Exhibit 99.2

M AY 2022 B IT N ILE H OLDINGS , I NC . (NYSE A MERICAN : NILE) Q1 2022 R ESULTS & C ORPORATE O VERVIEW

Forward - Looking Statements Confidential & Proprietary 1 B IT N ILE H OLDINGS , I NC . This presentation and other written or oral statements made from time to time by representatives of BitNile Holdings, Inc . (the “Company” or “BitNile”) contain “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 ; as amended . Forward - looking statements reflect the current view about future events . Statements that are not historical in nature, such as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward - looking statements . Such statements include, but are not limited to, statements contained in this presentation relating to our business, business strategy, expansion, growth, products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook . Forward - looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed . We caution you therefore against relying on any of these forward - looking statements . These risks and uncertainties include those risk factors discussed in Part I, “Item 1 A . Risk Factors” of our Annual Report on Form 10 - K for the fiscal year ended December 31 , 2021 (the “ 2021 Annual Report”) and other information contained in subsequently filed current and periodic reports, each of which is available on our website and on the Securities and Exchange Commission’s website ( www . sec . gov ) . Any forward - looking statements are qualified in their entirety by reference to the risk factors discussed in the 2021 Annual Report . Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned . Important factors that could cause actual results to differ materially from those in the forward looking statements include : a decline in general economic conditions nationally and internationally ; decreased demand for our products and services ; market acceptance of our products ; the ability to protect our intellectual property rights ; impact of any litigation or infringement actions brought against us ; competition from other providers and products ; risks in product development ; inability to raise capital to fund continuing operations ; changes in government regulation ; the ability to complete customer transactions and capital raising transactions . Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them . We cannot guarantee future results, levels of activity, performance or achievements . Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward - looking statements to conform these statements to actual results . All forecasts are provided by management in this presentation and are based on information available to us at this time and management expects that internal projections and expectations may change over time . In addition, the forecasts are based entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products .

Executive Summary & Recent Developments

Executive Summary BitNile Holdings, Inc . (the “Company”) is a diversified holding company with four operating segments within multiple verticals . Specifically, the Company owns operating subsidiaries within commercial real estate, Bitcoin mining and data center operations, commercial lending and activist investing, aerospace and defense, and EV charging and technology . The Company also sponsors a Special Purpose Acquisition Company (“SPAC”), Ault Disruptive Technologies that trades on the NYSE American under the symbol ADRT . Highlights : Ault Global Real Estate Equities, Inc . (“AGREE”), an operating subsidiary, owns a portfolio of four midmarket select service hotels across the Midwest . AGREE also owns a minority interest in a newly developed ultra - luxury hotel in New York City, as well as a general partner and a current 100 % equity interest in a multi - family residential condominium development property in St . Petersburg, Florida . BitNile , Inc . , an operating subsidiary, owns and operates a 617 , 000 sqft data center in western Michigan where it houses Bitcoin miners and hyperscale data center solutions . BitNile also holds a minority stake in a Decentralized Finance community and trading startup called Earnity , Inc . Digital Power Lending, LLC (“DPL”), an operating subsidiary, is a California licensed lender that lends across the capital structure to small cap companies through IPOs, PIPEs, and convertible debt structures . DPL also holds an activist investing portfolio where it seeks to influence management of underperforming and undervalued small and mid - cap companies . Gresham Worldwide, Inc . (“GWW”), an operating subsidiary, consists of Enertec Systems, Relec Electronics, Gresham Power Electronics, and Microphase Corporation . These four companies specialize in providing bespoke products to the global aerospace and defense industry with customers in the UK, Israel, and the United States . GWW is currently working through a merger with Giga - tronics (OTCQB : GIGA) . The Company has raised and deployed over $ 400 M in capital since 2020 while being virtually debt free other than some advantageous debt at the subsidiary level . The Company is uniquely positioned to capitalize on its debt free assets and the growing cryptocurrency industry . It is currently seeking opportunities to alternatively capitalize on its assets . Confidential & Proprietary 3 E XECUTIVE S UMMARY

BitNile Holdings, Inc. Organization Confidential & Proprietary 4 E XECUTIVE S UMMARY Microphase RELEC Electronics Enertec Systems Gresham Power Electronics T HIRD A VENUE A PARTMENTS AGREE M ADISON Producer of premium EV Chargers for commercial and retail customers Global provider and manufacturer of electronic and power systems solutions for defense, transportation, medical, and industrial markets ______________________ □ On December 27 , 2021 , BitNile Holdings and Gresham Worldwide entered into a Share Exchange Agreement with Giga - tronics Incorporated (OTCQB : GIGA) . Assuming the transaction is completed, BitNile Holdings will own approximately 68 % of the combined companies . □ BitNile Holdings owns 81 % of Imperalis Holdings, 56 . 4 % of Microphase, and 20 % of Ault Disruptive Technologies Corporation (NYSE American : ADRT) . □ All other operating subsidiaries are 100 % owned . IMPERALIS HOLDINGS t AULT DISTRUPTIVE TECHNOLOGIES LLC Inc.

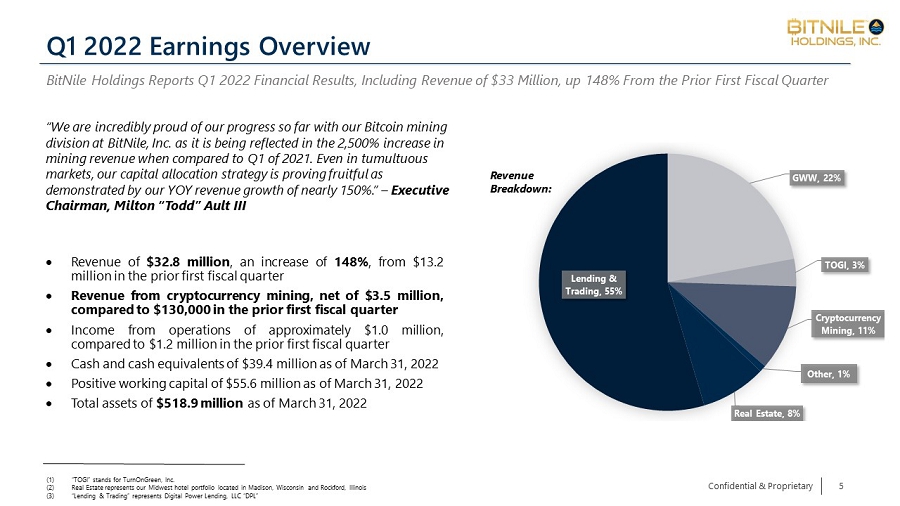

Q1 2022 Earnings Overview Revenue of $ 32 . 8 million , an increase of 148 % , from $ 13 . 2 million in the prior first fiscal quarter Revenue from cryptocurrency mining, net of $ 3 . 5 million, compared to $ 130 , 000 in the prior first fiscal quarter Income from operations of approximately $ 1 . 0 million, compared to $ 1 . 2 million in the prior first fiscal quarter Cash and cash equivalents of $ 39 . 4 million as of March 31 , 2022 Positive working capital of $ 55 . 6 million as of March 31 , 2022 Total assets of $ 518 . 9 million as of March 31 , 2022 Confidential & Proprietary 5 BitNile Holdings Reports Q 1 2022 Financial Results, Including Revenue of $ 33 Million, up 148 % From the Prior First Fiscal Quarter (1) “TOGI” stands for TurnOnGreen , Inc. (2) Real Estate represents our Midwest hotel portfolio located in Madison, Wisconsin and Rockford, Illinois (3) “Lending & Trading” represents Digital Power Lending, LLC “DPL” GWW, 22% TOGI, 3% Cryptocurrency Mining, 11% Other, 1% Real Estate, 8% Lending & Trading, 55% Revenue Breakdown: “We are incredibly proud of our progress so far with our Bitcoin mining division at BitNile , Inc. as it is being reflected in the 2,500% increase in mining revenue when compared to Q1 of 2021. Even in tumultuous markets, our capital allocation strategy is proving fruitful as demonstrated by our YOY revenue growth of nearly 150%.” – Executive Chairman, Milton “Todd” Ault III

“We are very pleased with these recent developments as we expect them to be driving forces in the long - term growth of our asset base and our overall capital allocation strategy.” – Executive Chairman, Milton “Todd” Ault III Recent Developments • Received full site plan approval from the city of St . Petersburg for our 23 - story 285 unit mixed use development anticipated to break ground in the Fall of 2022 . Confidential & Proprietary 6 • Completed the purchase of the outside owned 30 % of Alliance Cloud Services “ACS” making ACS a wholly owned subsidiary and further progressing our bitcoin mining operations . • Ault Alliance, Inc . has agreed to lend approximately $ 12 million (inclusive of existing loans) through a super - priority debtor - in - possession (“ DIP ”) loan to, and entered into an asset purchase agreement with, EYP, Inc . and its affiliates (“ EYP ”) providing for the acquisition of all of EYP’s assets for an aggregate consideration of approximately $ 68 million . M AY 2022 M AY 2022 A PRIL 2022 “ We are very excited about the possibility of acquiring EYP and partnering with its exceptional management team and staff. We are confident we can support EYP’s growth and maximize the long - term value of the business .” – Christopher Wu, President of Ault Alliance

BitNile, Inc.

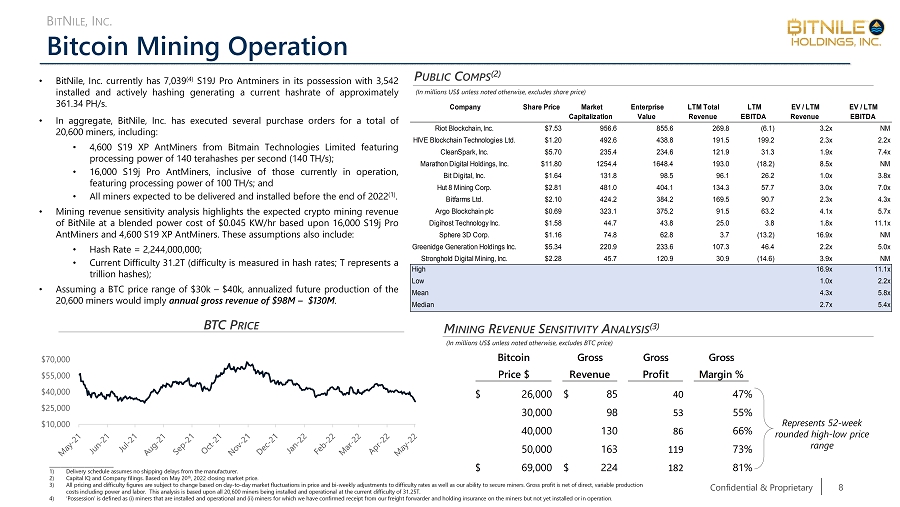

Bitcoin Mining Operation Confidential & Proprietary 8 B IT N ILE , I NC . BTC P RICE • BitNile, Inc . currently has 7 , 039 ( 4 ) S 19 J Pro Antminers in its possession with 3 , 542 installed and actively hashing generating a current hashrate of approximately 361 . 34 PH/s . • In aggregate, BitNile, Inc . has executed several purchase orders for a total of 20 , 600 miners, including : • 4 , 600 S 19 XP AntMiners from Bitmain Technologies Limited featuring processing power of 140 terahashes per second ( 140 TH/s) ; • 16 , 000 S 19 j Pro AntMiners, inclusive of those currently in operation, featuring processing power of 100 TH/s ; and • All miners expected to be delivered and installed before the end of 2022 ( 1 ) . • Mining revenue sensitivity analysis highlights the expected crypto mining revenue of BitNile at a blended power cost of $ 0 . 045 KW/hr based upon 16 , 000 S 19 j Pro AntMiners and 4 , 600 S 19 XP AntMiners . These assumptions also include : • Hash Rate = 2 , 244 , 000 , 000 ; • Current Difficulty 31 . 2 T (difficulty is measured in hash rates ; T represents a trillion hashes) ; • Assuming a BTC price range of $ 30 k – $ 40 k, annualized future production of the 20 , 600 miners would imply annual gross revenue of $ 98 M – $ 130 M . P UBLIC C OMPS (2) M INING R EVENUE S ENSITIVITY A NALYSIS (3) Represents 52 - week rounded high - low price range ______________________ 1) Delivery schedule assumes no shipping delays from the manufacturer. 2) Capital IQ and Company filings. Based on May 20 th , 2022 closing market price. 3) All pricing and difficulty figures are subject to change based on day - to - day market fluctuations in price and bi - weekly adjustme nts to difficulty rates as well as our ability to secure miners. Gross profit is net of direct, variable production costs including power and labor. This analysis is based upon all 20,600 miners being installed and operational at the curren t d ifficulty of 31.25T. 4) ‘Possession’ is defined as ( i ) miners that are installed and operational and (ii) miners for which we have confirmed receipt from our freight forwarder an d h olding insurance on the miners but not yet installed or in operation. (In millions US$ unless noted otherwise, excludes share price) (In millions US$ unless noted otherwise, excludes BTC price) $10,000 $25,000 $40,000 $55,000 $70,000 Riot Blockchain, Inc. $7.53 956.6 855.6 269.8 (6.1) 3.2x NM HIVE Blockchain Technologies Ltd. $1.20 492.6 438.8 191.5 199.2 2.3x 2.2x CleanSpark, Inc. $5.70 235.4 234.6 121.9 31.3 1.9x 7.4x Marathon Digital Holdings, Inc. $11.80 1254.4 1648.4 193.0 (18.2) 8.5x NM Bit Digital, Inc. $1.64 131.8 98.5 96.1 26.2 1.0x 3.8x Hut 8 Mining Corp. $2.81 481.0 404.1 134.3 57.7 3.0x 7.0x Bitfarms Ltd. $2.10 424.2 384.2 169.5 90.7 2.3x 4.3x Argo Blockchain plc $0.69 323.1 375.2 91.5 63.2 4.1x 5.7x Digihost Technology Inc. $1.58 44.7 43.8 25.0 3.8 1.8x 11.1x Sphere 3D Corp. $1.16 74.8 62.8 3.7 (13.2) 16.9x NM Greenidge Generation Holdings Inc. $5.34 220.9 233.6 107.3 46.4 2.2x 5.0x Stronghold Digital Mining, Inc. $2.28 45.7 120.9 30.9 (14.6) 3.9x NM High 16.9x 11.1x Low 1.0x 2.2x Mean 4.3x 5.8x Median 2.7x 5.4x LTM EBITDA EV / LTM Revenue EV / LTM EBITDA Company Share Price Market Capitalization Enterprise Value LTM Total Revenue Bitcoin Gross Gross Gross Price $ Revenue Profit Margin % 26,000$ 85$ 40 47% 30,000 98 53 55% 40,000 130 86 66% 50,000 163 119 73% 69,000$ 224$ 182 81%

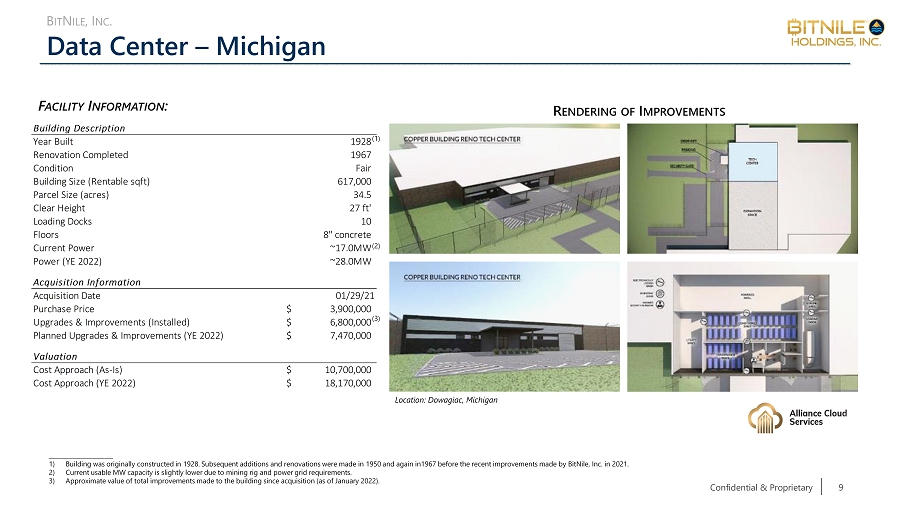

Building Description Year Built 1928 Renovation Completed 1967 Condition Fair Building Size (Rentable sqft) 617,000 Parcel Size (acres) 34.5 Clear Height 27 ft' Loading Docks 10 Floors 8" concrete Current Power ~17.0MW Power (YE 2022) ~28.0MW Acquisition Information Acquisition Date 01/29/21 Purchase Price 3,900,000$ Upgrades & Improvements (Installed) 6,800,000$ Planned Upgrades & Improvements (YE 2022) 7,470,000$ Valuation Cost Approach (As-Is) 10,700,000$ Cost Approach (YE 2022) 18,170,000$ Data Center – Michigan Confidential & Proprietary 9 B IT N ILE , I NC . R ENDERING OF I MPROVEMENTS ______________________ 1) Building was originally constructed in 1928. Subsequent additions and renovations were made in 1950 and again in1967 before t he recent improvements made by BitNile, Inc. in 2021. 2) Current usable MW capacity is slightly lower due to mining rig and power grid requirements. 3) Approximate value of total improvements made to the building since acquisition (as of January 2022). Location: Dowagiac, Michigan F ACILITY I NFORMATION : (1) (3) (2)

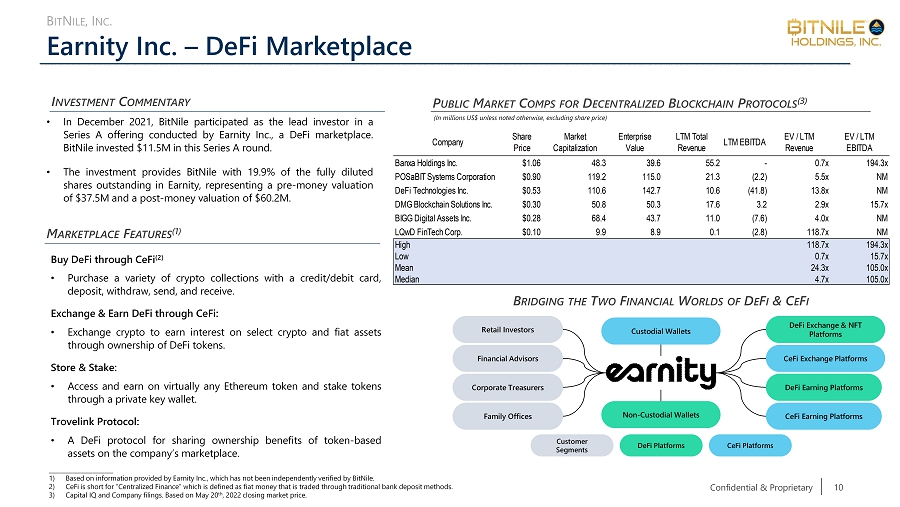

Earnity Inc. – DeFi Marketplace Confidential & Proprietary 10 B IT N ILE , I NC . Custodial Wallets Non - Custodial Wallets DeFi Exchange & NFT Platforms Family Offices Corporate Treasurers Retail Investors CeFi Exchange Platforms DeFi Earning Platforms CeFi Earning Platforms Financial Advisors Customer Segments DeFi Platforms CeFi Platforms Buy DeFi through CeFi ( 2 ) • Purchase a variety of crypto collections with a credit/debit card, deposit, withdraw, send, and receive . Exchange & Earn DeFi through CeFi : • Exchange crypto to earn interest on select crypto and fiat assets through ownership of DeFi tokens . Store & Stake : • Access and earn on virtually any Ethereum token and stake tokens through a private key wallet . Trovelink Protocol : • A DeFi protocol for sharing ownership benefits of token - based assets on the company’s marketplace . B RIDGING THE T WO F INANCIAL W ORLDS OF D E F I & C E F I M ARKETPLACE F EATURES (1) ______________________ 1) Based on information provided by Earnity Inc., which has not been independently verified by BitNile. 2) CeFi is short for “Centralized Finance” which is defined as fiat money that is traded through traditional bank deposit method s. 3) Capital IQ and Company filings. Based on May 20 th , 2022 closing market price. • In December 2021 , BitNile participated as the lead investor in a Series A offering conducted by Earnity Inc . , a DeFi marketplace . BitNile invested $ 11 . 5 M in this Series A round . • The investment provides BitNile with 19 . 9 % of the fully diluted shares outstanding in Earnity, representing a pre - money valuation of $ 37 . 5 M and a post - money valuation of $ 60 . 2 M . P UBLIC M ARKET C OMPS FOR D ECENTRALIZED B LOCKCHAIN P ROTOCOLS (3) I NVESTMENT C OMMENTARY (In millions US$ unless noted otherwise, excluding share price) Company Share Price Market Capitalization Enterprise Value LTM Total Revenue LTM EBITDA EV / LTM Revenue EV / LTM EBITDA Banxa Holdings Inc. $1.06 48.3 39.6 55.2 - 0.7x 194.3x POSaBIT Systems Corporation $0.90 119.2 115.0 21.3 (2.2) 5.5x NM DeFi Technologies Inc. $0.53 110.6 142.7 10.6 (41.8) 13.8x NM DMG Blockchain Solutions Inc. $0.30 50.8 50.3 17.6 3.2 2.9x 15.7x BIGG Digital Assets Inc. $0.28 68.4 43.7 11.0 (7.6) 4.0x NM LQwD FinTech Corp. $0.10 9.9 8.9 0.1 (2.8) 118.7x NM High 118.7x 194.3x Low 0.7x 15.7x Mean 24.3x 105.0x Median 4.7x 105.0x

Ault Global Real Estate Equities

Hospitality Portfolio Overview (1) Confidential & Proprietary 12 AGREE Transaction Overview : • In December 2021 , Ault Global Real Estate Equities, Inc . (AGREE) acquired a portfolio of four extended stay and select service hotels . • Three hotels are located approximately ten minutes outside of the state capital city of Madison, Wisconsin, while the fourth is near a major interstate highway in Rockford, IL, adjacent to a newly entitled HardRock C asino ; • 122 room Residence Inn (Marriott), Madison West/Middleton, WI ; • 136 room Courtyard (Marriott), Madison West/Middleton, WI ; • 133 room Hilton Garden Inn, Madison West/Middleton, WI ; and • 135 room Hilton Garden Inn, Rockford, IL . Total keys acquired : 526 • Vacant 1 . 6 - acre parcel adjacent to the hotel in Rockford . Primed for development of a possible restaurant, additional hotel, or mixed - use retail facility . • The purchase price of $ 69 . 2 M represents a 10 % cap rate based on 2019 Net Operating Income (NOI) of $ 6 . 9 M . ______________________ 1) Ault Global Real Estate Equities, Inc. (AGREE), the real estate investment division of Ault Alliance, Inc.

Hospitality Portfolio Operating Metrics Confidential & Proprietary 13 AGREE 1 2019 2020 2021 Occupancy (%) ADR (1) ($/key) NOI (2) ($M) Occupancy (%) ADR ($/key) NOI ($M) NOI (% ∆ 2019) Occupancy (%) ADR ($/key) NOI ($M) NOI (% ∆ 2019) NOI (% ∆ 2020) Rockford, IL 82% $144 $2.4 57% $111 $0.7 - 136% 75% $120 $1.2 - 51% 57% Middleton, WI 70% $147 $1.2 23% $103 $(0.4) - 133% 60% $115 $1.1 - 8% 351% Middleton, WI 70% $131 $1.5 23% $90 $(0.4) - 126% 60% $109 $0.3 - 80% 175% Middleton, WI 75% $133 $1.5 45% $94 $0.2 - 87% 73% $105 $0.6 - 56% 238% P ORTFOLIO T OTALS 74% $138 $6.6 37% $100 $0.1 - 120% 67% $112 $3.2 - 49% 205% Despite the global pandemic, the portfolio was still profitable in 2020 and rebounded in 2021 ______________________ 1) ADR – Average Daily Rate for each occupied guest room per day. 2) NOI – Net Operating Income.

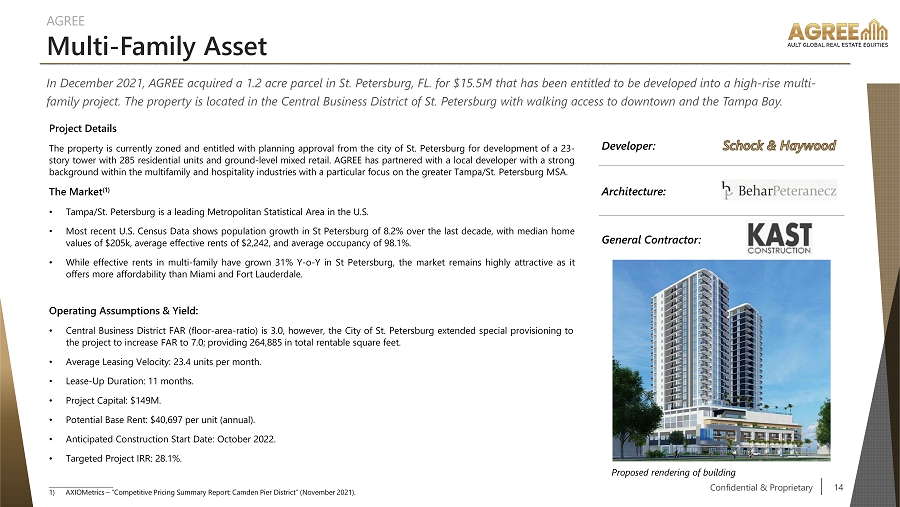

Multi - Family Asset Confidential & Proprietary 14 AGREE In December 2021, AGREE acquired a 1.2 acre parcel in St. Petersburg, FL. for $15.5M that has been entitled to be developed i nto a high - rise multi - family project. The property is located in the Central Business District of St. Petersburg with walking access to downtown an d t he Tampa Bay. Project Details The property is currently zoned and entitled with planning approval from the city of St . Petersburg for development of a 23 - story tower with 285 residential units and ground - level mixed retail . AGREE has partnered with a local developer with a strong background within the multifamily and hospitality industries with a particular focus on the greater Tampa/St . Petersburg MSA . The Market ( 1 ) • Tampa/St . Petersburg is a leading Metropolitan Statistical Area in the U . S . • Most recent U . S . Census Data shows population growth in St Petersburg of 8 . 2 % over the last decade, with median home values of $ 205 k, average effective rents of $ 2 , 242 , and average occupancy of 98 . 1 % . • While effective rents in multi - family have grown 31 % Y - o - Y in St Petersburg, the market remains highly attractive as it offers more affordability than Miami and Fort Lauderdale . ______________________ 1) AXIOMetrics – “Competitive Pricing Summary Report: Camden Pier District” (November 2021). Proposed rendering of building Operating Assumptions & Yield : • Central Business District FAR (floor - area - ratio) is 3 . 0 , however, the City of St . Petersburg extended special provisioning to the project to increase FAR to 7 . 0 ; providing 264 , 885 in total rentable square feet . • Average Leasing Velocity : 23 . 4 units per month . • Lease - Up Duration : 11 months . • Project Capital : $ 149 M . • Potential Base Rent : $ 40 , 697 per unit (annual) . • Anticipated Construction Start Date : October 2022 . • Targeted Project IRR : 28 . 1 % . Architecture: Developer: General Contractor:

Operating Subsidiaries

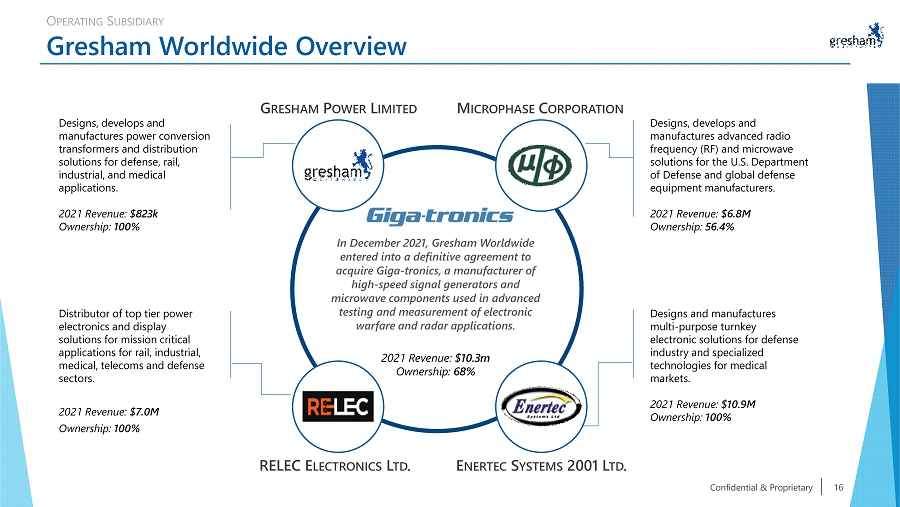

Gresham Worldwide Overview Confidential & Proprietary 16 O PERATING S UBSIDIARY Designs, develops and manufactures power conversion transformers and distribution solutions for defense, rail, industrial, and medical applications. 2021 Revenue: $823k Ownership: 100% M ICROPHASE C ORPORATION G RESHAM P OWER L IMITED E NERTEC S YSTEMS 2001 L TD . RELEC E LECTRONICS L TD . Designs, develops and manufactures advanced radio frequency (RF) and microwave solutions for the U.S. Department of Defense and global defense equipment manufacturers. 2021 Revenue: $6.8M Ownership: 56.4% Designs and manufactures multi - purpose turnkey electronic solutions for defense industry and specialized technologies for medical markets. 2021 Revenue: $10.9M Ownership: 100% Distributor of top tier power electronics and display solutions for mission critical applications for rail, industrial, medical, telecoms and defense sectors. 2021 Revenue: $7.0M Ownership: 100% In December 2021, Gresham Worldwide entered into a definitive agreement to acquire Giga - tronics, a manufacturer of high - speed signal generators and microwave components used in advanced testing and measurement of electronic warfare and radar applications. 2021 Revenue: $10.3m Ownership: 68%

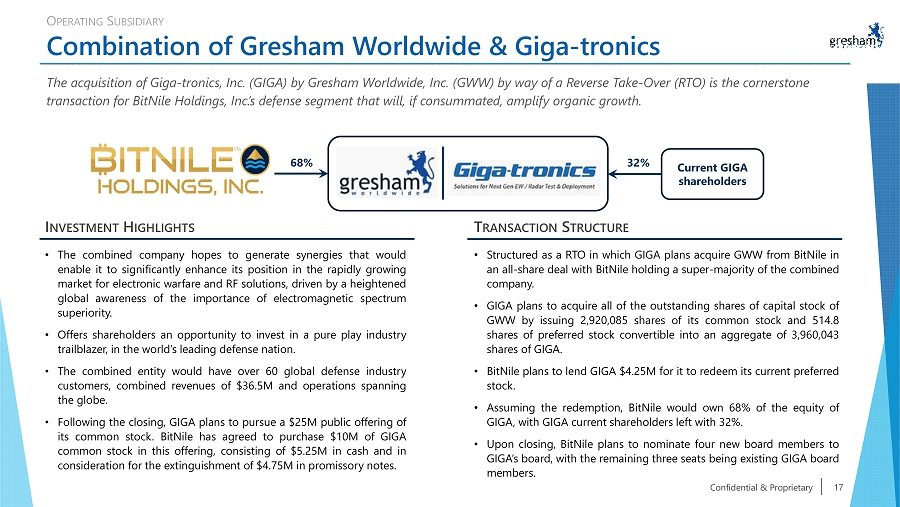

Combination of Gresham Worldwide & Giga - tronics Confidential & Proprietary 17 O PERATING S UBSIDIARY The acquisition of Giga - tronics, Inc. (GIGA) by Gresham Worldwide, Inc. (GWW) by way of a Reverse Take - Over (RTO) is the corners tone transaction for BitNile Holdings, Inc.’s defense segment that will, if consummated, amplify organic growth. I NVESTMENT H IGHLIGHTS • The combined company hopes to generate synergies that would enable it to significantly enhance its position in the rapidly growing market for electronic warfare and RF solutions, driven by a heightened global awareness of the importance of electromagnetic spectrum superiority . • Offers shareholders an opportunity to invest in a pure play industry trailblazer, in the world’s leading defense nation . • The combined entity would have over 60 global defense industry customers, combined revenues of $ 36 . 5 M and operations spanning the globe . • Following the closing, GIGA plans to pursue a $ 25 M public offering of its common stock . BitNile has agreed to purchase $ 10 M of GIGA common stock in this offering, consisting of $ 5 . 25 M in cash and in consideration for the extinguishment of $ 4 . 75 M in promissory notes . T RANSACTION S TRUCTURE • Structured as a RTO in which GIGA plans acquire GWW from BitNile in an all - share deal with BitNile holding a super - majority of the combined company . • GIGA plans to acquire all of the outstanding shares of capital stock of GWW by issuing 2 , 920 , 085 shares of its common stock and 514 . 8 shares of preferred stock convertible into an aggregate of 3 , 960 , 043 shares of GIGA . • BitNile plans to lend GIGA $ 4 . 25 M for it to redeem its current preferred stock . • Assuming the redemption, BitNile would own 68 % of the equity of GIGA, with GIGA current shareholders left with 32 % . • Upon closing, BitNile plans to nominate four new board members to GIGA’s board, with the remaining three seats being existing GIGA board members . 68% Current GIGA shareholders 32%

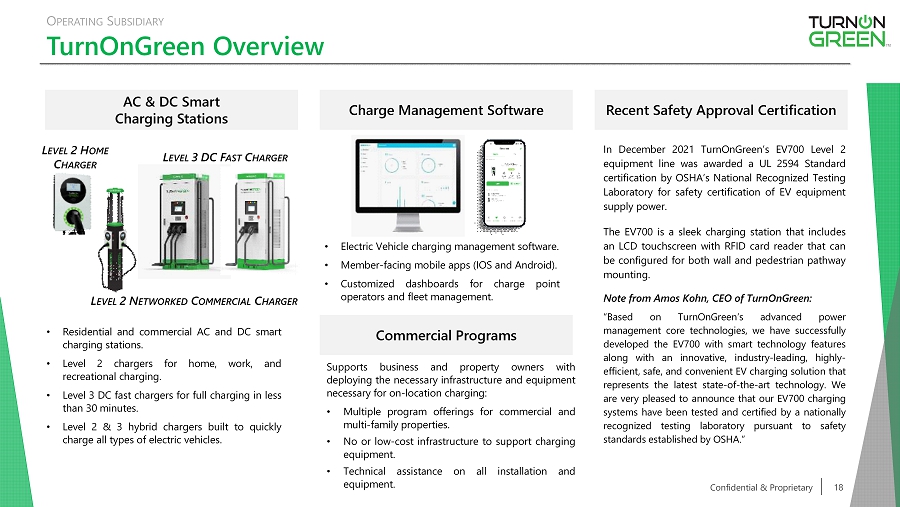

TurnOnGreen Overview Confidential & Proprietary 18 O PERATING S UBSIDIARY Supports business and property owners with deploying the necessary infrastructure and equipment necessary for on - location charging : • Multiple program offerings for commercial and multi - family properties . • No or low - cost infrastructure to support charging equipment . • Technical assistance on all installation and equipment . • Residential and commercial AC and DC smart charging stations . • Level 2 chargers for home, work, and recreational charging . • Level 3 DC fast chargers for full charging in less than 30 minutes . • Level 2 & 3 hybrid chargers built to quickly charge all types of electric vehicles . • Electric Vehicle charging management software . • Member - facing mobile apps (IOS and Android) . • Customized dashboards for charge point operators and fleet management . L EVEL 2 H OME C HARGER L EVEL 2 N ETWORKED C OMMERCIAL C HARGER L EVEL 3 DC F AST C HARGER AC & DC Smart Charging Stations Charge Management Software Recent Safety Approval Certification Commercial Programs In December 2021 TurnOnGreen’s EV 700 Level 2 equipment line was awarded a UL 2594 Standard certification by OSHA’s National Recognized Testing Laboratory for safety certification of EV equipment supply power . The EV 700 is a sleek charging station that includes an LCD touchscreen with RFID card reader that can be configured for both wall and pedestrian pathway mounting . Note from Amos Kohn, CEO of TurnOnGreen : “Based on TurnOnGreen’s advanced power management core technologies, we have successfully developed the EV 700 with smart technology features along with an innovative, industry - leading, highly - efficient, safe, and convenient EV charging solution that represents the latest state - of - the - art technology . We are very pleased to announce that our EV 700 charging systems have been tested and certified by a nationally recognized testing laboratory pursuant to safety standards established by OSHA . ”

Investment Vehicles

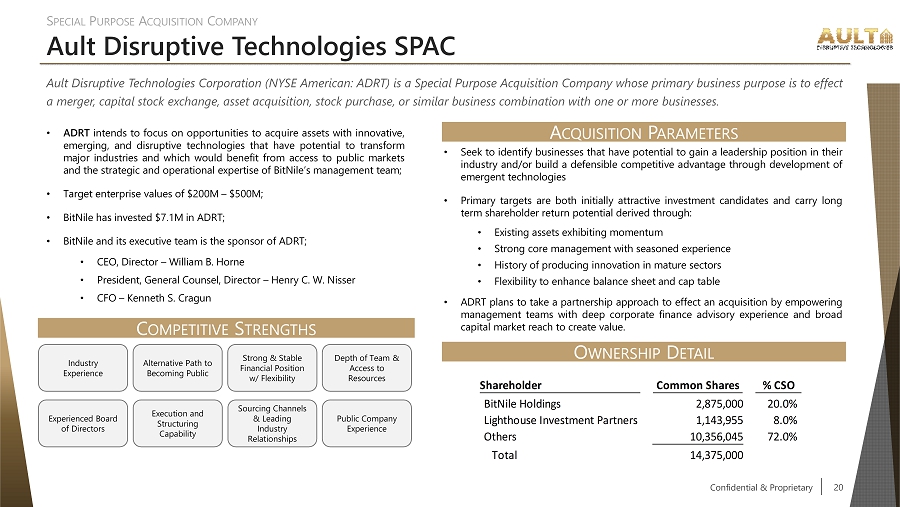

Ault Disruptive Technologies SPAC Confidential & Proprietary 20 S PECIAL P URPOSE A CQUISITION C OMPANY Ault Disruptive Technologies Corporation (NYSE American : ADRT) is a Special Purpose Acquisition Company whose primary business purpose is to effect a merger, capital stock exchange, asset acquisition, stock purchase, or similar business combination with one or more businesses . • ADRT intends to focus on opportunities to acquire assets with innovative, emerging, and disruptive technologies that have potential to transform major industries and which would benefit from access to public markets and the strategic and operational expertise of BitNile’s management team ; • Target enterprise values of $ 200 M – $ 500 M ; • BitNile has invested $ 7 . 1 M in ADRT ; • BitNile and its executive team is the sponsor of ADRT ; • CEO, Director – William B . Horne • President, General Counsel, Director – Henry C . W . Nisser • CFO – Kenneth S . Cragun Industry Experience Alternative Path to Becoming Public Strong & Stable Financial Position w/ Flexibility Depth of Team & Access to Resources Experienced Board of Directors Sourcing Channels & Leading Industry Relationships Execution and Structuring Capability Public Company Experience A CQUISITION P ARAMETERS • Seek to identify businesses that have potential to gain a leadership position in their industry and/or build a defensible competitive advantage through development of emergent technologies • Primary targets are both initially attractive investment candidates and carry long term shareholder return potential derived through : • Existing assets exhibiting momentum • Strong core management with seasoned experience • History of producing innovation in mature sectors • Flexibility to enhance balance sheet and cap table • ADRT plans to take a partnership approach to effect an acquisition by empowering management teams with deep corporate finance advisory experience and broad capital market reach to create value . C OMPETITIVE S TRENGTHS O WNERSHIP D ETAIL Shareholder Common Shares % CSO BitNile Holdings 2,875,000 20.0% Lighthouse Investment Partners 1,143,955 8.0% Others 10,356,045 72.0% Total 14,375,000

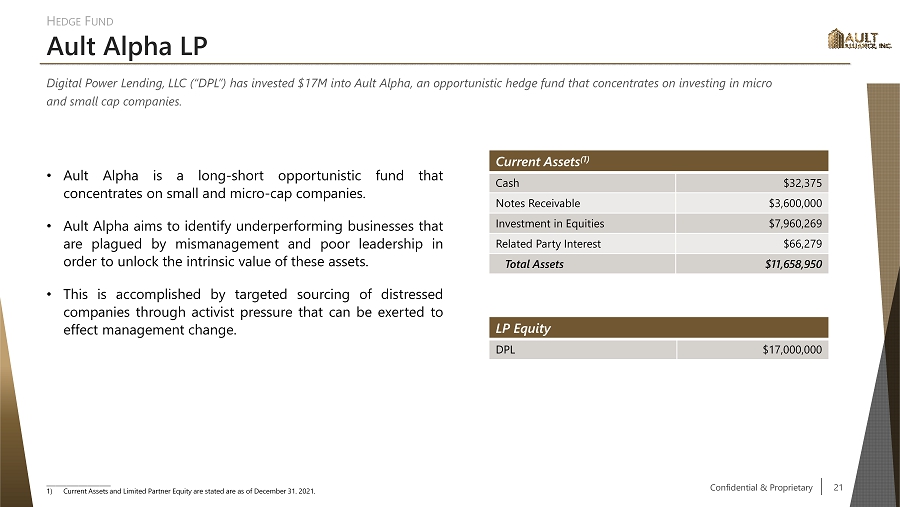

Ault Alpha LP Confidential & Proprietary 21 H EDGE F UND Digital Power Lending, LLC (“DPL”) has invested $17M into Ault Alpha, an opportunistic hedge fund that concentrates on invest ing in micro and small cap companies. • Ault Alpha is a long - short opportunistic fund that concentrates on small and micro - cap companies . • Ault Alpha aims to identify underperforming businesses that are plagued by mismanagement and poor leadership in order to unlock the intrinsic value of these assets . • This is accomplished by targeted sourcing of distressed companies through activist pressure that can be exerted to effect management change . ______________________ 1) Current Assets and Limited Partner Equity are stated are as of December 31. 2021. LP Equity DPL $17,000,000 Current Assets (1) Cash $32,375 Notes Receivable $3,600,000 Investment in Equities $7,960,269 Related Party Interest $66,279 Total Assets $11,658,950

Management

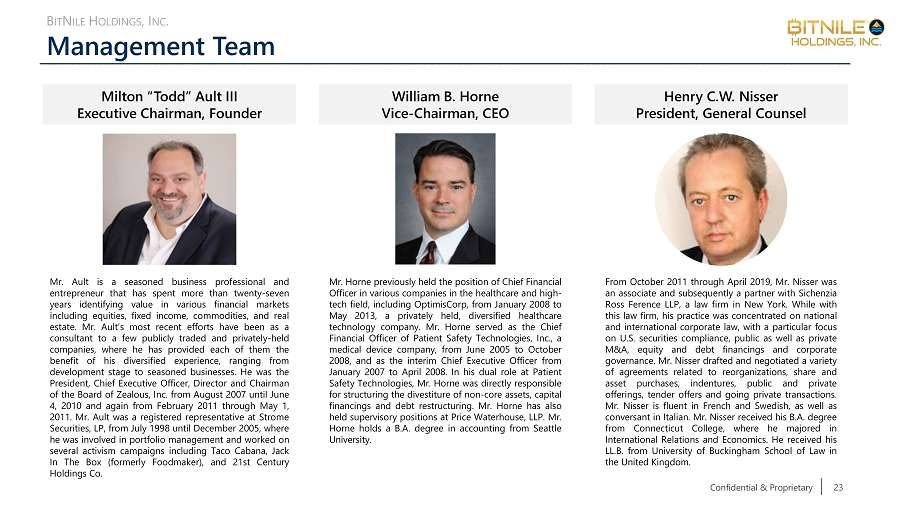

Management Team Confidential & Proprietary 23 Mr . Ault is a seasoned business professional and entrepreneur that has spent more than twenty - seven years identifying value in various financial markets including equities, fixed income, commodities, and real estate . Mr . Ault’s most recent efforts have been as a consultant to a few publicly traded and privately - held companies, where he has provided each of them the benefit of his diversified experience, ranging from development stage to seasoned businesses . He was the President, Chief Executive Officer, Director and Chairman of the Board of Zealous, Inc . from August 2007 until June 4 , 2010 and again from February 2011 through May 1 , 2011 . Mr . Ault was a registered representative at Strome Securities, LP, from July 1998 until December 2005 , where he was involved in portfolio management and worked on several activism campaigns including Taco Cabana, Jack In The Box (formerly Foodmaker), and 21 st Century Holdings Co . Mr . Horne previously held the position of Chief Financial Officer in various companies in the healthcare and high - tech field, including OptimisCorp, from January 2008 to May 2013 , a privately held, diversified healthcare technology company . Mr . Horne served as the Chief Financial Officer of Patient Safety Technologies, Inc . , a medical device company, from June 2005 to October 2008 , and as the interim Chief Executive Officer from January 2007 to April 2008 . In his dual role at Patient Safety Technologies, Mr . Horne was directly responsible for structuring the divestiture of non - core assets, capital financings and debt restructuring . Mr . Horne has also held supervisory positions at Price Waterhouse, LLP . Mr . Horne holds a B . A . degree in accounting from Seattle University . Milton “Todd” Ault III Executive Chairman, Founder William B. Horne Vice - Chairman, CEO Henry C.W. Nisser President, General Counsel From October 2011 through April 2019 , Mr . Nisser was an associate and subsequently a partner with Sichenzia Ross Ference LLP, a law firm in New York . While with this law firm, his practice was concentrated on national and international corporate law, with a particular focus on U . S . securities compliance, public as well as private M&A, equity and debt financings and corporate governance . Mr . Nisser drafted and negotiated a variety of agreements related to reorganizations, share and asset purchases, indentures, public and private offerings, tender offers and going private transactions . Mr . Nisser is fluent in French and Swedish, as well as conversant in Italian . Mr . Nisser received his B . A . degree from Connecticut College, where he majored in International Relations and Economics . He received his LL . B . from University of Buckingham School of Law in the United Kingdom . B IT N ILE H OLDINGS , I NC .

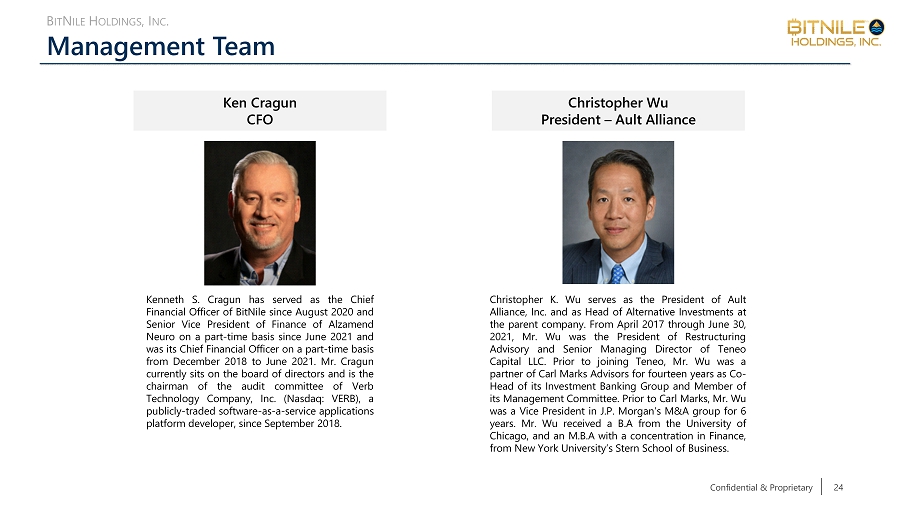

Management Team Confidential & Proprietary 24 Kenneth S . Cragun has served as the Chief Financial Officer of BitNile since August 2020 and Senior Vice President of Finance of Alzamend Neuro on a part - time basis since June 2021 and was its Chief Financial Officer on a part - time basis from December 2018 to June 2021 . Mr . Cragun currently sits on the board of directors and is the chairman of the audit committee of Verb Technology Company, Inc . (Nasdaq : VERB), a publicly - traded software - as - a - service applications platform developer, since September 2018 . Ken Cragun CFO Christopher Wu President – Ault Alliance Christopher K . Wu serves as the President of Ault Alliance, Inc . and as Head of Alternative Investments at the parent company . From April 2017 through June 30 , 2021 , Mr . Wu was the President of Restructuring Advisory and Senior Managing Director of Teneo Capital LLC . Prior to joining Teneo, Mr . Wu was a partner of Carl Marks Advisors for fourteen years as Co - Head of its Investment Banking Group and Member of its Management Committee . Prior to Carl Marks, Mr . Wu was a Vice President in J . P . Morgan’s M&A group for 6 years . Mr . Wu received a B . A from the University of Chicago, and an M . B . A with a concentration in Finance, from New York University’s Stern School of Business . B IT N ILE H OLDINGS , I NC .

Management Team Confidential & Proprietary 25 Mr . Turner spent approximately 19 years, including the last 10 as a partner, at Sichenzia Ross Ference LLP, a law firm in New York . His firm practice focused on corporate and securities law, including initial public offerings and secondary transactions, mergers and acquisitions, private investment fund formations, corporate governance and securities law compliance . Mr . Turner represented numerous public and private companies in private equity financing transactions, debt and venture capital offerings, domestic mergers, stock and assets acquisitions and other reorganization transactions . Mr . Turner received B . A . degrees from Elmira College in political science and international relations, and his J . D . degree from American University, Washington College of Law, where he was a member of the American University International Law Review . James Turner Deputy General Counsel David Katzoff has served as the Senior Vice President of Finance of BitNile since January 2019 . He is also the Chief Operating Officer of Alzamend Neuro since December 2020 and was previously its Senior Vice President of Operations from November 2019 to December 2020 . Mr . Katzoff served as the Chief Financial Officer of Lumina Media, LLC, a privately - held media company and publisher of life - style publications, from 2015 to December 2018 , and Vice President of Finance of Local Corporation from 2003 to 2017 . Mr . Katzoff earned a B . S . degree in business management from the University of California at Davis . David Katzoff Senior Vice President of Finance B IT N ILE H OLDINGS , I NC .