UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-07460

Exact name of registrant as specified in charter:

Delaware Investments® Dividend and Income Fund, Inc.

Address of principal executive offices:

2005 Market Street

Philadelphia, PA 19103

Name and address of agent for service:

David F. Connor, Esq.

2005 Market Street

Philadelphia, PA 19103

Registrant’s telephone number, including area code: (800) 523-1918

Date of fiscal year end: November 30

Date of reporting period: November 30, 2009

Item 1. Reports to Stockholders

| |

| |

| |

| |

| Annual Report | Delaware

Investments®

Dividend and

Income Fund, Inc. |

| |

| | November 30, 2009 |

| | |

| |

| | |

| |

| |

| |

| |

| |

| |

| | The figures in the annual report for Delaware Investments Dividend and Income Fund, Inc. represent past results, which are not a guarantee of future results. A rise or fall in interest rates can have a significant impact on bond prices. Funds that invest in bonds can lose their value as interest rates rise. |

| |

| |

| |

| |

| | Closed-end fund |

| |

Table of contents

| | > Portfolio management review | | 1 |

| | | |

| > Performance summary | | 4 |

| | | |

| > Security type and top 10 equity holdings | | 6 |

| | | |

| > Statement of net assets | | 8 |

| | | |

| | > Statement of operations | | 17 |

| | | |

| > Statements of changes in net assets | | 18 |

| | | |

| > Statement of cash flows | | 19 |

| | | |

| > Financial highlights | | 20 |

| | | |

| > Notes to financial statements | | 21 |

| | | |

| > Report of independent registered public accounting firm | | 27 |

| | | |

| > Other Fund information | | 28 |

| | | |

| > Board of trustees/directors and officers addendum | | 36 |

| | | |

| > About the organization | | 39 |

On January 4, 2010, Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) were sold by a subsidiary of Lincoln National Corporation to Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services. Please see recent press releases for more complete information.

Investments in Delaware Investments® Dividend and Income Fund, Inc. are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including subsidiaries or related companies, and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Fund, the repayment of capital from the Fund, or any particular rate of return.

Views expressed herein are current as of Dec. 8, 2009, and are subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services are provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments is the marketing name of Delaware Management Holdings, Inc. and its subsidiaries. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2010 Delaware Management Holdings, Inc.

All third-party trademarks cited are the property of their respective owners.

Portfolio management review

Delaware Investments® Dividend and Income Fund, Inc.

Dec. 8, 2009

| Performance preview (for the period ended Nov. 30, 2009) | | | | |

| Delaware Investments Dividend and Income Fund, Inc. @ market price | | 1-year return | | +86.93% |

| Delaware Investments Dividend and Income Fund, Inc. @ NAV | | 1-year return | | +53.26% |

| Lipper Closed-end Income and Preferred Stock Funds Average @ market price | | 1-year return | | +72.45% |

| Lipper Closed-end Income and Preferred Stock Funds Average @ NAV | | 1-year return | | +54.38% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Investments Dividend and Income Fund, Inc., please see the table on page 4.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. |

Delaware Investments Dividend and Income Fund, Inc. returned + 53.26% at net asset value and +86.93% at market price (both figures reflect all distributions reinvested) for the fiscal year ended Nov. 30, 2009. Complete, annualized performance information for Delaware Investments Dividend and Income Fund, Inc. is shown in the table on page 4.

Prices of risky assets fell steeply before recovery

The fiscal year was largely a story in two parts. The period began amid the worst economic and financial markets that the portfolio management team has ever witnessed. The latter part of the period, however, featured a considerable recovery, with what the team viewed as attractive opportunities within both the fixed income and equity markets.

At the start of the fiscal period, financial markets were still reacting to the jolt received when storied Wall Street investment bank Lehman Brothers declared bankruptcy in September 2008. The bankruptcy, followed soon after by the federal bailout of insurance giant American International Group (AIG), sent the financial markets into a near panic. Risk aversion had become extreme by late 2008 and investors generally fled “risk” assets for the relative safety of securities issued by the U.S. government and other sovereign entities. Signs of the fallout from the financial crisis were abundant, both in the economy and in the securities markets.

The S&P 500 Index, a measure of the broad stock market in the United States, dropped by March 2009 to its lowest level since September 1996. Meanwhile, high yield bond spreads (which are used to measure a bond’s perceived level of risk) in the U.S. peaked in December 2008 at 21.0% as measured by J.P. Morgan, a level not seen since January 1995. (Source: Bloomberg.)

The prices of energy and commodities also fell sharply during the first half of the year, before starting to recover during the latter half. In early March 2009, the broad-based Thomson Reuters/Jefferies CRB Commodity Index dropped to its lowest level since January 2002 (source: Bloomberg). The price of crude oil also sank, with the West Texas Intermediate (a type of crude oil used as a benchmark in oil pricing) hitting a low of $31 a barrel in late December 2008, a full 78% below its all-time peak price of $145 in early July 2008 (source: Bloomberg).

Global equity and fixed income markets touched lows in March, and then began to recover vigorously for much of the rest of the period. Governments and central banks around the world stressed their intentions of continuing to provide support for economic recovery for as long as necessary, which helped investors become more willing to accept risk. At first, many investors began to reach for risk at the expense of quality, within both the equity and fixed income markets. Lower-rated bonds, for example, significantly outperformed their higher-rated peers during the spring and summer months, while stocks of many companies with questionable fundamentals outpaced those of fundamentally solid companies. As the market recovery matured, however, it broadened to include almost every corner of the market, including higher-quality securities.

Importantly, economies around the world began to show early signs of stabilization and cyclical recovery. During the third calendar quarter of 2009, in fact, the

The views expressed are current as of the date of this report and are subject to change.

(continues) 1

Portfolio management review

Delaware Investments® Dividend and Income Fund, Inc.

U.S. economy expanded by an estimated 2.8%, according to the U.S. Commerce Department’s reading of GDP released in November. It was the fastest growth in the past two years.

Fund positioning

The Fund’s primary objective is to seek high current income, with a secondary objective of capital appreciation. In managing the Fund, we pursue these goals by investing broadly in a range of income-generating securities. These include core fixed income holdings (such as Treasury and agency securities) as well as investment grade and high yield corporate bonds, convertible bonds, real estate investment trusts (REITs), and large-cap value stocks.

Broadly speaking, we positioned the Fund defensively as the period began. When determining the Fund’s asset allocation at a portfolio level, for instance, we placed an emphasis on fixed income securities and convertible bonds over equities and REITs. From a risk-reward perspective, we tended to find fixed income asset classes as more appropriate for the Fund.

Among corporate bonds, for example, yields rose to historically high levels during the opening months of the period. Because prices decline as yields rise, the high yields on corporate bonds reflected the extreme risk aversion by investors at that time, and also highlighted some extraordinary value opportunities in our opinion. Although corporate bonds were affected by the difficult investment climate early in the period, both high yield and investment grade corporate bond positions within the Fund ultimately contributed performance for the fiscal year. Both asset classes performed well during the market’s recovery, and high yield bonds’ rebound was particularly notable.

Within high yield, the Fund generally carried a heavy position in speculative B-rated securities because we believed that the most favorable risk and reward opportunities existed there. Conversely, we maintained less exposure to bonds with a higher BB rating, which is just below investment grade.

Our limited exposure to BB-rated bonds moderated Fund returns, however, because these bonds were among the better-performing bonds within the high yield asset class. (Credit ratings based on Standard & Poor’s opinion.)

The Fund’s increased exposure to convertible bonds also added to its overall performance. We added to convertible bond exposure because we believed the combination of yield, capital structure positioning, and potential upside made them attractive.

Among our REIT holdings, we continued to employ our “bottom up” security selection strategy, in which we evaluate potential investments one by one, based on our assessment of each company’s growth prospects, relative valuation, and balance-sheet quality (among other factors). Given the highly volatile conditions of the fiscal year, however, our approach was more opportunistic than usual, as we sought to take advantage of shifting opportunities in the marketplace.

Early on, as the investment environment deteriorated, we made our REIT holdings more defensive by focusing on companies with longer lease terms, including healthcare and “triple net” REITs. Triple-net leases, in which tenants pay all property maintenance costs in addition to rent, tend to be relatively defensive because they provide a greater income stream to landlords. Simultaneously, we limited our exposure to companies with shorter-duration leases, such as hotel companies, which tend to have uncertain cash flows relative to other sectors. We also looked to avoid stocks of companies with what we believed were significant balance-sheet problems.

This defensive stance was generally beneficial to Fund performance during the downturn. Nonetheless, we calculated that the recovery would be much shorter than it turned out to be when credit markets loosened and the REIT market advanced. In actuality, credit conditions continued to improve, and by summer it was evident that a longer-lived improvement was taking place. Our maintenance of cautious positioning for a time caused the Fund’s REIT positions to trail the broader market gains during some of the rally.

2

The gains made during the fiscal year by the Fund’s large-cap value equity holdings were more subdued than those of its high yield fixed income or REIT holdings. Much of the performance gains (versus the broader equity markets) from this equity allocation relative to the S&P 500 Index came in periods of market decline, such as the first several months of the period and again in October 2009.

This trend has been consistent with the aim of our management approach; through our value-oriented, defensive style, we seek to do well in relative terms in down markets by minimizing losses. The biggest positive for the Fund’s large-cap value holdings came from de-emphasizing the financial sector, the hardest-hit group in the marketplace during the downturn. Fund returns were negatively affected by our holdings in both the materials and industrials sectors, two groups in which our security selection proved disappointing.

We recognize that the recent environment, one in which investors could be rewarded for simply increasing the amount of risk within their portfolios, cannot last forever. With this in mind, the Fund continued at the portfolio level to be positioned generally defensively at fiscal year end, based on our opinion of relative value opportunities among asset classes.

3

Performance summary

Delaware Investments® Dividend and Income Fund, Inc.

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Funds that invest in bonds can lose their value as interest rates rise, and an investor can lose principal. Please obtain the performance data for the most recent month end by calling 800 523-1918.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund.

| Fund performance | | | | | | | |

| Average annual total returns | | | | | | | |

| Through Nov. 30, 2009 | 1 year | | 5 years | | 10 years | | Lifetime |

| At market price | 86.93% | | 0.13% | | 5.96% | | 5.94% |

| At net asset value | 53.26% | | -0.53% | | 5.14% | | 3.80% |

Instances of high double-digit returns are unusual, cannot be sustained, and were primarily achieved during favorable market conditions.

Diversification may not protect against market risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate. High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors. REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Returns reflect the reinvestment of all distributions. Dividends and distributions, if any, are assumed, for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment policy. Shares of the Fund were initially offered with a sales charge of 6%. Performance since inception does not include the sales charge or any other brokerage commission for purchases made since inception. Past performance is not a guarantee of future results.

| Fund basics |

| As of Nov. 30, 2009 |

| |

| Fund objectives |

| The Fund seeks to achieve high current income. Capital appreciation is a secondary objective. |

| |

| Total Fund net assets |

| $66 million |

| |

| Number of holdings |

| 427 |

| Fund start date |

| March 26, 1993 |

| |

| NYSE symbol |

| DDF |

4

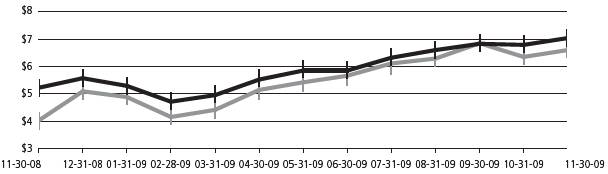

Market price versus net asset value (see notes below)

Nov. 30, 2008, through Nov. 30, 2009

| | | Starting value | | Ending value |

| | | (Nov. 30, 2008) | | (Nov. 30, 2009) |

| | Delaware Investments® Dividend and Income Fund, Inc. @ NAV | $5.22 | | $7.04 |

| | Delaware Investments Dividend and Income Fund, Inc. @ Market price | $4.02 | | $6.60 |

Past performance is not a guarantee of future results.

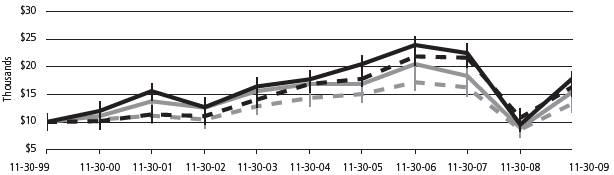

Performance of a $10,000 Investment

Average annual total returns from Nov. 30, 1999, through Nov. 30, 2009

| | | Starting value | | Ending value |

| | | | (Nov. 30, 1999) | | (Nov. 30, 2009) |

| | Delaware Investments Dividend and Income Fund, Inc. @ Market price | $10,000 | | $17,867 |

|

| | Delaware Investments Dividend and Income Fund, Inc. @ NAV | $10,000 | | $16,463 |

| | Lipper Closed-end Income and Preferred Stock Funds Average @ Market price | $10,000 | | $15,411 |

|

| | Lipper Closed-end Income and Preferred Stock Funds Average @ NAV | $10,000 | | $13,327 |

The chart assumes $10,000 invested in the Fund on Nov. 30, 1999, and includes the reinvestment of all distributions at market value. The chart assumes $10,000 invested in the Lipper Closed-end Income and Preferred Stock Funds Average at market price and at NAV. Performance of the Fund and the Lipper class at market value is based on market performance during the period. Performance of the Fund and Lipper class at NAV is based on the fluctuations in NAV during the period. Delaware Investments Dividend and Income Fund, Inc. was initially offered with a sales charge of 6%. Performance shown in both charts above does not include fees, the initial sales charge, or any brokerage commissions for purchases. Investments in the Fund are not available at NAV.

The Lipper Closed-end Income and Preferred Stock Funds Average represents the average return of closed-end income and preferred stock mutual funds tracked by Lipper (source: Lipper).

Market price is the price an investor would pay for shares of the Fund on the secondary market. NAV is the total value of one fund share, generally equal to a fund’s net assets divided by the number of shares outstanding.

Past performance is not a guarantee of future results.

5

Security type and top 10 equity holdings

Delaware Investments® Dividend and Income Fund, Inc.

As of November 30, 2009

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Percentage |

| Security Type | of Net Assets |

| Common Stock | 66.34 | % |

| Consumer Discretionary | 3.42 | % |

| Consumer Staples | 10.08 | % |

| Diversified REITs | 0.75 | % |

| Energy | 6.16 | % |

| Financials | 5.18 | % |

| Health Care | 10.84 | % |

| Health Care REITs | 2.76 | % |

| Hotel REITs | 0.37 | % |

| Industrial REITs | 0.34 | % |

| Industrials | 3.50 | % |

| Information Technology | 6.86 | % |

| Mall REITs | 1.60 | % |

| Materials | 1.67 | % |

| Mortgage REITs | 0.50 | % |

| Multifamily REITs | 1.39 | % |

| Office REITs | 1.37 | % |

| Office/Industrial REITs | 0.53 | % |

| Real Estate Operating REITs | 0.47 | % |

| Self-Storage REITs | 0.62 | % |

| Shopping Center REITs | 0.59 | % |

| Specialty REITs | 0.87 | % |

| Telecommunications | 3.12 | % |

| Utilities | 3.35 | % |

| Convertible Preferred Stock | 2.64 | % |

| Preferred Stock | 0.25 | % |

| Convertible Bonds | 14.05 | % |

| Aerospace & Defense | 0.77 | % |

| Automobiles | 0.26 | % |

| Banking, Finance & Insurance | 0.16 | % |

| Basic Materials | 1.01 | % |

| Building & Materials | 0.15 | % |

| Cable, Media & Publishing | 0.24 | % |

| Computers & Technology | 2.31 | % |

| Electronics & Electrical Equipment | 0.13 | % |

| Energy | 0.39 | % |

| Health Care & Pharmaceuticals | 2.59 | % |

| Leisure, Lodging & Entertainment | 0.61 | % |

| Real Estate | 1.74 | % |

| Retail | 0.23 | % |

| Telecommunications | 2.57 | % |

| Transportation | 0.39 | % |

| Utilities | 0.50 | % |

| Corporate Bonds | 43.08 | % |

| Banking | 2.11 | % |

| Basic Industry | 4.76 | % |

| Brokerage | 0.56 | % |

| Capital Goods | 3.29 | % |

| Consumer Cyclical | 5.34 | % |

| Consumer Non-Cyclical | 3.03 | % |

| Energy | 3.99 | % |

| Finance & Investments | 1.26 | % |

| Media | 3.09 | % |

| Real Estate | 0.23 | % |

| Services Cyclical | 4.24 | % |

| Services Non-Cyclical | 1.70 | % |

| Technology & Electronics | 1.34 | % |

| Telecommunications | 6.27 | % |

| Utilities | 1.87 | % |

| Senior Secured Loans | 0.57 | % |

| Exchange Traded Fund | 0.03 | % |

| Limited Partnerships | 0.24 | % |

| Warrant | 0.00 | % |

| Discount Note | 2.39 | % |

| Securities Lending Collateral | 6.11 | % |

| Total Value of Securities | 135.70 | % |

| Obligation to Return Securities Lending Collateral | (6.39 | %) |

| Borrowing Under Line of Credit | (30.45 | %) |

| Receivables and Other Assets Net of Liabilities | 1.14 | % |

| Total Net Assets | 100.00 | % |

6

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Percentage |

| Top 10 Equity Holdings | of Net Assets |

| Pfizer | 2.10 | % |

| Merck | 2.09 | % |

| Travelers | 2.00 | % |

| International Business Machines | 1.98 | % |

| Cardinal Health | 1.93 | % |

| Kimberly-Clark | 1.92 | % |

| Intel | 1.82 | % |

| Heinz (H.J.) | 1.75 | % |

| Edison International | 1.74 | % |

| Archer-Daniels-Midland | 1.72 | % |

7

Statement of net assets

Delaware Investments® Dividend and Income Fund, Inc.

November 30, 2009

| | | Number of | | | |

| | | | Shares | | Value |

| Common Stock – 66.34% | | | | | |

| Consumer Discretionary – 3.42% | | | | | |

| =∏† | Avado Brands | | 1,390 | | $ | 0 |

| *† | DIRECTV Class A | | 1,550 | | | 49,027 |

| Lowe’s | | 51,200 | | | 1,116,672 |

| Mattel | | 56,800 | | | 1,105,328 |

| | | | | | 2,271,027 |

| Consumer Staples – 10.08% | | | | | |

| Archer-Daniels-Midland | | 37,100 | | | 1,143,051 |

| CVS Caremark | | 35,900 | | | 1,113,259 |

| Heinz (H.J.) | | 27,400 | | | 1,163,130 |

| Kimberly-Clark | | 19,300 | | | 1,273,221 |

| Kraft Foods Class A | | 37,000 | | | 983,460 |

| Safeway | | 45,400 | | | 1,021,500 |

| | | | | | 6,697,621 |

| Diversified REITs – 0.75% | | | | | |

| Vornado Realty Trust | | 7,638 | | | 499,983 |

| | | | | | 499,983 |

| Energy – 6.16% | | | | | |

| Chevron | | 12,600 | | | 983,304 |

| ConocoPhillips | | 19,500 | | | 1,009,515 |

| Marathon Oil | | 32,500 | | | 1,060,150 |

| National Oilwell Varco | | 24,200 | | | 1,041,084 |

| | | | | | 4,094,053 |

| Financials – 5.18% | | | | | |

| Allstate | | 36,600 | | | 1,039,806 |

| Bank of New York Mellon | | 36,700 | | | 977,688 |

| † | Global Brands Acquisition | | 9,100 | | | 89,271 |

| Travelers | | 25,400 | | | 1,330,706 |

| | | | | | 3,437,471 |

| Health Care – 10.84% | | | | | |

| † | Alliance HealthCare Services | | 5,127 | | | 30,352 |

| † | Bristol-Myers Squibb | | 42,200 | | | 1,068,082 |

| Cardinal Health | | 39,800 | | | 1,282,754 |

| Johnson & Johnson | | 17,000 | | | 1,068,280 |

| Merck | | 38,384 | | | 1,389,890 |

| Pfizer | | 76,789 | | | 1,395,255 |

| Quest Diagnostics | | 16,700 | | | 967,598 |

| | | | | | 7,202,211 |

| Health Care REITs – 2.76% | | | | | |

| HCP | | 15,650 | | | 489,845 |

| Health Care REIT | | 9,060 | | | 403,623 |

| LTC Properties | | 3,800 | | | 97,698 |

| Nationwide Health Properties | | 8,800 | | | 299,288 |

| * | Omega Healthcare Investors | | 7,900 | | | 142,911 |

| Ventas | | 9,375 | | | 402,469 |

| | | | | | 1,835,834 |

| Hotel REITs – 0.37% | | | | | |

| Host Hotels & Resorts | | 23,100 | | | 243,012 |

| | | | | | 243,012 |

| Industrial REITs – 0.34% | | | | | |

| AMB Property | | 1,280 | | | 30,144 |

| ProLogis | | 15,000 | | | 196,200 |

| | | | | | 226,344 |

| Industrials – 3.50% | | | | | |

| † | Delta Air Lines | | 4 | | | 33 |

| † | Flextronics International | | 4,400 | | | 31,108 |

| † | Foster Wheeler | | 2 | | | 60 |

| * | Grupo Aeroportuario del Centro | | | | | |

| Norte ADR | | 5,800 | | | 70,818 |

| *† | Mobile Mini | | 1,651 | | | 25,112 |

| Northrop Grumman | | 19,900 | | | 1,090,520 |

| ∏=† | PT Holdings | | 350 | | | 4 |

| Waste Management | | 33,700 | | | 1,106,707 |

| | | | | | 2,324,362 |

| Information Technology – 6.86% | | | | | |

| Intel | | 63,100 | | | 1,211,520 |

| International Business Machines | | 10,400 | | | 1,314,040 |

| † | Motorola | | 124,800 | | | 999,648 |

| Xerox | | 134,200 | | | 1,033,340 |

| | | | | | 4,558,548 |

| Mall REITs – 1.60% | | | | | |

| † | General Growth Properties | | 6 | | | 39 |

| * | Macerich | | 8,265 | | | 245,966 |

| Simon Property Group | | 11,278 | | | 819,460 |

| | | | | | 1,065,465 |

| Materials – 1.67% | | | | | |

| duPont (E.I.) deNemours | | 32,100 | | | 1,110,018 |

| | | | | | 1,110,018 |

| Mortgage REITs – 0.50% | | | | | |

| Annaly Capital Management | | 2,300 | | | 42,343 |

| Chimera Investment | | 23,800 | | | 95,914 |

| Cypress Sharpridge Investments | | 14,800 | | | 193,880 |

| | | | | | 332,137 |

| Multifamily REITs – 1.39% | | | | | |

| Apartment Investment & | | | | | |

| Management | | 7,968 | | | 107,648 |

| BRE Properties | | 4,600 | | | 144,118 |

| Camden Property Trust | | 3,450 | | | 133,688 |

| Equity Residential | | 16,600 | | | 534,685 |

| | | | | | 920,139 |

| Office REITs – 1.37% | | | | | |

| * | Alexandria Real Estate Equities | | 3,090 | | | 174,183 |

| * | Boston Properties | | 3,000 | | | 200,940 |

| Brandywine Realty Trust | | 11,500 | | | 112,930 |

| Government Properties Income Trust | | 4,800 | | | 119,856 |

| Highwoods Properties | | 5,700 | | | 174,477 |

| Mack-Cali Realty | | 4,250 | | | 130,433 |

| | | | | | 912,819 |

| Office/Industrial REITs – 0.53% | | | | | |

| * | Digital Realty Trust | | 5,550 | | | 270,063 |

| Liberty Property Trust | | 2,700 | | | 80,028 |

| | | | | | 350,091 |

| Real Estate Operating REITs – 0.47% | | | | | |

| Starwood Property Trust | | 16,000 | | | 310,400 |

| | | | | | 310,400 |

8

| | | Number of | | | |

| | Shares | | Value |

| Common Stock (continued) | | | | | |

| Self-Storage REITs – 0.62% | | | | | |

| Public Storage | | 5,150 | | $ | 409,837 |

| | | | | | 409,837 |

| Shopping Center REITs – 0.59% | | | | | |

| Cedar Shopping Centers | | 5,700 | | | 34,428 |

| * | Federal Realty Investment Trust | | 300 | | | 19,296 |

| Kimco Realty | | 20,430 | | | 251,698 |

| Ramco-Gershenson Properties Trust | | 9,200 | | | 83,720 |

| | | | | | 389,142 |

| Specialty REITs – 0.87% | | | | | |

| Entertainment Properties Trust | | 6,320 | | | 199,649 |

| * | Plum Creek Timber | | 6,885 | | | 237,463 |

| * | Potlatch | | 4,825 | | | 142,048 |

| | | | | | 579,160 |

| Telecommunications – 3.12% | | | | | |

| AT&T | | 33,200 | | | 894,408 |

| =† | Century Communications | | 500,000 | | | 0 |

| Frontier Communications | | 24,400 | | | 192,760 |

| † | GeoEye | | 550 | | | 17,144 |

| Verizon Communications | | 30,700 | | | 965,822 |

| | | | | | 2,070,134 |

| Utilities – 3.35% | | | | | |

| Edison International | | 33,900 | | | 1,154,295 |

| † | Mirant | | 189 | | | 2,691 |

| NorthWestern | | 3,300 | | | 85,107 |

| Progress Energy | | 25,100 | | | 981,159 |

| | | | | | 2,223,252 |

| Total Common Stock (cost $47,571,627) | | | | | 44,063,060 |

| |

| Convertible Preferred Stock – 2.64% | | | | | |

| Banking, Finance & Insurance – 0.71% | | | | | |

| Aspen Insurance 5.625% | | | | | |

| exercise price $29.28, | | | | | |

| expiration date 12/31/49 | | 8,800 | | | 470,800 |

| @ | Fannie Mae 8.75% exercise price | | | | | |

| $32.45, expiration date 5/13/11 | | 3,500 | | | 4,900 |

| | | | | | 475,700 |

| Cable, Media & Publishing – 0.37% | | | | | |

| # | Interpublic Group 144A 5.25% | | | | | |

| exercise price $13.66, | | | | | |

| expiration date 12/31/49 | | 360 | | | 246,690 |

| | | | | | 246,690 |

| Energy – 0.46% | | | | | |

| El Paso Energy Capital Trust I | | | | | |

| 4.75% exercise price $41.59, | | | | | |

| expiration date 3/31/28 | | 5,250 | | | 176,715 |

| Whiting Petroleum 6.25% | | | | | |

| exercise price $43.42, | | | | | |

| expiration date 12/31/49 | | 800 | | | 128,768 |

| | | | | | 305,483 |

| Health Care & Pharmaceuticals – 0.37% | | | | | |

| Mylan 6.50% exercise price $17.08, | | | | | |

| expiration date 11/15/10 | | 220 | | | 245,630 |

| | | | | | 245,630 |

| Telecommunications – 0.73% | | | | | |

| Crown Castle International | | | | | |

| 6.50% exercise price $36.88, | | | | | |

| expiration date 8/15/12 | | 4,450 | | | 256,988 |

| Lucent Technologies Capital Trust I | | | | | |

| 7.75% exercise price $24.80, | | | | | |

| expiration date 3/15/17 | | 305 | | | 225,776 |

| | | | | | 482,764 |

| Total Convertible Preferred Stock | | | | | |

| (cost $1,963,794) | | | | | 1,756,267 |

| |

| Preferred Stock – 0.25% | | | | | |

| Banking, Finance & Insurance – 0.22% | | | | | |

| Bank of America | | | | | |

| 8.00% | | 150,000 | | | 130,834 |

| ·8.125% | | 15,000 | | | 13,084 |

| | | | | | 143,918 |

| Industrials – 0.00% | | | | | |

| †= | Port Townsend | | 70 | | | 0 |

| | | | | | 0 |

| Real Estate – 0.03% | | | | | |

| W2007 Grace Acquisitions I 8.75% | | 34,400 | | | 20,640 |

| | | | | | 20,640 |

| Total Preferred Stock (cost $1,079,051) | | | | | 164,558 |

| |

| | Principal | | | |

| | Amount | | | |

| Convertible Bonds – 14.05% | | | | | |

| Aerospace & Defense – 0.77% | | | | | |

| # | AAR 144A 1.75% exercise price | | | | | |

| | $29.43, expiration date 1/1/26 | $ | 260,000 | | | 240,825 |

| # | L-3 Communications Holdings 144A | | | | | |

| 3.00% exercise price $100.14, | | | | | |

| expiration date 8/1/35 | | 265,000 | | | 272,288 |

| | | | | | 513,113 |

| Automobiles – 0.26% | | | | | |

| Ford Motor 4.25% exercise price | | | | | |

| | $9.30, expiration date 11/15/16 | | 150,000 | | | 171,563 |

| | | | | | 171,563 |

| Banking, Finance & Insurance – 0.16% | | | | | |

| Jefferies Group 3.875% exercise | | | | | |

| price $39.20, expiration | | | | | |

| date 11/1/29 | | 115,000 | | | 107,238 |

| | | | | | 107,238 |

| Basic Materials – 1.01% | | | | | |

| Century Aluminum 1.75% exercise | | | | | |

| price $30.54, expiration | | | | | |

| date 8/1/24 | | 20,000 | | | 18,575 |

| Rayonier TRS Holdings 3.75% exercise | | | | | |

| price $54.82, expiration | | | | | |

| date 10/15/12 | | 345,000 | | | 361,387 |

| # | Sino-Forest 144A 5.00% exercise price | | | | | |

| | $20.29, expiration date 8/1/13 | | 255,000 | | | 290,063 |

| | | | | | 670,025 |

(continues) 9

Statement of net assets

Delaware Investments® Dividend and Income Fund, Inc.

| | | Principal | | | |

| | Amount | | Value |

| Convertible Bonds (continued) | | | | | |

| Building & Materials – 0.15% | | | | | |

| Beazer Homes USA 4.625% | | | | | |

| exercise price $49.64, | | | | | |

| expiration date 6/15/24 | $ | 110,000 | | $ | 100,925 |

| | | | | | 100,925 |

| Cable, Media & Publishing – 0.24% | | | | | |

| Interpublic Group 4.25% | | | | | |

| | exercise price $12.42, | | | | | |

| expiration date 3/15/23 | | 75,000 | | | 73,313 |

| VeriSign 3.25% exercise price | | | | | |

| $34.37, expiration date 8/15/37 | | 105,000 | | | 87,937 |

| | | | | | 161,250 |

| Computers & Technology – 2.31% | | | | | |

| Advanced Micro Devices | | | | | |

| 6.00% exercise price $28.08, | | | | | |

| expiration date 5/1/15 | | 70,000 | | | 61,775 |

| #144A 6.00% exercise price | | | | | |

| $28.08, expiration date 5/1/15 | | 450,000 | | | 397,125 |

| Euronet Worldwide 3.50% | | | | | |

| exercise price $40.48, | | | | | |

| expiration date 10/15/25 | | 435,000 | | | 402,918 |

| Hutchinson Technology 3.25% | | | | | |

| exercise price $36.43, | | | | | |

| expiration date 1/14/26 | | 340,000 | | | 257,975 |

| # | Intel 144A 3.25% exercise price | | | | | |

| $22.68, expiration date 8/1/39 | | 70,000 | | | 77,788 |

| Linear Technology 3.125% | | | | | |

| exercise price $47.33, | | | | | |

| expiration date 5/1/27 | | 120,000 | | | 117,150 |

| SanDisk 1.00% exercise price | | | | | |

| $82.35, expiration date 5/15/13 | | 280,000 | | | 220,500 |

| | | | | | 1,535,231 |

| Electronics & Electrical Equipment – 0.13% | | | | | |

| Flextronics International 1.00% | | | | | |

| exercise price $15.53, | | | | | |

| expiration date 8/1/10 | | 85,000 | | | 83,831 |

| | | | | | 83,831 |

| Energy – 0.39% | | | | | |

| Chesapeake Energy 2.25% | | | | | |

| exercise price $85.89, | | | | | |

| expiration date 12/15/38 | | 220,000 | | | 164,175 |

| Peabody Energy 4.75% exercise price | | | | | |

| $58.44, expiration date 12/15/41 | | 100,000 | | | 98,500 |

| | | | | | 262,675 |

| Health Care & Pharmaceuticals – 2.59% | | | | | |

| # | Allergan 144A 1.50% exercise price | | | | | |

| $63.33, expiration date 4/1/26 | | 415,000 | | | 466,874 |

| Amgen | | | | | |

| 0.375% exercise price $79.48, | | | | | |

| expiration date 2/1/13 | | 235,000 | | | 235,000 |

| #144A 0.375% exercise price | | | | | |

| $79.48, expiration date 2/1/13 | | 165,000 | | | 165,000 |

| Φ | Hologic 2.00% exercise price | | | | | |

| $38.59, expiration date 12/15/37 | | 280,000 | | | 228,200 |

| Inverness Medical Innovations 9.00% | | | | | |

| Series B exercise price $43.98, | | | | | |

| expiration date 5/15/16 | | 215,000 | | | 246,981 |

| LifePoint Hospitals 3.50% | | | | | |

| exercise price $51.79, | | | | | |

| expiration date 5/14/14 | | 110,000 | | | 98,863 |

| Medtronic 1.65% exercise price | | | | | |

| $55.41, expiration date 4/15/13 | | 275,000 | | | 280,844 |

| | | | | | 1,721,762 |

| Leisure, Lodging & Entertainment – 0.61% | | | | | |

| # | Gaylord Entertainment 144A 3.75% | | | | | |

| exercise price $27.25, expiration | | | | | |

| date 9/29/14 | | 220,000 | | | 208,450 |

| # | International Game Technology 144A | | | | | |

| 3.25% exercise price $19.97, | | | | | |

| expiration date 5/1/14 | | 160,000 | | | 196,400 |

| | | | | | 404,850 |

| Real Estate – 1.74% | | | | | |

| # | Corporate Office Properties 144A | | | | | |

| 3.50% exercise price $53.12, | | | | | |

| expiration date 9/15/26 | | 195,000 | | | 184,763 |

| Developers Diversified Realty | | | | | |

| 3.00% exercise price $74.75, | | | | | |

| expiration date 3/15/12 | | 65,000 | | | 59,719 |

| *# | Digital Realty Trust 144A 5.50% | | | | | |

| exercise price $43.00, expiration | | | | | |

| date 4/15/29 | | 220,000 | | | 282,974 |

| @ | MeriStar Hospitality 9.50% | | | | | |

| exercise price $10.18, | | | | | |

| expiration date 4/1/10 | | 230,000 | | | 236,095 |

| National Retail Properties | | | | | |

| 5.125% exercise price $25.42, | | | | | |

| expiration date 6/15/28 | | 210,000 | | | 216,038 |

| | Vornado Realty Trust 2.85% | | | | | |

| exercise price $159.04, | | | | | |

| expiration date 3/15/27 | | 175,000 | | | 175,875 |

| | | | | | 1,155,464 |

| Retail – 0.23% | | | | | |

| Pantry 3.00% exercise price $50.09, | | | | | |

| expiration date 11/15/12 | | 180,000 | | | 151,425 |

| | | | | | 151,425 |

| Telecommunications – 2.57% | | | | | |

| Alaska Communications System | | | | | |

| Group 5.75% exercise price | | | | | |

| $12.90, expiration date 3/1/13 | | 260,000 | | | 235,300 |

| Leap Wireless International 4.50% | | | | | |

| exercise price $93.21, expiration | | | | | |

| date 7/15/14 | | 120,000 | | | 94,800 |

| Level 3 Communications 5.25% | | | | | |

| exercise price $3.98, expiration | | | | | |

| date 12/15/11 | | 180,000 | | | 164,250 |

| NII Holdings 3.125% exercise price | | | | | |

| $118.32, expiration date 6/15/12 | | 410,000 | | | 372,587 |

| Qwest Communications International | | | | | |

| 3.50% exercise price $5.01, | | | | | |

| expiration date 11/15/25 | | 400,000 | | | 401,499 |

| # | SBA Communications 144A 4.00% | | | | | |

| exercise price $30.38, expiration | | | | | |

| date 10/1/14 | | 165,000 | | | 207,488 |

10

| | | Principal | | | |

| | Amount | | Value |

| Convertible Bonds (continued) | | | | | |

| Telecommunications (continued) | | | | | |

| # | Virgin Media 144A 6.50% exercise | | | | | |

| price $19.22, expiration | | | | | |

| | date 11/15/16 | $ | 198,000 | | $ | 231,165 |

| | | | | | 1,707,089 |

| Transportation – 0.39% | | | | | |

| Bristow Group 3.00% exercise price | | | | | |

| | $77.34, expiration date 6/14/38 | | 300,000 | | | 259,500 |

| | | | | | 259,500 |

| Utilities – 0.50% | | | | | |

| Dominion Resources 2.125% | | | | | |

| exercise price $36.14, expiration | | | | | |

| date 12/15/23 | | 290,000 | | | 329,150 |

| | | | | | 329,150 |

| Total Convertible Bonds | | | | | |

| (cost $9,073,391) | | | | | 9,335,091 |

| |

| Corporate Bonds – 43.08% | | | | | |

| Banking – 2.11% | | | | | |

| · | BAC Capital Trust XIV 5.63% 12/31/49 | | 215,000 | | | 143,513 |

| Capital One Capital V 10.25% 8/15/39 | | 135,000 | | | 148,870 |

| · | Citigroup Capital XXI 8.30% 12/21/57 | | 65,000 | | | 58,175 |

| # | GMAC 144A | | | | | |

| 6.00% 12/15/11 | | 71,000 | | | 67,539 |

| 6.625% 5/15/12 | | 85,000 | | | 81,281 |

| 6.875% 9/15/11 | | 174,000 | | | 169,215 |

| 6.875% 8/28/12 | | 196,000 | | | 187,670 |

| JPMorgan Chase Capital XXV | | | | | |

| 6.80% 10/1/37 | | 20,000 | | | 19,788 |

| @ | Popular North America Capital Trust I | | | | | |

| 6.564% 9/15/34 | | 70,000 | | | 51,479 |

| ·# | Rabobank 144A 11.00% 12/29/49 | | 150,000 | | | 185,984 |

| USB Capital IX 6.189% 10/29/49 | | 115,000 | | | 90,850 |

| Zions Bancorporation | | | | | |

| 5.50% 11/16/15 | | 57,000 | | | 39,661 |

| 6.00% 9/15/15 | | 141,000 | | | 98,232 |

| 7.75% 9/23/14 | | 65,000 | | | 57,906 |

| | | | | | 1,400,163 |

| Basic Industry – 4.76% | | | | | |

| # | Algoma Acquisition 144A | | | | | |

| 9.875% 6/15/15 | | 115,000 | | | 98,325 |

| California Steel Industries | | | | | |

| 6.125% 3/15/14 | | 113,000 | | | 105,655 |

| Century Aluminum 7.50% 8/15/14 | | 115,000 | | | 106,375 |

| ·# | Cognis GmbH 144A 2.299% 9/15/13 | | 75,000 | | | 69,000 |

| # | Drummond 144A 9.00% 10/15/14 | | 145,000 | | | 148,625 |

| # | Evraz Group 144A 9.50% 4/24/18 | | 195,000 | | | 196,462 |

| # | FMG Finance 144A 10.625% 9/1/16 | | 90,000 | | | 98,550 |

| Freeport McMoRan Copper & Gold | | | | | |

| 8.25% 4/1/15 | | 120,000 | | | 128,839 |

| 8.375% 4/1/17 | | 10,000 | | | 10,802 |

| * | Hexion US Finance 9.75% 11/15/14 | | 121,000 | | | 116,765 |

| # | Innophos Holdings 144A | | | | | |

| 9.50% 4/15/12 | | 115,000 | | | 115,575 |

| International Coal Group | | | | | |

| 10.25% 7/15/14 | | 163,000 | | | 158,925 |

| # | MacDermid 144A 9.50% 4/15/17 | | 188,000 | | | 187,059 |

| # | Momentive Performance Material | | | | | |

| 144A 12.50% 6/15/14 | | 70,000 | | | 77,000 |

| # | Murray Energy 144A 10.25% 10/15/15 | | 115,000 | | | 113,275 |

| # | NewPage144A 11.375% 12/31/14 | | 145,000 | | | 143,550 |

| · | Noranda Aluminum Acquisition | | | | | |

| PIK 5.274 % 5/15/15 | | 151,023 | | | 110,247 |

| Norske Skog Canada 8.625% 6/15/11 | | 61,000 | | | 45,598 |

| Novelis | | | | | |

| 7.25% 2/15/15 | | 50,000 | | | 45,375 |

| | #144A 11.50% 2/15/15 | | 72,000 | | | 75,240 |

| =@ | Port Townsend 7.32% 8/27/12 | | 102,592 | | | 74,379 |

| Potlatch 12.50% 12/1/09 | | 250,000 | | | 249,999 |

| Ryerson | | | | | |

| ·7.656% 11/1/14 | | 99,000 | | | 87,863 |

| 12.25% 11/1/15 | | 40,000 | | | 40,900 |

| # | Sappi Papier Holding 144A | | | | | |

| 6.75% 6/15/12 | | 101,000 | | | 94,036 |

| # | Steel Capital 144A 9.75% 7/29/13 | | 100,000 | | | 101,125 |

| # | Steel Dynamics 144A 8.25% 4/15/16 | | 127,000 | | | 128,905 |

| # | Teck Resources 144A | | | | | |

| 10.25% 5/15/16 | | 38,000 | | | 43,130 |

| 10.75% 5/15/19 | | 75,000 | | | 87,938 |

| # | Vedanta Resources 144A | | | | | |

| 9.50% 7/18/18 | | 100,000 | | | 99,750 |

| | | | | | 3,159,267 |

| Brokerage – 0.56% | | | | | |

| E Trade Financial PIK | | | | | |

| 12.50% 11/30/17 | | 116,875 | | | 132,069 |

| LaBranche 11.00% 5/15/12 | | 252,000 | | | 243,180 |

| | | | | | 375,249 |

| Capital Goods – 3.29% | | | | | |

| AMH Holdings 11.25% 3/1/14 | | 60,000 | | | 56,550 |

| Associated Materials | | | | | |

| 9.75% 4/15/12 | | 42,000 | | | 42,683 |

| | #144A 9.875% 11/15/16 | | 15,000 | | | 15,750 |

| Building Materials Corporation of | | | | | |

| America 7.75% 8/1/14 | | 104,000 | | | 103,480 |

| # | BWAY 144A 10.00% 4/15/14 | | 123,000 | | | 129,458 |

| ·# | C8 Capital 144A 6.64% 12/31/49 | | 100,000 | | | 70,715 |

| # | CPM Holdings 144A 10.625% 9/1/14 | | 28,000 | | | 29,400 |

| Eastman Kodak 7.25% 11/15/13 | | 99,000 | | | 79,200 |

| * | Graham Packaging Capital I | | | | | |

| 9.875% 10/15/14 | | 123,000 | | | 125,460 |

| # | Graphic Packaging International | | | | | |

| 144A 9.50% 6/15/17 | | 126,000 | | | 133,560 |

| Intertape Polymer 8.50% 8/1/14 | | 100,000 | | | 78,500 |

| JSG Funding 7.75% 4/1/15 | | 210,000 | | | 201,599 |

| # | Plastipak Holdings 144A | | | | | |

| 8.50% 12/15/15 | | 66,000 | | | 66,248 |

| 10.625% 8/15/19 | | 71,000 | | | 78,455 |

(continues) 11

Statement of net assets

Delaware Investments® Dividend and Income Fund, Inc.

| | | Principal | | | |

| | Amount | | Value |

| Corporate Bonds (continued) | | | | | |

| Capital Goods (continued) | | | | | |

| Pregis 13.375% 10/15/13 | $ | 222,000 | | $ | 212,009 |

| * | RBS Global/Rexnord 11.75% 8/1/16 | | 183,000 | | | 180,254 |

| # | Reynolds Group Issuer 144A | | | | | |

| 7.75% 10/15/16 | | 100,000 | | | 101,500 |

| * | Sally Holdings Capital | | | | | |

| 10.50% 11/15/16 | | 75,000 | | | 80,625 |

| * | Solo Cup 8.50% 2/15/14 | | 134,000 | | | 129,645 |

| Thermadyne Holdings 10.50% 2/1/14 | | 137,000 | | | 119,875 |

| USG | | | | | |

| 6.30% 11/15/16 | | 127,000 | | | 110,808 |

| | #144A 9.75% 8/1/14 | | 35,000 | | | 36,838 |

| | | | | | 2,182,612 |

| Consumer Cyclical – 5.34% | | | | | |

| # | Allison Transmission 144A | | | | | |

| 11.00% 11/1/15 | | 220,000 | | | 228,799 |

| * | ArvinMeritor 8.125% 9/15/15 | | 165,000 | | | 150,975 |

| Beazer Homes USA 8.625% 5/15/11 | | 138,000 | | | 134,550 |

| Burlington Coat Factory Investment | | | | | |

| Holdings 14.50% 10/15/14 | | 225,000 | | | 226,687 |

| * | Burlington Coat Factory Warehouse | | | | | |

| 11.125% 4/15/14 | | 70,000 | | | 72,800 |

| Carrols 9.00% 1/15/13 | | 33,000 | | | 33,330 |

| Denny’s Holdings 10.00% 10/1/12 | | 57,000 | | | 58,425 |

| Ford Motor 7.45% 7/16/31 | | 174,000 | | | 148,988 |

| Ford Motor Credit 12.00% 5/15/15 | | 260,000 | | | 299,935 |

| Goodyear Tire & Rubber | | | | | |

| 10.50% 5/15/16 | | 2,000 | | | 2,160 |

| Interface | | | | | |

| 9.50% 2/1/14 | | 19,000 | | | 18,929 |

| | #144A 11.375% 11/1/13 | | 50,000 | | | 54,938 |

| # | Invista 144A 9.25% 5/1/12 | | 118,000 | | | 120,360 |

| K Hovnanian Enterprises | | | | | |

| 6.25% 1/15/15 | | 40,000 | | | 29,000 |

| 7.50% 5/15/16 | | 70,000 | | | 50,750 |

| | #144A 10.625% 10/15/16 | | 70,000 | | | 71,750 |

| # | Landry’s Restaurants 144A | | | | | |

| 11.625% 12/1/15 | | 220,000 | | | 224,399 |

| M/I Homes 6.875% 4/1/12 | | 75,000 | | | 70,125 |

| Macy’s Retail Holdings | | | | | |

| 6.375% 3/15/37 | | 110,000 | | | 93,500 |

| 6.70% 7/15/34 | | 15,000 | | | 12,750 |

| 7.875% 8/15/36 | | 50,000 | | | 44,000 |

| Meritage Homes | | | | | |

| 6.25% 3/15/15 | | 24,000 | | | 21,960 |

| 7.00% 5/1/14 | | 108,000 | | | 103,140 |

| Mobile Mini 6.875% 5/1/15 | | 119,000 | | | 111,860 |

| Navistar International 8.25% 11/1/21 | | 145,000 | | | 143,188 |

| Norcraft Holdings Capital 9.75% 9/1/12 | | 150,000 | | | 143,250 |

| OSI Restaurant Partners | | | | | |

| 10.00% 6/15/15 | | 83,000 | | | 72,210 |

| Quiksilver 6.875% 4/15/15 | | 200,000 | | | 154,000 |

| Rite Aid 9.375% 12/15/15 | | 190,000 | | | 160,075 |

| # | Standard Pacific Escrow | | | | | |

| 144A 10.75% 9/15/16 | | 75,000 | | | 74,625 |

| * | Tenneco Automotive 8.625% 11/15/14 | | 146,000 | | | 143,810 |

| # | Toys R Us Property 144A | | | | | |

| 10.75% 7/15/17 | | 66,000 | | | 70,785 |

| *# | TRW Automotive 144A | | | | | |

| 7.00% 3/15/14 | | 210,000 | | | 199,763 |

| | | | | | 3,545,816 |

| Consumer Non-Cyclical – 3.03% | | | | | |

| Accellent 10.50% 12/1/13 | | 105,000 | | | 101,588 |

| # | Alliance One International 144A | | | | | |

| 10.00% 7/15/16 | | 133,000 | | | 140,315 |

| Bausch & Lomb 9.875% 11/1/15 | | 137,000 | | | 141,453 |

| # | Cott Beverages 144A | | | | | |

| 8.375% 11/15/17 | | 90,000 | | | 90,225 |

| DJO Finance 10.875% 11/15/14 | | 80,000 | | | 84,600 |

| # | Dole Food 144A | | | | | |

| 8.00% 10/1/16 | | 30,000 | | | 30,450 |

| 13.875% 3/15/14 | | 62,000 | | | 73,160 |

| # | Ingles Markets 144A 8.875% 5/15/17 | | 75,000 | | | 77,438 |

| Inverness Medical Innovations | | | | | |

| 9.00% 5/15/16 | | 104,000 | | | 105,820 |

| # | JBS USA Finance 144A | | | | | |

| 11.625% 5/1/14 | | 113,000 | | | 126,136 |

| # | JohnsonDiversey Holdings 144A | | | | | |

| 10.50% 5/15/20 | | 305,000 | | | 301,187 |

| LVB Acquisition | | | | | |

| PIK 10.375% 10/15/17 | | 57,000 | | | 61,418 |

| 11.625% 10/15/17 | | 75,000 | | | 81,938 |

| # | M-Foods Holdings 144A | | | | | |

| 9.75% 10/1/13 | | 42,000 | | | 43,890 |

| Smithfield Foods | | | | | |

| 7.75% 5/15/13 | | 155,000 | | | 144,537 |

| | #144A 10.00% 7/15/14 | | 38,000 | | | 39,995 |

| # | Tops Markets 144A 10.125% 10/15/15 | | 140,000 | | | 144,200 |

| Universal Hospital Services PIK | | | | | |

| 8.50% 6/1/15 | | 80,000 | | | 79,200 |

| Yankee Acquisition 9.75% 2/15/17 | | 150,000 | | | 144,000 |

| | | | | | 2,011,550 |

| Energy – 3.99% | | | | | |

| # | Antero Resources Finance 144A | | | | | |

| 9.375% 12/1/17 | | 115,000 | | | 115,863 |

| Chesapeake Energy 9.50% 2/15/15 | | 24,000 | | | 25,260 |

| Complete Production Service | | | | | |

| 8.00% 12/15/16 | | 77,000 | | | 75,845 |

| Copano Energy Finance 7.75% 6/1/18 | | 94,000 | | | 94,000 |

| Denbury Resources | | | | | |

| 7.50% 4/1/13 | | 15,000 | | | 15,075 |

| 9.75% 3/1/16 | | 66,000 | | | 70,125 |

| Dynegy Holdings 7.75% 6/1/19 | | 162,000 | | | 133,245 |

| El Paso | | | | | |

| 6.875% 6/15/14 | | 47,000 | | | 46,530 |

| 7.00% 6/15/17 | | 52,000 | | | 51,220 |

| # | El Paso Performance-Linked Trust 144A | | | | | |

| 7.75% 7/15/11 | | 33,000 | | | 33,700 |

12

| | | Principal | | | |

| | Amount | | Value |

| Corporate Bonds (continued) | | | | | |

| Energy (continued) | | | | | |

| · | Enterprise Products Operating | | | | | |

| 8.375% 8/1/66 | $ | 30,000 | | $ | 29,249 |

| Forest Oil 7.25% 6/15/19 | | 94,000 | | | 89,535 |

| *# | Headwaters 144A 11.375% 11/1/14 | | 145,000 | | | 148,987 |

| # | Helix Energy Solutions Group 144A | | | | | |

| 9.50% 1/15/16 | | 156,000 | | | 158,729 |

| # | Hercules Offshore 144A | | | | | |

| 10.50% 10/15/17 | | 145,000 | | | 147,175 |

| # | Hilcorp Energy I 144A | | | | | |

| 7.75% 11/1/15 | | 47,000 | | | 45,473 |

| 9.00% 6/1/16 | | 94,000 | | | 94,705 |

| # | Holly 144A 9.875% 6/15/17 | | 121,000 | | | 126,143 |

| * | Key Energy Services 8.375% 12/1/14 | | 141,000 | | | 138,356 |

| Mariner Energy 8.00% 5/15/17 | | 118,000 | | | 112,100 |

| MarkWest Energy Partners/Finance | | | | | |

| 8.75% 4/15/18 | | 130,000 | | | 131,625 |

| OPTI Canada | | | | | |

| 7.875% 12/15/14 | | 116,000 | | | 92,800 |

| 8.25% 12/15/14 | | 67,000 | | | 53,935 |

| PetroHawk Energy | | | | | |

| 7.875% 6/1/15 | | 80,000 | | | 80,200 |

| 9.125% 7/15/13 | | 52,000 | | | 54,210 |

| Petroleum Development | | | | | |

| 12.00% 2/15/18 | | 118,000 | | | 119,770 |

| Plains Exploration & Production | | | | | |

| 8.625% 10/15/19 | | 40,000 | | | 40,300 |

| Quicksilver Resources | | | | | |

| 7.125% 4/1/16 | | 115,000 | | | 104,363 |

| 11.75% 1/1/16 | | 33,000 | | | 36,836 |

| Regency Energy Partners | | | | | |

| 8.375% 12/15/13 | | 57,000 | | | 58,853 |

| # | SandRidge Energy 144A | | | | | |

| 9.875% 5/15/16 | | 123,000 | | | 126,690 |

| | | | | | 2,650,897 |

| Finance & Investments – 1.26% | | | | | |

| ·# | C5 Capital 144A 6.196% 12/31/49 | | 100,000 | | | 69,663 |

| Cardtronics 9.25% 8/15/13 | | 130,000 | | | 132,926 |

| International Lease Finance | | | | | |

| 5.25% 1/10/13 | | 85,000 | | | 68,553 |

| 5.35% 3/1/12 | | 15,000 | | | 12,801 |

| 5.55% 9/5/12 | | 50,000 | | | 40,295 |

| 5.625% 9/20/13 | | 120,000 | | | 94,515 |

| 6.375% 3/25/13 | | 25,000 | | | 20,139 |

| 6.625% 11/15/13 | | 70,000 | | | 56,547 |

| ·# | MetLife Capital Trust X 144A | | | | | |

| | 9.25% 4/8/38 | | 100,000 | | | 105,000 |

| @# | Nuveen Investments 144A | | | | | |

| 10.50% 11/15/15 | | 269,000 | | | 238,064 |

| | | | | | 838,503 |

| Media – 3.09% | | | | | |

| Affinion Group I 11.50% 10/15/15 | | 70,000 | | | 73,150 |

| # | Cablevision Systems 144A | | | | | |

| 8.625% 9/15/17 | | 80,000 | | | 82,400 |

| # | Cengage Learning Acquisitions 144A | | | | | |

| 10.50% 1/15/15 | | 85,000 | | | 79,263 |

| # | Charter Communications | | | | | |

| Operating 144A | | | | | |

| 10.00% 4/30/12 | | 33,000 | | | 33,743 |

| 10.375% 4/30/14 | | 66,000 | | | 67,485 |

| 12.875% 9/15/14 | | 273,000 | | | 305,418 |

| # | Columbus International 144A | | | | | |

| 11.50% 11/20/14 | | 135,000 | | | 138,888 |

| # | DISH DBS 144A 7.875% 9/1/19 | | 150,000 | | | 151,874 |

| # | MDC Partners 144A 11.00% 11/1/16 | | 70,000 | | | 70,350 |

| # | Mediacom Capital 144A | | | | | |

| 9.125% 8/15/19 | | 95,000 | | | 96,900 |

| Nielsen Finance | | | | | |

| | W12.50% 8/1/16 | | 66,000 | | | 58,080 |

| 10.00% 8/1/14 | | 75,000 | | | 77,813 |

| 11.50% 5/1/16 | | 35,000 | | | 37,800 |

| 11.625% 2/1/14 | | 2,000 | | | 2,160 |

| | #144A 11.625% 2/1/14 | | 40,000 | | | 43,200 |

| *# | Sinclair Television Group 144A | | | | | |

| 9.25% 11/1/17 | | 110,000 | | | 112,063 |

| # | Terremark Worldwide 144A | | | | | |

| 12.00% 6/15/17 | | 66,000 | | | 72,353 |

| # | Univision Communications 144A | | | | | |

| 12.00% 7/1/14 | | 103,000 | | | 112,528 |

| # | UPC Holding 144A 9.875% 4/15/18 | | 100,000 | | | 104,500 |

| # | XM Satellite Radio 144A | | | | | |

| 13.00% 8/1/13 | | 130,000 | | | 135,525 |

| XM Satellite Radio Holdings PIK | | | | | |

| 10.00% 6/1/11 | | 203,000 | | | 194,879 |

| | | | | | 2,050,372 |

| Real Estate – 0.23% | | | | | |

| Developers Diversified Realty | | | | | |

| 9.625% 3/15/16 | | 25,000 | | | 26,062 |

| # | Felcor Lodging 144A | | | | | |

| 10.00% 10/1/14 | | 130,000 | | | 127,400 |

| | | | | | 153,462 |

| Services Cyclical – 4.24% | | | | | |

| * | ARAMARK 8.50% 2/1/15 | | 87,000 | | | 87,653 |

| # | Ashtead Capital 144A 9.00% 8/15/16 | | 100,000 | | | 98,500 |

| Avis Budget Car Rental | | | | | |

| 7.625% 5/15/14 | | 190,000 | | | 175,750 |

| 7.75% 5/15/16 | | 80,000 | | | 72,000 |

| Delta Air Lines | | | | | |

| 7.92% 11/18/10 | | 61,000 | | | 61,000 |

| | #144A 9.50% 9/15/14 | | 65,000 | | | 66,300 |

| # | Galaxy Entertainment Finance 144A | | | | | |

| 9.875% 12/15/12 | | 240,000 | | | 242,399 |

| Gaylord Entertainment | | | | | |

| 6.75% 11/15/14 | | 66,000 | | | 60,060 |

| # | General Maritime 144A | | | | | |

| 12.00% 11/15/17 | | 85,000 | | | 88,613 |

| Global Cash Access 8.75% 3/15/12 | | 41,000 | | | 40,334 |

(continues) 13

Statement of net assets

Delaware Investments® Dividend and Income Fund, Inc.

| | | Principal | | | |

| | Amount | | Value |

| Corporate Bonds (continued) | | | | | |

| Services Cyclical (continued) | | | | | |

| # | Harrah’s Operating 144A | | | | | |

| 10.00% 12/15/18 | $ | 289,000 | | $ | 221,084 |

| * | Hertz 10.50% 1/1/16 | | 91,000 | | | 95,095 |

| # | Kansas City Southern de Mexico 144A | | | | | |

| 12.50% 4/1/16 | | 100,000 | | | 114,500 |

| MGM MIRAGE | | | | | |

| | *6.625% 7/15/15 | | 42,000 | | | 31,500 |

| 7.50% 6/1/16 | | 42,000 | | | 32,025 |

| | *7.625% 1/15/17 | | 145,000 | | | 110,925 |

| 13.00% 11/15/13 | | 101,000 | | | 115,014 |

| | #144A 11.375% 3/1/18 | | 75,000 | | | 65,063 |

| Mohegan Tribal Gaming Authority | | | | | |

| 7.125% 8/15/14 | | 100,000 | | | 63,500 |

| *# | NCL 144A 11.75% 11/15/16 | | 75,000 | | | 74,344 |

| @‡ | Northwest Airlines 10.00% 2/1/10 | | 55,000 | | | 413 |

| PHH 7.125% 3/1/13 | | 140,000 | | | 131,250 |

| Pinnacle Entertainment 7.50% 6/15/15 | | 226,000 | | | 202,269 |

| Royal Caribbean Cruises | | | | | |

| 6.875% 12/1/13 | | 80,000 | | | 75,600 |

| RSC Equipment Rental | | | | | |

| 9.50% 12/1/14 | | 202,000 | | | 198,718 |

| | #144A 10.25% 11/15/19 | | 15,000 | | | 14,625 |

| # | ServiceMaster PIK 144A | | | | | |

| 10.75% 7/15/15 | | 155,000 | | | 157,324 |

| # | Shingle Springs Tribal Gaming | | | | | |

| Authority 144A 9.375% 6/15/15 | | 171,000 | | | 124,830 |

| | | | | | 2,820,688 |

| Services Non-Cyclical – 1.70% | | | | | |

| # | Alliance HealthCare Services 144A | | | | | |

| 8.00% 12/1/16 | | 70,000 | | | 69,300 |

| Casella Waste Systems 9.75% 2/1/13 | | 137,000 | | | 134,260 |

| Community Health Systems | | | | | |

| 8.875% 7/15/15 | | 62,000 | | | 63,395 |

| Cornell 10.75% 7/1/12 | | 52,000 | | | 53,300 |

| HCA PIK 9.625% 11/15/16 | | 255,000 | | | 272,531 |

| Psychiatric Solutions | | | | | |

| 7.75% 7/15/15 | | 94,000 | | | 91,180 |

| | #144A 7.75% 7/15/15 | | 42,000 | | | 39,690 |

| Select Medical 7.625% 2/1/15 | | 179,000 | | | 172,288 |

| Tenet Healthcare 7.375% 2/1/13 | | 70,000 | | | 69,300 |

| · | US Oncology Holdings PIK | | | | | |

| 6.428% 3/15/12 | | 180,000 | | | 162,900 |

| | | | | | 1,128,144 |

| Technology & Electronics – 1.34% | | | | | |

| # | Advanced Micro Devices 144A | | | | | |

| 8.125% 12/15/17 | | 30,000 | | | 28,463 |

| Avago Technologies Finance | | | | | |

| 10.125% 12/1/13 | | 75,000 | | | 79,031 |

| First Data 9.875% 9/24/15 | | 295,000 | | | 264,025 |

| * | Freescale Semiconductor | | | | | |

| 8.875% 12/15/14 | | 173,000 | | | 147,915 |

| Sanmina-SCI 8.125% 3/1/16 | | 154,000 | | | 150,535 |

| * | SunGard Data Systems 10.25% 8/15/15 | | 138,000 | | | 142,140 |

| # | Unisys 144A 12.75% 10/15/14 | | 71,000 | | | 79,520 |

| | | | | | 891,629 |

| Telecommunications – 6.27% | | | | | |

| Cincinnati Bell 8.25% 10/15/17 | | 105,000 | | | 104,738 |

| # | Clearwire Communications 144A | | | | | |

| 12.00% 12/1/15 | | 295,000 | | | 290,788 |

| * | Cricket Communications | | | | | |

| 9.375% 11/1/14 | | 222,000 | | | 214,785 |

| # | Digicel Group 144A | | | | | |

| 8.25% 9/1/17 | | 110,000 | | | 108,075 |

| | *8.875% 1/15/15 | | 100,000 | | | 97,500 |

| # | DigitalGlobe 144A 10.50% 5/1/14 | | 61,000 | | | 65,575 |

| # | GCI 144A 8.625% 11/15/19 | | 145,000 | | | 145,725 |

| # | GeoEye 144A 9.625% 10/1/15 | | 65,000 | | | 67,763 |

| # | Global Crossing 144A 12.00% 9/15/15 | | 135,000 | | | 144,450 |

| Hughes Network Systems | | | | | |

| 9.50% 4/15/14 | | 127,000 | | | 128,905 |

| # | Intelsat Bermuda 144A | | | | | |

| 11.25% 2/4/17 | | 283,000 | | | 281,584 |

| Intelsat Jackson Holdings | | | | | |

| 11.25% 6/15/16 | | 236,000 | | | 253,109 |

| Level 3 Financing | | | | | |

| 9.25% 11/1/14 | | 66,000 | | | 58,575 |

| 12.25% 3/15/13 | | 66,000 | | | 69,218 |

| Lucent Technologies 6.45% 3/15/29 | | 156,000 | | | 120,900 |

| * | MetroPCS Wireless 9.25% 11/1/14 | | 214,000 | | | 215,605 |

| # | NII Capital 144A 10.00% 8/15/16 | | 138,000 | | | 146,970 |

| # | Nordic Telephone Holdings 144A | | | | | |

| 8.875% 5/1/16 | | 75,000 | | | 79,125 |

| PAETEC Holding 8.875% 6/30/17 | | 71,000 | | | 70,823 |

| # | Qwest 144A 8.375% 5/1/16 | | 5,000 | | | 5,250 |

| Qwest Communications International | | | | | |

| 7.50% 2/15/14 | | 61,000 | | | 60,695 |

| Sprint Capital | | | | | |

| 6.00% 12/1/16 | | 94,000 | | | 81,545 |

| 6.875% 11/15/28 | | 65,000 | | | 49,075 |

| 8.75% 3/15/32 | | 305,000 | | | 262,680 |

| # | Telcordia Technologies 144A | | | | | |

| 10.00% 3/15/13 | | 85,000 | | | 70,975 |

| Telesat Canada | | | | | |

| 11.00% 11/1/15 | | 80,000 | | | 85,000 |

| 12.50% 11/1/17 | | 94,000 | | | 101,520 |

| US West Capital Funding | | | | | |

| 7.75% 2/15/31 | | 80,000 | | | 65,200 |

| US West Communications | | | | | |

| 7.25% 9/15/25 | | 90,000 | | | 79,650 |

| # | Viasat 144A 8.875% 9/15/16 | | 75,000 | | | 76,031 |

| # | VimpelCom 144A 9.125% 4/30/18 | | 150,000 | | | 158,250 |

| Virgin Media Finance 8.375% 10/15/19 | | 100,000 | | | 100,500 |

| West 11.00% 10/15/16 | | 110,000 | | | 111,375 |

| # | Wind Acquisition Finance 144A | | | | | |

| 10.75% 12/1/15 | | 75,000 | | | 80,625 |

| 11.75% 7/15/17 | | 100,000 | | | 111,500 |

| | | | | | 4,164,084 |

14

| | | Principal | | | | |

| | Amount | | Value |

| Corporate Bonds (continued) | | | | | | |

| Utilities – 1.87% | | | | | | |

| AES | | | | | | |

| 7.75% 3/1/14 | $ | 83,000 | | $ | 83,623 | |

| 8.00% 10/15/17 | | 47,000 | | | 47,118 | |

| * | Edison Mission Energy 7.00% 5/15/17 | | 125,000 | | | 91,875 | |

| Elwood Energy 8.159% 7/5/26 | | 167,845 | | | 151,422 | |

| Energy Future Holdings | | | | | | |

| 10.875% 11/1/17 | | 66,000 | | | 46,695 | |

| * | Mirant Americas Generation | | | | | | |

| 8.50% 10/1/21 | | 200,000 | | | 181,999 | |

| w | Mirant Mid Atlantic Pass Through | | | | | | |

| Trust Series A 8.625% 6/30/12 | | 59,067 | | | 60,027 | |

| NRG Energy | | | | | | |

| 7.375% 2/1/16 | | 144,000 | | | 143,640 | |

| 7.375% 1/15/17 | | 45,000 | | | 44,775 | |

| Orion Power Holdings 12.00% 5/1/10 | | 116,000 | | | 119,770 | |

| · | Puget Sound Energy 6.974% 6/1/67 | | 110,000 | | | 97,200 | |

| * | Texas Competitive Electric Holdings | | | | | | |

| 10.50% 11/1/15 | | 141,000 | | | 100,815 | |

| TXU 5.55% 11/15/14 | | 105,000 | | | 72,975 | |

| | | | | | 1,241,934 | |

| Total Corporate Bonds | | | | | | |

| (cost $26,905,306) | | | | | 28,614,370 | |

| | |

| «Senior Secured Loans – 0.57% | | | | | | |

| Chester Downs & Marina Term | | | | | | |

| Tranche Loan 12.375% 12/31/16 | | 72,000 | | | 72,180 | |

| PQ Term Tranche Loan 6.79% 7/30/15 | | 170,000 | | | 142,658 | |

| Texas Competitive Electric Holdings | | | | | | |

| Term Tranche Loan B2 | | | | | | |

| 3.742% 10/10/14 | | 115,414 | | | 86,550 | |

| Univision Communications Term | | | | | | |

| Tranche Loan B 2.533% 9/29/14 | | 90,000 | | | 74,318 | |

| Total Senior Secured Loans | | | | | | |

| (cost $341,745) | | | | | 375,706 | |

| | |

| | Number of | | | | |

| | Shares | | | | |

| Exchange Traded Fund – 0.03% | | | | | | |

| Equity Fund – 0.03% | | | | | | |

| *ProShares UltraShort Real Estate | | 2,400 | | | 20,904 | |

| Total Exchange Traded Fund | | | | | | |

| (cost $59,893) | | | | | 20,904 | |

| | |

| Limited Partnerships – 0.24% | | | | | | |

| Blackstone Group | | 3,000 | | | 41,520 | |

| Brookfield Infrastructure Partners | | 7,600 | | | 117,040 | |

| Total Limited Partnerships | | | | | | |

| (cost $184,721) | | | | | 158,560 | |

| | |

| Warrant – 0.00% | | | | | | |

| =† | Port Townsend | | 70 | | | 1 | |

| Total Warrant (cost $1,680) | | | | | 1 | |

| | | | | | | |

| | Principal | | | | |

| | Amount | | |

| ¹Discount Note – 2.39% | | | | | | |

| Federal Home Loan Bank | | | | | | |

| 0.02% 12/1/09 | $ | 1,587,002 | | $ | 1,587,002 | |

| Total Discount Note (cost $1,587,002) | | | | | 1,587,002 | |

| |

| Total Value of Securities Before | | | | | | |

| Securities Lending Collateral – 129.59% | | | | |

| (cost $88,768,210) | | | | | 86,075,519 | |

| |

| | Number of | | | | |

| | Shares | | | | |

| Securities Lending Collateral** – 6.11% | | | | | | |

| Investment Companies | | | | | | |

| Mellon GSL DBT II Collateral Fund | | 1,228,217 | | | 1,228,217 | |

| BNY Mellon SL DBT II | | | | | | |

| Liquidating Fund | | 2,855,882 | | | 2,824,753 | |

| @†Mellon GSL Reinvestment Trust II | | 163,237 | | | 6,938 | |

| Total Securities Lending Collateral | | | | | | |

| (cost $4,247,336) | | | | | 4,059,908 | |

| |

| Total Value of Securities – 135.70% | | | | | | |

| (cost $93,015,546) | | | | | 90,135,427 | © |

| Obligation to Return Securities | | | | | | |

| Lending Collateral** – (6.39%) | | | | | (4,247,336 | ) |

| Borrowing Under Line of Credit – (30.45%) | | | (20,225,000 | ) |

| Receivables and Other Assets | | | | | | |

| Net of Liabilities – 1.14% | | | | | 757,501 | |

| Net Assets Applicable to 9,439,043 | | | | | | |

| Shares Outstanding; Equivalent to | | | | | | |

| | $7.04 Per Share – 100.00% | | | | $ | 66,420,592 | |

| |

| Components of Net Assets at November 30, 2009: | | | | |

| Common stock, $0.01 par value, | | | | | | |

| 500,000,000 shares authorized to the Fund | | $ | 97,186,304 | |

| Distributions in excess of net investment income | | | (66,931 | ) |

| Accumulated net realized loss on investments | | | (27,818,662 | ) |

| Net unrealized depreciation of investments | | | | | | |

| and foreign currencies | | | | | (2,880,119 | ) |

| Total net assets | | | | $ | 66,420,592 | |

| † | Non income producing security. |

| ‡ | Non income producing security. Security is currently in default. |

| · | Variable rate security. The rate shown is the rate as of November 30, 2009. |

| ¹ | The rate shown is the effective yield at the time of purchase. |

| @ | Illiquid security. At November 30, 2009, the aggregate amount of illiquid securities was $612,268, which represented 0.92% of the Fund’s net assets. See Note 10 in “Notes to financial statements.” |

| ∏ | Restricted Security. These investments are in securities not registered under the Securities Act of 1933, as amended, and have certain restrictions on resale which may limit their liquidity. At November 30, 2009, the aggregate amount of the restricted securities was $4 or 0.00% of the Fund’s net assets. See Note 10 in “Notes to financial statements.” |

(continues) 15

Statement of net assets

Delaware Investments® Dividend and Income Fund, Inc.

| | |

| = | Security is being fair valued in accordance with the Fund’s fair valuation policy. At November 30, 2009, the aggregate amount of fair valued securities was $74,384, which represented 0.11% of the Fund’s net assets. See Note 1 in “Notes to financial statements.” |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At November 30, 2009, the aggregate amount of Rule 144A securities was $15,370,289, which represented 23.14% of the Fund’s net assets. See Note 10 in “Notes to financial statements.” |

| « | Senior Secured Loans generally pay interest at rates which are periodically redetermined by reference to a base lending rate plus a premium. These base lending rates are generally: (i) the prime rate offered by one or more United States banks, (ii) the lending rate offered by one or more European banks such as the London Inter-Bank Offered Rate (LIBOR), and (iii) the certificate of deposit rate. Senior Secured Loans may be subject to restrictions on resale. Stated rate in effect at November 30, 2009. |

| W | Step coupon bond. Indicates security that has a zero coupon that remains in effect until a predetermined date at which time the stated interest rate becomes effective. |

| Φ | Step coupon bond. Coupon increases/decreases periodically based on a predetermined schedule. Stated rate in effect at November 30, 2009. |

| w | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |

| * | Fully or partially on loan. |

| ** | See Note 9 in “Notes to financial statements.” |

| © | Includes $4,253,690 of securities loaned. |

Summary of Abbreviations:

ADR — American Depositary Receipts

PIK — Pay-in-kind

REIT — Real Estate Investment Trust

See accompanying notes

16

Statement of operations

Delaware Investments® Dividend and Income Fund, Inc.

Year Ended November 30, 2009

| Investment Income: | | | | | | |

| Dividends | $ | 1,756,045 | | | | |

| Interest | | 3,270,000 | | | | |

| Securities lending income | | 36,455 | | $ | 5,062,500 | |

| |

| Expenses: | | | | | | |

| Management fees | | 424,571 | | | | |

| Reports to shareholders | | 122,610 | | | | |

| Dividend disbursing and transfer agent fees and expenses | | 94,780 | | | | |

| Legal fees | | 45,510 | | | | |

| Accounting and administration expenses | | 30,879 | | | | |

| NYSE fees | | 23,750 | | | | |

| Leverage expenses | | 18,958 | | | | |

| Audit and tax | | 16,363 | | | | |

| Pricing fees | | 15,128 | | | | |

| Dues and services | | 6,895 | | | | |

| Directors’ fees | | 4,004 | | | | |

| Custodian fees | | 3,931 | | | | |

| Insurance fees | | 1,668 | | | | |

| Consulting fees | | 783 | | | | |

| Registration fees | | 643 | | | | |

| Directors’ expenses | | 277 | | | 810,750 | |

| Less expense paid indirectly | | | | | (274 | ) |

| Total operating expenses (before interest expense) | | | | | 810,476 | |

| Interest expense | | | | | 230,345 | |

| Total operating expenses (after interest expense) | | | | | 1,040,821 | |

| Net Investment Income | | | | | 4,021,679 | |

| |

| Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currencies: | | | | | | |

| Net realized loss on: | | | | | | |

| Investments | | | | | (10,717,121 | ) |

| Swap contracts | | | | | (5,260 | ) |

| Foreign currencies | | | | | (249 | ) |

| Net realized loss | | | | | (10,722,630 | ) |

| Net change in unrealized appreciation/depreciation of investments and foreign currencies | | | | | 31,142,775 | |

| Net Realized and Unrealized Gain on Investments and Foreign Currencies | | | | | 20,420,145 | |

| |

| Net Increase in Net Assets Resulting from Operations | | | | $ | 24,441,824 | |

See accompanying notes

17

Statements of changes in net assets

Delaware Investments® Dividend and Income Fund, Inc.

| Year Ended |

| 11/30/09 | | 11/30/08 |

| Increase (Decrease) in Net Assets from Operations: | | | | | | | |

| Net investment income | $ | 4,021,679 | | | $ | 5,021,360 | |

| Net realized loss on investments | | (10,722,630 | ) | | | (16,172,098 | ) |

| Net change in unrealized appreciation/depreciation of investments | | 31,142,775 | | | | (46,110,238 | ) |

| Net increase (decrease) in net assets resulting from operations | | 24,441,824 | | | | (57,260,976 | ) |

| |

| Dividends and Distributions to Shareholders from:1 | | | | | | | |

| Net investment income | | (3,988,862 | ) | | | (5,710,800 | ) |

| Tax return of capital | | (2,947,565 | ) | | | (4,120,447 | ) |

| | | (6,936,427 | ) | | | (9,831,247 | ) |

| Capital Share Transactions: | | | | | | | |

| Cost of shares repurchased2 | | (2,916,169 | ) | | | (5,004,526 | ) |

| Decrease in net assets derived from capital share transactions | | (2,916,169 | ) | | | (5,004,526 | ) |

| Net Increase (Decrease) in Net Assets | | 14,589,228 | | | | (72,096,749 | ) |

| |

| Net Assets: | | | | | | | |

| Beginning of year | | 51,831,364 | | | | 123,928,113 | |

| End of year (including distributions in excess of | | | | | | | |

| net investment income of $66,931 and $156,700, respectively) | $ | 66,420,592 | | | $ | 51,831,364 | |

1See Note 4 in “Notes to financial statements.”

2See Note 6 in “Notes to financial statements.”

See accompanying notes

18

Statement of cash flows

Delaware Investments® Dividend and Income Fund, Inc.

Year Ended November 30, 2009

| Net Cash Provided by Operating Activities: | | | |

| Net increase in net assets resulting from operations | $ | 24,441,824 | |

| |

| Adjustments to reconcile net decrease in net assets from | | | |

| operations to cash provided by operating activities: | | | |

| Amortization of premium and discount on investments purchased | | (392,275 | ) |

| Purchase of investment securities | | (48,237,972 | ) |

| Proceeds from disposition of investment securities | | 51,950,262 | |

| Proceeds from disposition of short-term investment securities, net | | 2,652,908 | |

| Net realized loss from investment transactions | | 10,948,938 | |

| Net change in net unrealized appreciation/depreciation of investments and foreign currencies | | (31,142,775 | ) |

| Decrease in receivable for investments sold | | 121,116 | |

| Decrease in interest and dividends receivable and other assets | | 107,091 | |

| Increase in payable for investments purchased | | 254,540 | |

| Decrease in interest payable | | (11,965 | ) |

| Decrease in accrued expenses | | (47,269 | ) |

| Total adjustments | | (13,797,401 | ) |

| Net cash provided by operating activities | | 10,644,423 | |

| |

| Cash Flows Used for Financing Activities: | | | |

| Cash dividends and distributions paid | | (6,936,427 | ) |

| Purchase of fund shares (tender offer) | | (2,916,169 | ) |

| Net cash used for financing activities | | (9,852,596 | ) |

| Net increase in cash | | 791,827 | |

| Cash (overdraft) at beginning of year | | (774,889 | ) |

| Cash at end of year | $ | 16,938 | |

| |

| Cash paid for interest expense for leverage | $ | 242,310 | |

See accompanying notes

19

Financial highlights

Delaware Investments® Dividend and Income Fund, Inc.

Selected data for each share of the Fund outstanding throughout each period were as follows:

| | Year Ended |

| | 11/30/09 | | | 11/30/08 | | | 11/30/07 | | | 11/30/06 | | | 11/30/05 | |

| Net asset value, beginning of period | | $5.220 | | | $11.850 | | | $14.200 | | | $12.650 | | | $12.960 | |

| |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | |

| Net investment income1 | | 0.413 | | | 0.490 | | | 0.408 | | | 0.470 | | | 0.623 | |

| Net realized and unrealized gain (loss) on investments | | | | | | | | | | | | | | | |

| and foreign currencies | | 2.120 | | | (6.160 | ) | | (0.640 | ) | | 2.150 | | | 0.027 | |

| Total from investment operations | | 2.533 | | | (5.670 | ) | | (0.232 | ) | | 2.620 | | | 0.650 | |

| |

| Less dividends and distributions from: | | | | | | | | | | | | | | | |

| Net investment income | | (0.410 | ) | | (0.558 | ) | | (0.553 | ) | | (0.486 | ) | | (0.722 | ) |

| Net realized gain on investments | | — | | | — | | | (0.912 | ) | | (0.584 | ) | | (0.238 | ) |

| Return of capital | | (0.303 | ) | | (0.402 | ) | | (0.653 | ) | | — | | | — | |

| Total dividends and distributions | | (0.713 | ) | | (0.960 | ) | | (2.118 | ) | | (1.070 | ) | | (0.960 | ) |

| |

| Net asset value, end of period | | $7.040 | | | $5.220 | | | $11.850 | | | $14.200 | | | $12.650 | |

| |

| Market value, end of period | | $6.600 | | | $4.020 | | | $10.660 | | | $13.460 | | | $12.550 | |

| |

| Total return based on:2 | | | | | | | | | | | | | | | |

| Net asset value | | 53.26% | | | (50.35% | ) | | (0.94% | ) | | 22.41% | | | 5.44% | |

| Market value | | 86.93% | | | (57.51% | ) | | (5.99% | ) | | 16.96% | | | 15.38% | |

| |

| Ratios and supplemental data: | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $66,421 | | | $51,831 | | | $123,928 | | | $156,324 | | | $146,638 | |

| Ratio of expenses to average net assets | | 1.83% | | | 2.39% | | | 2.71% | | | 2.71% | | | 2.20% | |

| Ratio of expenses to adjusted average net assets | | | | | | | | | | | | | | | |

| (before interest expense)3 | | 1.05% | | | 0.88% | | | 0.84% | | | 0.88% | | | 0.91% | |

| Ratio of interest expense to adjusted average net assets3 | | 0.30% | | | 0.80% | | | 1.25% | | | 1.19% | | | 0.78% | |

| Ratio of net investment income to average net assets | | 7.06% | | | 5.12% | | | 2.92% | | | 3.59% | | | 4.81% | |

| Ratio of net investment income to adjusted average net assets3 | | 5.21% | | | 3.59% | | | 2.27% | | | 2.74% | | | 3.70% | |

| Portfolio turnover | | 65% | | | 64% | | | 49% | | | 63% | | | 94% | |

| |

| Leverage Analysis: | | | | | | | | | | | | | | | |

| Debt outstanding at end of period at par (000 omitted) | | $20,225 | | | $20,225 | | | $44,000 | | | $44,000 | | | $48,000 | |