Exhibit 99.1

S EPTEMBER 2022 B IT N ILE H OLDINGS , I NC . (NYSE A MERICAN : NILE) I NFORMATION A BOUT THE D IVESTITURE OF T URN O N G REEN AND THE A NTICIPATED D IVIDEND

Forward - Looking Statements Confidential & Proprietary 1 B IT N ILE H OLDINGS , I NC . This presentation and other written or oral statements made from time to time by representatives of BitNile Holdings, Inc . (the “Company” or “BitNile”) contain “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 ; as amended . Forward - looking statements reflect the current view about future events . Statements that are not historical in nature, such as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward - looking statements . Such statements include, but are not limited to, statements contained in this presentation relating to our business, business strategy, expansion, growth, products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook . Forward - looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed . We caution you therefore against relying on any of these forward - looking statements . These risks and uncertainties include those risk factors discussed in Part I, “Item 1 A . Risk Factors” of our Annual Report on Form 10 - K for the fiscal year ended December 31 , 2021 (the “ 2021 Annual Report”) and other information contained in subsequently filed current and periodic reports, each of which is available on our website and on the Securities and Exchange Commission’s website ( www . sec . gov ) . Any forward - looking statements are qualified in their entirety by reference to the risk factors discussed in the 2021 Annual Report . Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned . Important factors that could cause actual results to differ materially from those in the forward looking statements include : a decline in general economic conditions nationally and internationally ; decreased demand for our products and services ; market acceptance of our products ; the ability to protect our intellectual property rights ; impact of any litigation or infringement actions brought against us ; competition from other providers and products ; risks in product development ; inability to raise capital to fund continuing operations ; changes in government regulation ; the ability to complete customer transactions and capital raising transactions . Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them . We cannot guarantee future results, levels of activity, performance or achievements . Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward - looking statements to conform these statements to actual results . All forecasts are provided by management in this presentation and are based on information available to us at this time and management expects that internal projections and expectations may change over time . In addition, the forecasts are based entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products .

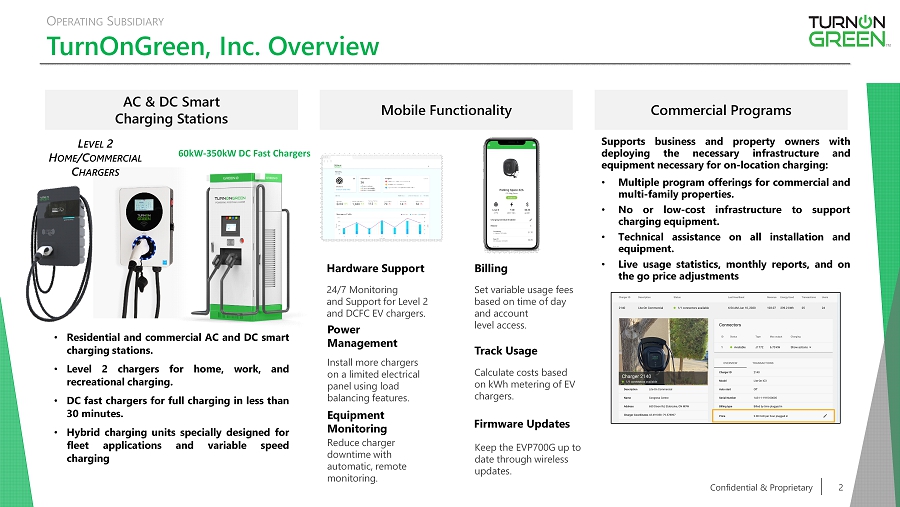

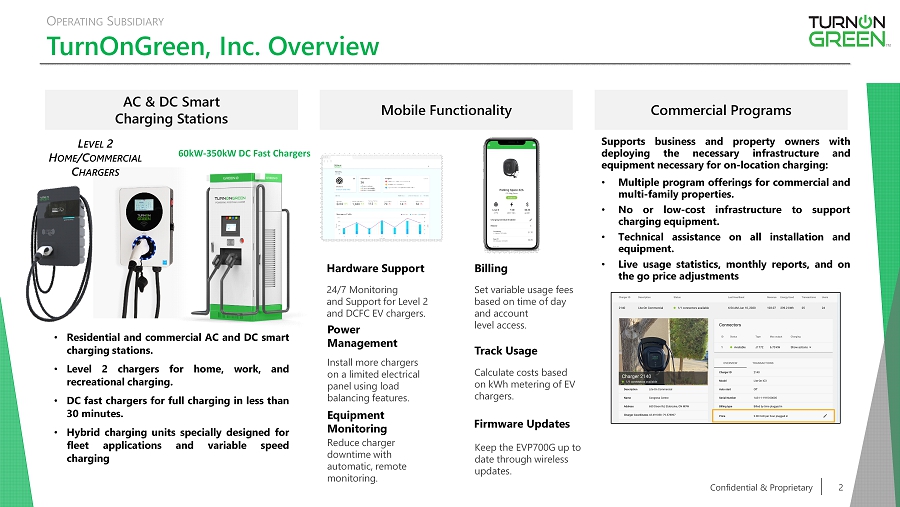

TurnOnGreen , Inc. Overview Confidential & Proprietary 2 O PERATING S UBSIDIARY Supports business and property owners with deploying the necessary infrastructure and equipment necessary for on - location charging : • Multiple program offerings for commercial and multi - family properties . • No or low - cost infrastructure to support charging equipment . • Technical assistance on all installation and equipment . • Live usage statistics, monthly reports, and on the go price adjustments • Residential and commercial AC and DC smart charging stations . • Level 2 chargers for home, work, and recreational charging . • DC fast chargers for full charging in less than 30 minutes . • Hybrid charging units specially designed for fleet applications and variable speed charging L EVEL 2 H OME /C OMMERCIAL C HARGERS AC & DC Smart Charging Stations Mobile Functionality Commercial Programs 60kW - 350kW DC Fast Chargers Hardware Support 24/7 Monitoring and Support for Level 2 and DCFC EV chargers. Power Management Install more chargers on a limited electrical panel using load balancing features. Equipment Monitoring Reduce charger downtime with automatic, remote monitoring. Billing Set variable usage fees based on time of day and account level access. Track Usage Calculate costs based on kWh metering of EV chargers. Firmware Updates Keep the EVP700G up to date through wireless updates.

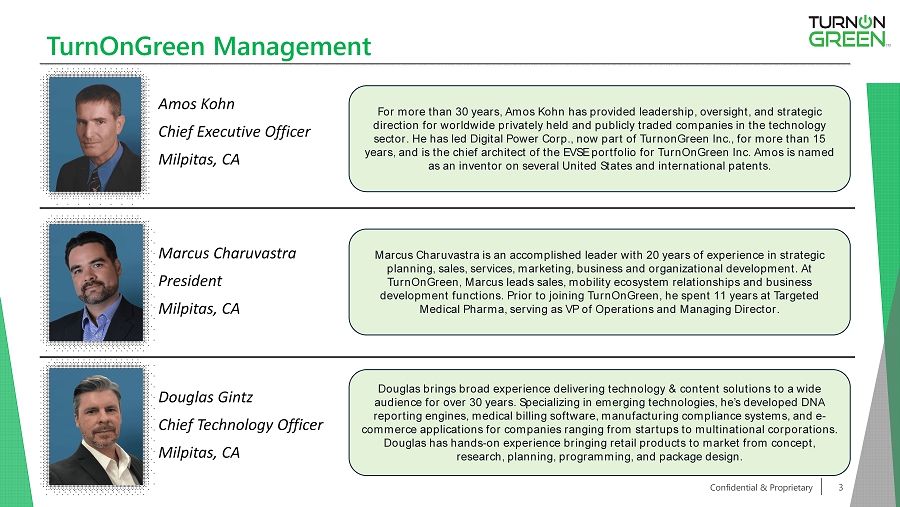

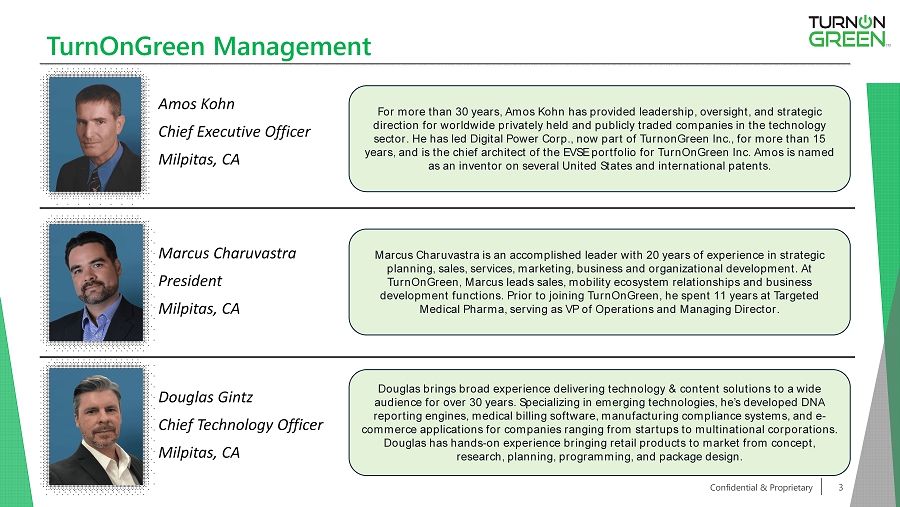

TurnOnGreen Management Amos Kohn Chief Executive Officer Milpitas, CA Confidential & Proprietary 3 Marcus Charuvastra President Milpitas, CA Douglas Gintz Chief Technology Officer Milpitas, CA For more than 30 years, Amos Kohn has provided leadership, oversight, and strategic direction for worldwide privately held and publicly traded companies in the technology sector. He has led Digital Power Corp., now part of TurnonGreen Inc., for more than 15 years, and is the chief architect of the EVSE portfolio for TurnOnGreen Inc. Amos is named as an inventor on several United States and international patents. Marcus Charuvastra is an accomplished leader with 20 years of experience in strategic planning, sales, services, marketing, business and organizational development. At TurnOnGreen , Marcus leads sales, mobility ecosystem relationships and business development functions. Prior to joining TurnOnGreen , he spent 11 years at Targeted Medical Pharma, serving as VP of Operations and Managing Director. Douglas brings broad experience delivering technology & content solutions to a wide audience for over 30 years. Specializing in emerging technologies, he’s developed DNA reporting engines, medical billing software, manufacturing compliance systems, and e - commerce applications for companies ranging from startups to multinational corporations. Douglas has hands - on experience bringing retail products to market from concept, research, planning, programming, and package design.

TurnOnGreen Divestiture • Divestiture of TurnOnGreen by way of its acquisition by Imperalis Holding Corp. • This transaction has created a separate, publicly traded EV charging and power solutions company • BitNile eliminated intercompany accounts and Imperalis issued BitNile 25,000 shares of Series A Preferred Stock, with each such share having a stated value of $ 1,000 and an aggregate liquidation preference of $25mm • BitNile will assist TurnOnGreen in pursuing an uplisting to the Nasdaq Capital Market • The company anticipates setting a record date to distribute BitNile’s shareholders approximately 140 million shares of TurnOnGreen common stock and warrants to purchase an additional 140 million shares of TurnOnGreen common stock Confidential & Proprietary 4 TurnOnGreen , Inc. (“ TurnOnGreen ”) is completing its reverse merger with Imperalis Holding Corp. (“ Imperalis ” ) creating a publicly traded EV Charging & Power Solutions Company Record Date (TBD) BitNile Shareholders to receive: 140,000,000 Shares 140,000,000 Warrants* *Warrants to become publicly traded at a later date subject to regulatory approval and compliance with US Securities laws