Exhibit 99.1

DPW Holdings Investor Presentation June 2019

SAFE HARBOR STATEMENT This presentation and other written or oral statements made from time to time by representatives of DPW Holdings, Inc. (somet ime s referred to as “DPW”) contain “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21 E of the Securities Exchange Act of 1934. Forward - looking statements reflect the current view about future events. Statements that are not historical in natu re, such as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticip ate s,” “estimates,” “we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward - looking statements . Such statements include, but are not limited to, statements contained in this presentation relating to our business, business strategy, expansion, growth, pr oducts and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward - looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward - looking statements. These risks and uncertainties include those risk factors d iscussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10 - K for the fiscal year ended December 31, 2018 (the “2018 Annual Report”) and other info rmation contained in subsequently filed current and periodic reports, each of which is available on our website and on the Securities and Exchange Co mmission’s website ( www.sec.gov ). Any forward - looking statements are qualified in their entirety by reference to the factors discussed in the 2018 Annual Repor t. Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or should the underlying assumpti ons prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include: a d ecline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; th e ability to protect our intellectual property rights; impact of any litigation or infringement actions brought against us; competition from other pro vid ers and products; risks in product development; inability to raise capital to fund continuing operations; changes in government regulation, the ability to compl ete customer transactions and capital raising transactions. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us t o p redict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward - looking statements to conform these statements to actual results. All forecasts are provided by management in this presentation and are based on information available to us at this time and m ana gement expects that internal projections and expectations may change over time. In addition, the forecasts are entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our pro duc ts.

Who We Are DPW Holdings, Inc. (NYSE American: DPW), incorporated in 1969, is a holding company managed by a team of seasoned Wall Street professionals with over 75 years of cumulative experience in Private Equity, Venture Capital and Activism We are a diversified holding company acquiring undervalued assets and disruptive technologies with a global impact Leadership: ▪ Milton “Todd” Ault III – Chairman and CEO ▪ William Horne – CFO ▪ Henry Nisser – EVP and General Counsel ▪ Darren Magot – Head of Operations ▪ Ken Cragun – Chief Accounting Officer ▪ David Katzoff – Senior VP of Finance ▪ Joe Spaziano – VP/CTO

Private Equity – Venture Capital - Activism Holding company model: ▪ Provides the structure to raise, allocate, deploy and manage significant permanent capital ▪ Provides the wherewithal to purchase companies we believe we can operate more effectively than incumbent management ▪ Allows management team the ability to successfully execute strategic plans Activism: We find undervalued companies using a methodology for valuing stocks that primarily looks for deeply depressed prices and become actively involved in those companies. Our approach: ▪ Influence the management of a target to improve shareholder value ▪ Acquire a controlling interest or outright ownership in order to implement changes required to improve the business ▪ Focus on operations and expanding the businesses What We Do

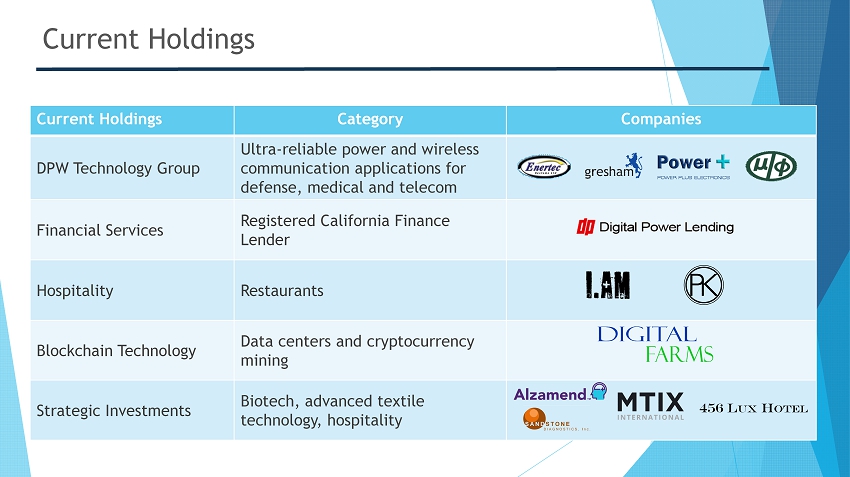

Current Holdings Current Holdings Category Companies DPW Technology Group Ultra - reliable power and wireless communication applications for defense, medical and telecom Financial Services Registered California Finance Lender Hospitality Restaurants Blockchain Technology Data centers and cryptocurrency mining Strategic Investments Biotech, advanced textile technology, hospitality 456 L UX H OTEL

Fremont, CA Sonora, CA Salisbury, UK Shelton, CT Karmiel, Israel Where We Do Business Newport Beach, CA DPW Holdings has a global footprint Headquartered in Newport Beach, CA European defense, naval and power solutions through Digital Power Ltd. (aka Gresham Power Electronics), located in Salisbury, UK Israel defense & aerospace combat solutions and medical technology through Enertec Systems Ltd., located in Karmiel, Israel North America defense & aerospace and telecommunication solutions through Microphase Corp., located in Shelton, CT North America power solutions through Power Plus Electronics located in Fremont, CA and Sonora, CA

Quarterly revenue up 33.6% from $5.2 million in Q1 - 2018 to $6.9 million in Q1 - 2019, primarily from acquisitions Q1 - 2019 net loss of $6.7 million including $2.4 million of non - cash charges Annual revenue up 167% from $10.2 million in 2017 to $27.2 million in 2018, primarily from acquisitions FY - 2018 net loss of $32.3 million including $16.8 million of non - cash charges Current backlog of $72.6 million, including $46.0 million in related party backlog (related - party backlog is delinquent in the production schedule) 2019 year - to - date reduction in short - term debt of $10.5 million Remaining short - term debt balance of $4.0 million expected to be resolved by Q3 Approximately $55 million in assets Stated goals: Decrease short - term liabilities Increase revenue growth Improve financial and operational performance Financial Highlights 2016 2017 2018 $7.1M $10.2M $27.2M Annual Revenue Q1 - 2018 Q1 - 2019 $5.2M $6.9M Quarterly Revenue

Where We Are Going Current Holdings Category Strategy Financial Services Financial Services (full - service) Filed $50 million Reg A+ note offering Expand MonthlyInterest.com Planned Financial Services acquisition Hospitality Restaurants Restaurant acquisitions in the pipeline Strategic Investments Biotech, advanced textile technology, hospitality Intend to provide additional funding to portfolio companies as needed

Pending Transactions Current Holdings Category Strategy DPW Technology Group Ultra - reliable power and wireless communication applications for defense, medical and telecom Moving forward with previously announced plans for IPO or possible sale Blockchain Technology Data centers and cryptocurrency mining Acquiring data center and moving forward with announced spin - off via distribution of shares to DPW’s stockholders

2019 Outlook First half of 2019 focused on $10.5 million debt reduction First half of 2019 results will reflect challenges with working capital issues Second half of 2019 – we project accelerated growth and improved bottom - line results Catalysts for growth and improved bottom - line results ▪ Executing on significant backlog with expected capital infusion ▪ Targeting two accretive acquisitions with significant top - line contribution ▪ Improving cash flow and bottom - line results from lower debt service load Targeting to exit the year with two publicly traded subsidiaries included in our consolidated financials (Digital Farms and DPW Technology Group, Inc.), providing financial flexibility and potential special dividend opportunities to DPW shareholders With acquisitions, expected revenue run rate of $60 - 75 million at the end of 2019

Thank you! Questions?