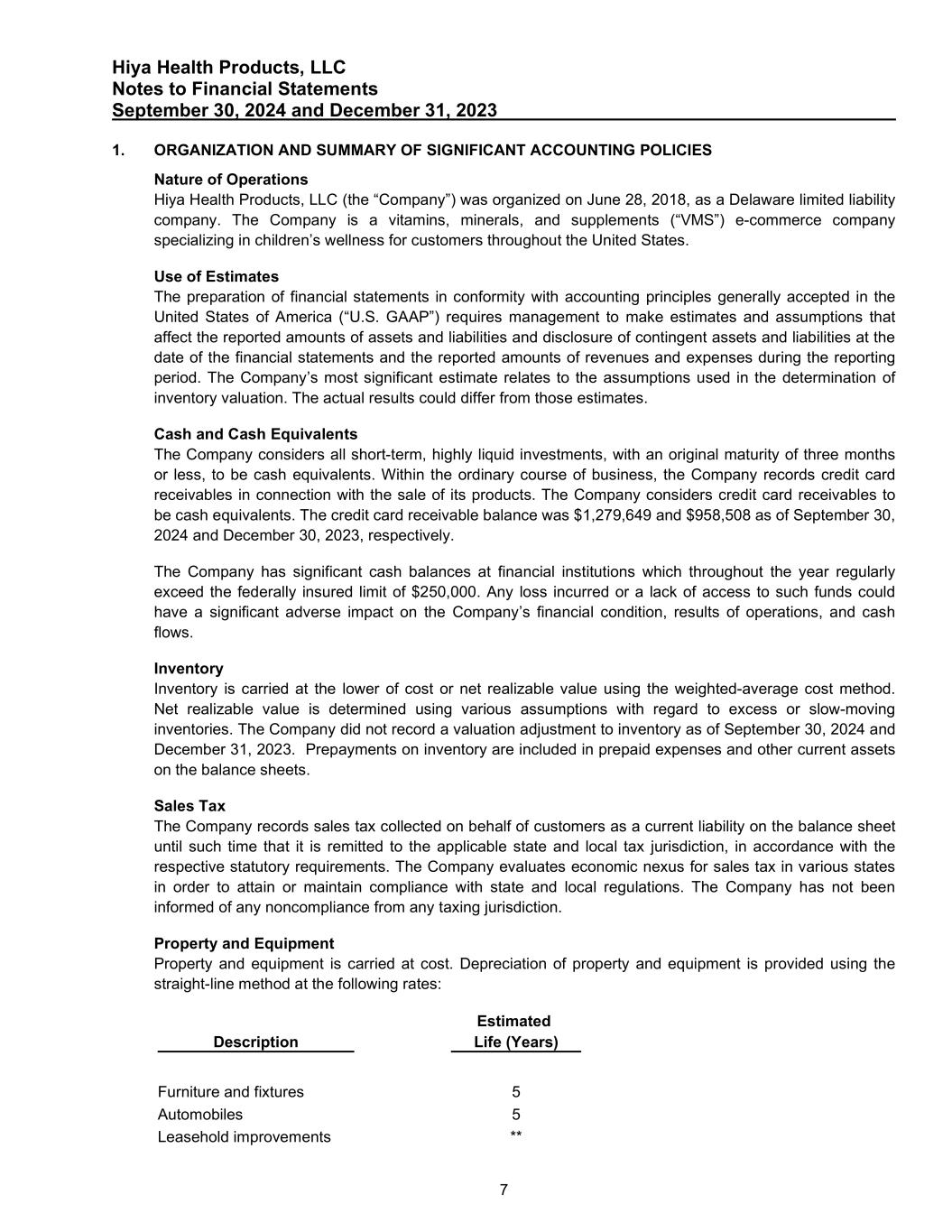

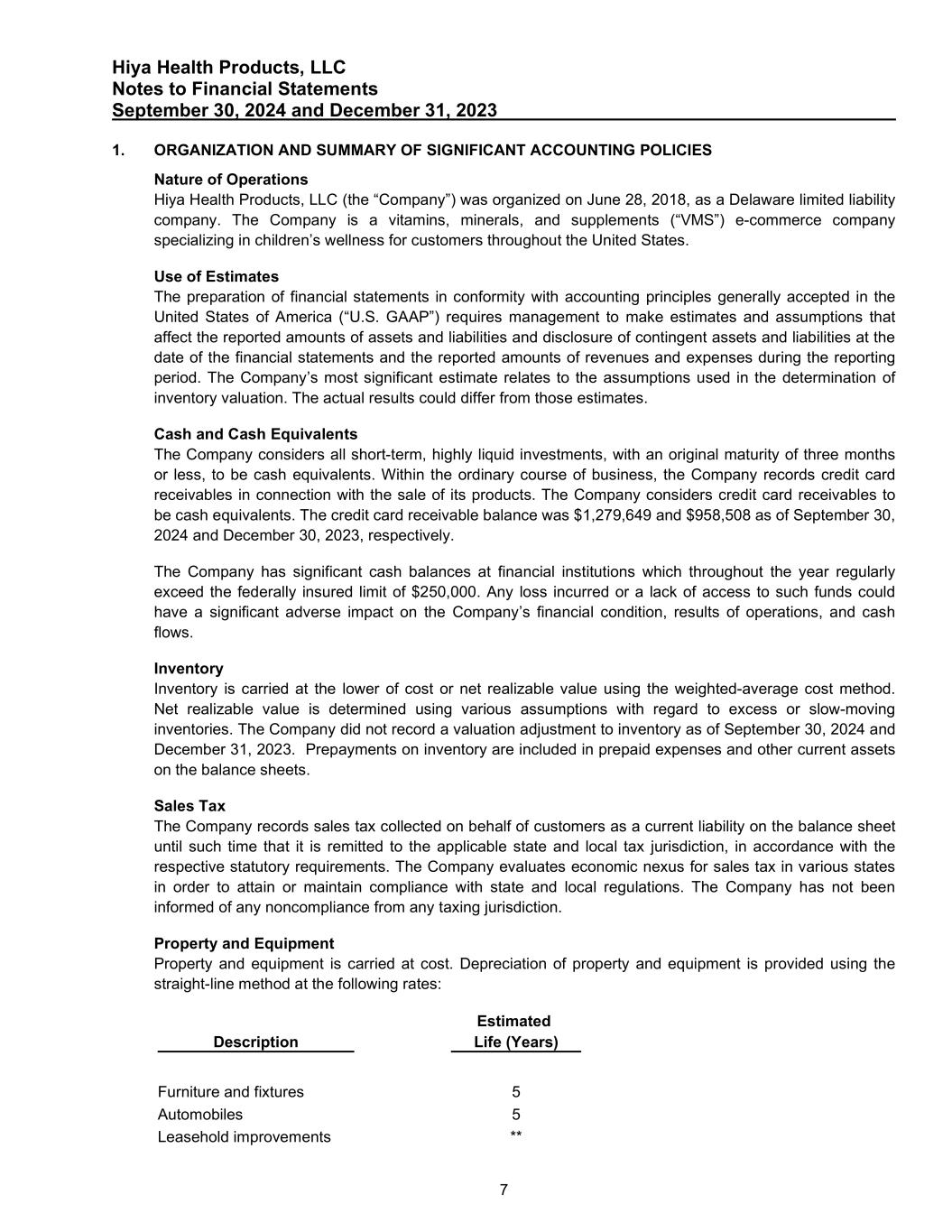

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 7 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Operations Hiya Health Products, LLC (the “Company”) was organized on June 28, 2018, as a Delaware limited liability company. The Company is a vitamins, minerals, and supplements (“VMS”) e-commerce company specializing in children’s wellness for customers throughout the United States. Use of Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company’s most significant estimate relates to the assumptions used in the determination of inventory valuation. The actual results could differ from those estimates. Cash and Cash Equivalents The Company considers all short-term, highly liquid investments, with an original maturity of three months or less, to be cash equivalents. Within the ordinary course of business, the Company records credit card receivables in connection with the sale of its products. The Company considers credit card receivables to be cash equivalents. The credit card receivable balance was $1,279,649 and $958,508 as of September 30, 2024 and December 30, 2023, respectively. The Company has significant cash balances at financial institutions which throughout the year regularly exceed the federally insured limit of $250,000. Any loss incurred or a lack of access to such funds could have a significant adverse impact on the Company’s financial condition, results of operations, and cash flows. Inventory Inventory is carried at the lower of cost or net realizable value using the weighted-average cost method. Net realizable value is determined using various assumptions with regard to excess or slow-moving inventories. The Company did not record a valuation adjustment to inventory as of September 30, 2024 and December 31, 2023. Prepayments on inventory are included in prepaid expenses and other current assets on the balance sheets. Sales Tax The Company records sales tax collected on behalf of customers as a current liability on the balance sheet until such time that it is remitted to the applicable state and local tax jurisdiction, in accordance with the respective statutory requirements. The Company evaluates economic nexus for sales tax in various states in order to attain or maintain compliance with state and local regulations. The Company has not been informed of any noncompliance from any taxing jurisdiction. Property and Equipment Property and equipment is carried at cost. Depreciation of property and equipment is provided using the straight-line method at the following rates: Estimated Description Life (Years) Furniture and fixtures 5 Automobiles 5 Leasehold improvements **

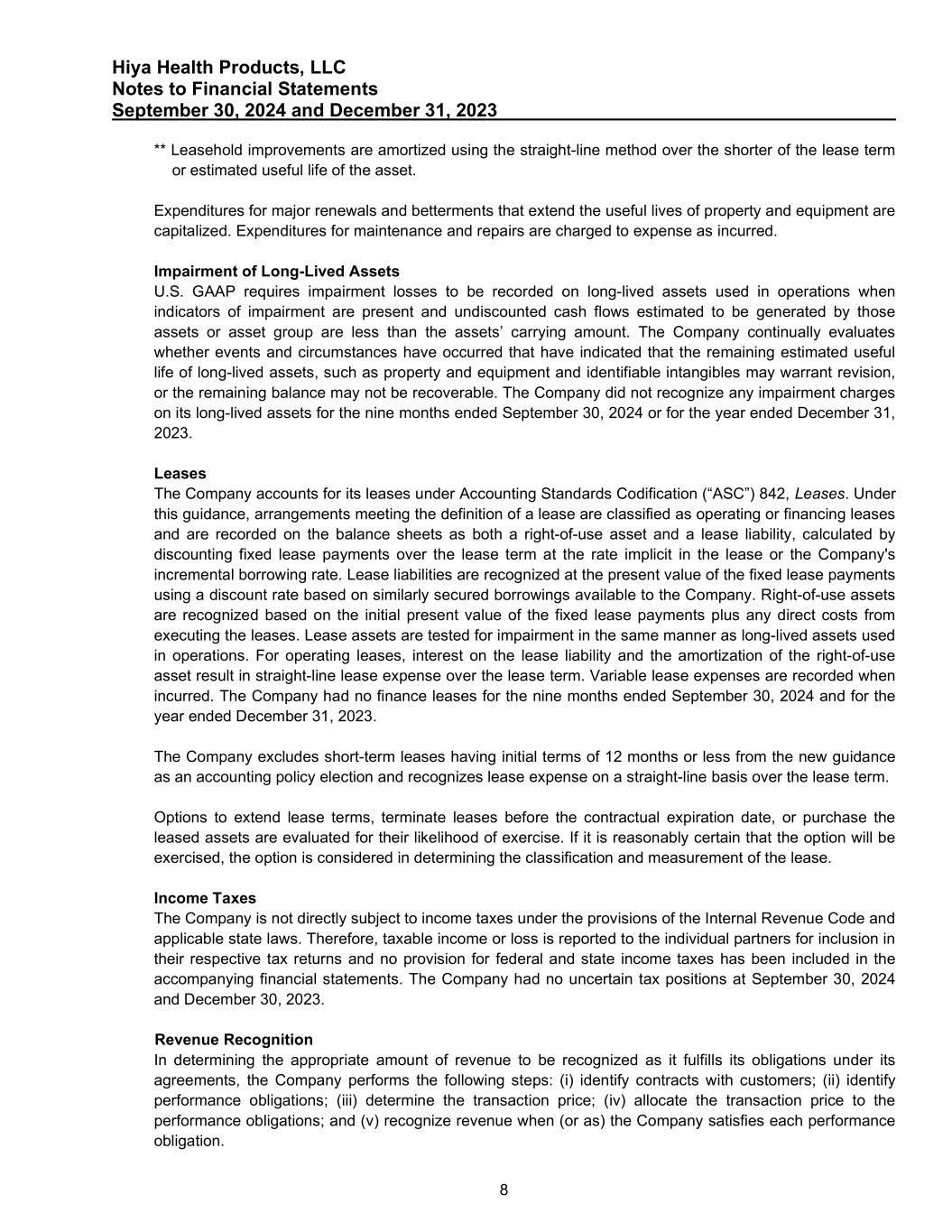

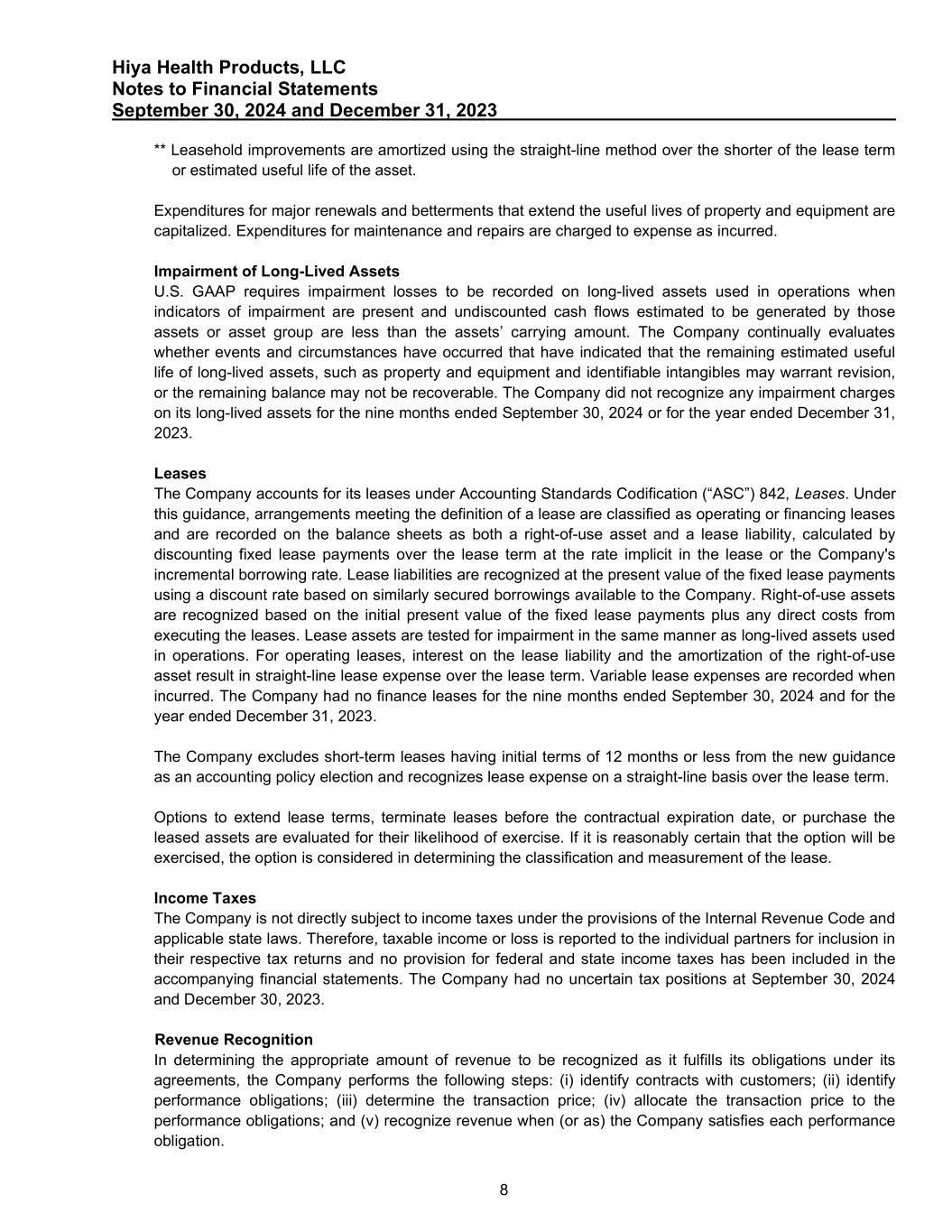

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 8 ** Leasehold improvements are amortized using the straight-line method over the shorter of the lease term or estimated useful life of the asset. Expenditures for major renewals and betterments that extend the useful lives of property and equipment are capitalized. Expenditures for maintenance and repairs are charged to expense as incurred. Impairment of Long-Lived Assets U.S. GAAP requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and undiscounted cash flows estimated to be generated by those assets or asset group are less than the assets’ carrying amount. The Company continually evaluates whether events and circumstances have occurred that have indicated that the remaining estimated useful life of long-lived assets, such as property and equipment and identifiable intangibles may warrant revision, or the remaining balance may not be recoverable. The Company did not recognize any impairment charges on its long-lived assets for the nine months ended September 30, 2024 or for the year ended December 31, 2023. Leases The Company accounts for its leases under Accounting Standards Codification (“ASC”) 842, Leases. Under this guidance, arrangements meeting the definition of a lease are classified as operating or financing leases and are recorded on the balance sheets as both a right-of-use asset and a lease liability, calculated by discounting fixed lease payments over the lease term at the rate implicit in the lease or the Company's incremental borrowing rate. Lease liabilities are recognized at the present value of the fixed lease payments using a discount rate based on similarly secured borrowings available to the Company. Right-of-use assets are recognized based on the initial present value of the fixed lease payments plus any direct costs from executing the leases. Lease assets are tested for impairment in the same manner as long-lived assets used in operations. For operating leases, interest on the lease liability and the amortization of the right-of-use asset result in straight-line lease expense over the lease term. Variable lease expenses are recorded when incurred. The Company had no finance leases for the nine months ended September 30, 2024 and for the year ended December 31, 2023. The Company excludes short-term leases having initial terms of 12 months or less from the new guidance as an accounting policy election and recognizes lease expense on a straight-line basis over the lease term. Options to extend lease terms, terminate leases before the contractual expiration date, or purchase the leased assets are evaluated for their likelihood of exercise. If it is reasonably certain that the option will be exercised, the option is considered in determining the classification and measurement of the lease. Income Taxes The Company is not directly subject to income taxes under the provisions of the Internal Revenue Code and applicable state laws. Therefore, taxable income or loss is reported to the individual partners for inclusion in their respective tax returns and no provision for federal and state income taxes has been included in the accompanying financial statements. The Company had no uncertain tax positions at September 30, 2024 and December 30, 2023. Revenue Recognition In determining the appropriate amount of revenue to be recognized as it fulfills its obligations under its agreements, the Company performs the following steps: (i) identify contracts with customers; (ii) identify performance obligations; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations; and (v) recognize revenue when (or as) the Company satisfies each performance obligation.

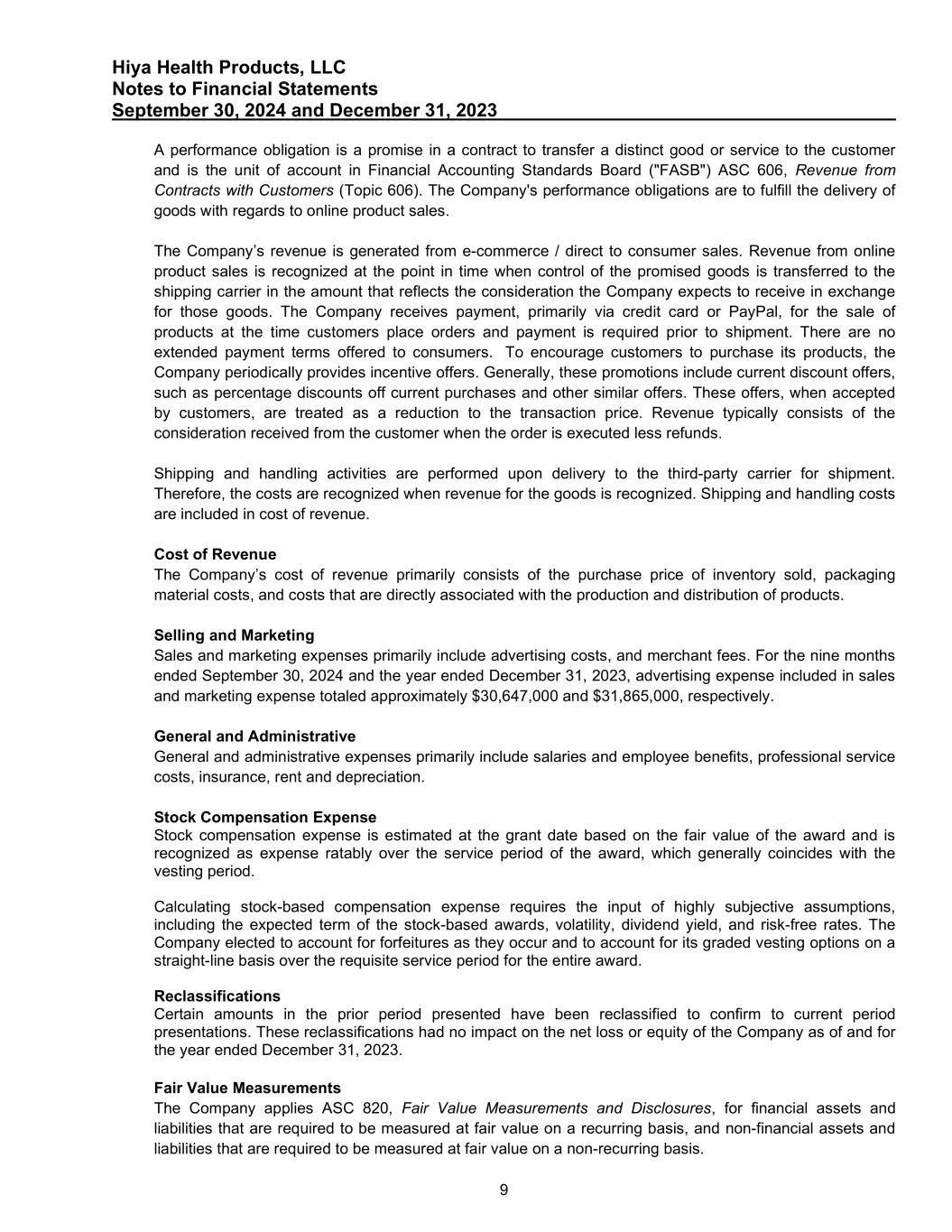

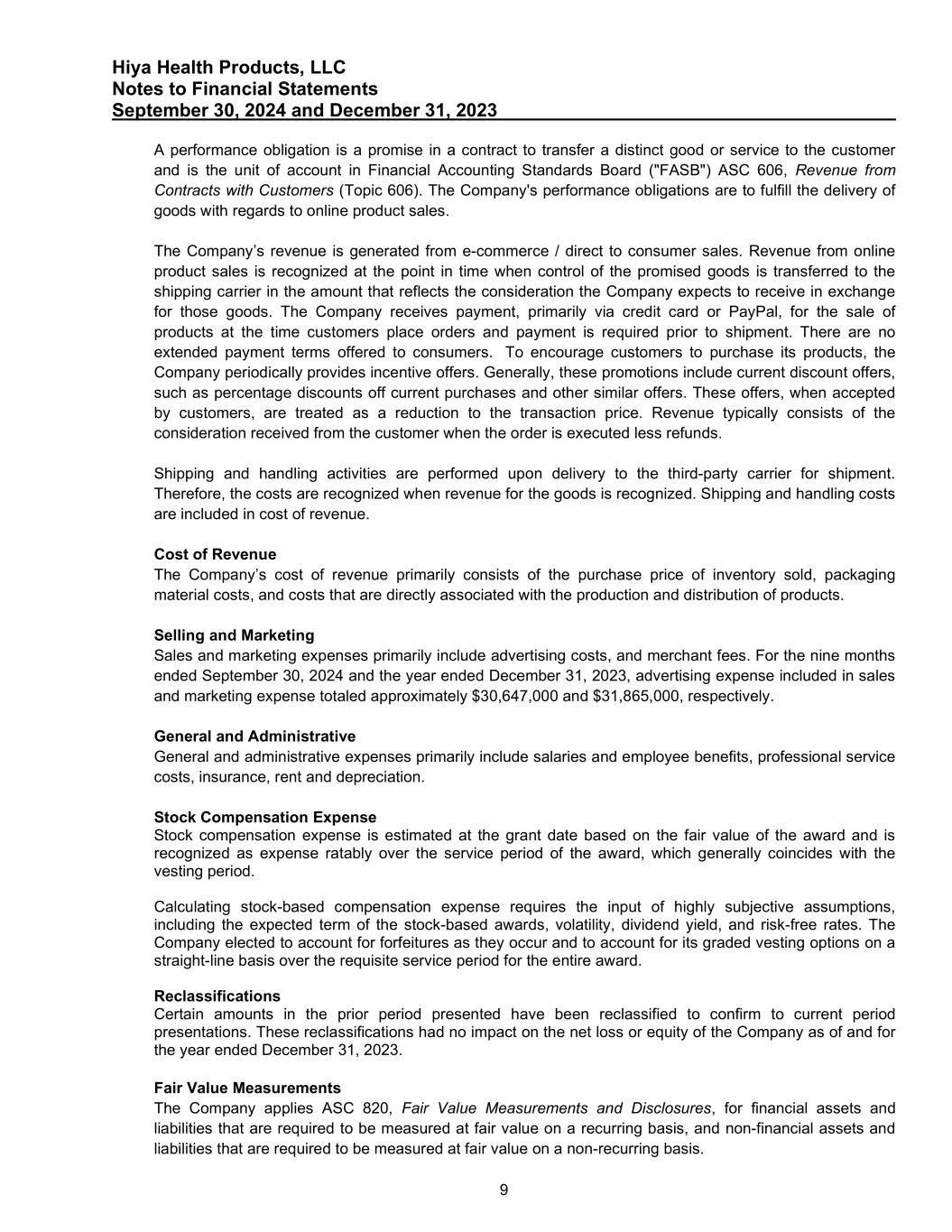

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 9 A performance obligation is a promise in a contract to transfer a distinct good or service to the customer and is the unit of account in Financial Accounting Standards Board ("FASB") ASC 606, Revenue from Contracts with Customers (Topic 606). The Company's performance obligations are to fulfill the delivery of goods with regards to online product sales. The Company’s revenue is generated from e-commerce / direct to consumer sales. Revenue from online product sales is recognized at the point in time when control of the promised goods is transferred to the shipping carrier in the amount that reflects the consideration the Company expects to receive in exchange for those goods. The Company receives payment, primarily via credit card or PayPal, for the sale of products at the time customers place orders and payment is required prior to shipment. There are no extended payment terms offered to consumers. To encourage customers to purchase its products, the Company periodically provides incentive offers. Generally, these promotions include current discount offers, such as percentage discounts off current purchases and other similar offers. These offers, when accepted by customers, are treated as a reduction to the transaction price. Revenue typically consists of the consideration received from the customer when the order is executed less refunds. Shipping and handling activities are performed upon delivery to the third-party carrier for shipment. Therefore, the costs are recognized when revenue for the goods is recognized. Shipping and handling costs are included in cost of revenue. Cost of Revenue The Company’s cost of revenue primarily consists of the purchase price of inventory sold, packaging material costs, and costs that are directly associated with the production and distribution of products. Selling and Marketing Sales and marketing expenses primarily include advertising costs, and merchant fees. For the nine months ended September 30, 2024 and the year ended December 31, 2023, advertising expense included in sales and marketing expense totaled approximately $30,647,000 and $31,865,000, respectively. General and Administrative General and administrative expenses primarily include salaries and employee benefits, professional service costs, insurance, rent and depreciation. Stock Compensation Expense Stock compensation expense is estimated at the grant date based on the fair value of the award and is recognized as expense ratably over the service period of the award, which generally coincides with the vesting period. Calculating stock-based compensation expense requires the input of highly subjective assumptions, including the expected term of the stock-based awards, volatility, dividend yield, and risk-free rates. The Company elected to account for forfeitures as they occur and to account for its graded vesting options on a straight-line basis over the requisite service period for the entire award. Reclassifications Certain amounts in the prior period presented have been reclassified to confirm to current period presentations. These reclassifications had no impact on the net loss or equity of the Company as of and for the year ended December 31, 2023. Fair Value Measurements The Company applies ASC 820, Fair Value Measurements and Disclosures, for financial assets and liabilities that are required to be measured at fair value on a recurring basis, and non-financial assets and liabilities that are required to be measured at fair value on a non-recurring basis.

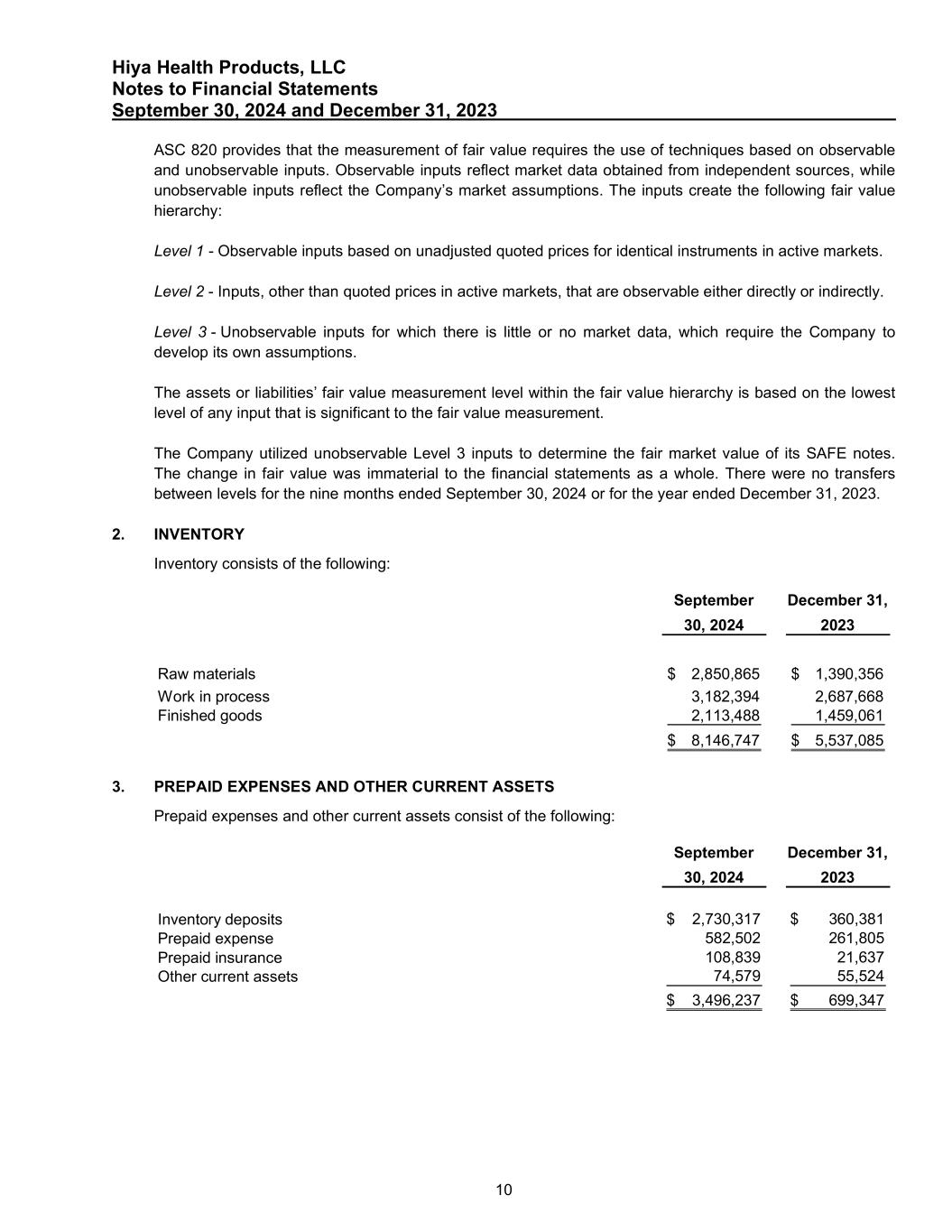

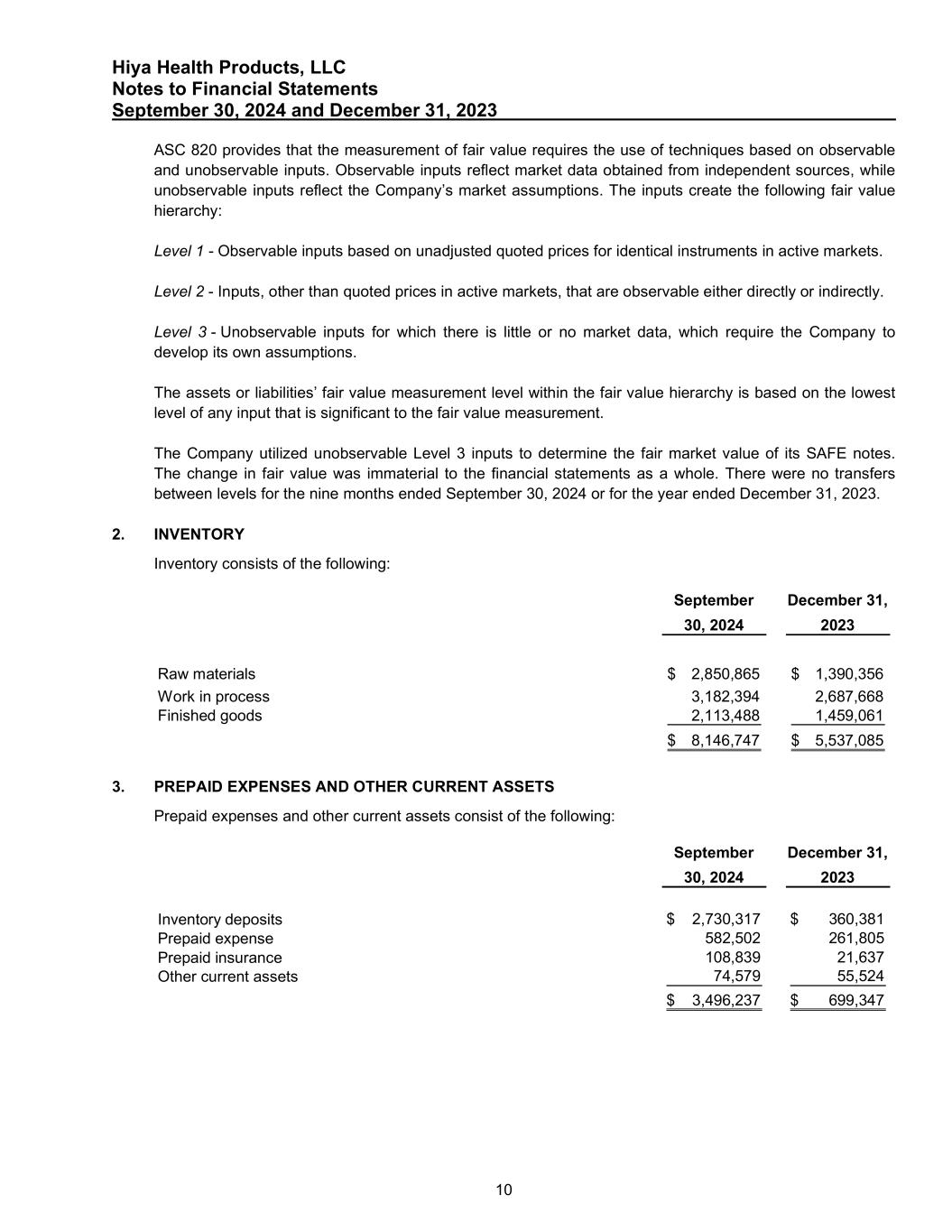

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 10 ASC 820 provides that the measurement of fair value requires the use of techniques based on observable and unobservable inputs. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company’s market assumptions. The inputs create the following fair value hierarchy: Level 1 - Observable inputs based on unadjusted quoted prices for identical instruments in active markets. Level 2 - Inputs, other than quoted prices in active markets, that are observable either directly or indirectly. Level 3 - Unobservable inputs for which there is little or no market data, which require the Company to develop its own assumptions. The assets or liabilities’ fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. The Company utilized unobservable Level 3 inputs to determine the fair market value of its SAFE notes. The change in fair value was immaterial to the financial statements as a whole. There were no transfers between levels for the nine months ended September 30, 2024 or for the year ended December 31, 2023. 2. INVENTORY Inventory consists of the following: September 30, 2024 December 31, 2023 Raw materials 2,850,865$ 1,390,356$ Work in process 3,182,394 2,687,668 Finished goods 2,113,488 1,459,061 8,146,747$ 5,537,085$ 3. PREPAID EXPENSES AND OTHER CURRENT ASSETS Prepaid expenses and other current assets consist of the following: September 30, 2024 December 31, 2023 Inventory deposits $ 2,730,317 $ 360,381 Prepaid expense 582,502 261,805 Prepaid insurance 108,839 21,637 Other current assets 74,579 55,524 $ 3,496,237 $ 699,347

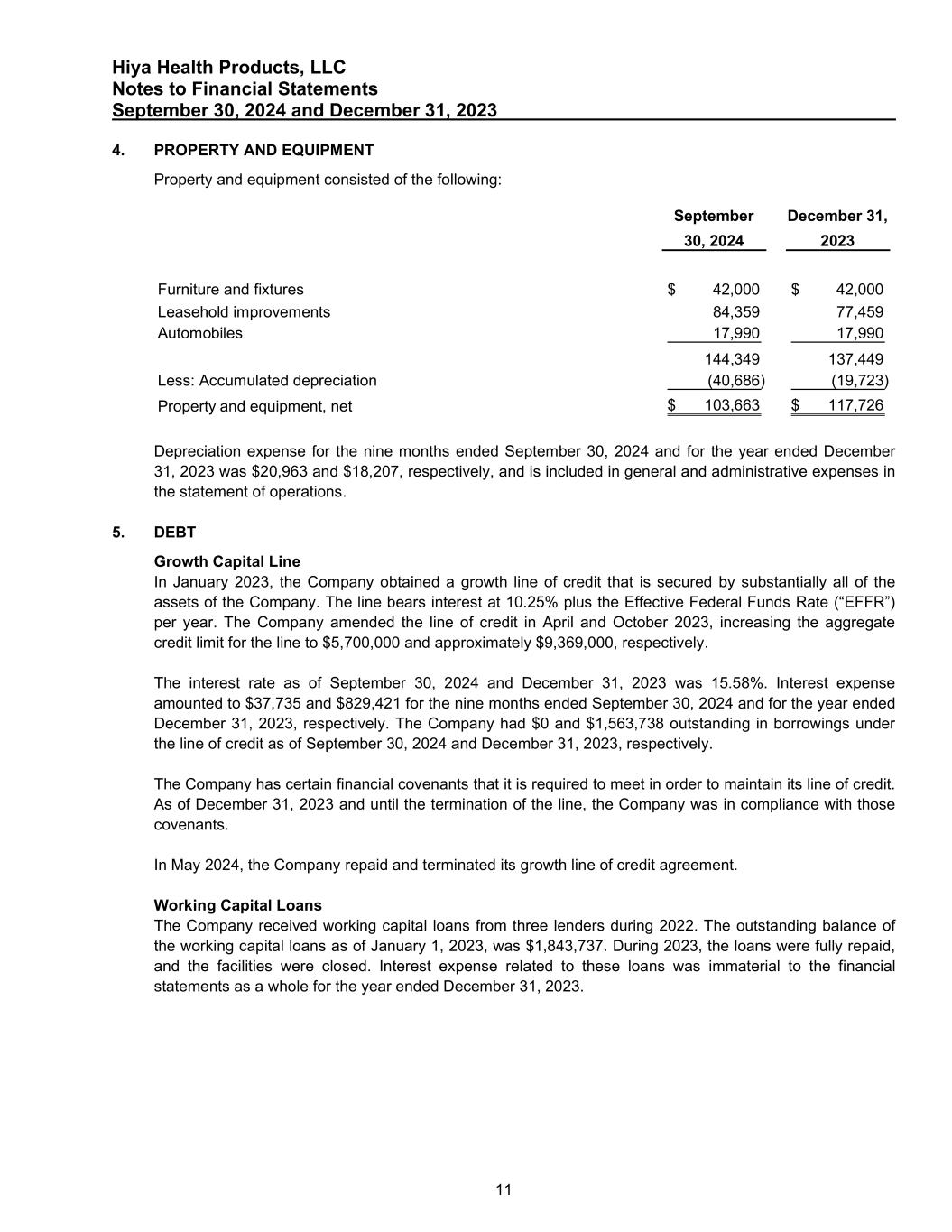

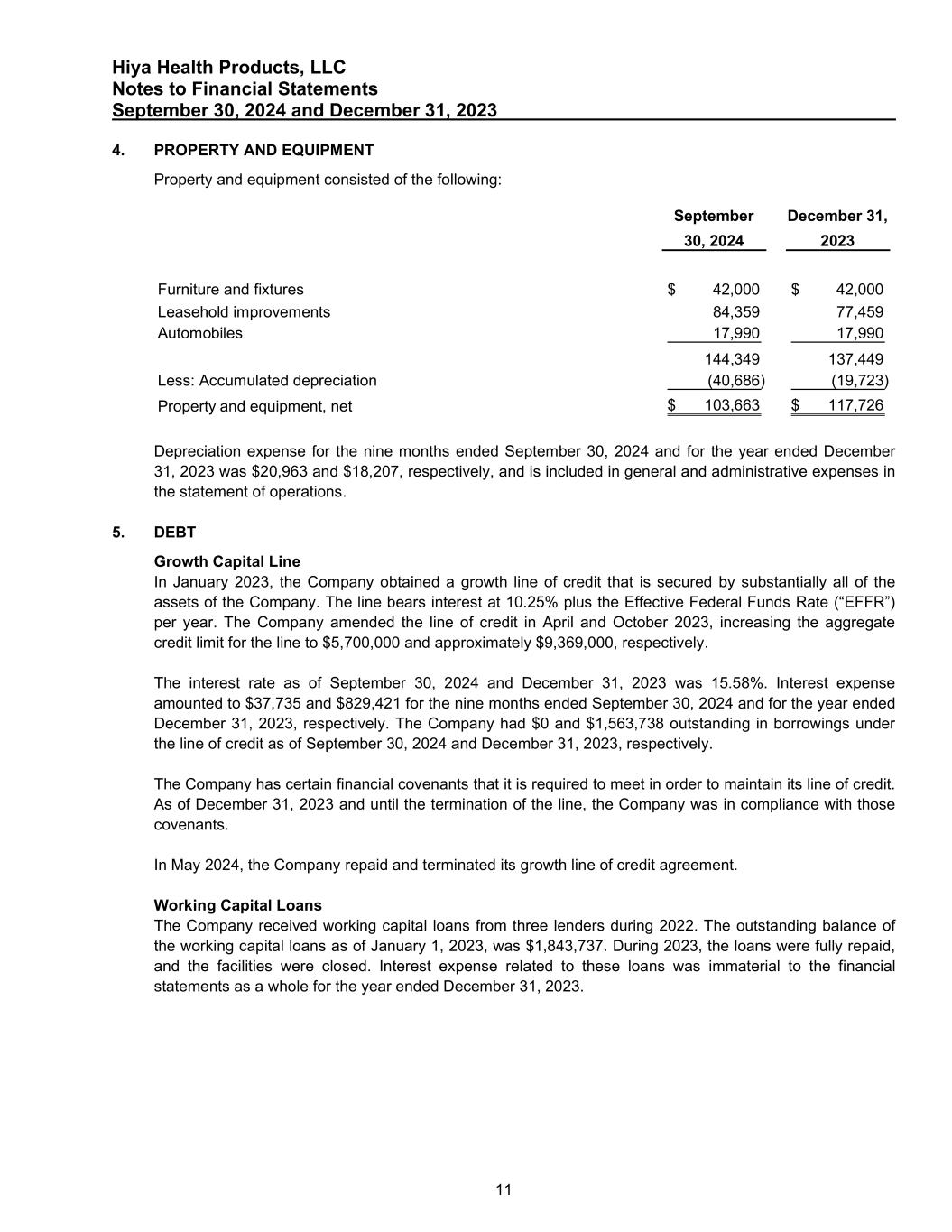

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 11 4. PROPERTY AND EQUIPMENT Property and equipment consisted of the following: September 30, 2024 December 31, 2023 Furniture and fixtures 42,000$ 42,000$ Leasehold improvements 84,359 77,459 Automobiles 17,990 17,990 144,349 137,449 Less: Accumulated depreciation (40,686) (19,723) Property and equipment, net 103,663$ 117,726$ Depreciation expense for the nine months ended September 30, 2024 and for the year ended December 31, 2023 was $20,963 and $18,207, respectively, and is included in general and administrative expenses in the statement of operations. 5. DEBT Growth Capital Line In January 2023, the Company obtained a growth line of credit that is secured by substantially all of the assets of the Company. The line bears interest at 10.25% plus the Effective Federal Funds Rate (“EFFR”) per year. The Company amended the line of credit in April and October 2023, increasing the aggregate credit limit for the line to $5,700,000 and approximately $9,369,000, respectively. The interest rate as of September 30, 2024 and December 31, 2023 was 15.58%. Interest expense amounted to $37,735 and $829,421 for the nine months ended September 30, 2024 and for the year ended December 31, 2023, respectively. The Company had $0 and $1,563,738 outstanding in borrowings under the line of credit as of September 30, 2024 and December 31, 2023, respectively. The Company has certain financial covenants that it is required to meet in order to maintain its line of credit. As of December 31, 2023 and until the termination of the line, the Company was in compliance with those covenants. In May 2024, the Company repaid and terminated its growth line of credit agreement. Working Capital Loans The Company received working capital loans from three lenders during 2022. The outstanding balance of the working capital loans as of January 1, 2023, was $1,843,737. During 2023, the loans were fully repaid, and the facilities were closed. Interest expense related to these loans was immaterial to the financial statements as a whole for the year ended December 31, 2023.

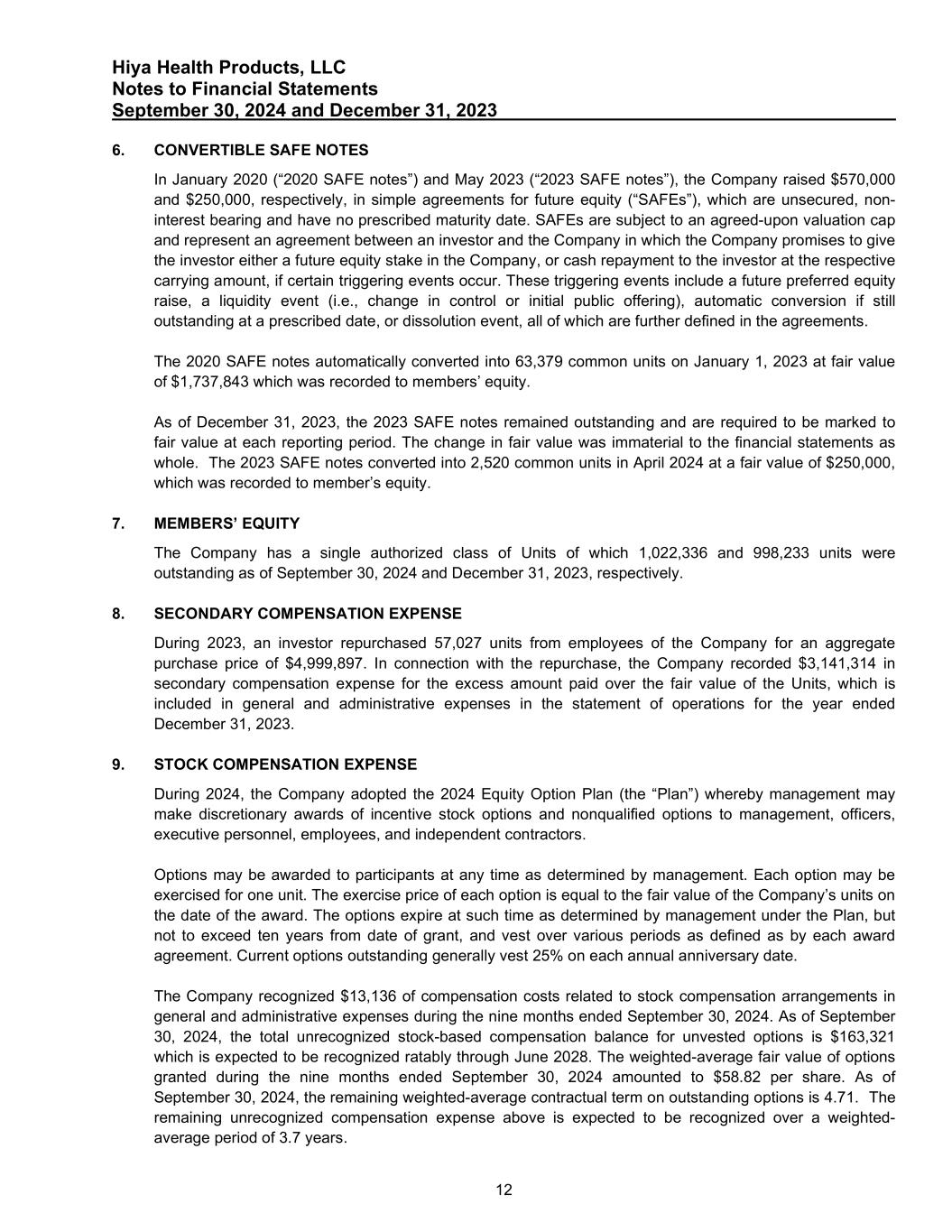

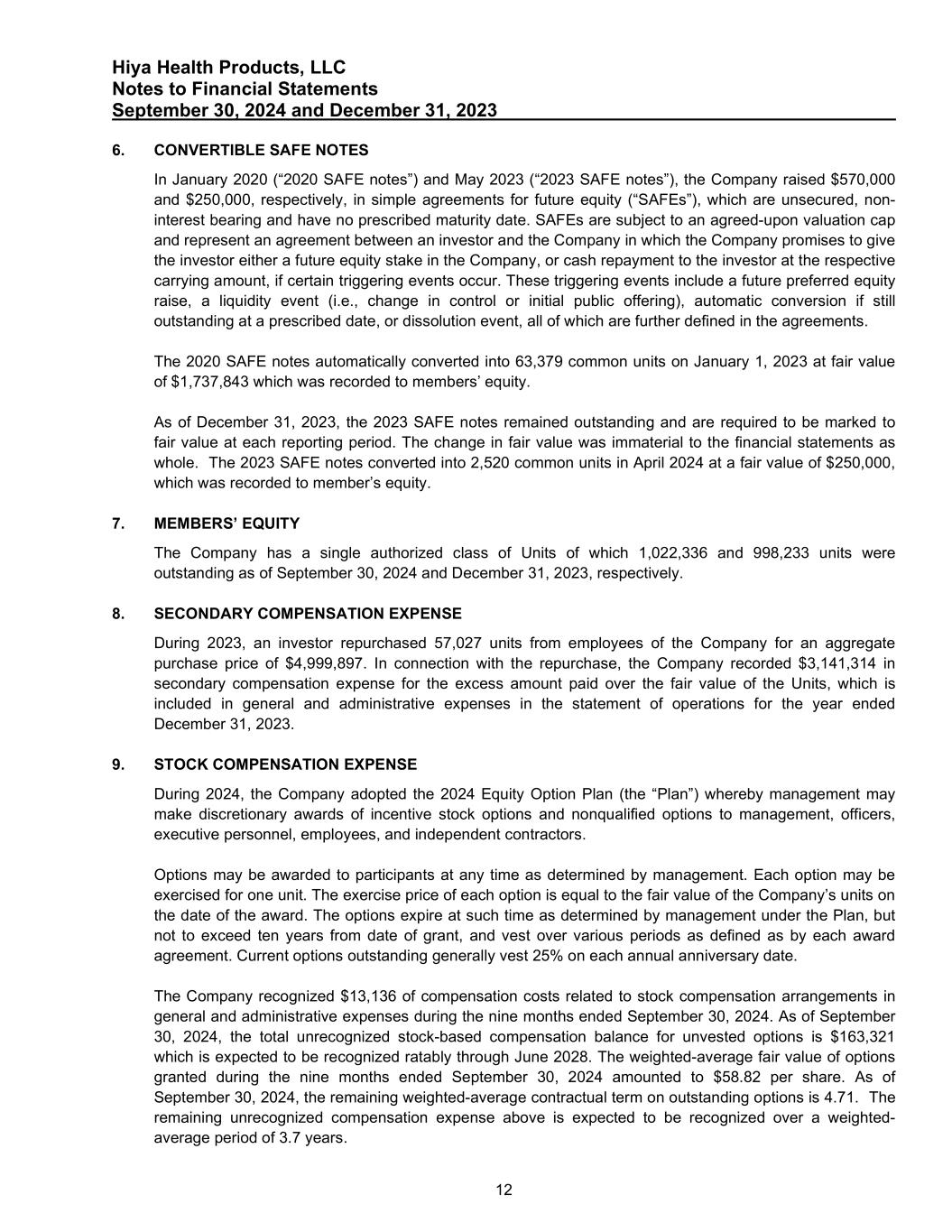

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 12 6. CONVERTIBLE SAFE NOTES In January 2020 (“2020 SAFE notes”) and May 2023 (“2023 SAFE notes”), the Company raised $570,000 and $250,000, respectively, in simple agreements for future equity (“SAFEs”), which are unsecured, non- interest bearing and have no prescribed maturity date. SAFEs are subject to an agreed-upon valuation cap and represent an agreement between an investor and the Company in which the Company promises to give the investor either a future equity stake in the Company, or cash repayment to the investor at the respective carrying amount, if certain triggering events occur. These triggering events include a future preferred equity raise, a liquidity event (i.e., change in control or initial public offering), automatic conversion if still outstanding at a prescribed date, or dissolution event, all of which are further defined in the agreements. The 2020 SAFE notes automatically converted into 63,379 common units on January 1, 2023 at fair value of $1,737,843 which was recorded to members’ equity. As of December 31, 2023, the 2023 SAFE notes remained outstanding and are required to be marked to fair value at each reporting period. The change in fair value was immaterial to the financial statements as whole. The 2023 SAFE notes converted into 2,520 common units in April 2024 at a fair value of $250,000, which was recorded to member’s equity. 7. MEMBERS’ EQUITY The Company has a single authorized class of Units of which 1,022,336 and 998,233 units were outstanding as of September 30, 2024 and December 31, 2023, respectively. 8. SECONDARY COMPENSATION EXPENSE During 2023, an investor repurchased 57,027 units from employees of the Company for an aggregate purchase price of $4,999,897. In connection with the repurchase, the Company recorded $3,141,314 in secondary compensation expense for the excess amount paid over the fair value of the Units, which is included in general and administrative expenses in the statement of operations for the year ended December 31, 2023. 9. STOCK COMPENSATION EXPENSE During 2024, the Company adopted the 2024 Equity Option Plan (the “Plan”) whereby management may make discretionary awards of incentive stock options and nonqualified options to management, officers, executive personnel, employees, and independent contractors. Options may be awarded to participants at any time as determined by management. Each option may be exercised for one unit. The exercise price of each option is equal to the fair value of the Company’s units on the date of the award. The options expire at such time as determined by management under the Plan, but not to exceed ten years from date of grant, and vest over various periods as defined as by each award agreement. Current options outstanding generally vest 25% on each annual anniversary date. The Company recognized $13,136 of compensation costs related to stock compensation arrangements in general and administrative expenses during the nine months ended September 30, 2024. As of September 30, 2024, the total unrecognized stock-based compensation balance for unvested options is $163,321 which is expected to be recognized ratably through June 2028. The weighted-average fair value of options granted during the nine months ended September 30, 2024 amounted to $58.82 per share. As of September 30, 2024, the remaining weighted-average contractual term on outstanding options is 4.71. The remaining unrecognized compensation expense above is expected to be recognized over a weighted- average period of 3.7 years.

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 13 The following table summarizes the Company’s stock option plan and the activity for the nine months ended September 30, 2024: Weighted- Average Aggregate Options Exercise Intrinsic Outstanding Price Value Balance at January 1, 2024 - Options granted 3,000 97.53$ -$ Balance at September 30, 2024 3,000 97.53$ -$ Exercisable at September 30, 2024 - -$ -$ Valuation Assumptions The Company estimated the fair value of stock options granted during 2024 using the Black-Scholes model with the following weighted-average assumptions: Expected term 3.7 years Volatility 80.95% Risk-free interest rate 4.53% Dividend yield 0% Expected Term The Company’s expected term represents the period that the awards are expected to be outstanding and was determined as a function of contractual terms of the stock-based awards and vesting schedules. The Company used the simplified method of calculation for estimating expected term. The options granted in 2024 have a five year term. Expected Volatility The volatility factor for the Company’s stock options was estimated using the average volatility of comparable publicly traded companies as a proxy for what would have been the Company’s volatility had the Company been public. Risk-Free Interest Rate The Company bases the risk-free interest rate used in the Black-Scholes model on implied yield currently available on U.S. Treasury zero-coupon issues with an equivalent remaining term. Expected Dividend Yield The Company does not anticipate that dividends will be distributed in the near future.

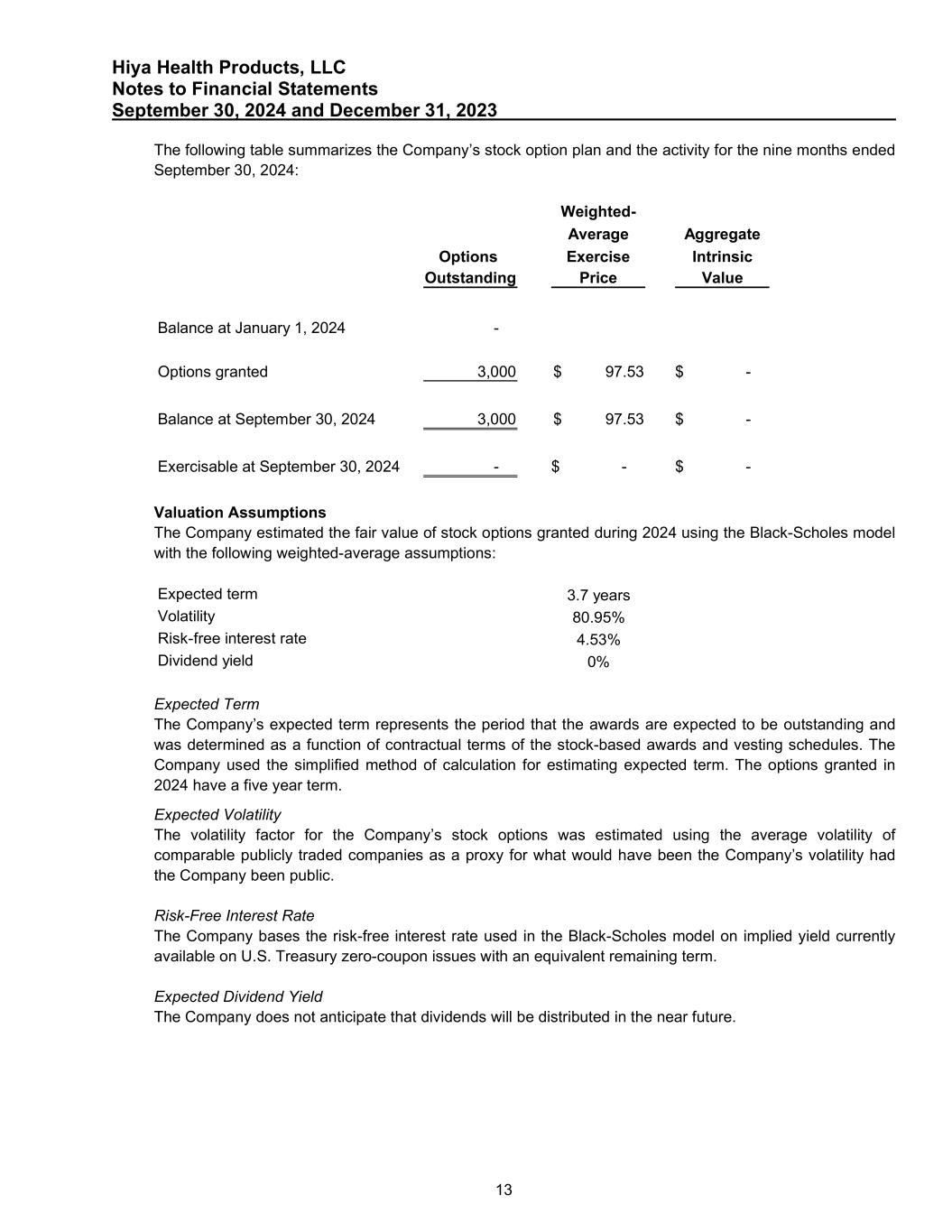

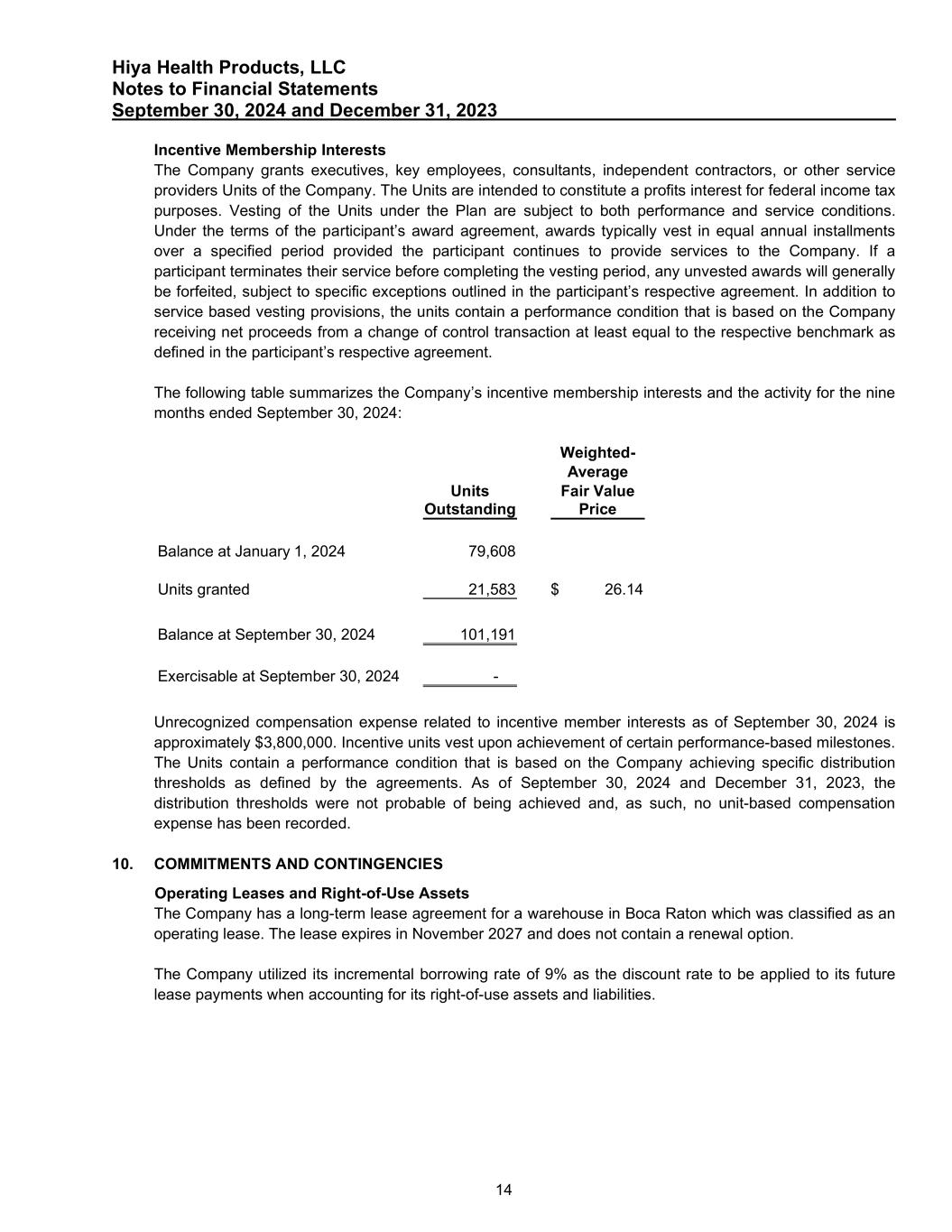

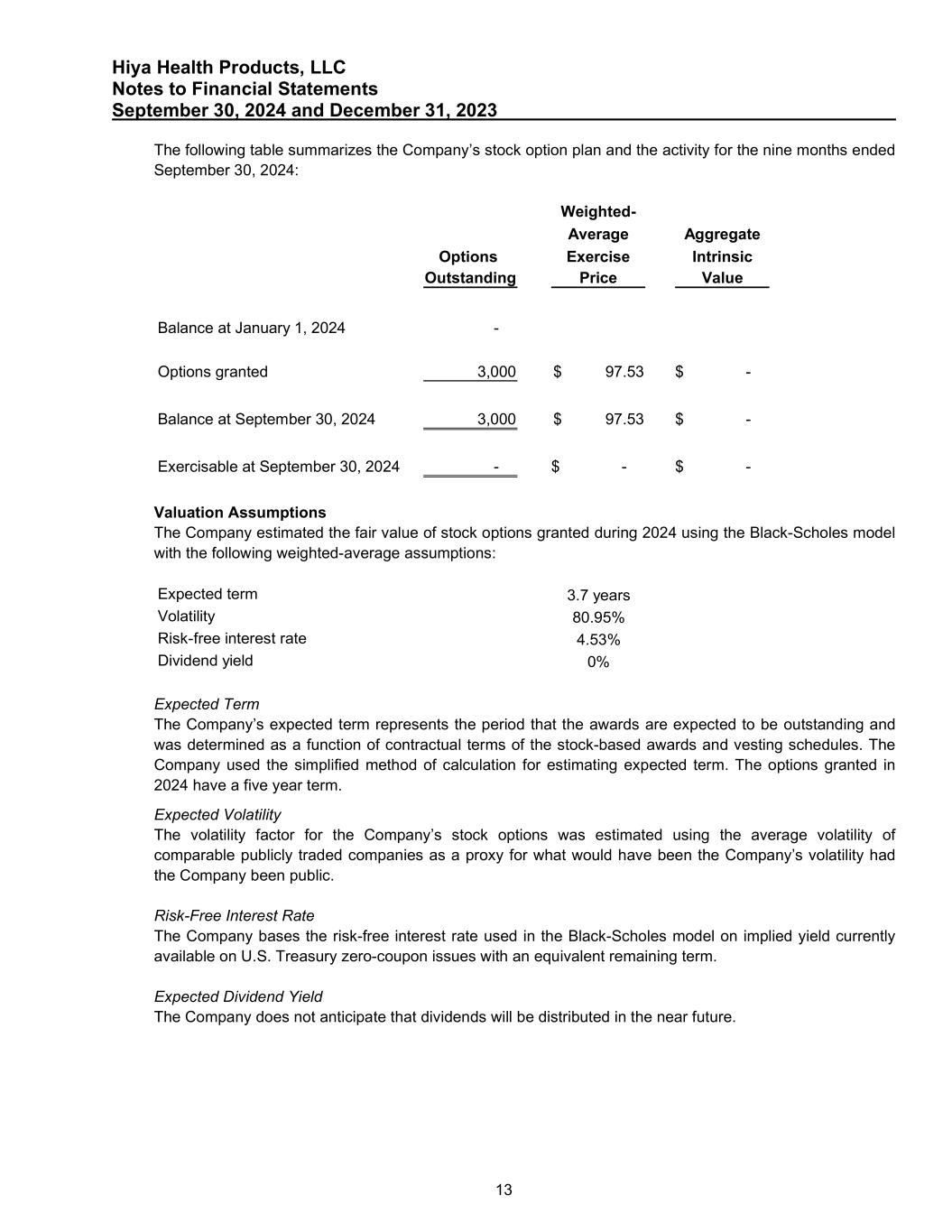

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 14 Incentive Membership Interests The Company grants executives, key employees, consultants, independent contractors, or other service providers Units of the Company. The Units are intended to constitute a profits interest for federal income tax purposes. Vesting of the Units under the Plan are subject to both performance and service conditions. Under the terms of the participant’s award agreement, awards typically vest in equal annual installments over a specified period provided the participant continues to provide services to the Company. If a participant terminates their service before completing the vesting period, any unvested awards will generally be forfeited, subject to specific exceptions outlined in the participant’s respective agreement. In addition to service based vesting provisions, the units contain a performance condition that is based on the Company receiving net proceeds from a change of control transaction at least equal to the respective benchmark as defined in the participant’s respective agreement. The following table summarizes the Company’s incentive membership interests and the activity for the nine months ended September 30, 2024: Weighted- Average Units Fair Value Outstanding Price Balance at January 1, 2024 79,608 Units granted 21,583 26.14$ Balance at September 30, 2024 101,191 Exercisable at September 30, 2024 - Unrecognized compensation expense related to incentive member interests as of September 30, 2024 is approximately $3,800,000. Incentive units vest upon achievement of certain performance-based milestones. The Units contain a performance condition that is based on the Company achieving specific distribution thresholds as defined by the agreements. As of September 30, 2024 and December 31, 2023, the distribution thresholds were not probable of being achieved and, as such, no unit-based compensation expense has been recorded. 10. COMMITMENTS AND CONTINGENCIES Operating Leases and Right-of-Use Assets The Company has a long-term lease agreement for a warehouse in Boca Raton which was classified as an operating lease. The lease expires in November 2027 and does not contain a renewal option. The Company utilized its incremental borrowing rate of 9% as the discount rate to be applied to its future lease payments when accounting for its right-of-use assets and liabilities.

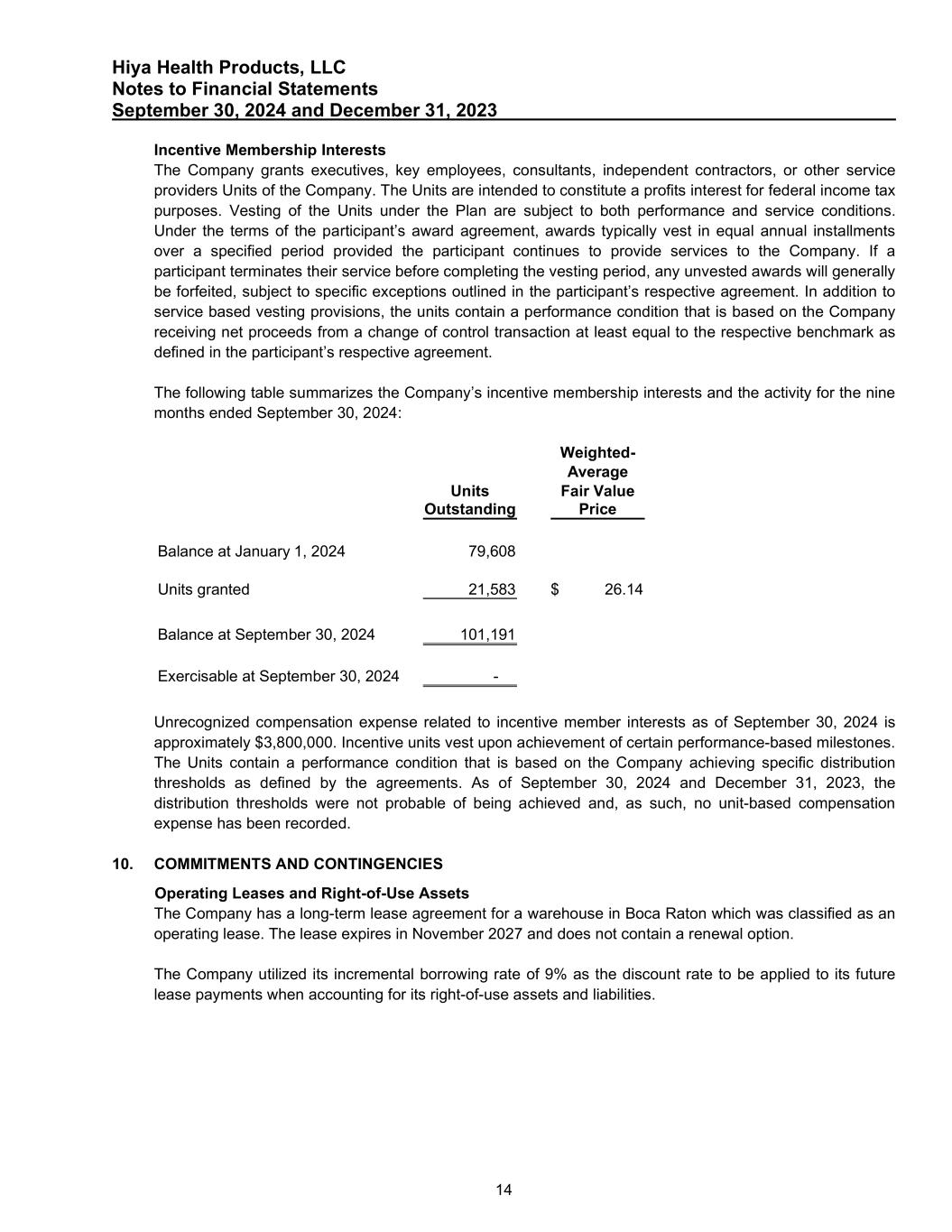

Hiya Health Products, LLC Notes to Financial Statements September 30, 2024 and December 31, 2023 15 As of September 30, 2024, the future minimum rental payments required under operating leases are as follows: 2025 153,909$ 2026 161,604 2027 169,684 2028 13,581 498,778 Less: Imputed interest on lease liability (62,989) Total lease liability 435,789$ Total lease expense amounted to $132,963 and $165,901 for the period ended September 30, 2024 and year ended December 31, 2023, respectively. The weighted-average remaining lease term is 3.17 and 3.92 years as of September 30, 2024 and December 31, 2023. Cash paid for operating leases included in the measurement of the lease liability was $110,087 and $141,338 for the nine months ended September 30, 2024 and the year ended December 31, 2023, respectively. General Litigation The Company is subject to claims and lawsuits that arise primarily in the ordinary course of business. It is the opinion of management that the disposition or ultimate resolution of such claims and lawsuits will not have a material adverse effect on the financial position, results of operations and cash flows of the Company. The Company will recognize a loss contingency when it is both possible and can be reasonably estimated. As of September 30, 2024, and December 31, 2023, there are no loss contingencies that are considered reasonably probable. 11. CONCENTRATION OF CREDIT RISK During the nine months ended September 30, 2024 and for the year ended December 31, 2023, there was no single customer that represented more than 10% of total Company sales. The Company had three inventory suppliers that accounted for approximately 92% of purchases and $430,000 in outstanding payables for the nine months ended September 30, 2024. The Company expects to maintain its relationship with these vendors. The Company had four inventory suppliers that accounted for approximately 85% of purchases and $1,332,000 in outstanding payables for the year ended December 31, 2023. The Company expects to maintain its relationship with these vendors. 12. RELATED PARTY TRANSACTIONS The Company utilizes a digital marketing agency where the founders of the agency are members of the Company. Services provided for the nine months ended September 30, 2024 and for the year ended December 31, 2023 amounted to approximately $558,000 and $1,493,000, respectively, and are included in general and administrative expenses on the Company’s statement of operations. 13. SUBSEQUENT EVENTS The Company has evaluated subsequent events through December 16, 2024, the date the financial statements were available to be issued, and has determined that there were no other events other than the events described above which occurred requiring disclosure in or adjustments to the financial statements.