- CTLP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

10-Q/A Filing

Cantaloupe (CTLP) 10-Q/A2016 Q3 Quarterly report (amended)

Filed: 24 Feb 17, 12:00am

Exhibit 10.1

PORTIONS OF THIS AGREEMENT HAVE BEEN OMITTED AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. CONFIDENTIAL TREATMENT HAS BEEN REQUESTED WITH RESPECT TO THE OMITTED PORTIONS, WHICH ARE MARKED BY ASTERISKS (“***”).

This Loan And Security Agreement is entered into as of March 29, 2016, by and between HERITAGE BANK OF COMMERCE (“Bank”) and USA Technologies, Inc. (“Borrower”).

Recitals

Borrower wishes to obtain credit from time to time from Bank, and Bank desires to extend credit to Borrower. This Agreement sets forth the terms on which Bank will advance credit to Borrower, and Borrower will repay the amounts owing to Bank.

Agreement

The parties agree as follows:

1. Definitions and Construction. |

1.1 Definitions. As used in this Agreement, the following terms shall have the following definitions: |

“Accounts” means all presently existing and hereafter arising accounts, contract rights, payment intangibles, and all other forms of obligations owing to Borrower arising out of the sale or lease of goods (including, without limitation, the licensing of software and other technology) or the rendering of services by Borrower, whether or not earned by performance, and any and all credit insurance, guaranties, and other security therefor, as well as all merchandise returned to or reclaimed by Borrower and Borrower’s Books relating to any of the foregoing.

“Adjusted EBITDA” means net income (loss) before interest income, interest expense, income taxes, depreciation, amortization, non-recurring professional service fees recorded in selling, general and administrative (SG&A) expenses that were incurred in connection with the VendScreen, Inc. transaction as well as other integration and transaction expenses related to VendScreen, Inc., change in fair value of warrant liabilities and stock-based compensation expense.

“Advance” or “Advances” means a cash advance or cash advances under the Revolving Facility.

“Affiliate” means, with respect to any Person, any Person that owns or controls directly or indirectly such Person, any Person that controls or is controlled by or is under common control with such Person, and each of such Person’s senior executive officers, directors, and partners.

“Bank Expenses” means all: reasonable costs or expenses (including reasonable attorneys’ fees and expenses) incurred in connection with the preparation, negotiation, administration, and enforcement of the Loan Documents; reasonable Collateral audit fees; and Bank’s reasonable attorneys’ fees and expenses incurred in amending, enforcing or defending the Loan Documents (including fees and expenses of appeal), incurred before, during and after an Insolvency Proceeding, whether or not suit is brought.

“Borrower’s Books” means all of Borrower’s books and records including: ledgers; records concerning Borrower’s assets or liabilities, the Collateral, business operations or financial condition; and all computer programs, or tape files, and the equipment, containing such information.

“Borrowing Base” means an amount equal to eighty-five percent (85%) of License and Transaction Revenue.

1.

“Business Day” means any day that is not a Saturday, Sunday, or other day on which banks in the State of California are authorized or required to close.

“Change in Control” shall mean a transaction in which any “person” or “group” (within the meaning of Section 13(d) and 14(d)(2) of the Securities Exchange Act of 1934) becomes the “beneficial owner” (as defined in Rule 13d-3 under the Securities Exchange Act of 1934), directly or indirectly, of a sufficient number of shares of all classes of stock then outstanding of Borrower ordinarily entitled to vote in the election of directors, empowering such “person” or “group” to elect a majority of the Board of Directors of Borrower, who did not have such power before such transaction.

“Closing Date” means the date of this Agreement.

“Code” means the California Uniform Commercial Code.

“Collateral” means the property described on Exhibit A attached hereto.

“Contingent Obligation” means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of that Person with respect to (i) any indebtedness, lease, dividend, letter of credit or other obligation of another; (ii) any obligations with respect to undrawn letters of credit for the account of that Person; and (iii) all obligations arising under any agreement or arrangement designed to protect such Person against fluctuation in interest rates, currency exchange rates or commodity prices; provided, however, that the term “Contingent Obligation” shall not include endorsements for collection or deposit in the ordinary course of business. The amount of any Contingent Obligation shall be deemed to be an amount equal to the stated or determined amount of the primary obligation in respect of which such Contingent Obligation is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof as determined by Bank in good faith; provided, however, that such amount shall not in any event exceed the maximum amount of the obligations under the guarantee or other support arrangement.

“Copyrights” means any and all copyright rights, copyright applications, copyright registrations and like protections in each work or authorship and derivative work thereof.

“Credit Extension” means each Advance or any other extension of credit by Bank for the benefit of Borrower hereunder.

“Daily Balance” means the amount of the Obligations owed at the end of a given day.

“Equipment” means all present and future machinery, equipment, computer hardware and software, tenant improvements, furniture, fixtures, vehicles, tools, parts and attachments in which Borrower has any interest.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations thereunder.

“Event of Default” has the meaning assigned in Section 8.

“GAAP” means generally accepted accounting principles as in effect from time to time.

“Guaranty” means the secured guaranty of even date by Stitch Networks Corporation and USAT Capital Corp LLC.

2.

“Indebtedness” means (a) all indebtedness for borrowed money or the deferred purchase price of property or services, including without limitation reimbursement and other obligations with respect to surety bonds and letters of credit, (b) all obligations evidenced by notes, bonds, debentures or similar instruments, (c) all capital lease obligations, and (d) all Contingent Obligations respecting obligations of the type set forth in (a), (b), or (c) above.

“Insolvency Proceeding” means any proceeding commenced by or against any person or entity under any provision of the United States Bankruptcy Code, as amended, or under any other bankruptcy or insolvency law, including assignments for the benefit of creditors, formal or informal moratoria, compositions, extension generally with its creditors, or proceedings seeking reorganization, arrangement, or other relief.

“Intellectual Property” means all of Borrower’s right, title, and interest in and to the following: Copyrights, Trademarks and Patents; all trade secrets, all design rights, claims for damages by way of past, present and future infringement of any of the rights included above, all licenses or other rights to use any of the Copyrights, Patents or Trademarks, and all license fees and royalties arising from such use to the extent permitted by such license or rights; all amendments, renewals and extensions of any of the Copyrights, Trademarks or Patents; and all proceeds and products of the foregoing, including without limitation all payments under insurance or any indemnity or warranty payable in respect of any of the foregoing.

“Inventory” means all inventory in which Borrower has or acquires any interest, including work in process and finished products intended for sale or lease or to be furnished under a contract of service, of every kind and description now or at any time hereafter owned by or in the custody or possession, actual or constructive, of Borrower, including such inventory as is temporarily out of its custody or possession or in transit and including any returns upon any accounts or other proceeds, including insurance proceeds, resulting from the sale or disposition of any of the foregoing and any documents of title representing any of the above, and Borrower’s Books relating to any of the foregoing.

“Investment” means any beneficial ownership of (including stock, partnership interest or other securities) any Person, or any loan, advance or capital contribution to any Person.

“IRC” means the Internal Revenue Code of 1986, as amended, and the regulations thereunder.

“License and Transaction Revenue” shall mean Borrower’s license and transaction fee revenue (as is reflected as such in its consolidated statement of operations) for the preceding three (3) calendar months.

“Lien” means any mortgage, lien, deed of trust, charge, pledge, security interest or other encumbrance.

“Loan Documents” means, collectively, this Agreement, any note or notes executed by Borrower, any guarantees by third parties, all documents and agreements listed in Section 3.1, and any other agreement entered into in connection with this Agreement, all as amended or extended from time to time.

“Material Adverse Effect” means a material adverse effect on (i) the business operations, condition (financial or otherwise) or prospects of Borrower and its Subsidiaries taken as a whole or (ii) the ability of Borrower to repay the Obligations or otherwise perform its obligations under the Loan Documents or (iii) the value or priority of Bank’s security interests in the Collateral.

3.

“Negotiable Collateral” means all letters of credit of which Borrower is a beneficiary, notes, drafts, instruments, securities, documents of title, and chattel paper, and Borrower’s Books relating to any of the foregoing.

“Obligations” means all debt, principal, interest, Bank Expenses and other amounts owed to Bank by Borrower pursuant to this Agreement or any other Loan Document (other than the Warrant), whether absolute or contingent, due or to become due, now existing or hereafter arising, including any interest that accrues after the commencement of an Insolvency Proceeding and including any debt, liability, or obligation owing from Borrower to others that Bank may have obtained by assignment or otherwise.

“Patents” means all patents, patent applications and like protections including without limitation improvements, divisions, continuations, renewals, reissues, extensions and continuations-in-part of the same.

“Periodic Payments” means all installments or similar recurring payments that Borrower may now or hereafter become obligated to pay to Bank pursuant to the terms and provisions of any instrument, or agreement now or hereafter in existence between Borrower and Bank.

“Permitted Indebtedness” means:

(a) Indebtedness of Borrower in favor of Bank arising under this Agreement or any other Loan Document; |

(b) Indebtedness existing on the Closing Date and disclosed in the Schedule; |

(c) Indebtedness not otherwise described in clauses (a) and (b) above, secured by a lien described in clause (c) of the defined term “Permitted Liens,” provided (i) such Indebtedness does not exceed the lesser of the cost or fair market value of the equipment financed with such Indebtedness (measured at the time of such acquisition) and (ii) such Indebtedness does not exceed $*** in the aggregate at any given time; |

(d) Subordinated Debt; |

(e) trade debt and operating leases incurred in the ordinary course of business; |

(f) Indebtedness in connection with insurance premium financing, credit cards or similar programs; |

(g) other unsecured Indebtedness not to exceed *** in the aggregate at any time; and |

(h)extensions, refinancings, modifications, amendments and restatements of any items of Permitted Indebtedness of the type described in clauses (a) through (g) above, provided that the principal amount thereof is not increased or the terms thereof are not modified to impose more burdensome terms upon Borrower.

“Permitted Investment” means:

(a) Investments existing on the Closing Date disclosed in the Schedule; and |

4.

(b) (i) marketable direct obligations issued or unconditionally guaranteed by the United States of America or any agency or any State thereof maturing within one (1) year from the date of acquisition thereof, (ii) commercial paper maturing no more than one (1) year from the date of creation thereof and currently having rating of at least A-2 or P-2 from either Standard & Poor’s Corporation or Moody’s Investors Service, (iii) certificates of deposit maturing no more than one (1) year from the date of investment therein issued by Bank, (iv) Bank’s money market accounts, (v) Investments made by Borrower in the accounts maintained by Borrower with JP Morgan Chase Bank to the extent permitted by Section 6.8; and (vi) other Investments in an aggregate amount not to exceed $*** outstanding at any time during the term of this Agreement. |

“Permitted Liens” means the following:

(a) Any Liens existing on the Closing Date and disclosed in the Schedule or arising under this Agreement or the other Loan Documents; |

(b) Liens for taxes, fees, assessments or other governmental charges or levies, either not delinquent or being contested in good faith by appropriate proceedings, provided that Borrower maintains adequate reserves on its books, and provided that no notice of any such Lien has been filed or recorded under the IRC; |

(d) Liens incurred in connection with the extension, renewal or refinancing of the indebtedness secured by Liens of the type described in clauses (a) through (c) above, provided that any extension, renewal or replacement Lien shall be limited to the property encumbered by the existing Lien and the principal amount of the indebtedness being extended, renewed or refinanced does not increase; |

(e) licenses of Intellectual Property granted to third parties in the ordinary course of business; and |

(f) rental or licensing of Inventory or Equipment to third parties in the ordinary course of business. |

“Person” means any individual, sole proprietorship, partnership, limited liability company, joint venture, trust, unincorporated organization, association, corporation, institution, public benefit corporation, firm, joint stock company, estate, entity or governmental agency.

“Prime Rate” means the rate published as the U.S. Prime Rate from time to time in the money rate column of The Wall Street Journal, whether or not such announced rate is the lowest rate available from Bank.

“Responsible Officer” means each of the Chief Executive Officer, the Chief Operating Officer, the Chief Financial Officer and the Controller of Borrower.

5.

“Revolving Facility” means the facility under which Borrower may request Bank to issue Advances, as specified in Section 2.1(a) hereof.

“Revolving Line” means a credit extension of up to Twelve Million Dollars ($12,000,000).

“Revolving Maturity Date” means the one-year anniversary of the Closing Date.

“Schedule” means the schedule of exceptions attached hereto and approved by Bank, if any.

“Shares” is one hundred percent (100%) of the issued and outstanding capital stock, membership units or other securities owned or held of record by a Borrower or any Subsidiary of Borrower, in any direct or indirect Subsidiary.

“Subordinated Debt” means any debt incurred by Borrower that is subordinated to the debt owing by Borrower to Bank on terms acceptable to Bank (and identified as being such by Borrower and Bank).

“Subsidiary” means, as to any Person, a corporation, partnership, limited liability company or other entity of which shares of stock or other ownership interests having ordinary voting power (other than stock or such other ownership interests having such power only by reason of the happening of a contingency) to elect a majority of the board of directors or other managers of such corporation, partnership or other entity are at the time owned, or the management of which is otherwise controlled, directly or indirectly through one or more intermediaries (including any Affiliate), or both, by such Person. Unless the context otherwise requires, each reference to a Subsidiary herein shall be a reference to a Subsidiary of Borrower.

“Trademarks” means any trademark and servicemark rights, whether registered or not, applications to register and registrations of the same and like protections, and the entire goodwill of the business of Borrower connected with and symbolized by such trademarks.

“Warrant” means the warrant to purchase common stock of the Borrower referred to in Section 3.1.

1.2 Accounting Terms. All accounting terms not specifically defined herein shall be construed in accordance with GAAP and all calculations made hereunder shall be made in accordance with GAAP. When used herein, the terms “financial statements” shall include the notes and schedules thereto. |

2. Loan and Terms Of Payment. |

Borrower promises to pay to the order of Bank, in lawful money of the United States of America, the aggregate unpaid principal amount of all Credit Extensions made by Bank to Borrower hereunder. Borrower shall also pay interest on the unpaid principal amount of such Credit Extensions at rates in accordance with the terms hereof.

(i) Subject to and upon the terms and conditions of this Agreement, Borrower may request Advances in an aggregate outstanding amount not to exceed the lesser of (i) the Revolving Line or (ii) the Borrowing Base. Subject to the terms and conditions of this Agreement, |

6.

amounts borrowed pursuant to this Section 2.1(a) may be repaid and reborrowed at any time prior to the Revolving Maturity Date, at which time all Advances under this Section 2.1(a) shall be immediately due and payable. Borrower may prepay any Advances without penalty or premium. |

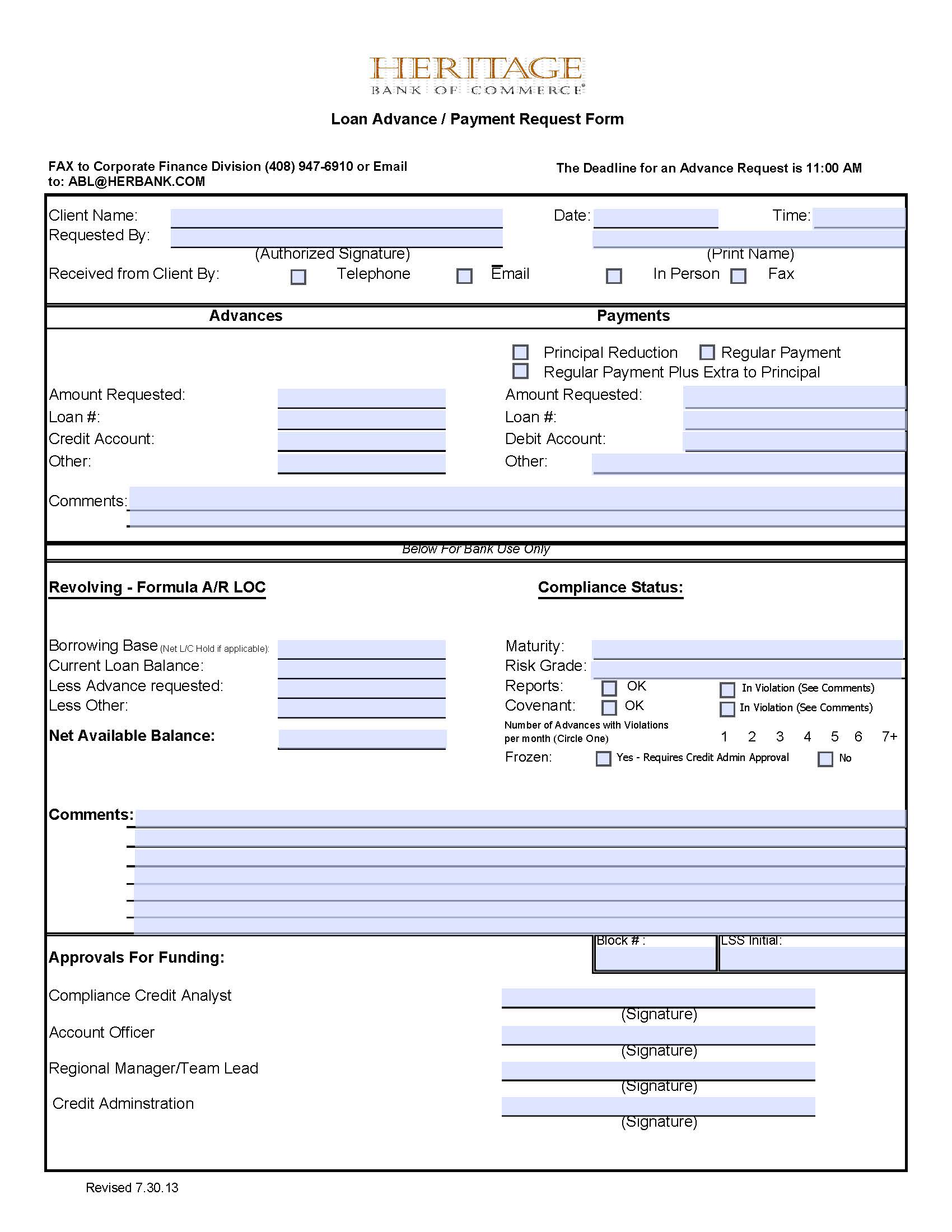

(ii) Whenever Borrower desires an Advance, Borrower will notify Bank by email, facsimile transmission or telephone no later than 2:00 p.m. Pacific Time, on the Business Day that is one day before the Business Day the Advance is to be made. Each such notification shall be promptly confirmed by a Borrowing Base Certificate in substantially the form of Exhibit C hereto, which may be accompanied by an Advance/Paydown Request in the form of Exhibit B hereto. Bank is authorized to make Advances under this Agreement, based upon instructions received from a Responsible Officer or a designee of a Responsible Officer, or without instructions if in Bank’s discretion such Advances are necessary to meet Obligations which have become due and remain unpaid. Bank shall be entitled to rely on any email or telephonic notice given by a person who Bank reasonably believes to be a Responsible Officer or a designee thereof, and Borrower shall indemnify and hold Bank harmless for any damages or loss suffered by Bank as a result of such reliance. Bank will credit the amount of Advances made under this Section to Borrower’s deposit account at Bank. |

2.2 Overadvances. If the aggregate amount of the outstanding Advances exceeds the lesser of the Revolving Line or the Borrowing Base at any time, Borrower shall immediately pay to Bank, in cash, the amount of such excess. |

(c) Payments. Interest hereunder shall be due and payable on the first business day of each month during the term hereof. Bank shall, at its option, charge such interest, all Bank Expenses, and all Periodic Payments against any of Borrower’s deposit accounts or against the Revolving Line, in which case those amounts shall thereafter accrue interest at the rate then applicable hereunder. Any interest not paid when due shall be compounded by becoming a part of the Obligations, and such interest shall thereafter accrue interest at the rate then applicable hereunder. All payments shall be free and clear of any taxes, withholdings, duties, impositions or other charges, to the end that Bank will receive the entire amount of any Obligations payable hereunder, regardless of source of payment. |

(d) Lockbox. Borrower shall cause all account debtors (other than account debtors relating to License and Transaction Revenue and QuickStart Lease Receivables) to wire any amounts owing to Borrower to such account (the “Bancontrol Account”) as Bank shall specify, and to mail all payments made by check to a post office box under Bank’s control. All invoices shall specify such post office box as the payment address. Bank shall have sole authority to collect such payments and deposit them to the Bancontrol Account. If Borrower receives any amount despite such instructions, Borrower shall immediately deliver such payment to Bank in the form received, except for an endorsement to the order of Bank and, pending such delivery, shall hold such payment in trust for Bank. |

7.

Funds from the Bancontrol Account shall be swept daily by Bank; two Business Days after clearance of any checks, Bank shall credit all amounts paid into the Bancontrol Account to Borrower’s operating account. Borrower shall enter into such lockbox agreement as Bank shall reasonably request from time to time. Bank may, at its option, conduct a credit check of the account debtors relating to the License and Transaction Revenue requested by Borrower for inclusion in the Borrowing Base. Bank may also verify directly with the respective account debtors the validity, amount and other matters relating to the License and Transaction Revenue, and notify any account debtor of Bank’s security interest in the Borrower’s Accounts. |

(e) Computation. In the event the Prime Rate is changed from time to time hereafter, the applicable rate of interest hereunder shall be increased or decreased, effective as of the day the Prime Rate is changed, by an amount equal to such change in the Prime Rate. All interest chargeable under the Loan Documents shall be computed on the basis of a three hundred sixty (360) day year for the actual number of days elapsed. |

2.4 Crediting Payments. Prior to the occurrence of an Event of Default, Bank shall credit a wire transfer of funds, check or other item of payment to such deposit account or Obligation as Borrower specifies. After the occurrence of an Event of Default, the receipt by Bank of any wire transfer of funds, check, or other item of payment shall be immediately applied to conditionally reduce Obligations, but shall not be considered a payment on account unless such payment is of immediately available federal funds or unless and until such check or other item of payment is honored when presented for payment. Notwithstanding anything to the contrary contained herein, any wire transfer or payment received by Bank after 12:00 noon Pacific Time shall be deemed to have been received by Bank as of the opening of business on the immediately following Business Day. Whenever any payment to Bank under the Loan Documents would otherwise be due (except by reason of acceleration) on a date that is not a Business Day, such payment shall instead be due on the next Business Day, and additional fees or interest, as the case may be, shall accrue and be payable for the period of such extension. |

(a) Facility Fees. On the Closing Date, a facility fee with respect to the Revolving Facility equal to $90,000; and |

(b) Bank Expenses. On the Closing Date, all Bank Expenses incurred through the Closing Date, including reasonable attorneys’ fees and expenses and, after the Closing Date, all Bank Expenses, including reasonable attorneys’ fees and expenses, as and when they are incurred by Bank. |

2.6 Term. This Agreement shall become effective on the Closing Date and, subject to Section 12.7, shall continue in full force and effect for so long as any Obligations (other than inchoate indemnity obligations and any other obligations which, by their terms, are to survive the termination of this Agreement) remain outstanding or Bank has any obligation to make Credit Extensions under this Agreement. Notwithstanding the foregoing, Bank shall have the right to terminate its obligation to make Credit Extensions under this Agreement immediately and without notice upon the occurrence and during the continuance of an Event of Default. Notwithstanding termination, Bank’s Lien on the Collateral shall remain in effect for so long as any Obligations (other than inchoate indemnity obligations and any other obligations which, by their terms, are to survive the termination of this Agreement) are outstanding, and shall be released and terminated by Bank immediately upon satisfaction of such Obligations. This Agreement may be terminated prior to the Revolving Maturity Date by Borrower effective two (2) Business Days after written notice of termination is given to Bank. |

8.

3. Conditions of Loans. |

3.1 Conditions Precedent to Initial Credit Extension. The obligation of Bank to make the initial Credit Extension is subject to the condition precedent that Bank shall have received, in form and substance satisfactory to Bank, the following: |

(a) this Agreement; |

(b) a certificate of the Secretary of Borrower with respect to incumbency and resolutions authorizing the execution and delivery of this Agreement; |

(c) UCC National Form Financing Statement; |

(d) an intellectual property security agreement; |

(e) a warrant to purchase common stock of Borrower; |

(f) the Guaranty; |

(g) receipt of a payoff letter from AvidBank concerning outstanding Indebtedness of Borrower due to such bank; and evidence satisfactory to Bank in its sole determination that any Lien securing obligations of Borrower to AvidBank (or any successor thereto) will be terminated, concurrently with the making of the initial Credit Extension; |

(h) certificate(s) of insurance naming Bank as loss payee and additional insured; |

(i) payment of the fees and Bank Expenses then due specified in Section 2.5 hereof; |

(j) current financial statements of Borrower; |

(k) delivery of the share certificates representing the Shares and stock powers held by Borrower; |

(l) a deposit account control agreement satisfactory to Bank with respect to each of Borrower’s accounts not with Bank; |

(m) an audit of the Collateral, the results of which shall be satisfactory to Bank; |

(n) establishment of the Bancontrol Account and lockbox arrangements; and |

(o) such other documents, and completion of such other matters, as Bank may reasonably deem necessary or appropriate. |

3.2 Conditions Precedent to all Credit Extensions. The obligation of Bank to make each Credit Extension, including the initial Credit Extension, is further subject to the following conditions: |

(a) timely receipt by Bank of the notice as provided in Section 2.1; |

9.

(b) the representations and warranties contained in Section 5 shall be true and correct in all material respects on and as of the date of Borrower’s request for such Credit Extension and on the effective date of each Credit Extension as though made at and as of each such date, and no Event of Default shall have occurred and be continuing, or would exist after giving effect to such Credit Extension. The making of each Credit Extension shall be deemed to be a representation and warranty by Borrower on the date of such Credit Extension as to the accuracy of the representations and warranties contained in Section 5 in accordance with and subject to this Section 3.2(b); and |

(c) in Bank’s sole discretion, there has not been any material impairment in the Accounts, general affairs, management, results of operation, financial condition or the prospect of repayment of the Obligations, or there has not been any material adverse deviation by Borrower from the most recent business plan of Borrower presented to and accepted by Bank. |

4. Creation of Security Interest. |

4.1 Grant of Security Interest. Borrower grants and pledges to Bank a continuing security interest in all presently existing and hereafter acquired or arising Collateral in order to secure prompt repayment of any and all Obligations and in order to secure prompt performance by Borrower of each of its covenants and duties under the Loan Documents. Such security interest constitutes a valid, first priority security interest in the presently existing Collateral, and will constitute a valid, first priority security interest in Collateral acquired after the date hereof. |

4.3 Right to Inspect. Bank (through any of its officers, employees, or agents) shall have the right, upon reasonable prior notice, from time to time during Borrower’s usual business hours but no more than twice a year (unless an Event of Default has occurred and is continuing), to inspect Borrower’s Books and to make copies thereof and to check, test, and appraise the Collateral in order to verify Borrower’s financial condition or the amount, condition of, or any other matter relating to, the Collateral. |

4.4 Pledge of Shares. Borrower hereby pledges, assigns and grants to Bank, a security interest in all the Shares, together with all proceeds and substitutions thereof, all cash, stock and other moneys and property paid thereon, all rights to subscribe for securities declared or granted in connection therewith, and all other cash and noncash proceeds of the foregoing, as security for the performance of the Obligations. On the Closing Date, or, to the extent not certificated as of the Closing Date, within ten (10) days of the certification of any Shares, the certificate or certificates for the Shares will be delivered to Bank, accompanied by an instrument of assignment duly executed in blank by Borrower. To the extent required by the terms and conditions governing the Shares, Borrower shall cause the books of each entity whose Shares are part of the Collateral and any transfer agent to reflect the pledge of the Shares. Upon the occurrence of an Event of Default hereunder, Bank may effect the transfer of any securities included in the Collateral (including but not limited to the Shares) into the name of Bank and cause new (as applicable) certificates representing such securities to be issued in the name of Bank or |

10.

its transferee. Borrower will execute and deliver such documents, and take or cause to be taken such actions, as Bank may reasonably request to perfect or continue the Shares. Unless an Event of Default shall have occurred and be continuing, Borrower shall be entitled to exercise any voting rights with respect to the Shares and to give consents, waivers and ratifications in respect thereof, provided that no vote shall be cast or consent, waiver or ratification given or action taken which would be inconsistent with any of the terms of this Agreement or which would constitute or create any violation of any of such terms. All such rights to vote and give consents, waivers and ratifications shall terminate upon the occurrence and continuance of an Event of Default. |

Borrower represents and warrants as follows:

5.1 Due Organization and Qualification. Borrower and each Subsidiary is a corporation duly existing under the laws of its state of incorporation and qualified and licensed to do business in any state in which the conduct of its business or its ownership of property requires that it be so qualified, except where the failure to so qualify or be licensed would not result in a Material Adverse Effect. |

5.2 Due Authorization; No Conflict. The execution, delivery, and performance of the Loan Documents are within Borrower’s powers, have been duly authorized, and are not in conflict with nor constitute a breach of any provision contained in Borrower’s Articles of Incorporation or Bylaws, nor will they constitute a material default under any material agreement to which Borrower is a party or by which Borrower is bound. Borrower is not in material default under any material agreement to which it is a party or by which it is bound. |

5.3 No Prior Encumbrances. Borrower has good and marketable title to its property, free and clear of Liens, except for Permitted Liens. |

5.5 Merchantable Inventory. All Inventory is in all material respects of good and marketable quality, free from all material defects, except for Inventory for which adequate reserves have been made. |

11.

hereof; or, in the past five (5) years, changed its jurisdiction of formation, corporate structure, organizational type, or any organizational number assigned by its jurisdiction. The chief executive office of Borrower is located at the address indicated in Section 10 hereof or such other location of which Bank has been notified in accordance with Section 7.2. As of the Closing Date, all Borrower’s Inventory and Equipment is located only at the location set forth in Section 10 hereof. |

5.9 No Material Adverse Change in Financial Statements. All consolidated and consolidating financial statements related to Borrower and any Subsidiary that Bank has received from Borrower fairly present in all material respects Borrower’s financial condition as of the date thereof and Borrower’s consolidated and consolidating results of operations for the period then ended. There has not been a material adverse change in the consolidated or the consolidating financial condition of Borrower since the date of the most recent of such financial statements submitted to Bank. |

5.10 Solvency, Payment of Debts. Borrower is solvent and able to pay its debts (including trade debts) as they mature. |

5.11 Regulatory Compliance. Borrower and each Subsidiary have met the minimum funding requirements of ERISA with respect to any employee benefit plans subject to ERISA, and no event has occurred resulting from Borrower’s failure to comply with ERISA that could result in Borrower’s incurring any material liability. Borrower is not an “investment company” or a company “controlled” by an “investment company” within the meaning of the Investment Company Act of 1940. Borrower is not engaged principally, or as one of the important activities, in the business of extending credit for the purpose of purchasing or carrying margin stock (within the meaning of Regulations T and U of the Board of Governors of the Federal Reserve System). Borrower and each Subsidiary have complied with all the provisions of the Federal Fair Labor Standards Act. Borrower and each Subsidiary have not violated any material statutes, laws, ordinances or rules applicable to it which would result in a Material Adverse Effect. |

5.12 Environmental Condition. None of Borrower’s or any Subsidiary’s properties or assets has ever been used by Borrower or any Subsidiary or, to the best of Borrower’s knowledge, by previous owners or operators, in the disposal of, or to produce, store, handle, treat, release, or transport, any hazardous waste or hazardous substance other than in accordance with applicable law; to the best of Borrower’s knowledge, none of Borrower’s properties or assets has ever been designated or identified in any manner pursuant to any environmental protection statute as a hazardous waste or hazardous substance disposal site, or a candidate for closure pursuant to any environmental protection statute; no lien arising under any environmental protection statute has attached to any revenues or to any real or personal property owned by Borrower or any Subsidiary; and neither Borrower nor any Subsidiary has received a summons, citation, notice, or directive from the Environmental Protection Agency or any other federal, state or other governmental agency concerning any action or omission by Borrower or any Subsidiary resulting in the releasing, or otherwise disposing of hazardous waste or hazardous substances into the environment. |

5.13 Taxes. Borrower and each Subsidiary have filed or caused to be filed all material tax returns required to be filed, and have paid, or have made adequate provision for the payment of, all material taxes reflected therein. |

5.14 Investments. Neither Borrower nor any Subsidiary owns any stock, partnership |

12.

interest or other equity securities of any Person, except for Permitted Investments. |

5.15 Government Consents. Borrower and each Subsidiary have obtained all material consents, approvals and authorizations of, made all material declarations or filings with, and given all material notices to, all governmental authorities that are necessary for the continued operation of Borrower’s business as currently conducted. |

5.16 Operating, Depository and Investment Accounts. Except as permitted by Section 6.8, none of Borrower’s nor any Subsidiary’s depository, operating, or investment account is maintained or invested with a Person other than Bank. |

5.17 Shares. Borrower has full power and authority to create a first lien on the Shares and no disability or contractual obligation exists that would prohibit Borrower from pledging the Shares pursuant to this Agreement. There are no subscriptions, warrants, rights of first refusal or other restrictions on transfer relative to, or options exercisable with respect to the Shares. The Shares have been and will be duly authorized and validly issued, and are fully paid and non-assessable. The Shares are not the subject of any present or threatened suit, action, arbitration, administrative or other proceeding, and Borrower knows of no reasonable grounds for the institution of any such proceedings. |

5.18 Full Disclosure. No representation, warranty or other statement made by Borrower in any certificate or written statement furnished to Bank contains any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained in such certificates or statements not misleading. |

Borrower shall do all of the following:

6.1 Good Standing. Borrower shall maintain its and each of its Subsidiaries’ corporate existence and good standing in its jurisdiction of incorporation and maintain qualification in each jurisdiction in which it is required under applicable law, except where the failure to so qualify would result in a Material Adverse Effect. Borrower shall maintain, and shall cause each of its Subsidiaries to maintain, in force all licenses, approvals and agreements, the loss of which would reasonably be expected to have a Material Adverse Effect. |

6.2 Government Compliance. Borrower shall meet, and shall cause each Subsidiary to meet, the minimum funding requirements of ERISA with respect to any employee benefit plans subject to ERISA. Borrower shall comply, and shall cause each Subsidiary to comply, with all statutes, laws, ordinances and government rules and regulations to which it is subject, noncompliance with which could have a Material Adverse Effect. |

(a) within twenty-five (25) days after the last day of each month, a Borrowing Base Certificate signed by a Responsible Officer in substantially the form of Exhibit C hereto, together with a report of accounts receivable and accounts payable aging; |

(b) as soon as available, but in any event within fifty (50) days after the end of Borrower’s fiscal quarter, a Borrower prepared consolidated balance sheet, income, and cash flow statement covering Borrower’s consolidated operations during such quarter, prepared in accordance with |

13.

GAAP, consistently applied, in a form acceptable to Bank, together with a churn report in form satisfactory to Bank, and a Compliance Certificate signed by a Responsible Officer in substantially the form of Exhibit D hereto; |

(c) as soon as available, but in any event within one hundred twenty (120) days after the end of Borrower’s fiscal year, audited consolidated financial statements of Borrower prepared in accordance with GAAP, consistently applied, together with an unqualified opinion on such financial statements of an independent certified public accounting firm reasonably acceptable to Bank; |

(d) copies of all statements, reports and notices sent or made available generally by Borrower to its security holders or to any holders of Subordinated Debt and all reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission, within 5 days of filing; |

(e) promptly upon receipt of notice thereof, a report of any legal actions pending or threatened against Borrower or any Subsidiary that could result in damages or costs to Borrower or any Subsidiary of *** Dollars ($***) or more, or any commercial tort claim (as defined in the Code) acquired by Borrower; |

(f) a copy of bank statements for any accounts not with Bank, within 30 days after the last day of each month; and |

(g) such budgets, sales projections, operating plans, other financial information including information related to the verification of Borrower’s Accounts as Bank may reasonably request from time to time. |

6.4 Audits. Bank shall have a right from time to time hereafter to audit Borrower’s Accounts and appraise Collateral at Borrower’s expense, provided that such audits will be conducted no more often than every six (6) months unless an Event of Default has occurred and is continuing. |

6.5 Inventory; Returns. Borrower shall keep all Inventory in good and marketable condition, free from all material defects except for Inventory for which adequate reserves have been made. Returns and allowances, if any, as between Borrower and its account debtors shall be on the same basis and in accordance with the usual customary practices of Borrower, as they exist at the time of the execution and delivery of this Agreement. Borrower shall promptly notify Bank of all returns and recoveries and of all disputes and claims, where the return, recovery, dispute or claim involves more than *** Dollars ($***). |

6.6 Taxes. Borrower shall make, and shall cause each Subsidiary to make, due and timely payment or deposit of all material federal, state, and local taxes, assessments, or contributions required of it by law, and will execute and deliver to Bank, on demand, appropriate certificates attesting to the payment or deposit thereof; and Borrower will make, and will cause each Subsidiary to make, timely payment or deposit of all material tax payments and withholding taxes required of it by applicable laws, including, but not limited to, those laws concerning F.I.C.A., F.U.T.A., state disability, and local, state, and federal income taxes, and will, upon request, furnish Bank with proof satisfactory to Bank indicating that Borrower or a Subsidiary has made such payments or deposits; provided that Borrower or a Subsidiary need not make any payment if the amount or validity of such payment is contested in good faith by appropriate proceedings and is reserved against (to the extent required by GAAP) by Borrower. |

(a) Borrower, at its expense, shall keep the Collateral insured against loss or |

14.

damage by fire, theft, explosion, sprinklers, and all other hazards and risks, and in such amounts, as ordinarily insured against by other owners in similar businesses conducted in the locations where Borrower’s business is conducted on the date hereof. Borrower shall also maintain insurance relating to Borrower’s business, ownership and use of the Collateral in amounts and of a type that are customary to businesses similar to Borrower’s. |

(b) All such policies of insurance shall be in such form, with such companies, and in such amounts as are reasonably satisfactory to Bank. All such policies of property insurance shall contain a lender’s loss payable endorsement, in a form satisfactory to Bank, showing Bank as an additional loss payee thereof, and all liability insurance policies shall show the Bank as an additional insured and shall specify that the insurer must give at least twenty (20) days notice to Bank before canceling its policy for any reason. Upon Bank’s request, Borrower shall deliver to Bank certified copies of such policies of insurance and evidence of the payments of all premiums therefor. All proceeds payable under any such policy shall, at the option of Bank, be payable to Bank to be applied on account of the Obligations. |

6.8 Operating, Depository and Investment Accounts. Borrower shall maintain and shall cause each of its Subsidiaries to maintain its primary depository, operating, and investment accounts with JP Morgan Chase Bank in accordance with its current practice provided each such account is subject to a Control Agreement in favor of Bank in form acceptable to Bank. For each other account that Borrower maintains outside of Bank, Borrower shall cause the applicable bank or financial institution at or with which any such account is maintained to execute and deliver an account control agreement or other appropriate instrument in form and substance satisfactory to Bank. Within forty-five (45) days of the Closing Date, Borrower will open an operating and Bancontrol account with Bank. |

6.9 Financial Covenants. |

(a) Maximum Churn Rate. Borrower’s number of connections as at the end of each fiscal quarter shall not decrease (i) by more than five percent (5%) as compared to Borrower’s number of connections as at the end of the immediately preceding fiscal quarter, or (ii) below *** connections. |

(b) Minimum Adjusted EBITDA. Borrower shall maintain quarterly Adjusted EBITDA, as set forth below, tested quarterly: |

Quarterly Period ending | Minimum Adjusted EBITDA |

March 31, 2016 | $1,197,750 |

June 30, 2016 | $1,542,750 |

December 31, 2016 | $1,180,500 |

March 31, 2017 | $1,387,500 |

(a) Use commercially reasonable efforts to protect, defend and maintain the |

15.

validity and enforceability of its Intellectual Property that is material to its business; (ii) promptly advise Bank in writing of material infringements of its Intellectual Property; and (iii) not allow any Intellectual Property material to Borrower’s business to be abandoned, forfeited or dedicated to the public. |

(b) Borrower shall promptly give Bank written notice of any applications or registrations of intellectual property rights filed with the United States Patent and Trademark Office, including the date of such filing and the registration or application numbers, if any. Borrower shall (i) give Bank not less than 30 days prior written notice of the filing of any applications or registrations with the United States Copyright Office, including the title of such intellectual property rights to be registered, as such title will appear on such applications or registrations, and the date such applications or registrations will be filed, and (ii) prior to the filing of any such applications or registrations, shall execute such documents as Bank may reasonably request for Bank to maintain its perfection in such intellectual property rights to be registered by Borrower, and upon the request of Bank, shall file such documents simultaneously with the filing of any such applications or registrations. Upon filing any such applications or registrations with the United States Copyright Office, Borrower shall promptly provide Bank with (i) a copy of such applications or registrations, without the exhibits, if any, thereto, (ii) evidence of the filing of any documents requested by Bank to be filed for Bank to maintain the perfection and priority of its security interest in such intellectual property rights, and (iii) the date of such filing. |

(c) Bank may audit Borrower's Intellectual Property to confirm compliance with this Section, provided such audit may not occur more often than twice per year, unless an Event of Default has occurred and is continuing. Bank shall have the right, but not the obligation, to take, at Borrower's sole expense, any actions that Borrower is required under this Section to take but which Borrower fails to take, after 15 days' notice to Borrower. Borrower shall reimburse and indemnify Bank for all reasonable costs and reasonable expenses incurred in the reasonable exercise of its rights under this Section. |

6.11 Further Assurances. At any time and from time to time Borrower shall execute and deliver such further instruments and take such further action as may reasonably be requested by Bank to effect the purposes of this Agreement. |

6.12 Landlord Waivers. Borrower shall use commercially reasonable efforts to deliver to Bank landlord waivers in respect of the premises at 100 Deerfield Lane, Suite 140, Malvern, Pennsylvania, 3103 Phoenixville Pike, Malvern, Pennsylvania, and 309 SW Sixth Avenue, Suite 700, Portland, Oregon. In the event that Borrower, after the Closing Date, intends to add any new offices or business locations, then Borrower shall use commercially reasonable efforts to deliver to Bank a landlord waiver prior to the addition of any such new office or business location. |

Borrower will not do any of the following:

7.1 Dispositions. Convey, sell, lease, transfer or otherwise dispose of (collectively, a “Transfer”), or permit any of its Subsidiaries to Transfer, all or any part of its business or property, other than: (i) Transfers of Inventory or Equipment in the ordinary course of business; (ii) Transfers of non-exclusive licenses and similar arrangements for the use of the assets or property of Borrower or its Subsidiaries in the ordinary course of business; or (iii) Transfers of worn-out or obsolete Equipment or Equipment no longer used in the business which was not financed by Bank. |

7.2 Change in Business; Change in Control or Executive Office. Engage in any business, or permit any of its Subsidiaries to engage in any business, other than the businesses currently |

16.

engaged in by Borrower and any business substantially similar or related thereto (or incidental thereto); experience a change in a Responsible Officer without providing Bank with notice of such change within five (5) days, or cease to conduct business in the manner conducted by Borrower as of the Closing Date; or suffer or permit a Change in Control; or without thirty (30) days prior written notification to Bank, relocate its chief executive office or state of incorporation or change its legal name; or without Bank’s prior written consent, change the date on which its fiscal year ends. |

7.3 Mergers or Acquisitions. Merge or consolidate, or permit any of its Subsidiaries to merge or consolidate, with or into any other business organization, or acquire, or permit any of its Subsidiaries to acquire, all or substantially all of the capital stock or property of another Person. |

7.4 Indebtedness. Create, incur, guarantee, assume or be or remain liable with respect to any Indebtedness, or permit any Subsidiary so to do, other than Permitted Indebtedness. |

7.5 Encumbrances. Create, incur, assume or suffer to exist any Lien with respect to any of its property, or assign or otherwise convey any right to receive income, including the sale of any Accounts, or permit any of its Subsidiaries so to do, except for Permitted Liens, or enter into any agreement with any Person other than Bank not to grant a security interest in, or otherwise encumber, any of its property, or permit any Subsidiary to do so. |

7.6 Distributions. Pay any dividends or make any other distribution or payment on account of or in redemption, retirement or purchase of any capital stock, or permit any of its Subsidiaries to do so, except that Borrower may repurchase the stock of former employees pursuant to stock repurchase agreements as long as an Event of Default does not exist prior to such repurchase or would not exist after giving effect to such repurchase, and the aggregate amount of such repurchase does not exceed $*** in any fiscal year, and Borrower may convert its preferred stock and any unpaid and accrued dividends thereon into common stock pursuant to its Articles of Incorporation, and Borrower may purchase or cancel shares of common stock of Borrower owned by its employees in satisfaction of withholding tax obligations relating to such employees. |

7.7 Investments. Directly or indirectly acquire or own, or make any Investment in or to any Person, or permit any of its Subsidiaries so to do, other than Permitted Investments; or other than Permitted Investments, maintain or invest any of its Investment property with a Person other than Bank or permit any of its Subsidiaries to do so unless such Person has entered into an account control agreement with Bank in form and substance satisfactory to Bank; or suffer or permit any Subsidiary to be a party to, or be bound by, an agreement that restricts such Subsidiary from paying dividends or otherwise distributing property to Borrower. |

7.8 Transactions with Affiliates. Directly or indirectly enter into or permit to exist any material transaction with any Affiliate of Borrower except for transactions that are in the ordinary course of Borrower’s business, upon fair and reasonable terms that are no less favorable to Borrower than would be obtained in an arm’s length transaction with a non-affiliated Person, or except for any compensation arrangements with any Affiliate, including any compensation paid to the directors of Borrower. |

7.9 Subordinated Debt. Make any payment in respect of any Subordinated Debt, or permit any of its Subsidiaries to make any such payment, except in compliance with the terms of such Subordinated Debt, or amend any provision contained in any documentation relating to the Subordinated Debt without Bank’s prior written consent. |

7.10 Inventory and Equipment. Store the Inventory or the Equipment with a bailee, |

17.

warehouseman, or other third party unless the third party has been notified of Bank’s security interest and Bank (a) has received an acknowledgment from the third party that it is holding or will hold the Inventory or Equipment for Bank’s benefit or (b) is in pledge possession of the warehouse receipt, where negotiable, covering such Inventory or Equipment. Except upon ten (10) days prior written notice to Bank, store or maintain any Equipment or Inventory at a location other than the location set forth in Section 10 of this Agreement. |

7.11 Compliance. Become an “investment company” or be controlled by an “investment company,” within the meaning of the Investment Company Act of 1940, or become principally engaged in, or undertake as one of its important activities, the business of extending credit for the purpose of purchasing or carrying margin stock, or use the proceeds of any Credit Extension for such purpose. Fail to meet the minimum funding requirements of ERISA, permit a Reportable Event or Prohibited Transaction, as defined in ERISA, to occur, fail to comply with the Federal Fair Labor Standards Act or violate any law or regulation, which violation could have a Material Adverse Effect, or a material adverse effect on the Collateral or the priority of Bank’s Lien on the Collateral, or permit any of its Subsidiaries to do any of the foregoing. |

Any one or more of the following events shall constitute an Event of Default by Borrower under this Agreement:

8.1 Payment Default. If Borrower fails to pay, when due, any of the Obligations; |

8.2 Covenant Default. |

(a) If Borrower fails to perform any obligation under Section 6 or violates any of the covenants contained in Section 7 of this Agreement; or |

(b) If Borrower fails or neglects to perform or observe any other material term, provision, condition, covenant contained in this Agreement, in any of the Loan Documents (other than the Warrant), or in any other present or future agreement between Borrower and Bank (other than the Warrant) and as to any default under such other term, provision, condition or covenant that can be cured, has failed to cure such default within ten days after Borrower receives notice thereof or any officer of Borrower becomes aware thereof; provided, however, that if the default cannot by its nature be cured within the ten day period or cannot after diligent attempts by Borrower be cured within such ten day period, and such default is likely to be cured within a reasonable time, then Borrower shall have an additional reasonable period (which shall not in any case exceed 30 days) to attempt to cure such default, and within such reasonable time period the failure to have cured such default shall not be deemed an Event of Default but no Credit Extensions will be made. |

8.3 Material Adverse Effect. If there occurs any circumstance or circumstances that would reasonably be expected to result in a Material Adverse Effect; |

8.4 Attachment. If any material portion of Borrower’s assets is attached, seized, subjected to a writ or distress warrant, or is levied upon, or comes into the possession of any trustee, receiver or person acting in a similar capacity and such attachment, seizure, writ or distress warrant or levy has not been removed, discharged or rescinded within twenty (20) days, or if Borrower is enjoined, restrained, or in any way prevented by court order from continuing to conduct all or any material part of its business affairs, or if a material judgment or other claim becomes a lien or encumbrance upon any portion of Borrower’s assets, or if a notice of lien, levy, or assessment is filed of record with respect to |

18.

any of Borrower’s assets by the United States Government, or any department, agency, or instrumentality thereof, or by any state, county, municipal, or governmental agency, and the same is not paid within twenty (20) days after Borrower receives notice thereof, provided that none of the foregoing shall constitute an Event of Default where such action or event is stayed or an adequate bond has been posted pending a good faith contest by Borrower (provided that no Credit Extensions will be required to be made prior to the stay or posting of bond ); |

8.6 Other Agreements. If there is a default or other failure to perform in any agreement to which Borrower is a party or by which it is bound resulting in a right by a third party or parties, whether or not exercised, to accelerate the maturity of any Indebtedness in an amount in excess of *** Dollars ($***) or which would have a Material Adverse Effect; |

8.7 Subordinated Debt. If Borrower makes any payment on account of Subordinated Debt, except to the extent the payment is allowed under any subordination agreement entered into with Bank; |

8.8 Judgments. If a judgment or judgments for the payment of money in an amount, individually or in the aggregate, of at least *** Dollars ($***) shall be rendered against Borrower and shall remain unsatisfied and unstayed for a period of twenty (20) days (provided that no Credit Extensions will be made prior to the satisfaction or stay of such judgment); or |

8.9 Misrepresentations. If any material misrepresentation or material misstatement exists now or hereafter in any warranty or representation set forth herein or in any certificate delivered to Bank by any Responsible Officer pursuant to this Agreement or to induce Bank to enter into this Agreement or any other Loan Document; or |

8.10 Guaranty. If any guaranty of all or a portion of the Obligations (a “Guaranty”) ceases for any reason to be in full force and effect, or any guarantor fails to perform any obligation under any Guaranty or a security agreement securing any Guaranty (collectively, the “Guaranty Documents”), or any event of default occurs under any Guaranty Document or any guarantor revokes or purports to revoke a Guaranty, or any material misrepresentation or material misstatement exists now or hereafter in any warranty or representation set forth in any Guaranty Document or in any certificate delivered to Bank in connection with any Guaranty Document, or if any of the circumstances described in Sections 8.3 through 8.8 occur with respect to any guarantor or any guarantor dies or becomes subject to any criminal prosecution. |

9. Bank’s Rights and Remedies. |

(a) Declare all Obligations, whether evidenced by this Agreement, by any of the other Loan Documents, or otherwise, immediately due and payable (provided that upon the occurrence of an Event of Default described in Section 8.5, all Obligations shall become immediately due and payable without any action by Bank); |

19.

(b) Cease advancing money or extending credit to or for the benefit of Borrower under this Agreement ; |

(c) Make such payments and do such acts as Bank considers necessary or reasonable to protect its security interest in the Collateral. Borrower agrees to assemble the Collateral if Bank so requires, and to make the Collateral available to Bank as Bank may designate. Borrower authorizes Bank to enter the premises where the Collateral is located, to take and maintain possession of the Collateral, or any part of it, and to pay, purchase, contest, or compromise any encumbrance, charge, or lien which in Bank’s determination appears to be prior or superior to its security interest and to pay all expenses incurred in connection therewith. With respect to any of Borrower’s owned premises, Borrower hereby grants Bank a license to enter into possession of such premises and to occupy the same, without charge, in order to exercise any of Bank’s rights or remedies provided herein, at law, in equity, or otherwise; |

(d) Set off and apply to the Obligations any and all (i) balances and deposits of Borrower held by Bank, or (ii) indebtedness at any time owing to or for the credit or the account of Borrower held by Bank; |

(e) Ship, reclaim, recover, store, finish, maintain, repair, prepare for sale, advertise for sale, and sell (in the manner provided for herein) the Collateral. Bank is hereby granted a license or other right, solely pursuant to the provisions of this Section 9.1, to use, without charge, Borrower’s labels, patents, copyrights, rights of use of any name, trade secrets, trade names, trademarks, service marks, and advertising matter, or any property of a similar nature, as it pertains to the Collateral, in completing production of, advertising for sale, and selling any Collateral and, in connection with Bank’s exercise of its rights under this Section 9.1, Borrower’s rights under all licenses and all franchise agreements shall inure to Bank’s benefit; |

(f) Dispose of the Collateral by way of one or more contracts or transactions, for cash or on terms, in such manner and at such places (including Borrower’s premises) as Bank determines is commercially reasonable, and apply any proceeds to the Obligations in whatever manner or order Bank deems appropriate; |

(g) Bank may credit bid and purchase at any public sale; and |

(h) Any deficiency that exists after disposition of the Collateral as provided above will be paid immediately by Borrower. |

9.2 Power of Attorney. Effective only upon the occurrence and during the continuance of an Event of Default, Borrower hereby irrevocably appoints Bank (and any of Bank’s designated officers, or employees) as Borrower’s true and lawful attorney to:(a) send requests for verification of Accounts or notify account debtors of Bank’s security interest in the Accounts; (b) notify all account debtors with respect to the Accounts to pay Bank directly; (c) sign Borrower’s name on any invoice or bill of lading relating to any Account, drafts against account debtors, schedules and assignments of Accounts, verifications of Accounts, and notices to account debtors; (d) make, settle, and adjust all claims under and decisions with respect to Borrower’s policies of insurance; (e) demand, collect, receive, sue, and give releases to any account debtor for the monies due or which may become due upon or with respect to the Accounts and to compromise, prosecute, or defend any action, claim, case or proceeding relating to the Accounts; (f) settle and adjust disputes and claims respecting the accounts directly with account debtors, for amounts and upon terms which Bank determines to be reasonable; (g) sell, assign, transfer, pledge, compromise, discharge or otherwise dispose of any Collateral; (h) receive and open all mail addressed to Borrower for the purpose of collecting the Accounts; (i) endorse |

20.

Borrower’s name on any checks or other forms of payment or security that may come into Bank’s possession; (j) execute on behalf of Borrower any and all instruments, documents, financing statements and the like to perfect Bank's interests in the Accounts and file, in its sole discretion, one or more financing or continuation statements and amendments thereto, relative to any of the Collateral; and (k) do all acts and things necessary or expedient, in furtherance of any such purposes; provided however Bank may exercise such power of attorney with respect to any actions described in clause (j) above, regardless of whether an Event of Default has occurred. The appointment of Bank as Borrower’s attorney in fact, and each and every one of Bank’s rights and powers, being coupled with an interest, is irrevocable until all of the Obligations (other than inchoate indemnity obligations and any other obligations which, by their terms, are to survive the termination of this Agreement) have been fully repaid and performed and Bank’s obligation to provide Credit Extensions hereunder is terminated. |

9.3 Accounts Collection. In addition to the foregoing, at any time after the occurrence of an Event of Default, Bank may notify any Person owing funds to Borrower of Bank’s security interest in such funds and verify the amount of such Account. Borrower shall collect all amounts owing to Borrower for Bank, receive in trust all payments as Bank’s trustee, and immediately deliver such payments to Bank in their original form as received from the account debtor, with proper endorsements for deposit. |

9.4 Bank Expenses. If Borrower fails to pay any amounts or furnish any required proof of payment due to third persons or entities, as required under the terms of this Agreement, then Bank may do any or all of the following after reasonable notice to Borrower: (a) make payment of the same or any part thereof; (b) set up such reserves under a loan facility in Section 2.1 as Bank deems necessary to protect Bank from the exposure created by such failure; or (c) obtain and maintain insurance policies of the type discussed in Section 6.7 of this Agreement, and take any action with respect to such policies as Bank deems prudent. Any amounts so paid or deposited by Bank shall constitute Bank Expenses, shall be immediately due and payable, and shall bear interest at the then applicable rate hereinabove provided, and shall be secured by the Collateral. Any payments made by Bank shall not constitute an agreement by Bank to make similar payments in the future or a waiver by Bank of any Event of Default under this Agreement. |

9.5 Bank’s Liability for Collateral. So long as Bank complies with reasonable banking practices, Bank shall not in any way or manner be liable or responsible for: (a) the safekeeping of the Collateral; (b) any loss or damage thereto occurring or arising in any manner or fashion from any cause; (c) any diminution in the value thereof; or (d) any act or default of any carrier, warehouseman, bailee, forwarding agency, or other person whomsoever. All risk of loss, damage or destruction of the Collateral shall be borne by Borrower. |

21.

9.6 Shares. Borrower recognizes that Bank may be unable to effect a public sale of any or all the Shares, by reason of certain prohibitions contained in federal securities laws and applicable state and provincial securities laws or otherwise, and may be compelled to resort to one or more private sales thereof to a restricted group of purchasers which will be obliged to agree, among other things, to acquire such securities for their own account for investment and not with a view to the distribution or resale thereof. Borrower acknowledges and agrees that any such private sale may result in prices and other terms less favorable than if such sale were a public sale and, notwithstanding such circumstances, agrees that any such private sale shall be deemed to have been made in a commercially reasonable manner. Bank shall be under no obligation to delay a sale of any of the Shares for the period of time necessary to permit the issuer thereof to register such securities for public sale under federal securities laws or under applicable state and provincial securities laws, even if such issuer would agree to do so. Upon the occurrence of an Event of Default which continues, Bank shall have the right to exercise all such rights as a secured party under the Code as it, in its sole judgment, shall deem necessary or appropriate, including without limitation the right to liquidate the Shares and apply the proceeds thereof to reduce the Obligations. Effective only upon the occurrence and during the continuance of an Event of Default, Borrower hereby irrevocably appoints Bank (and any of Bank’s designated officers, or employees) as such Borrower’s true and lawful attorney to enforce such Borrower’s rights against any Subsidiary, including the right to compel any Subsidiary to make payments or distributions owing to such Borrower. |

9.7 Remedies Cumulative. Bank’s rights and remedies under this Agreement, the Loan Documents, and all other agreements shall be cumulative. Bank shall have all other rights and remedies not inconsistent herewith as provided under the Code, by law, or in equity. No exercise by Bank of one right or remedy shall be deemed an election, and no waiver by Bank of any Event of Default on Borrower’s part shall be deemed a continuing waiver. No delay by Bank shall constitute a waiver, election, or acquiescence by it. No waiver by Bank shall be effective unless made in a written document signed on behalf of Bank and then shall be effective only in the specific instance and for the specific purpose for which it was given. |

9.8 Demand; Protest. Borrower waives demand, protest, notice of protest, notice of default or dishonor, notice of payment and nonpayment, notice of any default, nonpayment at maturity, release, compromise, settlement, extension, or renewal of accounts, documents, instruments, chattel paper, and guarantees at any time held by Bank on which Borrower may in any way be liable. |

Unless otherwise provided in this Agreement, all notices or demands by any party relating to this Agreement or any other agreement entered into in connection herewith shall be in writing and (except for financial statements and other informational documents which may be sent by first-class mail, postage prepaid, and except for the Warrant) shall be personally delivered or sent by a recognized overnight delivery service, certified mail, postage prepaid, return receipt requested, or by email or telefacsimile to Borrower or to Bank, as the case may be, at its addresses set forth below:

If to Borrower:USA TECHNOLOGIES, INC.

100 Deerfield Lane, Suite 140

Malvern, PA 19355

Attn: Chief Financial Officer

Email: lmaxwell@usatech.com

If to Bank:HERITAGE BANK OF COMMERCE

22.

150 South Almaden Blvd.

San Jose, California 95113

Attn: Mike Hansen

FAX: (408) 947-6910

Email: Mike.Hansen@herbank.com

The parties hereto may change the address at which they are to receive notices hereunder, by notice in writing in the foregoing manner given to the other.

11. CHOICE OF LAW AND VENUE; JURY TRIAL WAIVER. |

This Agreement shall be governed by, and construed in accordance with, the internal laws of the State of California, without regard to principles of conflicts of law. Each of Borrower and Bank hereby submits to the jurisdiction of the state and Federal courts located in the County of Santa Clara, State of California. BORROWER AND BANK EACH HEREBY WAIVE THEIR RESPECTIVE RIGHTS TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION BASED UPON OR ARISING OUT OF ANY OF THE LOAN DOCUMENTS (OTHER THAN THE WARRANT) OR ANY OF THE TRANSACTIONS CONTEMPLATED THEREIN, INCLUDING CONTRACT CLAIMS, TORT CLAIMS, BREACH OF DUTY CLAIMS, AND ALL OTHER COMMON LAW OR STATUTORY CLAIMS. EACH PARTY RECOGNIZES AND AGREES THAT THE FOREGOING WAIVER CONSTITUTES A MATERIAL INDUCEMENT FOR IT TO ENTER INTO THIS AGREEMENT. EACH PARTY REPRESENTS AND WARRANTS THAT IT HAS REVIEWED THIS WAIVER WITH ITS LEGAL COUNSEL AND THAT IT KNOWINGLY AND VOLUNTARILY WAIVES ITS JURY TRIAL RIGHTS FOLLOWING CONSULTATION WITH LEGAL COUNSEL.

If the jury waiver set forth in this Section is not enforceable, then any dispute, controversy or claim arising out of or relating to this Agreement, the Loan Documents (other than the Warrant) or any of the transactions contemplated therein shall be settled by judicial reference pursuant to Code of Civil Procedure Section 638 et seq. before a referee sitting without a jury, such referee to be mutually acceptable to the parties or, if no agreement is reached, by a referee appointed by the Presiding Judge of the California Superior Court for Santa Clara County. This Section shall not restrict a party from exercising remedies under the Code or from exercising pre-judgment remedies under applicable law.

12. General Provisions. |

12.1 Successors and Assigns. This Agreement shall bind and inure to the benefit of the respective successors and permitted assigns of each of the parties; provided, however, that neither this Agreement nor any rights hereunder may be assigned by Borrower without Bank’s prior written consent, which consent may be granted or withheld in Bank’s sole discretion. Bank shall have the right without the consent of or notice to Borrower to sell, transfer, negotiate, or grant participation in all or any part of, or any interest in, Bank’s obligations, rights and benefits hereunder. |

23.

misconduct. |

12.3 Time of Essence. Time is of the essence for the performance of all obligations set forth in this Agreement. |

12.4 Severability of Provisions. Each provision of this Agreement shall be severable from every other provision of this Agreement for the purpose of determining the legal enforceability of any specific provision. |

12.5 Amendments in Writing, Integration. Neither this Agreement nor the Loan Documents can be amended or terminated orally. All prior agreements, understandings, representations, warranties, and negotiations between the parties hereto with respect to the subject matter of this Agreement and the Loan Documents, if any, are merged into this Agreement and the Loan Documents. |

12.6 Counterparts. This Agreement may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same Agreement. In the event that any signature to this Agreement or any other Loan Document is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page were an original thereof. Notwithstanding the foregoing, Borrower shall deliver all original signed documents requested by Bank no later than ten (10) Business Days following the Closing Date. |

12.8 Confidentiality. In handling any confidential information Bank and all employees and agents of Bank, including but not limited to accountants, shall exercise the same degree of care that it exercises with respect to its own proprietary information of the same types to maintain the confidentiality of any non-public information thereby received or received pursuant to this Agreement except that disclosure of such information may be made (i) to the subsidiaries or affiliates of Bank in connection with their present or prospective business relations with Borrower, (ii) to prospective transferees or purchasers of any interest in the loans, provided that they are similarly bound by confidentiality obligations, (iii) as required by law, regulations, rule or order, subpoena, judicial order or similar order, (iv) as may be required in connection with the examination, audit or similar investigation of Bank and (v) as Bank may determine in connection with the enforcement of any remedies hereunder. Confidential information hereunder shall not include information that either: (a) is in the public domain or in the knowledge or possession of Bank when disclosed to Bank, or becomes part of the public domain after disclosure to Bank through no fault of Bank; or (b) is disclosed to Bank by a third party, provided Bank does not have actual knowledge that such third party is prohibited from disclosing such information. |

24.

12.9 Patriot Act Notice. Bank hereby notifies Borrower that, pursuant to the requirements of the USA Patriot Act, Title III of Pub. L. 107-56 (signed into law on October 26, 2001) (the “ Patriot Act "), it is required to obtain, verify and record information that identifies the Borrower, which information includes names and addresses and other information that will allow Bank, as applicable, to identify the Borrower in accordance with the Patriot Act. |

[signature page follows]

25.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first above written.

| USA Technologies, Inc.

By:/s/ Stephen P. Herbert Name: Stephen P. Herbert Title: Chairman and Chief Executive Officer |

| HERITAGE BANK OF COMMERCE

By:/s/ Karla Schrader Name: Karla Schrader Title:VP

|

DEBTOR:USA TECHNOLOGIES, INC.

SECURED PARTY:HERITAGE BANK OF COMMERCE

Exhibit A

COLLATERAL DESCRIPTION ATTACHMENT

TO LOAN AND SECURITY AGREEMENT

All personal property of Borrower (herein referred to as “Borrower” or “Debtor”) whether presently existing or hereafter created or acquired, and wherever located, including, but not limited to: