UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | |

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | |

| AptarGroup, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | | Title of each class of securities to which transaction applies: |

| | | |

| (2) | | Aggregate number of securities to which transaction applies: |

| | | |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| (4) | | Proposed maximum aggregate value of transaction: |

| | | |

| (5) | | Total fee paid: |

| | | |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | Amount Previously Paid: |

| | | |

| (2) | | Form, Schedule or Registration Statement No.: |

| | | |

| (3) | | Filing Party: |

| | | |

| (4) | | Date Filed: |

| | | |

| | | | | | | | | | | |

| NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS |

| | | |

| When? | Where? | Who? | |

| | |

9:00 a.m. CDT

on Wednesday,

May 5, 2021 | Live webcast online at

www.virtualshareholdermeeting.com/ATR2021 | Stockholders of Record

as of

March 12, 2021 |

To Our Stockholders:

It is my pleasure to invite you to attend our annual meeting of stockholders of AptarGroup, Inc. (“Aptar”) on May 5, 2021. At the meeting, we will review Aptar’s performance for fiscal year 2020 and vote on the following matters:

| | | | | | | | |

| Proposal | Board

recommendation | For more

information |

| 1. To elect the four director nominees named in the proxy statement to terms of office expiring at the annual meeting in 2024 | FOR all of the nominees named in the proxy statement for election to the Board of Directors | Page 7 |

| 2. To approve, on an advisory basis, Aptar’s executive compensation | FOR the resolution to approve executive compensation | Page 23 |

| 3. To ratify the appointment of the independent registered public accounting firm for 2021 | FOR the ratification of the appointment of the independent registered public accounting firm for 2021 | Page 24 |

We will also transact any other business that is properly raised at the meeting or any postponements or adjournments of the meeting.

Information Regarding Attending the Annual Meeting:

In light of public health concerns regarding the COVID-19 pandemic, the Board of Directors has determined that it is prudent that this year's annual meeting be held in a virtual-only format via live audio webcast. You may attend the virtual annual meeting at www.virtualshareholdermeeting.com/ATR2021. To participate in the annual meeting, you will need the 16-digit control number that appears on your Notice of Internet Availability of Proxy Materials, proxy card or the instructions that accompanied your proxy materials. Refer to the "Frequently Asked Questions" section of the proxy statement for detailed procedures regarding attending, submitting questions and voting at the virtual annual meeting.

A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours for ten days prior to the meeting for any purpose germane to the meeting at Aptar's corporate headquarters at 265 Exchange Drive, Suite 100, Crystal Lake, Illinois 60014. The stockholder list will also be available during the meeting at www.virtualshareholdermeeting.com/ATR2021.

Your Vote Is Important:

The vote of each stockholder is important to us. Whether or not you expect to attend the virtual annual meeting, I urge you to vote by the Internet or by telephone as soon as possible. If you received a printed copy of the proxy materials, you may also complete, sign and date your proxy card and return it in the envelope that was included with the printed materials.

| | | | | | | | | | | |

| | |

Internet (Preferred Voting Method) | Telephone | Mail |

| www.proxyvote.com | 1-800-690-6903 up until 11:59 pm Eastern Time, on May 4, 2021

| Mark, sign and date your proxy card and return it in the pre-addressed postage paid envelope we have provided or return it to: |

up until

11:59 pm Eastern Time, on May 4, 2021 | Vote Processing, c/o Broadridge

51 Mercedes Way

Edgewood, NY 11717 |

We look forward to your attendance at the virtual annual meeting on May 5, 2021 and addressing your questions and comments.

| | | | | |

| Sincerely, |

| /s/ Kimberly Y. Chainey |

Kimberly Y. Chainey Executive Vice President, General Counsel and Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 5, 2021: The Proxy Statement and the 2020 Annual Report/Form 10‑K are available at www.proxyvote.com.

| | | | | |

| TABLE OF CONTENTS | |

| Page |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Compensation Discussion and Analysis | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | |

| This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. | | 2021 Annual Meeting of Stockholders Information |

| Date and Time: | Wednesday, May 5, 2021 at 9:00 a.m. CDT |

| Location: | Live webcast online at www.virtualshareholdermeeting.com/ATR2021 |

| Record Date: | March 12, 2021 |

Our commitment to the environment and cost reduction

AptarGroup, Inc. (“Aptar” or “Company”) is pleased to take advantage of the Securities and Exchange Commission ("SEC") rule allowing companies to furnish proxy materials to their stockholders over the Internet. We believe that this e-proxy process expedites stockholders’ receipt of proxy materials, while also lowering the costs and reducing the environmental impact of our annual meeting. On March 26, 2021, we mailed to most of our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access our proxy statement and annual report and vote online. On the same date, we mailed to all other stockholders a copy of the proxy statement and annual report by mail unless they have elected to receive the annual meeting materials over the Internet.

| | | | | |

| Help us “go green” and reduce costs. For those stockholders who are still receiving paper copies of our proxy statement and annual report, please consider requesting electronic delivery or a Notice which will reduce the amount of paper materials needed to conduct our annual meeting. You may do so by contacting your broker, visiting www.proxyvote.com or emailing us at investorrelations@aptar.com. | |

Our Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Primary or Former Occupation | | Age | | Director

Since | | Independent | | Audit Committee | | Management

Development and

Compensation Committee | | Corporate Governance Committee |

Andreas C. Kramvis Operating Partner at AEA Investors | | 68 | | 2014 | | ✔ | | | | | | |

Maritza Gomez Montiel Former Deloitte LLP executive | | 69 | | 2015 | | ✔ | | | | | | |

Jesse Wu Advisor to private equity firms | | 64 | | 2018 | | ✔ | | | | | | |

Ralf K. Wunderlich Consultant and senior advisor to private equity firms | | 54 | | 2009 | | ✔ | | | | | | |

| | | | | | | | | | | |

| Committee Chairperson | | Member |

| | | |

Our Business Highlights

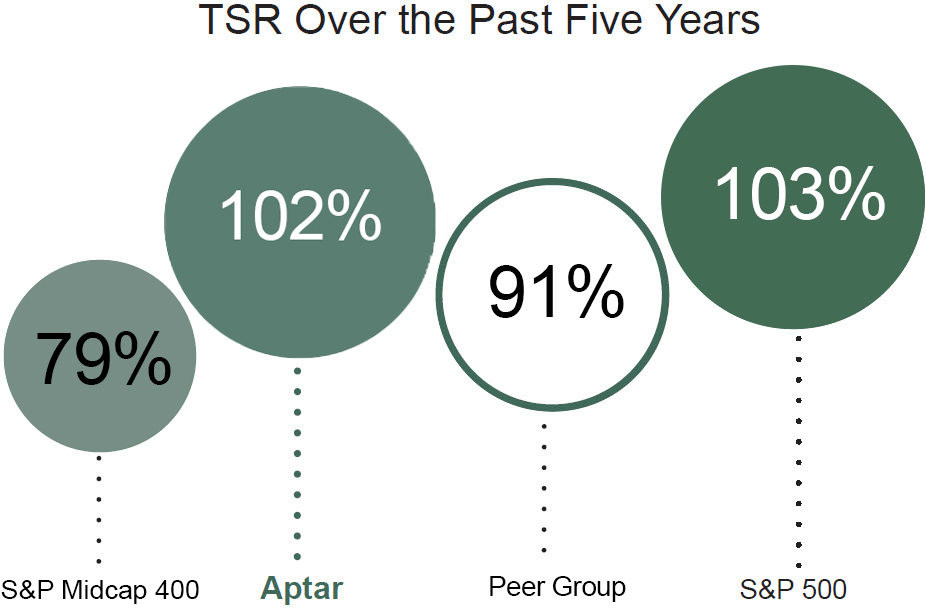

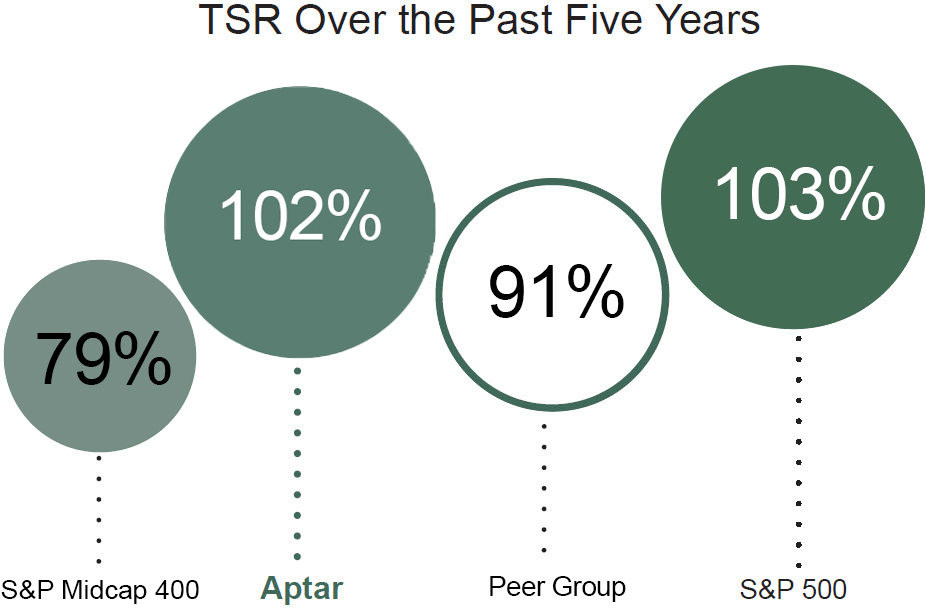

We continue to perform well against peers and deliver strong shareholder returns.

| | |

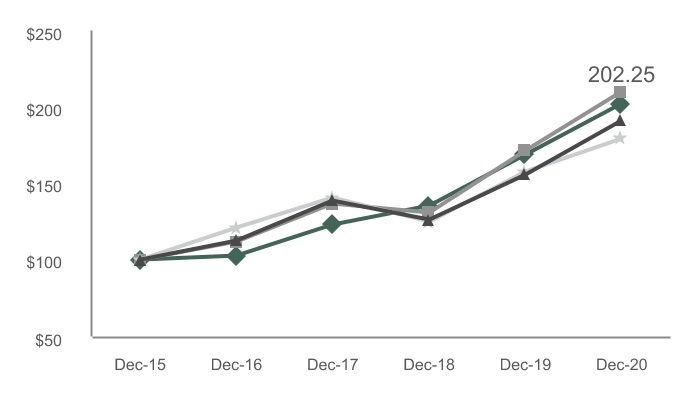

TOTAL SHAREHOLDER RETURNS (TSR) TSR (DIVIDENDS REINVESTED) |

| | | | | | | | | | | | | | |

| AptarGroup | S&P

500 Index | S&P

400 Index | Peer Group |

| | | | |

| Dec-15 | 100 | 100 | 100 | 100 |

| Dec-16 | 102.76 | 111.96 | 120.74 | 112.13 |

| Dec-17 | 122.62 | 136.40 | 140.35 | 138.44 |

| Dec-18 | 135.55 | 130.42 | 124.80 | 126.46 |

| Dec-19 | 168.72 | 171.49 | 157.49 | 155.41 |

| Dec-20 | 202.25 | 203.04 | 179.00 | 190.88 |

In 2020, we achieved the following financial and operational metrics.

| | | | | | | | |

$2.9 billion Record Reported Sales | $214 million Annual net income | $3.21 Annual diluted earnings per share |

$570 million Record Annual Cash Flow from Operations | (27%) and (30%) Reduction in Total Recordable Incident Rate (TRIR), and Lost Time Frequency Rate (LTFR), respectfully, from the prior year | 27th year 27th consecutive year of paying an increased aggregate annual dividend amount |

________________________________________

Forward-Looking Statements

This proxy statement contains forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are based on our beliefs as well as assumptions made by and information currently available to us. Words such as “expects,” “anticipates,” “believes,” “estimates,” “future,” “potential” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could” are intended to identify such forward-looking statements. Our actual results or other events may differ materially from those expressed or implied in such forward-looking statements due to known or unknown risks and uncertainties that exist in our operations and business environment. For additional information on these and other risks and uncertainties, please see our filings with the SEC, including the discussion under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-K and Form 10-Qs. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Our Corporate Governance Facts

| | | | | | | | | | | |

| ✔ | Independent directors meet regularly in executive session. | ✔ | Annual “Say-on-Pay Vote” on executive compensation |

| ✔ | Prohibition on directors and executive officers from hedging or pledging stock | ✔ | Annual Board and Committee self-evaluations |

| ✔ | Majority voting for directors and director resignation policy in uncontested elections | ✔ | Director age limits |

| ✔ | Stock ownership requirements for directors and executive officers | ✔ | Separate independent Chairman & CEO |

Our directors exhibit an effective mix of diversity, experience and perspective

| | | | | | | | |

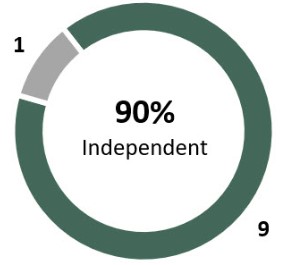

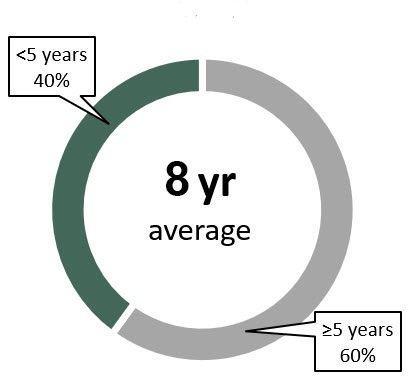

| INDEPENDENCE | TENURE | GENDER DIVERSITY |

| | |

Our Executive Compensation Philosophy and Objectives

| | | | | | | | |

| OUR PHILOSOPHY | | We believe the following factors are supportive of our compensation objectives: |

| | |

| Our compensation philosophy is designed to fairly reward our executives for growing our business and increasing value for stockholders, and to retain our experienced management team. | | ✔ Significant amount of pay that is performance-based and/or at-risk, with emphasis on performance-based pay to reward short- and long-term performance measured against pre-established objectives and a substantial amount provided in equity; |

| |

| ✔ Stock ownership guidelines, limits on executive officer stock trading and prohibition of hedging or pledging Aptar equity securities; |

| |

| ✔ Employment and change‑in‑control agreements that are designed to be competitive in markets in which we compete for executive talent; |

| |

| ✔ Absence of tax gross‑up agreements with named executive officers, other than those related to relocation benefits or expatriate assignments; |

| |

| ✔ Use of an independent compensation consultant; and |

| |

| ✔ Limited perquisites other than common perquisites provided in the context of expatriate assignments or related to relocation. |

Environmental, Social and Governance Enhancements

We are committed to advancing a more sustainable and equitable consumer economy that yields benefits for all.

| | | | | | | | |

| Our Belief System: |

| | |

| We believe lives should be enriched from having worked for and with Aptar. | We believe that 100 percent of all plastic packaging should be recycled. | We believe the packaging industry must be circular, with repeatable and positive effects on people, the planet and products. |

In 2020, we achieved the following corporate social responsibility benchmarks.

| | | | | | | | |

Top 100 Most Responsible Named one of "America's Most Responsible Companies 2021" by Newsweek and is ranked in the top 100 among 400 U.S. companies. | Top 100 Most Sustainable Named one of the "Top 100 Most Sustainable U.S. Companies" by Barron's as part of their 2019 ranking. | United Nations Global Compact Joined the United Nations (UN) Global Compact, the world's largest citizenship initiative, which focuses on universal principles in the areas of human rights, labor, environment and anti-corruption. |

Gender and Diversity KPI Alliance Joined the Gender and Diversity KPI Alliance, whose aim is the adoption and use of a set of Key Performance Indicators to measure gender and diversity in their companies and organizations. | ISS Prime Status In December of 2020 we were upgraded to Prime status with ISS ESG, one of the leading rating agencies for sustainable investments. | CDP "A" List Of the 5,800+ companies that disclose environmental metrics through the CDP, Aptar is among the 270 companies awarded an A score for Climate Change and also named a Superior Engagement Leader. |

Partnering with CARE Furthering women's education and economic empowerment. Early sponsor of the Fast + Fair COVID-19 Vaccine Response Campaign. | Gender Diversity Index ETF (SHE) Aptar is included in the SPDR® SSGA Gender Diversity Index ETF (SHE) which invests in companies that rank among the highest in gender diversity within senior leadership. | Eco-efficient Operations At year-end 2020, approximately 85% of our global electricity consumption is coming from renewable sources: 53% of Aptar sites were certified as "Landfill Free" through our internal program and globally we re-used or recycled more than 75% of all operational wastes. |

Several publications have recognized Aptar as a sustainable and responsible global company. Aptar was named in the top 100 of the “Most Sustainable U.S. Companies” three years in a row by Barron’s, in the top 100 of “America's Most Responsible Companies 2020 and 2021” by Newsweek and one of the “Most Responsible Companies in France” by Le Point.

Through our efforts to make our company healthier, safer and more sustainable, we achieved several important milestones. Aptar was recognized for leadership in corporate sustainability by the global environmental non-profit CDP, securing a place on its prestigious ‘A List’ for tackling climate change and Aptar was named a Supplier Engagement Leader. We also received Prime status in December 2020 by ISS ESG, one of the world’s leading rating agencies for sustainable investments. Aptar is pleased to join the United Nations (UN) Global Compact, which focuses on universal principles in the areas of human rights, labor, environment and anti-corruption.

In 2020, we published our sixth annual Sustainability Report using the GRI framework and served as active members of the Ellen MacArthur Foundation’s New Plastics Economy, the World Business Council for Sustainable Development and the CE100 Network. We continue to partner with TerraCycle’s® Loop platform on refillable and reusable products and with PureCycle TechnologiesSM, a company that separates color, odor and contaminants from plastic waste feedstock to transform it into ultra-pure recycled polypropylene.

At year-end 2020, 53% of our sites were Landfill Free certified, with verification by an independent third party, through our grassroots internal program. By focusing on reuse and recycling, we avoided disposal of more than 75% of wastes from our operations globally. We also significantly surpassed our renewable energy target, with approximately 85% of our global electricity consumption now coming from renewable sources.

This year we continued to progress our behavior-based employee safety program and surpassed our targets, reducing our Total Recordable Incident Rate (TRIR) by 27% and Lost Time Frequency Rate (LTFR) by 30% from year-end 2019.

We are proud to join the Gender and Diversity KPI Alliance, a group of diversity and inclusion advocates and more than 50 corporate leaders, to support the use of key performance indicators (KPIs) or high-level internal measurements that provide an overview of the diversity of our workforce and allow us to evaluate results, not efforts. To this end, we remain committed to the following diversity goal: by 2025, at least 30% of all Aptar leaders at the Vice President level and above will be women. At year-end 2020, women comprised 37% of the global employee population and 18% at senior leadership levels.

Throughout the year, our employees also supported the communities where we live and work through volunteering and financial support, including donations of PPE, sanitizers, cleaning solution and monetary donations related to COVID-19.

In February of this year, we announced that we have teamed with CARE, a remarkable organization that works around the globe to save lives, defeat poverty and achieve social justice. Through our newly announced, on-going partnership, Aptar will support CARE’s mission, including education programming, women’s economic empowerment efforts and CARE’s Crisis Response Campaign, by sponsoring the Fast + Fair COVID-19 Vaccine Response Campaign this year. CARE’s mission aligns with our purpose, values and mission to further diversity and inclusion, empower women and to support the communities where we live and work, along with global communities who are the most marginalized and the most in need.

| | |

| PROPOSAL 1—ELECTION OF DIRECTORS |

The Board of Directors is currently comprised of ten members divided into three classes, with one class of directors elected each year for a three year term. The Board of Directors proposes the following nominees, all of whom are currently serving as directors, to be elected to a term expiring at the 2024 annual meeting.

If any of the director nominees is unable or fails to stand for election, the persons named in the proxy intend to vote for a substitute nominee nominated by the Corporate Governance Committee of the Board of Directors.

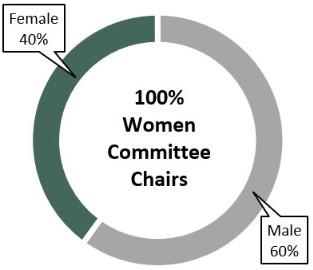

We believe all of the members of the Board of Directors are individuals of outstanding character and sound judgment that have the business experience and acumen necessary to work together effectively and to make valuable contributions to the Board of Directors and management. As a U.S.‑based company with significant international operations, particularly in Europe, we seek to maintain a balanced Board consisting of directors that are U.S. citizens and directors that are citizens from countries other than the U.S. Additionally, we value the following attributes: operating experience in packaging or packaging-related businesses; skill sets which may include experience in finance, strategic planning, marketing, pharmaceutical products and manufacturing; diversity, including a mix of genders and multi‑cultural viewpoints; and previous board of directors experience. Aptar was recognized by the Women’s Forum of New York as a “Corporate Champion” for gender diversity in the boardroom. Currently, our Audit, Management Development and Compensation, and Corporate Governance Committees are all chaired by women.

Set forth below is biographical and other background information concerning each director nominee and each continuing director. This information includes each person’s principal occupation as well as a discussion of the specific experience, qualifications, attributes and skills of each person that led to the Board of Directors’ conclusion that he or she should continue to serve as a director. In addition, set forth below is the year during which each person began serving on the Board of Directors and his or her age.

| | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE FOLLOWING NOMINEES FOR DIRECTOR. |

NOMINEES FOR ELECTION AT THIS MEETING TO TERMS EXPIRING 2024

| | | | | | | | | | | |

| ANDREAS C. KRAMVIS |

| | Mr. Kramvis is an operating partner at AEA Investors (a private equity firm). Mr. Kramvis was Vice Chairman of Honeywell International (a multi‑industry company with presence in Aerospace, Automation and Controls, Chemicals and Automotive Industries) from April 2014 to February 2017. From 2008 to 2014, Mr. Kramvis was President and Chief Executive Officer of the Honeywell Performance Materials and Technologies group (a developer of processes and chemicals for oil refining, petrochemicals and a variety of high-purity, high-quality performance chemicals and materials). Mr. Kramvis is also a director of several privately-held companies. From 2014 to 2019, Mr. Kramvis was a director of Axalta Coating Systems Ltd. (a NYSE-listed developer, manufacturer and seller of liquid and powder coatings). The Board of Directors concluded that Mr. Kramvis should continue to serve as a director of Aptar in part due to his experience from holding senior executive positions at Honeywell, as well as his management of several companies with global businesses across five different industries. This experience has also led the Board to determine that Mr. Kramvis is an “audit committee financial expert” as defined by the SEC. |

Director since: 2014 Age 68 |

| | | | | | | | | | | |

| MARITZA GOMEZ MONTIEL |

| | Ms. Montiel served as Deputy Chief Executive Officer and Vice Chairman of Deloitte LLP from 2011 through her retirement in May 2014. During Ms. Montiel’s tenure at Deloitte, she was the Advisory Partner for many engagements in which Deloitte was the principal auditor. Ms. Montiel has over 30 years of experience in leading and performing audits of various entities. Ms. Montiel is a director of McCormick & Company, Inc. (a NYSE-listed spice, herb and flavoring manufacturer); Royal Caribbean Cruises Ltd. (a NYSE-listed global cruise company) and Comcast Corporation (a Nasdaq-listed telecommunications company). The Board of Directors concluded that Ms. Montiel should continue to serve as a director of Aptar due to her experience from holding senior management positions in a global accounting and consulting firm, and her years of experience in leading and performing audit engagements. This experience has also led the Board to determine that Ms. Montiel is an “audit committee financial expert” as defined by the SEC. |

Director since: 2015 Age 69 |

| | | | | | | | | | | |

| JESSE WU |

| | Mr. Wu is an advisor to private equity firms. From 2003 through 2016, Mr. Wu held senior leadership roles at Johnson & Johnson (multinational medical devices, pharmaceutical and consumer packaged goods manufacturing company) including Chairman of Johnson & Johnson China and Worldwide Chairman of the company’s Consumer Healthcare Group. Mr. Wu was a director of The a2 Milk Company Limited (an ASX- and NZX-listed company that markets a2 milk and infant nutritional products globally) from May 2017 to February 2021, Shanghai Kehua Bio‑Engineering Co. Ltd. (a SZSE-listed manufacturer of in vitro diagnostic products) from May 2017 to June 2020, and Li‑Ning Company Limited (an HKSE-listed athletic shoes and sporting goods company) from August 2015 to March 2018. The Board of Directors concluded that Mr. Wu should continue to serve as a director of Aptar due to his knowledge of and background in consumer products and his international experience, including his extensive experience working in China. |

Director since: 2018 Age 64 |

| | | | | | | | | | | |

| RALF K. WUNDERLICH |

| | Mr. Wunderlich is an independent consultant and a senior advisor to private equity firms. He is an advisor to the Board of Elif Packaging (a flexible packaging solution supplier), and a non-executive director for the Shepherd Building Group (privately owned, UK based portable buildings and construction business). He is currently a director of Essentra PLC (a LSE-listed supplier of plastic and fibre products) and Huhtamaki Oyj (a Nasdaq Helsinki-listed global food packaging company). He is a former member of Amcor Limited’s Global Executive Team and former President of the business group Amcor Flexibles Asia Pacific (packaging solutions). Mr. Wunderlich also formerly served as a Director of LINPAC Group and AMVIG Group. The Board of Directors concluded that Mr. Wunderlich should continue to serve as a director of Aptar in part due to his senior executive positions at leading global packaging companies, his knowledge of and background in the packaging industry and his international experience in working with and from various European, American and Asian countries. |

Director since: 2009 Age 54 |

DIRECTORS WHOSE PRESENT TERMS CONTINUE UNTIL 2022

| | | | | | | | | | | |

| GIOVANNA KAMPOURI MONNAS |

| | Ms. Kampouri Monnas is an advisor and serves on the boards of several global companies. Effective February 2021 she is a member of the Board of Directors and Chair of the Governance Committee for the Hellenic Corporation of Assets and Participations S.A. (HCAP), the enterprise which oversees all Greek state owned companies, services and assets. As of 2019, she was Chairman of Exea Ventures BV in the Netherlands, a global family investment company with diverse holdings in fragrances, fashion, skin care, real estate and venture funds, which was recently relocated to Spain. Since 2006, Ms. Kampouri Monnas is also a director of Puig S.L. (a fashion, fragrance, cosmetics and skincare business). From 2006 to 2018, Ms. Kampouri Monnas was a member of the Supervisory board and Chairman of the Compensation Committee of Randstad Holding NV (the global world leader in the HR services industry, based in Amsterdam). From 2015 to 2018, Ms. Kampouri Monnas was a director of Imerys S.A. (a Euronext-listed producer of industrial minerals, based in France), while from 2005 to 2009 she was director of TNT BV. Her final executive role was President of Benckiser International, the German company that later was divided into Reckitt-Benckiser and Coty Inc. The Board of Directors concluded that Ms. Kampouri Monnas should continue to serve as a director of Aptar in part due to her senior leadership positions in leading global consumer goods companies, The Procter & Gamble Company and Joh. Benckiser GmbH, her expertise in the fragrance and cosmetic markets, which are particularly important to Aptar, and her global marketing experience. |

Director since: 2010 Age 65 |

| | | | | | | | | | | |

| ISABEL MAREY-SEMPER |

| | Ms. Marey-Semper was a member of the Executive Committee of L’Oréal S.A. (personal care company and world’s largest cosmetic company), in charge of Communications and Public Affairs, from July 2015 to December 2017. Prior to this, Ms. Marey-Semper served from 2011 to 2015 as Vice President and Head, Advanced Research at L’Oréal. Prior to joining L’Oréal, Ms. Marey-Semper served in executive positions at established industrial companies such as Compagnie de Saint Gobain S.A. (a Euronext-listed French multinational manufacturer and distributor of building materials) and Stellantis, (formerly Group PSA Peugeot Citroën, a Euronext-listed French multinational manufacturer of automobiles and motorcycles). Ms. Marey-Semper is a director of the Imagine Institute (institute for medical research and treatment of genetic diseases), the Inria Foundation (research foundation dedicated to digital science and technology) and Damae Medical (a medical company focused on diagnosing skin tumors without the need for a biopsy). Ms. Marey-Semper was a director of Rexel (a Euronext listed French distributor of electrical supplies) from 2014 to 2016. The Board of Directors concluded that Ms. Marey-Semper should continue to serve as a director of Aptar in part due to her experience from holding senior executive positions at L’Oréal, as well as other established companies, and her diverse and comprehensive experience in research, strategy, transformative programs, and finance. |

Director since: 2019 Age 53 |

| | | | | | | | | | | |

| STEPHAN B. TANDA |

| | Mr. Tanda became President and Chief Executive Officer of Aptar on February 1, 2017. Prior to this, Mr. Tanda served from 2007 until 2017 as an Executive Managing Board Director at Royal DSM NV (leading global supplier of ingredients and material solutions for the food, dietary supplement, personal care, medical device, automotive, paint, electronic and bio-material markets), where he was responsible for DSM’s Nutrition and Pharma activities, as well as DSM’s presence in the Americas and various corporate duties. Mr. Tanda is a director of Ingredion Incorporated (a NYSE-listed global supplier of high-quality food and industrial ingredient solutions). Mr. Tanda was a director of Patheon NV (formerly a NYSE-listed company that provided pharmaceutical development and manufacturing services) from March 2016 until the company was sold to Thermo Fisher Scientific in August 2017. The Board of Directors concluded that Mr. Tanda should continue to serve as a director of Aptar due in part to his role as President and Chief Executive Officer, his extensive global experience leading and building successful business-to-business organizations in several markets currently served by Aptar, as well as his transaction and integration experience. |

Director since: 2017 Age 55 |

DIRECTORS WHOSE PRESENT TERMS CONTINUE UNTIL 2023

| | | | | | | | | | | |

| GEORGE L. FOTIADES |

| | Mr. Fotiades has been Chairman of the Board since 2018. Mr. Fotiades has been President and CEO of Cantel Medical Corp. (NYSE-listed manufacturer of infection prevention and control products) ("Cantel") since March 2019. He was Operating Partner at Five Arrows Capital Partners (Rothschild Merchant Banking) from April 2017 until March 2019. From 2007 through April 2017, he was Chairman and Operating Partner of Healthcare Investments at Diamond Castle Holdings LLC (private equity investing). He is a director of the following NYSE-listed companies: Prologis, Inc. (integrated distribution facilities and services) and Cantel Medical Corp. In January 2021, Cantel and STERIS plc signed a definitive agreement pursuant to which STERIS plc will acquire Cantel. The Board of Directors concluded that Mr. Fotiades should continue to serve as a director of Aptar due to his extensive experience from previously held senior executive positions at leading healthcare and consumer product companies including Cardinal Health, Inc., Catalent Pharma Solutions, the former Warner-Lambert’s Consumer Health Products Group (now part of Johnson & Johnson) and Bristol-Myers Squibb’s Consumer Products, Japan division. The Board also considered his present and past board level experience with global organizations. |

Director since: 2011 Age 67 |

| | | | | | | | | | | |

| B. CRAIG OWENS |

| | Mr. Owens was the Chief Financial Officer and Chief Administrative Officer of Campbell Soup Company (global producer and seller of canned soups and related products) from 2008 through 2014. Mr. Owens is a director of Crown Holdings, Inc. (a NYSE-listed designer, manufacturer and seller of packaging products and equipment for consumer goods and industrial products). He is a former director of Dean Foods Company (a U.S. food and beverage company) and a former director of J. C. Penney Company, Inc. (a U.S. department store chain). The Board of Directors concluded that Mr. Owens should continue to serve as a director of Aptar due to his extensive experience in the consumer food and beverage industries, which is particularly relevant for Aptar’s Food + Beverage business, as well as his significant expertise in financial reporting, accounting, corporate finance and capital markets. This experience has also led the Board to determine that Mr. Owens is an “audit committee financial expert” as defined by the SEC. |

Director since: 2018 Age 66 |

| | | | | | | | | | | |

| DR. JOANNE C. SMITH |

| | Dr. Smith is a physician at the Shirley Ryan AbilityLab (formerly the Rehabilitation Institute of Chicago) and became the Shirley Ryan AbilityLab’s President and Chief Executive Officer in 2006. Dr. Smith is a director of Performance Health, Inc. (rehabilitation and wellness products manufacturer). From 2003 to 2015, Dr. Smith was a director of Hill‑Rom, Inc. (a NYSE-listed healthcare and medical technology, formerly Hillenbrand Industries). The Board of Directors concluded that Dr. Smith should continue to serve as a director of Aptar in part due to her executive background as President and Chief Executive Officer of a leading research and healthcare rehabilitation organization, her public company director experience, her knowledge of and background in the healthcare and medical technology industry, which is particularly relevant for Aptar’s Pharma business, and her strategic planning, operations and senior management experience. |

Director since: 1999 Age 60 |

CORPORATE GOVERNANCE

Aptar’s corporate governance documents are available through the Corporate Governance link on the Investor Relations page of the Aptar website at: investors.aptar.com, and include the following:

| | | | | |

| Corporate Governance Documents |

|

| Corporate Governance Principles |

|

| |

| Code of Conduct |

|

| |

| Director Independence Standards |

|

| |

| Board Committee Charters |

|

The information provided on our website is not part of this proxy statement and is therefore not incorporated herein by reference.

Corporate Governance Principles

The Board has adopted a set of Corporate Governance Principles to provide guidelines for Aptar and the Board to promote effective corporate governance. The Corporate Governance Committee is responsible for overseeing and reviewing the Corporate Governance Principles and recommending any changes to the Board. The Corporate Governance Principles cover topics including, but not limited to:

Code of Conduct

Ethical business conduct is a shared value of our Board, management and employees. Aptar’s Code of Conduct applies to our Board as well as our employees and officers, including our principal executive officer and our principal financial and accounting officer. The Code of Conduct summarizes the long‑standing principles of conduct that Aptar follows to ensure that business is conducted with integrity and in compliance with the law, including, but not limited to:

| | | | | |

| Code of Conduct |

|

| Conflicts of interest and fair dealing |

|

| |

| Disclosure obligations |

|

| |

| Confidentiality obligations |

|

| |

| Prohibition of insider trading |

|

| |

| Compliance with all laws, rules and regulations |

|

| |

| Confidential, anonymous submission of concerns |

|

Aptar encourages all employees, officers and directors to promptly report any violations of the Code of Conduct to the appropriate persons identified in the Code of Conduct. In the event that an amendment to, or a waiver from, a provision of the Code of Conduct that applies to any of our directors or executive officers is necessary, Aptar intends to post such information on its website as and when required by the SEC and the New York Stock Exchange (“NYSE”).

Sustainability

Aptar is committed to economic, social and environmental sustainability. Our sustainability report can be found on the Sustainability page of the Aptar website at www.aptar.com.

Policy Against Hedging and Pledging

Our Board has adopted a policy that prohibits executive officers and directors, and discourages employees, from engaging in hedging or pledging transactions involving any equity security of Aptar.

Human Capital

Our key human capital management objectives are to attract, retain and develop the highest quality talent. To support these objectives, our human resources programs are designed to develop talent to prepare them for critical roles and leadership positions for the future; reward and support employees through competitive pay, benefit, and incentive programs; enhance our culture through efforts aimed at making the workplace more engaging and inclusive; acquire talent and facilitate internal talent mobility to create a high-performing, diverse workforce; and evolve and invest in technology, tools, and resources to enable employees at work.

Diversity & Inclusion

At AptarGroup, our goal is to promote a diverse and inclusive culture. During 2020, we appointed a Diversity & Inclusion ("D&I") Global Leader and developed a D&I network of Aptar employees to assist in the implementation of D&I initiatives within their respective regions. Under the D&I network, a global Women's Network was launched and Aptar is continuing to identify and develop other employee resource groups in the future.

Common Stock Ownership Guidelines

The Board has adopted stock ownership guidelines that require all non-executive directors to hold shares of Aptar common stock having a value of at least five times the annual cash retainer for a non-executive director.

| | | | | | | | | | | | | | | | | |

| Board Member | Requirement | | Current Required Value |

| | | | | |

| Non-Executive Director | | | Annual | | |

| 5 | × | Cash | = | $500,000 |

| | Retainer | | |

Under the stock ownership guidelines, directors must achieve the required level of ownership within five years from becoming a director. As of March 12, 2021, the record date, every non-employee director (including the Chairman of the Board) is either in compliance with the guidelines or within the five-year phase-in period.

Board and Committee Structure

The Chairman of the Board is an independent director who is not an executive officer or employee of the Company. The Company believes that having an independent Chairman enhances the oversight ability of the Board. An independent Chairman can also provide stability and continuity during senior management transitions.

The Board has three primary committees, all with the following characteristics:

| | | | | | | | |

| Audit | Management

Development and

Compensation | Corporate Governance |

✔ Gender diverse and are chaired by women |

✔ Governed by a written charter approved by the Board |

✔ Comprised solely of independent directors |

✔ Decisions and actions reported to the full Board following each meeting |

An affirmative vote of at least 70% of the Board is required to change the size, membership or powers of these committees, to fill vacancies in them, or to dissolve them.

Audit Committee

| | | | | | | | |

M. Gomez Montiel, Chair A. Kramvis B. Owens | ✔ | Each member satisfies the heightened independence standards applicable to audit committee service |

| ✔ | Each member is an “audit committee financial expert” as defined by the SEC |

| ✔ | Oversees the financial reporting process, system of internal controls and audit process |

| ✔ | Reviews annual and interim financial statements |

| ✔ | Reviews the qualifications, independence and audit scope of the independent registered public accounting firm |

| ✔ | Responsible for the appointment, retention, termination, compensation and oversight of the independent registered public accounting firm |

| ✔ | Reviews process for monitoring compliance with laws, regulations and the Code of Conduct |

| ✔ | Approves or ratifies all related person transactions in accordance with the Related Person Transactions Policy |

Under the corporate governance requirements of the NYSE listing standards, if an audit committee member simultaneously serves on the audit committee of more than three public companies, the board must determine that such simultaneous service would not impair the ability of such member to effectively serve on the listed company’s audit committee. The Board has determined that the service of Ms. Montiel on the audit committee of more than three public companies does not impair her ability to serve effectively as a member of our Audit Committee.

Management Development and Compensation Committee

| | | | | | | | |

G. Kampouri Monnas, Chair B. Owens J. Wu | ✔ | Each member satisfies the heightened independence standards applicable to compensation committee service |

| ✔ | Discharges the Board’s responsibilities relating to compensation of the Company’s executives |

| ✔ | May not delegate its authority other than to subcommittees |

| ✔ | Reviews and recommends to the Board compensation plans, policies and programs |

| ✔ | Approves CEO and executive officer compensation, and employment and severance agreements, including change‑in‑control provisions |

| ✔ | Provides input and recommendations to the Board regarding the performance objectives for the CEO and other executive officers and their actual performance against such objectives |

| ✔ | Annually reviews the succession plans affecting corporate and other key management positions |

| ✔ | Reviews periodically the Company’s key human resources policies and practices relating to talent sourcing, talent development programs, and organizational engagement and effectiveness |

| ✔ | Monitors the Company’s policies, objectives and programs related to diversity, and reviews periodically the Company’s diversity performance in light of appropriate measures |

| ✔ | Reviews changing legislation and trends relating to compensation and broader management practices and evaluates impact on the Company |

| ✔ | Approves grants and/or awards of stock options, restricted stock units, long-term performance incentives based on total shareholder return, and other forms of equity-based compensation |

| ✔ | Receives recommendations annually from the CEO regarding the compensation levels of our other executive officers, including salary, annual performance incentives and equity compensation |

| ✔ | None of the members in 2020 had interlocking relationships within the meaning of SEC rules |

For further information on this committee’s procedures for consideration of executive compensation, see our “Compensation Discussion and Analysis.”

Under the Management Development and Compensation Committee charter, this committee has the authority to retain compensation consultants, independent legal counsel and other outside advisers as deemed necessary. For 2020, the Management Development and Compensation Committee engaged Pay Governance to be the Management Development and Compensation Committee’s compensation consultant. The Management Development and Compensation Committee has determined that Pay Governance is independent according to the adviser independence factors outlined by the NYSE and the SEC.

Corporate Governance Committee

| | | | | | | | |

J. Smith, Chair I. Marey-Semper R. Wunderlich | ✔ | Comprised solely of independent directors |

| ✔ | Identifies, evaluates and recommends to the Board individuals qualified to stand for election as directors, including nominations received from Board members, stockholders or outside parties |

| ✔ | Develops and recommends to the Board, Aptar’s corporate governance principles and standards to be applied in determining director independence |

| ✔ | Oversees annual evaluations of the Board, its committees and management, and the effectiveness of the Board as a working group |

| ✔ | Reviews and recommends to the Board appropriate compensation for non-employee directors, taking into consideration, among other items, director compensation levels of companies with similar annual revenues as Aptar |

| ✔ | Makes recommendations to the Board regarding changes to the size and composition of the Board or any Board committee |

| ✔ | Reviews the Company's efforts with regard to environmental, social, and governance matters, including with respect to the Company's annual sustainability report |

For further information on this committee’s procedures for director nominations, see “Nomination of Directors.”

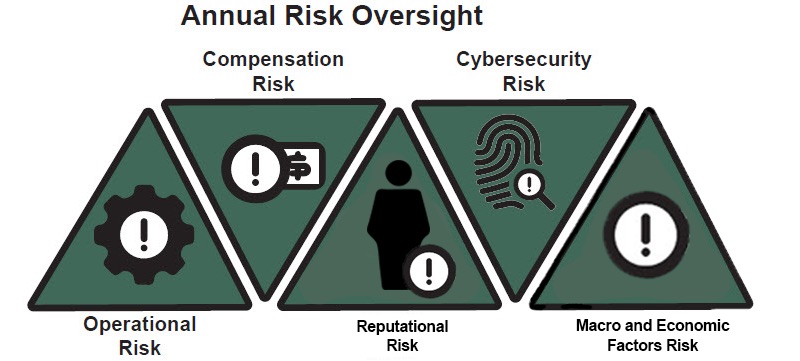

Risk Oversight

The Board is responsible for the Company’s risk oversight, which is designed to drive the identification, analysis, discussion and reporting of our high priority enterprise risks. The risk oversight program facilitates constructive dialog at the senior management and Board levels to proactively identify and manage enterprise risks. In connection with this process, the Board receives, analyzes and discusses a presentation annually that is prepared by senior management. This presentation includes an assessment and discussion of various risks, including but not limited to:

Risk Assessment of Cybersecurity Threats to Operations

Increased global information security threats and more sophisticated, targeted computer crime pose a risk to the confidentiality, availability and integrity of Aptar’s data, operations and infrastructure. The Company continues to assess potential threats and make investments seeking to reduce the risk of these threats by employing a number of security measures, including employee training, comprehensive monitoring of our networks and systems, ensuring strong data protection standards including authentication mechanisms are in place, and safeguarding our critical information assets. We also periodically test our systems for vulnerabilities and regularly rely on third parties to conduct such tests. The Company’s cybersecurity program has been reviewed by independent third parties against the National Institute of Standards and Technology (NIST) cybersecurity framework. In addition, the Company maintains cybersecurity insurance as part of its overall insurance portfolio.

Risk Assessment of Compensation Policies and Practices

The Company has concluded that there are not any compensation policies or practices that are reasonably likely to have a material adverse effect on the Company. The Board concurred with this conclusion. In conducting its risk assessment related to compensation policies and practices, the Company considered, among other things: that the policies and practices do not offer the opportunity for excessive awards; the Company has reasonable stock ownership guidelines; the policies and practices are reviewed and approved by the Management Development and Compensation Committee; the Company has an established, robust control environment; and the Company conducts a regular monthly business review that monitors quality of reporting and prevents excessive risk taking.

Independence of Directors

Our Corporate Governance Principles provide that the Board must be composed of a substantial majority of independent directors with an objective of having the Board consist entirely of independent directors (other than the CEO). No director qualifies as independent unless the Board affirmatively determines that the director has no material relationship with Aptar either directly or indirectly as a partner, stockholder or officer of an organization that has a relationship with Aptar.

| | | | | |

| 9 of 10 current directors are independent in accordance with the NYSE listing standards |

| Director | Independent |

| G. Fotiades | ✔ |

| M. Gomez Montiel | ✔ |

| G. Kampouri Monnas | ✔ |

| A. Kramvis | ✔ |

| I. Marey-Semper | ✔ |

| B. Owens | ✔ |

| J. Smith | ✔ |

| J. Wu | ✔ |

| R. Wunderlich | ✔ |

| S. Tanda* | |

________________________________________

* Current President and CEO

The Board has made its independence determination based on the following categorical standards, in addition to any other relevant facts and circumstances. These standards provide that a director generally will not be independent if:

•The director is or has been an employee of the Company within the last three years or has an immediate family member who is or has been an executive officer of the Company within the last three years.

•The director has received or an immediate family member has received, during any twelve‑month period within the last three years, more than $120,000 in direct compensation from the Company other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

•The director is, or has an immediate family member who is, a current partner of a firm that is the Company’s internal or external auditor (“Firm”).

•The director is a current employee of such Firm.

•The director has an immediate family member who is a current employee of such Firm and who personally works on the Company’s audit.

•The director was, or has an immediate family member who was, within the last three years but is no longer a partner or employee of such Firm and personally worked on the Company’s audit within that time.

•The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee.

•The director is a current employee or an immediate family member is a current executive officer of another company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues.

•The director or an immediate family member is, or has been within the last three years, a director or executive officer of another company that is indebted to the Company, or to which the Company is indebted, if the total amount of either company’s indebtedness for borrowed money to the other is or was 2% or more of the other company’s total consolidated assets.

•The director or an immediate family member is currently an officer, director or trustee of a charitable organization that in any of the last three fiscal years received from the Company, or any executive officer of the Company, annual charitable contributions to the organization that exceeded the greater of $1 million, or 2% of such charitable organization’s gross revenue for the last completed fiscal year.

The Board considers the following to be immaterial when making independence determinations:

•If a director is an officer, director or trustee of a charitable organization or entity to which the Company has made grants or contributions in the past year of less than $100,000.

Executive Sessions

Independent directors meet regularly in executive sessions without management. The Non-Executive Chairman of the Board, Mr. Fotiades, presides over these sessions. An executive session is held in conjunction with each regularly scheduled Board meeting and other sessions may be held from time to time as required.

Nomination of Directors

In identifying and evaluating nominees for director, the Corporate Governance Committee takes into account the applicable requirements for directors under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the listing standards of the NYSE. The Corporate Governance Committee also takes into account the outside positions of the director nominees, together with their contributions to Aptar’s Board and their other business and professional commitments, to ensure that each director had, and will have, sufficient capacity to serve on Aptar’s Board.

The Board has established a maximum age limit for director nominees. Nominees must be 74 years old or younger at the time of election or re-election. In addition, the Corporate Governance Committee may take into consideration such factors and criteria as it deems appropriate, including, but not limited to:

In addition to candidates recommended by members of the Board or management, the Corporate Governance Committee also considers individuals recommended by stockholders. The Corporate Governance Committee evaluates candidates recommended for director by stockholders in the same way that it evaluates any nominee recommended by members of the Board or management. In order to recommend a candidate, stockholders must submit the individual’s name and qualifications in writing to the Corporate Governance Committee (in care of the Secretary at Aptar’s principal executive offices at 265 Exchange Drive, Suite 100, Crystal Lake, Illinois 60014) and otherwise in accordance with all of the procedures outlined under “Other Matters—Stockholder Proposals and Nominations” for a director nomination.

The Corporate Governance Committee may engage outside advisers to identify potential director candidates from time to time. The effectiveness of the nomination process is evaluated by the Board each year as part of its annual

self‑evaluation and more formally by the Corporate Governance Committee as it evaluates and identifies director candidates.

Majority Voting Policy

Our amended and restated by-laws require majority voting for the election of directors in uncontested elections. This means that a director nominee in an uncontested election must receive a number of votes “FOR” that director’s election that exceeds the number of votes cast “AGAINST” that director’s election. Our Corporate Governance Principles further provide that any incumbent director who does not receive a majority of “FOR” votes will promptly tender to the Board his or her resignation from the Board. The Corporate Governance Committee will consider the tendered resignation and recommend to the Board whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will consider the recommendation and publicly disclose its decision within 120 days after the annual meeting. The director who tenders his or her resignation will not participate in the recommendation of the Corporate Governance Committee or the decision of the Board with respect to his or her resignation.

Communications with the Board of Directors

The Board has established a process for stockholders and other interested parties to communicate with the Board or an individual director, including the Non-Executive Chairman or the independent directors as a group. A stockholder or other interested party may contact the Board or an individual director by writing to their attention at Aptar’s principal executive offices at 265 Exchange Drive, Suite 100, Crystal Lake, Illinois 60014. Communications received in writing are distributed to the Board or to individual directors as appropriate in accordance with procedures approved by Aptar’s independent directors.

BOARD MEETING ATTENDANCE

The Board met 8 times in 2020. During 2020, no director attended fewer than 75% of the aggregate number of meetings of the Board held during such director’s term and the committees on which each director then served. Aptar does not have a formal policy regarding director attendance at the annual meeting of stockholders. Mr. Tanda attended the 2020 annual meeting.

Current Committee Membership and Meetings Held in 2020

| | | | | | | | | | | |

| Name | Audit | Management Development and Compensation | Corporate Governance |

| G. Fotiades (I) | | | |

| M. Gomez Montiel (I) | X* | | |

| G. Kampouri Monnas (I) | | X* | |

| A. Kramvis (I) | X | | |

| I. Marey-Semper (I) | | | X |

| B. Owens (I) | X | X | |

| J. Smith (I) | | | X* |

| S. Tanda | | | |

| J. Wu (I) | | X | |

| R. Wunderlich (I) | | | X |

| Number of Meetings in 2020 | 9 | 7 | 4 |

________________________________________

X*—Chairperson; (I)—Independent Director

In January 2021, Mr. Owens replaced Mr. Fotiades on the Management Development and Compensation Committee.

BOARD COMPENSATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Members (non-employee)* | |

| | •Received an annual retainer of $100,000. •Chairman received an annual retainer of $190,000. ** •These amounts are paid to directors after they are elected by shareholders at our annual meeting | |

| | | |

| | Received an equity grant under the 2018 Equity Incentive Plan with a grant date fair value equal to approximately $140,000, except for the Chairman of the Board, who received an equity grant with a grant date fair value equal to approximately $160,000. Accordingly, on May 6, 2020, each non‑employee director (other than the Chairman of the Board) was granted 1,354 RSUs and the Chairman of the Board was granted 1,547 RSUs. The 2020 RSUs vest on May 4, 2021, subject to the non‑employee director’s continued service through such date. | |

| | | |

| | Each director is eligible to participate in Aptar’s matching gift program, which matches eligible charitable donations by employees and non‑employee directors up to an aggregate of $6,000 annually per person. | |

| | | | | | | | | | | | |

| | | | | ADDITIONAL RETAINERS FOR COMMITTEE SERVICE | | | | | |

| | | | | | |

| | | | | | | |

| Audit Committee | | Management Development & Compensation Committee | | Corporate Governance Committee |

| •Chairperson: $17,000 | | | •Chairperson: $15,000 | | | •Chairperson: $10,000 |

| •Members: $11,000 | | | •Members: $7,000 | | | •Members: $7,000 |

* Employees of Aptar do not receive any additional compensation for serving as members of the Board or any of its committees. Each director is reimbursed for out-of-pocket expenses incurred while attending Board and committee meetings. No retirement benefits or perquisites are provided to non-employee directors.

** The Chairman is not an executive of Aptar.

| | | | | | | | |

Cash | | Annual cash payments are commensurate with our peers and allow us to attract and retain an experienced group of directors. |

| | |

Equity | | Equity grants facilitate alignment with stockholder interests. |

| | |

Charitable Contributions | | Directors are eligible to participate in our gift matching program which allows us to extend our charitable reach into the community. |

The non-employee director compensation program is designed to facilitate the continued attraction and retention of directors with the skills, expertise and experience valued by Aptar and position the total compensation for directors near the market median for the general industry survey data and Aptar’s peer group used to evaluate executive compensation (described below under “Compensation Determination” in the “Compensation Discussion and Analysis” discussion). No changes in compensation levels or design were made to the non-employee director compensation program as compared to 2019.

The following table includes fees paid in cash during 2020 and the grant date fair value of RSUs granted during 2020 to each non-employee director. Mr. Tanda, our Chief Executive Officer, does not receive additional compensation for his service as a director of Aptar. Please see the 2020 Summary Compensation Table for the compensation received by Mr. Tanda in his capacity as Chief Executive Officer of the Company.

2020 DIRECTOR COMPENSATION

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in Cash

($) | | Stock Awards

($)(1)(2) | | Total

($) |

| G. Fotiades | | 190,000 | | | 160,000 | | | 350,000 | |

| M. Gomez Montiel | | 128,000 | | | 140,000 | | | 268,000 | |

| G. Kampouri Monnas | | 122,000 | | | 140,000 | | | 262,000 | |

| A. Kramvis | | 111,000 | | | 140,000 | | | 251,000 | |

| I. Marey-Semper | | 107,000 | | | 140,000 | | | 247,000 | |

| B. Owens | | 111,000 | | | 140,000 | | | 251,000 | |

| J. Smith | | 117,000 | | | 140,000 | | | 257,000 | |

| J. Wu | | 107,000 | | | 140,000 | | | 247,000 | |

| R. Wunderlich | | 107,000 | | | 140,000 | | | 247,000 | |

________________________________________

(1)The amounts reported in this column represent the grant date fair value of RSUs granted during 2020, calculated using the closing market price of our common stock on May 6, 2020 ($104.86). As of December 31, 2020, Mr. Fotiades held 1,547 RSUs and each other non-employee director held 1,354 RSUs.

(2)The aggregate number of options which were granted prior to May 6, 2015 and which remained outstanding as of December 31, 2020 for each non-employee director is as follows: G. Fotiades—19,000; A. Kramvis—9,500; and J. Smith—28,500. None of the other non-employee directors held outstanding options as of December 31, 2020.

| | |

| PROPOSAL 2—ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

Pursuant to Section 14A of the Exchange Act, Aptar stockholders are being offered the opportunity to cast a non-binding advisory vote at the annual meeting to approve the compensation of Aptar’s Named Executive Officers (“NEOs”) as disclosed in the Compensation Discussion and Analysis (“CD&A”) and tabular disclosures of this proxy statement. This is not a vote on the Company’s general compensation policies or the compensation of the Board. We currently intend to submit an advisory vote on the compensation of our NEOs to our stockholders annually.

Aptar’s compensation philosophy and objectives are to fairly reward our executives for growing our business and increasing value to stockholders and to retain our experienced management team.

The overall compensation program for NEOs includes an annual performance incentive element that rewards the NEOs for the Company’s short-term performance and improvement in Company performance from the prior year, as well as equity-based elements (RSUs and long-term performance incentive awards in the form of performance-based RSUs, or PRSUs) that provide for long-term compensation that is driven by our share performance and, therefore, is aligned with our stockholders’ interests. The specific objectives of our compensation program are that a substantial portion of the NEOs’ compensation should be performance-based and should be delivered in the form of equity-based awards. Our CD&A describes our compensation philosophy and objectives in more detail.

The Board of Directors values the opinions of our stockholders. Although the resolution is advisory and non-binding, the Board will consider the outcome of the advisory vote when making future compensation decisions.

| | |

| |

The Board of Directors recommends a vote FOR the following non-binding resolution: “Resolved, that the compensation of the Company’s NEOs, as disclosed pursuant to the executive compensation disclosure rules of the SEC, including the CD&A, tabular disclosures, and other narrative executive compensation disclosures in this proxy statement, is hereby approved.” |

| | |

| PROPOSAL 3—RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2021 |

Aptar is asking stockholders to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP (“PwC”) as Aptar’s independent registered public accounting firm for the fiscal year ending December 31, 2021. PricewaterhouseCoopers LLP has audited Aptar’s consolidated financial statements annually for over 25 years.

| | |

| |

The Board of Directors and the Audit Committee recommend a vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Independent Registered Public Accounting Firm for 2021. |

As described in its charter, the Audit Committee is responsible for the appointment, retention, termination, compensation and oversight of Aptar’s independent registered public accounting firm. On an annual basis, the Audit Committee considers the engagement of the independent registered public accounting firm. In selecting PwC as Aptar’s independent registered public accounting firm for fiscal 2021, the Audit Committee evaluated, among other factors:

•PwC’s performance during fiscal year 2020 and in previous fiscal years, including the quality of PwC’s services, the sufficiency of PwC’s resources and the quality of the Audit Committee’s ongoing discussions with PwC;

•PwC’s tenure as the Company’s independent registered public accounting firm and the depth of its understanding of our business, accounting policies and practices and internal control over financial reporting;

•the professional qualifications of PwC, the lead audit engagement partner and other key engagement partners;

•the scope of PwC’s independence program and its processes for maintaining its independence;

•the scope of PwC's internal quality control program and the result of its most recent quality control reviews, including reviews by the Public Company Accounting Oversight Board;

•the appropriateness of PwC’s fees for audit and non-audit services (on both an absolute basis and as compared to its peer firms); and

•the relative benefits, challenges, overall advisability and potential impact of selecting a different independent registered public accounting firm.

PwC rotates its lead audit engagement partner every five years; the Audit Committee interviews proposed candidates and selects the lead audit engagement partner.

Representatives of PwC are expected to attend the annual meeting and will have the opportunity to make a statement if they desire to do so. It is also expected that those representatives will be available to respond to appropriate questions.

Independent Registered Public Accounting Firm Fees

The following table sets forth the aggregate fees (rounded to the nearest thousand) charged to Aptar by PwC for audit services rendered in connection with the audited consolidated financial statements and reports for the 2020 and 2019 fiscal years and for other services rendered during the 2020 and 2019 fiscal years to Aptar and its subsidiaries.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fee Category | | 2020 | | % of Total | | 2019 | | % of Total |

| Audit Fees | | $ | 3,944,000 | | | 85 | % | | $ | 3,795,000 | | | 87 | % |

| Audit-Related Fees | | 153,000 | | | 3 | % | | 3,000 | | | — | |

| Tax Fees | | 295,000 | | | 6 | % | | 241,000 | | | 6 | % |

| All Other Fees | | 273,000 | | | 6 | % | | 317,000 | | | 7 | % |

| Total Fees | | $ | 4,665,000 | | | 100 | % | | $ | 4,356,000 | | | 100 | % |

Audit Fees primarily represent amounts billed for the audit of Aptar’s annual financial statements, including statutory audits of the financial statements at certain non-U.S. locations, the audit of our internal control over financial reporting, reviews of our quarterly financial statements, providing consents and reviewing documents to be filed with the SEC.

Audit-Related Fees primarily represent amounts billed for services rendered in anticipation of an S-3 registration statement.

Tax Fees primarily represent amounts billed for services related to tax advice on the Company’s global tax structure, which includes U.S./international tax advisory and transfer pricing related services. Tax Fees also include tax compliance and preparation services including federal, state and international tax compliance and assistance with tax audits and appeals. Lastly, Tax Fees includes tax due diligence services in support of the Company's acquisition related activity.

All Other Fees primarily represent financial due diligence services performed in connection with the Company’s acquisition activity and for subscriptions to virtual accounting services.

The Audit Committee’s policies and procedures require pre‑approval for all audit and permissible non-audit services to be performed by Aptar’s independent registered public accounting firm. These services are pre‑approved by the entire Audit Committee; however, the Audit Committee may delegate to one or more of its members the authority to grant such pre‑approvals provided that any such decision of such member or members must be presented to the full Audit Committee at its next scheduled meeting.

| | |

| EXECUTIVE OFFICER COMPENSATION |

Compensation Discussion and Analysis

Executive Summary

Following is a discussion and analysis of our compensation programs as they apply to our NEOs for 2020, namely:

| | | | | |

| Named Executive Officer | Title |

| Stephan B. Tanda | President and Chief Executive Officer (“CEO”) |

| Robert W. Kuhn | Executive Vice President, Chief Financial Officer (“CFO”) |

| Gael Touya | President of Aptar Pharma segment |

| Marc Prieur | President of Aptar Beauty + Home Segment |

| Xiangwei Gong | President of Aptar Asia |

Financial and Operational Highlights

In 2020, Aptar achieved the following:

| | | | | | | | |

$2.9 billion Record Reported Sales | $214 million Annual net income | $3.21 Annual diluted earnings per share |

| | |

$570 million Record Annual Cash Flow from Operations | (27%) and (30%) Reduction in Total Recordable Incident Rate (TRIR), and Lost Time Frequency Rate (LTFR), respectfully, from the prior year | 27th year 27th consecutive year of paying an increased aggregate annual dividend amount |

________________________________________

In 2020, we also continued our strong total shareholder returns. While we performed in line with the S&P 500, we achieved a 102% total shareholder return (“TSR”) over the past five years, compared to: 91% TSR by our peer group; and 79% TSR by the S&P 400 Index.

| | | | | | | | |

| Environmental, Social and Governance Enhancements |

| In 2020, we achieved the following corporate social responsibility benchmarks: |

Top 100 Most Responsible Named one of "America's Most Responsible Companies 2021" by Newsweek and is ranked in the top 100 among 400 U.S. companies. | Top 100 Most Sustainable Named one of the "Top 100 Most Sustainable U.S. Companies" by Barron's as part of their 2019 ranking. | United Nations Global Compact Joined the United Nations (UN) Global Compact, the world's largest citizenship initiative, which focuses on universal principles in the areas of human rights, labor, environment and anti-corruption. |

Gender and Diversity KPI Alliance Joined the Gender and Diversity KPI Alliance, whose aim is the adoption and use of a set of Key Performance Indicators to measure gender and diversity in their companies and organizations. | ISS Prime Status In December of 2020 we were upgraded to Prime status with ISS ESG, one of the leading rating agencies for sustainable investments. | CDP "A" List Of the 5,800+ companies that disclose environmental metrics through the CDP, Aptar is among the 270 companies awarded an A score for Climate Change and also named a Superior Engagement Leader. |

Partnering with CARE Furthering women's education and economic empowerment. Early sponsor of the Fast + Fair COVID-19 Vaccine Response Campaign. | Gender Diversity Index ETF (SHE) Aptar is included in the SPDR® SSGA Gender Diversity Index ETF (SHE) which invests in companies that rank among the highest in gender diversity within senior leadership. | Eco-efficient Operations At year-end 2020, approximately 85% of our global electricity consumption is coming from renewable sources: 53% of Aptar sites were certified as "Landfill Free" through our internal program and globally we re-used or recycled more than 75% of all operational wastes. |

Executive Compensation Highlights

Our compensation practices in place during 2020 for our NEOs included the following governance elements that we believe support our compensation philosophies and objectives:

| | | | | |

| Governance elements supporting compensation philosophies and objectives |

|

| An independent Management Development and Compensation Committee |

|

| |

| Compensation Consultant retained by and reporting directly to the Management Development and Compensation Committee |

|

| |

| Pay that is designed to be competitive, with a significant portion delivered as performance-based or at‑risk compensation. –A significant portion of our targeted annual compensation is performance-based and/or subject to forfeiture (“at‑risk”), with emphasis on variable pay to reward short- and long-term performance measured against pre‑established objectives determined by our Company’s strategy and aligned with stockholder value creation. –For 2020, fixed compensation comprised only 17% of the target annual direct compensation (defined as base salary, annual incentive target and target grant date fair value of annual equity awards) for our CEO while variable compensation in the form of annual incentive target and target grant date fair value of annual equity awards comprised the remaining 83% of target annual direct compensation for our CEO. On average, approximately 76% of the target annual direct compensation for the other NEOs consisted of variable compensation. |

|

| |

| Emphasis on future pay opportunity vs. current pay –Our long-term incentive awards are equity-based and have multi-year vesting provisions to encourage retention. –For 2020, long-term incentive compensation comprised approximately 65% of the target annual direct compensation for our CEO and, on average, approximately 50% of the target annual direct compensation for the other NEOs. |

|

| |

| Mix of performance metrics supportive of our business strategy and compensation objectives |

|

The following table lists the material elements of Aptar’s 2020 executive compensation program applicable to the NEOs. The Management Development and Compensation Committee believes that the design of Aptar’s executive compensation program balances fixed and variable compensation elements, provides alignment with Aptar’s short and long‑term financial and strategic priorities through the annual and long-term incentive programs, and provides alignment with stockholder interests. Because this table represents elements of our annual direct compensation program, it does not include any one-time awards, such as retention awards, promotion grants, or performance recognition awards.

| | | | | | | | | | | | | | | | | | | | |

| Element | | Description | | Purpose | | Factors Influencing Amount |

| | | | | | |

| Salary | | Fixed cash compensation | | Facilitate attraction and retention | | Experience, market data, individual role and responsibilities and individual performance |

| | | | |

| Reviewed annually and adjusted if appropriate | | Recognize individual’s skills, competencies and experience | |

| | | | | | |

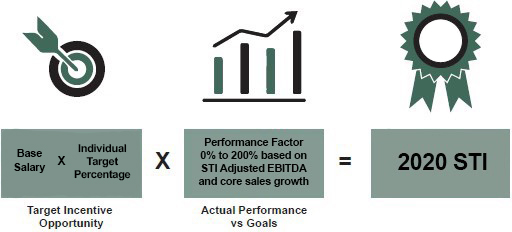

| Annual Short-Term Incentives (“STI”) | | Variable cash incentive compensation based on improvements in performance from the prior year | | Provide an incentive to achieve performance goals that are deemed critical to the business, our strategy and aligned with stockholder value creation | | Annual target opportunity determined annually based on market data, individual role and responsibilities; payout based on Company and Segment/unit performance compared to prior year |

| | | |

| Company and Segment/unit performance measured by improvements in Adjusted EBITDA and core sales (1) | | |

| | | | |

| Capped payouts if maximum goals are met | | Motivate improvement in Company performance from the prior year | |

| | | |

| Participants may elect to receive up to 50% of STI in RSUs. An additional 20% of election is granted in RSUs. | | |

| | | | | | |

| Long-term Incentives (“LTI”) | | PRSUs vest based on Company performance over 3 years in two areas: 1)Adjusted ROIC based on internally established objectives 2)TSR relative to the S&P 400 Mid Cap companies (2) | | Build ownership and align with stockholders’ interests | | Intended target amount of all LTI awards is based on individual role and responsibilities and market data; for PRSUs, vesting only occurs if a threshold level of achievement is attained |

| | | |

| | Provide an incentive to achieve performance goals that are deemed critical to the business, our strategy and aligned with stockholder value creation | |

| | | |

| | Facilitate retention | |

| | | | | |

| RSUs | | Build ownership and align with stockholders’ interests | | Intended target amount of all LTIP awards is based on individual role and responsibilities and market data; ratable vesting of RSU awards over a three year term. |

| | | |

| | Facilitate retention | |

| | | |

| | Reward long term success and growth | |